CPO Corn Products International Dec 2009 Presentation

-

Upload

ala-baster -

Category

Documents

-

view

214 -

download

0

Transcript of CPO Corn Products International Dec 2009 Presentation

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

1/74

Citis 2009 Food Fest1st Annual Food Manufacturing Conference

New York City, New YorkDecember 3, 2009

Ilene S. GordonChairman, President and

Chief Executive Officer

Cheryl K. BeebeChief Financial Officer

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

2/74

2

IndexForward looking statement - Page 3

Company background - Pages 4 to 14

Financial review - Pages 15 to 23

2009 Outlook - Pages 24 to 28Shareholder value proposition - Page 29

Appendix - Pages 31 to 74

Corn wet milling process - Pages 32 to 34

Geographic segments -Pages 35 to 51

North America - Pages 38 to 44

South America - Pages 45 to 48Asia/Africa - Pages 49 to 52

Additional financial data - Pages 53 to 64

Non-GAAP reconciliations - Pages 65 to 71

Company management - Pages 72 to 74

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

3/74

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

4/74

4

A Proven Global Leader in Our Industry

Highly respected Fortune 1,000 company with a rich,

100-year history of success, growth and innovation

Strong ethics and solid, unchanging values (integrity,

respect, excellence and financial success)

Consistently named to Forbes 400 Best Big Companies

and Fortunes Most Admired Companies annual lists

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

5/74

5

Experienced Management Team

CEO with extensive international

manufacturing and marketing experience

Strong senior management team averaging 18

years company tenure 7,800 talented employees worldwide with

nearly 12 years average company tenure

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

6/746

Production33 plants and 15 countries *,**

North AmericaUnited States, Canada, Mexico

South AmericaArgentina, Brazil, Chile, Colombia, Peru, Venezuela*

Asia/Africa

South Korea, Thailand, Pakistan, China**,

KenyaSouth Africa*

* Technical License Agreements

**Joint Venture

Strong and Unique Global Position

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

7/747

Pure-Play Starch Refiner/IngredientsCompany

SweetenersDextrose

Glucose

Maltose

High fructose corn syrup

Fermentation products

Polyols

Stevia

Starches

Industrial starches

Process food starchesFermentation products

Co-products

Corn gluten feedCorn gluten meal

Corn oil

corn syrups

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

8/748

Our Ingredients Are Critical Component

of Everyday Life

We Serve Customers in About 60 Diverse Industries/70 CountriesFood Industrial Fine Chemicals/

Sweeteners Starches Starches Pharmaceuticals

Carbonated beverages Cereals Paper IV Dextrose

Beer Soups Corrugated boxes Tableting excipientsSports drinks Sauces Textiles Fermentation feedstocks

Frozen desserts Drink mixes Adhesives

Canned fruits and vegetables Pudding Baby and face powders

Drink mixes Cakes Rubber

Presweetened cereals Cookies Leather

Breads Crackers Detergents

Fruit juices

Jams and jellies

Chewing gum

Cream filling

SyrupsCandy

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

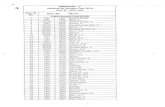

9/749

Ingredient Applications

Ingredient Applications

Animal Feeds & Pet Foods

Beverages & Soft Drinks

Building Materials

Canners & Packers

Cereals

Chemicals

Condiments

Confectionery, Gum & Cough Drops

Fats & Oils

Formulated Dairy Products

Ice Cream & Frozen Desserts

Jams, Jellies & Preserves

Meat Products

Mining/Metallurgy

Miscellaneous Foods

Miscellaneous Industry

Mixes & Prepared Foods

Paper, Corrugated & Related

Pastes & Adhesives

Personal Care

Pharmaceuticals

Syrups & Sweeteners

Textiles

Wines & Brewing

Modifi

edStarch

UnmodifiedSt

arch

Dextrin

Malto

dextrin

Glucos

e/CornSyrup

Dextros

e

HFCS Co

rnOil

Gluten

Feed

Gluten

Meal

GermM

eal

Steepw

ater

scFOS

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

10/7410

We Operate with a Clear Mission

Excel at the

Base Business

Grow

Defensible

Businesses in

New High-Growth

Regions

Expand

Value-AddedProduct

PortfolioSelectively

Drive Organic

Growth

To be the Premier Regional Provider of Refined, Agriculturally

Based Products and Ingredients Worldwide

Ingredients Solutions Provider

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

11/7411

Strong Americas position

Managing geographic breadth

Cultural understanding

Performance in difficult

environments

Reputation/assets/infrastructure

Managing alliance relationships

Core Capabilities A Building Platform

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

12/7412

Attributes and Attractions

Emphasis on shareholder value creation over the long term

2004-2008 CAGR

Net sales 13%

Operating income 20%

Net income 28%

Earnings per share 27%

Healthy balance sheet and solid cash flow generation

Product portfolio serves important and expanding markets

many opportunities to grow in coming years.

