Evaluation of the CAP measures applicable to the wine sector...The Languedoc-Roussillon region is...

Transcript of Evaluation of the CAP measures applicable to the wine sector...The Languedoc-Roussillon region is...

-

Written by Agrosynergie EEIG

November – 2018

Agrosynergie Groupement Européen d’Intérêt Economique

AGRICULTURE AND RURAL

DEVELOPMENT

Evaluation of the CAP measures applicable to the

wine sector

Case study report: France – Languedoc-Roussillon

-

EUROPEAN COMMISSION

Directorate-General for Agriculture and Rural Development

Directorate C – Strategy, simplification and policy analysis Unit C.4 – Monitoring and Evaluation

E-mail: [email protected]

European Commission B-1049 Brussels

mailto:[email protected]

-

EUROPEAN COMMISSION

Directorate-General for Agriculture and Rural Development 2018 EN

Evaluation of the CAP

measures applicable to the wine sector

Case study report: France – Languedoc-Roussilon

-

LEGAL NOTICE

The information and views set out in this report are those of the author(s) and do not necessarily reflect the official opinion of the Commission. The Commission does not guarantee the accuracy of the data included in this study. Neither the Commission nor any person acting on the Commission’s behalf may be held responsible for the use which may be made of the information contained therein.

More information on the European Union is available on the Internet (http://www.europa.eu).

Luxembourg: Publications Office of the European Union, 2019

Catalogue number: KF-04-18-986-EN-N ISBN: 978-92-79-97415-1 doi: 10.2762/609285

© European Union, 2018 Reproduction is authorised provided the source is acknowledged.

Images © Agrosynergie, 2018

Europe Direct is a service to help you find answers

to your questions about the European Union.

Freephone number (*):

00 800 6 7 8 9 10 11

(*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you).

http://europa.eu.int/citizensrights/signpost/about/index_en.htm#note1#note1

-

EEIG AGROSYNERGIE is formed by the following companies:

ORÉADE-BRÈCHE Sarl & COGEA S.r.l. 64 Chemin del prat Via Po 102

31320, Auzeville FRANCE 00198 Roma ITALIE

Tel. : + 33 5 61 73 62 62 Tel. : + 39 6 853 73 518

Fax : + 33 5 61 73 62 90 Fax : + 39 6 855 78 65

Email: [email protected] Email: [email protected]

Represented by: Represented by:

Thierry CLEMENT Francesca ANTILICI

This case study was carried out by the following Oréade-Brèche experts: Alice Devot,

Laurence Menet, Juliette Augier, Pierre Milliard, Juliane Papuchon, Alexandre Lyse and

Benjamin Berizzi

-

AGROSYNERGIE – Case study report: France – Languedoc-Roussillon

Evaluation of the impact of the CAP measures applicable to the wine sector i

Table of contents

1. DESCRIPTION OF THE WINE SECTOR IN LANGUEDOC ROUSSILLON ................................................................ 1

1.1 BACKGROUND INFORMATION ......................................................................................................... 1

1.2 STRUCTURE OF THE SECTOR ............................................................................................................ 3

1.3 STATISTICS AT CASE STUDY LEVEL ..................................................................................................... 4

2. THEME 1: NATIONAL SUPPORT PROGRAMMES ............................................................................................. 7

2.2 EFFECTS ON THE NSP AT THE LEVEL OF GROWERS ............................................................................... 10

2.3 EFFECTS OF THE NSP AT THE LEVEL OF PRODUCERS AND PRODUCTS ........................................................ 17

2.4 EFFECTS OF THE PROMOTION MEASURE ........................................................................................... 26

2.5 EFFECTS OF THE INFORMATION MEASURE ......................................................................................... 32

2.6 EFFICIENCY OF THE MANAGEMENT OF THE NSP ................................................................................. 34

2.7 COHERENCE OF THE NSP ............................................................................................................. 40

2.8 RELEVANCE OF THE NSP ............................................................................................................. 45

2.9 EU ADDED VALUE AND SUBSIDIARITY .............................................................................................. 49

3. THEME 2: SCHEME OF AUTHORISATIONS OF VINE PLANTINGS .................................................................... 51

3.1 SYNTHESIS OF THE INTERVIEWS ..................................................................................................... 51

3.2 CONCLUSION OF THE EXPERTS ....................................................................................................... 51

4. THEME 3: WINE PRODUCTS DEFINITION, RESTRICTIONS ON OENOLOGICAL PRACTICES AND AUTHORISED WINE GRAPE VARIETIES ......................................................................................................... 53

4.1 DETAILED DESCRIPTION OF THE IMPLEMENTATION AT MEMBER STATE AND REGIONAL LEVEL ......................... 53

4.2 COMPETITIVENESS DISTORTIONS DUE TO SPECIFIC RULES ON OENOLOGICAL PRACTICES ................................. 54

4.3 SYNTHESIS OF THE INTERVIEWS ..................................................................................................... 55

4.4 COMMENTS AND CONCLUSIONS OF THE EXPERT ................................................................................. 59

5. THEME 4: EU RULES ON LABELLING AND PRESENTATION ............................................................................ 60

5.1 DESCRIPTION OF THE LABELLING RULES APPLIED AT MEMBER STATE AND LOCAL LEVEL ................................. 60

5.2 EXISTING NATIONAL DATA ON NON-COMPLIANCE WITH LABELLING RULES ................................................. 61

5.3 SYNTHESIS OF THE INTERVIEWS ..................................................................................................... 62

6. THEME 5: CERTIFICATION PROCEDURES, MONITORING AND CHECKS ......................................................... 66

6.1 DESCRIPTION OF THE LOCAL IMPLEMENTATION OF THE RULES ................................................................ 66

6.2 EXISTING NATIONAL DATA ON NON-COMPLIANCE AND WORKLOAD ......................................................... 70

6.3 SYNTHESIS OF THE INTERVIEWS ..................................................................................................... 70

7. LIST OF THE LITERATURE AND INTERVIEWS ................................................................................................. 73

ANNEX 1 – DESCRIPTION OF THE NSP MEASURES .................................................................................................. 75

-

AGROSYNERGIE – Case study report: France – Languedoc-Roussillon

Evaluation of the impact of the CAP measures applicable to the wine sector ii

List of tables

Table 1: Market shares of wine produced in Languedoc-Roussillon (2016) ................................................................. 4 Table 2: Area in vineyard and production in FRANCE ................................................................................................... 4 Table 3: Area in vineyard and production in LANGUEDOC ROUSSILLON ...................................................................... 4 Table 4: Number of wine growers in Languedoc-Roussillon ......................................................................................... 4 Table 5: Area by variety (ha) in Languedoc-Roussillon ................................................................................................. 5 Table 6: Planting rights.................................................................................................................................................. 5 Table 7: Budget allocation per measure on the first three years of the 2014-2018 NSP ............................................. 7 Table 8: Implementation choices on the promotion measure ..................................................................................... 7 Table 9: Implementation choices on the restructuring and conversion measure ........................................................ 8 Table 10: Implementation choices on the investment measure .................................................................................. 9 Table 11: Wine product covered by the legislation .................................................................................................... 10 Table 12: Implementation choices on the “by product distillation” measure ............................................................ 10 Table 13: Amount of aid granted per action in France ............................................................................................... 11 Table 14: List of varieties eligible under the individual restructuring measure .......................................................... 11 Table 15: List of varieties eligible under the collective restructuring plan established in Languedoc-Roussillon .................................................................................................................................................................... 11 Table 16: Volume of wine exported by type of wine products in 2017 ...................................................................... 27 Table 17: Value of wine exported by type of wine products in 2017 ......................................................................... 27 Table 18: Rate of achievement of the foreseen expenditures per measures ............................................................. 34 Table 19: Quantified objectives set in the draft NSP and monitoring in the implementation report 2016 ............... 34 Table 20: Main criteria/procedure(s) ensuring the relevance of the selected applications ....................................... 35 Table 21: SWOT analysis of the wine sector in France................................................................................................ 45 Table 22: SWOT analysis of the LR wine sector .......................................................................................................... 46 Table 23: List of quotas reached for specific Languedoc Roussillon PDO/PGI areas .................................................. 48 Table 24: Change in production costs of competing wines between 2008 and 2015 ................................................ 55 Table 26: National DGCCRF monitoring and checks on wine sector in 2017 .............................................................. 62 Table 25: Types of controls performed by public authorities ..................................................................................... 68 Table 26: National DGCCRF monitoring and checks on wine sector in 2017 .............................................................. 70 Table 27 : National specific investigation on Spanish wine imported in France, in 2016 and 2017 ........................... 70 Table 30: Description of the measures eligible under the National Support Programmes ........................................ 75

