Figlo, Mijngeldzaken.nl, Jan van Lierop & Maarten Luiken – Zonder samenwerking geen business case!

FINANCE - Figlodownload.figlo.com/Commerce/FoW Winter edition... · insurer is using Figlo...

Transcript of FINANCE - Figlodownload.figlo.com/Commerce/FoW Winter edition... · insurer is using Figlo...

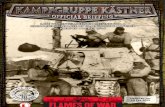

ONWINDOWS.COMMICROSOFT TECHNOLOGY IN BANKING, CAPITAL MARKETS AND INSURANCE

FINANCE ON WINDOWS “The goal of the CardLinx Association is

to enhance the customer experience”Eric Jorgensen, Microsoft

Windows 8 | Innovative mobile experiencesBranch transformation | Enriched personalised engagement

Wealth management | Building customer trust

Winter 2013 £9

Personal planningRobin van den Burg of Aegon Bemiddeling explains how the insurer is using Figlo technology to better serve its customers

1

Industry-wide transformationsThe financial services industry is undergoing unprecedented change. According to a recent Accenture study, insurance sold through digital channels will reach €25 billion annually in Europe. Similarly in retail banking, the relationship between customers and banks has been transformed. As stated by Gartner, 40 per cent of all in-person interactions between banks and their customers will be initiated or completed using a tablet by the end of 2015.

Connected by mobile and social technologies, customers are demanding higher levels of service than ever before and, with an increasing number of financial services providers to choose from, the pressure is on for financial institutions to deliver in order to remain competitive.

In this issue, we talk to Microsoft and its partners to find out how banks are transforming their branches to provide enriched and engaging experiences for customers. We also explore how this evolution is extending across the financial services industry and discover how Aegon Bemiddeling is using technology to continue delivering unprecedented levels of service to customers into the future.

We hope you enjoy this issue.

Karen ConeGeneral Manager, Worldwide Financial ServicesMicrosoft

WelcomeWinter 2013

didn’talready had.

Dell_EIT RIGHTpg Spread_Cloud_420mm x 280m.indd 1 2/6/2012 3:46:37 PM

Find the cloud you d know you a

You have cloud-ready systems already in place. Dell’s open virtualization and cloud solutions create e� ciencies within your existing infrastructure, giving you the tangible business benefi ts of the private cloud. Learn more at Dell.com/E� cientIT.

Dell_EIT LEFT pg Spread_Cloud_420mm x 280m.indd 1 2/6/2012 3:45:41 PM

7

32

36

16

News 12A roundup of the latest stories from the financial services industry, including an exclusive interview with Microsoft’s Erik Jorgensen, a roundtable discussion with six BIAN members, the launch of CardLinx Association and new product releases from Dell, Veeam and FreedomPay. We also highlight the main topics covered at Sibos and Goodacre’s Securities Industry conference and preview upcoming financial services events

Viewpoints 20Thought leadership articles from Dell’s Marc Stein, Etronika’s Kestutis Gardziulis, Microsoft’s Mark Margolis and Veeam Software’s Rick Vanover. Fiserv’s Jereon Dekker and Scala’s Daniel Rubenstein also provide insight into the latest industry trends

Cover story 26 Preparing for the future Lindsay James looks at why Aegon turned to Figlo to improve its customer services and boost agent productivity

Features Fostering innovative mobile experiences 32 Amber Stokes explores how financial institutions are embracing Microsoft’s Windows 8 platform Banking on the branch 36 Jacqui Griffiths asks Microsoft’s Luc Schamhart how the company is helping banks to deliver a unique and engaging customer experience Maintaining momentum in wealth 44 Rebecca Lambert speaks to Microsoft’s Rupesh Khendry to find out how Dynamics CRM can help wealth management firms build trust with their clients

In practice 46 We highlight how Capitec Bank worked with Scala and Ethniks to successfully implement digital signage technology at its branches in South Africa

Sign out Transforming modern data protection 48 Amber Stokes talks to Doug Hazelman, Veeam software’s vice president of product strategy, about the use of virtualisation in backup and recovery

ContentsWinter 2013

26

46

9

C

M

Y

CM

MY

CY

CMY

K

Freedom_Pay_Finance_Ad-v2.pdf 1 10/29/2013 8:54:25 PM

Publishing partners

Industry partners

PartnersWinter 2013

Finance on Windows is produced in partnership with Microsoft (NASDAQ ‘MSFT’), the world leader in software, services and solutions that help people and businesses realise their full potential. The company offers a wide range of products and services designed to empower people through great software – anytime, any place and on any device.

Customers worldwide search Pinpoint and Microsoft product-specific marketplaces for Microsoft partners and their applications and professional services. At the same time, Pinpoint works with business and product groups across Microsoft to effectively integrate Pinpoint throughout their marketing campaigns and websites, driving customer traffic to partners like you.

Accenture is a global management consulting, technology services and outsourcing company, with more than 223,000 people serving clients in more than 120 countries. Combining unparalleled experience, comprehensive capabilities across all industries and business functions, and extensive research on the world’s most successful companies, Accenture collaborates with clients to help them become high-performance businesses and governments.

For more than 26 years, Dell has empowered countries, communities, customers and people everywhere to use technology to realise their dreams. Customers trust us to deliver technology solutions that help them do and achieve more, whether they’re at home, work, school or anywhere in their world.

With over 15 years of expertise, Figlo delivers state-of-the-art software that supports financial awareness on a consumer level. Based on the latest Microsoft technology, its solutions are delivered to financial advisors, banking and insurance professionals. All information is available 24/7 through a secure online interface using the Windows Azure Platform.

Scala has a passion for creating intelligent digital signage solutions that move products, consumers and employees. Driving more than 500,000 screens worldwide, Scala solutions increase sales, improve brand loyalty, optimise the customer experience and reinforce business objectives. Scala is headquartered near Philadelphia in the US with multiple subsidiaries across Europe and Asia, and over 500 partners in more than 90 countries.

Download the OnWindows app to your Windows 8 or Windows Phone device to access digital editions of each issue of Finance on Windows and all other industry publications in the OnWindows suite.

Just search for ‘OnWindows’ in the Windows Store.

Published by Tudor RoseTudor House 6 Friar Lane, Leicester LE1 5RA, EnglandTel: +44 116 222 9900 Fax: +44 116 222 [email protected] www.tudor-rose.co.uk Managing Director: Jon Ingleton

Follow us: twitter.com/onwindowsBecome a fan on FacebookConnect on LinkedIn

ISSN 1473-2173Finance on Windows is Microsoft’s quarterly enterprise customer magazine for the financial services industry. For further information and to subscribe, please visit: www.onwindows.com/touch

Printed in Great Britain by The Manson Group.

© 2013 Tudor Rose Holdings Ltd. All rights reserved. No part of this publication may be stored or transmitted or reproduced in any form or by any means, including whether by photocopying, scanning, downloading onto computer or otherwise without the prior written permission from Tudor Rose Holdings Ltd.

Active Directory, BizTalk, Microsoft, Outlook, SharePoint, Visual Studio and Windows are either registered trademarks or trademarks of Microsoft in the US and/or other countries. The names of actual companies and products mentioned herein may be the trademarks of their respective owners.

