Driving a Vibrant Economy: Housing’s Role in Colorado’s ... · Housing’s Role in Colorado’s...

Transcript of Driving a Vibrant Economy: Housing’s Role in Colorado’s ... · Housing’s Role in Colorado’s...

December 201

Driving a Vibrant Economy: Housing’s Role in Colorado’s

Economic Success

January 2017

2

3

Table of Contents Acknowledgments…………………………………………………….. 5 Introduction…………………………………………………………… 6 Executive Summary…………………………………………………... 8 Economic Impact of Housing……………………………………….. 11 Data Sources…………………………………………………………. 16 Overview of Results…………………………………………………. 17 Neighborhood & Housing Diversity………………………………... 22 Issues Impacting Affordable Housing in Colorado……………….. 26 Appendix……………………………………………………………... 33 Colorado Futures Center at Colorado State University Review…. 51

4

5

Acknowledgements Over the past several years, housing in general has been a popular topic of conversation among policy-makers, interest groups and the public at large. With the housing market collapse in 2008 and subsequent Great Recession, we saw undeniably the impact that housing – as its own, distinct sector – has on the overall economy. In the years since 2008, we have marveled at the rebound of the economy and the steady improvement of the housing market as well. Yet there is more to this story that doesn’t always make the news headlines – and understanding the economic dynamics that shape the housing market and assigning tangible impact to those dynamics helps policy makers make informed choices about the programs and policies that promote or discourage housing development. Especially in the context of affordable housing and the current housing choices available to low-to-moderate income families, understanding the forces that drive supply and demand are critical to shaping the long term goals of our communities and ensuring we are meeting the housing needs of our entire community today and in the future. To accomplish this comprehensive study, several partners provided both financial and in-kind contributions. Thank you to the Metro Denver Association of Home Builders and their partners at the National Association of Home Builders who provided the initial data analysis and reports. In the data collection, we are grateful to the Shift Research Lab, Colorado Housing & Finance Authority and Metro Study for completing one of the most rigorous data collection processes to date. Other funding contributors include the Colorado Apartment Association, the Metro Denver Economic Development Corporation and Mile High Connects. This year, we are also grateful to the Colorado Futures Center at Colorado State University and Dr. Phyllis Resnick for providing the academic review. And finally, we applaud the efforts of Dr. Elliot Eisenberg, our lead economist, who not only provided substantial assistance during the data collection period and project design phase, but also has lent his considerable expertise to and was the primary author of this final report. The result is a thought-provoking report that we anticipate will shape housing policy conversations throughout the State of Colorado. Sara Reynolds Housing Colorado Executive Director

6

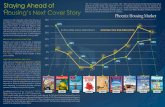

Introduction New home construction has always been a critical part of the overall health of the Denver metro region and the broader overall Colorado and U.S. economy. Nothing made that more poignant or apparent than the Great Recession that began in January 2008 and the ensuing collapse of the entire housing market and many other sectors directly or indirectly associated with the housing market. Fortunately, the State of Colorado and the Denver metro region have recovered substantially better than most of the entire nation from the Great Recession. House prices in the State of Colorado are up an impressive 31% from their pre-recession peaks. Similarly, house prices have surpassed their pre-recession highs by a staggering 40% in Boulder and Denver and 36% in Fort Collins. In Greeley, house prices are 25% higher than their prior peak, while in Colorado Springs they are up almost 10%. In Pueblo, prices have finally recovered and are now even with their pre-recession peak while in Grand Junction house prices are now 20% above their 2012 low and are just 12% below the high set in Q2 2008. Not surprisingly, rents in many of these fast appreciating areas are also rising very quickly, and thus the need for more new housing is more apparent than ever. A healthy economy clearly impacts the housing market. While most people enjoy where they live, the house that they live in, and public amenities, they are probably unaware about the many economic benefits new home building brings to the larger community or state. When households choose where to live, they carefully consider the benefits they will receive, but not surprisingly, may not be aware of the many public or collective benefits that result. Similarly, when a family builds a new home, they are focused on the benefits they will enjoy from their new house, but may fail to appreciate the array of economic benefits that accrue to the larger community because of the added employment that is created, the increased tax revenues that accrue, and the infrastructure that is built. As a result, it is not surprising that while often positively inclined towards the construction of homes like theirs, be they market-rate rental units or for sale properties, many households and communities display less enthusiasm towards the construction of rentals, both at market rate or subsidized units. Regrettably, communities all too often make it hard for new homes and in particular new affordable units to be built and in some cases actively prevent them from being built altogether. The question is, are these concerns warranted, or are these attitudes and behaviors economically self-defeating? This study looks carefully at these questions and quantifies the myriad economic and financial benefits new home construction brings to the Denver Metropolitan region and the entire State of Colorado. Moreover, this study looks both at market-rate and rent-subsidized construction as well as the economic impact of rehabilitating existing rent-subsidized communities. In 2015, the year of analysis of this study, the main findings are as follows:

• The contribution to gross state product of the home building analyzed in this report was $10.8 billion, or 3.4% of the entire gross state product of the State of Colorado.

7

• New home building and rehabilitation analyzed in this report support 151,304 full-time equivalent jobs, more than 5.9% of the entire Colorado labor force, and

• New home construction and rehabilitation analyzed in this report resulted in a flow of revenues to state and local governments totaling $2.45 billion.

This profound impact is in addition to contributions of many other sectors within the housing industry, including the lending and finance sector, the design community, and others that contribute hundreds of millions to the local and statewide economy. Indeed, the business of creating, preserving and meeting the housing needs of a rapidly growing state is multi-faceted and a true economic force in Colorado. It is the sincere hope of everyone involved in this project that after better understanding the substantial benefits new home building brings both to the Denver metro region and to the State of Colorado, a more balanced and thoughtful political debate about new housing will result. Ideally, this will be a debate where the facts are known and understood by all sides, a debate where emotion and rancor are kept to a minimum, a debate where all parties are treated with dignity and respect, and a debate that results in improved housing and economic outcomes for all Coloradans.

Peak One Neighborhood in Frisco, Colorado

8

Executive Summary This report presents the results of the state and local economic impacts of most new market-rate home building in calendar year 2015 in the State of Colorado and in the Denver metro region. This report also presents the most recent five-year average level of construction activity for new rent-subsidized and rehabilitation of rent-subsidized homes in the state of Colorado and in the Denver metro region. The one-time impacts, the recurring impacts and the cumulative 10-year impacts of construction on both these geographic areas are presented below. A discussion of the data, methodology and detailed results, along with a discussion of why housing diversity is important and the legislative and regulatory issues impacting affordable housing can be found in later sections. Colorado Construction Activity: One-Time Impacts During the year of construction, the combined economic impact of building 15,439 market-rate single-family homes, 9,610 market-rate multifamily homes, 977 rent-subsidized homes, and rehabilitating 651 rent-subsidized homes, representing 77% of all single-family construction and 81% of all multifamily construction in Colorado includes:

• $10.1 billion in income • $2.3 billion in taxes and other revenues for all governments, and • The continuation of 130,155 full-time equivalent one-year jobs.

These totals include all income and jobs for residents of Colorado. These totals also include all taxes, fees, permit costs, user charges and licensing fees for all taxing jurisdictions in Colorado. These results also represent all economic impacts of home building and rehabilitation including the economic impact that results from all residents who earn and spend income earned directly and indirectly from residential construction and including spending multipliers that result when earned income is re-spent within the borders of the State of Colorado. Colorado Construction Activity: Annual Post Construction Impacts The annually recurring economic activity that results from the building of 15,439 market-rate single-family homes, 9,610 market-rate multifamily homes, 977 rent-subsidized homes, and rehabilitating 651 rent-subsidized homes include:

• $1.3 billion in income • $386.6 million in taxes and other revenues for all governments, and • The creation of 21,149 full-time equivalent jobs.

