Use of Parabolic Trough Solar Collectors for Solar Refrigeration And

Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry … · 2016. 7....

Transcript of Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry … · 2016. 7....

MIDDLE EAST AND NORTH AFRICA ENERGY AND EXTRACTIVES GLOBAL PRACTICETHE WORLD BANK GROUP

M E N A E N E R G Y S E R I E S | R E P O R T N O . 9 4 8 3 4 - M N A

Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

MIDDLE EAST AND NORTH AFRICA (MENA) | ENERGY AND EXTRACTIVES GLOBAL PRACTICE | THE WORLD BANK GROUPP

ublic

Dis

clos

ure

Aut

horiz

edP

ublic

Dis

clos

ure

Aut

horiz

edP

ublic

Dis

clos

ure

Aut

horiz

edP

ublic

Dis

clos

ure

Aut

horiz

ed

M E N A E N E R G Y S E R I E S | R E P O R T N O . 9 4 8 3 4 - M N A

MIDDLE EAST AND NORTH AFRICAENERGY AND EXTRACTIVES GLOBAL PRACTICETHE WORLD BANK GROUP

Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

Copyright © March 2015 International Bank for Reconstruction and Development/The World Bank1818 H Street NW, Washington DC 20433Telephone: 202-473-1000; Internet: www.worldbank.orgSome rights reserved

This work is a product of the staff of The World Bank with external contributions. The findings, interpretations, and conclusions expressed in this work do not necessarily reflect the views of The World Bank, its Board of Executive Directors, or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries.

Nothing herein shall constitute or be considered to be a limitation upon or waiver of the privileges and immunities of The World Bank, all of which are specifically reserved. Nothing herein shall constitute or be considered to be a limitation upon or waiver of the privileges and immunities of The World Bank, all of which are specifically reserved.

All queries on rights and licenses should be addressed to the Publishing and Knowledge Division, The World Bank, 1818 H Street NW, Washington, DC 20433, USA; fax: 202-522-2625; e-mail: pubrights@ worldbank.org.

All images remain the sole property of their source and may not be used for any purpose without written permission from the source.

Written for the Energy Unit of the World Bank Middle East and North Africa Region, Energy and Extractives Global Practice, The World Bank Group.

Photo CreditsImages: ©The World Bank Group and ©StockXchng

Production CreditsProduction Editor: Marjorie K. Araya, ESMAPDesigner: Studio GrafikTypesetting: vPrompt eServicesReproduction: AGS

Contents | v

Contents

Acronyms and Abbreviations xxiv

Acknowledgments xxvii

Model Notation xxviii

Chapter 1 | Executive Summary 1

1.1 Introduction 1

1.2 MENA Countries Face Strong Competition from Leading Solar Markets 1

1.2.1 Concentrated Solar Power (CSP) Industries 1

1.2.2 Photovoltaic (PV) Industries 2

1.3 Egypt and Morocco Show the Highest Attractiveness Index for CSP and PV Component Industries 4

Chapter 2 | Introduction to the Value Chain of Solar Technologies 9

2.1 Concentrated Solar Power (CSP) Technology 9

2.1.1 Parabolic Trough Systems 9

2.1.2 Linear Fresnel Systems 13

2.1.3 Power Tower Systems 15

2.1.4 Dish/Engine Systems 17

2.2 Photovoltaic (PV) Technology 24

2.2.1 Crystalline (c-Si) Technologies 26

2.2.2 Thin Film (TF) Technologies 28

2.2.3 Shared Technologies 31

2.3 Other Related Activities 36

2.3.1 Research, Development and Innovation 36

2.3.2 Project Development 36

2.3.3 Engineering 37

2.3.4 Engineering, Procurement and Construction (EPC) 38

2.3.5 Operation and Maintenance (O&M) 38

vi | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

2.3.6 Financing 38

2.3.7 Technology Provision 38

2.3.8 Consulting 38

Chapter 3 | Methodology 39

3.1 Introduction 39

3.2 Benchmark Countries Selection 41

3.3 Primary Data Selection and Classification 41

3.4 Model: Data Normalization and Aggregation 43

3.4.1 Ranking of Indexes According to Weighting Factors 44

3.5 Hypothesis Validation 47

3.5.1 Robustness and Consistency Analysis 47

3.6 Solar Industries Value Chain Analysis 49

3.6.1 CSP Industry 50

3.6.2 PV Industries 52

3.7 Identification of Potentially Competitive (Target) Industries and Competitiveness Gaps 53

3.8 Building of Demand Scenarios 54

3.8.1 Increase in Installed Capacity Forecast 55

3.8.2 Component Demand Scenario 57

3.9 Recommendations and Impact Assessment 58

Chapter 4 | Attractiveness Assessment 59

4.1 Benchmark Analysis Summary Results 59

4.2 Algeria 65

4.2.1 Algeria’s Key Strengths and Weaknesses 65

4.2.2 Potentially Competitive Industries 67

4.3 Egypt 72

4.3.1 Egypt’s Key Strengths and Weaknesses 72

4.3.2 Potentially Competitive Industries 73

4.4 Jordan 77

4.4.1 Jordan’s Key Strengths and Weaknesses 77

4.4.2 Potentially Competitive Industries 77

4.5 Morocco 82

4.5.1 Morocco’s Key Strengths and Weaknesses 82

4.5.2 Potentially Competitive Industries 83

Contents | vii

4.6 Tunisia 88

4.6.1 Tunisia’s Key Strengths and Weaknesses 88

4.6.2 Potentially Competitive Industries 88

Chapter 5 | Strategic Recommendations and Proposed Actions 93

5.1 Introduction 93

5.2 Algeria 93

5.2.1 Gaps Analysis 93

5.2.2 Recommendations 95

5.3 Egypt 100

5.3.1 Gaps Analysis 100

5.3.2 Recommendations 103

5.4 Jordan 108

5.4.1 Gaps Analysis 109

5.4.2 Recommendations 110

5.5 Morocco 114

5.5.1 Gaps Analysis 114

5.5.2 Recommendations 116

5.6 Tunisia 123

5.6.1 Gaps Analysis 123

5.6.2 Recommendations 125

5.7 Recommendations for MENA Regional Cooperation 130

Chapter 6 | National Climate Innovation Center 134

Annexes 145

Annex 1 | Solar Technologies Value Chain Analysis 145

Concentrated Solar Power (CSP) Technology 145

Parabolic Trough Systems 145

Linear Fresnel System 149

Power Tower System 151

Dish/Engine System 153

Analysis of the Value Chain for CSP 155

Photovoltaic (PV) Technology 173

Annex 2 | Solar Energy Development Scenarios 196

Global Solar Industry Scenarios 196

MENA Solar Industry Scenarios 197

viii | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

MENA Market Potential 199

CSP and PV MENA market potential by 2020 200

Scenarios Sensitivity Analysis 205

Annex 3 | Benchmark Competitiveness Analysis Primary Data Definition 208

Overarching Categories: Production Factors 208

Overarching Categories: Demand Factors 209

Overarching Categories: Risk and Stability Factors 209

Overarching Categories: Business Support 210

Annex 4 | Benchmarking Model and Index Weights 211

Primary Data Normalization 211

Parameter Aggregation 211

Weights Distribution 212

Overarching Categories’ Weights 212

Competitiveness Parameters’ Weighting Factors 215

Primary Data’s Weight Factors 219

Comparison of MENA and Benchmark Countries as Statistical Populations 222

Model Robustness Using Different Aggregations 224

Parameter Aggregation Consistency 228

Annex 5 | Case Studies 229

Case Study: Mirror Industry in Egypt 229

Impacts of Mirror Industry Deployment 231

Case Study: Support Structure Industry in Egypt 231

Impacts of Support Structure Industry Deployment 233

Case Study: Support Structure Industry in Morocco 234

Impacts of Support Structure Industry Deployment 236

Case Study: Thin Film Modules Industry in Morocco 236

Certification and Testing Procedures 239

Case Study: Receiver Industry in Tunisia 239

Annex 6 | Benchmarking Analysis Results 241

Primary Data 241

Weights 248

References 259

Boxes

Box 4.1 | Certification and Testing Institute in Jordan 80

Box 4.2 | Success Story: CSP Industry Development in Spain 86

Box 5.1 | Success Story in PV Module Industry Development: China’s Development of the Crystalline Module Industry 117

Box 5.2 | Success Story: Reduction of Financial Risk in Morocco 121

Boxes | ix

x | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

Figures

Figure 1.1 | Investment Requirements vs. Technology Complexity for CSP Technology Industries 2

Figure 1.2 | CSP Industry Development Opportunities in MENA Countries 3

Figure 1.3 | Investment Requirements vs. Technology Complexity for PV Technology Industries 3

Figure 1.4 | PV Industry Development Opportunities in MENA Countries 4

Figure 1.5 | Competitiveness Parameters in Algeria Compared to Benchmark and MENA Averages 5

