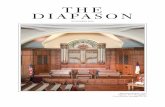

Diapason Commodity Strategy - 2012-04-30

Transcript of Diapason Commodity Strategy - 2012-04-30

For important Disclaimers and Disclosures, please refer to the last two pages of this publication

The Diapason Capital Markets Report A P R I L 3 0 , 2 0 1 2

V O L U M E 4 I S S U E 1 6

Key economic data this week

• March Pending Home Sales jump 4.1% m/m

• March Durable Goods Orders lower on aircraft

• February Case-Shiller House Price Index rise

• March New Home Sales gave back February gains

• April CBO Consumer confidence index falls

• Q1 initial jobless insurance claims gains gone

• Mar China HSBC “flash” PMI higher — still sub-50

• Mar China imports lower on payback to Jan-Feb gains

The commodity supercycle is ending? China isn’t all that matters, Part 2

• There has been a lot of debate about the end of the "Commodity Supercycle" in recent days. The subject came up along market speculations that a hard landing will take place in China, and that the "miracle" is "over. The premise here is that if the infrastructure development of China is over, then surely the so-called "Commodity Supercycle" is over.

• Could this meme be correct? We disagree with those notions on five counts: (1) We do NOT believe that China is in for a hard landing (we expect higher growth in Q2 2012), and (2) even if China’s growth ratchets down from "boiling" to "simmering" that does not necessarily mean an end to the upward trend in commodity prices as other emerging countries and even OECD economies would soon take up the "slack" from Chinese demand moderation;

• (3) a China paradigm shift from investment to consumption does not necessarily derail the commodity gravy train -- it just rearranges the order and the number of the train cars; (4) the Fed’s reaction function almost guarantees that rates will stay low too long again, and will likely re-ignite inflationary pressures in a 1970 context; and (5) the "commodity su-percycle" being discussed is not really a "Supercycle", but only a “boom” in a longer, larger, higher-amplitude period of economic activity (the “Long Wave” or “Kondratief (K) Wave”) which could top out in sometime in 2022-2026.

Chart of the Week: Pending home sales jump 4.1%

2 For important Disclaimers and Disclosures, please refer to the last two pages of this publication

The Diapason Capital Markets Report A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6 The Diapason Capital Markets Report

Commodity supercycle ending? China isn’t all that matters, Part 2

The supercycle that is supposed to end is just a “boom” in a much longer, larger “Supercycle” By Robert Balan and Alessandro Gelli

There has been a lot of debate about the end of the "Commodity Supercycle" in recent days. The subject came up along market speculations that a hard landing is happening in China, and that the "miracle" in the Middle Kingdom is "over. The premise here is that if the infrastructure development of China is over, then surely the so-called "Commodity Supercycle" is over. The pace of Chinese eco-nomic growth has gradually slowed over the past year as the economic stimulus has faded and government has tightened policy to ward off a surge in inflation. Not surprisingly, as growth has moderated, views on the outlook for both GDP and basic material consumption have become more pessimistic. An implosion in growth in China, the line of reasoning goes, will surely spell an end to the com-modity price boom seen in recent years.

Could this meme be correct? We disagree with those notions on five counts: (1) We do NOT believe that China is in for a hard landing (we expect higher growth in Q2 2012), and (2) even if Chinese growth ratchets down from "boiling" to "simmering" that does not necessarily mean an end to the upward trend in com-modity prices as other emerging countries and even OECD economies would soon take up the "slack" from a China demand moderation, (3) a China paradigm shift from investment to consumption does not necessarily derail the heavy com-modity gravy train -- it just rearranges the order of the train cars, (4) the Fed’s reaction function almost guarantees that rates will stay low too long again, and will likely re-ignite inflationary pressures in a 1970 context, and (5) the current "commodity supercycle" being discussed is not really a "Supercycle", but merely a “boom” in a longer, larger and higher-amplitude period of economic activity.

