DIC Asset Annual Report 2009 - DIC Asset AG · · PDF filehelped ensure that we were...

Transcript of DIC Asset Annual Report 2009 - DIC Asset AG · · PDF filehelped ensure that we were...

A N N U A L R E P O R T 2 0 0 9

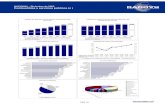

DIC Asset AG at a glance

Key operating figures in EUR million 2009 2008 H2 2009 H1 2009Gross rental income 133.6 134.5 -1% 66.3 67.3 -1%

Net rental income 123.8 126.2 -2% 61.1 62.7 -3%

Proceeds from the sale of real estate 15.2 49.9 -70% 8.3 6.9 +20%

Total revenues 171.3 207.1 -17% 86.0 85.3 +1%

Funds from operations (FFO) 47.6 42.7 +11% 25.9 21.7 +19%

EBITDA 110.8 125.0 -11% 54.7 56.1 -2%

EBIT 80.3 97.0 -17% 39.2 41.1 -5%

EBDA 46.6 53.2 -12% 25.5 21.1 +21%

Profit for the period 16.1 25.2 -36% 10.0 6.1 +64%

Investment 45.2 267.3 -83% 11.7 33.5 -65%

Cash flow from operating activities 38.7 37.2 +4% 19.9 18.8 +6%

Balance sheet data in EUR million 31.12.2009 31.12.2008 31.12.2009 30.06.2009

Equity ratio in % 24.0 24.1 0% 24.0 23.8 +1%

Investment property 2,024.2 2,022.9 0% 2,024.2 2,040.8 -1%

Net asset value 497.1 492.8 +1% 497.1 N/A N/A

Debt 1,682.7 1,681.0 0% 1,682.7 1,694.6 -1%

Total assets 2,213.4 2,214.8 0% 2,213.4 2,223.2 0%

Per share in EUR million 2009 2008 H2 2009 H1 2009

FFO 1.54 1.37 +12% 0.83 0.71 +17%

EBDA 1.51 1.71 -12% 0.82 0.69 +19%

Basic/diluted earnings 0.52 0.80 -35% 0.32 0.20 +60%

Net asset value 15.86 16.23 -2% 15.86 N/A N/A

FFO and profit for the periodin Euro million

FFOProfit for the period

20082007 200920092007

722.2492.8 497.1

2008

Total revenuesin Euro million

OtherProceeds from salesRental income

2009

171.3

2007 2008

Market value of investment property and NAVin Euro million

Opportunistic InvestmentsValue added Core plusNet asset value

236.2207.1

2,192.22,187.5 2,161.844.6

36.142.7

25.2

47.6

16.1

� Overview

List of Subsidiaries and Joint Ventures 134

Announcements on Voting Rights Year 2009 136

Glossary 138

Quarterly Financial Data 2009 140

Multi-Year Overview 141

Portfolio 142

Contact 145

� To our Shareholders 2

� Solidity in Detail 5

� The Share 22

� Group Management Report 26

� Consolidated Financial Statements 70

Notes 76

Auditors’ Report 123

� Statement on Corporate Governance 124

� Report of the Supervisory Board 131

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

2 �

Prof. Dr. Gerhard Schmidt, Chairman of the Supervisory Board and Ulrich Höller, Chief Executive Officer

Letter to our Shareholders

Letter to our Shareholders � 3

Dear Shareholders and Business Partners,Employees and Friends of our Company,

Against the backdrop of the financial and economic crisis, we havefaced a difficult year. Nevertheless, we were able to achieve a goodresult for our shareholders, proving once again the solid nature of ourbusiness model:

� Our operating result from real estate management (FFO – fundsfrom operations) amounts to EUR 48 million. It even represents aslight increase on the previous year’s result and is significantly bet-ter than we expected at the beginning of the year.

� At the end of the year, profit thus stands at EUR 16 million – a goodstarting point from which to push on towards our ambitious goals.

� In terms of rental, we exceeded the previous year’s volume by 25%.This success is particularly impressive because we were able to bucka clear downward trend in the market.

� With the primary aim of longer-term lettings in mind, we have invested more heavily in the portfolio. We have also acquired a fur-ther 25.1% of the shares in our property management companyDIC ONSITE, thus bringing it wholly into the Group.

� We are enabling our shareholders to participate once again in thesuccess of our company and will propose to the general share-holders’ meeting that a dividend amounting to EUR 0.30 per sharebe paid.

The good result is down to several factors which are founded on thestrengths of our company:

� One advantage is a clear focus on in-house property management:we can react quickly to changes in the market. In 2009, we focusedon reletting – with great success. The good result of the previousyear was exceeded by some margin, which helped to increase ourcash flow.

� We exploited our financing structure in 2009 to save over EUR 8 million in interest expenses.

� We pressed on with our earnings-oriented sales strategy with itsfocus on small and medium-sized properties and successfullyplaced properties for around EUR 60 million.

This is good news both for our shareholders and our customers, whocan rely as ever on our professional quality of service. Above all, how-ever, they are facts which enable us to secure a better position in themarket than many of our competitors. The healthy figures are the result of a long-term business model with an “airbag” strategy. Stablerental income provides the airbag. Its stability comes from

� long-term tenancy agreements� a diverse tenant structure and � attractive and well-managed rental properties.

The level of rental income, which now stands at around EUR 133 mil-lion, forms the basis of an attractive return for our shareholders, particularly at a time in which business transactions are only to be expected in certain segments of the transaction market.

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

4 �4 � Letter to our Shareholders

The business model adopted by DIC Asset AG does not just ensure investors an attractive return, it also relieves the burden of decision-making from the Board of Directors with regard to forced sales, whichare not uncommon in the market at present. Put simply: we can affordto hold on to the company’s assets and thus those of its shareholdersand not to sell them unnecessarily in what is currently a volatile market.

A prudent financing policy also forms part of the airbag strategy. It hashelped ensure that we were able to navigate the past few turbulentmonths safely and emerge unscathed. The strategy we have imple-mented for many years, that of agreeing our financing on a long-termand stable basis and with a healthy degree of flexibility, has enabledus to make corporate decisions calmly and with room to manoeuvre.

We are convinced that we have achieved the best possible result forour shareholders over the past year under the most difficult circum-stances for decades. Our goal for 2010 is to repeat this. This bringswith it further major challenges, because we will not see the eagerlyawaited start of a prolonged upturn in 2010, but rather in 2011. Withrespect to the strategy pursued by DIC Asset AG in this regard, threepoints are critical:

1. We focus our efforts on letting our real estate portfolio in order tocontinue to generate a basic return that is as high as possible.

2. We observe and analyse market trends with great precision, en-abling us to secure a strong position for entering the transactionmarket once again with expedient sales and, possibly, opportuni-ties to make purchases, which are becoming more attractive onceagain.

3. Furthermore, we are using the strengths of DIC Asset AG to provideit with further support: we are continuing to develop our successstrategy with the future expansion of the Funds business segment.This will increase our solidity and stability even further by makingthe most of the opportunities for growth while also giving usgreater room for manoeuvre to exploit future market trends.

We are happy to adapt a well-known formula into “never change asuccessful strategy”, which has generated profitable results both for usand for you, including in the more recent past. In this, we are buildingon the commitment and outstanding strengths of our teams of employees, whom we would like to thank for their efforts and theirgreat motivation to perform. We would be delighted if you were tocontinue to offer your loyal support to DIC Asset AG out of your conviction, and for your profit.

Yours sincerely,

Prof. Dr. Gerhard Schmidt Ulrich HöllerChairman of the Supervisory Board Chief Executive Officer

DIC Asset has strong business structures which can

withstand tough challenges.

