Exposing the Fraudulent Undisclosed Synthetic Diamond Trail

-

Upload

nguyendien -

Category

Documents

-

view

271 -

download

3

Transcript of Exposing the Fraudulent Undisclosed Synthetic Diamond Trail

7299 4 CORNERS OF THE GLOBE 7302 DIGGING THE DIRT7306 BRIEFLY NOTED 7307 OFF THE SHELF

DIAMOND INTELLIGENCE BRIEFS

A Confidential Service for

Executives in the Diamond and Diamond

Jewelry Business

30 May 2012 | Vol.27 No.710

Exposing the Fraudulent Undisclosed Synthetic Diamond Trail

EXCLUSIVE EXPOSÉ

By Chaim Even-Zohar

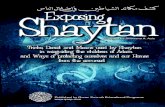

A photograph of the undisclosed synthetic diamonds submitted to the IGI in Antwerp.

DIAMOND INTELLIGENCE BRIEFS 7292

EDITORIAL

Selling synthetic diamonds as if they were naturally mined goods is, perhaps, the gravest crime one can commit within the trust-based diamond community. The (by now) notorious undisclosed synthetic polished diamond

parcel submitted to the International Gemological Institute (IGI) laboratory in Antwerp - that Diamond Intelligence Briefs first revealed last week - has catapulted to the top of the industry’s concerns – and perhaps its fears.

Among the industry’s leadership in the major centers one can sense an intense feeling of betrayal. Calls are being made for emergency meetings to contemplate what to do next. There seems a resolve that “someone has to pay for this dearly, has to be held accountable, has to be removed from this industry forever – or maybe even more infinitely….”

But it is not just anger reverberating through the international diamond centers – there is a genuine anxiety about the future of the diamond business.

DIB set out to uncover the transaction trail – finding the sellers and the source of the undisclosed synthetic diamonds. Chaim Even-Zohar’s second report on this subject follows:

Pure Synthetic Gemesis Parcel Reacting to last week’s story, the IGI advised that the parcel

of hundreds of synthetic stones was not “mixed” but made up entirely of synthetic stones. The buyer of the goods intimated that he made a selection from a larger assortment –maybe four or five times larger; he simply took “a cut.” One is talking about thousands of synthetic stones worth tens of millions of dollars if sold as naturally mined goods.

We believed last week that the parcel was composed of Gemesis-created materials. However, in order to allow any of the parties to come forward, we wrote in our editorial that Gemesis was the “most probable source.”

Then, we watched how Gemesis President and CEO Stephen Lux sprang into action. A responsible, concerned, realistic and humble manager would have responded along the lines of:

“This is very serious. This runs against all our ethics and good governance principles. I hope these are not our diamonds. In any event, we shall do everything to assist the industry to get to the bottom of this.”

Instead, Lux sent e-mails to select trade journalists in which

Image 2: DiamondView Fluorescence image: Non-heat treated CVD synthetic

Undisclosed CVD synthetic (Image 1): bluish green luminescence dominates as is often the case for synthetics that have been heat treated after synthesis. This CVD synthetic shows clear evidence of post synthesis heat treatment. As grown CVD synthetic (Image 2): orange luminescence from nitrogen-vacancy defects dominates as is generally the case for CVD synthetics that have not been heat treated after synthesis.

Coarser striations observed in the CVD synthetic in Image 2. These striations are a result of the “steps” that form during CVD synthesis. The difference in striations indicates that the CVD growth process was significantly different resulting in different surface features forming during growth.

Regions of blue luminescence observed in the CVD synthetic in Image 2 are a result of extended defects called dislocations. For synthetics these are generally associated with lower quality material.

Image 1: DiamondView Fluorescence image: Undisclosed CVD synthetic submitted to IGI

Comparison : CVD + heated from IGI Parcel versus other CVD Chemical Vapor Deposition (CVD) synthetics can be grown under a range of growth conditions and chemistries and the spectroscopic properties of the material will vary according to these differing growth conditions. In addition, these synthetics may be heat treated after synthesis to improve certain properties and this heat treatment can lead to changes in impurity structures, which can also be probed using spectroscopic techniques.

The greenish image of one of the stones in the IGI parcel shows identical characteristics of Gemesis synthetic images in the professional literature. The second image is of a non-heat treated CVD. The IGI is the lab that has the best judgment of what is a Gemesis stone, as they do all the Gemesis certification and know these stones very well.

DIB # 710, May 30, 2012

DIAMOND INTELLIGENCE BRIEFS 7293

EDITORIAL

he implicitly tarnished other producers who allegedly have the same synthetic capabilities and then declared: “Gemesis can assure the industry with 100 percent certainty it has not been involved in selling its diamonds as mined, and the undisclosed diamonds referenced in the DTC and IGI alerts are not Gemesis diamonds.”

We wonder what Stephen Lux will say after learning that,

beyond any shadow of a doubt, his statement was 100 percent inaccurate. More about this later.

Synthetic FingerprintsSynthetic diamonds have a very specific fingerprint; the

composition of the stone will identify its source. An experienced producer explained it in layman’s terms as follows: “The basic know-how for growing CVD or HPHT synthetic diamonds is not so difficult. The technology is widely available on the market. However, each producer has its own secret ‘recipe’ – what materials to use, what ‘ingredients to put in it,’ what seeds, what combination of temperatures, etc. After having acquired the HPHT diamond growing equipment, it still took Gemesis some seven years to get its recipe right. Therefore, when one compares several stones of Gemesis synthetics, one will unmistakably recognize that these come from one and the same source. The specific composition is unique to the Gemesis process.”

The DTC Diamond Research Center basically made a comparison between the goods submitted to the IGI – photos of which we publish with this article – and other known Gemesis photos. In a most careful manner, the DTC wrote in its alert to clients: “The DiamondView and photoluminescence results indicate that the CVD synthetics have been heat-treated post synthesis and we note that the combination of characteristics listed above [in the alert] is strikingly similar to that reported by the GIA for 16 CVD synthetics received from Gemesis Corporation.”

That being said, the ultimate confirmation comes from finding the physical source – the office, the inventory – of the synthetic diamonds that were submitted to the IGI. And indeed, we found it.

The Seller: Su-Raj Diamonds in New YorkThe trail of invoices covering the purchase of the undisclosed

synthetic diamonds leads to the source – Su-Raj Diamond & Jewelry USA in New York. This company is ostensibly owned by a partnership between Ashok Bhansali and Jatin Mehta (the very same Jatin Mehta who is also the majority shareholder in Gemesis). More precisely, Jatin’s ownership is through the publicly listed Su-Raj company in India – at least until recently.

When the buyer of the undisclosed synthetic diamond parcel discovered that the goods were synthetics, he immediately called the New York broker who had served as intermediary between him and Su-Raj. When the broker called Su-Raj’s Ashok Bhansali, the latter reputedly didn’t sound surprised. Formally, he has apparently claimed innocence. He reportedly has said that he “had bought these goods on the New York market.” He denied knowing that the diamonds sold in this transaction were synthetics. [DIB was unable to reach Bhansali before press time; we have left our phone number with his secretary.]

This is something the diamond trade has to come to terms with: when caught dealing in undisclosed synthetic diamonds that are being passed off natural, the first reaction will always be “I didn’t know.” In some instances this will undoubtedly be true.

In this article we are not accusing anyone specifically of committing a crime. We are not qualified, nor do we have any intention, to do so. We are just presenting the facts as we have uncovered them. We do say, however, that clearly a crime was committed by someone in the transaction chain. Otherwise, no undisclosed synthetics could have been submitted to the IGI lab. In our journalistic sleuthing, we didn’t look for people – but rather for the diamond source.

Gemesis NY Fulfillment Center in Su-Raj Offices

Now back to Gemesis. In a letter to shareholders in November 2001, Steve Lux reports that “the company has been working nonstop to properly complete and launch our new e-commerce website. It was the desire to report that the new Gemesis website, which would facilitate the sale of our diamonds and jewelry directly to consumers, was up and running. However, that event

Jatin Mehta

Stephen Lux

DIAMOND INTELLIGENCE BRIEFS 7294

EDITORIAL

has yet to occur.” The website has, in the meantime, become operational.

Writes Lux: “Gemesis has established its order fulfillment center in New York to appropriately handle the web-based sales.” Lux, who had told us previously that he is the CEO in charge of all Gemesis global sales – both from Singapore CVD facilities and from those produced by the HPHT process in Malaysia – has in fact moved the firm’s diamond inventory to New York. This transfer was completed around the end of 2011.

