Corporate Apportionment and Sourcing Rights in Multistate...

Transcript of Corporate Apportionment and Sourcing Rights in Multistate...

Corporate Apportionment and Sourcing

Rights in Multistate Tax Compact States Key Implications Triggered by California's Gillette Case

Today’s faculty features:

1pm Eastern | 12pm Central | 11am Mountain | 10am Pacific

Please refer to the instructions emailed to the registrant for the dial-in information.

Attendees can still view the presentation slides online. If you have any questions, please

contact Customer Service at 1-800-926-7926 ext. 10.

WEDNESDAY, JANUARY 23, 2013

Presenting a live 110-minute teleconference with interactive Q&A

Bruce Ely, Partner, Bradley Arant Boult Cummings, Birmingham, Ala.

Walter Pickhardt, Partner, Faegre Baker Daniels, Minneapolis

Donald Griswold, Partner, Crowell & Moring, Washington, D.C.

Jeremy Abrams, Attorney, Crowell & Moring, Washington, D.C.

For this program, attendees must listen to the audio over the telephone.

Tips for Optimal Quality

Sound Quality

Call in on the telephone by dialing 1-866-570-7602 and enter your PIN when

prompted.

If you have any difficulties during the call, press *0 for assistance. You may also

send us a chat or e-mail [email protected] immediately, so we can

address the problem.

Viewing Quality

To maximize your screen, press the F11 key on your keyboard. To exit full screen,

press the F11 key again.

Continuing Education Credits

Attendees must stay on the line throughout the program, including the Q & A

session, in order to qualify for full continuing education credits. Strafford is

required to monitor attendance.

Record verification codes presented throughout the seminar. If you have not

printed out the “Official Record of Attendance,” please print it now (see

“Handouts” tab in “Conference Materials” box on left-hand side of your computer

screen). To earn Continuing Education credits, you must write down the

verification codes in the corresponding spaces found on the Official Record of

Attendance form.

Please refer to the instructions emailed to the registrant for additional

information. If you have any questions, please contact Customer Service

at 1-800-926-7926 ext. 10.

FOR LIVE EVENT ONLY

Program Materials

If you have not printed the conference materials for this program, please

complete the following steps:

• Click on the + sign next to “Conference Materials” in the middle of the left-

hand column on your screen.

• Click on the tab labeled “Handouts” that appears, and there you will see a

PDF of the slides and the Official Record of Attendance for today's program.

• Double-click on the PDF and a separate page will open.

• Print the slides by clicking on the printer icon.

Corporate Apportionment and Sourcing Rights in Multistate Tax Compact States Seminar

Don Griswold, Crowell & Moring

Walter Pickhardt, Faegre Baker Daniels

Jan. 23, 2013

Jeremy Abrams, Crowell & Moring

jabrams.crowell.com

Bruce Ely, Bradley Arant Boult Cummings

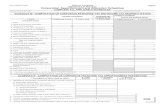

Today’s Program

California's Gillette Case

[Jeremy Abrams]

Implications For Sourcing Revenue From Services, Intangibles

[Don Griswold]

Issues Arising From Other State Cases And Guidance

[Bruce Ely]

Practical Decisions Facing Multi-State Companies

[Walter Pickhardt]

Slide 8 – Slide 24

Slide 46 – Slide 72

Slide 25 – Slide 41

Slide 42 – Slide 45

Notice

ANY TAX ADVICE IN THIS COMMUNICATION IS NOT INTENDED OR WRITTEN BY

THE SPEAKERS’ FIRMS TO BE USED, AND CANNOT BE USED, BY A CLIENT OR ANY

OTHER PERSON OR ENTITY FOR THE PURPOSE OF (i) AVOIDING PENALTIES THAT

MAY BE IMPOSED ON ANY TAXPAYER OR (ii) PROMOTING, MARKETING OR

RECOMMENDING TO ANOTHER PARTY ANY MATTERS ADDRESSED HEREIN.

