CONTENTS · 2019. 10. 8. · Rent Market Rent * Current Rent/SF Market Rent/SF Est. Total Net SF 8...

Transcript of CONTENTS · 2019. 10. 8. · Rent Market Rent * Current Rent/SF Market Rent/SF Est. Total Net SF 8...

BERKADIA | EL SEGUNDO, CA | 2321 ROSECRANS AVE, SUITE 3235 | EL SEGUNDO, CA 90245 | PHONE: 424.239.5900 | FAX: 424.239.5901

Berkdia.com a Berkshire Hathaway and Jefferies Financial Group company

1016 N CURSON AVENUE WEST HOLLYWOOD, CA 90046

October 2019

E X C L U S I V E M U L T I FA M I L Y O F F E R I N G

10 Units

Year Built

1964820Average SF

BRENT SPRENKLESenior Managing [email protected] BRE License #01290116

$3,890,000

PRICE REDUCED BY $105,000

BRENT SPRENKLESenior Managing [email protected] BRE License #01290116

� Prime West Hollywood -95 Walk Score

� Substantial RemainingRental Upside - Low Rents

� Many Recent Upgradesand Renovations

� Price Reduced $105,000 - Submit All Offers

� Perfect Unit Mixand Great Parking

SOUTH BAY LOS ANGELES OFFICE2321 Rosecrans Ave, Suite 3235El Segundo, CA 90245Phone: 424.239.5900Fax: 424.239.5901

1016 N Curson Avenue | West Hollywood, CA 90046

a Berkshire Hathaway and Jefferies Financial Group company

CONTENTSThe Asse t . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Va lua t ion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Marke t Pos i t i on ing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Append ix . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

PROPERTY SUMMARY

PROPERTY DESCRIPTION

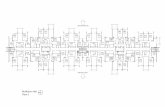

Number of Units 10 Year Built 1964

Average SF 820± Parcel Number 5530-018-012

The Curson Apartments is a 1960's constructiontwo-story apartment building located just south ofSanta Monica Boulevard. The property boasts aWalk Score of 95 which is considered a Walker'sParadise. The unit mix consists of eight largeone-bedroom apartments with one-bathroom andtwo large two-bedroom apartments withtwo-bathrooms.

The property has a full level of parking with oneparking space per unit. Apartments are individuallymetered for gas and electricity. Unit five wasoriginally a two-story apartment but it wasconverted into a single story one-bedroom. When

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com 1

PRICE REDUCED BY $105,000

this apartment becomes vacant the existing staircase to the other part of the original unit located in the basement could be

restored and the unit would become a three-bedroom townhouse apartment.

An opportunity for a new owner to increase the income is to lease the currently vacant downstairs of unit 5 as storage or potentially for another use. In addition, this space could possibly be used as an office for a new owner as it still has a bathroom and is configured as a one-bedroom apartment with a separate entrance from the rear. In addition, there is another storage

area in the garage that could be leased.

The current owner has made substantial upgrades to the property. Several units have been remodeled with high end finishes. The seller also had a new room installed as well as having a large portion of the plumbing replaced. The property does not require soft story retrofitting but the buyer should verify with the City of West Hollywood.

LOCATION DESCRIPTIONThe centrally located West Hollywood submarket is among the most attractive destinations in Los Angeles County. Some ofthe largest employers within the city include the Los Angeles County Metropolitan Transportation Authority, NCompassInternational, CityGrid Media, Dailey & Associates, the Oprah Winfrey Network, and CBS Broadcasting, who supportsapproximately 3,500 employees at their 1 million-square-foot Television City studio. West Hollywood is also situated nearsome of the premier employment hubs the region has to offer. Within a 5-mile radius, residents of West Hollywood canaccess centers like the Cedars-Senai Medical Center, Paramount Pictures Studios, UCLA, and the Century Plaza Towers.

The large concentration of entertainment industry businesses has created a vibrant cultural hub in West Hollywood thatincludes some of the most iconic destinations in the world. Spanning 1.6 miles, the historic and iconic Sunset Strip passesthrough the heart of West Hollywood and features 29 restaurants, 24 shopping destinations, nine hotels, and four musicvenues. Nestled along Melrose avenue, the Design District in West Hollywood is a cultural hub like no other, featuring morethan 200 merchants selling products and services that encompass art, health and fitness, design, fashion, food and drinks,and specialty services. Santa Monica Boulevard, a 2.8-mile corridor stretching between Los Angeles and Beverly Hills, is atrendy destination where more than 46,000 vehicles pass through daily, indulging in the 600 businesses, seven historiclandmarks, and numerous public parks this corridor has to offer.

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com 2

LOCATION DESCRIPTION

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

1016 NORTH CURSON AVENUE

NEIGHBORHOOD QUICK FACTS

WEST HOLLYWOOD

328.4kPopulation (Within Three Miles)

67%Renter Occupied Housing Units

(Within Three Miles)

$1.1mMedian Housing Unit Value

(Within Three Miles)

NEIGHBORHOOD SHOPPING

Guess | Foot Locker | Johnny Rockets

FROM THE

PROPERTY1.7miSF SHOPPING

DESTINATION460kTOTAL

STORES80

DEMAND DRIVER

Cedars-Sinai Medical Center

FROM THE

PROPERTY2.4miJOBS

SUPPORTED14.0kHOSPITAL

BEDS753

DEMAND DRIVER

Paramount Pictures StudioLaurel ES (K-8) | Fairfax HS (9-12)

FROM THE

PROPERTY2.4mi

JOBS

SUPPORTED5.0kSF

FACILITY800k

DEMAND DRIVER

CBS Television City

FROM THE

PROPERTY1.1miJOBS

SUPPORTED

SFFACILITY516k

3.5k

$72.8kMedian Household Income

(Within Three Miles)

PRIMARY EDUCATION

STUDENTS

SERVED694k

SCHOOLS

AND CENTERS

JOBS

SUPPORTED63.6k

1.3k

4.7%City Unemployment Rate

(June 2019)

NEIGHBORHOOD CONVENIENCES

Within a two-mile radius of the property

3

LOCATION MAP

1016 NORTH CURSON AVENUE1016 North Curson AvenueWest Hollywood, CA 90046

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com 4

AERIAL

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com 5

PROPERTY PHOTOS

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com 6

PROPERTY PHOTOS

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com 7

FINANCIAL ANALYSIS

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

1016 N. Curson Avenue

Unit # Unit DescriptionEstimated

Unit SF

Current

Rate

Current

Rent Per SF

Projected

Market Rate

1 One Bedroom, One Bath 775 $1,360.00 $1.75 $2,350.002 One Bedroom, One Bath 775 $1,360.00 $1.75 $2,350.003 One Bedroom, One Bath 775 $1,599.00 $2.06 $2,350.004 Two Bedroom, Two Bath 1,000 $1,697.00 $1.70 $2,800.005* One Bedroom, One Bath 775 $1,404.00 $1.81 $3,500.006 One Bedroom, One Bath 775 $2,317.00 $2.99 $2,350.007 One Bedroom, One Bath 775 $2,323.00 $3.00 $2,350.008 One Bedroom, One Bath 775 $2,200.00 $2.84 $2,350.009 Two Bedroom, Two Bath 1,000 $2,719.00 $2.72 $2,800.0010 One Bedroom, One Bath 775 $2,250.00 $2.90 $2,350.00

Unit DescriptionEstimated

SF

Current

Rate

Rent Range

Per SF

Projected

Market Rate

Percent

Vacant

Number

Vacant

Number of

Units

Percentage

of Total

Totals: One Bedroom, One Bath 6,200.00 $14,813.00 $1.75 - $3.00 $19,950.00 0.00% 08 80.00%

Two Bedroom, Two Bath 2,000.00 $4,416.00 $1.70 - $2.72 $5,600.00 0.00% 02 20.00%

8,200 $19,229.00 $25,550.00 0.00% 010

Unit DescriptionEstimated

SF

Current

Rate

Current

Rent Per SF

Projected

Market Rate

Projected

Rent Per SF

% Estimated

Upside

Rental

RangeAverages: One Bedroom, One Bath 775.00 $1,851.63 $2.39 $2,493.75 $3.22 34.68% $1,360 - $2,323

Two Bedroom, Two Bath 1,000.00 $2,208.00 $2.21 $2,800.00 $2.80 26.81% $1,697 - $2,719

* Unit 5 was originally a three-bedroom townhouse unit. The projected market lease rate assumes converting the unit back to its original configuration. Currently the unit is a single-level, one- bedroom, one-bathroom apartment, and the downstairs is empty but renovated and could potentially be leased as storage or used by the new owner for another use including an office. Buyer to verify with the city of West Hollywood about these matters.

The information listed above has been obtained from sources we believe to be reliable, however, we cannot accept responsibility for its correctness. All square footage and project market rental rates are estimated. Buyer to independently investigate.

NotesProjected

*See Note Below

8

FINANCIAL ANALYSIS

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

IMPORTANT INFORMATION & DISCLAIMER: The information contained herein is assumed to be correct and market-supported. Output produced from this model should not be considered an appraisal. Projections are forecasts and are not to be considered fact. The information contained in this file is privileged and confidential; it is intended only for use by Berkadia® and their clients. This file may not be reproduced physically or in electronic format without the expressed written consent of Berkadia. CAUTION: Security codes have been included into this file and unauthorized use may render this file useless. Berkadia® employees, affiliates, and contractors are instructed to hard-code this model for reproduction and distribution. Not responsible for errors and omissions.

