DRIVE Forward · 2020. 5. 22. · of Daihatsu light-duty commercial vehicles in Malaysia for the...

Transcript of DRIVE Forward · 2020. 5. 22. · of Daihatsu light-duty commercial vehicles in Malaysia for the...

DRIVEForward

(199301029757) A

NN

UA

L REPORT 20

19

(199301029757)

(284496-V)

(284496-V)

A N N U A L R E P O R T 2 0 1 9

The concept of our Annual Report this year focuses on adapting 5 values that fuel our resolve to DRIVE FORWARD. Solid in business and fluid in momentum, we will continue to adapt and innovate, to pursue and accelerate our growth in sight of the challenging environment ahead.

D eterminationR eturnsI nnovationV aluesE xcellence

DRIVE Forward

ANNUAL REPORT 2019

Annual Report 2019 1

CONTENTS02 Corporate Information

03Corporate Profile 04 Corporate Structure 05 Group Financial Performance: Five-Year Summary 07 Management Discussion and Analysis

16 Sustainability Statement 26 Profile of Directors

29 Management Team Profile 30Corporate Governance Overview Statement

41 Attendance at Board of Directors’ Meetings, Board Committee Meetings and General Meeting

42Summary of Directors’ Trainings for 2019

44 Statement on Risk Management and Internal Control

50 Report on Audit and Risk Management Committee

54 Other Information Required by the Listing Requirements of Bursa Malaysia Securities Berhad

57 Directors’ Responsibility Statementin Relation to the Financial Statements

58 List of Properties 63 Analysis of Shareholdings 67 Report of the Directors and AuditedFinancial Statements

169 Notice of Twenty-Sixth (26th) Annual General Meeting

176 Administrative Guide for the 26th Annual General Meeting

181 Proxy Form

MBM RESOURCES BERHAD2

Board of DirectorsY. Bhg. Datuk (Dr) Aminar Rashid bin SallehChairman, Independent Non-Executive Director

Encik Muhammad Lukman bin Musa @ HussainNon-Independent Non-Executive Director

Ms Wong Fay LeeNon-Independent Non-Executive Director

Y. Bhg. Dato’ Anwar bin Haji @ AjiSenior Independent Non-Executive Director

Mr Low Hin ChoongNon-Independent Non-Executive Director

Mr Ng Seng KongNon-Independent Non-Executive Director

Corporate Office23-01, Level 23, Menara MBMR1 Jalan Syed Putra58000 Kuala LumpurMalaysiaTel : (603) 2273 8803 Fax : (603) 2273 6803www.mbmr.com.my

Company SecretariesWong Peir Chyun (MAICSA 7018710)(SSM PC No. 202008001742)

Wong Wai Foong (MAICSA 7001358)(SSM PC No. 202008001472)

Stock Exchange ListingMain Market Bursa Malaysia Securities BerhadStock Code: 5983

Registered OfficeUnit 30-01, Level 30, Tower A Vertical Business Suite Avenue 3, Bangsar South No. 8, Jalan Kerinchi 59200 Kuala Lumpur Wilayah Persekutuan MalaysiaTel : (603) 2783 9191 Fax : (603) 2783 9111

AuditorsDeloitte PLT (LLP0010145-LCA)Chartered Accountants (AF 0080)

Principal BankersCIMB Bank BerhadHSBC Bank Malaysia BerhadMalayan Banking BerhadPublic Bank BerhadUnited Overseas Bank (Malaysia) Berhad

Share RegistrarTricor Investor & Issuing House Services Sdn BhdUnit 32-01, Level 32, Tower A Vertical Business Suite Avenue 3, Bangsar South No. 8, Jalan Kerinchi 59200 Kuala Lumpur Wilayah Persekutuan MalaysiaTel : (603) 2783 9299 Fax : (603) 2783 9222

Financial Calendar25th Annual General Meeting: 29 May 2019

2019 Results Announcement Quarter 1: 23 May 2019Quarter 2: 20 August 2019Quarter 3: 21 November 2019Quarter 4: 26 February 2020

Dividend Payments: Final for 2018: 28 June 2019First Interim for 2019: 19 September 2019Second Interim for 2019: 30 March 2020

Corporate Information

Annual Report 2019 3

MBM Resources Berhad (MBMR) is an automotive group with diverse investments in distributorship and dealership

of major international vehicle brands and automotive parts manufacturing in Malaysia.

The Group is well represented in all segments of the market from light trucks to medium and heavy duty trucks and

buses in the commercial vehicle market and, from compact entry level cars to luxury cars in the passenger vehicle

market. Its automotive parts manufacturing division, consisting of wheels, airbags, seatbelts, steering wheels and

noise, vibration and harshness (NVH) products, is a significant supplier to all the major brands in Malaysia.

Our VisionTo be a Complete Automotive Group

Our MissionTo be the Automotive Partnerof Choice to our Employees,

Customers and Investors

Motor Trading

Auto Parts Manufacturing

Corporate Profile

MBM RESOURCES BERHAD4

PARTS &ACCESSORIES

REPAIR &WARRANTY

SERVICING

AUTOMOTIVEPARTS

VEHICLEASSEMBLY

BODY &PAINT

VEHICLES

MA

NU

FA

CT

UR

ING

DISTRIBUTIO

N R

ET

AIL / D

EALERSHIP

The Complete Automotive Group

Motor Trading

Daihatsu (Malaysia) Sdn. Bhd. (DMSB) 51.5%DMM Sales Sdn. Bhd. (DMMS) 100%

Federal Auto Holdings Berhad (FAHB) 100%Federal Auto Cars Sdn. Bhd. 100%F.A. Wagen Sdn. Bhd. 100%

Hino Motors Sales (Malaysia) Sdn. Bhd. (HMSM) 20%

Perusahaan Otomobil Kedua Sdn. Bhd. (Perodua) 20%

Manufacturing

Hirotako Holdings Berhad (HHB) 99.9%Hirotako Acoustics Sdn. Bhd. (HASB) 100%Autoliv Hirotako Sdn. Bhd. (AHSB) 51%

Oriental Metal Industries (M) Sdn. Bhd. (OMI) 100%

Hino Motors Manufacturing (Malaysia) Sdn. Bhd. (HMMM) 20%

Property

Inai Benua Sdn. Bhd. 70%

MBMR Properties Sdn. Bhd. 100%

Note: A detailed list of the companies under the Group are shown in Notes 52 to 54 of the Reportof the Directors and Audited Financial Statements.

Subsidiary

Associate

Jointly Controlled

Corporate StructureAs of 20th May 2020

Annual Report 2019 5

Group Financial Performance :Five-Year Summary

Year ended 31st December 2015 2016 2017 2018 2019

Results (RM Million)Revenue 1,797.8 1,644.6 1,687.9 1,882.7 2,085.2Operating profit / (loss)* 63.2 2.3 (152.1) 48.2 81.5Jointly controlled entity’s results 15.6 11.7 9.9 14.3 11.9Associates’ results 102.1 131.2 119.1 183.1 190.8Profit / (loss) before tax 153.6 118.2 (45.3) 228.6 268.3Net profit / (loss) from continuing operations 128.3 111.4 (57.6) 213.5 257.3Net loss from discontinued operation (23.3) (35.5) (87.5) (24.6) (8.1)Profit / (loss) for the year 105.0 75.9 (145.1) 188.9 249.2Profit / (loss) attributable to equity holders 84.0 66.1 (138.7) 166.8 223.7Basic earnings per share (sen) 21.5 16.9 (35.5) 42.7 57.2Operating profit / (loss)* per share (sen) 16.2 0.6 (38.9) 12.3 20.9

Balance Sheets (RM Million)Share capital 390.7 390.7 391.7 391.7 391.7Shareholders’ equity 1,563.6 1,605.8 1,449.7 1,579.2 1,748.9Total assets 2,338.4 2,381.4 2,091.4 2,106.1 2,193.6Borrowings 372.4 374.9 283.1 145.5 35.9Debt / Equity (%) 23.8 23.3 19.5 9.2 2.1Net assets per share (RM) 4.0 4.1 3.7 4.0 4.5

Financial Ratios (%)Operating profit / (loss)* margin 3.5 0.1 (9.0) 2.6 3.9Return on equity 5.4 4.1 (9.6) 10.6 12.8Return on total assets 3.6 2.8 (6.6) 7.9 10.2

Vehicle Sales (Units)Passenger vehicles 25,617 24,190 23,665 25,428 26,331Commercial vehicles 1,411 1,242 1,100 1,537 1,682Total group 27,028 25,432 24,765 26,965 28,013

Equity IndicesClosing year end share price (RM) 2.4 2.2 2.2 2.2 3.9Price-earnings ratio (times) 11.2 13.0 (6.2) 5.2 6.8

*Operating profit / (loss) defined as profit / (loss) before tax excluding interest, depreciation and amortisation, jointly controlled entity’s results and associates’ results.

