Endorsed at - · PDF fileEndorsed at the 13th AFMM iii at non-retail investors, who can look...

-

Upload

nguyenhanh -

Category

Documents

-

view

213 -

download

0

Transcript of Endorsed at - · PDF fileEndorsed at the 13th AFMM iii at non-retail investors, who can look...

THE IMPLEMENTATION PLAN

Endorsed at

The 13th

ASEAN Finance Ministers Meeting

Prepared by

ASEAN Capital Markets Forum (ACMF)

Endorsed at the 13th

AFMM

TABLE OF CONTENTS

EXECUTIVE SUMMARY

1. Introduction and Background ................................................................................................. 1

2. Vision and approach to integration ......................................................................................... 2

3. Rationale ................................................................................................................................. 3

4. Obstacles and Challenges to Integration ................................................................................. 5

5. Core Components of the Implementation Plan ....................................................................... 6

6. Overview of the Implementation Plan for each Component .................................................. 7

APPENDIX 1 : KEY MILESTONES FOR THE MUTUAL RECOGNITION AND

HARMONIZATION FRAMEWORK.......................................................................................... 17

APPENDIX 2 : THE PROPOSED STRUCTURE OF FINANCIAL SERVICES

DIRECTORATE ........................................................................................................................... 18

ATTACHMENT: IMPLEMENTATION PLAN FOR REGIONAL INTEGRATION OF

CAPITAL MARKETS IN ASEAN .............................................................................................. 19

Endorsed at the 13th

AFMM

i

EXECUTIVE SUMMARY

The ASEAN Capital Markets Forum (ACMF) comprises securities regulators from 10 ASEAN

jurisdictions, namely Brunei Darussalam, Cambodia, Indonesia, Laos PDR, Malaysia, Myanmar,

Philippines, Singapore, Thailand and Vietnam. The ACMF is currently chaired by the Securities and

Exchange Commission, Thailand.

At the ASEAN Finance Ministers’ Meeting in Danang on 4 April 2008 (AFMM 2008), the ACMF

proposed to establish a Group of Experts (GOE) to assist in drafting a proposal for an ―Implementation

Plan to promote the Development of an Integrated Capital Market to achieve the objectives of the AEC

Blueprint 2015‖ (Implementation Plan 2015), and to present that Plan to the Finance Ministers for their

consideration at AFMM 2009.

The AEC Blueprint 2015 pertaining to capital markets seeks to achieve significant progress in building a

regionally integrated market, where within the region: 1) capital can move freely; 2) issuers are

free to raise capital anywhere; and 3) investors can invest anywhere. In such a market, anyone

would be able to trade in ASEAN capital market products freely in any ASEAN market at a competitive

fee from a single access point, with capital market intermediaries being able to provide services

throughout ASEAN based on home country approval.

Rationale for Regional Integration. There are two main reasons why ASEAN needs to support regional

financial cooperation and integration. The first is to strengthen financial intermediation, capacity, and risk

management to support national and regional growth. The second is to cooperate to reduce vulnerabilities

to external shocks and market volatility, a point that became clearer after the Asian Crisis of 1997 and is

underscored by the present global financial crisis. In this context, regional integration can facilitate both

domestic capital market development as well as global integration by providing the liquidity, scale, and

capacity to compete globally. Moreover, integration will contribute to financial stability by expanding the

market which can be accessed by regional players in the region, hence facilitating diversification, and

reducing domestic volatility resulting from global shocks. Additionally, regional cooperation can also

provide a greater voice on financial stability and development issues in global fora. This last

consideration has become particularly important for designing coordinated responses to current global

financial and economic crisis. In addition, regional integration initiatives and the associated alignment of

national regulatory standards with international standards provide an opportunity to draw the lessons of

the crisis for risk management, regulatory surveillance, asset securitization, and market microstructure.

Moreover, the growing competition from global players, and the pressures for consolidation and

efficiency enhancements due to technological and regulatory changes make regional integration of capital

markets a pressing policy concern and calls for a comprehensive strategy. ASEAN risks being irrelevant

if it fails to act cohesively as a region.

Challenges. Currently, however, progress toward regional integration of capital markets has been

constrained by the large differences in the levels of development and in the observance of regulatory

standards, capital controls, fragmented infrastructure, and insufficient coordination and monitoring

mechanisms. The key challenge therefore is to set up a well sequenced program of regional integration

initiatives to achieve the goals of AEC 2015, support it by embedding regional considerations into

domestic capital market development programs and reinforce the above through a well designed ASEAN-

level monitoring and coordination mechanism. The two-way interaction between strengthening domestic

capital markets, and fostering integration, requires that domestic capital market reforms and measures to

enhance greater cross-border access, together be properly sequenced and coordinated, based on:

- Common international standards.

- Judicious use of mutual recognition in finance and business.

Endorsed at the 13th

AFMM

ii

- Further liberalization of capital controls and exchange restrictions.

- Further strengthening prudential safeguards and risk management capabilities to help manage

volatility and compete effectively.

Therefore, a comprehensive approach is needed at the ASEAN level, supported by firm country level

implementation. Moreover, in the current context of the on-going global crisis, an accelerated program of

financial integration would position ASEAN strategically in the global financial architecture, assist

national governments to raise funding to combat recession and counter the emerging balance of payment

pressures, and strengthen domestic and regional financial intermediation to support growth.

Pre-conditions. To advance in financial integration, the region needs to further liberalize cross-border

capital flows. Despite progress made over the last few years, feedback and views received from the team

of experts confirm that capital account restrictions are impediments to cross-border flows.

Acknowledging the problem, the AEC Blueprint 2015 has included capital account liberalization in the

region’s financial integration program. However, capital account management practices differ

significantly across ASEAN countries. Moreover, other factors such as withholding tax arrangements—

also constitute barriers to capital account transactions in some cases. In addition, broader policy

considerations must be taken into account besides the goal of regional financial integration when each

country decides the specifics of its liberalization program.

However, while liberalization of cross-border capital flows and tax reform are important for capital

market integration under the AEC Blueprint objectives, they are clearly beyond the scope of the ACMF as

securities regulators. Therefore, the ACMF proposes that these and other recommendations beyond the

remit of the ACMF be further assessed by the relevant authorities such as the Ministries of Finance,

Central Banks, stock exchanges and also various working committees under the ASEAN process

(especially, the Working Committee on Capital Account Liberalization and the Working Committee on

Financial Services Liberalization) to develop and put in place the necessary action plans. As these issues

cut across several various parties, the ACMF is of the view that the ASEAN Secretariat as a central body

can play a key role in driving and coordinating the implementation of the initiatives to achieve the

recommendations under the Plan.

Prioritization. The ACMF members recognize that an effective implementation plan must be clearly

sequenced and prioritised. The AEC Blueprint envisages three distinct phases. The Implementation Plan

provides greater and more detailed description of the actions to be undertaken in these phases, including

identifying the actions that can be addressed directly by the ACMF and highlighting others that constitute

binding constraints that can only be addressed by Central Banks and Ministries of Finance. A large

number of the recommendations specified in the Implementation Plan can be worked upon by the ACMF

as early as Phase I as they relate directly to the capital market, while other initiatives such as liberalization

of capital account restrictions and reform of tax system may require further coordination and action by the

relevant authorities and working committees.