© 2019 Berkadia Real Estate Advisors Inc. Berkadia® is a trademark of Berkadia Proprietary Holding LLC. Investment sales and real estate brokerage businesses are conducted exclusively by Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. In California, Berkadia Real Estate Advisors Inc. conducts business under CA Real Estate Broker License #01931050; Vincent B. Norris, CA BRE Lic. # 843890. Berkadia Commercial Mortgage LLC conducts business under CA Finance Lender & Broker Lic. #988-0701; and Berkadia Commercial Mortgage Inc. under CA Real Estate Broker Lic. #01874116. For state licensing details visit: http://www.berkadia.com/legal/licensing.aspx All Rights Reserved. DRAFT REPORT: Privileged & Confidential, For Discussion Purposes Only.

The information listed above has been obtained from sources we believe to be reliable, however, we cannot accept responsibility for its correctness. All square footage and project market rental rates are estimated. Buyer to independently investigate.

9

PRO FORMA INCOME & EXPENSES1016 N. Curson Avenue

West Hollywood, CA 90046

Units Unit Type EstimatedUnit SF

Current Rental Range

Current Avg.Rent

MarketRent *

CurrentRent/SF

MarketRent/SF

Est. TotalNet SF

8 775 $1,852 $2,494 $2.39 $3.22 6,2002

1 Bed / 1 Bath2 Bed / 2 Bath 1,000

$1,360 - $2,323$1,697 - $2,719 $2,208 $2,800 $2.21 $2.80 2,000

10 820 $1,923 $2,555 $2.35 $3.12 8,200Gross SF 8,368

Income CurrentPro Forma

MarketPro Forma

3.00%Scheduled Market Rent Less: VacancyNet Rental Income

$230,748($6,922)$223,826

$306,600($9,198)

$297,402

Plus: Misc. Income Plus: Projected Storage (2 Rooms) Plus: Laundry Income

$1,200$7,200$2,400

$234,626

$1,200$2,400$2,400

$303,402Total Operating Income (EGI)

Estimated Expenses Percentage Per Unit$144 $1,440 $1,440$700 $7,000 $7,000

4.00% $923 $9,230 $12,264$485 $4,849 $4,849$312 $3,120 $3,120

1.173% $4,563 $45,627 $45,627$290 $2,900 $2,900$300 $3,000 $3,000$200 $2,000 $2,000

West Hollywood Rent RegistrationRepairs & MaintenanceManagement FeeUtilities (Water, Sewer, Electric & Gas)Contracted ServicesBase Property TaxesProperty Tax Direct AssessmentsInsuranceReplacement ReserveTotal Estimated Expenses $79,166 $82,200

34.31% 26.81%$9.46 $9.82

% of Scheduled Rent:Per SF:

Per Unit: $7,917 $8,220

Net Operating Income $155,459 $221,202

($121,783) ($121,783)$33,677 $99,419

3.0% 3.0%

1.94% 5.73%

Less: Debt ServiceProjected Net Cash FlowTotal Economic Loss

Cash-on-Cash Return (Based on Listing Price)Debt Service Coverage 1.28 1.82

Cap Rate Analysis Price $/Unit $/Foot Cap RateCurrent

Cap RateMarket

GRMCurrent

GRMPro Forma

Listing Price $3,890,000 $389,000 $464.87 4.00% 5.69% 16.10 12.44

All Financing Total LoanAmount

DownPayment LTV Monthly

PaymentDebt

Constant$2,178,000 $1,733,780 56% ($10,149) 5.6%

New First Mortgage (to be originated at purchase)LTV for this loan Amount Interest Rate Amortization Payment Fees I/O Term (yrs)

56% $2,178,000 3.80% 30 ($10,149) 1.00% 0

COMPARABLE SALE PROPERTIES

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

PROPERTY INFORMATION SALES DATAProperty Units Built Rentable SF Price Price/Unit Price/SF Cap

RateGRM Sale

Date1 866 Hilldale Avenue

866 Hilldale Avenue West Hollywood, CA 90069

8 1957 7,782 $4,200,000 $525,000 $539.71 4.27% 16.07 5/19

2 1323-1327 North Harper Avenue1323-1327 North Harper Avenue Los Angeles, CA 90046

10 1951 9,260 $4,200,000 $420,000 $453.56 3.98% - 5/19

3 1279 North Harper Avenue1279 North Harper Avenue West Hollywood, CA 90046

10 1964 9,718 $3,350,000 $335,000 $344.72 3.07% 19.29 3/19

4 8208 Norton Avenue8208 Norton Avenue West Hollywood, CA 90046

9 1957

5 7631 West Norton Avenue7631 West Norton Avenue West Hollywood, CA 90046

10 1960

Averages

S 1016 North Curson Avenue1016 North Curson AvenueWest Hollywood, CA 90046

10 1964

10

7,972 $3,245,000 $360,556 $407.05 19.55 3/19

8,583 $3,695,000 $369,500 $430.50 4.11% 15.73 3/19

$402,011 $435.11 3.86% 17.66

8,368 $3,890,000 $389,000 $464.87 4.00% 16.10

COMPARABLE SALE PROPERTIES

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

S. 1016 North Curson Avenue 1016 North Curson Avenue West Hollywood CA1. 866 Hilldale Avenue 866 Hilldale Avenue West Hollywood CA2. 1323-1327 North Harper Avenue 1323-1327 North Harper Avenue Los Angeles CA3. 1279 North Harper Avenue 1279 North Harper Avenue West Hollywood CA4. 8208 Norton Avenue 8208 Norton Avenue West Hollywood CA5. 7631 West Norton Avenue 7631 West Norton Avenue West Hollywood CA

11

COMPARABLE RENTAL PROPERTIES

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

1. Fountain Terraco1224 North FormosaAvenueLos Angeles, CA 90046

Units Built11 1963

Units Type SF Asking Rent Rent / SF6 2/2.00 820 $2,695 $3.29

WeightedAvg.820 $2,695 $3.29

2. 1200 North LaurelAvenue1200 North Laurel AvenueLos Angeles, CA 90046

Units Built10 1966

Units Type SF Asking Rent Rent / SF10 2/2.00 1,030 $2,900 $2.82 10 WeightedAvg. 1,030 $2,900 $2.82

3. 1440 North GardnerStreet1440 North GardnerStreetLos Angeles, CA 90046

Units Built16 1930

Units Type SF Asking Rent Rent / SF16 2/1.00 1,040 $2,800 $2.69 16 WeightedAvg. 1,040 $2,800 $2.69

4. Flores Street1326 North Flores StreetWest Hollywood, CA90069

Units Built30 1954

Units Type SF Asking Rent Rent / SF23 1/1.00 700 $2,195 $3.14 6 2/1.00 750 $2,435 $3.25

WeightedAvg. 725 $2,315 $3.20

12

COMPARABLE RENTAL PROPERTIES

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

5. Havenhurst1401-07 Havenhurst DriveLos Angeles, CA 90046

Units Built15 1939

Units Type SF Asking Rent Rent / SF15 1/1.00 770 $2,195 $2.85 15 WeightedAvg. 770 $2,195 $2.85

6. 1415-1417 NorthHarper Avenue1415-1417 North HarperAvenueWest Hollywood, CA90046

Units Built10 1953

Units Type SF Asking Rent Rent / SF10 1/1.00 $2,19510 WeightedAvg. $2,195

7. 1541 North LaurelAvenue1541 North Laurel AvenueLos Angeles, CA 90046

Units Built42 1970

Units Type SF Asking Rent Rent / SF42 1/1.00 1,000 $2,395 $2.40 42 WeightedAvg. 1,000 $2,395 $2.40

S. 1016 North CursonAvenue 1016 North CursonAvenueWest Hollywood, CA90046

Units Built10 1964

Units Type SF Current Rent Rent / SF8 1/1.00 775 $1,852 $2.39 2 2/2.00 1,000 $2,208 $2.21

10 WeightedAvg. 820 $1,923 $2.35

13

COMPARABLE RENTAL PROPERTIES

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

S. 1016 North Curson Avenue 1016 North Curson Avenue West Hollywood CA1. Fountain Terraco 1224 North Formosa Avenue Los Angeles CA2. 1200 North Laurel Avenue 1200 North Laurel Avenue Los Angeles CA3. 1440 North Gardner Street 1440 North Gardner Street Los Angeles CA4. Flores Street 1326 North Flores Street West Hollywood CA5. Havenhurst 1401-07 Havenhurst Drive Los Angeles CA6. 1415-1417 North Harper Avenue 1415-1417 North Harper Avenue West Hollywood CA7. 1541 North Laurel Avenue 1541 North Laurel Avenue Los Angeles CA

14

ECONOMIC & DEMOGRAPHIC OVERVIEW

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

Situated in the city of Los Angeles, just north of downtown, Hollywood has long been known as the center of the entertainment industry and is undergoing a rebirth to solidify its position as a major employment,retail, and recreation center. As one of the fastest growing residential markets in the United States, public and private developers have recently invested $4 billion in the neighborhood, with new residential, mixed-use, and commercial projects redefining the area, indicative of Hollywood’s revitalization success.

The entertainment industry is the backbone of Hollywood’s economy, home to one of the largest concentrations of entertainment and media companies in the world. Numerous major motion picture studios, television and radio studios, record companies, and post-production companies call the neighborhood home. With the iconic Hollywood sign overlooking the neighborhood on Mount Lee, Hollywood serves as the epicenter of Los Angeles’ tourism industry. More office space is under construction in Hollywood than anywhere else in Los Angeles County, attracting additional entertainment and media companies, as well as various corporate relocations.

