Data Governance: Choice or Necessity?

-

Upload

preston-gregg -

Category

Business

-

view

137 -

download

0

Transcript of Data Governance: Choice or Necessity?

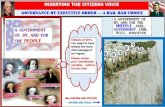

IS EFFECTIVE DATA GOVERNANCE A CHOICE OR A NECESSITY IN FINANCIAL SERVICES TODAY?

ENTITY WHITE PAPER

ENTITY WHITE PAPER IS EFFECTIVE DATA GOVERNANCE A CHOICE OR A NECESSITY IN FINANCIAL SERVICES TODAY?

INTRODUCTIONThe global banking industry is experiencing a period of uncompromising change that will permanently alter its shape, its ways of doing business, its winners and its losers.

“Flowing complete, accurate, timely data to the people and processes that need it is the lifeblood of a modern organisation.”

Ambuj Goyal, IBM

Data Governance is the activity of co-ordinating people, processes and systems to ensure that the information that powers an enterprise is accurate and trustworthy.

COST OF COMPLEXITY WITHIN BANKING SYSTEMS

While the banking industry was one of the first to adopt the concepts of Enterprise Data Management, there is still a lot to do; effective Data Governance is a moving target and is still a distant dream for the vast majority of enterprises.

In the last decade, the finance industry has witnessed constant mergers and acquisitions as the market has consolidated. This adds to an already complex system architecture map for most of these large organisations. Numerous legacy systems, a proliferation of product centric silos and duplicated data results in costly manual intervention and a loss of control. The integration of multiple systems over time has led to business rigidity rather than flexibility. In 2011, IBM’s Institute for Business Value estimated the cost of complexity for global banks to be $200bn.

REGULATORY REFORM

The 2008 financial crisis triggered an ongoing period of global and national regulatory reform. Banks are subject to a bewildering array of regulation including AML, KYC, SAMA, BASELII and Dodds-Frank and are fined huge sums for non-compliance. According to the 2012 Ernst and Young survey, “Progress in Financial Services Risk Management”, the scope, timing and potential impact of regulatory reform was the top challenge noted by almost 75% of respondents.

Regulatory reform necessitates making risk “everyone’s business”. Modern Banking is both “data driven” and “data dependent”. It logically follows therefore that the effective management of the data in the enterprise should be everyone’s business. To truly make it so and by treating data as an “Enterprise Asset” requires an effective Data Governance programme.

Regulation relating to capital requirements in banking groups (also known as regulatory capital or capital adequacy) will also create ripples along the information management supply chain. Investment banking operations are being ring-fenced, and regulators require that these operations report risk both independently and at group level. This will strain banking systems’ architecture, integration, data quality and Data Governance processes.

Failure to provide regulators with the information they require, in the format they require, when they ask for it, adds reputational risk to the plethora of risks already facing a modern bank.

2

IS EFFECTIVE DATA GOVERNANCE A CHOICE OR A NECESSITY IN FINANCIAL SERVICES TODAY?

Compliance is largely a costly and painful activity whose prize is the right to operate. From a data management perspective, however, its side effects are hugely beneficial as trusted, quality data that is available and usable in an appropriate form, at the point of need, has major advantages. These benefits can be felt in all business functions, whether retail banking, commercial banking, finance, risk, or marketing.

CUSTOMER CENTRICITY

Historically, the banking business model was built in product centric silos and paid no heed to a holistic view of the customer relationship. Today, however, customers expect banks to offer them the right products, at the right price, when they need them (e.g. at important milestones in their lives), and wherever they choose to buy them. All channels, whether at the branch, through customer service, online, or via mobile banking, should be incorporated. This requires trustworthy, relevant, consistent and timely information about customers. An enterprise level single view of customer data, spanning all aspects of the customer relationship and including household and social data, is fundamental, to be able to offer the right product combination, in real time, and to maximise cross-sell and up-sell opportunities.

Social media is changing the manner in which a bank communicates with many of its customers. It provides the opportunity for retail banks to communicate with, listen to, and build strong relationships with its customers. This improved interaction, however, will also heighten customer expectations. Not only do customers want 24/7 banking from an organisation that understands their particular circumstances but they also want immediate answers to their key financial questions, and they will gravitate towards organisations that can provide them. This will continue to fuel further rapid change in the industry. To capitalise on the opportunities presented by social media, banks will need to include Big Data in their Information Management and Data Governance strategies.