Views expressed in this magazine are not necessarily those of Microsoft or the publishers. Acceptance of advertisements does not imply official endorsement of the products or services concerned. While every care has been taken to ensure accuracy of content, no responsibility can be taken for any errors and/or omissions. Readers should take appropriate professional advice before acting on any issue raised herein.

The publisher reserves the right to accept or reject advertising material and editorial contributions. The publisher assumes no liability for the return or safety of unsolicited art, photography or manuscripts.

FINANCE ON WINDOWS

EditorAmber Stokes [email protected]

News editors Rebecca Gibson, Sean DudleyEditorial team Jacqui Griffiths, Lindsay James, Karen McCandless, Cherie RowlandsHead of editorial Rebecca LambertEditorial contributors Jeroen Dekker, Fiserv; Kestutis Gardziulis, Etronika; Marc Margolis, Microsoft; Daniel Rubenstein, Scala; Mark Stein, Dell; Rick Vanover, Veeam Software Advertising For advertising enquiries, please contact Ricky Popat on +44 116 222 9900 or [email protected]

Publication manager Ricky Popat, [email protected]

Partner managers Claire Brown, Zia Choudhury, Tim Grayson, Christian Jones, Andy Clayton-Smith, Daniel Wateridge, Thomas Wills SubscriptionsMichael Geraghty, [email protected] Reprints Stuart Fairbrother, [email protected] Publisher Toby Ingleton Art direction Bruce Graham Design Paul Robinson, Libby Sidebotham Creative direction Leigh Trowbridge Photography Cover photography by Tudor RoseAdditional photography by www.istockphoto.com Website development Chris Jackson Circulation Ritwik Bhattacharjee Business management Ampy Dhillon, Rachael Heggs, Lesley Krotochwil, Richard Pepperman

Microsoft Tag Scan or snap the tag for more information on FoW and Microsoft technology for enterprise businesses. To get a Tag Reader, visit http://gettag.mobi on your mobile phone browser.

Issue 51, Winter 2013Featuring a directory of over 100 Microsoft partners serving the worldwide financial services sector, as well as unique insights into Microsoft’s technology roadmap and regional industry trends, this guide is designed to give you a real overview of what will be happening across the industry over the next three years and beyond.

Order your copy now online at www.onwindows.com/partners

Financial ServicesGlobal Outlook 2013–2016

13www.onwindows.com

Why Microsoft joined CardLinx

Tell us more about the CardLinx Association.The CardLinx Association is a new interoperability organisation. Its goal is to enhance the consumer experience with local commerce and card-linked offers. The association will develop and institute common business practices and interoperability standards, helping to improve commerce experiences within this industry. Why did Microsoft decide to join? We identified the need for the CardLinx Association and reached out to other founding members to help establish it. We are excited about the value card-linked offers can provide to local businesses, allowing them to take advantage of excellent cost per action-based advert products with analytics around consumer engagement. It became clear that in order to accelerate adoption and build a relevant corpus of card-linked offers, we needed industry collaboration to arrive at common practices and approaches to cross-syndicating deals, finding ways to limit risk and so on.

What is Microsoft’s role within the association? It has been obvious to Microsoft that a non-biased, non-profit association was needed to overcome the interoperability and business standards issue in the card-linked industry. We’re focused on connecting digital advertising to the physical world in a way that minimises friction for merchants and consumers so they can engage with each other in valuable ways. We believe that card-linked offers will play a key role in delivering on this promise.

How will enterprise customers benefit? Working with industry leaders across a variety of domains – including payment networks, transaction processors, social networks and financial institutions – can bring cohesion to the local commerce space, which will benefit interested enterprise customers. Microsoft’s membership in the CardLinx Association will provide its business and advertiser community with greater choice and will also offer its consumers a richer collection of card-linked deals to choose from.

MarketwatchThe latest news in banking, capital markets and insurance

New association established for payment card offers

CardLinx was launched by Silvio Tavares (top right) and its founding members at the

Money 2020 event in Las Vegas, US

Leading banking, payment networks,

e-commerce and social media companies,

including Microsoft, Facebook and Bank of

America, have joined to form the CardLinx

Association, a new group that aims to

make it easier for consumers to take

advantage of online deals and offers via

their payment cards.

The initiative is currently being rolled

out across the US and will enable banks,

merchants and advertisers to deliver a digital

discount or promotion to consumers via their

credit, debit or other payment cards. This will

provide consumers with a more connected

and seamless redemption experience, and

save them from having to use paper coupons,

vouchers or promotion codes.

CardLinx will also develop and

promote common business practices and

interoperability standards to minimise friction

in the sourcing, serving, publishing, redeeming

and cross-syndicating of card-linked offers.

“The CardLinx Association brings together

thought leaders across a variety of important

linked industries, allowing us to define a

set of standards and services that will make

it easier for consumers to shop and for

merchants to sell their goods and services,”

said Silvio Tavares, founding CEO of the

CardLinx Association.

Interview

The CardLinx Association will streamline the digital and physical purchase experience

Erik Jorgensen, Microsoft’s general manager of local advertising, tells Rebecca Gibson about the company’s role in the association

CardLinx Association membership is open to financial institutions, publishers, advertisers and merchants, payment networks and offer technology companies. Its founding members include:• Affinity Solutions• Bank Of America• Cardlytics• CardSpring• Deem • Discover Network• Facebook • First Data• Linkable Networks• Living Social• MasterCard • Microsoft.

CardLinx members

Dynamics CRM 2013 out nowMicrosoft has released the online and

on-premise versions of Microsoft Dynamics

CRM 2013.

This latest iteration of Microsoft’s customer

relationship management (CRM) solution has

been designed to redefine how businesses

engage with their customers. It offers users an

enhanced experience that promotes end-user

productivity and demonstrates the power of

the solution when used in conjunction with

other Microsoft technologies. This includes

interoperability with Yammer, Lync and

Skype – delivering sales, service, marketing

and industry professionals a seamless and

customisable experience.

“We needed industry collaboration to arrive at common practices”

Eric JorgensenMicrosoft

Social insights: on the back of Microsoft’s acquisition of social intelligence provider InsideView, Dynamics CRM now has Social Insights capabilities embedded into it. Social Insights pulls real-time company and contact information from 30,000 sources

Industry templates: customers can now take advantage of pre-defined and configurable processes where each stage of a process is clearly outlined, identifying the recommended steps to completion

People-first design: all customer information is presented on one screen, helping people to see everything they need to know about their customer interactions in one place

Social connectivity: with Yammer, customers can quickly comment on posts or start contextual conversations from within Microsoft Dynamics CRM.

Key features in Dynamics CRM 2013

www.onwindows.com 15

Veeam Software has released the latest version

of Veeam Management Pack for VMware (MP),

which enables IT departments to monitor and

manage VMware and vSphere environments

through Microsoft System Center. Here are some

of the top new features included in version 6.5:

Veeam updates MP software Mutual Benefit deploys Accenture platform

MarketwatchThe latest news in banking, capital markets and insurance

Personal and commercial lines insurance

provider Mutual Benefit Group has become the

first US customer to deploy Accenture’s Claim

Components software to improve the efficiency

of its legacy claims systems.

The solution automates claims processing

and is integrated with the insurer’s existing

Accenture Duck Creek Policy Administration

system. This enables underwriters and claims

adjusters to transfer information quickly and

securely, while lowering costs. It also improves

customer service for its 85,000 policyholders in

Pennsylvania and Maryland.