You (and your employees, representatives, or agents) may disclose to any and all persons,

without limitation, the tax treatment or tax structure, or both, of any transaction

described in the associated materials we provide to you, including, but not limited to,

any tax opinions, memoranda, or other tax analyses contained in those materials.

The information contained herein is of a general nature and based on authorities that are

subject to change. Applicability of the information to specific situations should be

determined through consultation with your tax adviser.

7

CALIFORNIA’S GILLETTE CASE

Jeremy Abrams, Crowell & Moring

The Gillette Company, et. al. v. California Franchise Tax Board

I. Background

A. Multistate Tax Compact (the Compact)

B. California apportionment

II. Discussion

A. Procedural history

B. The Court of Appeal’s decision, on rehearing

C. Pending Supreme Court review

9

Multistate Tax Compact: Brief History

• UDITPA

• Northwestern Cement

• P.L. 86-272

• Willis Report

• Multistate Tax Commission

10

Multistate Tax Compact: Purpose

• Uniformity

• Equitable apportionment

• Taxpayer convenience

11

Multistate Tax Compact: Full Members

• Alabama, Alaska, Arkansas, California,* Colorado, District of

Columbia, Hawaii, Idaho, Kansas, Michigan, Minnesota,

Missouri, Montana, New Mexico, North Dakota, Oregon, South

Dakota, Texas, Utah, Washington

• *California withdrew from the Compact effective June 27,

2012.

12

Multistate Tax Compact: Apportionment Formula

• Article IV, Sect. 9

All business income shall be apportioned to this State

by multiplying the income by a fraction the numerator

of which is the property factor plus the payroll factor

plus the sales factor and the denominator of which is

three.

13

Multistate Tax Compact: Taxpayer Election

• Article III , Sect. 1

Any taxpayer subject to an income tax whose income

is subject to apportionment and allocation for tax

purposes pursuant to the laws of a party State or

pursuant to the laws of subdivisions in two or more

party States may elect to apportion and allocate his

income in the manner provided by the laws of such

States or by the laws of such States and subdivisions

without reference to this compact, or may elect to

apportion and allocate in accordance with Article IV.

14

California Apportionment

• Adopted UDITPA in 1966

• Uses its own numbering system

• Became signatory to Compact in 1974

• Pre-1993

• Dual apportionment statutes

• Cal. Rev. & Tax. Code

38006, art. IV, subd. 9

(Compact)

• Three factors, evenly weighted

• Cal. Rev. & Tax. Code

25128 (UDITPA)

• Three factors, evenly weighted

15

California Apportionment (Cont.)

• 1993 Amendment (switch to double-weighted sales)

• Cal. Rev. & Tax. Code

38006, art. IV, subd. 9 (Compact –

unchanged)

• Cal. Rev. & Tax. Code

25128 (double-weighted sales)

• “Notwithstanding Section 38006, all business income

shall be apportioned to this state by multiplying the

income by a fraction, the numerator of which is the

property factor plus the payroll factor plus twice the

sales factor, and the denominator of which is four …”

16

Gillette v. FTB: Taxpayers

• The Gillette Co. and subs

• Procter & Gamble Manufacturing Co.

• Kimberly-Clark Worldwide, Inc. and subs

• Sigma-Aldrich, Inc.

• RB Holdings (USA) Inc.

• Jones Apparel Group, Inc.

17

Gillette v. FTB: Procedural History

• Refund claims denied

• Superior Court decision

• Court of Appeal’s (first) decision

• Motion for rehearing

18

Gillette v. FTB: Issue

“[W]hether, for the tax years at issue since 1993,

Taxpayers were entitled to elect the Compact formula,

or, as respondent Franchise Tax Board (FTB) asserts, did

the 1993 amendment to section 25128 repeal and

supersede that formula, thereby making the state

formula mandatory?”

19

Gillette v. FTB: Decision On Rehearing (Oct. 2, 2012)

• Taxpayers have standing

• Refund claim for taxes paid pursuant to statute

• Third-party beneficiary of Compact

20

Gillette v. FTB: Decision On Rehearing (Cont.)

