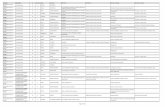

Dct 3 27 14

-

Upload

dakota-county-tribune -

Category

Documents

-

view

235 -

download

4

description

Transcript of Dct 3 27 14

TribuneDakota County

Farmington | Rosemountand the surrounding areas

www.dakotacountytribune.comMarch 27, 2014 • Volume 129 • Number 4

� ������ �����

News 952-846-2033

Display Advertising 952-846-2011

Classified Advertising 952-846-2000

Delivery 952-846-2070

INDEX

Opinion . . . . . . . . . . . . 4A

Sports . . . . . . . . . . . . . 9A

Classifieds . . . . . 11A-13A

Announcements . . . . 14A

ONLINE

NEWS

OPINION

THISWEEKEND

SPORTS

To receive a feed of breaking news stories, follow us at twitter.com/Sun-Thisweek.Discuss stories with us at facebook.com/SunThisweek

Helping young people understand autism

Autism Speaks through Miss Minnesota at schools in Eagan, Rosemount

by Tad JohnsonSUN THISWEEK

DAKOTA COUNTY TRIBUNE

When talking with children, a crown seems to command attention. That’s what Miss Minnesota Rebecca Yeh says about presentations she makes to students regarding an issue that’s near to her heart – au-tism. Yeh was at Northview Elementary School in Eagan and Rosemount High School on Wednes-day, March 19, talking about her experiences growing up with an older brother who has autism. “It is extremely im-portant to speak to students at those ages to show them that dif-ferences are good,” Yeh wrote in an email. “Our natural inclination is to gravitate toward those

Miss Minnesota Rebecca Yeh waves to the crowd during a parade in advance of the Miss America Pageant. Yeh, of Nisswa, visited with students in Eagan and Rosemount last week as an advocate of Autism Speaks. (Photo contributed by Sarah Morreim)

Miss Minnesota Rebecca Yeh plays the violin during the talent portion of the Miss America Pageant. Yeh, of Nisswa, visited with students in Eagan and Rosemount last week as an advocate of Autism Speaks. (Photo contributed by Sarah Morreim)

Motivating students at the molecular level

Rosemount teacher is semifinalist for state honor

by Tad JohnsonSUN THISWEEK

DAKOTA COUNTY TRIBUNE

Atoms are busy. While the nucleus of the cell is a constant, electrons rush about spinning round and round in constant mo-tion. Rosemount High School teacher Michelle Betts’ classroom might be best described with this molecular example. Over the past four years at the school, she has been the stable center in her chemistry and physi-cal science classes as stu-dents have zipped to places large and microscopic. It has engendered so much praise, her 2014 Teacher of the Year nomination impressed Education Min-nesota enough to place her among the 35 semifinalists. “I couldn’t believe that I had been nominated,” said Betts, who is currently on

maternity leave. “I cried, which many of my stu-dents and colleagues know I do when I am touched. I couldn’t believe that a stu-dent had taken the time to show their appreciation for me.” It wasn’t just one stu-dent. Several of her “student-electrons” spoke about how Betts inspired their in-terest in science to motivate them to do more than just experiment with the idea of turning to it as a college and career path. “Ms. Betts believed in me that first day of class, when I was so close to giv-ing up on science complete-ly, and now, because of her support and wisdom, I will be majoring in biochemis-try after graduation,” said Amari Brown, an RHS se-nior who was the school’s

Rosemount High School teacher Michelle Betts (right) and her students are wearing safety goggles in her chemistry class. Betts’ goggles are adorned with jewels, which she says are another way she brings fun to the classroom. (Photo submitted)

Everything’s coming up rosesGardens find new home at Dakota

County Fairgroundsby Jennifer Chick

SUN THISWEEKDAKOTA COUNTY TRIBUNE

Plants and flowers in gar-dens within UMore Park in Rosemount are finding a new home this spring. In June 2011, the Uni-versity of Minnesota and Dakota Aggregates signed a 40-year lease agreement for phased aggregate mining at UMore Park in Rosemount. Dakota Aggregates plans to mine nearly 200 million tons of gravel and sand from approximately 900 acres on the western edge of the 5,000-acre UMore Park in the Rosemount and Empire townships. While this gravel mining will bring in income to sup-port the university and the park, it is also creating dust and safety concerns at the Master Gardener Educa-tion and Research Display Gardens housed within UMore Park so the garden-

The roses at the Master Gardener Education and Research Display Gardens at UMore Park in Rosemount will find a new home this spring. They will be moved to the Dakota County Fairgrounds where the master gardeners are planning a variety of exhibits with approval from the Dakota County Board and Dakota County Ag Society. (Photo submitted)

Swedish choir has an encore Group that performed in 2012 returns to St. Joseph

by Tad JohnsonSUN THISWEEK

DAKOTA COUNTY TRIBUNE

A college choir from Sweden that performed at St. Joseph Catholic Church in Rosemount in 2012 is return-ing Saturday, March 29. The Vettern College Choir, com-

prised of 24 women and 20 men, will perform at 6:30 p.m. from a repertoire that includes traditional choral works, Swedish ethnic music and hymns. “It’s kind of lyrical,” Karen Ar-landson said in 2012 when she and her

The Vettern College Choir will perform at 6:30 p.m. Saturday, March 29, at St. Joseph Catholic Church in Rosemount. (Photo from Vettern College)

See TEACHER, 10ASee AUTISM, 8A

See ROSES, 10A See CHOIR, 10A

Public safety honoreesPolice Investigator John Winters and Fire Department Lt. Chad Ganfield are Rosemount’s public safety Employees of the Year.

Page 3A

Students want equal grades Some Minnesota students are advocating that school districts give equal grade-point weighting for classes taken in the district or at a college.

Page 4A

Squeeze-box splendorFresh off its “A Prairie Home Companion” appearance, Cafe Accordion Orchestra is set to perform in Rosemount on April 9.

Page 15A

A bountiful winter for South SuburbanThe recently concluded winter sports season might have been the South Suburban Conference’s best yet.

Page 9A

2A March 27, 2014 DAKOTA COUNTY TRIBUNE

Application Deadline: April 14, 2014

COMMUNITY ADVISORY COUNCIL TO FLINT HILLS RESOURCESCall 651-429-8391 to have an application mailed to you.

The Community Advisory Council to Flint Hills Resources provides volunteercommunity members an opportunity to meet monthly (September May) withrefinery management to discuss issues and make recommendations regarding

environmental, safety, and other issues of concern to citizens livingwithin close proximity to the refinery.

To learn more about the Council, please visit www.flinthillscac.org.

NOW ACCEPTING APPLICATIONSFOR FOUR NEW MEMBERS

APPLY IF YOU RESIDE IN:

Apple Valley, Hastings, and Rosemount

by Laura AdelmannSUN THISWEEK

DAKOTA COUNTY TRIBUNE

Lakeville took a detour on the way to determining the best place to locate its water tower and the optimal way to improve an intersec-tion. After months of pursu-ing a T-intersection at 190th Street and Holyoke Avenue, city staff recently proposed a less expensive solution and a water tower location that will not disrupt other properties or nearby devel-opment plans. Controversy had sur-rounded the T-intersection proposal because it required encroaching onto a residen-tial property and buying lots from developer Jim Stanton for a water tower on land where he planned to build housing. City Council members agreed at a March 24 work-shop to a new road design plan that keeps the inter-section’s existing alignment and adds bypass and turn lanes to improve safety. It also avoids encroaching onto neighboring proper-ties. The water tower is pro-posed to be located on city-owned land adjacent to the intersection. In the future, a round-about is planned for the intersection as traffic in-creases and development-fueled funding allows for its construction. The new recommended interim alignment is esti-mated to cost $192,000, sav-ing the city $576,000 that can be reallocated to other transportation projects, which could include safety

improvements to Dodd Boulevard near Lakeville North High School. While a conclusion to the issue has been reached, council members Colleen LaBeau and Doug An-derson expressed concern about the price the city paid to get there. According to City Engi-neer Zach Johnson, about $8,000 to $10,000 in engi-neering fees and uncalcu-lated hours of staff time were spent pursuing the T-intersection plan. LaBeau, who had ques-tioned the plans, negotia-tions, process and costs sur-rounding 190th road plans for months, said the situ-ation has caused “a lot of agony” to property owners and developers in the area. She urged caution by the staff moving forward as multiple developments are planned. Many of the develop-

ments are proposed near 190th Street and Dodd Boulevard, just north of the high school. According to the city, seven developments are now in the planning pro-cess after years of delay (see sidebar). LaBeau said she had been confused by city staff’s direction on the intersec-tion, because the new pro-posal is “where we should have been going in the first place.” Anderson agreed, and said city officials should challenge themselves to be more deliberate in their planning processes and “re-mind ourselves of the po-tential impacts this can have on people.” He said the city should try to retain good relation-ships with developers. Public Works Director Chris Petree said city staff had been hit with numerous issues at once, including a

study showing the need for another water tower, road issues and many newly res-urrected development plans. He said further study revealed that a water tower of the size and style needed could fit on a smaller prop-erty than staff originally re-alized. “We were able to further refine the area and come into a much smaller area that allowed us to have more options with the road design,” Petree said. Council Member Bart Davis said the city came to the right conclusion in the end. “Did we maybe do a little spinning?” he said. “I think we may have. But I want to thank you guys for at least sticking at this and coming up with what is a pretty rock-solid solution.”