Figure 1.6 | Competitiveness Parameters in Egypt Compared to Benchmark and MENA Averages 6

Figure 1.7 | Competitiveness Parameters in Jordan Compared to Benchmark and MENA Averages 6

Figure 1.8 | Competitiveness Parameters in Morocco Compared to Benchmark and MENA Averages 7

Figure 1.9 | Competitiveness Parameters in Tunisia Compared to Benchmark and MENA Averages 8

Figure 2.1 | Parabolic Trough Collectors Installed at Plataforma Solar de Almería (Spain) 10

Figure 2.2 | Schematics of a Parabolic Trough Collector 11

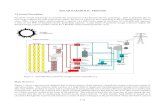

Figure 2.3 | General Schematics of a Parabolic Trough CSP Plant with Thermal Energy Storage 12

Figure 2.4 | Schematics of a Linear Fresnel Collector 13

Figure 2.5 | Functional Scheme of a Power Tower System, Using Molten Salt as HTF, with TES 15

Figure 2.6 | Main Components of a Heliostat 16

Figure 2.7 | Main Components of a Dish/Engine System 18

Figure 2.8 | Schematic Showing the Operation of a Heat-Pipe Solar Receiver 19

Figure 2.9 | Investment Requirements vs. Technology Complexity for CSP Technology Industries 20

Figure 2.10 | CSP Industry Development Opportunities (Normalized Attractiveness Index) in MENA Countries 21

Figure 2.11 | Developing Phases: From Design to Commercial Exploitation 22

Figure 2.12 | Market Share of the Different CSP Technological Approaches, Both Operating (Left) and under Construction (Right), 2012 24

Figure 2.13 | PV Solar Energy Value Chain 25

Figure 2.14 | Polysilicon Manufacturing Value Chain 26

Figure 2.15 | Ingot/Wafer Manufacturing Value Chain 27

Figure 2.16 | c-Si Cell Structure 28

Figure 2.17 | Types of Solar Glass 30

Figure 2.18 | Investment Requirements vs. Technology Complexity for PV Technology Industries 32

Figure 2.19 | PV Industry Development Opportunities (Normalized Attractiveness Index) in MENA Countries 33

Figure 2.20 | Global PV Module Pricing Learning Curve for c-Si and CdTe Modules, 1979–2015 35

Figure 2.21 | Market Share of the Different PV Technological Approaches, 2011 36

Figure 2.22 | Value Chain Related to Solar Energy Deployment 37

Figure 3.1 | Global Methodology 40

Figure 3.2 | Rankings of Attractiveness Indexes per Country, Aggregated for CSP Technology, with Different Normalization and Aggregation Techniques 48

Figure 3.3 | Rankings of Attractiveness Indexes per Country, Aggregated for PV Technology, with Different Normalization and Aggregation Techniques 49

Figure 3.4 | Investment Requirements vs. Technology Complexity for CSP Technology Industries 51

Figure 3.5 | Investment Requirements vs. Technology Complexity for PV Technology Industries 52

Figure 3.6 | Sample Graph: Country and MENA Average Normalized Attractiveness Index Score 53

Figure 3.7 | Sample Spider Graph Used to Identify Gaps 54

Figure 3.8 | Global and European CSP and PV Yearly Installed Capacity in Different Scenarios, Average 2008–20 55

Figure 3.9 | MENA CSP and PV Installed Capacity in 2020 for 3 Scenarios 56

Figures | xi

xii | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

Figure 3.10 | MENA CSP and PV Yearly Installed Capacity in Different Scenarios, Average 2008–20 56

Figure 4.1 | Normalized Attractiveness Index for Each Country, Aggregated for CSP Industries and Probability Density Function* for MENA and Benchmark Countries 66

Figure 4.2 | Normalized Attractiveness Index for Each Country, Aggregated for PV Industries and Probability Density Function* for MENA and Benchmark Countries 66

Figure 4.3 | Competitiveness Parameters in Algeria Compared to Benchmark and MENA Averages 67

Figure 4.4 | Normalized Attractiveness Indexes for CSP Target Industries in Algeria Compared to MENA Average* 68

Figure 4.5 | Normalized Attractiveness Indexes for PV Target Industries in Algeria Compared to MENA Average* 70

Figure 4.6 | Competitiveness Parameters in Egypt Compared to Benchmark and MENA Averages 70

Figure 4.7 | Normalized Attractiveness Indexes for CSP Target Industries in Egypt Compared to MENA Average 72

Figure 4.8 | Normalized Attractiveness Indexes for PV Target Industries in Egypt Compared to MENA Average 73

Figure 4.9 | Competitiveness Parameters in Jordan Compared to Benchmark and MENA Averages 75

Figure 4.10 | Normalized Attractiveness Indexes for CSP Target Industries in Jordan Compared to MENA Average 76

Figure 4.11 | Normalized Attractiveness Indexes for PV Target Industries in Jordan Compared to MENA Average 78

Figure 4.12 | Competitiveness Parameters in Morocco Compared to Benchmark and MENA Averages 79

Figure 4.13 | Normalized Attractiveness Indexes for CSP Target Industries in Morocco Compared to MENA Average 81

Figure 4.14 | Normalized Attractiveness Indexes for PV Target Industries in Morocco Compared to MENA Average 81

Figure 4.15 | Competitiveness Parameters in Tunisia Compared to Benchmark and MENA Averages 82

Figure 4.16 | Normalized Attractiveness Indexes for CSP Target Industries in Tunisia Compared to MENA Average* 83

Figure 4.17 | Normalized Attractiveness Indexes for PV Target Industries in Tunisia Compared to MENA Average* 85

Figure 4.18 | Normalized Attractiveness Indexes for PV Target Industries in Morocco Compared to MENA Average 85

Figure 4.19 | Competitiveness Parameters in Tunisia Compared to Benchmark and MENA Averages 88

Figure 4.20 | Normalized Attractiveness Indexes for CSP and PV Technologies in Tunisia Compared to MENA Average* 89

Figure 4.21 | Normalized Attractiveness Indexes for CSP Target Industries in Tunisia Compared to MENA Average* 91

Figure 4.22 | Normalized Attractiveness Indexes for PV Target Industries in Tunisia Compared to MENA Average* 91

Figure 5.1 | Key Axes in a Country’s Development Plan for Solar Component Industries 94

Figure 5.2 | Strengths and Weaknesses of Algeria vs. US in the Solar Glass Industry 94

Figure 5.3 | Strengths and Weaknesses of Egypt vs. United States and China in the Mirror Industry 101

Figure 5.4 | Strengths and Weaknesses of Morocco vs. China in the Structures & Tracker Industry 114

Figure 5.5 | Investment Zones, Main Seaports and International Airports in Morocco 122

Figure 5.6 | Strengths and Weaknesses of Tunisia vs. United States in the Receiver Industry 124

Figure 5.7 | Representation of the Combined MENA Advantages in the Competitiveness Analysis Compared to the Benchmark and MENA Country Averages 131

Figure 5.8 | Key Axes in a Regional Development Plan for Solar Component Industries 132

Figure A1.1 | Parabolic Trough Collectors Installed at Plataforma Solar de Almería (Spain) 146

Figure A1.2 | Schematics of a Parabolic Trough Collector 147

Figure A1.3 | General Schematics of a Parabolic Trough CSP Plant with Thermal Energy Storage 148

Figure A1.4 | Schematics of a Linear Fresnel Collector 149

Figure A1.5 | Functional Scheme of a Power Tower System using Molten Salt as HTF with TES 151

Figure A1.6 | Main Components of a Heliostat 152

Figures | xiii

xiv | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

Figure A1.7 | Main Components of a Dish/Engine System 154

Figure A1.8 | Schematic that Shows the Operation of a Heat-pipe Solar Receiver 155

Figure A1.9 | Investment Requirements vs. Technology Complexity for CSP Technology Industries 156

Figure A1.10 | CSP Industry Development Opportunities (Normalized Attractiveness Index) in MENA Countries* 157

Figure A1.11 | Developing Phases: From Design to Commercial Exploitation 158

Figure A1.12 | Market Share of the Different CSP Technological Approaches Both Operating (Left) and Under Construction (Right) as of 2012 160

Figure A1.13 | PV Solar Energy Value Chain 174

Figure A1.14 | Polysilicon Manufacturing Value Chain 175

Figure A1.15 | Ingot/Wafer Manufacturing Value Chain 176

Figure A1.16 | c-Si Cell Structure 177

Figure A1.17 | Types of Solar Glass 179

Figure A1.18 | Investment Requirements vs. Technology Complexity for PV Technology Industries 182

Figure A1.19 | PV Industry Development Opportunities (Normalized Attractiveness Index) in MENA Countries 183

Figure A1.20 | Global PV Module Pricing Learning Curve for c-Si and CdTe Modules, 1979–2015 185