To make a long story short: the Gemesis New York fulfillment center, i.e. the Gemesis inventory, is housed in the very same Su-Raj Diamond & Jewelry USA offices from which the sale of undisclosed synthetic diamonds was made. Is this just a coincidence? Maybe.

Gemesis has hired an experienced New York diamond salesman, Michael Chernick, to manage its fulfillment center. Chernick has a sterling reputation. He left a position as head of diamond buying at Kaprielian Enterprises, Inc. to work for Gemesis.

After Lux made his statement about being “100% certain that the [undisclosed] diamonds were not Gemesis diamonds,” we queried “How would you explain that a huge amount of pure synthetic stones would be available at your own fulfillment center, under the eyes of a Gemesis employee, in premises owned by the majority shareholder of Gemesis (both USA/Malaysia and Singapore) and that these synthetics would – as you suggest – 100% originate from NON-Gemesis sources?”

Lux responded: “there is no common ownership between Su-Raj NY and Gemesis USA. It is true that we have rented space in NYC but this space is independent of any other company, has its own entrance, staff, safe and pays fair market rent for its use. The owner of the premises happens to be Su-Raj NY.”

The undisclosed synthetic sale was made by Su-Raj Diamond & Jewelry USA – not by Gemesis. The paper trail shows that Su-Raj invoiced a local broker, and the local broker invoiced the Indian buyer in Antwerp.

An Equation That Does Not Add UpSomewhere, somehow, there is still something that doesn’t

make sense. Jatin Mehta has invested tens of millions of dollars in acquiring or developing Gemesis synthetic gem-quality diamond technologies. He is probably one of the two or three largest firms in the gem-synthetics world. Why would he risk his investments, his reputation, and his other diamond and jewelry enterprises by allowing a company under his ownership to engage in what appears to be unscrupulous activities? Might it have been “an accident?”

One might possibly argue about business ethics – Jatin is a shrewd and occasionally controversial businessman having created a billion-dollar diamond and jewelry empire. He has also had his share of legal challenges. But even his (many) detractors will agree that he has a brilliant mind, bordering on genius. Willfully doing something so stupid would be totally out

of character for him. Drawing Su-Raj into a possible criminal investigation would immediately impact his company’s share price and would draw in stock exchange investigators. With the trail now clear, it was time for Su-Raj Chairman Jatin Mehta to give some answers.

Su-Raj New York is NOT Su-Raj IndiaWe caught Jatin on the phone while he was on his way from

Dubai to New Delhi. He was eager to give explanations and to answer questions. The first thing he stressed was that on the 14th of February 2012, the Su-Raj mother company in India formally adopted a board resolution to disinvest from Su-Raj Diamonds & Jewelry USA, Inc. (in New York), from Su-Raj Diamonds NV (in Belgium), and from Su-Raj Diamonds (HK) Ltd. The board authorized Jatin Mehta “to execute the necessary transfer forms

CVD synthetic 0.52ct VS1

CVD synthetic 0.58ct VS1

CVD synthetic 0.56ct VS1

Photos of "Undisclosed

Synthetic Parcel" - courtesy IGI,

Antwerp

DIAMOND INTELLIGENCE BRIEFS 7295

EDITORIAL

and/or other documents and to do all necessary acts, deeds and things as may be required to carry out the aforesaid disinvestment of the subsidiary companies.”

Thus, while the name Su-Raj still appeared on the doors in New York, Belgium and Hong Kong, and the businesses were still operating as Su-Raj, Jatin Mehta made it clear that he was not involved with them anymore. The business in New York continued with his former partner, Ashok Bhansali. Though this may appropriately reflect the legal situation, it still raises many questions.

Clearly, Jatin Mehta went out of his way to disassociate himself with the undisclosed synthetic sale that had taken place in his offices. However, he remained very vague as to whom the shares of these subsidiaries were sold and for how much, and what has happened with their diamond stocks. The “effective implementation” date is not known as well.

Su-Raj (India) Company Secretary Asish Narayan confirms that the U.S. company "has not been privatized and its shares have not been sold to [Jatin's son] Mr. Suraj Mehta. Information on the sale of the shares will get reflected in our Annual Report to the shareholders and Statutory Authorities as per the legal requirements of ouyr country."

The New York Inventory of Su-Raj In the diamond business, when a partnership is being dissolved,

one of the partners (usually the financially stronger one) will post a notice in the diamond bourses announcing that from a certain date, one partner ceases to assume responsibility for the debts, obligations and actions of the other partner. Under New York law, if at the time the transaction took place, Jatin was neither a shareholder nor a director, he, indeed, cannot be held responsible for the company’s actions.

The nature of the “partnership” with Ashok Bhansali may well become a potent issue as this saga evolves. According the Su-Raj India Company Secretary Asish Narayan, “the question of breaking the partnership does not arise as the above [disinvested companies] are 100% subsidiaries and separate legal entities duly registered under the relevant corporate laws of respective countries.” According to the records of the New York Department of State, as of May 25, 2012, no name change had been filed for Su-Raj Diamonds & Jewelry USA, Inc. So why would Su-Raj India disinvest in its subsidiary but allow new shareholders to continue to use its name?

In India, Su-Raj (the mother company) is a member of the diamond bourse. The question thus arises as to whether such an announcement of ownership change to the bourses needed to be made. Narayan assures us that “our Company has not violated any statutory or customary laws of the Bharat Diamond Bourse.” In any event, the New York diamond market was apparently not aware of the separation. But the essence – to me – was the synthetic diamond stocks. How is it that whoever made the sale

DIAMOND INTELLIGENCE BRIEFS 7296

EDITORIAL

at Su-Raj Diamonds & Jewelry USA in New York had access to these un-inscribed synthetic diamond stocks?

Jatin Mehta ExplainsJatin Mehta had no clear answers. He alluded that it was

possible that the seller of the undisclosed synthetics (i.e. his former partner) “had misappropriated stocks held previously by the partnership.” It was also possible, he suggested, that “these stocks

originated from some [unnamed] Chinese producer who also sells massive amounts of gem-quality synthetics on the market.”

When I countered that the synthetics submitted to the IGI had the specific Gemesis fingerprint, the implications of which Jatin Mehta clearly comprehended, he offered another scenario:

“There were some people who had left Gemesis before I assumed control; they might have stolen our technology and are thus producing our typical characteristic Gemesis goods,” he suggested.

Neither answer is satisfying. Gemesis didn’t have CVD technology before Jatin Mehta became the controlling shareholder. So it seems implausible that the technology was stolen; and even if this was the case, it would have taken years to get to any production on a meaningful scale. Again, something doesn’t add up.

The Ashok Bhansali Factor Jatin Mehta suggested that at the relevant time, the Su-Raj

office in New York was managed and owned by Ashok Bhansali. Irrespective of the kind of involvement in the specific transaction

– on which we don’t want to comment – there remains the general question of overall legal responsibility. If Bhansali is a member of the Diamond Dealers Club of New York, this may also have ramifications.

Most of our contacts say that Bhansali is an employee and not a principal of Su-Raj Diamond & Jewelry USA, and if he

THE GEMESIS BOARD OF DIRECTORS: COUNCIL OF SAGES

Who runs the U.S. Gemesis Corporation? Its Board of Directors that counts only three individuals: Chairman (and company founder) Carter W. Clarke, Gene Josephs and Stephen Lux. The company has probably more than 100 shareholders, but the reality is that the bulk of the shares (next to the 50.1 percent that is held by Jatin Mehta or his

assignee) are held by a gentleman, now well over 80 years old, named Dwaine Willett. When Gemesis was about to go bankrupt, around 2006, Willett came to the rescue investing US$20 million in the company.

When Willett joined, virtually all of the company’s original shareholders saw their holdings diluted to next to nothing. One of those shareholders is Grace Venture Capital, an early supporter of Gemesis.

Willett comes from car dealerships. His background includes positions with A Betterway Rent-A-Car Inc., Willet Toyota Inc., and a Honda dealership in the Atlanta region. Since 1969, he has owned and operated up to seven auto dealerships in the Atlanta, Georgia, and Orlando, Florida, regions. He has been a majority shareholder in seven Budget-Rent-A-Car franchises operating in the Southeast and Midwest of the United States.

From the car rental business Willet drove straight into Gemesis through a company called Investment Partners of Orlando in which he is a partner. He appointed the president of this investment company, Gene Josephs, as his representative on the board of Gemesis. What background does Josephs bring to the table?

