Darwis Abd Rasak, Mohd Azhar Abdul Karim

Transcript of Darwis Abd Rasak, Mohd Azhar Abdul Karim

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 1/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

Development of Islamic Finance in Malaysia: A Conceptual Paper

Darwis Abd Razak School of Management, Universiti Sains Malaysia

11800, Penang, Malaysia

Tel: 04 6533888 Fax: 04 6577448

Email: [email protected]

Mohd Azhar Abdul Karim, PhD Faculty Business and Economics

Universiti Putra Malaysia

43400, Serdang, Selangor

Abstract

Islamic finance has made significant inroads in the international financial markets that have

achieved growing global awareness. Islamic finance now has a presence in over 60 countries,

especially in Muslim countries. In the context of financial infrastructure, the Malaysian Islamic

financial system is both robust and fast growing. The market has highly diversified players, with

Islamic banks, investment banks, takaful companies, development financial institutions, savings

institutions, fund management companies, stock brokers and unit trusts. The aim of this paper is

provide a conceptual understanding on the growth in Islamic Finance in Malaysia by exploring

its current and future development. It is observed that the participation in the Islamic finance

process would require the development of a comprehensive and well established Islamic

financial system such as: - a wide range of products and services; a good legal system, adequate

financial infrastructure with competitive tax structures, low cost of doing business, high

standards of business ethics, and conducive living conditions and cultural offerings. It would also

need to be supported by adequate human talents that would drive the business and spur

innovation. In addition, a strong regulatory regime in the Islamic financial system would be

October 18-19th, 2008Florence, Italy

1

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 2/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

another pull factor. The implication of this paper is to provide a platform for industry players and

regulators to highlights the recent developments in Islamic finance in Malaysia.

Key words: Development, Islamic Finance, Malaysia

October 18-19th, 2008Florence, Italy

2

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 3/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

1.0 Introduction

The Islamic finance industry is now in its fourth decade and, during that period, has developed

extremely rapidly. In the past few years, overall market growth has been estimated at between

15-20 percent annually although individual Islamic banks have reported even faster growth

(Howard, 2008). According to Bank Negara Malaysia (the Malaysian central bank), the number

of Islamic bank branches in Malaysia increased from 126 in 2004 to 766 in 2005. Elsewhere,

new Islamic financial institutions (IFIs) are being established rapidly in the industry’s

traditional markets in the Gulf Co-operation Council (GCC) countries. Islamic finance is also

on the rise in new markets such as Syria, Lebanon, the U.K., Turkey and Canada. In the U.K.,

for instance, two new Islamic banking license applications are currently being considered by

the Financial Services Authority (FSA), following the authorization in the past three years of

the Islamic Bank of Britain and the European Islamic Investment Bank (Yong, 2007).

With the rapidly changing international Islamic financial landscape, Islamic finance in Malaysia

is now becoming increasingly integrated to the international financial system (Zeti, 2008). The

world has witnessed the emergence of Islamic finance, and this phenomenon, as observed has

continued to grow strongly. Global asset size for Islamic finance is estimated to be between

US$200 and US$400 billion, and growing at 15% per annum. Apart from financial institutions

in the Middle East, global banks are also responding to tap the opportunities of this huge pool of

capital. Today, the number of Islamic financial institutions worldwide now exceeds over three

hundred in seventy-five countries and offering a wide range of Syariah compliant products (El-

Qorchi, 2005). This development has taken place in all segments of the Islamic financial

system in Malaysia including the Islamic banking and takaful industry, and in the Islamic

October 18-19th, 2008Florence, Italy

3

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 4/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

money and capital markets. These include Sukuk, takaful insurance, murabaha financing, as

well as deposits and property funds structured using Syariah principles. In conjunction with this,

there are now a large number of diverse players and institutions in the Islamic financial system

in Malaysia. There has also been a growing range of products and services being offered. The

pace of product innovation has intensified with more sophisticated Islamic financial products

including the structured and investment-linked products. These products have become

competitive both in terms of product structure and pricing. There has also been enhanced depth

of the Islamic financial markets. This has increased the attractiveness of the Islamic financial

instruments as an asset class for investment.

