CONFIDENTIAL Grouper Acquisition Opportunity Financial Overview August 2006.

-

Upload

jewel-nelson -

Category

Documents

-

view

214 -

download

0

Transcript of CONFIDENTIAL Grouper Acquisition Opportunity Financial Overview August 2006.

page 2

Overview of Financial Model

• Revenues exclusively based on advertising– In-stream video ads– Banner ads / ad-words– Sponsored search

• Assumes growth in unique user based and conservative CPMs

• COGS consist of streaming and web site bandwidth• Additional operating expenses primarily relate to three categories, each growing with the business over time

– Personnel– Infrastructure– Marketing

Revenues Revenues

CostsCosts

Adjustments to Management Model

Adjustments to Management Model

Investment and Return Investment and Return

• Grouper management provided an initial financial model • SPE base case adjusted the model

– Maintain management projections for unique user base through FY2008– Decrease CPMs over time– Increased total expenses by 5-10% of revenue

• Investment includes total consideration of $65MM– $52.5MM at closing– $12.5MM contingent on performance

• Discounted pre-tax cash flow analysis performed with a discount rate of 16.5% (in-line with SPE’s normal rate); terminal EBIT multiple of 8.0x

page 3

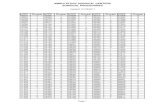

Comparison of Management Projections and SPE Base Case

Note: Figures provided by company were adjusted to Sony’s fiscal year-end.

SPE Base CaseSPE Base CaseManagement CaseManagement Case

FY 2006 FY2007 FY2008 FY2009

20.9 37.2 53.9 76.3

899.7 3,385.2 7,621.5 12,506.4

171.5 798.0 1,941.8 3,251.7

1,534.9 5,967.7 12,003.4 17,543.6

1.42$ 10.06$ 28.25$ 43.02$ 1.18 5.66 12.80 20.99 0.46 2.87 10.46 19.51

3.07$ 18.60$ 51.50$ 83.51$

1.68$ 6.99$ 15.13$ 22.81$

1.39$ 11.60$ 36.37$ 60.70$

5.36$ 9.41$ 10.95$ 12.34$ 1.63 4.80 5.11 7.90 1.51 2.08 2.39 2.73 1.67 2.07 3.54 4.74 0.08 0.46 1.29 2.09

10.23$ 18.82$ 23.28$ 29.80$

(8.85)$ (7.22)$ 13.09$ 30.91$

FY 2006 FY2007 FY2008 FY2009

20.9 37.2 53.9 72.5

899.7 3,385.2 7,621.5 12,379.1

171.5 798.0 1,941.8 3,186.7

1,534.9 5,967.7 12,003.4 17,393.4

1.59$ 11.80$ 37.34$ 58.31$ 0.85 4.49 11.22 16.87 0.54 3.74 15.28 28.04

2.97$ 20.03$ 63.84$ 103.23$

1.67$ 7.10$ 15.99$ 24.05$

1.29$ 12.93$ 47.85$ 79.18$

4.29$ 7.53$ 9.08$ 10.72$ 0.25 1.10 3.85 7.39 1.51 2.08 2.55 2.99 0.67 0.82 1.10 1.20

- - - -

6.71$ 11.53$ 16.58$ 22.29$

(5.42)$ 1.40$ 31.26$ 56.89$

(millions)

User Activity

End of Period Uniques

Page Views

Total Searches

Total Streams

P&L Performance

In-StreamBanner / Ad-wordsSponsored Search

Total Revenue

Total COGS

Gross Profit

PayrollMarketingG&AInternet, Hardware, SoftwareOther

Total Operating Expenses

Operating Profit

FY 2006 FY2007 FY2008 FY2009

Difference Between SPE Base Case and Management Projections

Total Revenue 0.10$ (1.43)$ (12.34)$ (19.72)$

Total COGS 0.01$ (0.10)$ (0.86)$ (1.23)$

Payroll 1.07$ 1.88$ 1.87$ 1.62$ Marketing 1.38 3.70 1.26 0.51 G&A - - (0.16) (0.26) Internet, Hardware, Software 1.00 1.25 2.43 3.54 Other 0.08 0.46 1.29 2.09

Operating Profit (3.43)$ (8.62)$ (18.18)$ (25.99)$

page 4

Grouper Growth Trajectory

Sale of Studio Content

Harvest High Quality User

Content

Promotion of Studio Content

Advertising Revenue

Grow User Base and Ad Inventory

IncreaseInventory

Drive Grouper Revenue

Decrease SPE Marketing Expense,

Increase SPE Sales

SPE Revenue at Higher Margins

SPE Acquires

Content at Lower Cost

Excluded from Financial Model (Potential Upside)Excluded from Financial Model (Potential Upside)Included in Financial ModelIncluded in Financial Model

page 6

Revenue Type

Revenue Drivers

In-Stream

Base of Users

Drivers of Inventory % Sold Revenue (in $mm)

Unique users for Grouper.com

+

Embedded unique user

Total unique users

Banner and Ad-words

Sponsored Search

Streams per unique X

Total uniques=

Total streams

Page views per unique

XTotal uniques

=Page views

% of page views searching

XPage views

=Searches

% of inventory sold(1)(2)

XTotal Streams

=Streaming ads sold

Ads sold per page (2) viewX

Page views=

Ads sold

% of inventory sold (2)

XSearches

=Ads sold

CPMX

Ads sold=

Revenue

CPMX

Ads sold=

Revenue

CPMX

Ads sold=

Revenue

(1) % of inventory sold for in-stream ads assumes pre-roll ads are placed with only 1/4 to 1/3 of videos.(2) % of inventory sold assumed to be highest in United States initially, Rest of World increases over time.

page 7

Revenue Assumptions – SPE Base Case Relative to Management Case

* Represents gross In-Stream CPM, including revenue share to partners.

• Slight increase in FY2009 unique users projected as a result of aggressive forecasting of an additional 3 months for the fiscal year SPE base case

• Same per user stream rates used

• Same % inventory sell through assumptions used

• Overall revenue at 70%-80% of management case– Video CPMs adjusted 85%-90% ($12-$16)– Banner / ad-words CPMs increased slightly– Sponsored search CPMS decreased to a constant $15

• Assumes smaller dedicated sales force based on ability to leverage SPE ad sales

page 8

Revenue Assumptions Comparison

* Represents gross In-Stream CPM, including revenue share to partners.

SPE Projected Base CaseSPE Projected Base CaseManagement CaseManagement Case

FY2006 FY2007 FY2008 FY2009

Unique Users (000)

Total Unique Users 20,868 37,211 53,905 76,309

Page Views (000)

Grouper.com PVs/Unique 15.9 25.7 32.9 33.5 Total Page Views 899,709 3,385,164 7,621,476 12,506,356

Total Searches (as a % of Page Views) 171,474 797,981 1,941,754 3,251,652

Streams (000)

Streams/Total Uniques 10.1 16.6 21.7 22.4 Total Streams 1,534,921 5,967,725 12,003,384 17,543,578

Sell-Through / Inventory

In-Stream, incl. Embbeded (from Streams) 185,086 999,854 2,717,879 4,455,878

% In-Stream Inventory Sold 12.1% 16.8% 22.6% 25.4%

Banner / Ad-words (from Page Views) 1,152,503 5,703,871 13,222,563 21,713,410

Banner / Adwords Inventory Sold (per page) 1.3 1.7 1.7 1.7

Sponsored Search (from Searches) 31,000 191,649 697,049 1,300,661

% of Sponsored Search Inventory Sold 18.1% 24.0% 35.9% 40.0%

CPMs / Unit Prices

In-Stream CPMs (excl rev share) * 13.92$ 16.29$ 13.77$ 12.54$

Banner / Ad-words CPMs 1.02$ 0.99$ 0.97$ 0.97$

Sponsored Search CPMs 15.00$ 15.00$ 15.00$ 15.00$

Revenue (000)