Supercycles do not turn on/off at the flick of a switch

In the first place, history tells us that a full-scale Commodity “Supercycle” does not turn on or off at the flick of a switch, and the travails of any one country -- even a humongous commodity user like China -- will not stop this heavy freighter train on its tracks. "Supercycles" by definition, arise from the interaction of two fundamental facets of a modern global economy: first, the existence of physical

A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6

lags in the economy, information limitations, and bounded ra-tionality in economic decision-making -- all of which creates/causes potential/actual oscillatory behavior; and second, a wide range of self-reinforcing processes exist which amplify the inherent oscillatory tendencies of the global economy (e.g., capital investment, labor markets and workforce partici-pation, real interest rates, inflation, debt, savings and con-sumption, and international trade) leading to so-called "Long Waves" or as is more well-known in economic circles, the "Kondratief (K) Waves".

It is important to understand that a full-scale Commodity Su-percycle within the K Wave is not comprised of one continuous uptrend in prices, but is composed of several booms or boom-lets, with different economic signatures and profiles. The com-monality that binds these booms and boomlets is the process

3 For important Disclaimers and Disclosures, please refer to the last two pages of this publication

The Diapason Capital Markets Report A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6 The Diapason Capital Markets Report

Commodity supercycle ending? China isn’t all that matters, Part 2

or combination of processes that cause the "Long Wave" in the first place. The variances in the signatures or profiles of these booms and boomlets within the "Long Wave" is con-sistent with the evolution of macro-economic conditions and their effect/consequences (the phases or the "seasons") within the broad sweeps of a 50-60 year long (Super)Cycle of economic activity.

An in-depth discussion of the "Long Wave" or "K Wave" is not germane at this point, and we will leave it for another report in the near-future. What we want to accomplish in this study is to pinpoint where we are in the current cycle, and whether or not we expect the boom/boomlet to continue, and if yes, for how long. To borrow a phrase once used about business cycles, it can be said that "the study of commodity booms necessarily begins with the decomposition of these booms". For our purposes, we will limit our analysis to

A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6

the booms and boomlets that occurred after WW II due to the paucity of data before that.

The three commodity booms after WW II

Three major commodity booms since the Second World War had taken place, and in all three, demand shocks predominated as triggers to the commodity price rises. However, as we will later see, these commodity booms do not always have the same characteristics.

The first boom, in 1949–51, was caused by the mas-sive inventory build-up in response to the Korean war. The second boom, in 1968–80, was accentuated by widespread harvest failures and by OPEC’s price man-agement, which tripled the price of oil. The third boom started in 2002 and may not have run its course

4 For important Disclaimers and Disclosures, please refer to the last two pages of this publication

The Diapason Capital Markets Report A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6 The Diapason Capital Markets Report

Commodity supercycle ending? China isn’t all that matters, Part 2

yet. In this boom, the explosive growth of China’s and India’s raw materials demand has played a key role. The first two booms collapsed as the world economy went into reces-sion and excessive inventories were sold out. The third boom wobbled in 2008 at the height of the Great Recession (GR), but higher commodity prices since then resumed their course, made new highs in 2011 and may extend once more on loose global monetary policy, even as commodity inventories remain under tight supply constraints.

Macroeconomic contexts of the three booms

It is a noteworthy observation that the growth of GDP and industrial production/capacity utilization accelerated strongly in the periods just preceding or marking the beginning of the three commodity booms. It is equally interesting to note that the end of the first and second booms characterized by substantial falls in commodity prices in 1952 and 1980,

A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6

coincided with a sharp weakening in the growth of GDP and industrial production (M. Radetzki, 2006).

It remains to be seen whether a similar coincidence will mark the end of the third boom, which is, from several points of view, very peculiar. Commodity prices fell sharply in late 2008 but the decline was brief, and by early 2010, commodity prices have gone higher than the highest levels they attained in 2008 before the GR. In contrast to the above uniformity as it per-tains to growth and industrial output, the booms oc-curred in periods with highly contrasting inflation and commodity/asset price performance. The evidence is reviewed below for each boom in turn.

The first commodity boom (1949-1951)

This boom was clearly and strongly related to the Ko-rean War, which broke out in June 1950, with an armi-stice reached in July 1953. The impact of the war on commodity markets was both direct and indirect. The direct impact arose from the insecurity felt about in-dustrial materials supply, amplified by the painful ex-periences of the Second World War that ended only 5 years prior to the new conflict, and by the importance of South and East Asia in the proximity of the war theater, as supplier of many agricultural and mineral industrial materials. The rebuilding of Europe and Ja-pan, no doubt, also played a role in this commodity boom, but the U.S. material requirements as it pre-pared for the Korean war did the most heavy lifting.