As mentioned earlier, the growth rate of Islamic Finance in Malaysia is impressive by any

standards. Malaysia, therefore, has the capacity to retain its leadership in global Islamic finance

despite the emergence of competition from centers such as Hong Kong and Dubai (Yong, 2007).

He said despite the stiff competition that Malaysia was facing, it was way ahead of other

countries in terms of product offerings and its sophistication, having been developing the market

for the last 40 years. This paper is therefore interested is provide a conceptual understanding on

the growth in Islamic finance in Malaysia by exploring its current and future development. The

following sections will discuss on the emergence of Islamic finance, operating environment for

Islamic finance, barriers to growth and the concluding remarks.

1.2 The Emergence of Islamic Finance

In essence, the purpose of Islamic economics is to identify and establish an economic order that

conforms to the precepts of the Islamic scripture and the narrated traditions of its prophet

October 18-19th, 2008Florence, Italy

4

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 5/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

(Chapra, 1992 and Naqvi, 1994). In the contemporary era, the move towards formulating an

Islamic economic framework that was in sync with prevailing economic needs took shape in the

1940s, and three decades later efforts to implement them were under way in dozens of countries

(Rahnema & Nomani, 1990; Kuran, 1993, 1995; and Malik, 1996). Despite the fact that Islamic

economics contains many distinguishing features, Islamic banking is now regarded as the

defining characteristic of an Islamic economic system (Kuran, 1995). The term “Islamic financial

system” is relatively new, appearing only in the mid-1980s. In fact, all earlier references to

commercial or mercantile activities conforming to Islamic principles were designated as either

“interest free” or “Islamic” banking. The first modern experiment with Islamic banking was

undertaken in Egypt. This pioneering initiative based on the profit-sharing principle was helmed

by Ahmad El Najjar. It involved the establishment of a savings bank in the Egyptian town of Mit

Ghamr in l963. By 1967, the number of banks operating on the same principles had grown to

nine (Siddiqi, l988). Thus, they functioned essentially as saving- investment institutions rather

than as commercial banks.

Though similar initiatives were being made in Malaysia and Pakistan, the overall growth of

Islamic banking was miniscule until the 1970s when the nascent reawakening was propelled

forward by the oil boom of 1974. The ensuing prosperity enjoyed by the predominantly Muslim

beneficiaries of this boom witnessed resurgence in the adoption of Islamic values in countries

with substantial Muslim populations and a concomitant rejection of the political and economic

structures of the West. This rejection was especially evident in the banking sector as many

Muslims opted to deposit their money and conduct commercial transactions with Shariah

October 18-19th, 2008Florence, Italy

5

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 6/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

compliant banks (Lewis & Algaoud, 2001). With the passage of time, the role of Islamic

financial instruments in the economy, particularly in the banking sector, began to expand.

The increased popularity and visibility of the sector was especially evident in the 1990s when

Islamic finance grew rapidly as Islamic and non-Islamic financial institutions devised new

instruments and both Muslims and non-Muslim clients alike began to embrace and utilize

Shariah compliant features such al-Muddarabah, al-Muassasah etcetera in their daily banking

transactions (Zeti, 2007). Furthermore, Islamic banking expanded as western banks themselves

(such as HSBC and Citibank) created a number of financial innovations consistent with Syariah

in order to capitalize on the increased demand for Islamic capital investment products (Warde,

2000, 2001). The existence of such Islamic features in the Western banking sector served as a

catalyst to draw financing from countries such as Saudi Arabia and Kuwait. Consequently, a

number of predominantly Islamic countries such as Iran, Malaysia, Pakistan, Saudi Arabia, and

Sudan Islamized their banking systems using highly innovative banking initiatives.