List of figures

Figure 1: PDO of the Languedoc and location ............................................................................................................... 2 Figure 2: PGI of the Languedoc and location ................................................................................................................ 2 Figure 3: Evolution of the volume of PDO/PGI wine and overall production in Occitanie ........................................... 3 Figure 4: Restructured vineyard over the total vineyard area (1977-2017) ............................................................... 12 Figure 5: Type of operations carried out under the collective plans for the two campaigns 2013-2015 in France.......................................................................................................................................................................... 13 Figure 6: Exports of non PDO/PGI wines ..................................................................................................................... 24 Figure 7: Distribution of the support granted for the different types of promotional operations by destination country ..................................................................................................................................................... 29 Figure 8: Example of visual edited by the CIVL under its “Happy Languedoc” campaign ........................................... 33 Figure 9: Amount of support granted under the restructuring measure.................................................................... 39

-

AGROSYNERGIE – Case study report: France – Languedoc-Roussillon

Evaluation of the impact of the CAP measures applicable to the wine sector iii

Glossary

CAP Common Agricultural Policy

COMTRADE United Nations International Trade Statistics Database

CMEF Common Monitoring and Evaluation Framework

CMO Common Market Organisation

CN Combined Nomenclature

CTR Criterion

EAGF European Agricultural Guarantee Fund

EAFRD European Agricultural Fund for Rural Development

EAV European Union added value

EC European Commission

EEA European Environment Agency

EEC European Economic Community

EEIG European economic interest group

EQ Evaluation question

EU European Union

EUROSTAT Statistical Office of the European Commission

FADN Farm Accountancy Data Network

FAO Food and Agriculture Organization of the United Nations

FNVA Farm net value added

GATT General Agreement on Tariffs and Trade

MIO Million €

MS Member State

NGO Non-Governmental Organization

NSP National Support Programmes

OIV International Organisation of Vine and Wine

PDO/PGI Protected Designations of Origin (PDO) and Protected Geographical Indications (PGI)

PO Producer Organisation

PPS Purchasing Power Standard

RD Rural Development

RDP Rural Development Program

RDR Rural Development Regulation

SDG Sustainable Development Goals

SME Small and Medium Enterprises

SO Standard Output

SPS Single Payment Scheme

SSG Special Agriculture Safeguard

SWOT Strengths, Weaknesses, Opportunities, Threats

TEU Treaty on the European Union

TFEU Treaty on the Functioning of the European Union

UAA Utilised Agricultural Area

USA United States of America

USDA United States Department of Agriculture

VAT Value Added Taxes

WTO World Trade Organisation

http://www.oiv.int/

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 1

1. DESCRIPTION OF THE WINE SECTOR IN LANGUEDOC ROUSSILLON

1.1 Background information

1.1.1 French wine sector

The French wine sector is very heterogeneous. The numerous stakeholders face different issues given their size, the level of integration of the wine making-process, the region, the type of wine produced. Therefore, the sector is fragmented. There are 21 regional interbranch organisations that represent the different wine-producing regions and are in charge of managing the specifications for the production of PDO/PGI wines from their regions.

In France, wine with PDO/PGI represents 95% of the wine production. The national interbranch organisation ANIVIN represents the producers of wine without PDO/PGI.

The administrations involved in the sector are:

INAO (National institute for Geographical Indications): it manages the policy of the Ministry as Agriculture as regards quality. It is characterised by its governance composed of both public authorities and professionals. Its missions are to monitor, control, and inform on the PDO/PGI delivrance, to delineate the production area, to promote international cooperation. The regional delegations (National Institute of Origin and Quality) works with ODG (Defence and Management Organisations) in charge of the management, monitoring, control and promotion of the local PGOs/PGIs.

FranceAgriMer: this organisation is in charge of the management of specific agricultural sectors including wine, fruits and fishing. It is governed by a council of representatives of the producers. FranceAgriMer is in charge, by a delegation of the French Ministry of Agriculture, of the design, administration and payment of the NSP as well as of the management of authorisations of plantings (including the granting of authorisation of new planting). FranceAgriMer also has regional delegations, in charge in particular of the management of the investments measure at local level, as well as of the information of local applicants

DGCCRF and DIRECCTE: those services of the ministry of economy (at national and regional level respectively) are in charge of the labelling conformity verification to ensure a clear and sufficient information to the consumers. It has for mission the litigation management regarding non-complying products as well on the domestic market as the foreign one. The “wine and spirits Brigade” serves that purposes and gives to this actor executive power and allow it to seize the judicial authorities to intervene.

The different types of stakeholders of the wine supply chain are also represented under different organisations (the winegrowers, the wine-producers and the brokers).

In France, the half of the wine production is made by cooperative.

The wholesalers market 60% of the production.

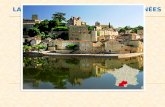

1.1.2 Languedoc-Roussillon

The Languedoc-Roussillon region is located in wine-growing zone C II according to the Appendix I of Regulation (EU) No 1308/2013.

In 2016, Languedoc-Roussillon is the first wine region in terms of area (223 700 ha). It represents 33% of the national production.

1

The agriculture in Languedoc-Roussillon is very specific. By comparison to the national average, the distribution of the Utilised Agricultural Area shows the following attributes

2:

Permanent crops are 700% higher than the national average ;

Grasslands and fallows are 50 % higher than the national average ;

Other types of crops are far below the national average.

In 2015, the share of vineyard represents 26% of the Utilised Agricultural Area3 in the region (233 069 ha over

the 882 995 ha of UAA). National average is 4% in 2013.4

1 Les chiffres de la filière viti-vinicole 2006/2016, Données et bilans, Données et bilans de FranceAgriMer, Octobre 2017

2 http://www.stats.environnement.developpement-durable.gouv.fr/portraits/NN_Agriculture_REG91.pdf

3 http://agreste.agriculture.gouv.fr/IMG/pdf/R9115C02.pdf

http://www.stats.environnement.developpement-durable.gouv.fr/portraits/NN_Agriculture_REG91.pdfhttp://agreste.agriculture.gouv.fr/IMG/pdf/R9115C02.pdf

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 2

1.1.2.1 List of the regional PDO/PGI

The following maps represent the different PDO/PGI of the Languedoc.