With solidity, stability and consistency in detail,

it achieves profitable results year after year.

� 5

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

Local expertise, wide-ranging networks and

a clearly targeted portfolio structure:

solid foundations for strong, durable assets.

Market values determined by independent experts confirmthe soundness of the portfolio in tough market conditions.

Market value of investment property EUR million

Co-Investments (269,7)Value added (930,1)Core plus (992,4)

6 �

2006 2007 2008

1,275.3

2,187.5 2,161.8

2009

2,192.2

A high level of stability

With solid business structures built on long-lasting resilience, DIC Asset managed tocombat a considerable downward trend in the market in 2009.

23.9

28.7

37.2

2006 2007 2008

Cash flow from operating activitiesEUR million

The cash flow from ongoing business operations proves highly stable in a difficultmarket environment.

2009

38.7

� 7

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

The balanced business model makes use

of synergies and diversifies risks.

8 �

Berlin

Mannheim

Munich

Frankfurt a. M.

Düsseldorf

Hamburg

Bavaria 8%Southwest 19%

Rhine Main area 24%

West region 11%

Rhineland 16%

Hamburg area/North 13%

Berlin/East 9%

Regional distribution of propertiesby lettable area in sqm

� Branches� Region with excellent economic performance� Region with good economic performance

The tenant structure in the DIC Asset portfolio is made up of some 1,600 tenants in various industries and the public sector.

The three portfolio segments "Core plus", "Value added" and "Co-Investments" represent different areas of earning potential managed by the business in a targeted manner. In the future, in addition to opportunistic transactions, the Co-Investments will include special funds: an additional business segment in which DIC Asset can display its provenstrengths.

Balanced business, diversified tenant structure

Main tenantsby rents paid

Public sector22%

Retail 20%

Telco/IT/Multimedia 12%

Others 28%

Industry 8%

Insurance/Banking 10%

� 9

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

With intensive property management, the

wholly owned subsidiary DIC ONSITE has

achieved successful lettings in spite of the

market trend.

Letting volumeLettable area in sqm

80.0

124.3

196.3

245.5

2006

�� New lettings

�� Renewals

2007 2008 2009

10 �

DIC Asset's property management service has also dealt with difficult tasks this yearwith great success. Between January and December 2009, letting volume rose to over 245,500 sqm –therefore the level of rental income remained stable and reliable.

Attractive earnings in a turbulent environment

Quarterly rental income EUR million

� 11

33.2 34.1 33.5 32.8

2009

Q1 Q2 Q3 Q4

33.8 33.9 33.3 33.5

2008

Q1 Q2 Q3 Q4

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

The regionally structured property manage-

ment service, in the form of six branches

in the main investment areas, allows for a

concentration of skills and expertise: "close

to the property and close to the tenants".

A strong, satisfied tenant base ensures a

sustainable rental income.

12 �

Strong tenant relationships

46,400

90,500

2007 2008

RenewalsArea in sqm

2009

136,700

� 13

Tenant satisfaction – indicated by lease renewals – is evidence of a good-quality portfolio.The volume of lease renewals increased by more than 50%, while the average rental priceremained stable.

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

The traditional Bienenkorbhaus property has

gained top-quality rental spaces and stable

anchor tenants following its renovation and

redevelopment.

14 �

In Spring 2009, the official reopening of the historic Bienenkorbhaus on Frankfurt’s Zeil was celebrated. The high-rise building was completely refurbished internally and extended with a new building featuring a modern glass façade.

This revitalisation in a prime retail location increased rental space by 15% and rental volumeby around 30%. Long-term rental contracts have been agreed with each of the anchor tenants, the shoe retailer Görtz and the Frankfurter Sparkasse, with a duration of 15 years.

The ambitious and complex redevelopment was honoured with the "immobilienmanager.AWARD 2010" for best project development in February 2010.

Professional redevelopment raises potential

� 15

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

With projects such as the new "MainTor"

quarter in Frankfurt, DIC is demonstrating its

profile with a combination of ideas, capital

resources and strength of implementation.

16 �

DIC Asset participates in high-quality projects in terms of urban development. For the MainTor, a new quarter in the centre of Frankfurt, DIC held a competition involving internationally renowned architects in order to produce the best possibledesigns for the distinctive "MainTor WinX" and "MainTor Panorama" towers.

Creative and integrated urban development

� 17

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

A clear, stable financial position provides

a strong backbone: all sub-portfolios are

financed individually, 85% of the financing

is fixed for the long term.

18 �

DIC Asset's strong financing model is organised on a conservative and sustainablebasis.

Of a total of over one and a half million euros of financial liabilities, only around53 million is to be refinanced in the next twelve months. The average interest ratewas reduced by 37 basis points in 2009 and therefore the financing costs could be reduced by 10% overall.

Refinancing requirements set for the long term

Financial debt fixed on a long-term basis

Financial debt cumulated

Financial debt by maturities

� 19

<1 y 1-2 y 2-3 y 3-4 y 4-5 y >5 y

31%

3%

9%12%

22%

100%

50%

0%

23%

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

High operational capacity, profitability

even during the economic crisis and timely

preparations for changing market situations

are among the fundamental strengths of

the company.

FFO – Funds from Operations*EUR million

20 �

*Operation income from property management, before depreciation, tax andprofits from sales and development projects

20082006 2007 2009

21.8

44.6 42.7

47.6

DIC Asset has started preparations for expanding its business model to meet the requirements of real estate special funds. Essential elements of the funding structureinclude a significant investment by DIC Asset, which will also apply its established asset and property management expertise to the management of funds.

The funds business segment will open up new groups of new investors as well as addi-tional sources of income – income from investments and ongoing management fees.

New market opportunities at a glance

Sources of income 2009EUR million

� 21

Rental income

Income from investments

Proceedsfrom sales

Management income

3.3

7.5

15.2

133.6

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

The Share

Financial crisis depresses prices at the beginning of theyearIn the first two months of 2009, global financial markets werestill in a state of shock following the Lehman bankruptcy.Several major banks and the world’s largest insurance com-pany AIG were rescued through concerted action. Consis-tent cuts in key interest rates and general guarantees keptthe financial system working but the interbank market re-mained severely blocked and share markets remained in freefall. Once again, the DAX fell by over 20% within two months.

Confidence returned in spring At the end of February 2009, market players’ confidence re-turned thanks to the various support measures; pricesstarted to rally and continued to do so until the year-end.The recovery on financial markets was helped by the indus-trialised countries which, through various programmes tostimulate the economy, created steady, artificial demand,which led to a slight economic upturn.

From an annual viewpoint, DIC Asset outperformed theindicesOur share performed in line with general market trends, although it was subject to increased fluctuation. In line withthe downward trend in the market at the beginning of theyear, the DIC asset share also fell to its 52-week low of EUR 2.65on 24 February 2009. With the subsequent recovery, the priceof our share tripled to a 52-week high on 7 October 2009 ofEUR 9.60. Our share ended 2009 +31% up, at EUR 8.15, andconsequently outperformed both the DAX and the SDAX. TheEPRA NAREIT Europe index, which reflects the performance ofthe largest European real estate companies, rose by +28%.

22 � The Share

2004 2005 2006 2007

0.35

0.560.75

1.65

2008

0.30

2009

0.30

Dividend per share Euro million

DIC Asset AG involves its shareholders inthe Group’s success by paying attractive,appropriate dividends. In setting thedividend, we are guided by the operat-ing profit, the Company’s current condi-tion and expected market trends.

For 2009, the Board of Directors is proposing a dividend of EUR 0.30 pershare.

