Distribution and exhibition sectors of indian film industry

-

Upload

biju-mohan -

Category

Documents

-

view

254 -

download

4

description

Transcript of Distribution and exhibition sectors of indian film industry

Indian Film Industry:

Distribution Sector

Short history

In the nascent decades of the film industry distributors hardly existed in India. In those

days producers dealt directly with exhibitors. The period from 1914 onwards, when

World War I disrupted European film production, film companies in the United States

attained a very strong position in the world cinema trade. In the same period Hollywood

films have established a dominant position in India and succeed to comprehensive

takeover of the Indian cinema market. While in 1913 the estimated share of US film

imports in India was a mere 3.8 per cent, by 1919 American films constituted 95 per

cent of India’s film imports. It was the Universal Film Company that came to dominate

the Indian market by the late 1910s. Universal took the lead amongst US film

companies by opening their first distribution offices in Bombay in 1916, Calcutta in

1917 and Madras in 1922. From 1917 Universal not only supplied the majority of films

screened in India, it also created a loyal following amongst local film audiences for

Universal serials and their stars.

By the introduction of sound movies, in 1930s, distribution system gradually emerged

as an important sector of the film industry. Initially, due to the cost of equipments it

concentrated only in a few towns like Bombay, Calcutta and Madras. Combined with a

tripling of the Indian population in the years between the two World Wars, the

possibility to show films in the regional languages led to the expansion of the

distribution sector.

After a period with relatively integrated studios prior to WWII, after Indian

Independence in 1947, Indian films have been produced, financed, distributed, and

exhibited in complex collaboration among hundreds of independent producers each

owning a small-scale production company (with one or fewer annual releases),

independent distributors (covering different regional territories), private financiers, and

stand-alone cinema operators.

1

After independence the first prime minister of India Jawaharlal Nehru decided to end

the domination of foreign distributors in India and support domestic film industry by

adopting new socialist policies. The foreign film companies were not allowed to directly

produce or distribute films in India. If a foreign film company wants to release a film in

India they have to come to an agreement with National Film Development Cooperation

and have to face la number of strict regulations from the Government. This helped

Indian film industry to attain self sustainability in the entire fields of film industry.

By 1948, there were no less than 887 distributors across the nation. As these figures

suggests, they are certainly not comparable to Hollywood distribution system, which

has traditionally operated as a cohesive force fully integrated into a monopolistic studio

system. After 1947, India was divided into five distribution territories or circuits.

International markets such as East and South Africa, were sometimes treated as a

sixth territory. Today these have further fragmented into twelve domestic territories.

After globalization the structure of industry again has changed considerably when

corporate giants and multiplex chains entered into the industry. Integration of different

sectors--production, distribution and exhibition--is the emerging tendency of the film

industry.

Territorial system of film distribution

To this day, distribution of film is a complex phenomenon in India. Since Indian film

market is wide and diverse, the film distribution business is still risky, highly

fragmented, and unorganized. A typical Bollywood movie releases in 150-350 cinemas,

including overseas release (this does not include B and C-grade centers located in

sub-urban and village areas. They receive the prints from the A-grade centers). Rarely

this number goes up to 700 (eg: the film ‘Devdas’(2002)). To cater the vast market, a

long chain of territorial system of film distribution is operating in the country. In this

territorial distribution chain in the country is geographically divided into different zones,

for which rights are sold separately. In some cases a major distribution company buys

the distribution rights from the producer and makes subcontracts arrangements with

other territorial distributors.

Major film production companies/reputed producer, organize a special screening of

uncompleted film for various territorial distribution companies. After the screening the

2

distributing companies estimate the commercial possibilities of the film and decide

whether they will distribute the film or not. In India usually the well-established

production houses have regular distributing partners with whom they have done

business for a long period of time. Rajshri Productions (P) Ltd., a corporate giant not

only produce films but also has a comprehensive film distribution network of 21 offices

covering 13,500 screens throughout India. UTV, another big player in Indian film

industry has a distributing system that covers 13,500 screens in India and 47,300

screens overseas. But majority of regional films do not enjoy this kind sophisticated

distribution system.

Three kinds of distributor’s nature of operations

The films were produced by sister concerns of the distributing companies. That means

the distributor himself produces the films.

Films were taken for distribution from producers to whom the distributor had given

financial assistance during production.

Distributor purchased the rights of the film from the film producer.

In few cases the producer himself distributes his film, because he could not find a

distributor for his film.

How it works

Producer: Distributors give him a minimum guarantee fee to the producer in return for

film rights in a territory within the country. Producers can recover up to 30 per cent of

the cost of the film by pre-selling it to distributors. If the movie does well and the

distributor recovers his money, any additional inflows get divided between the two.

Another 25 per cent of the revenue comes from overseas rights, 20 per cent from

satellite rights, 10 per cent from the emerging home video market, 10 per cent from

music (which includes wireless and Internet downloads). If the producer owns the

intellectual property rights and has not sold it off in perpetuity (generally, rights are

3

given for five years), he could make money selling his film to a TV channel in the long

term.

Distributor: They offer a minimum guarantees (MG) fee to the producer to book a

territory. They spend on print and publicity on which they take a 20 per cent

commission. Any overflow of revenue after recovery of the MG fee and commission is

divided between them and the producer. In cases like Yash Raj Films, which

distributes most of its films, while the risks are bigger, so are the gains.

Exhibitor: The old system in which distributors pays a rental to the theatre irrespective

of whether the movie ran or not is rapidly becoming history. Under a new system

revenue gets shared between theatre owners and distributors. Generally, in the first

week of a release, the split is even 50:50, in the second week the distributor gets 40

per cent and the exhibitors the rest, in the third week the distributor makes 30 per cent

and if the movie continues into the fourth week, he gets 25 per cent of the collections.