Products

1. vCenter failover: Veeam MP now automatically reconfigures if vCenter fails, allowing data to continue to be collected directly from vSphere hosts

2. Enhanced vSphere reports: administrators can now use the Configuration Tracking and Alert Correlation tools to see exactly what has changed in the vSphere environment

3. Integration with Veeam Backup & Replication: users will now be able to monitor their entire Veeam Backup & Replication infrastructure in System Center Operations Manager – including proxy servers, repository servers, WAN accelerators and back-up jobs.

Dell Venue Pro and XPS series to operate on Windows 8.1Dell’s new devices will run on the latest Windows operating system and are compatible with both Microsoft Office and current Windows applications

• Intel Atom quad-core Baytrail processors

• Office 2013 Home and Student included with the device

• Optional Dell Active Stylus.

Dell Venue 8 Pro

• Detachable keyboard • Removable battery• Variety of keyboard and

stylus options including Dell Active Stylus, Slim Keyboard and Mobile Keyboard with integrated battery.

Dell Venue 11 Pro

• 360-degree rotating hinge • First Quad HD display on an

11.6-inch ultrabook • Solid surface back-lit touch

keyboard.

Dell XPS 11

• Fourth generation Intel Core i5 and i7 quad core processor options

• NVIDIA discrete graphics options

• World’s first optional 15.6-inch Quad HD+ display.

Dell XPS 15

Contactless payments: in numbers

Payments

Microsoft partner FreedomPay has released its

Payments Platform as a Service solution, which

uses Microsoft SQL Server to enable banks to

improve sales and offer customer loyalty schemes

and incentives.

Offered via the Microsoft Windows Azure cloud

platform, the payments and incentives tool leverages

the FreedomPay Commerce Platform to deliver mobile

payments, digital wallet and commerce solutions

with banking-grade security through the Microsoft

alliance. It enables banks to offer real-time payment

transactions and discounts or offers to customers.

FCCU, USFirst Community Credit Union (FCCU) has installed an NCR APTRA Interactive Teller at an H-E-B grocery store in Houston,

Texas. The machine enables a remote FCCU teller to communicate with customers and conduct transactions in real time. Customers can also benefit from the teller’s intelligent deposit, bill pay and account and loan initiation functions.

China Resources Bank of Zhuhai, ChinaNCR is to provide hardware maintenance services for more than 200 units of its ATMs at

various branches of China Resources Bank of Zhuhai. As part of the five-year contract, NCR will offer a tailored maintenance service plan for the ATM networks in every branch. The bank also plans to install an additional 500 NCR ATMs, which run on the Microsoft Windows CE platform.

Nationwide, UK Nationwide Building Society is to deploy NCR’s text-to-voice software to improve ATM machine access for visually impaired

customers across the UK. As part of the project – which is aligned with the Royal National Institute of Blind People’s ‘Make Money Talk’ campaign – NCR’s Voice Guidance solution will be installed at 50 Nationwide branches by the end of 2013, while 75 per cent of its ATMs will have the functionality by February 2014. Nationwide will also update its ATM network with NCR’s Microsoft technology-based APTRA software.

Over the past few months, several financial institutions have decided to take advantage of NCR’s self-service and assisted-service software and hardware solutions to improve services and offer customers fast, convenient transactions.

NCR gains new financial services customers

FreedomPay debuts payment tool

European consumers made 211 million contactless purchases between August 2012

and July 2013

€1.8 billion has been spent on

contactless Visa cards since August 2012

There are currently 69 million Visa contactless cards in

circulation

More than 1 million contactless terminals

across Europe

The average value purchase value is €8.63

Poland has more than 10.1 million

contactless cards

Spain has increased the number of contactless

terminals to 266,020, a rise of 446 per cent since July 2012

More than 4 million Visa contactless journeys have been made on the UK’s London buses

since December 2012

www.onwindows.com 17

NotesMobile innovation tops the Sibos agenda

MarketwatchThe latest news in banking, capital markets and insurance

Mobile innovation, multi-channel payments

and regulation were the hot topics discussed

at Swift’s annual Sibos event, which took

place between 16-19 September at the Dubai

World Trade Centre, Dubai, UAE.

Going mobile

Speaking at the event, Skand Mittal, senior

product marketing manager for commercial

tablet marketing for industry at Microsoft, said:

“Financial services organisations are looking to

differentiate themselves and they can do that

through mobile innovation.”

In line with this, Microsoft and its industry

partners, such as SunGard, Thomson Reuters

and FreedomPay, used Sibos 2013 as a

platform to launch a range of Windows 8 B2B

and B2C apps and devices to help financial

institutions cater for the mobile generation,

while remaining secure and compliant.

“Competition is coming from non-banks

and changing the financial services industry

landscape,” said Karen Cone, Microsoft’s general

manager of Worldwide Financial Services.

“Providing an easy, do-it-your-way experience

that is personally and professionally relevant is

essential to customer retention and acquisition.”

Transforming payments systems

In one presentation, HSBC’s chief executive

of global banking and markets Samir Assaf

predicted that by 2020 alternative payments

will triple, while multi-channel payment

methods will transform the industry as

consumers increasingly turn to smart

technology. It will also encourage expansion in

emerging markets.

“Mobile technology can bring payments

services to people in remote communities

who have never had a bank account before,”

said Osama Al Rahma, general manager of Al

Fardan Exchange.

According to Anne Cairns, president

of international markets at MasterCard

Worldwide, the company has already

capitalised on this development: “We’ve

partnered with local technology firms to bring

card payment to shops, reducing the need for

cash and driving down the cost of payments

for poor people in South Africa,” she said.

Compliance and regulation

Financial institutions are adopting cross-

border standardisation via initiatives like

the SEPA and the adoption of common ISO

20022 messaging.

Fiserv launched Facta Manager, a

monitoring solution to enable financial

institutions to meet key requirements of the

Foreign Account Tax Compliance Act.

Bank of America Merrill Lynch joined Swift’s

Early Adopter Programme for the Japan Securities

Depository Centre (JASDEC), the country's central

securities depositry. JASDEC is working with Swift

to internationalise and standardise messaging

standards by adopting ISO 20022.

Cartes Secure Connexions

When: 19-21 November 2013Where: Parc des Expositions de Paris-Nord Villepinte, Paris, FranceWhat is it: Dedicated to exploring secure payments, identification and mobility solutions, Cartes will cover cloud security, electronic government trends and smart citiesWhy go: Meet with representatives from the industry’s full value chain and stay updated on industry trends. Delegates can also attend the Milipol Paris, the worldwide event for the internal state security marketWho will present: • Tom Conlon, VP of marketing and business

development, VeriFone• Caroline Drolet, head of mPOS, Visa Europe• Marc Sel, director, PWC

FinovateAsiaWhen: 14 November 2013Where: Max Atria, Singapore Expo, Singapore.What is it: The demo-only event will showcase the new innovations in financial and banking technology from a mixture of established companies and new start-upsWhy go: Learn about the latest industry innovations and network with leading financial institution executives, venture capitalists, analysts and entrepreneursWho will present: ANZ Banking Group, MasterCard, Microsoft

Events Dates for your diary

Securities industry striving for higher standards

Banks, regulators and technology providers

met on Friday 4 October at the Royal Bank

of Scotland Auditorium in London for the

annual Securities Industry Conference.