In-Stream Revenue 1,424$ 10,061$ 28,247$ 43,019$

Banner / Ad-words Revenue 1,181$ 5,662$ 12,796$ 20,986$

Sponsored Search Revenue 465$ 2,875$ 10,456$ 19,510$

Total Revenue 3,070$ 18,598$ 51,499$ 83,515$

Revenue by Territory , including Video and Banner / Adwords (000)

North America Revenue 1,674$ 8,887$ 21,675$ 35,303$

Asia Revenue 181$ 1,050$ 1,978$ 3,002$

Western Europe Revenue 221$ 1,406$ 3,569$ 5,666$

ROW Revenue 35$ 230$ 503$ 758$

FY2006 FY2007 FY2008 FY2009

Unique Users (000)

Total Unique Users 20,868 37,211 53,905 72,491

Page Views (000)

Grouper.com PVs/Unique 15.9 25.7 32.9 33.6 Total Page Views 899,709 3,385,164 7,621,476 12,379,074

Total Searches (as a % of Page Views) 171,474 797,981 1,941,754 3,186,737

Streams (000)

Streams/Total Uniques 10.1 16.6 21.7 22.4 Total Streams 1,534,921 5,967,725 12,003,384 17,393,449

Sell-Through / Inventory

In-Stream, incl. Embbeded (from Streams) 185,086 999,854 2,717,879 4,385,588

% In-Stream Inventory Sold 12.1% 16.8% 22.6% 25.2%

Banner / Ad-words (from Page Views) 1,152,503 5,703,871 13,222,563 21,365,134

Banner / Adwords Inventory Sold (per page) 1.3 1.7 1.7 1.7

Sponsored Search (from Searches) 31,000 191,649 697,049 1,274,695

% of Sponsored Search Inventory Sold 18.1% 24.0% 35.9% 40.0%

CPMs / Unit Prices

In-Stream CPMs (excl rev share) * 15.24$ 18.51$ 17.37$ 16.28$

Banner / Ad-words CPMs 0.74$ 0.79$ 0.85$ 0.79$

Sponsored Search CPMs 17.29$ 19.51$ 21.93$ 22.00$

Revenue (000)

In-Stream Revenue 1,586$ 11,800$ 37,339$ 58,311$

Banner / Ad-words Revenue 848$ 4,490$ 11,218$ 16,875$

Sponsored Search Revenue 536$ 3,740$ 15,285$ 28,044$

Total Revenue 2,969$ 20,030$ 63,841$ 103,230$

Revenue by Territory , including Video and Banner / Adwords (000)

North America Revenue 1,495$ 8,996$ 25,833$ 42,260$

Asia Revenue 145$ 964$ 2,871$ 4,350$

Western Europe Revenue 236$ 1,655$ 4,921$ 7,913$

ROW Revenue 28$ 202$ 645$ 1,051$

page 10

Market Support for Grouper Revenue Model

• Grouper will derive advertising revenue through three distinct business models– In-stream video ads– Banners and ad-words on the Grouper.com website– Sponsored searches

• Recent deals validate the overall potential for advertising associated with both user generate video and social networking sites

– Google / MySpace / Newscorp – Google will pay Fox Interactive Media $900M to provide search and advertising for Fox Interactive sites

– Google / MTV – Google agrees to distribute video clips from MTV Networks over the AdSense network

• Market has demonstrated willingness to pay premium CPMs for streaming video ads– Sony experience, independent analysts and industry experts have validated current

online video CPMs to be approximately $20 to $30 (1)

– In-line with traditional TV CPMs and positioned to benefit from growth of online advertising spend

– Grouper model conservatively assumes CPMs to be from $12.50 to $16.30

(1) Josh Bernoff, Forrester Research; Allie Savarino, SVP World of Worldwide Marketing, Unicast; Jeff Lanctot, VP of Media Buying, Avenue A Razorfish.

page 11

Google Strikes $900M Advertising Search Deal With MySpace and Fox Interactive Media Sites

Deal SpecificsDeal Specifics

Google Inc. will provide search and advertising for News Corp.'s MySpace and other Fox Interactive Media sites

Google will pay at least $900 million in advertising revenue to News Corp. over the next four years in an all-cash deal, provided traffic on the sites reaches an undisclosed threshold

Google will install its search boxes and keyword-driven ads

Google also receives the right to sell directly any display ads not sold by Fox

Google Inc. will provide search and advertising for News Corp.'s MySpace and other Fox Interactive Media sites

Google will pay at least $900 million in advertising revenue to News Corp. over the next four years in an all-cash deal, provided traffic on the sites reaches an undisclosed threshold

Google will install its search boxes and keyword-driven ads

Google also receives the right to sell directly any display ads not sold by Fox

ViewsViews

Analysts estimate that the deal could bring Google revenue (net of the $900 million paid to News Corp) of anywhere from $50 million to $200 million

"Google needed to win this deal to lock up the last remaining large and fast growing piece of traffic on the Web today. One thing is certain: Yahoo and MSN would have loved to sign News Corp., but could not make sense of a $900 million guarantee.“ – Jordan Rohan, RBC, August 8, 2006

"While we have highlighted the potential opportunity for Google on the display side for some time, we feel that Google has made limited progress on this front. We applaud this deal as an example of how Google can leverage its relationships and technology to grow an additional revenue stream and monetization models.“ – Benjamin Schachter, UBS, August 8, 2006

Analysts estimate that the deal could bring Google revenue (net of the $900 million paid to News Corp) of anywhere from $50 million to $200 million

"Google needed to win this deal to lock up the last remaining large and fast growing piece of traffic on the Web today. One thing is certain: Yahoo and MSN would have loved to sign News Corp., but could not make sense of a $900 million guarantee.“ – Jordan Rohan, RBC, August 8, 2006

"While we have highlighted the potential opportunity for Google on the display side for some time, we feel that Google has made limited progress on this front. We applaud this deal as an example of how Google can leverage its relationships and technology to grow an additional revenue stream and monetization models.“ – Benjamin Schachter, UBS, August 8, 2006

page 12

The Google Deal Implies Strong Revenue Potential for Grouper

Deal MetricsDeal Metrics Implied Grouper Revenue OpportunityImplied Grouper Revenue Opportunity

Total Deal Revenue $900 MM

Average Annual Revenue $225 MM

MySpace Uniques 54.1 MM

Revenue Per Unique 4.16$

( $ millions)

Unique Users (Avg)

Implied Banner/Ad-

wordsBanner/Ad-

words In-Stream

Sponsored Search TOTAL

FY2006 8.8 $36.6 $1.2 $1.4 $0.5 $3.1

FY2007 29.0 $120.6 $5.7 $10.1 $2.9 $18.6

FY2009 45.6 $189.6 $12.8 $28.3 $10.5 $51.5

FY2009 65.1 $270.7 $21.0 $43.0 $19.5 $83.5

Projected Revenue

page 13

Viacom Aggressively Pursues Stronger Position in Digital Space

Viacom’s MTV Networks Announces Intent to Acquire Atom Entertainment for $200MM

Viacom’s MTV Networks Announces Intent to Acquire Atom Entertainment for $200MM

Viacom announced on 8/09/2006 that they had signed a definitive agreement to acquire Atom Entertainment