After discussions Production Company or the independent producer comes to an

agreement with the distributor and collects minimum guarantees (MG) money from the

distributor. Then the producer hands over a letter of permission to the distributor to

make particular number of prints of the films. Distributor gives the permission letter to

the film lab (where the master print of the film is kept) and makes sufficient number of

prints. For a certain number of years the distributor will enjoy the sole right to distribute

the film in their predefined territory. But the copyright of the film will remain with the

producer. The distributor handles all the postproduction publicity and recoups the

amount from the producer’s share of the box-office receipts.

Distribution corresponds to wholesaling of the product produced. A full-fledged

distributor maintains a head office and branch offices in various parts of his territory.

The film is given to various theatres according to terms and conditions agreed upon.

They delegate at least one representative to each theatre where the film is screened to

see that things are going as planned and that correct accounts of collections are given

by the theatre owner to the distributor. The representative is given remuneration on a

daily basis. Whenever they are needed that is when films are being released the

company will call them for the job. But big distribution companies have permanent

representatives.

4

Financial sources for distribution

Distribution of film needs huge amount of funds. Most distributors invest money from

their own funds, which circulates in the distribution business. Distributors also borrow

money from different private financiers (including black money from the underworld).

Reputed distribution companies like Yash Raj productions and UTV borrows money

from Banks on the strength of their balance sheet. They also collect funds from IPOs,

like PNC or go to individual high net worth individuals or companies to put in money as

equity.

Distributors also get financial support from theatre owners who are eager to exhibit a

particular film at their theatre. The lack of institutional finance is the biggest problem for

regional film industry.

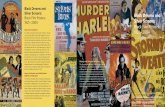

Publicity

Publicity of the film is one of the responsibilities of the distributor. Historically, Indians

have adopted different methods to publicize films. India’s cultural and geographic

variations reflect in these publicity techniques. Different kinds of promotional activities

are carried out in village areas, townships, sub-urban area and city areas. Some of

them are very innovative and regional phenomenon. But after globalization gradually

this diversity is vanishing and uniformity is reached every where.

Newspaper advertisements, posters, boards, printing and distribution of handbills,

publicity through vehicles fitted with loudspeakers, news coverage and articles on film

magazines and advertisement on radio and television channels are different methods

for publicity. In recent times most producers have started keeping large amounts set

aside for advertisement and publicity. During earlier days, load speakers on vehicles,

hand-bills, boards and posters were the major modes of publicity. Today besides

posters, advertisement on newspapers, magazine, television and radio are more

popular. Traitors on cinema theatres are another way of publicity.

Today advertisement in television is the most popular way of film marketing. Trailers

are repeatedly telecast in TV channels to attract public attention. Significant portions of

5

the film along with clippings of major artists and technicians talking about the movie are

now considered very effective as mode of advertisement. Parts of song sequences are

also included. Filmmakers also try to get the songs of their film included in popular

song based TV programmes in order to attract the public.

Nowadays distributors are using new kinds of marketing tools to ensure that the film

hits the bull's eye at the box office. To do so they associate star with a popular brand in

the market. For instance, the Coca Cola campaign ‘jiyo sir uthake’ (live with dignity)

was used with the star campaigner Amir Khan to speak out the “much needed

patriotism” among youngsters (central theme of the film Rang De Basanti) in the form

of a soft drink campaign.

For decades films songs have been the best brand identity of an Indian film irrespective

of the language of the film. The songs will be recorded even before production of a film

starts. On an average an Indian film has 4 to 6 songs in it. The music cassettes, CDs

and DVDs are released two or three weeks before the film release. Usually selling of

music copyright to a music distribution company brings good amount of sum to the

producer. The common belief in the industry is that if the songs became a hit then the

film’s chance to become a hit is very high. This shows the importance of music in the

promotion of Indian films.

Relations with theatres

It is the distributor who deals directly with the theatres. He is the link between the

producer and the exhibitor. The reputation, facilities and locality are the main

parameters to select theatres. Some distributors have permanent settlement with

theatres. This would mean that all films that they distribute are released in the same set

of theatres. In return they have some arrangement with the theatres. For example if the

collection fall below the holdover limits on a certain day these theatres may continue

exhibition even though they are entitled to change the film. These adjustments go a

long way in maximizing profits. For films which are expected to do well at the box-office

and films made by production companies with good track record, there is absolutely no

problem in getting theatres. But for new comers it is very difficult to get established

theatres to screen their films unless the season is not good

Major problems confronted by distribution concerns

6

1. Financial

The cost of distribution is very high in India. Cost of making one print works out to be

about $1200, the cost of its releasing more than 500 prints can be almost $ 600

thousand (close to 30% of the average cost of making movie). Compared to Hollywood

where the cost of prints for a Grand Nation wide release (almost 400 prints) hardly ever

exceeds 5% of the overall cost, this is a significant cost for Indian movies. This cost

limits the prints for the low budget films to just about 50-60 prints. The higher ones

manage with around 500 prints. {Assisi Charles, (2006, January 16), Lights, Camera…Take 2”, Times of India}. The trend is to release the movies first in big cities. After few

weeks when the collection from the big cities dips low enough the same print is used to

release the movie in smaller cities.

Like in production sector, very less institutional finance is available for distribution

sector. In regional film industry when advances are given, the contract with the

producers is that if the film fails, the producer must still repay the whole amount

covering the gap with collection using his own funds. However in many cases the

producer fails to do so. Once the film has flopped the condition of the producer is even

worse than that of the distributor and in most cases the former is not in position to

repay the amounts due to the latter. In such instances legal battles have been fought in

the courts of law and in many cases, the verdict has been in favor of the distributor.

Huge amounts are spent on film making today. For a distribution company to do good

business, films should be available constantly. However producers demand huge

amounts as advances. As production goes on producers often keep asking for more

and more money and the distributor cannot breakaway at this stage because his

money is already blocked with the producer. Low budget films may be available without

advances, but the risk of failure is higher for these films. Once larger amounts are

advanced, risks of the distributor go up. Thus the risk element in this business has

gone up steeply in recent years.