Hosted by UK business and technology

consultancy specialist Goodacre UK,

the conference was chaired by ex UK

politician Michael Portillo, who presented

the theme of regulation as being a major

topic for speakers.

Microsoft partner AutoRek presented

results of its report, Taking Control, An

analysis of current attitudes to Britain’s

financial controls agenda, which found that,

while 46 per cent of respondents thought

that the most likely cause of a financial

crisis in the future was a failure of financial

controls, 65 per cent of firms were actually

unaware of the maximum fine they face for a

regulatory breach of financial controls.

Anthony Browne, chief executive officer

at the British Banker’s Association said that

the industry was going through a change,

however. “There was a noticeable lull last

year,” Browne said. “Issues around bonuses

and changes to senior staff members have

meant that retail banks have put a lot more

effort into being customer focused. The

industry now has a focus to restore trust in

itself and strive for higher standards.”

Industry leaders highlighted the potential of mobile innovation at the 2013 Sibos event

Former UK politician Michael Portillo chaired the Securities Industry Conference in London

19www.onwindows.com

MarketwatchThe latest news in banking, capital markets and insurance

BIAN members discuss IT architecture challenges

The Banking Industry Architecture

Network (BIAN), an independent not-for-

profit association that defines banking

interoperability standards, released

the latest instalment of its Service

Landscape at this year’s Sibos event.

Service Landscape 2.5 will help drive

BIAN’s mission to support industry-wide

adoption of service oriented architecture

in order to cut banking technology

costs. Amber Stokes met with some of

its members at Sibos to talk about the

role BIAN is playing in the industry and

how it is helping banks to tackle they key

challenges they face.

Many people here at Sibos are discussing

the top IT trends that are having an impact

on the industry. What trend would you like

to highlight?

Don Trotta, global head of Financial Services, SAP and vice chair of the BIAN Board: When

we talk to banks, one of their top priorities is

to more easily comply with regulations. This

plays into what we’re trying to do at BIAN

in terms of standardisation in the banking

industry, which will allow banks to not only

remain compliant, but also drive growth and

customer centricity.

Ravi Pratap Singh, head of Global Product Management, Nucleus Software: Nucleus

Software focuses on a niche market in loans

management. For our customers it’s all about

customer retention and loyalty. To better

connect with consumers, loans management

software providers have to integrate with

banks’ multiple processes and systems.

Colin Kerr, Worldwide Industry Solutions manager, Microsoft: We are seeing something

very similar. According to the Capgemini and

Efma World Retail Banking Report 2013,

41 per cent of customers are not sure if they

will stay with their bank after one year. And

it wasn’t trust or fees that were the issue,

but the quality of service and ease of use of

banking channels. Banks are realising that

they need to become more customer centric –

and technology is the key enabler of that.

Jochen Schneider, chief operating officer of SunGard’s retail banking business and member of the BIAN board of directors: Recent SunGard

research found that consumers expect

mobile and internet banking channels to be

user friendly while still offering a high level

of functionality. This trend is applicable to

the branch too. Branches need to embrace

the latest technologies to offer a superior

customer service.

Chae An, vice president and CTO Financial Sector Solutions, IBM and member of the BIAN board of directors: Banks are also focusing on

providing a better service for their corporate

clients. Key to this is having good analytics

capabilities, which allows for improved cash

flow forecasting and risk management, and

the capacity to onboard clients quicker. This

is not only better for the bank as they can

collect revenue faster, but it’s also better for

the client as they get transactions quicker.

What emerging industry trend will really

take off in the next few years?

Trotta, SAP: I expect ‘as-a-service’ cloud models

will be more commonly used. This relates to the

main priorities I mentioned earlier in terms of

effectively dealing with regulatory compliance.

One way banks want to help manage their

cost structure is to move away from Capex

expenditure towards operating expenditures.

Cloud consumption models will enable this.

Hans Tesselaar, executive director, BIAN: Cloud

‘pay as you go’ models are also opening up

opportunities for smaller banks, particularly those

in developing countries that don’t necessarily

have the capital to invest in modern, enterprise-

level IT upfront. These kinds of organisations will

be more inclined to experiment with the cloud.

Established banks will then follow suit once they

see what’s possible.

Trotta, SAP: The success of cloud computing

comes down to standardisation. Banks

should start with a virtualisation initiative

that allows them to get into the right position

internally in the organisation, and then get

to the point where they can move to a full

cloud environment. BIAN is going to play an

important role in making this possible.

Schneider, SunGard: Another trend we have

witnessed is that many banks that have survived

the financial crisis have purchased and acquired

other banks to sustain growth. Therefore,

having other IT systems that can be integrated

in a modular way would be ideal, but they often

don’t have that luxury. One option is for banks

to move towards outsourcing models, but the

bigger players will stay on their current systems

and offer a cloud-based service on a bank-to-

bank basis instead.

How can BIAN help?

Trotta, SAP: BIAN provides the path by which

banks can get away from spending huge

amounts of money on integration to instead

invest in innovation and address the kinds of

challenges we’ve b een talking about.

An, IBM: Banks might consider themselves

to be unique, but a lot of what banks do is

common. And this is what’s important about

BIAN: by standardising the industry and also

capturing some of the business merits and

best use cases, banks can make use of this

information so that they don’t have to invest

in recreating what’s already there.

Schneider, SunGard: Traditionally, large banks

develop all of their own systems based on a set

of internal criteria. What we are doing in the

BIAN network is connecting the best architects

wihin the banks and software providers in

order to come up with a common and flexible

framework that banks must comply with.

An, IBM: The banking industry is rather like

car manufacturing: there are 15 different

models, but if you look behind the colours,

you will see that 70/80 per cent of the parts

are the same and they’re just assembled

differently. BIAN creates a common

foundation and semantic rules of how to

build software components for banks that

fit together.

Kerr, Microsoft: We, as software providers,

find the same thing – there are common

elements of an architecture that you need in

order to build software solutions. It doesn’t

make sense to compete on that; instead,

organisations should share best practices and

then differentiate on future functionality. And

that’s what BIAN encourages.

How do you expect BIAN to develop?

Schneider, Sungard: As the industry evolves,

software vendors need to deliver services

and modules that fit into that landscape.

We started this process earlier this year. We

produced a new framework and imported

the structure from BIAN to create a model to

form our requirements, structure our existing

software functionality and then produce new

code for the framework.

Kerr, Microsoft: There are 40 companies right

now involved in creating BIAN. There are

thousands of vendors out there and tens of

thousands of banks who are not involved. So

how do you encourage mass adoption? BIAN

has made great progress in reaching new

countries and new time zones, to the point

where we now nearly have representation

across the globe. But how do you make that

manifest itself into new solutions in those

geographies? Education is crucial.

Amber Stokes caught up with BIAN members at Sibos to discuss industry challenges and to find out why BIAN is more important than ever to the banking industry

21www.onwindows.com

ViewpointMulti-channel banking

The importance of consistent communicationKestutis Gardziulis discusses the challenges that multi-channel banking can create for organisations and how they can provide a better experience to customers

We live in interesting times. Technology

surrounds us, shapes the way we live and

interact and extends our abilities. Great

thinker Kevin Kelly wrote in his book What

Technology Wants: “We can see more of

God in a cell phone than in a tree frog.“

And it is true. We believe in a trend where

everything will be accessible through

mobile devices in the nearest future.