Share buy-back programme completedWe completed the share buy-back programme, which wasstarted in 2008, in February 2009 with the acquisition of4.7% of the capital stock. In total, some 1.5 million treasuryshares were acquired worth EUR 7.2 million in total, at anaverage price of EUR 4.91 per share.

Shareholder structure expanded by a long-term investorIn May 2009, we were able to acquire a new long-term focused investor in the form of solvia Vermögensverwal-tung. solvia Vermögensverwaltung is a highly regardedprivate asset management company with which we havealready worked successfully on other transactions. The in-vestment confirms our strategy and illustrates the appealof DIC Asset AG. solvia acquired the shares at a price ofEUR 6.50 per share and has ranked since then as one ofour largest shareholders with a total of 5.1%.

The Share � 23

100%

120%

140%

160%

60%

80%

40%

100%

120%

140%

160%

60%

80%

40%FebJan 09 Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan 10 Feb Mar

DIC Asset AGSDAXEPRA Developed Europe-Index

Diverse IR activitiesWe talk to our shareholders, investors and analysts on aregular basis about news within DIC Asset AG, discuss thelatest figures and respond to any queries. We consider atimely, relevant and reliable information policy to be ofgreat importance to ensure that potential investors canassess our company and the value of our share realistically.This is why the Investor Relations team reports directly tothe Board of Directors.

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

We started 2009 with an event for analysts, at which wewere able to discuss the situation on the real estate mar-ket and the prospects for the coming year with experi-enced market players. We explained the figures for the financial year and quarterly figures in detail and answeredquestions in a total of four telephone conferences. TheBoard of Directors and the Investor Relations team alsoparticipated in twelve events for the industry and analystsin Germany and Europe. Six roadshows took us to London,New York, Paris, Zürich and Vienna.

In 2009, we once again spoke to more than 200 share-holders, investors and analysts to explain the strengths ofour business model and the advantages of our share.

Positive assessments 15 institutions cover our share and produce analyses ofour company at regular intervals. Despite the difficult cap-ital market environment, the number of analysts report-ing on our company remained at a high level. With ten buyrecommendations, two thirds of analysts view our com-pany as being well positioned with better than averageprospects for the future at the beginning of March 2010.Three analysts advise holding the share and only two rec-ommend selling it.

Shareholder structureas at March 2010

Reporting on DIC Asset AGas at March 2010

sell hold buy

�Free float

� Deutsche ImmobilienChancen Group

� MSREF

� solvia Vermögens -verwaltung

10.4%

5.1%

45.1% 39.4%

24 � The Share

Dividend on previous year's levelOur long-term dividend policy is based on DIC Asset AG’soperating profit. The company’s current condition and anticipated market trends are included in the assessment.The Board of Directors will maintain its continuous divi-dend policy for the 2009 financial year and propose pay-ment of a dividend of EUR 0.30 per share to the GeneralShareholders’ Meeting. With an attractive dividend yieldof around 4% in relation to the closing price at the year-end of EUR 8.15, we would like to boost our shareholders’confidence still further and allow them an appropriateshare of the profit for the financial year.

Financial calendar

09.03.2010 Publication ofAnnual Report 2009

March/April 2010 Roadshows regarding Annual Results 2009

10.05.2010 Publication of Interim Report Q1/2010

18.05.2010 German Jour fixe Bank of America/Merill Lynch, London

26./27.05.2010 Kempen European Property Seminar 2010, Amsterdam

10.06.2010 Morgan Stanley European Property Conference 2010, London

05.07.2010 General Shareholders’ Meeting 2009 Frankfurt

17.08.2010 Publication of Interim Report Q2/2010

02./03.09.2010 EPRA Annual Conference 2010, Amsterdam

19.10.2010 Initiative Immobilien-Aktie 2010, Frankfurt

09.11.2010 Publication of Interim Report Q3/2010

10

32

Basic data on the share

Number of shares 31,349,999

Share capital in EUR 31,349,999

WKN / ISIN 509840 / DE0005098404

Ticker symbol DAZ

Free float 45.1%

Key indices EPRA, SDAX, DIMAX

Market segment Regulated market; Prime Standard (FWB); XETRA

OTC market; on all German exchanges

Key figures in Euro (1) 2009 2008

Earnings per share EUR 0.52 0.80

Net asset value per share EUR 15.86 16.23

FFO per share EUR 1.54 1.37

Price/Earnings ratio (2) EUR 15.67 7.78

Dividend per share EUR 0.30 0.30

Dividend yield (2) % 3.7% 4.8%

52-week-high EUR 9.60 22.68

52-week-low EUR 2.65 3.89

Annual closing price EUR 8.15 6.22

Average number of shares Thsd. 30,872 31,193

Market capitalisation EUR million 255 195

Price at the end of February 2010 EUR 8.18

(1) In each case closing prices in Xetra trading (2) In relation to annual closing price in Xetra trading

The Share � 25

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

26 � Management Report

Highlights of the financial year

Management Report

Company and Environment 27Strategy and Management 30General Economic Conditions 33Business Development 35Financial Information 45Risk Report 52Other Information 58Opportunities and Forecast 65

In 2009, DIC Asset AG continued its steady course andachieved a respectable result with a profit for the period ofEUR 16.1 million. In turbulent times we succeeded in creating a resilient basis for a good result through stablerental income. Thanks to our in-house property manage-ment, which was focussed particularly on reletting in 2009,we bucked the market trend in increasing our letting vol-ume. We have generated an FFO (Funds from Operations)of EUR 47.6 million from our operations – far more thanwe had set as our target for this year on the basis of a con-servative forecast. As at the previous year-end, the marketvalue of real estate assets (including our investments inopportunistic co-investments) amounted to EUR 2.2 billion. The net asset value per share remained virtuallyconstant at EUR 15.86. We shall involve our shareholders inthe result for 2009 through the payment of a dividend ofEUR 0.30.

� Profit for the period of EUR 16.1 million

� Funds from operations: annual target exceeded

� Dividend of EUR 0.30 per share

property management services available for the manage-ment and optimisation of the properties as well as its ex-pertise in structuring and managing portfolios. The Fundsbusiness segment will expand the real estate spectrum inthe segment of core products with a low risk profile, onwhich less focus has hitherto been placed. At the sametime, the business segment will open up new groups ofinvestors as well as additional sources of income – incomefrom the investments and ongoing management fees.

� Properties purchased for the portfolio or for their optimisation

We acquire first-class, high-yield properties with longleases to be held long-term in our Core plus portfolio. Wealso invest in properties for our Value added portfolio,whose value we increase through short or medium-termmeasures.

Operations and business processes

� Development of a new business segment: Funds We have now started preparations for an expansion in ourbusiness model, namely the launch of real estate specialfunds, and are working on the fund structure with a well-known partner. Attractive properties from our portfoliowill be selected for the first fund and structured in an innovative manner to produce a suitable sub-portfolio. Weaim to expand our portfolio of high-yield, low risk Coreproperties in this business segment and acquire suchproperties for funds via the market in future.

DIC Asset will remain significantly involved in the funds,with a holding of at least 20%, thus retaining a long-termalignment of interest with other fund investors. Further-more, it shall make its established and successful asset and

DIC Asset AG: commercial real estate specialist in GermanyDIC Asset AG is a real estate company that has specialisedin German commercial real estate. It invests in real estate,manages and optimises its portfolio and its investmentsthrough its own property and asset management teamand sells properties once it has added value to them. Itsportfolio, which encompasses 318 properties, is concen-trated on office property. The market value of its real estate assets amounts to some EUR 2.2 billion in total,which makes DIC Asset AG one of the largest listed real estate companies in Germany.

