Corporate Presentation ELE July 2020...2. US$2 million convertible loan with Tembo Capital 3. Sprott...

Transcript of Corporate Presentation ELE July 2020...2. US$2 million convertible loan with Tembo Capital 3. Sprott...

Corporate Presentation

October 2020| ELE

| ELE

Forward Looking Statements

2

Market and Industry Data

This corporate presentation includes market and industry data and forecast that were obtained from third-party sources, industry publications and publicly available information. Third-party sources generally state that

the information therein has been obtained from sources believed to be reliable, but there can be no assurances as to the accuracy or completeness of included information. Although management believes it to be

reliable, management has not independently verified any of the data from third-party sources referred to in this presentation, or analyzed or verified the underlying studies or surveys relied upon or referred to by such

sources, or ascertained the underlying economic assumptions relied upon by such sources.

Forward-Looking Statements

This corporate presentation contains “forward-looking information” within the meaning of applicable Canadian securities laws and “forward-looking statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995, (together, “forward-looking statements”), concerning the business, operations and financial performance and condition of the Company. Forward-looking statements include, but

are not limited to, statements with respect to the future price of gold, the estimation of mineral reserves and mineral resources; the realization of Mineral Reserve estimates; and the timing and amount of estimated

future production. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as “plans,” “expects” or “does not expect,” “is expected,” “budget,” “scheduled,” “estimates,”

“forecasts,” “intends,” “anticipates” or “does not anticipate,” “believes,” “projects” or variations of such words and phrases or state that certain actions, events or results “may,” “could,” “would,” “might” or “will be taken,”

“occur” or “be achieved.” Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made, and they are subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements,

including, but not limited to, volatility in the price of gold, discrepancies between anticipated and actual production by companies in our portfolio, risks inherent in the mining industry to which the companies in our

portfolio are subject, regulatory restrictions, the impact of the current COVID-19 pandemic on the companies in our portfolio, activities by governmental authorities (including changes in taxation), currency fluctuations

and the accuracy of the mineral reserves, resources and recoveries set out in the technical data published by the companies in our portfolio. Although management of the Company has attempted to identify important

factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be

no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on

forward-looking statements. The Company cautions readers not to place undue reliance on forward-looking statements, as forward-looking statements involve significant risks and uncertainties. Forward-looking

statements should not be read as guarantees of future performance or results and will not necessarily be accurate indications of whether or not the times at or by which such performance or results will be achieved. The

Company does not undertake to update any forward-looking statements except in accordance with applicable Canadian securities laws. Readers are directed to the Company’s Filing Statement filed under the

Company’s profile on SEDAR (www.sedar.com) for a complete list of applicable risk factors.

Investors are advised that National Instrument 43-101 Standards for disclosure for Mineral Projects (“NI 43-101”) of the Canadian Securities Administrators requires that each category of Mineral Reserves and Mineral

Resources be reported separately. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

JORC Code

Certain Resource and Reserve estimates covering properties related to certain mining assets in this corporate presentation have been prepared in reliance upon the JORC Code. Estimates based on JORC Code are

recognized under NI 43-101 in certain circumstances. In each case, the Mineral Resources and Mineral Reserves included in this presentation are based on estimates previously disclosed by the relevant property owner

or operator, without reference to the underlying data used to calculate the estimates. Accordingly, the Company is not able to reconcile the Resource and Reserve estimates prepared in reliance on JORC Code with that

of CIM definitions. The Company previously sought confirmation from its Qualified Person who is experienced in the preparation of Resource and Reserve estimates using CIM and JORC Code, of the extent to which an

estimate prepared under JORC Code would differ from that prepared under CIM definitions. The Company was advised that, while the CIM definitions are not identical to those of JORC Code, the Resource and Reserve

definitions and categories are substantively the same as the CIM definitions mandated in NI 43-101 and will typically result in reporting of substantially similar Reserve and Resource estimates.

Cautionary Note to U.S. Investors Concerning Estimates of Measured, Indicated or Inferred Resources

This corporate presentation uses the terms “measured”, “indicated”, and “inferred” Mineral Resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the

United States Securities and Exchange Commission does not recognize these terms. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, as to their economic and legal feasibility. It

cannot be assumed that all or any part of an inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred Mineral Resources mat not form the basis of feasibility or

other economic studies. United States investors are cautioned not to assume that all or any part of measured or indicated Mineral Resources will ever be converted into Mineral Reserves. United States investors are

also cautioned not to assume that all or part of an inferred Mineral Resource exist, or is economically or legally mineable.

Qualified Person

Richard Evans, FAusIMM, is Senior Vice President, Technical for the Company and a qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and approved the

scientific and technical disclosure contained in this presentation.

