Copy - Gryphon Property Partners

Transcript of Copy - Gryphon Property Partners

HEADER

Copy

1

HIGHLY REVERSIONARY MULTI-LET FREEHOLD CITY OF LONDON INVESTMENT

7-17 Jewry Street London EC3

HEADER

Copy

2 3

INVESTMENT SUMMARY

A WELL LET FREEHOLD WITH EXCITING REPOSITIONING OPPORTUNITIES IN A RAPIDLY CHANGING AREA OF CENTRAL LONDON WHERE THE TRADITIONAL CITY CORE MEETS THE DYNAMIC NEW MEDIA TECH WORLD OF ALDGATE

• Freehold.

• Located at the crossover between the increasingly vibrant Aldgate district popular with Technology Media Telecommunications (TMT) occupiers and the established City of London financial and insurance heartland.

• Close to numerous mainline and underground stations, such as Aldgate, Fenchurch Street and Tower Hill. Also close to the new Crossrail station at Liverpool Street (opening in 2018).

• The building comprises 45,062 sq ft of offices over ground and 7 upper floors as well as 7 basement car parking spaces.

• Multi-let to include 12 office tenants, producing a total passing rent of £1,319,326 per annum, reflecting very low average rent of approximately £28.24 per sq ft per annum for the ground and upper floor office space. All occupational leases are outside of the L&T Act 1954 (Part II).

• Well timed lease events to enable rents to be driven forward in the short to medium term with weighted average terms of 3.70 years to expiry and just over 3.11 years to breaks.

• Considerable active management, repositioning, alternative use opportunities in the short to medium term as well as significant medium to long term redevelopment potential, subject to planning.

• Offers are sought in the order of £30,850,000, subject to contract and exclusive of VAT.

• The above price reflects a net initial yield of 4.00% (assuming a purchaser’s costs at 6.77%) and a net capital value of £685 per sq ft.

• Assuming market rents of £50 per sq ft per annum on the best accommodation the reversionary yield would be in excess of 6.75%.

HEADER HEADER

Copy Copy

54

30 ST MARY AXE HERON TOWER

LIVERPOOLSTREET ALDGATE ALDGATE EAST

SHOREDITCH HIGH STREET

OLD SPITALFIELDSMARKET

THE LEADENHALL

BUILDINGFENCHURCH

STREET

ROYAL EXCHANGE/

BANK TOWER 42LLOYD’S OF

LONDON

6 7

LOCATION

BOUNDARY HOUSE IS SITUATED WITHIN THE CITY OF LONDON AT THE POINT WHERE THE TRADITIONAL FINANCIAL AND INSURANCE DISTRICTS MEET THE RAPIDLY EMERGING EASTERN AREA AROUND ALDGATE.

The property is located on the west side of Jewry Street, close to the junction with Fenchurch Street to the north and Crutched Friars to the south, which gives occupiers the benefit of easy access to the traditional insurance district of London. Institutions within close proximity include The London Underwriting Centre, Lloyd’s of London, Lloyd’s Registry of Shipping and The London Metal Exchange.

Local insurance and shipping market occupiers include Miller Group, AXA, Towergate Insurance, JLT, AIG, Lockton, Elborne Mitchell, Chubb and BMS.

The surrounding area to the east of Jewry Street is rapidly evolving and has attracted some of the most prominent Technology Media Telecommunications (TMT) companies in London. This area, known as Aldgate, has become home to a wide mix of occupiers such as Uber, WeWork, Tag Worldwide, Thomson Reuters, Maersk and Sky.

In addition to the above, Boundary House is also within easy reach of such destinations such as the Leadenhall Market, Spitalfields Market, Brick Lane, St Katharine Docks and the Whitechapel Art Gallery, all with their vibrant mix of dining, shopping, entertainment and cultural attractions.

