€¦ · Continuous Office of Units at NAV based prices Name of Mutual Fund : DSP BlackRock Mutual...

Transcript of €¦ · Continuous Office of Units at NAV based prices Name of Mutual Fund : DSP BlackRock Mutual...

Continuous Office of Units at NAV based pricesName of Mutual Fund : DSP BlackRock Mutual FundName of Asset Management Company : DSP BlackRock Investment Managers Pvt. Ltd.Name of Trustee Company : DSP BlackRock Trustee Company Pvt. Ltd.Address of the entities : Mafatlal Centre, 10th Floor, Nariman Point, Mumbai - 400021Website : www.dspblackrock.com

The particulars of the Scheme have been prepared in accordance with the Securities and Exchange Board of India (Mutual Funds) Regulations 1996, (herein after referred to as SEBI (MF) Regulations) as amended till date, and filed with SEBI, along with a Due Diligence Certificate from the AMC. The units being offered for public subscription have not been approved or recommended by SEBI nor has SEBI certified the accuracy or adequacy of the Scheme Information Document. The Scheme Information Document sets forth concisely the information about the scheme that a prospective investor ought to know before investing. Before investing, investors should also ascertain about any further changes to this Scheme Information Document after the date of this Document from the Mutual Fund / Investor Service Centres / Website / Distributors or Brokers. The investors are advised to refer to the Statement of Additional Information (SAI) for details of DSP BlackRock Mutual Fund, Tax and Legal issues and general information on www.dspblackrock.com. SAI is incorporated by reference (is legally a part of the Scheme Information Document). For a free copy of the current SAI, please contact your nearest Investor Service Centre or log on to our website. The Scheme Information Document should be read in conjunction with the SAI and not in isolation.

This Scheme Information Document is dated -----------

SCHEME INFORMATION DOCUMENT

PRODUCT LABELINGJune 29, 2015

2

SCHEME PRODUCT SUITABILITY RISKOMETER

DSP BlackRock Equity Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investmentinequityandequity-relatedsecuritiestoformadiversifiedportfolio

DSP BlackRock Opportunities Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investmentinequityandequity-relatedsecuritiestoformadiversifiedportfolio

DSP BlackRock Top 100 Equity Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investment in equity and equity-related securities of large cap companies (top 100 companies by market

capitalization)

DSP BlackRock Small and Mid Cap Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investment in equity and equity-related securities in companies beyond top 100 companies by market

capitalization

DSP BlackRock India T.I.G.E.R. Fund (The Infrastructure Growth and Economic Reforms Fund)

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investmentinequityandequity-relatedsecuritiesofcorporates,whichcouldbenefitfromstructuralchanges

brought about by continuing liberalization in economic policies by the Government and/or from continuing investments in infrastructure, both by the public and private sector

DSP BlackRock Technology.com Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investment in equity and equity-related securities of companies in media, telecom and information technology

sectors

DSP BlackRock Micro Cap Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investment in equity and equity-related securities in micro cap companies (beyond top 300 companies by market

capitalization)

DSP BlackRock Focus 25 Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth with exposure limited to a maximum of 25 stocks from an investment universe of top 200 companies by market capitalization

•Investment in equity and equity-related securities to form a concentrated portfolio

DSP BlackRock Natural Resources and New Energy Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investment in equity and equity-related securities of natural resources companies in sectors like mining, energy,

etc. and companies involved in alternative energy and energy technology and also, investment in units of overseas funds which invest in such companies overseas

PRODUCT LABELLING: OPEN ENDED GROWTH SCHEMES

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderately high risk

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderately high risk

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderately high risk

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderately high risk

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at high risk

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at high risk

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderately high risk

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at high risk

MODERATE

MODERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderately high risk

3

SCHEME PRODUCT SUITABILITY RISKOMETER

DSP BlackRock Tax Saver Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth with a three-year lock-in•Investmentinequityandequity-relatedsecuritiestoformadiversifiedportfolio

PRODUCT LABELLING: OPEN ENDED EQUITY LINKED SAVING SCHEME

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderately high risk

PRODUCT LABELLING: OPEN ENDED INCOME SCHEMES

SCHEME PRODUCT SUITABILITY RISKOMETER

DSP BlackRock Bond Fund

This Scheme is suitable for investors who are seeking*

•Income over a long-term investment horizon•Investment in money market and debt securities

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderate risk

DSP BlackRock Constant Maturity 10Y G-Sec Fund

This Scheme is suitable for investors who are seeking*

•Income over a long-term investment horizon•Investment in Government Securities with weighted average maturity of around 10 years

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderate risk

DSP BlackRock Short Term Fund

This Scheme is suitable for investors who are seeking*

•Income over a medium-term investment horizon•Investment in money market and debt securities

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderate risk

DSP BlackRock Income Opportunities Fund

This Scheme is suitable for investors who are seeking*

•Income over a medium-term investment horizon•Investment in money market and debt securities

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderate risk

DSP BlackRock Strategic Bond Fund

This Scheme is suitable for investors who are seeking*

•Income over a medium to long term investment horizon•Investment in actively managed portfolio of money market and debt securities

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderate risk

DSP BlackRock Money Manager Fund

This Scheme is suitable for investors who are seeking*

•Income over a short-term investment horizon•Investment in money market and debt securities

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderately low risk

DSP BlackRock Government Securities Fund

This Scheme is suitable for investors who are seeking*

•Income over a long-term investment horizon•Investment in Central government securities

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderate risk

DSP BlackRock Ultra Short Term Fund

This Scheme is suitable for investors who are seeking*

•Income over a short-term investment horizon.•Investments in money market and debt securities

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderately low risk

4

PRODUCT LABELLING: OPEN ENDED INCOME SCHEMES

PRODUCT LABELLING: FUND OF FUNDS SCHEMES

SCHEME PRODUCT SUITABILITY RISKOMETER

DSP BlackRock Banking & PSU Debt Fund

This Scheme is suitable for investors who are seeking*

•Income over a short-term investment horizon •Investment in money market and debt securities issued by banks and public sector entities/undertakings

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderate risk

DSP BlackRock MIP~ Fund

~Monthly income is not assured and is subject to availability of distributable surplus.

This Scheme is suitable for investors who are seeking*

•Income and capital growth over a medium-term investment horizon•Investment primarily in money market and debt securities, with balance exposure in equity/equity-related

securities

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderately high risk

PRODUCT LABELLING: OPEN ENDED BALANCED SCHEME

SCHEME PRODUCT SUITABILITY RISKOMETER

DSP BlackRock Balanced Fund

This Scheme is suitable for investors who are seeking*

•Capital growth and income over a long-term investment horizon•Investment primarily in equity/equity-related securities, with balance exposure in money market and debt

securities

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderately high risk

PRODUCT LABELLING: OPEN ENDED LIQUID SCHEME

SCHEME PRODUCT SUITABILITY RISKOMETER

DSP BlackRock Liquidity Fund

This Scheme is suitable for investors who are seeking*

•Income over a short-term investment horizon•Investment in money market and debt securities, with maturity not exceeding 91 days

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at low risk

PRODUCT LABELLING: OPEN ENDED MONEY MARKET MUTUAL FUND SCHEME IN INCOME CATEGORY

SCHEME PRODUCT SUITABILITY RISKOMETER

DSP BlackRock Treasury Bill Fund

This Scheme is suitable for investors who are seeking*

•Income over a short-term investment horizon•Investment in Treasury Bills & other Central government securities maturing within one year

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderately low risk

5

PRODUCT LABELLING: OPEN ENDED FUND OF FUNDS SCHEMES

SCHEME PRODUCT SUITABILITY RISKOMETER

DSP BlackRock World Gold Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investment in units of overseas funds which invest primarily in equity and equity related securities of gold mining

companies

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at high risk

DSP BlackRock World Energy Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investment in units of overseas funds which invest primarily in equity and equity related securities of companies

in the energy and alternative energy sectors

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at high risk

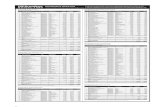

DSP BlackRock World Mining Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investment in units of overseas funds which invest primarily in equity and equity related securities of mining

companies

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at high risk

DSP BlackRock World Agriculture Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investment in units of overseas funds which invest primarily in equity and equity related securities of companies

in the agriculture value chain

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at high risk

DSP BlackRock US Flexible^ Equity Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investment in units of overseas funds which invest primarily in equity and equity related securities of companies domiciled

in, or exercising the predominant part of their economic activity in the USA ^Theterm“Flexible”inthenameoftheSchemesignifiesthattheInvestmentManageroftheUnderlyingFundcaninvesteitherin

growth or value investment characteristic securities placing an emphasis as the market outlook warrants.