The phenomenal growth of the Islamic Financial sector is underlined by the fact that there are

now about 300 Islamic financial institutions in 75 countries, holding assets estimated at more

than US$300 billion, and another US$400 billion in financial investments. The average growth

of the sector is estimated to be approximately 15 percent per annum and it is projected to grow

considerably in the foreseeable future, given the amount of oil wealth in much of the Muslim

world and a pent-up demand for investment products developed according to the tenets of the

Syariah, the legal and ethical code of Islam and the existence of an estimated 1.6 billion Muslims

world wide (Beccalli et al., 2006). Thus it is hardly surprising that many multinational financial

October 18-19th, 2008Florence, Italy

6

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 7/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

institutions are increasingly becoming actively involved in the sector. According to Chapra and

Ahmed (2002), the conventional banking industry has utilized the services of commercial

Islamic banks, Islamic investment companies, Islamic investment banks, insurance companies,

asset management companies, e-commerce, and brokers and dealers to cater for current and

future needs. As for financial products, the predominant ones are financial instruments based on

a diverse set of Islamic principles, insurance products, mutual funds and unit trusts, Islamic

bonds, and Sharia compliant stocks (Hasan & Basser, 2003). The growth of the Islamic financial

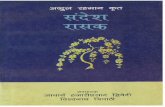

system via the expansion of its banking sector from the historical perspective is captured in

Figure 1.

Figure 1:

History of the Industry Development

Sources: Stages of Evolution in Islamic Finance: Islamic Financial Services Industry

October 18-19th, 2008Florence, Italy

Development of Industry Evolving richness in products

1950s

• Development of theoreticalframework

• Muslim-majority nationindependence

60s• Egypt and Malaysia pioneering

institutions

Establishment of OIC (1969)

70s• Islamic Development Bank (1974)

and DIB

• One country-one bank setup

80s

• Advancement of Islamic products

• Full “Islamiczation” of Pakistan,Sudan and Iran

• Formation of BIMB, Malaysia.

90s• Entry of global institutions e.g.

HSBC

00s

• Tipping point reached in somemarkets

• Development of industry buildinginstitutions

7

Commercial

banking

Insurance

Structured

and trade

financeEquity

Project

finance

Private

equity

Debt issues

Structured

products

2000s 1970s

1990s 1980s

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 8/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

The above explication clearly attest to the fact that Islamic finance has been acknowledged to be

a viable and competitive form of financial intermediation not only in Muslim countries but also

outside the Muslim world through its offering of a wide range of financial products and services

(Zeti, 2006). The viability, sustainability and competitiveness of Islamic finance have been

mainly due to a number of congealing factors that are both intrinsic and extrinsic in nature. The

intrinsic advantages of the Islamic financial system lay in its eschewing of conventional financial

tools such as interest which is anathema to the precepts of the Holy Quran. Instead, the system

adopted a sharia-based profit-sharing concept in its investment ventures thus spreading risk

profiles in a more equitable manner. Figure 2 encapsulates the types of banks and the Islamic

financial products offered in the relevant regions.

October 18-19th, 2008Florence, Italy

8

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 9/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

Figure 2:

Islamic Financial Services: Stages of Evolution in Islamic Finance

Institutions Products Area

Commercial Islamic BanksCommercial Islamic banking

products

Guff/Middle East

Takaful Takaful Asia Pacific

Islamic investment companies Mutual funds/unit trust Europe/Americas

Islamic investment banks Islamic BondsGlobal/OffshoreMarket

Asset management companies Syariah – compliant stocks

e-commerce Islamic stock broking

Broker/bankers

Commercial Islamic BanksCommercial Islamic banking

products

Guff/Middle East

Takaful Takaful Asia Pacific

Islamic investment companies Mutual funds/unit trust

Broker/bankers Islamic Bonds

Syariah – compliant stocks

Islamic stock broking

Commercial Islamic BanksCommercial Islamic banking products

Guff/Middle East

Takaful Takaful Asia Pacific

Islamic investment companies

Commercial Islamic BanksCommercial Islamic banking products

Guff/Middle East

Source: Aseambankers, World Islamic Funds and Capital Markets Conference, May 2006, Bahrain

1.3 The operating environment for Islamic finance

There are now a large number of diverse players and institutions in the Islamic financial system.

There has also been a growing range of products and services being offered. The pace of product

innovation has intensified with more sophisticated Islamic financial products including the

structured and investment-linked products (Guru et al, 2002). These products have become

competitive both in terms of product structure and pricing. There has also been enhanced depth

October 18-19th, 2008Florence, Italy

9

2000s

1990s

1980s

1970s

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 10/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

of the Islamic financial markets. This has increased the attractiveness of the Islamic financial

instruments as an asset class for investment. The standards are developed by the Islamic

Financial Services Board (IFSB) to govern the operations of Islamic financial institutions (Zeti,

2006). The IFSB has, not only, an important role in the harmonization of standards, but also

contributes towards the consistent development of Islamic finance across different jurisdictions.