Laura Adelmann is at [email protected].

Lakeville is proposing a T-intersection at 190th Street and Holyoke Avenue. A water tower is proposed to be located in the shaded area. (Photo submitted)

Development plans After years of slowdowns, development is pick-ing up again in Lakeville, particularly in the cen-tral area of the city roughly between Ipava Avenue and Hamburg Avenue and between 190th Street and County Road 50. As of March 25, these are the developments planned, according to the city: • Berres Ridge: Preliminary plat of 355 single-family lots proposed by Winkler Development Co. The development is west of Hamburg Avenue, east of Highview Avenue and north of 202nd Street (County Road 50). • Chokecherry Hill 2nd Addition: Final plat of 70 single-family lots proposed by Shamrock De-velopment. The development is east of Dodd Boulevard and north of 190th Street. • Kyla Crossing: Final plat of 40 single-family lots proposed by CNC Development. The development is northeast of Kenwood Trail (County Road 50) and west of Ipava Avenue. • Legacy: Preliminary plat of 148 single-family lots proposed by D.R. Horton Inc.-Minnesota. The development is east of Holyoke Avenue and south of 195th Street. • Summerlyn 2nd Addition: Final plat of 37 single-family lots proposed by Lennar, north of 194th Street and east of Dodd Boulevard. • Summerlyn North: Preliminary plat of 62 sin-gle-family lots proposed by Shamrock Develop-ment, south of 190th Street and west of Holyoke Avenue. • Summerlyn Northwest: Sketch plan of 83 single-family lots. The project, proposed by Lennar, is east of Dodd Boulevard and south of 190th Street.

— Laura Adelmann

DEVELOPMENT PLANS

City forwards revised intersection, water tower plan Previous plan involved land acquisitions

DAKOTA COUNTY TRIBUNE March 27, 2014 3A

Trying winter leads to busy pothole season Burnsville over budget on snow removal

by John GessnerSUN THISWEEK

DAKOTA COUNTY TRIBUNE

Burnsville city crews are looking back at a try-ing winter and ahead to a busy pothole season. Snow-removal costs in 2014 are about 30 percent higher than normal for this time of year, Public Works Director Steve Al-brecht said. Crews are out patching potholes, which are caused by the freezing of water that seeps into cracks in the blacktop. Patching began about three weeks ago. “Definitely, some areas that haven’t popped in the past are already popping,” Streets Superintendent Dan Tobritzhofer said. “If that does anything, it tells me we’re going to have a busy season once again.” The snowfall total in Burnsville was 63 inches as of March 24, compared with 40 to 50 inches in a typical winter, he said. With 50 days of subze-ro temperatures, there was no thawing to help clear the snow from 237 miles of city street and 450 cul-de-sacs. “We did a lot of haul-ing snow this winter, prob-

ably more frequently than we’ve done in the past,” Tobritzhofer said. The city dumps hauled snow at sites in Cliff Fen Park and Alimagnet Park. The city had to salt the roads more frequently be-cause snowfall was spread out over the winter with fewer big storms, he said. “And the chemical doesn’t work when you’re below zero,” Tobrifhotzer said, explaining that the city uses treated salt when temperatures dip below 12 above. Snow-removal costs

in 2014 will be about $210,000 higher than in a typical year if snowfall reaches normal levels for the remainder of the sea-son and in November and December, Albrecht said. The Public Works De-partment will look for savings to absorb or re-duce the budget overage, he said. The City Council can also draw on budget reserves. This spring, motor-ists can report potholes through the Request-Tracker system on the city website (www.burnsville.

org). The citizen reports, dubbed “civics,” go di-rectly to the Streets De-partment and are more effective than phone calls, officials say. “All civics get respond-ed to,” Tobritzhofer said. The city tries to fill report-ed potholes within three working days of getting a request, its website says. The online system is “not new, but we’re trying to get more people to use it,” Albrecht said. “We’ve seen use of it really ramp up the last two or three years.” Burnsville Parkway, 150th Street and 12th Av-enue are collector roads that get frequent pothole repairs, according to the website. Crews fill the holes temporarily with a bitu-minous mix. That will continue into June, when crews will begin making permanent repairs, Albre-cht said. Information on pot-hole repair is at http://www.burnsville.org/index.aspx?nid=868.

John Gessner can be reached at 952-846-2031 or email [email protected].

Pothole patching has begun in Burnsville. This photo was taken on Grand Avenue south of County Road 42, where crews were patching on March 24. (Photo by John Gessner)

Winters, Ganfield picked as Rosemount public safety employees of the year Two Rosemount public safety personnel were hon-ored March 22 for their service to the community. The police and fire em-ployees of the year were announced at an event held by the Rosemount post of the American Le-gion.

Police For nearly 21 years, Rosemount Police Inves-tigator John Winters has provided outstanding ser-vice to the residents of Rosemount. Through his dedication and commit-ment, he has contributed to the safety of the com-munity and development of a growing department. Winters has served in many roles throughout his career including patrol officer, school resource officer, tactical officer

with the Dakota County MAAG team, use-of-force instructor, crime scene technician, field training officer and a member of the bike patrol unit. Winters’ experience and training served him and the department well in 2013 as he displayed the leadership of a vet-eran officer when the Po-lice Department experi-enced many challenges and changes. He was re-sponsible for managing a number of high priority cases, coordinating with various agencies from the local to state level, and as-sisted with the transition of personnel in the Inves-tigations Unit. Through his tenacity and assiduous work style he has gained the reputation as a reliable and seasoned investigator with other agencies.

Winters displays a deep commitment for his peers to succeed, is always will-ing to make himself avail-able, and enjoys mentoring new officers. To further department growth and development, he continues to provide quality instruc-tion in his role as a use-of-force instructor and veteran crime scene team member.

Fire Lt. Chad Ganfield is the Firefighter of the Year. He joined the department in January 2003 and was promoted to lieutenant in April 2013. He is a truck lieutenant at Fire Station No. 2, and his duties in-clude assisting the truck captain with maintenance of the engine and tools, assisting with training and management of fire

personnel, and assisting with management of fire scenes. Ganfield is also the president of the Rose-mount Firefighter’s Relief Association and recent-ly took responsibilities of representing the de-partment in the Dakota County Juvenile Firesetter Education Program. He also volunteers his time to conduct tours of fire sta-tions with local commu-nity groups, attends yearly training, participates in department fundraisers and is always willing to assist with other projects around the department. Recently, Ganfield was hired as a full-time fire-fighter at Flint Hills Re-sources.

Work resumes April 1 on County

Road 5/Highway 13 interchange Dakota County will resume construction on the County Road 5 inter-change at Highway 13 in Burnsville starting April 1. During construction, traffic on Highway 13 will be reduced to one lane in each direction, and lane width restrictions and re-duced speed limits will be in effect. Highway 13 ac-cess to and from County Road 5 will also be closed through October.

Work will include con-struction of a bridge, ramps, a loop and retain-ing and noise walls. High-way 13 will be reconstruct-ed and improvements on County Road 5 and the frontage roads will wrap up. All improvements will increase safety and im-prove traffic flow at the intersection. Construction is ex-pected to be completed by early November 2014.

To receive email up-dates for the project, email Erin Borchert at [email protected] and include “CP 05-41 Updates” in the sub-ject line. For more information about construction and road access, visit www.da-kotacounty.us and search County Road 5 inter-change or call the Trans-portation Department at 952-891-7900.

