Dream Endowment Plan FAQs Final

-

Upload

shambhuknight123 -

Category

Documents

-

view

908 -

download

0

Transcript of Dream Endowment Plan FAQs Final

Prepared by Product Management 1 For Internal Circulation only

Frequently Asked Questions

TRA/01/09-10/3754 Jan 8th, 2010

Birla Sun Life Insurance Dream Endowment Plan – Frequently Asked Questions

Prepared by Product Management 2 For Internal Circulation only

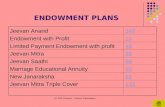

Contents BSLI Dream Endowment Plan – Summary .................................................................................................................................................... 3

1. What is BSLI Dream Endowment Plan? ................................................................................................................................ 3 2. What are the significant features of BSLI Dream Endowment Plan? .............................................................................. 3 3. Am I eligible for this plan? ...................................................................................................................................................... 3

Plan Structure ................................................................................................................................................................................................. 4 4. What is the term of the policy? ............................................................................................................................................... 4 5. What is Basic Sum Assured? ................................................................................................................................................... 4 6. What is Guaranteed Savings Date? ........................................................................................................................................ 4 7. What is the pay term? ............................................................................................................................................................... 4 8. What is the concept of Enhanced Sum Assured? ................................................................................................................. 4 9. What is the concept of Enhanced Savings Premium? ......................................................................................................... 4

Premium ............................................................................................................................................................................................................... 5 10. What is the premium to be paid? ............................................................................................................................................ 5 11. How can I pay my premiums? ................................................................................................................................................. 5 12. Can I increase or reduce my premium amount? .................................................................................................................. 5 13. Can I increase or reduce my Basic Sum Assured / Enhanced Sum Assured? ................................................................. 5

Investment Option .......................................................................................................................................................................................... 5 14. What are the investment options and how is my premium invested? ............................................................................. 5 15. What is the asset allocation of the investment funds? ........................................................................................................ 7 16. Can I invest /redirect my premium in different funds? ..................................................................................................... 7 17. Can I switch between funds? .................................................................................................................................................. 7 18. How do I keep a track of my investments? ........................................................................................................................... 7

Benefits ............................................................................................................................................................................................................ 7 19. What are the benefits offered under this plan? ................................................................................................................... 7 20. Can I withdraw some part of my Fund Value? .................................................................................................................... 8 21. Are riders or loans available with the plan? ......................................................................................................................... 8 22. Can I avail of tax benefits under this plan? What are the benefits available? ............................................................... 8

Policy Charges ................................................................................................................................................................................................. 8 23. What are the charges applicable to this plan? ...................................................................................................................... 8

Premium Discontinuance and Revival ......................................................................................................................................................... 10 24. What happens if I do not pay my premium on time? ....................................................................................................... 10 25. What happens if I do not pay my premium within the grace period? ........................................................................... 10 26. How can I revive my policy? ................................................................................................................................................. 11

Termination................................................................................................................................................................................................... 11 27. How long will my policy continue? ..................................................................................................................................... 11

Operational Guidelines ................................................................................................................................................................................. 11 28. Which application form is used for this plan? ................................................................................................................... 11 29. Can there be a proposer under this plan? ........................................................................................................................... 11 30. Can a customer increase his Enhanced Sum Assured in between the policy term?.................................................... 11 31. What are the financial and medical underwriting guidelines for BSLI Dream Endowment Plan? ......................... 11 32. What is the age proof required for BSLI Dream Endowment Plan? .............................................................................. 11 33. Can a housewife buy the BSLI Dream Endowment Plan? ............................................................................................... 11 34. Can a housewife opt for Enhanced Sum Assured under the BSLI Dream Endowment Plan? .................................. 12 35. Can a widow take BSLI Dream Endowment Plan if she is financially independent? If so, what additional

documents will be required? .............................................................................................................................................................. 12 36. Can an NRI / Foreign National of Indian Origin buy the BSLI Dream Endowment Plan? ....................................... 12 37. Can BSLI Dream Plan be issued under the MWP Act? .................................................................................................... 12 38. Can an employer take the BSLI Dream Endowment Plan for his employee? .............................................................. 12 39. Can a HUF buy BSLI Dream Endowment Plan? ................................................................................................................ 12 40. Can BSLI Dream Endowment Plan be assigned? .............................................................................................................. 12

Birla Sun Life Insurance Dream Endowment Plan – Frequently Asked Questions

Prepared by Product Management 3 For Internal Circulation only

Presenting the BSLI Dream Endowment Plan, a plan that gives you the guarantee of receiving your chosen Basic Sum Assured on the Guaranteed Savings date chosen by you. What’s more, you retain the freedom to keep pace with the ever changing world of your dreams for your family.