The figures from 2015 to 2018 have been restated to show OMI Alloy (M) Sdn Bhdas Discontinued Operation separately from the Continuing Operations.

MBM RESOURCES BERHAD6

Annual Report 2019 7

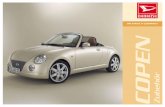

GROUP’S BUSINESS OVERVIEWMBM Resources Berhad (“MBMR”) Group operates through

two principal business divisions, namely, Motor Trading Division

and Auto Parts Manufacturing Division. Our Motor Trading

Division consists of the Daihatsu (Malaysia) Sdn Bhd Group

(“DMSB Group”) and Federal Auto Holdings Bhd Group

(“FAHB Group”). DMSB has been the exclusive sole distributor

of Daihatsu light-duty commercial vehicles in Malaysia for

the last 39 years. Currently, it distributes the Gran Max 1.5L

model with 17 different body applications to cater to various

business needs. DMSB, through its wholly-owned subsidiary

DMM Sales Sdn. Bhd., is the largest dealer for Perodua

vehicles whilst it also holds the largest dealership for Hino

commercial trucks and buses in Malaysia. Under FAHB Group,

we carry the luxury brand of Volvo with our flagship Volvo 4S

center in Glenmarie, our newly renovated Penang 3S center

and the central Kuala Lumpur 1S center. The Group is also

the biggest dealer of Volkswagen vehicles and operates its

Volkswagen 4S centers in Glenmarie and Johor Bahru and a

boutique 3S center in Sri Hartamas, Kuala Lumpur.

Management Discussion and Analysis

MBM RESOURCES BERHAD8

MANAGEMENT DISCUSSION AND ANALYSIS

DEALERSHIPF.A. WagenSdn Bhd

28,013219,149

VEHICLES SOLD

VEHICLES SERVICED

SERVICEOUTLETS

SALESOUTLETS

BODY &PAINT

1,010VEHICLES SOLD

24,226VEHICLES SERVICED

32

3

39SALESOUTLETS

37SERVICEOUTLETS

6BODY &PAINT

DEALERSHIPFederal Auto CarsSdn Bhd

2SERVICEOUTLETS

3SALESOUTLETS

1BODY &PAINT

833VEHICLES SOLD

12,226VEHICLES SERVICED

DISTRIBUTORSHIPDaihatsu (Malaysia)Sdn Bhd

* authorised dealers

1,358VEHICLES SOLD

9,412VEHICLES SERVICED

1

SERVICEOUTLETS

SALESOUTLETS

BODY &PAINT

8/21*13/24*

DEALERSHIPDaihatsu (Malaysia)Sdn Bhd

68

SERVICEOUTLETS

SALESOUTLETS

324VEHICLES SOLD

11,423VEHICLES SERVICED

DEALERSHIP (Largest in Malaysia)

DMM Sales Sdn Bhd

24,488VEHICLES SOLD

161,862VEHICLES SERVICED

SERVICEOUTLETS

SALESOUTLETS

BODY &PAINT

132

17

GROUP TOTAL

Our Motor Trading Division in Numbers

Annual Report 2019 9

MANAGEMENT DISCUSSION AND ANALYSIS

to the local automotive market. AHSB Group is involved in the

manufacturing of safety restraint systems such as airbags and

seatbelts, as well as steering wheels.

Additionally, the Group has investments in commercial and

passenger vehicle assembly / manufacturing and distributorships

through its main associates, i.e. Perodua, Hino Motors

Manufacturing (Malaysia) Sdn Bhd and Hino Motors Sales

(Malaysia) Sdn Bhd ( “Perodua” and “Hino”).

The Group is also a significant auto parts supplier to all the major

car brands in Malaysia through its Auto Parts Manufacturing

Division. The Auto Parts Manufacturing Division is comprised of

our subsidiaries Oriental Metal Industries (M) Sdn Bhd (“OMI”)

and Hirotako Acoustics Sdn Bhd (“HASB”), as well as our jointly

controlled entity Autoliv Hirotako Sdn Bhd Group (“AHSB Group”).

OMI is involved in the manufacturing of steel wheels and module

assembly of tyres, whilst HASB supplies a wide range of products

ranging from dampening sheets to insulators and felts, collectively

termed as Noise, Vibration and Harshness (“NVH”) products

Our Auto Parts Manufacturing Division in Numbers

228,000STEERING WHEELS

364,000STEEL WHEELS

163,000ALLOY WHEELS

2,398,000TYRE ASSEMBLY

524,000AIRBAGS

1,568,000SEAT BELTS

657,000NVH PRODUCTS

MBM RESOURCES BERHAD10

MANAGEMENT DISCUSSION AND ANALYSIS

FINANCIAL PERFORMANCE (Restated) FY FY %RM Mil 2019 2018 Change

RevenueTotal Group’s reportable segments and all others 2,110.8 1,927.0 9.5Less: Discontinued operation (25.6) (44.3) (42.2)Continuing operations, as reported 2,085.2 1,882.7 10.8

Continuing operationsOperating profit 36.0 31.6 13.9Net one-off gains from disposals / costs 27.2 - >100Net finance income / (costs) 2.4 (0.4) >100Share of joint venture results 11.9 14.3 (16.8)Share of associates’ results 190.8 183.1 4.2Profit before tax 268.3 228.6 17.4

Discontinued operationOperating loss (5.3) (19.6) 73.0Net finance costs (2.8) (5.0) 44.0Loss before tax (8.1) (24.6) 67.1

In 2019, MBMR Group’s revenue from continuing operations

increased to RM2.09 billion as compared to 2018’s revenue of

RM1.88 billion, an improvement of RM202.50 million or 10.8%.

The increase was contributed by both our Motor Trading and Auto

Parts Manufacturing Divisions. 2019 also marks an important

milestone for MBMR Group where the Group’s revenue crossed

the RM2 billion mark.

2015 2016 2017 2018 2019

8.5%

0%

-5.9

%

-13.

0%

3.9

%

0.9

%

8.9%

3.8%

-2.6

% -0.6

%

Group's Vehicle Sales

TIV

Revenue from our Motor Trading Division increased by 10.8% to

RM1,876.1 million as compared to 2018’s revenue of RM1,693.3

million with our Group vehicle sales increasing by 3.9% year-on-

year, against the 0.9% increase in Total Industry Volume (“TIV”).

Despite the lack of tax-free factor to boost vehicle sales, consumer

preferences were clearly steered towards national makes in 2019,

setting another record sale for Perodua at 240,341 units, an

increase of 5.8% against 2018, thus firmly placing Perodua at its

top market leader position with the passenger vehicles market

share of 43.7% versus 42.6% in 2018. MBMR Group likewise

achieved new heights with our Perodua sales volume at 24,488

units, as compared to the 23,350 units sold in 2018, an increase

of 4.9%. Among the Perodua models, the new Myvi continued

to garner highest sales volume since its launch in November 2017,

complemented by the newly launched Aruz and persistent

demand for the remaining Perodua models. As for Volvo, the SUV

range remains our customers’ favourite with the addition of the

XC40 CKD version available for deliveries since the beginning of

the year. The Daihatsu brand in 2019 also brought in higher than

expected volume due to increased fleet customer sales.

For the Auto Parts Manufacturing Division, revenue from

continuing operations increased further to RM207.2 million in

2019, a 12.4% increase from 2018’s RM184.4 million. The revenue

increase was mainly contributed by higher production demand for

the tyre assembly and NVH products.

With the higher sales volume, the Group’s 2019 operating profits

from continuing business (excluding one-off net gain/costs, net

finance costs, and share of joint venture and associates’ results),

as shown in the “Financial Performance” table was RM36.0million,

a further improvement of RM4.4million or 13.9% as compared to

the operating profit of RM31.6million in 2018.

In June 2019, the Group ceased its alloy wheel operations as

planned and thereby reduced operating losses by RM14.3 million,

or 73.0% as compared to the operating losses from the preceding

financial year. The alloy wheel operation has since been classified

as Discontinued Operation.

During the year, the Company also successfully disposed of 22%

each of its shareholdings in its associated companies, Hino Motors

Manufacturing (Malaysia) Sdn Bhd (“HMMM”) and Hino Motors

Sales (Malaysia) Sdn Bhd (“HMSM”) to Hino Motors, Ltd, for cash

consideration of RM43.0 million and RM31.4 million respectively,

resulting in a total gain of RM24.8 million. Subsequent to the Percentage Change in Group Vehicle Sales vs TIV

Annual Report 2019 11

MANAGEMENT DISCUSSION AND ANALYSIS

disposal, the Company’s shareholding in HMMM and HMSM

reduced from 42% to 20%. The proceeds from the disposals were

fully utilised to pay down bank borrowings within the Group.