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at high risk

DSP BlackRock Dynamic Asset Allocation Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investments in units of one or more equity mutual funds and debt mutual funds of DSP BlackRock Mutual Fund

MODERATEMO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at moderate risk

DSP BlackRock Global Allocation Fund

This Scheme is suitable for investors who are seeking*

•Long-term capital growth•Investments in units of overseas funds which invest in equity, debt and short term securities of issuers around the

world

MODERATE

MO

DERATEL

Y

LOW

MODERATELY

HIGH

HIGHLOW

Investors understand that theirprincipal will be at high risk

*Investorsshouldconsulttheirfinancialadvisorsifindoubtaboutwhethertheproductissuitableforthem.

SPONSORSPONSOR

DSP HMK HOLDINGS PVT. LTD.andDSP ADIKO HOLDINGS PVT. LTD. (Collectively)Mafatlal Centre, 11th Floor, Nariman Point, Mumbai - 400 021.Telephone No.: 022 2272 2731 Fax No.: 022 2272 2732

DSP BlackRockInvestment Managers Pvt. Ltd.Mafatlal Centre, 10th Floor, Nariman Point Mumbai - 400 021 Tel: 022- 6657 8000Fax: 022-6657 8181

DSP BlackRock TrusteeCompany Pvt. Ltd.Mafatlal Centre, 10th Floor, Nariman Point Mumbai - 400 021 Tel: 022- 6657 8000Fax: 022-6657 8181

Computer Age Management Services Pvt. Ltd.Unit : DSP BlackRock Mutual Fund, VII Floor, Tower I,Rayala Towers, 158, Anna Salai,Chennai - 600 002.Tel.: 044-28432771 Fax: 044-30212755

AUDITORS TO THE MUTUAL FUNDS. R. Batliboi & Co. LLP12th Floor, The Ruby,29 Senapati Bapat Marg,Dadar (West)Mumbai – 400 028Tel No : 022 6192 2268

Citibank N.A.Securities & Funds ServicesFirst International Financial Centre (FIFC), 11th Floor, Plot Nos. C 54 and C55, G Block, Bandra Kurla Complex, Bandra East, Mumbai 400051Tel: 022- 61756908 Fax: 022- 26532205/26532347/66940766

ASSET MANAGEMENT COMPANY

BlackRock Inc.40 East 52nd Street, New York, NY 10022, USA.

TRUSTEE

CUSTODIAN REGISTRAR

TABLE OF CONTENTS

SECTION I – HIGHLIGHTS/SUMMARY OF THE SCHEME(S) 2

SECTION II – DEFINITIONS 13

SECTION III – ABBREVIATIONS & INTERPRETATION 15

SECTION IV – INTRODUCTION 16

A. RISK FACTORS 16

B. RISK MANAGEMENT STRATEGIES 24

C. REQUIREMENT OF MINIMUM INVESTORS IN THE SCHEME(S) 27

D. SPECIAL CONSIDERATIONS 27

E. DUE DILIGENCE BY THE AMC 28

SECTION V - INFORMATION ABOUT THE SCHEME(S) 29

A. TYPE OF SCHEME(S) 29

B. WHAT IS THE INVESTMENT OBJECTIVES OF THE SCHEME(S)? 30

C. HOW WILL THE SCHEME(S) ALLOCATE ITS ASSETS? 32

D. WHERE WILL THE SCHEME(S) INVEST? 38

E. WHAT ARE THE INVESTMENT STRATEGIES? 49

F. FUNDAMENTAL ATTRIBUTES 71

G. HOW WILL THE SCHEME(S) BENCHMARK ITS PERFORMANCE? 72

H. WHO MANAGES THE SCHEME(S)? 75

I. WHAT ARE THE INVESTMENT RESTRICTIONS? 77

J. HOW HAS THE SCHEME(S) PERFORMED? 79

K. COMPARISON BETWEEN THE SCHEMES(S) 90

SECTION VI – UNITS AND OFFER 94

A. NFO DETAILS 94

B. CONTINOUS/ONGOING OFFER DETAILS 94

C. PERIODIC DISCLOSURES 111

D. COMPUTATION OF NAV 113

SECTION VII – FEES AND EXPENSES 114

A. NFO EXPENSES 114

B. ANNUAL SCHEME RECURRING EXPENSES 114

C. LOAD STRUCTURE 116

D. TRANSACTION CHARGES 117

SECTION VIII – RIGHTS OF UNITHOLDERS 117

SECTION IX – PENALTIES AND PENDING LITIGATIONS 117

2

SECTION I – HIGHLIGHTS/SUMMARY OF THE SCHEME(S)Sr. No. HIGHLIGHTS OF THE SCHEME DSP BLACKROCK BOND FUND DSP BLACKROCK STRATEGIC

BOND FUNDDSP BLACKROCK SHORT TERM

FUND

1. Investment Objective The primary investment objective of the Scheme is to seek to generate an attractive return, consistent with prudent risk, from a portfolio which is substantially constituted of high quality debt securities, predominantly of issuers domiciled in India. This shall be the fundamental attribute of the Scheme. As a secondary objective, the Scheme will seek capital appreciation.

The primary investment objective of the Scheme is to seek to generate optimal returns with high liquidity through active management of the portfolio by investing in high quality debt and money market securities.

The primary investment objective of the Scheme is to seek to generate returns commensurate with risk from a portfolio constituted of money market securities and/or debt securities.

2. Plans Available under the Scheme

• Regular Plan• Direct Plan

• Institutional Plan• Direct Plan

• Regular Plan• Direct Plan

3. Options Available under both the plans

•Growth•Dividend-Payout Dividend-Reinvest Dividend•Monthly Dividend-Payout Dividend-Reinvest Dividend

•Growth•Dividend- Payout Dividend- Reinvest Dividend•DailyDividendReinvest•WeeklyDividend- Payout Dividend- Reinvest Dividend•MonthlyDividend- Payout Dividend- Reinvest Dividend

•Growth•Dividend -Reinvest Dividend-Payout Dividend•Weekly Dividend Reinvest•Monthly Dividend-Payout Dividend-Reinvest Dividend

4. Minimum Application Amount(First Purchase)

Rs. 1,000/- and any amount thereafter

5. Minimum Application Amount(Subsequent Purchase)

Rs. 1,000/- and any amount thereafter

6. Minimum installment for Systematic Investment Plan (SIP)

Rs. 500/-

7. Minimum installment for Systematic Withdrawal Plan (SWP) and Systematic Transfer Plan (STP)

Rs. 500/-

8. Entry Load Not Applicable

The upfront commission on investment made by the investor shall be paid to the ARN Holder directly by the investor, based on the investor’s assessment of various factors including service rendered by the ARN Holder

9. Exit Load Holding period from date of allotment:<= 12 months - 1%> 12 months - Nil

Holding period from date of allotment:<= 7 calendar days - 0.10%> 7 calendar days - Nil

Holding period from date of allotment:<= 3 months: 0.25%> 3 months: Nil

10. Liquidity The Mutual Fund will endeavor to dispatch redemption proceeds within 3 Business Days from the date of the acceptance of redemption request.

The Mutual Fund will endeavor to dispatch redemption proceeds within 1 Business Day from the date of the acceptance of redemption request.

11. Benchmark Index CRISIL Composite Bond Fund Index CRISIL Short Term Bond Fund Index

12. Transparency/NAV Disclosure AMC will declare separate NAV under Institutional Plan, Regular Plan and Direct Plan of the concern Schemes. NAV will be determined for every Business Day, except in special circumstances described under ‘Suspension of Sale and Redemption of Units’ in the SAI. Also, full portfolio in the prescribed format will be disclosed by publishing in the newspapers or by sending to the Unit Holders within 1 month from the end of each half-year. The portfolio will also be displayed on the website of the Mutual Fund. The monthly portfolio of the Schemes shall be available in a user-friendly and downloadable format on the website viz. www.dspblackrock.com on or before the tenth day of succeeding month.

3

Sr. No. HIGHLIGHTS OF THE SCHEME DSP BLACKROCK

LIQUIDITY FUNDDSP BLACKROCK INCOME

OPPORTUNITIES FUND

DSP BLACKROCK GOVERNMENT

SECURITIES FUND

DSP BLACKROCK TREASURY BILL FUND

1. Investment Objective The primary investment objective of the Scheme is to seek to generate a reasonable return commensurate with low risk and a high degree of liquidity, from a portfolio constituted of money market securities and high quality debt securities.

The primary investment objective of the Scheme is to seek to generate returns commensurate with risk from a portfolio constituted of money market securities and/or debt securities.

The primary objective of the Scheme is to generate income through i n v e s t m e n t in Central G o v e r n m e n t Securities of various maturities.