Banking services are no exception.

Every financial institution speaks about

mobile strategies or mobile applications. Fast

runners have created a sophisticated presence

on mobile devices. Banks want to be modern,

innovative and be popular among customers,

but often this innovation stops with the

launch of a new mobile app. Too often the

look and feel across these multiple channels

is inconsistent. But what if a customer realises

that there is a function or service that they

want that is not available on that app? If,

for instance, a new customer learns of the

interesting mobile presence of a bank, comes

across limitations while using the app and then

is faced with a completely different experience

when they try the website or branch, they

will simply go elsewhere. Banks should be

centred around the customer, which means

they need to ensure all channels are consistent

and complement each other for a seamless

customer experience.

If a bank wants to be technology savvy

and innovative in order to attract the new

generation of customers and keep the

branch network alive, then they should be

consistent across all channels. They should

move transactions online and leave the

branch as an embassy of the bank and brand.

At the same time, they should provide an

appropriate level of sophisticated and user

friendly technology that mirrors that of the

online and mobile offering within the branch.

After all, customers still come to the branch

when they need a personal approach and

want to make a serious financial decision.

And so, instead of inconsistent experiences,

banks should instead provide the same

innovative experience in the bricks and

mortar branch that the customers have

already experienced across other channels

and have now learned to expect.

Core business should still not be forgotten,

but technology is there at your fingertips to

unify the experience, impress the market and

exceed limits. Technology such as interactive

walls, touch surfaces and natural user

interfaces will help banks to communicate

their message.

Banks conduct business with people and

people today like to learn, play games and be

educated in an informal way. So banks should

recreate the image of a historical branch and

bring back customers who want to have a

personal touch and receive the best possible

service. Banks should allow technology to

expand their offerings as technology expands

natural life.

Kestutis Gardziulis is CEO and co-founder at Etronika

“Banks should allow technology to expand their offerings as technology expands natural life”

Kęstutis Gardžiulis Etronika

ViewpointSecurity

Marc Stein provides tips on how best to migrate to newer operating systems, as Windows XP end of service nears

How to ease the pain of migrating operating systems

Changing from one operating system to

another often poses a challenge for IT

departments. This issue is currently top of

mind for many as Windows XP support comes

to an end in 2014. Many companies are yet to

make the changeover from Windows XP and,

with new iterations of Windows being released,

now is the time for enterprises to ensure their

migration strategy is up to scratch.

Migrating operating systems can affect a large

number of other systems and users have to be able

to continue their work with minimum disruption

and difficulties.

The starting point of any successful migration

project is to assess its scope. This includes

collecting information on all the computers,

applications, tools and operating systems that

are being used by staff. While this may seem

like an obvious step, many companies lack

the necessary information or may not have

up-to-date records, as changes are often not

documented in full.

Companies should use the opportunity to

tidy up their data and applications in advance

and only migrate ‘clean’ systems to their new

platforms, helping to reduce the time and

bandwidth required for the transition. At this

point, it’s worth creating migration guidelines

that can serve as a binding definition of what

applications, user settings and types of data

will and won’t be selected for migration.

When planning the migration process, it

should be divided into a number of different

phases, and companies should allow enough

leeway between these phases, so they can

cope with unexpected problems or unforeseen

bottlenecks. Incorporating a test phase into the

process is also advisable.

Selecting the right time to begin the process

is crucial. In the case of automatic migrations,

administrators select when the upgrades begin.

In this case evenings or weekends are the

best times as it minimises disruption to users.

However, the process should be carried out

in stages as migrating all PCs simultaneously

routinely creates unexpected problems.

Selecting online or offline before commencing

the migration is also important. Online

migrations are initiated from within the existing

system, providing administrators with an

excellent overview of the migration process, and

it is easy to spot errors and problems quickly. In

the case of offline migrations, computers boot

using another media, such as a DVD or from

the network, to start the upgrade routine. This

method is faster but not as easy to monitor.

If a company has remote offices in other

countries, it must ensure that upgrades use the

correct language for the locality and pay careful

attention to the project, especially in locations

with no on site IT team. Companies should

plan training courses and prepare measures to

ensure that staff are prepared to use the software

correctly and have no difficulties with it.

Finally, involving the users early will

ensure the project is successful. Migration

projects are meant to increase a company’s

productivity, however, this can only happen

if the users feel positive about the migration.

Companies should inform their staff as

early as possible about the reasons for the

transition, highlight the advantages for users

and address any feedback.

Marc Stein is executive director of software sales at Dell

“Now is the time for enterprises to ensure their migration strategy is up to scratch”

Marc SteinDell

23www.onwindows.com

“Virtualisation has changed today's game of operating and provisioning of datacentre resources”

ViewpointCustomer relationship management

ViewpointVirtualisation

Making offsite backups easier

Driving sustainable relationshipsMark Margolis discusses how Microsoft Dynamics CRM can reduce business complexity and provide asset managers with a single view of their investors

The modern data centre has many demands, including robust protection. But what about getting backup data offsite? Rick Vanover from Veeam Software says offsite backup is easy with the right approach

Virtualisation has changed today’s game of

operating and provisioning of datacentre

resources. Although it has made it easy for

us to deploy and administer applications and

services delivered from the datacentre, we

still have an opportunity to improve one key

area: getting backups offsite.

Many technologies have been built around

datacentres that we administer. However, these

technologies don’t address getting backups

offsite. And no matter what we do in these

datacentres, we are likely to continue to have a

need to get backups offsite.

The reality has become that there is an ever-

growing expectation that our IT services will be

made available. We’ve invested in the modern

datacentre with robust virtualisation, but we

may not have considered the bigger picture in

regards to availability. Increasing availability

beyond the primary site is possibly a new

opportunity for many environments to deliver

a more available datacentre.

Talk to any datacentre professional and they’ll

assure that site availability will be easier when the

entire profile is virtualised. Once the datacentre

footprint is virtualised, the options are so large to

get backups offsite and provide that additional

level of protection. Some of the most popular

ways to get backups offsite include:

Replicated virtual machines. This is a great

way to achieve quick return on investment by

having ready-to-go virtual machines at a remote

site ready for a failover process.

Cloud storage. Storing backups in object-

based cloud storage can be an excellent way

to provide offsite protection when a secondary

site isn’t an option.

Storage replication. If you have storage

systems that provide file or volume replication,

that may be a great way to get disk-based

backups offsite.

Tape. Writing backups to tape today is now a

feasible option. The portability and acquisition

cost simply can’t be beat.

Offsite backups. With virtual machines, we

can leverage a relatively uniform source data

profile and apply techniques to write the

backups to a remote storage resource.

While this list is good and flexible, it may not

work for everyone. There are many factors and

benefits that influence the best approach for your

environment, including available bandwidth

(and its reliability), retention requirements, cloud

storage readiness, security requirements and

restore situation requirements.

Couple this with the ever-shrinking backup

window and it surely is a discussion that

will take some time. There is one thing to

consider as the options present themselves;

the differences between capabilities now,

documented requirements and expectations

for recovery situations. The business has less

patience and more data than it used to and IT

pros are left hanging in the balance.