Further, the Group recognised RM11.9 million gain from disposal

of a property under the Motor Trading Division to monetise

unutilised properties. We also wrote off various one-off costs at

the Motor Trading Division amounting to a net RM9.5 million.

Together, the net one-off disposals and write off totalled

RM27.2 million.

With the aforesaid increase in Perodua’s performance in 2019,

complemented by the increase in Hino’s market share of the

domestic commercial vehicle market from 8.9% to 10.2% in

2019, albeit partly offset by the lower shareholdings in HMMM

and HMSM from June 2019 onwards, the Group’s share of the

associates’ results therefore increased by RM7.7 million or 4.2%

to RM190.8 million against 2018’s share of RM183.1 million. The

share of the joint venture entity’s results is however lower in 2019

by RM2.4 million or 16.8% as the profit in 2018 included a recovery

of some long outstanding claims.

Overall, the Group recorded profit before tax from continuing

operations of RM268.3 million in 2019, the highest ever profit

achieved by the Group.

FINANCIAL POSITIONAs at 31 December 2019, the Group’s net assets have increased

from RM1,828.5 million to RM2,012.6 million, an improvement

of RM184.1 million. The Group’s net assets per share (attributable

to equity holders) therefore increased from RM4.03 to RM4.47

per share.

The increase in net assets of the Group was mainly contributed by

current year’s profits from our Business Divisions and consistent

performance from the associates especially Perodua, as well

as our joint venture entity. The unlocking of the higher value in

HMMM and HMSM through the aforementioned disposals also

contributed to the increase in the Group’s net assets value. The

proceeds from the disposal were subsequently utilised to pay

down bank borrowings. The Group’s bank borrowings therefore

reduced further from RM145.5 million to RM35.9 million, with a

pay down of RM109.6 million during the year.

In 2019, the Group incurred capital expenditures amounting to

RM14.7 million to further upgrade our showrooms and workshop

facilities as our continuous efforts to expand business operation

and enhance customer comforts and satisfaction. The upgrades

were carried out on various Perodua, Daihatsu and Hino outlets.

Our Volvo Penang 3S center also underwent an extensive

renovation to achieve better customer experience. Part of

the capital expenditures also went to tooling in our Auto Parts

Manufacturing Division to prepare for new productions in the

coming year.

Not forgetting to reward our shareholders, the Group paid RM58.6

million in dividend to our shareholders in 2019 as compared to

RM17.6 million paid in 2018.

With that, the Group was still able to increase its cash and bank

balances from RM197.4 million in 2018 to RM265.6 million by

31 December 2019.

OPERATIONAL REVIEWMotor Trading DivisionIn 2019, our Motor Trading Division recorded revenue of RM1,876.1

million, a 10.8% improvement from 2018’s revenue of RM1,693.3

million. The Division’s operating profit before interest and tax,

excluding the earlier mentioned one-off gains/write off, is higher

in 2019 by RM6.2 million or 26.5% against the performance in

2018. Aside from consistent vehicle sales, the higher performance

in 2019 was mostly due to action taken to discontinue and thereby

eliminate any further losses from the Iveco business.

MBM RESOURCES BERHAD12

MANAGEMENT DISCUSSION AND ANALYSIS

As mentioned in the earlier paragraphs, Perodua continued to enjoy strong consumer demand for all its models and ended the year with a 4.9% increase in sales volume. Volvo’s sales volume also increased by 5.6% year-on-year with the boost coming from the addition of XC40 from the beginning of the year, as well as the launch of the new S60 sedan model in the month of October. As for Volkswagen, we faced increasing price pressure which led to lower margins coupled with lower demand after the high GST tax-free volume in 2018. Increased operating costs was also a factor affecting the profit in 2019. In terms of vehicle sales market share, the Group contributed to 10.2% of Perodua’s new car registrations, and 45% and 17.3% respectively of Volvo and Volkswagen new car registrations in 2019.

In our commercial vehicle segment, 2019 saw impressive

performance from our Daihatsu team with an 18.3% increase

in sales volume as compared to 2018 mainly lifted by higher

fleet sales volume. We are seeing results from earlier efforts

to introduce programmes for the Daihatsu dealers including

supports for roadshows, campaigns, etc., as well as new initiatives

to support existing customers and attract new interest with

programmes such as the Daihatsu Business Fleet Program, a

comprehensive fleet program management which provides

innovative solutions and service support to customers. Hino, on

the contrary, closed the year with 16.7% reduction in sales volume

mainly due to intense competition and long body-building process

which delayed invoicing.

With concerted efforts to improve aftersales efficiency and

service quality, the Division’s aftersales saw an increase of 8.7%

in revenue for the year from RM153.9 million in 2018 to RM167.3

million in 2019. Some of the initiatives implemented during the

year included the introduction of Kaizen activities at various

service centers, strengthening of aftersales standard procedures

and the DMSB-Hino Customer Loyalty Program. Given that

margins coming from aftersales services are higher, the Group

will intensify its effort to increase throughput volume and value

through efficiency improvement and upselling.

153,

875

167,

348

150,

275

156,

263

160,

059

2015 2016 2017 2018 2019

Aftersales Revenue (RM’000)

After Sales Vehicle Sales

2019

40.6%59.4%

39.3%60.7%

2018

Gross Margin between Vehicle Sales and Aftersales

TIV Group's Vehicle Sales Group Share of TIV

2015 2016 2017 2018 2019

598

,714

604

,287

666,

674

580

,124

576

,635

26,965

4.5%

24,765

4.3%

25,432

4.4%

27,028

4.1%

28,013

4.6%

Group Vehicle Sales Market Share

Annual Report 2019 13

MANAGEMENT DISCUSSION AND ANALYSIS

Auto Parts Manufacturing DivisionThe Division recorded revenue from continuing operations of

RM207.2 million in 2019, a 12.4% increase from 2018’s RM184.4

million contributed mainly by our module assembly business

and NVH products. The Division’s continuing operating profit

before interest and tax (excluding the gain from disposal of 22%

shareholding in HMMM) however, drew in mixed performance

with a net reduction of RM1.4 million or 11.1% against 2018. The

reduction is mainly coming from the declining steel wheel volume.

Our NVH products also brought in slightly lower profit despite

higher revenue mainly due to increased product testing costs

incurred for the coming year’s production.

Wheels and tyre assembly

Given that the domestic market demand for steel wheels has been

on declining trend in recent years, OMI’s steel wheel business

also recorded a further 9.5% reduction in revenue in 2019.

Notwithstanding, with the continuous efforts to optimise internal

resources, reduce cost and improve efficiency by minimising

machine downtime and labour turnover, our steel wheel business

remained profitable. That said, the Management is also reviewing

the steel wheel business strategies moving forward.

As for the module assembly business, we are seeing increasing

business opportunities with revenue and sales volume for 2019

higher by 15% and 7.2% respectively. The increase came mostly

from new model productions commenced during the year. We

are also seeing an increasing shift by carmakers opting for more

value-add services, i.e component purchases in addition to pure

tyre assembly services which brings in additional margins for

our tyre assembly services. In 2019, OMI’s share of Malaysia’s

tyre assembly market increased by 4% to 84% against the Total

Industrial Production (“TIP”) volume of 571,632 units (Source:

MAA). The increase came from higher market share for OMI’s

major customers such as Proton, Perodua & Toyota.

In June 2019, we fulfilled all the alloy wheel delivery obligations

to our customers and proceeded as planned to close our alloy

wheel operations. All the known significant impairments and

provisions had been fully recognised. The Management is also

negotiating with potential buyers to sell the alloy wheel plant and

its machinery. We target to complete the sale in the current year.

Safety Products

Our jointly controlled entity, AHSB Group, is a 51% owned joint

venture with Autoliv AB. AHSB Group is involved in the design,

testing and manufacture of safety restraint products and systems

for motor vehicles. Our products include seat belts, airbags and

steering wheels. Autoliv AB is the world’s leading safety restraint

company with the highest market share globally.

We see a consistent year of performance from AHSB Group

in 2019 with a total of 2.3 million products delivered to the

customers, and a marginal growth of 1.4% over the production

volume in 2018. Likewise, revenue also increased by 2.7% to

RM201.8 million as compared to 2018. AHSB maintained its

market leader position in Malaysia for 2019 with market shares of

the aforesaid products at 49%, 40% and 31% respectively.