Josephs, now in his early 70s, worked for IBM Corporation for 31 years holding various positions including systems engineer, marketing representative, financial programs manager within state/local government, product staff and field marketing management. In 1998, he assumed the helm of Investment Partners of Orlando (IPO), a venture capital firm with investments primarily in high technology companies. He sits on the boards of a range of companies in the software, high-tech and banking sector.

Carter W. Clarke, now deep in his 80s as well, founded and served as the first CEO of Gemesis. He spent 26 years in the U.S. Army in a variety of command and staff positions, attaining the rank of Brigadier General in 1970. Clarke retired from the Army in 1973 to pursue business interests. From 1975 to 1980, he founded several electronic security companies. He is the last remaining member of the old guard.

Jatin Mehta is not represented on the board. Maybe he doesn’t need it.

Bharat Diamond Bourse

DIAMOND INTELLIGENCE BRIEFS 7297

EDITORIAL

is a principal, it would only be a few percentages, perhaps signifying more of a profit-sharing arrangement rather than a formal ownership. The 44-year-old Bhansali has a long history with Su-Raj, actually all of his working life has been tied to the company. As a teenager, he started to work for the company in Mumbai. He soon moved to what was then called Alma Diamond in New York, which was a partnership between Jatin Mehta and a now retired brother-in-law.

Bhansali has been associated with a number of companies, such as ASB International, Inc. (in New Jersey), Su-Raj Diamonds Industries PVT Ltd. (in New York) and others. More recently, he also seems to be a shareholder in Shine Diamonds & Jewelry LLC, a company established in 2007 in New York. Another company is VJM Jewelry, LLC, in New York, which closed its doors in mid-2011.

His status at Su-Raj Diamond & Jewelry USA is formally that of Company Secretary and Treasurer, while Jatin Mehta is Chairman. To what extent any of this makes Bhansali owner or responsible director is not for us to determine. Clearly, Bhansali is a core factor in this story.

Where is the Gemesis Rough Production?The interview with Jatin Mehta was extremely frank. Moving

to the subject of rough synthetic production, we noted that based on publicly available information, there seems to be a lot of synthetic rough unaccounted for. Where is the missing synthetic rough, we queried. Jatin countered that there had never been much production – and the figures quoted in the market are greatly exaggerated.

Our figures are based on a variety of sources. There was a 2007 interview (by Danielle Rossingh of the National Post), where Gemesis CEO Steve Lux stressed his “aim is to take 10% of the rough market, in value terms, in five years.” That would put synthetic rough sales at a US$1.7 billion annual level, which is clearly not remotely the case – and certainly not for Gemesis.

Focusing specifically on his company, Stephen Lux (in a 2009 interview with David Finlayson, a journalist with “The Gazette”) said:

“Four years ago, Gemesis had 24 diamond-producing machines. Now it has several hundred producing hundreds of millions of dollars revenue at the wholesale level.” Hundreds of millions?

In 2011, according to the Gemesis financial reports submitted to shareholders, Gemesis’s gross revenues were running at a level of about US$250,000 per month. That comes to about US$3 million a year (three single millions). We know that a few years ago, the company was selling synthetic rough at a level of some US$2-US$3 million a month. Thus, we have now the rather perplexing and incomprehensible situation in which the company is obviously growing – but its revenues are plunging to near nothing. The hundreds of millions of dollars in revenues on the wholesale level seem, to paraphrase a term used by Lux,

“close to 100% a distant pipe-dream.”

GEMESIS SYNTHETICSARE UNIQUE AND IDENTIFIABLE

The individual characteristics (or “recipe”) of each CVD synthetic diamond is also the result of the specific technologies derived from unique patents. This week, another Gemesis-Singapore patent was published as described below. Producers using patents held by other producers sooner or later will find themselves in court.

LATEST GEMESIS SINGAPORE PATENT DETAILS:Method for growing white color diamonds by using diborane and nitrogen in combination in a microwave plasma chemical vapor deposition system

Applicant: The Gemesis Company, SingaporePublication: 2012-04-05Filed: 2010-10-11Status: application

Scientific Description: The present application discloses the details of a microwave plasma chemical vapor deposition process that uses Nitrogen and Diborane simultaneously in combination along with the Methane and Hydrogen gases to grow white color diamonds. The invention embodies using nitrogen to avoid inclusions and impurities in the CVD diamond samples and Diborane for the color enhancement during the growth of diamond. It is also found that heating of the so grown diamonds to 2000 C results in significant color enhancement due to the compensation of Nitrogen and Boron centers in the samples. The origin of the various colors in diamond is explained on the basis of the band diagram of CVD diamond.

A close-up of the boxes of undisclosed synthetic diamonds

that were submitted to the IGI in Antwerp.

DIAMOND INTELLIGENCE BRIEFS 7298

EDITORIAL

New Synthetic Marketing Strategy in the Making?

Why would the Su-Raj mother company disinvest from Su-Raj offices in such important countries such as USA, Belgium and Hong Kong? According to one source close to the situation, “Jatin Mehta will walk the extra mile to keep the synthetics business out of the Su-Raj public company. He is most likely to register these companies in the names of his children and wife Sonia and then turn these venues into marketing offices of synthetics. For this very same reason one can soon expect the disinvestment from the Dubai-based subsidiary Su-Raj Diamonds and Jewellery DMCC as well,” predicts my source. [By the way: Su-Raj in India is going to change its name in the near future – it will be renamed

“Winsome Diamonds and Jewellery Limited.”]“It seems quite likely that much of the Singapore CVD synthetic

production, annealed by the Gemesis Malaysia operations, is already channeled through the New York office. This would certainly explain the undisclosed synthetic diamond sale,” concludes the insider.

This could be reason for the minimal sales level of Gemesis USA – to the detriment of its American shareholders. Since the creation of Gemesis, some US$50-US$60 million has been poured into it, says one shareholder. This begs the questions: Where is the money? Where is the rough? Was Su-Raj “bypassing” Gemesis in its sales, as the New York incident might imply?

Anyone Invited to Inspect Su-Raj JewelrySu-Raj mostly sells its products to jewelry wholesalers in New

York, Antwerp, Hong Kong and Dubai with whom it has long established relationships. “Is it possible,” I asked Jatin Mehta almost hesitatingly, “that if we would take a tour of jewelry stores selling your products we might find undisclosed synthetics diamonds set in jewelry?”

Jatin became upset. “I invite any industry body, the DTC, the

HRD Antwerp among the Diamond Labs with Synthetic-Detection Technology

In this editorial, we have mentioned the IGI and De Beers as having technology to distinguish synthetic diamonds from naturally mined ones. The HRD Antwerp diamond lab has also developed a compact

screening device, called the “D-Screen,” which differentiates natural from potentially synthetic colorless or near-colorless polished diamonds.

“For the large majority of near colourless polished diamonds on the market, D-Screen guarantees that the diamond is not-synthetic and not-HPHT treated. For the number of stones that are referred for further examination, an additional investigation in a reliable laboratory is necessary,” reports the HRD Antwerp.

The diamond-grading lab says that it has also developed a compact screening device for traders to use in their office or elsewhere that will conclusively identify synthetic diamonds. “By screening the diamonds, ‘D-Screen’ can distinguish between natural diamonds and potentially synthetic or treated ones. The instrument tells whether a diamond passes the test or is recommended for further examination in the diamond lab.”

labs, yourself, to come immediately to India and I will facilitate visits to every place where we have diamond jewelry for you to inspect,” he answered. “I am running a transparent business on the highest ethical standards.”

Then I asked if, likewise, he would cooperate – and have his people cooperate, including those at Gemesis – in giving all information and every assistance to investigate the New York undisclosed synthetic diamond sale. To this, he answered, “of course! That goes without saying.” I believe his response was uttered with the utmost sincerity.

What Next? A Sigh of Relief!On the eve of the Las Vegas show, the greater understanding

of the source of the undisclosed synthetic diamond transaction trail will give many dealers a sigh of relief. They can be confident about their own stocks, as they know where they bought their own goods. The “witch hunt” that was going on, easily representing the loudest whisper in the diamond pipeline, is over. What remains is that the industry and the authorities will have to decide what to do with the players in the fraudulent transaction trail.

Clearly, something happened in a New York partnership that had been dissolved. The main ex-partner, Jatin Mehta, has unequivocally pledged his cooperation in getting to the bottom of this. Ashok Bhansali has still not returned our phone calls.

