CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL Body Shop Indonesia ceo Suzy Hutomo Insight 10 Retail...

-

Upload

nguyenkhanh -

Category

Documents

-

view

221 -

download

0

Transcript of CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL Body Shop Indonesia ceo Suzy Hutomo Insight 10 Retail...

If consumers won’t go to stores, the stores are going to have to go to consumers. This seems to be the

thinking behind French perfumery chains Sephora and Marionnaud’s initiative to launch beauty trucks. The Sephora truck is dedicated to providing make-up

lessons using the retailer’s own brand and traveled to more than 17 French towns over the summer. As well as providing make-up lessons and beauty tips, vouchers for discounts on the brand’s products at Sephora stores are also dispensed. The Marionnaud truck also offers

complimentary makeovers and manicures and will be stationed in key areas in Paris from the end of September. The idea of a beauty truck is not new. A string of beauty brands, including

Thierry Mugler, Rimmel and Glossup, have all launched beauty trucks. However, given the declining traffic at perfumeries and department stores and the fact that consumers don’t get that excited about these stores any more, the truck concept could become more widespread, thereby mirroring other industries with their food trucks and fashion trucks. The trucks offer a different experience from the traditional store format, usually create a buzz and perhaps most importantly go to where the consumer is, whether at a concert, sporting event, beach or high-traffic shopping area. Trucks may just be the motor that industry players need to drive more consumers to beauty.

www.bwconfidential.com

Comment

The inside view on the international beauty industry

Inside

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

The buzz 2News roundup

Netwatch 6Beauty blogger review

Interview 8The Body Shop Indonesia ceo Suzy Hutomo

Insight 10Retail consolidation

Show review 14Cosmeeting & Creative Beauty

Store visit 16Murad, Los Angeles

Oonagh PhillipsEditor in [email protected]

Vavavoom

September 25-October 8, 2014 #98

l TFWA World Exhibition, Cannes, Oct 26-31

l Luxe Pack Monaco, Oct 27-29 l Cosmoprof Asia, Nov 12-14

Meet the BW Confidential team at:

The

buz

z

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

www.bwconfidential.com - September 25-October 8, 2014 #98 - Page 2CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

News roundupTh

e b

uzz News roundup

The

buz

z

At a glance...

L’Oréal is to acquire Brazilian haircare company Niely Cosmeticos, which was founded in 1981 and claims to be the largest independent hair color and haircare company in Brazil. It reported net sales of R$405m (€140m) in 2013. The Brazilian company markets two main brands: Cor & Ton for hair coloration and

Niely Gold for shampoos and care. The products are distributed at retailers, wholesalers, supermarkets, pharmacies and perfumery chains in Brazil. Niely Cosmeticos founder Daniel Fonseca de Jesus will join L’Oréal Brazil’s strategic committee as vice president.

Japanese beauty group Shiseido has announced changes to its corporate structure. The Luxury Marketing Group and Consumer Marketing Group, which is part of its Strategic Marketing Department in the Domestic Cosmetics Division, will be reorganized into three departments: Prestige Marketing, Cosmetics Marketing and Personal Care Marketing.

Italian contract manufacturer Intercos filed a request to list on the Italian stock exchange on September 9.

Strategy

Stay informed with our daily news headlines on www.bwconfidential.com

n L’Oréal acquires Brazilian haircare brand Niely Cosmeticos

n World Duty Free Group ceo to leave company

n DFS to open first store in Europe

n AS Watson creates in-house digital team

Interparfums SA reported net profit of €13.8m in the first half of 2014, compared to €35.3m in the same period of 2013, primarily due to the loss of the Burberry license. The company said that the figures were not comparable due to the termination of the licensing agreement in March 2013. Net sales for the period reached €143.9m, which on a like-for-like basis

represented an increase of 21% on 2013. Growth was driven by Montblanc Legend, the launch of Montblanc Emblem and Karl Lagerfeld and steady sales from Lanvin.

Coty’s fourth-quarter results fell short of analysts’ expectations, with net sales falling 1.6% to $1.04bn and a net loss that came in at $20.1m. For the full year, net sales fell 2.1% (-1.6% like-or-like) to $4.55bn, while net loss stood at $97.4m. The company said that the decline in sales for the year was mainly due to a difficult

market in color cosmetics, particularly in North America. Coty said its plan to reduce costs, which involves a new company structure

organized by category and region that was announced in July, as well as other cuts, should result in annual savings of $200m within the next three years. For 2015 Coty is targeting a return to sales growth.

Results

n n n

The

buz

z

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

www.bwconfidential.com - September 25-October 8, 2014 #98 - Page 3CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

News roundupTh

e b

uzz News roundup

The

buz

z

Health & beauty retailer AS Watson Group (ASW) has created a dedicated in-house digital team, called eLab, to support its e-commerce business. The team will work alongside each of the group’s business units to advise on strategies and web and mobile development. It will service Superdrug and The Perfume Shop in the UK, Kruidvat, Marionnaud and ICI Paris XL in Europe and Watsons in Asia.

