Driving change in the European securities markets - PwC · Driving change in the European...

Transcript of Driving change in the European securities markets - PwC · Driving change in the European...

Helping you respond to market reform

Understanding MiFID IIDriving change in the European securities markets

www.pwc.com/mifid

The review of the Markets in Financial Instruments Directive (MiFID II) will impact investment firms and the overarching European securities markets structure fundamentally. In addition to upgrading the current regime for equities markets, MiFID II proposes to extend this revised regime to a far wider range of product classes, including over-the-counter (OTC) derivatives and fixed income products. It will have significant strategic repercussions for firms undertaking investment business in all securities markets.

The European Commission (EC) intends to put forward its proposed revisions to the overall MiFID framework in October 2011 with a view to it going live as soon as possible, perhaps, as soon as 2013 where the revisions respond to specific commitments to the G20. MiFID II is a focal point in a much wider overhaul of securities regulations, with specific links to the Regulation on OTC derivatives, central counterparties and trade repositories (EMIR) and the Regulation on short-selling and credit default swaps (Short-selling), as well as the review of the Market Abuse Directive (MAD), changes to the Transparency and Prospectus Directives, proposals for Central Securities Depositories (CSD), and amendments to the Securities Law

Directive (SLD). It also links directly to key regulatory changes in the asset management industry, including the amendments to the Undertakings for Collective Investment in Transferable Securities Directive (UCITS) and the Alternative Investment Fund Managers Directive (AIFMD) and the Packaged Retail Investment Products (PRIPs) initiative.

In this paper, we provide an overview of the EC’s MiFID II consultation paper, highlighting key objectives and specific proposals. We also look at the legislative process whereby these changes will be introduced identifying how firms can make sure their views or concerns are heard.

Introduction

2 Understanding MiFID II

Understanding MiFID II 3

The EC’s MiFID II consultation paper (published 8 December 2010) suggested sweeping changes to the regulation of European securities markets. Key goals for the new regime will be enhancing financial stability, improving market efficiency and competitiveness, and ensuring investor protection.

The new regime, as outlined in the consultation paper, will fundamentally change the way securities markets operate in the EU, particularly in relation to perceived shortcomings exposed during the financial crisis. The review also addresses market developments since MiFID’s implementation in 2007, notably the increased use of technology and its effect on trading practices.

The consultation paper has generated significant interest and debate, drawing over 4,200 responses from firms and industry bodies, some expressing significant concerns about the proposals. We suspect, however, that given the current political and regulatory agendas, the EC will push forward with the majority of the changes outlined in one way or another.

MiFID’s primary aims were to create a robust common regulatory framework

Overview of MiFID II

for Europe’s securities markets while promoting competition and enhancing investor protection. It focused mainly on the equities markets. MiFID II looks to combine these original aims with an overriding objective of mitigating the risk in financial systems as a whole - against the backdrop of commitments to the G20 - and ensuring market efficiency.

From a systemic risk perspective, the financial crisis also highlighted weaknesses in the European Union’s (EU) supervisory framework, leading to the creation of the European System of Financial Supervisors, including the European Systemic Risk Board and the European Supervisory Authorities (ESAs). A central mandate of the ESAs is to develop a ‘single rulebook’, while converging supervisory practices. With MiFID II, we expect the ongoing debate on the extent to which supervisory power in Europe should be centralised to continue. Clearly, though, the European Securities and Markets Authority (ESMA) will play a different role going forward than its predecessor, the Committee of European Securities Regulators.

4 Understanding MiFID II

Key proposals

The EC consultation paper on MiFID II poses 147 discussion points in eight sections aimed at strengthening the current EU regulatory framework. The main changes proposed are:

Market structureA key commitment to the G20 which has influenced the EC’s consideration of possible regulatory changes relating to market structures is that all systemically important financial institutions, markets and instruments should be subject to an appropriate degree of regulation and oversight (Declaration on Strengthening the Financial System, London, April 2009). The Financial Stability Board (FSB) has subsequently confirmed that financial market infrastructures should be considered systemically important.

The EC’s proposal was that all trading platforms - whether multilateral or bilateral, discretionary or non-discretionary - should be captured by the regime. It recognised, however, that the approach needs to be balanced by the ‘proportionality principle’ which is designed to reduce regulatory burdens for smaller operators and firms, thus lowering barriers to entry.

Another consideration was ensuring competitive equality between regulated markets and multilateral trading facilities (MTFs). The lighter regulatory regime introduced by MiFID for MTFs has led to competitive distortions which the EC believes need to be addressed.