Core Strategy. The core strategy in the Plan is a mutual recognition/harmonization process of expanding

scope and country coverage, supported by efforts to liberalize capital account restrictions and to reform

tax system, the establishment of trading and settlement system alliances and infrastructure, and a

strengthened coordination and monitoring processes at both regional and country levels to support

implementation.

Given the differing levels of capital market development and readiness amongst ASEAN countries, the

mutual recognition initiatives should be implemented bilaterally first and then multilaterally as other

countries become ready to join in. In addition, it is often easier to relax restrictions on activities targeted

Endorsed at the 13th

AFMM

iii

at non-retail investors, who can look after themselves and need less protection than retail investors.

Therefore, it may be practicable to enable cross-border products and services to be made available first to

non-retail investors (NRI) and make them available to retail investors (RI) later, when adequate

protections are in place.

In addition, in light of the rapidly changing environment of the global financial market, the ACMF will

review and assess the recommendations in the Implementation Plan as appropriate and take into

consideration prevailing circumstances including market readiness and adequate safeguards for investor

protection, and reprioritize where necessary. This will ensure an orderly and practical approach towards

the implementation of the initiatives.

The Plan is guided by the key principles summarized in Box 1.

Box 1: Key Principles of the Implementation Plan

Themes and Strategic Initiatives. The Implementation Plan seeks to achieve the goals of AEC Blueprint

2015 by offering a comprehensive set of strategic initiatives and formulating specific implementation

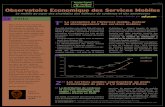

actions and milestones. The initiatives cover three broad themes as presented in Figure 1.

Figure 1: Three Broad Themes and Six Strategic components

Creating an Enabling

Environment for Regional

Integration*

Creating the Market Infrastructure

and Regionally Focused Products and

Intermediaries

Strengthening the

Implementation Process

Mutual Recognition

Framework.

ASEAN exchange alliance and

governance framework.

Promoting new products and

building ASEAN as an asset class.

Strengthening bond markets.

Aligning domestic capital

market development plan to

support regional

integration.

Reinforcing ASEAN

working process. * To create an enabling environment, restrictions on capital flow should also be gradually liberalized along with the reform of tax

system in order to facilitate cross-border transactions. However, as these issues are beyond the scope of ACMF, relevant

authorities and working committees should further assess to develop and put in place the necessary action plans.

Adoption of international standards to the maximum extent possible.

Progressive liberalization to facilitate more open access and cost reduction through greater

competition.

Sequencing of regional integration initiatives taking into account ease of implementation, market

preferences and technical linkages.

Adequate coordination of ASEAN level working processes.

Consistent implementation of policies to support regional integration at country level, with

effective monitoring mechanisms.

Strong communications plan and consultative processes to build consensus and set priorities for

integration initiatives.

Endorsed at the 13th

AFMM

iv

Under each of the above themes, six strategic components were identified, discussed and developed in a

series of consultative meetings organized under the ADB regional technical assistance programs in 2007-

2008. Supported by these programs, a Group of Experts (GOE) and the ACMF have developed the

Implementation Plan as presented in Figure 2.

Strategic Component I

Mutual Recognition framework to facilitate

Cross border fund raising

Product distribution

Cross border investments within ASEAN

Market access by intermediaries

Strategic Component IV

Strengthen bond markets

Accelerate reform initiatives in bond

issuance, listing & distribution

Design a regional strategy for ratings

comparability

Improve market liquidity, and clearing &

settlement of linkages

Strategic Component II ASEAN exchange alliance and governance framework Build trading linkages and setup ASEAN Board Enhance governance, trading efficiency

& cost reduction Clearing, depository, and settlement linkage Marketing and investor education

Strategic Component III

Promote new products & build ASEAN as an asset

class

Promote private sector led regional products

development

Promote ASEAN star companies under the

ASEAN board

Strategic Component V

Align domestic CMDP to support regional

integration

Align national development initiatives to

support cross border integration

Adopt phased approach to liberalization

to ensure domestic market readiness

Strategic Component VI

Reinforce ASEAN working process

Establish ASEAN Coordinating Team,

comprising dedicated resources from ASEC

and dedicated point persons from ACMF

members to monitor, coordinate, report and

raise issues on the Implementation Plan.

Endorsed at the 13th

AFMM

v

Figure 2: Six Strategic components and Key Initiatives - An Overview

SUMMARY OF THE IMPLEMENTATION PLAN

Subject Findings and Recommendations

Key

Principles of the

Implementation

Plan

Adoption of international standards to the maximum extent possible.

Progressive liberalization to facilitate more open access and cost reduction through greater

competition.

Sequencing of regional integration initiatives taking into account ease of implementation,

market preferences, and technical linkages.

Adequate coordination of ASEAN level working processes.

Consistent implementation of policies to support regional integration at country level, with

effective monitoring mechanisms.

Strong communications plan and consultative processes to build consensus and set priorities for

integration initiatives.

1. Introduction and

Background • Implementation Plan is to promote the Development of an Integrated Capital Market to achieve the

objectives of the AEC Blueprint 2015

2. Vision and the

Approach to

Integration

• The AEC Blueprint 2015 pertaining to capital markets seeks to achieve significant progress in

building a regionally integrated market, where within the region: 1) capital can move freely; 2)

issuers are free to raise capital anywhere; and 3) investors can invest anywhere.

• Two closely related approaches: 1) to focus on full harmonization of domestic laws, regulations, and

operations in order to facilitate cross-border access (undertaken in EU); and 2) to create enabling

conditions for access with broad harmonization, and supported by mutual recognition and a greater

freedom for capital movements. (implicit in the AEC blueprint 2015)

3. Rationale

• Two main reasons support regional financial cooperation and integration: 1) to strengthen financial

intermediation and risk management to support national and regional growth; and 2) to cooperate to

reduce vulnerabilities to external shocks and market volatility, a point that became clearer after the

Asian Crisis of 1997.

4. Obstacles and

Challenges to

Integration

• Obstacles are:

(i) significant differences in the levels of development of capital markets;

(ii) some views that domestic markets should be integrating with the rest of the world rather than

within ASEAN;

(iii) countries differ significantly in the extent to which their national development plans include

the measures to enable and benefit from greater regional integration;

(iv) existence of capital controls and exchange restrictions in many jurisdictions, differences in the

withholding tax regimes; and

(v) lack of clarity on the coordination and monitoring mechanisms in ASEAN

• The key challenge therefore is to set up a well sequenced program of regional integration initiatives

to achieve the goals of AEC 2015, support it by embedding regional considerations into domestic

capital market development programs and reinforce the above through a well designed ASEAN-

level monitoring and coordination mechanism.

5. Core

Components of

the

Implementation

Plan

The core strategy in the Plan is a mutual recognition/harmonization process of expanding scope and

country coverage, the building up of needed trading and settlement system alliances and

infrastructure, and a strengthened coordination and monitoring processes at both regional and

country levels to support implementation.

Endorsed at the 13th

AFMM

vi

6. Overview of the Core Components and Recommendations

Subject Recommendations*

A. Creating an Enabling Environment for Regional Integration

[Strategic Component I ] Mutual Recognition(MR) and Harmonisation Framework

Facilitate cross-border fund

raising

• Harmonize disclosure standards, align distribution rules and develop MR framework for

primary offerings.

• MR of market professionals involved in primary offerings.