LVMH-owned travel retailer DFS is to move into Europe with the opening of a new store in Venice. DFS says the store will be a venue for promoting Venice’s public events and cultural institutes as well as a retail store. To open in 2016, the store will sell beauty and fragrance, watches and jewelry, fashion and accessories and Italian food, gifts and wine. AS Watson-owned Marionnaud is changing its name to Marionnaud Paris on the occasion of the perfumery chain’s 30th anniversary. The retailer launched an advertising campaign in France on September 9 to mark the anniversary, and has created a dedicated website, www.30ansdinspirationsbeaute.fr (30 years of beauty inspiration). Marionnaud has also fitted out a beauty truck that will offer complimentary makeovers and other services between September 25 and October 4 in high-traffic areas in Paris.

Sephora France is looking to make-up lessons on the go with its new Beauty Truck, which travelled to 17 towns in France this summer, offering beauty lessons using the retailer’s own brand of make-up. Aimed at 15-to-25-year-olds, the free lessons are given by professional make-up artists. After each class, users are given a beauty prescription, cards featuring beauty advice and tips, as well as vouchers for discounts on Sephora-branded products. A photo station in the truck also allows consumers to post pictures of their makeovers on social networks.In other news, Sephora will offer engraving on perfume bottles at six of its stores in

France from the end of the year for the purchase of a 100ml fragrance. The chain will also offer an engraving service on its website for €7.

France-based flash-sale site Vente Privée has launched Kooroo, a service dedicated to new launches, including those in the beauty category. Kooroo works on the same principle as Vente Privée by offering limited quantities of products for sale during a short time period with a discount for members. Vente Privée says the new service offers brands an opportunity to build visibility for their new launches. Kooroo’s first operation is in conjunction with L’Occitane, offering products from its Aromachologie range. The next event will be for the Paris-Saint Germain fragrance by ST Dupont (Interparfums).

US-based beauty subscription box company Birchbox is opening a pop-up shop in Paris from December 5-24. The 100m2 (1,076ft2) store will house a discovery area, where visitors can create their own beauty boxes, a gifting corner and an area devoted to flash beauty services. An edited selection of products gleaned from Birchbox’s bestsellers will be on sale. “The pop-up store is a way for us to test the potential for a bricks-and-mortar store here in France,” Birchbox Europe gm Quentin Vacher tells BW Confidential. Birchbox is also unveiling its first vending machine in France in October. Posted in high-

traffic areas, such as hotels and nightclubs, the machines offer a selection of four different surprise kits—each cost €4 and contain two products.

Retail

n n n

n n n

News roundupTh

e b

uzz News roundup

The

buz

zTh

e b

uzz

Travel-retail operator World Duty Free Group’s (WDFG) ceo of nine years, José Maria Palencia, is leaving the company before the end of the year. His departure is the result of differing views on the future direction of the group, which went public last year. WDFG’s new development strategy will focus on organic growth, mergers and acquisitions.

Following the acquisition of travel-retail operator Nuance by Dufry announced in June, Nuance president and ceo Roberto Graziani is leaving the company at the end of the year.

Estée Lauder Companies has named Agnes Landau senior vice president global general manager of its Darphin brand, effective January 2015. Landau is currently svp global marketing Clinique. In her new role, she will report to Stephane de la Faverie, svp and global general manager, Origins, Ojon and Darphin. Landau will be based in Paris.

L’Oréal has named Richard Cymberg to the role of clients management director for the group’s travel-retail division. The travel-retail division has also named John Mangan to the position of general manager travel retail Europe, Middle East, Africa and India.

The Estée Lauder brand has named former L’Oréal executive Marie-Pierre Stark-Flora to the role of senior vice president of global marketing. She replaces Charisse Ford.

Beiersdorf-owned La Prairie has appointed Laurent Marteau head of travel retail worldwide, a newly created position. Marteau was previously travel retail international director at LVMH Fragrance Brands.

Avon evp and cfo Kimberly Ross will leave the direct seller in October. Avon vp and corporate controller Robert Loughran will be acting cfo in the interim.

Flavor and fragrance company Mane has named Isabelle Guerlin director of perfume development fine fragrance EMEA.

Fragrance house Cosmo International Fragrances has appointed Mirco Czech as global account executive for Germany, Switzerland and Austria.

Fragrance spray specialist Travalo has appointed Stéphanie Jacquet, most recently global commercial & trade marketing leader Lacoste and Rochas fragrances at P&G, as marketing manager. John Kammerman, formerly gm North Asia at Imperial Tobacco, has been named travel retail manager. The appointments went into effect in August.

Peoplen n n

10TH EDITION

ADF_PCD_110x130_BW_confidential_vecto.indd 1 07/05/14 10:51

n n n

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

www.bwconfidential.com - September 25-October 8, 2014 #98 - Page 5

News roundupTh

e b

uzz News roundup

The

buz

zTh

e b

uzz

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

BW Confidential4 avenue de la Marne92600 Asnières sur Seine, [email protected]: +33 (0)1 74 63 49 61Fax: +33 (0)1 53 01 09 79

www.bwconfidential.comISSN: 2104-3302Publisher: Nicolas GrobEditorial Director: Oonagh Phillips [email protected] Editor: Alissa [email protected] Coordinator & Assistant: Katie [email protected]: Tina Clark, Alex Wynne,

Renata Ashcar, Mayu Saini, Raphaëlle Choël, Corinne Blanché

Subscriptions1 year: electronic publication (20 issues) +

print magazine (4 issues) + daily news: €499 or US$699

[email protected]@bwconfidential.comBW Confidential is published by Noon Media513 746 297 RCS NanterreCopyright © 2014. All rights reserved. Reproduction in whole or in part withoutpermission is strictly prohibited.

