First World Hybrid Real Estate Plc › wp-content › uploads › ... · First World Hybrid Real...

Transcript of First World Hybrid Real Estate Plc › wp-content › uploads › ... · First World Hybrid Real...

May 2019

First World Hybrid Real Estate Plc

First World Hybrid Real Estate Investment offering

• Dividend yield around 4.5% in sterling - long leases, strong tenants

• Modest capital growth over time - rental growth an important driver

• Better liquidity and pricing certainty than typical direct property investments but less volatility than publicly quoted and traded property

• With the benefit of a Regulated Fund

– Isle of Man registered Collective Investment Scheme – Managed by FIM Capital who is regulated by FSA in Isle of Man and

approved by FSCA in SA– Listed on TISE and subject to listing regs– Being IOM domiciled, is non UK Situs asset and no dividend withholding tax– Distribution and accumulating share class options

REITs Direct Real Estate

• UK listed REITs, yielding approximately 4%

• Priced on stock market therefore readily tradeable and liquid

• Generate diversified, property related returns

• Primarily to provide liquidity for redemptions

• UK commercial real estate, yielding just under 6%

• Robust income - FRI, long leases (WAULT >10 years)

• Low volatility - each property is independently valued biannually on a rolling basis

First World Hybrid Real Estate

First World Hybrid Real Estate Solid track record – expansion

Dec 2014

Dec 2015

Dec 2016

Dec2017

Dec 2018

YTD 2019

No. of properties 2 7 12 16 18 19

Gross asset value £15m £37m £75m £107m £132m £138m

First World Hybrid Real Estate Performance – Annual returns (GBP)

Income return as expected - predictable Price return

• Property portfolio robust • REITs volatile

Dec 2014*

Dec 2015

Dec 2016

Dec 2017

Dec2018

March 2019

April2019

16.3% 7.2% 6.7% 9.1% 3.3% 5.6% 5.4%

Income = 5.1% 5.2% 5.1%

Price = -1.8% 0.4% 0.3%

* Commencing 31/01/2014

First World Hybrid Real Estate Performance – Comparative returns (GBP)

Annualised ReturnsAnnualised Returns

1 year 31 Dec 2018

1 Year30 April 2019

3 Years30 April 2019

FWHRE 3.3% 5.4% 7.2%

UK REITs -12.8% -2.8% 2.1%

Composite Index(S&P 500, FTSE 100 & FTSE EuroFirst 300) -5.4% 8.6% 13.9%

SA Listed property (ZAR) -22.8% -9.6% -3.5%

Positive comparative outcome Strong outperformance of UK REITS

First World Hybrid Real EstatePerformance - without the volatility

Listed volatilityRetail prime office emphasis

Independently appraisedDistribution warehousing emphasis

£900 000

£1 000 000

£1 100 000

£1 200 000

£1 300 000

£1 400 000

£1 500 000

£1 600 000

£1 700 000

Jan

14

Mar

14

May

14

Jul 1

4

Sep

14

Nov

14

Jan

15

Mar

15

May

15

Jul 1

5

Sep

15

Nov

15

Jan

16

Mar

16

May

16

Jul 1

6

Sep

16

Nov

16

Jan

17

Mar

17

May

17

Jul 1

7

Sep

17

Nov

17

Jan

18

Mar

18

May

18

Jul 1

8

Sep

18

Nov

18

Jan

19

Mar

19

First World Hybrid Real Estate NAREIT UK REITs TRGBPSource: Bloomberg & Marriott

Sector - targets 75% warehousing / 25% regional offices

Geographic Institutional locations – sector driven

Ticket size £4 to £20m

Maintain WAULT > 10 yrsMin 8 years individually

Lease type FRI, upwards only

Covenant 4A1 min

Rental growth

Yield

Property Portfolio - Strategy / acquisition filter

First World Hybrid Real Estate Property portfolio – why this property type?