2

| ELE

| ELE

3

• Cash-generating gold royalty company targeting near-term

growth through material acquisitions

• Since 2017, Elemental has acquired five producing royalties

• Growth in pipeline – Mercedes royalty paying from 2022

• Estimated US$5.3 million Revenue in 2020, 85% from gold

• Experienced team with a proven track record and material

ownership (24%)

• Uncapped Revenue and No Buybacks: future increases in

Reserves will deliver value to Elemental at zero cost

Introduction to Elemental

Invest in producing gold royalties with platform for growth

Source: Elemental estimates at a US$1,900/oz average gold price for H2/2020

0.4

1.4

2.4

5.3

-

1.0

2.0

3.0

4.0

5.0

-

0.3

0.6

0.9

1.2

1.5

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2017 2018 2019 2020

Kwale

Amancaya

Wahgnion

Mt Pleasant

Annual Revenue (Trailing 12m, RHS)

Elemental Revenue Growth (US$m)

| ELE

Royalty & Streaming Model Benefits

4

Clear strategy

Disciplined, accretive acquisitions to date

Established operators

Track record and reliable cash flow

Low overheads

No funding commitments, funds available to reinvest

Experienced Management

Scalable model, targeting growth

Geographically diversified

Reduced risk

Exploration upside free

Many assets produce beyond original lives

| ELE

5

Diverse Cash-Generating Portfolio

Gold-focused portfolio across countries and top tier operators

Strong Operators

Reduces corporate, management and

operational/technical risk

Preferred Commodity

Direct exposure to gold production

Gold

85%

Silver

4%Mineral

Sands

11%

2020E Revenue by Commodity1

Producing

98%

Producing Assets

Minimises funding or construction

risks outside of Elemental control

September 2020 NAV1

Proven Jurisdictions

Protection from local political

instability, expropriation, policy

changes

Source: Elemental estimates

| ELE

1. Close price and exchange rates as of September 30, 2020

2. Includes 1.6m in the money options and performance rights

3. Estimate following Sprott Resource Lending Loan Repayment

Selected Institutional Shareholders

Post-Listing Capital Structure

6

Elemental Shares Outstanding (m) 44.5

Share Price (C$/share)1 1.36

Market Capitalisation (US$m) 45.5

Fully Diluted Market Capitalisation (US$m)2 47.2

Cash (US$m)3 10.1

Enterprise Value (US$m) 37.1

• Management and directors are major shareholders (24%)

• Tightly held register - top 20 shareholders hold 68%

• No third party warrants - all options / PSUs held by

directors, management and team

• Management incentivised by share price performance

• Strong institutional shareholder base with a 35%

shareholding

• Debt free, proposed US$20m acquisition facility available

from Sprott Resource Lending

Institutional

35%

Directors and

Management

24%

Private

41%

| ELE

Advisory PanelManagement Team

Elemental Board

Board and Management Team

7

Experienced and incentivised management team, who have grown Elemental from zero to US$45m valuation

John Robins

Director

Peter Williams

Director

Martin Turenne

Director

Greg Owen

Vice President

Operations

Richard Evans

Senior Vice President

Technical

David Baker

Vice President

Business Development

Matt Anderson

CFO

Frederick Bell

CEO

Director

Matthew Tack

Advisory Panel

Jim Paterson

Advisory Panel

Mining Corporate and Finance Experience:

| ELE

Corporate Timeline

8

2017

Q2 Q4Q1 Q3

Panton &

Kwale

acquisitions

completed

Panton

0.5% NSR on

Pre-Feasibility

PGM project in

Australia

Kwale

0.25% GRR on

mineral sands

mine in Kenya

Highlights

• Acquired a portfolio of cash-generating and growth royalties over three years prior to listing

• Targeted advanced gold royalties in top-tier mining jurisdictions

• Raised and deployed US$18.5m as a private company

2018

Q2 Q4Q1 Q3

2019

Q2 Q4Q1 Q3

2020

Q2Q1 Q3

Mt Pleasant

acquisition

completed

A$10/oz or 0.5%

NPI on

producing gold

mine in

Australia

Mercedes &

Amancaya

acquisitions

completed

Mercedes

1% NSR on

producing gold &

silver mine in

Mexico

Amancaya

2.25% NSR on

producing gold &

silver mine in Chile

Wahgnion

acquisition

completed

1% NSR on

producing gold

mine in Burkina

Faso

TSX-V Listing

Listed on the

TSX Venture

Exchange in

conjunction

with C$24m

fundraise

Future Accretive Acquisitions

Continue to target producing or near-term

producing royalties over quality precious

metals assets

Reserves and Resources Growth

Future increases in Reserves and Resources

from exploration at existing assets delivers

additional value to Elemental at zero cost

Investment Opportunity

• Ideal platform for growth with a base of five

producing royalties

• Completed RTO onto TSX-V in July 2020 alongside

C$24.0m equity fundraise

• Experienced management team in place to continue

targeting accretive transactions in the precious

metals sector

• Best positioned to complete deals: proposed

US$20.0m acquisition facility, C$13.5m cash

| ELE

DateEquity Raise

(US$m)Acquisitions

Equity Price1

(C$/share)Share Price Growth

February 2017 1.0 Kwale, Panton 0.29 369%

December 2017 0.8 Mount Pleasant 0.52 162%

August 2018 4.0 Mercedes, Amancaya 0.87 56%

December 2019 4.5 Wahgnion 1.01 35%

July 2020 17.3 Reverse Take Over 1.30 5%

Proven History of Shareholder Returns Since Incorporation

9

Since its first acquisition in 2017, Elemental has generated consistent returns for shareholders; both whilst as a private company, and after listing in July 2020