Figure 1: PDO of the Languedoc and location

Figure 2: PGI of the Languedoc and location

4 Nombre d’exploitations, superficie agricole utilisée, volume de travail en UTA et production brute standard en France

métropolitaine en 2013, Agreste

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 3

The production of PGI wine is superior to the production of PDO wine in Languedoc Roussillon. Wine without PDO/PGI is not significant. Another specificity of this region is the fact that wine growers produce both PDO and PGI on the same holding.

Figure 3: Evolution of the volume of PDO/PGI wine and overall production in Occitanie5

Languedoc-Roussillon offers a multitude of conditions and grapes benefiting from favorable weather conditions. An important restructuring over the last 30 years has fostered a development of Mediterranean grape varieties such as Grenache, Mourvèdre or Syrah. The vineyard consists of the following grape varieties

6:

Red grapes (77% of the vineyard) : Syrah (21%), Grenache (20%), Carignan (15%), Merlot (15%), Cabernet Sauvignon (9%), Cinsaut (6%), Mourvedre (3%), Marselan (2%).

White grapes : Chardonnay (28%), Sauvignon (15%), Muscat à petits grains (10%), Grenache (8%), Viognier (8%), Muscat d’Alexandrie (5%), Vermentino (3%), Macabeu (3%), Piquepoul (3%), Colombard (3%)

The diversity of terroirs and varieties that can be found in Languedoc is also found for the geographical denominations. This part of France thus counts twelve different protected designation of origin knowing that their number varies quickly with the creation of new PDO as well as the modification of others. Among these PDO, those that stand out most structurally and economically are:

PDO Languedoc, formerly Coteaux du Languedoc (PDO since 1985), that includes different denominations.

PDO Corbières (designation since 1985) which is the first in the region in terms of volume in 2015 and surfaces with nearly 132 khl produced (5% of the production of Languedoc PDO).

Faugères PDO is the most valued with a price of € 526.4 / hl in 2015.

However, as shown in Figure 3: Evolution of the volume of PDO/PGI wine and overall production in Occitanie, the volume of wine under PGI is more important, notably because of the large volume engaged under the Pays d’Oc protected geographical designation. Pays d’Oc is the 1

st French PGI exported and the 1

st French PGO sold

in France. Its vineyard extends on 120 000 hectares and involves 20 000 winegrowers, that make wine either on their holdings or sell their grapes to cooperatives. PGI wines from Pays d’Oc are mainly varietal wines, made from 58 different varieties

7.

5 Occitanie is the new administrative region composed of Midi-Pyrenees and Languedoc-Roussillon. Source :

http://www.occitanie.chambre-agriculture.fr/fileadmin/user_upload/National/FAL_commun/publications/Occitanie/agriscopie2016_viticulturep19.pdf 6 DGDDI extraction CVI 02/2017

7 Extracted the 23/08/18 from https://www.paysdoc-wines.com

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 4

1.2 Structure of the sector

Languedoc Roussillon is the first wine region in France with 19 752 exploitations and 192 286 ha (27% of the total vineyard) in 2010

8, of which 20 000 ha are irrigated.

9

Table 1: Market shares of wine produced in Languedoc-Roussillon (2016)

2012 2013 2014 2015

PDO Volume 9.9% 9.7% 10.9% 10.9%

Value 4.2% 4.3% 5.2% 5.3%

PGI Volume 73% 73% 77% 75%

Value 73% 72% 76% 74%

Source : Customs data

1.3 Statistics at Case study level

Area in vineyard and volume produced

In Languedoc-Roussillon, the overall area in vineyard represents 223 651 ha in 2016, of which 63% is dedicated to the PGI (141 754 ha) and 32% to the PDO wine production (70 671 ha). The PGI areas have been increasing between 2012 and 2016, to the detriment of areas without PDO/PGI.

The volume produced is stable over the 2012-2016 period. Only the volume under PGI varied from one year to another, between 8.6 and 9.4 million hL.

Table 2: Area in vineyard and production in FRANCE

2012 2013 2014 2015 2016

Total

Vineyard area (ha) 754 853 755 249 752 199 747 507 754 473

Production (000 hl) 34 300 33 829 37 351 37 429 36 752

PDO

Vineyard area (ha) 447 744 447 162 444 111 441 200 446 588

Production (000 hl) 19 754 18 764 22 012 21 453 21 264

PGI

Vineyard area (ha) 191 626 192 470 193 284 195 280 196 749

Production (000 hl) 12 077 12 589 12 730 13 212 12 818

Wine without PDO/PGI

Vineyard area (ha) 40 488 40 491 39 455 35 631 35 433

Production (000 hl) 2 469 2 476 2 447 2 573 2 474

*For production: since April 2016, wine industries are taken into account in addition to harvesting wineries.

Sources: French customs (DGDDI)

Table 3: Area in vineyard and production in LANGUEDOC ROUSSILLON

2012 2013 2014 2015 2016

Total

Vineyard area (ha) 221 779 223 049 222 264 223 978 223 651

Production ( 000 hl) 12 056 13 305 12 443 13 339 12 105

PDO

Vineyard area (ha) 70 565 70 143 69 348 69 775 70 671

Production ( 000 hl) 2 555 2 545 2 706 2 763 2 577

PGI

Vineyard area (ha) 137 066 135 581 137 665 140 764 141 754

Production (000 hl) 8 617 9 303 8 660 9 417 8 735

Wine without PDO/PGI

Vineyard area (ha) 14 159 17 325 15 252 13 440 11 226

Production ( 000 hl) 883 1 456 1 077 1 159 794

*For production: since April 2016, wine industries are taken into account in addition to harvesting wineries.

Sources: French customs (DGDDI)

Number of grower and producers

8 FranceAgriMer, SSP_RA_2010

9 http://draaf.occitanie.agriculture.gouv.fr/L-irrigation-contribue-a-18-de-la,2575

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 5

In Languedoc-Roussillon, the number of growers has registered fluctuations from one year to another according to the Eurostat data. It was 18 190 in 2010 (of which 13 621 growing wine under PGI), reached a peak in 2015 with 20 304 and then decrease to 16 630 in 2016.

Table 4: Number of wine growers in Languedoc-Roussillon

2010 2013 2014 2015 2016

Total 18190 16440 n.a 20304 16630

Of which PDO 7129 n.a n.a 11847 n.a

Of which PGI 13621 n.a n.a 18629 n.a

Sources: Eurostat

Area by variety

The area per variety is available since 2014. In Languedoc-Roussillon, the four main varieties grown are red grapes: Syrah, Grenache, Carignan and Merlot. It is interesting to notice that almost all varieties have registered a decrease in area in 2015 that was fully recovered in 2016. In most of the cases, the area in 2016 was even higher than it was in 2014. Syrah, Grenache, Merlot, Cinsault and Marselan registered an increase in area between 2014 and 2016.

White grapes are cultivated to a smaller extent. International varieties such as Chardonnay and Sauvignon are those with the largest areas. They have registered an increase in areas, notably the Chardonnay. Other white grapes in expansion are Vermentino and Colombard, although cultivated on very limited areas.