• Compact is binding on member states

• Indicia of an interstate compact

• Binding contract

• Valid state law

• State retains control over the tax base and rate.

21

Gillette v. FTB: Decision On Rehearing (Cont.)

• Cannot unilaterally repeal Compact provisions

• Compact supersedes subsequent, conflicting state statutes.

• States are prohibited from impairing obligations of contracts.

• FTB’s construction would violate the state Constitution.

22

Slide Intentionally Left Blank

Gillette v. FTB: Pending Supreme Court Review

• Nov. 13, 2012: FTB files petition for review

• Dec. 28, 2012: Court extends time for grant/denial to Feb.

11, 2013

• Jan. 16, 2013: Court grants FTB’s petition for review

• Stay tuned!

24

IMPLICATIONS FOR SOURCING REVENUE FROM SERVICES, INTANGIBLES

Don Griswold, Crowell & Moring

To Apportionment And Beyond: Additional Refund Opportunities

I. Statutory departures from Article IV provisions

A. Apportionment formula

B. Sourcing of sales other than sales of tangible personal

property

C. Business income definition

D. Industry specific apportionment

E. Other definitions

II. Broader implications of Article IV?

26

Departures From Compact Apportionment Formula

I. Double-weighted sales

A. Alabama, Arkansas, California, District of Columbia, Idaho

B. Example:

All business income shall be apportioned to this state by multiplying

the income by a fraction, the numerator of which is the property

factor plus the payroll factor plus double the sales factor, and the

denominator of which is four (4). Ark. Code Ann.

26-5-101

II. Shift to single-sales factor formula

A. Colorado, Michigan, Minnesota, Oregon, Texas

B. Example:

All business income shall be apportioned to this state by multiplying

the income by the sales factor. O.R.S.

314.650

27

Departures From Sourcing Of Sales Other Than Sales Of Tangible Personal Property

Compact rule: Greater costs of performance

Sales, other than sales of tangible personal property,

are in this State if:

(a) The income-producing activity is performed in this

State; or

(b) The income-producing activity is performed both in

and outside this State and a greater proportion of the

income-producing activity is performed in this State

than in any other State, based on costs of

performance.

Art. IV, Sect. 17

28

Market-Based Sourcing

Sales of services

• Location where service is delivered

• Alabama, Texas

• Example

• The taxpayer’s market for a sale is in this state ... In the

case of sale of a service, if and to the extent the service is

delivered to a location in this state. Ala. Code Sec. 40-27-1

Art. IV. Subd. 17.(a)(3).

• Location where benefit is received

• Minnesota, Utah

• Michigan

• Special rules for sales from securities brokerage services,

transportation services, telecommunications services

29

Market-Based Sourcing (Cont.) Royalties from the use of patents, copyrights, etc.

• Where the intangible property is used by the purchaser

• Alabama, Colorado, Michigan, Minnesota, Utah

• Example where property used in more than one state

• If the property is used in more than one state, the royalties

or other income must be apportioned to this state pro rata

according to the portion of use in this state. If the portion

of use in this state cannot be determined, the royalties or

other income must be excluded from both the numerator

and the denominator. Intangible property is used in this

state if the purchaser uses the intangible property or the

rights therein in the regular course of its business

operations in this state, regardless of the location of the

purchaser's customers.

• Minn. Stat.

290.191 Subd. 5(h)

30

Other Sourcing Rules Pro rata cost of performance

• Colorado – services performed within and outside of the state

• The portion of the gross receipt included in the Colorado numerator

is found by multiplying the gross receipt by a fraction, the

numerator of which is the direct costs incurred in the performance

of that service in Colorado and the denominator of which is the

direct costs incurred in the performance of that service

everywhere. Colo. Code Regs. 39-22-303.5.4(c)

Unique rule

• Arkansas - sales, other than sales of tangible personal property, are in

this state if:

(a) The income-producing activity is performed in this state; or

(b) The income-producing activity is performed both within and

without the state, in which event the portion of income allocable to this

state shall be the percentage that is used in the formula for allocating

income to Arkansas during the year of the sale. Ark. Code

26-51-717

31

Departures From Business Income Definition

Compact definition

“Business income” means income arising from transactions

and activity in the regular course of the taxpayer’s trade

or business and includes income from tangible and

intangible property if the acquisition, management and

disposition of the property constitute integral parts of the

taxpayer’s regular trade or business operations.

