COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:50:11 …€¦ · 2231-104-0000 Permissive MVL Tax -...

Transcript of COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:50:11 …€¦ · 2231-104-0000 Permissive MVL Tax -...

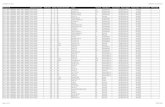

Fund Types / Funds

OriginalBudgetAmount

Estimated Receipts -Amended Certificate

of ResourcesActual

Receipts

VarianceFavorable

(Unfavorable)

1000 General

General

$474,618.00 $473,960.68 $473,960.68 $0.001000-101-0000 General Property Tax - Real Estate

$0.00 $0.00 $0.00 $0.001000-102-0000 Tangible Personal Property Tax

$19,632.00 $19,528.23 $19,528.23 $0.001000-103-0000 Permissive Sales Tax

$693,397.00 $717,447.05 $717,447.05 $0.001000-302-0000 Fees

$701,904.00 $800,518.45 $800,518.45 $0.001000-302-0101 Fees{RUMPKE FEES}

$1,250,000.00 $1,250,000.00 $1,250,000.00 $0.001000-302-0104 Fees{Rumpke - 2015 Consent Decree}

$0.00 $0.00 $0.00 $0.001000-401-0000 Fines

$0.00 $17,128.49 $17,128.49 $0.001000-531-0000 Estate Tax

$448,246.00 $470,378.32 $470,378.32 $0.001000-532-0000 Local Government Distribution

$58,373.00 $62,836.90 $62,836.90 $0.001000-533-0000 Liquor Permit Fees

$1,943.00 $2,067.35 $2,067.35 $0.001000-534-0000 Cigarette License Fees

$67,922.00 $67,371.10 $67,371.10 $0.001000-535-0000 Property Tax Allocation

$0.00 $0.00 $0.00 $0.001000-539-0000 Other - State Receipts

$0.00 $34,306.17 $34,306.17 $0.001000-591-0000 Intergovernmental Receipts (Non-State and Non-Federal)

$142,952.00 $186,172.00 $182,013.23 ($4,158.77)1000-701-0000 Interest

$22,030.00 $33,755.85 $33,755.85 $0.001000-802-0000 Rentals and Leases

$0.00 $0.00 $0.00 $0.001000-802-0299 Rentals and Leases{SC rental receipts}

$538,743.00 $216,847.12 $216,847.12 $0.001000-892-0000 Other - Miscellaneous Non-Operating

$0.00 $36,373.54 $36,373.54 $0.001000-892-0017 Other - Miscellaneous Non-Operating{Demolition Expense Fund}

$35,000.00 $67,420.42 $67,420.42 $0.001000-892-0018 Other - Miscellaneous Non-Operating{Nuisance Abatements}

$0.00 $1,192.56 $1,192.56 $0.001000-892-0103 Other - Miscellaneous Non-Operating{Township Memorial Fund}

$0.00 $0.00 $0.00 $0.001000-921-0000 Sale of Notes

$0.00 $0.00 $0.00 $0.001000-931-0000 Transfers - In

$0.00 $187,911.00 $187,911.00 $0.001000-951-0000 Sale of Fixed Assets

$0.00 $0.00 $0.00 $0.001000-999-0000 Other - Other Financing Sources

$4,454,760.00 $4,645,215.23 $4,641,056.46 ($4,158.77)General Fund Total:

$4,454,760.00 $4,645,215.23 $4,641,056.46 ($4,158.77)General Funds Total:

Comparison of Budgeted and Actual Receipts

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:50:11 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 1 of 7Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount

Estimated Receipts -Amended Certificate

of ResourcesActual

Receipts

VarianceFavorable

(Unfavorable)

2000 Special Revenue

Motor Vehicle License Tax

$43,553.00 $44,657.33 $44,657.33 $0.002011-536-0000 Motor Vehicle License Tax - State Levied