Strong, diverse and global customer base

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

13/74

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

14/7414

Management/Shareholder Alignment

Executive compensation aligned with shareholders

Management variable compensation

Direct stock ownership targets for officers

Short-term

EPS/Operating Income 50% Operating Cash Flow 25%

Working Capital 25%

Long-term

Shareholder return 50% Return on capital employed (ROCE) 50%

Annual Incentive Plan

EPS/Operating Income 60%

Individual 20%

Working Capital/ROCE 20%

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

15/74

15

Financial

ReviewReturn to index

G hi S t

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

16/74

16

Geographic Segments2008 Annual Net Sales

($ millions)

12%

60%

28%

North America South America As ia/Af rica

North America

51%32%

17%

United States Mexico Canada

South America

29%

53%

18%

Brazil

Argentina

Other

Asia /Afri ca

59%41%

Korea Other

Total Net Sales - $3,944

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

17/74

17

Sales by Product Category & Markets Served

55%

20%

25%

54%

21%

25%

52%

22%

26%

53%

23%

24%

55%

22%

23%

57%

22%

21%

53%

22%

25%

0%

10%

20%

30%

40%

50%

60%

2002 2003 2004 2005 2006 2007 2008

Sweeteners

Starches

Co-Products &Other

Soft Drink

Industry, 13%

Animal Feed, 12%Brewing Industry,

12%

Other, 38%

Processed Foods

Industry, 25%

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

18/74

18

Income Statement Selected Highlights*Period Ended September 30

Q1 Q2 Q3 9 months 9 months 9 months(In millions, except per share amounts) ange

Net sales $831 $912 $971 $2,713 $3,043 -11%

Gross profit 93 112 153 358 564 -37%

Margins 11.2% 12.2% 15.8% 13.2% 18.5%

Operating income - before

impairment and restructuring cost1 39 52 88 179 370 -59%

Operating margin - adjusted basis1

4.7% 5.7% 9.1% 6.6% 12.2%

Diluted earn ings per share -

adjusted

2 $0.22 $0.34 $0.70 $1.27 $2.90 -56%

1 - Adjusted to exclude the Q2 2009 impairment and restructuring charges - see appendix page 70 for reconciliaton of this non-GAAP financial measure to

the corresponding GAAP financial measure

2 - Adjusted to exclude the Q2 2009 after tax impact of impairment and restructuring charges - see appendix page 71 for a reconciliation of this non-

GAAP financial measure to the corresponding GAAP financial measure

* - See appendix pages 55 and 56 for summary income statements

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

19/74

19

Estimated Sources of Diluted Earnings Per Share

Nine Months Ended September 30

Return to index

(dollars per share)

Earnings per share - 2008 2.90$

Changes from operations:*

Margins - Price / Mix (0.24)

Co-Product recovery (1.65) (0.95)Change in volumes (0.19)Foreign currency values (0.27)

Non-operational changes:*

Financing cost (0.07)Change in non-controling interest 0.02 0.02Effective tax rate 0.03Shares outstanding 0.04

Impairment and restructuring charges (1.47)

Net change for the period (3.10)

Earnings per share - 2009 (0.20)$

* Based on an estimated effective tax rate of 32.8%.* - Based on an estimated effective tax rate of approximately 34%

Cash Flow Highlights

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

20/74

20

Cash Flow HighlightsFor the Nine Months Ended September 30

($ millions)

2009 2008

Cash provided by operations: 368$ 16$

Net income (loss) (11) 227Write-off of impaired assets 124 -

Working capital 154 (293)Depreciation and amortization 95 98

Cash invested in the business: (102)$ (157)$

Fixed assets, net (98) (160)

Cash used for financing activities: (214)$ 83$

Net increase (decrease) in debt (180) 101Dividends paid (34) (31)