2. Problems with theatres

Sometimes distributors face problem in fixing up terms of agreement with the

exhibitors. The holdover figures are often fixed too high and it is inflated quite often. A

good number of films are made every year and the theatres are eager to screen new

7

films for which collections are expected to be higher. So after a few weeks, even if the

film has not reached the holdover limit, they play tricks to show the holdover has

reached on a particular day and stop screening the film before it has completely

exploited the market. In areas where the number of theatres is few, there is a problem

of getting theatres on time for films. Another complaint is that the theatres do not reveal

the correct accounts of collections to the distributor. But this is not the case when films

are released in A class. ‘A’ class theatres are more accountable and have good

professional working track records. But situation is not same in some B and C class

theatres. Sometimes they project hardly 50% of actual collection to the distributor.

Representatives of the distributor (who is underpaid by the distribution company) in

many cases, join hand with the exhibitor in framing wrong accounts.

For reputed distribution companies these problems never exist. They have adequate

finance to distribute the film and theatres would like to keep constant friendly business

relationship with the distributor. Like any other business field it is the bigger players

who get more benefits in film industry also. Smaller players suffer a lot and most of the

time vanishes from the industry with in few years of operation.

B and C-grade centers located in outlying areas have to wait 5-8 weeks to receive the

worn prints from the A-grade centers. This poses several problems for the owners of B

and C-grade centers. Audience demand for a motion picture product often does not last

5-8 weeks, lessening their opportunity to fill their cinema houses with paying patrons.

Presentation quality also suffers, due to the worn prints they receive. The motion

picture producer suffers, too, as the limited availability of the movie in the opening

weeks encourages the rampant sale of pirated DVDs. Thus, the current film distribution

model in India has created a downward business spiral for the owners of B and C-

grade centers

3. Piracy

Piracy is one of the major problems affecting trade in this segment. The unauthorized

reproduction of films in video forms and/or display of the video through cable network

without proper authorization from the film producers are the most common forms of

piracy in India. At present, there is no uniform method of estimating the contribution of

core copyright industry to the GDP and the potential loss of revenue due to piracy.

According to the Film Federation of India, the film industry is loosing approximately

8

US$ 76 million per annum in revenue due to piracy. Indian films are first released in the

theatres and/or cinema halls and subsequently they are released through other media

such as videos and cable network. However, in many cases the unauthorized version

of the film is shown through the cable network or videos and this affects the earnings of

the film industry. On an average, a theatre owner loses as much as 40 per cent of

legitimate business due to piracy by the cable operators

(Audio-visual Policies and International Trade: The Case of India, HWWA-Report, Hamburg Institute of International Economics, 2003)

Cable Piracy

Unauthorized cable television transmission remains the predominant form of piracy of films in India. As many as 60,000 cable systems exist in India, and these systems continue to frequently telecast films without authorization, often using pirated videos for their transmissions. These cable systems seriously affect the financial stability of film industry. Ministry of Information and Broadcasting, the representatives of the film industry and the cable service providers have signed a joint memorandum whereby the latter have agreed not to make unauthorized cable telecasts on their networks and to cancel licenses who violates the law. A similar memorandum has also been signed by the cable industry with the IMPPA (Indian Motion Pictures and Producer's Association), a local association of the film industry. But these memoranda have little impact on piracy since the cable networks are known to be in breaking of the law, as well as of specific orders of the court.

Inefficient resistance against piracy

There is currently no national coordination body devoted to resist piracy in India, but

instead, law enforcement is left to each individual state. This leads to an inefficient

system, with a wide variance in capabilities and results throughout India. Moreover,

there is little expertise within the police and the court system for handling piracy cases.

Police sometimes take up to a year to prepare the charge sheet on a defendant and

then leave out pertinent information. Often investigations are cursory, with no attempt

made to locate the source of the pirated films. The heavily burdened legal and judicial

systems mean that outstanding cases often take years to be resolved.

9

Distributors X Quality films

The distributor has a strategic position and is capable of even controlling the industry

because he is the link between the two processes of production and marketing of the

films. Many low-budget films addressing socially relevant issues were not accepted by

distribution companies. These risks are mostly faced by small banner movies or movies

with low profile actors and actresses, from whom the perceived gain of screening the

film is low. However a distributor often dictates terms and conditions to the producer

regarding theme, cast etc., of the film in an attempt to pamper the tastes of a large

audience which often lead to degradation of the quality of the film. This is a major

problem currently faced by Indian language films.

Every year hundreds of films close their journey unopened. The producer cannot find a

distributor for his film. Distributors reject these films because they do not find

commercial spicy entertainment element in those films.

International Distribution

Historically Indian films are very popular in Asian countries, Arab countries, Russia and

African countries. Despite the restrictions imposed in the 1990s by the Taliban,

Afghanis love to watch Bollywood films. Bollywood films rules have huge fans in Iran,

Pakistan, Bangladesh, Sri Lanka and Nepal. Bollywood has a strong hold in South East

Asia in countries such as China, Indonesia and Malyasia. The fascination of Bollywood

came to light in China during the Dilip Kumar era, a popular icon of the yesteryears.

From early 1950’s Bollywood films were well received in USSR, especially Raj

Kapoor’s film. According to Ashok Sharma, Indian Ambassador to Surinam.

“The popularity of Bollywood in the CIS dates back to the Soviet days when the films from Hollywood and other Western countries were banned in the Soviet Union. As there was no means of other cheap entertainment, the films from Bollywood provided the Soviets a cheap source of entertainment as they were supposed to be non-controversial and non-political. In addition, the Soviet Union was recovering from the onslaught of the Second World War. The films from India, which were also recovering from the disaster of partition and the struggle for freedom from colonial rule, were found to be a good source of providing hope with entertainment to the struggling masses. The

10

aspirations and needs of the people of both countries matched to a great extent. These films were dubbed in Russian and shown in theatres throughout the Soviet Union. The films from Bollywood also strengthened family values, which was a big factor for their popularity with the government authorities in the Soviet Union”

(http://en.wikipedia.org/wiki/Bollywood)

Bollywood is hugely popular in Africa with over 60% of African Nations becoming a

commercial success for Bollywood.