The insecurity prompted a widespread build-up of stra-tegic raw materials inventories, which added to de-mand and pushed up prices. Purely speculative de-mand also contributed to the asset markets' strength,

5 For important Disclaimers and Disclosures, please refer to the last two pages of this publication

The Diapason Capital Markets Report A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6 The Diapason Capital Markets Report

Commodity supercycle ending? China isn’t all that matters, Part 2

but it probably played a lesser role than during the commodity booms of later times. This is because stock markets were buoyant in the early 1950s, and offered ample opportuni-ties for profits.

Furthermore, flexible instruments for speculation in commodity markets had not yet been developed at that time. The indirect impact to commodity prices arose from the boost to economic growth and industrial output that resulted from the war operations, which re-sulted in extremely strong macroeconomic performance in 1950 and 1951.

Inflation characteristics of the first boom

The inflationary performance during the first boom follows a somewhat unusual path. Available inflation indexes indicate only moderate inflation for the whole of the 4-year pe-riod under scrutiny. The Consumer Price Index increased from 6.2 in 1948 to 9.59 in

A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6

1951, a rise of roughly 55%. There clearly was poten-tial for the inflation variation to be wider, but the in-crease in prices during the period proved surprisingly benign (more or less). This may be linked to the sharp fall in the 1950 dollar prices of manufactured exports, primarily in consequence of the European devaluations in late 1949.

When measured by the aggregate commodity index, this boom does not appear to be particularly strong. Commodity prices peaked in the first quarter of 1951 at a level 45.4% above 1949, used as the base year in analyzing the first boom. Neither is it particularly dura-ble. By the second quarter of 1952, the constant price increases had reduced to only 16% above the base year. The boom was limited, by and large, to seven quarters.

The prices of both commodity groups fell back later in 1952 as it became clear that the Korean war would not spread into a world-wide conflict, and with the sharp slowdown in economic growth recorded in that year. In addition, dramatic reductions in the strategic stock lev-els added to supply, and so contributed to the ensuing price weakness.

An important explanation to the relatively weak ampli-tude of this commodity boom is that the major con-suming countries were relatively self-sufficient in en-ergy and food at the time, and that in any case there was little export of these materials from the proximity of the war scene. The OPEC cartel had not yet come into existence, the US was still a net oil exporter, while domestic coal dominated Western Europe’s energy needs. All of these, of course, changed during the sec-ond commodity boom.

6 For important Disclaimers and Disclosures, please refer to the last two pages of this publication

The Diapason Capital Markets Report A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6 The Diapason Capital Markets Report

Commodity supercycle ending? China isn’t all that matters, Part 2

The second commodity boom (1968-1980)

The second boom was much stronger than the first. It was also much more pervasive in that the prices of all commodity groups rose sharply. Similar to what happened in the first boom, a very strong macroeconomic performance during 1972 and 1973 constituted an important trigger to the rising commodity prices. But there were three additional trig-gers. First trigger was that the boom had been preceded by two consecutive years of widespread crop failures, on which a dramatic cut in Peruvian fishery was superimposed. Peru’s anchovy catch declined from 12.6 million tons in 1990 to 2.3 million in 1973.

The scarcity of food led to substitution in land use, e.g. from cotton to grains, which re-sulted in falling agricultural raw materials supply. The year 1973, therefore, saw deficient inventories both for food and agricultural raw materials.

A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6

The second trigger was of course the very sharp price increases instituted by OPEC late in 1973. Given the heavy weight of oil in international commodity trade, this had a strong repercussion on the aggregate com-modity index.

The third trigger was the loose monetary policies of the Federal Reserve at that time, which we documented in last week's report (see "Commodity supercycle end-ing? Not if the Fed runs true to form" Part 1, The Diapa-son Capital Markets Report, April 19, 2012). The ensu-ing surfeit of liquidity for periods longer than necessary triggered a massive inflationary run.

The very high inflation through the duration of the sec-ond boom provided further dissimilarity from the first commodity boom. Not only did the period record very strong price rises, irrespectively how measured, for raw materials as well as for manufactures.

The years were also characterized by chaotic changes in the parities between major currencies, all of which were freely floating after the dollar anchor had been removed and the dollar itself was made non-convertible to gold in 1971. Measured by CPI, inflation totalled no less than 305% over the 12-year period, a sharp contrast to the first commodity boom.