*Share Price as of September 30, 2020.

| ELE

Asset Snapshot

10

WAHGNION

1.0% NSR

MERCEDES

1.0% NSR

FROM JULY 2022

AMANCAYA

2.25% NSR

KWALE

0.25% GRRPANTON

0.5% NSR

MT PLEASANT

A$10/OZ OR

5% NPI

Principal Royalties Other Royalties Management and Board

| ELE

District-Scale Licences – Free Carry on Exploration and Capital Expenditure

11

Future increases in Resources and Reserves over district-scale licence areas continue to deliver value to Elemental at zero cost

Wahgnion: 1,022km2

Announced 25% production increase from 2020-2025

“The exploration program has recommenced with the intent of

replacing reserves and extending the mine life.”

“Ongoing exploration has returned positive results and is

prioritized on extending mine life through the growth of

reserves in proximity to existing mine workings and the

delineation of future resources”

Mercedes: 692km2

Teranga Gold - September 2020 News Release Premier Gold - August 2020 Press Release

| ELE

0.4

1.4

2.4

5.3

5.7

5.4

6.6

--

1

2

3

4

5

6

7

2017 2018 2019 2020E 2021E 2022E 2023E

Gro

ss R

oyalt

y R

even

ue (

US

$m

)

Kwale Amancaya Mt Pleasant

Wahgnion Mercedes

Targeting further material

accretive acquisitions

Note: Estimated gold Price US$1,900/oz H2/2020, US$1800/oz thereafter. 2020E includes Q1 and Q2 revenues from publicly disclosed company filings. Includes anticipated Mineral Resource conversion to Mineral Reserves at Amancaya and Kwale, and

small-scale mining on Mt Pleasant royalty area. Wahgnion production profile from News Release dated August 6, 2020 and available at www.terangagold.com

Revenue Growth through Existing Royalty Portfolio

12

• Elemental team has targeted near term production

since first transaction in 2017

• Grown from US$0.4m revenue in 2017 to an

estimated US$5.3m in 2020

• Transformational acquisitions in producing gold

royalties increases the size and diversity of the

revenue streams

• Disciplined use of capital as a private company –

now can revisit deals that were not suitable for

Elemental at the time

• Future growth locked in - Mercedes royalty

payable from July 2022 following a time hurdle

• Expected upgrading of Mineral Resources into

Reserves and commencement of small-scale

mining operations at Mount Pleasant

• Ideal base for further accretive transactions

| ELE

9.1

14.115.4 16.2

20.121.9

24.3

30.5

72.4 153.6 n/a

0x

10x

20x

30x

40x

Elemental Osisko Royal Gold Maverix Sandstorm Wheaton Nomad Franco

Nevada

Ely Metalla Vox

Pri

ce t

o H

1/2

020 A

nn

ualise

d R

even

ue

13

Royalty peers typically

trading at higher

Price/Revenue multiples

Source: Company Filings. Revenue to June 30, 2020. Metalla Revenue six months to May 31, 2020. Market Capitalisations from Capital IQ as of August 24, 2020

Attractive Value Proposition

Elemental most attractively priced precious metals royalty company

H1/2020 Revenue

(US$m)2.5 69.7 256.4 20.3 40.1 502.7 12.4 435.9 1.0 1.0 0.0

| ELE

98%94%

76%

66%

41% 41%

6%

0%

25%

50%

75%

100%

ELE FNV WPM MMX SSL OR MTA

% o

f N

AV

in

Pro

du

cin

g A

ssets

14

98% of Elemental NAV

attributable to producing assets.

