Evolution Gaming - As real as it gets · 2019. 7. 19. · P/L detail 8 Group Apr-Jun Apr-Jun...

Transcript of Evolution Gaming - As real as it gets · 2019. 7. 19. · P/L detail 8 Group Apr-Jun Apr-Jun...

-

Evolution Gaming Interim report January-June 2019

19 July 2019

1

CEO, Martin Carlesund

CFO, Jacob Kaplan

-

Highlights

In the quarter:• Revenue growth +45% to 85,7 MEUR (59,3)

• EBITDA increase +63% to 42,7 MEUR (26,2)

• EBITDA margin 49,8% (44,2)

• EBIT increase +69% to 36,6 MEUR (21,7)

2

• Positive reception for new games• EGR Live Casino provider of the year – 10th consecutive • Full-year EBITDA-margin expected in 47-49% range

-

Continued strong increase in activity across network

3

Bet spots

0

1,000,000,000

2,000,000,000

3,000,000,000

4,000,000,000

5,000,000,000

6,000,000,000

16Q1 16Q2 16Q3 16Q4 17Q1 17Q2 17Q3 17Q4 18Q1 18Q2 18Q3 18Q4 19Q1 19Q2

Be

t sp

ots

Bet spots

YoY growth+56%

-

Increase in staff

4

Full Time Equivalents (FTE)

1,7692,027

2,394 2,4262,539

2,740

3,0853,243

3,600

3,970

4,319

4,671

5,120

0

1,000

2,000

3,000

4,000

5,000

6,000

16Q2 16Q3 16Q4 17Q1 17Q2 17Q3 17Q4 18Q1 18Q2 18Q3 18Q4 19Q1 19Q2

FT

E

FTE, end of period

YoY growth+42%

-

Live Casino vertical is stronger than ever

5

-

Geographic breakdown

6

Based on GGR

Q2/19 Q1/19 Q4/18 Q3/18 Q2/18

Nordics 8% 9% 9% 9% 9%

United Kingdom 13% 13% 14% 14% 16%

Rest of Europe 49% 49% 51% 49% 50%

Rest of World 30% 29% 26% 28% 25%

Total 100% 100% 100% 100% 100%

Regulated markets 35% 34% 30% 29% 31%

Mobile 70% 68% 64% 60% 58%

-

Financial development

7

EUR million

27.1 29.234.3

39.742.3

45.750.7 51.6

59.364.3

70.2

79.3

85.7

10.6 10.813.0

17.0 19.221.8 22.6 22.0

26.2 28.031.6

35.9

42.7

39.1%37.0% 37.9%

42.8%

45.4%47.7%

44.6%42.6%

44.2% 43.5%45.0% 45.3%

49.8%

16Q2 16Q3 16Q4 17Q1 17Q2 17Q3 17Q4 18Q1 18Q2 18Q3 18Q4 19Q1 19Q2

Revenue EBITDA EBITDA, %

-

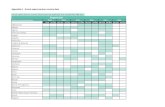

P/L detail

8

Group Apr-Jun Apr-Jun Jan-Jun Jan-Jun Jul 2018- Jan-Dec

(EUR thousands) 2019 2018 2019 2018 Jun 2019 2018

Revenues 85,701 59,211 164,988 110,782 299,556 245,350

Other revenues 27 41 37 64 41 68

Total operating revenues 85,728 59,252 165,025 110,846 299,597 245,418

Personnel expenses -30,451 -24,244 -59,486 -45,095 -112,065 -97,674

Depreciation, amortisation and impairments -6,116 -4,480 -11,845 -8,596 -21,446 -18,197

Other operating expenses -12,547 -8,840 -26,891 -17,630 -49,324 -40,063

Total operating expenses -49,114 -37,564 -98,222 -71,321 -182,835 -155,934

Operating profit 36,614 21,688 66,803 39,525 116,762 89,484

Financial items -51 -43 -96 -86 -168 -158

Profit before tax 36,563 21,645 66,707 39,439 116,594 89,326

Tax on profit for the period -2,034 -1,569 -3,602 -2,756 -6,712 -5,866

Profit for the period 34,529 20,076 63,105 36,683 109,882 83,460

Average number of shares after dilution 183,565,260 181,685,230 183,565,260 181,685,230 183,189,254 182,625,245

Earnings per share after dilution (EUR) 0.19 0.11 0.34 0.20 0.60 0.46

-

Cash flow and financial resources

9

Note: Op. cash flow defined as EBITDA – Change in NWC – Investing activities

Capital expenditure Operating cash flow Balance sheet summaryEUR m

14%

12%12% 12%

14%15%

13% 14%

12%

10%

0

2

4

6

8

10

12

17

Q1

17

Q2

17

Q3

17

Q4

18

Q1

18

Q2

18

Q3

18

Q4

19

Q1

19

Q2

MEU

R

TangiblesIntangibles% of revenue, rolling 12 month

0%

10%

20%

30%

40%

50%

60%

70%

80%

0

5

10

15

20

25

30

35

17

Q1

17

Q2

17

Q3

17

Q4

18

Q1

18

Q2

18

Q3

18

Q4

19

Q1

19

Q2

MEU

R

Op. Cash flow Cash conversion

EUR million 2019-06-30 2018-12-31

Total non-current assets 98 604 62 095

Current assets 108 931 93 611

Cash and cash equivalents

88 680 84 951

Total current assets 197 611 178 562

Total assets 296 215 240 657

Total equity 182 118 162 270

Total long-term liabilities 18 659 5 619

Total current liabilities 95 438 72 768

Total equity and liabilities 296 215 240 657

Note: Excluding acquisition of Ezugi 19Q1

-

Look ahead…

• Live vertical continues to grow its share of total market

• Continue to invest based on customer demand

• Expect to sustain margin level from H1 in H2

• Continue to take market-shares and to increase gap to our competitors

10

-

Q&A

11