The acquisition would serve to further strengthen Viacom’s presence in digital media

Atom Entertainment is a marketer and distributor of broadband entertainment; formed by the 2001 merger of Internet Shockwave.comand AtomFilms

In 2005, Atom acquired the online games portal AddictingGames and the online video site AddictingClips (1.7MM unique users)

This deal would follow acquisitions of other online entities, including: NeoPets, XFire, Y2M, GameTrailers.com and IFILM

Viacom announced on 8/09/2006 that they had signed a definitive agreement to acquire Atom Entertainment

The acquisition would serve to further strengthen Viacom’s presence in digital media

Atom Entertainment is a marketer and distributor of broadband entertainment; formed by the 2001 merger of Internet Shockwave.comand AtomFilms

In 2005, Atom acquired the online games portal AddictingGames and the online video site AddictingClips (1.7MM unique users)

This deal would follow acquisitions of other online entities, including: NeoPets, XFire, Y2M, GameTrailers.com and IFILM

Viacom Considers Bid for BeboViacom Considers Bid for Bebo

According to the Financial Times, Viacom is potentially evaluating an acquisition of Bebo, a social network similar to MySpace

Bebo is the top site in Ireland and the UK

25MM unique users worldwide as compared to 90MM for MySpace

It is rumored that BT (the telecom group) had offered £300MM for Bebo

Bebo reportedly looking for greater than $1BN

According to the Financial Times, Viacom is potentially evaluating an acquisition of Bebo, a social network similar to MySpace

Bebo is the top site in Ireland and the UK

25MM unique users worldwide as compared to 90MM for MySpace

It is rumored that BT (the telecom group) had offered £300MM for Bebo

Bebo reportedly looking for greater than $1BN

page 14

Blue Chip Companies Are Advertising on Traditional and User-Generated Video Sites

AT&T, Nike, Neutrogena, Above The Influence, Pepsi, Kohl's, Clairol, Neutrogena, Target

Snickers, Altoids, Playstation, Virgin Mobile (w/text message contest), Axe, Nike, Puma

Intel, Oscar Meyer, Hershey's, Moviefone, Kraft, I Can't Believe It's Not Butter

Suave, Tylenol, Zyrtec, Disney, Pampers, Swiffer, Bounty, Mr. Clean

Dr. Pepper, Chili's, Superpages, Neosporin, Mazda, Benadryl, Lipitor, State Farm

Dodge, Honda, Air Force, Toyota, FOX Searchlight, AllTel

Ads by Google, E-Bay, True.com, classmates.com, heavy.com, Blockbuster Online

Sierra Mist, University of Phoenix Online, Cingular, Chili's, Universal Studios

Traditional Advertisers AdvertisersUser Generated

page 15

Online Video CPMs Are Currently $20-$30, In-line with Traditional TV CPMs and Positioned to Benefit From Growth of Online Ad Spend

Industry CommentaryIndustry Commentary

• Josh Bernoff, Forrester analyst

“…the driving force of the online video market is advertising…advertisers are paying $25 per thousand users who see their online commercials, more than they pay for network television”

• Allie Savarino, SVP World of Worldwide Marketing at Unicast

“…while rich media ads on average cost around $10-20 on a cost per thousand basis the video commercials cost around $25-30 for the same rate… a comparable cost with advertising on a US television network to the same number of television viewers for a 15- to 30-second spot.”

• Jeff Lanctot, VP of media buying at Avenue A Razorfish

“Advertisers are now paying about $20 to $30 a CPM for a 15-second spot that pre-rolls a broadband video… one reason advertisers are warming up to Web broadband content is because they can interact with consumers.”

• Trends in Sony Ad Sales

Online video ad components of deals are being priced at CPMs of roughly $30.00. Sony’s advertising partners are demonstrating strong demand for cross-platform packaged deals.

page 16

Television CPMs Have Grown to Reach $23.50, Initial Online Video CPMs Are At a Similar Level

$23.50$22.30$20.30$19.00$19.20$18.10$16.60

$14.60

$0.00

$5.00

$10.00

$15.00

$20.00

$25.00

$30.00

1998 1999 2000 2001 2002 2003 2004 2005

CBS ABC NBC FOX WB Average CPM

Source: Nielson Media Research.

CPM Pricing TrendsCPM Pricing Trends

5 yr CAGR: 5.4%

page 17

Media spending does not yetreflect consumption

Advertising dollars are shifting online to address the current gap

2003-’05 US Advertising CAGR

Contribution to Growth

Television:

TV Stations 1.5% 2%

Cable Networks 15.6% 19%

Cable MSOs 8.1% 3%

CBS Net, FOX Net 5.8% 9%

Total Television 7.0% 34%

Magazines 8.9% 5%

Newspapers 3.4% 11%

Radio 0.2% 0%

Outdoor 7.1% 5%

Online 50.4% 45%

Total 8.4% 100%

SUMMARY

Traditional Media 5.1% 55%

Online 50.4% 45%

Total 8.4% 100%

Consumer Time is Shifting Online and Drove 50% Annual Growth in Online Ad Spending Over the Last Three Years

Network TV20%

Cable TV25%

Radio27%

Other11%

Magazines4%

Newspaper5%

Games2%

Internet6%

Network TV24%

Cable TV19%

Radio29%

Newspaper6%

Magazines4%

Other14%

Internet2%

Games2%

1999

2005

page 18

Internet Advertising is Forecast to Grow 22% Annually through 2009, Reaching 25% of the $115BN Domestic Advertising Market

36.6 40.0 39.6 43.2 44.0 47.2 48.2 52.2 53.3

14.214.7 16.3

18.9 21.724.3 26.9

29.733.4

7.16.0 7.3

9.612.6

16.120.0

24.128.2

$0

$20

$40

$60

$80

$100

$120

$140

2001 2002 2003 2004 2005 2006 2007 2008 2009

Broadcast Netw orks Cable Netw orks Online

US

$ (

Bil

lio

ns

)

Overall ’05 – ’09 Projected CAGR: 10.1%

Broadcast ’05 – ’09 Projected CAGR: 4.9%

Cable/Sat ’05 – ’09 Projected CAGR: 11.4%

Online ’05 – ’09 Projected CAGR: 22.3%

TV

& O

nli

ne

Ad

ve

rtis

ing

Sp

en

d

Source: Veronis Suhler, 2005 Note: Cable/satellite growth expected to be driven by increasing audience share of prime time ratings, ability to target within specific demographic groups, improved sales system; broadcast growth expected to be driven by sustained ratings and ad rates, continued appeal as optimal means to reach large audiences

Online %: 12% 10% 12% 13% 16% 18% 21% 23% 25%

57.9 60.7 63.271.7

78.3

87.695.1

106.0114.9

page 19

Using Yahoo! as a proxy for the global Internet, both traffic and CPMs continue to rise as the Internet becomes a significant play for advertisers.