Operations

Company and Environment � 27

COMPANY AND ENVIRONMENT

Company structure

Portfolio Co-Investments

Strategy and managementi.a. group development, strategic assetand portfolio management, acquisitionsand sales

Portfolio and investmentsInflow of rental income, sales proceeds profit from investments, managementfee income

Real estate managementRealistaion of value creation strategy asset and property management,tenants’ services , letting

Core plus Value added Opportunistic Investments Funds

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

To conclude tenancy agreements, we have to hold ourown in competition with providers offering similar qual-ity properties in similar positions at similar prices. Here,the key competitive advantage is the effective asset andproperty management service provided by DIC ONSITE.Our in-house property management service gives us theedge in terms of customer loyalty, speed and proximity tothe market through our on-site presence and the fact thatour properties are managed directly. Our strategy broughtus significant advantages in 2009.

We optimise the portfolio by selling properties oncewe have added value. Here, we are pitted against marketplayers offering properties in comparable income and riskcategories, of comparable quality and offering a compa-rable return. Demand for large-scale properties was verysubdued in 2009 and the sale processes were frequentlyprotracted particularly because of the financing issues involved, which put prices under pressure. We have there-fore concentrated on smaller, more marketable properties.Thanks to our intensive knowledge of the market and theexcellent networking skills of our sales team, we were ableto agree the sale of 19 properties in 17 transactions in2009.

In the domain of Opportunistic Investments, minorityholdings in complementary real estate segments are acquired. Long-term-oriented core properties are to be acquired in the future Funds segment.

� Tenant-focused property management Our property management company DIC ONSITE has almost 90 employees operating from six offices located inareas where our portfolio is concentrated. With the helpof our property and asset management services for ourproperties and investments, we support our tenants directly and ensure high levels of satisfaction and cus-tomer loyalty. As a result, we secure and increase our rentalincome and generate regular revenues from propertymanagement.

� Value-oriented portfolio optimisation In addition to tenant-satisfaction, we pursue a policy ofsteadily optimising our properties through long-term lets,repositioning or modernisation. In the case of more extensive development services, we make use of the expertise within the DIC Group. We also optimise cashflow, based on long-term business plans and correspon-ding financing structures.

� Selective sales to optimise our portfolioAs an active asset manager, we realise gains and sell properties when attractive opportunities arise. The mainpriority here is to optimise the portfolio to maximise earn-ings in the long-term.

� Fund managementFor the new Funds business segment, we identify suitableinvestment properties in accordance with the respectiveinvestment criteria (particularly core properties) andarrange the purchase of properties. In addition to opera-tional property management, we look after our investorsand provide them with information on the current statusof their investments through prompt and transparent reporting.

LocationsWe maintain regional branches in the areas where ourproperty portfolio is concentrated, to offer efficient anddynamic on-site management of our tenants and proper-ties. The majority of our employees are involved in prop-erty management in Frankfurt am Main, Mannheim,Berlin, Hamburg, Düsseldorf and Munich. The Board of Directors and the head office of DIC Asset AG are locatedin Frankfurt am Main, from where the Group is managedand strategic, management and administrative tasks arecarried out.

Competitive position and sales market When acquiring properties, we compete with national andinternational companies. In the past financial year, thesupply of attractive properties fell and, at the same time,there was a marked decrease in activity among interna-tional investors, in particular. When investing, the regionalmarket knowledge available in our branches gives us aclear edge, particularly over our international competitors.

28 � Company and Environment

Management and Supervision

Board of DirectorsThe Board of Directors of DIC Asset AG manages the com-pany's business. It establishes corporate strategy, runs thecompany, carries out corporate planning and installs effective and adequate risk management systems. TheBoard of Directors consists of three members. Each mem-ber of the Board of Directors is responsible for an areawithin the company laid down in the rules of procedure.

Supervisory BoardThe Board of Directors works closely with the SupervisoryBoard when making important decisions and keeps it in-formed regularly and when required of all business developments and strategic issues. The Supervisory Boardis the statutory control and supervisory body, and, as such,advises the Board of Directors in the decision-makingprocess, supervises its operations and decisions, includingthrough the Audit Committee and has approval rights inspecific situations. The Supervisory Board of DIC Asset AGconsists of six members. During 2009, it held five jointmeetings with the Board of Directors, plus four telephonemeetings.

Statement on corporate governance and additionaldisclosuresThe Statement on Corporate Governance was publishedon the DIC Asset AG website and can be accessed thereat any time. The statement is also a component of the section with the same name "Statement on CorporateGovernance”, where further information on DIC Asset AG’scorporate governance is also to be found. The remunera-tion report containing individual information on the com-pensation of the Board of Directors and Supervisory Boardis also given there.

The control system and processes are explained in detail inthe Risk Report and, in particular, in the comments on theinternal control system.

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

30 � Strategy and Management

Group strategy: a focussed business modelSTRATEGY AND MANAGEMENT

Property management: Adding value through our own effortsDIC Asset AG exploits the potential of properties and investments through its in-house property and asset man-agement team via DIC ONSITE. We make profits along theentire value added chain and manage the deployment ofour resources directly. Through our branches, we have apresence in the areas where our investment is concen-trated, which ensures that we are close to tenants. In thisway we develop regional expertise, learn about opportu-nities directly and are able to counter any undesirable de-velopments in the locality speedily. In 2009, we confirmedthis strategic focus on property management by takingover the remaining shares in DIC ONSITE and integratingit completely within the Group.

segments. As a result, the investment strategy covers thevarious investment computations of the cyclical real estatesector comprehensively.

Stable portfolio architecture We ensure a balance of various properties in the port folio,which allows both attractive opportunities and avoids riskbeing concentrated. Our in-house property managementand regional expertise allows us to diversify our invest-ments across a wide range of locations – including attrac-tive secondary locations. In addition to regional diversifi-cation, our policy of letting to different groups of tenantsfrom independent sectors is another key factor in the re-silience of our real estate portfolio.

� Direct and indirect investment in categories offering attractive returns

� Development of a high-yield, robust portfolio � Value is added from the company’s own

resources� New Funds business segment will build on tried

and tested strengths

DIC Asset AG specialises in commercial real estate, partic-ularly office property in Germany. We look after our ten-ants and increase the value of our properties through ourin-house property management service. Our investmentstrategy aims to develop a quality-oriented, high-yield anddiversified portfolio in different income and risk classes.Through our proximity to our tenants and regional mar-kets, we acquire a key edge in terms of location and expertise, most notably compared with international com-petitors. The Group’s strategic focus provided itself againin 2009: we were able to win over an additional strategicmajor investor with our business model and haveachieved great success in property management, whichwill be durable in its effects, with a substantial increase inletting volume.

Earnings-oriented investment strategyWe invest in three segments, which offer attractive yields,using specific income and risk categories. Properties gen-erating substantial cash flow in the Core plus segment aredestined to be held long-term, the Value added segmentencompasses more management-intensive propertieswith short- to medium-term optimisation potential andthe Opportunistic Investments segment contains invest-ments with minority shares in complementary real estate

Core plus Value addedOpportunisticInvestments

� Opportunistic investments andproject developments of the DIC Group with investments from co-investors

� High potential for value creation

� Long-term rentals, first class proper-ties with the potential for value creation

� Long-term investment horizon anddiversification

approx. 992 EUR million

45%

approx. 930 Mio. Euro

43%

approx 270 EUR million

12%

Segments overview and portfolio strategy

Direct portfolio Co-Investments

� Properties with value creation potential that can be realised in theshort and medium term

� Properties with a greater risk/rewardprofile

Strategy and Management � 31

Long-term oriented financial managementExisting finance is always agreed long-term and focusedon the respective property objectives. Our high-yieldproperties, which generate easily calculable, steady cashflow, offer a reliable basis for the investment of moderateto large amounts of external capital. We agree attractiveterms for these borrowings and hedge them adequatelyagainst any increase in interest rates. In addition to creditlines, we use current profits from letting and disposal gainsto finance longer-term focused measures to add value.