Table 5: Area by variety (ha) in Languedoc-Roussillon

2012 2013 2014 2015 2016

Syrah N n.a n.a 40105 38892 41471 +

Grenache N n.a n.a 38360 36824 40539 ++

Carignan N n.a n.a 29947 24988 29997 /

Merlot N n.a n.a 28183 27691 29712 +

Cabernet Sauvignon N n.a n.a 16474 15771 16866 /

Cinsault N n.a n.a 10263 9785 11957 +

Mourvedre N n.a n.a 5135 4990 5295 /

Marselan N n.a n.a 3226 3592 4466 +

Chardonnay B n.a n.a 14405 14733 16683 ++

Sauvignon B n.a n.a 8483 8490 9080 +

Muscat a petits grains B n.a n.a 5764 5551 5993 /

Grenache B n.a n.a 4102 3934 4654 +

Viognier B n.a n.a 4123 4241 4530 +

Muscat d’Alexandrie B n.a n.a 2599 2510 2692 +

Vermentino B n.a n.a 1647 1742 2012 ++

Macabeu B n.a n.a 1974 1696 1991 /

Piquepoul B n.a n.a 1623 1649 1774 +

Colombard B n.a n.a 1257 1329 1609 ++

Sources: DGDDI & Eurostat

Authorisations of new plantings

In Languedoc-Roussillon, the demands for authorisations of new plantings did not reach the limitation set at regional level. The winegrowers are not looking for additional areas. They are rather focusing on how to restructure their vineyard to adapt their production to the market demand.

Table 6: Planting rights

Number of

beneficiaries Area in 2017

Area converted to authorisation of new planting

PDO 101 95 983

PGI 234 382 1639

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 6

Number of

beneficiaries Area in 2017

Area converted to authorisation of new planting

Wine without GI 12 11 36

Sources: DG Agri, based on data from FranceAgriMer

Industry structure in Languedoc-Roussillon10

The wine production in Languedoc-Roussillon has been historically made by large cooperatives that provided the market with significant volume of wine. However, the decrease of the consumption and the increasing demand for quality wine have led the sector to restructure. Consequently, the volume produced dropped, from 30 Mhl in the 70’s to 10 Mhl today. At the same time, the sector became more concentrate: producing facilities gathered and their number decreased.

Currently, despite the trend of producers investing in wine-making units to produce their own wine on their holding, two types of cooperatives remain in Languedoc-Roussillon:

- Large structures focusing on the volume produced, to provide significant customers in France and abroad.

- Smaller structures with higher flexibility and capacity to innovate, able to produce wine with different features and to offer specific products adapted to the various market segments.

10

Information collected from the interview with the representative of a significant PGI of the region.

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 7

2. THEME 1: NATIONAL SUPPORT PROGRAMMES

2.1.1 Financial allocation

On the 20014-2018 programming period, France has implemented 6 measures: Information, Promotion, Restructuration, Investment, By-product distillation.

Table 7: Budget allocation per measure on the first three years of the 2014-2018 NSP

Measure 2013-2014 2014-2015 2015-2016

Restructuring and conversion of vineyards (Art. 46) 102 100.6 106.9

Promotion (Art. 45) 45.3 45 41.4

Investment (Art. 50) 106.3 102.5 103.3

Information (Art. 72) - - 0.7

By product distillation (Art. 52) 29.1 34.3 33.2

Source : FranceAgriMer

2.1.2 Promotion on third countries measure

This measure is a part of the aid program. The general objectives pursued: improve competitiveness of French wines, and quality and notoriety image development. To achieve this goal, specific objectives aim to consolidate and improve French wines, Protected Designation of Origin, Protected Geographical Indication or the non PDO/PGI wines with variety mention, in the third countries and to allow French beneficiaries - company or interbranch - to improve their knowledge of the third countries market.

To this purpose, operational objectives are targeted on the development of public relation events and media relations, promotion, advertising, international exhibition and trade fairs participation realised by French beneficiaries at international level, besides European Union as well as economical information, techniques and marketing acquisition on export market and evaluation of the action of promotion and information.

It is a question to intervening on a sufficient number of third countries disposing of export opportunities and to consolidate or increase wine exportation toward those countries.

Table 8: Implementation choices on the promotion measure

Type of aid and rate of support

Expenditures of less than € 100 are not eligible, except for expenses related to travel expenses, personnel costs and valuated samples. And the total amount of the estimated expenses composing the assisted operation must be greater than € 10,000 excluding tax.

European participation does not exceed 50% of the amount of eligible expenditure. The rate can be adjusted downwards according to the envelope of the call for projects and priority criteria.

Beneficiaries

- Private companies mainly operating in the wine sector, - professional organisations, - wine producer’s organisations, wine producer’s organisation associations, - temporary or permanent wine producer’s associations or interbranch organisation of the wine

sector.

Eligibility and selection criteria

- the operations and their constituent actions are clearly defined: they describe the promotional activities, the mention of the products concerned by the action including the estimated amount of the corresponding costs

- the assurance that the proposed cost of the action is not higher than the normal price of the market;

- the assurance that beneficiaries have sufficient technical capacity to cope with the specific constraints of trade with third countries, as well as the resources needed to ensure that action is implemented in the most effective way possible;

- the beneficiaries demonstrate that the availability of products, in both quality and quantity, will be sufficient to meet long-term market demand after the end of the promotion;

- the consistency of the proposed strategies with the objectives set and the foreseeable impact on the growth of the demand for the products concerned.

Public law bodies are not eligible for the present measure. To be eligible, an operation must present all the information necessary to evaluate its eligibility. Failure to meet one of the five eligibility criteria leads to rejection of the transaction.

Implementation period Transactions are carried out between January 1st and December 31st of the year following that of the aid application. Each operation covers a period of one year. Aid for an operation can be extended once for a maximum of two years or twice for a maximum of one year for each extension.

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 8

Information regarding the management of the measure

Priority criteria Respective weighting

Recipients unaided in the past 2

Beneficiaries helped in the past and proposing a new country 2

Beneficiaries assisted in the past proposing the continuation of their operation for the same country

1

At the end of the closing of the call for projects, FranceAgriMer examines all the aid applications against the eligibility criteria. At the time of this instruction, FranceAgriMer carries out a rating of the operations with regard to the priority criteria to establish a classification of the requests for aid.

2.1.3 Restructuring and conversion measure

The general objective pursued in the scope of this measure is to improve competitiveness of French wine producers. To achieve this goal, specific objectives aimed to facilitate tool production adaption to the market expectations and to competition conditions, in particular at international level. The measure must enable the structure, grape varieties planting, or the driving mode to change, with a declension of the measure for each vineyard area.

For this purpose, the operational objectives are declined as:

Vineyard adaptation to specifications - in particular with Geographical Indication – implementation of product quality improvement or as an answer to sellers.

Vineyard replanting enabling to supply wines matching the market demand identified by producers. Wine competitive factors improvement, in particular cost production reduction and adaptation to

climate change effects.

To achieve those goals are particularly encourage:

Vineyard collective restructuration, since it spurs the sector to continue its organisation efforts on the collective strategies definition. It is realised by wine growers around a collective structure proposing a collective plan orientation for a vineyard area. Each plan develops a strategy and is subject to validation at the given vineyard area level. The collective restructuration plan is pluriannual and compels the wine grower to commit in terms of surface to restructure on a duration of three campaigns (with an estimated distribution by year)

Vineyard restructuration by young wine growers installing or applicant of less than 40 years old who previously benefited of the support to installation support to ensure the continuation of those holdings.

Table 9: Implementation choices on the restructuring and conversion measure

Type of aid and rate of support

The total amount of aid may not exceed 50% of the actual costs of the restructuring and 100% of the lost revenue. The amount of the aid for the costs involved in the restructuring is calculated on the basis of a standard scale of unit costs established following a study carried out by an independent body of FranceAgriMer.

Beneficiaries The wine growers as natural or legal person enrolled to the computerized vineyard register.