However, if you take the right approach to

data protection, you can meet all requirements

and keep your stakeholders happy. One

way to do that is to approach modern data

protection as built for virtualisation; which is

what we have been advocating at Veeam for

many years now.

Rick Vanover is a product strategy specialist for Veeam Software based in Columbus, Ohio

Rick Vanover Veeam Software

An asset management firm’s customer

relationship management (CRM)

objectives can be described as relatively

straightforward; however I would describe

the implementations as some of the most

complex I have come across.

Asset management firms have had to

change considerably over recent times. Fund

managers need to focus on more sustainable,

long-term relationships. They also need to

be more transparent and understand their

investors better so that they can grow and

retain investors.

In turn, investors have high expectations

and institutional and private investors have

high expectations with regards to their

client servicing requirements, demanding

personalised and tailored client reporting.

The pace of regulatory changes has meant

that many organisations have had to rethink

their approach to managing operational and

compliance risk. Fund managers need to

make sure that they remain compliant without

impacting performance.

Traditionally, firms would buy best-of-breed

apps or build their own, which has led to poor

levels of integration, inefficiencies and a less

than ideal investor experience (across multiple

channels). Firms are asking for systems and

processes that they can configure and integrate,

instead of complex customisation.

With these changes, firms are looking to

reduce complexity in the business by adopting

best practice, but with the flexibility they need

to support their own models, and they want this

on all devices (mobile and tablet) in a secure

and usable way. If I were to so summarise the

top needs it would look as follows:

1) Visibility of investor holdings and

underlying beneficial owner

2) Complex relationship mapping of third

parties, nominees and custodians

3) Client reporting

4) Campaign and communication management

5) Capturing mandates and investment

guidelines

6) Visibility management of the investor and

fund on-boarding process

7) Managing investor road shows

8) Investor servicing and client queries

9) Investor portals

10) Automation, alerts and exception handling.

All of this can be accomplished with lots of

complex integration and bespoke development,

however the alternative and increasingly

popular approach is to use the Microsoft

Dynamics CRM platform. Tailored applications

can be built to view and produce customised

reports on holdings, or give the ability to

look at exceptions and alerts. Complex

relationships can be mapped and tailored

investor information can be distributed for

new fund launches. Data can be captured for

on-boarding new clients in a compliant fashion,

providing economies of scale and reducing the

operational risk. Furthermore, all the business

has access to the same information and the

commonality of the application means people

adopt the Dynamics CRM platform quickly as it

is familiar and intuitive.

Mark Margolis is a CRM specialist with over 13 years of product management, development and delivery of highly successful and award winning products to the financial services sector

“Fund managers need to focus on more sustainable, long-term relationships”

Mark MargolisMicrosoft

25www.onwindows.com

ViewpointDigital signage

Merging channelsDaniel Rubenstein discusses the importance of integrating digital signage solutions with mobile devices in order to provide a more personalised service in a branch

There has been much debate about the

future of bank branches and whether they

will cease to remain important. According to

research and industry experts, bricks-and-

mortar branches are not going away, but

rather evolving and will be used differently

in the future. Experts agree that branches

offer the best opportunities to strengthen

and expand customer relationships. At Scala

we believe that technology, innovation and

channel integration will play a key role in

re-engineering and re-energising the branch.

Banks are moving to an omni-channel

strategy. The in-branch experience needs to be

consistent across all channels including online

and mobile, offering customers information in

any channel that they want to interact.

Banks are now moving to smaller branch

locations and they’re starting to evolve the

role of their tellers so that they provide more

personalised advice on products and services.

The role of the branch is shifting to become

a sales and advisory centre rather than a

transaction centre.

People often assume that branches appeal

more to senior customers, while the younger

generation is choosing other channels over

branches completely. But we’re actually seeing

the younger generation visiting the branch.

The main difference, however, is that they are

not entering branches for a simple transaction;

they’re instead looking for problem solving, rich

advice and personalised attention. In a recent

survey, adults under 30 were more likely to

indicate that they don’t avoid bank branches,

and they aren’t as interested in opening

accounts online compared to older consumers.

Bankers are strategising and expanding their

digital channels to attract a new generation of

young and profitable customers.

Digital banking interactions are taking

place in the branches, where advisers armed

with tablets can quickly open accounts and

customers can interact with a specialist via

telepresence. Through digital signage, banks

have the ability through interactivity and

mobility to provide advisory and personal

finance content that will complement their

merchandising campaigns and provide their

customers the confidence to make a transaction.

Many digital signage companies view the

use of mobile devices as a threat, but Scala

believes that it can complement digital signage.

Integrating mobile technologies with digital

signage will provide a more interactive, engaging

and personalised experience in the branch.

QR codes, for example, can allow customers

to scan for information relating to a product

or service in the branch and then consume the

information while on the go. Another way our

digital signage technology can link to a customer’s

smartphone is through turning that device into

a remote control, where customers can use their

device to change the content on the digital sign

and access information of personal interest.

Banks are thinking hard about their branch

strategies and Scala is ahead of the curve in

what we deliver to our customers. The evolution

of the branch and the use of innovative digital

signage and mobile solutions is still in the

early stages, but banks understand what their

challenges are and what their customers want.

We at Scala are allowing them to deliver on this.

Daniel Rubenstein is senior director of financial services at Scala

“The in-branch experience needs to be consistent across all channels including online and mobile”

Daniel Rubenstein Scala

ViewpointFinancial crime

Fighting financial crimeJeroen Dekker explains how Fiserv helps financial institutions protect themselves through its behaviour monitoring platform, powered by Microsoft technology

Across the financial services industry, criminals

are constantly looking for weak defences to

exploit for different types of fraud, money

laundering, sanctions violations, tax evasion,

corruption, embezzlement and more. To

combat this persistence, regulators are making

increasing demands that institutions take

adequate steps to protect themselves and their

customers through clear demonstration of

compliance with regulations around security

and integrity. Conversely, innovation in digital

payments and banking relationships, driven

by the potential for competitive advantage,

introduces new risks for fraud and compliance

teams to mitigate.

One key capability in this enduring fight is

behavioural monitoring: the ability to model,

detect, investigate and resolve risks based on a

continually updated understanding of how each

customer is supposed to behave. Timely detection

of irregular or incongruent behaviour (that signals

potential criminal activity) enables fraud teams to

prevent significant losses by stopping payments

before they occur, and anti-money laundering

teams to report suspicions to their country’s

financial intelligence unit.

This key capability is provided by our Financial

Crime Risk Management (FCRM) Platform.

The FCRM Platform is used by over a thousand

institutions around the world, ranging from small

community and high street retail banks to global

life insurance and wealth management firms.

And it needs a lot of data. It is often the biggest

database our clients have, for example monitoring

all transactional activity on 60 million accounts

at one bank in the UK. Updating and judging the

behavioural profiles of each customer with every

transaction requires very intensive processing,

with a web-based investigation environment sitting

behind that for end users to review alerts, explore

the customer’s background and relationships,

collect evidence and execute a decision.

We chose to build and run all this on a

Microsoft technology stack: coded in the .NET

Framework, using a SQL Server database, running

on Windows. Our clients appreciate the lower

cost of ownership to set up and operate this

infrastructure and the transparency provided by

SQL Server. Fiserv benefits as well, running hosted

versions for hundreds of banks and credit unions

in North America.