In a tough, mature market, with significant regulatory constraints, growth is reliant on nurturing the right relationships with the right customers.

INFORMATION SECURITY & PRIVACY

Research conducted by the Economic Intelligence Unit has identified that IT Security is high on banks’ list of priorities; this is understandable given the reputational risk associated with security breaches and data theft. With data managed across a complex network of internal and third-party systems, almost 90% of respondents in this report stated that failures have severe consequences for compliance.

Furthermore, protecting personal data and preventing fraud is the minimum that customers expect from financial organisations. The cost of getting these wrong is high in terms of fines, loss of business and damage to the brand.

Effective management of each of the above issues is essential for banks to achieve compliance and to retain and build competitive edge in this new era of banking. Transparent data for regulatory reporting, customer centricity to increase uptake of personalised financial products, trustworthy management reporting, and an enterprise view of risk and liquidity are the pillars on which this competitive edge can be built.

The drivers for accurate and governed information at an enterprise level dominate today’s banking industry. Right now, effective Data Governance within banking is not a choice, but a necessity.

IS EFFECTIVE DATA GOVERNANCE A CHOICE OR A NECESSITY IN FINANCIAL SERVICES TODAY? ENTITY WHITE PAPER

3

MANAGEMENT SOLUTIONS

WHAT IS DATA GOVERNANCE?

Data Governance is the activity of co-ordinating people, processes and systems to ensure that the information that powers an enterprise is accurate and trustworthy.

All enterprises rely on information from many sources, both internal and external, to feed critical business processes. Data Governance, if implemented effectively, can enable better decision making, reduced risk, regulatory and legal compliance, enhanced sales, enhanced customer satisfaction, business efficiency and reduced operational cost. Effective Data Governance plays a pivotal role in deriving value from the data the drives the organisation.

WHY DO DATA GOVERNANCE PROGRAMMES SUCCEED OR FAIL?

The probability of the success, or indeed the failure, of Data Governance programmes increases due to a number of factors.

LACK OF AN IDENTIFIED BUSINESS PROBLEM

A number of Data Governance initiatives fail because organisations implement them focusing purely on Data Quality without considering the context and scope of the business problem. Data Governance is too often implemented for the sake of Data Governance.

Without a compelling strategic business driver that C-Level decision makers are aware of and care deeply about, the likelihood of obtaining Executive Sponsorship for a Data Governance programme is low. Furthermore, if the programme commences without clear definition of its objectives, board level backing will be finite as other, better specified projects compete for important resources; the programme will only progress if there are measurable and incremental results against strategic business drivers.

It is therefore important to understand and define the specific business problems that a successful Data Governance initiative will address.

In the main, in the banking industry, C-Level concerns relate to regulatory compliance, risk management, revenue generation, operational efficiency, decreased cost, customer loyalty, customer service and improved decision making.

A specific business need might be to improve the identification of credit risk with respect to organisations with complex global ownership structures. In our experience, the foundation of this is rooted in data quality, master data management, hierarchy management and data governance principles. These contribute to customer onboarding and ongoing customer risk management processes.

Alternatively, timely and accurate regulatory reporting is predicated on the ability to aggregate data in a consistent and meaningful form across many business units and geographies.

Defining the business problems specify “WHY” an organisation is tackling Data Governance and what outcomes are expected. Individual Data Governance initiatives should align to business objectives – data quality processes, data stewardship, the technology utilised - all relate to “HOW” you get there.

If an organisation allows process and technology to shape business decisions rather than the business priorities driving technology and process, then the business benefits hoped for from the Data Governance initiative will never be reached.

Conversely as a Data Governance programme incrementally tackles the identified business problems, it gains support from the business functions and momentum to extend its scope to additional areas.

4

MANAGEMENT SOLUTIONS

ENTITY WHITE PAPER IS EFFECTIVE DATA GOVERNANCE A CHOICE OR A NECESSITY IN FINANCIAL SERVICES TODAY?

OBTAIN EXECUTIVE SPONSORSHIP

A passionate belief that data is the lifeblood of a modern organisation is essential at a very senior level if a Data Governance initiative is to be successful.