Eligibility and selection criteria

- the detailed description of the proposed actions;

- the proposed deadlines for the implementation of the actions: except in case of force majeure, the actions must be carried out during the wine year1 N-1 / N or during the wine-growing year N / N + 1 for grubbing-up whose prior application was filed in the N-1 / N campaign;

- the areas concerned for each operation.

Implementation period The operations are carried out during the viticultural campaign of the aid request. Each operation covers a period of one year (call for projects in autumn and realization in the following spring).

Information regarding the management of the measure

No priority criterion within the meaning of the Delegated Regulation is retained.

The request for restructuring aid is submitted by teleprocedure to the FranceAgriMer training services by the beneficiary at the end of the N-1 year.

Whatever the chosen restructuring modality (collective or individual), the application submitted for the restructuring assistance campaign N-1 / N must contain the information necessary to instruct:

- the eligibility of the beneficiary;

- eligibility criteria;

- the eligibility of the costs presented.

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 9

2.1.4 Investment measure

The objective of this measure is to enable the wine sector companies face competition on the global markets through tool production optimisation and elaboration conditions and wines market entry, and supply adaptation to match market demand.

Besides priority is given to operations:

Carried out in favour of environment Enhancing new vine growers’ installation Presenting a specific economic impact on the sector Participating to the restructuring of the sector.

Table 10: Implementation choices on the investment measure

Type of aid and rate of support

The aid is granted in the form of a grant. In the general case, the aid rate is 30% maximum of the eligible expenditure (15% for intermediate companies and 7.5% for large companies).

Beneficiaries

- wine-growing enterprises regardless of their legal form (individual or company) producing or marketing the products referred to in Annex VII, Part II of Council Regulation (EU) No 1308/2013, (cf. Table 11 below)

- wine producer organizations,

- associations producers or interbranch organizations, carrying out a production, processing, packaging or marketing operation in the wine sector.

Eligibility and selection criteria

- the operations and actions constituting them are clearly defined; they describe the investment actions, including the estimated amount of the corresponding costs;

- the request ensures that the costs of the proposed action do not exceed the normal market price;

- the application ensures that the beneficiaries have access to sufficient technical and financial resources to ensure that the operation is implemented effectively and that the company which has submitted an aid application is not in difficulty within the meaning of the third subparagraph of Article 50 (2) of Regulation (EU) No 1308/2013;

- the application makes it possible to analyze the consistency of the proposed strategies with the objectives set and the foreseeable impact in terms of improving the overall performance of the processing and marketing facilities, their adaptation to market demands, and increasing their competitiveness.

The transaction must present all the information required to assess eligibility. Failure to meet one of the four eligibility criteria leads to rejection of the transaction.

Implementation period The measure operates by periods of opening calls for projects, with an allocated budget, within the framework of a mandatory teleprocedure.

Information regarding the management of the measure

To guarantee the reasonable costs of expenses reimbursed on the basis of supporting documents, the eligible expenses are subject to a ceiling, a comparison on the basis of a reference grid, or the submission of several quotes.

When the beneficiary has carried out one of the following operations in the 12 months preceding the submission of the aid application, he obtains a point of priority.

Transactions are rated on 20 points according to priority criteria mentioned above.

They are then ranked according to the total score obtained and are selected in descending order of note until the allocated envelope is exhausted.

Priority criteria Weighting on 20

Investments that can have positive effects in terms of energy savings, overall energy efficiency and environmentally sustainable processes.

12

New installed 3

Material with specific economic impact for the sector 4

Collective operation, restructuring of the company, creation of a union or operation with a village exit

1

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 10

Table 11: Wine product covered by the legislation

Source: REGULATION (EC) No 1234/2007

2.1.5 By product distillation

The general objective of the support for the distillation of by-products of winemaking is to preserve the quality of the wines by avoiding the overpressure of the grapes and to limit the environmental pressure which would result from the spreading of by-products. Ultimately, the success of the measure is based on the maintenance of distillation tools near the winemaking centers. The measure therefore has the operational objective of preserving the distilleries network by offsetting the costs borne by the distillers for carrying out this service of general interest.

Table 12: Implementation choices on the “by product distillation” measure

Type of aid and rate of support

The aid consists of two components: an amount to offset the costs of by-product collection and an amount to offset the costs of processing the by-products. When the by-products are delivered by the producer, the amount intended for collection is returned to the producer; The maximum authorised rate of aid is paid to the distiller as:

- Collection and transformation of pomaces: 1.1 €/%vol/hl

- Collection and transformation of lees: 1.1 €/% vol/hl

Beneficiaries

- Distillers processing the by-products of vinification delivered for distillation into crude alcohol with an alcoholic strength of not less than 92% vol and which may be used exclusively for industrial or energy purposes.

- Distillers who wish to benefit from this aid must be certified by FranceAgriMer before any distillation operation.

Eligibility and selection criteria

Aid applications are eligible when they meet the following objectives:

- the aid is paid for alcohol derived from the distillation of wine-by-products and having an alcoholic strength of not less than 92% vol;

- the products of distillation are used exclusively for industrial or energy purposes.

Implementation period

Information regarding the management of the measure

For operations of up to 5 million euros in aid and benefiting from an advance, the beneficiary must send to FranceAgriMer by 15 November of the year in which an advance has been paid, a summary statement of the invoices paid on 15 October of the year in question, in accordance with the model of the payment request (template available on the FranceAgriMer website) and signed by the beneficiary.

2.2 Effects on the NSP at the level of growers

2.2.1 Information on the implementation of the restructuring and conversion

measure

The following table shows the detailed implementation data at national level.

Table 13: Amount of aid granted per action in France

Action Individual restructuration Individual restructuration

for young growers (YG)

Collective restructuration

collective (collective plan) included YG

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 11

Action Individual restructuration Individual restructuration

for young growers (YG)

Collective restructuration

collective (collective plan) included YG

Plantation 4 800 4 800 4 800

Grubbing up 300 300 300

Trellising 1 900 1 900 1 900

Irrigation device Installation

800 800 800

Compensation for loss of earnings 1 000 2 000 4 500

Maximum total amount

(in euros/ha) 8 800 9 800 12 300

Source: FranceAgriMer, 2018

However, it is important to precise that the list of grape varieties eligible for support differ from a wine basin to another. Moreover, the list also varies if the beneficiary applies under a collective plan or individually.

The following list describes the grape varieties that can be planted and are eligible under the individual restructuring measure at regional level.

Table 14: List of varieties eligible under the individual restructuring measure

White grape varieties Grey grape

varieties Rosé grape

varieties Red Grape varieties

Altesse; Alvarinho; Aranel; Arriloba; Arvine; Bourboulenc ; Carignan Blanc ; Chardonnay ; Chasan ; Chenin ; Clairette ; Clarin ; Colombard ; Grenache Blanc ; Gros manseng ; Liliorila ; Bacabeu ; Marsanne ; Mauzac ; Muscat à petits grains ; muscat d’Alexandrie ; Muscat ottonel ; parrellada ; perdea ; Petit manseng ; pinot blanc ; piquepoul blanc ; riesling ; Rivairenc blanc ; Roussanne ; sauvignon ; Semillon ; sylvaner ; terret blanc ; tourbat ; ugni blanc ; Verdelho ; vermentino ; viognier

Grenache Gris Pinot gris Sauvignon Gris, Rivairenc gris, Terret gris

Gewurztraminer, Mauzac rose, muscat à petit grains

Alicante henri bouschet ; Arinarnoa ; Aubun ; Barbera ; Brun argenté ; Carbernet franc ; Carbernet-sauvignon ; Cabestrel; Calabrese; Caladoc; Carignan; Carmenère; Castets ; Chenanson ; Cinsault ; Cot ; Counoise ; Couston ; Dolcetto ; Egiodola ; Ekigaina; Fer; Ferradou ; Gamaret ; Gamay de bouze ; Gamay de chaudenay; gamay; Ganson ; Gramon ; Grenache ; Jurançon Noir ; Kadarka ; Lledoner pelut ; Marselan ; Mavrud ; Merlot ; Mondeuse ; Monerac ; Morrastel ; Mourvèdre ; Muscat de Hambourg ; Négrette ; Nielluccio ; Petit Verdot ; Pinot Noir ; Pinotage ; Piquepoul Noir ; Plant de Brunel ; Portan; Primitivo ; Rivairenc ; Saperavi ; Segalin ; Semebat ; Syrah ; Tannat ; Tempranillo ; Terret noir ; Trousseau

Source : INTV-GPASV-2017-2811

The following list refers to the grape varieties eligible under the collective restructuring plan established in Languedoc-Roussillon.