BSLI Dream Endowment Plan – Summary 1. What is BSLI Dream Endowment Plan?

BSLI Dream Endowment Plan is a non participating unit linked savings plan that offers guarantees with an option to increase your life cover, option to augment your savings thereby helping you achieve your Dreams for Wealth Creation.

2. What are the significant features of BSLI Dream Endowment Plan?

The significant features of this plan are: � Receive a minimum amount of no less than Basic Sum Assured on Guaranteed Savings Date. � Freedom to choose the number of years you want to pay your premiums � Freedom to increase the financial security for your loved ones by choosing an Enhanced Sum Assured � Freedom to increase your savings by choosing an Enhanced Savings Premium � Freedom to meet any emergency funds requirements by making partial withdrawals � You enjoy tax benefits under section 80C and section 10(10D) of the Income Tax act, 1961

3. Am I eligible for this plan?

You are eligible if you are between age 30 days – 65 years

Birla Sun Life Insurance Dream Endowment Plan – Frequently Asked Questions

Prepared by Product Management 4 For Internal Circulation only

Plan Structure

4. What is the term of the policy?

BSLI Dream Endowment Plan has a fixed policy term of 30 years.

5. What is Basic Sum Assured?

Basic Sum Assured is the minimum savings amount guaranteed to be payable on the chosen date prior to maturity. It is also the minimum benefit payable on death of the life insured. You can choose any amount of Basic Sum Assured subject to a minimum of Rs. 3,00,000 and a minimum Basic Premium of Rs. 8,000.

6. What is Guaranteed Savings Date?

Guaranteed Savings Date (GSD) is the chosen date before maturity on which your Basic Fund Value is guaranteed to equal your Basic Sum Assured. Your options for GSD are 10th, 15th, 20th, 25th or 30th policy anniversary.

7. What is the Pay Term?

Pay Term is the number of years you want to pay premiums to get the Basic Sum Assured on the Guaranteed Savings Date. The premiums are payable till Guaranteed Savings Date, however you have an option of single pay and short pay of 5-pay, 10–pay, 15-pay or 20-pay for your convenience.

8. What is the concept of Enhanced Sum Assured?

You have an option to increase your insurance cover to safeguard your family’s financial security over and above the Basic Sum Assured. This is Enhanced Sum Assured. The premium payable towards Enhanced Sum Assured is called Enhanced SA Premium. ���� Enhanced Sum Assured option can be chosen only at policy inception; it cannot be chosen, increased or decreased

during the policy term. Eligibility Criteria

Entry Age Term Enhanced Sum Assured

Min. 18 years 10 years Rs. 50,000

Max. 65 years 30 years* No limit

* maximum age at Guaranteed Savings Date is 75 years

9. What is the concept of Enhanced Savings Premium? You have an option to enhance your savings by paying additional premium over and above your Basic Premium. This is Enhanced Savings Premium. This premium will be invested in well established suite of 10 investment funds

At inception you choose -

1. What amount you want guaranteed? – Basic Sum Assured

2. When do you want this guaranteed amount? – Guaranteed Savings Date

3. How long will you pay to receive this guaranteed amount? – Pay Term

At inception you can also choose -

4. Increased protection – Enhanced Sum Assured

5. Increased savings – Enhanced Savings Premium

Birla Sun Life Insurance Dream Endowment Plan – Frequently Asked Questions

Prepared by Product Management 5 For Internal Circulation only

and you retain complete control and flexibility to manage your investments. You can choose any amount of Enhanced Savings Premium subject to minimum of Rs. 5,000. The pay term for Enhanced Savings Premium is same as chosen for the base plan. ���� Enhanced Savings Premium option can be chosen only at policy inception. However it can be discontinued or

decreased subject to a minimum of Rs. 5,000 after three completed policy years.

Premium

10. What is the premium to be paid?

Based on your age at entry, gender, your choice of Basic Sum Assured and Guaranteed Savings Date, AMS will calculate Basic Premium.