HEADER

Copy

LOCAL OCCUPIERS

1. Accenture

2. ACE Insurance

3. AIG

4. Amlin

5. Aon

6. Arch Insurance

7. Ascot Underwriting

8. Aspen Insurance

9. Aviva PLC

10. Axis Speciality Europe

11. Beazley Group

12. Brit

13. Browne Jacobson

14. Chubb

15. Clyde & Co

16. Curzon Maritime Ltd

17. Cunningham Lindsey

18. The Fairtrade Foundation

19. Gensler

20. HCC International

21. Hermes

22. Interiors Group

23. JLT

24. Kennedys

25. Kirkland & Ellis

26. LCH Clearnet

27. Lloyd’s

28. Lockton

29. Markel International

30. Miller Insurance Group

31. Munich RE Group

32. PLP Architecture.

33. QBE Europe

34. Royal Bank of Scotland

35. RSA

36. Salesforce

37. SG Hambros Bank

38. Standard Life Investments

39. Sungard Availability

Services

40. Swiss RE

41. TAG Worldwide

42. Thomas Miller

43. Tokio Marine Kiln

44. Trinity House

45. Uber

46. W.R. Berkley

47. Wells Fargo

48. Westpac Banking

Corporation

49. WeWork

50. Willis

1. Omino

2. Skygarden

3. Luc’s Brasserie

4. Le Paris Grill

5. Duck & Waffle

6. The Culpeper

7. The Dispensary

8. East India Arms

9. One Under Lime

10. Lamb Tavern

11. The Mayor of Scaredy Cat

Town

12. Discount Suit Company

Cocktail Bar

13. The Three Lords

14. Number 49

15. The Hoop & Grapes

16. Hungry Donkey Greek

Kitchen

17. Pitt Cue

18. Draft House Seething

19. Walter & Monty

20.WM Barker and Co

1. Virgin Active

2. Motel One

3. Hotel Indigo

4. David Lloyd

5. Chamberlain Hotel London

6. Apex City of London Hotel

7. Grange City Hotel

8. Tower Of London

9. St Katherine Dock

Local Occupiers

Restaurants & Bars

Hotels & Leisure

10 11

COMMUNICATIONS

CROSSRAIL

The local transport communications are excellent with Fenchurch Street Station (mainline, District and Circle Line Underground), Tower Hill and Aldgate East Underground (District and Circle Line Underground and DLR at Tower Hill) all nearby, whilst Bank Underground (Central, Northern, Waterloo & City lines and DLR) and Liverpool Street (Mainline, District & Circle and Central lines) are within close walking distance.

Crossrail is due to be delivered in 2018 and is set to revolutionise London’s East-West connections with high speed, high frequency train services. London’s overall transport capacity will increase by 10%, transporting up to 200 million people per annum, with up to 24 trains per hour in each direction at peak times.

Liverpool Street station is a short walk from Boundary House, which will have the following journey times once Crossrail services are complete in 2018.

The Aldgate Highway Changes and Public Realm Improvements Project

ALDGATE CHANGING

The eastern core of Aldgate has seen considerably high levels of investment over recent years with over 2 million sq ft of office space having been developed and more than 1 million sq ft of it being taken up in the last 18 months or so. In addition more than ten acres of parks, seating areas and gardens are being regenerated within the proximity of Jewry Street. This has been combined with over 40 new restaurants, cafes and bars, as well as numerous new hotels who add to list of local amenities close to Boundary House. Furthermore there are over 10 new residential developments which will ensure a modern, vibrant, balanced environment.

At the northern end of Jewry Street, the Aldgate area will receive a major uplift in spring 2017 as changes to the traffic layout ensure well thought out traffic flow, introduce pedestrian crossing points, allow easier navigation of bus services and introduce two new public spaces on the eastern edge of the City of London.

The Aldgate Highway Changes and Public Realm Improvements Project will enhance safety for road users by improve cycling routes, pedestrian routes and connections whilst introducing more greenery and improving lighting in the area

ALDGATE IS ONE OF LONDON’S FASTEST DEVELOPING SUB-MARKETS. THE AREA HAS EVOLVED AS A MIXED USE DISTRICT AND HAS CONSEQUENTLY EXPERIENCED A STRONG UPSURGE IN RETAIL, CAFES, RESTAURANTS AND HOTELS TO THE LOCALITY. THE BALANCE BETWEEN WORK, PLEASURE AND CONVENIENCE IS NOW ONE OF THE MOST APPEALING ASPECTS OF THE AREA, ATTRACTING A WIDE VARIETY OF OCCUPIER TO THE VICINITY.