Figure A1.21 | Market Share of the Different PV Technological Approaches, 2011 186

Figure A2.1 | Projected Global CSP Installed Capacity, 2008–35 196

Figure A2.2 | Projected Global PV Installed Capacity, 2008–35 197

Figure A2.3 | MENA CSP (Left) and PV (Right) Installed Capacity to 2020 (MW) 197

Figure A2.4 | Global CSP Development: Current Capacity and Capacity under Construction (MW) 198

Figure A2.5 | Global PV Development: Current Capacity and Projected Future Capacity by 2014 (MW) 198

Figure A2.6 | Market Share Evolution for Target Industries Hypotheses, 2011–21 (%) 200

Figure A2.7 | Algeria CSP Market Potential to 2020 Taking into Account Market Share Hypotheses 200

Figure A2.8 | Algeria PV Market Potential to 2020 Taking into Account Market Share Hypotheses 201

Figure A2.9 | Egypt CSP Market Potential to 2020 Taking into Account Market Share Hypotheses 201

Figure A2.10 | Egypt PV Market Potential to 2020 Taking into Account Market Share Hypotheses 202

Figure A2.11 | Jordan CSP Market Potential to 2020 Taking into Account Market Share Hypotheses 202

Figure A2.12 | Jordan PV Market Potential to 2020 Taking into Account Market Share Hypotheses 203

Figure A2.13 | Morocco CSP Market Potential to 2020 Taking into Account Market Share Hypotheses 203

Figure A2.14 | Morocco PV Market Potential to 2020 Taking into Account Market Share Hypotheses 204

Figure A2.15 | Tunisia CSP Market Potential to 2020 Taking into Account Market Share Hypotheses 204

Figure A2.16 | Tunisia PV Market Potential to 2020 Taking into Account Market Share Hypotheses 205

Figure A2.17 | Scenarios in Algeria for CSP Potential Market 205

Figure A2.18 | Scenarios in Algeria for PV Potential Market 205

Figure A2.19 | Scenarios in Egypt for CSP Potential Market 206

Figure A2.20 | Scenarios in Egypt for PV Potential Market 206

Figure A2.21 | Scenarios in Jordan for CSP Potential Market 206

Figure A2.22 | Scenarios in Jordan for PV Potential Market 206

Figure A2.23 | Scenarios in Morocco for CSP Potential Market 207

Figure A2.24 | Scenarios in Morocco for PV Potential Market 207

Figure A2.25 | Scenarios in Tunisia for CSP Potential Market 207

Figure A2.26 | Scenarios in Tunisia for PV Potential Market 207

Figure A4.1 | Investment Requirements vs. Technology Complexity for CSP Technology: Group Definition 212

Figure A4.2 | Investment Requirements vs. Technology Complexity for PV Technology: Group Definition 213

Figures | xv

xvi | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

Figure A4.3 | Investment Requirements vs. Technology Complexity for CSP Technology 216

Figure A4.4 | Investment Requirements vs. Technology Complexity for PV Technology 217

Figure A4.5 | Production Competitiveness Parameters for CSP Industries 218

Figure A4.6 | Production Competitiveness Parameters for PV Industries 218

Figure A4.7 | Global Attractiveness Index by Country for CSP: MENA and Benchmark 223

Figure A4.8 | Global Attractiveness Index by Country for PV: MENA and Benchmark 223

Figure A4.9 | Rankings of Attractiveness Indexes per Country, Aggregated for CSP Technology, with Different Normalization and Aggregation Techniques 226

Figure A4.10 | Rankings of Attractiveness Indexes per Country, Aggregated for PV Technology, with Different Normalization and Aggregation Techniques 227

Figure A5.1 | Market Share Evolution for Target Industries Hypotheses, 2011–21 (%) 230

Figure A5.2 | Comparison of Total Demand for Mirror Industry vs. Range of Production for a Mirror Factory in Egypt, 2014–20 (m2) 230

Figure A5.3 | Cumulative Cash Flow for a Mirror Industry in Egypt, (US$ mil) 231

Figure A5.4 | Market Share Evolution for Target Industries Hypotheses, 2011–21 (%) 232

Figure A5.5 | Comparison of Total Demand for Support Structure Industry vs. Range of Production for a Support Structure Factory in Egypt, 2014–20 (tons) 233

Figure A5.6 | Cumulative Cash Flow for a Support Structure Industry in Egypt, 2013–20 (US$ mil) 234

Figure A5.7 | Market Share Evolution for Target Industries Hypotheses, 2011–21 (%) 235

Figure A5.8 | Comparison of Total Demand for Support Structure Industry vs. Range of Production for a Support Structure Factory in Morocco, 2014–20 (tons) 235

Figure A5.9 | Cumulative Cash Flow for a Support Structure Industry in Morocco, 2013–20 (US$ mil) 236

Figure A5.10 | Market Share Evolution for Target Industries Hypotheses, 2011–21 (%) 237

Figure A5.11 | Comparison of Total Demand for TF Modules Industry vs. Range of Production for a TF Modules Factory in Morocco, 2014–20 (MW) 238

Figure A5.12 | Cumulative Cash Flow for a TF Modules Industry in Morocco, 2013–20 (US$ mil) 238

Figure A5.13 | Market Share Evolution for Target Industries Hypotheses, 2401–21 (%) 240

Figure A5.14 | Comparison of Total Demand for Receiver Industry vs. Range of Production for a Receiver Factory in Tunisia, 2014–20 (000 units) 240

Figures | xvii

xviii | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

Tables

Table 2.1 | CSP Solar Fields 9

Table 2.2 | Main Entry Barriers for the Difficult-to-reach CSP Industries 22

Table 2.3 | Characteristics of Concentrated Solar Power Systems 23

Table 2.4 | Conversion Efficiencies of Different PV Commercial Modules (%) 25

Table 2.5 | Main Entry Barriers for the Difficult-to-reach PV Industries 34

Table 3.1 | Primary Data Related to Production Factors 41

Table 3.2 | Primary Data Related to Demand Factors 42

Table 3.3 | Primary Data Related to Risk and Stability Factors 42

Table 3.4 | Primary Data Related to Business Support Factors 43

Table 3.5 | Global Ranking of Competitiveness Parameters According to Weight 44

Table 3.6 | Ranking of Competitiveness Parameters by Solar Industry (CSP Industries) 45

Table 3.7 | Ranking of Competitiveness Parameters by Solar Industry (PV Industries) 46

Table 3.8 | Rankings of Attractiveness Indexes per Country, Aggregated for CSP Technology, When Using Different Normalization and Aggregation Techniques 47

Table 3.9 | Rankings of Attractiveness Indexes Per Country, Aggregated for PV Technology, when Using Different Normalization and Aggregation Techniques 48

Table 3.10 | CSP Solar Industries by Technology 50

Table 3.11 | PV Solar Industries by Technology 51

Table 3.12 | Market Share in Target Industries Hypotheses for Each MENA Country 57

Table 4.1 | Normalized Attractiveness Index for CSP Component Industries (I) 60

Table 4.2 | Normalized Attractiveness Index for CSP Component Industries (II) 60

Table 4.3 | Normalized Attractiveness Index for Thin Film and Shared PV Component Industries 61

Table 4.4 | Normalized Attractiveness Index for Cristalline PV Component Industries 61

Table 4.5 | Normalized Competitiveness Parameters Included in the Overarching Categories Production Factors and Demand Factors, Aggregated for the CSP Solar Industries 62

Table 4.6 | Normalized Competitiveness Parameters Included in the Overarching Categories Production Factors and Demand Factors, Aggregated for All the PV Solar Industries 63

Table 4.7 | Normalized Competitiveness Parameters Included in the Overarching Categories Risk and Stability Factors and Business Support Factors, Aggregated for All the CSP Solar Industries 64

Table 4.8 | Normalized Competitiveness Parameters Included in the Overarching Categories Risk and Stability Factors and Business Support Factors, Aggregated for All the PV Solar Industries 65

Table 4.9 | Algeria’s Key Strengths and Competitive Gap Weaknesses Analysis 69

Table 4.10 | Impacts and Main Competitors – Algeria 71

Table 4.11 | Egypt’s Key Strengths and Competitive Gap Weaknesses Analysis 74

Table 4.12 | Impacts and Main Competitors: Egypt 77

Table 4.13 | Jordan’s Key Strengths and Competitive Gap Weaknesses Analysis 80

Table 4.14 | Impacts and Main Competitors: Jordan 81

Table 4.15 | Morocco’s Key Strengths and Competitive Gap Weaknesses Analysis 84

Table 4.16 | Impacts and Main Competitors: Morocco 87

Table 4.17 | Tunisia’s Key Strengths and Competitive Gap Weaknesses Analysis 90

Tables | xix

xx | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

Table 4.18 | Impacts and Main Competitors: Tunisia 92

Table 5.1 | Associated Impact on Competitiveness Parameters Due to Recommended Strategic Actions 96