Several parts of the world, including in Malaysia, have implemented the prudential standards

issued by the IFSB. These standards which have been designed to take into account the unique

features specific to Islamic finance will contribute towards ensuring its soundness and stability.

In the Malaysian approach, the Malaysian scholars have applied the concept of bai al-dayn or the

sale of debts. The formal definition is: “…the sale of debt as a type of contract in which the

creditor sells his payable right upon the debtor either to the debtor either to the debtor… or to a

third party. This sale [sic] contract between two parties may be either on the spot or forward

basis. It may also be either at a discount price or at the cost price” claimed by Moustapha (2003).

The growing role of Islamic finance in mobilizing and channeling funds to productive

investment activities across borders contributes to more efficient allocation of funds across

borders and facilitates international trade and investment. According to Zeti (2007), greater

diversification of risks also contributes towards promoting international financial stability. The

more recent developments in Islamic finance is the growing significance of the sukuk market to

become an increasingly important component of the Islamic financial system. She added that

modern sukuk, sometimes referred to as Islamic bonds, are better described as Islamic

investment certificates. This distinction is as crucial as it is important, and it is stressed

throughout this pioneering work that sukuk should not simply be regarded as a substitute for

October 18-19th, 2008Florence, Italy

10

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 11/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

conventional interest-based securities. The aim is not simply to engineer financial products that

mimic fixed-rate bills and bonds and floating-rate notes as understood in the West, but rather to

develop innovative types of assets that comply with Shari’a Islamic law. Conventional bonds that

yield interest, or riba, are of course prohibited under Shari’a law. Furthermore, those who buy

and sell conventional bonds are rarely interested in what is actually being financed through the

bond issue, which could include activities and industries that are deemed haram such as the

production or sale of alcohol. Companies that are highly leveraged with bank debt may seek

refinancing through issuing bonds, but such companies are not regarded as suitable for Muslim

investors.

1.3.1 Developments in the sukuk markets

The year 2007 has seen an exceptional growth of the global sukuk market which expanded by

more than 70 percent during the year. New issues during the year reached a record high to about

US$47 billion and the outstanding global sukuk market has now surpassed the US$100 billion

mark. Despite the more challenging international financial environment arising from the

financial crisis that has occurred in a number of the advanced economies in the recent twelve

months, the sukuk market while also affected, it has been to a lesser extent. Up until June 2008,

it has held its ground with a total global issuance now exceeding US$10 billion (refer Figure 3

and 4).

October 18-19th, 2008Florence, Italy

11

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 12/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

Figure 3:

Sukuk Market in Malaysia

Figure 4:

Sukuk Types in Malaysia

October 18-19th, 2008Florence, Italy

12

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 13/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

With greater recognition of the sukuk market as a competitive and attractive form of financing,

the global sukuk market is expected to continue its growth going forward. The International

Islamic financial hub evolving in Malaysia is supported by five pillars as discussed below.

Pillar 1: Sukuk Origination

Following the first ever sukuk in the world that was issued in Malaysia in 1990, Malaysia has

now developed a deep, liquid and vibrant sukuk market. Recently, the largest sukuk ever was

raised in the Malaysian sukuk market in 2007 (Bank Negara, 2008). The magnitude was

approximately RM15 billion or about USD5 billion equivalent. Despite being issued during the

height of the sub-prime crisis, it attracted huge demand and was oversubscribed by more than

two times. Sukuk origination has thus been identified as one of the important pillars of the

Malaysian Islamic financial system. As of the end of 2007, more than 60 percent of the

outstanding global sukuks originated from Malaysia. It has been increasing by an annual rate of

about 20 percent and it accounts for about 56 percent of the outstanding bond market in

Malaysia.

Pillar 2: Islamic Fund and Wealth Management

The sukuk market has been an important source of financing for productive investment activities,

while for investors it provides potential for diversification into new asset classes. The second

pillar in the Malaysia Islamic financial hub is the Islamic fund and wealth management industry.