Facilitate cross-border

product distribution

• Allow local intermediaries to distribute ASEAN listed products, with marketing support

services.

• MR of other market professionals, e.g. involved in marketing.

• MR framework for distribution of CIS products.

Facilitate cross-border

investments by investors

• Promote cross-border investments through local intermediaries.

• Develop harmonized criteria for NRI (Non-Retail Investors).

• Recognize ASEAN exchanges under host country rules.

• Adopt a liberalization plan to allow NRI/RI to invest freely in ASEAN.

Facilitate market access by

intermediaries

• MR framework for provision of products and services by market intermediaries to NRI.

• Work toward single passport with home country approval.

B. Creating the Market Infrastructure and Regionally Focused Products and Intermeidaries

[Strategic Component II-I ] Develop Exchange Alliance Framework

Formulation of medium term

vision for the ASEAN

exchanges

• Formulate Medium Term Vision.

• Engage ASEAN Exchanges for overall governance and implementation of exchange

alliances.

Build Infrastructure

• Set up ASEAN Common Exchange Gateway (ACE)– electronic link for direct access by

foreign brokers, as clients of local members.

• ASEAN clearing houses act as central counterparty for cross-border trades.

• Form depository links for cross-border settlement and custody.

• Organize joint banking services, including forex and corporate actions, for economies of

scale.

Promote Cross-border

Trading and Develop

Regional Markets

• Set up an ASEAN Marketing Committee.

• Develop comprehensive marketing plan including investor education, marketing news and

data dissemination etc.

• Act as catalyst to promote trading volume, help remove barriers to cross-border trade and

promote products, regional intermediaries and star companies.

[Strategic Component II-2 ] Strengthening Exchange and Corporate Governance

Demutualization • Complete the demutualization process.

Coordinate listing rules,

corporate governance

standards • Map requirements in the listing rules, corporate governance and disclosure standards.

Enhance information sharing

and cooperation among

exchanges

• ASEAN exchanges endeavour to sign multilateral MOU for cooperation and information

sharing to facilitate exchange linkages.

Endorsed at the 13th

AFMM

vii

Subject Recommendations*

[Strategic Component III ] Promote New Products and Regional Intermediaries

Promote new regional

products

• Form private sector led task force to develop and promote new regional product

development including ETFs, securitization products, index futures and other hedging

products to brand ASEAN as an asset class.

Promote Regionally Active

Markets Intermediaries • Create an enabling environment to support growth and consolidation of regionally oriented

intermediaries.

[Strategic Component IV ] Strengthen Bond Market Development and Integration

Review On-going Bond

Market Initiative

• ACMF to initiate dialogue with other regional groupings to agree on priorities

• Establish mechanisms to address roadblocks in bond issuance and investments on a regional

basis.

Build and Link

Infrastructure and Promote

Market Liquidity

• Facilitate cross-border trading, settlement & information linkages.

• Formulate regional strategy for ratings comparability.

• Develop disclosure standards for Central Trade Reporting System

• Create ASEAN pool of market-makers in debt instruments.

C. Strengthening the Implementation Processes

[Strategic Component V ] Domestic Capital Markets Development Plans

Review and speed up

domestic capital development

plans to facilitate integration

Draw lessons from financial crisis to strengthen domestic financial sector and better

prepare for capital market integration.

Align domestic capital market development plans with the mutual recognition and

harmonization initiatives.

Identify appropriate risk

management measures to

mitigate risks associated from

increased cross border

activities

• Engage with market participants measures to ensure financial sector stability as capital

market integration progresses and draw lessons from the financial crisis.

[Strategic Component VI ] Strengthening the ASEAN Implementation and Coordination

Process through the ASEAN Secretariat

Establish dedicated team at

the ASEC for capital market

integration

Establish dedicated resources at the ASEAN Secretariat, with supporting dedicated contact

persons from each ACMF member.

Develop and agree on the Terms of Reference (TOR) for capital market integration team in

the FID including developing a consolidated action plan, streamlining of the existing

ASEAN working committees and task forces, and report progress or raise issue to

stakeholders on a regular basis.

Facilitate implementation of

recommendations that are

beyond the scope of ACMF

ASEAN Secretariat coordinates and works with relevant Working Committees and other

related parties to facilitate the implementation of recommendations that are beyond the

scope of ACMF.

* Recommendations that are beyond the purview of securities regulators should be further assessed by the relevant authorities

and working committees to develop and put in place the necessary action plans

Endorsed at the 13th

AFMM

1

1. Introduction and Background

At the ASEAN Finance Ministers’ Meeting in Danang on 4 April 2008 (AFMM 2008), the

ACMF proposed to establish a Group of Experts (GOE) to assist in drafting a proposal for an

“Implementation Plan to promote the Development of an Integrated Capital Market to

achieve the objectives of the AEC Blueprint 2015” (Implementation Plan 2015) and to

present that Plan to the Finance Ministers for their consideration at AFMM 2009.

The Implementation Plan 2015 seeks to achieve the goals of AEC Blueprint 2015 by offering

a comprehensive set of strategic initiatives and formulating specific implementation actions

and milestones. The initiatives cover three broad themes:

a. Creating an Enabling Environment for Regional Integration

b. Creating the Market Infrastructure and Regionally Focused Products and

Intermediaries, and

c. Strengthening the Implementation Process

Under each of the above themes, several strategic components were identified, discussed and

developed in a series of consultative meetings organized under the ADB regional technical

assistance programs in 2007-2008. Supported by these programs, a team of ADB consultants

has developed the Implementation Plan presented in this report, guided and overseen by the

Group of Experts appointed by the ACMF1. The plan is further elaborated in the

accompanying Background Report.

The Implementation Plan builds on a range of ongoing initiatives:

The work of ACMF to bring about harmonization of selected capital market

regulations,

Various bilateral initiatives among ACMF members to cooperate in key areas.

The initiatives on various capital market and payment system topics by other regional

for such as Asia Pacific Regional Committee of IOSCO (APRC), and Executive

Meeting of the East Asia-Pacific Central Banks (EMEAP).

The work of stock exchanges to build trading linkages and build alliances (ASEAN

Common Exchange Gateway (ACE).

1The work on the Implementation Plan was supported by the ADB Regional Technical Assistance Project: ADB TA 6473 –

REG: Strengthening South East Asian Financial Markets. The overall project was guided by Mr. Jaseem Ahmed (Director,

Financial Sector, Public Management, and Trade Division, Asian Development Bank). The task manager was Junghoon Park

(Private Sector Development Specialist, Financial Sector, Public Management, and Trade Division, Asian Development

Bank). The ADB Consultant team included Mr. Andrew Sheng (Project Guide, Chief Advisor, China Banking and Regulatory

Commission), Mr. V. Sundararajan (Project Coordinator, Director, Centennial Group), three other international consultants,

and three national consultants. The Group of Experts chosen by the ACMF to oversee the drafting of the Implementation Plan

2015 consisted of: Mr. Jose Isidro Camacho (Former Secretary of Finance of the Philippines, Vice Chairman, Asia Pacific

Credit Suisse), Mr. Banyong Pongpanich (Chairman, Phatra Securities Company ltd.), Dr. Thillainathan Ramasamy (Director,

Bursa Malaysia Berhard) and Mr. Piyush Gupta (CEO, South East Asia Pacific, Citibank, N.A.).