Expertise and networkingDIC Asset AG’s success is based on using skilled employeeswidely. Our intensive networking in the regional and national real estate industry and with investors helps usto secure advantages for ourselves in letting and placingour properties. To do this we employ staff with leadershipqualities and highly qualified specialists, and provide ouremployees with training appropriate to their skills.

Sales: Realising value and optimising the portfolioWe sell properties at appropriate times for realising addedvalue and optimising the portfolio with regard to its regional focus and types of use. We invest the funds thatare released in new properties or use them to optimise thecompany’s financing.

Redevelopment in prime location: the Bienenkorbhaus on Frankfurt’s Zeil, winner of the immobilienmanager.AWARD 2010

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

increase in value from letting properties (including thechange in vacancies and increase in rental income) andfunds from operations after deducting taxes related tocapital employed (return on equity, ROE) are of central im-portance. In the case of properties in the Co-Investmentssegment, in which we hold minority shares, in principle,the internal rate of return (IRR) is also used as a key figure.Deviations are analysed promptly and managementmeasures established in regular meetings with the Boardof Directors and the respective manager.

InvestmentsDIC Asset AG has direct and indirect investments in 228companies. In most cases, these are property holdingcompanies, via which the Group’s operations are pre-sented. These property companies are combined andmanaged through holding companies. DIC Asset AG’s central investment is DIC ONSITE GmbH, which organisesthe management and optimisation of properties as thecompany’s own property and asset manager. The stake inDIC ONSITE was increased by 25% in 2009 and hasamounted to 100% since October 2009.

Company management

Internal planning and management system Our management system helps DIC Asset AG increase thevalue of the company in the interests of shareholders, em-ployees and business partners and aims to achieve prof-itable growth in sales. We manage our individual proper-ties and portfolios as independent companies and focusthem on the prospects for growth and the individual income situation. It is based on a planning and budgetingprocess that is built on detailed planning at individualproperty level (bottom-up planning) and is finalised viathe targets set (as top-down planning).

Integration of risks and opportunities The targets recorded are supplemented by findings fromrisk management and specific opportunities. This is firstlycarried out at property and portfolio level and then aggregated over the segments to group level. Planned developments and actual earnings are compared andmonitored continuously as a component of risk manage-ment.

Management using key figuresIn essence, DIC Asset AG is managed on the basis of ag-gregated earnings from the individual investments andportfolios. We use specific income-oriented key figures,which are checked against regular reports, to monitor theagreed targets. In this regard, the operating profit fromreal estate management (funds from operations, FFO), the

32 � Strategy and Management

2009 was a difficult year for DIC Asset AG, as it was for al-most every other company. The continuing financial crisisand the abrupt change in economic framework conditionsalso increased the challenges of our business. Activity onthe transaction market virtually ground to a halt, whilecompetition increased markedly on the letting market.Even though our business was not unaffected by this, wewere able to adhere to our sound, successful course.

ployed in 2009, which is only 0.2 million more than in theprevious year. The unemployment rate averaged 8.2%. Itincreased by 0.4 percentage points compared with theprevious year.

Special measures to stabilise the banksThe European Central Bank reacted to the instability in thebanking system by cutting interest rates in several stages,as did central banks throughout the world; the key inter-est rate in the euro zone has stood at a historically low1.0% since May 2009. This was supplemented by extraor-dinary measures such as the purchase of euro bonds andextending the term of refinancing transactions to 12months, which were all aimed solely at reflating and sta-bilising the interbank market.

Financing conditions are difficult despite low interestratesThe low level of interest rates had scarcely any impact onthe company’s investing activities. Lending fell in view ofthe sharp recession, however, many companies were alsofaced with a marked deterioration in financing conditions.

2009 dominated by a record recession Following six years of continuous growth, the Germaneconomy shrank sharply in 2009 with a fall in gross domestic product of 5.0%. Uncertainty as to the survival ofthe financial system after the financial crisis peaked in au-tumn 2008 slammed the brakes on global economic ac-tivity and this had a knock-on effect until the end of the2008/2009 winter. Exports, the most important driver inthe German economy, were hit particularly by a fall in pro-duction of some 17%. In the course of the year, economicgrowth recovered incrementally thanks to governmentsupport measures and the return of confidence in financialsystems throughout the world.

Domestic consumer expenditure, supported by measuresto stimulate the economy such as the car scrappagescheme, provided positive impetus: private consumer expenditure rose by 0.4%, while government expenditurerose by 2.7% compared with the previous year. The infla-tion rate only increased by 0.4% on average over the year.In both 2007 and 2008, the consumer price index rose byover 2.0%.

A stable employment market has cushioned the downturnThe government succeeded in supporting the employ-ment market in 2009 by financing short-time working.While the sharp drop in production had a significant im-pact on the employment market, the increase in unem-ployment remained very moderate. However, at times,around one million people were employed on a short-timebasis in 2009. On average, 3.4 million people were unem-

Macroeconomic trendsGENERAL ECONOMIC CONDITIONS

General Economic Conditions � 33

2005 2006 2007 2008

2009

Gross domestic product

Number of people employeed

4.0%

3.0%

2.0%

1.0%

0.0%

-1.0%

-2.0%

-3.0%

-4.0%

-5.0%

General conditions: gross domestic product and number of people employed (respective change in %)

Source Statistisches Bundesamt

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

Sector trends

A decline in the letting marketThe economic slump had a marked impact on the officeletting result in major office locations (including Berlin,Düsseldorf, Frankfurt, Hamburg, Munich and Stuttgart) in2009. Against the background of economic uncertaintyand lower production capacity, companies cancelled orpostponed planned moves and concentrated on the effi-cient use of existing space. Here, the comparatively stableemployment market proved to be a great support in pre-venting more drastic developments. According to analysisby leading estate agents, the reduction in space let inmajor office locations stood at between 26% and 28% atjust over two million sqm. Düsseldorf and Munich suffereddisproportionately, while Berlin and Stuttgart escapedmost lightly. We identified the same trend, albeit to a lessmarked degree, in medium-sized and smaller office loca-tions.

More competition, more incentives for tenancy agreementsIncreased demand for tenancy extensions, often forshorter terms, was particularly characteristic of lettingmarkets in 2009. New tenancies were rarer and thereforetook place against tougher competition involving greateruse of incentives. As a result, peak rents fell slightly in all lo-cations; estate agents estimate a reduction of around 5%.

Vacancy rates have increased – despite little newbuildingIn 2009, over a million square metres of completed spaceequipped to meet the demands of the 21st century cameon the market for the first time in the major office loca-tions. This equates to an increase of over 20% comparedwith the previous year but is well below the boom in new

construction between 2001 and 2003. Despite the lack ofspeculative project developments, in conjunction with thereduction in letting figures, this had a significant impacton vacancy rates. The vacancy rate in all major office loca-tions increased by 10% on average because of the nega-tive net absorption. Fewer new projects were started in2009, meaning that the number of completions will fallfollowing the end of the current financial year.