Malaysia is centrally located in the ASEAN region that has a population of 570 million. It is also

positioned centrally between the major Asian economies of India, China, Japan and Korea.

Malaysia has always been a highly open economy in trade and investment activities and has been

October 18-19th, 2008Florence, Italy

13

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 14/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

a major recipient of foreign direct investment for more than a hundred years. As a destination for

financial investment, the Malaysian capital market offers a wide range of world class financial

products. More than 85 percent of the listed companies in the equity market are Shariah

compliant, representing about 60 percent of total market capitalization. Other investment

opportunities include in Shariah-compliant real estate investment trusts (REIT), in unit trusts and

in the Islamic exchange traded fund (ETF).

Pillar 3: International Islamic Banking

The Islamic financial system has also been extensively liberalized to allow for the entry of

foreign Islamic financial institutions that offer both domestic and international banking business.

In addition, the foreign equity ceiling in Islamic financial institutions has been raised to a

maximum of 49 percent as part of the effort to promote strategic alliances. The Islamic banking

business in foreign currencies can be conducted by the international currency business units

(ICBUs) that may be set up within existing financial institutions and the international Islamic

banks. Such international Islamic banks may be established as either a branch or a subsidiary.

Currently, about 16 percent of total assets in the Malaysian banking system are Shariah

compliant.

Pillar 4: International Takaful Business

The fourth pillar is takaful and retakaful business. There are now eight takaful operators, several

of which are joint ventures with foreign shareholding that conduct both domestic and

international takaful business. In addition, licenses have been granted to three reinsurance

players to undertake retakaful business in Malaysia. Several existing takaful operators have set

October 18-19th, 2008Florence, Italy

14

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 15/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

up international currency business units (ICBUs) and one new international takaful company has

been licensed as an international takaful operator to conduct foreign currency takaful business.

Pillar 5: Human Capital and Thought Leadership

The fifth pillar is human capital and thought leadership. Several important human capital

development projects have been implemented to foster Islamic finance thought leadership and to

create a supply of talent for the Islamic finance industry. Having a sufficient pool of the talent

and expertise has been key to the development of the Islamic financial hub in Malaysia. The

International Centre for Education in Islamic Finance (INCEIF) which has an international

faculty and students from more than 40 countries is focused on programmes for Islamic finance

professionals and specialists to meet the human capital requirements of the global Islamic

financial services industry.

1.4 Barriers to Islamic Financial

The prospects for the growth of Islamic finance look bright. Nonetheless, there are several

obstacles currently preventing faster uptake of Islamic financial products. These include the issue

of regulatory capital and relative risk weightings and the Islamic Financial Services Board

(IFSB) guidance; a lack of human capital; piecemeal financial and legal architecture; weaknesses

in financial reporting and transparency; and the overarching problem of a lack of Shariah

convergence. These barriers are discussed below:-

October 18-19th, 2008Florence, Italy

15

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 16/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

1.4.1 Risk weighting

In 2006, the IFSB issued two standards – the Capital Adequacy Standard (CAS) and the Guiding

Principles of Risk Management for Institutions offering Islamic Financial Services. CAS offers

guidance on the requirements for minimum capital adequacy to cover for credit, market and

operational risks of IFIs that is equivalent to the Basel II Capital framework for conventional

banking institutions. According to the IFSB, the key difference between CAS and Basel II

provisions is the computation of an institution’s risk-weighted capital ratio (RWCR). In Islamic

banking, given that the risks on assets financed by profit-sharing investment account holders do

not represent risk to the capital of the institution, the CAS allows risk-weighted assets that are

funded by the account holders to be deducted from the institution’s total risk-weighted assets in

the calculation of RWCR.

