e0a05Module 2 - Risk and Return

-

Upload

siddharath-singh -

Category

Documents

-

view

218 -

download

0

Transcript of e0a05Module 2 - Risk and Return

-

8/2/2019 e0a05Module 2 - Risk and Return

1/27

Amity Business School

Amity Business SchoolMBA Class of 2013, Semester II

FINANCIAL MANAGEMENTModule II

BHAVNA RANJAN1

-

8/2/2019 e0a05Module 2 - Risk and Return

2/27

Amity Business School

Module II: Valuation Concepts

Time Value of Money,

Risk and Return,

Financial and Operating Leverage.

2

-

8/2/2019 e0a05Module 2 - Risk and Return

3/27

Amity Business School

RISK AND RETURN

While taking any financing decisions regarding investmentand financing, the finance manager has to achieve a right

balance between risk and return.

3

-

8/2/2019 e0a05Module 2 - Risk and Return

4/27

Amity Business School

CONCEPT OF RETURN

The objective of any investor is to maximize expected returns

from the investments.

Returns may be

- Realized return- Expected return

COMPONENTS OF RETURN

-Yield - The periodic cash receipts or income on the investmentin the form of interest and dividends

-Capital Gain Appreciation (depreciation) in the price of the

asset. It is the difference between the purchase price and the

price at which asset can be sold.4

-

8/2/2019 e0a05Module 2 - Risk and Return

5/27

Amity Business School

RETURN OF A SINGLE ASSET - MEASURING

RATE OF RETURN

The rate of return on an asset / investment for a given period

is the annual income received plus change in market price.

k = Dt + (Pt Pt-1)

Pt-1Where k = Rate of return

Dt = Income or cash flows receivable from the securityPt = Price of the security at the end of the holding

period

Pt-1 = Price at the beginning of the holding period

5

-

8/2/2019 e0a05Module 2 - Risk and Return

6/27

Amity Business School

Illustration

a) If a share of ACC is purchased for Rs 3580 on January 10 last

year, and sold on January 11 of this year at Rs 3700 and the

company paid a dividend of Rs 35 for the year, calculate rate of

return

a) If a 14% Rs 1000 ICICI debenture was purchased for Rs 1350and the price of this security rises to Rs 1500 by the end of a

year, calculate rate of return on the debenture.

6

-

8/2/2019 e0a05Module 2 - Risk and Return

7/27

Amity Business School

PROBABILITIES AND RATES OF RETURN

The expected Rate of Return is the weighted average of all

possible returns multiplied by their respective probabilities.

7

-

8/2/2019 e0a05Module 2 - Risk and Return

8/27

Amity Business School

Illustration

Rate of Return

State of the

Economy

Probability of

economy

Bharat

Foods

Oriental

Shipping

Boom 0.30 16 40

Normal 0.50 11 10

Recession 0.20 6 -20

Calculate Expected Rate of Return

-

8/2/2019 e0a05Module 2 - Risk and Return

9/27

Amity Business School

RISK

Risk can be defined as the variability of actual return from the

expected return associated with the given asset/ investment.

The greater the variability, greater is the risk.

9

-

8/2/2019 e0a05Module 2 - Risk and Return

10/27

Amity Business School

MEASUREMENT OF RISK

The risk associated with a single asset is assessed from both

behavioral and quantitative/ statistical point of view.

Behavioral view of risk can be obtained by using

- Sensitivity analysis

- Probability (distribution)

Quantitative/ Statistical measures of risk of an asset are:

- Standard Deviation

- Coefficient of Variation: measure of risk per unit of expected

return. S.D/ Expected return10

-

8/2/2019 e0a05Module 2 - Risk and Return

11/27

Amity Business School

Question

Vineet invested in equity shares of Wipro Ltd., its anticipated

returns and associated probabilities are given below:

You are required to calculate the expected rate of return and

risk in terms of standard deviation.

11

Return (%) 12 15 18 20 24 26 30

Probability 0.05 0.10 0.24 0.26 0.18 0.12 0.05

-

8/2/2019 e0a05Module 2 - Risk and Return

12/27

Amity Business School

RISK AND RETURN OF PORTFOLIO

A Portfolio means a combination of two or more securities

(assets)

12

-

8/2/2019 e0a05Module 2 - Risk and Return

13/27

Amity Business School

EXPECTED RETURN OF A PORTFOLIO

The expected return on a portfolio is the weighted average of

the expected rates of return on assets comprising the portfolio.

E(rp)= w E (rt)

E(rp) Expected return from portfolio

w = Proportion invested in asset

E (rt) = Expected return from asset t

13

-

8/2/2019 e0a05Module 2 - Risk and Return

14/27

Amity Business School

EXPECTED RETURN OF A PORTFOLIO

Suppose the expected return on two assets, L (low risk low

return) and H (High risk high return) are 12 and 16 percent

respectively. If the corresponding weights are 0.65 and 0.35,

what is the expected portfolio return

14

-

8/2/2019 e0a05Module 2 - Risk and Return

15/27

Amity Business School

Question

Mr. Sharmas portfolio consists of six securities. The individual

returns of the security in the portfolio are given below:

Calculate the weighted average return of the securities

consisting the portfolio.