Investment market has overcome the state of shock A slight recovery found its way into the transaction marketfor commercial real estate in summer 2009. Transactionsworth over EUR 3 billion were completed in both the thirdand fourth quarters, while the figures for the first twoquarters were only EUR 1.8 and 1.9 billion respectively. Thevolume traded totalled around EUR 10.5 billion. This is asignificant reduction of around 50% compared with 2008.

A focus on smaller propertiesAt around EUR 16 million per property, the average trans-action size was smaller than in 2008. Some four billioneuros (equals 42% of the total volume) were invested inoffice property. This was followed by retail properties, atjust over EUR 2.9 billion (accounting for 30%). Mixed useproperties and warehouse and logistics space both accounted for less than 10%. The main players in 2009were investors from Germany; there has been a wide-spread reduction in interest from international investors.The sustained interest among private investors, who invested around EUR 1 billion in 2009, was remarkable.

Rising prices for core propertiesMany transactions collapsed because of the difficulty inarranging financing and because of the difference between the prices purchasers were prepared to pay andthe prices demanded by vendors. In 2009, demand forfully-let properties in first-rate locations with long tenan-cies and a low risk profile was particularly strong. Sincethere are few of these properties available, prices in thismarket have again increased slightly in recent months asactivity on the transaction market picked up slightly.Throughout the year, it was difficult to establish prices andconduct negotiations for opportunistic investment targets(in secondary locations, with shorter remaining terms,higher vacancy rates etc.).

For 2010 as a whole, we are expecting another difficultyear for the real estate sector. We describe our expecta-tions in more detail in the section “Opportunities and Forecast”.

34 � General Economic Conditions

Trend in rentals and transactions

Office lease take-up in sqm million *

Transaction volume EUR million

2008 2009 2008 2009

20

10

2.9

2.1

* A-office locations Berlin, Düsseldorf, Frankfurt,Hamburg, Munich und Stuttgart

Source Jones Lang LaSalle

Real estate management

� Letting volume increased by 25%� Leases expiring in 2010 already reduced by 34% � Ancillary leasing costs reduced

We let 245,500 sqm in a fiercely competitive market, whichhas significantly stabilised our income base and providedlong-term support for our profits. While the market as awhole shrank by some 30%, we succeeded in expandingour letting volume by some 25%. In view of the markedincrease in competition, we concentrated very success-fully on extending existing tenancies. At the same time,we slightly increased new tenancies at a high level. Oursuccess in the reporting year has affirmed our strategicfocus, namely managing property in-house.

More space let In 2009, our intensive letting activity helped us to succeedin bucking the falling market trend: in the portfolio as awhole, at 245,000 sqm, we let over 49,000 sqm (+25%)more than in the previous year. Given the increase in com-petition for tenants, our focused, local activity involvingcreative, tailor-made letting solutions became even moreimportant. Our new tenancies, at 108,800 sqm, were +3%up on the previous year’s good result, while we increasedlease renewals, based on the satisfaction of our tenants,by +51% to 136,700 sqm. The average term remaining onour tenancy agreements increased by 0.2 years to 5.6years. The rental per square metre decreased slightly byEUR 0.12 to EUR 10.38 per sqm.

The good letting result kept rental income virtually on theprevious year’s basis. The letting volume represents rentalincome of some EUR 24.8 million per year. We reduced thepotential pro rata volume of tenancies expiring in 2010from the original figure of EUR 15.7 million by EUR 5.4 mil-lion or 34% in the past financial year.

Business Development � 35

BUSINESS DEVELOPMENT

Occupancy rate gradually stabilised during the yearIn 2009, we were able to keep the occupancy rate virtuallystable at around 87% (previous year: around 88%). Whenfigures during the year are examined, the continuous im-provement becomes apparent: from January to the middleof the year, the rate rose from 86% to 88%. In August, it fellback temporarily as a result of tenancies ending on a fixedor planned basis to 86%. Through intensive activity, we in-creased the occupancy rate to 87% by the year end.

* excluding revolving agreements

Potential lease expiryRental income in % *

40

50

30

20

10

1 year 2 years 3 years 4 years ≥5 years

8% 12% 13%

9.6%

57.4%

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

36 � Business Development

AN ATTRACTIVE ANCHOR TENANT� Surge in quality in the retail mix� Long-term, large-scale tenancies

The Stadtbadgalerie in the centre of Bochum combines retail andoffice space. The anchor tenant was Karstadt, which operated a discount store.

We terminated the tenancy agreement – before the company’s insolvency – and repositioned the building. Our new anchor ten-ant, Modepark Röther, has increased the appeal of the property toother new tenants with its branch range and quality. The tenancyagreement covers 6,500 sqm and runs for ten years.

Stadtbadgalerie Bochum (Düsseldorf Branch – West Region)

OPTIMISED FOR EDUCATIONAL USE� Focused letting� Occupancy ratio increased significantly

The 5,300 sqm large office building in Berlin had ahigh vacancy rate when we took it over. We fo-cused the building on educational use – in linewith its immediate surroundings, which include aschool and a kindergarten – and carried out reno-vations. In September 2009, we acquired our newanchor tenant in the form of an ecclesiastical edu-cational establishment, which wants to establish aprimary school on an area of 2,000 sqm. We alsolet 400 sqm to a company specialising in adult ed-ucation. Overall, the new agreements increase theoccupancy rate significantly, to around two thirds.

Berlin, Bundesallee (Berlin Branch – Berlin/East Region)

20092008

Letting volume +25%Lettable area in sqm

245,500

196,300

Letting volume

in sqm on signature 2009 2008

Office 145,300 114,600

Retail 32,700 17,700

Other commercial 60,200 59,500

Residential 7,300 4,500

Total 245,500 196,300

Parking (units) 1,990 1,070

In 2009, we were able to conclude several larger individuallets, meaning that a volume of more than 60,000 sqm wasachieved from the ten largest lets. We extended a long-term tenancy covering over 9,900 sqm with the insurancegroup AXA in Wiesbaden. We let office space of 9,100 sqmin a property in Mannheim to the Federal State of Baden-Württemberg. Our sole tenant Nokia Siemens Networksextended its tenancy agreement for 8,800 sqm in the Science Park in Ulm. In Hamburg, DELACAMP AG, a spe-cialist supplier of office printing materials, and Antalis,a major European paper wholesaler, rented a total of14,100 sqm.

The five largest leasing deals in 2009

Tenant’s name Area in sqm Location

AXA 9,900 Wiesbaden

Vermögen und Bau BW 9,100 Mannheim

Nokia Siemens Networks 8,800 Ulm

DELACAMP AG 7,300 Hamburg

Antalis GmbH 6,800 Hamburg

Total 41,900

Business Development � 37

ATTRACTIVE LETTING TERMS WITH NO DISCOUNTS� Long-term tenancies with no incentives� Rental income increased by 34%

We acquired the multi-storey office building inMannheim, which had a vacancy rate of 40%, in2007. We invested some EUR 0.4 million in mod-ernising the space with the aim of winning overnew tenants with fixtures and fittings that meetthe demands of the 21st century. In 2009, ourbranch succeeded in letting just over 2,100 sqm,on a 5-year tenancy to the University of Mannheimand a 15-year tenancy to the City of Mannheim, di-rectly and without the use of brokers or incentives,by a targeted approach to potential tenants. Thesetenancies increased the occupancy rate in theproperty to 75% at present and boosted rental income by some 34%.