HEATHROWAIRPORT

HAYES &HARLINGTON HANWELL

EALINGBROADWAY PADDINGTON

TOTTENHAM

STANSTED

COURT ROAD

CUSTOMHOUSEMAIDENHEAD SOUTHALL WEST EALING ACTON

MAIN LINEBOND STREET FARRINGDON WHITECHAPEL

MARYLAND MANOR PARKLIVERPOOL

MOORGATE/

STREET

WOOLWICH

ABBEY WOOD

STRATFORD FOREST GATE SHENFIELDROMFORD

READING

CANARYWHARF

LUTON

GATWICK

Station Existing journey time (mins) Journey time following opening of Crossrail (mins)

Canary Wharf 19 6

Whitechapel 5 2

Farringdon 4 2

Tottenham Court Road 8 4

Bond Street 11 7

Paddington 19 10

Heathrow 50 32

Station Service Average Walking Time Distance

Aldgate Underground - Metropolitan, Circle 2 mins 210m

Aldgate EastUnderground - Circle, Hammersmith & City

5 mins 450m

Fenchurch Street Overground 1.5 mins 120m

Tower Hill Underground - Circle, District 4 mins 300m

Liverpool StreetOverground, (Crossrail 2018) Underground - Central, Circle, Metropolitan, Hammersmith & City

8 mins 750m

Tower Gateway DLR 4 mins 350m

Monument Underground - Circle, District 11 mins 804m

13

RIVER THAMES

St BotolphBuilding

The LeadenhallBuilding

Lloyds of London

20Fenchurch

Street

30 St Mary Axe

HeronTower

Tower 42

16

11

12

13

14

159

8

7

10

4

3

2

5

12

LOCAL DEVELOPMENTS

THE SURROUNDING INSURANCE DISTRICT AND ALDGATE AREAS HAVE RECENTLY SEEN EXCEPTIONAL LEVELS OF INVESTMENT AND DEVELOPMENT, ATTRACTING SOME OF THE UK’S LARGEST PROPERTY COMPANIES, DEVELOPERS AND HOUSE BUILDERS.

Minories Estate4C Hotels

Aldgate UnionDerwent London

Roman Wall HouseL+R (being sold)

Aldgate TowerAldgate Developments

Creechurch Place Helical Bar/HOOPP

Beagle HouseAldgate Developments

80 Fenchurch StreetPartners Group & Marick

Royal Mint StreetIJM Land

Goodman’s FieldsBerkeley Homes

40 Leadenhall StreetTIAA Henderson Real Estate

1 Commercial StreetRedrow/Angelo Gordon

Dixon House, Fenchurch Street Greenoak

9 Prescot StreetDerwent London

Matrix, Aldgate High StreetDorsett Hospitality

The ButterflyFosun and Portsoken Advisors

1

10

13

4

7

2

11

14

5

8

3

12

15

6

9

14 15

DESCRIPTION

Boundary House comprises a purpose built office building constructed circa mid-1950’s and is arranged over basement, ground and seven upper floors. The building has a net internal area of 45,062 sq ft including basement storage accommodation.

The property is of reinforced concrete framed construction with reinforced concrete floors. The elevations are clad with cavity facing brickwork inset with single glazed painted steel framed windows. There is an area of painted steel framed single glazed curtain walling to the front elevation and there is reconstituted stone cladding provided up to first floor level to the street facing elevations.

The main entrance to the building on Jewry Street leads to the reception area which has two six-person passenger lifts serving all floors with the exception of the basement and 7th floor. The building is served by three staircases with WCs located off the main staircase at each level with the exception of the ground and 7th floor.

The property has undergone a rolling refurbishment programme and the specification of the offices varies on the individual floors / units. A number of the floors (5th, 6th and pt 7th) remain as centrally heated offices with the remainder benefiting from air-conditioning / cooling systems (instillations dates ranging from 1998 to 2015 depending on the floor / units). The provision of raised floors, perimeter trunking and suspended ceilings varies also from floor to floor. Detail on the specification of each of the floors is available upon request.

The building benefits from 7 car parking spaces located in the basement of the building and accessed off the junction of Rangoon and Jewry Street.

16 17

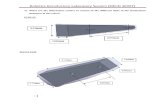

FLOOR PLANS

GROUND

JEW

RY

STR

EE

T

BASEMENT

5TH 2ND

ACCOMMODATION

FLOOR AREA SQ M AREA SQ FT

7th Floor 181 1,943

6th Floor 329 3,542

5th Floor 406 4,373

4th Floor 580 6,239

3rd Floor 746 8,033

2nd Floor 745 8,031

1st Floor 686 7,381

Ground Floor 473 5,094

Basement Storage 41 426

TOTAL 4,187 45,062

There are 7 car spaces in the basement

A copy of the Plowman Craven report is available upon request. (this includes the new IPMS 3 measurements which the vendor has opted out of for marketing purposes)

JLTSpace 1

SeacrestSpace 2

RopnerSpace 3

SeacrestSpace 4

SeacrestSpace 7

AntaresSpace 6

SeacrestStorage

Cage

SeacrestStorage

CageSeacrestSpace 5

Not to scale. For identification purposes only.