Great Place to LiveHollywood ranked among the top 10 “Great Neighborhoods to Live in Los Angeles”- Great American Country

Millennial FriendlyWith the lure of a career in Hollywood, Los Angeles is one of the “Top U.S. Cities where Millennials want to Live”- Realtor.com

Corporate RelocationsViacom, Netflix, and Fender Guitar have recently relocated to Hollywood, and now occupy more than 568,000 square feet of space- Variety.com; Viacom.com/news

Office Space DevelopmentMore office space is being built in Hollywood than anywhere else in Los Angeles County- Hollywood Chamber of Commerce

15

ECONOMIC & DEMOGRAPHIC OVERVIEW

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

DEMOGRAPHICS

n From 2019 to 2024, the city of Los Angeles’ population is forecast to grow 4.1%, reaching 4,110,855 residents

n 32% of city residents age 25 years or older hold a bachelor’s degree or higher, compared

to 30% nationally

n 27% of Los Angeles households earn $100,000 or more annually

n 57% of housing units in Los Angeles are renter occupied, compared to 31% nationally

n The city’s median household income is projected to reach $62,487 by 2024, up 11.1% from 2019

INDUSTRY BREAKDOWN

AVERAGE ANNUAL WAGE BY OCCUPATION

Management $133.7k

Healthcare Practitioners and Technical $94.8k

Business and Financial Operations $81.4k

Education, Training, and Library $69.3k

Sales and Related $45.4k

Office and Administrative Support $42.7k

Transportation and Material Moving $39.4k

Production $38.3k

Personal Care and Service $29.7k

Food Preparation and Serving Related $27.8k

Source: BLS Occupational Employment Statistics Survey

With breakthrough technology companies and research organizations, the home of the largest entertainment industry in the world, and a strong tourism industry, Los Angeles County has one of the most diverse, dynamic economies in the country.

The metro division added approximately 56,100 jobs during the 12-month period ending in April 2019, 20,500 of which were in the Education and Health Services sector.

Source: BLS Current Employment Statistics Survey

Education & Health Services

19%Trade, Transportation, & Utilities

19%

Financial Activities

5%Professional & Business

Services

14%

Leisure & Hospitality

12%

Government

13%

Information

5%

Other Services

4%

Manufacturing

8%

Construction

3%

LOS ANGELES, CA

METRO DIVISION

EMPLOYMENT BY

SECTOR

16

ECONOMIC & DEMOGRAPHIC OVERVIEW

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

EMPLOYMENT TRENDS

JUNE 2019

n 4.7% the city’s monthly unemployment rate was down

20 basis points Y-o-Y

JUNE 2019

n 63,000 jobs were created in the metro division,

a 1.4% annual increase

(300,000)

(200,000)

(100,000)

0

100,000

200,000

0%

3%

6%

9%

12%

15%

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019*

Unemployment Rate Jobs Added / Lost*Projected

LOS ANGELES COUNTY

LARGEST EMPLOYERS

Los Angeles County 107,500

Los Angeles Unified School District 63,580

City of Los Angeles 49,500

University of California, Los Angeles 46,200

U.S. Government 45,000

Kaiser Permanente 36,900

State of California 29,900

University of Southern California 27,430

Northrop Grumman Corporation 16,600

Target Corporation 15,000

Source: Los Angeles Almanac; LAUSD; USC

17

ECONOMIC & DEMOGRAPHIC OVERVIEW

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

TRADE & LOGISTICS

n 1.2 Million Jobs Supported

n $58 Billion Annual Wages and Tax Revenues

n $431.4 Billion Worldwide Trade Value

Los Angeles is one of the world’s leading trade and logistics centers. Based on a recent report, the Los

Angeles Customs District ranked first in the nation in terms of total worldwide trade handled, totaling more

than $431.4 billion. The Port of Los Angeles and the Port of Long Beach provide access to major U.S.

markets and the Pacific Rim, and handle over 40% of all inbound containers for the entire United States.

Combined, the ports support more than 1.2 million direct and indirect jobs and generate over $58

billion annually in wages and tax revenues.

Port of Los Angeles

MANUFACTURING

n No. 1 Manufacturing Center in the Country

n 65 Manufacturing Firms

n 344,200 Jobs Supported

Los Angeles’ unique geography, strong infrastructure, and skilled workforce make it an ideal location for

manufacturing companies. With more than 344,200 jobs supported in the sector, Los Angeles serves as

the top manufacturing center in the country. Approximately 65 plants are situated along the city’s I-605

Corridor, providing easy access to the growing industrial hub. Companies like Northrop Grumman

Corp., Edelbrock LLC, and Belkin International Inc. help make up the industry’s strong focus on

aerospace, fabricated metals, and food processing.

Northrop Grumman Corp.

18

ECONOMIC & DEMOGRAPHIC OVERVIEW

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

ARTS & ENTERTAINMENT

n $198 Billion Economic Impact Metrowide

n 1,500 Theater Productions

n 792,600 Jobs Supported Metrowide

As the “Entertainment Capital of the World,” Los Angeles is home to major production studios including

Disney, Paramount, Universal, and Warner Brothers. Each year, the city boasts more than 1,500

theatrical productions throughout its 225 theaters, making arts and culture major drivers in the region.

Over 792,600 jobs are supported directly and indirectly in the creative economy, helping generate an

economic impact of $198 billion. There are more artists, writers, filmmakers, actors, dancers, and

musicians living in Los Angeles than any other city in the world.

Paramount Pictures

PROFESSIONAL & BUSINESS SERVICES

n 13 Fortune 500 Headquarters

n $205.2 Billion Combined Annual Revenue

n 627,500 Jobs Supported

According to the Global Financial Centres Index, Los Angeles is home to one of the most competitive

financial centers in the world, contributing to one of the most dynamic business economies. Los Angeles’

historic Financial District, referred to as the “Wall Street of the West,” is home to corporate skyscrapers,

law firms, and real estate companies. More than 627,500 jobs are supported by major businesses

including Amgen, Avery Dennison, and Mattel. Of the more than 50 Fortune 500 companies in

California, 13 are headquartered in Los Angeles County

Avery Dennison

19

ECONOMIC & DEMOGRAPHIC OVERVIEW

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

CONSTRUCTION AND DEVELOPMENT

n $1 Billion Redevelopment Project n 1.4 Million SF Mixed-Use Development

The site of the historic Crossroads of the World complex is

set to undergo a major revitalization project. Crossroads

Hollywood will be an eight-acre, 1.4 million-square-foot,

mixed-use development. The project will be comprised of nine

buildings including up to: 308 hotel rooms, 950 residential

units, including 84 affordable units, 185,000 square feet of

commercial space, 95,000 square feet of office space and 2,494

underground parking spaces. The proposed realignment of Las

Palmas Avenue and Sunset Boulevard will promote pedestrian

safety and enhance connectivity. The $1 billion project has

an estimated 48-month construction timeline, with expected

completion in 2022.

CROSSROADS HOLLYWOOD

n $2.6 Billion Investment n 1.5 Million SF of Commercial Space

A 70,000-seat sport stadium and multiuse development

is currently under construction in Inglewood’s new City of

Champions district, approximately 10 miles north of Torrance.

The stadium will be the new home of the NFL’s Rams and

Chargers franchises. At three million square feet, it will be

the largest stadium in professional football. The $2.6 billion,

300-acre, multipurpose facility will also include a 6,000-seat

performance venue, more than 1.5 million square feet of retail

and office space, 2,500 homes, a 300-room hotel, and 25

acres of parks. Combined team annual revenue is estimated

to generate $700 million to the region. The new stadium is

expected to be completed in time for the 2020 NFL season.

LOS ANGELES STADIUM IN NEW CITY OF CHAMPIONS DISTRICT

n $6.3 Billion Investment n 22,000 Construction Jobs

Construction on the Metro’s Purple Line continues. The

project’s first phase is nearing completion and will open to the

public in 2023. In February 2018, officials broke ground on the

$2.5 billion second phase, which will run 2.5 miles west from

Wilshire Boulevard and La Cienega Avenue to Century City. The

final section from Century City to the VA campus is expected to

break ground in 2019. In total, the Purple Line extension project

will cost about $6.3 billion. At build-out, the nine-mile extension

will add seven more stops, generating 78,000 new daily trips.

With an expected completion date in 2026, the Purple Line will

be fully operational for the 2028 Summer Olympics.

METRO PURPLE LINE

20

ECONOMIC & DEMOGRAPHIC OVERVIEW

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

CONSTRUCTION AND DEVELOPMENT

n $270 Million Office Tower n 2,990 Jobs Supported

Along Vermont Avenue in Los Angeles’ Koreatown, a three-site

development is underway. Site one of the Vermont Corridor

will include a $270 million, 21-story tower that will house

government offices and nearly 2,200 employees. The second

site will be converted into 172 units of residential housing.

Additionally, the building will feature street-level retail and

a rooftop deck. Site three includes demolishing the existing

parks and recreation office and replacing it with a six-story

structure with senior housing units and a 13,200-square-foot

community center. In total, the sites will support more than

2,990 employees and provide over 2,100 parking spaces. All

three sites are expected to be completed by 2023.

VERMONT CORRIDOR

n $700 Million Renovation n 5,500 Permanent Jobs

Paramount Pictures, the only major film studio to be

headquartered in Hollywood, is undergoing a $700 million

expansion and renovation of its headquarters on Melrose

Avenue. The project will include the addition of 1.4 million

square feet of new technologically advanced studio space,

increased production support, and surrounding community

enhancements. The 25-year, master-planned project will

support an estimated 7,300 construction jobs and 5,500

permanent studio jobs.

PARAMOUNT PICTURES

n $14 Billion Investment n 121,000 Construction Jobs

Known as the largest public-works program in the history of

the city of Los Angeles, the $14 billion LAX modernization

program began in 2009 and has a projected completion date of

2023. The Tom Bradley International Terminal was completed in

September 2013 and features new aircraft gates and concourses,

retail shops and other amenities. Other projects that were recently

completed include new taxiways and taxi lanes, infrastructure

upgrades, and renovation improvements to all terminals. The

future $5.5 billion Landside Access Modernization Program

(LAMP) will generate additional terminal renovations and provide

the growing number of airport passengers convenient connections

to public transportation from the airport.