Table 5.2 | Gaps Addressed by Strategic Recommendations Relating to the Axes of the Industrial Development Plan in Algeria: Production Factors and Demand Factors 97

Table 5.3 | Gaps Addressed by Strategic Recommendations Relating to the Axes of the Industrial Development Plan in Algeria, Risk and Stability Factors and Business Support Factors 98

Table 5.4 | General Recommendations to Improve the Flexibility of the Labor Market 101

Table 5.5 | Associated Impacts in Competitiveness Parameters Due to Recommended Strategic Actions 103

Table 5.6 | Gaps Addressed by Strategic Recommendations Relating to the Axes of the Industrial Development Plan in Egypt, Production Factors and Demand Factors 104

Table 5.7 | Gaps Addressed by Strategic Recommendations Relating to the Axes of the Industrial Development Plan in Egypt, Risk and Stability Factors and Business Support Factors 105

Table 5.8 | Associated Impacts in Competitiveness Parameters Due to Recommended Strategic Actions 110

Table 5.9 | Gaps Addressed by Strategic Recommendations Relating to the Axes of the Industrial Development Plan in Jordan: Production Factors and Demand Factors 111

Table 5.10 | Gaps Addressed by Strategic Recommendations Relating to the Axes of the Industrial Development Plan in Jordan: Risk and Stability Factors and Business Support Factors 112

Table 5.11 | General Recommendations to Improve the Flexibility of the Labor Market 115

Table 5.12 | Associated Impacts in Competitiveness Parameters Due to Recommended Strategic Actions 116

Table 5.13 | Gaps Addressed by Strategic Recommendations Relating to the Axes of the Industrial Development Plan in Morocco: Production Factors and Demand Factors 118

Table 5.14 | Gaps Addressed by Strategic Recommendations Relating to the Axes of the Industrial Development Plan in Morocco: Risk and Stability Factors and Business Support Factors 119

Table 5.15 | Course on Hot-dip Galvanizing and Corrosion Protection 122

Tables | xxi

Table 5.16 | General Recommendations to Improve the Flexibility of the Labor Market 124

Table 5.17 | Associated Impacts in Competitiveness Parameters Due to Recommended Strategic Actions 125

Table 5.18 | Gaps Addressed by Strategic Recommendations Relating to the Axes of the Industrial Development Plan in Tunisia: Production Factors and Demand Factors 126

Table 5.19 | Gaps Addressed by Strategic Recommendations Relating to the Axes of the Industrial Development Plan in Tunisia: Risk and Stability Factors and Business Support Factors 127

Table 5.20 | Potential Autonomy of Individual MENA Countries to Develop Various Industries based on Domestic Demand 131

Table 6.1 | Course on Hot-Dip Galvanizing and Corrosion Protection 137

Table 6.2 | Master’s in Carbon Offsetting Clean Development Mechanism and Carbon Markets 138

Table 6.3 | Course on Sputtering Laser Techniques and Encapsulation 139

Table 6.4 | Financing Specific Actions to be Conducted by CIC 141

Table 6.5 | Access to Information Actions to be Conducted by CIC 142

Table 6.6 | Training: Specific Actions to be Conducted by CIC 143

Table 6.7 | Networking Facilitation Actions to be Conducted by CIC 144

Table A1.1 | CSP Solar Fields 145

Table A1.2 | Main Entry Barriers for the Difficult-to-Reach CSP Industries 157

Table A1.3 | Characteristics of Concentrated Solar Power Systems 159

Table A1.4 | Conversion Efficiencies of Different PV Commercial Modules 173

Table A1.5 | Main Entry Barriers for the Difficult-to-Reach PV Industries 184

Table A2.1 | Projected Global Solar Installed Capacity (GW), 2008–35 196

Table A2.2 | Market Share Hypotheses for Each MENA Country to 2020 (%) 199

Table A4.1 | Weight Factors for Overarching Categories in Industries within Group I: CSP Industries 214

Table A4.2 | Weight Factors for Overarching Categories in Industries within Group II: CSP Industries 214

Table A4.3 | Weight Factors for Overarching Categories in Industries within Group III: CSP Industries 214

xxii | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

Table A4.4 | Weight Factors for Overarching Categories in Industries within Group IV: CSP Industries 214

Table A4.5 | Weight Factors for Overarching Categories in Industries within Group I: PV Industries 214

Table A4.6 | Weight Factors for Overarching Categories in Industries within Groups II and III: PV Industries 215

Table A4.7 | Weight Factors for Overarching Categories in Industries within Group IV: PV Industries 215

Table A4.8 | Percentage Used to Set up a Weight Factor to Relevant Manufacturing Ability and Material Availability According Technological Complexity: CSP Industries 216

Table A4.9 | Percentage Used to set up a Weight Factor to Relevant Manufacturing Ability and Material Availability According Technological Complexity: PV Industries 217

Table A4.10 | Competitiveness Parameters Associated with Risk and Stability Factors 219

Table A4.11 | Competitiveness Parameters Associated with Business Support Factors 219

Table A4.12 | Weight Factors Applied to Primary Data within the Labor Market Competitiveness Parameter 220

Table A4.13 | Weight Factors Applied to Primary Data within the Material Availability Competitiveness Parameter; Example: Receiver Industry 220

Table A4.14 | Weight Factors Applied to Primary Data within the Relevant Manufacturing Ability Competitiveness Parameter 220

Table A4.15 | Weight Factors Applied to Primary Data within the Fiscal Policy Competitiveness Parameter 220

Table A4.16 | Weight Factors Applied to Primary Data within the Component Demand Competitiveness Parameter 221

Table A4.17 | Weight Factors Applied to Primary Data within the Risk Associated with Doing Business Competitiveness Parameter 221

Table A4.18 | Weight Factors Applied to Primary Data within the Risk Associated with Demand Competitiveness Parameter 221

Table A4.19 | Weight Factors Applied to Primary Data within the Industry Structure Competitiveness Parameter 222

Table A4.20 | Weight Factors Applied to Primary Data within the Innovation Capacity Competitiveness Parameter 222

Table A4.21 | Weight Factors Applied to Primary Data within the Logistical Infrastructure Competitiveness Parameter 222

Table A4.22 | Calculation Methods Used for Parameter Aggregation and Normalization 224

Table A4.23 | Rankings for CSP Technology Using Different Normalization and Aggregation Techniques 226

Table A4.24 | Rankings for PV Technology Using Different Normalization and Aggregation Techniques 223

Table A4.25 | Cronbach’s Alpha (α) for Competitiveness Parameters 228

Table A6.1 | Primary Data Related to Production Factors: MENA Countries 241

Table A6.2 | Primary Data Related to Production Factors: Benchmark Countries 242

Table A6.3 | Primary Data Related to Demand Factors: MENA Countries 243

Table A6.4 | Primary Data Related to Demand Factors: Benchmark Countries 243

Table A6.5 | Primary Data Related to Stability and Risk Factors: MENA Countries 244

Table A6.6 | Primary Data Related to Stability and Risk Factors: Benchmark Countries 245

Table A6.7 | Primary Data Related to Business Support Factors: MENA Countries 246

Table A6.8 | Primary Data Related to Business Support Factors: Benchmark Countries 248

Table A6.9 | Weight Factor for an Industry within an Attractiveness

Index ( is) – Weighting Overarching Categories: CSP Industries 248

Table A6.10 | Weight Factor for an Industry within an Attractiveness Index ( i

s) – Weighting Overarching Categories: PV Industries 248

Table A6.11 | Weight Factor within an Overarching Category ( i js, ) –

Weighting Competitiveness Parameters: CSP Industries 249

Table A6.12 | Weight Factor within an Overarching Category ( i js, ) –

Weighting Competitiveness Parameters: PV Industries 250

Table A6.13 | Weight Factor within a Competitiveness Parameter ( j ks, ) –

Weighting Normalized Primary Data: CSP Industries 251

Table A6.14 | Weight Factor within a Competitiveness Parameter ( j ks, ) –

Weighting Normalized Primary Data: PV Industries 256

Tables | xxiii

xxiv | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

Acronyms and Abbreviations

ADEREE National Agency for the Development of Renewable Energy and Energy Efficiency (Morocco)

AGADIR Arab Mediterranean Free Trade Agreement

ANME Agence Nationale pour la Maîtrise de l’Énergie (Tunisia)

ANOVA Analysis of variance

API American Petroleum Institute

BIPV Building Integrated Photovoltaic

BoPET Biaxially oriented poly-ethylene terephthalate

CDM Clean development mechanism

CdS Cadmium sulfide

CCGT Combined cycle gas turbine

CIC Climate Innovation Center

CIGS Copper-indium-gallium selenide

CIS Copper-indium sulfide

CoSPER Committee for Rural Electrification Program (Morocco)