• Distribution warehousing – E Retailing and logistics– Demand > supply = above inflation

rental growth

• Retail – Value retailers preferred – Traditional retailers on back foot

• Offices– Regional offices good value – London offices fully priced and

rental under pressure

Property selection influenced by profound changes in consumer shopping behaviour and technology

Property portfolio – Geographically spread

• All leases FRI, upwards only

• Earliest renewal in just under 5 years

• All offices leases have fixed or RPI linked upward reviews

• Strong tenants with substantial balance sheets

• Max exposure to any single tenant 13% - Crown

First World Hybrid Real Estate Property portfolio – lease criteria

Lease structure and length enhances income predictability

Tenant selection and financial standing underpins income certainty

12

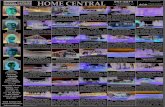

First World Hybrid Real Estate Property portfolio – photography and property detail

• Access the Marriott website http://www.marriott.co.za/first-world-hybrid-real-estate to access details, photos and drone coverage of each property

• The preview video is drone coverage of 3 key properties – one of each property type

First World Hybrid Real EstatePortfolio valuation – positive trend

Good investment demand for long lease, well tenanted property

Valuations will be supported by strong occupational market.

• Each property is independently valued on the anniversary of its acquisition in six monthly intervals thereafter.

• Rolling valuations, by design, to reduce volatility. • Barclays requirement – every 3 years on a rolling basis• Valuation trend

• In 2018 - 13 up, 2 flat, 1 down• In 2019 – 4 up, 2 flat

First World Hybrid Real Estate Portfolio debt - well justified

• Variable Rate (approx. 50%) 82bps LIBOR + 1.90% margin = 2.72%

• 5 year Fixed rate (approx. 50%) 1.34% all in + 1.90% margin = 3.24%

• Positive leverage upfront (<3% ave debt rate versus 5.8% direct property yield)

• Max 50% LTV on property acquisition price

• Actual LTV is currently 43% of property portfolio and <40% of total assets

• Interest covered 4 ½ X by rental (the ultimate test)

Using debt simply makes good senseHedge increases predictability of income yield

First World Hybrid Real EstateREITs – Fundamental part of the structure

• REITs provide liquidity for redemptions and property related returns pending investment in direct property

• 4 REITS – Large and liquid

– £ based, UK dominant

– Distribution warehousing emphasis - Londonmetric/Tritax Big Box/Segro/LXi

– Outperformed NAREIT index

First World Hybrid Real EstateLiquidity & Redemptions

• Liquidity target level – 25% of NAV, reviewed quarterly

• Redemptions– 2019 YTD: 5% of NAV (2018 and 2017: 9% and 10%)

Prudent liquidity held to meet reasonable redemptions

• Gating and suspension provisions – As with all open ended funds, there are standard provisions to deal with

extraordinary circumstances– Gating – maximum weekly redemption is 5% of shares in issue, excess c/f– Suspension circumstances - where pricing is not reflective of underlying

property valuations or where not practical to realise an investment

There to protect the interests of all investors

First World Hybrid Real Estate UK Property Market – key considerations

• Property yields attractive relative to bonds – Meaningful positive yield differential, and no growth in bonds

• Occupational market generally sound – With exception of retail, occupational market fundamentals sound

– Especially distribution warehousing where rental growth above inflation

– Speculative development remains constrained

• Debt at manageable levels – LTVs - industry ave circa 55% (20% lower than 2007), significantly deleveraged

– IC ratios - with interest rates well below property yields, significant headroom

Unlike 2008 - no cause for alarm

First World Hybrid Real Estate Brexit – key considerations • Economic and political environment

– Ongoing uncertainty likely to have had a negative impact on business investment and UK GDP generally (hard to quantify). Despite this, UK economy has grown and better than forecasts post Referendum.

• Property market – Both occupational and investment markets performed far better than

speculated post Referendum. Evidenced in bidding & valuations.

– With international investors making up ½ of investment activity, weaker sterling positive for these buyers

• FWHRE’s properties – No specific Brexit risk – no London or international head offices, no export

focussed manufacturing. Generally UK consumer focussed.

UK to remain 1st world economy and an attractive destination to store wealth

First World Hybrid Real Estate plc Summary

• Leases and tenant strength underpin robust and attractive dividend yield in sterling

• Occupational market supportive of modest capital growth over time

• Better liquidity and pricing certainty than typical direct property investments but less volatility than publicly quoted and traded property

• Comfort of a Regulated Fund