The EC’s consultation paper also recognised that the systematic internaliser (SI) regime introduced by MiFID has not worked as intended. Only a limited number of firms have registered as SIs, raising questions as to the ongoing validity of this regime.

Finally, MiFID failed to take full account of market developments, particularly with regard to the increased use of technology. The upsurge in automated trading generally, and high frequency trading in particular, has significantly changed the way in which markets operate. This has simultaneously significantly reduced the size of transactions on ‘lit’ markets and encouraged significant growth of ‘dark’ markets (either dark pools of liquidity or dark orders), including ‘over-the-counter’ trading.

Key proposalsDefining ‘admission to trading’ as • the decision by the operator of a regulated market (RM), multilateral trading facility (MTF), or organised trading facility (OTF) to allow a financial instrument to be traded on its system

Introducing a broad definition of • an OTF which would include any facility or system operated by an investment firm not already regulated as a RM, an MTF or a systematic internaliser (SI)

Operating an OTF would equate to • providing an investment service and be subject to minimum governance and other requirements

Introducing a ‘sub-regime’ for • broker crossing networks which would include converting them to an MTF (or SI) once a certain threshold is crossed

Requiring that all ‘clearing • eligible’ and sufficiently liquid derivative contracts are traded on a RM, MTF or OTF in line with the G20 commitment

Providing a new, broad definition • of automated trading which will encompass algorithmic and high frequency trading, and ensuring that firms and markets using such systems have appropriate controls in place

Ensuring that SIs maintain • two-sided quotes, a minimum quote size and publish post-trade data monthly if exercising the post-trade exemption(s)

Ensuring organisational • requirements for MTFs comparable to those applied to RMs, and strengthening supervision of RMs, MTFs and OTFs

Introducing the possibility for any • RM or MTF to create specialised markets for small and medium sized enterprises (SMEs) using a simplified regime.

Understanding MiFID II 5

Pre- and post-trade transparencyMiFID focused primarily on enhancing transparency for shares admitted to trading on regulated markets whether or not traded on exchange, on MTFs or OTC. The financial crisis exposed the weaknesses in this limited approach and the EC is now looking to reinforce transparency for shares admitted to trading on regulated markets, and extend this revised regime to equity-like instruments and to shares admitted to trading solely on MTFs. It also wants to apply pre-trade transparency requirements to indications of interest (IOIs).

The EC also proposes revisiting the existing waivers to pre-trade transparency requirements. Its proposals closely reflect CESR recommendations in this regard. It aims to tighten availability of the waivers across the EU and to ensure their consistent application across Member States.

In addition to strengthening the regime for equities, the EC is also proposing to adopt pre- and post-transparency regimes for non-equities, tailored to each asset class.

Emphasising ‘real-time’ • publication of post-trade data, and reducing allowances for deferred publication

Applying pre- and post-trade • transparency obligations to ‘equity-like’ instruments including depositary receipts, exchange-traded funds, and certificates.

Non-equities

Introducing a pre- and post-trade • transparency regime for all non-equities and derivatives eligible for clearing tailored by asset class for all investment firms operating OTC, as well as RMs, MTFs and OTFs

Requiring investment firms • operating OTC to flag trades in post-trade transparency reports.

Data consolidationBy opening up both trading and data aggregation and dissemination to competition, MiFID led to data fragmentation and higher costs for investment firms. Inconsistency in data quality presented significant difficulties to comparison and aggregation.

The EC proposals focus on removing data fragmentation by prescribing data formats and formalising the channels for data dissemination, and reducing costs.

Key proposalsEquities

Extending existing pre- and • post-trade transparency requirements to shares admitted to trading on MTFs (and OTFs)

Modifying current pre-trade • waivers and ensuring consistent application by supervisors across the EU through ESMA monitoring

Capturing indications of interest • within pre-trade regime

‘Stubs’ no longer meeting large-in-• scale waiver thresholds should not remain ‘dark’; the reference price waiver would apply to gross price, not include embedded fees, and be subject to minimum order size

Key proposalsIntroducing a consolidated tape • for all share trades

Requiring post-trade reporting • through Approved Publication Arrangements (APAs): detail and content of post-trade reports to be clarified, as well as reporting responsibilities along the transaction chain

Reducing the cost of post-trade • data for investors by unbundling pre- and post-trade data.

Measures specific to commodity derivative marketsMiFID currently applies to all types of commodity derivatives that are regarded as financial instruments. However, given significant operating differences in commodity derivative markets, the EC believes that they require special consideration under MiFID II.

Again, the EC’s approach is influenced by the G20 commitments to ensure that all systemically important firms are adequately regulated and supervised and that all OTC derivatives which are sufficiently standardised (and eligible for clearing) are traded on recognised trading platforms. This is further compounded by growing concerns amongst the international community about the potential impact of speculation on price volatility particularly in energy and food markets.