The primary objective of the Scheme is to generate income through investment in a portfolio comprising of Treasury Bills and other Central Government Securities with a residual maturity less than or equal to 1 year.

2. Plans Available under the Scheme

• Institutional Plan• Direct Plan

• Regular Plan• Direct Plan

3. Options Available under both the plans

• Growth• Daily Dividend

Reinvest• Weekly Dividend- Reinvest Dividend- Payout Dividend

• Growth• Dividend - Reinvest Dividend- Payout Dividend• Daily Dividend Reinvest• Weekly Dividend - Reinvest Dividend- Payout Dividend• Monthly Dividend - Reinvest

Dividend- Payout Dividend• Quarterly Dividend - Reinvest

Dividend - Payout Dividend

• Growth• Dividend- Reinvest

Dividend- Payout Dividend• Monthly

Dividend- Reinvest

Dividend- Payout Dividend

• Growth• Daily DividendReinvest• Dividend- Reinvest Dividend- Payout Dividend• Monthly Dividend- Reinvest Dividend- Payout Dividend

4. Minimum Application Amount (First Purchase)

Rs. 1,000/- and any amount thereafter

5. Minimum Application Amount (Subsequent Purchase)

Rs. 1,000/- and any amount thereafter

6. Minimum installment for SIP Not Available Rs. 500/-

7. Minimum installment for SWP and STP

Rs. 500/-

8. Entry Load Not Applicable

The upfront commission on investment made by the investor shall be paid to the ARN Holder directly by the investor, based on the investor’s assessment of various factors including service rendered by the ARN Holder.

9. Exit Load Nil Holding period from the date of allotment:<= 12 months: 1%> 12 months: Nil

Holding period from date of allotment:<= 7 calendar days - 0.10%> 7 calendar days - Nil

Nil

10. Liquidity The Mutual Fund will endeavor to dispatch redemption proceeds within 1 Business Day from the date of the acceptance of redemption request.

The Mutual Fund will endeavor to dispatch redemption proceeds within 2 Business Days from the date of the acceptance of redemption request.

11. Benchmark Index CRISIL Liquid Fund Index 50% of CRISIL Short Term Bond Fund Index + 50% of CRISIL Composite Bond Fund Index

CRISIL Long Term Gilt Index

CRISIL Composite T-Bill Index

12. Transparency/NAVDisclosure

AMC will declare separate NAV under Institutional Plan, Regular Plan and Direct Plan of the concerned Schemes. NAV will be determined for every Business day (everyday in the case of DSP BlackRock Liquidity Fund), except in special circumstances described under ‘Suspension of Sale and Redemption of Units’ in the SAI. Also, full portfolio in the prescribed format will be disclosed by publishing in the newspapers or by sending to the Unit Holders within 1 month from the end of each half-year. The portfolio will also be displayed on the website of the Mutual Fund. The monthly portfolio of the Schemes shall be available in a user-friendly and downloadable format on the website viz. www.dspblackrock.com on or before the tenth day of succeeding month.

4

Sr. No.

HIGHLIGHTS OF THE SCHEME DSP BLACKROCK MONEY MANAGER FUND

DSP BLACKROCK BALANCED FUND

DSP BLACKROCK MIP FUND^

1. Investment Objective The primary investment objective of the Scheme is to seek to generate returns commensurate with risk from a portfolio constituted of money market securities and/or debt securities.

The primary investment objective of the Scheme is to seek to generate long term capital appreciation and current income from a portfolio constituted of equity and equity relatedsecuritiesaswellasfixedincome securities (debt and money market securities).

The primary Investment objective of the scheme is to seek to generate income, consistent with prudent risk, from a portfolio which is substantially constituted of quality debt securities. The Scheme will also seek to generate capital appreciation by investing a smaller portion of its corpus in equity and equity related securities of issuers domiciled in India.

2. Plans Available under the Scheme

• Regular Plan• Direct Plan

3. Options Available under both the plans

• Growth• Dividend-Reinvest Dividend-Payout Dividend• Daily Dividend Reinvest• Weekly Dividend-Reinvest Dividend-Payout Dividend• Monthly Dividend-Reinvest Dividend-Payout Dividend

• Growth• Dividend-Reinvest Dividend-Payout Dividend• Quarterly Dividend-Reinvest Dividend-Payout Dividend

• Growth• Monthly Dividend-Payout Dividend-Reinvest Dividend• Quarterly Dividend -Payout Dividend-Reinvest Dividend

4. Minimum Application Amount (First Purchase)

Rs. 1,000/- and any amount thereafter

5. Minimum Application Amount (Subsequent Purchase)

Rs. 1,000/- and any amount thereafter

6. Minimum installment for SIP Rs. 500/-

7. Minimum installment for SWP and STP

Rs. 500/-

8. Entry Load Not Applicable

The upfront commission on investment made by the investor shall be paid to the ARN Holder directly by the investor, based on the investor’s assessment of various factors including service rendered by the ARN Holder.

9. Exit Load Nil Holding Period from date of allotment:< 12 months - 1%>= 12 months - Nil

Holding Period from date of allotment:< 12 months: 2%>= 12 months and < 24 months: 1%>= 24 months and < 36 months: 0.50%>= 36 months: Nil

10. Liquidity The Mutual Fund will endeavor to dispatch redemption proceeds within 3 Business Days from the date of the acceptance of redemption request.

The Mutual Fund will endeavor to dispatch redemption proceeds within 2 Business Days from the date of the acceptance of redemption request.

11. Benchmark Index CRISIL Liquid Fund Index CRISIL Balanced Fund Index CRISIL MIP Blended Index

12. Transparency/NAV Disclosure AMC will declare separate NAV under Regular Plan and Direct Plan of Schemes. NAV will be determined for every Business Day, except in special circumstances described under ‘Suspension of Sale and Redemption of Units’ in the SAI.

Also, full portfolio in the prescribed format will be disclosed by publishing in the newspapers or by sending to the Unit Holders within 1 month from the end of each half-year. The portfolio will also be displayed on the website of the Mutual Fund.

The monthly portfolio of the Schemes shall be available in a user-friendly and downloadable format on the website viz. www.dspblackrock.com on or before the tenth day of succeeding month.

^Monthly income is not assured and is subject to the availability of distributable surplus.

5

Sr. No. HIGHLIGHTS OF THE SCHEME DSP BLACKROCK EQUITY FUND DSP BLACKROCK

OPPORTUNITIES FUNDDSP BLACKROCK TOP 100

EQUITY FUND

1. Investment Objective The primary investment objective of the Scheme is to seek to generate long term capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of issuers domiciled in India. This shall be the fundamental attribute of the Scheme.

The primary investment objective of the Scheme is to seek to generate long term capital appreciation and the secondary objective is income generation and the distribution of dividend from a portfolio constituted of equity and equity related securities concentrating on the investment focus of the Scheme.

The primary investment objective of the Scheme is to seek to generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of the 100 largest corporates, by market capitalisation, listed in India. This shall be the fundamental attribute of the Scheme.

2. Plans Available under the Scheme

• Regular Plan• Direct Plan

3. Options Available under both the plans

• Growth• Dividend-Payout Dividend-Reinvest Dividend

4. Minimum Application Amount(First Purchase)

Rs. 1,000/- and any amount thereafter

5. Minimum Application Amount(Subsequent Purchase)

Rs. 1,000/- and any amount thereafter

6. Minimum installment for SIP Rs. 500/-7. Minimum installment for SWP

and STP Rs. 500/-

8. Entry Load Not Applicable

The upfront commission on investment made by the investor shall be paid to the ARN Holder directly by the investor, based on the investor’s assessment of various factors including service rendered by the ARN Holder.

9. Exit Load Holding Period from date of allotment:< 12 months - 1%>= 12 months - Nil

10. Liquidity The Mutual Fund will endeavor to dispatch redemption proceeds within 3 Business Days from the date of the acceptance of redemption request.

11. Benchmark Index CNX 500 Index S&P BSE 100 Index12. Transparency/NAV Disclosure AMC will declare separate NAV under Regular Plan and Direct Plan of Schemes. NAV will be determined for

every Business Day, except in special circumstances described under ‘Suspension of Sale and Redemption of Units’ in the SAI. Also, full portfolio in the prescribed format will be disclosed by publishing in the newspapers or by sending to the Unit Holders within 1 month from the end of each half-year. The portfolio will also be displayed on the website of the Mutual Fund.The monthly portfolio of the Schemes shall be available in a user-friendly and downloadable format on the website viz. www.dspblackrock.com on or before the tenth day of succeeding month.

Sr. No.