4A March 27, 2014 DAKOTA COUNTY TRIBUNE

State economy varies with school investment To the editor: Joe Nathan recently gave kudos to some local high schools for dramatic per-formances that won awards in the state one-act play festival. Teenagers who can express themselves on stage give themselves a precedent for accomplishment later in life. Likewise, as several let-ters pointed out, prekinder-garten youngsters who find they can memorize the al-phabet and learn social be-havior show above-average performance for years. In addition, they are less likely to drop out of high school and instead they complete curricula, earn diplomas and often go on to postsec-

ondary studies, regardless of income levels. Unfortunately, some op-ponents of public educa-tion may downplay the very real achievements of these young people. These op-ponents may argue against state funding for local schools, instead preferring use of local property taxes to pay for the training of our next generations. In-creased property taxes are a hardship for those on fixed or stagnant incomes. Min-nesota has suffered a de-cline in the excellence of its public schools as a result. A leading Democratic contender for Congress in the 2nd District, Mike Obermueller, has been acutely aware of these trends. As the dad of teen-agers, he’s had to contend with wavering school fund-ing and prohibitive tuition

at college. He has spoken publicly in appreciation of the work of the governor and Legislature in freezing college costs and paying off the school debt. Obermuel-ler’s priorities are those of many local residents who want to return our state to its position of pre-eminence in education on the nation-al stage. It’s not surprising that there seems to be a direct correlation between school funding and busi-ness success in our wider economy.

CATHY JOHNSONFarmington

Let’s put Minnesota firstTo the editor: Minnesota has an ex-citing opportunity to be first in the nation and win

a competitive advantage in power generation for the future. All we need is the courage to expect that Min-nesotans needs are put first. Xcel, the power compa-ny, and the Public Utilities Commission is deciding on future electricity provision this month. They have a decision between imported, and as shown this winter, potentially unreliable natu-ral gas and investing in the local Geronimo Solar proj-ect. The solar project, ac-cording to administrative law judge Eric Lipman in his review, represented the “best value for money” now and into the future. Reliable, cheap energy will be crucial to the eco-nomic development and security for any state going forward. Providing this as well as dealing with our re-sponsibility to do all we can to provide a habitable plan-et for humans should be an easy win on this project. Acting in a positive and economically beneficial way is the best investment we can make in Minnesota. Why purchase old technol-

ogy and lock us into obso-lescence when we can invest in new technology whose time has come, and reap the benefits. Solar costs have consistently been on a downward trajectory as have the batteries. Natural gas is struggling to make a profit and suffers from overstated potential. Solar is cheaper than natural gas on an official head-to-head price comparison, with-out state or utility subsidy. The future is here, let’s be the first. It makes common sense.

LOUISE HALLApple Valley

Halverson

worked to stop

warehouse tax To the editor: We wanted to take a moment to thank our lo-cal state Rep. Laurie Hal-verson for all of her work to successfully repeal the business-to-business ware-house tax before it went into effect on April 1.

Halverson realized the problems this tax would cause and got to work on this issue immediately af-ter the end of the 2013 ses-sion. She reached out to us and fellow legislators on both sides of the aisle to find ways to repeal the tax. She went directly to House leadership with us and pushed for repeal. Just the threat of this tax looming on the horizon was hurting Eagan businesses — forcing them to consider either cutting jobs or mov-ing entire facilities out of Minnesota. Halverson was key to preventing that from happening. Thanks to Halv-erson’s work, this important local industry will continue to grow and create jobs. On behalf of our busi-nesses, thank you to Rep. Halverson — it’s great to have a legislator who works to truly represent her com-munity.

RICHARD MURPHYMurphy Logistics, EaganKATHY FORRESTERStrategic Warehousing, Eagan

Letters to the editor policySun Thisweek welcomes letters to the editor. Submitted letters must be no more than 350 words. All letters must have the author’s phone number and address for verification purposes. Anonymous letters will not be accepted. Letters re-flect the opinion of the author only. Sun Thisweek reserves the right to edit all letters. Submission of a letter does not guarantee publication.

Opinion

Letters

Legislators wisely listening as students ask for equal treatment

Bullying law will improve the well-being of all children

by Joe NathanSUN THISWEEK

DAKOTA COUNTY TRIBUNE

Six high school students spoke out last week, and legislators listened. As college costs rise, families are look-ing for ways to help students be better pre-pared and earn college credits while still in high school. Richfield High School students Sam Petrov, Beisite Wang, Henry Hoang, Wen-dy Hughes, Michelle Nguyen and Cherish Kovach – most of whom have taken col-lege-level courses on both high school and college campuses – asked for something simple. They urged equal treatment when their high school grade point average is figured, regardless of where their college-level courses are taught. In a survey of 34 districts and charter leaders, I found that most agree with what the students suggest. GPA is important for scholarships. Some colleges and universities use GPAs to determine whether students are accept-ed. Unfortunately the Richfield School Board rejected students’ request to have equal weighting for college-level courses taught on a high school and college cam-pus. But Minnesota’s House Education Policy Committee heard and agreed with the students. On a bipartisan voice vote of about 10-1, legislators agreed to give districts two options: either weigh all dual-credit courses equally (above other courses) or weigh all high school cours-es equally, with no extra “weight” on students’ GPAs for taking college-level courses.

Thirty-four districts and charter school leaders responded when I asked last week about how they figured GPAs: • 17 rated all high school courses equal-ly, giving no extra weight to college-level courses. • Four gave extra weight to all dual-credit courses, whether offered at the high school or on a college campus. • Seven gave extra weight only to col-lege-level courses offered in their school and no extra weight to PSEO courses taught on a college campus. • Two weight dual-credit courses taught in the high school and will review courses taught on college campuses to determine value. • One gives some, but not as much weight to PSEO courses as to college-level courses taught in the high school. • Three do some variation of the above. Districts currently ask colleges to accept college-level courses that their high school faculty teach, including those like College in the Schools and concurrent enrollment, that don’t have nationally scored tests. Ad-vanced Placement and International Bac-calaureate do use national tests. Since high schools faculty ask college faculty to trust them, shouldn’t high school faculty trust the value of courses on college campuses? Bloomington Schools Superintendent

Les Fujitake wrote that the district weights those college level courses taught in the high school, but not PSEO courses taught on college campuses “because the district has control over staff development, cur-riculum development and the rigor of the courses (taught in the schools). The dis-trict does not have this control over PSEO courses.” Farmington Superintendent Jay Hau-gen wrote: “We currently weight AP and all concurrent enrollment courses (CIS - U of M, and Senior to Sophomore - SCSU) that are taught by FHS staff. Students enrolled in these courses have their GPA weighted with a 1.2 multiplier based on a standard 4.0 grading system. For classes at outside institutions for which we control neither the instructor, nor the content, we do not weight grades. We are not in a posi-tion to evaluate the quality of the instruc-tor nor the rigor of the course.” Tony Taschner, district communica-tions specialist at Rosemount-Apple Val-ley-Eagan schools, wrote: “All courses that are eligible for honors ranking are weight-ed equally, include all Advanced Place-ment and College in the Schools courses. Whether concurrent enrollment and PSEO courses are eligible for honors ranking is dependent on the curriculum used by the institution. When a student is accepted for a PSEO course, the school counselor and department head review the curricu-lum used by the institution to determine if the course is eligible for honors ranking. Presently, our only concurrent enrollment partnership is with Inver Hills Community College; these courses are not eligible for honors ranking in our district.” Many community and business groups

across the political spectrum supported the GPA weighting bill, House File 2049, which includes the students’ ideas. Support comes from, among other groups, Growth and Justice, Parents United, the African American Leadership Forum, Hector Gar-cia of the Chicano/Latino Affairs Council, Minnesota Association of Alternative Programs, MinnCan, Minnesota Business Partnership, Minnesota Chamber of Com-merce, and the Center for School Change, where I work. The Minnesota Association of School Administrators and the Minnesota Associ-ation of Secondary School Principals testi-fied against the bill, arguing that districts should be allowed to decide. The bill would allow districts to decide between two options – while preserving equal treatment of all college level courses. Some districts are trying to encourage stu-dents to stay in the high school classes so dollars don’t flow to the college to pay for PSEO courses. The vast majority of stu-dents are choosing courses offered in high schools. The House bill prizes both local deci-sions and equal treatment of dual credit courses. That seems like a reasonable com-promise. Richfield students and state legislators wisely are encouraging more students to take these courses and asking schools to treat them equally.