15

Security

Proportion of investment in the

portfolio ReturnWipro 10% 18%

Latham 25% 12%

SBI 8% 22%

ITC 30% 15%

RNL 12% 6%

DLF 15% 8%

-

8/2/2019 e0a05Module 2 - Risk and Return

16/27

Amity Business School

MEASUREMENT OF PORTFOLIO RISK

The total risk of a portfolio made up of two assets can be defined as:

s2p = (w1)2s21 + (w2)

2s22 + 2w1w2s1,2

or

s2p = (w1)2s21 + (w2)

2s22 + 2w1w2r1,2s1s2

Where s2p = Variance of returns of the portfolio

w1 = Fraction of total portfolio invested in asset 1

w2 = Fraction of total portfolio invested in asset 2

s21 = variance of asset 1

s1 =Standard Deviation of asset 1

s22 = variance of asset 2

s2 = Standard Deviation of asset 2

s1,2 = co-variance between returns of two assets

r1,2 = Coefficient of correlation between the two returns

16

-

8/2/2019 e0a05Module 2 - Risk and Return

17/27

Amity Business School

TYPES OF INVESTMENT RISK

Total Risk = Systematic Risk + Non- Systematic Risk

= Market Risk + Unique Risk

17

-

8/2/2019 e0a05Module 2 - Risk and Return

18/27

Amity Business School

SYSTEMATIC RISK/ MARKET RISK/ NON-

DIVERSIFIABLE RISKThe variability in a securitys total returns that is directly

associated with overall movements in the general market or

economy is called systematic risk(market risk).

The market risk of a stock represents that portion of its risk

which is attributable to economy wide factors like the growth

rate of GNP, inflation rate, money supply, credit policy. This

part of risk cannot be reduced through diversification.

18

-

8/2/2019 e0a05Module 2 - Risk and Return

19/27

Amity Business School

UNSYSTEMATIC RISK/ UNIQUE RISK/

DIVERSIFIABLE RISK

The variability in a securitys total returns not related to overall

market variability is called non-systematic risk.

The unique risk of a security represents that portion of its

total risk which stems from firm specific factors and not the

market as a whole. This can be reduced through diversification.

Ex: workers go on a strike, a formidable competitor enters the

market, change in consumer preferences etc.

19

-

8/2/2019 e0a05Module 2 - Risk and Return

20/27

Amity Business School

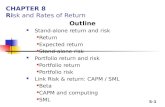

No of Stocks in Portfolio10 20 30 40 2,000+

Market Risk/ Systematic risk

Unique Risk / Unsystematic risk

Risk

RELATIONSHIP BETWEEN DIVERSIFICATION AND RISK

-

8/2/2019 e0a05Module 2 - Risk and Return

21/27

Amity Business School

1. MARKET RISK

The variability in a securitys return resulting from fluctuations in

the aggregate market is known as market risk.

All securities are exposed to market risks including recession,

changes in economy, law, inflation, Increase in GNP etc.

21

-

8/2/2019 e0a05Module 2 - Risk and Return

22/27

Amity Business School

2. INTEREST RATE RISK

The variability in a securitys return resulting from changes in

the level of interest rates is referred to as interest rate risk.

Such risks generally affect securities inversely, that is, otherthings being equal, security prices move inversely to interest

rates. For example, bond prices change in the opposite

direction.

22

-

8/2/2019 e0a05Module 2 - Risk and Return

23/27

Amity Business School

3. BUSINESS RISK

The risk of doing a business in a particular industry or

environment is called business risk.

As a holder of corporate securities, you are exposed to the riskof poor business performance. This may be due to variety of

factors like heightened competition, emergence of new

technology, management performance etc.

23

-

8/2/2019 e0a05Module 2 - Risk and Return

24/27

Amity Business School

4. FINANCIAL RISK

Financial risk arises when companies resort to financial leverage

or the use of debt financing. The more the company resorts to

debt financing, the greater is the financial risk.

24

-

8/2/2019 e0a05Module 2 - Risk and Return

25/27

Amity Business School

BETA

William Sharpe has suggested that the systematic risk can be

measured by beta. Beta can be viewed as an index of the

degree of the responsiveness of the securitys return with the

market return.

The sensitivity of a security to market movements is called beta.

Beta measures the risk of an individual asset relative to the

market portfolios return.

Beta measures the market risk The beta for the market portfolio

is 1. 25

-

8/2/2019 e0a05Module 2 - Risk and Return

26/27

Amity Business School

MEASUREMENT OF MARKET RISK -

CONCEPT OF BETAThe sensitivity of a security to market movements is called beta.

Beta measures the risk of an individual asset relative to the

market portfolios return

Beta can be measured by correlation / regression.

Beta measures the market risk The beta for the market portfolio

is 1.

26

-

8/2/2019 e0a05Module 2 - Risk and Return

27/27

Amity Business School

BETAExample 1: A security which has a beta of 1.5 experiences

greater fluctuation than the market portfolio. If return on

market portfolio is expected to increase by 10%, the return on

the security is expected to increase by 15% (1.5 x 10%)

Example 2 : A security with beta 0.8 fluctuates less than the

market portfolio. If the return on the market portfolio is

expected to rise by 10%, the return on the security with beta

0.8 is expected to rise by 8% (.08 x 10%)

27