No, we still don’t know everything yet – but we know enough to conclude that there is no reason for a clash between the synthetic producers and the natural diamond industry. Both sides seem committed to take all the necessary measures to avoid recurrence. And, most importantly, the main players involved are engaged – and will be engaged – in a dialogue. This certainly will restore the confidence that had been shaken by this unfortunate Antwerp/New York incident. ♦

Chaim Even-Zohar

HRD Antwerp's D-Screen

Technology

DIAMOND INTELLIGENCE BRIEFS 7299

4 CORNERS OF THE GLOBE

Report: Mbada Diamonds Injects $300 Million into National Coffers

Marange diamond miner Mbada Diamonds has contributed approximately US$300 million in revenue to the Zimbabwe government over the past two years, according to Mbada Chairman, Dr. Robert Mhlanga.

Recently appearing before the government’s Portfolio Committee on Mines and Energy, Mhlanga said his company had earned a total of US$592.5 million

since commencing operations in 2009, reports the state-run Herald. He said of that amount, US$76.2 million had been paid to government as royalties, US$33.9 million for resource depletion, and US$5.96 million had been paid as marketing fees, according to the news source. He added that a further US$117.2 million had been paid to government as dividend, US$42.5 million as corporate tax and US$17.8 million had been paid as withholding tax.

“In total we have paid a total of US$293,549,914 to Government and this constitute nearly 50 percent of the gross we generate with 26 percent going to working capital while 24 percent went to the other shareholder (Reclamation),” Mhlanga said, as quoted by the Herald. He added that the company’s accounts are audited by KPMG.

During his presentation, he reportedly raised the issue that U.S. and EU sanctions against the diamond mining companies operating in Chiadzwa were hindering them from competing on a level playing field.

Alrosa MullsRough Supply to Gokhran in 2012

Alrosa and its subsidiaries Alrosa-Nyurba, Almazy Anabara and

Severalmaz could supply up to 4 billion rubles (US$124.5 million) worth of rough diamonds to the State Precious Metals and Gemstones Repository (Gokhran) in 2012, reports Interfax, citing an Alrosa statement.

Alrosa did not sell diamonds to the Gokhran in 2011. The repository bought US$1 billion in rough from Alrosa in 2009.

According to Interfax, Alrosa thought about selling US$300 million worth of diamonds to the Gokhran in 2011, but changed its mind after market prices increased last year by, on average, 53 percent to US$129.5 per carat. Instead, the Gokhran reportedly bought diamonds from OJSC Nizhne-Lenskoye and OJSC Uralmaz, neither of which is a member of the Alrosa group.

The Gokhran can spend up to 9.95 billion rubles (US$309.8 million) on precious metals and gemstones this year, compared with a budget of 10.45 billion rubles (US$325.4 million) in 2011, notes Interfax.

KP Chairwoman Visits Angola

The Chairwoman of the Kimberley Process Certification Scheme (KPCS), U.S. Ambassador Gillian Milovanovic, was in Angola last week for a two-day working

visit, reports the Angola Press. Citing a statement released by the U.S. embassy in Angola, the press service notes that the main purpose of the ambassador’s visit was to meet with local authorities interested in diamond mining.

During her visit, the KPCS Chair was to hold talks with Angolan officials of the Ministries of Foreign Affairs and Geology, Mining and Industry, as well as with representatives of the state-owned diamond company Endiama and the African Diamond Producers Association (ADPA), to discuss the KPCS-related issues, reports the Angola Press. This was the ambassador’s first visit to Angola since her appointment as chair of the KPCS in 2012.

A Second Chinese Firm May Start Mining Marange Diamonds

Another Chinese firm may soon join Anjin in its diamond mining operations in Zimbabwe’s Marange diamond area. As part of its diversification strategy, China-based Tiens, an international company involved in marketing Chinese traditional medicines and supplemental health food products, is planning to send a

special delegation to Zimbabwe to meet with President Mugabe and to formalize plans to venture into diamond and platinum mining, reports the state-run Herald.

Speaking shortly after his arrival at Harare International Airport last week, Tien President Kevin Hou confirmed that in the following month a special delegation from Tiens headquarters will meet Zimbabwe government officials over their proposal, reports the news source, which adds that the Tien president was welcomed by Zanu-PF Politburo member Cde Kumbirai Kangai and his wife.

“We are hoping to co-operate with Zimbabwe companies in this huge business plan. Zimbabwe has vast business opportunities and a good market hence we are looking forward to expand our activities in this country,” Hou said, as quoted by the Herald.

Country manager Lei Li said there are about 100,000 Tiens distributors currently in Zimbabwe.

Robert Mhlanga

RU

SSIA

ZIM

BA

BW

E

ZIM

BA

BW

E

AN

GO

LA

DIAMOND INTELLIGENCE BRIEFS 7300

4 CORNERS OF THE GLOBE

10 Illegal Diggers Killed in South African Diamond Mine

Search and rescue teams have recovered the bodies of 10 illegal diamond diggers who were killed last week in a collapsed tunnel at De Beers’ deserted Namaqualand diamond mines in South Africa’s Northern Cape Province, according to media reports.

While 11 diggers escaped from the collapsing tunnels last Tuesday, May 22, and one survivor was rescued, De Beers believes that an additional 11 diggers remain trapped in what it calls the “illicit diamond digging operation”

at Bontekoe, the site which forms part of the illegally excavated tunnels.

Rescue EffortsDe Beers Consolidated Mines (DBCM) officials and representatives from its mining

and support team have been at the site of the accident since last Tuesday as part of the rescue team, which also includes Proto Teams and the South African Police Services Disaster Recovery Unit. According to DBCM, three of the 11 diggers who had escaped harm returned to the site to assist the recovery team to try and map where the tunnels and trapped diggers might be. The rescue team has also deployed a Trapped Persons Location Device above grown and in the collapsed tunnels where people may be trapped.

“We express our condolences to the relatives of the deceased recovered from the Bontekoe site. We continue to have one priority and it remains single-mindedly to search for survivors and enable the safe recovery of all trapped diggers,” said Phillip Barton, DBCM Chief Executive Officer, in a statement released over the weekend. “We will continue to deploy our Company resources at the site until the tunnels are found and safely cleared in the coordinated effort to, hopefully, recover any survivors still trapped at the site.”

Barton added: “Our mission is to safely find any survivors of the collapse. We are focused on a human tragedy not on other matters. We again urge, personally, all those directing, encouraging and participating in illegal mining to put safety first and to cease their activities and to cooperate with the authorities in the region before another person is injured of loses their life.”

NamaqualandDBCM stopped operations in Namaqualand around three years ago pending the

mines’ sale to fellow miner Trans Hex, which signed a US$27 million (225 million rand) acquisition deal last year. The miner reportedly closed down access to the mines in April when it discovered illegal miners from the area had started work in the tunnels.

SDA Calls on Indian Institutes to Offer Diamond, Jewelry Courses

India’s Surat Diamond Association (SDA) is proposing that state-run industrial training institutes (ITIs) as well as other universities associated with the diamond industry start offering diamond polishing and jewelry manufacturing courses to help fill the vacuum of skilled manpower trained in modern technology used in the trade.

According to the Business Standard, in coming years, an estimated one million

trained workers will be required for India’s domestic diamond and jewelry manufacturing needs.

“About 20 per cent of the workforce migrated during the slowdown in 2008, of which only 10 per cent are back. So there is already a deficit. Plus there is only one institute, the Indian Diamond Institute, (IDI) which provides training of using modern technology in diamond polishing,”

SDA President Dinesh Navadia said, as quoted by the news source.

Citing the big gap in supply and demand of workers trained in modern technology of diamond polishing and jewelry fabrication, former SDA President Rohit Mehta estimates that the industry needs at least 200,000 trained workers every year.

“It is estimated that we require 10 lakh [1 million] workers in jewellery fabrication units in the next couple of years. The GJEPC and other jewellery associations believe that full-time courses in jewellery should be introduced by universities. We need many more institutes like IDI to impart education and degree courses in the gem and jewellery field,” Chandrakant Sanghvi, regional Chairman of the Gems and Jewellery Export Promotion Council (GJEPC) and President of the Gujarat Hira Bourse, told Business Standard.

Phillip Barton

Namaqualand Mines in South Africa's Northern Cape Province

SOU

TH A

FRIC

A

IND

IA

DIAMOND INTELLIGENCE BRIEFS 7301

4 CORNERS OF THE GLOBE

Element SixAnnounces Its First U.S. Synthetic Diamond Manufacturing Facility in Silicon Valley

Synthetic diamond super- materials company Element Six reports that it is opening its first U.S. manufacturing facility in Silicon

Valley. The facility will house employees in the production, technical and customer service fields, and will serve to establish a direct connection to Element Six Tech- nologies Division’s customers and partners in the U.S.