After liberalization some of the domestic film production giants started to explore the

possibilities of international market. Yashraj Productions and Rajshri Production, UTV

are the key player in this sector. Others are making collaboration with international

distributors to distribute their films internationally.

As a consequence, film exports have grown from more than US$ 48.4 million in1998 (198 titles) to around US$ 111 million in 2001. Presently Indian films are exported to around 95 countries world wide. Among them the US and Canada accounted for 30% of the total exports (by volume of prints0 in the year 2000, followed by the UK (25%)(Audio-visual Policies and International Trade: The Case of India, HWWA-Report,

Hamburg Institute of International Economics, 2003)

The report also predicted that the overseas market for Indian films, which is currently worth $162m (Rs7bn), will grow at a compound annual growth rate (CAGR) of 18% which is higher than the CAGR of the domestic box office at 16%.

(FICCI-Frames conference, 2007 March 26-28)

Globalization and news threats for domestic film distribution

India after independence adopted an economic system which called protectionism. It

was socialist in its economic planning. Sometimes it was criticized as the License Raj

(investment, industrial and import licensing). But drastic changes occurred during the

late 80s when Indian Prime Minister Rajiv Gandhi decided to open the market for

privatization and globalization. At that time India faced a severe depletion in foreign

exchange reserves. Also during that time foreign debt reached its peaks. The condition

got worse in such a state that in 1991, the country had just enough foreign exchange

left to pay for a few weeks of imports. World Bank and International Monetary Fund

advised Indian Government to open up the economy for multinational companies and

11

foreign direct investment.

Under Prime Minister P.V Narasimha Rao and his finance minister Manmohan Singh

(Present day prime minister) India adopted “New Economic Policy”. Many public

monopolies were removed, allowed automatic approval of foreign direct investment in

many sectors. Since then, the overall direction of liberalization has remained the same,

irrespective of the ruling party. The public sector is being steadily, albeit slowly,

dismantled.

Globalization has changed the destiny of Indian film industry like any other industry

sector in India. Prior to 1990s, the National Film Development Corporation (NFDC)

under the Film Wing of the Ministry of Information and Broadcasting had the sole

authority to import foreign films. Foreign film producing companies and trade

associations had to enter into agreement with NFDC for import and distribution of their

products in Indian marker. This restriction was removed in the year 1992. India had a

quantitative restriction on film imports and the total numbers of titles imported were

restricted to 100 per year. This restriction was also removed in 1992.

After 1992, major US distributors have opened their branch offices in India. These

include Columbia Tristar Films of India Ltd., Twentieth Century Fox India Inc,

Paramount Films of India Ltd., and Warner Bros. (F.E.) Inc. They distribute their

respective principals’ films in India. Additionally, Columbia Tristar Films of India Ltd.

Distributes, Buena Vista Films; Twentieth Century Fox India Inc. distributes MGM films;

and Paramount Films of India Ltd. distributes United Artists and Universal films. Now

they can also distribute Indian language films inside India and as well as outside the

nation. This has a negative impact on the revenue income of Indian distributors.

Domestic distributors have made major losses in the first seven months, while overseas distributors have made marginal profits, after considering the print and marketing costs. If inflows and outflows of the overseas distributors are excluded, then the losses of the domestic distributors are close to Rs 65 crore.(Rs.650 million).This means that while the overseas distributors have just broken even, the entire loss for the segment is on account of domestic distributors.(The economic times survey, economic times, FRIDAY, OCTOBER 18, 2002)

The on going liberalization has helped the distribution sector to adopt new strategies to

12

enhance its profit from the market but it also created new challenges in front of

domestic distributors.

Foreign films in Indian film marketEven though foreign films especially films from Hollywood have a strong market share

in most of the developed countries around the world, in India, the share of foreign films

is relatively small at around 5-10% of total box-office revenue. One of the reasons for

this low share is that the number of international releases in India is less compared to

domestic films. For example in 2004 just 80 foreign films were released and in the

same year 900 Indian films were released. But when we study growth rate, the total

gross box office collections of International films have grown over 33 per cent in the

first four years of this decade. 40 per cent of such collections are contributed by

international films which were dubbed in local Indian languages. In 1998 mega hit

Titanic grossed almost Rs 600 Million in India. Thus, distribution of dubbed versions of

foreign films in local Indian languages has huge potential in Indian film market. Some of

the International Distributors such as Sony Pictures Releasing of India (SPRI) and

Warner Brothers have already made headway in this regard.

But in 2005 Hindi filmmakers managed to reverse the trend with a spirited

performance. Overall, revenues are estimated at a healthy Rs 3,600 crore in 2005, up

18 per cent over the previous year. According to market estimates, the box office share

of Hollywood movies in India has declined from a high of about 9 per cent, to around 4

per cent in the year 2005 (about Rs 150 crore in all).

13

Further, if we compare the box office collections of the Top 10 Foreign films with the

Top 10 Hindi mainstream films in 2004, foreign films have less average gross collection

compared to Hindi mainstream film in India.

(Source: Report on Entertainment and Media, India, DAVOS 2006, January 25-29)

Home video market

India has more than 26 million DVD/ VCD users, with a 25% annual growth rate. This is

about a fourth of all TV ownership in the country. Even then home video accounts for a

mere 7% of the total film revenues which is estimated around Rs. 1750-2000 Million.

Mean time U.S home video market is almost the same revenue size as that of the

theatrical market. Whereas the North American and US video industries have been

able to make significant contributions to inward investment into new film production,

India’s video business is struggling to find sufficient margins and – at this stage – does

not have the market to sustain substantial production advances to producers against

video rights. As a result, those rights account only for about 5% of film producers’

revenues and advances to new productions range only between $105,000 and

$320,000 for the more commercial titles. On the bigger “hero” films distributors can

expect to shift between 15 to 20,000 units of DVD and between 100 to 120,000 units of

14

VCD in the “sell-through” market.