Rampant inflation brings on negative real rates

The rampant inflation which had resulted in negative real interest rates for long periods, the chaos in cur-rency markets and the poor performance on the stock exchanges in the early 1970s led many investors to move out of bonds and shares and into real estate, art, commodities, and gold.

The speculative demand for commodity inventories as a

7 For important Disclaimers and Disclosures, please refer to the last two pages of this publication

The Diapason Capital Markets Report A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6 The Diapason Capital Markets Report

Commodity supercycle ending? China isn’t all that matters, Part 2

‘‘safe’’ store of value was a further contributory factor to the commodity and gold boom. The aggregate commodity price index in nominal dollar rose sharply in 1973, and remained above a 250 average through 1974 and 1975 -- the energy index was at about 330, all the other commodity indices around 150. In the course of 1974, under the weight of the recession prompted by the oil crisis, the constant dollar metals and agricultural raw materials indices fell back sharply, to end the year at 100. They re-mained at that level through 1975, when the recession deepened. The metal prices were additionally depressed by large sales between mid-1973 and mid-1974 from the US government’s strategic stockpiles, and in late 1974 from excessive commercial stocks in Japan that had been built up in the preceding year.

Rising crude oil prices did most of the damage

Energy prices rose significantly at the end of 1973, slightly later than the prices of other

A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6

commodities, but by early 1974 the energy prices had risen by much more than any other commodity group. And despite fluctuations in the constant prices, prompted mainly by inflation, they remained 150–200% above the base year (1970). The machinations of the OPEC oil cartel explain the difference. Oil domi-nates the energy price index, and members of OPEC adjusted (decreased) supply to the falling demand in 1974 and 1975, caused by the combination of deep-ening recession and the price shock.

The cartel’s success in defending its desired price is clearly seen in the relative stability of nominal crude prices from the beginning of 1974, and was followed by another run-up in commodity/gold prices until 1980, when prices fell over the next six years, effec-tively killing the 1970s era of high inflation (thanks to then Fed Chairman Volker's jacking up of short-term interest rates). Thereafter, commodity prices were

8 For important Disclaimers and Disclosures, please refer to the last two pages of this publication

The Diapason Capital Markets Report A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6 The Diapason Capital Markets Report

Commodity supercycle ending? China isn’t all that matters, Part 2

A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6

India) into the global economic horserace triggered a massive run-up in commodities.

In 2004, the year when commodity prices rose substantially, the economic growth in the OECD accelerated strongly, and attained a historical high of 3.3% for GDP and 4.1% for industrial output. But a similar acceleration in developing Asia was probably of greater significance for commodity markets. For although the latter area accounted for 27% of global GDP in 2005, compared with OECD’s 52%, the two Asian giants China and India were passing through a development stage that is much more inten-sive in primary materials use than the dematerializing mature OECD economies (M. Radetzki, 2006).

China specially stands out in this respect. The country’s share of global demand growth for petroleum between 2000 and 2005, at 28% was almost double its share of global GDP in 2005 (15.4% in PPP terms). In some metal markets, China’s domi-nance had become unsustainably extreme. Its share of global demand growth between 2000 and 2005 was more than 50% for aluminium, 84% for steel and 95% for copper.

Producers caught unaware by China, India demand

Raw material producers were caught unaware, and with the contemporary habit of just-in-time inventories in many produc-tion chains at that time, and little spare production capacity, prices in many markets moved up strongly. There was also an-other factor that amplified the importance of China and India in the commodities race -- a dollar added to the GDP in developing Asia absorbs more than twice the quantity of commodities as does a corresponding dollar’s growth in the OECD countries.

Therefore, the two countries would contribute about equally to commodity demand growth if their economies expanded at the same rates. But since developing Asia’s economies expanded at more than twice the OECD rate, it would follow that their

more or less stable and quiet (excepting minor run-ups every now and then) un-til late 2001, when China made a dramatic entrance to the world stage, courtesy of the World Trade Organization.