Endorsed at the 13th

AFMM

2

The ASEAN+3 Asian Bond Market Initiative (ABMI) to develop and integrate local

currency bond markets.

The proposals by the ASEAN Working Committee on Capital Market Development

(WC-CMD) and its task forces to promote market linkages, market access, and market

liquidity, and

Various Asian Development Plan (ADB) studies and recommendations on regional

integration.

There are five main sections to this report. Sections 2 and 3 seek to present a vision for

regional capital market integration, and the rationale for integration, as envisaged for the AEC

2015; Section 4 briefly reviews the obstacles and challenges in achieving integration; Sections

5 present the core components of the Implementation Plan, with Section 6 providing a

summary of the Plan in each of the strategic components. An Attachment presents the

Implementation Plan as a schedule of specific actions to be taken in three phases (2009-2010,

2011- 2012 and 2013-2015).

2. Vision and Approach to Integration

The AEC Blueprint 2015 pertaining to capital markets seeks to achieve significant

progress in building a regionally integrated market, where within the region: 1) capital

can move freely; 2) issuers are free to raise capital anywhere; and 3) investors can invest

anywhere. In such a market anyone would be able to trade in ASEAN capital market products

freely in any ASEAN market at a competitive fee from a single access point, with capital

market intermediaries being able to provide services throughout ASEAN based on home

country approval.

In order to build such a market in ASEAN, there are essentially two closely related

approaches: One is to focus on full harmonization of domestic laws, regulations, and

operations in order to facilitate cross-border access - based primarily on international

principles, standards and best practices. This is supported by mutual recognition in any sectors

that are not subject to harmonization and by liberalization measures that will ensure an

absence of national restrictions on access. This is broadly the approach taken in the European

Union. Another approach is to create enabling conditions for access with broad

harmonization, and supported by mutual recognition and a greater freedom for capital

movements. This is the vision and the approach that is implicit in the AEC Blueprint 2015.

The two approaches are complementary rather than alternatives, because effective

implementation of a mutual recognition regime necessarily requires adequate progress in

strengthening and harmonization of key laws and practices in order to safeguard investor

protection, market integrity, and systemic stability. The objective of regional capital market

integration, regardless of the approach, should be to help build the efficiency, capacity

and liquidity needed to compete effectively amidst global markets and players. Thus,

implementing regional integration should not exclude non-regional participants, but should

focus on enhancing the capacity to compete both regionally and globally.

Endorsed at the 13th

AFMM

3

3. Rationale

Two main reasons support regional financial cooperation and integration. The first is to

strengthen financial intermediation, capacity and risk management to support national

and regional growth. The second is to cooperate to reduce vulnerabilities to external

shocks and market volatility, a point that became clearer after the Asian Crisis of 1997.

Following the crisis, considerable attention has been given to strengthening local currency

bond markets and their regional integration as a means to diversify credit sources, minimize

risks due to currency and maturity mismatches and thereby foster financial stability. Enhanced

regional positioning can attract more capital and order flow due to increased liquidity and size.

Aligning national regulatory approaches will reduce administrative costs of operating in the

region and enhance its competitiveness.

Thus, regional integration can facilitate both domestic capital market development as

well as global integration by providing the liquidity, scale and capacity to compete

globally and manage volatility more effectively. ASEAN capital markets have made

significant progress in depth, trading volume and openness and are large when viewed as a

group. However, they are small individually and the range of products and openness within

ASEAN remains low. Moreover, the markets remain relatively illiquid, with high transaction

costs and large equity premiums, because of subscale trading volumes. In these circumstances,

regional (and global) integration that allows greater cross-border access to investors and

issuers can help broaden the investor base and range of products. This would strengthen

domestic capital markets and provide the liquidity, scale and capacity to compete globally. At

the same time, however, further strengthening the efficiency and integrity of domestic capital

markets is essential for continued regional integration via interoperability and

interconnectivity and improved liquidity and order flows.

Moreover, the growing competition from global players (e.g. stock exchanges), and the

pressures for consolidation and efficiency enhancements due to technological and

regulatory changes make regional integration of capital markets a pressing policy

concern and calls for a comprehensive strategy. Consultations with equity markets

regulators and market players have highlighted that ASEAN exchanges will have to compete

with global exchanges. In the current state of development of equity markets in the region,

such competition could undermine domestic capital markets and further regional integration.

Global regulatory and technological developments in the securities markets and the emergence

of new classes of investors, including hedge funds, have intensified competition among stock

exchanges and encouraged consolidation of exchanges, domestically and globally. Unless

ASEAN exchanges work together to collaborate and achieve parity with larger players in

terms of cost, liquidity, product range and technology investments, good companies in the

region will rely on the larger and more liquid markets outside ASEAN, including North Asia,

North America and Europe and make national exchanges increasingly less relevant. In

addition, if demutualized exchanges in the region were to seek alliances with major trading

blocs independently, such actions will jeopardize regional integration initiatives. Furthermore,

the region's exchanges run the risk of being cherry picked by global suitors and may end up

worse than in a collaborative solution (Figure 3).

Endorsed at the 13th

AFMM

4

Figure 3: Three Scenarios for Southeast Asia

The threat of domestic exchanges being marginalized or cherry picked by global players in the

face of growing competition and consolidation among global exchanges calls for a

strengthened strategy for regional collaboration and integration. It also requires that regional

integration become a core priority in the national capital market development strategies.

Similar considerations apply to bond markets, again calling for an expedited regional

integration strategy. Progress in integration of equity markets has to be in tandem with

similar progress in bond market integration. This would ensure that the issuers, investors and

market intermediaries have adequate tools for risk management and portfolio diversification.

In addition, building up scale and liquidity in national bond markets can be greatly facilitated

by accessing regional and global markets.

Generally, by facilitating access to a larger integrated market, regional cooperation and

integration can build awareness of ASEAN as an asset class and enhance the region’s

attractiveness for global capital flows. Moreover, integration could contribute to financial

stability by expanding the market to which regional players have access, making

diversification easier and reducing domestic volatility resulting from global shocks. Regional

cooperation can also provide a greater voice on financial stability and development issues in

global fora. This last consideration has become particularly important for designing

coordinated responses to current global financial and economic crisis. In addition, regional

integration initiatives and the associated alignment of national regulatory standards with

international standards provide an opportunity to draw lessons from the crisis to strengthen

risk management, regulatory surveillance, asset securitization and market microstructure.

Endorsed at the 13th

AFMM

5

Indeed, the ongoing global financial crisis has further strengthened the case for ASEAN

integration. Calls for reforming the global financial architecture and overhauling regulatory

and supervisory regime have been forthcoming from many sources, such as the G-20. This

creates an opportunity for ASEAN countries to do their part in a way that facilitates their

integration regionally and globally, but with the appropriate safeguards to enhance financial

stability. Also, the ability of some integrated areas—like the EU—to offer financial support to

its members and financial institutions has made them more resilient. The crisis has also made

even more obvious the advantages of advance planning to deal with financial turmoil.

Furthermore, it has highlighted the need for coordinating the thrust of policies—even if each

country still chooses its own way of carrying them out. Also, experiences such as that of the

EU clearly indicate that a larger economic and financial area, acting with a concerted voice,

has more influence in global economic decisions.