Art. IV, Sect. 1.(a)

32

Business Income Definition

• Alabama

• “Notwithstanding any other provision of law to the

contrary and specifically, Section 40-27-1, for purposes of

Article IV of the Multistate Tax Compact, the term

“business income” means [transactional test]; or income

from tangible or intangible property if the acquisition,

management, or [additional categories of income].”

• Ala. Code Sect. 40-27-1.1

• District of Columbia

• “Business income” means all income that is apportionable

under the Constitution of the United States.

• D.C. Code Sect. 47-1801.04(5)

33

Business Income Definition (Cont.)

• Idaho

• “Business income” means [transactional test] and includes income

from the acquisition, management, or disposition of tangible and

intangible property when such acquisition, management, or

disposition constitutes integral or necessary parts of the taxpayer’s

trade or business operations. Gains or losses and dividend and

interest income from stock and securities of any foreign or domestic

corporation shall be presumed to be income from intangible

property, the acquisition, management, or disposition of which

constitutes an integral part of the taxpayer’s trade or business; such

presumption may only be overcome by clear and convincing evidence

to the contrary.

• Idaho Code

63-3027

34

Business Income Definition (Cont.)

• New Mexico

• “Business income” means income arising from transactions and activity in the

regular course of the taxpayer's trade or business and income from the

disposition or liquidation of a business or segment of a business.

“Business income” includes income from tangible and intangible property if

the acquisition, management or disposition of the property constitute

integral parts of the taxpayer's regular trade or business operations.

• N.M. Stat. Ann.

7-4-2

• Oregon

• “Business income” means income arising from transactions and activity in the

regular course of the taxpayer’s trade or business and includes income from

tangible and intangible property if the acquisition, the management, use or

rental, and the disposition of the property constitute integral parts of the

taxpayer’s regular trade or business operations.

• O.R.S.

314.610

35

Departures From Industry Specific Apportionment

• No industry specific formulae in the Compact except

exclusion of financial organizations and public utilities

• If a taxpayer has income from business activity as a public

utility but derives the greater percentage of its income

from activities subject to Article IV, then the taxpayer may

elect to allocate and apportion its entire net income as

provided in Article IV.

36

Industry Specific Apportionment

• California franchisors

• Following receipts attributed to the state in which the

franchisee’s place of business is situated, provided the taxpayer is

taxable in such state

• Advertising fees, administrative/advisory services fees, site

acquisition fees

• If the taxpayer is not taxable in the state in which the franchisee’s

place of business is, or would have been, located, the receipts

shall be attributed to the state in which the principal office of the

taxpayer’s employee or employees performing such services is

located, except that if such services are performed by an

independent contractor the receipts shall be attributed to the

state of the taxpayer’s commercial domicile.

• Cal. Code Regs. 25137-3

37

Industry Specific Apportionment (Cont.)

• Manufacturing

• Print media

• Broadcasting

• Shipping

• Telecommunications

38

Slide Intentionally Left Blank

Departures From Other Article IV Definitions

40

• Sales

• All gross receipts of the taxpayer not allocated under

paragraphs of this Article

• Compensation

• Wages, salaries, commissions and any other form of

remunerations paid to employees for personal services

Broader Implications Of Article IV?

41

ISSUES ARISING FROM OTHER STATE CASES, GUIDANCE

Bruce Ely, Bradley Arant Boult Cummings

Issues With Other State Cases And Administrative Guidance On Similar Issues

A. With California’s withdrawal, 18 states plus D.C. remain full members of the Compact. At least 10 of those states have apportionment provisions that differ from UDITPA, e.g., a single sales factor.

