Cost of Capital

-

Upload

brainzasif -

Category

Documents

-

view

33 -

download

1

Transcript of Cost of Capital

1Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

2Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Here we discuss the following:-

Overall Cost of Capital

The Capital Asset Pricing Model (CAPM)

Weighted Average Cost of Capital (WACC)

Here we discuss the following:-

Overall Cost of Capital

The Capital Asset Pricing Model (CAPM)

Weighted Average Cost of Capital (WACC)

Cost of Capital

3Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Cost of Capital is the required rate of return on the various types of financing. The overall cost of capital is a weighted average of the individual required rates of return (costs).

Overall Cost of Capital

4Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Type of Financing Mkt. Val Weight

Long-Term Debt $ 35M 35%

Preferred Stock $ 15M 15%

Common Stock Equity $ 50M 50%

$ 100M 100%

Market Value ofLong-Term Financing

5Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Cost of Debt Cost of Debt is the required rate of return on investment of the lenders of a company.

ki = kd ( 1 - T )

Cost of Debt

P0 =Ij + Pj

(1 + kd)jn

j =1

6Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Assume that Basket Wonders (BW) has $1,000 par value zero-coupon bonds

outstanding. BW bonds are currently trading at $385.54 with 10 years to maturity. BW tax

bracket is 40%.

Determination of the Cost of Debt

$385.54 =$0 + $1,000

(1 + kd)10

7Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

(1 + kd)10 = $1,000 / $385.54= 2.5938

(1 + kd) = (2.5938) (1/10)

= 1.1 kd = .1 or 10%

Interest is tax deductible, so

kd AT or ki = kd BT(1 - T)

= 10%(1 - 0.40)

= 6%.

Determination of the Cost of Debt

8Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Cost of Preferred StockCost of Preferred Stock is the required rate of return on investment of the preferred shareholders of the company.

kP = DP / P0

Cost of Preferred Stock

9Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Assume that Basket Wonders (BW) has preferred stock outstanding with par value of $100, dividend per share of $6.30, and a

current market value of $70 per share.

kP = $6.30 / $70

kkPP = 9%9%

Determination of the Cost of Preferred Stock

10Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Dividend Discount ModelDividend Discount Model Capital-Asset Pricing Capital-Asset Pricing

Model Model Bond-Yield-Plus-Risk-Premium-Bond-Yield-Plus-Risk-Premium-

ApproachApproach

Cost of Equity Approaches

11Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Dividend Discount ModelDividend Discount Model

The cost of equity capitalcost of equity capital, ke, is the discount rate that equates the present value of all expected future dividends with the current market price of the

stock.

D1 D2 D(1+ke)1 (1+ke)2 (1+ke)

+ . . . ++P0 =

12Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Constant Growth ModelConstant Growth Model

The constant dividend growthconstant dividend growth assumptionassumption reduces the model to:

ke = ( D1 / P0 ) + g

Assumes that dividends will grow at the constant rate “g” forever.

13Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Assume that Basket Wonders (BW) has common stock outstanding with a current market value of

$64.80 per share, current dividend of $3 per share, and a dividend growth rate of 8% forever.

ke = ( D1 / P0 ) + g

ke = ($3(1.08) / $64.80) + .08

kkee = .05 + .08 = 0.130.13 or 13%13%

Determination of the Cost of Equity Capital

14Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Now, let’s talk about Capital Asset

Pricing Model

15Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

CAPM is a model that describes the relationship between risk and expected

(required) return; in this model, a security’s expected (required) return is the risk-free rate plus a premium based on the

systematic risk of the security.

CAPM is a model that describes the relationship between risk and expected

(required) return; in this model, a security’s expected (required) return is the risk-free rate plus a premium based on the

systematic risk of the security.

Capital Asset Pricing Model (CAPM)

16Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

1. Capital markets are efficient.

2. Homogeneous investor expectations

over a given period.

3. Risk-free asset return is certain

(e.g. treasury securities).

4. Market portfolio contains only systematic risk

1. Capital markets are efficient.

2. Homogeneous investor expectations

over a given period.