LaunchesFrance-based Maesa is to launch a color-cosmetics range for women’s magazine brand Elle this month following a five-year licensing agreement the group signed with Elle publisher Lagardère. Elle Makeup is positioned as an affordable color line, but with the packaging codes and formula quality of a selective brand, according to Maesa. “In make-up there are three segments: ultra mass with budget brands, traditional mass and selective. However, there is not an offer in the €12-€20 range, so with Elle we want to create the masstige category in make-up and show that products of prestige quality do not have to be expensive,” comments Maesa ceo Julien Saada. The line comprises 123 references; lipsticks are priced from €12.90, foundation costs €16.90 and nail polish is priced at €8.90. In France, Elle Makeup will be sold exclusively at retailer Monoprix for six months.

“We are aiming to be among Monoprix’s top-five brands in the next two to three years,” says Saada. In terms of overall objectives, Maesa is targeting wholesale sales of €10m in two to three years. Maesa will expand distribution in France to other retailers and also plans to launch

the make-up line internationally. An agreement has been signed to launch in Dubai, UAE in 2015.

Carven (Groupe Jacques Bogart) is looking to re-launch its men’s fragrance offer with the introduction of a new scent, Carven pour Homme. The spicy, woody fragrance was created by Francis Kurkdjian and Patricia Choux of Takasago. Its bottle was created by designer Thierry de Baschmakoff. Carven will also re-launch its Vétiver scent, the brand’s first men’s fragrance which

was introduced in 1957. The fragrances will roll out between October 2014 and February 2015. Carven pour

Homme retails at €39 (30ml EdT), €59 (50ml EdT) and €79 (100ml EdT). Vétiver is priced at €62 (50ml EdT) and €82 (100ml).

Coty is to launch a new fragrance for its Balenciaga franchise called B. Balenciaga. The fragrance is the first to launch under the fashion brand’s new designer Alexander Wang. It is described as a green woody scent and was created by Domitille Bertier of IFF. The launch will be backed by a print campaign shot by photographer Steven Klein. B. Balenciaga will begin to roll out from November and retails at €58 (30ml EdP),

€80 (50ml EdP) and €100 (100ml EdP).

Italian company Mavive is to launch its first fragrance from denim brand Replay this fall. The men’s fragrance, called Replay Relover, comes in a gun-shaped bottle. There is also a 25ml version in the shape of bullet.

The fragrance, composed by Drom perfumer Valérie Garnuch-Mentzel, has top notes of bergamot, yuzu and pear, a heart of pink pepper and cardamom and a base of rosemary sandalwood and musk. It will roll out from this month. The 25ml EdT Bullet version retails at €19.90, while the 50ml EdT costs €39 and the 80ml EdT €49. n

n n n

BW Confidential reports on what the bloggers are saying about beauty

Net

wat

ch Beauty blogger review

US drugstore chain Walgreens’ purchase of the remaining shares of UK drugstore operator Alliance Boots has caused a buzz among US bloggers, who are eager to see products like Boots’ flagship No 7 line become more widely available. In the UK, however, the deal has drawn criticism from bloggers, who say that the products are sold “much cheaper” in the US.

The high price points of recently launched prestige facial creams has been a subject of interest in the blogosphere. Some bloggers report that the expensive products often fail to live up to their claims and that the majority give no better results than mid-priced creams. A number of reviewers also complain that the information provided on the products’ packaging is often sacrificed for the sake of the pack’s design.

US brand YoYo Lipgloss has gotten rave reviews for its “cool and novel” concept. The retractable lip gloss, which can be clipped to the inside of a handbag, has been described as fun and practical, and is also liked for its shine.

Dual-purpose make-up products like lip and cheek pencils and stains have created a small buzz on the web. Many bloggers praise the convenience and simplicity of the two-in-one products, but the results are sometimes cause for disappointment. The products are said to have limited lasting power and tend to provide an unnatural finish.

The

view

s ex

pre

ssed

in t

his

sec

tio

n a

re t

ho

se o

f b

log

ger

s an

d d

o n

ot

rep

rese

nt

the

op

inio

ns

of

BW

Co

nfi

den

tial

BW ConfidentialThe inside view on the internationalbeauty industry

Coming soon from BW Confidential

The Future of Beauty

A special luxury collector’s edition of howthe global beauty industry will look over the next 10-15 years

Distribution: TFWA World Exhibition,Cannes Luxe Pack Monaco + Subscriber copies

Publication date: October 2014

For advertising opportunities: [email protected]

170X297.indd 1 23/09/14 16:27

BW ConfidentialThe inside view on the internationalbeauty industry

Coming soon from BW Confidential

The Future of Beauty

A special luxury collector’s edition of howthe global beauty industry will look over the next 10-15 years