The building has been measured by Plowman Craven in accordance with the RICS Code of Measuring Practice (6th edition) to provide the following Net Internals Areas:

18 19

TENURE TENANCIES

Freehold. The building is multi-let to 12 office tenants with lease expires between November 2017 and May 2023. All the leases are outside the protection of the Landlord and Tenant Act 1954 (Part II).

The basement car parking spaces and storage accommodation are let on numerous licences and there is additional income from telecom providers via roof top and basement installations.

The tenancy schedule is outlined opposite:

Not to scale. For identification purposes only. This plan is based upon the Ordnance Survey Map with the sanction of the controller of H.M. Stationery Office. Crown Copyright reserved.

TENANT FLOOR AREA SQ FT

LEASE START LEASE EXPIRY

BREAK DATE*

NEXT REVIEW

RENT P.A. RENT PER SQ FT

P.A.

COMMENT

Holman Fenwick Willan Part 7th 888 29/09/2012 07/05/2023 25/12/2017 £12,862 £14.48

Rent free from 25/12/2017 to 23/06/2018 and 24/06/2020 to 28/09/2020. Sub-let to Fidentia Insurance Brokers Ltd at £26,167 p.a.x.

Ropner Insurance Services

5th, 6th & Part 7th

8,970 26/12/2014 25/12/2019 £133,485 £14.88

Holman Fenwick Willan 4th 6,239 29/09/2012 07/05/2023 25/12/2017 £149,132 £23.90Rent free from 25/12/2017 to 23/6/2018 and 24/6/2020 to 28/09/2020.

Holman Fenwick Willan 3rd (West) 2,311 29/09/2012 07/05/2023 25/12/2017 £52,647 £22.78Rent free from 25/12/17 to 23/06/2018 and 24/6/2020 to 28/09/2020.

SQ-M2 3rd (South) 2,736 16/07/2014 15/07/2019 £100,000 £36.55

Brink's 3rd (North) 2,986 15/04/2014 14/04/2019 15/04/2017 £109,135 £36.55The break option is personal to Brinks Ltd and there is a rent free from 15/04/2017 to 15/07/2017.

Seacrest Shipping Company

2nd (South)

2,227 02/07/2014 01/07/2019 £83,038 £37.29

Senior Wright 2nd (North) 5,804 06/05/2014 24/03/2019 £169,180 £29.15

Grimme Butcher Jones 1st (West) 1,945 04/03/2016 03/03/2021 £87,750 £45.12

Wings Corporate Travel 1st (North) 3,157 16/08/2014 15/08/2019 15/08/2017 £78,260 £24.79Tenant exercised break option to terminate in 15/08/2017

Building Services Design 1st (South) 2,279 22/11/2013 21/11/2018 £66,000 £28.96

Callcredit Public Sector (being surrendered **)

Ground (West)

1,575 19/12/2012 01/06/2016** £78,750 £50.00Currently being surrendered and under offer to re-let at £50 per sq ft on a 5 year lease term**

London Business Connections

Ground (South)

1,708 25/03/2016 24/03/2021 25/03/2019 £80,000 £46.841 month additional rent free if break is not activated

Coal Intelligent Technology

Ground (North)

1,811 30/09/2013 29/09/2018 £60,500 £33.41

EE Ltd & Hutchison 3GBasement and Roof

N/A 25/12/2011 24/12/2021See

comment25/12/2016 £37,087

Rent review linked to RPI. Tenant can termi-nate at any time on six months notice and Landlord on 12 months.

Seacrest Shipping Company

Storage Cages (in basement car park)

426 07/07/2014 See

comment See

comment £2,500

Terminable by either party on three months notice.

JLT Management Services

1 x car park-ing space

N/A 31/03/2013See

commentSee

comment £3,500

Terminable by either party on one months notice.

Ropner Insurance Services

1 x car park-ing space

N/A 28/10/2015 25/12/2019See

comment £2,000

Terminable on one months notice by either party after 28/4/16

Antares Underwriting Services

1 x car park-ing space

N/A 28/01/2011See

commentSee

comment £3,500

Termnable by either party on one months notice.

Seacrest Shipping Company

4 x car park-ing spaces

N/A 02/07/2014 01/07/2019 £10,000 Documented under occupational lease.

UK Power Networks (formerly LEB)

Basement N/A 24/07/1957 23/07/2017 - An electricity transformer chamber. Annual rent of 1 shilling. (Not excluded from L&T Act 1954 II)

Total 45,062 £1,319,326 £28.24Rent psf calculated on office accomodation only.