Similar values only seen in larger

royalty peers

Source: CIBC Research published December 12, 2019, Elemental estimates

Producing Focus

Majority of value attributable to producing assets

| ELE

15

Three years operating pre-RTO, acquired six

royalties, built database and industry

relationships

Existing deal pipeline

Ongoing shareholder introductions

Listed company lowers cost of capital

vs private company

Ability to offer equity at ground floor

valuation – attractive for deal targets

Moderate leverage allows

growth without dilution

Skilled, cohesive management team built over

three years prior to listing

UK, Australia, Canada based teams have exposure

to different opportunities vs peers

Supported by Discovery Group, Tembo Capital,

and an experienced Board & Advisory Panel

Strong Growth Pipeline

Elemental best positioned to continue accretive acquisitions

| ELE

Targeting Portfolio Acquisitions

16

Elemental can deliver multiples of cash returns to counterparties by offering equity participation in transformational portfolio deals

Royalty Portfolio Vendor Date Portfolio Acquiror Share Price Gain*

July 2016 13 royalties 534%

December 2016 11 royalties 121%1

July 2017 3 royalties, 1 stream 348%

May 2018 54 royalties 108%

April 2019 15 royalties 98%

December 2019 20+ royalties 20%

February 202010 royalties, streams, and gold

loans 70%

*Share Price gain from transaction announcement to September 30, 2020, adjusted for dividends and share splits. Source: Capital IQ. Transactions typically have a mix of cash and equity consideration.

1. Goldfields sold their equity investment on 6 June 2019

| ELE

0

20

40

60

80

ELE Maverix Metals Metalla Royalty

Market Capitalisation on Listing (US$m)

0

1

2

3

4

5

ELE Maverix Metals Metalla Royalty

Annual Revenue on Listing (US$m)

0%

100%

200%

300%

400%

500%

600%

700%

0 3 6 9 12 15 18 21 24 27 30 33 36 39 42

Months from Listing

Maverix Metals

Metalla Royalty

Strong Peer Performance following Listing

17

+540%

+647%

0

1

2

3

4

5

ELE Maverix Metals Metalla Royalty

Producing Royalties on Listing

Source: Capital IQ, Company filings

| ELE

Royalty Company Outperformance

18Source: Capital IQ. Royalty index consists of FNV, RGLD & WPM. Share price performance rebased to Dec 2007.

131%

244%

636%

0%

100%

200%

300%

400%

500%

600%

700%

800%

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

GDX - Gold Miners Equity ETF Gold Royalty Index

| ELE

19

Elemental Royalties Summary

• Ground floor investment opportunity into a growing gold

royalty company

• 98% of NAV in producing assets

• Clear strategy to acquire cash-generating royalties

• Demonstrated ability to find, evaluate and complete deals

on producing royalties

• Experienced management team with strong track record

and support from Discovery Group, mining connected

shareholders, and Advisory Panel

Investment Case

Investment Case

• Underpinned by 4 cash-generating royalties

• 85% of revenues from gold, 4% from silver

• Organic growth with Mercedes royalty paying from July

2022

• Listing unlocks deal pipeline – utilising cash, leverage and

equity for accretive acquisitions

• Equity attractive to royalty counterparties to achieve

market multiples versus simple cash returns

An opportunity to invest in high quality gold royalties with exciting growth prospects

| ELE

20

LONDON

123 Buckingham Palace Road

London SW1W 9SH

United Kingdom

Contacts

VANCOUVER

Suite 1020 – 800 West Pender Street

Vancouver, British Columbia

V6C 2V6

Canada

General Enquiries:

Opportunities:

PHONE

+44 (0) 20 3983 7040

Appendix 1 Asset Overviews

| ELE

Project

Location: Burkina Faso

Operator: Teranga Gold

TSX: TGZ

Market Capitalisation US$1.8bn

Commodity: Gold

Mine Type: Open pit

Stage: Production

2020E Production: 150-165koz Au

Mine Life:

(Reserves only)11 years

Royalty

Royalty: 1% NSR

Deal Date: January 2020

2020E Revenue: US$2.7m

Reserves & Resources

Reserves: 1.55Moz @ 1.59 g/t Au

Resources (M&I): 2.37Moz @ 1.49g/t Au

Resources (Inf): 0.24Moz @ 1.41g/t Au

Portfolio: Wahgnion

22

Source: NI 43-101 Technical Report on the Wahgnion Gold Operations dated July 31, 2019 available on the Company’s website at www.terangagold.com and SEDAR at www.sedar.com.

Mineral Reserves are included in Mineral Resources. Market Capitalisation from Capital IQ as of September 30, 2020. Mineral Reserve and Resource Statement in Appendix

2020 estimated production and revenue based on production guidance, published on August 8, 2020, on Teranga’s website at a US$1,900/oz gold price

| ELE

Project

Location: Chile

Operator: Austral Gold Ltd

ASX: AGD

Market Capitalisation US$95m

Commodity: Gold & Silver

Mine Type: Open pit & Underground

Stage: Production

2019 Production: 56koz Au, 527koz Ag

Mine Life:

(Reserves only)

2 years, ongoing exploration for Resource

conversion and new prospects in royalty area

Royalty

Royalty: 2.25% NSR

Deal Date: June 2018

2019 Revenue: US$1.7m

Reserves & Resources

Reserves: 102koz Au @ 6.3g/t Au, 470koz Ag @ 29g/t Ag

Resources (M&I): 171koz Au @ 8.8g/t Au, 748koz Ag @ 38g/t Ag

Resources (Inf): 140koz Au @ 5.9g/t Au, 426koz Ag @ 18g/t Ag

Portfolio: Amancaya

23

Source: Austral Gold Limited’s 2019 Annual Report dated March 5, 2020. The report is prepared in accordance with NI 43-101 and is available on the Austral Gold’s website at www.australgold.com and SEDAR at www.sedar.com