Joe Nathan, formerly a Minnesota public school teacher, administrator and PTA pres-ident, directs the Center for School Change. Reactions welcome, [email protected]. Columns reflect the opinion of the author.

by Sen. Greg ClausenSPECIAL TO SUN THISWEEK AND DAKOTA COUNTY

TRIBUNE

I would like to address concerns ex-pressed in a March 21 letter to the edi-tor regarding the Safe and Supportive Schools Act, also referred to as the bully-ing bill. The Safe and Supportive Schools Act is a result of recommendations from the 2012 Governor’s Task Force on the Pre-vention of Bullying. The 57-page report concluded that Minnesota’s 37-word an-ti-bullying law, currently deemed by the U.S. Department of Education to be one of the weakest in the nation, is too weak to effectively safeguard students in Min-nesota schools. The task force also found that the current law lacks the definition, guidance and tools schools need to keep students safe. Unfortunately there has been a great deal of confusion and misrepresentation of the Safe and Supportive Schools Act. I am not the author or co-author of the bill, but as a former educator I have pro-vided a number of amendments that I be-lieve offer clarity and will assist in imple-mentation. The definition of bullying in the bill contains similar language found in the Rosemount-Apple Valley-Eagan School District 196 policy. Bullying involves an

imbalance of power; the conduct is re-peated or forms a pattern; bullying is in-timidating, threatening, abusive or harm-ing; and there is actual physical harm to a student or a student’s property or threat of harm to person or property. Cyberbul-lying is also defined. These are standards school personnel would use to define bul-lying and that are currently used in Dis-trict 196. Bullying has decreased in District 196 schools due to the proactive responses of our School Board, superintendent and administration, principals and class-room teachers. District 196 is ahead of the curve in developing and implement-ing effective preventative policies. It will not be necessary for District 196 to do a major rewrite of the current policy or implement major additional require-ments resulting from the Safe and Sup-portive Schools Act. However, this is not the case throughout Minnesota, where many school districts have no policies or

insufficient policies in place. The writer suggests that only children from select groups would receive protec-tion from bullying under this bill. The bill is for all students, and also identifies enumerations for groups more likely to be bullied. The majority of these groups list-ed are also found in the Minnesota Hu-man Rights Act. In addition, the bill does not change current law regarding parental notification. The writer is correct in stating that the Safe and Supportive Schools Act is un-funded. District 196 is an example of a district that has implemented a bullying policy and provided staff training, with-out additional funding, that meets the major bill requirements. Districts will be required to provide in-service training to employees on a three-year cycle on what constitutes bullying and what actions should be taken when an employee observes inappropriate be-havior relating to bullying. This is similar to the current requirement that teachers be in-serviced every three years on mental health issues. One option to address fund-ing concerns is for schools to use Safe Schools Levy dollars to support imple-mentation. Letters in support of the Safe and Sup-portive Schools Act have been submitted by the Minnesota Parent Teacher As-

sociation, Association of Metro School Districts, Minnesota Elementary School Principals’ Association, Minnesota As-sociation of School Administrators and Minnesota Association of Secondary School Principals. Also submitting letter of support are Minneapolis Public Schools Superinten-dent Bernadeia Johnson, the Diversity Council (based in Rochester), Education Minnesota, the Minnesota School Social Workers Association, the Minnesota As-sociation of Charter Schools, the Univer-sity of Minnesota and the North Star Boy Scout Council. A child should never feel intimidated or harassed while trying to learn. Parents should never experience their child being tormented by bullying to the point that he or she withdraws from school, suffers from depression or takes his or her own life. The Safe and Supportive Schools Act will improve the well-being of all children. I believe that support and commitment to our kids, regardless of their background, is an important investment in the future of our community and our state.

Sen. Greg Clausen, DFL-Apple Val-ley, represents Senate District 57, which includes Apple Valley, Rosemount, Coates and portions of northeast Lakeville. Col-umns reflect the opinion of the author.

Sun Thisweek

ColumnistJoe Nathan

Guest

ColumnistSen. Greg Clausen

PUBLISHER . . . . . . . . . . . . . . . Julian AndersenPRESIDENT . . . . . . . . . . . . . Marge WinkelmanGENERAL MANAGER . . . . . . . . . . . . Mark WeberFARMINGTON EDITOR . . . . . . . . . . .Andy RogersROSEMOUNT EDITOR . . . . . . . . . . .Tad Johnson

SPORTS EDITOR . . . . . . . . . Mike ShaughnessyNEWS ASSISTANT . . . . . . . . . . . . . .Darcy OddenTHISWEEKEND . . . . . . . . . . . . . Andrew MillerSALES MANAGER . . . . . . . . . . . . . Mike Jetchick

Andy Rogers | FARMINGTON NEWS | 952-846-2027 | [email protected] Johnson | MANAGING EDITOR/ROSEMOUNT | 952-846-2033 | [email protected]

Mike Shaughnessy | SPORTS | 952-846-2030 | [email protected] Odden | CALENDARS/BRIEFS | 952-846-2034 | [email protected]

Mike Jetchick | AD SALES | 952-846-2019 | [email protected] Anderson | DIRECTOR OF NEWS | 952-392-6847 | [email protected]

15322 GALAXIE AVE., SUITE 219, APPLE VALLEY, MN 55124952-894-1111 FAX: 952-846-2010

A division of ECM Publishers, Inc.

TribuneDakota County

Correction A March 21 article about Total Wine & More’s efforts to enter the Minnesota market contained incorrect information about attorney Bill Griffith. Griffith is rep-resenting the Minnesota Licensed Beverage Association, not Total Wine & More.

DAKOTA COUNTY TRIBUNE March 27, 2014 5A

church. Luca said officials at his church support the product “since its inten-tion is to help young chil-dren learn more about the faith.” Paul Seppman and Griffin Olson, also All Saints Catholic School students, proposed start-ing an aerial photography business, leasing a rela-tive’s plane to provide the service. Other ideas included B’Tudes, a positive-mes-sage T-shirt business; Bel-la Bee’s, a beeswax candle company; and Fit Bottle Band, a band to wrap around a water bottle fit-ted with a marker for people to track their con-sumption.

All 11 companies be-fore the panel were fund-ed to some degree. Katie said the products were so good she never thought she would receive the most funding. “There were some re-ally amazing ideas,” Katie said. “They were so clev-er.” Bornhauser said the students will all register their businesses with the state, and their products will be featured for sale at the May 22 South of the River Small Business Expo from 2:30-6:30 p.m. at the Buck Hill Event Center, 15400 Buck Hill Road, Burnsville. “We’ll have about 50 businesses south of the river presenting products, and we’ll have students on the lower level doing the same thing,” Bornhauser said. “We’re real excited.” He said he’s excited to continue YEA and is seeking more involvement from the business commu-nity. Bornhauser said the business people who got involved enjoyed getting to know the students and en-couraging the next genera-tion of entrepreneurs. He said the students proved to be interested and eager to learn. “The kids were really engaged,” Bornhauser said. “Their maturity lev-els from when we started to now grew by leaps and bounds. I’m amazed at how much they’ve grown over the 20 weeks.” For more information, go to yea.lakeville.com. Laura Adelmann is at [email protected].

by Laura AdelmannSUN THISWEEK

DAKOTA COUNTY TRIBUNE

Lakeville middle-schoolers gained confi-dence, experience and capital after plunging into Minnesota’s first student version of “Shark Tank.” Dressed professionally, 18 Young Entrepreneurs Academy students pitched their business ideas to lo-cal investors in hopes of attracting dollars. Working with busi-ness mentors, the students had spent months devel-oping business plans for their ideas at YEA, a U.S. Chamber of Commerce-sponsored program that started last fall in Lakev-ille. YEA is frequently de-scribed as “Shark Tank” meets “The Apprentice,” an after-school class that brings in business leaders to help students conceive, plan, fund and open a real business. The Investor Panel Pro-gram event is a highlight of YEA. With numbers, projec-tions, plans and products in hand, the students took turns taking the stage to pitch their ideas to a group of Lakeville business peo-ple during the March 19 Investor Panel Program held at Kenwood Trail Middle School. Each panel member contributed to a $6,000 pool available to invest in the students’ businesses. Following the student presentations, investors independently completed ballots to direct the pool of funds. Katie Mills, a McGuire Middle School sixth-grad-er, attracted $1,325 for her company, Zen Pen. It was the panel’s largest award. As a result, she will rep-resent Minnesota in New York at the YEA regional competition in May; two winners there will advance to the national competi-tion in June. Katie won the inves-tors’ confidence with her brightly decorated mugs that come in a variety of designs. She can also cre-ate custom designs on re-quest. Lakeville Area School Board Chair Roz Peter-son was the event’s master of ceremonies. A success-

ful entrepreneur herself, Peterson praised Katie’s product and her proactive efforts to sell the mugs. Zen Pen mugs are al-ready being sold at Salon 500 in Burnsville. Katie said she also has orders to fill at her school, and a business in Califor-nia has expressed interest in carrying her line. (For ordering information, email Katie at [email protected].) “She’s already sold some of them,” Peterson said. “So I think the fact that she was already jump-started a little bit more than the other students helped accelerate her vis-ibility, as well as she had a pretty strong plan.” Lakeville Area Cham-ber of Commerce Presi-dent Todd Bornhauser, who spearheaded the effort to start YEA in Lakeville last fall, said the presentations were impres-sive. “They exceeded my ex-pectations,” Bornhauser said. “The students did an outstanding job. They all brought their A-plus games to their presenta-tions.” Bornhauser added that Katie’s business plan showed a good return on investment, and dur-ing her presentation “her personality really came through.” He said her passion for the business was apparent and impressed the inves-tors. Katie’s mom, Missy Mills, said she encourages her children to pursue a sport and an academic ex-tracurricular activity every year, and was happy Katie decided to join YEA. She expressed appre-ciation for the business community members who helped make the program possible, and especially noted Bornhauser’s ef-forts. “Without him, this pro-gram would not exist,” Mills said. She also credited Cen-tury Middle School teach-er Stacy Luurtsema for helping lead the class and assist Bornhauser with the program. “This is an awesome program with great op-portunities for everyone,” Mills said.