3. Risk-free asset return is certain

(e.g. treasury securities).

4. Market portfolio contains only systematic risk

CAPM Assumptions

17Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

The CAPM equationThe CAPM equation::

kj = krf + j(km - krf)

where:

kj = the Required Return on security j,

krf = the risk-free rate of interest,

j = the beta of security j, and

km = the return on the market index.

Also referred as SML (discussed in subsequent slides)

18Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Example:Example:

Suppose the Treasury bond rate is 6%, the average return on the KSE 100 index is 12%, and OGDC has a beta of 1.2.

According to the CAPM, what should be the required rate of return on OGDC stock?

19Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

kj = .06 + 1.2 (.12 - .06)

kj = .132 = 13.2%

According to the CAPM, OGDC

stock should be priced to give

a13.2% return.

kj = krf + j (km - krf)

20Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Beta

Measures a stock’s market risk, and shows a stock’s volatility relative to the market. In other words, it measures the sensitivity of a stock’s returns to changes in returns on the market portfolio.

Indicates how risky a stock is if the stock is held in a well-diversified portfolio.Its an index of systematic risk.

The beta for a portfolio is simply a weighted average of the individual stock betas in the portfolio.

21Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Calculating betas

Run a regression of past returns of a security against past returns on the market.

The slope of the regression line (sometimes called the security’s characteristic line) is defined as the beta coefficient for the security.

22Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Illustrating the calculation of beta

.

.

.ki

_

kM

_-5 0 5 10 15 20

20

15

10

5

-5

-10

Regression line:

ki = -2.59 + 1.44 kM^ ^

Year kM ki

1 15% 18%

2 -5 -10

3 12 16

23Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

REQUIRED RETURNON STOCK

REQUIRED RETURNON MARKET PORTFOLIO

Beta < 1Beta < 1(defensive)(defensive)

Beta = 1Beta = 1

Beta > 1Beta > 1(aggressive)(aggressive)

Each characteristic characteristic line line has a

different slope.

BetaBeta =RiseRiseRunRun

Characteristic Lines and Different Betas

Characteristic LineCharacteristic Line

24Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Comments on beta

If beta = 1.0, the security is just as risky as the average stock.

If beta > 1.0, the security is riskier than average.

If beta < 1.0, the security is less risky than average.

Most stocks have betas in the range of 0.5 to 1.5.

25Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Can the beta of a security be negative?

Yes, if the correlation between Stock i and the market is negative (i.e., ρi,m < 0).

If the correlation is negative, the regression line would slope downward, and the beta would be negative.

However, a negative beta is highly unlikely.

26Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Beta coefficients for HT, Coll, and T-Bills

ki

_

kM

_

-20 0 20 40

40

20

-20

HT: β = 1.30

T-bills: β = 0

Coll: β = -0.87

27Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Comparing expected return and beta coefficients

Security Exp. Ret. Beta HT 17.4% 1.30Market 15.0 1.00USR 13.8 0.89T-Bills 8.0 0.00Coll. 1.7 -0.87

Riskier securities have higher returns, so the rank order is OK.

28Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

29Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Rj is the required rate of return for stock j,

Rf is the risk-free rate of return,

j is the beta of stock j (measures systematic risk of stock j),

RM is the expected return for the market portfolio.

Rj is the required rate of return for stock j,

Rf is the risk-free rate of return,

j is the beta of stock j (measures systematic risk of stock j),

RM is the expected return for the market portfolio.

RRjj = RRff + j(RRMM - RRff)

The Security Market Line (SML):

As discussedbefore in slide # 17

30Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

The Security Market Line (SML):Calculating required rates of return

SML: ki = kRF + (kM – kRF) βi

Assume kRF = 8% and kM = 15%.

The market (or equity) risk premium is RPM = kM – kRF = 15% – 8% = 7%.

31Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

RRjj = RRff + j(RRMM - RRff)

MM = 1.01.0

Systematic Risk (Beta)

RRff

RRMM

Req

uir

ed R

etu

rnR

equ

ired

Ret

urn

RiskRiskPremiumPremium

Risk-freeRisk-freeReturnReturn

The Security Market Line (SML):

32Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Beta Coefficients for Selected Companies

33Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Example - Portfolio Beta Calculations

Amount Portfolio

Share Invested Weights Beta

(1) (2) (3) (4) (3) (4)

ABC Company $ 6 000 50% 0.90 0.450

LMN Company 4 000 33% 1.10 0.367

XYZ Company 2 000 17% 1.30 0.217

Portfolio $12 000 100% 1.034

34Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Example - Portfolio Expected Returns and Betas

Assume you wish to hold a portfolio consisting of asset A and a riskless asset. Given the following information, calculate portfolio expected returns and portfolio betas, letting the proportion of funds invested in asset A range from 0 to 125%.

Asset A has a beta of 1.2 and an expected return of 18%.

The risk-free rate is 7%. Asset A weights: 0%, 25%, 50%, 75%, 100%

and 125%.

35Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Example - Portfolio Expected Returns and Betas

Proportion Proportion Portfolio Invested in Invested in Expected Portfolio Asset A (%) Risk-free Asset (%) Return (%) Beta

0 100 7.00 0.00

25 75 9.75 0.30

50 50 12.50 0.60

75 25 15.25 0.90

100 0 18.00 1.20

125 -25 20.75 1.50

36Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Lisa Miller at Basket Wonders is attempting to determine the rate of return required by their stock investors. Lisa is

using a 6% Rf and a long-term market expected rate of return of 10%. A stock analyst following the firm has calculated

that the firm beta is 1.2. What is the required rate of return on the stock of

Basket Wonders?

Lisa Miller at Basket Wonders is attempting to determine the rate of return required by their stock investors. Lisa is

using a 6% Rf and a long-term market expected rate of return of 10%. A stock analyst following the firm has calculated

that the firm beta is 1.2. What is the required rate of return on the stock of

Basket Wonders?

Determination of the Required Rate of Return

37Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

RBW = Rf + j(RM - Rf)

RBW = 6% + 1.2(10% - 6%)

RBW = 10.8%The required rate of return exceeds the

market rate of return as BW’s beta exceeds the market beta (1.0).

RBW = Rf + j(RM - Rf)

RBW = 6% + 1.2(10% - 6%)

RBW = 10.8%The required rate of return exceeds the

market rate of return as BW’s beta exceeds the market beta (1.0).

BWs Required Rate of Return

38Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Lisa Miller at BW is also attempting to determine the intrinsic value of the stock. She

is using the constant growth model. Lisa estimates that the dividend next period will be $0.50 and will grow at a constant rate of 5.8%.

The stock is currently selling for $15.

What is the intrinsic value of the stock? Is the stock over or underpriced?

Lisa Miller at BW is also attempting to determine the intrinsic value of the stock. She

is using the constant growth model. Lisa estimates that the dividend next period will be $0.50 and will grow at a constant rate of 5.8%.

The stock is currently selling for $15.

What is the intrinsic value of the stock? Is the stock over or underpriced?

Determination of the Intrinsic Value of BW

39Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

The stock is OVERVALUED as the market price ($15) exceeds the

intrinsic value ($10).

The stock is OVERVALUED as the market price ($15) exceeds the

intrinsic value ($10).

$0.50$0.5010.8%10.8% - 5.8%5.8%

IntrinsicIntrinsicValueValue

=

= $10$10

Determination of the Intrinsic Value of BW

Refer to the next slide

40Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

If the expected return is more than the required rate of return stock , the stock is UNDERPRICED

If the expected return is less than the required rate of return stock , the stock is OVERPRICED

If the expected return is more than the required rate of return stock , the stock is UNDERPRICED

If the expected return is less than the required rate of return stock , the stock is OVERPRICED

UNDERPRICED AND OVERPRICED STOCKS

41Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

What is the market risk premium?

Additional return over the risk-free rate needed to compensate investors for assuming an average amount of risk.