LAX MODERNIZATION PROGRAM

21

ECONOMIC & DEMOGRAPHIC OVERVIEW

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

DELIVERIES AND ABSORPTION

NEW DELIVERIES

n 137 units through the first six months of 2019

NET ABSORPTION

n (263) units through June 2019

One of the hot spots for Los Angeles multifamily development, the Hollywood submarket has seen an average of approximately

800 new units added annually over the past five years. Deliveries peaked in 2014 with 1,400 new units and 2018 was the

third busiest year of construction activity since 2012 with nearly 650 units coming online. With an estimated 2,800 units

currently under construction, the stage is set for 2019 to see the highest number of new multifamily units being added this

cycle with nearly 1,750 units slated for completion by December. While Hollywood’s multifamily inventory primarily consists of

studio and one-bedroom Class B properties, the recent development boom is providing a much needed infusion of top-end

luxury product highly coveted by millennial residents that the submarket previously lacked.

Hollywood’s name recognition, the concentration of entertainment industry employers, and central location in the city have

helped keep demand for multifamily units in the submarket relatively on-pace with construction levels over the past five years.

The relocation of Netflix, Fender Guitar, and Viacom to Hollywood have enabled demand to keep pace with construction

activity as net absorption has averaged over 750 units annually over the past five years. Net demand in Hollywood reached

a five-year high of over 1,500 units in 2018 and is expected to surpass 970 units in 2019, despite a slow first half of the

year which saw negative net absorption of 263 units.

0

500

1,000

1,500

2,000

2,500

2013 2014 2015 2016 2017 2018 2019*

Deliveries Absorption*PROJECTED

HOLLYWOOD

APARTMENT SUBMARKET

22

ECONOMIC & DEMOGRAPHIC OVERVIEW

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

$2,1

02

$2,1

98

$2,3

19

$2,4

27

$2,4

41

$2,5

42

$2,5

40

$1,700

$1,900

$2,100

$2,300

$2,500

$2,700

92%

93%

94%

95%

96%

97%

2013 2014 2015 2016 2017 2018 2019*Rent Occupancy*PROJECTED

RENT AND OCCUPANCY

EFFECTIVE RENT

n $2,140 in June 2019, up 2.7% annually

OCCUPANCY RATE

n 95.6% in 2Q19, down 20 bps Y-o-Y

Over the past five years, the major construction boom in Hollywood has slowly pushed the submarket occupancy rate down,

a trend that was reversed in 2018, as a swell in demand bolstered the Hollywood submarket up to 96.1. With diminished

demand through the first half of 2019, the average occupancy rate in the submarket dropped 20 basis points annually to

95.6% through June. Name recognition and the influx of new tech industry jobs continue to generate demand from residents

moving to the area. New developments are targeting an affluent segment of the renter population that work for content

hungry tech companies looking to collaborate with Hollywood’s entertainment industry.

After peaking at near 5% in mid-2016, annual rent growth in the Hollywood submarket has slowed to 2.7% in the first

half of 2019, pushing effective rent up to $2,140 per month. The decrease in momentum has been most pronounced

among class A properties which is to be expected given the amount of new luxury product being delivered and operators

offering concessions to attract new renters. Hollywood has been one of the more historically affordable Westside submarkets,

with rents increasing rapidly in the more westward edges of the submarket which include the Wilshire and Sunset Boulevard

corridors. A massive influx of office space and hotels into Hollywood is expected to attract an abundance of new residents.

This would enable the Hollywood submarket to be able to fend off challenges from the explosion of luxury unit construction in

Downtown and tech-friendly corridors in Culver City and Venice Beach, testing Hollywood’s ability to attract and retain wealthy

renters in the future.

HOLLYWOOD

APARTMENT SUBMARKET

23

ECONOMIC & DEMOGRAPHIC OVERVIEW

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

EDUCATION

HIGHER EDUCATIONn 625,000 students metrowide

ANNUAL GRADUATESn 60,000 produced by metro Los Angeles universities each year

With over 120 colleges and universities that provide jobs and drive economic growth, the region is a hub for higher education and generates sustained demand for off-campus housing. The universities alone produce 60,000 graduates annually, the highest number of any county in the nation.

The University of California Los Angeles (UCLA) is world-renowned for its high-quality academic, research, and athletic programs. UCLA offers over 125 undergraduate majors and 150 graduate degree programs. The university is one of the largest employers in the region, supporting approximately 46,200 jobs countywide. With an enrollment of 45,430 students, UCLA generates $1.8 billion in taxes and a $12.7 billion economic impact in the Southern California region.

The University of Southern California (USC) has an enrollment of over 45,690 students and employs more than 27,430 residents. USC has the largest private university graduate program in the nation in science, engineering, and health. In 2017, the University of Southern California was ranked No. 23 among national universities by U.S. News and World Report.

CITY OF LOS ANGELES

HIGHER EDUCATION

Los Angeles Community College District 152,690

University of Southern California 45,690

University of California Los Angeles 45,430

California State University Northridge 39,820

California State University Los Angeles 28,250

Loyola Marymount University 9,670

Mount Saint Mary’s University 2,270

Source: listed college websites; California Community Colleges Chancellor’s Office

LIFESTYLE AND ENTERTAINMENT

HOLLYWOOD & HIGHLAND

n 90+ shops & restaurants

HOLLYWOOD WALK SCORE

n 91/100 considered a “Walker’s Paradise”

At the epicenter of the “Entertainment Capital of the World” is Hollywood Boulevard. From Highland Avenue to Orange Drive, landmarks, museum, restaurants, and shops line the streets to give residents the true Hollywood experience. Hollywood & Highland offers world-class shopping and dining with over 70 brand-name retailers and 25 full-service restaurants. At night, Hollywood comes to life with its eclectic mix of bars and nightclubs. Residents can grab a drink at popular spots such as the historic Frolic Room, The Know Where Bar, and Mama Shelter, which features a rooftop lounge with a 360-degree view of the area. W Hollywood features some of the most glamorous spots such as the Delphine Eatery & Bar, The Living Room, and Station Hollywood.

Universal Studios Hollywood is the premier theme park for jaw-dropping adventure that immerses visitors into their favorite movies and TV shows. More than 8.1 million visitors come to experience the magic at the Wizarding World of Harry Potter, heart-racing action at the World-Famous Studio Tour, and fast-paced adventure at the Fast & Furious Supercharged ride. Just outside of the main park is the Universal CityWalk, a three-block entertainment district. With more than 30 places to eat, 30 unique shops, a 19-screen theater, the 5 Towers Stage, and a nightclub, CityWalk is ranked as the “Best Theme Park Entertainment Area.”

Hollywood Boulevard

24

ECONOMIC & DEMOGRAPHIC OVERVIEW

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

TRANSPORTATION

MTA PASSENGERS

n 440.9m annual rail and bus riders

LAX AIRPORT

n 87.5m passengers served in 2018

Los Angeles boasts an extensive freeway network, with major routes including the Santa Ana Freeway (I-5), San Diego Freeway (I-405), Foothills Freeway (I-210), Santa Monica and San Bernardino freeways (I-10), Harbor Freeway (I-110), Long Beach Freeway (I-710), and San Gabriel River Freeway (I-605).

The Metropolitan Transportation Authority (MTA) provides local bus and rail service, linking communities including Long Beach, Downtown L.A., Hollywood, Pasadena, and the San Fernando Valley. MTA offers over 1,500 square miles of service area and employs more than 9,200 residents.

The Los Angeles International Airport (LAX) supports 408,000 local jobs and has an annual economic impact of $60 billion. LAX served over 87.5 million passengers in 2018, making it the third-busiest airport in the nation and seventh-busiest airport in the world.

Los Angeles International Airport

25

ECONOMIC & DEMOGRAPHIC OVERVIEW

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

Sources: Berkadia; Tetrad; U.S. Census Bureau; U.S. Bureau of Labor Statistics; Apartment Data Services; Moody’s; CoreLogic; Wikipedia; Axiometrics; California Association of Realtors; City of Los Angeles CAFR; State of California Employment Development Department Forbes; California Division of Tourism; Los Angeles County Metropolitan Transportation Authority; Los Angeles County; Los Angeles Times; Los Angeles Economic Development Corporation; Los Angeles Area Chamber of Commerce; Los Angeles World Airports; Port of Los Angeles; Los Angeles Unified School District; Los Angeles Convention and Visitors Bureau; City of Los Angeles; Los Angeles Business Journal; Los Angeles Daily News; Los Angeles Downtown News; UCLA; USC; CSU-Northridge; CSU-L.A.; Los Angeles Community College District; Mt. St. Mary’s College; Occidental College; Southern California Association of Governments; Airports Council International

BY THE NUMBERS

TOTAL POPULATION

2010 3,792,621

2019* 3,950,259

2024* 4,110,855

Growth Rate (2019 - 2024) 4.1%

TOTAL HOUSEHOLDS

2010 1,318,168

2019* 1,381,652

2024* 1,444,740

Growth Rate (2019 - 2024) 4.6%

MEDIA INCOME

2010 $47,110

2019* $56,269

2024* $62,487

Growth Rate (2019 - 2024) 11.1%

RENT SHARE OF WALLET

National - 2019 27.2%

Hollywood Submarket - 2019 53.6%

National - 2024* 27.1%

Hollywood Submarket - 2024* 55.3%

MEDIAN AGE

2010 34.7

2019* 37.0

2024* 38.6

MEDIAN HOME PRICE

June - 2018 $1,675,000

June - 2019 $1,825,000

Growth Rate Y-o-Y 9.0%

EMPLOYMENT GROWTH (MD)

June - 2018 4,508,100

June - 2019 4,571,100

Growth Rate Y-o-Y 1.4%

RENT VS. OWN

Average Mortgage Payment** $8,255

Effective Rent $2,514

Difference $5,741

*Projected**30-yr fixed; 20% down; 4.0% interest rate; 0.79% CA property taxes; $1,000 annual homeowner’s insurance