Distribution: TFWA World Exhibition,Cannes Luxe Pack Monaco + Subscriber copies

Publication date: October 2014

For advertising opportunities: [email protected]

170X297.indd 1 23/09/14 16:27

BW ConfidentialThe inside view on the internationalbeauty industry

Coming soon from BW Confidential

The Future of Beauty

A special luxury collector’s edition of howthe global beauty industry will look over the next 10-15 years

Distribution: TFWA World Exhibition,Cannes Luxe Pack Monaco + Subscriber copies

Publication date: October 2014

For advertising opportunities: [email protected]

170X297.indd 1 23/09/14 16:27

BW ConfidentialThe inside view on the internationalbeauty industry

Coming soon from BW Confidential

The Future of Beauty

A special luxury collector’s edition of howthe global beauty industry will look over the next 10-15 years

Distribution: TFWA World Exhibition,Cannes Luxe Pack Monaco + Subscriber copies

Publication date: October 2014

For advertising opportunities: [email protected]

170X297.indd 1 23/09/14 16:27

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

www.bwconfidential.com - September 25-October 8, 2014 #98 - Page 8CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

“

Inte

rvie

w

The Body Shop Indonesia

l No of stores: 116l Average store openings

per year: 10

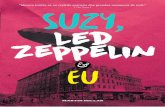

The Body Shop Indonesia ceo Suzy Hutomo”

Growth is taking place not only in the big metropolises like Jakarta, but also in tier-two cities such as Balikpapan and Lampung, where we see a strong development of malls and increasing consumption

The Body Shop Indonesia ceo Suzy Hutomo

The Body Shop Indonesia ceo Suzy Hutomo talks about the state of the beauty market in Indonesia

A growing market

How has The Body Shop Indonesia evolved since you acquired the license in 1992 and what are your plans for the future?Our first store opened in December 1992 at Pondok Indah Mall in Jakarta and we opened our 100th store in 2013 in the Centre Point Mall Medan. Today we have 116 stores in more than 25 big cities in Indonesia. We have been expanding steadily, opening more than 10 stores per year on average in the past two years mainly in tier-two cities. We plan to open an average of 10 stores per year focusing on big cities and cities with potential.The product focus is on skincare and make-up. Indonesia is a promising market

for us because The Body Shop is relevant to consumers here, providing them with targeted products suitable for their needs and the climate. Many products have light, refreshing textures, like the recently launched Vitamin E Aqua Boost Sorbet or our best-selling Drops of Youth Concentrate, that are perfect for our market’s climate.

How do you see the beauty market developing in Indonesia?The beauty market in Indonesia has high potential. Economic growth is robust and there is a large middle class that is growing rapidly. This growth is taking place not only in the big metropolises like Jakarta, but also in tier-two cities, such as Balikpapan and Lampung, where we see a strong development of malls and increasing consumption.Secondly, Indonesian women are discovering that they can use more than just basic

beauty products. They are savvier and are more willing to try new offerings and will also purchase more cosmetics as their income levels rise. The growth of the beauty market is also fuelled by the arrival of more international

beauty brands in the market. Consumers used to feel like they had to travel overseas to shop, whereas now, these brands are available locally. I believe prestige brands will grow quite well as the middle and middle-upper

classes continue to grow. Having said that, we will probably see the mass brands keep pace. This can be attributed to the general income of the population increasing and more consumers buying at hypermarkets and convenience stores.

What are the main challenges for beauty players in Indonesia? In this market, it is important to have a local perspective, through local partners, and understand Indonesian consumers and how they perceive brands. We are not as sophisticated as other markets, so things that work well elsewhere may not succeed here. Local relevance and having the right products for the market are key.You need to be flexible when doing business in Indonesia. Local regulations and

import procedures are not always predictable. As with other emerging markets, infrastructure could also be a challenge, notably given the geography of Indonesia with its scattered islands. n n n

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

www.bwconfidential.com - September 25-October 8, 2014 #98 - Page 9CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

Inte

rvie

w

“

The Body Shop Indonesia ceo Suzy Hutomo

The Body Shop Indonesia ceo Suzy Hutomo ”

You need to be flexible when doing business in Indonesia. Local regulations and import procedures are not always predictable. Infrastructure could also be a challenge, notably the geography of Indonesia with its scattered islands

How is the retail landscape developing?Malls are the main shopping destination for cosmetics. The modern mall is a retail format that is relevant and flourishing in Indonesia. Our brand is still performing well in Jakarta’s Citraland Mall where we have been present since the mall opened in 1993, and where we have seen the profile of consumers evolve over the years, drawing crowds mainly from the area’s universities and offices. We are also present and excelling in the two new malls that opened in the same area in 2000 with a more premium positioning. The internet is still in a nascent stage, although it is growing by leaps and

bounds, notably with the younger generation on social media; there is tremendous opportunity to engage with consumers here. Although it will take time, there is definitely potential for e-commerce. At the moment, consumers like to go online to browse and do research, but not yet to purchase. Most consumers still prefer to go into the store where they can get advice from staff, especially when shopping for skincare products.