Unlike the totals in the one-time impacts section above, these totals are annually recurring and result from all new and rehabilitated homes becoming occupied and the new households earning income, paying sales taxes, income taxes, property taxes and all other governmental fees, and spending part of their income in the State of Colorado.

9

Colorado Construction Activity: Cumulative 10-Year Impacts –Construction plus Annual Post Construction While understanding the benefits of new home building and renovation activity in the year of construction is critically important, as is understanding the annually recurring benefits, to fully appreciate the magnitude of the total benefits residential construction provides, it is valuable to look at the sum of the benefits over a longer period-of-time. To that end, the cumulative 10-year benefits that result from building 15,439 market-rate single-family homes, 9,610 market-rate multifamily homes, 977 rent-subsidized homes, and rehabilitating 651 rent-subsidized homes include:

• $22.9 billion in income • $5.9 billion in taxes and other revenues for all governments, • The continuation of 130,155 full-time equivalent one-year jobs, and • 21,149 full-time equivalent permanent jobs

Denver Region Construction Activity: One-Time Impacts During the year of construction, the local economic impact of building 8,928 market-rate single-family homes, 8,015 market-rate multifamily homes, 647 rent-subsidized homes, and rehabilitating 508 rent-subsidized homes in the Denver metro region which represent 96% of all single-family construction and 89% of all multifamily construction in Denver includes:

• $7.5 billion in local income • $1.1 billion in taxes and other revenues for all local governments, and • The continuation of 99,775 full-time equivalent one-year jobs.

These totals include all local income and jobs for residents of the Denver metro region as defined by the Denver Regional Council of Governments (DRCOG). This definition includes Adams, Arapahoe, Boulder, Clear Creek, Douglas, Gilpin and Jefferson counties, the City and County of Denver, and the City and County of Broomfield. For purposes of this report, southwest Weld County is not included. These totals also include all taxes, fees, permit costs, user charges, and licensing fees for all the above jurisdictions. These results also represent all economic impacts of home building and rehabilitation including the economic impact that results from all residents who earn and spend income earned directly and indirectly from residential construction and including spending multipliers that result when earned income is re-spent within this nine-county Denver region. Denver Region Construction Activity: Recurring Impacts The annually recurring economic activity that results from the building of 8,928 market-rate single-family homes, 8,015 market-rate rental homes, 647 rent-subsidized homes, and rehabilitating 508 rent-subsidized homes include:

10

• $1.2 billion in local income, • $226.2 million in taxes and other revenues for all local governments, and • The creation of 18,393 full-time equivalent jobs.

Unlike the totals in the one-time impacts section above, these totals are annually recurring and result from all new and rehabilitated homes becoming occupied and the new households earning income, paying sales taxes, income taxes, property taxes and all other governmental fees and spending part of their income in the 9-county Denver area as defined above. Denver Region Construction Activity: Cumulative 10-Year Impacts –Construction plus Annual Post Construction While understanding the benefits of new home building and renovation activity in the year of construction is critically important, as is understanding the annually recurring benefits, to fully comprehend the magnitude of the benefits it is also valuable to look at the sum of the benefits over a longer period-of-time. To that end, the cumulative 10-year benefits that result from the building of 8,928 market-rate single-family homes, 8,015 market-rate rental homes, 647 rent-subsidized rental homes, and rehabilitating 508 rent-subsidized homes in the Denver region include:

• $18.5 billion in local income, • $3.3 billion in taxes and other revenues for all local governments, • The continuation of 99,775 full-time equivalent one-year jobs, and • 18,393 full-time equivalent permanent jobs.

Tabor Grand Hotel Apartments in Leadville, Colorado

11

Economic Impact of Housing To fully appreciate the benefits that result from new home construction, it is necessary to analyze the three distinct revenue streams new home construction creates. The first is the construction phase, the second is the induced or ripple phase, and the third is the occupancy phase. By adding up these three phases over a longer period-of-time (be it a year, or ten years) one arrives at the total benefit of the construction activity. Before looking at more detailed results by project type, tenant type and geographic location, it is important to understand how the impacts of home building are modeled and highlight some of the key, and often misunderstood, pieces of each of the three distinct economic phases of home building. The Construction Phase – Direct Spending The construction phase is the easiest phase to understand. This is the phase in which raw land is developed and a house is built. This phase usually lasts about nine months from beginning to end, and is all too often thought of as the only benefit that housing confers on a geographic area. This may be because it is the only phase that is visible. Of course, the construction phase is just the beginning of the benefits that new housing bestows on a city, county or state. The calculation of the benefit phase begins by subtracting the cost of raw land from the sale price of the house to arrive at the value of construction put in place. The National Association of Home Builders model (hereinafter “the model”) then converts the value of construction put in place into wages and salaries for workers, commissions for salespeople and Realtors, as well as profits for business owners. The model also includes all permit costs and fees paid by developers and builders to governments and converts those payments into full-time equivalent jobs. This process occurs on a regular basis each time a home is built. Every few weeks, employees get paid; commission checks are made out to salespeople and realtors; checks are made out to rental firms for the use of equipment; subcontractors get paid and they in-turn pay their employees; and then the process repeats. Importantly, households spend most of what they earn, and that spending is what fuels the induced phase or the ripple phase, which comes next. As an aside, in the State of Colorado property taxes are assessed at different rates for different classes of property. Residential property is assessed at a rate of 7.96%, while most other property classes, including vacant land, are assessed at a rate of 29% (excluding oil & gas valuation, which is assessed at a much higher rate). Thus, the property tax assessment ratio on vacant land actually falls when it is reclassified as residential. Of course, the total property tax payment rises as the land plus its’ new house is now taxed, albeit at the lower residential assessment rate. As for rent-subsidized properties, depending upon the tax-exempt status of the owner, the property may be exempt from property taxes. In the case of non-exempt residential property that

12

is being rehabilitated, property tax assessment rates do not change since the property is continually classified as residential throughout the rehabilitation work, although the overall property tax bill may increase as the value of the property increases. Before proceeding, it is important to note that this model is conservative when estimating the magnitude of the construction phase. Unlike other models, it explicitly removes all economic impacts that cannot be directly attributed to the construction activity being analyzed. Unless a local good or service is explicitly needed to build a home and is produced locally, it is ignored. For example, if a builder buys carpet for a new home, only the commission on the carpet and the profit made on the carpet are captured by the model, the rest of the spending leaks out of the local economy. Due to this conservative approach, the calculated economic impact of the construction phase is lessened, as is the subsequent induced or ripple phase compared with other such models. The Induced or “Ripple” Phase The induced or “ripple” phase, while separate from the construction phase, is fully dependent on it. This phase exists because much of the income earned and taxes collected in the construction phase get spent locally. As such, this phase is an economic “knock-on” from the construction phase and is thus also referred to as the induced phase. This induced phase lasts exactly as long as the construction phase, generally about nine months. This is because every two weeks or every month, the people working on the new home -- be it directly as construction workers or indirectly as, for example, a waiter in a restaurant frequented by construction workers -- get paid. Importantly, the vast majority of income that is earned gets spent and a large percentage of that spending occurs in the local community, with the rest leaking out of the economy. Money leaks out each time a local resident goes on vacation, buys something not made locally such as clothing or gasoline, or else saves some of his or her paycheck. Note that some income goes towards taxes, and that results in increased revenue and employment for the governments so it also stimulates the local economy. Critically, the spending that is unleashed each time paychecks are deposited leads to more spending. For example, a landscape architect may spend some of his earnings hiring a babysitter, who in turn uses that money to buy groceries, and the cashier at the grocery store may in turn use some of his earnings to buy some plants from a local nursery, and so on. Not surprisingly, the induced phase and the soon to be discussed occupancy phase are both larger for the State of Colorado than for the Denver metro region. This is because the smaller the area, the larger the leakages out of it. That is, some of the spending and taxes paid by households that leak out of the Denver metro region remain in the State of Colorado. What is perhaps most important about this phase, other than its substantial magnitude, is that it needs to be counted and recognized. Too frequently, the induced phase is glossed over because it is difficult to directly see its economic impact. To that point, the only way this phase would generate no economic impact would be if those with income from the construction phase elected to spend none of it.

