EC208 – Introductory Econometrics. Topic: Spurious/Nonsense Regressions (as part of chapter on...

-

Upload

collin-roberts -

Category

Documents

-

view

216 -

download

0

description

Transcript of EC208 – Introductory Econometrics. Topic: Spurious/Nonsense Regressions (as part of chapter on...

EC208 – Introductory Econometrics

EC208 – Introductory Econometrics

• Topic: Spurious/Nonsense Regressions (as part of chapter on Dynamic Models)

EC208 – Introductory Econometrics

• Topic: Spurious/Nonsense Regressions (as part of chapter on Dynamic Models)

• Important topic: - highlights pitfalls of regression analysis - data mining - stresses the importance of careful

consideration of the statistical properties of economic time series

EC208 – Introductory Econometrics

• Topic: Spurious/Nonsense Regressions (as part of chapter on Dynamic Models)

• Important topic: - highlights pitfalls of regression analysis - data mining - stresses the importance of careful

consideration of the statistical properties of economic time series

• Presentation: 1) Motivate the problem empirically 2) Provide simple technical arguments

3) Corroborate with simulation-based example

4) Give practical reccomendations

EC208 – Introductory EconometricsSpurious Regressions

• Telecommunications demand as a function of…

EC208 – Introductory EconometricsSpurious Regressions

• Telecommunications demand as a function of… the price of beef !!!???

EC208 – Introductory EconometricsSpurious Regressions

• Telecommunications demand as a function of… the price of beef !!!???

• Argument: improved fit (R-squared)

EC208 – Introductory EconometricsSpurious Regressions

• Telecommunications demand as a function of… the price of beef !!!???

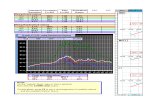

• Argument: improved fit (R-squared)• Another example: UK government

expenditures and Private Consumption in Burkina-Faso (annual data, 1954-1998), regression in logs

=============================================================Dependent Variable: Log(Gov)Method: Least Squares Sample: 1954 1998 Included observations: 45 ============================================================= Variable Coefficient Std. Error t-Statistic Prob.============================================================= C -10.0400 0.285481 -35.1687 0.0000 Log(Cons) 1.084797 0.023368 46.42229 0.0000 =============================================================R-squared 0.980437 Mean dependent var 3.142963 Adjusted R-squared 0.979982 S.D. dependent var 1.386575 S.E. of regression 0.196179 Akaike info criteri -0.376149 Sum squared resid 1.654911 Schwarz criterion -0.295853 Log likelihood 10.46336 F-statistic 2155.029 Durbin-Watson stat 0.377805 Prob(F-statistic) 0.000000 =============================================================

3

EC208 – Introductory EconometricsSpurious Regressions

1

2

3

4

5

6

55 60 65 70 75 80 85 90 95

LOG(GOV)

10

11

12

13

14

15

55 60 65 70 75 80 85 90 95

LOG(CONS)

- Both series display a trending pattern, as most macroeconomic time series do

1

2

3

4

5

6

55 60 65 70 75 80 85 90 95

LOG(GOV)

10

11

12

13

14

15

55 60 65 70 75 80 85 90 95

LOG(CONS)

- Both series display a trending pattern, as most macroeconomic time series do- What are the implications of this trending behaviour?

EC208 – Introductory EconometricsSpurious Regressions

• In a regression model is consistent if

ttt uxy

0

)()(

)()(

)()()ˆ(

111

111

1

tttt uxTxxT

uXTXXT

uXXXE

EC208 – Introductory EconometricsSpurious Regressions

• In a regression model is consistent if

• must be well-behaved, so that • “good behaviour” means that regressors must be stationary(and ergodic)

ttt uxy

0

)()(

)()(

)()()ˆ(

111

111

1

tttt uxTxxT

uXTXXT

uXXXE

XX QXXTp )lim( 1

EC208 – Introductory EconometricsSpurious Regressions

• Strict stationarity implies that the distribution of a process does not change with time

• Weak stationarity: first and second moments are constant through time

txxCovtxE

jjtt

t

,),(,)(

EC208 – Introductory EconometricsSpurious Regressions

• Strict stationarity implies that the distribution of a process does not change with time

• Weak stationarity: first and second moments are constant through time

• Simple example: white noise

txxCovtxE

jjtt

t

,),(,)(

0,

0,0),(0)(

2

j

jCovE

jtt

t

EC208 – Introductory EconometricsSpurious Regressions

• Strict stationarity implies that the distribution of a process does not change with time

• Weak stationarity: first and second moments are constant through time

• Simple example: white noise

• Many economic time series seem to be stationary after differencing:

txxCovtxE

jjtt

t

,),(,)(

0,

0,0),(0)(

2

j

jCovE

jtt

t

),0(,, 21 tttttt xxxx

EC208 – Introductory EconometricsSpurious Regressions

• Strict stationarity implies that the distribution of a process does not change with time

• Weak stationarity: first and second moments are constant through time

• Simple example: white noise

• Many economic time series seem to be stationary after differencing:

• This means that the series in levels is a random walk (or I(1) process):

txxCovtxE

jjtt

t

,),(,)(

0,

0,0),(0)(

2

j

jCovE

jtt

t

),0(,, 21 tttttt xxxx

ttt xx 1

EC208 – Introductory EconometricsSpurious Regressions

1

-25

-20

-15

-10

-5

0

5

10

1

Random walk with drift and with no drift

EC208 – Introductory EconometricsSpurious Regressions

• Random walks arise from theory (e.g., Hall, 1978) or empirically

• A random walk is a special case of an autoregression

• Running an autoregression for each series…1with ,1 ttt xx

=============================================================Dependent Variable: Log(Gov)Method: Least Squares Sample: 1954 1998 Included observations: 45 ============================================================= Variable Coefficient Std. Error t-Statistic Prob.============================================================= C 0.098612 0.022772 4.330323 0.0001LOG(GOV(-1)) 0.996638 0.006730 148.0875 0.0000=============================================================R-squared 0.998088 Mean dependent var 3.188173Adjusted R-squared 0.998041 S.D. dependent var 1.368644S.E. of regression 0.060547 Akaike info criterion -2.726413Sum squared resid 0.153968 Schwarz criterion -2.645313Log likelihood 61.98100 F-statistic 21929.91Durbin-Watson stat 0.618692 Prob(F-statistic) 0.000000=============================================================