What are Indonesia’s beauty consumers looking for? Consumers are looking for relevance. They don’t just want to buy a product; they expect to understand the benefits of the product and also what the brand stands for. They want to engage with us and we are in turn very involved in the communities where we operate. Indonesians like to know what they can do to improve them-selves so they are also looking for personalized advice and service.In certain respects, consumers are evolving. With middle-class women now having

more disposable income, they want to treat themselves more and they also want to better understand what beauty can do for them. Engaging local brand ambassadors helps to connect with consumers as they are more exposed to mass media today and find beauty icons aspiring.

How does the brand’s natural aspect impact emerging markets like Indonesia? Natural brands like The Body Shop have great potential in Indonesia. The market has a long history of being close to nature, being one of the most biodiverse countries, so it is easy for consumers in Indonesia to understand and appreciate the benefits of our products, which are based on natural ingredients. Of course, with urbanization and more people living in cities, there is also an increasing desire among consumers to get back to nature. Clear messaging and transparency about product

information, along with customer and after-sales service, are essential to building trust. This is very important, especially in an emerging market like Indonesia, where brand equity and trust are key to success. In part, this is because some products are not safe or are not very well made. n

n n n

s The Body Shop Flagship store in Plaza Senayan, Jakarta

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

www.bwconfidential.com - September 25-October 8, 2014 #98 - Page 10CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

Insi

ght

“

”Planet Retail health and beauty analyst Denise Klug

Suppliers are more dependent on listing at stores if a player is massive; you have to have your product in these stores

BW Confidential analyzes what the recent wave of retail consolidation means for stores, suppliers and consumers

Getting togetherRetail consolidation

Retail consolidation continues apace. In the perfumery, department-store, drugstore and travel-retail channels there has been a spate of M&A over

the past two years. Consolidation is seen by some as the only way of growing, gaining market share or even surviving in today’s market. In France for example, given the increasingly difficult climate and the rise of

e-commerce (with major brands like Chanel opening their own e-commerce sites and Amazon launching a prestige beauty store), sources say that most independent perfumeries in the country are now up for sale as they simply can no longer compete in the market. Indeed, WSL Strategic Retail ceo Wendy Liebmann says consolidation is being driven by a sense of necessity, as retailers look for new ways and resources to grow in difficult economic conditions. “People feel that being bigger does that,” she says.M&A is also a way of getting into new markets where it is too difficult for

retailers to go it alone or where it would take too long to make an impact. This was the case of Alliance Boots’ acquisition of Latin America pharmacy chain n n n

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

www.bwconfidential.com - September 25-October 8, 2014 #98 - Page 11CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

Insi

ght Retail consolidation

“

Farmacias Ahumada, which operates 1,400 stores in Mexico and Chile. Boosting its position in France was also a main driver of German perfumery

retailer Douglas’ acquisition of French chain Nocibé. Through the deal, Douglas became France’s largest perfumery network in store numbers, with 645 doors. In terms of sales, the group is now number two in France, behind LVMH-owned Sephora, while Marionnaud comes in third place.

The balance of powerChanging the balance of power with suppliers is one driver of the retail consolidation trend. “Suppliers are more dependent on listing at stores if a player is massive; you have to have your product in these stores,” says Planet Retail health and beauty analyst Denise Klug. This was one of the reasons for Swiss

travel retailer Dufry’s acquisition of The Nuance Group this year. The Swiss group says the combination of the two companies will confirm Dufry’s position as the worldwide leader in the airport retail industry, with a global market share of 15% and a presence in 63 countries, 239 airports and a network of 1,750 stores. Following the announcement of the deal, Dufry ceo Julian Diaz said that travel retail needed consolidation given the growing strength of suppliers, and he predicted more M&A among operators. Dufry also said that it expects to see an improvement in gross margin through increased purchasing power.However, suppliers are often wary of these

mega mergers and view one less player to deal with as automatically meaning reduced negotiating power. When the news emerged that Douglas was to acquire Nocibé, for example, alarm bells rang at many beauty houses. Aside from the repercussions on shelf

space and margins in the wake of these deals, suppliers also usually question where savings will be made and fear that there will be less investment in-store, as money is poured into the acquisition process, expansion and integration. Indeed, the risks are significant,

n n n

n n n

Main retail deals at a glance US drugstore retailer Walgreens announced in August that it would acquire the remaining 55% share of British pharmacy/health and beauty retailer Alliance Boots for £3.13bn ($5.29bn). Named Walgreens Boots Alliance, the combined company will operate 11,000 stores in 10 countries and is forecasting sales of between $126bn and $130bn in 2016.

Also in August, Alliance Boots completed its acquisition of Latin American pharmacy chain Farmacias Ahumada, which operates some 1,400 stores in Mexico and Chile and has revenues of around £835m ($1.38bn).

German real-estate group Signa finalized its acquisition of German department-store operator Karstadt in August this year. The group had acquired 75.1% of Karstadt in 2013, and the deal will see it invest some €300m in the struggling retailer. Karstadt operates some 80 department stores in major German cities.

Swiss travel retailer Dufry announced it would acquire the world’s sixth largest duty-free and travel-retail company, The Nuance Group, for Sfr1.55bn ($1.73bn). The deal confirms Dufry’s position as the worldwide leader in the airport retail industry, with a global market share of 15% and a presence in 63 countries, 239 airports and a network of 1,750 stores.