B. International Business Machines Corp. v. Michigan Dept. of Treasury, Dkt. No. 306618 (Mich. Ct. App. 11/20/12, unpublished); motion for leave to appeal to Mich. S. Ct. pending; motion to admit Gillette attorneys pro hac vice also pending

C. Health Net, Inc. v. Oregon Dept. of Revenue, Dkt. No. 120649D (pending in Oregon Tax Court)

43

Issues With Other State Cases And Administrative Guidance On Similar Issues (Cont.)

D. Announcement, Oregon Dept. of Revenue, www.oregon.gov/DOR/bus/Pages/corp-tax_main.aspx (last visited 1/16/13)

E. Graphic Packaging Corp. v. Comptroller, Dkt. No.

GN-12-003038 (pending in Travis Co. Dist. Ct.)

D. Texas Comptroller of Public Accounts, Hearing Decision Nos. 106,508 (7/13/12) and 104,752 (8/18/11)

E. Multistate Tax Commission statements/positions

F. Council On State Taxation (COST) responses

44

Slide Intentionally Left Blank

PRACTICAL DECISIONS FACING MULTI-STATE COMPANIES

Walter Pickhardt, Faegre Baker Daniels

Pending Litigation In MTC States

47

Graphic Packaging

Health Net

IBM

Gillette

Other MTC States Where Litigation May Arise

• Litigation may also arise in the following MTC states, because they do not follow the

Compact’s three-factor, equal-weighted apportionment formula.

48

CALIFORNIA

49

California: SB 1015

• After oral argument in Gillette, but prior to the decision, the California Legislature enacted SB 1015, which Gov. Brown signed on June 27, 2012.

• SB 1015 repealed the Multistate Tax Compact.

• The repeal of the Compact left standing the California three-factor formula that double-weights the sales factor.

• SB 1015 enacted the doctrine of election (citing federal law), and said it was declaratory of existing California law.

• SB 1015 may not be constitutional.

– Under Proposition 26, “any change in state statute which results in any taxpayer paying a higher tax” must pass by a two-thirds vote.

– SB 1015 was passed without a two-thirds vote.

50

The Federal Doctrine Of Election

• The doctrine of election is a not-often-cited, federal equitable doctrine whose

continuing validity has been questioned. See 62 Tax Lawyer 335

• The doctrine consists of the following two elements: (1) There must be a free choice

between two or more alternatives, and (2) There must be an overt act by the taxpayer

communicating the choice to the taxing authority. See Grynberg v. Commissioner, 83

TC 255 (1984); see also Pacific National Co. v. Welch, 304 U.S. 191 (1938)

• The doctrine is not common in state tax cases, but there are some California cases

applying the doctrine.

51

California’s Position On The Doctrine Of Election

• California’s position is that taxpayers that filed original returns using California’s

weighted (or single-factor) formula made a binding election and cannot later file

amended returns to change that election to the MTC formula. See FTB Tax News

(Oct. 5, 2012) and FTB Notice 2012-01 (October 5, 2012)

– A counter-argument would be that California has consistently denied that an

MTC election is available, so the taxpayer was not given a “free choice.”

– Another counter-argument would be that California’s threat of imposing

substantial penalties for using the MTC formula on a return filed before the due

date deprived taxpayers of a “free choice.”

– Yet another counter-argument would be that a party must have clean hands to

invoke equitable doctrines. The above facts indicate a lack of clean hands.

52

California’s Large Corporation

Understatement Penalty (LCUP)

• California imposes a 20% penalty on understatements of tax exceeding the greater of

(1) $1 million, or (2) 20% of the tax shown on an original return or shown on an

amended return filed on or before the original or extended due date of the return for

the taxable year.

• This is a strict liability penalty. There is no abatement, even for reasonable cause.

• However, no penalty is imposed if an understatement is attributable to a change in

law that occurs after:

– The date the taxpayer files the return for the taxable year for which the change

is operative.

– The extended due date for the return of the taxpayer for the taxable year for

which the change is operative.