Issuance (repurchase) of common stock,net (1) 10

Return to index

N t D bt P iti

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

21/74

21

Net Debt Position

Quarter End

$695

$820$821$866

$161$175

$91$107

$730

$645

$534

$759

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

Dec. 31, 2008 Mar. 31, 2009 Jun. 30, 2009 Sep. 30, 2009

million

s

Total DebtCash

Net Debt

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

22/74

22

Dividend History*

*Adjusted for 2-for-1 stock split effective January 25, 2005

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Annual Cash Dividend Paid Per Common Share

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

23/74

23

Key Metrics*

($ millions)

30-Sep 31-Dec 30-Sep

2009 2008 2008

Debt to capitalization 29.0% 36.1% 29.4%

Debt to adjusted EBITDA** (TTM) 1.9 X 1.5 1.2 X

Operating working capital $424 $439 $482(excluding short-term debt, cash and def. tax)

% of 12 mo. Net sales 11.7% 11.1% 12.2%

Net debt (total debt less cash) $534 $759 $612

* See appendix pages 65-71 for a reconciliation of these non-GAAP financial measures to GAAP financialmeasures

** Adjusted to exclude the impact of impairment and restructuring charges of $125 million in Q2 2009

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

24/74

24

Outlook

2009 is a challenging year but we believe we operatefrom a position of strength and flexibility with proven

business models

2009 performance expected to be negatively impacted

by:

Major negative swing in co-product pricing, primarily in North Americaand largely from corn oil, contributing to higher net corn costs

Significant, double-digit currency devaluations in virtually all of our

international businesses

Generally lower demand due to the global economic recession

Second half of 2009 should be stronger than the first half Expect second half diluted EPS of $1.24 to $1.44 compared to first half

diluted EPS $0.56*

* excluding the $1.47 after-tax impact of impairment and restructuring charges taken in Q2-2009Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

25/74

25

Outlook

Healthy balance sheet, solid liquidity, and substantial

cash flow should be key advantages, especially in this

global recessionary environment

Four areas are key to our 2009 performance Staying close to our customers

Keeping an eye on our cost structure

Maintaining a strong balance sheet and solid liquidity

Executing flawlessly

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

26/74

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

27/74

27

Outlook - Cash Flow from Operations

($ millions)Cash Flow from Operations

($100)

$0

$100

$200

$300

$400

$500

$600

2002 2003 2004 2005 2006 2007 2008 2009 (est.)

Cash Flow Net Income

Expect 2009 cash flow fromoperations of $425-525 million

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

28/74

28

$0

$50

$100

$150

$200

$250

2001 2002 2003 2004 2005 2006 2007 2008 2009Est.

Cap-X

D&A

Outlook - Cap-X and D&A

($ millions)

2009 Cap-X to be approximately $150 million vs. $219million in 2008 Most of the 2009 spending is carryover projects from 2008

Annual maintenance cap-x is about $50 million

*

*

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

29/74

29

Shareholder Value Proposition

Strategic StrengthsSingle focus starch refining

Clear long-term strategy

Specific growth pathwaysMgmt/shareholder alignment

ATTRACTIVEGROWTH PROFILE

Low CostModern plants

Favorable locations

Worldwide network

Global cost optimization

Organizational DepthExperienced management

Focused workforce

Technical & market expertise

Financial FlexibilitySolid balance sheet

Good cash generation

Low maintenance cap-x

Investment grade ratings

Leading PositionsDiverse geographies

Product/customer breadth

Valuable alliancesHigh barriers to entry

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

30/74

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

31/74

31

Appendix

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

32/74

32

Corn Wet Milling Process

Return to index

Corn

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

33/74

33

CornBasic Structure and Approximate Yield*

Kernel Structure

Hull Fiber

Starch

Protein

Germ

Approximate Yield

Starch 68%

Gluten Feed 19%

Gluten Meal 5%

Germ Corn oil 4%

Germ meal 3%

*Note: These are only approximations due to our use of varieties of hybrids throughout our world

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

34/74

34

Corn Wet Milling Process

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

35/74

35

Geographic Segments

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

36/74

36

Strong and Unique Global PositionProducing: 15 countries**,*** 33 plants**,***

Marketing: 70 countries

North America 3United States 4

Canada, Mexico 1

South America 1Argentina, Brazil, Chile, Colombia, Peru, Venezuela**

Asia/Africa

South Korea, Thailand, Pakistan, China***,

KenyaSouth Africa**

*Share of production capacity

**Technical License Agreements

***Joint Venture

Geographic Installed-Capacity Leadership

Top Tieror 1

Rank*

Source: Corn Products International Competitive Intelligence Process Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