German beauty retailer Douglas Holding finalized its acquisition of French perfumery chain Nocibé in June, becoming France’s largest perfumery chain with 645 doors. Although the purchase price was not made public, Nocibé was valued at between €500m and €550m with revenues of some €680m in 2013.

South African retailer Woolworths Holding Limited announced the acquisition of Australia’s second-largest department-store operator David Jones Limited in April 2014, for R21.4 bn ($2bn). The combined companies operate 1,151 stores in 16 countries for combined sales of R51bn ($4.77bn) in 2013.

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

www.bwconfidential.com - September 25-October 8, 2014 #98 - Page 12CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

Insi

ght Retail consolidation

particularly as the drive to cut costs can overshadow the fundamental business itself. Sources say that since Advent International acquired German retailer Douglas in 2012, business has been unstable. There have been a large number of staff departures and morale is low as management looks to further cut costs. Some say this is unlikely to change as Advent, a private-equity company, prepares to sell Douglas in the near future, which will likely cause further upheaval.In addition, Liebmann says that large retailers that grow through acquisition

can find themselves in danger of losing the agility required to respond quickly and effectively to changing consumer and lifestyle trends. “The operational challenges often slow down the responsiveness to the consumer,” she says, adding that large-scale success can be a double-edged sword. “Take Sephora, you get that scale where there’s one on every corner, but as a consumer looking for something that’s a bit different, it’s hard to find.”

What’s next?Consolidation is set to continue. One ceo from a major brand recently told BW Confidential that in the next three years suppliers will probably only be dealing with two or three main retailers in the US and Europe in both the domestic and travel-retail market.In travel retail, more operators are no

doubt looking for buys following the Dufry deal. As news emerged that Word Duty Free ceo José Maria Palencia is to leave the company, the retailer hinted that it is looking to pursue business combinations with other operators. And in Europe, analysts see what remains

of the independent perfumeries either forming groups or selling to the region’s main players. In Italy, eyes are still on perfumery chain Limoni to see how business will pan out. The retailer was bought by private-equity company Orlando Italy in 2012 and is expected to go up for sale again after 2015. Retailers may also look to acquire online

pure players to help boost their business in this area. In a move aimed at harnessing the growth potential of digital retailing, n n n

Main retail deals at a glanceChinese conglomerate Sanpower Group agreed in April this year to buy an 89% stake in UK-based department-store chain House of Fraser in a deal that values the retailer at around £450m ($746m).

Canadian food and pharmacy retailer Loblaw Companies Limited acquired Canadian drugstore retailer Shoppers Drug Mart in a C$12.4bn ($11.31bn) deal in March this year. The combined company operates some 2,300 stores including 1,800 pharmacies and on a pro forma basis generated revenues of C$43bn ($39.23bn) in 2013.

US-based luxury retailer Neiman Marcus was sold for $6bn to private-equity group Ares Management and Canada Pension Plan Investment Board in 2013. Neiman Marcus operates 79 points of sale: 41 Neiman Marcus stores, two Bergdorf Goodman stores and 36 Last Call outlet centers.

Canadian department store retailer Hudson’s Bay Company acquired US prestige department store operator Saks Incorporated for $2.9bn in July 2013. The combined company operates some 320 stores and reported retail sales of $5.22bn for the year ended February 1, 2013.

Italian department store operator La Rinascente, owned by Thailand’s Central Retail Corporation, acquired Danish department store Illum, located in Copenhagen, in March 2013 for an undisclosed sum. La Rinascente operates 11 stores in Italy and plans to open a second flagship in Rome in 2015.

Divine Investments, a fund owned by a group of Qatar-based private investors, finalized the acquisition of French department store chain Printemps in July 2013.

n n n

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

www.bwconfidential.com - www.bwconfidential.com - September 25-October 8, 2014 #98 - Page 12 - Page 13CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

Insi

ght Retail consolidation

Tuesday, Sept 30

2014, 5pm-7pm

404 NYC404 10th Ave New YorkPlease send RSVP requests to:

#beauty20

US retail giant Wal-Mart acquired start-up tech company Luvocracy this summer. The Luvocracy application combines social networking and retailing by enabling consumers to view and purchase products that are recommended by friends, bloggers or other influencers.While all this may make life more difficult for brands, consumers look set

to benefit. They say that shoppers will be offered better prices, as consolidation could provoke price wars among traditional players. However, with the big players getting bigger and chains becoming more ubiquitous, there is also a risk that the consumer will be faced with a certain sameness of offer. In this way analysts suggest that consolidation will in fact create gaps in the market for small niche players that provide a different, perhaps more original offer. “I think that there is much more potential for personalized beauty products and offerings, particularly when we talk about formats that use new retail technologies,” says Klug, pointing to the example of US-based subscription beauty box retailer Birchbox, which recently opened its first brick-and-mortar store in New York. The retail landscape looks set to shift once again. n

n n n

”WSL Strategic Retail ceo Wendy Liebmann

“The operational challenges [as a result of retail M&A]often slow down the responsiveness to the consumer