4. Obstacles and Challenges to Integration

The studies suggested that regional integration, particularly of private capital markets,

has shown only limited progress in ASEAN. Consultations with regulators and market

players have highlighted several factors that have hindered regional integration.

First, the significant differences in the levels of development of capital markets and in the

extent of observance of global standards has naturally led to focusing on domestic capital

market development and to varied perceptions of costs, risks, and benefits of regional

integration among market players and country authorities. These perceptions have been

influenced by the concerns in some countries about limited new business opportunities in less

developed markets and in other countries by the perceived competitive threat from the more

advanced market players.

Second, some market players were of the view that domestic markets should be integrating

with the rest of the world rather than within ASEAN and that the value of regional

integration and of promoting ASEAN as an asset class remained unclear. Thus there remains a

pressing need for an effective communication plan to articulate the objectives and benefits of

ASEAN capital market integration.

Third, reflecting these differences in the perceived costs and benefits, countries differ

significantly in the extent to which their national development plans include the measures to

enable and benefit from greater regional integration. Thus, regional initiatives have not been

translated into country policies in many cases.

Fourth, the existence of capital controls and exchange restrictions in many jurisdictions,

differences in the withholding tax regimes, uneven development of and portfolio restrictions

on institutional investors, all constrain regional integration. Moreover, differences in the range

of products, particularly the lack of derivatives markets or of regionally focused products in

many jurisdictions, have hindered both domestic market development and regional integration.

In any case, the large differences in regulatory regimes and market infrastructure —as

reflected in the degree of observance of global supervisory and market standards—have raised

transactions costs for cross-border transactions.

Endorsed at the 13th

AFMM

6

Fifth, the lack of clarity on the coordination and monitoring mechanisms in ASEAN has

also impeded progress toward regional integration. While there are many ASEAN initiatives

on financial market integration, mechanisms to coordinate and sequence them remain weak.

Institutional mechanisms to monitor and support the implementation of regionally agreed

standards and programs at the country level are missing.

The key challenge therefore is to set up a well sequenced program of regional integration

initiatives to achieve the goals of AEC 2015, support it by embedding regional considerations

into domestic capital market development programs and reinforce the above through a well

designed ASEAN-level monitoring and coordination mechanism. The two-way interaction

between strengthening domestic capital markets, and fostering integration, requires that

domestic capital market reforms and measures to enhance greater cross-border access, together

be properly sequenced and coordinated, based on:

- Common international standards,

- Judicious use of mutual recognition in finance and business,

- Further liberalization of capital controls restrictions,

- Further strengthening prudential safeguards and risk management capabilities to help

manage volatility and compete effectively.

A comprehensive strategy and a well-sequenced plan to implement the strategy are discussed

in the next section.

5. Core Components of the Implementation Plan

The core strategy for regional integration is a mutual recognition/harmonization process

of expanding scope and country coverage, supported by phased removal of capital account

and other restrictions1, the building up of trading and settlement system alliances and

infrastructure, and a strengthened coordination and monitoring processes at both regional and

country levels to support implementation. These strategies, presented as six strategic

components of the Implementation Plan, were discussed with the GOE and the private sector.

They are classified into the three main themes mentioned earlier.

A. Creating an Enabling Environment for Regional Integration2

1. Design and Implement a Mutual Recognition/Harmonization framework of gradually

expanding scope and country coverage (Strategic Component I)

B. Creating the Market Infrastructure and Regionally Focused Products and

Intermediaries 1. Implement an Exchange Alliance framework to facilitate cross-border trades with local

brokers initially; and strengthen and harmonize exchange governance, listing rules and

corporate governance framework (Strategic Component II).

1 These works are beyond the scope of ACMF. 2 To create an enabling environment, restriction on capital flow should also be gradually liberalized along with the reform of

tax system in order to facilitate cross-border transactions. However, these issues are beyond the scope of ACMF, therefore,

relevant authorities and working committees should further assess to develop and put in place the necessary action plans.

Endorsed at the 13th

AFMM

7

2. Promote new products and regionally active intermediaries to build awareness of

ASEAN as an asset class (Strategic Component III).

3. Reinforce and expedite implementation of ongoing strategies and initiatives to

strengthen and integrate bond markets (Strategic Component IV).

C. Strengthening the Implementation Processes.

1. Refine the strategies for domestic capital market development in each ASEAN

country and incorporate measures and milestones that support regional integration

initiatives. (Strategic Component V)

2. Strengthen the ASEAN level working mechanisms in order to better coordinate

regional integration initiatives and monitor and support its implementation at the

country level. (Strategic Component VI)

6. Overview of the Components of the Implementation Plan

A. Creating the Preconditions

A. Develop a mutual recognition/harmonization framework, and expand the reach of

products, services, and countries covered by the framework over time.

The core strategy for regional integration is to develop a mutual recognition process with

gradually expanding scope and country coverage. Cross-border access to capital markets

within ASEAN is facilitated by relieving entrants to regional markets of the regulatory burden

of fully complying with more than one regulatory regime through mutual recognition or

harmonization. Such relief lowers costs, enhances competition, encourages product innovation

and increases investors’ access to the diversity of products and services available in the region.

The mutual recognition and harmonization framework for ASEAN covers the following four

areas of cross-border activities:

Facilitating cross-border fundraising activities

Facilitating cross-border distribution of products, such as those listed on ASEAN

exchanges, Islamic products and collective investment schemes (CIS)

Facilitating investments by investors in ASEAN

Facilitating market access by market intermediaries

Implementation actions for each of these areas are summarized in Figure 4.

Endorsed at the 13th

AFMM

8

Figure 4: Mutual Recognition (MR) and Harmonisation Framework

ASEAN Mutual Recognition Guidelines

In order to provide a coherent framework to coordinate the many and diverse strategic mutual

recognition and harmonization activities to foster integration, the ACMF will develop

ASEAN Mutual Recognition Guidelines. The Guidelines would provide broad principles to

govern and support the mutual recognition and harmonization programs and guide ACMF

members to identify and sequence initiatives for mutual recognition supported by

harmonization, and assist countries to determine their readiness to enter into such cross-border

arrangements. The initiatives should begin with products, services and activities that are

consistent with market preferences, likely to add most value to capital market development

within ASEAN and/ or are easy to implement. Taking regulatory action to facilitate cross-

border transactions is not sufficient to promote regional integration unless the action generates

increased private sector cross-border activities.

• Harmonize disclosure standards, align distribution rules and develop MR framework for primary offerings

• MR of market professionals involved in primary offerings

• Allow local intermediaries to distribute ASEAN listed products, with marketing support services

• MR of other market professionals ,e.g. involved in marketing

• MR framework for distribution of CIS

products

• Promote cross-border investments through local intermediaries

• Develop harmonized criteria for NRI

• Recognize ASEAN exchanges under host country rules

• Adopt a liberalization plan to allow NRI/RI to invest freely in ASEAN

• Develop MR framework for provision of products and services by market intermediaries to NRI

• Work toward single passport with home country approval

Facilitate cross-border fund raising

• Develop ASEAN MR Guidelines; Canvass leading market intermediaries in home markets to obtain views on the product and services likely to be marketed within ASEAN

• Regulatory mapping

• Compliance with relevant IOSCO Principles, ASEAN Peer review mechanism

• Clear and effective Communication Plan

• Strong investor protection regime

• Remedies / Dispute resolution mechanisms

• Bilateral / Multilateral MOU for enforcement and information sharing

Implementation Actions

Pre-requisites and Supporting Initiatives

Facilitate cross-border product distribution

Facilitate cross-border investments by

investors

Facilitate market access by

intermediaries

Endorsed at the 13th

AFMM

9

The following broad principles will be considered in formulating the Guidelines:

To set priorities for the mutual recognition and harmonization taking into account

―quick wins‖ and ―appropriate responses‖ to the current global crisis as well as market

preferences. Undertake sequenced cross-border initiatives for mutual recognition and

harmonization, based on consultations with market players.