Mineral Reserves are included in Mineral Resources. Market Capitalisation from Capital IQ as of September 30, 2020. Mineral Reserve and Resource Statement in Appendix

| ELE

Project

Location: Mexico

Operator: Premier Gold Ltd

TSX: PG

Market Capitalisation US$465m

Commodity: Gold & Silver

Mine Type: Underground

Stage: Operating

2019 Production: 60koz Au, 191koz Ag

Mine Life:

(Reserves only)

6 years, awaiting updated Reserve and Resource

estimate following 40,840m 2019 drilling program

Royalty

Royalty: 1% NSR after hurdle (July 2022)

Deal Date: June 2018

2019 Revenue: n/a

Reserves & Resources

Reserves: 395koz Au @ 3.6g/t Au, 2.7Moz Ag @ 25g/t Ag

Resources (M&I): 356koz Au @ 3.4g/t Au, 4.0Moz Ag @ 38g/t Ag

Resources (Inf): 231koz Au @ 4.2g/t Au, 2.0Moz Ag @ 36g/t Ag

Portfolio: Mercedes

24Source: Premier Gold Mines Limited’s Management Discussion and Analysis for the year ending December 31, 2019. The report is prepared in accordance with NI 43-101 and is available on Premier’s company profile at www.sedar.com

Mineral Reserves are not included in Mineral Resources. Market Capitalisation from Capital IQ as of September 30, 2020. Mineral Reserve and Resource Statement in Appendix

| ELE

Portfolio: Other Assets

25

Asset Information Kwale Mt Pleasant Panton

Location: Kenya West Australia West Australia

Operator: Base Resources Ltd Zijin Mining Group Panoramic Resources Ltd

ASX/AIM: BSE HKSE: 2899 ASX: PAN

Market Capitalisation US$211m Market Capitalisation US$21bn Market Capitalisation US$143m

Commodity: Mineral Sands Gold Platinum, Palladium, Gold

Mine Type: Open Pit Open-pit & underground Open-pit & Underground

Stage: Production Production Historical feasibility study

2019 Production:74kt Rutile, 348kt Ilmenite,

31kt Zircon2.2koz Au -

Mine Life:

(Reserves only)4 years - -

Royalty

Royalty: 0.25% GRR A$10/oz or 5% NPI 0.5% NSR

Deal Date: Feb 2017 Sept 2017 Feb 2017

2019 Revenue: US$0.5m US$0.02m n/a

Reserves & Resources

Reserves: 1.4Mt HM @ 3.4% HM -

Resources (M&I): 2.4Mt HM @ 3.1% HM 469koz Au @ 1.9g/t1 879koz Pt @ 2.3g/t, 963koz Pd @ 2.5g/t

Resources (Inf): - 711koz Au @ 2.8g/t1 129koz Pt @ 1.9g/t, 139koz Pd @ 2.0g/t

Source: Market Capitalisation from Capital IQ as of September 30, 2020.

Note 1: The Mount Pleasant royalty contains a historical resource estimate based on the Norton Gold Fields Limited announcement dated February 3, 2015, titled “January 2015 Mineral Resource & Ore Reserve update”, which was prepared in accordance with

the JORC Code, and is available on the ASX website at https://www.asx.com.au/asx/statistics/displayAnnouncement.do?display=pdf&idsId=01596085 . Elemental believes that the resources disclosed are reliable but should not be relied on as a current

resource estimate, and no qualified person of Elemental has done sufficient work to classify the above estimate as current mineral resources. Elemental is not treating the historical estimate as current Mineral Resources or Mineral Reserves.

Other sources: Base Resources Ltd.’s ASX announcement dated August 13, 2020, “2020 Mineral Resources and Ore Reserves Statement”. The ASX announcements are prepared in accordance with the JORC Code. The ASX announcements are available on Base

Resources’ website at https://baseresources.com.au/investors/announcements/. Mineral Reserves are included in Mineral Resources. Panoramic Resources Ltd.’s ASX announcements dated September 30, 2015, titled “Mineral Resources and Ore Reserves at

June 30, 2015”, The ASX announcement is prepared in accordance with the JORC Code and is available on Panoramic’s website at https://panoramicresources.com/asx-announcements/. Mineral Reserves are included in Mineral Resources.

Appendix 2 Board and Management

| ELE

Board

27

John Robins

Director

John is a professional geologist, prospector and entrepreneur with over 35 years of experience in the mining

industry. In 2008 he was awarded the AMEBC Spud Huestis award for his contributions to mineral exploration in

British Columbia and Yukon. He has been involved in over a billion dollars in M&A activity and has generated

over $500 million in direct and indirect mineral expenditures throughout Canada, Latin America and Australia.