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

www.bwconfidential.com - September 25-October 8, 2014 #98 - Page 14CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

This year’s Cosmeeting and Creative Beauty turned out to be smaller format events than what the industry has seen in previous years. The trade shows, organized by

Beyond Beauty Events (part of the Informa group), hosted 361 exhibitors compared with 480 in 2013. Some 196 companies exhibited at Cosmeeting, the event dedicated to finished products, while there were 165 exhibitors at Creative Beauty, which is devoted to ingredients, formulations and packaging. Visitor numbers this year were also down by 15% to 18,248. Several exhibitors expressed disappointment, partly due to the smaller size and what they said was slower traffic. However, Beyond Beauty Events managing director Pradip Bala said that while the

show may have been smaller, organizers had invested in bringing high-quality visitors to the event. “The show was smaller, as companies tightened budgets; the market is difficult and some exhibitors that took several booths in the past only took one this year. However, my feeling is that meetings were better and big companies such as BCM and Lumson were satisfied.” He continued: “The success of a trade show today isn’t about big floor areas, but about specialization and quality visitors.”Bala added that while overall he was pleased with the Cosmeeting event, for Creative

Beauty the organizers needed to communicate a clearer message, especially in light of the number of competing trade shows that have emerged in Paris. In its communication, the aim is to focus the event as full-service, multi-sector show attracting international visitors. There were positives. Business was brisk at French industry cluster Cosmetic Valley’s

booths, while there was also a buzz in the Zoom area devoted to niche beauty brands and which played host to 44 brands. Brands in the area said that they had seen a good number of European buyers at the show. New features at this year’s show included Cosmeeting Selective, which aimed to

connect nine brands with solid experience in their home market with key buyers through pre-arranged meetings. “Zoom is interesting to see new concepts, but 60-70% of these brands don’t survive and buyers are looking for brands that have more staying power, which is why we introduced Cosmeeting Selective,” Bala explains. The event’s conference line-up (30 conferences in all) was also singled out as a highlight of the event. Next year’s events will take place from September 15-17.

BW Confidential reports on what was seen and heard at Cosmeeting & Creative Beauty, which took place in Paris from September 9-11

Beauty on showCosmeeting & Creative Beauty

Show

rev

iew

Cosmeeting & Creative Beauty Took Place: September 9-11 in ParisTotal Exhibitors: 361 exhibitors vs 480 in 2013Cosmeeting exhibitors: 196Creative Beauty exhibitors: 165Visitors: 18,248, -15% vs 2013

n n n

Beauty Challenger AwardsFrench brand Bye Bye Racines came out on top at the Beauty Challenger Awards, which recognizes niche and up-and-coming brands. The brand, which markets a hair color spray to cover roots in between salon visits, won four prizes: the Grand Prix, the Press Prize (whose jury members included BW Confidential editor in chief Oonagh Phillips), the Haircare Prize and the Web User Prize. The Make-up brand winner was German company Und Gretel, the Facial Skincare Prize went to Russian company Natura Siberica and Lise London took home the Fragrance Prize. Nail brand Fabbnails won the Beauty Blog Favorite Award.

“

”Beyond Beauty Events managing director Pradip Bala

The show was smaller, as companies tightened budgets; the market is difficult and some exhibitors that took several booths in the past only took one this year. However, my feeling is that meetings were better

CONFIDENTIAL CONFIDENTIAL CONFIDENTIALCONFIDENTIAL CONFIDENTIAL CONFIDENTIALCONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

www.bwconfidential.com - September 25-October 8, 2014 #98 - Page 15CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

Show

rev

iew

Show

rev

iew Cosmeeting & Creative Beauty

n n n Seen in showFormer LVMH beauty executive Alejandro Rasic presented his new brand, Ayres. The Miami-based company takes its inspiration from the tango culture of Argentina—Rasic’s birthplace. Ayres comprises three bodycare collections—Patagonia, Pampas Sunrise and Midnight Tango—that each feature five skus claimed to be made of all-natural ingredients (body lotion, bar soap, shower cream, body butter and body polish). Prices range from €10-€28. Rasic launched the brand in November 2013 on Ayresbeauty.com and on beauty subscription website Birchbox. In July this year, the brand went live on European subscription site Glossybox. It is also distributed in Holland, Belgium and Luxembourg and just signed to enter Russia. Rasic is looking for distribution through independent boutiques, concept stores and “trendy” department stores.

Belgian brand JYB Cosmetic’s line, launched last year, was formulated to boost the skin’s natural functions through what it claims is the use of 100% natural and biodegradable ingredients. “We wanted our organic formulas to boost the skin’s natural defenses, but we also wanted to offer pleasant textures and scents,” explains co-founder Jean-Yves Berlemont. All products in the nine-sku range contain between 57% and 97% organic ingredients and come in vacuum-packed packaging, meaning that the formulas last up to six months after opening. JYB is sold in 70 doors in Belgium and is aiming to be in 150 pos by the end of this year, mainly pharmacies, concept stores and high-end beauty salons. It is also launching in Denmark in 2015 and is prospecting the Middle East, Hong Kong and Macau.