In 2018, AHSB managed to recover some one-off long

outstanding claims, which partly contributed to its higher profit

for the year. Consequently, the share of our joint venture results

in 2019 is lower due to the absence of such claims. Operationally,

AHSB Group’s profit was higher by 7.2% in 2019 as compared to

2018 due to higher production demand from customers.

In 2019, AHSB received the Outstanding Quality Performance

award from Assembly Services Sdn Bhd, the car assembler for

Toyota, and Best Quality award from Toyota Boshoku UMW Sdn

Bhd. The latter also awarded AHSB a Certification of Appreciation

for commitment towards new model development.

Acoustics productsSeat beltsAirbags

Steel wheels Tyre assembly Steering wheelsAlloy wheels

TIP

2015 2016 2017 2018 2019

614,664

545,253

499,639

564,971 571,632

Auto Parts Manufacturing Production Volume vs TIP

MBM RESOURCES BERHAD14

MANAGEMENT DISCUSSION AND ANALYSIS

GDP on 31 Mar 2020 to -0.1% against the backdrop of growing

uncertainty over the duration and overall impact of the Covid-19

outbreak, a stark contrast to the earlier 4.5% GDP target.

Globally, the International Monetary Fund (“IMF”) projected that

global economy would contract by 3% in 2020, an extraordinary

reversal from early 2020 when the Fund forecasted that the world

economy would outpace 2019 and grow by 3.3%. According to the

IMF, this year’s fall in output would be far more severe than the

last recession, when the world economy contracted by less than

1% between 2008 and 2009.

With these bleak data and forecasts in mind, we expect to face

a very challenging year ahead indeed. The reduced demand will

certainly intensify competition from other brands and new dealers

and put tremendous pressure on our volumes and margins. At the

Manufacturing side, we likewise expect significant reduction in

production demand from carmakers, exacerbated by delays in

vehicle pricing approvals for certain carmakers, which in turn will

further affect our production supply.

To counter these challenges, the Group has refocused its

Transformation Programme that commenced earlier this year to

formulate strategies in driving mid to long-term growth, as well

as taking mitigating actions in current operations post-MCO

period through cost rationalisation and efficiency improvement,

tightening of performance measurements as well as adjusting of

product and service offerings.

The Group will continue with our current focus to improve

aftersales volume and margin to partially negate the flattish

vehicle demand. At our manufacturing plant, increase in

automated facilities is also in the pipeline to increase efficiency

and profitability in the long run.

Acoustics products

Our wholly-owned subsidiary, HASB, is a major supplier of a wide

range of NVH products to the domestic automotive industry

including dampening sheets, NVH and felt products. These NVH

products are cost competitive and feature lightweight products

for better protection against heat and noise as well as better fuel

efficiency. HASB’s technical partner, Autoneum, continues to

provide strong technological support. Autoneum is a global leader

in acoustic and thermal management solutions for vehicles.

HASB’s revenue for 2019 saw an impressive 16.1% increase due to

the launch of various new model productions during the year such

as the Toyota Yaris and Mazda CX-8 models. HASB’s market share

on dampening sheets therefore increased by 5% to 81% and NVH

products likewise increased by 3% to 43% against the Malaysian

OEMs’ TIP volume.

OutlookAt the beginning of 2020, we had only expected a relatively

subdued operating environment with the Malaysian Automotive

Association projecting a flattish total vehicle sales of 607,000

units in 2020, a mere 0.5% increase from 2019’s 604,287 units.

Things soon took a sharp downturn with the extensive outbreak of

the Covid-19, and the subsequent lock-downs implemented across

the globe including Malaysia. The Movement Control Order

(“MCO”) in Malaysia started on 18 March 2020 and was gradually

loosened from 4 May 2020 onwards. During the MCO, businesses

were asked to shut down to curb the spread of Covid-19 virus.

MBMR Group complied with the Malaysian Government’s orders

and took all necessary precautions within the business premises

of the Group. MBMR Group also supported Malaysia’s efforts to

combat Covid-19 with a RM300,000 contribution towards much

needed medical supplies to healthcare facilities. The Covid-19

outbreak will have an impact to the Group’s operations moving

forward and we expect to see the slowdown in demands to

continue into the near future amidst all the uncertainties.

Locally, Bank Negara had reported on 4 Apr 2020 that Malaysia’s

Gross Domestic Product (GDP) is expected to contract to a

range of -2.0% to 0.5% (2019: 4.3%) driven mainly by private

consumption, albeit at a slower pace of 4.2% as compared to

2019’s 7.6%. Real GDP for various sectors are also expected to

slow down with the Services sector reducing to 2.3% (2019: 6.1%)

and the Manufacturing sector to an alarming -8.6% (2019: 3.8%).

The World Bank had also lowered its projection of Malaysia’s

Annual Report 2019 15

MANAGEMENT DISCUSSION AND ANALYSIS

Meanwhile, we remain hopeful for gradual recovery in consumer

confidence and cosumptions once the Covid-19 situation has been

brought under control. We are also confident of the quality and

product mix of the vehicles within the Group, especially with the

steady demand Perodua enjoys within its unique market segment,

the continuous strength of the Volvo brand, the potential new

models from Volkswagen, as well as the commercial vehicles

from Daihatsu and Hino that cater to specific market segments.

Moreover, we expect further growth in our Auto Manufacturing

Division as various parts developments for national and non-

national models have led to a number of new contracts for the

Division in 2020 and beyond.

DividendFor the financial year 2019, we declared a total of 13.0 cents

(2018: 6 cents) dividend to-date amounting to RM50.8 million.

The Directors have also recommended a final dividend of 9.0

cents (2018: 6 cents) per ordinary share to be approved at the

forthcoming Annual General Meeting (“AGM”), taking the

dividend for 2019 to a total 22 cents (2018: 12 cents), or an

estimated RM86.0 million, the highest dividend ever declared by

the Group. The higher dividend payout is in line with the Group’s

practice to reward shareholders with regular and healthy dividend

in line with our financial performance.

During the year, the Group has also announced a dividend payout

policy of a minimum of 60% of the Company’s net profit. In

computing the dividend payout ratio, we have excluded the gain

from the Hino Sales as the full proceeds received have been

utilised to pay down bank borrowings within the Group. The

reduction in bank borrowings within the Group will no doubt

translate to better profit and dividend in the future. With that

adjustment, the Group is pleased to announce that including the

proposed final dividend, the dividend payout ratio for 2019 based

on the adjusted net profit of the Company is 80%.

AppreciationWe would like to express our heartfelt appreciation for

the continuous support we received from our customers,

shareholders, business partners and other stakeholders. We thank

our employees for their continuous dedication and commitment

to the Group.

2019 has been a year of change for the Board of MBMR. We

therefore take this opportunity to express our sincere and

heartfelt appreciation to all our present and past Board members

for their support and guidance throughout the year, and for

their valuable contributions to the Group over the years. We bid

farewell to our Ex-Chairman, Dato’ Abd Rahim bin Abd Halim,

our Directors Encik Mustapha bin Mohamed and Encik Shamshin

@ Shamshir bin Ghazali, who all retired at the AGM on 29 May

2019. At the same time, we welcome in our new Chairman of the

Board, Datuk (Dr) Aminar Rashid bin Salleh who was appointed as

a Director on 29 May 2019, and re-designated as Chairman of the

Board on 25 June 2019, as well as Ms Wong Fay Lee who was re-

appointed to the Board on 29 May 2019.

MBM RESOURCES BERHAD16

Sustainability Statement

In 2018, MBMR’s sustainability journey started with the

introduction and highlights of a few programmes that have been

implemented. The results may not seem to be very prominent

yet it has one way or another influence the company’s business

progression and helps the cost-saving programmes. Business

progression is key to our sustainability goal. This drives us to

develop our product range and innovate service offerings, expand

our markets globally and increase our engagement with customers

to better meet their needs.

MBMR is committed not only to give the stakeholders better

investment returns but also to provide a safe, secure and non-

threatening living environment to the community and work

atmosphere to its staff. Our employees energise our business

growth. We recompense our people at competitive market

rate and improve their personal and career development by

continuously supporting them through skills development at work

and professional training.

During our first report in 2018, a materiality matrix of issues was

provided and validated by our subsidiaries and combined into a

consolidated matrix of 13 prioritised issues relating to the business

activities of the Group. Subsequently the materiality matters were

approved by the Board and formed the basis of an agreed set of

key performance indicators used to report on our performance.

However our subscription to the materiality matters are still in

preliminary stage. The materiality matters need a more detailed

assessment before it can be disclosed. Due to this, we formed a

sustainability team in every subsidiary to carry out the planning to

form a committee in the Sustainability team to embark on the task.