Kaiserring, Mannheim (Mannheim Branch – Southwest Region)

Josef-Haubrich-Hof, Cologne (Düsseldorf Branch – Rhineland Region)

BETTER LET UNDER OUR OWN AUSPICES� Letting to individual tenants� Rental increased by 10%

We decided not to extend a general tenancyagreement at the Josef-Haubrich-Hof building inCologne, which was predominantly used as a doc-tors' centre. We took the view that by letting di-rectly to individual tenants – and carrying outstructural improvements – we could achieve ahigher rental. We optimised the physical structure,created additional space and upgraded the tech-nical equipment. As a result, we have found newtenants for 84% of the space so far and increasedthe rental by 10%. There is also further potentialfor an increase in income of 20%.

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

38 � Business Development

Ancillary leasing costs reduced The reduction in ancillary leasing costs, the so-called “second rental”, is an important element in the currentcompetitive letting market with price-conscious tenants.In 2009, we examined the properties in our portfolio systematically with regard to their ancillary costs and efficiency. The quality of our buildings was clear in thecomparison with the sector benchmarks contained inJones Lang LaSalle's OSCAR study: over 90% of all proper-ties, which are predominantly used as offices, reportedbetter results than the benchmarks established by JonesLang LaSalle.

Hamburg, Osterstraße(Hamburg Branch – North Region)

A good result can always be improved on, most notablyin technical property management: through our in-houseproperty management, we can recognise potential sav-ings easily and implement them consistently. We imple-ment a comprehensive package of measures, which includes energy saving measures and the renegotiation ofservice agreements among other things. This has alreadyallowed us to reduce assignable ancillary costs by around2% for 2009. We have also created the preconditions for asignificant additional reduction of probably 5-7% for 2010.

Comparable rental income virtually stableLike-for-like rental income – that is the comparable in-come from properties in the portfolio in 2008 and 2009(excluding project developments) – fell slightly by 4.2%compared with the previous year to EUR 136.7 million p.a.If the scheduled termination of the tenancy agreementwith Deutsche Börse AG is not taken into account, the reduction was -0.4%. Even before Deutsche Börse AGmoved out, we succeeded in letting 28% of the space toan international IT consultancy for six years, which partlycompensated for the fall in rental.

FULLY LET AND EFFICIENT� Modernisation has a positive impact on operating costs� Income increased by 30% through full utilisation

The property is centrally located in a district of Hamburg and offers arental space of 6,700 sqm. Some 1,000 sqm was vacant when we tookthe property over in 2007. We optimised the space by installing fixturesand fittings that met market requirements and, at the same time, re-duced operating costs through the use of modern technology. When let-ting the property we focused on its principal use, as a medical practice,and its easy accessibility and approached suitable tenants selectively.Achieving full occupancy in the third quarter produced an increase inrental income of 30%.

� Residual term of the tenancy agreements increases to 5.6 years

� Slight reduction in market values of 1.6%� Net Asset Value virtually stable at EUR 15.86

per share

At the end of 2009, our real estate portfolio encompassed318 properties with a pro rata lettable area of 1,274,500sqm. The properties generated annual rental income ofEUR 142.4 million (including opportunistic co-invest-ments) and have a market value of EUR 2,192.2 million. Inthe course of the year, our portfolio volume was increasedby three additions with a floor space of 12,780 sqm. Thiswas matched by the disposal of 23 properties in total witha floor space of 13,900 sqm.

Regrouping and renaming process in the segmentsFor the makeup of the portfolio, with effect from 31 De-cember 2009 we regrouped a total of eleven propertieswithin our Core plus and Value added segments in linewith their progress and changes in letting and value ap-preciation. Six properties moved to the Core plus segmentand five properties to the Value added segment. As partof the preparations of the Funds business segment we alsorenamed the Core segment Core plus.

Portfolio

Business Development � 39

Forms of use(by rents paid)

Retail 17%

Residential 1%

Office 68%

Others 14%(e.g. logistics,

industrials)

Main tenants(by rents paid)

Retail 20%

Telco/IT/Multimedia 12%

Insurance/Banking 10%

Industry 8%

Others 28% Public Sector 22%

Portfolio overview

as at 31.12.2009 Core plus Value added Co-Investments Total

Lettable area in sqm * 469,100 637,100 168,300 1,274,500

Market value of real estate assets 992.4 930.1 269.7 2,192.2in EUR million *

Number of properties 48 137 133 318

Residual terms in years 7.1 4.2 4.7 5.6

Occupancy rate 93.4% 82.8% 83.0% 86.7%

Rental income per sqm in EUR 12.19 9.28 8.82 10.38

Annualised rental income in EUR million * 66.5 60.5 15.4 142.4

Portfolio: Broad diversification focused on office space

* pro-rata values

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

Market value of the real estate holdings has fallenslightlyThe annual market valuation of our portfolio by inde-pendent surveyors, in which each of our properties is reviewed, took place at the end of 2009. The market valueis based on a sales-oriented consideration and is the esti-mated transaction amount at which a property wouldchange hands between the purchaser and vendor undernormal conditions on the date of the valuation. Havingfallen sharply in the previous year, the market as a wholeappears to have bottomed out as at 31 December 2009with market values only having fallen slightly.

The result for our portfolio: the cumulative market value ofcomparable portfolios (like for like) is slightly down,namely -1.6%, on the level of the previous year, which is amarked stabilisation compared with the previous year'sreduction of -8.5%. Following the acquisitions, disposalsand the adjustment in value, our portfolio had a marketvalue of EUR 2,192.2 million as at 31 December 2009. Inthe previous year, the market value was EUR 2,161.8 mil-lion. The Net Asset Value rose slightly by +0.9% compared

with the previous year to EUR 497.1 million. The Net AssetValue per share amounted to EUR 15.86 (previous year EUR16.23).

We record our assets at cost less depreciation, which iswhy the change in market value has no direct impact onthe balance sheet. The section on assets provides more information on how our properties are reported.

Three additions in the portfolioWithin the year we acquired three properties with a let-table area of 12,780 sqm worth EUR 33.5 million in our direct portfolio. All the properties were from previous acquisitions and ownership has passed to us now thatconstruction is complete.

Earnings-oriented sales policy continuesIn 2009, our activities remained focused on placing smallerand medium-sized properties and attracting private investors. We have postponed the sale of larger propertiessuch as the Bienenkorbhaus in Frankfurt into the futurewhen revival in demand from institutional investors, in

particular, will pick up once more and financing conditionswill be better.

From our Core plus and Value added portfolios, we sold13 properties with a pro rata volume of EUR 15.2 million ata profit of EUR 1.5 million, which was credited to the income statement. Ten properties worth a total of EUR38.8 million were sold from the Opportunistic Investmentssegment, in which we hold minority interests.

With the sales proceeds we achieved, we exceeded the respective carrying or market values. We achieved mostsales in the fourth quarter, which argues in favour of aslight revival in the market. The average transaction vol-ume amounted to EUR 2.8 million. The largest propertywas the Rathausplatz property in Eschborn worth someEUR 11 million, followed by four properties with a trans-action volume of between EUR 4.0 and 7.0 million.

The transaction volume of the sales agreed in 2009amounted to some EUR 60 million in total without takingaccount of the amount of the investment.

40 � Business Development

Changes in market valueEUR million

Portfolio market value as at 31.12.2008 2,161.8

+ Acquisitions/additions 78.3

- Sales/disposals -22.0

+/- impact of valuation -25.9

Portfolio market value as at 31.12.2009 2,192.2

Transaction volume 2009 by quartersAfter signing, no consideration of investment stake volume

EUR million Number of Transactionproperties volume

Q1 2 12.1

Q2 6 9.4

Q3 2 2.8

Q4 9 35.5

Total 19 59.8

approx. 992 EUR million

45%

approx. 930 EUR million

43%approx.