A key aspect of the EC’s proposal is the revision of the existing exemptions for commodity firms from MiFID requirements. At this stage, the likely outcome is that more commodity derivative firms will be subject to the MiFID regime in the future. Another outcome is likely to be the introduction of requirements for position reporting, and perhaps associated position limits.

Key proposalsEnsuring complete powers for • regulators to manage and control positions more rigorously

Adopting a common framework • for all types of commodity derivative, as far as possible

Introducing appropriate • exemptions for non-financial market participants

Requiring that commodity • derivative contracts are designed to ensure convergence between future and spot prices

Revising current MiFID • exemptions relating to commodity firms.

Key proposalsAlign MiFID transaction reporting • requirements with requirements under MAD (and vice versa)

Extending reporting requirements • to financial instruments admitted to trading on MTFs and OTFs, and to any instruments which are correlated to and influence the price of financial instruments which are admitted to trading

Extending MiFID’s scope to • depositary receipts and to all commodity derivatives

Imposing transaction reporting • requirements directly on RMs, MTFs and OTFs when they offer access to firms not authorised as investment firms or credit institutions

Requiring RMs, MTFs and OTFs to • retain order data for 5 years

Imposing requirements for • transmission of order details along

Transaction ReportingTransaction reports are a key tool for supervisors to monitor the potential risks in the financial markets. MiFID required that transactions in all financial instruments admitted to trading on a regulated market should be reported to home country supervisor.

The EC’s proposals would significantly extend transaction reporting requirements in terms of the financial instruments covered, and clarify reporting responsibilities along the transaction chain. The EC intends to align the scope of the MiFID and MAD regimes in this regard.

The EC also intends revisiting the content of transaction reports and including a requirement to identify who is making the underlying investment decision, and perhaps the individual trader involved. It also intends to address current discrepancies between EU Member States in terms of when transactions need to be reported, and also in terms of the content of transaction reports.

the transaction chain, including identification of the person making the investment decision

Introducing a common EU • transaction report template

Enabling direct reporting by • investment firms to a reporting mechanism at EU level

Requiring supervisory approval of • all third parties reporting on behalf of investment firms (‘Approved Reporting Mechanisms’)

Waiving the MiFID reporting • obligations on an investment firm which has already reported an OTC contract to a trade repository or competent authority under EMIR: trade repositories under EMIR would be required to be approved ‘ARMs’ under MiFID.

6 Understanding MiFID II

Understanding MiFID II 7

Investor protectionInvestor confidence was significantly damaged by the financial crisis so the EC’s intention to revisit the investor protection measures in MiFID is not surprising. The EC proposals seek to extend the application of the MiFID investor protection regime to a wider scope of firms, financial products and services. They also focus on the quality of advice, information and services provided to the client, on the protection of client assets, and on requirements related to ‘best execution’ which, although outlined, were not thoroughly clarified in the original regime. The proposals will also include specific requirements related to Packaged Retail Investment Products (PRIPs), complementing a directive focusing on cross-sectoral issues relating to such products.

Key proposalsEnsuring investment firms which • are exempt from MiFID are subject to national regimes with ‘minimum’ requirements in certain areas: proper authorisation process, information to clients, suitability test, inducements, reporting to clients, and a duty to act in the best interests of the client when transmitting orders

Extending MiFID conduct of • business and conflict of interest requirements to structured deposits (advised and non-advised sales), to direct sales of own shares by investment firms and to situations where an investment firm acts on behalf of both the issuer and the investor

Strengthening requirements • around ‘execution-only’ trading by better defining complex and non-complex products, or eliminating the execution-only regime entirely

Reinforcing provisions around • investment advice, particularly in terms of ‘independent and fair analysis’, whether advice is ‘whole of market’ or more limited, information provided to clients, long-term assistance and use of distribution channels

Enhancing information provided • to clients about complex products

and reforming reporting requirements on ‘inducements’, including banning third party inducements in respect of portfolio management and when ‘independent’ advice is given to the client (note: the EC is also considering banning inducements in respect of all investment services)

Revamping the client • categorisation regime to exclude certain clients and products from the eligible counterparty regime, abolish or limit the presumption that professional clients are experience and knowledgeable, and exclude municipalities from being eligible counterparties or professional investors

Expressly including the principle • of civil liability of investment firms to clients in relation to breaches of MiFID conduct of business rules

Requiring trading venues to • publish information on execution quality, and putting the onus on firms to ensure clients understand how their orders are being executed

Subjecting firms dealing on own • account to the MiFID regime

Harmonising national approaches • to organisational requirements and governance rules, including ‘fit and proper’ requirements and the roles of directors and supervisors

Strengthening the role of the • compliance function in relation to the launch of new products, services and operations

Adding specific requirements in • relation to portfolio management of discretionary segregated accounts

Ensuring consistency in the • application of the MiFID conflicts of interest regime across the EU in relation to the sales process

Strengthening rules relating to the • segregation of client assets

Applying certain MiFID rules to • underwriting and placement of primary issues of financial instruments.