CPV Concentrated photovoltaic

CSP Concentrated solar power

DNI Direct normal irradiation

EIB European Investment Bank

EPC Engineering, Procurement and Construction contract; occ., Contractor of EPC

EPIA European Photovoltaic Industry Association

ESMAP Energy Sector Management Assistance Program

EU European Union

EVA Ethylene-vinyl acetate

E&Y Ernst & Young

FDI Foreign direct investment

FIT Feed-in tariff

GAFTA Greater Arab Free Trade Area

GCR Global Competitiveness Report

GDP Gross domestic product

GHG Greenhouse gas

GHI Global Horizontal Irradiation

GNP Gross national product

GW Gigawatt

GWe Gigawatt-electric

GWh Gigawatt-hour

HTF Heat transfer fluid

ICT Information and communication technology

IEA International Energy Agency

IFC-WB International Finance Corporation (World Bank Group)

IPF Investment Promotion Fund

IPP Independent power producer

ISCC Integrated solar combined cycle

ISO International Organization for Standardization

ITO Tin-doped indium oxide

kW Kilowatt

kWe Kilowatt-electric

KWh Kilowatt-hour

LCD Liquid crystal display

LCOE Levelized cost of energy

MAD Moroccan Dirham

MASEN Moroccan Agency for Solar Energy

MEMR Ministry of Energy and Mineral Resources (Jordan)

MENA Middle East and North Africa

MG-Si Metallurgical grade silicon

MW Megawatt

MWe Megawatt-electric

MWh Megawatt-hour

NAMA Nationally appropriate mitigation action

NREA New and Renewable Energy Authority (Egypt)

NTF-PSI Norwegian Trust Fund for Private Sector and Infrastructure

NTM Nontariff measures

OEM Original equipment manufacturer

O&M Operation and maintenance

ONEE Office National De l’Électricité et de l’Eau Potable (Morocco)

PB Power block

PECVD Plasma-enhanced chemical vapor deposition

PER Plan de Energías Renovables (Spain)

PERG Global Rural Electrification Program

PGESCO Power Generation Engineering and Services Co. (Egypt and Bechtel)

PV Photovoltaic

PVF Poly-vinyl fluoride

RD Royal Decree

RE Renewable energy

RCREEE Regional Centre for Renewable Energy and Energy Efficiency

ROW Rest of the world

R&D Research and development

SF Solar field

SME Small and medium enterprises

SITC Standard International Trade Classification

Si’Tarc Small Industries Testing and Research Centre (India)

SCR Silicon controlled rectifier

STA Solar Technology Advisors

Acronyms and Abbreviations | xxv

xxvi | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

STC Standard test conditions

SWOT Strengths, weakness/limitations, opportunities and threats

TCO Transparent conductive oxide

TCS Trichlorosilane (HSiCl3)

TES Thermal energy storage

TF Thin film

US United States of America

US$ United States dollar

WEO World Energy Outlook

Acknowledgments

This study was prepared by a World Bank team led by Roger Coma Cunill and composed of Chandrasekar Govindarajalu, Silvia Pariente-David, Fanny Missfeldt-Ringius, Manaf Touati, Fowzia Hassan, and Mohab Hallouda, all of the Middle East and North Africa Region, Energy and Extractives Global Practice.

The assessment was drafted by a consortium of consultants composed of Solar Technology Advisors (STA)––Jorge Servert and Eduardo Cerrajero––and Accenture––Jose Ramón Alonso and Paz Nachón.

The team would like to thank the peer reviewers––Mario Ragwitz and Inga Boie (Fraunhofer ISI), and Silvia Martinez-Romero (ESMAP) and Nathalia Kulichenko (GEEDR)––for their valuable comments.

The team is grateful for the funding for this study by the Norwegian Trust Fund for Private Sector and Infrastructure (NTF-PSI) and the Energy Sector Management Assistance Program (ESMAP) representing the commitment of the World Bank and these organizations to support the MENA countries in the development of opportunities around solar energy.

Stakeholder workshops were conducted in Egypt and Morocco to garner feedback from client countries, industry participants, and donors. Interim results were presented and discussed at the MENAREC (Middle East North Africa Renewable Energy Conference) (May 2012) and Solar Paces (October 2012) regional conferences. Final results were presented in Morocco in Skhirat (January 2013) and Marrakech (October 2013).

Alicia Hetzner edited the report and Marjorie K. Araya (ESMAP) managed the final production.

Acknowledgments | xxvii

xxviii | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

Model Notation

Pkc Primary datum (of the country “c”)

pkc Normalized datum

j ks, Weight of data within a Competitiveness parameter (for the industry “s”)

CPjs c, Competitiveness parameter

cpjs c, Normalized Competitiveness parameter

i js, Weight of Competitiveness parameters within an Overarching category

OC js c, Overarching category

ocjs c, Normalized Overarching category

is Weight of an Overarching category within the Attractiveness index

AIs c, Attractiveness index (of the country “c” for the industry “s”)

ais c, Normalized Attractiveness index

R Mean correlation

Superscripts:

c Country

b Benchmark country

m MENA country

s Solar industry

pv Solar industry related to PV

csp Solar industry related to CSP

Subscripts:

i Overarching category

j Competitiveness parameter

k Datum

Chapter 1 | Executive Summary | 1

11111CHAPTER ONE:

Executive Summary

1.1 Introduction

The objective of this study is to assess the competitiveness of five selected Middle East and North Africa (MENA) countries—Algeria, Egypt, Jordan, Morocco and Tunisia—to attract private sector investments in the Concentrated Solar Power (CSP) and Photovoltaic (PV) industries.1 The study develops an Attractiveness index for these countries and compares them to a group of Benchmark countries comprising Chile, China, Germany, India, Japan, South Africa, Spain, and the United States. The study also identifies the existing gaps between the MENA and Benchmark countries; and proposes recommendations to improve the competitiveness of MENA countries and, hence, to develop a local solar industry. To achieve these goals, a macro- and microeconomic analysis is carried out through a competitiveness benchmark

analysis, together with an analysis of the solar industry value chain and the projected component demand.

The Attractiveness index for each solar industry is composed of all relevant variables that an investor would take into account in his/her decision to set up a manufacturing plant.2

The four main factors for such a decision are3: (i) Production: productivity, and costs of production factors; (ii) Demand: expected internal and external demand for solar components; (iii) Risk and stability: Real and perceived risks; and (iv) Business support: Specific support and enabling environment. PV and CSP are complementary, rather than directly competitive. For this reason, developers should carefully assess their needs and environment when choosing which solar technology to use.

1.2 MENA Countries Face Strong Competition from Leading Solar Markets

1.2.1 CONCENTRATED SOLAR POWER (CSP) INDUSTRIES

The value chain analysis reveals three groups of industries with differing technological complexity4 and investment requirements (Figure 1.1). They comprise a group of industries that can be independently developed (independent industries); a group of

industries that are best developed based on existing conventional industries (conventional industries); and a group of industries that, due to their complexity and required investment, are not likely to be developed (difficult-to-reach industries).

Overall, MENA countries have some potential to attract investments in manufacturing facilities of

1 This study complements the World Bank study [69] published in March 2011.2 The Attractiveness index is a synthetic indicator built by aggregating 49 parameters, as described in the Methodology section. 3 Resulting from discussions with leading solar companies.4 The analysis of technological complexity is based on consulting and interviews with solar experts according to their internal manufacturing processes.

2 | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

conventional (heat exchanger, pumps, storage tanks, and condensers) and independent (structure and tracker and solar salt) industries due to their higher Attractiveness index (Figure 1.2).

1.2.2 PHOTOVOLTAIC (PV) INDUSTRIES

The value chain analysis of Crystalline and Thin Film technologies5 reveals three groups of industries with differing technological complexity and investment requirements (Figure 1.3): a group of industries related to the Thin Film components (TF industries); a group of industries shared by

Crystalline and Thin Film technologies (sharedindustries), such as support structure and inverters; and a group of industries difficult to reach in most parts of the world, including Benchmark countries, due to their technological complexity and investment requirements. Most Crystalline industries, except for the module assembly, fall into this last category.6

Overall, MENA countries are more suited to develop shared industries such as inverters and support structures. In the medium term, if current world-wide overcapacity were to diminish, investments in Thin Film PV, solar glass, and modules industries could be considered (Figure 1.4).

Figure 1.1 | Investment Requirements vs. Technology Complexity for CSP Technology Industries

Difficult to reach Conventional Independent

Technology Complexity

Inve

stm

ent R

equi

rem

ents

Steam Turbine

HTF Thermal Oil

Electrical Generator

HTF Pumps

HighLow

Low

High

Pumps

Receiver

Storage Tanks

Heat exchanger

Structure & Tracker

Solar Salt

Complexity and Investment Requirements for the CSP Solar Industry

Condenser

Mirror

Source: STA/Accenture.