13

The Occupancy Phase While the first two phases are relatively short in duration, the occupancy phase lasts as long as the home is occupied. This is because this phase derives its economic vitality from the recurring income earned by the occupant of the home. Once money is earned by the homeowner or renter, the majority of it gets spent, with much of the spending going towards local purchases of goods and services. As was the case with the induced phase, the occupancy phase creates secondary, tertiary and quaternary ripple effects as money from the new homeowners or renters goes from hand to hand to hand while slowly dissipating (due to leakages) until the cycle starts afresh when the new homeowner or renter earns another paycheck. As this process goes on indefinitely so does the economic stimulus created. Although the impact of this phase is smaller than the impact of the induced phase (as the income earned during the length of time it takes to build a house, typically nine months, is not nearly as large as the expenditures involved when building a house), because this phase lasts much longer, the cumulative economic impact of this phase easily exceeds the impact of the first two phases, even when the construction and ripple phases are combined. To better understand the long-run impact the occupancy phase has, this study includes a 10-year economic impact analysis.

New or Existing Residents?

As for the newly built house or apartment, it may be that the new home is occupied by a household new to the community, and thus directly increases the population of the community. Alternatively, it may be that an existing homeowner sells their house and moves into the newly-built house, with a new-to-the community household buying the now vacant existing house. Either way, it is fair to assume that the new home was built to accommodate an increase in the population of the community. Thus, all the jobs created during the occupancy phase are ongoing permanent jobs for the community. These jobs include public and private sector jobs that collectively cater to the needs of the new residents.

How Much Spending? The amount of spending by the households that live in the newly built or newly rehabilitated homes varies quite dramatically. At one extreme, there are buyers with huge incomes that purchase million dollar homes. These households spend a considerable amount of their sizable incomes on locally produced goods and services, and in that way substantially stimulate the local economy, and create many permanent ongoing jobs in the community. For example, they may regularly frequent local coffee shops and restaurants, hire tutors for their children, attend sporting and cultural events, have live-in help, and so on. There are also misperceptions concerning the economic impacts of multi-family housing on the community. In fact, industry trends monitored by the National Apartment Association find that households earning $50,000 or more have been the fastest growing sector of renters over the past five years. This can be attributed to several factors, including both a rapidly aging population seeking to downsize into maintenance-free, walkable communities, but also the impacts of the “echo boom” and a rapid increase in the number of 20-29 year olds entering the housing market.

14

Nationally, we see 78 million students graduating with an average student loan debt of $28,000. This group seeks flexibility to move to other markets as they seek employment, and they do not want to add a mortgage to their debt load. While the preferences and spending habits of these two populations may be slightly different, these trends and the added consumer spending induced by these groups have a direct impact on local jobs and the consumption of goods and services provided through local businesses. At the other end of the spectrum are occupants of rent-subsidized homes. These households have low incomes and thus stimulate the local economy less than wealthy buyers of big new homes. However, the reduction in local spending is not as large as one might expect for several reasons. First, lower-income households, despite wanting to save money, frequently are unable to do so, since all that they earn is spent on necessities such as housing, healthcare, food and transportation, with precious little left for savings. Second, rent payments made by these households frequently remain in the local community since the occupied rental homes are frequently owned and operated by local housing groups and authorities. By contrast, mortgage payments made by homeowners tend to accrue to investors outside the geographic area of interest. One major misunderstanding about the occupancy phase is that it is often characterized as the phase where property taxes are collected, and nothing more. In this narrative, this phase is small and new homes are little more than property tax paying entities. Of course, nothing could be further from the truth. While property taxes may be the largest tax payment made by a household to a government, property taxes are not the only tax revenue generated during this phase. Sales and use taxes, franchise taxes, water taxes, cell phone taxes and others are collected, as are other fees that governments levy to cover the cost of providing public services.

How Many Children?

Another misconception about this phase is that each family that moves into a newly built home has 2.5 school age children. Since education costs are the single largest expense of local government, new homes are perceived to be financially very detrimental. However, the actual number of school age children per house is about 0.6 not 2.5. Therefore, the cost of educating a household’s children is about one-fourth of what many think it is. Moreover, this excludes any intergovernmental aid that is provided to the local school district that further reduces the cost to the community of a new household.

Assumptions and Examples

Throughout this report, the occupancy phase results assume that absent the new home being built, there would be no new revenue to the area. This is because even if the homeowner commutes to a job far away, the clear majority of the income earned by the household is spent where the household lives, not where the job is. As such, one may think of a house as a way of keeping income earned in the community from leaking out. This is like the mindset that encourages the building of retail establishments in a community. Absent good retail options, households will drive outside the community to movies and restaurants and more generally spend their money elsewhere, harming the local economy and reducing local multipliers.

15

To better understand the approach used, consider the following example. Imagine a new household moves to Colorado and the householder finds employment in Denver. Further, assume that unable to find affordable housing in Denver, the household lives in Greeley. The key question is where will the vast majority of household spending occur? It is highly likely that most household spending will occur in Greeley, since that is where the household will shop and dine because that is where the household lives. As such, where the household lives is the key determinant of where household spending will occur, not where the householder works. Let us now see how economically beneficial different types of housing are to both the Denver metro region and the State of Colorado. Given the different types of construction analyzed and the varying quantities involved, it should not be surprising that the results vary. That said, in all cases the benefits are large.

CityScape at Belmar in Lakewood, Colorado

16

Data Sources Data for subsidized affordable housing production and rehabilitation were obtained from a variety of primary sources in an effort to achieve a full census over the 2011 - 2015 timeframe. Despite some restrictions in the provision of owner-occupied home detailed information and lack of response to some data requests from housing authorities, the resulting data set includes nearly the entire population of subsidized affordable production and rehabilitation. The period 2011 through 2015 was used, as rent-subsidized activity can vary substantially from year to year. By using a five-year average of all such activity, it is hoped that results provided are a fair representation of average annual rent-subsidized activity. Sources for the data include, Colorado Division of Housing, Colorado Housing and Finance Authority, inclusionary housing jurisdictions (Denver, Boulder, Aspen, and Summit County), public housing authorities within the State of Colorado, National Housing Preservation Database, “HUD User Data: Picture of Subsidized Households” and information from HUD Multifamily FHA insured projects. Subsidized funding programs include Community Development Block Grant, HOME Investment Partnership Program, Colorado Housing Development Grant, Neighborhood Stabilization Program, Section 8 Housing Choice Voucher Program, Private Activity Bonds, and Low Income Housing Tax Credits. All related data coordination work was executed in partnership with the Colorado Housing Finance Authority and The Piton Foundation. Data for all market-rate housing production were provided by the Denver office of MetroStudy, and include construction activity in calendar year 2015. Since market-rate activity fluctuates much less than rent-subsidized activity and is much higher, using a five-year average was not considered necessary. Other sources for the market-rate data include: Colorado Department of Local Affairs, Colorado Department of Revenue, MetroStudy lot-by-lot new housing surveys, assorted proprietary MetroStudy surveys of local builders, developers and other industry associates, and the Colorado Apartment Vacancy & Rent Survey conducted by The University of Denver.

