EconS 305 - Oligopoly - Part 1

Transcript of EconS 305 - Oligopoly - Part 1

EconS 305 - Oligopoly - Part 1

Eric Dunaway

Washington State University

November 19, 2015

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 1 / 32

Introduction

We are now ready to use some of the concepts that we learned duringGame Theory and apply them to our previous models.

Today, we are going to look at situations in which two �rms withmarket power compete against one another.

What will happen to the equilibrium?Does the type of competition matter?

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 2 / 32

Oligopoly

Recall the assumptions of the perfectly competitive model:

Free Entry and ExitPrice TakingHomogenous ProductsPerfect Information

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 3 / 32

Oligopoly

In oligopoly (Like monopoly, but with two or more �rms wieldingmarket power), the assumptions we will be using change into thefollowing:

Some barriers to EntryMarket PowerHomogenous ProductsPerfect Information

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 4 / 32

Oligopoly

Before, in monopoly, we had just a single �rm picking a quantity thatled to a market price.

Now, we have multiple �rms selling an identical product and all oftheir quantities a¤ect the market price.

If one �rm produces a lot, it can hurt all of the other �rms.

We are going to look at several types of competition between �rms,but before we get going, let�s establish a base case.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 5 / 32

Cartel Pricing

We have talked about cartels before.

A cartel is where several �rms work together to �x a price higher thanthe perfectly competitive price.

A cartel can maximize the total pro�t for all of the �rms.

Basically, all of the �rms will charge the same price as if they were amonopolist, and they achieve this by dividing up the monopoly quantityevenly among themselves.Let�s look at an example.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 6 / 32

Cartel Pricing

Consider a situation where two identical �rms (a duopoly, we willmostly be focusing on these) coexisting in a market decide to form acartel. They face the inverse demand curve

p = 70� q1 � q2

where q1 denotes the quantity produced by �rm 1 and q2 denotes thequantity produced by �rm 2. Both �rms face a constant marginalcost of MC = 10.

For simplicity, I could (in the cartel case) make a substitution ofQ = q1 + q2 where Q represents the market quantity. This worksbecause the �rms are working together. The inverse demand functionbecomes

p = 70�Q

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 7 / 32

Cartel Pricing

From here, we follow the same steps as under monopoly. First, weneed the marginal revenue, which comes from applying the power ruleto the total revenue.

TR = pQ = (70�Q)Q = 70Q �Q2

MR = 70� 2Q

Next, we set marginal revenue equal to marginal cost,

MR = MC

70� 2Q = 10

2Q = 60

Q� = 30

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 8 / 32

Cartel Pricing

Plugging it back in to the inverse demand function, we get the marketprice,

p� = 70�Q� = 70� 30 = 40From here, we know that the total market output is equal toQ� = 30. Since we have two �rms, they each take an equal share ofthat output, and hence

q�1 = q�2 =

Q�

2= 15

This leads to total revenue and total cost for each individual �rm(They will be the same since the �rms are identical) of

TR1 = pq�1 = 40(15) = 600

TC1 = 10q�1 = 10(15) = 150

and pro�ts of

π�1 = TR1 � TC1 = 600� 150 = 450Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 9 / 32

Cartel Pricing

Pricing as a cartel yields the highest total pro�ts for the �rms.

The key is that we are looking at the joint pro�ts of the �rms, notindividual pro�ts.Perhaps there is a way for an individual �rm to do better at theexpense of the other �rm?

Of course there is.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 10 / 32

Cartel Pricing

Why don�t we see many cartels today?

Why? Because they are self destructive.They�re also illegal in most countries.

There are too many incentives for individual �rms in a cartel to cheatand take more of the market pro�ts for themselves at the expense oftheir partners.

In a more advanced game theory course, we could look at the level of"patience" a �rm must have to sustain cooperation within a cartel.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 11 / 32

Cartel Pricing

Why does OPEC survive?

Recall OPEC (The Organization of Petroleum Exporting Countries)acts as a cartel for crude oil throughout the world.

They survive because of Saudi Arabia.

Basically, Saudi Arabia has implemented what is known as a GrimTrigger Strategy. If any member of OPEC cheats, Saudi Arabia willrespond by �ooding the market with cheap oil, destroying the pro�tsfor all the cartel members.Saudi Arabia can do this because they get their oil extremely cheaply,and they have a ridiculous amount of cash on hand (a war chest).The cheap oil prices in the last year may be the result of Saudi Arabiapunishing some OPEC members (There are several other plausiblereasons, too).

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 12 / 32

Bertrand vs Cournot

In the 19th century, two economists proposed alternate ways for �rmsto compete.

Louis Bertrand proposed that �rms compete by setting prices.Antoine Cournot proposed that �rms compete by setting quantities.They hated each other academically.

We will analyze Bertrand competition today, and Cournotcompetition next time.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 13 / 32

Bertrand Competition

As before, Bertrand Competition is where �rms compete in prices.