HIGHLIGHTS OF THE SCHEME DSP BLACKROCK TECHNOLOGY.COM FUND

DSP BLACKROCK INDIA T.I.G.E.R. FUND (THE INFRASTRUCTURE

GROWTH AND ECONOMIC REFORMS FUND)

DSP BLACKROCK SMALL AND MID CAP FUND

1. Investment Objective The primary investment objective of the Scheme is to seek to generate long term capital appreciation and the secondary objective is income generation and the distribution of dividend from a portfolio constituted of equity and equity related securities concentrating on the investment focus of the Scheme.

The primary investment objective of the Scheme is to seek to generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changesbrought about by continuing liberalization in economic policies by the Government and/or from continuing investments in infrastructure, both by the public and private sector.

The primary investment objective is to seek to generate long term capital appreciation from a portfolio that is substantially constituted of equity and equity related securities which are not part of the top 100 stocks by market capitalization. From time to time, the fund manager will also seek participation in other equity and equity related securities to achieve optimal portfolio construction.

2. Plans Available under the Scheme

• Regular Plan• Direct Plan

6

Sr. No.

HIGHLIGHTS OF THE SCHEME DSP BLACKROCK TECHNOLOGY.COM FUND

DSP BLACKROCK INDIA T.I.G.E.R. FUND (THE INFRASTRUCTURE

GROWTH AND ECONOMIC REFORMS FUND)

DSP BLACKROCK SMALL AND MID CAP FUND

3. Options Available under both the plans

• Growth• Dividend-Payout Dividend-Reinvest Dividend

4. Minimum Application Amount(First Purchase)

Rs. 1,000/- and any amount thereafter

5. Minimum Application Amount(Subsequent Purchase)

Rs. 1,000/- and any amount thereafter

6. Minimum installment for SIP Rs. 500/-7. Minimum installment for SWP

and STPRs. 500/-

8. Entry Load Not Applicable

The upfront commission on investment made by the investor shall be paid to the ARN Holder directly by the investor, based on the investor’s assessment of various factors including service rendered by the ARN Holder.

9. Exit Load Holding Period from date of allotment: < 12 months - 1%>= 12 months - Nil

Holding Period from date of allotment: < 24 months - 1%>= 24 months - Nil

Holding Period from date of allotment: < 18 months - 1%>= 18 months - Nil

10. Liquidity The Mutual Fund will endeavor to dispatch redemption proceeds within 3 Business Days from the date of the acceptance of redemption request.

11. Benchmark Index S&P BSE TECk Index S&P BSE 100 Index CNX Mid Cap Index12. Transparency/NAV Disclosure AMC will declare separate NAV under Regular Plan and Direct Plan of Schemes. NAV will be determined for

every Business Day, except in special circumstances described under ‘Suspension of Sale and Redemption of Units’ in the SAI.

Also, full portfolio in the prescribed format will be disclosed by publishing in the newspapers or by sending to the Unit Holders within 1 month from the end of each half-year. The portfolio will also be displayed on the website of the Mutual Fund.

The monthly portfolio of the Schemes shall be available in a user-friendly and downloadable format on the website viz. www.dspblackrock.com on or before the tenth day of succeeding month.

Sr. No.

HIGHLIGHTS OF THE SCHEME DSP BLACKROCK NATURAL RESOURCES AND NEW ENERGY FUND

DSP BLACKROCK WORLD GOLD FUND

DSP BLACKROCK TAX SAVER FUND

1. Investment Objective The primary investment objective of the Scheme is to seek to generate capital appreciation and provide long term growth opportunities by investing in equity and equity related securities of companies domiciled in India whose pre-dominant economic activity is in the:(a) discovery, development, produc-

tion, or distribution of natural re-sources, viz., energy, mining etc.;

(b) alternative energy and energy technology sectors, with emphasis given to renewable energy, automotive and on-site power generation, energy storage and enabling energy technologies.

The Scheme will also invest a certain portion of its corpus in the equity and equity related securities of companies domiciled overseas, which are principally engaged in the discovery, development, production or distribution of natural resources and alternative energy and/or the units/shares of BlackRock Global Funds – New Energy Fund, BlackRock Global Funds – World Energy Fund and similar other overseas mutual fund schemes.

The primary investment objec-tive of the Scheme is to seek capital appreciation by investing predominantly in units of Black-Rock Global Funds - World Gold Fund (BGF - WGF). The Scheme may, at the discretion of the Investment Manager, also in-vest in the units of other similar overseas mutual fund schemes, which may constitute a signifi-cant part of its corpus.

The primary investment objective of the Scheme is to seek to generate medium to long-term capital appreciation from a diversified portfoliothat is substantially constituted of equity and equity related securities of corporates, and to enable investors avail of a deduction from total income, as permitted under the Income Tax Act, 1961 from time to time.

7

Sr. No.

HIGHLIGHTS OF THE SCHEME DSP BLACKROCK NATURAL RESOURCES AND NEW ENERGY FUND

DSP BLACKROCK WORLD GOLD FUND

DSP BLACKROCK TAX SAVER FUND

2. Plans Available under the Scheme

• Regular Plan• Direct Plan

3. Options Available under both the plans

• Growth• Dividend-Payout Dividend-Reinvest Dividend

• Growth• Dividend-Payout Dividend

4. Minimum Application Amount(First Purchase)

Rs. 1,000/- and any amount thereafter Rs. 500/- and any amount thereafter

5. Minimum Application Amount(Subsequent Purchase)

Rs. 1,000/- and any amount thereafter Rs. 500/- and any amount thereafter

6. Minimum installment for SIP Rs. 500/-7. Minimum installment for SWP

and STPRs. 500/- Rs. 500/-

(subject to completion of 3 years Lock-in Period)

8. Entry Load Not ApplicableThe upfront commission on investment made by the investor shall be paid to the ARN Holder directly by the investor, based on the investor’s assessment of various factors including service rendered by the ARN Holder.

9. Exit Load Holding Period from date of allotment:< 12 months - 1%>= 12 months - Nil

Holding Period from date of allotment:< 24 months - 1%>= 24 months - Nil

Not Applicable

10. Liquidity The Mutual Fund will endeavor to dispatch redemption proceeds within 3 Business Days from the date of acceptance of redemption request.

The Mutual Fund will endeavor to dispatch redemption proceeds within 5 Business Days from the date of acceptance of redemption request.

The Mutual Fund will enable redemption of Units after 3 years from the date of allotment of Units. The Mutual Fund will endeavor to dispatch redemption proceeds within 3 Business Days from the date of acceptance of redemption request.

11. Temporary suspension of subscription

The AMC/Trustee reserves the right to temporarily suspend subscriptions in/switches into the Scheme, if the limits prescribed by SEBI for overseas investments for the Mutual Fund (currently equivalent to US$ 600 mn) are exceeded/expected to be exceeded.

-

12. Benchmark Index 35% S&P BSE Oil & Gas Index, 30% S&P BSE Metal Index, 35% MSCI World Energy (net as expressed in INR)

FTSE Gold Mines (cap) (in INR terms)

CNX 500

13. Lock-in Period - - DSPBRTSF is open for continuous redemption subject to the completion of a Lock-in Period of 3 years from the date of allotment, as prescribed in the ELSS Guidelines. Currently, the tax benefits are restricted to aninvestment amount as described in the section, “Taxation on investing in Mutual Funds” in the SAI. However, any investment amountinexcessofthespecifiedamount will also be subject to the Lock-in Period of 3 years. It may, however, be noted that, in the event of the death of the Unit Holder, the nominee or legal heir, (subject to production of requisite documentary evidence to the satisfaction of the AMC) as the case may be, shall be able to redeem the investment only after the completion of one year, or any time thereafter, from the Date of Allotment of Units to the deceased Unit Holder.The Trustee reserves the right to change the Lock-in Period prospectively from time to time, in the event of amendment(s) in the ELSS Guidelines with respect to the Lock-in Period.

8

Sr. No.

HIGHLIGHTS OF THE SCHEME DSP BLACKROCK NATURAL RESOURCES AND NEW ENERGY FUND

DSP BLACKROCK WORLD GOLD FUND

DSP BLACKROCK TAX SAVER FUND

14. Transparency/NAV Disclosure AMC will declare separate NAV under Regular Plan and Direct Plan of Schemes. NAV will be determined for every Business Day, except in special circumstances described under ‘Suspension of Sale and Redemption of Units’ in the SAI. Also, full portfolio in the prescribed format will be disclosed by publishing in the newspapers or by sending to the Unit Holders within 1 month from the end of each half-year. The portfolio will also be displayed on the website of the Mutual Fund.The monthly portfolio of the Schemes shall be available in a user-friendly and downloadable format on the website viz. www.dspblackrock.com on or before the tenth day of succeeding month.

Sr No.