Mr Robins is the founder of the Discovery Group of companies and is currently Chairman and director of

Bluestone Resources Inc, Fireweed Zinc Corporation and K2 Gold Corp

Frederick Bell

CEO, Director

Frederick co-founded Elemental Royalties in 2016 following his role as Managing Director of a listed gold

exploration company, Goldcrest Resources plc, where he assembled a portfolio of gold licences in northeast

Ghana to take to AIM. He has wide experience in the mining industry, including as General Manager of an ASX-

listed uranium company from the age of 25. Frederick received the ‘Young Rising Star’ Award at Mines & Money

2018, read history at the University of Edinburgh and is on the Committee of Young Mining Professionals in

London.

Peter Williams

Director

Peter was the first Manager of WMC Geoscience technology before he became a founding member of

Independence Group Limited, $0.20 in 2002 to $6 in 2006 and now $3bn+. He was a founding director of

Ampella Mining Ltd, a vendor of Gryphon Minerals’ Banfora Gold Project and involved in the project generation

for Papillion’s Mali projects. Peter co-founded the International Resource Sector Intelligence company, Intierra,

and also co-founded the first hard rock mineral seismic company in the world, HiSeis.

Martin Turenne

Director

Martin is senior executive with over 15 years’ experience in the commodities industry, including 10 years in the

mining industry, Martin is currently CEO of FPX Nickel Corp. He was formerly CFO of First Point Minerals Corp.

from 2012 to 2015 and previously with KPMG LLP and Methanex Corporation. He is a member of the Chartered

Professional Accountants of Canada and serves on the board of directors of the Association for Mineral

Exploration of British Columbia.

| ELE

Management and Advisory Panel

28

Greg Owen

Vice President

Operations

Greg has over 10 years of mining industry experience with both public and private companies, including as

Business Development Manager of Metals Exploration Plc, an AIM-listed exploration company developing the

Runruno gold-molybdenum project in the Philippines; and VP Corporate Development of Altus Strategies Plc as

part of IPO in August 2017 & the acquisition of TSX-V listed Legend Gold Corp in January 2018.

Richard Evans

Senior Vice President

Technical

Richard is a geologist and a co-founder of Elemental Royalties. He has over 30 years of technical and commercial

resource industry experience on five continents with a metals focus. He spent 18 years with WMC covering

exploration, feasibility, underground mining, business development and audit. He was a founding shareholder and

consultant to Mantra Resources, acquired by ARMZ for A$1bn.

David Baker

Vice President

Business Development

David has over 10 years’ experience in the mining and mine finance industries. He started his career in Equity

Research at BMO Capital Markets before joining Kulczyk Investments as part of the team that founded QKR

Corporation and acquired the Navachab Gold Mine. Prior to joining Elemental, David was Vice President at

Tamesis Partners LLP, specialising in corporate advisory, research, and equity capital markets.

Matt Anderson

CFO

Matt is a chartered professional accountant who has served as CFO of public companies in the mining industry for

over 10 years. He earned a Bachelor of Commerce degree from McGill University and earned his CPA while

articling at a large accounting firm. He is currently the managing director of Malaspina Consultants Inc.

Matthew Tack

Advisory Panel

Jim Paterson

Advisory Panel

Member

Appendix 3 Reserves and Resources

Mineral Reserve Estimates

30

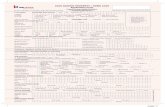

Proven Reserves

ProjectTonnes

(Mt)

Grade

(g/t Au)

Contained Metal

(koz Au)

Grade

(g/t Ag)

Contained Metal

(koz Ag)

Amancaya1 0.3 6.9 59 32.0 274

Mercedes2 0.2 9.0 56 81.0 503

Wahgnion3 2.9 1.37 130 - -

HM Assemblage

Material

(Mt)

In Situ HM

(Mt)

HM

(%)

Ilmenite

(%)

Rutile

(%)

Zircon

(%)

Kwale South Dune4 35 1.2 3.5% 58% 14% 6%

Probable Reserves

ProjectTonnes

(Mt)

Grade

(g/t Au)

Contained Metal

(koz Au)

Grade

(g/t Ag)

Contained Metal

(koz Ag)

Amancaya1 0.2 5.5 43 25.0 196

Mercedes2 3.2 3.3 339 21.7 2,222

Wahgnion3 27.4 1.61 1,420 - -

HM Assemblage

Material

(Mt)

In Situ HM

(Mt)

HM

(%)

Ilmenite

(%)

Rutile

(%)

Zircon

(%)

Kwale South Dune4 5 0.2 2.9% 51% 12% 5%

Total Mineral Reserves

ProjectTonnes

(Mt)

Grade

(g/t Au)

