Agricultural Productivity Growth in Latin America and the - GTAP

Financial Deepening and Bank Productivity in Latin America

description

Transcript of Financial Deepening and Bank Productivity in Latin America

Financial Deepening and Financial Deepening and Bank Productivity in Latin Bank Productivity in Latin AmericaAmericaGeorgios ChortareasUniversity of Athens

Claudia GirardoneUniversity of Essex

Jesus G. Garza GarciaUniversity of the West of England

Cass Business SchoolEmerging Scholars in Banking and Finance

December 9th, 2009

IntroductionIntroductionFinancial liberalisation has been a recent

important trend in the financial sectors in Latin America.

Main idea was to generate a more competitive banking sector.

Aizenman (2005) suggests that financial liberalisation gained from increased savings in the economy (mainly through foreign capital).

This increase in savings in the economy was expected to increment the level of financial deepening in the economy (particularly the credit to the private sector).

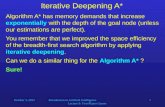

Financial DeepeningFinancial DeepeningFigure 1

Bank Credit to the Private Sector in terms of GDP, Average Percentage

1999-2006

0

20

40

60

80

100

120

140

160

Arg

entin

a

Bra

zil

Chi

le

Col

ombi

a

Cos

ta R

ica

Par

agua

y

Per

u

Uru

guay

Vene

zuel

a

Latin

Am

eric

a*

Sou

th E

ast

Asi

a**

EU

RO

Are

a***

UK

Data obtained from IFS (International Financial Statistics) from the IMF (line 32D.ZF).*The Latin American average is calculated using the following countries: Argentina, Brazil, Chile, Colombia, Costa Rica, Paraguay, Peru, Uruguay and Venezuela. For Venezuela the average is calculated from 1999-2004 due to data availability. **The South East Asia average is calculated using the following countries: Brunei, Cambodia, Malaysia, Laos, Myanmar, Singapore, Thailand, Hong Kong, South Korea, Philippines and Vietnam. The average for Brunei and Vietnam was computed for the years 1999-2005 and for Myanmar from 1999-2004 due to data availability. ***The data for the EURO Area was elaborated including all the countries in the European Union.

Figure 2Figure 2Financial Deepening in Financial Deepening in Latin AmericaLatin America

Source: IFS (International Financial Statistics from the IMF)*The Latin American average is calculated using the following countries: Argentina, Brazil, Chile, Colombia, Costa Rica, Paraguay, Peru, Uruguay and Venezuela; except for M2/GDP in which Peru and Venezuela were excluded due to data availability.

Literature ReviewLiterature ReviewEconomists have largely disagreed on the role

of financial development and economic growth.

Increased numbers of financial institutions and financial instruments help reduce information costs in the economy (Rioja and Valev, 2004).

Many other studies find a positive relationship between finance and growth (King and Levine (1993a, b, c), Roubini and Sala-i-Martin (1992), Pagano (1993), Jayaratne and Strahan (1996), Levine (1997a, 1998), Arestis and Demetriades (1997), Rajan and Zingales (1998), Lindh (2000), Levine et al. (2000) among others.

Literature ReviewLiterature Review“Thus, if finance is to explain

economic growth, we need theories that describe how financial development influences resource allocation decisions in ways that foster productivity growth...”

Levine, 2004: p. 6

Literature ReviewLiterature ReviewRecent studies address how financial

development affects economic growth through greater productivity (economic).

Particularly, Levine et al. (2000), Arestis et al. (2002) and Arestis et al. (2006) argue that financial development affects economic growth through productivity growth.

There are various studies which suggest that financial development may enhance greater economic productivity and contribute to a more efficient allocation of capital.

MotivationMotivationLatin American financial systems are

highly bank- based.Extensive literature on the relationship

between financial deepening and economic growth.

No literature focusing on the microeconomic relationship: financial deepening and banking productivity and/or vice-versa.

Financial deepening forms the broad environment in which banks operate.

DataDataData obtained from Bankscope

and the IFS from the IMF.Study includes 9 Latin American

countries: Argentina, Brazil, Chile, Colombia, Costa Rica, Paraguay, Peru, Uruguay and Venezuela.

Observations: 973Years: 2000 - 2006

MethodologyMethodology

tiitititi

ttitititititititi

taGDPpercapiXRATEGOV

TRADECPIPCRPCRPCRTFPTFP

,,8,8,7

,6,52,41,3,21,1,,

TFP = TOTAL FACTOR PRODUCTIVITYPCR= CREDIT TO THE PRIVATE SECTOR /GDPCPI = CONSUMER PRICE INDEXTRADE = SUM OF EXPORTS + IMPORTS / GDPGOV = TOTAL GOVERNMENT EXPENDITURE / GDPXRATE = AVERAGE ANNUAL EXCHANGE RATEGDP per capita = GROSS DOMESTIC PRODUCT per capita

GMM Panel Data: endogenous variables (TFP, PCR) exogenous variables: macro variables

TFP or the Malmquist TFP or the Malmquist IndexIndexThe Malmquist Productivity Index is a

distance function which measures the degree of productivity using a multi input and multi output approach.