Katie Mills smiled broadly when she learned her company, Zen Pen, had drawn the most money from Lakeville business investors at a March 19 Young Entrepreneurs Academy Investor Panel Program. (Photo submitted)

Zen Pen triggers big investment YEA student Katie Mills advances to regional competition

Lakeville Area School Board Member Jim Skelly said there is a lot of discus-sion nationally about how to get businesses more in-volved with education. He praised the Lakeville busi-ness community for em-bracing YEA and being the first to implement it in Minnesota. “This is a viably dem-onstrated project,” Skelly said. “There may have been many in the com-munity who have talked about wanting something like this, but the businesses really drove the idea.” Peterson added that the program exposes Lakeville students to a broader edu-cation than is available in the middle schools. “The neat thing about this is it’s really giving a student a lifelong skill set that is not taught in a classroom today,” Peter-son said. Mills also noted the important role the busi-ness mentors played in the students’ new ventures and expressed gratitude

for Katie’s mentor, Matt Manley of Great Southern Bank. She said he gave Katie encouragement, assistance and support as she worked to develop details of her business plan. Those plan details were of prime interest to Inves-tor Panel members, who posed challenging im-promptu questions to the students after every pre-sentation. Questions addressed topics from production and insurance costs to marketing goals and sales projections. Luca Wallace, a sixth-grader at All Saints Cath-olic School, appeared well-prepared for the questions he faced. He sought funding to open his company, Choco-late Trinity, with its un-usual first product line: chocolate rosaries. Questions included whether he would donate some of his profits to char-ity (yes) and if the product would be acceptable to the

Katie Mills explains her business, Zen Pens, to investor panel member Colleen LaBeau, also a Lakeville City Council member and owner of a local real estate business. (Photo by Laura Adelmann)

All Saints Catholic School eighth-grader Paul Steppmann chats with a potential investor about G.P. Aerial, an aerial photography business he and classmate Griffin Olson created. (Photo by Laura Adelmann)

6A March 27, 2014 DAKOTA COUNTY TRIBUNE

Former Rosemount High School student part of research team that discovers cause of disease Joseph Merriman, a former Rosemount High School student studying for his PhD in microbi-ology at the University of Iowa Carver School of Medicine, is part of a research team that discovered the cause of infective endocarditis – a disease that affects 40,000 people per year and has a 50 percent mortality rate. In a research article published in “mBio,” a publication of the Amer-ican Society of Micro-biology, the culprit is a bacterial toxin produced by a common bacteria called staphylococcus aureus. The article it says, “The Centers for Disease Control and Prevention reported in 2007 that staphylococcus aureus is the most significant cause of serious infec-tious diseases in the United States.” “The serious aspect (of infective endocardi-tis) is that half the peo-ple will die, and the other half will develop stroke, because pieces of (the) colony of bacteria break off and go into the brain,” Patrick Schlievert, chair of microbiology at the UI Carver College of Medicine who led the research, said in a Fox News online story. “Peo-ple will develop left side

paralysis. A significant percentage, their heart will fail. And then some develop kidney disease and metastatic infections anywhere else. … So it’s the most serious of the staph diseases.”

Arts and crafts group forming A Farmington arts and crafts group is hold-ing an organizational meeting at 2 p.m. Friday, March 28, in the Empire Room at the Farmington Senior Center, 325 Oak St. Those interested in arts and crafts work are invited to help develop ideas for a networking group promoting shows, sales and sharing. For more information, call 651-280-6971.

Pancake breakfast Farmington Knights of Columbus will hold a pancake breakfast from 9 a.m. to noon Sunday, April 6, at Church of St. Michael, 22120 Denmark Ave. Pancakes, French toast, sausage links, and scrambled eggs will be served along with coffee, juice and water. Good-will offerings will be ac-cepted. Proceeds will go to local community needs.

Farmington Library events During its remodeling project, the Farmington Library is located in tem-porary space on the sec-ond floor of City Hall, 430 Third St. in down-town Farmington.

Hours are noon to 8 p.m. Monday and Tues-day; 10 a.m. to 5:30 p.m. Wednesday through Fri-day; 10 a.m. to 2 p.m. Saturday. Closed on Sun-day. • Farmington Library Afternoon Book Group, 12:30-1:30 p.m. Tues-day, April 1, at Dunn Bros Coffee, 20700 Chip-pendale Ave. W., Farm-ington. The group will discuss “The Guernsey Literary and Potato Peel Pie Society” by Mary Ann Shaffer. • Storytime for All Ages, 10:30-11:30 a.m. Friday, April 4. Stories and activities for mixed-ages such as child care groups and families. Ages 0-6. Call 651-438-0250 for more information.

Dakota County offers walking program Dakota County’s Sim-ple Steps Walking Pro-gram begins April 1. The free program rewards participants for making a commitment to improve their health. Register at www.da-kotacounty.us (search “Simple Steps”) or call 651-554-6100.

Job Transitions Group Catherine Byers Breet will present “Lost in Translation” at the April 1 meeting of the Easter Job Transitions Group. She will cover how to translate your strengths and skills into a target marketing plan, 30-sec-ond pitch, resume and interviewing skills that

work. The group meets at 7:30 a.m. at Easter Lu-theran Church – By the Lake, 4545 Pilot Knob Road, Eagan. Small group sessions for those who would like the opportunity to pro-cess their job loss in a safe, caring environment will be offered at 9:30 a.m. in a private setting at the church following the speaker. Call 651-452-3680 for information.

CenterPoint Energy urges customers to be on alert for potential scam Utility customers around the country are being targeted by utility bill scams and the “Green Dot” prepaid debit card scam, and CenterPoint Energy is warning cus-tomers to be alert. Posing as utility com-pany employees, scam-mers are calling custom-ers to tell them they are behind on their bills and have a short time to make a payment. The custom-ers are told to pay with their credit card or pur-chase a Green Dot pre-paid debit card or other type of reloadable debit card, load the card with money and then provide the serial number from the card to avoid having their service shut off at the meter. “We want to remind customers to report any suspicious activity to their local police de-partment, and if they fall victim, contact their bank or other financial institution(s) to report an

incident,” said Joe Vor-therms, vice president of gas operations for Cen-terPoint Energy. To avoid falling victim to any scam, CenterPoint Energy reminds custom-ers of the following: • Protecting personal and financial customer data is of utmost impor-tance to CenterPoint En-ergy. • CenterPoint Energy phone agents (whether inbound or outbound) will never personally re-quest banking or credit card information over the phone, but will instead transfer a customer to an Interactive Voice Re-sponse system to collect payment information for natural gas bills. • To verify a payment or amount due, call your utilities customer service number that is printed on your utility bill. • Credit card num-bers and any personal information should not be provided when suspi-cious. • Contact 911 and re-port suspicious activity to the local police. Report the incident to the local utility provider and the BBB. The Better Business Bureau of Min-nesota is closely tracking these types of scams and have provided an infor-mative video to help pro-tect the public.

Early farming in Dakota County “The Origin of Food – Early Farming in Dakota County 1860s-1920s,” a free educational program for families, will be of-fered 1-4 p.m. Sunday,

May 4, at Dakota City Heritage Village on the Dakota County Fair-grounds, 4008 220th St. W., Farmington. Participants will be able to watch teams of Belgian draft horses plowing fields in prepara-tion for planting corn and try their hand at milking a cow. Farm implements used in the 1860s to early 1900s will be on display. Participants will learn how staple foods – corn, wheat, soybeans – make the journey from field to table. A pork chop dinner will be available for $6. The program is spon-sored by the Dakota County Historical Soci-ety and Dakota City Her-itage Village. For more information, contact Da-kota City Heritage Vil-lage at 651-460-8050.