Convergence of regulatory framework and supervisory practicesIn recent years, many have argued that discrepancies in application of EU law in Member States - whether as a result of national options and discretions embedded in the legislation or different interpretations at the national level - have created impediments to the Single Market. The financial crisis also threw up some fundamental concerns about the cohesion and coherence of the EU supervisory structure.

As mentioned earlier, ESMA (and the other ESAs) has a clear mandate to develop a ‘single rule book’ and promote convergence of supervisory practices. However, to facilitate this, the EC must systematically revisit existing EU legislation and remove unnecessary or unused options and discretions from the legislation.

Another major criticism levied against the supervisory framework is the inconsistency in enforcement. This has arisen because national supervisors have different powers and national sanction regimes vary considerably in their effectiveness. The EC is targeting some key areas to improve both consistency and effectiveness.

Key proposalsRemoving Member State • discretion on tied agents so that tied agents may operate in all Member States (using an EU passport) but prohibiting tied agents from holding client money or assets

Creating a common EU mandatory • regime for telephone and electronic recording (requiring recording of client orders covering receipt and transmission of orders, and the execution of orders and transactions concluded when dealing on own account in all financial instruments) and requiring record retention for at least 3 years

To ensure consistency, abolishing • Article 4 of MiFID, which provides that national regulators can impose additional requirements on investment firms in exceptional cases

8 Understanding MiFID II

Enhancing the power of national • regulators to undertake on-site investigations, to request the freezing or sequestration of assets and to ask judicial authorities to enter private premises and seize documents

Introducing an effective • sanctioning regime with strong enforcement practices and a whistle-blowing regime

Introducing a third country • regime in MiFID to investment firms based on strict equivalence assessments.

Reinforcement of supervisory powersThe subprime lending products which triggered the financial crisis have made regulators fully aware that, in order to ensure financial stability going forward, it may be necessary on occasion to intervene if innovative products develop characteristics which may significantly increase systemic risk. The EC is proposing therefore, that national supervisors and ESMA be given the necessary powers to intervene when they feel such risk may arise in terms of financial products within the scope of MiFID.

Key proposalsEnabling the EC to ban specific • investment activities, products or services that raise significant and sustained investor protection concerns or generate systemic risk

Providing national regulators • extra powers to temporarily ban or restrict the trading or distribution of an investment product where it represents a serious threat to market confidence or the financial stability of a Member State or the EU

Harmonising national regulators’ • powers to intervene at any stage in a derivative contract, through powers associated with the use of position limits.

Understanding MiFID II 9

The EC’s consultation paper has provided some good insights into possible changes coming with MiFID II. Clearly, it will have a significant impact across the whole value chain of investment firms and will impact the way that firms undertake investment business within the market place. Although the detailed changes will not be known for some time, firms that act now will be best placed to be able to capture potential strategic market opportunities, plan proactively for the required business and operational changes and maximise any operational efficiencies. Over the coming months, affected firms should conduct the following activities:

Strategy: Identify any business • threats and strategic opportunities arising from MiFID II

Revenue impacts: Determine areas of • MiFID II that will have revenue/business structure impacts

What should you be doing to prepare for MiFID II?

Governance: Bring together a • Steering Committee and a Working Group to co-ordinate initial activity and get the right people from the business involved

High level planning: Gauge key • timings and “must do now” activities plus early indicative IT budgeting

Regulatory priority: Look for inter-• dependencies with other regulatory changes to prioritise key work-streams and identify implementation efficiencies

Public policy: Link business impact • analyses into public/lobbying policy

Education: Deliver knowledge of the • changing landscape early.

10 Understanding MiFID II

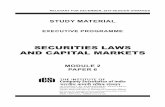

If you wish to influence the debate, the first step is to ensure that you have clear messages to deliver. Then, there are various means to get your views across during the negotiations:

You can work with European and national industry bodies to relay your messages indirectly, and/or •

You can approach the co-legislators directly:•

Your national legislators – generally Finance or Economic Ministers and/or national regulators – to provide -input to the Council debate, and

Individual Members of the European Parliament to discuss particular concerns, or -

A combination of the above two approaches. -

It can also be useful to discuss concerns with the EC and ESMA as they continue to influence the debate through the co-decision process.