Und Gretel is an organic color cosmetics brand co-founded by Berlin-based make-up artist Christina Roth. The selective-priced brand—products range from €18 to €78—is comprised of 48 skus in the eyes, lips and face categories. Und Gretel is in the pre-launch phase; its online shop will open before the end of this year. According to managing director and co-founder Stephanie Dettmann, the brand is targeting distribution through concept stores and luxury perfumeries.

French mask specialist Collagena was showing its range of facial masks and patches. “Masks are big in Asia, and they are making their way to other markets. However, most masks have a fabric base, and Collagena is the only company in Europe that offers hydrogel-based masks,” comments Collagena sales director Karine Taieb-Finet. The hydrogel base—a combination of water and active ingredients— is said to allow the formulas to better penetrate the skin than fabric masks. The range comprises six masks priced from €29 to €34, each with its own function: hydrating, whitening, anti-aging, soothing, detoxifying, and sunburn relief. Collagena also markets under-eye patches and a line of five topical skincare products. The brand is sold in more than 500 pharmacies in France and ships internationally from its e-boutique.

Japan-based company Ruhaku presented its organic whitening range. The formula’s star ingredient is the Gettou leaf, which is said to have anti-oxidant properties. Ruhaku’s range is comprised of a Balance Lotion, Brightening Essence, Night Repair Oil and Day Moist Cream. Prices range from €29 to €44. The brand is distributed through department store Seibu in Japan as well as in spas, and Ruhaku is looking to enter the French market through organic shops and department stores. n

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

www.bwconfidential.com - September 25-October 8, 2014 #98 - Page 16CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

Stor

e vi

sit

Murad flagshipl Location: Los Angeles,

California, l Size:1,500ft2

(139m2) l Special features:

Guided Skincare Applications,

Inclusive Health Skin Consultations and

skin evaluations using a camera to measure lines and wrinkle and

inflammation

US-based skincare company Murad is opening its first standalone store in Los Angeles, California in October, which will serve as the brand’s global

flagship location. The opening of the 1,500ft2 (139m2) store also marks the brand’s 25th anniversary.The boutique will sell Murad’s entire range of skincare products, but is

also intended to educate consumers about nutrition, supplements and stress management. In addition to product sales the store will offer a range of services, including Guided Skincare Applications, Inclusive Health Skin Consultations designed to reflect the brand’s holistic approach and YouthCam Evaluations using a high-definition camera to measure lines and wrinkles, age spots and sun spots, and inflammation.The boutique features an Interactive Art Wall, where customers will be able to

create digital artwork that they can then share on social media. Murad also announced that it will renovate its Inclusive Health Spa in Los

Angeles this year. n

Skincare brand Murad opens its first standalone store

Murad looks to boutiques

CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

www.bwconfidential.com - September 25-October 8, 2014 #98 - Page 17CONFIDENTIAL CONFIDENTIAL CONFIDENTIAL

Stor

e vi

sit

s The store offers a range of skin analysis services, including an evaluation with a high-definition camera

s The new flagship store will sell the Murad brand’s entire range

BW ConfidentialThe inside viewon the internationalbeauty industry

News headlines every day

bwconfidential.com

The print magazine

Four times a year

www.bwconfidential.com N°19 September-October 2014

InterviewFerragamo Parfums ceoLuciano Bertinelli

Travel retail: EuropeHow the region is faring &the continent’s top airports

Market watch: AfricaThe potential & challenges ofthe next big region for beauty

PackagingHow make-up packsare evolving

Insight: fragrance creationWhat’s next for the industry?

The inside view on the international beauty industry

Please complete this form and return it:

• by post: BW Confidential - Subscription Department 4 avenue de la Marne - 92600 ASNIERES - France• by fax: +33 (0) 1 53 01 09 79• by email: [email protected]

Subscription order form

Yes, I want to subscribe to BW Confidential

r 2 year subscription: €799 or US$1,099: • the electronic publication (40 issues) • daily news on www.bwconfidential.com • the print magazine (8 issues)

r 1 year subscription: €499 or US$699: • the electronic publication (20 issues) • daily news on www.bwconfidential.com • the print magazine (4 issues)

+ Free: each subscription includes full access to the entire contents of BW Confidential’s archives on www.bwconfidential.com

Payment method r € r US$

r CB, Visa, Mastercard/Eurocard l_l_l_l_l l_l_l_l_l l_l_l_l_l l_l_l_l_l Expiration date: l_l_l_l_l Security code l_l_l_l

r American Express l_l_l_l_l_l l_l_l_l_l_l_l l_l_l_l_l Expiration date: l_l_l_l_l Security code l_l_l_l_l

r Please bill me

Contact information

Company:..............................................................................................

First name:............................................................................................

Last name:............................................................................................

Job title:................................................................................................

Address:................................................................................................

Postal code:...........................................................................................

City:......................................................................................................

Country:................................................................................................

Email (required):....................................................................................

VAT number (required for European Union):....................................................

Signature & date:

Subscribe for 2 years and save 20%

#

EP20

14 -

Offe

r val

id u

ntil

Febr

uary

28,

201

5

Every two weeks

The electronic publication

Autopromo-abo 210x297mmNEW-exe.indd 1 06/08/14 14:26