Table 15: List of varieties eligible under the collective restructuring plan established in Languedoc-Roussillon

White grape varieties Red grape varieties

Chardonnay Grenache Blanc Marsanne Muscat à petit grains Roussanne Sauvignon Blanc Vermentino Viognier

Cabernet Franc Cabernet Sauvignon Cinsault Cot Grenache Gris Grenache Noir Marselan Merlot Mourvèdre Niellucio Pinot Noir Syrah

Source : INTV-GPASV-2015-5712

11

Décision relative aux modalités d’octroi de l’aide à la restructuration et à la reconversion du vignoble pour la campagne 2016-2017 en application du programme d'aide national de l’OCM vitivinicole 2014-2018

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 12

In Languedoc-Roussillon, an important share of the vineyard has undergone a restructuring. The figure hereunder shows that, when the overall vineyard surface were decreasing, the restructuring share was progressively increasing. In 2017, 212 000 ha had been restructured, over 233 000 ha of vineyard, i.e. 90% of the vineyard.

Figure 4: Restructured vineyard over the total vineyard area (1977-2017)

Source: FranceAgriMer Montpellier

2.2.2 Information from the literature

The implementation report 2016 presents a lot of information on the implementation of the restructuring and conversion measure. Specific information was collected through a survey to all the beneficiaries of the 2013-14 and 2014-15 campaigns. The information collected covers in particular:

- The type of operation supported

- The main objectives pursued by beneficiaries in mobilizing the support

- Repartition by region

- The repartition of the support by type of operation in the PDO area and outside of this area: in the PDO area, a change of density and tillage are the mains supported actions, followed by conversion. Out of those area, conversion is the most frequent type of operation supported, followed change of density. Besides irrigation is most often implemented in those area.

In France, during the first two campaigns of the national aid program, the plantations under the collective plans represent an accumulated area of 18 414 hectares (nearly 70% of the areas assisted under the restructuring measure). 9 624 hectares were restructured as part of collective operations during the 2013/2014 campaign and 8 790 hectares during the 2014/2015 campaign. During both campaigns, the collective restructuring actions are distributed as shown in the figure below. For each campaign, the restructuring operations with an objective of improving the management techniques in the vineyard represent 57 to 58 % of the total areas engaged under the restructuring measure. Then, varietal reconversion to adapt the vineyard to the market demand represents 35 to 36 % of these areas.

12

Décision relative aux agréments du plan collectif de restructuration du vignoble du bassin viticole Languedoc-Roussillon et de son porteur de projet et aux critères d’éligibilité et de priorité pour ce plan déposé en application du programme d’aide national de l’OCM vitivinicole 2014-2018 pour les campagnes 2015-2016 à 2017-2018.

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 13

Figure 5: Type of operations carried out under the collective plans for the two campaigns 2013-2015 in France

Source: Implementation report of the French National Support Programme, 2016

2.2.3 Synthesis of the interviews

IQ 1.1 To what extent did the restructuring and conversion operations supported by the NSP impact the production potential of vineyards, in terms of quantity? In terms of quality? at the level of the region / of the Member State?

At national level

The NSP management services at national level mentioned that the restructuring measure supported in particular the installation of irrigation systems which may have impacted the production potential, but the impact on production haven’t been quantified. Regarding conversion, the measure supported conversion toward a large range of varieties, including both low and highly productive varieties. Hence they have no evidence that the operation supported under the NSP have increased production potential in terms of quantity. Regarding quality, from the administrators’ point of view, the operations supported by the measure generally did not result in a change from non PDO-PGI vineyards to certified vineyards. The main objective of conversion has actually been to adapt to the demand of the market (see IQ1.5).

At regional level

The grubbing-up scheme in force until 2011 has resulted in a significant decrease of the vineyard area in Languedoc-Roussillon.

One of the issues of wine growing is to maintain the yield above a minimum threshold in order to ensure the profitability of the production. The restructuring measure can help to overcome this issue by ensuring a minimum yield and profitability of the production, notably through the introduction of the irrigation. Thus, the restructuring measure might have an impact on the quantity produced. The restructuring of the vineyard might also have an effect on quantity through the introduction of trellis systems that increase the productivity through the use of agricultural machineries. Moreover, this measure, via planting adapted grape varieties to climate change, indirectly allow an increase of the volume of grape produced.

Then, the volume produced is fostered by the restructuring of the sector. Indeed, the regional managing authority indicated that the volume produced for varietal wines were achieved thanks to the restructuring measure. This is particularly important for the region since the main PGI Pays d’Oc is mainly known for its volume of production that reaches 6 million of hectolitres. It is the larger PGI in the world.

In terms of quality, the restructuring measure has mainly been used across the years to plant international trending grape varieties, to adapt to consumer’s demand. Hence, in Languedoc Roussillon, this measure has been used to plant Grenache, Syrah, Cabernet Sauvignon, Merlot, Chardonnay. N.B: Spain and Italy according to the regional managing unit, had different strategic approaches developing their local grape varieties. Traditional grape varieties (Cinsault and Carignan) were also planted back as they are of quality and adapted to climate change.

Then, in order to develop new wine products and extend their offer, the producers implemented the restructuring measure in synergy with the investment measure allowing the producers to adapt their production unit to white wines and rosé of better quality. Investment measure was used to modernize the production chain of wine allowing the development of cooling systems and other specific equipment necessary for the production of these wines.

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 14

IQ 1.2 Did the NSP measures intend to support changes in the vineyard management practices or foster specific practices (i.e. organic agriculture, low mechanised systems, etc.)?

At national level

From the point of view the managers of the NSP at national level, the measure had no objective to foster any specific practice. While the environmental aspect have been a priority criteria for the selection of application from support to investments (Measure 3), this aspect haven’t been taken into account in the selection of applications for restructuring and conversion. However, environmental compliance (e.g. Water directive, cross-compliance, etc.) are checked by other administrations.

At regional level

At regional level, the managing authority indicates that the management practices have been evolving and it is important to enable the vineyard to adapt to these changes. The restructuring measure enables the producers to change their practices by changing the density of vineyard, tying up vines and install irrigation system. Indeed, in Languedoc-Roussillon, the lack of water is a growing issue that different areas must face: Pyrénées-Orientales, Corbières and Minervois.

Then, to strengthen the wine growers and adapt the vineyards to the threat of climate change, the restructuring measure supports the introduction of Spanish, Greek and Portugese varieties that are more resistant. However, it is possible for wine growers to introduce these varieties only for production without PDO. Premium are granted for the use of such varieties.