In general, our business drives within an ecosystem encompassing

the environment and the community. Preserving the quality

of safety, air and land would allow us to operate smoothly and

unhindered. The people trust in the company and have confidence

in the products we carry and the services that are part of

significant measures to us.

We focused on our set targets and the challenges while making

greater efforts to improve our sustainability reporting and

documentation.

OUR SUSTAINABILITY GOVERNANCESustainable management and social responsibility are among our

essential values. They form the base of our work, they guide our

corporate strategy and they will take us into the future.

We believe that sustainable and responsible business increases

our ability to innovate and meet the future – a value-added to the

company. It allows us to identify risks and opportunities early and

opens up the transformation processes we need.

Annual Report 2019 17

SUSTAINABILITY COMMITTEE LEADERS (SUBSIDIARY)

Mr Ngeow Zoo Gin (Autoliv Hirotako Sdn Bhd)

Mr Thean Lip Sung (Hirotako Acoustics Sdn Bhd)

Mr Low Eng Hong & Mr Chai Kin Poh (OMI Group)

Encik Noor Arman Putra bin Mohd Madi (Daihatsu (Malaysia) Sdn Bhd)

Encik Adam Firsham bin Aqil (Federal Auto Holdings Berhad)

The key elements of our sustainability structure include: Our sustainability governance structure development is

progressing as we get more involvement from the subsidiary

members. This development is to ensure the successful

management of ESG issues in the MBMR Group.

Board level - governance and oversight

MBM Resources Berhad’s Board of DirectorsThe Board have the ultimate responsibility for the management, general affairs, direction, performance and long-term success of the company. The Board reviews and monitors various aspect of the governance and other oversight issues.

Sustainability ManagementCommittee

Chief Executive Officer (CEO)The committee led by our Chief Executive Officer (CEO), is responsible for managing and overseeing the progress of all the sustainability strategies and goals.

Leads the integration of sustainability into our business and communications, working with all the business unit head to unlock capacity for business growth.

Chief Sustainability Officer (CSO) Leads our sustainability agenda to drive transformational change across the company and to monitor the progress of sustainability programmes.

MBMR Team – Cross-functional executive team

Reporting directly to CEO and CSO, the team engages leadership across business units, departments and provides further oversight and strategic guidance. This team also mobilised employees to implement strategies. The functions involve operations, marketing, public affairs and communications, human resources, environmental health and safety and investor relation.

Subsidiaries Sustainability Team -leadership - strategic development of our goals

Autoliv Hirotako Sdn Bhd (AHSB)Hirotako Acoustics Sdn Bhd (HASB)Daihatasu (Malaysia) Sdn Bhd (DMSB)Federal Auto Holdings Berhad (FAHB)Oriental Metal Industry (M) Sdn Bhd (OMI)

The team are responsible for the implementation of the strategic development of our sustainability goals. They work together as function leaders and our Sustainability Management Committee.

Sustainability Team Members (Subsidiary based)

The core team that help coordinate daily activities and implement sustainability initiatives. The team play a key role in helping integrate sustainability across the company’s value chain. They are the owner of priority sustainability topics and are responsible for implementing strategies, tracking performance, and engaging employees.

BOARD OF DIRECTORSDatuk (Dr) Aminar Rashid bin Salleh (Chairman)

Mr Low Hin ChoongMr Ng Seng Kong

Dato’ Anwar bin Haji @ AjiEncik Muhammad Lukman bin Musa @ Hussain

Ms Wong Fay Lee

CHIEF EXECUTIVE OFFICER (CEO)Dr Muhammad Iqbal bin Shaharom

MBM RESOURCES BERHAD’S SUSTAINABILITY COMMITTEE TEAM

Ms Edawati Heli Ms Rohaida Abd Rashid

AUTOLIVHIROTAKO

HIROTAKO ACOUSTICS

OMI GROUP

DAIHATSU MALAYSIA

FEDERAL AUTO

HOLDINGS

Mr Vellayadevan

Muthiah

Ms Ong

Soon Yee

Encik Muhammad Radzi Ahmat

Suhaimi

Encik Muhamad

Ramzi Zahir

Ms Janet Chong Mung Wooi

Ms ChristineTheresa

Ms Ruby Teh

Mr Choo Chuon

Kong

Encik Wan Mohd Amir Wan Norazmee

Mr Andy

Carlson Anak Granger

Ms Arnie

SyuhaidaMd Zelan

Encik Rosli bin

Idris

Ms Azierah Deezie

Encik Muhammad

Fahmi Norrizan

Encik KhairilAshraf Ismail

MBM RESOURCES BERHAD18

SUSTAINABILITY STATEMENT

OUR SUSTAINABILITY GOALSEnvironmental

We recognise the importance of environmental protection for

the long term sustainability of our businesses. As highlighted

in our previous report, our materiality matters showed that the

most immediate issues within our own operations are related

to resource use and the impact of the consumption of energy,

water and waste generation. MBMR Group of companies

mainly operate in industrialised zones in Shah Alam, urban

primary areas in Kuala Lumpur and few other states in Malaysia.

Therefore, our significant target is to minimise carbon footprint,

reduce energy consumption, lower water impact and improve

waste management.

ENERGY SAVINGElectricity consumption is the largest direct source of carbon

emissions by the Group and we are committed to manage and

reduce our energy usage. We target to achieve at least 5%

electricity consumption for 2020 and committed to continue to

monitor the conservation of energy. While working on assessment

on carbon footprint, our Group of companies continue to initiate

energy saving activities such as:

• Change use of normal lightings to LED.

• Scheduled maintenance inspection to reduce high energy

consumption during start up.

• Electricity consumption control within the company by

implementing timer switches.

• Implementation on solar panel investment.

In our previous report, we have disclose the total consumption and

savings from some of the above initiatives and we will continue

to share the details in our full report. As for the initiatives that

are still under planning such as solar panel installation, we plan to

disclose on the investments of the above initiatives, the process,

and the initial outcome of the implementation.

WATER CONSERVATIONAlthough we are well aware that Malaysia are blessed with an

abundance of water resources, we still conserve the usage of

water to ensure issues such as water shortages and crisis do not

occur in the future.

Our Group consumed 148,393 cubic metric of water in 2019.

Compared to other industries especially in manufacturing, the

total consumption is still manageable. Management approach in

controlling and monitoring the usage of water for cooling process

at the manufacturing plant is effective and the implementation of

cooling tower and water curtain help in reducing the consumption

as the water can be reused or recycled.

Both sectors in the Group will continue to monitor the water

consumption and continuously strive to lower water usage.

Some of the current water conservation practices in MBMR are:

• Water treatment for manufacturing operations in HASB

and OMI.

• Rain water harvesting at Menara MBMR (monitored by

MBMR Properties Sdn Bhd).

• Water recycling for manufacturing chiller systems.

2,818,1282,881,9322,857,428

2,287,9232,369,811

2,692,816

2,161,896 2,087,940

2,884,464

1,118,2411,564,553

3,136,731

2,572,9692,031,573

2017 2018 2019

1,378,724

AH

SBH

ASB

OM

ID

MSB

FAH

B

Electricity Consumption 2017/2018/2019

Annual Report 2019 19

SUSTAINABILITY STATEMENT

MINIMISING WASTEProper waste management is vital for protection of the

environment and local population health. Packaging and waste

have become an increasingly important material issue as

consumers and businesses are finding ways to minimise their

environmental impact. MBMR Group similarly is participating

in implementing strategies to reduce, reuse and recycle waste

and packaging.

Our manufacturing sector uses appropriate technologies to handle

and treat various waste and pollutants in achieving their goal to

minimise waste. Minimising waste include many different kinds of

support and our people are working together to ensure that the

minimising waste programme is implemented accordingly.

These are some of the initiative that has been carried out

throughout the year:

• Ban of plastics usage.

• Reusing discards.

• Comprehensive recycling.

• Reduce schedule waste.

• Waste water treatment.

• Paper recycling for production of goods.

• Reinforce policies, regulations, incentives and financing

structures to support the implementation.

SOCIALMost companies in Malaysia are facing the same issue in

recruitment and retention of employees. In this challenge, we are

focusing more on creating and maintaining safe workplace and

building an engaging, supportive culture to empower our people.

EQUAL OPPORTUNITYAmidst aggressive competition for talent and manpower, we

stand with the principle of equal employment opportunity and

acknowledged as a diverse and responsible employer by all our

people. We always believe that the company and the business

will be stronger when our workforce reflects the communities in

which we operate.

MBMR practices fair treatment to all our people and commit to

provide our people with a working environment that is free from

discrimination and harassment. Our aim is always to provide

the most efficient and comfortable working environment for

our people.