HIGHLIGHTS OF THE SCHEME

DSP BLACKROCK WORLD ENERGY FUND

DSP BLACKROCK WORLD MINING FUND

DSP BLACKROCK MICRO CAP FUND

DSP BLACKROCK FOCUS 25 FUND

1. Investment Objective

The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Energy Fund and BlackRock Global Funds – New Energy Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constituteasignificantpartof its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time.

The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in the units of BlackRock Global Funds – World Mining Fund. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constituteasignificantpartof its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time.

The primary investment objective is to seek to generate long term capitalappreciation from a portfolio that is substantially constituted of equity and equity related securities, which are not part of the top 300 companies by market capitalization. From time to time, the Investment Manager will also seek participation in other equity and equity related securities to achieve optimal portfolio construction. This shall be the fundamental attribute of the Scheme.

The primary investment objective of the Scheme is to generate long-term capital growth from a portfolio of equity and equity-related securities including equity derivatives. The portfolio will largely consist of companies, which are amongst the top 200 companies by market capitalisation. The portfolio will limit exposure to companies beyond the top 200 companies by market capitalization upto 20% of the net asset value. The Scheme will normally hold equity and equity-related securities including equity derivatives, of upto 25 companies. Further, the Scheme will also have at least 95% of the invested amount (excluding investments in debt securities, money market securities and cash and cash equivalents) across the top 25 holdings in the portfolio. The Scheme may also invest in debt and money market securities, for defensive considerations and/or for managing liquidity requirements. There can be no assurance that the investment objective of the Scheme will be realized.

2. Plans Available under the Scheme

•RegularPlan•DirectPlan

3. Options Available under both the plans

•Growth•Dividend-Payout Dividend-Reinvest Dividend

4. Minimum Application Amount (First Purchase)

Rs. 1,000/- and any amount thereafter

5. Minimum Application Amount (Subsequent Purchase)

Rs. 1,000/- and any amount thereafter

6. Minimum installment for SIP

Rs. 500/-

7. Minimum installment for SWP and STP

Rs. 500/-

8. Entry Load Not ApplicableThe upfront commission on investment made by the investor shall be paid to the ARN Holder directly by the investor, based on the investor’s assessment of various factors including service rendered by the ARN Holder.

9. Exit Load Holding Period from the date of allotment:< 24 months – 1%>= 24 months – Nil

9

Sr No.

HIGHLIGHTS OF THE SCHEME

DSP BLACKROCK WORLD ENERGY FUND

DSP BLACKROCK WORLD MINING FUND

DSP BLACKROCK MICRO CAP FUND

DSP BLACKROCK FOCUS 25 FUND

10. Liquidity The Mutual Fund will endeavor to despatch redemption proceeds within 5 Business Days from the date of acceptance of redemption request.

The Mutual Fund will endeavor to despatch redemption proceeds within 10 Business Days from the date of acceptance of redemption request.

The Mutual Fund will endeavor to dispatch redemption proceeds within 3 Business Days from the date of acceptance of redemption request.

11. Temporary suspension of subscription

The AMC/Trustee reserves the right to temporarily suspend subscriptions in/switches into the Scheme or terminate the SIP/STP into the Scheme if the limits prescribed by SEBI for overseas investments by the Mutual Fund are exceeded/expected to be exceeded (currently the limit for the Mutual Fund is equivalent to US$ 600 mn.).

- -

12. Benchmark Index 70% MSCI World Energy (Net) 30% MSCI World (Net)

Euromoney Global Mining (cap) Index (in INR terms) (Erstwhile known as HSBC Global Mining (cap) Index

S&P BSE Small Cap Index S&P BSE 200

13. Transparency/NAV Disclosure

AMC will declare separate NAV under Regular Plan and Direct Plan of Schemes. NAV will be determined for every Business Day, except in special circumstances described under ‘Suspension of Sale and Redemption of Units’ in the SAI. Also, full portfolio in the prescribed format will be disclosed by publishing in the newspapers or by sending to the Unit Holders within 1 month from the end of each half-year. The portfolio will also be displayed on the website of the Mutual Fund.The monthly portfolio of the Schemes shall be available in a user-friendly and downloadable format on the website viz. www.dspblackrock.com on or before the tenth day of succeeding month.

Sr No.

HIGHLIGHTS OF THE SCHEME

DSP BLACKROCK WORLD AGRICULTURE FUND DSP BLACKROCK US FLEXIBLE* EQUITY FUND

1. Investment Objective

The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of BlackRock Global Funds - World Agriculture Fund (BGF - WAF). The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme mayalso invest a certain portion of its corpus in money market securities and/ or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized.It shall be noted ‘similar overseas mutual fund schemes’ shall have investment objective, investmentstrategyandriskprofile/considerationsimilar to those of BGF – WAF.

The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of BlackRock Global Funds US Flexible Equity Fund (BGF - USFEF). The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes,whichmayconstituteasignificantpartofitscorpus.The Scheme may also invest a certain portion of its corpus in money market securities and/ or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized. It shall be noted ‘similar overseas mutual fund schemes’ shall have investment objective, investment strategy andriskprofile/considerationsimilartothoseofBGF–USFEF.*Theterm“Flexible”inthenameoftheSchemesignifiesthatthe Investment Manager of the Underlying Fund can invest either in growth or value investment characteristic securities placing an emphasis as the market outlook warrants.

2. Plans Available under the Scheme

• Regular Plan• Direct Plan

3. Options Available under both the plans

•Growth•Dividend-PayoutDividend-ReinvestDividend

4. Minimum Application Amount (First Purchase)

Rs. 1,000/- and any amount thereafter

5. Minimum Application Amount (Subsequent Purchase)

Rs. 1,000/- and any amount thereafter

6. Minimum installment for SIP

Rs. 500/-

7. Minimum installment for SWP and STP

Rs. 500/-

8. Entry Load Not ApplicableThe upfront commission on investment made by the investor shall be paid to the ARN Holder directly by the investor, based on the investor’s assessment of various factors including service rendered by the ARN Holder.

9. Exit Load Holding Period from date of allotment:< 24 months: 1%>= 24 months: Nil

10. Liquidity The Mutual Fund will endeavor to despatch redemption proceeds within 5 Business Days from the date of acceptance of redemption request.

10

11. Temporary suspension of subscription

The AMC/Trustee reserves the right to temporarily suspend subscriptions in/switches into the Scheme or terminate the SIP/STP into the Scheme, if the limits prescribed by SEBI for overseas investments are exceeded/expected to be exceeded (currently the limit for the Mutual Fund is equivalent to US$ 600 mn.).

12. Benchmark Index DAX Global Agribusiness Index Russell 1000 Index13. Transparency/NAV

DisclosureAMC will declare separate NAV under Regular Plan and Direct Plan of Schemes. NAV will be determined for every Business Day, except in special circumstances described under ‘Suspension of Sale and Redemption of Units’ in the SAI.Also, full portfolio in the prescribed format will be disclosed by publishing in the newspapers or by sending to the Unit Holders within 1 month from the end of each half-year. The portfolio will also be displayed on the website of the Mutual Fund.The monthly portfolio of the Schemes shall be available in a user-friendly and downloadable format on the website viz. www.dspblackrock.com on or before the tenth day of succeeding month.

Sr No.

HIGHLIGHTS OF THE SCHEME

DSP BLACKROCK BANKING & PSU DEBT FUND DSP BLACKROCK DYNAMIC ASSET ALLOCATION FUND

1. Investment Objective

The primary investment objective of the Scheme is to seek to generate income and capital appreciation by primarily investing in a portfolio of high quality debt and money market securities that are issued by banks and public sector entities/undertakings. There is no assurance that the investment objective of the Scheme will be realized.

The investment objective of the Scheme is to seek capital appreciation by managing the asset allocation between specifiedequitymutualfundsschemesanddebtmutualfunds schemes of DSP BlackRock Mutual Fund.The Scheme will dynamically manage the asset allocation betweenthespecifiedequitymutualfundsschemesanddebt mutual funds schemes of DSP BlackRock Mutual Fund based on the relative valuation of equity and debt markets. The Scheme may also invest a certain portion of its corpus in money market securities and/ or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized.

2. Underlying Funds/Schemes

- The Underlying Schemes for equity allocation would be DSPBREF and/or DSPBRTEF and/or DSPBRF25F and/or DSPBROF and/or DSPBRITF whereas the Underlying Schemes for debt allocation would be DSPBRSBF and/or DSPBRSTF and/or DSPBRMMF and/or DSPBRBPDF and/or DSPBRIOF.