1.4.2 Human capital

Human capital development is crucial, as the current lack of qualified young Islamic bankers

looks set to hamper the development of the sector should it not be addressed. In part, this low

investment in the industry stems from the fact that the sector lacks a global industry body to

oversee standardization of continuous education and training. The lack of human capital in the

sector affects all regions, including nascent markets such as the U.K. Training of Islamic bankers

has not kept pace with the rapid growth of the sector and, as a result, there are shortages

throughout the industry. The two centers for training have been KFH and Bank Islam Malaysia,

which between them have been responsible for training many Islamic bankers. In 2006, for

example, Bank Negara set up an RM500m endowment fund to support The International Centre

for Education in Islamic Finance (INCEIF), with the main objectives of making Malaysia the

October 18-19th, 2008Florence, Italy

16

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 17/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

leading center for Islamic finance education and developing human capital for the global Islamic

finance industry. Similarly in 2006, The Central Bank of Bahrain set up a US$4.6m Islamic

Finance Education scheme in cooperation with eight IFIs based in Bahrain.

1.4.3 Regulation and legal frameworks

While rising demand for Islamic finance has helped lead to handsome returns for key players,

some experts in the industry are concerned that the rapid proliferation of IFIs has not been

matched by development in the Islamic finance regulatory and supervisory architecture and

infrastructure, especially in the GCC states. “One thing that worries me,” explains Ali Al-

Ghannam, Head of International Real Estate at Kuwait Finance House (KFH), “is that the IFIs

should be controlled better to avoid any bubble in the industry. There are a huge number of new

IFIs being established in the market. Many banks and traditional companies are converting to

Islamic finance. Islamic banking windows at global majors are proliferating. Many of these

institutions are not going after the concept itself, but are following the flow of money.

1.4.4 Financial reporting

The quality and transparency of financial reporting and disclosure in the Islamic finance industry

differs significantly from one regulatory jurisdiction to another. There is a general concern in the

market and among those interviewed that IFIs, with the notable exceptions of those operating in

the U.K., Malaysia, Bahrain and perhaps Turkey, should have more rigor in their disclosure and

financial reporting, especially to the general market.

October 18-19th, 2008Florence, Italy

17

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 18/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

1.5 Concluding Remarks

Islamic finance has made significant inroads in the international financial markets that have

achieved growing global awareness. Islamic finance now has a presence in over 60 countries,

especially in Muslim countries. In the context of financial infrastructure, the Malaysian Islamic

financial system is both robust and fast growing. The market has highly diversified players, with

Islamic banks, investment banks, takaful companies, development financial institutions, savings

institutions, fund management companies, stock brokers and unit trusts. The aim of this paper is

provide a conceptual understanding on the growth in Islamic Finance in Malaysia by exploring

its current and future development. It is observed that the participation in the Islamic finance

process would require the development of a comprehensive and well established Islamic

financial system such as: - a wide range of products and services; a good legal system, adequate

financial infrastructure with competitive tax structures, low cost of doing business, high

standards of business ethics, and conducive living conditions and cultural offerings. It would also

need to be supported by adequate human talents that would drive the business and spur

innovation. In addition, a strong regulatory regime in the Islamic financial system would be

another pull factor. The implication of this paper is to provide a platform for industry players and

regulators to highlights the recent developments in Islamic finance in Malaysia.

References

Beccalli, E., Casu, B. and Girardone, C. (2006). Efficiency and stock performance in European

banking. Journal of Business Finance and Accounting , 33 (1-2), 245-262.

Bhupinder Singh "Banking on Islamic Finance". Malaysian Business. . FindArticles.com. 03

Sep. 2008. http://findarticles.com/p/articles/mi_qn6207/is_20040516/ai_n24907561

October 18-19th, 2008Florence, Italy

18

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 19/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

Chapra, M. U. & Ahmed, H. (2002). Corporate governance in Islamic Financial Institutions.

Occasional Paper No. 6, Islamic Research and Training Institute, Islamic Development

Bank, Kingdom of Saudi Arabia.

Chapra, M. Umer (1985). Towards a Just Monetary System, The Islamic Foundation.

Chapra, M. Umer, (1992). Islam and the Economic Challenge (Leicester. Islamic Foundation.

El-Qorchi Mohammed (2005). Islamic Finance Gears Up- While gaining ground, the industry

faces unique regulatory challenges. Finance and development magazine IMF , 42(4).

Guru B., J. Staunton and Balashanmugam. (2002). Determinants of commercial bank

profitability in Malaysia. University Multimedia working papers

Howard Davies, chairman of the Financial Services Authority

http://www.fsa.gov.uk/Pages/Library/Communication/Speeches/2002/sp103.shtml

Kuran, T. (1995). Private Truths, Public Lies. The Social Consequences of Preference

Falsification. Cambridge MA. Harvard University Press.