In general, our workforce reflects the diversity in gender,

ethnicity, religion and culture. This diverse culture is celebrated

by the Group with organising events such as Chinese New Year

dinner, Raya open house and Deepavali open house dinner.

12,61611,1289,483

6,7775,989

4,756

367,746445,120

47,445

52,65452,962

66,326

23,11323,094

2017 2018 2019

16,507

AH

SBH

ASB

OM

ID

MSB

FAH

B

Water Consumption 2017/2018/2019

MBM RESOURCES BERHAD20

SUSTAINABILITY STATEMENT

HEALTHIER WORKPLACEWe believe that our people are the driving force of a strong

business and that a motivated workforce delivers value to

our stakeholders.

Fitness activities have been proven to improve health and

wellbeing as well as foster teamwork and a stronger work culture.

MBMR promotes a healthy lifestyle by encouraging our people

to maintain their fitness through regular exercise and participate

in sports activities organised by the Group. The motivation and

interest furthermore come with encouragement from support

such as venue, equipment and prize sponsorship by the company.

Besides building a healthy community, this encouragement also

indirectly creates healthy competition and fair game which in

practise can make our people more focused on delivering better

results and continuously improving their skills and strategy.

Below are a few of the activities conducted in 2019 by the MBMR

Group:

• Badminton Tournament

• Charity Runs

• Fit Run

• Bukit Gasing Hiking

• Bowling Tournament

• Table Tennis Tournament

To measure the effectiveness of our activities, we plan to view our

employees’ overall health improvement reports from quarterly

health reports from the subsidiaries. This effort will require support

from the Human Resources Departments and the Business Unit

Head. This is part of the improvement plan that we believe will

benefit the company in the long run. The measure shall be able

to justify the returns of the investment in the time, efforts and

amount of support by both employer and the employees.

COMMUNITY ENGAGEMENTOur community engagement campaigns and programmes focused

on creating the awareness of the importance of safety, health,

relationship and environmental conservation.

We are continuously involved in sharing information and are always

looking forward to participate in events that involve educating the

community in topics related to our businesses.

In 2019, we conducted various activities that involved almost all

levels of community – from individuals to government agencies.

We are committed to balance our business needs with the

support for community growth and well-being. So, it is important

to us to take a more strategic approach to planning our future

investment programmes that are linked to our business and areas

of operations. The investment strategy will focus on support

programmes for community safety education, environmental

awareness and health activities.

Although we have yet to establish any specific community

investment, as part of our continuing commitment to improve

the support to our community, we successfully organised our

corporate social responsibility programmes such as KITA Festival,

PINK October, Rohingya Winter Mission 3.0, blood donation

drive, visit to old folks home, donation to Red Crescent Malaysia,

and more in 2019.

Annual Report 2019 21

SUSTAINABILITY STATEMENT

STAFF BENEFITS AND DEVELOPMENTIt is the norm in any organisation that compensation and benefits play a vital role in organisational performance. In MBMR, we always evaluate and assess the employee’s compensation and benefits aspects as we are well aware that this is part of the contributing factor to our business performance.

MBMR Group management has implemented a strategic compensation and benefits scheme to clearly define the salaries grading of new recruitment, incremental scheme of salaries, the method of rewarding and giving incentives, and other indirect reward schemes.

Part of the benefits received by the employees includes skills development and training. Employees within the Group receive training in areas relevant to their function. Relevant employees receive ongoing training on the latest legal and regulatory requirements such as updates to the Employment Act, Company Act and MACC Act.

Trainings always take place as priority in MBMR Group. We encourage our people to keep themselves efficient by upgrading their skills, education level and even general knowledge of new areas of their interest.

Our full report will share on the outcome of the trainings and how the trained employees share their knowledge and training experiences with their colleagues. In one of our sustainability effort – staff retention and development, it is a must for the staff to upgrade their skills and knowledge that are related to their work. On yearly basis, each department’s heads are encouraged to set training targets for their subordinates and work on the

financial planning for management approval.

MINIMISING INJURIESNothing is more important than the safety and health of our

people. We ensure everyone is well educated and committed to

minimising injuries in the workplace.

We aim to foster a risk-adverse working environment, eliminate

safety hazards and target zero fatalities all across our Group.

It is not only the management’s responsibility but also that of

the people involved in achieving this goal. MBMR strive to

ensure that our people understand that they have a share in this

responsibility and everyone is accountable for not only their

personal health and safety but also their colleagues.

In related to the above, we always keep our people reminded,

educated and at all times aware of the hazards around them at the

work place. The reminder, education and awareness continues

and are scheduled in advance on a yearly basis.

• Health screening and blood donation program.

• Distribute a N95 mask to all DMM’s outlets.

• Organise safety talk such as Fire Prevention program.

• Ensure that all facilities are well maintained and safe to be used.

• Forklift training for the manufacturing sector.

• Chemical spillage audit.

• Fire drill training.

• Safety campaign by NIOSH.

• Safety DOJO visit by Autoliv.

• CPR and AED training.

• Monthly audit for fire equipment and first aid.

MBM RESOURCES BERHAD22

SUSTAINABILITY STATEMENT

OUR STAKEHOLDERSAs a business entity, we operate within the regulatory parameters in the countries which we conduct business, and the general community

at large. As such, our stakeholders are as follows:

ShareholdersBetter Investment

Returns

EmployeesBetter Benefits and

Compensation

CommunityContinuous Support in Educating the People

Around UsCustomersTo Be More

Customer Centric

SuppliersMore Business Opportunities with Fair Deals

ContractorsFair Negotiation

and BusinessOpportunities

Business PartnersBetter Future Business

Engagement

GovernmentAgencies

Continuous Support in Protecting the

Environment and Sharing Our Prosperity

Stakeholders

Our goals are to:

Our Shareholders• Continuous effort to maintain long-term stability and growth in

shareholder value and return on investment, and to enhance the

competitive position of our business.

• Investing to build on and preserve the value of our assets,

capabilities and relationships.

• Responsible management of our investment and business risks.

• Recognition of the importance of social and environmental

issues to our shareholders and our shared values.

• True, fair and complete disclosure of the financial position and

operating performance of MBMR group.

Our Employees• A work environment free of harassment or discrimination based

on gender, physical or mental state, race, nationality, religion,

age, family status or sexual orientation, or any other attribute

recognised by the laws of the country.

• A culture of respect, trust and mutual understanding fostered

through open, two-way communication, positive encouragement

of employees’ participation in discussions and willingness to discuss

problems and concerns raised at any level in the organisation.

• Opportunities for learning and professional and career

development.

• Remuneration structures that provide fair rewards for

contributions made, together with retirement and health care

benefits.

• Objective performance assessments and decisions with clearly

articulated performance goals and expectations.

• Recognition and rewards for excellence in individual and team

performance.

• A safe, healthy and productive work environment, complemented

with the necessary training, equipment and support.

• Safeguards for the privacy of personal data and employee records.

• Encouragement of work-life balance.

Annual Report 2019 23

SUSTAINABILITY STATEMENT

Our Communities• Earning the acceptance of the communities in which

we operate.

• Contribution to the development of sound government

policies and laws that balance the social, economic and

environmental needs of the communities we serve.

• Participation in public education on safety and

environmental related issues.

• Active engagement in activities in the community.

Our Customers• Safe, reliable and cost-effective products and services

to customers.

• Continuous improvement in the value of our services.

• Delivery of customer service pledges and regulatory

requirements.

• An effective response to customer needs and

preferences concerning our products and services.

Our Business Partners and Suppliers• Impartial business decisions made without conflict of

interest or undue influence.

• Safeguards against bribery and unethical behaviour

and practices.

• Exchange of experience and knowledge for

mutual benefits.

• Long-term, mutually beneficial relationships.

STAKEHOLDER’S ENGAGEMENTAs a public listed company, we interact with numerous

stakeholder groups at national level. Stakeholder

engagement is one of the aspects that are managed and

considered as part of an important ingredient for the

successful mission in any of MBMR’s developments. We

engage our stakeholders to understand their diverse and

evolving expectations and incorporate that understanding

into our business strategies.

Our consistent adoption of a transparent approach to our

investor’s relation efforts continues with events, meetings

and visits by the community.

Events Description Frequency

Annual General Meeting (AGM)

Yearly meeting with the members or shareholders was held on 24 May 2019 at The Royale Chulan Hotel, Damansara. During the meeting a presentation of the company’s financial performance and other activities was reported by the CEO, Dr Muhammad Iqbal bin Shaharom and new Board Members were elected. We also shared our future plans during this meeting to ensure our stakeholders are aware of the business developments.