The Aerie in Denver, Colorado

17

Overview of Results This section presents the economic impacts of a wide variety of housing activity. It begins by presenting the results for market-rate single-family and multi-family construction, within the State of Colorado and then within the smaller Denver metro region. This section then examines new rent-subsidized construction at the statewide level and then in the Denver metro region, and concludes by highlighting the economic impact of rehabilitating existing rent-subsidized homes in the State of Colorado and the Denver metro region. The benefits of new residential construction, be it market-rate or rent-subsidized, and the impacts of residential rehabilitation activity are large and varied. This section gives a brief overview of the general themes that are pervasive through this analysis. For more details, please consult the tables below and appendices A through H located in the back of the report. Five key recurring themes run through all the new construction and rehabilitation results. First, the 10-year totals are many multiples of the construction phase or the induced phase. This is because the third phase, the occupancy phase, unlike the first two phases, which both last less than a year, lasts as long as the homes are occupied. Thus, despite being much smaller than either the construction phase or the induced phase, over time it is the occupancy phase that generates a very large percentage of the 10-year totals. Therefore, the occupancy phase should always be included when measuring the potential impact of new home building. Second, the amount of income, taxes and employment generated during the induced phase, while smaller than the amounts generated during the construction phase, are larger than the annual amount generated during the occupancy phase. The point here is that despite the construction phase receiving the bulk, if not all, of the attention, the induced phase is large, despite being frequently dismissed. Third, in every case of new construction, the total number of construction jobs generated during the construction and ripple phases are less than all the jobs created in the rest of the economy. That is, even though it is residential dwellings that are being built, more than half the jobs created are not in construction. This is because residential construction requires so many inputs from so many other industries. When home building is doing well, so is the rest of the economy. Fourth, in all cases, the economic impacts are all substantially larger when the unit of analysis is the State of Colorado compared to the Denver metro region. This is because the Denver metro region is smaller than the larger Colorado data, and the bigger the geographic area being analyzed, the larger the economic multipliers due to fewer leakages. Multipliers and economic leakage are a critical part of this economic analysis, or any analysis where construction activity takes place, be it a hospital, football stadium or industrial park. The underlying notion is that when a dollar is injected into an economy, it multiplies because it leads to more spending, which then creates more income, and so on. The multiplier effect refers to the increase in final income arising from any new injection of spending. Of course, the size of the multiplier depends on many things, including household savings rates, and the quantity of goods and services imported from outside the area of study, all of which are leakages and depress the size of the multiplier. In this analysis, the two major differences between the Colorado studies

18

and the Denver metro region studies are the supply of goods and services that are imported and the level of taxation. Fifth, the number of full time equivalent construction and induced jobs per house is quite large at roughly five-and-a half-jobs per house for new market-rate construction activity and two jobs per house for rent-subsidized construction activity. This difference exists because market-rate homes are substantially more expensive than rent-subsidized homes. Employment effects are roughly three-quarters as large for rent-subsidized multifamily rehabilitation work at roughly one-and-a-half jobs per home regardless of location compared to new construction activity as the amount spent per unit is less than it is when new rent-subsidized homes are built. Finally, because of the conservative framework of this analysis, there are no occupancy effects for rehabilitation work. This is because it is assumed that all rehabilitated homes were occupied prior to being rehabilitated.

Table A 8,928 New Denver Market Rate Single-Family Units

Local Taxes & Jobs Income Fees Construction Phase $2,351,502,700 $473,483,000 27,976 Induced Phase $1,331,573,800 $165,974,700 21,526 Occupancy Phase $436,744,500 $95,617,000 6,988 10-year totals $7,832,149,250 $1,547,819,200

Temporary Jobs 49,502 Permanent Jobs 6,988 Temporary Jobs/House 5.54 Permanent Jobs/House 0.78

Table B 15,439 New Colorado Market Rate Single-Family Units

Local Taxes & Jobs Income Fees Construction Phase $3,539,902,700 $962,475,300 39,574 Ripple Phase $2,300,809,100 $470,065,500 36,553 Occupancy Phase $797,596,300 $232,229,300 12,550 10-year totals $13,417,876,650 $3,638,719,150

Temporary Jobs 76,127 Permanent Jobs 12,550 Temporary Jobs/House 4.93 Permanent Jobs/House 0.81

19

Table C 8,015 New Denver Market Rate Multifamily Units

Local Taxes & Jobs Income Fees Construction Phase $2,436,218,700 $287,166,000 28,513 Induced Phase $1,229,114,900 $160,197,800 19,619 Occupancy Phase $707,815,000 $128,463,200 11,163 10-year totals $10,389,576,100 $1,667,764,200

Temporary Jobs 48,132 Permanent Jobs 11,163 Temporary Jobs/House 6.01 Permanent Jobs/House 1.38

Table D 9,610 New Colorado Market Rate Multifamily Units

Local Taxes & Jobs Income Fees Construction Phase $2,542,383,500 $470,485,400 27,768 Ripple Phase $1,478,404,100 $314,140,800 23,278 Occupancy Phase $525,912,900 $149,115,800 8,213 10-year totals $9,016,960,150 $2,201,226,300

Temporary Jobs 51,046 Permanent Jobs 8,213 Temporary Jobs/House 5.31 Permanent Jobs/House 0.85

Table E 647 New Denver Rent Subsidized Units

Local Taxes & Jobs Income Fees Construction Phase $69,383,300 $4,898,700 807 Induced Phase $32,579,100 $4,372,800 513 Occupancy Phase $15,503,100 $2,104,000 242 10-year totals $249,241,850 $29,259,500

Temporary Jobs 1,320 Permanent Jobs 242 Temporary Jobs/House 2.04 Permanent Jobs/House 0.37

20

Table F

977 New Colorado Rent Subsidized Units

Local Taxes & Jobs Income Fees Construction Phase $103,087,300 $14,327,800 1,127 Ripple Phase $55,451,400 $11,508,200 869 Occupancy Phase $24,836,300 $5,291,500 386 10-year totals $394,483,550 $76,105,250

Temporary Jobs 1,996 Permanent Jobs 386 Temporary Jobs/House 2.04 Permanent Jobs/House 0.40

Table G

508 Rehabilitated Denver Rent Subsidized Units

Local Taxes & Jobs Income Fees Construction Phase $43,000,500 $2,611,800 509 Induced Phase $19,877,200 $2,685,500 312 First Year Totals $62,877,700 $5,297,300 821 Temporary Jobs 821 Temporary Jobs/House 1.62

Table H

651 Rehabilitated Colorado Rent Subsidized Units

Local Taxes & Jobs Income Fees Construction Phase $50,705,000 $6,453,500 567 Ripple Phase $26,819,400 $5,599,500 419 First Year Totals $77,524,400 $12,053,000 986 Temporary Jobs 986 Temporary Jobs/House 1.51