Somebody at the top must own and care deeply about Data Governance and expect significant return on investment through its eventual implementation across the organisation. In order for Data Governance initiatives to be successful they require cross departmental thinking and organisational change and therefore need C-Level buy-in and leadership.

Effective sponsorship at the right level in the business increases the probability of success with the Data Governance initiative. Executive level sponsors are more likely to fund projects that align with the strategic objectives for the organisation.

In a banking context, one would expect the newly required (according to Dodds-Frank) Chief Risk Officer to be an Executive-Level sponsor, given the impact that accurate data has on the effective assessment of enterprise-wide risk. Support should also be forthcoming from other C-Level Executives including finance, marketing, customer service, retail banking, corporate banking and compliance, as each function is dependent on data to perform effectively.

Effective sponsorship, however, requires a lot more than being an advocate for Data Governance and securing its funding. Effective sponsorship requires passionate leadership with a vision for business change, that the project is funded, and that you make those responsible for implementation accountable for realising the business benefits outlined in the business case. This awareness of accountability at the early stages of the Data Governance programme increases the probability of a successful implementation.

BUSINESS CASE

Executive-level sponsorship is more likely if the initiative is reinforced by a strong business case, with quantified Return-on-Investment.

Executives must allocate resources to competing projects, and those with clearly identified benefits and value have more chance of moving forward. Furthermore, those projects without a clear business case are more likely to be cancelled or to be perceived as failures, simply because quantifiable business outcomes were not defined for the project at the outset.

As with Master Data Management, Data Governance is an enabler of future value and its benefits can be realised across multiple business functions simultaneously, for example, finance, customer service, risk management and marketing. Example business cases might be expressed in terms of customer satisfaction, cross sell, up sell, operational efficiency, improvements to strategic decision making, or regulatory compliance.

In the current post-recessionary climate, projects that progress also tend to be those whose value can be derived as a series of deliverables staged over time. ‘Big Bang’ initiatives where all the value is at the end of a multi-year programme have proven to fail all too often and therefore don’t even get off the starting blocks in the current climate.

It is important to document, agree and continually measure the value of each business benefit, and when that value will be delivered.

CONDUCT A MATURITY ASSESSMENT

Before any Data Governance programme is initiated, you must first understand the maturity of the organisation in terms of existing policies, practices and processes. An assessment must also be made as to the desired/attainable future state (which may not be the perfect end state) but represents a sensible vision for Data Governance. This high level Data Governance Maturity

5

MANAGEMENT SOLUTIONS

IS EFFECTIVE DATA GOVERNANCE A CHOICE OR A NECESSITY IN FINANCIAL SERVICES TODAY? ENTITY WHITE PAPER

Assessment will lead to recommendations in order to achieve a desired future state, and these recommendations will need to be prioritised as part of a Data Governance roadmap. The programme should deliver value incrementally and ultimately lead to Data Governance maturity across the entire organisation. Data Governance should become part of the DNA of the organisation and not a separate function.

Failure to understand the gap between as is and to be and failure to measure processes and progress will inevitably lead to programme failure. Most organisations have an idea that they are not where they want to be, but not where that is or where they are. They never understand how to get there.

It is important that all of the stakeholders across business units are involved in the assessment; ideally from business functions that will be improved by Data Governance, identified when defining the business problem.

A Maturity Assessment should not be a one-off event. It should be conducted at regular intervals, to measure progress along the Data Governance Maturity Curve for the data relevant to the particular business issue being solved.

The results of a Maturity Assessment should be documented and presented to senior decision makers, outlining next steps and priorities key to the success of the Data Governance programme. This helps to ensure continued buy-in and sponsorship.

BUILD A ROADMAP

Rolling out an effective Data Governance framework and discipline across a complex organisation is not simple, cannot be done overnight, requires buy in from multiple stakeholders and involvement from teams across the entire business. For these reasons, it is impossible to undertake a big bang approach to programme execution. Also, Executive Sponsorship tends to be predicated on successful delivery on an incremental basis and wanes rapidly if this is not forthcoming.

The business problems to be solved, together with the Maturity Assessment, allow the identification of a reference architecture to support the strategic aims of the business. A series of smaller, prioritised by business case, more tactical projects can then be defined within the confines of an enterprise programme that deliver the strategy but in incremental units.