The third commodity boom (2002-present)

The third commodity boom started in late 2001 and it may not have run its course yet. Like the preceding booms, it was importantly triggered by a demand shock. As in earlier commodity booms, the demand shock was importantly a re-sult of fast macroeconomic expansion. Furthermore, it was likewise abetted by then Fed Chairman Greenspan's decision to hold short-term rates low far longer than necessary after the dot-com collapse in 2000 and the subsequent growth recession. The ensuing demand from a rapid economic reflation of the Western economies after the 2000 contraction, and the entry of China (and subsequently

9 For important Disclaimers and Disclosures, please refer to the last two pages of this publication

The Diapason Capital Markets Report A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6 The Diapason Capital Markets Report

Commodity supercycle ending? China isn’t all that matters, Part 2

A P R I L 3 0 , 2 0 1 2 V O L U M E 4 I S S U E 1 6

to the upward price push, as did the storm damage to production installations in the autumn of that year (Hurricane Katrina in the U.S.). Oil prices remained at very high levels late in 2005 and early 2006, despite virtually full capacity utilization by OPEC. Metals and minerals prices rose as fast as energy until early 2005, then fell and stagnated for a while. By early 2007, a rapid rise in energy prices left all commodity sectors behind, culminating in a top spot price of $147.30/bbl by July, and subsequently helping trigger the Great Recession of 2007-2008.

Crude and commodity prices will rise further

Last week, we asked: "Is the commodity supercycle end-ing?" We answered: "Not if the Fed runs true to form" Part 1 (Diapason Capital Markets Report, April 19, 2012). The primary premise leading to that belief was that "the Fed's reaction function almost guarantees that interest rates will stay too long, reigniting inflation". The chart on the left tells us that the Fed is in the process of repeating past er-rors, since they almost always react very late to develop-ments in the economy rather than being proactive. In short, the Fed is way too easy today, and this portends higher inflation in the future.

And if we think through the implications of a repeat of those errors (especially in a 1970s context), then we will come to the conclusion that commodities will continue to rise higher in coming years. Given the context of a “Long Wave” dynamics still likely operative in commodity prices, we may still have a series of booms/busts with an up-wards bias for a few more years, possibly until 2022-2026.

No, we don’t think the “Commodity Supercycle” is going to end sometime very soon, if the Fed's reaction function runs true to form (as is almost always the case).

contribution to commodity demand growth overwhelmed that of the OECD (as can be gleaned from the data on the previous page).

The inflation record across the third boom is a bit unusual, as was that of the first boom (at least in its early stages). While national statistics have recorded an extremely low inflation in all important countries, the CPI Index increased from 1.6% in 2002 and 4.75% in 2005. The inflation recorded by the index in the 2 years is almost entirely due to a sizable decline by some 30% in the US dollar parity versus the Euro.

As in the second boom, the energy index, reaching almost 200 at its initial peak in 2005, recorded the strongest price increase. Oil, of course dominates this index. The small inventories resulting from OPEC production restrictions in the years preceding the boom, along with a further short output cut by the cartel early in 2005 contributed

10 For important Disclaimers and Disclosures, please refer to the last two pages of this publication

The Diapason Capital Markets Report

Contact Information Diapason Commodities Management S.A Malley Lumières Chemin du Viaduc 1 Case Postale 225 1000 Lausanne 16 Switzerland +41 21 621 13 10 www.diapason-cm.com

Diapason Commodities Management UK LLP 18 Upper Brook Street 5th floor London W1K 7PU United Kingdom +44 207 290 2260 www.diapason-cm.com

Sales Team _________

Salvatore Miserendino Head, Marketing & Business Development Tel : +44 207 290 2260 [email protected]

Sébastien Max Sales Tel: +41 21 621 13 15 [email protected]

Waleed Albahr Sales Tel: +44 207 290 2262 [email protected]

Research Team _______________

Sean Corrigan Chief Investment Strategist [email protected]

Robert Balan Sr. Market Strategist [email protected]

Alessandro Gelli Fundamental Research [email protected]

Marion Megel Fundamental Research [email protected]

Chiharu-Claire Nishida Sales Tel: +41 21 621 13 14 [email protected]

Xavier Gendre Sales Tel: +41 21 621 13 12 [email protected]

Mark McDonnell Institutional Sales Tel: +44 207 290 2263 [email protected]

Fabien Espic Quantitative Research [email protected]