Next generation real-time detection capabilities

were delivered in the recent launch of our FCRM

Platform and, sticking with our philosophy of

providing a single integrated platform, we have

again leveraged Microsoft technologies around

complex event processing.

What also differentiates the Fiserv solution

is true flexibility; to solve new, different and

changing business problems associated with

financial crime with a single strategic platform,

and to empower skilled business users to do so

themselves. It is neither efficient nor effective to

keep buying separate tools, to call your vendor

for custom coding every change, or even to ask IT

for resources – when new fraud attacks emerge

in a matter of minutes. Institutions need to react

quickly and often to keep risks under control. Of

course, our deep expertise will still be available as

and when needed so that, in partnership with us,

our clients can leverage their installation – and the

holistic view it provides to fight financial crime –

over and over again.

Jeroen Dekker is senior product manager, financial crime risk management at Fiserv

“One key capability in this enduring fight is behavioural monitoring”

Jeroen Dekker Fiserv

www.onwindows.com 27

With a history dating back more than 150 years, Aegon is an

international provider of life insurance, pensions and asset

management, servicing customers in the Netherlands, the US, the UK

and countries in CEE and Latin America.

“Customers are always looking for ways to ensure a stable financial

future,” explains Robin van den Burg, director of Aegon Bemiddeling.

“For example, the moment that they retire from work they expect to

have a healthy income. It is our role to make this possible. We provide

products and services that protect what's important to our customers,

and help them save and invest for the future. And we provide services

that help them manage their assets and resources once they retire. We

believe that everyone – regardless of their income – deserves to retire

with dignity and peace of mind.”

Trust is at the core of Aegon’s services and products. “Customers pay

a monthly amount for their savings plan and trust us to deliver a good

service,” says Van den Burg. “This role has been important for a long

time, but has become even more pivotal recently, as in many countries

around the world the traditional safety nets provided by governments

or company pension plans are no longer adequate. Increasingly, people

realise that they need to take greater personal responsibility for planning

Cover storyAegon

Preparing

When Aegon sought to improve the way it serviced its customers, it turned to Figlo for help. Lindsay James reports

for thefuture

29www.onwindows.com

Cover story Aegon

“The Figlo Platform enables financial

services organisations to build their own

online financial insight solution, which is

either portal- or platform-based,” explains Jan

van Lierop, CEO of Figlo the Netherlands.

“The Figlo Platform is designed for easy

integration with the existing IT environment

and applications. It is based on the Microsoft

.NET Framework and can be used with

standard browsers and on virtually any device

including Microsoft Surface tablets. Powered

by Windows Azure, the solution is offered as a

highly secure 24/7 cloud-based service.”

Figlo’s relationship with Microsoft runs

deep – the two companies formed a strategic

alliance earlier this year. “Microsoft has a long-

term commitment to supporting mission-

critical applications in financial services. Our

alliance with Figlo provides our financial

services customers with an integrated, cost-

effective financial planning platform on which

they can build future-generation applications

that meet the evolving demands of their

business,” says Chris Colyer, senior director of

Worldwide ISV Alliances at Microsoft.

“The Figlo solution is comparable to Lego,”

explains Chris de Vries, business consultant at

Figlo. “It is based on mostly generic building

blocks that fit perfectly together. In this way

we can easily create tailored solutions for each

of our clients. Building on Figlo’s financial

planning platform, we created a solution for

Aegon that enables customers to understand

whether or not their product still meets their

needs and whether they require further advice.”

For this particular project, Figlo and Aegon

worked alongside Yellowtail, a consultancy

and software development firm, to build on

the Figlo Platform and create a solution that

best fits Aegon’s needs.

“We have a lasting partnership,” explains

Robin Bouman, Yellowtail’s principal

consultant. “By getting involved from the

outset, we were able to understand Aegon’s

vision. We could help the company decide

which solution would help their on-going

business needs, help them implement it and

ensure it seamlessly integrates with existing

IT systems. The better the match beforehand,

the faster the configuration, integration and

implementation processes.”

The finished solution, which Aegon has

called ‘Financial Check’ can be accessed

by customers via their ‘MyAegon’ account.

and saving for retirement. Our commitment is

to offer services that are as clear, effective and

easy to understand as possible. Not only this,

but we want to provide ways that customers

can better understand their options. For

example, customers can use our Pension App

or explore their financial future in a serious

gaming website called Speeljetoekomst.nl

(play your future).”

The need to provide better service was

compounded by a recent agreement between

AFM, the Dutch authority for financial

markets, and Adfiz, a Dutch financial branch

organisation, which stipulates that financial

advisors operating in the country should

support customers with linked insurances

and with free aftercare. This means ensuring

that when a customer takes out a policy it

marks the beginning of a process, not the end.

“The regulations have contributed to a

process in which the interests of the customer

are better safeguarded,” explains Van den

Burg. “This is a good thing. Advancing

technological developments, including

the move towards online and mobile

technologies, teamed with the after effects of

the economic crisis, are also making their own

contribution to this process.”

However, with just a small team of advisors

to handle a large customer base, Aegon

realised that the only way it could provide the

level of service it wanted was by investing in

new technologies. “Aegon has transformed

from being a more or less product-oriented

company towards a customer-centric

organisation, although this process is still

going on and we still have a lot of work

ahead of us,” Van den Burg explains. “We

used to send customers a letter once a year

highlighting the value of their savings plan,

and that was pretty much it. Our role was very

much a passive one. We wanted to change

this and actively help our customers plan for

their futures, assessing whether the product

they were using was totally right for them.

In today’s digital age we knew the internet

would be key to this, but we weren’t sure how

until we met with the team at Figlo.”

After meeting with a number of different

technology suppliers, Figlo stood out as a

leader. “Figlo has the most complete system

that can be leveraged in a flexible way to work

for all scenarios and situations,” Van den Burg

says. “The company was the best partner to

help us meet our goals and give our customers

the service they deserve.”

Having established itself as a strong

player in the Dutch financial services IT

market over the last 17 years, Figlo has

developed a number of solutions for personal

finance planning, financial product advice

and personal finance management. These

solutions allow financial advisors and

banking and insurance professionals to gain

comprehensive insight into their finances in a

way that is intuitive and accessible.

Aegon is committed to providing a better service to its customers

www.onwindows.com

Cover story Aegon

Because the system is linked to Aegon’s back-

office and customer relationship management

systems, all of the known information is

already populated. Therefore customers can

quickly and easily see which products they

have and what their options are.

“For example, say you are 42 years old and

you set up a pension plan ten years ago. You

can log in, see the stock exchange results for

the last ten years and see what return you’re

likely to receive at pension age,” explains

Aegon’s Van den Burg. “You can see the

government pension you are likely to receive,

you can upload your company pension details

from the Dutch pension registry system, and,

in just eight clicks, understand your entire

financial future. With this information you

can decide whether you want to stay with

the product you have, choose an alternative

solution, or whether you want to receive help

and advice from an advisor. It’s so simple.”

Aegon implemented the solution in just

six months. “Using this type of building-

block approach is up to 70 per cent quicker

than building a solution from scratch

and it’s more cost effective too,” explains

Yellowtail’s Bouman.

With this solution, Aegon is giving its

customers better control of their finances.