Your Annual Policy Premium = Basic Premium

Plus Enhanced SA Premium, if Enhanced Sum Assured is chosen

Plus Enhanced Savings Premium, if chosen

���� Enhanced Savings Premium has no separate insurance cover. ���� Annual Policy Premium x 5 = < Basic Sum Assured plus Enhanced Sum Assured

If this criterion is not met, then we will automatically add or increase the Enhanced Sum Assured to meet this criterion.

11. How can I pay my premiums?

You can pay your policy premium annually, semi-annually, quarterly or monthly. Annual and semi-annual installments - cash (up to Rs. 50,000), cheque, credit card and ECS Quarterly installments - ECS only Monthly installments - ECS or salary deduction only (minimum three months premium required) ECS includes standing instruction, direct debit and other automated payment modes.

12. Can I increase or reduce my premium amount?

You cannot increase or decrease Basic Premium and Enhanced SA premium however, you have an option to reduce subject to a minimum of Rs. 5,000 or discontinue paying your Enhanced Savings Premium after completion of 3 policy years. Thereafter the annual policy premium will get reduced accordingly.

13. Can I increase or reduce my Basic Sum Assured / Enhanced Sum Assured? No, you cannot increase or reduce the Basic Sum Assured / Enhanced Sum Assured during the policy term.

Investment Option

14. What are the investment options and how is my premium invested?

Basic premium and Enhanced SA premium (net of investment guarantee charge) is used to purchase units in investment fund Enhancer under Guaranteed Option.

The total value of your investment under Guaranteed Option is your Basic Fund Value

Guaranteed Savings Fund (GSF) is the accumulation of Basic Premium and Enhanced SA Premiums at 3% p.a. (net of investment guarantee charge) and is vested on Guaranteed Savings Date. On the Guaranteed Savings Date, Guaranteed Savings Fund is guaranteed to be at least equal to Basic Sum Assured provided all premiums have been paid when due and there are no partial withdrawals from the Basic Fund Value.

Thereafter the Basic Fund Value is guaranteed to be at least the Guaranteed Savings Fund payable on Death, Surrender and Maturity.

Birla Sun Life Insurance Dream Endowment Plan – Frequently Asked Questions

Prepared by Product Management 6 For Internal Circulation only

Enhanced Savings Premium (net of premium allocation charge) is invested across 10 investment funds under Self-

Managed Option. You have complete control and flexibility to manage your Enhanced Savings Premiums. Total value of your investments under Self-Managed Option is your Enhanced Fund Value

Thus, your Fund Value is Basic Fund Value plus Enhanced Fund Value

Birla Sun Life Insurance Dream Endowment Plan – Frequently Asked Questions

Prepared by Product Management 7 For Internal Circulation only

15. What is the asset allocation of the investment funds?

Investment Fund Risk Profile Asset Allocation * Min. Max.

Income Advantage Very Low Debt Instruments, Money Market & Cash Equities & Equity Related Securities

100% 0%

100% 0%

Assure Very Low Debt Instruments, Money Market & Cash Equities & Equity Related Securities

100% 0%

100% 0%

Protector Low Debt Instruments, Money Market & Cash Equities & Equity Related Securities

90% 0%

100% 10%

Builder Low Debt Instruments, Money Market & Cash Equities & Equity Related Securities

80% 10%

90% 20%

Enhancer Medium Debt Instruments, Money Market & Cash Equities & Equity Related Securities

65% 20%

80% 35%

Creator Medium Debt Instruments, Money Market & Cash Equities & Equity Related Securities

50% 30%

70% 50%

Magnifier High Debt Instruments, Money Market & Cash Equities & Equity Related Securities

10% 50%

50% 90%

Maximiser High Debt Instruments, Money Market & Cash Equities & Equity Related Securities

0% 80%

20% 100%

Multiplier High Debt Instruments, Money Market & Cash Equities & Equity Related Securities

0% 80%

20% 100%

Super 20 High Debt Instruments, Money Market & Cash Equities & Equity Related Securities

0% 80%

20% 100%

* In each investment fund, the Money Market & Cash asset allocation will not exceed 40%. Money Market Instruments are debt instruments of less than one year maturity. It includes mutual funds, collateralised borrowing & lending obligation, certificate of deposits, commercial papers etc. Investment in Money Market Instrument supports for better liquidity management.