To undertake mapping of regulatory rules in specific areas where mutual

recognition is being considered.

To work towards complying with IOSCO Principles relevant to the product,

service or activity to be offered cross-border. This would ensure regulatory

equivalence in entering the mutual recognition arrangements.

To clarify the responsibilities of the home regulator, and the host regulator in

administering a specific MR framework, including arrangements to disclose the

observance of relevant standards through peer review in order to demonstrate readiness

to join the framework.

To enable host regulator to rely on the laws of the home country to the greatest

extent possible to protect the interests of the local investors, protect the integrity of the

local markets and manage the systemic risk in host country.

To strengthen investor protection regime with adequate rights and remedies and

dispute resolution mechanism.

To continue strengthening bilateral (and multilateral) arrangements for regulatory

cooperation and information sharing.

Phased approach towards mutual recognition.

ACMF members recognize that an effective implementation plan for mutual recognition

must have clear prioritization. Therefore, the measures that have been identified for Phase 1

can generally be undertaken by ACMF members as part of their supervisory authority. Some

measures particularly those for Phase 2 and 3 would have an impact on the extent of financial

services liberalization and would need to have the input of authorities and fora to deal with

capital account and financial services liberalization.

Given the differing levels of capital market development and readiness amongst ASEAN

countries, the mutual recognition initiatives should be implemented bilaterally first and then

multilaterally as other countries become ready to join in. In addition, it is often easier to relax

restrictions on activities targeted at non-retail investors who may be more vigilant of their

rights and hence require less protection. Therefore, it may be practicable to enable cross-

border products and services to be made available first to non-retail investors (NRI) and

subsequently to retail investors (RI), complemented by an enhanced investor protection

regime. Key Milestones for Component I are contained in Appendix 1.

Endorsed at the 13th

AFMM

10

B. Creating the Market Infrastructure and Regionally Focused Products

and Intermediaries

B1. Implement the vision for the Exchange Alliance Framework. Strengthen and

harmonize exchange governance, listing rules and corporate governance framework.

Greater cooperation among ASEAN equity markets is desirable. Through collaboration,

exchanges in the region can achieve the following benefits:

a. Decrease the cost of operations and technology;

b. Facilitate broker access across exchanges, thus boosting liquidity;

c. Increase the value of the pool of listed companies, preventing flight to other markets

outside ASEAN.

The ASEAN Common Exchange Gateway (ACE) initiative of the regional exchanges to forge

alliances and provide trading links requires the exchanges to regulate cross-border trading on

their markets effectively. It is also important for securities regulators to collaborate more

closely to enable effective and timely regulation of cross-border transactions through

enhanced information sharing and regulatory coordination. In many aspects, the proposed

mutual recognition initiatives and their sequencing (under Strategic Component I) would

provide the foundation for the ACE initiative.

In response to emerging challenges, ASEAN exchanges have decided to build an alliance to

link their exchanges to promote liquidity through increased intra ASEAN trades. As they

dismantle barriers to trade and adopt international standards, they will attract more

international funds.

Key recommendations are summarized in figure 5 below, further elaborated in Attachment to

this report (under Strategic Component II).

Endorsed at the 13th

AFMM

11

Figure 5: Exchange Alliance Framework

In addition to these initiatives, continued strengthening of exchange governance, corporate

governance and accounting and auditing in line with international standards should remain on-

going priorities that support regional integration3. Key initiatives in this area are summarized

in figure 6 below, and further elaborated in Attachment to this report (under Strategic

Component II).

3 See Strategic Component II in the Attachment for proposed actions.

• Formulate Medium Term Vision

• Engage ASEAN Exchanges for overall governance and implementation of exchange alliances

• Setup ACE– electronic link for direct access by foreign brokers, as clients of local members

• ASEAN clearing houses act as central counterparty for cross-border trades.

• Form depository links for cross-border settlement and custody.

• Organize joint banking services, including forex and corporate actions, for economies of scale

• Set up an ASEAN Marketing Committee

• Develop comprehensive marketing plan including Investor education, marketing news and data dissemination etc.

• Act as catalyst to promote trading volume, help remove barriers to cross-border trade and promote regional products, regional intermediaries and star

companies.

Formulate Medium term Vision for ASEAN Exchanges

Implementation Actions

Build Infrastructure

Promote Cross-border Trading and Develop Regional Markets

Pre-requisites and Supporting Initiatives

• Allow distribution of listed products on ASEAN exchanges by local intermediaries and facilitate cross-border provision of marketing services

• MR regime for market professionals involved in marketing

• Recognize ASEAN exchanges under host country rules

• Information sharing among exchanges on market surveillance ACE, cross listed entities, and trading.

Endorsed at the 13th

AFMM

12

Figure 6: Strengthening Exchange and Corporate Governance

The incentives for the development of new products to foster regional integration are

influenced by the capital market development strategy and the specifics of the exchange

alliance framework. Technical cooperation among exchanges can facilitate development of

new products, help narrow developmental gaps of ASEAN markets and facilitate the design of

regionally-focused products. For example, ASEAN exchanges can take leadership in creating

interest rate futures contracts, with a view to an eventual linking of the exchanges and

contracts through a single Board and central clearing arrangements. Close collaboration

among exchanges and regulators would be critical to support the private sector in designing

and trading new products of regional appeal. Regulators and exchanges can facilitate the

efforts once the private sector has determined the commercial viability of ASEAN products.

Development of strong regionally-oriented intermediaries will be facilitated by the growth of

regionally-focused products and the expansion of mutual recognition arrangements. Investor

education and market promotion efforts by ASEAN exchanges would also be important.

In addition, the regulators can provide an enabling environment to foster growth of such

intermediaries through the creation of an enabling environment to support the establishment of

regionally oriented intermediaries. A list of implementation sections is summarized in figure 7

below and further elaborated in the Attachment.

• Complete demutualization of exchanges

• Map requirements in the listing rules, corporate governance and disclosure standards

• ASEAN exchanges endeavour to sign bilateral/multilateral MOU for cooperation and information sharing to facilitate exchange linkages

Complete demutualization

Implementation Actions

Coordinate listing rules and corporate governance

standards

Enhance information sharing and cooperation among

exchanges

• Compliance with relevant IOSCO Principles

• Regulatory mapping

• Effective communication between regulators, between regulators and exchanges and between exchanges

• Strong investor protection

Pre-requisites and Supporting Initiatives strengthening

B2. Promote new products and intermediaries to build awareness of ASEAN as an asset

class

Endorsed at the 13th

AFMM

13

Figure 7: Promote new Products and Regional Intermediaries

Key issues in bond markets development - such as improving liquidity, strengthening public

debt management, enhancing trading, clearing and settlement microstructures and streamlining

capital controls - have been addressed by several regional initiatives including the Asian Bond

Market Initiative (ABMI), which is an ASEAN+3 program, and initiatives from other fora

including EMEAP, WC-CMD of ASEAN. ACMF will draw on these initiatives in setting

priorities for further actions in bond market development and integration.