3. Plans Available under the Scheme

•Regular Plan•Direct Plan

4. Options Available under both the plans

•Growth•DailyDividendReinvest•WeeklyDividend - Payout Dividend - Reinvest Dividend•MonthlyDividend - Payout Dividend - Reinvest Dividend•QuarterlyDividend - Payout Dividend - Reinvest Dividend•Dividend - Payout Dividend - Reinvest Dividend

•Growth•MonthlyDividend - Payout Dividend - Reinvest Dividend

5. Minimum Application Amount (First Purchase)

Rs. 1,000/- and any amount thereafter

6. Minimum Application Amount (Subsequent Purchase)

Rs. 1,000/- and any amount thereafter

7. Minimum installment for SIP

Rs. 500/-

8. Minimum installment for SWP and STP

Rs. 500/-

9. Entry Load Not ApplicableThe upfront commission on investment made by the investor shall be paid to the ARN Holder directly by the investor, based on the investor’s assessment of various factors including service rendered by the ARN Holder.

10. Exit Load Holding period from date of allotment:<= 1 month: 0.25%> 1 month: Nil

Holding Period from date of allotment:•<=1year:1%•>1yearand<=2years:0.5%•>2years:Nil

11

11. Liquidity The Mutual Fund will endeavor to despatch redemption proceeds within 2 Business Days from the date of acceptance of redemption request.

The Mutual Fund will, not later than 5 Business Days from the date of allotment, commence redemption of Units of the Scheme, on an on–going basis. The Mutual Fund will endeavor to dispatch redemption proceeds within 5 Business Days from the date of acceptance of redemption request.

12. Benchmark Index CRISIL Short Term Bond Fund Index CRISIL Balanced Fund Index13. Transparency/NAV

DisclosureAMC will declare separate NAV under Regular Plan and Direct Plan of Scheme. NAV will be determined for every Business Day, except in special circumstances described under ‘Suspension of Sale and Redemption of Units’ in the SAI.Also, full portfolio in the prescribed format will be disclosed by publishing in the newspapers or by sending to the Unit Holders within 1 month from the end of each half-year. The portfolio will also be displayed on the website of the Mutual Fund.The monthly portfolio of the Schemes shall be available in a user-friendly and downloadable format on the website viz. www.dspblackrock.com on or before the tenth day of succeeding month.

Sr. No.

HIGHLIGHTS OF THE SCHEME DSP BLACKROCK GLOBAL ALLOCATION FUND

DSP BLACKROCK CONSTANT MATURITY 10Y G-SEC FUND

DSP BLACKROCK ULTRA SHORT TERM FUND

1. Type of Scheme Open ended fund of funds scheme Open ended gilt Scheme Open ended income (debt) scheme

2. Investment Objective The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of BlackRock Global Funds - Global Allocation Fund (BGF - GAF). The Scheme may also invest in the units of other similar overseas mutual fund schemes which may constitute a significant part ofits corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/ or money market/liquid schemes of DSP BlackRock Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized. It shall be noted ‘similar overseas mutual fund schemes’ shall have investment objective, investmentstrategyandriskprofile/consideration similar to those of BGF – GAF.

The investment objective of the Scheme is to seek to generate returns commensurate with risk from a portfolio of Government Securities with weighted average maturity of around 10 years. There is no assurance that the investment objective of the Scheme will be realized.

The investment objective of the Scheme is to seek to generate returns commensurate with risk from a portfolio constituted of money market securities and/or debt securities. There is no assurance that the investment objective of the Scheme will be realized.

3. Plans Available under the Scheme

• Regular Plan• Direct Plan

4. Options Available under both the plans

• Growth • Dividend-Payout Dividend-Reinvest Dividend

• Growth • Dividend -Payout Dividend-Reinvest Dividend• Monthly Dividend-Payout Dividend-Reinvest Dividend• Quarterly Dividend-Payout Dividend-Reinvest Dividend

• Growth • Daily Dividend-Reinvest Dividend• Weekly Dividend-Payout Dividend-Reinvest Dividend• Monthly Dividend-Payout Dividend-Reinvest Dividend• Quarterly Dividend-Payout Dividend-Reinvest Dividend

5. Minimum Application Amount(First Purchase)

Rs. 1,000/- and multiples of Re. 1/- thereafter

Rs. 1,000/- and any amount thereafter

6. Minimum Application Amount(Subsequent Purchase)

Rs. 1,000/- and multiples of Re. 1/- thereafter

Rs. 1,000/- and any amount thereafter

7. Minimum installment for SIP Rs. 500/-8. Minimum installment for SWP

and STPRs. 500/-

12

Sr. No.

HIGHLIGHTS OF THE SCHEME DSP BLACKROCK GLOBAL ALLOCATION FUND

DSP BLACKROCK CONSTANT MATURITY 10Y G-SEC FUND

DSP BLACKROCK ULTRA SHORT TERM FUND

9. Entry Load Not ApplicableThe upfront commission on investment made by the investor shall be paid to the ARN Holder directly by the investor, based on the investor’s assessment of various factors including service rendered by the ARN Holder.

10. Exit Load Holding Period from date of allotment: < 24 months: 1%>= 24 months: Nil

Holding Period from date of allotment: <=7 calendar days – 0.10%> 7 calendar days – Nil

Nil

11. Liquidity The Mutual Fund will endeavor to dispatch redemption proceeds within 5 Business Days from the date of acceptance of redemption request.

The Mutual Fund will endeavor to dispatch redemption proceeds within 3 Business Days from the date of acceptance of redemption request.

The Mutual Fund will endeavor to dispatch redemption proceeds within 1 Business Days from the date of acceptance of redemption request.

12. Benchmark Index 36% S&P 500 Index, 24% FTSE World ex-US Index, 24% BofA ML Current 5-Year US Treasury Index, 16% Citigroup Non-USD World Government Bond Index

CRISIL 10 Year Gilt Index 50% of CRISIL Composite CP Index + 50% of CRISIL Composite CD Index

13. Transparency/NAV Disclosure AMC will declare separate NAV under Regular Plan and Direct Plan of Scheme. NAV will be determined for every Business Day, except in special circumstances described under ‘Suspension of Sale and Redemption of Units’ in the SAI.Also, full portfolio in the prescribed format will be disclosed by publishing in the newspapers or by sending to the Unit Holders within 1 month from the end of each half-year. The portfolio will also be displayed on the website of the Mutual Fund.The monthly portfolio of the Schemes shall be available in a user-friendly and downloadable format on the website viz. www.dspblackrock.com on or before the tenth day of succeeding month.

14. Temporary suspension of subscription/ Winding up of the Scheme in case exposure to India equity by Underlying Fund exceeds 15% of the net asset of Underlying Fund

(i) In case the exposure to Indian equities through BGF-GAF or through other similar funds (Underlying schemes) in which the Scheme invest exceeds 15 % of the net assets of Underlying schemes as the case may then a rebalancing period of three months from the date in initial breach shall be allowed so as to bring back the exposure to Indian equities within the said 15% limit.

(ii) In case this breach exceeds beyond the said three (3) months, the Scheme shall stop fresh subscription (including switch-in and future installments of Systematic transactions (SIP/STP) in the Scheme for the next nine (9) months.

(iii) In case the breach as mentioned in point (i) still continues after a period of twelve (12) months since the initial breach, the Scheme shall be would up after providing intimation of the same to the unitholders with an exit option for a period of thirty (30) days at the then prevailing NAV without any exit load.

Note:1. SIP/SWP/STP facility is available only in the Direct & Regular Plan of the Schemes and Institutional Plan of DSP BlackRock Strategic Bond Fund. 2. Switch facility and the facility of SWP/STP are currently not available for transactions carried out through the stock exchange mechanism.3. No fresh purchase/additional purchase/switch-ins/STP-ins shall be accepted in the Institutional Plan (‘Discontinued plan’) under DSP BlackRock

Equity Fund, DSP BlackRock Top 100 Equity Fund, DSP BlackRock Opportunities Fund, DSP BlackRock India T.I.G.E.R Fund (The Infrastructure Growth and Economic Reforms Fund), DSP BlackRock Technology.com Fund, DSP BlackRock Small and Midcap Fund, DSP BlackRock Micro Cap Fund, DSP BlackRock Natural Resource New Energy Fund, DSP BlackRock World Gold Fund, DSP BlackRock World Energy Fund, DSP World Mining Fund, DSP BlackRock Income Opportunities Fund and DSP BlackRock Money Manager Fund and Regular Plan (‘Discontinued plan’) under DSP BlackRock Liquidity Fund and DSP BlackRock Strategic Bond Fund. However, the redemption/switch-out/ SWP/ STP - out from Discontinued plan shall be processed.