(Reference: Frames 2006, annual report, FICCI)

In India almost 90% of films are released in VCD/DVD formats after the film is

withdrawn from the A class theatres (after late nineties VHS format is almost

disappeared from the market). These video formats are sold through wide network of

video shops in the entire nation. The video rental shops, video libraries, institutional

libraries and home users are the main customers of this home video market.

Pirate videos cause severe damage to the home video market in India. Most of the

film’s pirated copies are available in major cities well before the local theatrical release

of the title (so-called “pre-release” piracy), with a significant number of the pirated

VCDs being manufactured locally or imported from Gulf countries, Malaysia, and now

Pakistan.

To tackle this piracy issue home video distribution companies are now adopting new

marketing strategies. For example Moser Baer, India's largest and world’s second

largest optical storage manufacturer has lounged a marketing plan to sell film VCDs for

just Rs 28 and DVDs for Rs 34. They purchased video rights from film companies and

market them through 100000 outlets in all over the country. Due to augmented

availability and cheap price customers opted to buy the original videos instead of

pirated copies. They also influenced the local governing bodies to take strict actions

against piracy and several raids were carried out through out the states where Moser

Baer lounged the campaign. By adopting these comprehensive strategies the

campaign was a huge success in India.

(“Moser Baer launches its Hindi home video titles nationally”, press release, Mumbai, March 15, 2007)

Internet marketing

There are about 38.5 million Indians uses internet regulary. About 3.6 million homes in

the country have a personal computer and about 1.5 million of them are powered by

broadband. About 20 million Indians live outside the country and most of them use the

Internet. Because of this Bollywood moviemakers are slowly waking up to the

possibility of exploiting the Internet for film distribution. For example the Hindi film

`Supari' became the world's first feature film to be offered to end-customers for

15

downloading from the Internet, using the emerging peer-to-peer technology. The Yash-

Raj Films-distributed product was offered for download from the popular Net file

sharing resource, Kazaa at a cost of $ 2.99. Since then, according to Sharman

Networks which owns the web sharing operation, over 200 downloads of `Supari', have

been sold. Thus the international marketing of Indian films through internet has created

excitement among film community in India.

Some of the leading film distribution companies in India

Rajshri Productions (P) Ltd. (http://www.rajshri.com)

RAJSHRI PICTURES (P) LTD., is the largest all-India film distribution company India

having 19 branch offices at major cities of the nation. RAJSHRI PICTURES (P) LTD.

was established on August 15, 1947 at the dawn of India's independence. Over the

years, besides distributing its own 50 classic films, RAJSHRI PICTURES (P) LTD. has

distributed many of Indian Cinema's best and most successful films including Sholay,

Dharamveer, Devdas, Munnabhai MBBS, Krrish, etc.

Yash Raj Films Pvt. Ltd.( http://www.yashrajfilms.com)

Yash Chopra, renowned Bollywood filmmaker founded Yash Raj Films in 1971. Yash

Raj handles movie distribution both in India and overseas.

UTV (http://www.utvnet.com)

UTV’s distribution network covers 13,500 screens in India and 47,300 screens

overseas. They distributes films in India, US, UK, Dubai, South Africa, Australia, Fiji

and Japan.

Eros Multimedia (http://www.erosplc.com)

The business of Eros was founded in 1977. One of market leader in the international

distribution of Bollywood films

Mukta Arts Ltd. (http://www.muktaarts.com)

Mukta Arts Limited was established in 1978. The company has assumed a prolific

character, by venturing into all sectors of film industry including film distribution.

16

International Film Distributing Companies in India

Before nineties the foreign films were distributed by domestic distribution companies in

India. But after the restrictions on foreign film distributors were withdrawn on 1992

many international film distributing companies started their functioning in India. So

majority of domestic distributing companies which were specialized in marketing

foreign films were closed down. Now the major foreign film distributing companies have

head office in Mumbai where Bollywood is situated. Seven Hollywood studios are

directly functioning in the country of which Sony, United Artist, Universal, Paramount

(which handles distribution for Dream Works and Universal), Warner Brothers and 20th

Century Fox (which works through Warner Brothers) are the key players.

In these distributors Sony Pictures Releasing of India Ltd., is the biggest one which on

an average distributes 100 prints of a film, with some dubbed in Hindi, Tamil and

Telugu.

Sony Pictures Releasing of India Limited (SPRIL)

SPRIL is earlier known as Columbia Tristar Films of India Ltd., has distributed, films

like Hitch, Fun With Dick and Jane, Bewitched, Stealth, Click, Memoirs of a Geisha, European Gigolo, , The DaVinci Code, in 2005 and 2006. It is a key player in Indian

film market.

Address: SONY PICTURES RELEASING OF INDIA LIMITED

503, Alpha, Hiranandani Gardens,

Main Street, Powai, Mumbai.

E-Mail: [email protected]

Web: www.sonypictures.in

Twentieth Century Fox India Inc

Released big hits like Titanic, The Full Monty and The X-Men. Other than marketing

and distributing their own international films in India, they also distribute Indian movies

that are made in English like English August and Split Wide Open.

Address:Twentieth Century Fox India Inc.

17

Metro House, 3rd floor

Mahatma Gandhi Road, MUMBAI 400 020

Phone (91 22) 22004012 / 22014290, Fax : 22089388, www.foxmoviesindia.com

Exhibition sectorA short history of exhibition sector of Indian film industry

In India, first exhibition of Cinema was held on July 7, 1896 at the Watson Hotel in

Bombay. Six silent short films made by Lumiere Brothers namely Entry of

Cinematograph, The Sea Bath, Arrival of a Train, A Demolition, Ladies & Soldiers on

Wheels and Leaving the Factory were the films screened on that day. In the early

decades of last century Cinema houses were set up in major Indian cities, like one in

Madras (in 1900 by Major Warrick), the Novelty Cinema in Bombay (where newsreels

from the Boer Wars were shown) and the Elphinstone Picture Palace in Calcutta (set

up by J.F. Madan in 1907). Apart from these, a number of film shows were arranged in

tents. Records say that on December 26, 1905, two Italians, Colorello and Cornaglia,

organized film screening in a tent at the Azad Maidan Bombay opposite St. Xavier's

College. Such kinds of film screenings were also held in J.F. Madan's tent cinema at

the Calcutta Maidan. Because of the unavailability of permanent theatres films were

also traveled from one city to another and screenings were done in temporary tents. In

1904, Manek Sethna started the Touring Cinema Co. in Bombay and a year later,

Swamikannu Vincent, a draughtsman for the railways set up a touring cinema going

around small towns and villages in the South India. Transportation of screening

equipments and inflammable film reels were always a high risky job for the exhibitors.