90046 ZIP Code

*ProjectedAnnual Rent / Median Household Income

26

DEMOGRAPHICS

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

Site Map1016 N Curson Ave, West Hollywood, CA 90046

Legend

Powered by Sitewise Pro Data Source: STI PopStats

27

DEMOGRAPHICS

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

Median Household Income1016 N Curson Ave, West Hollywood, CA 90046

Legend

Powered by Sitewise Pro Data Source: STI PopStats

28

DEMOGRAPHICS

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

Traffic Profile1016 N Curson Ave, West Hollywood, CA 90046

Traffic Map

# Street Cross St Dir Vol. Dist (mi) # Street Cross St Dir Vol. Dist (mi)1 Santa Monica Blvd Sierra Bonita Ave E 42,091 0.1 11 Santa Monica Blvd N Fuller Ave E 49,601 0.3

2 Santa Monica Blvd N Gardner St W 37,273 0.2 12 Waring Ave N Spaulding Ave W 1,560 0.3

3 N Vista St Romaine St S 9,186 0.2 13 N Genesee Ave Waring Ave S 1,063 0.3

4 N Gardner St Santa MonicaBlvd

S 9,186 0.2 14 N Fuller Ave Santa MonicaBlvd

S 2,297 0.3

5 N Vista St Willoughby Ave S 1,949 0.2 15 N Fuller Ave Santa MonicaBlvd

N 2,910 0.3

6 Santa Monica Blvd N Vista St E 45,006 0.2 16 Waring Ave N Genesee Ave W 1,969 0.3

7 N Stanley Ave Waring Ave S 1,398 0.2 17 Santa Monica Blvd N Orange GroveAve

E 40,000 0.3

8 N Spaulding Ave Waring Ave S 2,033 0.3 18 N Spaulding Ave Waring Ave N 2,479 0.3

9 Waring Ave N Curson Ave E 1,741 0.3 19 Santa Monica Blvd N Fuller Ave W 50,052 0.3

10 N Vista St Lexington Ave N 10,000 0.3 20 Waring Ave N Genesee Ave E 1,811 0.3

Powered by Sitewise Pro Data Source: Kalibrate

29

DEMOGRAPHICS

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

DEMOGRAPHIC PROFILE2010 Census, 2019 Estimates & 2024 Projections

Calculated using Proportional Block Groups

2019-Aug-05

Lat/Long: 34.089266/-118.355029

This

repo

rt w

as p

rodu

ced

usin

g da

ta fr

om p

rivat

e an

d go

vern

men

t sou

rces

dee

med

to b

e re

liabl

e. T

he in

form

atio

n he

rein

is p

rovi

ded

with

out r

epre

sent

atio

n or

war

rant

y of

any

kin

d.

1016 N Curson Ave, WestHollywood, CA 90046

Los Angeles-Long Beach et

al, CAUS Benchmark0 - 1 mi 0 - 3 mi 0 - 5 mi

Popu

latio

n

Area in square miles 3 28 79 4,849 3,537,439

Est. Population/square mile 18,126 11,564 11,204 2,734 94

2024 Projection 58,797 347,415 931,506 13,945,456 352,150,978

2019 Estimate 55,635 328,409 888,209 13,258,217 332,230,239

2010 Census 53,264 314,175 860,989 12,828,837 312,471,327

2000 Census 56,386 322,637 884,130 12,365,353 281,421,872

Growth 2019-2024 5.7% 5.8% 4.9% 5.2% 6.0%

Growth 2010-2019 4.5% 4.5% 3.2% 3.3% 6.3%

Growth 2000-2010 -5.5% -2.6% -2.6% 3.7% 11.0%

Hous

ehol

ds

2024 Projection 34,849 173,096 404,102 4,634,625 133,146,162

2019 Estimate 32,946 163,529 384,553 4,392,923 125,636,242

2010 Census 31,462 156,751 372,295 4,233,985 118,092,823

2000 Census 31,954 156,693 371,312 4,068,951 106,741,406

Growth 2024-2029 3.9% 3.9% 3.5% 3.0% 4.4%

Growth 2019-2024 5.8% 5.9% 5.1% 5.5% 6.0%

Growth 2010-2019 4.7% 4.3% 3.3% 3.8% 6.4%

Growth 2000-2010 -1.5% 0.0% 0.3% 4.1% 10.6%

2024 Proj. Pop. In Households 58,030 342,754 919,537 13,739,956 344,212,882

2019 Est. Pop. In Households 54,869 323,748 876,201 13,052,691 324,298,478

2024 Proj. Avg. HH Size 1.67 1.98 2.28 2.96 2.59

2019 Est. Avg. HH Size 1.67 1.98 2.28 2.97 2.58

Hous

ing Vacant Housing Units 2,515 7% 15,097 8% 31,878 8% 254,297 5% 15,275,560 11%

Occupied Housing Units 32,946 93% 163,529 92% 384,553 92% 4,392,923 95% 125,636,242 89%

Owner-Occupied 6,408 18% 43,033 24% 103,082 25% 2,218,862 48% 81,937,171 58%

Renter-Occupied 26,538 75% 120,496 67% 281,471 68% 2,174,061 47% 43,699,071 31%

Ethn

icity

Population by Ethnicity 55,635 328,409 888,209 13,258,217 332,230,239

White 45,430 82% 213,750 65% 465,031 52% 7,064,254 53% 241,767,473 73%

Black 2,218 4% 20,591 6% 77,797 9% 915,415 7% 41,260,648 12%

Asian 3,178 6% 42,737 13% 138,218 16% 2,003,967 15% 16,532,239 5%

Other 4,808 9% 51,331 16% 207,163 23% 3,274,581 25% 32,669,879 10%

Hispanic or Latino 6,159 11% 69,814 21% 308,458 35% 5,894,353 44% 58,622,851 18%

Educ

. Less than HS Diploma 1,571 4% 22,900 10% 107,007 17% 1,829,871 21% 28,680,879 13%

HS, Some Col. or Assoc. Deg. 14,745 35% 84,669 35% 241,220 38% 4,132,928 47% 125,691,590 56%

Bach. Degree or Higher 26,085 62% 132,828 55% 279,629 45% 2,898,430 33% 68,685,101 31%

Powered by Sitewise Pro -1- Demographic Source: STI PopStats

30

DEMOGRAPHICS

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

DEMOGRAPHIC PROFILE2010 Census, 2019 Estimates & 2024 Projections

Calculated using Proportional Block Groups

This

repo

rt w

as p

rodu

ced

usin

g da

ta fr

om p

rivat

e an

d go

vern

men

t sou

rces

dee

med

to b

e re

liabl

e. T

he in

form

atio

n he

rein

is p

rovi

ded

with

out r

epre

sent

atio

n or

war

rant

y of

any

kin

d.

2019-Aug-05

Lat/Long: 34.089266/-118.355029

1016 N Curson Ave, WestHollywood, CA 90046

Los Angeles-Long Beach et

al, CAUS Benchmark0 - 1 mi 0 - 3 mi 0 - 5 mi

Age

Total Population 55,635 328,409 888,209 13,258,217 332,230,239

Age 0 to 14 11,316 20% 63,965 19% 173,579 20% 2,460,488 19% 57,956,154 17%

Age 14 to 18 715 1% 8,376 3% 30,381 3% 625,705 5% 16,803,938 5%

Age 18 to 22 562 1% 8,241 3% 30,579 3% 754,261 6% 20,904,128 6%

Age 22 to 25 641 1% 7,430 2% 25,814 3% 556,534 4% 13,508,449 4%

Age 25 to 35 6,433 12% 39,760 12% 112,627 13% 1,795,695 14% 41,409,370 12%

Age 35 to 45 13,533 24% 64,036 19% 156,299 18% 1,778,148 13% 41,270,011 12%

Age 45 to 55 9,063 16% 51,043 16% 130,556 15% 1,772,055 13% 42,287,286 13%

Age 55 to 65 5,800 10% 38,601 12% 104,432 12% 1,638,658 12% 43,608,051 13%

Age 65 to 75 4,263 8% 27,294 8% 73,322 8% 1,121,820 8% 32,541,392 10%

Age 75 to 85 2,165 4% 13,783 4% 36,183 4% 547,774 4% 16,403,770 5%

Age 85 and over 1,144 2% 5,878 2% 14,436 2% 207,079 2% 5,537,690 2%

Median Age 40.7 40.5 39.4 37.4 38.7

Average Age 39.8 39.7 38.9 38.2 39.4

Fam

ily

Families by # of Workers 8,432 63,763 185,257 3,027,573 84,028,738

No workers 1,072 13% 6,273 10% 18,812 10% 341,599 11% 12,647,826 15%

1 worker 2,264 27% 20,811 33% 65,673 35% 1,005,954 33% 27,650,248 33%

2 workers 4,533 54% 31,208 49% 81,580 44% 1,214,378 40% 34,484,840 41%

3 or more workers 563 7% 5,472 9% 19,192 10% 465,642 15% 9,245,824 11%

Enro

llmen

t Total Population 55,635 328,409 888,209 13,258,217 332,230,239

Pre-High School 1,824 3% 25,238 8% 87,315 10% 1,725,707 13% 44,506,398 13%

High School 795 1% 8,909 3% 34,690 4% 759,014 6% 18,097,316 5%

College/Grad/Prof 4,217 8% 24,574 7% 69,209 8% 1,186,525 9% 24,305,059 7%

Not enrolled 48,800 88% 269,689 82% 696,994 78% 9,586,971 72% 245,321,466 74%

Per Capita Income $62,373 $58,722 $45,101 $33,262 $31,882

Empl

oym

ent

Total Pop. Age 16+ 43,983 260,301 699,631 10,489,117 265,928,221

Labor Force 34,278 78% 192,303 74% 496,531 71% 6,769,899 65% 167,973,139 63%

In Armed Forces 63 0% 89 0% 202 0% 5,226 0% 1,126,419 0%

Civilian, Employed 32,496 74% 182,715 70% 470,274 67% 6,436,957 61% 159,679,719 60%

Civilian, Unemployed 1,719 4% 9,499 4% 26,056 4% 327,716 3% 7,167,001 3%

Not in Labor Force 9,705 22% 67,998 26% 203,100 29% 3,719,218 35% 97,955,082 37%

Unemployment Rate 5.0% 4.9% 5.2% 4.8% 4.3%

Powered by Sitewise Pro -2- Demographic Source: STI PopStats

31

DEMOGRAPHICS

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

DEMOGRAPHIC PROFILE2010 Census, 2019 Estimates & 2024 Projections

Calculated using Proportional Block Groups

2019-Aug-05

Lat/Long: 34.089266/-118.355029

This

repo

rt w

as p

rodu

ced

usin

g da

ta fr

om p

rivat

e an

d go

vern

men

t sou

rces

dee

med

to b

e re

liabl

e. T

he in

form

atio

n he

rein

is p

rovi

ded

with

out r

epre

sent

atio

n or

war

rant

y of

any

kin

d.