Level 1: Co-decision procedure (first reading)

Source: PwC

Commissionproposal

Broadstakeholderconsultation

Council of ministers (EcoFIN)

European parliament

Economic and Monetary AffairsCommittee (ECON) (primary)

SupportingCommittees (secondary)

National legislators (generally Finance Ministries)

COREPER (EU Permanent Representations)

General approach

NegotiatedCommonPosition

Dra

ft re

port

ECO

N

Yes

No

Legislationadopted2-step process1. Vote in European Parliament (plenary)2. Adoption by EcoFIN Council

Lobbying activity at national level

• Hearings with interest groups• Open debate• Individual lobbying activity

Communication AmendedCommission

Proposal

Am

endm

ents

Vote

ECO

N

Opinions from relevant EUbodies, particularly theEuropean Central Bank (ECB)

All regulatory proposals since thefinancial crisis have been adopted infirst reading. However, the ‘normal’process is for two readings (reiterationof process). Second reading adds atleast 6 months to the process.

Second reading

ECONreport

Trilogue:CouncilParliamentCommission

As previously mentioned, the EC is expected to issue its formal proposals for MiFID II in October 2011. The proposals then will be discussed separately by the two ‘co-legislators’, the Council of Ministers and the European Parliament prior to adoption. Given the likely complexity of the proposals, these negotiations may be protracted. The best estimate for the adoption of the amendments to the ‘Level 1’ Directive (Directive 2004/39/EC) would be Q4 2012.

How can you influence the debate?

Understanding MiFID II 11

Pan-EuropeanUllrich Hartmann Partner +49 17526 50257 [email protected]

ItalyLía Turri Partner +39 02778 5356 [email protected]

Czech RepublicJiri Klumpar Director +42 02511 52077 [email protected]

SpainEnrique Fernandez Albarracin Director +34 91568 4504 [email protected]

AustriaElisabeth Rein Senior Manager +43 15018 81745 [email protected]

NorwayClint Sookermany Director +47 9526 1278 [email protected]

GermanyMartina Rangol Senior Manager +49 69958 52280 [email protected]

UKHoward Scott Partner +44 20780 49851 [email protected]

USGraham O’Connell Partner +1 64647 12547 [email protected]

Pan-EuropeanWendy Reed Director +32 2710 7245 [email protected]

LuxembourgEmmanuelle Henniaux Partner +35 249484 82111 [email protected]

FranceLudivine Gimet Senior Manager +33 15657 7565 [email protected]

SwedenSussanne Sundvall Partner +46 08555 33273 [email protected]

BelgiumJean-François Bourmanne Director +32 2710 9426 [email protected]

PortugalCláudia Parente Goncalves Senior Manager +35 12135 99208 [email protected]

IrelandGarvan O’Neill Partner +35 31792 6218 garvan.o’[email protected]

UKLaura Cox Partner +44 20721 21579 [email protected]

Pan-EuropeanFolker Trepte Partner +49 89579 05530 [email protected]

NetherlandsMartin Eleveld Partner +31 88792 4997 [email protected]

FranceMarc Ripault Director + 33 15657 1286 [email protected]

SwitzerlandChristiana Suhr Brunner Partner +41 05879 22566 [email protected]

Cyprus George Lambrou Partner +35 72255 5728 [email protected]

SpainAntonio Carrascosa Morales Director +34 91568 4634 [email protected]

ItalyFabiano Quadrelli Partner +39 02667 20538 [email protected]

UKMunib Ali Director +44 20780 49470 [email protected]

PwC Contacts

This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, PricewaterhouseCoopers LLP, its members, employees and agents do not a responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it.

© 2011 PwC. All rights reserved. Not for further distribution without the permission of PwC. “PwC” refers to the network of member firms of PricewaterhouseCoopers International Limited (PwCIL), or, as the context requires, individual member firms of the PwC network. Each member fir agent of PwCIL or any other member firm. PwCIL does not provide any services to clients. PwCIL is not responsible or liable for the acts or omissions of any of its member firms nor can it control the exercis professional judgment or bind them in any way. No member firm is responsible or liable for the acts or omissions of any other member firm nor can it control the exercise of another member firm’s professional judgment or bind another member firm ce. accept or assume any liability, erved. firm is a separate legal entity and does not act as or PwCIL in any way.

Design ML1-2011-07-19-1731-GA

www.pwc.com/mifid

![2. Securities Markets[1]](https://static.fdocuments.net/doc/165x107/577cd0b61a28ab9e7892ef1b/2-securities-markets1.jpg)