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

450,000

500,000

Q1:03 Q2:03 Q3:03 Q4:03 Q1:04 Q2:04 Q3:04 Q4:04 Q1:05 Q2:05 Q3:05 Q4:05

Ya

ho

o G

lob

al M

on

thly

Un

iqu

e V

isito

rs (

MM

)

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

Avg

. Mkt

g. S

erv

. Re

ven

ue

/ 1

,00

0 P

ag

es

(RP

M)

Global Monthly Unique Visitors (000's) (a) Avg. Mktg. Serv. Revenue / 1,000 Pages (RPM)Line 3 Line 4Line 5

Growth in Demand for Online Advertising is Driving 25% Annual Growth in Banner Ad CPMs

2003 Avg CPM $1.64

2004 Avg CPM $2.33

2005 Avg CPM $2.642 yr CAGR: 25.6%

page 21

SPE Base Case – COGS Drivers and Assumptions

Cost AssumptionsCost Assumptions

FY2006 FY2007 FY2008 FY2009

Streaming Bandwidth

Bandwidth cost per MB per Month 50.00$ Cost of Streaming 1 Video 0.0009$ Cost of Streaming One Page 0.0001$

Total Streams (000) 1,534,921 5,967,725 12,003,384 17,543,578 Streaming Costs 1,386$ 5,388$ 10,836$ 15,838$

Total Page Views (000) 899,709 3,385,164 7,621,476 12,506,356 Page View Costs 81$ 306$ 688$ 1,129$

Payroll

Headcount 50 67 77 83

Cost per Head 107$ 140$ 142$ 149$ Total Payroll 5,357$ 9,409$ 10,953$ 12,340$

Marketing

% of Revenue 52.9% 25.8% 9.9% 9.5%Marketing Expense 1,625$ 4,796$ 5,112$ 7,899$

Infrastructure Technology

% of Revenue 54.4% 11.1% 6.9% 5.7%Infrastructure Expense (Total) 1,669$ 2,072$ 3,537$ 4,740$

Cost DriversCost Drivers

Bandwidth cost per meg per month 50.00$ MpbsPer day cost 1.67$ Per hour cost 0.07$ Peak to Average (efficiency) 2.0 Calculated Cost per Hour 0.14$

Bitrate for Video 260 KbpsAverage Video Preview 1.5 min# of Videos Played per hour 40# of Vids Played per hr per meg (max usage) 154

• COGS based on 95th percentile pricing with current vendor (GNI), in line with management case

– Bandwidth cost of $50 per meg per month does not assume packaged pricing (negotiated volume discounts)

– Does not assume bandwidth price to decrease over time, although this will likely be the case

– Does not include reduced bandwidth costs associated with the use of P2P file sharing

page 23

Comparison of Operating Costs Drivers and Assumptions

• Operating expense in the SPE base case included adjustments to the Grouper management case

– SPE projected payroll costs reflect increase of 25% to management projections to account for higher salaries and benefits

– Marketing costs are adjusted to reflect the greater of 10% of calendar revenue or $5M

– Initial infrastructure spend increased an additional $1M in first calendar year and $2M each subsequent calendar year

– “Other” cost contingency was added at 2.5% of revenue

Management CaseManagement Case SPE Projected Base CaseSPE Projected Base Case

FY2006 FY2007 FY2008 FY2009

Payroll

Headcount 50 67 77 83

Cost per Head 107$ 140$ 142$ 149$ Total Payroll 5,357$ 9,409$ 10,953$ 12,340$

Marketing

% of Revenue 52.9% 25.8% 9.9% 9.5%Marketing Expense 1,625$ 4,796$ 5,112$ 7,899$

Infrastructure Technology

% of Revenue 54.4% 11.1% 6.9% 5.7%Infrastructure Expense (Total) 1,669$ 2,072$ 3,537$ 4,740$

FY2006 FY2007 FY2008 FY2009

Payroll

Headcount 50 67 82 90

Cost per Head 86$ 112$ 111$ 119$ Total Payroll 4,286$ 7,527$ 9,080$ 10,718$

Marketing

% of Revenue 8.4% 5.5% 6.0% 7.2%Marketing Expense 248$ 1,100$ 3,849$ 7,387$

Infrastructure Technology

% of Revenue 22.5% 4.1% 1.7% 1.2%Infrastructure Expense (Total) 669$ 822$ 1,104$ 1,200$

page 24

Payroll Assumptions – SPE Base Case

Variations to Management Case

• Maintains salaries for key management consistent with Grouper management model

• Assumes additional 25% cushion applied to total overhead numbers

• Lower revenue triggered less need for sales force and advertising support

• Assumes smaller dedicated sales force based on ability to leverage SPE ad sales

* Not yet hired.

FY 2006 FY2007 FY2008 FY2009

Total Revenue $3,069,685 $18,597,766 $51,498,524 $83,514,559

Total COGS $1,681,794 $6,994,978 $15,129,335 $22,813,017

Gross Profit $1,387,890 $11,602,788 $36,369,189 $60,701,542

Marketing $1,625,000 $4,795,813 $5,112,294 $7,899,421G&A $1,506,382 $2,082,083 $2,392,610 $2,728,478Internet, Hardware, Software $1,669,000 $2,072,000 $3,536,913 $4,739,652Other $76,742 $464,944 $1,287,463 $2,087,864

Payroll and Headcount $5,357,325 $9,408,891 $10,952,580 $12,340,186

Total Operating Expenses $10,234,450 $18,823,731 $23,281,860 $29,795,602

Operating Profit ($8,846,559) ($7,220,943) $13,087,328 $30,905,941

Amortization (1) ($1,428,571) ($2,857,143) ($2,857,143) ($2,857,143)

EBIT ($10,275,131) ($10,078,086) $10,230,186 $28,048,798

FY 2006 FY2007 FY2008 FY2009

Payroll and Headcount $5,357,325 $9,408,891 $10,952,580 $12,340,186

Felser #Salary $110,000 $119,831 $125,823 $127,339 $127,339Tax and Benefits $19,173 $20,132 $20,374 $20,374Total $139,004 $145,954 $147,713 $147,713

Samuel #Salary $110,000 $119,831 $125,823 $127,339 $127,339Tax and Benefits $19,173 $20,132 $20,374 $20,374Total $139,004 $145,954 $147,713 $147,713

Aviv #Salary $130,000 $141,619 $148,700 $150,491 $150,491Tax and Benefits $22,659 $23,792 $24,079 $24,079Total $164,278 $172,492 $174,570 $174,570

Sitrin #Salary $100,000 $108,938 $114,384 $115,763 $115,763Tax and Benefits $17,430 $18,302 $18,522 $18,522Total $126,368 $132,686 $134,285 $134,285

Shambroom #Salary $140,000 $152,513 $160,138 $162,068 $162,068Tax and Benefits $24,402 $25,622 $25,931 $25,931Total $176,915 $185,760 $187,998 $187,998

Amen * 0Salary $0 $0 $0 $0Tax and Benefits $0 $0 $0 $0Total $0 $0 $0 $0

StaffSalary Monthly $8,204 $8,730 $8,958 $8,987Average Months / Year 8.27 10.74 10.65 11.17 Number of Workers 45 62 72 78

Salary $3,051,976 $5,814,022 $6,870,504 $7,827,474Tax and Benefits $488,316 $930,244 $1,099,281 $1,252,396Total $3,540,292 $6,744,266 $7,969,785 $9,079,870

TOTAL $4,285,860 $7,527,112 $8,762,064 $9,872,149

SPE Adjsutment (25%) $1,071,465 $1,881,778 $2,190,516 $2,468,037

SPE Base Case Model $5,357,325 $9,408,891 $10,952,580 $12,340,186

page 26

Valuation Based on SPE Base Case

Valuation ParametersValuation Parameters Discounted Cash FlowDiscounted Cash Flow

7.0x 8.0x 9.0x 10.0x

$216 $247 $278 $309

Discount Rate Valuation11.5% $158 $178 $198 $21814.0% 145 163 182 20016.5% 133 150 166 18319.0% 122 137 153 16821.5% 112 126 141 155

Terminal EBIT Multiple

Terminal Value

(1) EBIT reflects operating profit less estimated amortization of technology/software assets totaling $20MM over 7 years. Initial estimate requires third party review for final figures. Assumes transaction close at 9/30/2006.