These early wins facilitate continued Executive Level sponsorship as success and measurable Return-on-Investment give confidence that resources are being allocated appropriately.

The roadmap should highlight the types and timings of Data Governance projects that deliver value on an incremental basis. Each project should stand to win its right to resources based on the strength of its individual business case within the programme structure. Key stakeholders should agree and understand which data domains will be governed (meta data, reference data, master data (customer, account, product, etc)) and how implementing policies and processes around them will impact and contribute value to the business.

Drawing up a heatmap presenting a two dimensional matrix of all of the ‘information pains‘ identified during the Maturity Assessment, with business value on one axis and investment on the other, provides an objective mechanism to prioritise implementation. It is an effective mechanism to derive and manage the programme roadmap over a period of time.

The Maturity Assessment enables Executive Level management to visualise the data maturity of key factors including data quality, data security, data auditability, data consistency, data accessibility and data availability across the organisation. Together with the heatmap, it enables the organisation to create the optimum roadmap for tackling projects incrementally with a view to deriving maximum business benefit as soon as possible.6

MANAGEMENT SOLUTIONS

ENTITY WHITE PAPER IS EFFECTIVE DATA GOVERNANCE A CHOICE OR A NECESSITY IN FINANCIAL SERVICES TODAY?

Prioritising the delivery of these Data Governance initiatives, taking into account the practical

considerations of resourcing service delivery, is not straight forward but leads to effective

planning and management and therefore minimises the costs and timescales of implementation.

The roadmap should also include, if it is not already in place, the creation of a Data

Governance Council, which will be made up of those key decision makers whose business

functions are affected by a lack of properly governed data. Within banks, depending on

the business problem, C-Level Executives from risk management, compliance, finance, retail

banking, corporate banking, customer service and marketing should consider participation.

Any initial and periodic successes should be communicated widely across the organisation

(as part of a structured communications plan) as this will facilitate the further adoption of

Data Governance across the enterprise.

CONCLUSION

This paper has sought to highlight some the pressures facing the financial community in

terms of compliance, security, privacy, customer service, market consolidation and business

centricity. These are recognised as many of the major threats and opportunities in the

financial world today.

We have sought to highlight that in each case, the management of these threats and

opportunities is exclusively down to the effective management and control of the data within

the enterprise as an asset of that Enterprise. Data truly is the lifeblood of a modern organisation!

For a financial organisation wishing to survive the pressures currently facing it and needing

to enhance its competitiveness and agility, it is safe to say that effective Data Governance

holds all of the cards. Effective Data Governance is not a choice, it is a necessity.

Having drawn this conclusion, however, the world is littered with failed, stalled or

ineffective Data Governance programmes that do not deliver value. This is largely because

the value and complexity of a change programme that touches the entire organisation is

not properly understood at the outset.

Success is achieved through hard work and a strong enterprise level programme, a

structured, iterative and agile approach with strong leadership and management, an

operating group, operating model, reference architecture, data architecture, data

management, data quality, data assurance, metrics and measures. Nobody said it would be

easy, but the benefits to a modern financial services organisation are immense.

Effective Data Governance is truly the key to business success in the 21st Century.

ABOUT ENTITY GROUP

Entity Group is an information management solutions specialist. Entity provides

independent consultancy, software solutions and services that exploit the value

of information and deliver competitive advantage to large scale clients across the

information management lifecycle; its services range from an information management

strategic review, through to analysis and implementation services for Big Data, data

modelling, information integration, master data management and analytics.

Entity provides information management services across the finance and insurance,

pharmaceutical, automotive, media and utilities industries.

Entity is committed to long term collaboration with our clients and partners, most of

whom continue to work with us over many years and multiple projects. In addition to

working directly with end-user organisations, Entity’s bespoke data management and

domain expertise often sees the company called in to solve unusual or highly-challenging

business data issues on behalf of global IT services companies and software vendors.7

MANAGEMENT SOLUTIONS

IS EFFECTIVE DATA GOVERNANCE A CHOICE OR A NECESSITY IN FINANCIAL SERVICES TODAY? ENTITY WHITE PAPER

For more information please contact:

General Manager, Entity Group North AmericaPreston Gregg