21

DENVER

All Const & Ripple Rev $7,513,250,200 All Const & Ripple Taxes $1,101,390,300 All C &R jobs 99,775

All Recurring Income $1,160,062,600 All recurring taxes $226,184,200 All recurring Jobs 18,393

All ten-year income $18,533,844,900 All 10-year Taxes $3,250,140,200 All 10-year temp jobs 99,775 All ten-year occ jobs 18,393

1st year impacts are Income $8,093,281,500

Taxes $1,214,482,400 Jobs 118,168

COLORADO

All Const & Ripple Rev $10,097,562,500 All Const & Ripple Taxes $2,255,056,000 All C&R jobs 130,155

All Recurring Income $1,348,345,500 All recurring taxes $386,636,600 All recurring Jobs 21,149

All ten-year income $22,906,844,750 All 10-year Taxes $5,928,103,700 All 10-year temp jobs 130,155 All ten-year occ jobs 21,149

1st year impacts are Income $10,771,735,250

Taxes $2,448,374,300 Jobs 151,304

22

Neighborhood & Housing Diversity The topic of diversity is one that frequently comes up in discussions of housing. While it is of critical importance, it is well worth reviewing why. In short there are two reasons. First, absent housing diversity, neighborhood diversity is impossible, and from what we have learned from on-going research (as shown below), there are significant benefits to neighborhood diversity. Second, even within neighborhoods that are reasonably diverse across, for example, income, not everyone wishes to live the same way. That is, some families will prefer to live closer to the central business district, while others will prefer to live further away, still other families might wish to rent while others prefer to own. Having more neighborhoods that exhibit at least some housing diversity allows for better economic and social outcomes. Neighborhood Diversity Neighborhoods make a critical contribution to the well-being of children and households as it is at the neighborhood level that most public and private sector services are obtained, with the most critical being schools. Other important services that are provided at the neighborhood level include supermarkets, recreational facilities, healthcare and daycare, to name just a few. Collectively, these institutions shape each neighborhood and in turn strongly impact the quality of life enjoyed by the residents. To offer just one example, teenagers are strongly influenced by their peers who are usually dominated by neighbors, classmates and family friends. Ideally, such peers encourage a focus on school work, foster healthy competition in sports, and promote drug avoidance. However, that is not always the case. In schools that are in predominantly poor neighborhoods, research consistently confirms drop-out rates are elevated, teen pregnancy rates are generally higher, and the percentage of graduates who find post-high school employment is lower than in other communities. In addition, some neighborhoods offer better access to jobs and transportation than others. While only a small percentage of persons work near where they live, improved access to both jobs and public transit dramatically enhance employment opportunities and economic mobility over a lifetime. As is well understood, families with higher incomes are better able to move where they want. As such, they gravitate to neighborhoods with good public and private services, low crime rates, good schools, high quality amenities and so on. In making these deliberate decisions, these families consciously enhance their quality of life and improve the likely outcomes of their children. Regrettably, as household incomes decline, there are significantly fewer options available, and in particular, fewer high quality options. That is, lower income families and households, due to their limited incomes, have less to spend on housing and as such have much more limited choice as to where they live. In neighborhoods where lower and even moderate income families and households end up living, many social and economic outcomes are regrettably, less favorable.

23

For instance, in lower income neighborhoods there are more likely to be fast food franchises and convenience stores, and less of a likelihood that there will be supermarkets with fresh produce, banks, specialty shops, and other anchor institutions that encourage economic vibrancy. Thus, at a minimum, employment opportunities in these neighborhoods are more limited. There is also strong evidence that lower income neighborhoods are exposed to heightened levels of pollution, and violence. In addition, in neighborhoods with low incomes, house price appreciation is usually much weaker. This lack of home price appreciation deprives these households of a potential source of wealth, which can be used to start a business, provide for educational costs, help with medical bills, provide a better retirement, and generally a multitude of financial opportunities and upward mobility. As if the above were not troubling enough, in neighborhoods where the housing stock is in poor condition, research shows that health outcomes are often compromised due to reduced access to health care services. For example, fewer doctors accept Medicare in poorer, less racially-diverse communities. Longer-term effects include elevated rates of death from heart disease and assorted cancers. In conclusion, in poorer neighborhoods there is less physical and social capital, and this combination contributes to a lower quality of life and reduced economic opportunities. Housing Diversity To help break this destructive cycle of, among other things, limited educational and employment opportunities, it is preferable to plan and build communities that possess a diverse stock of housing. Ideally, communities should be able to accommodate households with not only relatively diverse incomes, but with householders of different ages, households at different stages in their work lives, and households that require varying degrees and types of supportive social services. In this way, the built environment can play a constructive role in improving and enhancing family and financial outcomes. Rather than simply building new communities of just single-family detached homes or expanding, or in-filling, existing communities with more housing that is largely indistinguishable from what is already there, as is often the case, communities should be encouraged to build housing that is suitable for many different types of households. Building just one type of housing is akin to an ice cream shop selling one flavor of ice cream or an automaker producing just one model of car. It can work, but adding some diversity to the offerings would be a definite improvement, attracting a greater mix of economic and social investment. Ideally, neighborhood diversity would include single-family detached homes, multifamily units, rental apartments, condominiums, garden apartments, townhomes, high density areas, low density areas, and areas with combination of all types. In addition, some units might be expected have garages while others might not. Similarly, some dwellings might be quite large, while others of the same type might be quite small. For example, a diversified apartment building or

24

complex could have three-bedroom multifamily units, two-bedroom units, one-bedroom units and studios. Elsewhere in the same neighborhood, some single-family detached units might be 3,000 square feet while other units might be just 750 square feet. This is a direct reflection of the shifting demographics seen throughout the country, and certainly within Colorado. Currently, 32% of all millennials are still living with their parents and no doubt will entering the housing market imminently, while at the same time, 78 million seniors nationwide report a desire to downsize their housing to a more maintenance-free lifestyle. These forces, and existing pent-up demand, will have a dramatic impact on the design and outcome of communities for the foreseeable future. A perfect example of a diversified neighborhood is the mixed-use redevelopment at the former site of Stapleton Airport. Not only are there dozens of parks, bike paths, and millions of square feet of retail, but there are all types of residential structures, varying in price from income-qualified for-sale homes and affordable rental units, to luxurious single-family detached homes at prices upwards of $1,000,000, with virtually every price point in between. It cannot be stressed enough that to have a successful local economy and fluid labor market it is essential to have a healthy and diverse housing market. A healthy housing market includes an ample supply of new and existing houses, expensive and inexpensive units, rental units and owner-occupied units. Insuring that many housing alternatives are available increases the ability of all households, and all prospective households hoping to move into the community, to find a dwelling that is suitable for their particular lifestyle. Furthermore, it is generally understood that households will spend money in the community where they reside (versus the community they commute to for employment), and thus a diverse housing mix will encourage an equally diverse mix of business opportunities and investment. For example, some households may have been saving for years and are finally ready to buy a starter house. By contrast, some households may have just sent their last child off to school and are suddenly empty-nesters and want to downsize and move downtown after spending several decades in the suburbs. Others are comprised of recent college graduates who need an affordable rental apartment near their place of employment if they are to make ends meet on their entry level salary. Still others need some of the social services that only come with rent-subsidized units if they are to remain independent and live on their own, while still other households need access to numerous supportive services in addition to rent subsidies. Some households very much need to be near public transit because they simply cannot afford a car. Elderly persons may be able unable to drive, so living near public transit allows them to lead dignified, independent lives. Some individuals have physical limitations that prevent them from living in a single-family home and they too count on being able to find a multifamily unit that works for them. Some families are drawn to the suburbs because of the space that comes with living in suburbia and the lower price per square foot of finished construction. They may want a backyard like they had when they were young for their growing household to enjoy. When jobs relocate to the suburbs or to the exterior parts of the city, living outside of the city can also end up reducing commuting times.