37/74

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

38/74

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

39/74

39

North America Region Margin Stability

More than 100 years old in the US

Improved industry fundamentals

High capacity utilization rates

Industry rationalization/plant closures

Ethanol demand

Higher US, Canadian contract pricing

Mexico leadership

Open border as of January 1, 2008

HFCS beverage usage tax eliminated

Only North American corn refiner with full-scale

sweetener and starch facilities in all 3 NAFTA countries

unique position

Canada 3 corn refining plants

Mexico 3 corn refining plants

Ingredient technology center

United States 3 corn refining plants

1 polyol plantIngredient technology center

Canada

Mexico

United States

Return to index

Historical Update North America

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

40/74

40

Historical Update North America1997 to 2003 Driven by Mexican HFCS Situation

*Source: Corn Products Competitive Intelligence Process

1997 Large Mexican HFCS market border closed to US exports

Result: US overcapacity utilization: 90s% low 70s%*

Corn Products locally produced HFCS in Mexico

Strong results through 2001

1998 and 1999 US Recovery underway

2000 Detour

2001 to present US corn refiners environment

Major structural change among US corn refiners

Grind capacity utilization: 90s%*

- Ethanol demand: more than doubled

Finishing capacity utilization improved*

2002 & 2003 Corn Products US/Canada results increased substantially

Mexico levies 20% tax on HFCS-sweetened soft drinks

Return to index

Historical Update North America

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

41/74

41*Source: Corn Products Competitive Intelligence Process

1997 Large Mexican HFCS market border closed to US exportsResult: US overcapacity utilization: 90s% low 70s%*

CPOs locally produced HFCS in Mexico

Strong results through 2001

1998 and 1999 US Recovery underway

2000 Detour

2001 to present US corn refiners environment

Major structural change among U.S. corn refiners

Grind capacity utilization: 90s%*

- Ethanol demand: more than doubled

Finishing capacity utilization improved*

2002 & 2003 CPO US/Canada Operating Income increased substantially

Mexico 20% tax on HFCS-sweetened soft drinks

Except for ethanol

No expansions since 1997*

Historical Update North America1997 to 2003 Driven by Mexican HFCS Situation

Return to index

Historical Update North America

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

42/74

42*Source: Corn Products International Competitive Intelligence Process

**Source: Associated Press, August 17, 2004 ; ***Source: Decatur Daily, October 4, 2005

Competitive arena*: US HFCS processor company changes

November 2000: 7 HFCS producers 3 with 17% of capacity

March 2002 thru present: 4 HFCS producers with 97% of capacity

Historical Update North America

ProGold MCP Cerestar

Cargill

Cargill ADM 30%

CPMCP

ADM

Coors

Gone1997

2000

2002

2004

2005

2006

Cargill

Shuts Dayton

Closes Dimmitt, TX**

Idles Decatur, AL***

Restarts Decatur, AL

Closing Decatur, AL2009

Return to index

N h A i I di

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

43/74

43

North America Ingredients

BASIC INGREDIENTS

HFCS

Corn Starch

Corn Syrup

Liquid Dextrose

Blends

SPECIALTY INGREDIENTS

Refined Corn Oil

Crystalline Dextrose

Modified Starches

Maltodextrine

Polyols

Fructooligosaccharide

Caramel Color

ANIMAL NUTRITION

& HEALTH

Gluten Feed

Gluten Meal

Other

Return to index

Net Sales and Operating Income/Margins

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

44/74

44

Net Sales and Operating Income/Margins

North America 2001-2008

$2,369

$2,052

$1,588

$1,422$1,419

$1,219$1,212

$1,329

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

$2,200

$2,400

2001 2002 2003 2004 2005 2006 2007 2008

0

50

100

150

200

250

300

350

Net Sales Operating Income

Net Sales

($ millions)

Operating Income

($ millions)

5.1%

6.1%

4.2%

8.2%

4.6%5.4%

11.4%

13.2%

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

45/74

45

South America

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

46/74

S th A i I di t

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

47/74

47

South America Ingredients

BASIC INGREDIENTS

High Maltose Syrup

Regular Starch

Glucose Corn Syrup

HFCS

Liquid Dextrose

Syrup Blends

SPECIAL INGREDIENTS

Food Modified Starches

Industrial Modified Starches

Dried Blends

Crystalline Dextrose

Dried Syrups

Maltodextrine

Sorbitol, Mannitol, Liquid

Maltitol

Fructooligosaccharide

Caramel Color

Adhesives & Dextrines

Fats & Emulsifiers

Refined Corn Oil

ANIMAL NUTRITION

& HEALTH

Gluten Feed

Gluten Meal Other, Basic & Special

Ingredients

Raw Materials:

Regular and Waxy Corn, Tapioca, Wheat & Soy Flour, Sucrose

Return to index

Net Sales & Operating Income/Margins

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

48/74

48

p g g

South America 2001-2008

$495

$670$603

$1,120

$925

$440$401

$556

$0

$200

$400

$600

$800

$1,000

$1,200

2001 2002 2003 2004 2005 2006 2007 2008

0

50

100

150

200

Net Sales Operating Income

Net Sales

($ Millions)

Operating Income

($ Millions)

16.8%

17.6%16.8% 12.5%

14.5%

15.5%

12.4%

13.5%

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

49/74

A i /Af i R i E i F

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

50/74

50

Decades of operations in various countries

Geographic growth opportunities

Significant capacity shares

Favorable market drivers

Multi-national customersmigrating production here

Asian Region

South Korea 2 corn refining plants

Thailand 1 tapioca plant

Malaysia Regional marketing

office

Pakistan 2 corn refining plants

China 1 modified starch plant (JV)

India Rep office

African Region

Kenya 1 corn refining plant

South Africa 4 plants (TLA)

Nigeria Sales office

Asia/Africa Region Expansion Focus

Kenya

Pakistan

Malaysia

Thailand

South Afr ica

South KoreaChina

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

51/74

Net Sales & Operating Income/Margins

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

52/74

52

p g g

Asia/Africa 2001-2008

$454

$414

$363$335

$308

$278$251

$235

$0

$50$100

$150

$200

$250

$300

$350

$400

$450

$500

2001 2002 2003 2004 2005 2006 2007 2008

0

20

40

60

80

100

120

Net Sales Operating Income

Net Sales

($ Millions)

Operating Income

($ Millions)

19.4%15.6%

15.8% 14.6%21.5%

19.2% 10.9%

8.4%

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

53/74

53

Financial Data

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

54/74

Summary Income StatementQ t E d d

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

55/74

55

Quarter Ended($ millions, except per share amounts)

31-Mar 30-Jun 30-Sep2009 2009 2009

Net sales $831 $912 $971

Gross profit 93 112 153M a rg ins 11.2% 12.2% 15.8%

Operating Expenses 55 61 66

Op. income before impairment

and restructuring charges 39 52 88

Impairment/restructuring cost - 125 -

Operating income (loss) 39 (73) 88

Financing Costs, net 11 11 9

Taxes 33.8% 1.1% 31.2%

Net income (loss) of CPI $17 ($85) $53

Diluted earnings (loss) per share $0.22 ($1.13) $0.70

Return to index

Summary Income StatementNi M th E d d S t b 30

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

56/74

56

Nine Months Ended September 30($ millions, except per share amounts)

2009 2008 Change

Net sales $2,713 $3,044 (11%)

Gross profit 358 564 (37%) Ma rg ins 13.2% 18.5%

Operating expenses 182 208 (13%)

Op. income before impairment

and restructuring cost 179 370 (52%)

Impairment/restructuring cost 125 -

Operating income (loss) 54 370 (85%)

Financing costs,net 31 24 31% Ta xe s 148.0% 34.5%

Net income (loss) of CPI (15) 221 (107%)

Diluted earnings (loss) per share ($0.20) $2.90 (107%)

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

57/74

Net Sales Top Six Countries

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

58/74

58

Year Ended: 2002-2008

2008 2007 2006 2005 2004 2003 2002

United States 1,221$ 1,021$ 770$ 710$ 765$ 738$ 605$Mexico 750 668 532 450 383 331 332

Canada 399 363 286 262 271 260 281

Sub Total 2,370$ $2,052 1,588$ 1,422$ 1,419$ 1,329$ 1,218$

Brazil 594$ 498$ 350$ 322$ 288$ 251$ 195$

Korea 187 195 185 186 187 170 162

Argentina 200 160 129 114 106 102 63

Others 593 486 369 316 283 250 233

Total 3,944$ 3,391$ 2,621$ 2,360$ 2,283$ 2,102$ 1,871$

($ millions)