The company, part of the De Beers Family of Companies and co-owned by Belgian materials group Umicore, says that its continued expansion into the U.S. market is in direct response to the growing demand and interest in synthetic diamonds for commercial use in advanced technology applications.

“As the pioneers of the commercial CVD diamond markets, we have the technical excellence, capabilities and track record to develop entirely new applications for synthetic diamond,” says Cyrus Jilla, Element Six Chief Executive Officer. “With our new Santa Clara facility, we will build on our 25% year on year growth, and deliver innovative products which enhance productivity, reduce energy consumption and lower operational costs.”

The company has also recently announced the construction of a US$32 million synthetic diamond supermaterials research and development facility in Oxford in the UK. To read more details of this UK facility, click here: http://tinyurl.com/cyfd4fq

Former Botswana President Joins Shrenuj BoardIntegrated diamond firm Shrenuj & Company Limited reports that Festus G.

Mogae, former President of the Republic of Botswana, has joined the company’s Board of Directors as an independent director.

Mogae, who worked at the International Monetary Fund and the Bank of Botswana before serving as the country’s Vice-President from 1992 to 1998, rose to the post of President in 1998 and served two full terms of presidency, the maximum allowed by the constitution of Botswana, till 2008. Mogae currently serves as Special Envoy of the United Nations Secretary-General on Climate Change. In 2010, he also joined the Advisory Board of U.S. Nonprofit TeachAIDS.

Among his other internationally recognized achievements, Mogae was awarded the Grand Cross of the Légion d’honneur by former French President Nicolas Sarkozy in 2008 for his “exemplary leadership” in making Botswana a “model” of democracy and good governance.

“Mr. Mogae brings a great wealth of knowledge in areas including finance, economics, corporate governance, and leadership. He has been an exceptional role model in leadership and has in-depth understanding of diamond-economics,” says Shreyas Doshi, Chairman and Managing Director of Shrenuj & Co.

“A significant part of our growth is expected from diamond producing countries. We have fairly large manu- facturing operations in Botswana and South Africa. The insight of Mr. Mogae into these producing centers will help us achieve our ambitious targets,” adds Doshi.

Financial ResultsIn other company news, the integrated gem and jewelry manufacturer and retailer

has recorded a 28 percent increase in revenue for fiscal 2011-2012 to US$560.3 million (INR 31.5 billion). The DTC sightholder’s profit for the year, totaling US$12.5 million (INR 703.4 million), also showed a double-digit growth of 24 percent.

During the year, Shrenuj commissioned a jewelry-manufacturing unit in Botswana and a diamond-polishing unit in South Africa. It also proposes to augment its diamond polishing manufacturing by commissioning another large-scale factory in India later this year.

The company reports that it secured a “significantly large” supply contract for 2012-15 from the DTC London and DTC Botswana.

“We are pleased with the performance of the company, especially since the year 2011-12 was particularly challenging. The input prices of raw material, [namely] diamonds and gold were on the rise. The economic uncertainty added to lowered sales revenues in Euro zone. The rise in US demand was compensated by slightly subdued growth rates in China. In this scenario, our focus was on preventing credit risk while sustaining growth,” says company Chairman and Managing Director Shreyas Doshi.

Continues Doshi: “The rise in revenue is a result of further broad-basing our customer base and extending our footprint to new markets. This is a long-term strategy and we will see its impact on our bottomline in the coming four to five years. The fact that we have been able to protect our margins despite a falling rupee is evidence that our systems and operational efficiencies have improved during the year.”

Synthetic Diamond in semiconductors provides superior thermal management of high power devices; lowering device operating temperatures resulting in system

size reduction and improved reliability (Photo: Business Wire)

Festus Mogae

UN

ITED

STA

TES

IND

IA

DIAMOND INTELLIGENCE BRIEFS 7302

DIGGING THE DIRT

Alrosa’s 2011 Diamond Sales Grow 24% in Value

Russian mining conglomerate Alrosa reports that it produced 34.6 million carats in 2011, up 1 percent from the 34.3 million carats produced in 2010.

Total revenue for the year grew 21 percent to US$4.4 billion (137.7 billion rubles), which the Yakutia-based miner attributes to “solid” diamond sales and strong prices. Net profit for Alrosa more than doubled in 2011 to US$853.9 million (26.7 billion rubles).

Alrosa’s debt declined 6 percent to US$3 billion (95.5 billion rubles).

Diamond SalesIn 2011, Alrosa sold 32.9 million carats, down

17 percent in volume from 39.5 million carats sold in 2010, when the miner says it sold diamonds from inventories accumulated in 2009. Despite the decrease in sales volume, a continuous increase in diamond prices drove Alrosa’s diamond revenue for 2011 up 24 percent in value to US$4 billion (125.3 billion rubles). According to Alrosa, the average diamond price per carat increased 53 percent year over year to US$129.5 per carat in 2011.

Alrosa reports that in 2011, prices for its gem-quality diamonds reached US$196.9 per carat, up 60 percent from US$123.3 per carat in 2010. The price per carat for non-gem-quality diamonds also rose 60 percent year over year, from US$4.8 per carat in 2010 to US$7.7 per carat in 2011.

2011The miner says that 2011 was characterized

by strong demand in the first nine months and a period of lower demand in 4Q. “To sustain average selling prices in 4Q 2011, Alrosa reduced auction sales and offered diamonds of better quality to its clients under long-term agreements. These measures resulted in an increase in Alrosa’s average selling prices in 4Q 2011 and helped to partially compensate for lower sales volumes,” explains the miner in its 2011 financial results.

Q1 2012In a recently published statement summarizing

a meeting of its Executive Committee, which met on May 25, Alrosa reports that it produced 8.1 million carats during the first quarter of 2012, down 19 percent year over year from the 10 million carats produced in the first quarter of 2011.

DIAMOND INTELLIGENCE BRIEFS 7303

DIGGING THE DIRT

Rockwell Diamonds Inc. has completed two strategic projects at its Saxendrift mine in South Africa’s Northern Cape Province. The new in-field screen and the bulk x-ray and single particle sorter plant were the first capital projects approved by Rockwell’s board for implementation by the company’s new management team.

In-Field Screen The new in-field screen was

commissioned to address the high sand content in the gravel that was impacting the mine’s ability to achieve its productions targets.

The new 3.0m x 8.0m Dabmar Bivitec screen is designed to treat gravels with a high sand and moisture content at the required processing rates. The project, which included a magnetic scalping plant, came in under budget and has been delivering the anticipated benefits for the past four months, notes Rockwell. The screen is running in excess of 95 percent efficiency notwithstanding the fact that it is operating at 17 percent above its design throughput.

“Another meaningful positive impact of the new in-field screen is enhanced pan plant efficiency. This is due to the

higher quality gravels, cleared of excess sand and small particles being fed into the plant,” explains James Campbell, Rockwell Chief Executive Officer. “We are now also in a position to consider mining certain blocks that have a higher sand content, that could previously not be processed and have the potential to increase the life of mine at Saxendrift.”

Campbell adds that: “The new in-field screen, along with contops and a change in the bottom cut-off has enabled us to increase our monthly volume throughput by over 30% whilst maintaining our operating costs at the same level as a year ago… Based on the results of this project,

the technology will be incorporated into the mines which we are planning to build at our Middle Orange River projects to grow our production profile.”

Bulk X-Ray System The commissioning of the bulk x-ray

technology that was approved by the Board in September 2011 was completed to scope and on budget in mid April 2012 with very encouraging results so far. This strategic initiative is based on a high throughput Bourevestnik (BV) sorter and one BV single particle sorter and is aimed at improving concentrate efficiency and final sorting of diamond-bearing ore with a total capital cost of $1.5 million, reports Rockwell. Having started processing old recovery tailings at Saxendrift in April, 316 stones totaling 1,109 carats have been recovered in the first four weeks of production. This includes 14 stones exceeding 10 carats with the largest weighing 52.67 carats.

This project has been viewed as a “Proof of Concept” test plan, which, if successful, could be applied to Rockwell’s other, as yet undeveloped, Middle Orange properties, says the miner.

The project program includes sampling of recovery and pan plant tailings. Once complete, the 100 tonnes per hour plant will be used to bulk sample the gravels from the Jasper Mine, subject to the acquisition proceeding as planned.