25

In addition to aiding households, it is critical to remember that promoting housing diversity also helps business. If housing is very expensive, as it is in Boston, New York and San Francisco, and increasingly here in more urbanized areas throughout Colorado, employers have a difficult time finding employees and that stunts the ability of businesses to grow. At this point in the business cycle, with unemployment rate as low as it is, attracting workers is a strategic advantage for growing firms. But this advantage only exists if workers can afford to live where the jobs are. In high-cost cities, the cost of living has risen so much that growing firms can essentially only recruit workers from other equally expensive or yet more expensive cities, as workers from less expensive cities have sticker shock when they discover how expensive housing is. This is also true when companies are considering relocation, and other, less expensive housing markets begin to look more attractive. While recent research shows that Colorado still trails notoriously high cost areas like California and New York, the same research reveals that most essential community workers, such as patrol officers, teachers and nurses, cannot afford to live in the community they serve. Reversing this trend is not impossible, but will take persistent effort, focus and an understanding of what must be done to counter the existing economic forces. In addition to helping business, a sufficient supply of housing across the affordability continuum also helps reduce traffic, reduce strain on infrastructure and in the process, reduces commute times for everyone. The more expensive housing is, with all else equal, the further households must go from employment centers to find affordable accommodations, and every day, that added distance must be travelled, twice! Since existing roads are already being used beyond their capacity, as can be seen by rush-hour traffic jams, this extra commuting by workers living far from their employer simply adds to the overall gridlock and reduction in quality of life. Fortunately, the market gives excellent signals about the condition of the local housing markets in a community. If prices are rising quickly in one area, it is a clear sign that there is an insufficient amount of housing in that vicinity. If prices are rising for one type of housing, it suggests that there is not enough of that type. If all housing prices are rising quickly, it means not enough housing of any type is being built, resulting in heated competition between buyers which drives up housing prices. If this condition exists for an extended period, it is a sign of a serious underlying new housing supply problem. While there are certainly no quick and easy solutions to these problems, there is also no reason to give up hope and declare the situation hopeless. To that end, in the next section a number of legislative and regulatory issues impacting housing affordability are discussed to examine more closely the intended and unintended consequences on affordability and community vitality. After all, doesn’t everyone deserves a safe, decent and affordable place to live?

26

Issues Impacting Affordable Housing in Colorado Below, some of the major issues affecting housing affordability in the State of Colorado and the Denver metro region are discussed and where possible solutions are offered. There is no one solution that will resolve the phenomenon of rapidly rising housing prices throughout the state. However, inaction is certain to lead to increasing affordability problems. Moreover, it is acknowledged that there is a never a single solution or package of solutions that is a “one-size-fits-all” for every community. Ideally, different communities will adopt the combination of solutions that best fit their particular set of circumstances and community priorities. To underscore the importance of this issue, the White House has recently issued a “tool kit” on housing policy (https://www.whitehouse.gov/sites/whitehouse.gov/files/images/Housing_Development_Toolkit f.2.pdf ) that urges states and municipalities to examine local barriers to housing development that are reducing the ability of housing markets to respond to growing demand. As one of the most rapidly-growing regions of the country, Colorado needs to be at the forefront of this movement. A recent report by the Urban Land Institute of Colorado provides an in-depth look at strategies currently employed in select Colorado communities, but also examines other areas of the country where progressive policies are having a meaningful impact on housing affordability (http://colorado.uli.org/wp-content/uploads/sites/19/2016/10/Overcoming-barriers-to-affordable-ULI-CO-report-9-30-16.pdf).

Regulatory Issues

Limited availability of owner-occupied, multi-family housing (condos and townhomes) – Many attribute the shortage of available condos and townhomes to a rather unique set of laws in Colorado concerning construction defects litigation. Condo construction has effectively ground to a halt due in part to concerns among builders about the growing number of lawsuits over construction issues. Today, condos represent just 3.4 percent of new housing starts in the Denver metro area, compared to 20 percent in 2007. Because of this, would-be first-time homebuyers, including young professionals, have significantly fewer options and are increasingly being forced in to, and further contributing to, the skyrocketing rental market. The lack of condominium options also leaves behind seniors who are looking to downsize from single-family homes yet do not wish to rent.

In addition to forcing individuals out of homeownership and into the rental market, the lack of condos and townhomes leads to higher prices. Homeownership opportunities that might have been more affordable rapidly become unaffordable with increased demand and stagnant supply. This forces people to either purchase or rent further from downtown and further from their place of employment, making commutes longer and costlier, and reduces the quality of life. The lack of condominiums has also necessarily altered the composition of the newly built high density neighborhoods. Rather than having a healthy mix of owners and renters, these necessarily end up being communities where the overwhelming number of households rent. Preferably, a mix that offers households a tenure choice is best. That way the neighborhood is more likely to better mirror the population of the larger community.

27

Multiple Denver-area municipalities including Aurora, Arvada, Castle Rock, Centennial, Colorado Springs, Commerce City, Denver, Douglas County, Lakewood, Littleton, Lone Tree, Parker and Wheat Ridge, have implemented reforms to reduce the threat of expensive, time-consuming litigation. However, absent a permanent, legislative fix, builders and developers will still be largely unwilling to build as the risks are simply too great. The Homeownership Opportunity Alliance (www.housing4co.org), a coalition of more than 50 Colorado housing, economic development, trade and business groups, as well as more than 30 mayors), continues to support a legislative solution that will:

• Create a quick resolution process that is fair to homeowners who need repairs while protecting the rights of all owners in a community;

• Allow construction of more diverse and affordable housing options, closer to downtown and work, so that young workers can own rather than rent and seniors can make housing choices;

• Encourage new developments near light rail and transit stations that provide easy access to commuting, shopping and urban-living options, and promote density and sustainable housing options that consumers want but cannot access currently; and

• Foster conditions that will encourage builders to construct more affordable housing and thereby provide increased homeownership opportunities.

The consequences of impact fees - Rising impact fees price out hundreds, if not thousands, of households out of the market. According to the National Association of Home Builders, every $1,000 increase in the price of a home in the Denver metro area prices out 1,791 households and 2,540 in the State of Colorado. Moreover, impact fees force the burden of affordable home building primarily onto the new home building community and buyers of new homes.

There are alternatives and hybrids – for example, the City of Denver recently implemented a combination of higher property taxes and new development fees to raise about $150 million over the next decade to support affordable housing.

Moreover, impact fees are a bigger issue when building affordable homes compared to higher price homes. It is much easier for a builder to pass along the assorted fees they face when building a luxury home that costs $750,000 as those homes have higher profit margins and the fees represent a much smaller percentage of the sales price. By contrast, on a simple starter home fees can be a large part of the eventual sales price.

An alternative approach to impact fees is to incentivize builders by offering them density bonuses if they build affordable housing. This policy has the virtue of increasing the stock of new housing which puts downward pressure on house prices rather than driving up house prices and exacerbating affordability problems. Moreover, there are several ways that the bonus density can be awarded, including programs that require affordable housing to receive the bonus.