1016 N Curson Ave, WestHollywood, CA 90046

Los Angeles-Long Beach et

al, CAUS Benchmark0 - 1 mi 0 - 3 mi 0 - 5 mi

Empl

oyed

Pop

ulat

ion

Employed Pop. Age 16+ 32,496 182,715 470,274 6,436,957 159,679,719

Agr., forestry, fish & hunt,min., constr.

528 2% 6,053 3% 22,339 5% 406,645 6% 13,219,075 8%

Manufacturing 1,389 4% 7,963 4% 26,215 6% 692,268 11% 16,478,350 10%

Wholesale & retail trade 3,185 10% 19,962 11% 54,987 12% 904,286 14% 22,495,828 14%

Transp. and warehousing,and utilities

959 3% 4,556 2% 14,822 3% 328,826 5% 8,160,424 5%

Information 5,465 17% 23,671 13% 45,389 10% 241,493 4% 3,328,383 2%

Fin., ins., RE & rental/leasing 2,026 6% 12,403 7% 30,178 6% 432,856 7% 10,513,873 7%

Prof., sci., mgmt, admin, andwaste mgmt

5,551 17% 30,193 17% 71,791 15% 845,927 13% 17,979,262 11%

Prof., sci., & technical svcs 4,603 14% 24,415 13% 49,526 11% 509,399 8% 10,992,396 7%

Mgmt of companies & ent. 81 0% 185 0% 368 0% 5,378 0% 153,078 0%

Admin, support & waste mgmt 868 3% 5,593 3% 21,897 5% 331,150 5% 6,833,788 4%

Educ., health and soc. svc 4,586 14% 29,000 16% 79,393 17% 1,300,909 20% 36,912,880 23%

Arts, ent., rec., accom. & food 6,494 20% 32,742 18% 78,727 17% 706,288 11% 15,265,112 10%

Other services (exceptpublic admin)

1,998 6% 13,268 7% 38,212 8% 379,273 6% 7,813,494 5%

Public Administration 316 1% 2,905 2% 8,221 2% 198,186 3% 7,513,038 5%

Employed Civilian Pop. Age 16 + 32,496 182,715 470,274 6,436,957 159,679,719

White Collar 26,541 82% 140,647 77% 318,709 68% 4,074,447 63% 101,238,014 63%

Blue Collar 5,955 18% 42,068 23% 151,565 32% 2,362,510 37% 58,441,705 37%

Whi

te C

olla

r Mgmt, Business, and Fin. Op. 7,886 24% 38,836 21% 80,749 17% 993,652 15% 24,208,627 15%

Professional & Related 10,713 33% 60,676 33% 130,080 28% 1,406,562 22% 35,614,546 22%

Healthcare support 261 1% 1,726 1% 6,561 1% 113,642 2% 3,785,247 2%

Sales & related 3,324 10% 19,822 11% 51,330 11% 715,262 11% 16,868,999 11%

Office & admin support 4,357 13% 19,587 11% 49,990 11% 845,329 13% 20,760,595 13%

Blue

Col

lar

Protective service 137 0% 1,475 1% 5,608 1% 115,217 2% 3,485,920 2%

Food prep & serving 1,928 6% 11,743 6% 35,739 8% 370,606 6% 9,109,973 6%

Building & grounds cleaning& maint.

175 1% 4,674 3% 25,647 5% 289,052 4% 6,247,003 4%

Personal care & service 1,995 6% 9,599 5% 25,066 5% 312,386 5% 5,929,034 4%

Farming, fishing, and forestry 53 0% 325 0% 1,049 0% 22,252 0% 1,156,325 1%

Constr., Extraction, & Maint. 523 2% 5,991 3% 23,921 5% 459,986 7% 13,084,164 8%

Prod., Transp., & Mat. Moving 1,143 4% 8,262 5% 34,534 7% 793,011 12% 19,429,286 12%

Powered by Sitewise Pro -3- Demographic Source: STI PopStats

32

DEMOGRAPHICS

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

DEMOGRAPHIC PROFILE2010 Census, 2019 Estimates & 2024 Projections

Calculated using Proportional Block Groups

2019-Aug-05

Lat/Long: 34.089266/-118.355029

This

repo

rt w

as p

rodu

ced

usin

g da

ta fr

om p

rivat

e an

d go

vern

men

t sou

rces

dee

med

to b

e re

liabl

e. T

he in

form

atio

n he

rein

is p

rovi

ded

with

out r

epre

sent

atio

n or

war

rant

y of

any

kin

d.

1016 N Curson Ave, WestHollywood, CA 90046

Los Angeles-Long Beach et

al, CAUS Benchmark0 - 1 mi 0 - 3 mi 0 - 5 mi

Hous

ehol

d Si

ze

Households by HH Size 32,946 163,529 384,553 4,392,923 125,636,242

1-person household 17,650 54% 74,411 46% 147,950 46% 1,036,461 24% 33,405,834 27%

2-person household 11,161 34% 51,253 31% 114,538 31% 1,188,448 27% 41,124,256 33%

3-person household 2,590 8% 18,118 11% 50,992 11% 716,704 16% 20,255,178 16%

4-person household 1,012 3% 11,765 7% 37,836 7% 669,376 15% 16,950,354 13%

5-person household 289 1% 4,780 3% 18,333 3% 378,401 9% 8,157,703 6%

6-person household 122 0% 1,922 1% 8,110 1% 189,719 4% 3,313,208 3%

7 or more person household 123 0% 1,279 1% 6,794 1% 213,814 5% 2,429,709 2%

Hous

ehol

d Ty

pes

Households by Type 32,946 163,529 384,553 4,392,923 125,636,242

1 Person Households 17,650 54% 74,411 46% 147,950 46% 1,036,461 24% 33,405,834 27%

Family Households 8,432 26% 63,763 39% 185,257 39% 3,027,573 69% 84,028,738 67%

Married-couple family 6,864 21% 46,338 28% 122,150 28% 2,102,440 48% 61,623,518 49%

W/ own children < 18 yrs 1,611 5% 16,475 10% 48,512 10% 923,433 21% 24,263,247 19%

No own children < 18 yrs 5,253 16% 29,863 18% 73,638 18% 1,179,007 27% 37,360,271 30%

Male HHer: no wife present: 533 2% 5,865 4% 20,364 4% 285,796 7% 6,137,526 5%

W/ own children < 18 yrs 143 0% 1,871 1% 7,264 1% 113,140 3% 2,879,872 2%

No own children < 18 yrs 390 1% 3,994 2% 13,099 2% 172,656 4% 3,257,654 3%

Female HHer: no husband: 1,035 3% 11,560 7% 42,743 7% 639,337 15% 16,267,694 13%

W/ own children < 18 yrs 336 1% 4,593 3% 19,257 3% 290,494 7% 8,652,929 7%

No own children < 18 yrs 699 2% 6,967 4% 23,486 4% 348,843 8% 7,614,765 6%

Nonfamily Households 6,864 21% 25,355 16% 51,346 16% 328,889 7% 8,201,670 7%

Gro

up Q

uart

ers

2019 Est. Group Quarters 772 4,611 11,921 205,526 7,931,761

Institutionalized 369 48% 1,560 34% 4,223 34% 82,589 40% 3,993,848 50%

Non-Institutionalized 403 52% 3,051 66% 7,698 66% 122,937 60% 3,937,913 50%

College 0 0% 337 7% 526 7% 61,585 30% 2,522,776 32%

Military 0 0% 0 0% 0 0% 37 0% 337,872 4%

Other 403 52% 2,714 59% 7,172 59% 61,315 30% 1,077,265 14%

2010 Census Group Qtrs Pop. 818 4,783 12,387 210,917 8,025,278

2019 Est. Group Qtrs Pop. 772 4,611 11,921 205,526 7,931,761

2024 Proj. Group Qtrs Pop. 772 4,611 11,921 205,500 7,938,096

Vehi

cles

Housing by Vehicles Avail. 32,946 163,529 384,553 4,392,923 125,636,242

None 3,671 11% 20,459 13% 56,423 13% 354,410 8% 11,108,830 9%

1 vehicle 18,487 56% 80,393 49% 178,170 49% 1,434,401 33% 41,802,564 33%

2 vehicles 8,945 27% 50,069 31% 116,013 31% 1,621,093 37% 46,927,965 37%

3 vehicles 1,418 4% 9,487 6% 24,683 6% 637,122 15% 17,804,491 14%

4 vehicles 272 1% 2,310 1% 6,469 1% 240,361 5% 5,725,487 5%

5 or more vehicles 151 0% 810 0% 2,794 0% 105,536 2% 2,266,905 2%

Avg. # of Vehicles Available 1.3 1.4 1.4 1.8 1.8

Powered by Sitewise Pro -4- Demographic Source: STI PopStats

33

DEMOGRAPHICS

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

DEMOGRAPHIC PROFILE2010 Census, 2019 Estimates & 2024 Projections

Calculated using Proportional Block Groups

2019-Aug-05

Lat/Long: 34.089266/-118.355029

This

repo

rt w

as p

rodu

ced

usin

g da

ta fr

om p

rivat

e an

d go

vern

men

t sou

rces

dee

med

to b

e re

liabl

e. T

he in

form

atio

n he

rein

is p

rovi

ded

with

out r

epre

sent

atio

n or

war

rant

y of

any

kin

d.