Rockwell Completes Two Strategic Projects at Saxendrift

South Africa's Saxendrift Mine

Saxendrift In-Field Screen

DIAMOND INTELLIGENCE BRIEFS 7304

DIGGING THE DIRT

Report: KKR No Longer Interested in Ekati Sale KKR & Co. L.P. has backed away from the sale of BHP Billiton’s Ekati diamond mine

in Canada’s Northwest Territories, the Financial Times reports, citing unnamed sources.The New York-based private equity house was initially named as a potential bidder

for the mine back in March, following BHP Billiton’s November announcement that it was reviewing its diamonds business and its future in it. The sale of the Ekati mine, which industry participants say is worth between US$750 million and US$1.2 billion, had also attracted initial interest from private equity firm Apollo Global Management, among others, according to the Financial Times.

While KKR could still renew its interest in Ekati, the firm’s turnaround raises questions about demand for such assets, the newspaper reports. Meanwhile, Rio Tinto, who announced a similar strategic review of its diamond business in March, has appointed Morgan Stanley to assess options for its diamond mines in Australia, Canada and Zimbabwe, which, all together, could be worth as much as US$2 billion, writes the Financial Times.

BHP Billiton has maintained that it could hold on to Ekati, though the auction is still ongoing. The news report also notes that sources have observed in recent days an interest from De Beers in buying the mine despite concerns of potential antitrust issues.

While BHP Billiton still holds an 80 percent interest in Ekati, in early February, it completed the sale of its 51 percent interest in the Chidliak diamond exploration project in Canada’s Nunavut province to project operator Peregrine Diamonds Ltd.

Afri-Can Completes Geophysical Survey on EPL 3403 Marine Diamond Concession

Afri-Can Marine Minerals Corporation reports that it has completed its geophysical survey on Exclusive Prospecting License (EPL) 3403 marine diamond concession in Namibia.

According to the Canadian diamond exploration company, the geophysical survey covered 1,251 line-kilometers over an area of 90 square kilometers in the south end of EPL 3403. The survey also included Depositional Areas 1, 2 and 3 already delineated by previous sampling programs.

The survey data were “consistently of very high resolution and quality” and will enable Afri-Can to develop cross-section maps and three-dimensional models of the Depositional Areas. The geology, morphology and stratigraphy of the south end of EPL 3403 will be analyzed in preparation for the second sampling phase, notes

the company. The goal of the geophysical survey and second sampling phase is to start delineating resources on Depositional Areas 1 and 2 in anticipation of trial mining.

EPL 3403 covers approximately 800 square kilometers and is adjacent to and contiguous with Namdeb’s Atlantic One Mining Lease (ML) 47, which currently produces in excess of 1,100,000 carats per year.

RioZim in Talks with Rio Tinto for Full Control of Murowa Diamond Mine

Independent Zimbabwean owned and listed miner RioZim Limited has engaged Rio Tinto in talks to take full control of the Murowa diamond mine in South Central Zimbabwe following the global miner’s intention to leave the diamond business, reports Reuters, citing a key shareholder in RioZim.

Currently, Rio Tinto holds a 78 percent stake in Murowa, which produced 367,000 carats in 2011, while RioZim controls 22 percent of the mine. RioZim was created in 2004 when Rio Tinto largely left Zimbabwe while retaining its diamond interest.

“We’re now in discussions with Rio Tinto Plc to acquire the 78 percent of Murowa that they want to offload,” reports Reuters, quoting Harpal Randhawa, whose private equity group Global Emerging Markets (GEM) recently bought 25 percent of the Zimbabwean firm.

Rio Tinto announced in March its intention to leave the diamond industry, effectively inviting bids for its diamond operations, including the Argyle mine in Australia and its 60 percent share in the Diavik mine in Canada.

Randhawa, who said only time would tell if his group’s decision to invest in RioZim was “either brave or stupid,” said the firm was compliant with Zimbabwe’s empowerment law as it was 54 percent controlled by locals, according to Reuters.

Under Zimbabwe’s current indeginiza- tion law, the government seeks to transfer at least 51 percent shareholding in foreign firms, including mines and banks, to locals.

According to the news source, RioZim, which is battling to clear a US$50 million debt owed to local banks, badly needs to recapitalize its gold mines and develop its substantial coal and chrome concessions.

Aerial View of Ekati’s Koala Pit

Murowa Processing

DIAMOND INTELLIGENCE BRIEFS 7305

DIGGING THE DIRT

Mountain Province Diamonds Approves C$31.3M Initial Gahcho Kué

Capital ProgramMountain Province Diamonds Inc. and its Gahcho Kué Joint

Venture partner, De Beers Canada Inc., have approved the initial capital to advance the Gahcho Kué diamond mine at Kennady Lake in Canada’s Northwest Territories in preparation for development.

The US$30.5 million (C$31.3 million) budget [US$20.8 million (C$21.3 million) for 2012 and US$9.8 million (C$10 million) for Q1, 2013] will focus on advancing: preparation work for the construction and operating permit applications; front-end engineering and design (FEED); preparations and procurement for the 2013 winter road; detailed engineering; purchase of critical long-lead equipment; and the feasibility study update.

The Gahcho Kué Project consists of a cluster of four diamondiferous kimberlites, three of which have a probable mineral reserve of 31.3 million tonnes grading 1.57 carats per tonne for total diamond content of 49 million carats.

In related news, the technical sessions of the Environmental Impact Review (EIR), which were intended to resolve as many technical issues as possible prior to the public hearings, took place in Yellowknife from May 22 to May 25, 2012, and concluded successfully, reports the miner. The EIR continues to progress in accordance with the work plan established by the Mackenzie Valley Environmental Impact Review Board (MVEIRB) with the closure of the public record under the EIR expected prior to the end of 2012.

Additionally, Mountain Province Diamonds reports that an updated independent valuation of the diamonds recovered from the Gahcho Kué project, conducted by WWW International Diamonds Consultants Ltd. and based on the WWW Price Book as of March 7, 2012, indicates that the valuation of the Gahcho Kué diamonds increased marginally from April 2011 to March 2012 with the actual value per carat increasing by approximately 1 percent from US$185 to US$186. The modeled values also remained essentially unchanged.

Mountain Province, which holds a 49 percent share in Gahcho Kué, also controls 100% of the Kennady North Diamond Project comprising thirteen leases and claims immediately to adjacent to the De Beers JV property.

Namakwa Diamonds’ First Auctionof Kao Diamonds Nets $6.47 Million

in Revenue Namakwa Diamonds Ltd’s first sale of diamonds from the Kao

diamond mine in Lesotho realized revenues of US$6.47 million, with achieved prices 17 percent higher than initial estimates. The recent auction took place in Antwerp through Fusion Alternatives, tender partner of I Hennig & Co. According to Namakwa, sales will continue through Fusion Alternatives for at least the next six months.

During the auction, 16,388 carats were sold at an average selling price of US$395 per carat, with an average diamond size of 0.36 carats. The largest diamond sold was 38 carats at US$6,668 per carat, with an 11-carat diamond selling for US$15,020 per carat and four diamonds with sizes varying between 6 and 14 carats selling for an average of US$7,100 per carat.

The diamonds sold were sourced predominately from the mine’s hardrock kimberlite ores. Namakwa Diamonds holds a 62.5 percent interest in Kao, with the government of Lesotho and Kimberlite Investments Lesotho Limited holding the remaining 25 percent and 12.5 percent, respectively.

“We are delighted with the outcome of our first tender sale in Antwerp of [Kao mine operator] Storm Mountain Diamonds’ production from the Kao Mine. Achieved prices were 17% higher than anticipated resulting in an additional US$1m in sales income. The significant improvement in achieved price reflects both the increased parcel size on comparative diamond sales in Johannesburg, as production ramps-up at the Kao Mine, and the international exposure provided by our tender partner, Fusion Alternatives. We look forward to regular monthly sales in Antwerp for the foreseeable future,” says Richard Collocott, Chief Executive Officer of Namakwa Diamonds.

Since January 2012, Namakwa has sold 49,771 carats from the Kao mine, achieving US$13.76 million in revenue.

Gahcho Kue

aerial view

Kao Project in Phase 1 Production

DIAMOND INTELLIGENCE BRIEFS 7306

BRIEFLY NOTED

Gem-A to Hold International Gemmology Conference in November 2012

The Gemmological Association of Great Britain (Gem-A) has announced that it is holding an international gemological conference in London scheduled for November 3-5, 2012.

The conference, to take place in the Hotel Russell, Bloomsbury, aims to bring together a range of globally renowned speakers and international delegates to discuss a variety of relevant issues pertaining to the international gem and jewelry trade.