The managing authority also inform that the restructuring measure enabled to introduce varieties that enable to reduce the use of pesticides by 80%. These varieties are eligible to the restructuring support and contribute to reach environmental and economic objectives, since the reduction of treatments also reduces the costs of production.

IQ 1.3 To what extent did the NSP resulted in changes in the management practices of vineyards? Which practices were introduced/abandoned? Did those changes have an impact at national or regional level (e.g. acting as role model)?

Given that support to investments have been focused on production, no direct effect of the NSP on the management practices of vineyards was observed. Nevertheless:

At national level

The NSP management services mentioned that the restructuring measure have to a certain extent facilitated the adaptation of the vineyard structure to better manage problems related to disease or to the drought (e.g. management enabling a better aeration / protection of the vineyard, cover crop). It was also mentioned by the administration and one representative of the sector that the introduction of grape varieties resistant to diseases and/or drought may be expected to contribute to a reduction of the use of pesticides and water.

The Ministry of Agriculture confirmed that an interesting share of the projects of restructuring & conversion include an environmental objective.

At regional level

No specific mention of management practices introduced or abandoned were mentioned during the interview. The NSP had an impact on the type of grape varieties produced, however, the management practices mainly rely on the AOP/IGP specifications.

The restructuring measure supported the implementation of trellis systems allowing the use of agricultural machineries. One can deduce that support under this measure may have had an effect on the management practices.

One growers explained that theoretically, the restructuring measure supports wine growers to set up an irrigation system. However, this operation is supported only if winegrowers have a water collection point nearby. One of the main issues in the Languedoc-Roussillon is the water scarcity. Very few wine-growers could benefit from this operation. The Restructuring measure did not have a significant impact on the management practices of vineyards and was mainly used to plant more adapted grape varieties and/or to adapt the density to the specifications of PDO/PGIs.

As opposed to the statement of the managing authority, another producer highlights that the varieties eligible to the restructuring aid are not those requiring no phytosanitary treatments that could contribute to climate change mitigation reducing the management practices to basic seasonal practices on the vines and land.

IQ.1.4 Have the NSP measures impacted the costs of production?

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 15

At national level

The NSP management services consider that the programme have had a very positive impact on the cost of production as well as on the revenue of growers.

At regional level

The managing authorities at regional level think that the restructuring measure can impact significantly the yield and enable the winegrowers to optimise their production system, adapting the density to enable the use of machinery. These changes must positively impact the production costs.

However, one producer underlines that the main cost is the labour. The specifications from the PDO/PGI are very constraining and induces the employment of specialised workers for certain tasks. The NSP measures won’t impact labour costs.

IQ.1.5 Have the NSP measures resulted in a better adaptation of the vineyards structure and management practices to market demands? E.g. in terms of variety, quality.

At national level

The NSP managing authority explained that the general objective of the conversion measure is to support a better adaptation of the vineyard to the market demands without targeting any specific variety, in order to “support the diversity” of varieties and products in the Member State. Hence the impact in terms of quality cannot be assessed.

At regional level

According to the regional unit of the managing authority, one of the objective of the restructuring and conversion measure is to enable the conversion of vineyards by plantings different varieties adapted to the different markets. Market demand is directly taken into account to set up the list of grape varieties eligible for vineyards restructuring. The LR region used to produce great quantity of wine of little quality in the middle of the 20

th century. Since 70’s, the main goal of the sector in the region was to produce less quantity of better

quality to adapt to market demand. That’s why the grubbing-up premiums were widely used to reduce the areas planted in vines whereas the restructuring measure helped to remove traditional grape varieties such as Cinsault and Carignan to plant Merlot, Cabernet Sauvignon and other international grape varieties more trending and renowned by that time. The collective restructuring plan implemented in the region aims at supporting varieties addressed to mass market that may be less profitable, that is why the premium granted to the producers is higher under the collective restructuring plan than the individual measure. The regional collective plans are set up by committee composed of producers, cooperatives and other regional stakeholders that draw the strategy to be implemented in their region. This scheme enables cooperation and coordination of the restructuring operations implemented in the region.

The Languedoc-Roussillon region is very typical as regards the extent of the grape varieties cultivated, which is significant. The diversity of soil and the large number of producers contribute to the capacity of the region to offer a large category of products to answer the demand of the different market segments. Notably, specific varieties have been planted to access export markets.

The varietal conversion is of two types in the region:

- One aims at targeting international market by planting Grenache, Syrah, Cabernet-Sauvignon, Cinsault. This strategy is generally implemented by producers under the PGI “Pays d’Oc” in low lands and low hills. It represents 50% of the production and international varieties occupy up to 60% of the areas.

- The other looks at reintroducing traditional varieties that are very specific of the region and better adapted to the climatic conditions, such as Carignan and Cinsault.

Currently, 30% of the vineyard is cultivated with PDO. The specifications required for this type of production don’t allow the producers to be innovative. On the opposite, the PGI gives more flexibility and allows the producers to plant more resistant varieties.

Used together, the investments and restructuring supports contributed to raise the international reputation of white and rosé wines produced in Languedoc-Roussillon, as quality products. Notably, the “Chardonnet du Languedoc” has seen its notoriety growing on global market. The share of white varieties has been increasing due to the progress achieved in the equipment, mainly thanks to the investment support. Investments made really enabled to improve the quality of wine by improving the technology, the aeration and investing in quality vats.

According to winegrowers and producers, the NSP is a necessary tool to adapt the vineyards structure and management practices to market demand. However, all interviewees pointed out the high level of complexity in the application process. Moreover, some stakeholders did not understand why some supporting documents were required.

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 16

IQ 1.6 Have the NSP measures had an impact on the income of wine growers?

The following answers concern the effect of the NSP as a whole. The simple effect of the restructuring and conversion measure on growers could not be distinguished.

At national level

The NSP is generally perceived as positive. See IQ 1.4.

At regional level

According to the managing authority at regional level, there is a minimum price to be perceived by the wine growers producing PGI and Pays d’Oc, for the production to be profitable: it is 4000€/ha. However, it is not possible to assess to what extent the restructuring measure helped the producers to achieve this threshold. Then, the NSP has allowed the winegrowers to adapt to market demand and hence had an impact on the income of wine growers.

However, it is important to understand that the NSP was conceived as a tool to support the winegrowers’ development plans and not a vital support for the survival of the activity in the region.

As regards the beneficiaries, they think that the NSP support is a substantial amount of money that can help to develop their projects, but it is not considered as an additional income.

2.2.4 Conclusion of the expert

Crossing the information collected in the interviews, please provide your conclusion on the:

Impact of the NSP on the production potential in terms of quantity and quality

In terms of quality, the NSP has a great impact on the grape varieties cultivated in the region. According to the stakeholders, the grubbing-up of traditional grape varieties to plant international trending ones was consequent in the region. Thanks to the NSP, investments in cooling machineries allowed growers to produce rosé and white wines of great quality that wouldn’t be if they had not invested in these machineries.

In terms of quantity, the NSP had no impact on the production potential. Indeed, the quantity produced on the field greatly depends on the AOP and IGP specifications that are quite restrictive concerning the density of vines per hectare, the number of vine shoots remaining after pruning, etc.

Impact of the NSP on the vineyard management practices

The NSP encourages the introduction of improved vineyard management practices. The main changes in management practices consisted in changing gobelet-trained vines into trellis-trained vines, allowing access to agricultural machineries.