(2) 4 year discounted pre-tax cash flow analysis (2006-2009) performed with a discount rate of 16.5% (in-line with SPE’s normal rate); terminal EBIT multiple of 8.0x.(3) Total consideration includes $52.5m at closing; $12.5m contingent on performance and paid over the course of 2007 and 2008. (4) Deepwater mark represents cumulative cash position.

(millions) FY 2006 FY2007 FY2008 FY2009

Total Revenue 3.07$ 18.60$ 51.50$ 83.51$

Total COGS 1.68$ 6.99$ 15.13$ 22.81$

Gross Profit 1.39$ 11.60$ 36.37$ 60.70$

Total Operating Expenses 10.23$ 18.82$ 23.28$ 29.80$

Operating Profit (8.85)$ (7.22)$ 13.09$ 30.91$

Amortization (1) (1.43)$ (2.86)$ (2.86)$ (2.86)$

EBIT (10.28)$ (10.08)$ 10.23$ 28.05$

Impact on SPE

DCF Value (2) 149.62$

Total Consideration (3) (65.00)$

NPV 88.99$

IRR 47%

Deepwater Mark (4) Mar-08 (76.36)$

page 28

Grouper Actual Monthly Performance Year-to-Date

(millions) Jan-06 Feb-06 Mar-06 Apr-06 May-06 Jun-06

Operating Metrics

End of Period Uniques - - 0.8 4.5 7.0 6.4 Unique User Growth NM NM NM 455.7% 56.3% -8.7%

Financial Metrics

Revenue $0.00 $0.00 $0.00 $0.00 $0.00 $0.00

COGS $0.00 $0.00 $0.00 $0.02 $0.03 $0.03

Gross Profit ($0.00) ($0.00) ($0.00) ($0.02) ($0.03) ($0.03)Gross Margin NM NM NM NM NM NM

Payroll $0.20 $0.20 $0.20 $0.20 $0.21 $0.26Marketing $0.01 $0.01 $0.01 $0.01 $0.01 $0.01G&A $0.04 $0.08 $0.07 $0.07 $0.09 $0.24

Total Operating Expenses $0.24 $0.29 $0.28 $0.28 $0.31 $0.51OpEx as % of Revenue NM NM NM NM NM NM

Operating Profit ($0.24) ($0.29) ($0.28) ($0.30) ($0.34) ($0.54)

(1)

(1) May to June unique user decrease due to change in Yahoo! search engine algorithm.

page 29

Grouper Networks – Management Projections

Note: Figures provided by company were adjusted to Sony’s fiscal year-end.

(millions) FY 2006 FY2007 FY2008 FY2009

User Activity

End of Period Uniques 20.9 37.2 53.9 72.5

Page Views 899.7 3,385.2 7,621.5 12,379.1

Total Searches 171.5 798.0 1,941.8 3,186.7

Total Streams 1,534.9 5,967.7 12,003.4 17,393.4 FY 2006 FY2007 FY2008 FY2009

P&L Performance

In-Stream 1.59$ 11.80$ 37.34$ 58.31$ 53.4% 58.9% 58.5% 56.5%Banner / Ad-words 0.85 4.49 11.22 16.87 28.5% 22.4% 17.6% 16.3%Sponsored Search 0.54 3.74 15.28 28.04 18.1% 18.7% 23.9% 27.2%

Total Revenue 2.97$ 20.03$ 63.84$ 103.23$ 100.0% 100.0% 100.0% 100.0%

Sales Commission 0.21$ 1.40$ 4.47$ 7.23$ 7.0% 7.0% 7.0% 7.0%Video Streaming 1.39 5.39 10.84 15.70 46.7% 26.9% 17.0% 15.2%Page View Bandwidth 0.08 0.31 0.69 1.12 2.7% 1.5% 1.1% 1.1%

Total COGS 1.67$ 7.10$ 15.99$ 24.05$ 56.4% 35.4% 25.1% 23.3%

Gross Profit 1.29$ 12.93$ 47.85$ 79.18$ 43.6% 64.6% 74.9% 76.7%

Payroll 4.29$ 7.53$ 9.08$ 10.72$ 144.3% 37.6% 14.2% 10.4%Marketing 0.25 1.10 3.85 7.39 8.4% 5.5% 6.0% 7.2%G&A 1.51 2.08 2.55 2.99 50.7% 10.4% 4.0% 2.9%Internet, Hardware, Software 0.67 0.82 1.10 1.20 22.5% 4.1% 1.7% 1.2%Other - - - - 0.0% 0.0% 0.0% 0.0%

Total Operating Expenses 6.71$ 11.53$ 16.58$ 22.29$ 226.0% 57.6% 26.0% 21.6%

Operating Profit (5.42)$ 1.40$ 31.26$ 56.89$ NM 7.0% 49.0% 55.1%

Percent of Total Revenue

page 30

Management Projections – Assumptions

Revenue Drivers and AssumptionsRevenue Drivers and Assumptions Cost Drivers and AssumptionsCost Drivers and Assumptions

* Represents gross In-Stream CPM, including revenue share to partners.

FY2006 FY2007 FY2008 FY2009

Unique Users (000)

Total Unique Users 20,868 37,211 53,905 72,491

Page Views (000)

Grouper.com PVs/Unique 15.9 25.7 32.9 33.6 Total Page Views 899,709 3,385,164 7,621,476 12,379,074

Total Searches (as a % of Page Views) 171,474 797,981 1,941,754 3,186,737

Streams (000)

Streams/Total Uniques 10.1 16.6 21.7 22.4 Total Streams 1,534,921 5,967,725 12,003,384 17,393,449

Sell-Through / Inventory

In-Stream, incl. Embbeded (from Streams) 185,086 999,854 2,717,879 4,385,588

% In-Stream Inventory Sold 12.1% 16.8% 22.6% 25.2%

Banner / Ad-words (from Page Views) 1,152,503 5,703,871 13,222,563 21,365,134

Banner / Adwords Inventory Sold (per page) 1.3 1.7 1.7 1.7

Sponsored Search (from Searches) 31,000 191,649 697,049 1,274,695

% of Sponsored Search Inventory Sold 18.1% 24.0% 35.9% 40.0%

CPMs / Unit Prices

In-Stream CPMs (excl rev share) * 15.24$ 18.51$ 17.37$ 16.28$

Banner / Ad-words CPMs 0.74$ 0.79$ 0.85$ 0.79$

Sponsored Search CPMs 17.29$ 19.51$ 21.93$ 22.00$

Revenue (000)

In-Stream Revenue 1,586$ 11,800$ 37,339$ 58,311$

Banner / Ad-words Revenue 848$ 4,490$ 11,218$ 16,875$

Sponsored Search Revenue 536$ 3,740$ 15,285$ 28,044$

Total Revenue 2,969$ 20,030$ 63,841$ 103,230$

Revenue by Territory , including Video and Banner / Adwords (000)

North America Revenue 1,495$ 8,996$ 25,833$ 42,260$

Asia Revenue 145$ 964$ 2,871$ 4,350$

Western Europe Revenue 236$ 1,655$ 4,921$ 7,913$

ROW Revenue 28$ 202$ 645$ 1,051$

FY2006 FY2007 FY2008 FY2009

Streaming Bandwidth

Bandwidth cost per MB per Month 50.00$ Cost of Streaming 1 Video 0.0009$ Cost of Streaming One Page 0.0001$

Total Streams (000) 1,534,921 5,967,725 12,003,384 17,393,449 Streaming Costs 1,386$ 5,388$ 10,836$ 15,702$

Total Page Views (000) 899,709 3,385,164 7,621,476 12,379,074 Page View Costs 81$ 306$ 688$ 1,118$

Payroll

Headcount 50 67 82 90

Cost per Head 86$ 112$ 111$ 119$ Total Payroll 4,286$ 7,527$ 9,080$ 10,718$

Marketing

% of Revenue 8.4% 5.5% 6.0% 7.2%Marketing Expense 248$ 1,100$ 3,849$ 7,387$

Infrastructure Technology

% of Revenue 22.5% 4.1% 1.7% 1.2%Infrastructure Expense (Total) 669$ 822$ 1,104$ 1,200$

page 31

(1) EBIT reflects operating profit less estimated amortization of technology/software assets totaling $20MM over 7 years. Initial estimate requires third party review for final figures. Assumes transaction close at 9/30/2006.