ALL OCCUPATIONAL TENANCIES ARE HELD OUTSIDE OF THE L&T ACT 1954 (Part II) (with exception of basement transformer) NB. Details of service charge caps and rental deposits can be provided upon request. There are no anticipated service charge shortfalls for the service charge year ending June 2016.*Tenant only breaks.**The ground floor west unit is currently being surrendered and under offer to re-let at £50 per sq ft on a 5 year lease term. The vendor will top up the rent free period or provide 12 month rent cover at £50 per sq ft should the letting not proceed.

20 21

Key Tenant Covenants

Holman Fenwick Willan LLP

Holman Fenwick Willan LLP, founded in 1883, is an international law firm with over 450 lawyers and support staff (151 partners) working from offices all over the UK.

Accounts to the 31st March 2015 show the company made a pre-tax profit of £49,468,000 with a turnover of £128,903,000 and a total assets of £80,992,000. The company has an Experian Delphi Score of 87.

www.hfw.com

Senior Wright Ltd

Senior Wright Ltd is a Lloyd’s Broker established in 1983.

Accounts to the 31st December 2014 show the company had a turnover of £3,492,334 and total assets of £8,681,963. The company has an Experian Delphi Score of 82.

www.seniorwright.co.uk

Ropner Insurance Services

Ropner Insurance Services is one of the leading Marine brokers within the London market, incorporated in 1913.

Accounts to the 31st March 2015 show the company made a turnover of £7,123,051 and total assets of £10,871,985. The company has an Experian Delphi Score of 81.

www.ropnerins.co.uk

Brink’s

Brink’s, incorporated in 1969, is an American security and protection company with 134,000 employees worldwide.

Accounts to the 31st December 2014 show the company made a pre-tax profit of £2,502,000 with a turnover of £36,236,000 and a total assets of £23,701,000. The company has an Experian Delphi Score of 100.

www.brinks.com

SQ-M2

square metre, incorporated in 2002 with c. 25 staff, is a refurbishment and fit-out contractor working within listed, residential and commercial properties.

Accounts to the 30th December 2014 show the company made a pre-tax profit of £473,913 with a turnover of £21,450,060 and a total assets of £7,886,148. The company has an Experian Delphi Score of 75.

www.square-metre.com

Seacrest Shipping Company Ltd

Seacrest Shipping Company, incorporated in 1961, are Shipping Agents with a 200-year history, 50 years of which have been in London.

Accounts to the 30th April 2015 show the company had a turnover of £830,000 and a total assets of £789,822. The company has an Experian Delphi Score of 100.

Grimme Butcher Jones Ltd

Grimme Butcher Jones is a long established broker at Lloyds specialising in Aviation.

Accounts to the 31st December 2014 show the company had a turnover of £2,706,092 and a total assets of £20,290,024. The company has an Experian Delphi Score of 60.

www.gbj-ltd.co.uk

Wings Corporate Travel

Wings Travel Management are international specialists in offshore, marine and high-profile corporate travel.

Accounts to the 28th February 2015 show the company had a turnover of £3,291,998 and total assets of £4,113,884. The company has an Experian Delphi Score of 100.

www.wings.travel

16%of income

£214,641

8%of income

£100,000

13%of income

£169,180

7%of income

£95,538

10%of income

£133,485

7%of income

£87,750

8%of income

£109,135

6%of income

£78,260

TOTAL INCOME

£1,319,326

ESTIMATED RENTAL VALUE

£2,230,000*

MARKET COMMENTARY The City of London occupational office market continues to be very active. Vacancy rates are approximately 5% (c. 5.5m sq ft) which is one of the lowest since 2001. Total take up for the year ending 2015 exceeded 7m sq ft, the second highest for some 15 years and take up for Q1 2016 has remained strong. Prime Rents currently stands at approximately £68.50 per sq ft per annum. Rental growth is forecast to continue with prime rents set to rise to £75.00 per sq ft per annum plus by 2018. At Boundary House rents of £45.00 per sq ft per annum on the 1st floor (west) and close to £47.00 per sq per annum on the ground floor (south) have recently been achieved. Our estimated rental value assumption of £50.00 per sq ft on the best accommodation therefore reflects good value in the City context.

*Assumes the office rents range from £45 to £50 per sq ft pa (depending on the floor/unit) and they are in a well presented condition to includeair conditioning/cooling. A breakdown of the ERVs is available on request.