Kattukaran Warunni Joseph, the first film exhibitor in Kerala has such a story to tell:

In 1907 Joseph purchased Edison Bioscope from a German man and named the equipment as “Jose Bioscope.” During the Thrissur Pooram (a famous religious festival in Kerala) he built a temporary tent for screening films and installed his machine in it. The screening was a big success. Inspired by the big success of the screening he started touring all over South India with his Bioscope. On such a tour he was traveling

18

near the coastal area of Mangolore, suddenly a heavy wind started blow on his vehicle. The wind took his equipment to the sea and he lost it forever.

During silent era interpreters worked in theaters, who would interpret the images on

the screen. Usually he uses a tinge of sarcasm in his interpretation. He criticizes the

social realities sprinkled with humor. The ability of the interpreters to grab the attention

of the audience helped the film to get popularity. By the arrival of the sound films

interpreters went behind the curtains and never came back.

The boom in cinema theatres came in the '30s. Most of them are architectural

landmarks like The Regal, Plaza, Central, New Empire, Broadway, Eros and Metro

which were built in Mumbai.

In the Independent India, the popularity of films helped the growth of film screens all

over the nation. Theatres were built by private and well as government sectors in urban

and rural areas. The theatres in the urban areas have sophisticated equipments and

facilities but theatres in rural area the lacks these facilities.

In the last two decades of 20th century, average occupancy in Indian cinema halls has

fallen considerably due to high entertainment taxes and the onslaught of cable

television. This has led to a further decline in the quality and maintenance of cinema

halls in the country, leading to an even greater number of people preferring to watch

television or films at home. In the eight years from 1983 to 1995, 46 out of the 146

cinema halls in Mumbai closed down and since 2000 fifty theaters were shut down in

the same city.

Entrance of multiplexes has bought drastic changes in the form and operations of

exhibition sector in India.

Social contributions of film theatres to the nation

Indian society is divided into different ethical, economical and social sections. The

caste system is so rigid that the lower caste people were never allowed to participate

in mainstream activities (Among present day urban society the role of caste system is

vanishing significantly but still now it is prominent in rural areas). Even they were not

allowed to enter temples, upper caste people’s houses or schools. They were

considered as lesser human beings. Majority of the population comes under this

19

category. The hatred created by nation’s partition still generates conflicts between two

main religions (Hindu and Muslim). Since the society doesn’t have a “common place”

to get together or “common activities” to do, gradually the disbelief between the

communities grown.

But film theatres created a venue where all the communities can come together and

share some hours under the same roof. The divisions between castes or religion never

existed inside the theatre.

“The Cinema Hall was the first performance centre in which all Indians sat under the

same roof. The basis of the seating is not on the hierarchic position of the patron but

essentially on his purchasing power. If he cannot afford paying the higher rate, he has

either to keep away from the performance or be with ‘all and sundry’” (K. Sivathamby, Tamil Film as a Medium of political Communication, 1981, New Century Book House).

“Film culture in Indian context is political for the following reasons: it is founded on a

democratic promise and it develops around the notion of spectatorial rights. I not only

have a right to be present in the cinema hall but have the further right to make

demands of the narrative, the star, etc. The cinema has to acknowledge my presence

and address my expectations.”(S.V. SRINIVAS, PUBLISHED IN SEMINAR, NUMBER 525, 2003 (APRIL), pp. 47-51.)

By this way theatres have created an atmosphere where people can experience the

meaning of social equalities which went further into strengthening Indian democracy.

Classification of film theatres

According to the CII-KPMG report of 2005, there are about 12,900 screens in the

country, out of which 95 percent are single screens. About 60 per cent of the theatres

in the country are situated in the four Indian southern states- Andhra Pradesh, Tamil

Nadu, Kerala and Karnataka servicing only 22 per cent of the Indian population. Tamil

Nadu and Andhra Pradesh have 5,160 theatres while Karnataka and Kerala have 2,451

theatres. (Source: Report on Entertainment and Media, India, DAVOS 2006)

20

In contrast to China (has 65,000 screens) and US (has 36,000 Screens) India's screen

density is very low even though it produces more films in a year. The US has 117

screens (per million populations) and the UK has 30 screens (per million populations).

But India has only 12 screens per a million populations. Even if a gap of just 8 screen

average (as per the UNESCO Report of 2001, quoted in the CII-KPMG Report 2005) is

considered, there is a potential demand of about 8,000 additional screens in the

country

21

Even then number of people going to theatre is high in India. The Central Board of Film

Certification of India cites on its website that every three months an audience as large

as India's billion-strong population visit cinema halls. Indian exhibition sector is not

adequate for meeting the needs of this high attendance.

In India, exhibition market is divided into different centers according to the population

and social & economic status of the place. They are called A, B and C centers. A

center will have a greater population and market share compared to B and C centers.

The best exhibition theaters are always situated at ‘A’ centers. B centers are usually

situated in townships and sub-urban areas. Most of underdeveloped areas (like

villages) come under C centers. Majority of Indian populations lives in C-centers.

Single screen theatres

Single screen cinema halls are divided in to A, B and C categories based on location

as well as the kind of facilities they offer. An average ‘A ‘class theatre has more than

1000 seats capacity. ‘A’ class theatres are those where films are released first. They

are situated in major towns and cities in prime locality and have good seating comforts,

excellent up-to-date equipments, air-conditioning and parking facilities. Collection

levels are very high in ‘A’ class theatres compared to ‘B’ and ‘C’ class theatres. In early

days, films were first released in ‘A’ class theatres because the number of release

prints was less as compared to theatres. In recent years, more prints have been

distributing and so some ‘B’ centers are also getting new prints along with A centers.