(2) 4 year discounted pre-tax cash flow analysis (2006-2009) performed with a discount rate of 16.5% and terminal EBIT multiple of 8.0x.(3) Total consideration includes $52.5m at closing; $12.5m contingent on performance and paid over the course of 2007 and 2008. (4) Deepwater mark represents cumulative cash position.

Comparison of Sensitivities on the Operating Model

Upside Case(above management projections)

Upside Case(above management projections)

DownsideDownsideBase Case (below management projections)

Base Case (below management projections)

Increased unique users to 125% of management forecast

Assumes higher CPMs Increased total expenses by 5-10%

of revenue

Increased unique users to 125% of management forecast

Assumes higher CPMs Increased total expenses by 5-10%

of revenue

Maintain management projections for unique user base

Assumes average CPMs Increased total expenses by 5-10%

of revenue

Maintain management projections for unique user base

Assumes average CPMs Increased total expenses by 5-10%

of revenue

Decreased unique users to roughly equal 80% of management forecast

Assumes lower CPMs Increased total expenses by 5-10%

of revenue

Decreased unique users to roughly equal 80% of management forecast

Assumes lower CPMs Increased total expenses by 5-10%

of revenue

A B C

(millions)

Operating Statistics

End of Period Uniques

Page Views

Total Searches

Total Streams

Financial Performance

Total Revenue

Total COGS

Gross Profit

Total Operating Expenses

Operating Profit

Amortization (1)

EBIT

DCF Value (2) 336.77$

Total Consideration (3) (65.00)$

Deepwater Mark (4) Dec-07 (69.25)$

Impact on SPE

DCF Value (2) 90.37$

Total Consideration (3) (65.00)$

Deepwater Mark (4) Sep-08 (81.91)$

Impact on SPE

DCF Value (2) 149.62$

Total Consideration (3) (65.00)$

Deepwater Mark (4) Mar-08 (76.36)$

Impact on SPE

FY2006 FY2007 FY2008 FY2009

20.9 37.2 53.9 76.3

899.7 3,385.2 7,621.5 12,506.4

171.5 798.0 1,941.8 3,251.7

1,534.9 5,967.7 12,003.4 17,543.6

3.07$ 18.60$ 51.50$ 83.51$

1.68$ 6.99$ 15.13$ 22.81$

1.39$ 11.60$ 36.37$ 60.70$

10.23$ 18.82$ 23.28$ 29.80$

(8.85)$ (7.22)$ 13.09$ 30.91$

(1.43)$ (2.86)$ (2.86)$ (2.86)$

(10.28)$ (10.08)$ 10.23$ 28.05$

FY2006 FY2007 FY2008 FY2009

25.6 46.2 67.2 95.4

1,094.2 4,348.5 9,790.3 16,065.2

213.6 1,025.1 2,494.3 4,177.0

1,816.3 7,428.8 15,011.2 22,007.6

4.77$ 29.71$ 83.12$ 136.89$

2.07$ 9.18$ 20.25$ 30.90$

2.70$ 20.53$ 62.87$ 105.99$

10.37$ 20.13$ 30.14$ 41.90$

(7.68)$ 0.41$ 32.73$ 64.09$

(1.43)$ (2.86)$ (2.86)$ (2.86)$

(9.10)$ (2.45)$ 29.87$ 61.24$

FY2006 FY2007 FY2008 FY2009

16.2 29.3 42.5 60.1

754.5 2,677.2 6,027.5 9,890.7

140.0 631.1 1,535.6 2,571.6

1,250.7 4,693.4 9,459.4 13,831.0

2.24$ 13.75$ 38.97$ 63.57$

1.35$ 5.44$ 11.81$ 17.83$

0.88$ 8.30$ 27.16$ 45.74$

10.12$ 18.30$ 20.99$ 25.18$

(9.24)$ (10.00)$ 6.17$ 20.57$

(1.43)$ (2.86)$ (2.86)$ (2.86)$

(10.66)$ (12.86)$ 3.31$ 17.71$

page 32

SPE Projections – Upside Case A

(millions) FY 2006 FY2007 FY2008 FY2009

User Activity

End of Period Uniques 25.6 46.2 67.2 95.4

Page Views 1,094.2 4,348.5 9,790.3 16,065.2

Total Searches 213.6 1,025.1 2,494.3 4,177.0

Total Streams 1,816.3 7,428.8 15,011.2 22,007.6 FY 2006 FY2007 FY2008 FY2009

P&L Performance

In-Stream 2.12$ 15.13$ 43.26$ 67.85$ 44.4% 50.9% 52.0% 49.6%Banner / Ad-words 1.95 10.15 23.75 38.97 40.8% 34.2% 28.6% 28.5%Sponsored Search 0.71 4.43 16.12 30.07 14.8% 14.9% 19.4% 22.0%

Total Revenue 4.77$ 29.71$ 83.12$ 136.89$ 100.0% 100.0% 100.0% 100.0%

Sales Commission 0.33$ 2.08$ 5.82$ 9.58$ 7.0% 7.0% 7.0% 7.0%Video Streaming 1.64 6.71 13.55 19.87 34.4% 22.6% 16.3% 14.5%Page View Bandwidth 0.10 0.39 0.88 1.45 2.1% 1.3% 1.1% 1.1%

Total COGS 2.07$ 9.18$ 20.25$ 30.90$ 43.4% 30.9% 24.4% 22.6%

Gross Profit 2.70$ 20.53$ 62.87$ 105.99$ 56.6% 69.1% 75.6% 77.4%

Total Operating Expenses 10.37$ 20.13$ 30.14$ 41.90$ 215.0% 65.2% 33.8% 28.1%

Operating Profit (7.68)$ 0.41$ 32.73$ 64.09$ NM 1.4% 39.4% 46.8%

Percent of Total Revenue

page 33

SPE Projections – Upside Case Assumptions

Revenue Drivers and AssumptionsRevenue Drivers and Assumptions Cost Drivers and AssumptionsCost Drivers and Assumptions

A

* Represents gross In-Stream CPM, including revenue share to partners.

