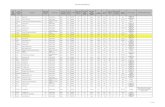

!Search rankings report downtowndough.com categories 12-1-2012

deGraaf’s Dailynew.renmac.com/wp-content/uploads/2012/09/Daily09072012.pdf · 2018. 11. 19. ·...

Transcript of deGraaf’s Dailynew.renmac.com/wp-content/uploads/2012/09/Daily09072012.pdf · 2018. 11. 19. ·...

deGraaf’s Daily

Friday, September 7, 2012

Intermediate Term BarometerIndustry Group Technical Rankings

Jeffrey deGraaf, CMT, CFA Rob Ginsberg Alex Meintel, CMT Chetan Jain [email protected] disclosure on last page

Strongest WeakestHousehold Durables Diversified Consumer Services

Construction Materials Air Freight & Logistics

Industrial Conglomerates Professional Services

Media

Water Utilities

Real Estate Management & Development

Office Electronics

Risk On!The most liquid of these trades is likely the reemergence of the “convergence trade” where German bond yield rise relative to the decline in peripheral European debt financing (such as Spain). 6% is the currently yield on 10yr Spanish debt versus 1.55% for the same maturity German Bunds (both denominated in Euros…..so far), a spread that’s likely to close as central banks around the world distort the information content of the price mechanism of sovereign debt.

The momentum that has been lacking in equities for much of the summer presented itself after one of the most widely anticipated government decisions in recent memory. It was a day of both internal and external accumulation with a most bullish TRIN reading of .28. Frankly, breadth of 3.8:1 was a little lighter than what we would have anticipated, but with all sectors advancing, it was more representative of money moving into the market, and not just rotating within the market. Curiously, copper closed down on the day, and small caps showed no distinct advantage versus large caps. 20‐day highs expanded, but only to the 40% threshold. The base‐count from this breakout can get to an impressive 1580, but that number seems aggressive to us given the near overbought condition and deteriorating (though not critical) sentiment readings.

Importantly, liquidity driven rallies tend to benefit highly volatile and low quality names the most. The bad news is that the moves tend to last for 6‐8 weeks and then fizzle. That said, technology names had the highest number of positive volatility alerts in the S&P yesterday though materials and financials as a group performed better. Industrial relative performance (4th ranked yesterday) will be an important component to durability, and we’d prefer to see follow‐through by Tuesday of next week. For traders, a dash to trash makes sense particularly given the potential for performance chasing. We’ve included the 24 highest volatility names with bad charts that qualify as “juice” for a mean‐reversion bounce.

Please Do Not Forward