Comments on "Large Estimates of the Elasticity of Intertemporal Substitution: is it the aggregate...

-

date post

20-Oct-2014 -

Category

Education

-

view

270 -

download

2

description

Transcript of Comments on "Large Estimates of the Elasticity of Intertemporal Substitution: is it the aggregate...

Comments on ’Large Estimates of theElasticity of Intertemporal Substitution: is

it the aggregate return series or theinstrument list?’

by Fabio Gomes and Lourenco Paz

Matheus Albergaria de Magalhaes1

1Instituto Jones dos Santos Neves (IJSN) and FUCAPE Business School

Quarto Encontro de Economia do Espırito Santo (IV EEES)November 4t.h, 2013

Organization

Contribution

Motivation

Suggestions

Conclusions

References

Contribution

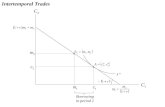

I Main focus of the paper: elasticity of intertemporalsubstitution (EIS).

I Authors revisit estimation issues related to the EIS (e.g.,

Gomes and Paz 2013a).

I Two main contributions:

1. Investigate if Mulligan’s (2002) estimates are plagued by theweak instrument problem (Stock, Wright and Yogo 2002).

2. Estimate Mulligan’s specifications using Yogo’s (2004) andDacy and Hasanov’s (2011) instrument sets.

Contribution

I Results indicate that Mulligan’s (2002) aggregate capitalreturn series is able to deliver relatively large and statisticallysignificant estimates of the EIS (greater than one).

I Additionaly, Mulligan’s original instrument set does not sufferfrom the weak instrument problem.

I Conclusion: the aggregate capital return series constructed byMulligan (2002) is the reason behind large EIS estimates.

Motivation

I EIS: why should we care?

I Economists have worried about EIS issues for a long time(e.g., Hansen 1985).

I EIS is an important parameter in several areas of Economicsand Finance.

I A few examples:

1. Effects of inflation.

2. Incidence effects of capital taxes.

3. Aggregate effects of financial intermediation.

4. Business-Cycle analysis.

Motivation

I Problem: empirical literature produced very mixed results.

I Time-series studies: EIS values close to 0.

I Panel Data studies: EIS values around 1.

I Results seem to depend on measure used as proxy for theexpected real rate of return (generally not observed) (Murray

2006).

Motivation

EIS - Country Heterogeneity

Source: Havranek et al. (2013, Fig.2, p.7).

Motivation

EIS - Method Heterogeneity

Source: Havranek et al. (2013, Fig.3, p.8).

Motivation

EIS - Impact Heterogeneity

Source: Havranek et al. (2013, Fig.1, p.2).

Suggestions

I Authors present a very interesting analysis.

I I learned a great deal from this paper.

I My suggestions will focus mainly on future research.

Suggestions

I Suggestion 1: estimate EIS through cointegration techniques.

I Favero (2005) used a recursive Epstein-Zin utility functionand a linearized intertemporal budget constraint to derive anexplicit long-run consumption function.

I New possibility: evaluation of future discounted labourincome growth as a determinant of the current value ofhuman capital.

Suggestions

I Suggestion 2: use capital income tax rate.

I Motivation: conditional on observable characteristics ofindividuals, tax rate movements cause exogenous shifts in theafter-tax interest rate.

I Using data on total non-durable consumption from theConsumer Expenditure Survey (CEX) over a two-decadeperiod, Gruber (2006) estimates a surprisingly high value forthe EIS (around 2).

I New possibility: Mulligan’s aggregate return series may notbe the only reason behind large values for the EIS.

Conclusions

I At the end of the day, EIS still poses an empirical puzzle foreconomists.

I Weak instruments seem to be a major concern in this case...

I ...but I feel that the search for aggregate return series mayprovide more interesting (and intuitive) answers in the nearfuture.

I Conclusion: authors should focus on finding empiricalmeasures that reflect EIS on theoretical grounds.

References

DACY, D.; HASANOV, F. A finance approach to estimating consumption parameters.

Economic Inquiry, v.49, n.1, p.122-154, 2011.

FAVERO, C.A. Consumption, wealth, the elasticity of intertemporal substitution and

long-run stock market returns. Bocconi University, Mimeo., Nov.2005, 26p.

GOMES, F.A.; PAZ, L.S. Estimating the elasticity of intertemporal substitution: is the

aggregate financial return free from the weak instrument problem? Journal of

Macroeconomics, v.36, n.1, p.63-75, Feb.2013 [2013a].

GOMES, F.A.; PAZ, L.S. Large estimates of the elasticity of intertemporal

substitution: is the aggregate return series or the instrument list? Quarto Encontro de

Economia do Espırito Santo (IV EEES). Anais..., Nov.2013, 11p. [2013b].

References

GRUBER, J. A tax-based estimate of the elasticity of intertemporal substitution.

NBER working paper n.11945, Jan.2006, 30p.

HANSEN, Gary D. Indivisible labor and the business cycle. Journal of Monetary

Economics, v.16, n.3, p.309-327, 1985.

HAVRANEK, T.; HORVATH, R.; IRSOVA, Z.; RUSNAK, M. Cross-country

heterogeneity in intertemporal substitution. Charles University, Mimeo., Aug.2013,

39p.

MULLIGAN, C.B. Capital, interest, and aggregate intertemporal substitution. NBER

working paper n.9373, Dec.2002, 45p.

References

MURRAY, M.P. Avoiding invalid instruments and coping with weak instruments.

Journal of Economic Perspectives, v.20, n.4, p.111-132, Fall 2006.

STOCK, J.H.; WRIGHT, J.H.; YOGO, M. A survey of weak instruments and weak

identification in Generalized Method of Moments. Journal of Business & Economic

Statistics, v.20, n.4, p.518-529, Oct.2002.

YOGO, M. Estimating the elasticity of intertemporal substitution when instruments

are weak. Review of Economics and Statistics, v.86, n.4, p.797-810, 2004.

Thank You

Matheus Albergaria de Magalhaes

http://www.sites.google.com/site/malbergariademagalhaes