Final BCG Matrix Ppt

Transcript of Final BCG Matrix Ppt

Market Applications & practices

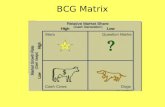

BCG Matrix

The BCG matrix model was developed by Bruce Henderson in the early 1970’s

The BCG matrix stands for Boston consulting group

The BCG matrix model is a portfolio planning model

The BCG model is a well-known portfolio management tool used in product life cycle theory

INTRODUCTION

• Market share is the percentage of the total market that is being serviced by your company, measured either in revenue terms or unit volume terms

• The higher your market share, the higher proportion of the market you control

What is Market Share?

Relative MarketShare

=

Business unit sales this year

Leading rival sales this year

Market growth is used as a measure of a market’s attractiveness

Markets experiencing high growth are ones where the total market share available is expanding, and there’s plenty of opportunity for everyone to make money

What is Market Growth?

MarketGrowt

h=

Individual sales this year-Individual sales last year

Individual sales last year

BCG matrix is often used to prioritize which products within company product mix get more funding and attention

It has 2 dimensions: MARKET SHARE & MARKET GROWTH

The BCG Matrix consist of 4 category in a portfolio of a company Stars, Cash cows, Dogs, Question marks

Cont…

BCG Model

Stars (high growth, high market share)◦ Stars are defined by having high market share in

a growing market◦ Large amounts of cash◦ Leaders in the business◦ Generate large amounts of cash◦ Need lot of support from promotion and

placement◦ Stars are likely to grow into cash cows

Stars

Cash Cows (low growth, high market share)◦ Cash cows are in a position of high market share

in a mature market◦ If competitive advantage has been achieved, cash

cows have high profit margins and generate a lot of cash flow

◦ Because of the low growth, promotion and placement investments are low

◦ Investments into supporting infrastructure can improve efficiency and increase cash flow more

◦ Cash Cows are often the stars of yesterday and they are the foundation of a company

Cash Cows

Dogs (low growth, low market share)◦ Dogs are in low growth markets and have low

market share◦ Dogs should be avoided and minimized◦ Expensive turn-around plans usually do not help◦ Dogs must deliver cash, otherwise they must be

liquidated

Dogs

Question Marks (high growth, low market share)◦ They have high cash demands and generate low returns,

because of their low market share◦ Question marks have high demands and low returns due to

low market share◦ These products are in growing markets but have low market

share◦ Question marks are essentially new products where buyers

have yet to discover them◦ The marketing strategy is to get markets to adopt these

products so as to convert them to Stars for the company◦ These products need to increase their market share quickly or

they become dogs◦ The best way to handle Question marks is to either invest

heavily in them to gain market share or to sell them

Question Marks

DOGNestea

MilkybarNestle Crunch

CASH COWSCerelac

STARSNescafe

Maggi NoodlesMaggi Sauce

QUESTION MARKMilo

Kit-KatMaggi SoupsNestle Butter

Bu

sin

ess G

row

th R

ate

Market Share

Hig

h

High

Low

Low

Nestle’s BCG Matrix

BCG Matrix is simple and easy to understand It helps to quickly and simply screen the opportunities

and make most of them It is used to identify how corporate cash resources can

best be used to maximize a company’s future growth and profitability

BCG model is helpful for managers to evaluate balance in the firm’s current portfolio of Stars, Cash Cows, Question Marks and Dogs

BCG method is applicable to large companies that seek volume and experience effects

It provides a base for management to decide and prepare for future actions

Benefits

Market growth is not the only indicator for attractiveness of a market.

Sometimes Dogs can earn more cash than Cash Cows The problems of getting data on the market share and

market growth There is no clear definition of what constitutes a "market" A high market share does not necessarily lead to

profitability all the time The model uses only two dimensions – market share and

growth rate. This may tempt management to emphasize a particular product, or to divest prematurely

The model neglects small competitors that have fast growing market shares

Limitations

Thank you

Name Roll Number

Devang Kataria 25

Dhiraj Kherajani 26

Disha Desai 27

Fakruddin Faraz Sayed 28

Gurmeet Singh 29

Hardik Dave 30