4. w.e.fJanuary1,2013,theexistinginvestmentintheSchemeswithnoplans,arebeingidentifiedunderRegularPlanoftheconcernedSchemes.5. AMC will declare separate NAV for Discontinued plan of the concerned Schemes on every Business Day and everyday incase of DSP BlackRock

Liquidity Fund, except in special circumstances described under ‘Suspension of Sale and Redemption of Units’ in the SAI.

13

SECTION II – DEFINITIONSInthisSID,thefollowingwordsandexpressionshallhavethemeaningspecifiedunlessthecontextotherwiserequire.

Applicable NAV The NAV applicable for purchase or redemption based on the time of the Business Day on which the subscription/redemption request is accepted.

Application Supported by Blocked Amount (ASBA)

ASBAisanapplicationcontaininganauthorizationtoaSelfCertifiedSyndicateBank(SCSB)toblocktheapplicationmoney in the bank account maintained with the SCSB, for subscribing to a New Fund Offer.

AMC or Investment Managers or DSPBRIM

DSP BlackRock Investment Managers Pvt. Ltd., the asset management company, set up under the Companies Act, 1956, and authorised by SEBI to act as the asset management company to the schemes of DSP BlackRock Mutual Fund.

Bank Abankisafinancialinstitutionandafinancialintermediarythatacceptsdepositsandchannelsthosedepositsintolending activities, either directly by loaning or indirectly through capital markets.

Banking as per Banking Regulation Act, 1949

As per Section 5(b) of Banking Regulation Act, 1949, banking means the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdrawable by cheque, draft, order or otherwise.As per Section 5(c) of Banking Regulation Act, 1949 a “Banking Company” means any company which transacts the business of banking in India.

Beneficial owner BeneficialOwnerasdefinedintheDepositoriesAct,1996meansapersonwhosenameisrecordedassuchwithadepository.Business Day DSPBREF, DSPBRBalF, DSPBRTF, DSPBROF, DSPBRITF, DSPBRSMF, DSPBRTSF DSPBRTEF, DSPBRF25F and DSPBRMCF: A

day other than (i) Saturday and Sunday, (ii) a day on which the National Stock Exchange is closed and (iii) a day on which Sale and Redemption of Units are suspended.DSPBRLF: A day other than (i) Saturday and Sunday, (ii) a day on which the banks in Mumbai are closed, (iii) a day on which the Sale and Redemption of Units are suspended and (iv) a day on which the money markets are closed/not accessible.DSPBRBF, DSPBRSTF, DSPBRIOF, DSPBRMMF and DSPBRSBF: A day other than (i) Saturday and Sunday, (ii) a day on which the banks in Mumbai are closed, (iii) a day on which money markets are closed/not accessible (iv) a day on which the Sale and Redemption of Units are suspended.DSPBRMIPF: A day other than (i) Saturday and Sunday, (ii) a day on which either the National Stock Exchange or the banks in Mumbai are closed, (iii) a day on which money markets are closed/not accessible and (iv) a day on which the Sale and Redemption of Units are suspended.DSPBRBPDF, DSPBRCM10YGF, DSPBRGF, DSPBRTBF and DSPBRUSTF: A day other than (i) Saturday and Sunday, (ii) a day on which the Reserve Bank of India or the banks in Mumbai are closed, (iii) a day on which there is no Reserve Bank of India clearing/settlement of securities, (iv) a day on which money markets are closed/not accessible and (v) a day on which the Sale and Redemption of Units are suspended.DSPBRWGF: A day other than (i) Saturday and Sunday, (ii) a day on which the banks in Mumbai are closed, (iii) a day on which the Reserve Bank of India is closed, (iv) a day when BGF – WGF is closed for subscription/redemption, (v) a day on which the sale and redemption of Units are suspended.DSPBRWEF: A day other than (i) Saturday and Sunday, (ii) a day on which the banks in Mumbai are closed, (iii) a day on which the Reserve Bank of India is closed, (iv) a day when BGF – WEF and BGF – NEF are/is closed for subscription/redemption, (v) a day on which the sale and redemption of Units are suspended.

DSPBRWMF: A day other than (i) Saturday and Sunday, (ii) a day on which the banks in Mumbai are closed, (iii) a day on which the Reserve Bank of India is closed, (iv) a day when BGF – WMF is closed for subscription/redemption, (v) a day on which the sale and redemption of Units are suspended.

DSPBRNRNEF: A day other than (i) Saturday and Sunday, (ii) a day on which the National Stock Exchange is closed, (iii) a day when BGF – NEF and/or BGF – WEF are/is closed for subscription/redemption, (iv) a day on which the sale and redemption of Units is suspended.

DSPBRWAF: A day other than (i) Saturday and Sunday, (ii) a day on which the banks in Mumbai are closed, (iii) a day when BGF – WAF is closed for subscription/redemption, (iv) a day on which the sale and redemption of Units are suspended and (v) a day on which Reserve Bank of India is closed.DSPBRUSFEF: A day other than (i) Saturday and Sunday, (ii) a day on which the banks in Mumbai are closed, (iii) a day when BGF – USFEF is closed for subscription/redemption, (iv) a day which is a non business day for the U.S (v) a day on which the sale and redemption of Units are suspended and (vi) a day on which Reserve Bank of India is closed.DSPBRDAAF: A day other than (i) Saturday and Sunday, (ii) a day on which the banks in Mumbai are closed, (iii) a day when the Underlying Scheme(s) is(are) closed for subscription/redemption, (iv) a day on which the sale and redemption of Units are suspended and (v) a day on which Reserve Bank of India is closed.DSPBRGAF: A day other than (i) Saturday and Sunday, (ii) a day on which the banks in Mumbai are closed, (iii) a day when BGF – GAF is closed for subscription/redemption, (iv) a day on which the sale and redemption of Units are suspended and (v) a day on which Reserve Bank of India is closed.

BlackRock Global Funds – World Agriculture Fund/ BGF – World Agriculture Fund/BGF – WAF, BlackRock Global Funds - World Gold Fund/BGF - World Gold Fund/BGF - WGF, BlackRock Global Funds - New Energy Fund/BGF - New Energy Fund/BGF - NEF, BlackRock Global Funds - World Energy Fund/BGF - World Energy Fund/BGF - WEF, BlackRock Global Funds - World Mining Fund/BGF - World Mining Fund/ BGF-WMF/ BlackRock Global Funds – US Flexible Equity Fund/ BGF - US Flexible Equity Fund/BGF - USFEF / BlackRock Global Funds – Global Allocation Fund/BGF – GAF/BGF – Global Allocation Fund.

Undertaking for Collective Investment in Transferable Securities (UCITS) III Fund approved by Commission for the Supervision of the Financial Sector, Luxembourg, with BlackRock (Luxembourg) S.A. as the management company.

Central Government Securities SecuritiescreatedandissuedbytheCentralGovernment,assuchGovernmentSecuritiesdefinedunderSection(2) of the Public Debt Act, 1944 (18 of 1944)

Custodian Citibank N.A., Mumbai branch, acting as a custodian to the Schemes, or any other Custodian who is approved by the Trustee.Depository ADepositoryasdefinedintheDepositoriesAct,1996andincludesNationalSecuritiesDepositoryLimited(NSDL)

and Central Depository Services Limited (CDSL).

14

Depository Participant (DP) Depository Participant (DP) is an agent of the Depository which acts like an intermediary between the Depository and the investors. DP is an entity which is registered with SEBI to offer depository-related services.

Direct Plan Direct Plan is a separate plan for direct investments i.e. investments not routed through a distributor.DSPBRBalF DSP BlackRock Balanced FundDSPBRBF DSP BlackRock Bond FundDSPBRBPDF DSP BlackRock Banking & PSU Debt FundDSPBRCM10YGF DSP BlackRock Constant Maturity 10Y G-Sec FundDSPBRDAAF DSP BlackRock Dynamic Asset Allocation FundDSPBREF DSP BlackRock Equity FundDSPBRF25F DSP BlackRock Focus 25 FundDSPBRIOF DSP BlackRock Income Opportunities FundDSPBRGF DSP BlackRock Government Securities FundDSPBRGAF DSP BlackRock Global Allocation FundDSPBRITF DSP BlackRock India T.I.G.E.R. Fund (The Infrastructure Growth and Economic Reforms Fund)DSPBRLF DSP BlackRock Liquidity FundDSPBRMCF DSP BlackRock Micro Cap FundDSPBRMIPF DSP BlackRock MIP Fund DSPBRMMF DSP BlackRock Money Manager FundDSPBRNRNEF DSP BlackRock Natural Resources and New Energy FundDSPBROF DSP BlackRock Opportunities FundDSPBRSBF DSP BlackRock Strategic Bond FundDSPBRSMF DSP BlackRock Small and Mid Cap FundDSPBRSTF DSP BlackRock Short Term FundDSPBRTBF DSP BlackRock Treasury Bill FundDSPBRTEF DSP BlackRock Top 100 Equity FundDSPBRTF DSP BlackRock Technology.com FundDSPBRTSF DSP BlackRock Tax Saver FundDSPBRWAF DSP BlackRock World Agriculture FundDSPBRWEF DSP BlackRock World Energy FundDSPBRWGF DSP BlackRock World Gold FundDSPBRWMF DSP BlackRock World Mining FundDSPBRUSFEF DSP BlackRock US Flexible Equity FundDSPBRUSTF DSP BlackRock Ultra Short Term FundEntry Load Load on purchase of Units.Exit Load Load on redemption of Units.First time mutual fund investor Aninvestorwhoinvestsforthefirsttimeeverinanymutualfundeitherbywayofsubscriptionorsystematicinvestmentplan.FII Foreign Institutional Investor, registered with SEBI under the Securities and Exchange Board of India (Foreign

Institutional Investors) Regulations, 1995.Fund of Funds/FOF A mutual fund scheme that invests primarily in other schemes of the same mutual fund or other mutual funds.Investment Management Agreement

The Agreement dated December 16, 1996, entered into between DSP BlackRock Trustee Company Pvt. Ltd. and DSP BlackRock Investment Managers Pvt. Ltd., as amended from time to time.