Return to index

Long-Lived Assets Top Six Countries

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

59/74

59

as of December 31: 2001-2008

2008 2007 2006 2005 2004 2003 2002 2001

United States 527$ 506$ 466$ 428$ 407$ 406$ 433$ 434$Mexico 397 370 365 382 401 426 433 457

Canada 165 188 154 176 173 165 147 151

Sub Total 1,089$ 1,064$ 985$ 986$ 981$ 997$ 1,013$ 1,042$

Brazil 261$ 320$ 219$ 160$ 125$ 112$ 88$ 131$

Korea 201 276 280 252 243 212 210 186

Argentina 149 137 125 120 117 116 67 135

Others 206 216 198 183 175 171 146 158

Total 1,906$ 2,013$ 1,807$ 1,701$ 1,641$ 1,608$ 1,524$ 1,652$

($ millions)

Return to index

Percent of Net Sales

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

60/74

60

Percent of Net Sales

2008 2007 2006 2005 2004 2003 2002 2001

Starch 22% 22% 22% 23% 22% 21% 20% 20%

Sweeteners 53% 57% 55% 53% 52% 54% 55% 57%

Co-products & other 25% 21% 23% 24% 26% 25% 25% 23%

Major Industries

Processed foods 25% 25% 19% 19% 22% 21% 21% 22%

Soft drink 13% 16% 18% 18% 17% 17% 17% 20%

Brewing 12% 11% 11%

Animal feed 12% 11% 10% 11% 19% 19% 16% 15%

Return to index

Summary Balance Sheet

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

61/74

61

2008, 2007 and 2006

2008 2007 2006

Current assets 1,297$ 1,089$ 837$

Net fixed assets 1,447 1,500 1,356Other assets 463 514 452

Total assets 3,207$ 3,103$ 2,645$

Current liabilities* 653$ 544$ 443$

Total debt 866 649 554

Other liabilities 290 286 274

Redeemable equity 14 19 44

Stockholders' equity 1,384 1,605 1,330

Total liabilities and equity 3,207$ 3,103$ 2,645$

*Excludes short-term debt

($ millions)

Return to index

Summary Cash Flow

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

62/74

62

2008 and 2007

2008 2007

Cash flow from operations (79)$ 258$Net income 267 198Depreciation 128 125

(Increase) decrease in margin accounts (295) 55Increase in other trade working capital (163) (114)Other (16) (6)

Cash flow from investing (219)$ (232)$Fixed assets, net (219) (174)Acquisition - (59)Sale of investment - -Other - 1

Cash flow from financing 230$ 15$

Net increase (decrease) in debt 257 83Dividends paid (42) (33)Issuance (Repurchase) of common, net 10 (39)Excess tax benefit onshare-based compensation 5 6Other - (2)

($ millions)

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

63/74

Creditworthiness Improvement

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

64/74

64

2002 2008($ millions)

EBIT

EBITDA

Interest Expense, Net

Total DebtBook Capital

Market Capitalization

EBITDA Interest Coverage

EBIT Interest Coverage

Total Debt/EBITDA

Total Debt/Book Capitalization

Total Debt/Market CapitalizationSubsidiary Debt as a % of Total Debt

2005 2004(b)

2003 2002(a)

$ 180 $ 178 $ 174 $ 153

286 280 275 256

32 33 39 37

528 568 550 600

1,912 1,877 1,802 1,710

2,465 2,794 2,146 2,013

8.9x 8.5x 7.1x 6.9x

5.6x 5.4x 4.5x 4.2x

1.8x 2.0x 2.0x 2.3x

28% 30% 31% 35%

21% 20% 26% 30%14% 20% 18% 25%

2006

(c)

$ 225

339

28

554

2,072

3,304

12.0x

8.0x

1.6x

27%

17%18%

(a)Includes unusual items of $8 million pre-tax or $5 million after-tax.

(b)Includes net charges of $21 million pre-tax and $15 million after-tax.