Bond markets differ fundamentally from equity markets in their trading arrangements and

have been primarily transacted over the counter (OTC). Regional integration of these markets

requires strong cooperation between the government as an issuer of debt, the central bank as

banking supervisor and watchdog for financial stability, the securities regulator and the

principal dealers that ensure market liquidity. Thus, initiatives undertaken by the exchanges-

such as a common gateway for equity transactions might have a limited applicability to bond

markets. While some exchanges list and trade bonds and their clearing and settlement

platforms can handle bond trading and clearing, the percentage of total turnover tends to be

very low. The experience of other regions also suggests that trying to promote debt market

development and integration modeled on equity market structures may have negative

implications for bond market fundamentals such as liquidity. The focus should be on ensuring

price transparency through disclosure and reporting; the reporting platform could well be the

Securities Exchange rather than an independent (e.g. Central Bank-run) platform.

• Form private sector led task force to develop and promote new regional product development including ETFs, securitization products, index futures and other hedging products to brand ASEAN as an asset class.

• Create an enabling environment to support growth and consolidation of regionally oriented intermediaries..

Promote new regional products

Implementation Actions

Promote Regionally Focused Market Intermediaries

Pre-requisites and Supporting Initiatives

• Strengthening and harmonization of mergers and acquisitions framework.

• Facilitate cross-border investments by investors (Strategic Component I)

• Mutual recognition of product offerings (e,g, Islamic Products)

B3. Reinforce implementation of the on-going strategies and initiatives to strengthen and

integrate regional bond markets.

Endorsed at the 13th

AFMM

14

Nevertheless, the ASEAN regulators have an important role to play in several areas of bond

market integration, primarily in ensuring mutual recognition of offering documents, improving

post-trade transparency as an element of investor protection, in fast-tracking new products that

are commercially viable and also in encouraging regional integration of the clearing and

trading infrastructure. ASEAN regulators should also look at moving some derivatives and

their clearing onto exchange platforms and fundamentally reassess the more complex and

opaque derivatives that gave rise to recent credit market problems. ASEAN regulators should

encourage ratings comparability in the region, or a national ratings scale that can be compared

across countries. Strategic Component IV of the Attachment presents a detailed list of

Implementation Actions, and are summarized below in Figure 8.

Figure 8: Strengthen Bond Market Development and Integration

• ACMF to initiate dialogue with other regional groupings to agree on priorities

• Establish mechanisms to address roadblocks in bond issuance and investments on a regional basis.

• Facilitate cross-border trading, settlement and information linkages.

• Formulate regional strategy for ratings comparability.

• Set disclosure standards for Central Trade Reporting System (CTRS)

• Create ASEAN pool of market-makers in debt instruments.

Review On-going Bond Market Initiative

Implementation Actions

Build and Link Infrastructure and Promote Market Liquidity

Pre-requisites and Supporting Initiatives

• Capital Market Development Plans to incorporate goals of integration of bond markets

• Progress toward MR of primary offerings of debt securities and related harmonization of offering rules.

• Enhance tax structure

• Regional cooperation in Islamic product structures and development.

Endorsed at the 13th

AFMM

15

Significant differences in the levels of development of domestic capital markets in ASEAN

countries hinder the pace of integration. Efforts are still needed to build consensus in the

region on the benefits of financial markets integration and to ensure that actions taken at the

national level are consistent with that goal. Such efforts could include the following: 1) close

monitoring of developments in regional financial integration and analysis of the related costs

and benefits. This would illustrate the value of integration for the private sector and help

monitor the effectiveness of policies to foster integration; 2) strengthened efforts to take into

account regional integration objectives and policies, such as mutual recognition and regulatory

harmonization into capital market development strategies. The initiatives and actions along

these national lines are summarized in figure 9 below and spelled out in the Implementation

Plan.

Figure 9: Domestic Capital Markets Development Plans

At an informal meeting in Dubai on October 7, 2008, the ASEAN Finance Ministers approved

a proposal to strengthen the capacity of the ASEAN Secretariat (ASEC) to undertake both

macroeconomic surveillance as well as managing the implementation and coordination of the

financial integration process. This would involve establishing a standalone unit in the ASEC,

comprising a Macroeconomic Surveillance Division and a Financial Integration Division, both

supported by full-time staff.

Draw lessons from financial crisis to

strengthen domestic financial sector and better

prepare for capital market integration

Align domestic capital market development

plans with the mutual recognition and

harmonization initiatives

• Engage with market participants

measures to ensure financial sector

stability as capital market integration

progresses and draw lessons from the

financial crisis.

Review and speed up domestic capital development plans to facilitate integration

Implementation Actions

Identify appropriate risk management measures to mitigate risks associated from

increased cross border activities

C2. Reinforce and better coordinate ASEAN working processes: An update on ASEAN

processes, and the need for new initiatives

C. Strengthening the Implementation

C1. Enhance the Scope of Domestic Capital Market Development Plans in order to help

implement regional integration initiatives

Endorsed at the 13th

AFMM

16

In order for the proposed Financial Integration Division (FID) of ASEC to be effective in

driving and coordinating the processes towards capital market integration, it is important that

ASEC has the appropriate capacity to undertake this role. It is proposed that a dedicated team

for capital market integration be established in the FID. The role of the dedicated team would

include (i) developing a Consolidated Action Plan to serve as a central reference for

sequencing, reprioritizing and monitoring the strategic initiatives under the Implementation

Plan, (ii) streamlining the Implementation Pan with the various committees under ASEAN,

and (iii) monitoring and reporting of the progress of the initiatives under the Implementation.

The ACMF members will support the dedicated team in the FID by having designated contact

person. The role of ASEC in assisting the financial integration process is depicted below; the

proposed structure of the new unit in ASEC appears in Appendix 2.

The above initiatives and the associated actions are summarized in Figure 10.

Figure 10: Strengthening the ASEAN Implementation and Coordination Process

through the ASEAN Secretariat

• Establish dedicated resources at the ASEAN Secretariat, with supporting dedicated contact persons from each ACMF member

• Develop and agree on the Terms of Reference (TOR) for capital market integration team in the FID including developing a consolidated action plan, streamlining of the existing ASEAN working committees and task forces, and report progress or raise issue to stakeholders on a regular basis.

ASEAN Secretariat coordinates and works with relevant Working Committees and other related parties to facilitate the implementation of recommendations that are beyond the

scope of ACMF

Implementation Actions

Establish dedicated team at ASEC for capital market integration

Facilitate implementation of recommendations that are beyond the scope of ACMF

Endorsed at the 13th

AFMM

17

Appendix 1

Key milestones for the mutual recognition and harmonization framework

i) Facilitating cross-border fund raising and M&A activities

ACMF members adopt the ASEAN and Plus Standards (for disclosure of primary cross-

border offerings of equity and debt securities) into their respective regulatory framework,

and commit to work towards phasing out the non-core Plus standards to facilitate

alignment of ASEAN standards over time.