According to Gem-A, this year’s speakers include:• Dr. Hanco Zwaan from the Netherlands Gemmological Laboratory, who will talk about

new sources of emeralds from Brazil.• Thomas Hainschwang from GEMLAB, Liechtenstein, who will cover the challenge of

identifying recent generations of melee-sized synthetic diamonds.• Bear Williams of Stone Group Laboratories, USA, who will give a report on advanced

instruments for the smaller labs.• Lore Kiefert from Gübelin Gem Lab, Switzerland, who will focus on gems from Guinea,

Sierra Leone, and Liberia.• Also speaking are Richard Hughes, author of Ruby & Sapphire, Joanna Whalley from

the Victoria & Albert Museum, and Jerry Sisk from JTV, Jewelry Television.Seminars and talks have been arranged for Saturday, November 3rd and Monday,

November 5th to coincide with the conference. Tuesday, November 6th will be dedicated to visits to the Crown Jewels and the Natural History Museum in London.

NY Giants Unveil Tiffany &Co.-Designed Super Bowl Ring

Professional American football team the New York Giants recently unveiled their commemorative championship ring for winning Super Bowl XLVI at Tiffany & Co.’s flagship store in New York. The white gold ring was designed by Tiffany & Co. with input from the team’s ownership, General Manager Jerry Reese, Coach Tom Coughlin and players – notably captains Eli Manning, Justin Tuck and Zak DeOssie.

“We feel especially honored to craft the trophy and commemorative rings for Super Bowl XLVI, because both are in celebration of our own New York Giants, who gave us yet another performance on the field that no Giants fan will ever forget,” said Michael

J. Kowalski, chairman and CEO of Tiffany & Co.The top of the ring is covered in round brilliant diamonds that are

pave set. There are also four Vince Lombardi trophies on the ring top, commemorating the four Giants’ Super Bowl wins, and each set with a marquis diamond representing the football. The trophies surround the Giants’ iconic NY logo, which is set with round brilliant diamonds

on an outline of blue enamel. The top of the ring also includes 37 blue sapphires channel set on the outer bezel. The text around the bezel reads

“2011 World Champions New York Giants.” The team’s 2007 ring was white gold and featured diamonds without additional color.

The rings shank tells the story of this season’s championship team and honors The Giants legacy. One shank of the ring has the Giants logo, the Lombardi Trophy, the NFL shield, the words “Super Bowl XLVI” and the final score – NYG 21 NE 17. The opposite shank has the recipient’s name, the Giants circular logo with the player’s number in the center and EST. 1925 (the year the franchise was founded). The lower palm side of shanks list the four seasons the Giants won the Super Bowl: 1986, 1990, 2007 and 2011.

Additionally, engraved inside the ring are the words “Finish” and “All In” two phrases that reportedly rallied the Giants throughout the 2011 season.

DEF Gala to Salute Global Success

of Botswana’s Diamond Industry

The Africa-focused Diamond Empower- ment Fund (DEF) and the embassy of the Republic of Botswana have invited international diamond industry leaders, government officials, and business executives to attend a special VIP black-tie event to celebrate the global success of the diamond industry in Botswana. The event, titled The Gala Salute to Botswana:

“Diamonds Empower Africa,” is scheduled for June 5, 2012, at the Botswana embassy in Washington, DC, and will take place during the Kimberley Process Certification Scheme’s intersessional meeting.

“We are pleased to recognize the outstanding progress and sustainable impact that the diamond industry continues to have on the people and economy of Botswana as a global model of good corporate social responsibility,” says Phyllis Bergman, DEF President.

During the evening, there will be a live auction for a six-night safari adventure for two, donated by Wilderness Safaris in Botswana, including an exclusive day tour of Diamond Trading Company Botswana’s facility in Gaborone. In addition, Debswana will arrange for a private tour of its Jwaneng mine, the world’s richest diamond mine by value.

Presenting sponsor for the Gala Salute to Botswana is Tiffany & Co. Support sponsors include Exelco Group, Julius Klein Group, and Leo Schachter Diamonds.

DEF’s mission is to develop the next generation of leaders in Africa by supporting education initiatives in diamond-producing nations.

DIAMOND INTELLIGENCE BRIEFS 7307

OFF THE SHELF

Christie’s Magnificent Jewels Brings in $72.3 MillionChristie’s Magnificent Jewels sale, held earlier this month in Geneva, brought in

US$72.3 million with an 84 percent sell-through rate by lot and 86 percent sell-through rate by value. The auction’s top lot was an antique Indian emerald, diamond and enamel 18th century sarpech, which sold for US$4.7 million, setting a world record price for an Indian sarpech at auction.

The auction’s second-highest earner was a pair of pear-shaped D, VVS2, potentially IF diamond ear pendants of 16.21 and 15.67 carats by Harry Winston, which sold for US$4 million, or US$127,500 per carat. The sale’s third-highest earner, an octagonal-cut Burmese sapphire brooch of 47.15 carats by Mellerio, sold for US$3.6 million, or US$77,500 per carat, achieving a record price per carat for a Burmese sapphire at auction.

The Magnificent Jewels sales results combined with the May 14th charity auction, the Jewels for Hope: The Collection of Mrs. Lily Safra, totaled US$110.2 million, the highest result for a series of jewelry auctions at Christie’s Geneva.

“From the ‘Hope Ruby’, which sold for a record US$6.5m from the collection of Mrs. Lily Safra to an Indian emerald sarpech which achieved a sensational price after a 10 minute bidding-war in the saleroom between two determined bidders, jewellery buyers from all over the world showed great depth as they bid at the highest levels for every rare jewel and gem offered,” says Rahul Kadakia, Head of Christie’s Geneva and New York Jewellery Departments.

For more details of the auctions’ results, click here: http://tinyurl.com/8x4ed96

Richemont’s Jewelry Sales Rise 32%Swiss luxury goods group Richemont reports that its jewelry sales increased 32

percent to US$5.9 billion (€4.6 billion) for the fiscal year ended March 31, 2012. Both brands comprising its Jewelry Maisons, Cartier and Van Cleef & Arpels, performed

“exceptionally well” and reported high growth across product categories and channels. “Demand for High Jewellery pieces was solid and more accessible jewellery ranges enjoyed very strong demand. Cartier’s watch collections, including premium and technical pieces, were equally successful,” reports Richemont in its fiscal report for the 12-month period.

Sales for the group’s Specialist Watchmakers Maison increased 31 percent during the fiscal year to US$2.97 billion (€2.3 billion)

Richemont’s total global sales for the 12-month period grew 29 percent to US$11.3 billion (€8.9 billion). According to Richemont, the growth in sales reflected the

continuing demand for established product lines, the successful introduction of new products and the impact of boutique openings. By

region, Asia-Pacific recorded the highest sales growth for the fiscal year (43 percent)

following by Americas (26 percent), Europe (20 percent) and Japan (13 percent).

Richemont’s profit for the fiscal year grew 43 percent to US$1.97 billion (€1.5

billion).

Signet Jewelers Posts 1.4% Growth in Q1 Sales

Signet Jewelers Limited reports that sales for the first quarter, ended April 28, 2012, grew 1.4 percent to US$900 million, compared to US$887.3 million recorded a year ago.

Total sales in the specialty jewelry retailer’s U.S. division, where it operates under the brands Kay Jewelers and Jared The Galleria of Jewelry as well as other regional brands, came to US$751.5 million, up 1.8 percent, compared to US$738 million in the same quarter a year ago.

Meanwhile, Signet Jewelers reports that total sales in its UK division, where it operates under the brands H. Samuel and Ernest Jones, were US$148.5 million, down 0.5 percent versus the US$149.3 million recorded a year ago.

The company’s income before taxes totaled US$128.5 million, a 9.1 percent rise year over year, while its net income for the 13-week period grew 9.4 percent to US$82.5 million.

BIDZ.com, Inc. Signs Going Private Merger

AgreementBidz.com Inc., an online jewelry retailer

has entered into a definitive merger agreement with Glendon Group, Inc. to be acquired for $0.78 per share in cash.

The proposed transaction is expected to close in the fourth quarter of 2012, and is subject to certain closing conditions specified in the merger agreement. Glendon Group has obtained equity financing commitments in an aggregate amount sufficient to complete the merger. There is no financing condition to Glendon Group’s obligation to complete the merger.

Following completion of the tran- saction, Bidz.com, which offers its products through a live auction format as well as a fixed price online retail store, Buyz.com, would become a privately held company and its stock would no longer trade on the Nasdaq Capital Market.

This 32.08-carat cushion-shaped Burmese ruby and diamond ring by

Chaumet, renamed “The Hope Ruby,” sold at the “Jewels for Hope: The Collection of Mrs. Lily Safra” charity auction

for US$6.7 million, setting a new world record

price for any ruby sold at auction.