22 23

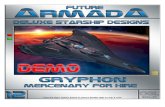

REPOSITIONING/REDEVELOPMENT

REPOSITIONING OPPORTUNITIES

In the short to medium term there is scope to make improvements/create additional space by adopting strategies such as opening up floors and removing existing corridors/lobbies and removing perimeter heating, potential levelling the entrance and creating a ‘cut away’ on the ground floor allowing a basement conversion to useable office, studio or retail accommodation. Other asset management initiatives include driving rents in the short term by potential lease re-gears and surrenders (such as the ‘Wings’ unit on the 1st floor north) as well as re-letting the ground floor unit that is currently being surrendered.

The exterior of the building would also benefit from recladding of front façade and a more contemporary entrance canopy and lobby. There is also the possibility of adding additional floors on the western wing of the building, subject to structure and planning permission.The building provides potential for alternative uses, such as hotel use, either by way of redevelopment or reconfiguration of the existing building, subject to planning and relevant consents.

REDEVELOPMENT OPPORTUNITIES

Lacey and Saltykov have carried out a feasibility study to provide a predominantly grade A office building on the site. The ‘base case’ scenario comprises a net internal area of approximately 75,509 sq ft over basement, ground and 11 upper floors. This scheme takes on board comments from the City of London Planning Department following a pre-application meeting in 2014 and incorporates ‘set backs’ on the top two floors. Without the ‘set backs’ the scheme could potentially provide 80,524 sq ft. The proposed scheme is subject to planning and the other assumptions as set out in the feasibility report which is available on request.

Lacey and Saltykov’s proposed approximate ‘base case’ floor by floor areas (incorporating set backs on the top two floors) are set out below:

CGI of development

Lacey + Saltykov Architects have provided these images as part of a feasibility study having received pre-application advice from the City of London.

Level GIA (sq m) GIA (sq ft) NIA (sq m) NIA (sq ft)

B2 655 7,050 - -

B1 584 6,286 412 4,435

Ground 501 5,393 286 3,078

Level 1 857 9,225 687 7,395

Level 2 857 9,225 687 7,395

Level 3 857 9,225 687 7,395

Level 4 857 9,225 687 7,395

Level 5 857 9,225 687 7,395

Level 6 725 7,804 558 6,006

Level 7 725 7,804 558 6,006

Level 8 725 7,804 558 6,006

Level 9 725 7,804 558 6,006

Level 10 564 6,071 395 4,252

Level 11 315 3,391 255 2,745

Total 9,804 105,529 7,015 75,509

Ground Floor Level Typical Floor (Levels 6, 7, 8, 9)

24

CONTACT & VIEWINGS

Please contact the below for further information and viewings:

Mike Pope

020 3440 980707799 664 [email protected]

Jeremy Trice

020 3440 980207798 636 [email protected]

John Morton

020 3440 981007785 960 [email protected]

Misrepresentation Act 1967: Gryphon Property Partners for themselves and for the vendor(s) or lessor(s) of this property whose agents they are, give notice that: 1. These particulars do not constitute, nor constitute any part of, an offer or contract. 2. None of the statements contained in these particulars as to the property are to be relied on as statements or representations of fact. 3. Any intending purchaser or lessee must satisfy himself by inspection or otherwise as to the correctness of each of the statements contained in these particulars. 4. The vendor(s) or lessor(s) do not make or give and neither Gryphon Property Partners nor any person in their employment has any authority to make or give, any representation or warranty whatever in relation to this property. Finance Act 1989: Unless otherwise stated all prices and rents are quoted exclusive of VAT. Property Misdescription Act 1991: These details are believed to be correct at the time of compilation but may be subject to subsequent amendment. April 2016

www.cube-design.co.uk (Q3464)

PLANNING PROPOSAL

DATAROOM

VAT

EPC

The site is located within the City of London. It is not located within a Conservation Area and of the property is not listed.

Our client is seeking offers in the order of £30,850,000 (thirty million, eight hundred and fifty thousand pounds), subject to contract and exclusive of VAT.

A purchase at this level reflects a net initial yield of 4.00% (assuming a purchaser’s costs at 6.77%) and a net capital value £685 per sq ft.

Assuming market rents of £50 per sq ft on the best accommodation the reversionary yield would be in excess of 6.75%

Access available upon request.

The building has been elected for VAT. The sale may be treated as a Transfer of a Going Concern (TOGC) depending on the purchasers VAT status.

Boundary House has an Energy Performance Certificate (EPC) rating of D.