1016 N Curson Ave, WestHollywood, CA 90046

Los Angeles-Long Beach et

al, CAUS Benchmark0 - 1 mi 0 - 3 mi 0 - 5 mi

Hous

ehol

d In

com

e

Households by HH Inc. 32,946 163,529 384,553 4,392,923 125,636,242

$0 to $24,999 6,710 20% 31,220 19% 83,335 22% 795,798 18% 26,012,365 21%

$25,000 to $34,999 2,298 7% 12,311 8% 34,338 9% 357,164 8% 11,700,753 9%

$35,000 to $49,999 3,085 9% 15,646 10% 45,242 12% 493,872 11% 16,039,272 13%

$50,000 to $74,999 5,009 15% 24,538 15% 58,975 15% 698,221 16% 22,183,411 18%

$75,000 to $99,999 4,000 12% 18,961 12% 42,197 11% 541,058 12% 15,728,922 13%

$100,000 to $149,999 5,392 16% 24,769 15% 51,078 13% 704,341 16% 18,103,749 14%

$150,000 to $249,999 4,910 15% 26,752 16% 51,353 13% 621,015 14% 12,867,039 10%

$250,000 or more 1,542 5% 9,331 6% 18,034 5% 181,454 4% 3,000,731 2%

Median Household Income $ 71,655 $ 72,807 $ 62,000 $ 69,129 $ 59,496

Average Household Income $ 104,177 $ 116,839 $ 103,148 $ 99,251 $ 83,143

Hous

ehol

ders

<25

yrs HHer < 25 yrs by HH Inc. 619 4,672 12,301 110,042 4,553,394

$0 to $24,999 201 32% 1,524 33% 4,358 35% 41,190 37% 1,904,647 42%

$25,000 to $34,999 96 16% 572 12% 1,685 14% 13,975 13% 649,018 14%

$35,000 to $49,999 86 14% 688 15% 1,886 15% 16,921 15% 732,649 16%

$50,000 to $99,999 193 31% 1,322 28% 3,088 25% 27,583 25% 1,005,252 22%

$100,000 or more 43 7% 566 12% 1,285 10% 10,373 9% 261,828 6%

Median Household Income $ 37,212 $ 40,476 $ 36,074 $ 34,895 $ 30,572

Average Household Income $ 52,096 $ 62,686 $ 55,355 $ 53,389 $ 43,844

Hous

ehol

ders

25-

44 y

rs HHer 25-44 yrs by HH Inc. 17,643 77,056 171,484 1,547,987 41,069,918

$0 to $24,999 2,276 13% 10,684 14% 29,401 17% 235,507 15% 6,819,281 17%

$25,000 to $34,999 1,056 6% 5,307 7% 15,277 9% 126,882 8% 3,554,630 9%

$35,000 to $49,999 1,787 10% 7,582 10% 21,716 13% 180,068 12% 5,265,952 13%

$50,000 to $99,999 5,538 31% 23,947 31% 51,025 30% 470,697 30% 13,700,660 33%

$100,000 or more 6,987 40% 29,537 38% 54,065 32% 534,833 35% 11,729,395 29%

Median Household Income $ 80,920 $ 78,284 $ 66,034 $ 71,913 $ 65,248

Average Household Income $ 110,827 $ 115,520 $ 99,945 $ 100,130 $ 87,231

Hous

ehol

ders

45-

64 y

rs HHer 45-64 yrs by HH Inc. 9,897 54,072 131,932 1,785,197 49,098,250

$0 to $24,999 1,682 17% 8,854 16% 25,025 19% 256,467 14% 8,309,713 17%

$25,000 to $34,999 599 6% 3,593 7% 10,952 8% 122,301 7% 3,611,463 7%

$35,000 to $49,999 950 10% 5,221 10% 15,118 11% 182,801 10% 5,382,024 11%

$50,000 to $99,999 2,721 27% 13,167 24% 33,944 26% 504,693 28% 14,960,033 30%

$100,000 or more 3,945 40% 23,236 43% 46,893 36% 718,935 40% 16,835,017 34%

Median Household Income $ 81,004 $ 84,248 $ 69,055 $ 80,959 $ 71,489

Average Household Income $ 116,458 $ 132,807 $ 115,011 $ 110,352 $ 94,596

Powered by Sitewise Pro -5- Demographic Source: STI PopStats

34

DEMOGRAPHICS

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

DEMOGRAPHIC PROFILE2010 Census, 2019 Estimates & 2024 Projections

Calculated using Proportional Block Groups

2019-Aug-05

Lat/Long: 34.089266/-118.355029

This

repo

rt w

as p

rodu

ced

usin

g da

ta fr

om p

rivat

e an

d go

vern

men

t sou

rces

dee

med

to b

e re

liabl

e. T

he in

form

atio

n he

rein

is p

rovi

ded

with

out r

epre

sent

atio

n or

war

rant

y of

any

kin

d.

1016 N Curson Ave, WestHollywood, CA 90046

Los Angeles-Long Beach et

al, CAUS Benchmark0 - 1 mi 0 - 3 mi 0 - 5 mi

Hous

ehol

ders

> 6

5 yr

s HHer > 65 yrs by HH Inc. 4,787 27,729 68,836 949,697 30,914,680

$0 to $24,999 2,551 53% 10,158 37% 24,551 36% 262,634 28% 8,978,724 29%

$25,000 to $34,999 547 11% 2,840 10% 6,424 9% 94,006 10% 3,885,642 13%

$35,000 to $49,999 261 5% 2,155 8% 6,522 9% 114,082 12% 4,658,647 15%

$50,000 to $99,999 558 12% 5,063 18% 13,116 19% 236,306 25% 8,246,388 27%

$100,000 or more 870 18% 7,513 27% 18,223 26% 242,669 26% 5,145,279 17%

Median Household Income $ 23,122 $ 40,490 $ 42,110 $ 50,701 $ 42,892

Average Household Income $ 61,004 $ 98,490 $ 96,929 $ 82,517 $ 65,310

Hous

ing

Valu

e

Owner-Occ. Housing Units 6,408 43,033 103,082 2,218,862 81,937,171

$0 to $49,999 84 1% 582 1% 1,342 1% 39,843 2% 5,407,441 7%

$50,000 to $99,999 48 1% 334 1% 660 1% 28,221 1% 8,075,752 10%

$100,000 to $199,999 25 0% 509 1% 1,714 2% 42,919 2% 19,362,217 24%

$200,000 to $499,999 234 4% 1,456 3% 5,295 5% 300,354 14% 30,775,457 38%

$500,000 or more 6,017 94% 40,152 93% 94,070 91% 1,807,525 81% 18,316,304 22%

Median Housing Unit Value $ 1,090,606 $ 1,105,049 $ 1,080,434 $ 831,002 $ 250,602

Average Housing Unit Value $ 1,336,350 $ 1,460,140 $ 1,414,954 $ 946,431 $ 369,830

Workplace Establishments 2,991 18,762 39,916 395,632 8,397,295

Workplace Employees (FTE) 29,756 236,967 507,230 6,334,588 145,992,596

Mor

tgag

e Ri

sk

Mortgage by Mort.-Risk Ratio 921 5,233 12,230 278,640 11,742,446

Under 1.0 6 1% 28 1% 55 0% 3,278 1% 522,954 4%

1.0 to 2.0 84 9% 364 7% 816 7% 16,226 6% 2,692,711 23%

2.0 to 3.0 198 21% 1,050 20% 2,468 20% 50,720 18% 3,980,280 34%

3.0 to 4.0 305 33% 1,601 31% 3,725 30% 84,577 30% 2,741,972 23%

4.0 to 5.0 260 28% 1,768 34% 3,978 33% 80,438 29% 1,281,356 11%

5.0 and over 69 8% 422 8% 1,188 10% 43,401 16% 523,173 4%

Average Mortgage Risk 3.5 3.6 3.6 3.7 2.8

Powered by Sitewise Pro -6- Demographic Source: STI PopStats

35

APARTMENT UPDATE

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

a Berkshire Hathaway and Jeferies Financial Group company

SECOND QUARTER 2019

MARKET AT A GLANCE

OCCUPANCY AND RENT TRENDS

LOS ANGELES - WESTMULTIFAMILY REPORT

APARTMENT DEMAND BRISK AMID WAVE OF NEW INVENTORY

Following years of insuicient apartment development, multifamily developers’ eforts to build up inventory were apparent

during the last 12 months. Builders completed 10,128 apartments in Los Angeles West since June 2018, a 165% increase from

the same period one year earlier. Deliveries in the Downtown Los Angeles submarket accounted for 50% of the new stock

in Los Angeles West. Apartment demand in Downtown Los Angeles was brisk, but not enough to overtake the wave of

new development, resulting in an 80-basis-point annual reduction in occupancy to 94.6% in June of this year. Furthermore,

heightened competition in the Downtown Los Angeles submarket prompted the lowest annual rate of rent growth of all

submarkets in the county. The trend in apartment fundamentals was more favorable across Los Angeles West. Average

occupancy of 96.1% in June was the same as one year prior, resulting from robust leasing activity. At the same time, average

efective rent increased 2.0% year over year to $2,700 per month. Rent growth, however, may be tested in the near term as

10,607 apartments are slated for delivery during the next four quarters.