Contained Metal

(koz Au)

Grade

(g/t Ag)

Contained Metal

(koz Ag)

Amancaya1 0.5 6.3 102 29.0 470

Mercedes2 3.4 3.6 395 25.1 2,725

Wahgnion3 30.3 1.59 1,550 - -

HM Assemblage

Material

(Mt)

In Situ HM

(Mt)

HM

(%)

Ilmenite

(%)

Rutile

(%)

Zircon

(%)

Kwale South Dune4 40 1.4 3.4% 57% 13% 6%

Sources:

1. Austral Gold Limited’s 2019 Annual Report dated March 5, 2020. The report is prepared in accordance with NI 43-101 and is available on the Austral Gold’s website at www.australgold.com and SEDAR at www.sedar.com

2. Premier Gold Mines Limited’s Management Discussion and Analysis for the year ending December 31, 2019. The report is prepared in accordance with NI 43-101 and is available on Premier’s company profile at www.sedar.com

3. NI 43-101 Technical Report on the Wahgnion Gold Operations dated July 31, 2019 available on the Company’s website at www.terangagold.com and SEDAR at www.sedar.com

4. Base Resources Ltd.’s ASX announcement dated August 13, 2020, “2020 Mineral Resources and Ore Reserves Statement”. The ASX announcements are prepared in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and

Ore Reserves (“JORC Code”). The ASX announcements are available on Base Resources’ website at https://baseresources.com.au/investors/announcements/

Mineral Resource Estimates

31

Measured Resources

Project

Tonnes

(Mt)

Grade

(g/t Au)

Contained Metal

(koz Au)

Grade

(g/t Ag)

Contained Metal

(koz Ag)

Amancaya1 0.3 10.2 101 49.0 480

Mercedes2 0.3 3.3 27 51.2 417

Wahgnion3 3.3 1.36 140

HM Assemblage

Material

(Mt)

In Situ HM

(Mt)

HM

(%)

Ilmenite

(%)

Rutile

(%)

Zircon

(%)

Kwale South Dune4 55 1.8 3.2% 58% 14% 6%

Tonnage

(Mt)

Grade

(g/t Pt)

Grade

(g/t Pd)

Grade

(g/t Au)

Grade

(% Cu)

Grade

(% Ni)

Contained

(koz Pt)

Contained

(koz Pd)

Panton5 6.5 2.1 2.3 0.3 0.06% 0.25% 441 475

Indicated Resources

ProjectTonnes

(Mt)

Grade

(g/t Au)

Contained Metal

(koz Au)

Grade

(g/t Ag)

Contained Metal

(koz Ag)

Amancaya1 0.3 7.3 70 28.0 269

Mercedes2 3.0 3.4 329 36.9 3564

Wahgnion3 46.4 1.50 2,230

Mount Pleasant – Tuart6 3.6 1.8 212

Mount Pleasant - Racetrack6 4.3 1.9 257

HM Assemblage

Material

(Mt)

In Situ HM

(Mt)

HM

(%)

Ilmenite

(%)

Rutile

(%)

Zircon

(%)

Kwale South Dune4 20 0.6 2.9% 52% 12% 6%

Tonnage

(Mt)

Grade

(g/t Pt)

Grade

(g/t Pd)

Grade

(g/t Au)

Grade

(% Cu)

Grade

(% Ni)

Contained

(koz Pt)

Contained

(koz Pd)

Panton5 5.6 2.4 2.7 0.3 0.08% 0.28% 438 488

Sources:

1. Austral Gold Limited’s 2019 Annual Report dated March 5, 2020. The report is prepared in accordance with NI 43-101 and is available on the Austral Gold’s website at www.australgold.com and SEDAR at www.sedar.com. Mineral Reserves are included in Mineral Resources.

2. Premier Gold Mines Limited’s Management Discussion and Analysis for the year ending December 31, 2019. The report is prepared in accordance with NI 43-101 and is available on Premier’s company profile at www.sedar.com. Mineral Reserves are not included in Mineral Resources.

3. NI 43-101 Technical Report on the Wahgnion Gold Operations dated July 31, 2019 available on the Company’s website at www.terangagold.com and SEDAR at www.sedar.com. Mineral Reserves are included in Mineral Resources.

4. Base Resources Ltd.’s ASX announcement dated August 13, 2020, “2020 Mineral Resources and Ore Reserves Statement”. The ASX announcements are prepared in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (“JORC Code”).

The ASX announcements are available on Base Resources’ website at https://baseresources.com.au/investors/announcements/. Mineral Reserves are included in Mineral Resources.

5. Panoramic Resources Ltd.’s ASX announcements dated September 30, 2015, titled “Mineral Resources and Ore Reserves at June 30, 2015”, The ASX announcement is prepared in accordance with the JORC Code and is available on Panoramic’s website at https://panoramicresources.com/asx-

announcements/. Mineral Reserves are included in Mineral Resources.