Its size depends on the perceived risk of the stock market and investors’ degree of risk aversion.

Varies from year to year, but most estimates suggest that it ranges between 4% and 8% per year.

42Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Calculating required rates of return

kHT = 8.0% + (15.0% - 8.0%)(1.30)

= 8.0% + (7.0%)(1.30)

= 8.0% + 9.1% = 17.10%kM = 8.0% + (7.0%)(1.00) = 15.00%

kUSR = 8.0% + (7.0%)(0.89) = 14.23%

kT-bill = 8.0% + (7.0%)(0.00) = 8.00%

kColl = 8.0% + (7.0%)(-0.87) = 1.91%

43Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Expected vs. Required returns

k) k( Overvalued 1.9 1.7 Coll.

k) k( uedFairly val 8.0 8.0 bills-T

k) k( Overvalued 14.2 13.8 USR

k) k( uedFairly val 15.0 15.0 Market

k) k( dUndervalue 17.1% 17.4% HT

k k

^

^

^

^

^

^

Refer Slide # 27

44Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Illustrating the Security Market Line

..Coll.

.HT

T-bills

.USR

SML

kM = 15

kRF = 8

-1 0 1 2

.

SML: ki = 8% + (15% – 8%) βi

ki (%)

Risk, βi

45Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

An example:Equally-weighted two-stock portfolio

Create a portfolio with 50% invested in HT and 50% invested in Collections.

The beta of a portfolio is the weighted average of each of the stock’s betas.

βP = wHT βHT + wColl βColl

βP = 0.5 (1.30) + 0.5 (-0.87)

βP = 0.215

46Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Calculating portfolio required returns

The required return of a portfolio is the weighted average of each of the stock’s required returns.

kP = wHT kHT + wColl kColl

kP = 0.5 (17.1%) + 0.5 (1.9%)

kP = 9.5%

Or, using the portfolio’s beta, CAPM can be used to solve for expected return.

kP = kRF + (kM – kRF) βP

kP = 8.0% + (15.0% – 8.0%) (0.215)

kP = 9.5%

47Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Verifying the CAPM empirically

The CAPM has not been verified completely.

Statistical tests have problems that make verification almost impossible.

Some argue that there are additional risk factors, other than the market risk premium, that must be considered.

48Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

More thoughts on the CAPM

Investors seem to be concerned with both market risk and total risk. Therefore, the SML may not produce a correct estimate of ki.

ki = kRF + (kM – kRF) βi + ???

CAPM/SML concepts are based upon expectations, but betas are calculated using historical data. A company’s historical data may not reflect investors’ expectations about future riskiness.

49Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

50Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Lets recall from before three ways to determine the cost of equity, ke or ks :

1. Capital Asset Pricing Model (CAPM)

ks = kRF + (kM - kRF)b

2. Dividend-Yield-Plus-Growth-Rate-Approach (DCF)

ks = D1/P0 + g.

3. Bond-Yield-Plus-Risk-Premium-Approach:

ks = kd + RP.

51Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

What’s the cost of equity based on the CAPM?

kRF = 7%, RPM = 6%, b = 1.2.

ks = kRF + (kM - kRF )b.

= 7.0% + (6.0%)1.2 = 14.2%.

52Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

What’s the DCF cost of equity, ks?Given: D0 = $4.19 ;P0 = $50; g = 5%.

k

D

Pg

D g

Pgs

1

0

0

0

1

$4. .

$50.

. .

.

19 1050 05

0 088 0 05

13 8%.

53Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Find ks using the own-bond-yield-plus-risk-premium method.

(kd = 10%, RP = 4%.)

ks = kd + RP

= 10.0% + 4.0% = 14.0%

54Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

What’s a reasonable final estimateof ks?

Method EstimateCAPM 14.2%DCF 13.8%

kd + RP 14.0% Average 14.0%

Generally, the three methods will

not agree.

55Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

56Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Let’s turn our attention to weighted average

cost of capital

57Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Weighted Cost of CapitalWeighted Cost of Capital

The weighted cost of capital is just the weighted average cost of all of the financing sources.

58Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Weighted Cost of CapitalWeighted Cost of Capital

CapitalCapital

Source Cost Structure Source Cost Structure

debt 6% 20%debt 6% 20%

preferred 10% 10%preferred 10% 10%

common 16% 70%common 16% 70%

59Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Weighted cost of capital =

.20 (6%) + .10 (10%) + .70 (16)

= 13.4%

Weighted Cost of CapitalWeighted Cost of Capital(20% debt, 10% preferred, 70% common)(20% debt, 10% preferred, 70% common)

60Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

What’s the WACC? (30% debt, 10% preferred, 60% common)(30% debt, 10% preferred, 60% common)

( (kd = 10%, kps = 9%, ks = 14%))

WACC = wdkd(1 - T) + wpskps + wceks

= 0.3(10%)(0.6) + 0.1(9%) + 0.6(14%)

= 1.8% + 0.9% + 8.4% = 11.1%.

61Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

WACC Estimates for Some Large U. S. Corporations

Company WACCIntel 12.9%General Electric 11.9Motorola 11.3Coca-Cola 11.2Walt Disney 10.0 AT&T 9.8Wal-Mart 9.8Exxon 8.8H. J. Heinz 8.5BellSouth 8.2

62Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

What factors influence a company’s WACC?

Market conditions, especially interest rates and tax rates.

The firm’s capital structure and dividend policy.

The firm’s investment policy. Firms with riskier projects generally have a higher WACC.

63Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Should the company use the composite WACC as the hurdle rate for

each of its projects?

NO! The composite WACC reflects the risk of an average project undertaken by the firm. Therefore, the WACC only represents the “hurdle rate” for a typical project with average risk.

Different projects have different risks. The project’s WACC should be adjusted to reflect the project’s risk.

64Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Find the division’s required return on equity and weighted average cost of capital

based on the CAPM, given these inputs:

Target debt ratio = 10%.kd = 12%.

kRF = 7%.Tax rate = 40%.betaDivision = 1.7.Market risk premium = 6%.

65Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Division’s required return on equity :

Division’s WACCWACC = wdkd(1 – T) + wcks

= 0.1(12%)(0.6) + 0.9(17.2%) = 16.2%

ks = kRF + (kM - kRF )b.

ks = 7% + (6% )1.7

= 17.2%

Find the division’s ks and WACC :

66Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

How does the division’s WACC compare with the firm’s overall WACC?

Division WACC = 16.2% versus company WACC = 11.1%.

Indicates that the division’s market risk is greater than firm’s average project.

“Typical” projects within this division would be accepted if their returns are above 16.2%.

67Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

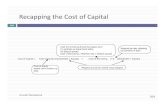

Recall from before (slide # 3), Cost of Capital is the required rate of return on the various types of financing. The overall cost of capital is a weighted average of the individual required rates of return (costs).

Overall Cost of Capital of the Firm

68Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Type of Financing Mkt Val Weight

Long-Term Debt $ 35M 35%

Preferred Stock $ 15M 15%

Common Stock Equity $ 50M 50%

$ 100M 100%

Market Value of Long-Term Financing

Figures fromSlide # 4

69Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Cost of Capital = kx (Wx)

Recall the following cost of capital figures for Basket Wonders (refer to slide # 5 onwards)

Cost of Debt (ki) = 6%6%

Cost of Preferred Stock (kp) = 9%9%

Cost of Equity (ke) =13%13%

n

x=1

Weighted Average Cost of Capital (WACC)

70Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Cost of Capital = kx (Wx)

WACC (Basket Wonders) =

WACC = .35(6%) + .15(9%) + .50(13%)

WACC = .021 + .0135 + .065 = .0995 or 9.95%

n

x=1

Weighted Average Cost of Capital (WACC)

71Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

Hang in there! It was a great and an enjoyable ride

Yeah, that’s easy for

you to say!

End of Chapter

72Copyright © 2009, FM, Prepared by Amyn Wahid All rights reserved.

End of Term