$1,800

$2,000

$2,200

$2,400

$2,600

$2,800

94.5%

95.0%

95.5%

96.0%

96.5%

97.0%

3Q14 1Q15 3Q15 1Q16 3Q16 1Q17 3Q17 1Q18 3Q18 1Q19

OCCUPANCY AND RENT TRENDS

Occupancy Rate Effective Rent

OCCUPANCYRATE

EFFECTIVERENT

TOTAL INVENTORY

96.1%

$2,700

408,015

Unchanged since 2Q18

Up 2.0% since 2Q18

36

APARTMENT UPDATE

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

BERKADIASECOND QUARTER 2019

DELIVERIES AND DEMAND

ECONOMIC TRENDS

LOS ANGELES - WESTMULTIFAMILY REPORT

0

3,000

6,000

9,000

2014 2015 2016 2017 2018 2019*

DELIVERIES AND DEMAND

Deliveries Demand*Year to date

UNEMPLOYMENT*2018 2019

EMPLOYMENT*2018 2019

EXISTING SFH SALES**2018 2019

MEDIAN SFH PRICE**2018 2019

10-YEAR TREASURY**2018 2019

4.7%

4.50m

62.5k

$574.9k

2.91%

4.6%

4.55m

53.9k

$591.4k

2.07%

Payrolls in Los Angeles County expanded with 50,200

workers in the 12 months ending in April 2019, a 1.1%

year-over-year increase. The gain trailed the national

job growth rate of 1.7%. Employment grew in eight of

the 11 job sectors in the county. Staing increases were

most prevalent in the education and health services

and the leisure and hospitality sectors, supported by

27,000 new households since April 2018, and steady in-

migration of young, talented foreign labor. Education

and health services institutions created 19,500 new

jobs since April 2018, a 2.4% annual gain. A substantial

increase in the median household income and a 3.1%

annual rise in local tourism in 2018 boosted the leisure

and hospitality industry where 9,600 workers were

hired, a 1.8% increase. White-collar employment also

expanded. Companies in the professional and business

services segment grew payrolls 1.1% with 7,000 new

hires. High-tech start-ups and electronic gaming

companies gravitated to Silicon Beach, boosting

information sector payrolls with 4,100 new workers,

equating to 1.9% annual growth.

-10 BPSCHANGE

1.1%CHANGE

-13.8%CHANGE

2.9%CHANGE

-80 BPSCHANGE

U.S.ANNUAL RENT

27.2%share of wallet

REGIONANNUAL RENT

44.2%share of wallet

*April; **June

DELIVERIES

Units YTD

LA - WEST

5,895

DELIVERIES

Units YTD

LA - METRO

8,719

NETABSORPTION

LA - WEST

Units YTD3,951

NETABSORPTION

LA - METRO

6,138Units YTD

37

APARTMENT UPDATE

1016 NORTH CURSON AVENUE1016NCursonAve.BerkadiaREA.com

BERKADIA

© 2019 Berkadia Real Estate Advisors LLCBerkadia® is a registered trademark of Berkadia Proprietary Holding LLCDocument sources: Axiometrics; Berkadia Research; Federal Reserve Bank of St. Louis; Moody’s

SECOND QUARTER 2019

SUBMARKET BREAKDOWN

LOS ANGELES - WESTMULTIFAMILY REPORT

SUBMARKET NAME 2Q18 2Q19 2Q18 2Q19 2Q18 2Q19 2Q19 ANNUAL 2Q19 ANNUAL

Brentwood/Westwood/Beverly Hills 96.7% 97.1% 3.7% 2.3% $3,352 $3,430 345 530 240 316

Downtown Los Angeles 95.4% 94.6% 2.4% 0.4% $2,509 $2,520 1,221 4,498 1,505 5,153

Hollywood 95.9% 95.5% 1.7% 2.7% $2,481 $2,549 67 689 355 1,098

Mid-Wilshire 96.4% 96.5% 3.3% 2.6% $2,178 $2,236 1,109 2,602 1,390 2,577

Palms/Mar Vista 96.5% 96.5% 4.1% 1.8% $2,628 $2,676 -1 330 132 342

Santa Monica/Marina del Rey 95.8% 96.4% 2.0% 1.6% $3,427 $3,483 305 904 267 642

TOTALS 96.1% 96.1% 2.8% 2.0% $2,648 $2,700 3,046 9,552 3,889 10,128

OCCUPANCY AVG RENTCHANGE

AVG RENT NETABSORPTION

DELIVEREDUNITS

38

a Berkshire Hathaway and Jefferies Financial Group company

The material contained in this document is confidential, furnished solely for the purpose of considering investment in the property described therein and is not to be copied and/or used for any purpose or made available to any other person without the express written consent of Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. In accepting this, the recipient agrees to keep all material contained herein confidential.

This information package has been prepared to provide summary information to prospective purchasers and to establish a preliminary level of interest in the property described herein. It does not, however, purport to present all material information regarding the subject property, and it is not a substitute for a thorough due diligence investigation. In particular, Berkadia Real Estate Advisors LLC, Berkadia Real Estate Advisors Inc. and Seller have not made any investigation of the actual property, the tenants, the operating history, financial reports, leases, square footage, age or any other aspect of the property, including but not limited to any potential environmental problems that may exist and make no warranty or representation whatsoever concerning these issues. The information contained in this information package has been obtained from sources we believe to be reliable; however, Berkadia Real Estate Advisors LLC, Berkadia Real Estate Advisors Inc. and Seller have not conducted any investigation regarding these matters and make no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. Any pro formas, projections, opinions, assumptions or estimates used are for example only and do not necessarily represent the current or future performance of the property.

Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. and Seller strongly recommend that prospective purchasers conduct an in-depth investigation of every physical and financial aspect of the property to determine if the property meets their needs and expectations. We also recommend that prospective purchasers consult with their tax, financial and legal advisors on any matter that may affect their decision to purchase the property and the subsequent consequences of ownership.

All parties are advised that in any property the presence of certain kinds of molds, funguses, or other organisms may adversely affect the property and the health of some individuals. Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. recommend, if prospective buyers have questions or concerns regarding this issue, that prospective buyers conduct further inspections by a qualified professional.

The Seller retains the right to withdraw, modify or cancel this offer to sell at any time and without any notice or obligation. Any sale is subject to the sole and unrestricted approval of Seller, and Seller shall be under no obligation to any party until such time as Seller and any other necessary parties have executed a contract of sale containing terms and conditions acceptable to Seller and such obligations of Seller shall only be those in such contract of sale.

For more information on these and other Berkadia® exclusive listings, please visit our website at www.Berkadia.com

Berkadia®, a joint venture of Berkshire Hathaway and Jefferies Financial Group, is an industry leading commercial real estate company providing comprehensive capital solutions and investment sales advisory and research services for multifamily and commercial properties. Berkadia® is amongst the largest, highest rated and most respected primary, master and special servicers in the industry.

© 2019 Berkadia Proprietary Holding LLC

Berkadia® is a trademark of Berkadia Proprietary Holding LLC

Investment sales and real estate brokerage businesses are conducted exclusively by Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. Commercial mortgage loan origination and servicing businesses are conducted exclusively by Berkadia Commercial Mortgage LLC and Berkadia Commercial Mortgage Inc. Tax credit syndication business is conducted exclusively by Berkadia Affordable Tax Credit Solutions. In California, Berkadia Real Estate Advisors Inc. conducts business under CA Real Estate Broker License #01931050; Vincent B. Norris, CA BRE Lic. # 843890. Berkadia Commercial Mortgage LLC conducts business under CA Finance Lender & Broker Lic. #988-0701; and Berkadia Commercial Mortgage Inc. under CA Real Estate Broker Lic. #01874116. This proposal is not intended to solicit commercial mortgage loan brokerage business in Nevada.For state licensing details visit: http://www.berkadia.com/legal/licensing.aspx

SOUTH BAY LOS ANGELES OFFICE2321 Rosecrans Ave, Suite 3235 | El Segundo, CA 90245

Phone: 424.239.5900 | Fax: 424.239.5901

ALBUQUERQUE, NM

AMBLER, PA

ATLANTA, GA

AUSTIN, TX

BATON ROUGE, LA

BIRMINGHAM, AL

BOCA RATON, FL

BOSTON, MA

CAMAS, WA

CHARLESTON, SC

CHATTANOOGA, TN

CHICAGO, IL

CLEVELAND, OH

COLORADO SPRINGS, CO

DALLAS, TX

DC METRO

DENVER, CO

DETROIT, MI

EL SEGUNDO, CA

FRESNO, CA

HOUSTON, TX

IRVINE, CA

JACKSONVILLE, FL

KANSAS CITY, MO

LAS VEGAS, NV

LEXINGTON, KY

LOS ANGELES, CA

MARBLEHEAD, MA

MEMPHIS, TN

MIAMI, FL

MIDVALE, UT

MURRIETA, CA

NASHVILLE, TN

NEW YORK, NY

NEWPORT NEWS, VA

ORLANDO, FL

PASADENA, CA

PHILADELPHIA, PA

PHOENIX, AZ

PORTLAND, OR

RALEIGH, NC

RICHMOND, VA

SALT LAKE CITY, UT

SAN ANTONIO, TX

SAN DIEGO, CA

SAN FRANCISCO, CA

SEATTLE, WA

SHREWSBURY, NJ

ST. LOUIS, MO

TAMPA, FL

TEMPE, AZ

TUCSON, AZ

WOODLAND HILLS, CA

HYDERABAD - INDIA