Relay For Life kickoff A kick-off event for Relay For Life officials and teams in Apple Val-ley, Burnsville, Eagan, Farmington, Lakeville and Rosemount will be 6:30-7:30 p.m. Thursday, April 10, at the American Cancer Society Office, 2520 Pilot Knob Road, Suite 150, Mendota Heights. Doors will open at 6 p.m. for networking with other Dakota County Relayers. Attendees will receive fundraising ideas and event updates. Supplies and registration informa-tion will be provided. Call Katy Fischgrabe at 651-255-8721 for more information.

Area Briefs

2014 Tax Guide

Look for this TAX

GUIDE each week thru

April!

DAKOTA COUNTY TRIBUNE March 27, 2014 7A

651 463 4545. .

Kent Boyum - Pastor

SUNDAY SCHOOL - 9 AMWORSHIP - 10 AMEVENING WORSHIP - 6:30 PMWED. FAMILY NIGHT - 6:30 PM

SUNDAY SCHOOL - 9 AMWORSHIP - 10 AMEVENING WORSHIP - 6:30 PMWED. FAMILY NIGHT - 6:30 PM

Kent Boyum Pastor

christianlifeag.orgchristianlifeag.org

Native plant garden workshop A free Blue Thumb workshop on creating na-tive plant gardens will be offered from 6:15-8 p.m. Thursday, April 10, at Burnsville City Hall, 100 Civic Center Parkway. Participants will learn how to build and maintain native and rain gardens that help filter storm water runoff. Design and installation assistance will be avail-able to attendees. Some residents who attend will also qualify for a $250 Blue Thumb grant through Dakota County to install their new gardens. The city of Burnsville also of-fers grants of up to $1,000 for residents with qualified water quality improvement projects. Registration is re-quired by emailing [email protected] or calling 651-480-7777. Visit www.dakotacountyswcd.org/bluethumb.html for more information.

Red Cross flood app The American Red Cross has launched its new flood app to help save lives and reduce losses from floods and flash floods. The free app gives iPhone, iPad and Android smartphone users instant access to local and real-time information, so they know what to do before,

during and after a flood. The content is available in English and Spanish based on the user’s language set-tings on their mobile de-vice. The app includes loca-tion-based, audible Na-tional Oceanic and Atmo-spheric Administration (NOAA) flood and flash flood watches and warn-ings – even if the app is closed. The app is the latest in the series of Red Cross emergency preparedness apps that put lifesaving information right in the hands of people whenever and wherever they need it. The expert advice in Red Cross apps – including apps for first aid, torna-does, hurricanes, wildfires, earthquakes and other ser-vices – has been used to help save lives during disas-ters and medical emergen-cies. Red Cross apps have been downloaded on nearly 4 million mobile devices. The new app, along with the others, can be found in the Apple App Store and the Google Play Store for Android by searching for American Red Cross or by going to redcross.org/mo-bileapps.

Burnsville Performing Arts Center begins transition to Ames Center The Burnsville Perform-ing Arts Center has official-ly begun transitioning its

name to the Ames Center. Patrons of the facility will notice the new name on the center’s website, marketing materials, email alerts and show information. The new name also means a new website URL – www.ames-center.com. The recently updated site will contain all of the same information that was available previously, and patrons will still be able to access the site using www.burnsvillepac.com for the foreseeable future. Over the next several months, passersby will also notice new signage identify-ing the facility as the Ames Center on the building and in Nicollet Commons Park. The new name signifies the ongoing partnership between the city of Burns-ville and the community’s supporters of the arts. For more information visit www.ames-center.com.

Books, volunteers needed for library sale The Friends of the Wescott Library group is looking for book dona-tions and volunteers for its upcoming spring book sale. Books can be dropped off at the information desk at Wescott Library, 1340 Wescott Road, Eagan. Book sale volunteers are needed April 27-May 4. For more information, contact Kay at 651-454-4318 or at [email protected].

Boy Scouts of America Troop 298 from Christus Victor Lutheran Church in Apple Valley toured the state Capitol and visited with Rep. Tara Mack, R-Apple Valley, and Sen. Greg Clausen, DFL-Apple Valley, on March 13. The Scouts also saw the state Supreme Court, watched Mack and Clausen in action and witnessed a demonstration by Move MN for more mass transit. Above, Mack and Scouts take a break from discussing the elimination of regulations on crossbows during archery hunts. (Photo submitted)

Troop 298 visits state Capitol

Worship DirectoryShare your weekly worship schedule or other activities with the

community. Email [email protected] or call 952-392-6875 for rates and informatilon.

8A March 27, 2014 DAKOTA COUNTY TRIBUNE

who are similar to us and to avoid those who are differ-ent. Now, imagine what an experience we would have if we were to switch this in-clination so that we gravi-tate toward those who are different. Awareness does not start in adulthood, but rather in the very first so-cial interactions children have with one another.” Kammy Kramer, Au-tism Speaks family services community liaison and mother of a Northview first-grader with autism, invited Yeh to the school in advance of Autism Aware-ness Month in April and World Autism Awareness Day on April 2. “I believe Rebecca’s message will truly resonate for (my daughter) Ada and for all her classmates,” said Kramer, who has advocat-ed for legislation regarding improving the state’s au-tism services. Yeh’s platform, “My Voice for Philip,” honors the gifts of her 22-year-old brother, who was diag-nosed when he was 4, has pervasive developmental disorder and is in the mid-dle of the autism spectrum. “Philip’s differences have made his strengths that much more visible,” she said. “He is brutally honest, trustworthy and committed to his passions, making him an incredibly unique individual.” She said her goal as a

representative of Autism Speaks is to highlight au-tism as a difference rather than a disability. “I have seen the stigma surrounding autistic in-dividuals,” Yeh said. “We often fail to recognize strengths when all we can see is the disability.” She said her brother has perfect vision, an extraor-dinary memory and the character of a saint. She also aims to com-municate that no two people with autism are the same. “Without recognizing that this misconception can apply to all people, we are guilty of treating peo-ple on the spectrum as less, not equal,” Yeh said. She said the best way to remove the stereotypes surrounding autism is to encourage those who are unfamiliar with the disor-der to interact with those who have autism. “I’ve seen the challenges Phil has and will continue to encounter in school, relationships, and in his future ability to live inde-pendently,” Yeh said. “He struggles to understand body language, humor and sometimes finds it dif-ficult to communicate his thoughts and feelings with others. In addition, his IQ is below average, setting him back intellectually from his peers and in his opportunities as a young adult.” Yeh said there is more

work to be done to detect autism in children so they can access the services they need to help manage it. She said parents need to know the early signs and symptoms. “Autism will continue to puzzle us with its idio-pathic nature and unique expression in thousands of individuals,” Yeh said. “Funding autism research, educating, and supporting individuals on the spec-trum can remove ignorance in regards to autism.” Yeh, 20, is the daughter of Tim and Kathy Yeh, of Nisswa, Minn. She recently completed her sophomore year at Ohio Northern University where she is pursuing a ca-reer as a clinical pharma-cist. She has been a self-employed violin instructor since the age of 13 and per-forms regularly as a solo-ist, as a member of a string trio, and occasionally as part of a string quartet. The Miss Minnesota Scholarship Pageant is an official preliminary to the Miss America Pageant, in which Yeh finished as fourth runner-up, won the Talent Preliminary Award and $12,000 in educational scholarships. More information about autism is at www.au-tismspeaks.org.

Email Tad Johnson at [email protected].

AUTISM, from 1A

Former Eagan child care provider gets 45 days for infant’s death A former Eagan child care provider will spend slightly more than a month in jail for the death of an infant that was the result of the provider’s un-safe sleep practices. Beverly Anne Greena-gel, 66, was sentenced to 45 days in Dakota Coun-ty Jail on March 20 after pleading guilty last De-cember to second-degree manslaughter. Three-month-old Dane Ableidinger died on Aug. 18, 2011, after Greena-gel placed him face down on a fluffy blanket on the floor of her home. The placement was in violation of safe-sleep standards required by Greenagel’s

license as a family child care provider. The infant’s official cause of death was listed as “probable posi-tion asphyxia.” Greenagel was caring for 21 children — more than allowed under her li-cense — and attempted to cover up her lack of super-vision. Dane’s death was one of 11 in Minnesota’s child care sites that year, which drew media attention and prompted tougher regu-lations and state safety laws. Since then, child care deaths fell to three last year. Greenagel’s hesitancy to accept responsibility — including expressing reser-

vations in a pre-sentencing interview about whether she was responsible — prompted prosecutors to increase her jail time from 30 days to 45 days in the plea agreement, according to a Star Tribune report. Although Greenagel’s sentence is significantly lower than the recom-mended sentencing guide-lines for the felony charge, she has agreed to several conditions, including that she will give a presenta-tion to other child care providers on every Aug. 18 for the next 10 years on the need to follow safety guidelines. — Jessica Harper