Once a year

Analyst Briefing

Two briefings organised simultaneously with the release of our quarter 2 and quarter 4 results to Bursa Malaysia. The briefings attended by financial analysts, fund managers and research analysts to gain further insight and review of the presented results.

Twice a year

Events with Authorities

Events organised with the local authorities and regulators in sharing our knowledge with the community. The list of events shared in our community engagement is in this report.

Occasional

New Outlets Launch and Media Relation

The media involvement in our Group are important as they are the main channel for our media coverage on any events we organise. In 2019, we launched a new centre in the Northern region of Malaysia as part of our business expansion plan.

Occasional

Websites and Email

Our website - www.mbmr.com.my, provides information on the company’s subsidiaries, business partners, associates and updated information on our business performance. We formed a team to monitor the updates and progressively enhance the website on a timely manner.Currently, we are in the midst of updating our website and looking forward to a new look in 2020.We also can be reached at [email protected] to ease our investors, suppliers, contractors and the community to communicate with us.To ease our monitoring on the whistleblowing matters we created a new email especially for community that have any disclosure related to inappropriate practices occurring within the MBMR Group. We can be reached at [email protected].

Progressively

MBM RESOURCES BERHAD24

SUSTAINABILITY STATEMENT

MATERIALITY MATTERSOur focus in 2018 was to define the materiality matter

and to set the sustainability target for 2021. As part

of the process to derive this report, as well as to go

one step further and define the reference points for

a comprehensive sustainability strategy, in July 2019,

we conducted a sustainability workshop, bringing

together the internal company perspective with that

of MBMR’s broad range of external stakeholders.

The workshop shares the details of sustainability

reporting and the importance of sustainability. During

the session, we held a discussion on which topics

carried the highest relevance for MBMR at that point

in time and the topics set to gain importance in the

future. The structured workshop included Business

Unit Heads, Human Resources, Internal Auditors,

and Operation Departments of all subsidiaries,

Finance and Procurement and Risk Management.

Input and feedback received throughout 2018 in

various interactions with customers, employees,

investors, regulators, and other external stakeholders

was incorporated into the discussion. The outcome

was summarised, verified with senior management,

and fed into the resulting materiality matrix. The

comprehensive sustainability strategy definition will be initiated in the second

half of 2020.

The details behind each category in the matrix, as well as the reasoning behind

their placement, are described below (see graphic and tables).

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

10% 20% 40% 60% 80% 100% 120%

Innovation

Government/RegulatorsPolicy & GovernanceWaste Management

WaterRaw Materials

Customer Satisfaction

Product Quality

Safety & Health

Employee Relation

Sta� WelfareEnergy

CSR

Significance of Group’s Economic, Environmental and Social Impacts

Influ

ence

on

Skat

ehol

der A

sses

smen

ts a

nd D

ecisi

ons

Material Matters Aspect Included Explanation

Product Quality - Sustainable products- Quality standards- Certifications

Consumer behaviour is changing and resources are becoming scarcer. We are incorporating the questions of how the procurement, production and use of materials can reduce the dispose section in the waste management inverted pyramid. It is also important for us to ensure that our products meet the predetermined standard by the regulatory.

Customer Satisfaction

- Customer relations- Service quality- Feedback

Customers are one of our most important stakeholder and it is crucial for us to maintain an ongoing positive interaction with them to understand their needs and thus provide best-fitting solutions for them. Only with our customers are partners can we create a sustainable impact across the organisation.

Policy & Governance - Corporate governance- Business ethics and

compliance- Human rights

A well-directed, administered and controlled organisation to ensure its stability and the integration of stakeholders’ expectations and interest particularly the corporate governance: independence of the BOD; existence of specific committees.

Raw Materials - Resources management- Alternative materials

All materials are scarce and it is important to well manage the consumption. Scarce of materials also means cost efficiency. Limitation of access to get the materials will cost the materials to be more expensive. Thus, alternative materials are crucial.

Waste Management - Management methods- Regulators requirements

An improper solid waste management system may contribute to a worsening environmental degradation of the community. Management are to ensure procedures comply with the regulators requirements in managing the waste.

Materiality Matrix

Annual Report 2019 25

SUSTAINABILITY STATEMENT

The following topics were identified as being relevant for the business, but carrying a lower materiality encumbrance. We consequently

keep them on our monitoring for future development, while at the same time ensuring that we mark a positive impact in these matters

with concern to the affected stakeholders.

Material Matters Aspect Included Explanation

Corporate Social Responsibility

- Recognition of local communities’ needs in order to create awareness of our products and services and ensure their positive impact

Our production sites do not carry material risks for or have adverse effects on local communities and the direct impact is low. However, engagement with the community and cooperation with them on a local level is important for us to keep our reputation as a good company to the community.

Energy - Usage/consumption- Operation control- Cost effectiveness

Energy related matter still one of the issue that need to be well monitored. Our management is committed to tackle the challenges to reduce consumption and to be more cost effective.

Staff Welfare - Work-life balance- Health and wellbeing

A good organisation should be able to allow the employees to enjoy their freedom to learn and grow. Develop a continuous improvement culture and recognise good work or achievements. Compensating the employees by providing a healthy and happy environment.

Safety & Health - Safe workplace To care about our people who work for the company and to void any risk impacting their health and physical integrity by ensuring a culture of “Safety First” especially in manufacturing sector.

Employee Relation - Employee management- Training and development

The broad spectrum of functions and roles within our business requires efficiency in human resource management process and the possibility to engage, develop and retain employees. Continuous training and skills devel-opment are mandatory to keep the high quality productivity.

Government/Regulators

- Regulators requirements- Compliance issues

Other than taking regulatory requirements as compliance matters, it is also act as guidelines to be aligned to the business efficiency and responsibility.

Innovation - Innovation in new business models

Innovation is the key to business progress, especially in time of economic cri-sis. Embedded innovation in value chain (ie. Idea generation, Development and Implementation).

Water - Water management Our operations are not water intensive. Yet it is important for us to keep monitoring the water management as it is part of the scarce resources. Sus-tainable water is a significant topic for society at large.

MBM RESOURCES BERHAD26

Profile of Directors

Y. Bhg. Datuk (Dr) Aminar Rashid bin SallehAged 60, Male, MalaysianChairman, Independent Non-Executive Director

Qualifications• Diploma in Civil Engineering, University Technology

MARA, Shah Alam• Degree in Civil Engineering, University Technology

MARA, Shah Alam• Executive Diploma in Business Administration,

University of Central Lancashire, United Kingdom.

Working Experience / Other DirectorshipsPresent:• Group Advisor New Business Development of Ingress

Corporation Berhad• Director of Universiti Teknologi Mara (UiTM)• Director of Universiti Teknologi Mara Holdings (UiTMH)Past:• President & Chief Executive Officer of Perusahaan

Otomobil Kedua Sdn Bhd (Perodua) from 2013 to 2018• Managing Director of Perodua from 2009 to 2012• Executive Director, Strategic Marketing Group of UMW

Toyota Motor Sdn Bhd from 2007 to 2009• Executive Director, Strategic Planning Group of UMW

Toyota Motor Sdn Bhd on 2006• Executive Director, Sales Group of UMW Toyota Motor

Sdn Bhd from 2004 to 2005• Director, Human Capital Group of UMW Toyota Motor

Sdn Bhd from 2001 to 2003• General Manager, HR and Administration of UMW

Toyota Motor Sdn Bhd from 1996 to 2001• Manager, Property and Facilities of UMW Toyota Motor

Sdn Bhd from 1992 to 1996• Property and Purchasing Manager of Utusan Melayu

(M) Sdn Bhd on 1992• Property and Maintenance Manager of Techart Sdn

Bhd from 1985 to 1991• Project Engineer, Techart Sdn Bhd from 1983 to 1985 Membership of Board Committees in MBMR:• Audit and Risk Management Committee (Member)• Nominating and Remuneration Committee (Chairman)• Group Transformation Committee (Chairman)

Date Appointed to the Board29 May 2019

Mr. Low Hin ChoongAged 58, Male, MalaysianNon-Independent Non-Executive Director

Qualifications• Bachelor Degree in Business Administration and

Computer Science (Hons), University of Belfast, United Kingdom

Working Experience / Other DirectorshipsPresent:• Director of CathRx Ltd• Director of Perusahaan Otomobil Kedua Sdn Bhd• Director of Hirotako Holdings Berhad• Director of Federal Auto Holdings BerhadPast:• Director of Daihatsu (Malaysia) Sdn Bhd

Membership of Board Committees in MBMR:• Long Term Incentive Plan Committee (Chairman)• Group Transformation Committee (Member)

Date Appointed to the Board18 May 2011

Annual Report 2019 27

Y. Bhg. Dato’ Anwar bin Haji @ AjiAged 69, Male, MalaysianIndependent Non-Executive Director

Qualifications• Master of Arts, International Studies, Ohio University,

United States of America• Bachelor of Economics (Hons), University of Malaya,

Malaysia

Working Experience / Other DirectorshipsPresent:• Chairman of Zelan Berhad• Director of CIMB Principal Asset Management BerhadPast:• Chairman of Faber Group Berhad from 2001 to 2008• Various management positions in Khazanah Nasional

Berhad from 1994 to 2004 including the position of Managing Director.