Mutual Fund/ Fund

DSP BlackRock Mutual Fund, a trust set up under the provisions of the Indian Trusts Act, 1882, and registered with SEBI vide Registration No. MF/036/97/7.

NAV

Net Asset Value of the Units of the Schemes (and Plans and Options, if any, therein) calculated in the manner provided in this SID or as may be prescribed by the SEBI (MF) Regulations from time to time.

Non Business Day A day other than a Business Day.Offer Document This Scheme Information Document (SID) and Statement of Additional Information (SAI) (collectively).RBI Reserve Bank of India, established under the Reserve Bank of India Act, 1934.Registrar and Transfer Agent or RTA Computer Age Management Services Pvt. Ltd.Scheme Information Document/Combined Scheme Information Document/SID/Combined SID

This document issued by DSP BlackRock Mutual Fund, offering Units of DSPBRBF, DSPBRBalF, DSPBRBPDF, DSPBRCM10YGF, DSPBRDAAF, DSPBREF, DSPBRF25F, DSPBRGF, DSPBRGAF, DSPBRIOF, DSPBRITF, DSPBRLF, DSPBRMCF, DSPBRMIPF, DSPBRMMF, DSPBRNRNEF, DSPBROF, DSPBRSBF, DSPBRSMF, DSPBRSTF, DSPBRTBF, DSPBRTEF, DSPBRTF, DSPBRTSF, DSPBRWAF, DSPBRWGF, DSPBRWEF, DSPBRWMF, DSPBRUSFEF and DSPBRUSTF.

Self Certified Syndicate Banks ThelistofbanksthathavebeennotifiedbySEBItoactasaSCSBfortheASBAprocessasprovidedonwww.sebi.gov.in.Statement of Additional Information/SAI

A document containing details of the Mutual Fund, its constitution, and certain tax, legal and general information and legally forming a part of the SID.

Scheme/Schemes DSPBRBF, DSPBRBalF, DSPBRBPDF, DSPBRCM10YGF, DSPBRDAAF, DSPBREF, DSPBRF25F, DSPBRGF, DSPBRGAF, DSPBRIOF, DSPBRITF, DSPBRLF, DSPBRMCF, DSPBRMIPF, DSPBRMMF, DSPBRNRNEF, DSPBROF, DSPBRSBF, DSPBRSMF, DSPBRSTF, DSPBRTBF, DSPBRTEF, DSPBRTF, DSPBRTSF, DSPBRWAF, DSPBRWGF, DSPBRWEF , DSPBRWMF, DSPBRUSFEF and DSPBRUSTF collectively or individually as the context permits, referred to as “the Schemes” and “the Scheme” respectively.

SEBI Securities and Exchange Board of India, established under the Securities and Exchange Board of India Act, 1992.Sponsors or Settlors DSP ADIKO Holdings Pvt. Ltd. & DSP HMK Holdings Pvt. Ltd. (collectively) and BlackRock Inc. Stock Exchange/Exchange BSE Ltd., NSE or any other recognized stock exchange in India, as may be approved by the Trustee.Stock Exchange mechanism/Trading Platforms

MFSS (platform offered by NSE), BSE StAR MF (platform offered by BSE) or any other recognised stock exchange trading platform, with whom the AMC registers itself to facilitate transactions in mutual fund units.

T.I.G.E.R. The Infrastructure Growth and Economic Reforms.Trust Deed Trust Deed dated December 16, 1996 and all supplemental Trust Deed to the original Trust Deed executed on

December 16, 1996.Trustee DSP BlackRock Trustee Company Pvt. Ltd., a company set up under the Companies Act, 1956 and approved by

SEBI to act as the Trustee to the Schemes of DSP BlackRock Mutual Fund.Unit The interest of an investor which consists of one undivided share in the Unit Capital of the relevant Option in

each of the Plans under the Schemes offered by this SID.Unit Holder/Unitholder/ Investor A participant/holder of Units in the Schemes offered under this SID.

15

SECTION III – ABBREVIATIONS & INTERPRETATIONIn this SID the following abbreviations have been used:

AMC: Asset Management Company LTV: Loan to Value Ratio

AMFI : Association of Mutual Funds in India MBS: Mortgaged Backed Securities

AML: Anti-Money Laundering MFSS: Mutual Fund Service System

ABS: Asset Backed Securities NAV: Net Asset Value

ASBA: Application Supported by Blocked Amount NEFT: National Electronic Funds Transfer

AOP: Association of Person NFO: New Fund Offer

BSE: BSE Ltd. NRI: Non-Resident Indian

BSE StAR MF: BSE Stock Exchange Platform for Allotment and Repurchase of Mutual Funds

NRE: Non Resident External

CAS: Consolidated Account Statement NRO: Non Resident Ordinary

CAMS: Computer Age Management Services Pvt. Ltd. NSE / National Stock Exchange:

National Stock Exchange of India Ltd.

CDSL: Central Depository Services (India) Limited NSDL: National Securities Depository Limited

CBLO: Collateralised Borrowing and Lending Obligation OTC: Over the Counter

DFI: Development Financial Institutions OTM: One Time Mandate

DTP: Dividend Transfer Plan POA: Power of Attorney

DP: Depository Participant PIO: Person of Indian Origin

DFI: Development Financial Institutions PMLA: Prevention of Money Laundering Act, 2002

ECS: Electronic Clearing System POS: Points of Service

EFT: Electronic Funds Transfer PSU: Public Sector Undertaking

FII: Foreign Institutional Investor RBI: Reserve Bank of India

FRA: Forward Rate Agreement RTGS: Real Time Gross Settlement

FIRC: ForeignInwardRemittanceCertificate SEBI: Securities and Exchange Board of India

FOF: Fund of Funds SI: Standing Instructions

FPI: Foreign Portfolio Investor SIP: Systematic Investment Plan

HUF: Hindu Undivided Family SWP: Systematic Withdrawal Plan

IMA: Investment Management Agreement STP: Systematic Transfer Plan

IRS: Interest Rate Swap STT: Securities Transaction Tax

ISC: Investor Service Centre SCSB: SelfCertifiedSyndicateBank

KYC: Know Your Customer SLR: Statutory Liquidity Ratio

INTERPRETATION

For all purposes of this SID, except as otherwise expressly provided or unless the context otherwise requires:

l TheTermsdefinedinthisSIDincludethepluralaswellasthesingular.l Pronouns having a masculine or feminine gender shall be deemed to include the other.l All references to “US$” refer to United States Dollars and “Rs./INR” refer to Indian Rupees. A “Crore” means “ten million” and a “Lakh” means a

“hundred thousand”.

l References to times of day (i.e. a.m. or p.m.) are to Mumbai (India) times and references to a day are to a calendar day including non-Business Day.

16

SECTION IV – INTRODUCTION

A. RISK FACTORS

Standard Risk Factors:• Investment in mutual fund Units involves investment risks such

as trading volumes, settlement risk, liquidity risk, default risk, including the possible loss of principal.

• As the price / value / interest rates of the securities in which the Schemesinvestfluctuates,thevalueofinvestors’investmentsinthe Schemes may go up or down. In addition to the factors that affect the value of individual securities, the NAV of the Schemes canbeexpectedtofluctuatewithmovementsinthebroaderequityand bond markets and may be influenced by factors affectingcapital markets in general, such as, but not limited to, changes in interest rates, currency exchange rates, changes in governmental policies, taxation, political, economic or other developments and increased volatility in the stock and bond markets.