Discounted Cash FlowDiscounted Cash Flow

FY2006 FY2007 FY2008 FY2009

Streaming Bandwidth

Bandwidth cost per MB per Month 50.00$ Cost of Streaming 1 Video 0.0009$ Cost of Streaming One Page 0.0001$

Total Streams (000) 1,816,333 7,428,829 15,011,176 22,007,554 Streaming Costs 1,640$ 6,707$ 13,552$ 19,868$

Total Page Views (000) 1,094,236 4,348,469 9,790,294 16,065,247 Page View Costs 99$ 393$ 884$ 1,450$

Payroll

Headcount 50 67 88 98

Cost per Head 107$ 140$ 137$ 148$ Total Payroll 5,357$ 9,409$ 12,046$ 14,535$

Marketing

% of Revenue 34.1% 18.3% 9.9% 9.4%Marketing Expense 1,625$ 5,425$ 8,255$ 12,920$

Infrastructure Technology

% of Revenue 37.0% 8.3% 6.0% 5.7%Infrastructure Expense (Total) 1,765$ 2,469$ 4,953$ 7,752$

7.0x 8.0x 9.0x 10.0x

$449 $513 $577 $641

Discount Rate Valuation11.5% $356 $398 $439 $48114.0% 328 366 404 44216.5% 302 337 372 40619.0% 279 311 343 37521.5% 258 287 317 346

Terminal EBIT Multiple

Terminal Value

FY2006 FY2007 FY2008 FY2009

Unique Users (000)

Total Unique Users 25,571 46,224 67,170 95,394

Page Views (000)

Grouper.com PVs/Unique 16.3 25.7 32.9 33.5 Total Page Views 1,094,236 4,348,469 9,790,294 16,065,247

Total Searches (as a % of Page Views) 213,599 1,025,060 2,494,312 4,176,964

Streams (000)

Streams/Total Uniques 10.4 16.7 21.8 22.5 Total Streams 1,816,333 7,428,829 15,011,176 22,007,554

Sell-Through / Inventory

In-Stream, incl. Embbeded (from Streams) 222,634 1,243,001 3,392,017 5,566,636

% In-Stream Inventory Sold 12.3% 16.7% 22.6% 25.3%

Banner / Ad-words (from Page Views) 1,439,937 7,327,002 16,985,263 27,892,321

Banner / Adwords Inventory Sold (per page) 1.3 1.7 1.7 1.7

Sponsored Search (from Searches) 39,193 246,186 895,406 1,670,786

% of Sponsored Search Inventory Sold 18.3% 24.0% 35.9% 40.0%

CPMs / Unit Prices

In-Stream CPMs (excl rev share) * 17.56$ 19.74$ 16.59$ 15.39$

Banner / Ad-words CPMs 1.35$ 1.39$ 1.40$ 1.40$

Sponsored Search CPMs 18.00$ 18.00$ 18.00$ 18.00$

Revenue (000)

In-Stream Revenue 2,118$ 15,127$ 43,260$ 67,845$

Banner / Ad-words Revenue 1,946$ 10,154$ 23,745$ 38,974$

Sponsored Search Revenue 705$ 4,431$ 16,117$ 30,074$

Total Revenue 4,770$ 29,712$ 83,122$ 136,894$

Revenue by Territory , including Video and Banner / Adwords (000)

North America Revenue 2,522$ 13,970$ 34,842$ 57,699$

Asia Revenue 275$ 1,760$ 4,559$ 7,621$

Western Europe Revenue 436$ 2,836$ 7,553$ 12,681$

ROW Revenue 64$ 440$ 1,207$ 2,043$

page 34

SPE Projections – Base Case B

(1) EBIT reflects operating profit less estimated amortization of technology/software assets totaling $20MM over 7 years. Initial estimate requires third party review for final figures. Assumes transaction close at 9/30/2006.

(2) 4 year discounted pre-tax cash flow analysis (2006-2009) performed with a discount rate of 16.5% (in-line with SPE’s normal rate); terminal EBIT multiple of 8.0x.(3) Total consideration includes $52.5m at closing; $12.5m contingent on performance and paid over the course of 2007 and 2008. (4) Deepwater mark represents cumulative cash position.

(millions) FY 2006 FY2007 FY2008 FY2009

User Activity

End of Period Uniques 20.9 37.2 53.9 76.3

Page Views 899.7 3,385.2 7,621.5 12,506.4

Total Searches 171.5 798.0 1,941.8 3,251.7

Total Streams 1,534.9 5,967.7 12,003.4 17,543.6 FY 2006 FY2007 FY2008 FY2009

P&L Performance

In-Stream 1.42$ 10.06$ 28.25$ 43.02$ 46.4% 54.1% 54.8% 51.5%Banner / Ad-words 1.18 5.66 12.80 20.99 38.5% 30.4% 24.8% 25.1%Sponsored Search 0.46 2.87 10.46 19.51 15.1% 15.5% 20.3% 23.4%

Total Revenue 3.07$ 18.60$ 51.50$ 83.51$ 100.00% 100.00% 100.00% 100.00%

Sales Commission 0.21$ 1.30$ 3.60$ 5.85$ 7.00% 7.00% 7.00% 7.00%Video Streaming 1.39 5.39 10.84 15.84 45.14% 28.97% 21.04% 18.96%Page View Bandwidth 0.08 0.31 0.69 1.13 2.65% 1.64% 1.34% 1.35%

Total COGS 1.68$ 6.99$ 15.13$ 22.81$ 54.79% 37.61% 29.38% 27.32%

Gross Profit 1.39$ 11.60$ 36.37$ 60.70$ 45.21% 62.39% 70.62% 72.68%

Total Operating Expenses 10.23$ 18.82$ 23.28$ 29.80$ 333.40% 101.22% 45.21% 35.68%

Operating Profit (8.85)$ (7.22)$ 13.09$ 30.91$ (288.19%) (38.83%) 25.41% 37.01%

Amortization (1) (1.43)$ (2.86)$ (2.86)$ (2.86)$ (46.54%) (15.36%) (5.55%) (3.42%)

EBIT (10.28)$ (10.08)$ 10.23$ 28.05$ (334.73%) (54.19%) 19.87% 33.59%

Impact on SPE

DCF Value (2) 149.62$

Total Consideration (3) (65.00)$

NPV 88.99$ (52.50)$ (6.25)$ (3.75)$ -$

IRR 47%

Deepwater Mark (4) Mar-08 (76.36)$ #####

Percent of Total Revenue

page 35

SPE Projections – Base Case Assumptions

Revenue Drivers and AssumptionsRevenue Drivers and Assumptions Cost Drivers and AssumptionsCost Drivers and Assumptions

B

* Represents gross In-Stream CPM, including revenue share to partners.

Discounted Cash FlowDiscounted Cash Flow

FY2006 FY2007 FY2008 FY2009

Streaming Bandwidth

Bandwidth cost per MB per Month 50.00$ Cost of Streaming 1 Video 0.0009$ Cost of Streaming One Page 0.0001$

Total Streams (000) 1,534,921 5,967,725 12,003,384 17,543,578 Streaming Costs 1,386$ 5,388$ 10,836$ 15,838$

Total Page Views (000) 899,709 3,385,164 7,621,476 12,506,356 Page View Costs 81$ 306$ 688$ 1,129$

Payroll

Headcount 50 67 77 83

Cost per Head 107$ 140$ 142$ 149$ Total Payroll 5,357$ 9,409$ 10,953$ 12,340$

Marketing

% of Revenue 52.9% 25.8% 9.9% 9.5%Marketing Expense 1,625$ 4,796$ 5,112$ 7,899$

Infrastructure Technology

% of Revenue 54.4% 11.1% 6.9% 5.7%Infrastructure Expense (Total) 1,669$ 2,072$ 3,537$ 4,740$

7.0x 8.0x 9.0x 10.0x

$216 $247 $278 $309

Discount Rate Valuation11.5% $158 $178 $198 $21814.0% 145 163 182 20016.5% 133 150 166 18319.0% 122 137 153 16821.5% 112 126 141 155

Terminal EBIT Multiple

Terminal Value

FY2006 FY2007 FY2008 FY2009

Unique Users (000)

Total Unique Users 20,868 37,211 53,905 76,309

Page Views (000)