• Special Assistant to the Secretary General of the Ministry Finance from 1993 to 1994

• Principal Assistant Secretary in the Finance Division, Federal Treasury under Ministry of Finance from 1991 to 1993

• Deputy Director of Petroleum Development Division under Prime Minister’s Department from 1986 to 1991

• Principal Assistant Secretary in Foreign Investment Division, Economic Planning Unit under Prime Minister’s Department from 1982 to 1984

• Attachment with Investment Division of the Malaysian Tobacco Company Berhad under the British Malaysia Industry & Trade Association training scheme from 1984 to 1985

• Principal Assistant Secretary in Economic & International Division, Federal Treasury under Ministry of Finance from 1980 to 1981

• Principal Assistant Secretary in Budget Division, Federal Treasury under Ministry of Finance from 1978 to 1980

• Assistant Director in Industries Division under Ministry of International Trade & Industry from 1973 to 1978

Membership of Board Committees in MBMR:• Audit and Risk Management Committee (Chairman)• Nominating and Remuneration Committee (Member)• Long Term Incentive Plan Committee (Member)

Date Appointed to the Board16 January 2018

Mr. Ng Seng KongAged 66, Male, MalaysianNon-Independent Non-Executive Director

Qualifications• Fellow Member of the Association of Chartered Certified

Accountants, United Kingdom• Fellow Member of the Chartered Institute of Management

Accountants, United Kingdom• Member of Chartered Global Management Accountant

Working Experience / Other DirectorshipsPresent:• Managing Director of UMS Holdings Berhad• Chairman of Hirotako Holdings Berhad• Director of Federal Auto Holdings Berhad• Director of Hino Motors Sales (Malaysia) Sdn Bhd• Director of Hino Motors Manufacturing (Malaysia) Sdn BhdPast:• Director of UMS Corporation Sdn Bhd from 1981 to 2001• Financial Controller in MKS Sdn Bhd from 1980 to 1981• Auditor of a chartered accounting firm in London from

1975 to 1979

Membership of Board Committees in MBMR:• Long Term Incentive Plan Committee (Member)

Date Appointed to the Board1 October 2015

MBM RESOURCES BERHAD28

Profile of Directors (continued)

Encik Muhammad Lukman bin Musa @HussainAged 45, Male, MalaysianNon-Independent Non-Executive Director

Qualifications• Fellow Member of the Institute of Chartered Accountants

in England and Wales• Member of the Malaysian Institute of Accountants• Bachelor degree in Accountancy Studies, University of

Portsmouth, United Kingdom

Working Experience / Other DirectorshipsPresent:• Independent Non-Executive Director and Chairman of

Audit Committee of 7-Eleven Malaysia Holdings Berhad• Advisor of ECS Solutions Sdn BhdPast:• Acting Chief Executive Officer and Chief Financial Officer

of MARA Corporation Sdn Bhd from 2016 to 2019• Chief Operating and Financial Officer of Unitar Capital Sdn

Bhd from 2011 to 2016• Audit and Assurance Director of Ernst & Young from 2008

to 2011• Manager under Banking and Capital Market Group of Ernst

& Young LLP, London from 2003 to 2008• Internal Auditor of Habib Bank AG Zurich from 2002 to

2003• Senior Auditor of John Cumming Ross Ltd in 2001• Senior Auditor of Andersen & Co, Malaysia (formerly

known as Arthur Andersen & Co) from 1998 to 2001

Membership of Board Committees in MBMR:• Audit and Risk Management Committee (Member)• Group Transformation Committee (Member)

Date Appointed to the Board28 January 2019

Ms. Wong Fay LeeAged 56, Female, MalaysianNon-Independent Non-Executive Director

Qualifications• Bachelor Degree in Law, University of Sydney• Graduate Diploma in Applied Finance and Investments,

Securities Institute Australia

Working Experience / Other DirectorshipsPresent:• Chairman of Federal Auto Holdings Berhad• Director of Apex Investment Services Berhad• Director of Med-Bumikar Mara Sdn Bhd• Director of Daihatsu (Malaysia) Sdn BhdPast:• Group Head of Risk, Legal & Compliance of MBM

Resources Berhad from 2011 to 2018• Managing Director of Federal Auto Holdings Berhad from

2016 to 2017• Executive Director of MBM Resources Berhad from 2014

to 2017• Private Equity Investing from 2002 to 2010• Risk Management Consultant at the Clearing Division of

the Hong Kong Exchange from 2001 to 2002• CEO and Director of Malaysian Derivatives Clearing

House Berhad from 1995 to 2000• Manager, Product Development of Malaysian Securities

Commission from 1993 to 1995• Senior Solicitor with Mallesons Stephen Jaques in

corporate, banking and finance practice (Sydney and South East Asia offices) from 1987 to 1992

Membership of Board Committees in MBMR:• Nominating and Remuneration Committee (Member)• Group Transformation Committee (Member)

Date Appointed to the Board29 May 2019

Notes:1. Save as disclosed, none of the Directors has any family relationship with any Director and/or major shareholders of the Company.2. None of the Directors has any conflict of interest with the Company.3. Other than traffic offences, none of the Directors have been convicted of any offences within the past five years nor have been imposed any public sanction or penalty by the relevant regulatory bodies during the financial year 2019.

Annual Report 2019 29

Dr. Muhammad Iqbal bin ShaharomAged 62, Male, MalaysianPresident & Chief Executive Officer

Qualifications• Bachelor Degree in Business

Administration (BBA) – Major in International Business & Banking, University of Toledo (AACSB), Ohio, United States of America

• Master’s Degree in Business Administration (MBA) – Major in Finance & Strategic Management, University of Toledo (ACCSB), Ohio, United States of America

• Business Administration (DBA, University Utara Malaysia) (AACSB)

• Certified Professional Trainer and Facilitator (CPTF), University Malaya

• Institute for Mergers, Acquisition & Alliance (IM&A & M&AP) Vienna, Austria

Working Experience / Other DirectorshipsPresent:• President & CEO of MBM Resources Berhad• Director of Federal Auto Holdings

Berhad• Director of Daihatsu (Malaysia) Sdn Bhd• Director of Autoliv Hirotako Sdn Bhd• Director of Oriental Metal Industries

(M) Sdn BhdPast:• Managing Director of Daihatsu

(Malaysia) Sdn Bhd• Vice President – Corporate of MBM

Resources Berhad• Vice President – Motor Trading of

MBM Resources Berhad• Chief Operating Officer of DRB-Hicom Holdings Berhad• Deputy Chief Marketing Officer of

Chery Automobile (M) Sdn Bhd• Vice President of Naza Quest Auto

Sdn Bhd

Date Appointed to MBMR:4 October 2018

Mr Ngeow Zoo GinAged 61, Male, MalaysianVice President, Manufacturing

Qualifications• Bach (Hons) Mechanical Engineering,

University Malaya Working Experience / Other DirectorshipsPresent:• Vice President, Manufacturing of MBM

Resources Berhad• Chief Operating Officer of Autoliv

Hirotako Sdn Bhd• Director of Hirotako Acoustics Sdn

Bhd• Director of Oriental Metal Industries

(M) Sdn BhdPast:• Factory Manager of Paragon Union

Bhd (1990- 1995)· • Tan Chong Motor Assemblies Sdn

Bhd (1982- 1990)- Last position as Purchasing Manager

Date Appointed to MBMR:1 March 2018

Ms Chin Tze Fui @ Annie ChinAged 51, Female, MalaysianChief Financial Officer

Qualifications• Bachelor of Science in Accounting

(Honours), Oklahoma State University, United State of America

• Member of Malaysian Institute of Accountants (MIA)

Working Experience / Other DirectorshipsPresent:• Chief Financial Officer of MBM

Resources Berhad• Director of Daihatsu (Malaysia) Sdn Bhd

Past:• Group Financial Controller of MBM

Resources Berhad• Partner of Annbren Management &

Consultancy Services • Group Financial Controller of Scomi

Group Berhad• Regional Finance Controller of Scomi

Group Berhad, Oilfield services• Audit Manager of Ernst & Young

Date Appointed to MBMR: 1 November 2016