3

EC208 – Introductory EconometricsSpurious Regressions

=============================================================Dependent Variable: Log(Cons)Method: Least Squares Sample: 1954 1998 Included observations: 45 ============================================================= Variable Coefficient Std. Error t-Statistic Prob.============================================================= C 0.050190 0.145684 0.344510 0.7322LOG(Cons(-1)) 1.003277 0.011974 83.79065 0.0000=============================================================R-squared 0.994053 Mean dependent var 12.19506Adjusted R-squared 0.993912 S.D. dependent var 1.247209S.E. of regression 0.097316 Akaike info criterion -1.777324Sum squared resid 0.397754 Schwarz criterion -1.696225Log likelihood 41.10113 F-statistic 7020.873Durbin-Watson stat 2.282059 Prob(F-statistic) 0.000000=============================================================

3

EC208 – Introductory EconometricsSpurious Regressions

EC208 – Introductory EconometricsSpurious Regressions

• However, random walks are not stationary!

EC208 – Introductory EconometricsSpurious Regressions

• However, random walks are not stationary!- consider - substituting back, we get - substituting recursively, we get

121 ttt xx 122 tttt xx

tt txx 0

EC208 – Introductory EconometricsSpurious Regressions

• However, random walks are not stationary!- consider - substituting back, we get - substituting recursively, we get

• The process has a deterministic trend component, , and a stochastic trend

121 ttt xx 122 tttt xx

tt txx 0

t t

EC208 – Introductory EconometricsSpurious Regressions

• However, random walks are not stationary!- consider - substituting back, we get - substituting recursively, we get

• The process has a deterministic trend component, , and a stochastic trend

• Shocks have permanent effects, long memory process

121 ttt xx 122 tttt xx

tt txx 0

t t

EC208 – Introductory EconometricsSpurious Regressions

• However, random walks are not stationary!- consider - substituting back, we get - substituting recursively, we get

• The process has a deterministic trend component, , and a stochastic trend

• Shocks have permanent effects, long memory process• Taking expectations, we have

121 ttt xx 122 tttt xx

tt txx 0

t t

txtxExE tt 00 )()(

EC208 – Introductory EconometricsSpurious Regressions

• However, random walks are not stationary!- consider - substituting back, we get - substituting recursively, we get

• The process has a deterministic trend component, , and a stochastic trend

• Shocks have permanent effects, long memory process• Taking expectations, we have • Calculating the variance

121 ttt xx 122 tttt xx

tt txx 0

t t

txtxExE tt 00 )()(

2

21

0

)...(

)(

)()(

t

V

V

txVxV

t

t

tt

EC208 – Introductory EconometricsSpurious Regressions

• Mean and variance vary with time! Random walks are non-stationary processes

EC208 – Introductory EconometricsSpurious Regressions

• Mean and variance vary with time! Random walks are non-stationary processes

• Back to OLS: non-stationary regressors means that

does not converge to a finite matrix)lim( 1 XXTp

EC208 – Introductory EconometricsSpurious Regressions

• Mean and variance vary with time! Random walks are non-stationary processes

• Back to OLS: non-stationary regressors means that

does not converge to a finite matrix• Hence, OLS is not consistent• Nor asymptotically normal

)lim( 1 XXTp

EC208 – Introductory EconometricsSpurious Regressions

• Simple Monte Carlo experiment(Monte Carlo corresponds to a lab experiment in

Econometrics…)- Generate n.i.d. variables - Construct independent random walks (no drift)

- Regress - Compute - Repeat the process 10 000 times

)1,0.(.. dint

0, 010 yyy tt

0, 020 xxx tt

ttt uxy 10 statisticDWratios,-t,,ˆ 2

1 R

T t-ratio rejection frequency (5%)

50 0.7448 0.3063100 0.8249 0.5404250 0.8883 0.7229500 0.9239 0.8115

1000 0.9425 0.8672

DWR 2

- Conventional t-tests reject the null of no relationship more often than it should (sample size worsens the problem)- R-squared converges to a non-degenerate distribution- DW statistic converges to 0- This suggests informal way of recognizing spurious regressions- This experiment closely follows Granger & Newbold (1974), whose results were later confirmed analitically by Phillips (1986)

EC208 – Introductory EconometricsSpurious Regressions

• Practical implications• Standard inference does not apply• Importance of distinguishing between I(0) and I(1) • What should we do to avoid nonsense regressions

- regressions in differences: non-stationarity solved, but long run information (in levels) is lost

- Cointegration: some economic variables share a common stochastic trend, implying a long run relationship (regression in levels makes sense, under certain conditions)

ttt uxy

EC208 – Introductory EconometricsSpurious Regressions

• Students were introduced to new concepts:- Spurious/Nonsense regressions- stationary time series- Random walks/I(1) processes- Monte Carlo simulation- Hints for cointegration

• While making use of acquired ideas:- Regression/Large sample properties of OLS- Hypothesis testing- Fit of a regression- Autocorrelation (testing for…)- Dynamic modelling

EC208 – Introductory EconometricsSpurious Regressions

The End