Created by the Swedish statistician Malmquist in 1953, it was first proposed by Caves, Christensen, and Diewert (1982).

It has since been further developed by Fare (1998), Fare et al. (1994) among others.

TFP or the Malmquist TFP or the Malmquist IndexIndex

21

111

1111111

1, ),(),(

),(),(),,,(

ttt

ttt

ttt

ttttttt

tt xyDxyD

xyDxyDxxyyM

Where M is the Malmquist Productivity Index D is the distance function made up of inputs and outputs. A value of M >1 implies an increase of productivityA value of M=1 means no change in productivity and M <1 is a reduction in productivity.

The distance function is the DEA input-oriented approach.x = inputs (interest rate expenses, personnel expenses and other operating expenses)y= outputs (loans and other earning assets)

TFP or the Malmquist TFP or the Malmquist IndexIndex

21

111

11

1

11111

1, ),(),(

),(),(

),(),(),,,(

ttt

ttt

ttt

ttt

ttt

ttttttt

tt xyDxyD

xyDxyD

xyDxyDxxyyM

MI(TFP) TEC TC

Where MI represents the Malmquist Index (TFP- Total Factor Productivity), TEC is the technical efficiency change and TC is the technological change.

• The technical efficiency change relates to how close firms are operating in relation to the best practice frontier. • On the other hand, technical change refers to the shift in the best practice frontier.

Empirical ResultsEmpirical ResultsFigure 3

TFP, TC and TEC average annual geometric average in Latin America (%)

TFP, TC and TEC are the geometrical averages for the corresponding years in Latin America. The Latin American average includes the countries in study: Argentina, Brazil, Chile, Colombia, Costa Rica, Paraguay, Peru, Uruguay and Venezuela.

Empirical ResultsEmpirical ResultsTable 1

GMM dynamic panel data, TFP as the dependent variableTFP(a)

TFP(b)

TFP(c)

TFP lagged(t-1) .061 -.059 -.019

PCR 1.133*** 1.488*** PCR lagged(t-1) 1.56*** -.845

PCR lagged(t-2) .832* .228

CPI .032*** .031*** .043*** TRADE -.34 .267 -.082 GOV -2.618*** -2.857* -2.647**XRATE -.036*** -.095* -.058*GDP per capita -.059 -.039 -.184 Cte. 1.481** 1.128 2.511** AR(1)p-valueAR(2)p-valueHansen J testp-valueObservationsYear dummies

-2.04(0.042)

1.22(0.224)25.89 (0.359)

973Yes

-1.58(0.113)-0.19

(0.853)28.31

(0.166)513Yes

-1.87 (0.062)-0.03 (0.977)19.48 (0.427)

973Yes

Empirical ResultsEmpirical ResultsTable 2

GMM dynamic panel data, PCR as the dependent variablePCR(d)

PCR(e)

PCR(f)

PCR lagged(t-1) .463** .986*** .835*** TFP .016*** .008* TFP lagged(t-1) -.011 -.015 TFP lagged(t-2) -.024** -.005 CPI -.005*** -.004*** -.006*** TRADE .286*** .22*** .223*** GOV .683*** .21 .301 XRATE -.001 -.009 -.006 GDP per capita .095*** .11*** .117*** Cte. -.8*** -.902*** -.951*** AR(1)p-valueAR(2)p-valueHansen J testp-valueObservationsYear dummies

-2.6(0.009)-2.02

(0.043)44.96

(0.006)973Yes

-1.44(0.150)-1.15

(0.251)36.91

(0.024)513Yes

-1.05 (0.293)-1.02 (0.310)22.57 (0.257)

513Yes

ResultsResultsThe main findings indicate there is a

strong positive relationship between TFP and PCR and vice-versa (model f).

CPI is positive and significant when explaining banking sector productivity but negative and significant when explaining financial deepening.

TRADE, is positive and significant when explaining financial deepening.

Government expenditure is negative and significant with TFP, implying that greater government expenditure decreases banking productivity.

Other resultsOther resultsXRATE variable is negatively and

significantly related TFP.GDP per capita is positively and

significantly related with PCR.

Conclusions 1/2Conclusions 1/2The above results are in general

supportive of a positive relationship between financial deepening and banking productivity.

This finding suggests that a channel through which the beneficial effects of financial deepening find their way through the economy is the banking system.

Conclusions 2/2Conclusions 2/2Evidence of reverse causality

between financial deepening and banking productivity.

The finding of reverse causality may indicate the existence of a virtuous cycle between financial deepening and banking productivity where one facilitates the other.

Policy ImplicationsPolicy ImplicationsPolicy oriented measures in the

region should take in consideration the positive causality between financial deepening and banking productivity and try to increase the level of credit to the private sector as a stimulant of economic growth.