16. Can I invest /redirect my premium in different funds?

Yes, you can invest/redirect your Enhanced Savings Premium in different funds under Self-Managed Option. You can modify your premium allocation percentage for Enhanced Savings Premium by using the premium redirection facility. ���� No premium redirection is allowed under Guaranteed Option.

17. Can I switch between funds?

Yes, you can switch your Enhanced Savings Premium from one investment fund to another at any time provided the switched amount is for at least Rs. 5,000. Switching can be only done within the investment funds offered under Self-Managed Option. ���� No switching is allowed under Guaranteed Option.

18. How do I keep a track of my investments?

You can monitor your investments

• on our website (www.birlasunlife.com) with your CPIN and TPIN number;

• through the annual statement detailing the number of units you have in each investment fund and their respective unit price as of the last policy anniversary; and

• through the published unit prices of all investment funds on our website as well as in the newspapers.

Benefits

19. What are the benefits offered under this plan?

Guaranteed Additions Additional units @ 2% of the average Fund Value i.e. Basic Fund Value plus Enhanced Fund Value in the last 60 months is added to your policy on the 10th policy anniversary and on every 5th policy anniversary thereafter.

Birla Sun Life Insurance Dream Endowment Plan – Frequently Asked Questions

Prepared by Product Management 8 For Internal Circulation only

Death Benefit In the unfortunate event of the death of the life insured, the nominee will receive;

Higher of (Basic Fund Value* + Enhanced Fund Value) or Basic Sum Assured reduced by partial withdrawals as follows

− Before the life insured attains the age of 60, the Basic Sum Assured payable on death is reduced by partial withdrawals made in the preceding two years.

− Once the life insured attains the age of 60, the Basic Sum Assured payable on death is reduced by all partial withdrawals made from age 58 onwards.

Additionally prior to Guaranteed Savings Date we will also pay Enhanced Sum Assured, if any

Surrender Benefit You have an option to surrender your policy anytime for its surrender value. The surrender value payable is

Basic Fund Value* + Enhanced Fund Value less Surrender Charge, if any If the policy is surrendered, during the first 3 years, the surrender value will be paid to you only at the end of the third year. The surrender value as of the date of the surrender request will not be affected by any market fluctuations and will remain constant till the time it is paid to you.

After three completed policy years if the policy is surrendered, the surrender value will be paid to you immediately. After five completed policy years, the surrender value is fund value since there are no surrender charges after 5 policy years.

Maturity Benefit

On the maturity date of your policy you will receive Basic Fund Value* + Enhanced Fund Value

* Higher of Basic Fund Value or Guaranteed Savings Fund is payable on death, surrender or maturity starting on

Guaranteed Savings Date.

20. Can I withdraw some part of my Fund Value?

In case of any financial contingencies, you have the flexibility to withdraw part of your Fund Value through partial withdrawals. Partial Withdrawals are allowed after three completed policy years provided the life insured has attained the age of 18. Unlimited partial withdrawals can be done free of charge. The minimum amount of partial withdrawal is Rs. 5,000. There is no maximum limit, but you are required to maintain a minimum Fund Value equal to one annual policy premium plus any surrender charge.

21. Are riders or loans available with the plan? Riders and loans are not available with this plan.

22. Can I avail of tax benefits under this plan? What are the benefits available?

You will be eligible for tax benefits under Section 80C and Section 10(10D) of the Income Tax Act, 1961 as per the prevailing income tax laws & are subject to amendments made thereto from time to time.

Policy Charges

23. What are the charges applicable to this plan?

Service Tax and other levies, as applicable, will be levied as per extant tax laws. Investment Guarantee Charge

Birla Sun Life Insurance Dream Endowment Plan – Frequently Asked Questions

Prepared by Product Management 9 For Internal Circulation only

An investment guarantee charge of 2% of the Basic Premium and Enhanced SA Premium is levied when the premiums are received and before invested in the investment fund Enhancer under Guaranteed Option. This charge is guaranteed never to increase. Premium Allocation Charge

No premium allocation charge is deducted from your Basic Premium and Enhanced SA Premium.

Premium allocation charge is deducted from the Enhanced Savings Premium when received and before invested in the investment funds under Self-Managed Option.