270 EUR million12%

Core plus Value added OpportunisticInvestments

Market value as at 31.12.2009EUR million

MainTor project: Progress in the planning processThe end of the zoning process for the MainTor project isapproaching: The zoning plan was submitted to the mu-nicipal authorities for a decision at the beginning of 2010and is expected to come into effect in spring following aresolution by the Frankfurt City Councillors. This is thebasis for the first stage of construction, which will startwith the demolition of the building on Weißfrauenstraßein the north east of the site.

With an investment volume of approximately EUR 500 million, the DIC Group will construct an open and livelyquarter on one of the most attractive development sites inthe Frankfurt city centre. The project development willopen up historic routes from the city centre to the riverMain and provides for a central square. Three towers willbe constructed – the 100 metre high “WinX“ and two tow-ers of 64 metres each. While the towers will be used almostentirely as office space, smaller residential buildings willsupplement the variety of uses to which the site can beput.

Project developments

� Bienenkorbhaus reopened � MainTor project: the end of the development

plan process is imminent

We carry out development work on suitable propertiesto achieve a significant increase in their value by reposi-tioning the properties or increasing the space that can beused with major structural work. Building work on the Bienenkorbhaus has been completed since the beginningof 2009 and the well-known building has been reopened.With the MainTor project, we are coming to the end ofthe approval process and have recently chosen the bestdesigns for the two high-rise buildings in an advisoryprocess.

A new Bienenkorbhaus on Frankfurt’s ZeilThe Bienenkorbhaus was awarded the prize for the bestproject development by the magazine Immobilienman-ager in February 2010. In April 2009, we celebrated the official reopening of the historic Bienenkorbhaus onFrankfurt's Zeil. In a construction period of just over oneyear, the high-rise building was completely refurbished internally to meet the technical requirements of the 21stcentury and extended with a new building featuring amodern glass façade. The investment volume amountedto EUR 75 million in total. The refurbishment increased therental volume by some 30% and added high quality retailspace, for which the shoe retailer Görtz and the Frank-furter Sparkasse have each agreed 15 year tenancy agree-ments. The occupancy rate, based on rental income, currently comes to 85%.

The project is gaining in statureOne of the smaller towers, namely the MainTor Porta, is tobe constructed in the first phase of construction. A panelof representatives of the City of Frankfurt, the DIC Groupand independent experts chose the best solutions for thetwo high-rise buildings, namely “WinX” and “MainTorPanorama”, from seven entries in a process for calling inexpert opinions from architects in December 2009. Twodesigns of the architects KSP Jürgen Engel and Prof. Mäck-ler, which together form a harmonious urban solution, willprobably be selected in March 2010 following further processing.

Acquisition of MainTor project sharesIn the third quarter of 2009, the DIC Group acquired theshares of its co-investor Morgan Stanley Real Estate Funds(MSREF) and now holds 100% of the MainTor project. Con-centrating the investments will benefit the consultationprocesses in the current stage of the project and may accelerate stages of the project. Additional partners maybe involved in the subsequent construction of individualsub-sections. As a result, DIC Asset AG’s minority holding,which is held via the Opportunistic Investments segment,increased from 20% to 40%.

Business Development � 41

Man

agem

ent R

epor

tTh

e Sh

are

Solid

ity in

Det

ail

Ove

rvie

wCo

rpor

ate

Gov

erna

nce

Fina

ncia

l Sta

tem

ents

To o

ur S

hare

hold

ers

The knowledge, performance and commitment of our em-ployees provide the basis for our company’s success. Weshall only achieve our ambitious targets, if we have com-petent and motivated employees, who represent our com-pany successfully to tenants and business partners.

Property management: Enhanced structure and organisationIn 2009, we focused particularly on developing our property management activities, where the number ofemployees more than quadrupled to 89 in the period from2006 to 2009 following the establishment of DIC ONSITE.Following this period of rapid growth, we analysed the po-tential for organisational improvements and, in particular,strengthened the areas of Key Accounting, Controllingand technical management. We have also intensified ourtraining and opportunities to acquire qualifications. Weaim to work out further opportunities for improvementwith our employees in the current financial year througha broadly based customer satisfaction survey.

Positioning as an attractive employer The principal task of our personnel management team isto enthuse high performing staff about our company andto retain them long-term. Entrepreneurial thought and action, the ability to act on one's own initiative, flexibilityand specialist knowledge are of vital importance for us.We endeavour to position DIC Asset AG as an excellentemployer, both now and in the future, in order to appealto talented and highly qualified candidates. We are investing in collaborations with selected technical univer-sities and universities to recruit junior staff with impres-sive academic qualifications.

Qualification and personal developmentPersonal development aims to promote our employeesand improve their qualifications. We support our employ-ees in their personal further development and advance-ment and invest in disseminating knowledge and compe-tence. We analyse the skills and motivation of ouremployees systematically as basis for our personnel de-velopment and base personnel-related decisions and de-velopment measures on these results. We have imple-mented a modular development programme, whichdovetails with this, for management.

Training in the GroupAs a company, we invest in training young people andview this as an important socio-political contribution. In2009, two employees participated in training on the realestate sector in the Frankfurt and Mannheim offices.

Incentives and recognising performance Our employees’ salaries consist of a basic income, per-formance-related components and supplementary bene-fits and are geared towards achieving our strategic andoperational targets. As a result, we consciously encourageand support a focus on performance and an awarenessof entrepreneurial issues – depending on the area of responsibility of the individual employee.

Focus on property management As at 31 December 2009, DIC Asset AG employed 112 employees throughout Germany in the Group comparedwith 99 at the end of the previous year. On average it employed some 106 employees in 2009 – some 10 morethan in 2008. The company's concentration on propertymanagement is apparent from its personnel structure. 89employees, which equates to 80% of the workforce, workin asset and property management for our 100% propertymanagement subsidiary DIC ONSITE. It operates through-out Germany with six branches located in areas where ourportfolio is concentrated. DIC Asset AG is managed fromFrankfurt am Main, as the location of the Board of Direc-tors, and central management and administrative tasks arealso carried out there.

In 2009, expenses of EUR 9.2 million in total were incurredfor salaries. Of this figure, performance-related compen-sation amounted to EUR 0.9 million, social security contri-butions, pensions and other benefits totalled EUR 1.0 million.

Our employees

Employee structure

Number of employees 31.12.2009 31.12.2008

Portfolio management and investment 8 8

Property and asset management 89 78

Group management andadministration 15 13

Total 112 99

42 � Business Development

Following a bumpy start, the performance of our sharewas positively supported by the widespread recovery infinancial markets in 2009. Thanks to our reliable businessmodel and sound results, DIC Asset AG outperformed therelevant indices, namely the SDAX and EPRA, and endedthe year around 30% higher. You can find more informa-tion in the “Share” section.

As a real estate company with a long-term investmenthorizon, we shall benefit from dealing with resources andthe environment in an economical and sustainable man-ner. Our portfolio encompasses 318 properties in some 90cities. Our activities and those of our tenants generatewaste, which is disposed of. Our companies and our ten-ants consume electricity and water. Real estate manage-ment also results in the release of carbon dioxide and hasother effects on the environment. In our entrepreneurialdecisions and processes, we take account of ecologicaland social requirements and, wherever possible, foregothe opportunities for short-term gains in favour of funda-mental options for optimisation. Our focus on sustainabil-ity also includes dealing with our employees, customersand business partners in a fair and responsible manner.

Measures affecting portfolio properties The effective management of our existing properties is ofequally great interest both for us and for our tenants. Wemaintain a continuous discussion with our tenants regarding the economical consumption of electricity andheat in our properties and show them opportunities foroptimising their consumption.