5 Crystalline PV has 80%–90% of market share, with Thin Film largely making up for the remaining. Concentrated Photovoltaic (CPV) has not been included directly in the study due to its lower penetration rate, but CPV technology requirements are included in the CSP and PV technology, because some of the components (trackers, optics, cells), are common to the other two solar technologies. Thus, CPV technology also could be of interest to MENA countries in the future. 6 Crystalline industries represent a market with experienced actors in an over-production capacity situation that has exerted downward pricing pressure on the value chain.Thus, the barriers of entry to this market are very high and currently not suitable to MENA countries.

Chapter 1 | Executive Summary | 3

Figure 1.3 | Investment Requirements vs. Technology Complexity for PV Technology Industries

Difficult to reach TF Shared

PV - Crystalline PV - Thin Film PV - Shared

Technology Complexity

Inve

stm

ent R

equi

rem

ents

HighLow

Low

HighPolysilicon

Ingots/Wafers

Cells

Solar Glass

Complexity and Investment Requirements for the PV Solar Industry

TF Materials

c-Si Modules

TF Modules

Inverters

Support Structure

Source: STA/Accenture.

Figure 1.2 | CSP Industry Development Opportunities in MENA Countries

1.0 Average MENA

Algeria

Egypt

Jordan

Morocco

Tunisia

Average Benchmark

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

Structu

re & Tra

cker

Storage Tanks

Steam Turbine

HTF PumpsHTF Th

ermal O

il

Heat Exchanger

Electrical G

enerator

Condenser

Solar Salt

Receiver

Pumps

Mirror

Source: STA/Accenture.

Note: The range covered by Benchmark countries is shaded.

4 | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

1.3 Egypt and Morocco Show the Highest Attractiveness Index for CSP and PV Component Industries

The selected MENA countries lag behind the Benchmark countries, but present opportunities for improving their attractiveness to investors. For a given country, attractiveness varies among different component industries according to the country’s suitability to fulfill the specific needs of that industry (such as low energy price for energy-intensive industries, availability and price of critical materials) and investors’ preferences. The strengths and weaknesses of each MENA country for the development a local solar industry follow.

Algeria’s key strengths are the costs of energy for industrial consumers,7 its industry structure, and its solar energy targets. The four main aspects to improve would be its availability of required components and materials, risks associated with doing business, innovation capacity, and logistical infrastructure. Algeria could, however, explore opportunities in industries with higher energy requirements such as solar glass, TF materials and TF modules.

Figure 1.4 | PV Industry Development Opportunities in MENA Countries

Average MENA

Algeria

Egypt

Attra

ctiv

enes

s in

dex

Jordan

Morocco

1.0

0.9

0.8

0.7

0.6

0.5

0.4

0.3

0.2

0.1

Tunisia

Cells

Modules c-Si

Ingots Wafers

Polysilicon

Solar glass

TF Materials

TF Modules

Inverter

Support Stru

cture

Average Benchmark

Source: STA/Accenture.

Note: The range covered by Benchmark countries is shaded.

7 A low-cost electricity presents a competitive advantage to private investors in energy-intensive industries. However, from the point of view of the country, subsidies to energy consumption introduce tensions in the system because they veil the true price signal to electricity consumers and may lead to adverse economic and environmental impacts[94]. For a country that generates its electricity largely from natural gas, a true price of electricity would need to take into account the LCOE (levelized cost of energy) of a CCGT (Combined Cycle Gas Turbine) plant, estimated at 5$c/kWh, and add to it transportation costs, business margin, and others to arrive at the final number[93].

Chapter 1 | Executive Summary | 5

Egypt’s key strengths are its low cost of labor and of energy for industrial consumers;8 its availability of materials for solar industries, particularly glass, steel, and stainless steel; and a high manufacturing ability. The key aspect to improve would be its fiscal and financial costs, which undermine the country’s competitiveness. Egypt should focus on developing the CSP Structure & Tracker industries and the Support structure industry for PV. In the medium term, Egypt could consider opportunities to innovate

in some of the conventional CSP industries (heat exchanger, storage tanks) and to develop the solar glass and Mirror industries, with a strategy to take advantage of regional synergies. Investments in new reflective materials also could be explored in Egypt.9

Jordan’s key strengths for solar industry development are its fiscal and financial costs, low risk associated with doing business, and its higher education rates. On the other hand, a weak industrial structure10 and

Figure 1.5 | Competitiveness Parameters in Algeria Compared to Benchmark and MENA Averages

Innovation capacity

Industry structure

Financial risk

Risk associated to demand

Risk associated to doing business

Component demand

Fiscal and financial costs

Cost of energy (industrial)

Relevant manufacturing ability

Material availability

Labor market

Logistical infrastructure

Algeria

1.00

0.80

0.60

0.40

0.20

-

Production

Demand

Risk and stability

Business support

Benchmark Country Average

MENA Country Average

Source: STA/Accenture.

8 A low cost of electricity presents a competitive advantage for private investors in energy-intensive industries. However, from the point of view of the country, subsidies to energy consumption introduce tensions in the system because they veil the true pricesignal to electricity consumers and may lead to adverse economic and environmental impacts[94]. Although energy cost for industrial consumers is still low in Egypt, the cost has risen substantially over the past year and is expected to keep increasing because national subsidies to fossil fuels have been reduced.9 All-aluminum and multilayer aluminum reflectors[6], as well as reflective films ([7], [8]) are entering the market. However, despite having advantages compared with conventional glass Mirrors (light weight, no thermal shock, lower expected price), they also have disadvantages (durability concerns) and scant or no track record.10 Industrial structure refers to (a) the presence of large international industrial companies, (b) the % of industrial GDP, and (c) local clustering of suppliers needed for the solar industry being considered.

6 | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

Figure 1.7 | Competitiveness Parameters in Jordan Compared to Benchmark and MENA Averages

Innovation capacity

Industry structure

Financial risk

Risk associated to demand

Risk associated to doing business

Component demand

Fiscal and financial costs

Cost of energy (industrial)

Relevant manufacturing ability

Material availability

Labor market

Logistical infrastructure

Jordan

1.00

0.80

0.60

0.40

0.20

-

Production

Demand

Risk and stability

Business support

Benchmark Country Average

MENA Country Average

Source: STA/Accenture.

Figure 1.6 | Competitiveness Parameters in Egypt Compared to Benchmark and MENA Averages

Egypt

Labor market

Material availability

Relevant manufacturingability

Cost of energy (industrial)

Financial risk Fiscal and financial costs

Component demand

Risk associated to doingbusiness

Risk associated to demand

Production

Demand

Risk and stability

Business support

Benchmark Country Average

MENA Country Average

Industry structure

Logistical infrastructure

Innovation capacity

1.00

0.80

0.60

0.40

-

0.20

Source: STA/Accenture.

Chapter 1 | Executive Summary | 7

high cost of industrial energy, combined with lower expected local demand are drawbacks to new industrial developments. However, investments for some niche applications, as well as the creation of a regional Certification and Testing Institute, could be explored.

Morocco’s key strengths are its planned solar demand for 2020; the government’s commitment and support;11 and the overall industrial structure in the country, which includes the presence of large international companies alongside specific local clustering. The main aspects to improve are the cost of industrial energy, materials availability, innovation capacity, and logistical infrastructure. Morocco could focus on developing the CSP Structure & Tracker

industries and the Support structure industry for PV; and in the medium term, consider opportunities to innovate in the conventional CSP industries (condenser, pumps).

Tunisia’s keys strengths are its level of education, business sophistication, and a better-than-average logistical infrastructure. However, a weak industrial structure and high cost of energy for industrial customers, combined with low material availability and relevant manufacturing ability, could pose drawbacks to new industrial developments. In the short term, the CSP Receiver industry and the materials industry for PV TF may be of particular interest for development in Tunisia.

Figure 1.8 | Competitiveness Parameters in Morocco Compared to Benchmark and MENA Averages

Innovation capacity

Industry structure

Financial risk

Risk associated to demand

Risk associated to doing business

Component demand

Fiscal and financial costs

Cost of energy (industrial)

Relevant manufacturing ability

Material availability

Labor market

Logistical infrastructure

Morocco

1.00

0.80

0.60

0.40

0.20

-

Production

Demand

Risk and stability

Business support

Benchmark Country Average

MENA Country Average

Source: STA/Accenture.

11 The Moroccan Agency for Solar Energy (MASEN) is a Joint Stock company with a Board of Trustees and a Supervisory Board. MASEN aims at implementing a program to use solar energy to develop integrated electricity production projects with a minimum total capacity of 2000 MW in the areas of Morocco that are capable of doing so[91].