There were opposite views between the managing authority and the winegrowers as regards the eligibility of resistant varieties that would encourage a reduction of the chemicals inputs used. Whereas the managing authority explained that such varieties have been made available in the frame of the reconversion support to enable changes in management practices and adaptation to climate changes (these varieties being more resistant to the drought), the producers interviewed often regretted that the resistant varieties they were willing to grow were not eligible.

Impact of the NSP on the competitiveness of wine growers

The NSP support had an impact on the competitiveness of wine growers helping them to grow grape varieties internationally renowned and to invest in machineries for a production of a better wine quality. Theoretically, the implementation of irrigation systems or the introduction of machineries should have contributed to the improvement of the managing practices, however it was not possible to assess whether this has really led to a reduction in production costs.

However, all the wine growers complained of the over control of the activities supported by the NSP. There are too many controls made by too many different bodies. Several winegrowers mentioned that the control bodies were going too far in the control procedures and were only trying to find a mistake to take back the money granted. Winegrowers do not understand the multiple controls due to few scammers. Moreover, controls are carried out by different stakeholders having different objectives and calculating the areas engaged differently. For efficiency purposes, harmonisation in the controls and the methods of calculation should be carried out.

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 17

2.3 Effects of the NSP at the level of producers and products

2.3.1 Effects on the competitiveness key factors of wine producers

2.3.1.1 Synthesis of the interviews

IQ 1.7 Could you please explain what are the current issues encountered by the wine sector in your Member States /region and describe the strategies implemented by the wine producers to address them?

At national level:

According to the national authorities, the wine market is experiencing increasing competition and globalisation. Many changes are happening, relating to the number of consumers, the markets structure, the consumers’ taste, etc. The issue for EU wine producers is to secure their place on global market, while keeping opening new markets abroad. This is why the promotion support is important: without support for 5 years, an operator may lose a market due to all these changes. The objective of the NSP is to improve the competitiveness of French wine producers on domestic markets and to enable them to cope with the challenges of exports development. That is why the NSP support investment to improve the production, thus reducing the production costs and/or increasing the quality. Indeed, to increase their competitiveness, the operators need to decrease their prices or increase their margin. The decrease of production costs is particularly strategic in the case of PDO/PGI winegrowers that prevent growers to benefit from higher yields.

To improve the quality, the issue is to introduce technical changes to the vineyards’ practices (trellising, irrigation system, etc.). This will also help producers to better cope with climatic issues (i.e. drought).

Therefore, it is important for a producer to know its market(s) and understand the expectations of the consumers, so as to valorise its products. However, when winegrowers/producers sell to a cooperative or a broker exclusively, they don’t have access to the end consumers and this may hinder their knowledge of the market. The investment measure has enabled winegrowers to produce wine on their holding by investing in wine-making equipment. This is positive from the point of view of national authorities since it enabled them to better valorise their production.

Similarly, some wine traders invested in wine-making units, notably in Burgundy and Bordelais. These large operators are important for the wine sector because their large size allow them to conquer new markets.

Finally, the authorities also mentioned that the risk of frauds in the wine sector is significant. This is particularly true given the importance of the sector for the exports (the wine products are the second main important exportations in France, just after the aircraft industry). The foreign importing countries are requiring certificates and guarantees (USA and China notably). Their already were cases of frauds, to supply foreign demand for French wines of high notoriety when the production was particularly low for climatic reasons.

According to the representatives of the sector, the wine producers and traders have to face high costs for the marketing of their products on foreign markets (distribution and listing costs). Indeed, given the decrease in the consumption of wine in France (-70% over 60 years), the potential for growth is on global market, especially in North America and Asia (China and South-East Asia). Costs to sell abroad are high: they represent up to 50% of the costs for a famous brand of champagne (Moet & Chandon). As a result, only producers able to invest in these costs can conquer foreign markets, and it is pointless to support small companies that could not face them over the 5-years period of support. Only the companies that have spontaneously decided to conquer foreign markets because they can “afford” it should be supported.

The increasing demand for green, pesticide-free wine products is another issue. This in particularly true in Germany. However, it is difficult at this stage to produce wine without chemical inputs. Winegrowers are already trying to reduce pesticides, but it is not possible yet to produce without using fungicides.

Then, the adaptation to the demand raises several issues, e.g. adapting the product to demand for darker or lighter rosé wine according to the markets. Also, the vineyards must be adapted to the demand, by planting the right varieties of grape. However, the investments to adapt the vineyards are heavy and the results is to be expected on the long-run. Producers must also find a way to decrease the level of alcohol content, which kept increasing. The olfactory/gustative balance is indeed optimised in wines with lower alcohol content.

In France, it is also important to develop mi-range products, because the producers must be able to provide a full range of products, not only top range products, to their customers.

Finally, another issue in France, especially in the wine sector, is the distribution of the value-added along the supply chain, more specifically, between winegrowers/producers and traders. Indeed, few large traders use to call for a certain volume of grapes/wine (thousands of HL) from specific varieties at a given price, so the winegrowers are notable to negotiate.

-

AGROSYNERGIE - Case study report: France – Languedoc-Roussillon

Evaluation study of the impact of the CAP measures applicable to the wine sector 18

At regional level:

According to the managing authority at regional level, there is a deficit of the supply in wine on French and EU markets. French operators must import wine from Italy and Spain. This is associated to a decrease in yield of 30 %. This is important because the yield is the principal driver of competitiveness and it has decrease due to the climate change (increase need for irrigation to maintain the yield), the use of clones that are less productive than previous plants, the lower density. Wine produced with PGI/Pays d’Oc have average yields of 60 hl/ha, whereas competitors in Chili, which are not subject to the same constraints, achieved yield of 100hl/ha for the same grape varieties.

The strategy implemented now by the operators in the region is to emphasize a denomination rather than a variety and to increase its notoriety on markets. This was the case of the Pays d’Oc PGI that has become more and more well-known abroad.

Then, there was a strong need in Languedoc Roussillon to access and modernize wine processing units and adapt them to the international standards. The cooperatives, which represent 69% of the wine produced in the region, have important needs but their profitability is lower. For this type of operator, the support rate is limited to 40%, thus the investment is heavy and risky.

The complexity and administrative burden associated with the management of application forms is a major issue in France and in the region. The fact that some NSP measures are managed at regional level and other such as the Promotion measure are managed at national level, makes the management of the application form for the Management Authorities and the applicants very complex:

It was stated that the investment measure was complicated to manage at regional level because of the broad range of eligible operations that can be supported and changing rules from one year to another that made it very complicated for the applicants and control bodies to understand what conditions have to be checked.

The promotion measure was mentioned as a complex measure that should be dealt at regional level. Indeed, a lot of interested applicants called the regional authorities to ask for details and insight but the regional authority could not give them an appropriate answer considering the fact that it was a measure dealt at national level. The beneficiaries had to call the central team in Paris to reach someone that could provide them with the intelligence they needed. In the case of the promotion measure, the current issues come from the French ministry and is not because of EU regulation whatsoever.

The representative of the main PGI of the Languedoc Roussillon region mentioned as main issues the decrease of the wine consumption in France and the continuous changing trends on the international market of varietal wines, which is very tense. To address these issues, the PGI has developed a strategy on two axes which consists in:

Democratising the wine consumption toward the new generation of consumers with the development of wine products in bag-in-box.

Facilitating the access to wine consumption by mentioning the grape variety on the bottle (increased legibility of the supply for consumers).

This strategy has enabled the PGI to register a steady growth on the French market over the last 15 years, despite the decreasing trend in wine consumption.