For simplicity, we will only consider the case where there are two �rms,a duopoly, and they sell identical products.

Each �rm chooses a price, and the �rm with the lowest price gets allof the customers.

This is a very important assumption.In the case of a tie, the �rms each get half of the customers.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 14 / 32

Bertrand Competition

We will use game theory to determine each �rm�s optimal price.

In this game, the �rms are the players, and their strategies are theprices they choose. They move simultaneously and their payo¤s aretheir respective pro�t levels.

Like we learned in the bargaining game, prices are continuous variables.

Let�s look at �rm 1�s best response function.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 15 / 32

Bertrand Competition

We can break up �rm 1�s best response function into three segments.

When �rm 2�s price is above the monopoly price.When �rm 2�s price is between the marginal cost and the monopolyprice.When �rm 2�s price is below the marginal cost.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 16 / 32

Bertrand Competition

p1

p2pMMC

pM

MC

p1 = p2

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 17 / 32

Bertrand Competition

The highest price that any �rm would want to charge is the monopolyprice.

This is the price that each �rm would charge if they were cooperatingin a cartel.This price gives the highest level of pro�ts if a single �rm has all thecustomers.

If �rm 2 were charging a price above the monopoly price (whichwould be dumb, but we need to cover all of our cases), �rm 1 wouldwant to respond by charging exactly the monopoly price.

They would get all of the customers and have the most pro�ts possible.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 18 / 32

Bertrand Competition

p1

p2pMMC

pM

MC

p1 = p2

BR1(p2)

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 19 / 32

Bertrand Competition

If �rm 2�s price is between the marginal cost and the monopoly price,�rm 1 has a few options:

It could charge a price higher than �rm 2�s and get no customers.It could charge a price equal to �rm 2�s and get half of the customers.It could charge a price lower than �rm 2�s and get all of the customers.

Optimally, �rm 1 would want to take the third option and get all ofthe customers. It also wants to charge the highest price possible tomaximize its pro�ts.

This means that �rm 1�s best response is to charge a price one unit(penny) lower than �rm 2�s price.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 20 / 32

Bertrand Competition

p1

p2pMMC

pM

MC

p1 = p2

BR1(p2)

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 21 / 32

Bertrand Competition

Lastly, if �rm 2�s price is below marginal cost, �rm 2 is actually losingpro�ts with every unit sold.

It would not be optimal to try and undercut them any further.

Firm 1�s best response would then be to charge a price equal tomarginal cost and accept zero pro�ts.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 22 / 32

Bertrand Competition

p1

p2pMMC

pM

MC

p1 = p2

BR1(p2)

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 23 / 32

Bertrand Competition

We can perform the same analysis to obtain �rm 2�s best responsefunction.

Since �rm 1 and �rm 2 are identical, we will �nd the exact same results.

Let�s plot �rm 2�s best response function.

Notice that I get this line by mirroring �rm 1�s best response functionacross the p1 = p2 line.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 24 / 32

Bertrand Competition

p1

p2pMMC

pM

MC

p1 = p2

BR2(p1)

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 25 / 32

Bertrand Competition

In order to �nd our equilibrium, we just need to �nd where the bestresponse functions intersect.

Intuitively, at this point the best responses for both �rms align andneither �rm has any incentive to deviate away from that price level.This will constitute a Nash Equilibrium.

To �nd this, we can plot the best response functions on top of oneanother.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 26 / 32

Bertrand Competition

p1

p2pMMC

pM

MC

p1 = p2

BR1(p2)

BR2(p1)

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 27 / 32

Bertrand Competition

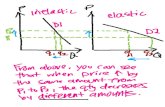

As we see in the �gure, the only Nash Equilibrium is where both �rmscharge

p1 = p2 = MC

This is exactly the same as the perfectly competitive price. This leadsboth �rms to receive zero economic pro�ts in equilibrium.

The consumers get it pretty good, though.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 28 / 32

Bertrand Competition

This equilibrium should make sense.

Firms will want to undercut one another until any furtherundercutting would result in negative pro�ts. This happens wherep = MC and pro�ts equal zero.

Next time, we�ll look at what happens when �rms compete inquantities.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 29 / 32

Summary

When �rms compete, they both have incentives to deviate from themonopoly price.

Bertrand competition leads to both �rms pricing at the perfectlycompetitive level.

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 30 / 32

Preview for Monday

Cournot Competition

Quiz 3

Have a great break!

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 31 / 32

Assignment 7-2 and 7-3 (1 of 1)

1. Consider a two �rm duopoly that faces an inverse demand curve of

p = 150� q1 � q2

and constant marginal costs of MC = 60.

a. If the �rms behave as a cartel, what are the equilibrium quantities, priceand pro�ts for each �rm? (Hint: They will be equal to one another)

b. If the �rms compete in prices (Bertrand competition), what are theequilibrium quantities, price and pro�ts for each �rm? (Hint: Alsoequal)

Eric Dunaway (WSU) EconS 305 - Lecture 31 November 19, 2015 32 / 32