‘C’ class theatres are situated in underdeveloped areas like villages. They do not have

facilities like Air conditioning, Digital sound system, proper seating arrangement or

parking place. Most of them are occasionally used as wedding halls or seminar halls

because of the lesser income from movie screening. These theatre owners do not

spend much money to improve the seating comforts or to keep pace with technological

changes in equipments.

Multiplexes

Most of the theatres in India are single-screen theatres and not the highest quality,

which has resulted in lower occupancy rates and lower ticket prices. This provided an

opportunity for companies to take over such theatres on lease/contract basis (most of

such theatres are owned by individuals who are running into losses and hence are

22

willing to enter into such contracts) for up-gradation or conversion to multiplexes. Such

up-gradation and conversions to multiplexes is resulting in higher occupancy rates and

thereby the opportunity for exhibitors to charge higher ticket prices. This growth of the

multiplexes has resulted in the average ticket prices to rise as high as US$ 1.7 from a

low of US$ 33 cents. Further, average occupancy levels have also steadily risen

resulting in higher box office collections. Such companies also retain the right to

monitor the ticket collections and having retained a share are able to recover their

investments faster than if they opted to set-up a new theatre.

The commercial operations of India’s first multiplex-PVR Anupam launched on June

1997 at Saket, New Delhi. Now there are 73 multiplexes operating in India with the

western region having 42 multiplexes, followed by northern region having 23 and south

and east regions having five and three respectively. PVR, Adlabs and other companies

are aggressively increasing their reach in the country (PVR has 68 screens in 16

locations of the country. Of these, PVR Bangalore is the biggest multiplex in India with

11 screens in it). Shringar Cinema is also rolling out multiplexes in B and C class

centers. Multiplexes in India are also now diversifying their sales while others

contribute the rest (for some places the other revenue is almost as high as 50%). For

example in 2006 PVR multiplexes collected Box office revenue of Rs 369 Millions,

Food and Beverage revenues were Rs 115 Millions and formed second largest source

of revenue, Ad revenues were Rs 46 Million and royalty income stood at Rs 6 Millions.

Multiplexes also have greater occupancy and better cost management compared to

single screens.

Main multiplex chains in India

Company No. of properties No. of Screens No. of seats

PVR Cinemas 7 34 7,333

Inox Leisure 5 25 7,344

Adlabs Films 4 14 5,666

Shringar Cinemas 3 14 4,588

Wave Cinemas 3 13 4,380

E City Entertainment 3 14 3,952

23

Total 25 114 33,263

(Source: PVR News release, 2006)

The above mentioned companies comprise around 40% of all India multiplexes in India

in terms of total number of screens and seats. PVR Cinemas is the largest in terms of

number of screens.

Multiplex cinemas in numbers comes near just 5% of total theatre screens, today earn

nearly 65% of all box-office revenue in India.

How it worksWhen a film is scheduled to release in a theatre the theater owner will come to an

agreement with distributor. Usually the distributing company has some settlements with

theaters regarding regular release of films in the theater. Sometimes theater also

approaches the producers/distributor for films. In those cases they will give some

advance money to producer before the film releases. Some percentage (3% to 5%) of

total share of the exhibitor is also given by all theaters to the distributor for

advertisement and publicity expenses.

The holdover in all theatres is fixed at that level where total net collections from all

three shows in a day, at least equals the net collections from one full show. If

collections in a day fall below that level, the film is deemed to have reached the

holdover. Terms regarding share of collections vary from place to place and the

bargaining capacity of distributor of theatre. But in general practice 40 percent of net

collections are taken by the theatre during the first week, 45 percent during the second

week and 50 percent from the third week onwards. From the gross collection the

theatre has to pay entertainment tax to the local civil administration body. In India

entertainment tax is very high compared to other countries (the details has been

included under the heading ‘Tax System’ in this article).Other than entertainment tax

theater has to pay a show tax (almost $ 0.25 per show) to the local civil administration

body.

The numbers of films that are exhibited in the theater in a year depend largely on the

popularity of the films screened. Successful films will run more than six weeks and flop

films may not last even a week. In multi-theatre complexes, when a film’s collections

24

come down, it will shift to smaller theatre in the complex. Thus a film may run at the

center for more days.

When number of films decreases in a year or many films flops in the market theatre

face many problems. To get films they have to face a good competition with other

theatres. Exhibitors are also keen to get films involving popular stars and proven

themes at the box office. Films made by reputed directors and well established

production concerns are generally favored. In order to attract good films, theatres offer

high advances to film producers. A major complaint from the theatre owners is that if

the film flops in the market, the distributors do not return the advanced money and they

tend to adjust it in their next film. This some times creates conflicts between theatre

and Distribution Company.

Revenue

Movie tickets in India are among the cheapest in the world (the average ticket costs

US$0.20; in comparison, the average ticket in the U.S. in 2005 costs US$6.41). India

accounts for 73% of Asia-Pacific movie admissions, currently estimated at US$2.9

billion.

Even though India is the largest producer of films, revenuewise it accounts for only 1

percent of global film industry revenues. Because till now Indian film industry is highly

depending on theatre viewer ship for revenue making (the industry realizes almost 70%

of its total revenue of INR 59 billion from domestic and overseas theatre viewer ship,

unlike in countries like the US which earn only 35% of revenue from theatre viewer ship

while the remaining 65% is derived from other revenue sources such as

DVD/VHS/Cable, Satellite, pay per view etc.- page no: 50, “Indian entertainment industry Focus 2010: Dreams to reality”, A CII-KOMG Report ). Since the ticket costs

are very low and high entertainment tax system Indian film industry is suffering from

revenue loss very year.

Tax System

India has one of the highest levels of entertainment tax among the Asian countries.