“Today, customers want to be able to manage

their finances on their own terms, and the

Financial Check product facilitates that,”

says Van den Burg. “They don’t have to

spend hours talking to advisors, and they

don’t have to keep explaining their situation.

And because everything is pre-filled online –

something that I haven’t seen achieved by any

other tool on the market – it couldn’t be easier

for them to understand their future outcome.”

The solution is also benefiting advisors.

“Advisors can use their time far more

efficiently,” Van den Burg says. “Because the

customer already has a basic overview of their

situation, time spent with advisors is greatly

reduced, and can be focused on the most

important things.”

“This is one of the compelling features of

the Figlo Platform,” Figlo’s De Vries explains.

“We are able to create bespoke consumer

applications on one side and have the advisors

using our out of the box application (Figlo

Advisor) on the other side, working from the

same platform and using the same data.”

What’s more, because the solution integrates

with Aegon’s CRM system, advisors can see in

real time when the customer has logged in and

made updates. “This gives better insight to the

advisor and also provides us with the reporting

capabilities we need to meet the needs of the

regulators,” says Van den Burg.

The solution’s reliance on Microsoft

technologies is also a major benefit. “We

needed a stable environment and platform

that was of a market-leading standard,” says

Van den Burg. “The combination of Figlo and

Microsoft certainly delivers on that.”

Initial feedback from customers has been

positive. “This kind of tool isn’t the norm in

this industry,” Van den Burg explains. “It took

our customers a while to understand that there

was no hidden agenda – we were actually

giving them the freedom to choose how to

move forward with their pensions. But once

they understood what the solution can do for

them, they were delighted with it and have

told us it’s a solution we should be proud of.

We’re happy with that and believe that this will

undoubtedly help us achieve our international

mission to ‘transform tomorrow’.”

Looking ahead, Aegon is already working

with Figlo on another project. Also, Yellowtail

has been invited by Aegon to help define

its online strategy for the next three years.

Van den Burg believes the companies have a

strong future together. “We’re working on a

financial planning project and we have some

other exciting initiatives in the works,” he

says. “Overall, I believe that Figlo is in the best

position to help us fulfil our commitment to

our customers both now and in the future.”

“Figlo is in the best position to help us fulfil our commitment to

our customers both now and in

the future”

Robin van den BurgAegon Bemiddeling

www.onwindows.com 33

Standfirst - can be your choice of size/font etc.

It is now more than a year since Microsoft launched Windows 8. Amber Stokes explores how financial institutions are embracing the platform

through mobile innovation,” adds Skand

Mittal, senior product marketing manager

of commercial tablet marketing for

industry at Microsoft. “They are therefore

deploying mobile technology solutions

that are delivering a whole variety of

benefits to their organisation and their

customers alike.”

Many banks have invested in the Windows

8 operating system in the last 12 months to

drive innovative and secure mobile strategies

that align with what their customers are

demanding. Windows 8 devices and apps are

helping them to deliver more personalised

services to customers across channels,

while the security capabilities and familiar

management interface means they don’t

have to compromise on security or spend

their limited resources on incremental

management infrastructure to manage

Windows 8 mobile devices.

Microsoft’s Windows 8.1 update, which

became available in October, offers many

new features that can deliver further

benefits. “The enhanced security and

management features in Windows 8.1 like

biometric support for user authentication

and remote business data removal are

really beneficial to banks to keep their

sensitive customer data secure, and at

the same time help IT managers remotely

manage mobile devices more efficiently,”

says Mittal. “Windows 8.1 continues

Microsoft’s long history of providing the

security, manageability and compliance

that financial institutions rely on. As the

industry goes mobile, the importance of

access control, data security and computing

power become even more important.

Financial institutions recognise the power

of the Windows 8.1 platform on mobile

devices as being essential to providing the

solutions that their customers demand. It

also enables new critical business mobility

and productivity scenarios that meet

the rigorous IT standards for security,

manageability and support required in

today’s financial services industry.”

Many Microsoft partners are investing

in Windows 8.1 through the development

of new business-to-business apps for the

financial services industry. Their aim is

to optimise business processes and allow

organisations to ultimately deliver a better

service to their customers.

SunGard IntelliMatch Enterprise

Management Studio

SunGard recently launched IntelliMatch

Enterprise Management Studio – a

reconciliation management solution

available on Microsoft SQL Server as well as

an app that organisations will be able to run

on a Windows 8.1 device.

“The remit of reconciliation has

changed over the years and it now covers

anything that involves validation of a

system, data, message or file,” explains

Richard Chapman, director of IntelliMatch

product management at SunGard. “It’s

a highly saturated marketplace in the

The financial services industry is

undergoing unprecedented change as

financial institutions develop new business

models to generate revenue through

customer acquisition and retention,

improve loyalty by embedding products

and services into the everyday lives of

customers, and reduce costs while ensuring

a high level of operational control.

“Customers have more information and

ways to connect than ever before. Providing

an easy, do-it-your-way experience that

is personally and professionally relevant

is essential to customer acquisition and

retention. Competition is coming from

non-banks and changing the financial

services industry landscape, and the bottom

line is more important than ever,” says

Karen Cone, general manager, Microsoft

financial services. “Microsoft and our

industry partners are focused on building

great mobile experiences to help financial

services institutions harness this new

technology and evolve their businesses.”

“Banks are looking to differentiate in

what is a highly competitive market

today, and a key way to do that is

Feature Windows 8

Fostering innovativemobile experiences

35www.onwindows.com

to more detail if attention is required. This

provides treasury managers with a real-time

and complete view of their positions and risk

from anywhere at any time.

“The Temenos Treasury Management

Dashboard app provides essential business

analytics in an innovative, visual way,”

says Mittal. “Pie charts provide easily

consumable information, so that the user

can check holdings, for example, that are

colour coded. The user can tell straight

away the condition the holdings are in just

by which colour it is. Being able to consume

complex data quickly and easily allows

people to take instant corrective action.”

The recently released Microsoft

Surface 2 and Pro 2, and a range of its

OEM tablets are a great fit for financial

services organisations looking to build

on their mobile strategies, while at the

same time ensuring they meet stringent

regulatory requirements.

The Surface Pro 2 tablet has the capability

to become a complete laptop replacement

through its many enhancements that

could prove useful for financial services

enterprises. It is powered by a fourth-

generation Intel Core i5 processor which,

combined with other improvements, delivers

increased performance and up to 75 per cent

longer battery life than Surface Pro.

Similarly, the Surface 2 also offers key new

features such as increased camera resolution,

which will make it easier for front line staff to

communicate with customers or colleagues

remotely, while also being thinner and

lighter than its predecessor. A range of new

accessories are also available, such as the

docking station for Surface Pro, which will

allow users to quickly connect a Surface Pro

and Surface Pro 2 to desktop PC peripherals

in a single step.

Banks across the globe are already getting

behind Microsoft’s Surface. Hokkoku Bank, a

Japan-based financial services company, has

purchased more than 2,000 units of Surface

Pro across its 112 retail branches and 11

loan centres. The bank was previously using

tablets alongside notebooks and desktop

PCs, but the implementation of Surface Pro

as a hybrid tablet has meant that the bank

can use a single device as both a PC and a

tablet. The improved screen resolution in

the Surface Pro also means that Hokkoku

Bank can present products to customers a lot

more easily.