Robert Balan has more than 3 decades of experience in the financial markets. Education in mining engineering, computer science, and training in economics led to a commodity analysis career during the commodity boom of the early 1970s. Robert made a switch to global macro focus in the early 1980 when the commodity bull market waned, with specialization in foreign exchange. Robert wrote a very high profile daily FX analysis while Geneva-based in the mid-1980s (the first FX commentary with a real global readership, "most accessed" in the Reuters and Telerate net-works from 1988 to 1994). He worked for Swiss Bank Corp and Union Bank of Switzerland (precursors of today’s new UBS) as head of technical research and proprietary trader in various major finance centers (London, New York, and Toronto) from late 1980s to mid-1990s. A stint at Bank of America as head of global technical research (London, New York) followed in late 1990s to early 2000s. He returned to Switzerland in 2004 as head of technical research and strategy, and FX market analyst for Swiss Life Asset Management in Zurich. He joined Diapason Commodities Man-agement in 2008 as senior market strategist utilizing macro-economic drivers, structural/technical data in modeling asset price and sector movements. Robert wrote a book on the Elliott Wave Prin-ciple in 1988, hailed by the London Society of Technical Analysts as best book ever written on the subject. Robert is a member of the National Association for Business Economics (NABE), USA.

The Diapason Capital Markets Report is published and edited by Robert Balan, Senior Mar ket Strategist

Edouard Mouton Head of the Quantitative Desk [email protected]

Diapason Commodities Management SA 2012

Any disclosure, copy, reproduction by any means, distribution or other action in reliance on the contents of this document without the prior written consent of Diapason is strictly prohibited and could lead to legal action.

Victor Neamtu Quantitative Research [email protected]

11 For important Disclaimers and Disclosures, please refer to the last two pages of this publication

The Diapason Capital Markets Report

DISCLAIMER General Disclosure This document or the information contained in does not constitute an offer or a solicitation, or a recommendation to purchase or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information contained in this document is issued for information only. An offer can be made only by the approved offering memorandum. The investments described herein are not publicly distributed. This document is confidential and submitted to selected recipients only. It may not be reproduced nor passed to non-qualifying persons or to a non professional audience. For distribution purposes in the USA, this document is only intended for persons who can be defined as “Major Institutional Investors” under U.S. regulations. Any U.S. person receiving this report and wishing to effect a transaction in any security discussed herein, must do so through a U.S. registered broker dealer. The investment de-scribed herein carries substantial risks and potential investors should have the requisite knowledge and experience to assess the characteristics and risks associated therewith. Accordingly, they are deemed to understand and accept the terms, conditions and risks associated therewith and are deemed to act for their own account, to have made their own independent decision and to declare that such transaction is appropriate or proper for them, based upon their own judgment and upon advice from such advisers as they have deemed necessary and which they are urged to consult. Diapason Commodities Management S.A. (“Diapason”) disclaims all liability to any party for all expenses, lost profits or indirect, punitive, special or consequential damages or losses, which may be incurred as a result of the information being inaccurate or incomplete in any way, and for any reason. Diapason, its directors, officers and employees may have or have had interests or long or short positions in financial products discussed herein, and may at any time make purchases and/or sales as principal or agent. Certain statements in this presentation constitute “ forward-looking statements”. These statements contain the words “anticipate”, “believe”, “intend”, “estimate”, “expect” and words of similar meaning. Such forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results to differ materially from the ones ex-pressed or implied by such forward-looking statements. These risks, uncertainties and assumptions include, among other factors, changing business or other market conditions and the pros-pects for growth. These and other factors could adversely affect the outcome and financial effects of the plans and events described herein. Consequently, any prediction of gains is to be con-sidered with an equally prominent risk of loss. Moreover, past performance or results does not necessarily guarantee future performance or results. As a result, you are cautioned not to place undue reliance on such forward-looking statements.

These forward-looking statements speak only as at the date of this presentation. Diapason expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any for-ward-looking statements contained herein to reflect any change in Diapason’s expectations with regard thereto or any change in events, conditions or circumstances on which any such state-ment is based. The information and opinions contained in this document are provided as at the date of the presentation and are subject to change without notice.

This document is issued by Diapason and maybe distributed by both entities Diapason or Diapason Commodities Management UK LLP (“Diapason UK”). Diapason is regulated by the Swiss Financial Market Supervisory Authority (FINMA) and Diapason UK is authorised and regulated by the Financial Services Authority (“FSA”).