(c)

Market capital assumes year-end share prices

2007

$ 343

468

38

649

2,436

3,533

12.3x

9.0x

1.4x

27%

18%23%

2008

$ 447

575

38

866

2,405

3,157

15.1x

11.7x

1.5x

36%

27%28%

Return to index

Non-GAAP Financial Measures

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

65/74

65

Non-GAAP Financial Measures

The Company reports its financial results in accordance with generally accepted accountingprinciples (GAAP). However, Management believes that certain items not calculated inaccordance with GAAP, including non-GAAP performance measures, results excluding the impact

of impairment and restructuring charges incurred during the second quarter of 2009, ratios andtrends, guidance with respect to earnings per diluted share for 2009 excluding impairment andrestructuring charges incurred in the second quarter of 2009, may provide investors with ameaningful presentation of useful information on a basis consistent with the way in whichmanagement monitors and evaluates the Companys operating performance and provide investorswith additional information to assess and facilitate a more clear understanding of our financialresults. The non-GAAP information is presented for analytical purposes only, should not beconsidered in isolation and should not be used as a substitute for our financial results calculatedunder GAAP. In addition, these non-GAAP amounts are susceptible to varying interpretations andcalculations, and the amounts presented may not be comparable to similarly titled measures of othercompanies. Our reconciliation of debt to capitalization, debt to adjusted EBITDA, operatingworking capital, earnings per share for the three months ended June 30, 2009 excluding impairmentand restructuring charges incurred in that quarter, guidance with respect to earnings per diluted

share for 2009 excluding impairment and restructuring charges incurred in the second quarter of2009 to the most directly comparable financial measures calculated and presented in accordancewith GAAP is presented in this Appendix.

Return to index

Key Metric GAAP ReconciliationR t C it l E l d t D b 31

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

66/74

66

Return on Capital Employed at December 31

($ millions)Return on Capital Employed 2008 2007Total stockholders equity* $1,605 $1,330

Add:

Cumulative translation adjustment* 132 214

Minority interest in subsidiaries* 21 19

Redeemable common stock* 19 44

Share-based payments subject to redemption* 9 4

Total debt* 649 554

Less:

Cash and cash equivalents* (175) (131)

Capital employed* (a) $2,260 $2,034

Operating income $434 $347

Adjusted for:

Income taxes (at effective tax rates of 32.0% in 2008 and

33.5% in 2007) (139) (116)

Adjusted operating income, net of tax (b) $295 $231

Return on Capital Employed (b a) 13.1% 11.4%

* Balance sheet items used in computing capital employed

represent beginning of period balances

Return to index

Key Metric GAAP ReconciliationD b T l C i li i

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

67/74

67

Debt to Total Capitalization

($ millions)

30-Sep 31-Dec 30-Sep

Debt to Capitalization percentage 2009 2008 2008

Short-term debt $162 $206 $223

Long-term debt 533 660 505

Total debt (a) $695 $866 $728

Deferred income tax liabilities $109 $105 $126

Redeemable common stock 14 14 18

Share-based payments subject to redemption 7 11 10

Total equity 1,575 1,406 1,597

Total capital $1,705 $1,536 $1,751

Total debt and capital (b) $2,400 $2,402 $2,479

Debt to Capitalization percentage (ab) 29.0% 36.1% 29.4%

Return to index

Key Metric GAAP ReconciliationD bt t Adj t d EBITDA R ti (TTM)

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

68/74

68

Debt to Adjusted EBITDA Ratio (TTM)

($ millions)30-Sep 31-Dec 30-Sep

Debt to adjusted EBITDA ratio 2009 2008 2008

Short-term debt $162 $206 $223

Long-term debt 533 660 505 Total debt (a) $695 $866 $728

Net income attributable to CPI $31 $267 $267

Add back:

Impairment and restructuring charges 125 - -

Net income attributable to non-controlling interest 6 8 7

Provision for income taxes 43 130 144

Interest expense, net 38 38 35

Depreciation 126 128 130

Adjsuted EBITDA (b) $369 $571 $583

Debt to adjusted EBITDA ratio (a b) 1.9 1.5 1.2

Return to index

Key Metric GAAP ReconciliationO ti W ki C it l % f N t S l

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

69/74

69

Operating Working Capital as % of Net Sales

($ millions)

Operating Working Capital 30-Sep 31-Dec 30-Sep

as a percentage of Net Sales 2009 2008 2008

Current assets $1,193 $1,297 $1,252

Less: Cash and cash equivalents (161) (107) (116)

Less: Deferred income tax assets (57) (99) (50)

Adjusted current assets $975 $1,091 $1,086

Current liabilities $713 $859 $828

Less: Short-term debt (162) (206) (223)

Less: Deferred income tax liabilities - - (1)