The ACMF adopts a mutual recognition framework for market professionals involved in

the primary offerings, such as the advisor, valuers, underwriter etc.

The ACMF aligns other distribution rules and adopts a comprehensive mutual recognition

framework for primary offerings.

ii) Facilitating cross-border distribution of products, including listed products, Islamic products

and CIS

The ACMF allows local intermediaries to distribute ASEAN-listed products to NRI,

facilitates the cross-border provision of marketing services when such marketing

professionals are part of the local intermediary team.

The ACMF adopts a mutual recognition framework for cross-border offers of CIS within

ASEAN to NRI, and commits to move into APRC expedited-entry framework for CIS

products.

iii) Facilitating investments by investors in ASEAN

The ACMF adopts and harmonizes policies towards licensing, branching and consolidation

of regionally active market intermediaries.

Adopt harmonized definitions / criteria of what constitutes NRI

Adopt a liberalization plan, to gradually remove restrictions on cross-border investments to

facilitate NRI (and eventually RI) to invest freely within ASEAN.

iv) Facilitating market access by market intermediaries

Adopt an MR framework to facilitate cross-border provision of products and services by

market intermediaries with the view towards a single passport regime, with home country

approval.

Endorsed at the 13th

AFMM

18

Appendix 2

The Proposed Structure of Financial Services Directorate

ASEC in its Proposal Paper to the AFMM in Dubai in October 2008 suggested the following

organization structure for its new standalone unit, comprising a Financial Integration Division

and Macroeconomic Surveillance Division as in Chart 1 below.

Chart 1: Proposed Structure of Financial Services Directorate

Notes:

Existing Positions of ASEC

Proposed New Positions

ADR = Assistant Director

SO = Senior Officer

TO = Technical Officer

TA = Technical Assistant

Source: ASEAN Secretariat

ASEAN Secretariat New Standalone Unit

(Chief Economist/Director)

Macroeconomic

Surveillance Division

Macro economist 1

(ADR)

Macro economist 3

(SO)

Economic Analyst (TO)

Macro economist 2

(ADR)

Macro economist 4

(SO)

Economic Analyst (TO)

Financial Integration

Division

Senior Officer 2 (SO)

Technical Officer 2 (TO)

Technical

Assistant 2 (TA)

Senior Officer 1 (SO)

Technical

Officer 1 (TO)

Technical Assistant 1 (TA)

Endorsed at the 13th

AFMM

19

Attachment:

Implementation Plan for Regional Integration of

Capital Markets in ASEAN

Endorsed at the 13th

AFMM

20

STRATEGIC

INITIATIVES

Implementation Plan

PHASE I

2009-2010

PHASE II

2011-2012

PHASE III

2013-2015

Component I: Implement a mutual recognition framework while continuing to strengthen and

harmonize national laws, regulations and supervision practices within ASEAN countries in line with

global standards. 1. Develop a mutual

recognition

framework and

guidelines for cross-

border recognition

initiatives

a. ACMF develops

ASEAN Mutual

Recognition Guidelines

as a foundation for

facilitating cross-border

activities

Continue----

(Periodically review

and modify the ASEAN

MR guidelines based on

experience)

2. Develop a list of

sequenced cross-

border initiatives on

MR and

harmonization

a. Formulate a clear and

effective

communication plan for

all stakeholders to build

consensus on the

benefits and objectives

of the ASEAN Capital

Market Integration and

the scope of the

Implementation Plan.

b. ACMF members

canvass leading market

intermediaries in their

home countries to

obtain views on the

demand for cross border

products and services

and identify a list of

sequenced initiatives for

cross-border

recognition. c. ACMF undertakes

mapping of regulatory

requirements in areas

where mutual

recognition is being

considered. d. ACMF members

identify regulatory

barriers to be relaxed or

removed to facilitate

cross-border

transactions. e. ACMF members

review and amend

legislation as required

to support mutual

recognition and

harmonization.

a. Where required,

ACMF members, with

the support from

ASEAN Secretariat,

undergo an independent

assessment of

observance of agreed

international standards,

and to make the results

of the assessments

transparent.

Continue----

Continue ----

Continue -----

Continue----

Endorsed at the 13th

AFMM

21

3. Facilitate cross-

border distribution of

primary offerings of

equity and debt

securities and listed

products, within

ASEAN.

3.1 Implement ASEAN

and Plus Standards

through the adoption

of these standards into

ACMF members’

respective regulatory

frameworks, with a

view to eventually

adopting harmonized

ASEAN disclosure

standards for primary

offerings of securities.

a. ACMF members

adopt and

operationalize the

ASEAN and Plus

standards into

respective regulatory

frameworks, and where

necessary, take steps to

amend/revise domestic

laws to permit the use

of these Standards for

cross-border primary

offerings.

b. ACMF monitors the

progress of member

countries in their efforts

to adopt the ASEAN

and Plus Standards, and

the easing of Plus

Standards to facilitate

the development of

ASEAN Disclosure

Standards.

a. ACMF members

phase out country

specific Plus Standards.

a. ACMF adopts

harmonized ASEAN

disclosure standards for

primary offerings.

3.2 Broadly harmonize

other regulatory

requirements to

support cross-border

primary offerings

a. ACMF members map

language and governing

law requirements for

primary offers of

securities and agree for

cross border offer

documents to non-retail

investors be governed

by the law of the

ASEAN issuer’s

country of incorporation

and presented in a

common language. b. ACMF develops

communication

mechanisms between

member countries

during prospectus

submission, review and

registration for cross-

border offerings.

ACMF ensures that

a. ACMF develops

mutual recognition

framework for primary

offerings, and

procedures for entering

into mutual recognition

arrangements.

b. Where necessary,

ACMF members take

steps to amend/revise

domestic laws to permit

cross border offers

under the mutual

recognition framework

for primary offerings.

a. ACMF members

establish bilateral and

eventually multilateral

mutual recognition

arrangements for cross

border primary

offerings.

Continue------

Endorsed at the 13th

AFMM

22

information to all

investors contain the

same information and is

distributed at the same

time. ACMF works

towards more closely

harmonized distribution

timelines. c. BCLMV countries

are encouraged to report

progress in capital

market development

initiatives to ACMF

periodically. d. ACMF facilitates

requests for assistance

in enforcement and

exchange of

information between

member countries.

Continue------

Continue------

3.3 Develop mutual

recognition of market

professionals involved

in cross-border

offerings such as

sponsors, financial

advisors, credit rating

agencies

a. ACMF identifies

types of market

professionals involved

in cross-border

offerings, and map the

current

licensing/registration

regime.

b. ACMF develops

framework for mutual

recognition of market

professionals involved

in cross-border

offerings and

procedures for entering

into mutual recognition

arrangements.

a. ACMF members

establish bilateral and

eventually multilateral

mutual recognition

arrangements of market

professionals involved

in cross-border primary

offerings.

Endorsed at the 13th

AFMM

23

4. Facilitate cross-

border distribution of

products

4.1 Allow distribution

of listed products on

ASEAN exchanges by

local intermediaries

a. ACMF members

allow distribution of

listed products on

ASEAN exchanges by

local intermediaries

particularly to the non-

retail investors.

b. ACMF members

facilitate the cross-

border provision of

supporting marketing

services by exempting

capital market

professionals from local

authorization

requirements when such

professionals are part of

the local

marketing/intermediary