8 | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

The creation of a Climate Innovation Center (CIC) could assist investors, professionals and policy-makers in MENA countries to develop

local solar industries. The CIC could help to fill MENA’s gaps in financing, access to information, consulting and training, and networking.

Figure 1.9 | Competitiveness Parameters in Tunisia Compared to Benchmark and MENA Averages

Innovation capacity

Industry structure

Financial risk

Risk associated to demand

Risk associated to doing business

Component demand

Fiscal and financial costs

Cost of energy (industrial)

Relevant manufacturing ability

Material availability

Labor market

Logistical infrastructure

Tunisia

1.00

0.80

0.60

0.40

0.20

-

Production

Demand

Risk and stability

Business support

Benchmark Country Average

MENA Country Average

Source: STA/Accenture.

Chapter 2 | Introduction to the Value Chain of Solar Technologies | 9

22222222222CHAPTER TWO

Introduction to the Value Chain of Solar Technologies

2.1 Concentrated Solar Power (CSP) Technology

Although, strictly speaking, “concentrated solar power” also could apply to low- and high-concentration photovoltaic systems, the term is more commonly used to describe technologies that use the thermal energy from solar radiation to generate electricity. These systems can be subdivided in three main subsystems:

• Solar field (SF), in which Mirrors (or, in some new developments, lenses) are used to concentrate (focus) sunlight energy and convert it into high temperature thermal energy (internal energy). This heat is transferred using a heat transfer fluid (HTF), which can be synthetic oil (the most widely used), molten salt, steam, air, or other fluids. Although they require highly precise, two-axis tracking systems, the point focus systems enable higher concentration ratios and, therefore, higher temperatures and efficiencies. On the other hand, linear focus systems are less demanding but also less efficient. Either way, as with any concentrating solar technology, only the beam (direct) component of the solar irradiation is used, because the diffuse portion does not follow the same optical path so will not reach the focus.

• Power block (PB), in which the heat contained in the HTF is used to generate electricity. The most common approach is to produce high pressure steam, which then is channeled through a conventional steam turbine and generator in a Rankine cycle. The Dish/Engine systems, however, use a Stirling engine.

• Thermal energy storage (TES) system, in which excess energy from the SF is stored for further use in the PB. The state of the art in this field is to use molten salts stored in two tanks (one “cold” and one “hot”), and a reversible heat exchanger. Additional approaches are steam storage, direct use of molten salt as HTF, and experimental prototypes.

To sum up, actual CSP plants utilize four alternative technological approaches: Parabolic Trough Systems, Linear Fresnel Systems, Power Tower Systems, and Dish/Engine Systems.

2.1.1 PARABOLIC TROUGH SYSTEMS

The Parabolic Trough today is considered a commercially mature technology, with thousands of megawatts already installed in commercial power

Table 2.1 | CSP Solar Fields

Point Focus Linear Focus

Single focus Power Tower systems*

Multiple focus Dish/Engine systems Parabolic Trough systemsLinear Fresnel systems

Source: Authors. Note: *Multitower solar fields are at a demonstration stage (a 5-MWe plant started operation in 2009).

10 | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

plants, mainly in the US and Spain. In 2012 Parabolic Trough comprised approximately 95 percent of total CSP installed capacity (Figure 2.1).

Parabolic Trough (as well as Linear Fresnel) is a 2D concentrating system in which the incoming direct solar radiation is concentrated on a focal line by one-axis-tracking, parabola-shaped Mirrors. They are able to concentrate the solar radiation flux by 30–80 times, heating the HTF to 393ºC. (A different approach using molten salts as HTF can heat to 530ºC but is not yet commercially proven.) The typical unit size of these plants ranges from 30 MWe–80 MWe (megawatt-electric). Thus, they are well suited for central generation with a Rankine steam turbine/generator cycle for dispatchable markets.

A Parabolic Trough solar field comprises a variable number of identical “solar loops” connected in parallel. Each loop can raise the temperature of a

certain amount of HTF from the “cold” to the “high” operation temperature (typically from 300ºC to 400ºC). The loops contain from 4 to 8 independently moving subunits called “collectors.” The main components of a Parabolic Trough collector are:

• HTF Thermal Oil: A synthetic oil is used as heat transfer fluid in all commercial Parabolic Trough CSP plants actually in operation. The most commonly used oil is a eutectic mixture of biphenyl and diphenyl oxide. Additional fluids (such as silicone-based) are under development and testing.

• Mirror: It reflects the direct solar radiation incident on it and concentrates it onto the Receiver placed in the focal line of the Parabolic Trough collector. The Mirrors are made with a thin silver or aluminum reflective film deposited on a low-iron, highly transparent glass support to give them the necessary stiffness and parabolic shape.

Figure 2.1 | Parabolic Trough Collectors Installed at Plataforma Solar de Almería (Spain)

Source: Photo courtesy of PSA-CIEMAT.

Chapter 2 | Introduction to the Value Chain of Solar Technologies | 11

• Receiver or absorber tube: It consists of two concentric tubes. The inner tube is made of stainless steel with a high-absorptivity, low-emissivity coating, and channels the flow of the HTF. The outer tube is made of low-iron, highly transparent glass with an antireflective coating. A vacuum is created in the annular space. This configuration reduces heat losses, thus increasing overall collector performance.

• Structure & Tracker: The solar tracking system changes the position of the collector following the apparent position of the sun during the day, thus enabling concentrating the solar radiation onto the Receiver. The S&T system consists of a hydraulic drive unit that rotates the collector around its axis, and a local control that governs the drive unit. The structure, in turn, must keep the shape and relative position of the elements, transmitting the driving force from the tracker and avoiding deformations caused by their own weight or other external forces such as the wind.

The power block of a Parabolic Trough CSP plant resembles a conventional Rankine-cycle power plant. The main difference is that, instead of combustion or a nuclear process, the heat used to generate superheated steam is collected in the solar field and transferred using a HTF. The main components of the power block are:

• Condenser: Although it also is a heat exchanger, the condenser’s design is more complex. The condenser affects the overall performance of the plant more than the other heat exchangers in the plant because it modifies the discharge pressure of the turbine. For this reason, the turbine manufacturer could try to limit the possible suppliers of condensers to give a performance guarantee, or even include the condenser in its own scope of supply.

• Electrical generator: Within the generator, the rotary movement from the turbine is transmitted to a series of coils inside a magnetic field, thus producing electricity due to electromagnetic induction. The design and manufacturing of a generator requires special materials and a highly specialized workforce, available to only a limited number of companies around the world. To manufacture generators, carbon steel, stainless steel, and special alloys are required, as well as copper and aluminum in smaller amounts.

• Heat exchanger: Two different sets of heat exchangers are required in the PB. First, HTF-water heat exchangers (usually referred to as SGS, or steam generation system) are required to generate the high-pressure and -temperature steam that will drive the turbine. Second, water-water heat exchangers recover the heat from turbine bleeds to preheat the condensate or feed water, thus increasing the Rankine cycle efficiency. If a TES system is included, a reversible, molten salt-HTF heat exchanger also is necessary. To manufacture exchangers, carbon steel and stainless steel are required, as well as copper and aluminum in smaller amounts.

• HTF Pumps: The materials commonly used in joints for the range of temperatures and pressures

Figure 2.2 | Schematics of a Parabolic Trough collector

0302

01

01 02 03

Sun rays

Solar Field Piping Ref lector Absorber tube

Source: STA.

12 | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

required for this application are not compatible with the chemical composition of the HTF oil. Thus, specific designs and materials, derived mostly from the petrochemical industry, are necessary.

• Pumps: Several sets of pumps are required within a Parabolic Trough CSP plant: feed water pumps; cooling water pumps; condensate pumps; and other minor pumps for dosing, sewage, raw water, and water treatment purposes. If a TES system is included, molten salt pumps also are necessary. Carbon steel and stainless steel, as well as copper, aluminum, and other materials in smaller amounts, are required to manufacture pumps.

• Steam turbine: The expansion of the steam inside the turbine will cause the motion of the rotor

blades, and this movement will be transmitted to the Electrical generator to produce electricity. The design and manufacturing of a turbine requires special materials and a highly specialized workforce, available to only a limited number of companies around the world. Carbon steel, stainless steel, and special alloys are required for to manufacture steam turbines.

• Storage tanks: A large number of tanks and pressure vessels are required in a Parabolic Trough CSP plant. They include raw and treated water storage tanks; deaerator; steam drum; and condensate tank for the Rankine cycle; HTF storage; expansion; and ullage vessels and other minor tanks for sewage and water treatment intermediate steps. If a TES system is included, molten salt “hot” and “cold” storage tanks also

Figure 2.3 | General Schematics of a Parabolic Trough CSP Plant with Thermal Energy Storage

Generator

Steam turbine

Hot salt storage

Condenser

Cooling tower

Substation

Salt storage heat exchanger

Cold salt storage

Steam generator

Solar field

02

03

04

05

06

07

08

09

10

01

0809 07

04

05 06

10

0203

01

Source: STA.