DIAMOND INTELLIGENCE BRIEFS 7308

OFF THE SHELF

Rio Tinto Finds Strong Potential for New Diamond Jewelry Niche in China

Rio Tinto reports that new market research confirms the growing trend towards diamond fashion jewelry in China. Global market research company Ipsos was commissioned by Rio Tinto to help them further understand consumer perceptions in China regarding fashion jewelry (i.e., jewelry pieces comprising small, affordable diamonds).

FindingsOf particular note were the following findings:

• Chinese consumers no longer see diamonds as purely a store of wealth or bridal purchase.

• Diamond fashion jewelry is desirable and part of a broader trend in China towards “affordable luxury.”

• Diamond fashion jewelry is attractive as a versatile accessory for everyday wear.

• Design is critical to the Chinese consumer when purchasing fashion jewelry.

Rio Tinto says that these insights challenge the conventional wisdom that Chinese consumers only appreciate large, high-

quality white diamonds or gold jewelry. According to PLDG Creative Intelligence, an independent global jewelry trend and forecasting company, this trend in China is consistent with other key jewelry markets where, “diamond jewellery consumers increasingly want affordability, beautiful designs and to feel unique. As a result international brands and designers are using small diamonds for innovative designs, not tied to the bridal market.”

China ExpansionNotes Jean-Marc Lieberherr, General Manager for the sales

and marketing of Rio Tinto Diamonds: “These are important findings for Rio Tinto as we are accelerating our marketing investment in the Chinese diamond jewellery market. It is also good news for diamond manufacturers, jewellery designers, retailers and consumers.”

With growth in China expected to change the face of the diamond jewelry market, Rio Tinto has partnered with leading diamond jewelry manufacturer and retailer Chow Tai Fook, promoting diamonds as fashion accessories in imaginatively designed jewelry.

Tiffany & Co.’s Worldwide Sales Rise 8% in Q1

Tiffany & Company has recorded an 8 percent growth in worldwide net sales to US$819 million for the first quarter ended April 30, 2012. Net earnings rose 1 percent to US$82 million.

Sales by RegionSales in the Americas, which represent slightly less than half

of worldwide sales, rose 3 percent to US$386 million. Combined Internet and catalog sales in the Americas increased 1 percent.

Sales in the Asia-Pacific region increased 17 percent to US$195 million. In Japan, sales rose 15 percent to US$142 million while sales in Europe increased 3 percent to US$88 million.

Meanwhile, Tiffany reports that its other sales declined 14 percent to US$9 million due to lower wholesale sales of finished products to independent distributors.

The high-end jewelry retailer opened four stores during the first quarter: in Mexico City, Montreal, Salt Lake City and Wuhan, China. As of April 30, 2012, Tiffany & Co. operated 251 stores (105 in the Americas, 59 in Asia-Pacific, 55 in Japan and 32 in Europe), compared with 232 stores (96 in the Americas, 52 in Asia-Pacific, 55 in Japan and 29 in Europe) a year ago.

“In terms of our sales for the first quarter, regions outside the Americas performed generally as expected. However, the Americas region underperformed, continuing a soft trend that began in the last quarter of 2011 and compounded by the difficult comparison to substantial sales growth in last year’s first quarter. These sales results led to net earnings modestly trailing our expectations,” says Michael J. Kowalski, chairman and chief executive officer.

Outlook“We are updating our forecast for the full year to reflect these

first quarter results and to reflect lower near-term expectations. Although we are very early into the second quarter, worldwide sales are currently increasing by a low-single-digit percentage, reflecting difficult year-over-year comparisons and decelerating rates of economic growth in many countries,” adds Kowalski.

In its updated management outlook for the full year ending January 31, 2013, the company expects worldwide net sales to increase 7-8%, versus the previous expectation calling for 10% growth.

In other company news, Tiffany & Co.’s Board of Directors has appointed Andrew W. Hart to the newly created position of Senior Vice President - Diamonds and Gemstones. Hart joined Tiffany in 1999 and, since 2002, has been Vice President - Diamonds and Gemstones. Hart will continue to report to James N. Fernandez, executive vice president and chief operating officer.

Additionally, Tiffany’s stockholders have appointed Robert Singer to its Board of Directors. He will chair the board’s audit committee and replaces Thomas Presby, who has retired.

Singer’s appointment brings Tiffany’s board’s total to nine.

Jean-Marc Lieberherr

DIAMOND INTELLIGENCE BRIEFS 7309

OFF THE SHELF

Sotheby’s Earns $9.7 Millionfor ‘Beau Sancy’

Sotheby’s Geneva earned US$89.6 million from its recent Magnificent Jewels and Noble Jewels sale, whose top lot, the 34.98-carat “Beau Sancy,” fetched US$9.7 million. The sale had a sell-through by lot of 85.3 percent and by value of 94.6 percent.

Beau SancyPassed down through the royal families of France, England,

Prussia and the House of Orange, the stone, a “modified pear double rose cut” royal diamond, exceeded its pre-sale estimate of between US$2 to US$4 million.

First acquired by Nicolas de Harlay, Lord of Sancy, in Constantinople in the mid to late 1500’s, the Beau Sancy is most likely to have originated from the mines in south-central India near the city of Golconda, the source of history’s best-known diamonds, including the Hope, the Koh-i-Noor and the Regent, according to Sotheby’s. The Beau Sancy has been shown publicly only four times in the last 50 years: first in 1972 in Helsinki; in 1985 in Hamburg; in 2001 in Paris; and finally in 2004 in Munich.

Other HighlightsThe sale’s second highest earner was a ring featuring a

Fancy Intense purple-pink brilliant-cut diamond weighing 3.71 carats set between two marquise-shaped rubies, which fetched US$5.5 million against a pre-sale estimate of US$2-US$4 million. Another highlight was a diamond necklace suspending a pear-shaped diamond weighing 41.40 carats, named by the buyer as

“Dubai Vision,” which sold for US$4.95 million, against a pre-sale estimate of US$3-US$4.9 million. Among other highlights were a Harry Winston diamond ring weighing 36.43 carats sold for US$4.1 million, while a natural pearl and diamond Murat Tirara by Chaumet sold for US$3.9 million.

DIAMOND INTELLIGENCE BRIEFS, available only by subscription, is published on a weekly basis to ensure a speedy dissemination of information indispensible to executives in the

diamond and diamond jewelry business. While the information herein is carefully compiled from sources believed reliable, no responsibility for its accuracy can be assumed and no representation of warranty expressed or implied is made as to their completeness or correctness.Diamond Intelligence Briefs may not be reproduced, distributed, published or used otherwise for any purpose but for the personal information of the subscriber without the prior written consent of the publisher.

1 year subscription - US$590 * Individual issues of DIB are available for US$25

website: www.diamondintelligence.com

Editorial and Research Management:Chaim Even-Zohar, Editor

Rachel Segal, Managing EditorAnat Hod, Graphics

Subscriptions and Circulation:CEZ Holdings Ltd.

Silver Bldg., 7 Abba Hillel St., Ramat Gan, Israel

P.O.B. 3441, Ramat Gan 52136, IsraelTel: 972-3-5750196, Fax: 972-3-5754829

© Copyright 2012by Diamond intelligence Services Inc.

Hearts On Fire Diamonds Releases New APP for iPhone and iPad

Hearts On Fire has released a new app for the iPhone and iPad that allows consumers to both browse the entire Hearts On Fire jewelry collection as well as view four new brand videos that help buyers understand the difference and value of the brand’s diamonds.

According to the diamond-jewelry retailer, the catalog portion of the app gives consumers the opportunity to sort by categories such as diamond engagement rings, diamond earrings, and diamond pendants. When browsing through the catalog, once a design is chosen, a larger jewelry image, product details, and pricing then become available.

In addition to the product catalog, there is a never-before-seen tour of the Hearts On Fire Diamond cutting factory.

“Hearts On Fire knows that today’s consumer needs to access information whenever and wherever they need it. Allowing our customers the ability to easily see brand and product information on their iPhones and iPads will enhance their research and shopping process,” says Caryl Capeci, VP Marketing Hearts On Fire.

Users have the ability to purchase any of the designs on the app by contacting the Perfection Stylist team.

To download the app for free, visit: http://www.heartsonfire.com/app.

The Hearts On Fire diamonds are sold in 650 retailers spanning 34 countries and in 14 HOF stores globally, as well as via the internet.

Beau Sancy