Percentage of Enhanced Savings Premium

Policy Year

Single Pay

Non-Single Pay Enhanced Savings Premium

< 1 lakh < 5 lakh 5 lakh +

1 2.00% 15.00% 10.00% 5.00% 2+ NA 5.00% 5.00% 5.00%

This charge is guaranteed never to increase

Fund Management Charge The daily unit price of each investment fund is adjusted to reflect the fund management charge.

Per annum and reflected daily in Unit Price

Investment Fund Fund Management Charge (p.a.)

Income Advantage, Assure, Protector and Builder 1.00%

Enhancer and Creator 1.25%

Magnifier, Maximiser, Multiplier and Super 20 1.35%

Policy Administration Charge

Policy administration charge as a percentage of Basic Premium is deducted monthly by canceling units from the investment fund/s at that time.

Percentage of Basic Premium

Policy year

Pay Term (years)

1 5 10 15 20+

1 -3 2.00% 7.50% 15.00% 25.00% 30.00%

4+ Nil 0.75% 1.50% 2.50% 3.00%

plus Rs. 480 on first Rs. 8,000 in all years

This charge is guaranteed to never increase for the first three policy years, after which it can be increased by no more than 5% p.a. since inception.

Mortality Charge This charge will be deducted monthly by canceling units proportionately from the investment funds. For Basic Sum Assured - charge is per 1000 Sum at Risk (Basic Sum Assured less Fund Value) and will vary based on gender and attained age. The annual charge for sample ages is as under - Charge per 1000 of Sum at Risk

Attained Age 25 35 45 55 65

Female 1.284 1.387 2.287 5.340 13.197 Male 1.328 1.535 2.822 7.105 17.459

Enhanced Sum Assured - charge is per 1000 of Enhanced Sum Assured and will depend on the issue age, gender and Guaranteed Savings Date.

Birla Sun Life Insurance Dream Endowment Plan – Frequently Asked Questions

Prepared by Product Management 10 For Internal Circulation only

Mortality and Enhanced Sum Assured charges are guaranteed never to increase. Surrender Charge

Surrender charge is applied if the policy is surrendered before the completion of five policy years: As a percentage of Basic Premium

Percentage of Basic Premium

Completed Policy Year

Pay Term (years)

1 5 10 15 20+

Less than 3 10.00% 30.00% 60.00% 90.00% 100.00%

3 to < 4 5.00% 15.00% 30.00% 45.00% 50.00%

4 to < 5 2.50% 7.50% 15.00% 22.50% 25.00%

5 + Nil Nil Nil Nil Nil

As a percentage of Enhanced Savings Premium

Percentage of Enhanced Savings Premium

Completed Policy Year

Single Pay

Non-Single Pay Enhanced Savings Premium

< 1 lakh < 5 lakh 5 lakh +

Less than 3 10.00% 30.00% 20.00% 10.00%

3 to < 4 5.00% 15.00% 10.00% 5.00%

4 to < 5 2.50% 7.50% 5.00% 2.50%

5 + Nil Nil Nil Nil

This charge is guaranteed to never increase.

Premium Discontinuance and Revival 24. What happens if I do not pay my premium on time?

If you are unable to pay your policy premium by the due date, you will be given 30-day grace period, to pay your due premiums, during which your policy will continue.

25. What happens if I do not pay my premium within the grace period?

During the first three policy years – Your policy will lapse if we do not receive the entire policy premium by the end of the grace period. The insurance under your policy will cease and your fund value will be held in suspense after deduction of surrender charges. This net fund value will be paid out to you only at the end of the third policy year or the end of the two-year revival period, whichever is later. You can revive your policy within two-years from its lapse date by paying all outstanding policy premiums and providing us with evidence of insurability satisfactory to us. If the life insured dies while the policy is not yet revived, we will pay the fund value as of the lapse date immediately and terminate the contract.

After three completed policy years – you have the right to reduce (subject to minimum of Rs. 5,000) or stop paying enhanced savings premium by submitting a request to us and the policy premium will be reduced accordingly. If we do not receive the entire policy premium by the end of the grace period, then you will be given a period of two years

Guaranteed Savings Date

Charge per 1000 of Enhanced Sum Assured

Male Female

10 15 20 25 30 10 15 20 25 30 Age 25 1.380 1.434 1.516 1.551 1.585 1.345 1.377 1.440 1.459 1.482 Age 35 1.884 2.093 2.321 2.473 2.981 1.619 1.733 1.933 2.025 2.334 Age 45 3.941 4.502 5.040 5.875 7.227 3.042 3.498 3.911 4.487 5.487 Age 55 9.504 10.808 12.946 - - 7.341 8.255 9.308 - -

Birla Sun Life Insurance Dream Endowment Plan – Frequently Asked Questions

Prepared by Product Management 11 For Internal Circulation only

to pay all outstanding premiums till date. Your policy will continue during these two years, as well as all insurance cover and charges. At the end of this two-year period, we will give you the choice to either surrender your policy or continue it without the payment of additional policy premiums. Your policy will, however, be deemed as surrendered should your fund value equal one annual policy premium.