Trademarks All rights reserved. “DIAPASON COMMODITIES INDEX”, “ DCI”, “ DIAPASON COMMODITIES MANAGEMENT” and “ DIAPASON” are trademarks and service marks of Diapason. “ BNP Paribas” and “ BNPP” are trademarks and service marks of BNP PARIBAS, “ DJ-UBS” are trademarks and service marks of UBS, and “SP GSCI” are trademarks and service marks of the McGraw-Hill Companies Inc. “Jim Rogers”, " Rogers", “ Rogers International Commodity Index”, and "RICI" are trademarks and service marks of Beeland Interests, Inc. (“Beeland Inter-ests”) which is owned and controlled by James Beeland Rogers, Jr., and are used subject to license.

All proprietary rights with respect to the DCI and any component thereof belong to Diapason, with respect to the DCI BNP Paribas Enhanced Index and any component thereof to Diapason and BNP PARIBAS, with respect to the DJ-UBS to UBS, with respect to the SP GSCI to McGraw-Hill Companies Inc., with respect to the RICI and any component thereof belong to Beeland In-terests (the DCI, the DCI BNP Paribas Enhanced Index, the DJ-UBS, the SP GSCI, the RICI® hereafter individually an “Index”, collectively the “Indexes” and each of their owners, an “Index Owner”).

The Index Owners and their affiliates do not sponsor, endorse, sell or promote Diapason products by this documentation and make no representation or warranty, express or implied, nor accept any responsibility, regarding the accuracy or completeness of this presentation, or the advisability of investing in securities or commodities generally, or in Diapason products or in futures par-ticularly or as to results to be obtained from the use of the Indexes. Diapason assumes sole responsibility for this documentation which has not been reviewed by the other Index Owners. Any third party product based on or in relation to the Indexes may only be issued upon the prior written approval of their respective owners and upon execution of a licensing agreement between those parties and the party intending to launch a product.

12 For important Disclaimers and Disclosures, please refer to the last two pages of this publication

The Diapason Capital Markets Report

DISCLAIMER Trademarks (continued) The Index Owners and their affiliates disclaim any liability to any party for any inaccuracy in the data on which their respective Index are based, for any mistakes, errors, omissions or inter-ruptions in the calculation and/or dissemination of such Indexes, or for the manner in which they are applied in connection with the issue and offering of a product. The Index Owners and their affiliates make no warranty, express or implied, as to results to be obtained by owners of products, or any other person or entity from the use of their respective Index, any data included therein or linked therewith or products based thereon. The Index Owners and their affiliates do not make any express or implied warranties, and expressly disclaim all warranties of merchant-ability or fitness for a particular purpose or use with respect to their respective Index and any data included therein. Without limiting any of the foregoing, in no event shall the Index Owners and their affiliates have any liability for any lost profits or indirect, punitive, special or consequential damages or losses, even if notified of the possibility thereof.

Electronic Communication (E-mail) In the case that this document is sent by E-mail, the E-mail is considered as being confidential and may also be legally privileged. If you are not the addressee you may not copy, forward, dis-close or use any part of it. If you have received this message in error, please delete it and all copies from your system and notify the sender immediately by return E-mail. The sender does not accept liability for any errors, omissions, delays in receipt, damage to your system, viruses, interruptions or interferences.

Copyright

© Diapason Commodities Management SA 2012 Any disclosure, copy, reproduction by any means, distribution or other action in reliance on the contents of this document without the prior written consent of Diapason is strictly prohibited and could lead to legal action. Last update on 13 February 2012 Compliance approved: April 30, 2012

![Commodity Profile & Strategy Agreement Title: [insert] Reference: [insert]](https://static.fdocuments.net/doc/165x107/568155f7550346895dc3bf24/commodity-profile-strategy-agreement-title-insert-reference-insert-56ef364b95ad8.jpg)

![[Commodity Name] Commodity Strategy](https://static.fdocuments.net/doc/165x107/568135d2550346895d9d3881/commodity-name-commodity-strategy.jpg)

![BPI Best Procurement Implementation [Commodity Name] Commodity Strategy [Name] [Date]](https://static.fdocuments.net/doc/165x107/56649e365503460f94b2512d/bpi-best-procurement-implementation-commodity-name-commodity-strategy-name.jpg)