53

California’s Position On The LCUP For 2011 Returns

• Returns for calendar 2011 were due Oct. 15, 2012, after Gillette had been decided but

before it technically became “final.”

• California announced that taxpayers filing returns relying on Gillette would be subject to

the LCUP. if the case were later reversed.

• Taxpayers were put between a rock and a hard place.

– File based on Gillette and risk the LCUP if Gillette were reversed; or

– Don’t file based on Gillette, file amended returns and face the argument that they

made a binding “election” to use weighted apportionment

54

California Proposition 39

• In November 2012, the California voters approved a ballot initiative, Proposition 39.

• Proposition 39 requires multi-state corporations (with some exceptions) to use a

single-factor apportionment formula with market-based sourcing, for sales of services

and intangibles.

• Proposition 39 is effective for tax years

beginning on or after Jan. 1, 2013.

55

California Apportionment – Through 2012

• The apportionment options for years through 2012 are:

– Three-factor, double-weighted sales factor

– Single sales factor with market-based sourcing

– MTC three-factor (equal-weighted) apportionment, if Gillette is affirmed

56

California Apportionment – 2013

• If SB 1015 is unconstitutional, then the apportionment options are:

– Single sales factor, pursuant to Proposition 39

– MTC apportionment, if Gillette is affirmed

• If SB 1015 is constitutional, then the only apportionment option is:

– Single sales factor, pursuant to Proposition 39

57

California Taxpayer Options Through 2011

Tax Year: Original Returns

• Some taxpayers may have filed returns using MTC apportionment during 2012.

– If Gillette is reversed, there is a possibility of the LCUP applying.

– A counter-argument would be that the LCUP does not apply when there is a

change of law after the date the taxpayer files the return.

– But, California may argue that Gillette was not the law until after the Court of

Appeals decision on hearing (Oct. 12, 2012) became “final” 30 days later (Nov.

1, 2012).

58

California Taxpayer Options Through 2011

Tax Year: Amended Returns

• Should taxpayers now file amended returns to use MTC apportionment?

– Filing a refund claim now should not implicate the LCUP, as the penalty applies

for refunds shown on amended returns filed on or before the original or

extended due date of the return for the taxable year.

– California allows protective claims. They should be prepared following the

procedures in FTB Notice 2012-01 (Oct. 2, 2012). No action will be taken on

such claims until after Gillette is resolved.

– Despite allowing protective refund claims, California can be expected to argue

that the taxpayer is bound by the apportionment method elected on the original

return, under the doctrine of election.

• There are counter-arguments to the doctrine of election, including (1) that it is

inapplicable (SB 1015 is unconstitutional) and (2) that the doctrine applies only when

the taxpayer has “free choice” between two or more alternatives. That was not the

case here (especially given the threat of the LCUP).

59

California Taxpayer Options For 2012

And 2013: Original Returns

• Should a taxpayer file an original return using MTC apportionment?

– The risk is that MTC apportionment will not be available if either

(1) SB 1015 is constitutional (because it revoked MTC apportionment), or (2)

Gillette is overturned (because then MTC apportionment was never available).

– If SB 1015 is constitutional, California will probably penalize the taxpayer using the

LCUP.

• If the Court of Appeals decision in Gillette is still the law when the original return is filed,

and subsequently Gillette is reversed, the change-in-law defense to the LCUP may be

applicable.

60

California Taxpayer Options For 2012

And 2013: Amended Returns

• Should a taxpayer file an original return using Proposition 39 apportionment and file a

protective claim using MTC apportionment?

– The LCUP does not apply for refunds shown on amended returns filed after the

original or extended due date of the return for the taxable year.

– Protective claims may be filed following the procedures in FTB Notice 2012-01

(Oct. 2, 2012).

– However, California will likely argue that the taxpayer is bound by the

apportionment method elected on the original return under the doctrine of

election. So, a taxpayer taking this route will need to defeat the doctrine of

election argument.

• As the situation is constantly evolving, taxpayers will need to monitor developments.