Since exhibition of entertainment products are under the legislative powers of the

25

respective state governments, the nature and extent of the tax varies widely across the

different states, ranging from 14 to 167 per cent. Due to this, a large proportion of the

theatre ticket receipts go towards tax, which could have been invested for the

development and maintenance of the theatres. Moreover, different state governments

have different statutory framework for entertainment tax. For example, in Delhi the

entertainment tax is regulated by the Delhi Entertainment and Betting Tax Act (1996),

in Gujarat by the Gujarat Entertainment Tax Act (1977) and in West Bengal by the

Bengal Amusement Tax Act (1922) and the West Bengal Entertainment-cum-

Amusement Act (1982). The Central Government does not have any statutory power to

issue directions to the State governments for levying entertainment tax. Apart from the

basic entertainment tax, municipal show tax, new releases tax and property tax are

levied by most state governments/municipal authorities/local bodies which generally

range between 1–2%. The non-uniformity of regulatory framework creates confusion

and acts as a disincentive for foreign investment in theatres/exhibition halls. In 2001,

the central government, after discussion with the state ministers, had decided to fix the

upper limit of entertainment tax at 60 per cent uniformly across the country, giving the

states the freedom to fix their rates within this ceiling.

(The analysis of tax system in some major States is presented in the Appendix)

Government’s policies to promote exhibition sector

Both the central and state governments have taken various steps to encourage

investment in film exhibition theatres/multiplexes. But the concessions are

accompanied with conditions aimed to prevent concentration of multiplexes in select

regions and in some cases to promote regional cinema. For example, the Union

Budget (2002–03) announced an exemption of 50 per cent profits from tax under Sec

801B of the Income Tax Act for large convention centres and multiplex theatres in non-

metros for the next five years. This will provide incentives for developers to invest

outside the large metro cities.

Various States, such as Gujarat, Maharashtra and Andhra Pradesh, provide

entertainment tax exemptions to facilitate theatre construction. The Gujarat government

also provides a seven-year tax holiday for construction of multiplexes.

National Film Development Corporation (NFDC) has a scheme for giving commercial

loans up to US$ 0.07 million for theatre construction. Of late, NFDC is suffering from

26

financial constraints and it is becoming extremely difficult for this organisation to

finance film production and theatre construction. In fact, in the past 3–4 years, NFDC

has not disbursed any loans for theatre construction.

Globalization: Challenges and Opportunities

a) Impacts of multiplex boom

Multiplexes have introduced new marketing and exhibition possibilities in front of Indian

film industry. Multiple screens in multiplexes have created new spaces for low budget

and art films. Before, those films can’t be screened in major theatres because they

usually do not pull as much viewers to the theatre. Big theatres can’t function if the

viewer attendance is mediate or low. But screens with lesser seats are very suitable for

low budgets films. It will promote production of art cinema in near future.

But multiplexes are alienating lower class from theatres. Due to the heavy ticket charge

majority of population can’t approach multiplexes. Their dependence on television and

cable network is increasing drastically. So the democratic space created by traditional

theatres is vanishing gradually from cities. In Indian context it will create negative

impact in a long run.

b) Digital Cinema- new possibilities

India is on the verge of becoming the largest digital theatre country in the world - a

revolutionary opportunity waiting to be tapped by potential investors. For a country as

large as India, film distribution and exhibition is a completely different ball game. Today

around 12,000 theatres in the country are being serviced by around 300 celluloid prints

released for a mainstream commercial film. As these prints are insufficient, they are

first released in ‘A’ class cities and thereafter re-circulated to the ‘B’ and ‘C’ class cities

in the country. After having run for a couple of weeks in ‘A’ class cities, the quality of

such prints deteriorates considerably. This impacts the occupancy rates in the already

run-down theatres and also the ticket prices. Further, during the period when the new

releases are running in the ‘A’ class cities, pirated copies from these celluloid prints are

developed to cater to such audiences in the ‘B’ and ‘C’ class cities. But all this is now

set to change. Theatres across the country are now going digital thanks to the

pioneering initiatives by companies such as Mukta Adlabs and few others. Such

27

companies are now taking control over these run-down theatres in ‘B’ and ‘C’ class

cities and up-grading them to a digital theatre. The costs of upgrading to a digital

theatre costs is estimated at about US$ 22 thousand per theatre, which requires the

installation of a digital projector and server to run the digital prints. As a result of such

digitalisation, such theatres are able to obtain prints at the same time that the film is

released. This coupled with superior quality is resulting in higher occupancy rates and

higher ticket prices. As most companies are working on a revenue-share basis, the

break-even time for such projects is estimated to be less than two years.

Theatre-owners too have no reasons for complaints. Companies installing the digital

projection companies often take up the burden of capital expenditure in return for a

share in the box office collections. As a result of the digital projection system, the

quality of the films being screened has shot up significantly impacting the occupancy

rates, which have been reported to increase to almost 50 per cent in some of these

large-seating single screen theatres. Since the films are screened at the same time the

films is released nation-wide, theatre owners now have the wherewithal to charge

higher ticket prices as well. Film processing companies are also gearing up to cater to

this potential demand of churning out digital prints. The cost of producing a digital film

is estimated to be a fourth of the cost of a celluloid print- hence the film producer too is

excited as now he is able to generate a much larger number of prints than earlier. This

not only helps in a larger release of his film but more significantly able to curb the

menace of piracy which was depleting his box office collections by almost 90 per cent.

If one were to aggregate the number of theatres that are planned for the digital

conversion, this would aggregate to about 10 per cent of the theatres in the country

today. Hence, the balance 90 per cent of the theatres is waiting to be digitalized!

Digital revolution can also provide alternative display spaces for digital films that bear

potential as a distinct genre. Redefining film form and content, digital films could

prompt and occupy viewing spaces as differing from conventional films. It will also

promote ‘walk through’ films that require simultaneous projection on more than one

screen, not necessarily of conventional theatre size.

Appendix

28

29

30

(Source - FCCI Report 2006)

(Source - FCCI Report 2006)

31