Eagan real estate agent gets ‘Cooking’ Longtime agent opens new

business, follows family path by Jessica Harper

SUN THISWEEKDAKOTA COUNTY TRIBUNE

Selling real estate is in Stephanie Cook’s blood. It’s a talent that spans genera-tions from her grandmother to her parents and uncle. So it seemed natural for Cook to follow her family tradi-tion, not only as an agent but as a small-business own-er. After spending more than a decade in the indus-try, Cook opened Cook-ing Real Estate in 2013, an Eagan-based subsidiary of the Multiple Listing Service, a nationwide free online real estate listing service. As a teen, the Eagan resi-dent helped out at a family friend’s real estate agency, but didn’t’ envision herself joining the family business. After graduating high school, she studied business and communications at the University of Minnesota. Within a few years Cook decided to follow her fam-ily’s footsteps and became a real estate mortgage con-sultant in 2001 at her par-ents’ brokerage firm in Lino Lakes. “When I was in college, I realized how passionate I was about real estate,” she said. By 2006, Cook yearned to spread her own wings and opened her own bro-kerage firm called Big Idea Homes. The business was taking off despite the economic re-cession. While others in the in-dustry saw their sales plum-met in 2008, Big Ideas saw

its best sales year, Cook said. “Sometimes it’s best to be in real estate when the market is down because those who are not serious get out,” she said. But three years later everything came to a halt when Cook left the industry to grieve the sudden death of her newborn son. That year, Big Idea Homes dis-solved. “It was a time of self-discovery,” Cook said. For the next three years, Cook tried her hand at the restaurant industry as a corporate trainer for Crave Corp. But by 2012, she was again feeling the real estate industry’s pull and joined MLS. “I really loved it and missed the feeling of pur-pose in my career,” Cook said. “The most rewarding thing is helping people fol-low their dreams.” One year later, Cook, a licensed real estate agent, approached the company about creating a subsidiary in Eagan. The company jumped on the idea. While MLS provides list-ings and search tools, Cook-ing Real Estate provides real estate services for buyers and sellers. Starting a new business after being back in the in-dustry a short time wasn’t easy. “Getting back into con-tact with people and letting people what we were doing was hard in the beginning,” Cook said. The greatest challenge,

she said, is to stay on top of ever-changing technology. However, this same technol-ogy has provided an advan-tage as well, Cook said. By operating a subsid-iary of MLS, Cook has direct access to its many tools such as innovative real estate apps, which she said gives her a competitive edge over other agents. Still in its first year, Cooking Real Estate has grown exponentially on re-ferrals and word-of-mouth alone. Today the company is among MLS’ top two sub-sidiaries in terms of sales. Cook credits her success to the sales team’s pressure-free sales tactics and willing-ness to be available 24 hours a day, seven days a week. “We try to be one step ahead of everyone else, but we are also not pushy sales-people,” Cook said. “We would never want to put someone in a house they don’t want.” To date Cooking Real Estate has four employees, but as the company grows, Cook said she hopes to add seven more agents with each specializing in different ar-eas of real estate. As she plans for the years to come, Cook said she hopes to continue to in-crease sales, while keeping standards high. “Most importantly, I want to make sure 100 per-cent of my clients are taken care of and their needs are met,” she said.

Jessica Harper is at [email protected] or facebook.com/sunthisweek.

DAKOTA COUNTY TRIBUNE March 27, 2014 9A

Sports

Sports Briefs

Farmington team wins state The Farmington Hock-ey Association’s Under-12 B girls team ended a 49-1-1 season by defeating Wayzata 3-0 in the cham-pionship game of the state tournament the weekend of March 14-16 in Maple Grove. It is the Farming-ton association’s first state championship. Farmington defeated North Shore 5-1 and Wa-conia 1-0 in earlier rounds of the tournament. Players include Ava Patnode, Abby Bollig, Bethany Lukaseczk, Bai-ley Zimmer, Izzy Zwart, Halley Weinberger, Olivia Dahl, Natalie Roehrich, Josie Laube, Maddie Ton-sager, Alex Walsh, Grace Auge, Bailey Kelley, Kai-tlyn Abraham, Angelina Lind, Cassie Knutson, Jenna Gerold and Emma Frost. Nick Gerold is head coach and Amy Madden, Eric Kelley, Andy Zim-mer, Bob Dahl and Jeff Weinberger are assistant coaches.

Notebook: SSC teams have winter to remember by Mike Shaughnessy

SUN THISWEEKDAKOTA COUNTY TRIBUNE

The state basketball championships Lakeville North’s boys and East-view’s girls won in the last couple of weeks capped the best sports season in the South Suburban Con-ference’s brief history. The league, which be-gan operation in the sum-mer of 2010, just claimed winter state champion-ships in wrestling (Apple Valley), boys and girls basketball, and both di-visions of dance team (Eastview won the Class 3A high kick and jazz ti-tles). In two sports, two South Suburban schools battled each other for state championships. Apple Valley defeated Prior Lake for the Class 3A wrestling champion-ship and Eastview beat Bloomington Kennedy for the Class 4A girls bas-ketball title. Beyond that, the con-ference had the second- and third-place finishers in Class AA boys hockey (Lakeville North and Ea-gan), the third-place fin-isher in Class AA girls hockey (Lakeville North), the fourth-place team in Class 4A girls basketball (Lakeville North), two teams in the state Class AA gymnastics meet (Rosemount and Lakev-ille North, which fin-ished fourth and sixth), a sixth-place team in girls Alpine skiing (Lakeville North), two of the top seven teams in girls Nor-dic skiing (Burnsville and Eastview) and the fourth-

place boys Nordic skiing team (Eagan). Two boys basketball players from the confer-ence were finalists for the Mr. Basketball award – Apple Valley’s Tyus Jones

(who won the award) and Lakeville North’s J.P. Macura. Seven wrestlers from SSC schools won individual championships at the state tournament; two more were won by

wrestlers from Shakopee, which will join the confer-ence this fall. Burnsville’s Vivian Hett was girls state Nordic skiing runner-up for the second consecu-tive year. Rosemount div-er Daniel Monaghan was state champion for the second straight year and Lakeville South senior Mitch Herrera won two distance freestyle races at the state swimming meet. That came on the heels of a strong fall season for South Suburban teams. Eagan won the Class 3A volleyball champion-ship and three other SSC teams (Rosemount foot-ball, Eastview boys soc-cer and Lakeville North girls soccer) were state runners-up. SSC schools also had a strong presence in adapt-ed sports. Dakota United, which includes Apple Val-ley, Eagan, Eastview and Rosemount, and Burns-ville/Farmington/Lakev-ille were second-place fin-ishers in the recent floor hockey tourney. The conference might become even more com-petitive in the 2014-15 school year. Bloomington Jefferson and Blooming-ton Kennedy, two of the league’s three smallest high schools, are depart-ing for the Metro West Conference. They will be replaced by Farmington and Shakopee, which are among the state’s 25 larg-est schools. For years, the Lake Conference has been known as the state’s stron-gest conference in ath-letics. But it’s clear that the upstart league to the

south has closed the gap.

Basketball

all-stars Apple Valley’s Den-nis Austin and Eagan’s Michael Gorder will play in the Minnesota High School All-Star Basketball Series this weekend. Austin will play the Blue team, which will be coached by Chisholm’s Bob McDonald, who is retiring after 59 years and 1,012 victories, a state re-cord. Gorder will play for the Gold squad. The four-team all-star tourney will begin at 7 p.m. Friday at St. Cloud State University and conclude Saturday with games at 2:15 and 4 p.m. at Macal-ester College in St. Paul. Apple Valley guard Tyus Jones will not play in the series. He is sched-uled to leave Friday for the McDonald’s All-American Game, which will be Wednesday, April 2, in Chicago. Lakeville North’s J.P. Macura, the star of the state Class 4A tournament, also will not play in the Minnesota all-star series.

Great 8 tourney A number of local play-ers participated last week-end in the Ted Brill Great 8 Festival, the annual high school all-star hockey tournament held at Wako-ta Arena in South St. Paul. Goalie Will Dupont and forwards Connor Hyden and Tristen Ha-zlett of Lakeville North played for the Section 1 team, which had Lakev-ille North’s Trent Eigner as one of its coaches. Also

playing for Section 1 were defenseman Andrew Byers and forward Patrick Lau-derdale of Lakeville South and Farmington defense-man Alex Aubrecht. Burnsville forwards Cole Borchardt, Dylan Weigel and Petr Havluj played for the Section 2 team. The Section 3 squad included Apple Valley defenseman Tyler Heuer, Eagan defenseman Tay-lor Karel, Eagan forward Jack Jenson, and Eastview forwards Mitchell Cerra-to, Jake McGlocklin and John Snodgrass. The Section 8 team won the tournament, with a 5-1 victory over Section 4 in the championship game Sunday afternoon. The Section 1 and Section 3 teams both went 1-2 in the tournament, while Section 2 went 0-3.