61

OREGON

62

Oregon: Doctrine Of Election

• Oregon case law has recognized the doctrine of election.

• It would not be surprising if Oregon were to argue that a taxpayer not making the

election to use MTC apportionment on its original return is precluded from doing so

by the doctrine of election.

• However, in one case, the Tax Court refused to apply the doctrine when the tax form

did not provide sufficient information to apprise the taxpayer that the election could be

made. See Uniroyal, Inc. v. Department of Revenue, 5 Or. Tax 29 (1972)

63

Oregon: Amended Returns

• Oregon has advised taxpayers to file protective refund claims to secure the right to a

refund, should the state lose in litigation “similar to Gillette.”

• The release provides that claims may be either in the form of an amended return or a

letter to the Revenue Department.

• For details on how to prepare the filing, see the department’s news release dated

Sept. 24, 2012.

• Oregon might assert the doctrine of election, even though its news release does not

mention it. This is an unavoidable risk for prior years.

• If an original return can be filed, taxpayers may want to claim MTC apportionment on

an original return.

64

Oregon: Original Returns

• Should taxpayers file original returns claiming MTC apportionment?

– There is a risk that the substantial understatement penalty could apply.

However, the penalty can be avoided if there is substantial authority for the

position, or if the relevant facts are adequately disclosed in the return and the

position has a reasonable basis.

– It would seem that that there is a reasonable basis for MTC apportionment and

that disclosure of the position should be enough to preclude the Revenue

Department from imposing the penalty, but there can be no assurances.

65

MICHIGAN

66

Michigan: 2011 P.A. 40

• The Michigan Legislature, in an attempt to foreclose future apportionment using the MTC

three-factor, equal-weighted formula, enacted 2011 P.A. 40, which was signed by the governor

on May 25, 2011.

• The law states that beginning Jan. 1, 2011 any taxpayer subject to the Michigan Business Tax

act, or the income tax act of 1967, shall, for purposes of that act, apportion and allocate in

accordance with the provisions of that act and shall not use MTC apportionment.

– Michigan imposed its Michigan Business Tax (MBT) beginning in 2008, the year at issue

in IBM.

– Michigan replaced the MBT with a corporate income tax (CIT) in 2011, the same year it

repealed the MTC formula.

• Although Michigan repealed the MTC formula, Michigan remained a member of the MTC. If

Gillette is correct, a member of the MTC is bound under Compact law to allow an election of

the MTC formula unless it completely withdraws from the Compact by enacting a statute

repealing the Compact.

67

Michigan: Amended Returns

• IBM has lost in the Michigan Court of Appeals, but it filed an application for leave to

appeal with the state Supreme Court on Dec. 28, 2012.

– Michigan advised the Court of Appeals that there are more than 100 pending

cases similar to IBM.

• Taxpayers may want to file amended returns to protect their rights to a refund, in the

event the IBM case is reversed or another taxpayer is successful.

• The Michigan Treasury Department has not provided guidance on filing protective

claims.

• There does not appear to be any Michigan case law addressing the doctrine of

election.

• The Treasury Department has not provided guidance on whether it would claim the

doctrine of election applies, but if IBM were to be overturned, it would not be

surprising if Michigan were to make such an argument.

68

Michigan: Original Returns

• Should a taxpayer file an original return using MTC apportionment?

– The benefit is that using MTC apportionment on an original return eliminates the

possible argument based on the doctrine of election.

• There is a risk that the Treasury Department might impose the negligence penalty,

but it can be abated for reasonable cause.

69

Slide Intentionally Left Blank

TEXAS

71

Texas – Original Or Amended Return?

• Texas has relatively light penalties. A penalty of 5% of the tax due is imposed on an

entity that fails to pay the tax when due. An additional 5% penalty is imposed if the

entity fails to pay the tax within 30 days after the due date.

• A taxpayer therefore could take the position on an original return without significant

penalty exposure.

• However, an amended return is also a possibility, because Texas does not appear to

have any authority applying the doctrine of election.

72