Grouper.com PVs/Unique 15.9 25.7 32.9 33.5 Total Page Views 899,709 3,385,164 7,621,476 12,506,356

Total Searches (as a % of Page Views) 171,474 797,981 1,941,754 3,251,652

Streams (000)

Streams/Total Uniques 10.1 16.6 21.7 22.4 Total Streams 1,534,921 5,967,725 12,003,384 17,543,578

Sell-Through / Inventory

In-Stream, incl. Embbeded (from Streams) 185,086 999,854 2,717,879 4,455,878

% In-Stream Inventory Sold 12.1% 16.8% 22.6% 25.4%

Banner / Ad-words (from Page Views) 1,152,503 5,703,871 13,222,563 21,713,410

Banner / Adwords Inventory Sold (per page) 1.3 1.7 1.7 1.7

Sponsored Search (from Searches) 31,000 191,649 697,049 1,300,661

% of Sponsored Search Inventory Sold 18.1% 24.0% 35.9% 40.0%

CPMs / Unit Prices

In-Stream CPMs (excl rev share) * 13.92$ 16.29$ 13.77$ 12.54$

Banner / Ad-words CPMs 1.02$ 0.99$ 0.97$ 0.97$

Sponsored Search CPMs 15.00$ 15.00$ 15.00$ 15.00$

Revenue (000)

In-Stream Revenue 1,424$ 10,061$ 28,247$ 43,019$

Banner / Ad-words Revenue 1,181$ 5,662$ 12,796$ 20,986$

Sponsored Search Revenue 465$ 2,875$ 10,456$ 19,510$

Total Revenue 3,070$ 18,598$ 51,499$ 83,515$

Revenue by Territory , including Video and Banner / Adwords (000)

North America Revenue 1,674$ 8,887$ 21,675$ 35,303$

Asia Revenue 181$ 1,050$ 1,978$ 3,002$

Western Europe Revenue 221$ 1,406$ 3,569$ 5,666$

ROW Revenue 35$ 230$ 503$ 758$

page 36

SPE Projections – Downside Case C

(millions) FY 2006 FY2007 FY2008 FY2009

User Activity

End of Period Uniques 16.2 29.3 42.5 60.1

Page Views 754.5 2,677.2 6,027.5 9,890.7

Total Searches 140.0 631.1 1,535.6 2,571.6

Total Streams 1,250.7 4,693.4 9,459.4 13,831.0 FY 2006 FY2007 FY2008 FY2009

P&L Performance

In-Stream 1.11$ 7.85$ 22.43$ 34.60$ 49.9% 57.1% 57.6% 54.4%Banner / Ad-words 0.76 3.70 8.55 14.06 34.0% 26.9% 21.9% 22.1%Sponsored Search 0.36 2.20 7.99 14.92 16.2% 16.0% 20.5% 23.5%

Total Revenue 2.24$ 13.75$ 38.97$ 63.57$ 100.0% 100.0% 100.0% 100.0%

Sales Commission 0.16$ 0.96$ 2.73$ 4.45$ 7.0% 7.0% 7.0% 7.0%Video Streaming 1.13 4.24 8.54 12.49 50.5% 30.8% 21.9% 19.6%Page View Bandwidth 0.07 0.24 0.54 0.89 3.0% 1.8% 1.4% 1.4%

Total COGS 1.35$ 5.44$ 11.81$ 17.83$ 60.5% 39.6% 30.3% 28.0%

Gross Profit 0.88$ 8.30$ 27.16$ 45.74$ 39.5% 60.4% 69.7% 72.0%

Total Operating Expenses 10.12$ 18.30$ 20.99$ 25.18$ 449.9% 130.7% 51.4% 37.1%

Operating Profit (9.24)$ (10.00)$ 6.17$ 20.57$ NM NM 15.8% 32.4%

Percent of Total Revenue

page 37

SPE Projections – Downside Case Assumptions

Revenue Drivers and AssumptionsRevenue Drivers and Assumptions Cost Drivers and AssumptionsCost Drivers and Assumptions

C

* Represents gross In-Stream CPM, including revenue share to partners.

Discounted Cash FlowDiscounted Cash Flow

FY2006 FY2007 FY2008 FY2009

Streaming Bandwidth

Bandwidth cost per MB per Month 50.00$ Cost of Streaming 1 Video 0.0009$ Cost of Streaming One Page 0.0001$

Total Streams (000) 1,250,720 4,693,388 9,459,421 13,831,014 Streaming Costs 1,129$ 4,237$ 8,540$ 12,486$

Total Page Views (000) 754,544 2,677,161 6,027,453 9,890,665 Page View Costs 68$ 242$ 544$ 893$

Payroll

Headcount 50 67 72 77

Cost per Head 107$ 140$ 149$ 149$ Total Payroll 5,357$ 9,409$ 10,747$ 11,483$

Marketing

% of Revenue 72.7% 33.0% 9.9% 9.4%Marketing Expense 1,625$ 4,540$ 3,872$ 6,006$

Infrastructure Technology

% of Revenue 70.3% 14.0% 8.0% 5.7%Infrastructure Expense (Total) 1,573$ 1,928$ 3,109$ 3,604$

7.0x 8.0x 9.0x 10.0x

$144 $165 $185 $206

Discount Rate Valuation11.5% $96 $109 $122 $13614.0% 87 99 111 12416.5% 79 90 102 11319.0% 72 82 93 10321.5% 66 75 85 94

Terminal EBIT Multiple

Terminal Value

FY2006 FY2007 FY2008 FY2009

Unique Users (000)

Total Unique Users 16,237 29,299 42,460 60,134

Page Views (000)

Grouper.com PVs/Unique 15.4 25.7 32.9 33.5 Total Page Views 754,544 2,677,161 6,027,453 9,890,665

Total Searches (as a % of Page Views) 139,999 631,084 1,535,638 2,571,573

Streams (000)

Streams/Total Uniques 9.8 16.6 21.7 22.4 Total Streams 1,250,720 4,693,388 9,459,421 13,831,014

Sell-Through / Inventory

In-Stream, incl. Embbeded (from Streams) 146,619 785,027 2,141,293 3,511,037

% In-Stream Inventory Sold 11.7% 16.7% 22.6% 25.4%

Banner / Ad-words (from Page Views) 938,010 4,510,912 10,457,078 17,172,073

Banner / Adwords Inventory Sold (per page) 1.2 1.7 1.7 1.7

Sponsored Search (from Searches) 24,915 151,566 551,262 1,028,629

% of Sponsored Search Inventory Sold 17.8% 24.0% 35.9% 40.0%

CPMs / Unit Prices

In-Stream CPMs (excl rev share) * 13.72$ 15.99$ 13.45$ 12.32$

Banner / Ad-words CPMs 0.81$ 0.82$ 0.82$ 0.82$

Sponsored Search CPMs 14.50$ 14.50$ 14.50$ 14.50$

Revenue (000)

In-Stream Revenue 1,115$ 7,852$ 22,431$ 34,600$

Banner / Ad-words Revenue 760$ 3,696$ 8,548$ 14,057$

Sponsored Search Revenue 361$ 2,198$ 7,993$ 14,915$

Total Revenue 2,236$ 13,745$ 38,972$ 63,572$

Revenue by Territory , including Video and Banner / Adwords (000)

North America Revenue 1,202$ 6,485$ 16,710$ 27,744$

Asia Revenue 106$ 692$ 1,823$ 2,879$

Western Europe Revenue 163$ 1,081$ 2,834$ 4,481$

ROW Revenue 20$ 154$ 386$ 580$