6. The Mount Pleasant royalty contains a historical resource estimate based on the Norton Gold Fields Limited announcement dated February 3, 2015, titled “January 2015 Mineral Resource & Ore Reserve update”, which was prepared in accordance with the JORC Code, and is available on the

ASX website at https://www.asx.com.au/asx/statistics/displayAnnouncement.do?display=pdf&idsId=01596085 . Elemental believes that the resources disclosed are reliable but should not be relied on as a current resource estimate, and no qualified person of Elemental has done sufficient work

to classify the above estimate as current mineral resources. Elemental is not treating the historical estimate as current mineral resources or mineral reserves

Mineral Resource Estimates (continued)

32

Total Measured and Indicated Resources

ProjectTonnes

(Mt)

Grade

(g/t Au)

Contained Metal

(koz Au)

Grade

(g/t Ag)

Contained Metal

(koz Ag)

Amancaya1 0.6 8.8 171 38.0 748

Mercedes2 3.3 3.4 356 38.1 3981

Wahgnion3 49.6 1.49 2370

Mount Pleasant - Tuart 3.6 1.8 211

Mount Pleasant - Racetrack 4.3 1.9 258

HM Assemblage

Material

(Mt)

In Situ HM

(Mt)

HM

(%)

Ilmenite

(%)

Rutile

(%)

Zircon

(%)

Kwale South Dune4 75.0 2.4 3.1% 56% 13% 6%

Tonnage

(Mt)

Grade

(g/t Pt)

Grade

(g/t Pd)

Grade

(g/t Au)

Grade

(% Cu)

Grade

(% Ni)

Contained

(koz Pt)

Contained

(koz Pd)

Panton5 12.2 2.3 2.5 0.3 0.07% 0.26% 879 963

Inferred Resources

ProjectTonnes

(Mt)

Grade

(g/t Au)

Contained Metal

(koz Au)

Grade

(g/t Ag)

Contained Metal

(koz Ag)

Amancaya1 0.7 5.9 140 18.0 426

Mercedes2 1.7 4.2 231 36.1 1997

Wahgnion3 5.2 1.41 240

Mount Pleasant - Tuart6 1.9 3.8 232

Mount Pleasant - Racetrack6 6.3 2.4 480

HM Assemblage

Material

(Mt)

In Situ HM

(Mt)

HM

(%)

Ilmenite

(%)

Rutile

(%)

Zircon

(%)

Kwale South Dune4 - - - - - -

Tonnage

(Mt)

Grade

(g/t Pt)

Grade

(g/t Pd)

Grade

(g/t Au)

Grade

(% Cu)

Grade

(% Ni)

Contained

(koz Pt)

Contained

(koz Pd)

Panton5 2.2 1.9 2.0 0.3 0.11% 0.31% 129 139

Sources:

1. Austral Gold Limited’s 2019 Annual Report dated March 5, 2020. The report is prepared in accordance with NI 43-101 and is available on the Austral Gold’s website at www.australgold.com and SEDAR at www.sedar.com. Mineral Reserves are included in Mineral Resources.

2. Premier Gold Mines Limited’s Management Discussion and Analysis for the year ending December 31, 2019. The report is prepared in accordance with NI 43-101 and is available on Premier’s company profile at www.sedar.com. Mineral Reserves are not included in Mineral Resources.

3. NI 43-101 Technical Report on the Wahgnion Gold Operations dated July 31, 2019 available on the Company’s website at www.terangagold.com and SEDAR at www.sedar.com. Mineral Reserves are included in Mineral Resources.

4. Base Resources Ltd.’s ASX announcement dated August 13, 2020, “2020 Mineral Resources and Ore Reserves Statement”. The ASX announcements are prepared in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (“JORC Code”).

The ASX announcements are available on Base Resources’ website at https://baseresources.com.au/investors/announcements/. Mineral Reserves are included in Mineral Resources.

5. Panoramic Resources Ltd.’s ASX announcements dated September 30, 2015, titled “Mineral Resources and Ore Reserves at June 30, 2015”, The ASX announcement is prepared in accordance with the JORC Code and is available on Panoramic’s website at https://panoramicresources.com/asx-

announcements/. Mineral Reserves are included in Mineral Resources.

6. The Mount Pleasant royalty contains a historical resource estimate based on the Norton Gold Fields Limited announcement dated February 3, 2015, titled “January 2015 Mineral Resource & Ore Reserve update”, which was prepared in accordance with the JORC Code, and is available on the

ASX website at https://www.asx.com.au/asx/statistics/displayAnnouncement.do?display=pdf&idsId=01596085 . Elemental believes that the resources disclosed are reliable but should not be relied on as a current resource estimate, and no qualified person of Elemental has done sufficient work

to classify the above estimate as current mineral resources. Elemental is not treating the historical estimate as current mineral resources or mineral reserves