Clean sweep

for awards With Tyus Jones recent-ly being named 2014 Mr. Basketball, Apple Valley High School athletic direc-tor Pete Buesgens pointed out that his school is the first to have students who have won the player of the year awards in boys and girls basketball, and boys and girls hockey. Carol Ann Shudlick won Ms. Basketball in 1990 and her sister Linda won the same award in 1995. Annamarie Holmes was Ms. Hockey in 1997 and David Fischer was Mr. Hockey in 2006. Email Mike Shaughnessy at [email protected].

Abby Nelson helped Rosemount finish fourth in the state Class AA gymnastics meet. (Photo by Mike Shaughnessy)

Eastview’s Hana Metoxen drives past a Bloomington Kennedy player during the state high school Class 4A girls basketball championship game. (Photo by Mike Shaughnessy)

Lightning works hard for the trophyEastview grinds out 3 victories at state for school’s first girls hoops title

by Mike ShaughnessySUN THISWEEK

DAKOTA COUNTY TRIBUNE

Eastview isn’t the tallest team in the state. It might not even be the most tal-ented. But when it comes to determination, the Lightning appears to have few if any peers. At the state girls bas-ketball tournament last week Eastview faced three teams that were not intim-idated by its No. 1 seed, No. 1 state ranking or 28-1 record. Those opponents – St. Paul Central, Eden Prairie and Bloomington Kennedy – came equipped to give the Lightning a bat-tle, and winning all three games made the school’s first state title in the sport all the more satisfying for Eastview’s players. “It’s not really fun to come in and beat some-body by 20,” Eastview senior Kari Opatz said following her team’s 64-61 victory over Blooming-

ton Kennedy in the Class 4A final Saturday night at Williams Arena. “We knew it wasn’t going to be easy. All the teams we played were really good. It’s great to win games like this and know we did it as a team.” One of the biggest rea-sons for Eastview’s success is “these kids have never quit, ever,” coach Melissa Guebert said. And they weren’t about to start Saturday night. For 35 minutes of the Class 4A champion-ship game the Lightning struggled to catch up with Bloomington Kennedy. In the 36th minute, Eastview caught and passed the Ea-gles. Junior guard Madi-son Guebert banked in a shot with 48 seconds left to give Eastview its first lead. It also proved to be the game-winning basket. Bloomington Kennedy, Eastview’s South Subur-ban Conference rival, led

by 12 points with 7:03 re-maining and was up 61-54 with 2:30 to play. “It was very possible to come back from that, and we knew we had it in us,” Madison Guebert said. “We were all very composed,” Opatz said. “When we did lose to Ken-nedy (during the regular season), we got frazzled a bit. We knew if we stayed composed and relaxed, we’d be able to play our game.” Eastview (31-1) scored the final 10 points of the game, with several Lightning players making huge plays. Senior for-ward Emee Udo had four points, two rebounds and a steal down the stretch. After Hana Metoxen made two free throws to bring the Lightning within one point at 61-60, Erika Schlosser got her hand on the Kennedy inbounds pass, causing the Eagles’ Tonoia Wade to lose the

ball out of bounds. The Lightning then got it to Madison Guebert, who scored to give Eastview its first lead. Opatz added two free throws for her team’s final points. Kennedy was held to 24 points in the second half and was shut out over the final 2:30. Kenisha Bell, Kennedy’s Marquette-bound senior guard, had 24 points but only six after halftime. “We always know when we lock down on defense the offense will come,” Metoxen said. “That’s been a big focus for us.” In addition to Madison Guebert’s game-high 29 points, Opatz had 13 and Metoxen finished with 11. The Lightning had some shots swatted away by Kennedy defenders early in the game, but con-tinuing to attack the bas-ket was key to the second-half rally.

College roundup: Local players on display at NCAA regionalMen’s hockey

tourney Saturday, Sunday at Xcel Energy Center

by Mike ShaughnessySUN THISWEEK

DAKOTA COUNTY TRIBUNE

Plenty of Minnesota-born players will be on display at the NCAA West Regional men’s hockey tournament this weekend at Xcel Energy Center. Minnesota, the host team and No. 1 overall seed, will play Robert Morris in a semifinal game at 4:30 p.m. Saturday, with St. Cloud State and Notre Dame meeting in the other semifinal at 8. The winners play at 6:30 p.m. Sunday for a spot in the NCAA Frozen Four, scheduled for April 10-12 in Philadelphia. Hudson Fasching of Burnsville, a former Apple Valley High School player, is tied for fourth in scor-ing for Minnesota with 28 points (12 goals, 16 assists). Former Lakev-ille South player Justin

Kloos has 27 points on 12 goals and 15 assists. De-fenseman Brady Skjei of Lakeville, a former Lakev-ille North player, has six goals and five assists for 11 points. Apple Valley High School graduate A.J. Mi-chaelson has three points (one goal, two assists) in 14 games. Minnesota won the in-augural Big Ten Confer-ence regular-season cham-pionship but lost to Ohio State in the semifinals of the conference tourna-ment last weekend. St. Cloud State has 11 native Minnesotans on its roster including former Lakeville North player Charlie Lindgren, the Huskies’ backup goalie. Notre Dame forward Mario Lucia is the son of Minnesota head coach Don Lucia. Robert Morris has no native Minnesotans on its roster.

Wolfe breaks in Eagan native Megan Wolfe completed her first season with the University of Minnesota women’s

hockey team, scoring 16 points (three goals, 13 assists) in 40 games and earning a plus-27 rating. The Gophers finished 38-2-1 and were stopped just short of a third con-secutive national champi-onship when they lost to Clarkson 5-4 in the Wom-en’s Frozen Four final.

Milestone

for Moulton Former Eagan High School pitching standout Sara Moulton now has put herself into the University of Minnesota softball re-cord book. When the se-nior pitched a shutout as the Gophers beat South Carolina 1-0 on March 19 she became the first pitch-er in school history with 100 career victories. Moulton’s 44 shutouts also are a school record. The Gophers were 24-4 overall after splitting a doubleheader against Ne-braska on Sunday. Bree Blanchette, also an Eagan High graduate, is the Gophers’ starting center fielder and is bat-

ting .250. Paige Palkovich, a sophomore from Apple Valley who played high school ball at Eastview, is a utility player for Minne-sota. Moulton’s pitching sparked Eagan to the state high school Class 3A softball championship in 2008. The Gophers are sched-uled to play Michigan State in a Big Ten Confer-ence series at home this weekend – weather per-mitting, of course.

MIAC hockey

awards Several former Burns-ville High School play-ers received postseason hockey awards from the Minnesota Intercollegiate Athletic Conference. Adam Smyth, a se-nior forward at Gustavus Adolphus, was named first-team All-MIAC, as did Nick Senta, a junior defenseman for St. John’s. It was Smyth’s second All-MIAC award. Another BHS graduate, Gustavus junior forward

Andy Pearson, was named to the conference’s All-Sportsmanship team. Also named first-team All-MIAC were St. John’s junior forward John Haeg, a Lakeville native who played high school hockey at Holy Angels, and Gus-tavus sophomore goalie John McLean, an Eagan native who previously played at Minnehaha Academy.

Academic honor

for Albers Eagan native and Uni-versity of New Hampshire soccer player A.J. Albers made the America East honor roll for fall 2013. New Hampshire had 114 student-athletes on the fall honor roll, the most of any America East school. Twenty of the 30 men’s soccer players earned the award, which goes to student who have a grade-point average of 3.0 or higher.

Email Mike Shaughnessy at [email protected].

10A March 27, 2014 DAKOTA COUNTY TRIBUNE

ers have begun moving their plants and gardens to Da-kota County Fairgrounds in Farmington. Since 2001, Dakota County master gardeners have been tending a six-acre plot in UMore Park. They have more than 25 differ-ent gardens growing there. Those gardens include a rose garden, bird garden, blue-berry garden, sustainable gardens, peonies and veg-etables. The master garden-ers have been experimenting with different varieties and using the gardens as a tool to educate the public on the types of plants that can grow in Minnesota. But when the Univer-sity of Minnesota was look-ing for money-generating ideas at UMore Park, they opened up the area across the road from the gardens for gravel mining. Corinne Johnson, a Da-kota County master garden-er from Apple Valley, said the increased traffic was not ideal for the gardens, which often hold public education-al events where thousands of people visit throughout the year. So the master gardeners started looking for another area to plant their gardens. The Dakota County Fairgrounds had often been discussed as an ideal spot