Adjusted current liabilities $551 $653 $604

Operating working capital (a) $424 $438 $482

Net sales for the last 12 months (b) $3,613 $3,944 $3,938

Operating Working Capital as a percentage

of Net Sales (a b) 12.2%11.7% 11.1%

Return to index

Reconciliation to Non-GAAPO ti I d O ti M i

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

70/74

70

Operating Income and Operating Margin

3 Months 3 Months 3 MonthsEnded Ended Ended

(in millions) Mar. 31, 2009 Jun. 30, 2009 Sep. 30, 2009

Net sales (a) 831$ 912$ 971$

Operating income (loss) (b) 39 (73) 88

Impairment/restructuring charges - 125 -

Operating income before impairment

and restructuring charges (c)39$ 52$ 88$

Operating margin - GAAP basis (ba) 4.7% -8.0% 9.1%

Operating margin - adjusted basis (ca) 4.7% 5.7% 9.1%

9 Months 9 Months

Ended Ended

(in millions) Sep. 30, 2009 Sep. 30, 2008

Net sales (a) 2,713$ 3,043$

Operating income (b) 54 370

Impairment/restructuring charges 125 -

Operating income before impairment and

restructuring charges (c)179$ 370$

Operating margin - GAAP basis (ba) 2.0% 12.2%

Operating margin - adjusted basis (ca) 6.6% 12.2%

Return to index

Reconciliation to Non-GAAP EarningsP Sh

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

71/74

71

Per Share

Reconciliation to Non-GAAP Earnings Per Share ("EPS")

(Unaudited)

(in millions) EPS (in millions) EPSNet (loss) attributable to CPI ($84.8) ($1.13) ($15.2) ($0.20)

Add back:

110.3 1.47 110.3 1.47

on- net ncome $25.5 $0.34 $95.1 $1.27

econc a on o on- arn ngs er are u ance or

(Unaudited)

2009

Guidance

EPSEarnings per share Guidance (GAAP basis), as presented $0.33 - $0.53

Add back:

Impairment and restructuring charges 1.47

Earnings per share Guidance (Non-GAAP) $1.80 - $2.00

Nine Months Ended

9/30/2009

Three Months Ended

June 30, 2009

Impairment / restructuring charges, net of income tax benefit of $14.7 million

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

72/74

72

Management

Return to index

Management ProfilesCEO d CFO

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

73/74

73

CEO and CFOIlene S. Gordon - Chairman, President and Chief Executive Officer

Ilene Gordon became chairman, president and chief executive officer on May 4, 2009.Gordon, 55, previously was president and CEO of Alcan Packaging, a subsidiary of RioTinto Group, positions to which she was appointed in 2006. She led a $6.5 billion globalpackaging business with 130 factories and 30,000 employees in 30 countries, servingcustomers in the food, beauty, tobacco and pharmaceutical industries. Gordon previouslywas senior vice president of Alcan, Inc. and president and CEO of Alcan Packaging. Prior

to that, she was president of Alcan Packagings $1.4 billion food packaging Americas unit.Alcan acquired Pechiney in 2003 and prior to the acquisition, Gordon was Pechineyssenior vice president and president of plastic packaging. Gordon spent 17 years inexecutive roles at the Packaging Corporation of America, a division of Tenneco Inc.Before joining Tenneco, she spent two years as director of strategic planning at Signode, aleading global packaging company specialized in materials handling, which today is a partof Illinois Tool Works. From 1976-1980, Gordon was a strategy consultant at the BostonConsulting Group (BCG), an international management consulting firm. Gordon holds abachelors degree in mathematics, Phi Beta Kappa, from the Massachusetts Institute ofTechnology (MIT) in Cambridge, Mass., and a masters degree in management from MIT'sSloan School of Management. She serves on the board of directors of Arthur J. Gallagher& Company and United Stationers.

Cheryl K. Beebe - Chief Financial OfficerCheryl Beebe, 53, was appointed vice president and chief financial officer in 2004. Priorto this position, she served as vice president of finance and corporate treasurer of theCompany. Beebe has held various positions of increasing responsibility in marketing,market services, audit, finance and treasury functions, since joining CPC International in1980. She holds a bachelors degree in accounting from Rutgers University and a mastersdegree of business administration in corporate finance from Fairleigh Dickinson

University. Beebe is a member of the board of directors of Packaging Corporation ofAmerica and the board of trustees of Fairleigh Dickinson University.

Return to index

-

8/14/2019 CPO Corn Products International Dec 2009 Presentation

74/74