Chapter 2 | Introduction to the Value Chain of Solar Technologies | 13

are necessary. Carbon steel and stainless steel are required to manufacture tanks.

The state of the art in the field of thermal energy storage (TES) is to use molten salts. The most common mixture used for this purpose is referred to as “Solar salt,” and is composed by sodium nitrate (NaNO3) and potassium nitrate (KNO3). As described above, this salt is stored in two tanks (one “cold” and one “hot”), and a reversible heat exchanger is used to move energy from the solar field and to the power block.

Other elements also are necessary, such as piping, insulation, and either flexible piping or rotating joints to connect adjacent collectors, as well as electric switchgear, water treatment equipment, etc. However, these elements are either unspecific of CSP technology or, in the case of flexible piping or rotating joints, pose a minor fraction of the investment costs and are a highly specialized component, and thus have been omitted from this report.

2.1.2 LINEAR FRESNEL SYSTEMS

Linear Fresnel Systems are conceptually simple, using inexpensive, compact optics (flat Mirrors) that can produce saturated steam at 150ºC–360ºC with less than 1 ha/MW land use. Linear Fresnel systems account for 2 percent of total CSP installed capacity. This percentage is expected to increase in the near future as the system’s share in the pipeline increases (Figure 2.1).

The Fresnel system uses flat or slightly curved Mirrors to direct sunlight to a fixed absorber tube positioned above the Mirrors, sometimes with a secondary reflector to improve efficiency. With flat Mirrors that are close to the ground, Linear Fresnel collectors are less expensive to produce and less vulnerable to wind damage. On the other hand, efficiency is lower due to a lower concentration ratio, and the intra-day energy outflow variation is higher than in Parabolic Trough.

Figure 2.4 | Schematics of a Linear Fresnel Collector

Absorber tubePrimary fresnel ref lectorSecond stage ref lector 02 0301

Sun rays

02

03 01

Source: STA.

14 | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

A Linear Fresnel solar field comprises a variable number of identical “solar loops” connected in parallel. Each loop can raise the enthalpy of a certain amount of HTF. Most[1] commercial applications use water as HTF in a Direct Steam Generation (DSG) configuration; and, instead of raising the temperature, these applications increase the vapor fraction of the fluid. The main components of a Linear Fresnel loop are:

• Mirror: Mirror reflects the direct solar radiation incident on it and concentrates it onto the Receiver placed in the focal line of the Linear Fresnel loop. The Mirrors are made with a thin silver or aluminum reflective film deposited on a low-iron, highly transparent glass support to give them the necessary stiffness. They are similar to the Mirrors for Parabolic Trough, differing in size and shape. Alternatively, aluminum foils are being tested by some leading companies (3M).

• Receiver or absorber tube: Receiver is made of stainless steel with a high-absorptivity and low-emissivity coating, it channels the flow of the HTF. The tube is placed inside a secondary reflector with a flat cover made of low-iron, highly transparent glass with an antireflective coating. This configuration reduces heat losses and increases the half-acceptance angle,12 thus increasing overall performance.

• Structure & Tracker: Solar tracking system changes the position of the mirrors following the apparent position of the sun during the day, thus enabling concentrating the solar radiation onto the Receiver. S&T consists of several drives that rotate the mirrors, and a local control that governs the drive unit. The structure, in turn, must keep the shape and relative position of the elements, transmitting the driving force from the tracker, and avoiding deformations caused by their own weight or other external forces such as the wind.

The power block of a Linear Fresnel CSP plant resembles a conventional Rankine-cycle power

plant. The main difference is that, instead of a combustion or nuclear process, the heat used to generate superheated steam is collected in the solar field and transferred using a heat transfer fluid. The main components of the PB are:

• Condenser: It is analogous to the equipment described for Parabolic Trough plants.

• Electrical generator: It is analogous to the equipment described for Parabolic Trough plants.

• Heat exchanger: Most commercial Linear Fresnel applications use water as HTF in a Direct Steam Generation (DSG) configuration. Thus, the need for heat exchangers is largely reduced compared to in a Parabolic Trough plant. The Solar Field will act as SGS (Steam Generation System), generating the high-pressure and temperature steam that will drive the turbine. Water-water heat exchangers are still necessary to recover the heat from turbine bleeds to preheat the condensate or feed water, thus increasing the Rankine cycle efficiency. Carbon steel and stainless steel, as well as copper and aluminum in smaller amounts, are required for their manufacture.

• Pumps: Several sets of pumps are required within a Linear Fresnel CSP plant: feed water pumps, cooling water pumps, condensate pumps, and other minor pumps for dosing, sewage, raw water and water treatment purposes. Carbon steel and stainless steel are required for their manufacture, as well as copper, aluminum, and other materials in smaller amounts.

• Steam turbine: It is analogous to the equipment described for Parabolic Trough plants.

• Storage tanks: A large number of tanks and pressure vessels are required in a Linear Fresnel CSP plant. They include raw and treated water storage tanks, the deaerator, the steam drum, the condensate tank for the Rankine cycle; and other minor tanks for sewage and water treatment intermediate steps. Depending on the DSG configuration, additional steam drums could

12 The half-acceptance angle is the angle of the maximum cone of light that will reflect onto the focus; it is used to characterize non-ideal optic systems.

Chapter 2 | Introduction to the Value Chain of Solar Technologies | 15

be required for the solar field. Carbon steel and stainless steel are required for their manufacture.

The state of the art in the field of thermal energy storage (TES) is to use molten salts. However, the use of water (phase change) in Linear Fresnel plants makes it difficult using actual molten salts. Short-term energy storage using steam is the usual approach in these plants, if any[1].

Other elements also are necessary, such as piping, insulation, electric switchgear, and water treatment equipment. However, these elements are either not specifically for CSP technology or pose a minor fraction of the investment costs, so have been omitted from this report.

2.1.3 POWER TOWER SYSTEMS

The Power Tower systems, also known as Central Receiver systems, have more complex optics than the systems above because they are based on a 3-D concentration concept. A single solar Receiver is mounted on a tower, and sunlight is concentrated by means of a large paraboloid that is discretized

in a field of heliostats. Multitower systems also are under development. Power Tower systems currently represent 3 percent of total CSP installed capacity (Figure 2.1). This share is expected to increase in the near future because its share in the pipeline is higher than 3 percent.

Concentration factors for this technology range are between 200 and 1,000. Plant unit sizes could range between 10 MW and 200 MW so are suitable for dispatchable markets. Integration in advanced thermodynamic cycles also is feasible.

Although less mature than the Parabolic Trough technology, after a proof-of-concept stage, the Power Tower is taking its first steps into the market with three commercial plants that are in operation in southern Spain: PS1O0 and PS20 (11 and 20 MWe, using saturated steam as heat transfer fluid) and Gemasolar (17 MWe, using molten salts as HTF). Sierra SunTower, a 5-MWe plant in Lancaster, California (US) started operation in 2009 using a multitower solar field.

Figure 2.5 | Functional Scheme of a Power Tower System, Using Molten Salt as HTF, with TES

Generator

Steam turbine

Hot salt storage

Condenser

Cooling tower

Substation

Receiver

Cold salt storage

Steam generator

Solar field

02

02

03

03

04

04

05

05

06

06

07

07

08

08

09

09

10

10

01

01

Source: STA.

16 | Competitiveness Assessment of MENA Countries to Develop a Local Solar Industry

To this day, more than 10 different experimental Power Tower plants have been tested worldwide, generally small demonstration systems between 0.5 MWe and 10 MWe. Most of these plants operated in the 1980s.

A wide variety of heat transfer fluids including saturated steam, superheated steam, molten salts, atmospheric air, or pressurized air can be used. Temperatures vary between 200ºC and 1,000ºC.

Falling particle Receiver and beam-down Receiver are other promising technologies but further from the market.

A Power Tower solar field comprises a variable number of identical heliostats, which reflects the sunlight towards the Receiver. The heat transfer fluid temperature will reach 250ºC to 700ºC, depending on whether the HTF used is air, steam, molten salt, or others. The main components of a Power Tower solar field are:

• Mirror (or “facet”): Reflects the direct solar radiation incident on it and concentrates it onto the Receiver. The Mirrors are made with a thin silver or aluminum reflective film deposited on a low-iron, highly transparent glass support to give them the necessary stiffness. They are almost identical to the Mirrors for Parabolic Trough, differing only in size and shape. Although small heliostats can be made of flat glass, a slight curvature is necessary for larger sizes.13

• Receiver:14 Collects the radiation reflected by the heliostats and transfers it to the HTF as heat. The Receiver is the real core of a Power Tower system and the most technically complex component, because the former must absorb the incident radiation under very demanding concentrated solar flux conditions and with minimum heat loss. Receivers can be classified either by their