Rather than relying on impact fees, creating an ongoing dedicated source of funding for affordable housing is a key component in addressing long-term affordable housing needs. In addition to property and sales taxes, funding for affordable housing can come from real estate transfer taxes, document recording fees, excise taxes, developer impact fees, tax increment

28

financing (TIF), interest on various government-held accounts, loan repayments, an increase in the local sales tax, or a mix of several of these sources. As an example, Seattle voters recently approved a property tax mill levy that will raise an estimated $290 million over the next seven years. A dedicated fund of $30 million per year could fundamentally change the affordable housing dynamic in Colorado.

The key is to appreciate that everyone benefits when affordable housing is built. Spreading the burden as broadly as possible reduces the burden upon any single sector or source of funding and eliminates the volatility and smooths funding and production. As such, any source of low-level, broad-based funding is ideal.

Density limits – Zoning ordinances that limit density increase prices, thereby exacerbating inequality, and reinforce the not in my backyard (NIMBY) phenomenon. Many common community assumptions surrounding affordable housing center on concerns of increased traffic accidents, higher crime rates, and additional costs to schools and other municipal services. A number of studies monitored through the Center for Housing Policy have confirmed that if higher density affordable housing is well designed, fits in with the surrounding neighborhood, and is well managed, there are generally no negative impacts of that housing on the property values of neighboring houses, and in many cases values may increase as a result of the neighborhood redevelopment (https://www.trulia.com/blog/trends/low-income-housing/).

Density limits can create effects that ripple down into the community in many ways. As an example, homes near good elementary schools are typically about two and a half times as expensive as a home near poorer-performing schools, and there is a corresponding difference in school test-scores. The housing cost gap, and the associated gap in schools’ test-scores, can be reduced by adopting less restrictive zoning. Zoning, and generally the siting of affordable housing can enable affordable options in higher socio-economic neighborhoods that commonly come with higher quality public services, which in turn creates more opportunities for economic advancement. While admittedly changing the zoning regulation in existing communities is very difficult, allowing higher densities in new neighborhoods and redeveloping neighborhoods is an excellent way to increase the supply of new housing without upsetting the status quo.

Accessory dwelling units (ADUs) – also called “granny flats” are second dwelling units created on a lot with an existing house, attached house or manufactured home. They have the potential to create new affordable housing, add diversity to neighborhoods and expand housing options, especially for baby boomers who are aging and millennials who are otherwise living with their parents. A major benefit of ADUs is that the capital invested comes entirely from the private sector saving valuable public funds for other projects.

However, as is always the case, ADUs are not without detractors. Neighbors often feel that ADUs spoil the character of their neighborhood, depress home values and create parking and traffic issues. As with any affordable housing option, the key is good design and neighborhood compatibility. Micro-housing – While only time will tell if tiny houses are a fad or part of the long-term solution to housing affordability, they are currently in high demand. In some areas, tiny houses

29

may fit well within existing zoning as accessory dwelling units, while in other areas, zoning and building codes may need to be revisited to allow for small houses. Moreover, some communities and housing agencies have started to venture into creating dedicated developments for tiny houses, and these efforts should be given fair consideration. Similarly, micro-housing developments can be part of the solution in some urban areas, including areas where there is infill development. In all these cases, neighborhood compatibility and parking must be carefully taken into consideration.

Expensive homes – Finally, construction of expensive houses should not be discouraged. While building high-priced units may at first blush appear to decrease housing affordability, not building expensive units makes things worse as wealthier home buyers bid up the prices of houses that they want to buy. This in turn, raises the price of the next tranche of housing and so on. With more units available, even if they are expensive, a damper on the rate of increase in the cost of high-priced housing is created. More generally, this suggests that any home building is better than no building. Thus, ordinances that make it difficult to build big houses should be reviewed with an aim to limit their impact. Any additional supply at any level – including the higher valued homes, will assist in growing much-needed supply.

Capital and Finance Issues

Low Income Housing Tax Credits – Low-Income Housing Tax Credit (LIHTC) units account for roughly one-third of all multifamily rental housing constructed between 1987 and 2006. As units built with LIHTCs age, however, many of the properties financed using the program age-out and become eligible to quit the program’s rent and income restrictions. This concern has prompted a recent study of the issue by the U.S. Department of Housing and Urban Development. The study found that while most LIHTC properties are likely to remain affordable, that may not be the case with for-profit owners in rapidly appreciating housing markets such as the metro front range and most areas in Colorado. HUD recommends that state housing finance authorities (HFAs) identify properties at risk of higher rent and/or conversion and make resources available to preserve those properties as affordable.

Moreover, there has been repeated talk of eliminating and/or curtailing the size of the LIHTC program. Without a doubt, eliminating or reducing the LIHTC program will have a tremendously negative impact on the production of affordable housing. On the other end of the continuum, there are also current proposals in Congress to expand LIHTC allocations by as much as 50%. To that end, lobbying the Colorado delegation is essential.

Specific to Colorado is the recent reinstatement – and continuation – of a state Low Income Housing Tax Credit. Modeled after the federal LIHTC program, this modest investment has demonstrated huge success in further leveraging the federal LIHTC program and rapidly escalating production of affordable housing units throughout the state. This program will be funded through 2019, and advocating for the ongoing funding of this program will be essential to maintain the forward momentum.

Foreign investment – Foreign investors, particularly from China, have shown interest in the multifamily market. A specialized program known as the Immigrant Investor Program (EB-5)

30

allows interested foreign investors to offer low-cost money with flexible underwriting. Because the program requires that all projects built by EB-5 investors create or preserve 10 permanent, full time jobs (non-construction), mixed-use developments that combine, for example, a mix of apartments and food and beverage establishments are especially attractive. Within the EB-5 program, there is a subcategory of investment called Regional Centers. An EB-5 Regional Center is a private enterprise or a regional governmental agency, approved by US Customs and Immigration Service and authorized under the Immigrant Investor Pilot Program that engages in a targeted investment program within a defined geographic region. Colorado currently has 16 approved Regional Centers, many of which invest in the Denver and Front Range areas. There are Regional Centers approved across the United States, meaning Colorado’s centers compete with others across the country, so efforts to attract foreign and especially Chinese investors can help bring those investment dollars into Colorado. Down payment assistance programs – Even when a home is affordable, many buyers struggle to come up with the necessary down payment to make a purchase. That is why down payment assistance programs can fill a critical need for many first-time homebuyers. Down payment assistance is available through the Colorado Housing and Finance Authority and a multitude of other agencies located throughout Colorado. Under a down payment assistance program, income-qualified buyers who can make monthly mortgage payments can receive cash grants that can be used toward the down payment or for closing costs. However, in the highly competitive Denver real estate market, offers with small down payments are not as competitive as higher down payments, and especially against all-cash offers. Realtors and agents can assist by helping buyers to have realistic expectations and write good offers. Nonetheless, without down payment assistance programs, many buyers will never be able to enter the market at all, so these types of programs should be supported, expanded if possible, and widely publicized. Rental assistance – There are numerous public and private programs available to provide a range of relief to families struggling to maintain affordable rental housing. Several voucher programs are administered by HUD and state agencies, while other industry partners also can provide temporary assistance on utility costs, security deposits and rental application fees. For some households, affordability may be a longer-term concern that requires a permanent housing solution, while other households may simply need temporary assistance to address immediate circumstances. Community partners, such as local apartment associations and realtor associations, can direct clients to the programs and services that can provide both temporary and long-term assistance.

