Emma article pg1

-

Upload

emma-schuback -

Category

Documents

-

view

84 -

download

0

Transcript of Emma article pg1

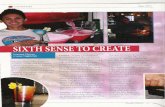

FEATURE INVESTOR PROFILE

urrently sitting on eight properties, worth almost $4 million, with plans for another purchase in September 2013, Emma Schuback has made some

fast but steady progress on her portfolio. She may not be your average investor, with properties spanning from mining towns to the United States, but she is undoubtedly successful, with $104,000 in positive cash flow per annum after expenses.

“It … gives us the flexibility to be generous

34 www.spionline.com.au NOVEMBER 2012

Generating cash flow in excess of $100,000 a year can seem like a difficult task. However, Emma Schuback, who has been buying properties since 2010, has achieved this and is ready for more. She tells Jennifer Duke how she got there

backwards from there,” she explains, advocating a measured, logical approach.

In fact, the biggest hurdle for Emma wasn’t the enormity of her aim, nor the sacrifices she may have to make to save the money to put down on the properties initially.

It was having faith in herself and her plan.“I kept telling myself I wasn’t educated enough

but I’d been to all these seminars and was doing what I needed to in terms of due diligence … so once I got started I couldn’t stop!”

with holidays and travel and see the world,” Emma says. “My dad gave me and my family that great gift when I was young and I love seeing how happy my son, Ryan, is seeing new places. He’s been in helicopters over volcanoes and swum with spinner dolphins.”

However, this achievement wasn’t realised without some serious hard work, with her number one piece of advice being to not go in half-heartedly and “just randomly buying properties. Think about where you want to end up and work

$100KCASHFLOWPER YEAR... AFTER EXPENSES