Kuran, Timur, (1993). The Economic Impact of Islamic Fundamentalism, in Fundamentalisms

and the State. Remaking Polities, Economies, Militance, Martin E. Marty and R. Scott

Aleby, eds. Chicago. University of Chicago Press, 302-41.

Kuran, Timur. (1995). Islamic Economics and the Islamic Subeconomy. The Journal of

Economic Perspectives, 9(4), 155-173.

Lewis, M.K., and Algaoud, L.M. (2001). Islamic banking . Edward Elgar. Cheltenham, UK

Moustapha, Dr. Sano Koutoub (2003), The Sale of Debt: As Implemented by Islamic Financial

Institutions in Malaysia accessed on December 9, 2003 at

www.drsan.net/papers/malaysia.htm.

October 18-19th, 2008Florence, Italy

19

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 20/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

Naqvi, Syed Nawab Haider. (1994). Islam, Economics, and Society (London. Kegan Paul

International).

Rahnema, Ali, and Farhad Nomani, (1990). The Secular Miracle. Religion, Politics, and

Economic Policy in Iran. (London. Zed Books).

Siddiqi, M.N., ( l988). Islamic banking. theory and practice in M. Ariff (ed.).

Siddiqi, M.N., (1983b). Issues in Islamic Banking, Islamic Foundation, Leicester.

Siddiqi, M.N., (1985). Partnership and Profit-Sharing in Islamic Law, Islamic Foundation,

Leicester.

Siddiqi, M.N., (l982 ). Islamic Approaches to Money, Banking and Monetary Policy. A Review in

M. Ariff (ed.).

Siddiqi, M.N., (l983a). Banking Without Interest, The Islamic Foundation, Leicester.

Warde, I. (2000). Islamic Finance in the Global Economy. Edinburgh. University of Edinburgh

Press.

Warde, I. (2001). The prophet and the profits. Islamic finance, Le Monde Diplomatique,

September.

Wong, C.H. (1995). Bank Islam Malaysia Berhad. Performance evaluation, in Al-Harran, S.

(Eds).Leading Issues in Islamic Banking and Finance, Pelanduk Publications, Petaling Jaya

Yong Yen Nie (2007), Malaysia way ahead in Islamic finance

http://www.theedgedaily.com/cms/content.jsp?id=com.tms.cms.article.Article_faa8145a-

cb73c03a-ffeef100-9d6f6ff5

Zeti Akhtar Aziz (2006): Recent developments in Islamic finance in Malaysia, Keynote address

by Governor of the Central Bank of Malaysia, at the Malaysian Islamic Finance Issuers and

Investors Forum 2006, Kuala Lumpur, 14 August 2006

October 18-19th, 2008Florence, Italy

20

8/6/2019 Darwis Abd Rasak, Mohd Azhar Abdul Karim

http://slidepdf.com/reader/full/darwis-abd-rasak-mohd-azhar-abdul-karim 21/21

8th Global Conference on Business & Economics ISBN : 978-0-9742114-5-9

Zeti Akhtar Aziz, (2006). Towards Islamic finance as an integral component of the International

Financial System, Governor's Opening Speech at the 5th Annual Islamic Finance Summit,

24 January, 2006, London.

Zeti Akhtar Aziz (2007): Malaysia’s experience in strengthening its market for global sukuk

activities, Keynote address by Governor of the Central Bank of Malaysia, at the 2nd

Malaysian Islamic Finance – Issuers and Investors Forum 2007 "Malaysia as Global Sukuk

Centre: Towards Greater Vibrancy of Malaysian Sukuk Market", Kuala Lumpur, 13

August 2007.

Zeti Akhtar Aziz (2008), Growing significance of Islamic finance, Opening remarks by

Governor of the Central Bank of Malaysia, at the Malaysian Islamic Finance 2008 Issuers

and Investors Forum – ISSUER'S DAY (Launch of the MIFC Global Communications

campaign), Kuala Lumpur, 11 August 2008.

October 18-19th, 2008Florence, Italy

21