Tax Increment Subsidies – While many communities applaud the benefits of urban residential growth, individuals can have strong incentives to oppose it if it is planned too close to where they live. Since most urban areas are already built up, someone or some group is almost always impacted. To overcome this problem, diverting some of the added property taxes from the new construction to existing nearby residents can be a clever way to blunt NIMBYism. As an example, the benefit to existing households near a new construction site may take the form of a temporary property tax cut, for a period of five or ten years, or investment in some other neighborhood amenity, such as a new recreation center or library.

31

Seek creative solutions - There is no silver bullet approach when it comes to providing more affordable housing. Creative solutions must be sought. A proposal created by the Colorado Apartment Association focuses on a voluntary plan in which multifamily housing providers could offer existing apartment units to the City for a ten to twenty year term and rent it to those who qualify at 60-80% AMI, in exchange for a tax abatement. This approach eliminates the three year construction time frame, offers preferred integration of affordable housing and rapidly assists the City in obtaining their housing goals.

Supply Side Issues

Construction labor shortage – Estimates are that 30 percent of construction workers moved into new fields after the housing bust, meaning that now there is a significant lack of skilled construction workers and tradespeople. Residential construction is not able to keep up with demand, and because labor costs are high, homebuilders are more likely to turn to higher-margin expensive homes and build fewer starter homes, making it even harder for first time buyers to find an entry-level home. Due to the construction labor shortage, some contractors are starting to turn down jobs that have penalties for late completion, and subcontractors are having a hard time finding adequate staffing. While worker wages are rising, because home prices are so expensive, fewer and fewer construction/trades workers can afford to live in the communities where they are building – creating the paradox of "I have never made so much money yet have never felt so poor."

One estimate is that 30,000 new construction jobs will be needed in Colorado in the next seven years. The Central 70 project between I-25 and Chambers road alone is expected to create thousands of construction jobs. The solution is increased training classes, vocational training and apprenticeship programs. This would increase the supply of construction workers and therefore, the supply of new housing units that, at a minimum, would reduce the rate of increase in rents and home prices. Colorado’s 2015 Work Act, which dedicates $10 million over three years for various industry/technical college programs is a great start, but more needs to be done. Several new construction training programs are underway, including programs created by Colorado Construction Institute and the Associated General Contractors of Colorado, as well as many employer-based programs. But more programs are needed and should be encouraged. Additionally, high schools need to place more emphasis on vocational education and career opportunities, particularly for students who are not on a traditional college path.

Highway Infrastructure - At present, due to rapid population growth, traffic in and around Colorado metro areas has substantially worsened, turning morning commutes into traffic jams as bad as they are in Los Angeles, Washington D.C., or New York. The added traffic in turn drives up house prices in the city, leading to a vicious cycle of people moving out into the suburbs and creating even more traffic congestion.

Colorado’s transportation funding is inherently complicated and made more so by the variability of revenues and the impacts of the Tax Payer Bill of Rights (TABOR). Additionally, the state’s gas tax of 22 cents per gallon has not changed since 1992 despite inflation that has dramatically reduced the real purchasing power of that funding source. Several groups are looking at ways to increase funding for transportation, including a sales tax increase and/or issuing bonds for

32

highway projects. And while a key component of the solution is in multi-modal and transit-oriented development, mass transit almost never pays fully for itself, meaning that funding for transit competes with highway infrastructure needs.

That said, vehicles in Colorado travelled 40 billion miles on state highways and roads in 2012, and the Colorado Department of Transportation (CDOT) expects that to jump to nearly 70 billion by 2040. Addressing these increasing levels of traffic will require additional capacity. This necessarily means widening of interstates, state highways and local roads; more reliance on mass transit to help people get around and to keep them from contributing to traffic congestion; and increased use of toll roads, such as E-470, as a way of attracting private-sector funds.

Water and wastewater – In Colorado, water is and always will be a major issue. This is why water conservation and water development must remain high priorities if housing, affordable or otherwise, is to be developed in large numbers. In the Denver area, those costs can be staggeringly large. A recent auction of a 500-acre farm near Mead brought in $12.6 million, with much of that price attributed to the property’s water rights, which can be utilized for agriculture, development or industrial processes, including oil and gas extraction. Just as with any commodity, scarcity and demand impact prices, which is why tap fees vary widely across the state. In combination with sewer fees, their impact on development costs can be substantial, and they pose an ongoing utility cost to the homeowner once the home is occupied. Therefore, efforts to integrate water development and efficiency into land use planning should be supported. Colorado’s Indoor WaterSense Fixture requirement and other similar efforts to promote water conservation (e.g. the recent rain barrel legislation) are examples of legislative changes that can help to reduce water demand. Demand Issues Population in-migration due to marijuana legalization – Without a doubt, the new business and employment opportunities in the recreational marijuana industry have created additional demand for housing. A portion of the spike in housing demand and in homelessness may also be attributed to individuals moving to Colorado to take advantage of legal recreational marijuana use – the so-called “marijuana migrants.” A recent study using data provided by CoreLogic estimated that the legalization of marijuana has increased housing prices by approximately eight percent in communities where recreational pot sales are allowed. State and local officials must keep this in mind as new legislation is considered and as spending of the associated tax revenues is allocated. Given that the law has boosted demand for housing, it is reasonable that at least some of the revenues from the tax on marijuana should be dedicated to affordable housing. This is a unique and continually evolving issue in Colorado with a myriad of other public service and finance concerns. Housing, along with impacts on public safety, education and other community infrastructure will become more known as time goes on. Population growth – Colorado, and in particular the Front Range, has experienced unprecedented growth post the 2008 recession. As the economy has rebounded, the opportunities for employment, along with quality of life, have driven growth through the state. The Colorado State Demography office has confirmed an annual net population growth of 100,000 new residents each year and predicts this trend will continue for the foreseeable future.

33

This growth includes households with varying incomes and varying needs for different housing types. Consumer preferences – With such rapid, and diverse, population growth comes a range of housing preferences. Today’s millennials carry an average $28,000 student loan debt, which impacts the amount and type of housing costs they can afford and/or are willing to commit to. This additional debt speaks to the need for more affordable rental and purchase options for this large segment of the population. On the other end of the spectrum, seniors looking to downsize represent another shift with significant impacts of the housing market, leaving traditional single family homes and seeking a more maintenance-free lifestyle. And overall, consumer preferences are trending towards more dense, walkable neighborhoods, making a case for diverse housing options in integrated neighborhoods. Final Thoughts Real estate markets – like many other markets in our economy – are cyclical. The challenges of developing a robust and growing community that not only responds to current need but also anticipates and adjusts to meet future conditions require careful planning and strong leadership. Just as there are many unique and distinct regions and communities in Colorado, there is no one-size-fits-all approach – or single strategy - to increasing housing supply and providing affordable options. Instead, careful consideration to even the smallest steps to increase availability of supply and reduce impediments found in oversight and regulatory reform can collectively move the needle and assure a continuum of housing choice to meet our communities’ needs both now and in the future. Contact For more information on the findings of this study, please contact: Elliot F. Eisenberg, Ph.D., GraphsandLaughs, LLC , [email protected], 202.306.2731 Housing Colorado, Sara Reynolds, Executive Director; [email protected], 303.863.0124 Home Builders Association of Metro Denver, Cherie Talbert, Senior Vice President, [email protected], 303.551.6734 Colorado Apartment Association, Nancy Burke, Vice President of Government and Community Affairs, [email protected], 303.548.3193

34

Appendix