26. How can I revive my policy?

You can revive your policy by paying all outstanding premiums. The current charge for the revival is Rs.100. This charge can be increased any time, subject to maximum of Rs.1000.

Termination

27. How long will my policy continue?

The policy will terminate at the earliest of, (a) the date the surrender request is confirmed; (b) the date on which the two-year period ends after the policy has lapsed, unless the policy is revived as per the

Premium Discontinuance provision; (c) the date when fund value equals one annual policy premium as per the Premium Discontinuance provision; (d) the date the life insured dies;

(e) the policy maturity date; or (f) the fund value becomes zero.

Operational Guidelines

28. Which application form is used for this plan? The main application form has to be used for this plan

29. Can there be a proposer under this plan?

Yes, there can be a proposer and s/he can be different from the Life Insured under the plan. 30. Can a customer increase his Enhanced Sum Assured in between the policy term?

Enhanced Sum Assured can only be chosen at policy inception. Customer cannot increase or decrease the Enhanced Sum Assured in between the policy term.

31. What are the financial and medical underwriting guidelines for BSLI Dream Endowment Plan?

Both financial and medical underwriting will be on the basis of the Total Sum Assured i.e., Basic plus Enhanced Sum Assured.

32. What is the age proof required for BSLI Dream Endowment Plan?

Age proof is mandatory for the Life Insured. If opting for Basic Sum Assured (without any Enhanced Sum Assured) only, we can accept non-standard age proof, subject to existing underwriting guidelines. For proposals with Enhanced Sum Assured, only standard age proof will be acceptable.

33. Can a housewife buy the BSLI Dream Endowment Plan? Yes, a housewife can buy the BSLI Dream Endowment Plan, subject however to the applicable financial underwriting guidelines for housewives (same as for other products).

Birla Sun Life Insurance Dream Endowment Plan – Frequently Asked Questions

Prepared by Product Management 12 For Internal Circulation only

34. Can a housewife opt for Enhanced Sum Assured under the BSLI Dream Endowment Plan?

Since the Enhanced Sum Assured under the BSLI Dream Endowment Plan is similar to a Term rider, the conditions for Enhanced Sum Assured will be similar to that for the Term rider. Hence like the Term rider, the Enhanced Sum Assured option will not be available for housewives (non-earning lives)

35. Can a widow take BSLI Dream Endowment Plan if she is financially independent? If so, what additional

documents will be required? An independent widow can take the BSLI Dream Endowment Plan, subject however to specific underwriting guidelines applicable for widows (like other products).

36. Can an NRI / Foreign National of Indian Origin buy the BSLI Dream Endowment Plan?

Yes, an NRI from an approved country can purchase a BSLI Dream Endowment Plan. However it can be offered to only service sector NRIs. Also, the standard underwriting guidelines and questionnaires for an NRI would apply. Enhanced Sum Assured will not be offered to FNIO, Indians with dual citizenship and non-earning members like students, housewives etc. with no income source of their own and residing abroad.

37. Can BSLI Dream Plan be issued under the MWP Act? Yes the BSLI Dream Plan can be issued under the MWP Act.

38. Can an employer take the BSLI Dream Endowment Plan for his employee?

The employer can take the BSLI Dream Endowment Plan for his employee in a situation where the employee is the Life Insured as well as the policy owner while the employer pays the premium on behalf of the employee. In such cases, the policy owner (employee) will have to provide a letter from his employer stating that the premium for the policy will be paid by the latter as a part of employee-benefits to the employee.

39. Can a HUF buy BSLI Dream Endowment Plan? Yes, BSLI Dream Endowment Plan can be purchased by an HUF or Karta of an HUF.

40. Can BSLI Dream Endowment Plan be assigned?

Yes, BSLI Dream Endowment Plan can be assigned.