Deepening IFAD’s Engagement with the Private Sector Executive Board Informal Seminar 13 September...

-

Upload

victoria-joseph -

Category

Documents

-

view

218 -

download

3

Transcript of Deepening IFAD’s Engagement with the Private Sector Executive Board Informal Seminar 13 September...

Deepening IFAD’s Engagement with the Private Sector

Executive Board Informal Seminar

13 September 2011

Outline

• Why a new strategy?• The process for a new strategy• Changing global and rural landscapes • What has IFAD done so far?• IOE recommendations and management response• The new strategy• Next steps

Why a new strategy ?

• Existing strategy: 2005-2010

• IOE evaluation (May 2011) recommends new strategy

• EB endorses IOE recommendation

• Changing global and rural landscapes

The process for a new strategy

• Internal Policy Reference Group

• Internal stock-taking • IOE evaluation findings

and lessons learned• Consultations with various

stakeholders• Consistency with existing

IFAD policies/strategies

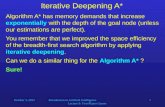

Changing global and rural landscapes

• The private sector is the engine of growth in most economies

• Higher food prices have attracted more private investment in agriculture

• Increasing interest by the private sector to incorporate the poor into their supply chains

• PPPs have been proliferating – especially along value chains, with a variety of models/schemes

Spectrum of actors in rural areas: A heterogeneity of actors

What has IFAD done so far ?

• An increasing role as a facilitator (honest broker) in value chains

• Establishing PPPs at project and programme level

• Supporting the emergence of a private rural financial sector

• Supporting an appropriate business environment

Increasing role as facilitator in value chains

• Since 1999, 78 projects with value-chain components

- 68 projects in 2004-2009

• Projects with value-chain components increased from 3.3% to 45.5% between 1999 and 2009

• Farmers’ organizations play a key role in empowering farmers and getting higher prices and income

Integrating small farmers into value chains: Sri Lanka National Agribusiness Development Prog.

• The project finances development of inclusive value chains in partnership with the private sector and CBOs

• Approach is to encourage the private companies/CBOs to work in partnership with small producers

• US$24 million allocated for long-term debt and equity financing

• First RFPs issued in March 2011 resulted in US$60 million in requests from 30 proposals

Establishing PPPs: Vegetable Oil Development Project in Uganda

• The PPP leveraged US$120 million from a private company to produce vegetable oil domestically

• Created a factory, plantation jobs, and livelihoods for about 3,000 smallholder producers

• Among the key success factors of this PPP are transparent land purchases, respect for the environment, and a fair and just pricing formula

Rural Financial Sector: The Fund for Rural Economic Development in Armenia (FREDA)

• Part of an IFAD loan to Armenia (US$ 6 million) was used to establish an equity fund (FREDA)

• FREDA’s objective is to invest in private agro-processing enterprises that have development impact

• 8 investments have been made or are about to be completed

Limitations and constraints of IFAD’s current approach*

• Not all governments are willing to pass on IFAD loan funds to private businesses

• Private businesses are sometimes reluctant to get involved

• Government systems can be ineffective • IFAD might have limited freedom of choice in selection of private

sector partners• IFAD project cycle and timeframe reduces flexibility• Although IFAD is working with institutions that directly support the

private sector, there is a large firm bias in this work

* Based on IOE evaluation of 2005 Private Sector Strategy (May 2011)

IOE recommendations and management response

The way forward:• Clearer & more focused definition of the private sector• Strengthening existing instruments• COSOPs as a platform for more systematic engagement• Pursue partnerships more actively• Create a separate private-sector financing facility• Strengthen capacity of IFAD staff

What will the new strategy focus on?

The new strategy

Increase use of project loans and grants

• Replicate successful project experiences with PPPs

• Partner along value chains• Continue supporting private

rural financial sector • Increase use of grants and

supplementary funds directed at private-sector development and PPPs (e.g. AECF and AAF)

Use COSOPs more systematically

• Use COSOPs more systematically as:

- the main tool to consult with private sector stakeholders

- platform for policy dialogue on supportive business environment

- building partnerships on rural private-sector development

- identify needs and gaps for rural private-sector development

Support a better rural business environment

• Through our projects and COSOPs, support a better policy environment for rural businesses to thrive:- registration, licensing, certification,

contract enforcement, property rights, etc.

• Partner with other IFIs and UN agencies - promote responsible agricultural

investments as well as sustainable environmental and social policies – in line with IFAD policies

- Contribute to “Doing Business Report” agri-business indicators (with WB, IFC, UNIDO)

Pursue partnerships more actively

• Develop and strengthen partnerships with:- domestic and international private

sector- other IFIs and MDBs- UN organizations- NGOs, CSO, networks

• Partnerships should be driven by:- common purpose- complementarity of competencies- increasing knowledge, resources,

market access to our target groups- improving sustainability of

interventions

Important to assess reputational risk and conduct careful due diligence procedure when partnering with private sector companies

Develop new instruments for promoting rural private-sector development

IOE Recommendation: Establish a new private-sector financing facility

Rationale: • Rural businesses (mostly

SMEs) have difficulty obtaining financing, technology, and technical assistance for their businesses to grow

• Most donors and private equity funds focus on the large business sector

• There is a niche for IFAD to fill this gap

Supporting rural businesses reduces poverty1

1 Taken from Technoserve Presentation

Example: Technoserve results in 2009

Next steps (1)

Explore the feasibility for a separate Private-Sector Financing Facility

Some preliminary facts:• Facility would focus on rural SMEs• There is expressed demand for

finance and technical assistance by rural SMEs

• Facility would not be funded through IFAD replenishment resources

• Facility would aim to fill a gap in supporting rural businesses, which other IFIs and private investment funds have not been able to fill so far

Next steps (2)

The feasibility study would:- describe this gap more fully- assess the risks, challenges,

opportunities, potential sources of funds, and types of instruments that this facility could offer, in line with IFAD’s mandate and target clients

- review IFAD’s organizational structure and HR needs

- propose various options/models for the facility

Setting targets and monitoring the strategy

• The strategy will be monitored through the annual Report on IFAD’s Development Effectiveness (RIDE)

• Work with DCED and the Global Impact Investing Network (GIIN) to develop appropriate results and impact measurement standards

• Once approved, IFAD will determine training and capacity needs of staff, commensurate with the new strategy’s main activities