$633.00 $1,014.93 $969.17 ($45.76)2011-701-0000 Interest

$44,186.00 $45,672.26 $45,626.50 ($45.76)Motor Vehicle License Tax Fund Total:

Gasoline Tax

$315,850.00 $313,770.08 $313,770.08 $0.002021-537-0000 Gasoline Tax

$2,067.00 $4,898.47 $4,768.27 ($130.20)2021-701-0000 Interest

$0.00 $121,597.00 $121,597.00 $0.002021-892-0000 Other - Miscellaneous Non-Operating

$317,917.00 $440,265.55 $440,135.35 ($130.20)Gasoline Tax Fund Total:

Road and Bridge

$857,666.00 $854,595.18 $854,595.18 $0.002031-101-0000 General Property Tax - Real Estate

$0.00 $0.00 $0.00 $0.002031-102-0000 Tangible Personal Property Tax

$122,369.00 $122,367.88 $122,367.88 $0.002031-535-0000 Property Tax Allocation

$0.00 $7,772.74 $7,772.74 $0.002031-892-0000 Other - Miscellaneous Non-Operating

$980,035.00 $984,735.80 $984,735.80 $0.00Road and Bridge Fund Total:

Police District

$5,905,207.00 $5,943,635.93 $5,943,635.93 $0.002081-101-0000 General Property Tax - Real Estate

$0.00 $0.00 $0.00 $0.002081-102-0000 Tangible Personal Property Tax

$189,592.00 $264,178.33 $263,752.13 ($426.20)2081-302-0000 Fees

$42,447.00 $41,228.95 $41,228.95 $0.002081-401-0000 Fines

$0.00 $0.00 $0.00 $0.002081-511-0000 Federal Funds

$607,230.00 $530,972.81 $530,972.82 $0.012081-535-0000 Property Tax Allocation

$0.00 $0.00 $0.00 $0.002081-539-0000 Other - State Receipts

$0.00 $0.00 $0.00 $0.002081-539-0503 Other - State Receipts{Special Programs}

$0.00 $0.00 $0.00 $0.002081-591-0000 Intergovernmental Receipts (Non-State and Non-Federal)

$7,500.00 $16,009.12 $16,009.12 $0.002081-801-0503 Gifts and Donations{Special Programs}

Comparison of Budgeted and Actual Receipts

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:50:11 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 2 of 7Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount

Estimated Receipts -Amended Certificate

of ResourcesActual

Receipts

VarianceFavorable

(Unfavorable)

$319,339.00 $320,292.92 $320,292.92 $0.002081-892-0000 Other - Miscellaneous Non-Operating

$450,442.00 $491,588.81 $491,588.81 $0.002081-892-0502 Other - Miscellaneous Non-Operating{Mall/Walmart}

$219,000.00 $227,043.49 $227,043.49 $0.002081-892-0504 Other - Miscellaneous Non-Operating{NWLSD}

$0.00 $0.00 $0.00 $0.002081-931-0000 Transfers - In

$7,740,757.00 $7,834,950.36 $7,834,524.17 ($426.19)Police District Fund Total:

Fire District

$9,269,840.00 $9,243,923.62 $9,243,923.62 $0.002111-101-0000 General Property Tax - Real Estate

$0.00 $0.00 $0.00 $0.002111-102-0000 Tangible Personal Property Tax

$6,000.00 $92,653.10 $92,688.10 $35.002111-302-0000 Fees

$1,294,968.00 $1,364,298.68 $1,364,298.68 $0.002111-535-0000 Property Tax Allocation

$306,156.00 $299,137.08 $299,137.08 $0.002111-892-0000 Other - Miscellaneous Non-Operating

$10,876,964.00 $11,000,012.48 $11,000,047.48 $35.00Fire District Fund Total:

Zoning

$66,535.00 $61,880.00 $61,880.00 $0.002181-301-0000 Licenses and Permits

$98,388.00 $126,569.73 $126,569.73 $0.002181-302-0000 Fees

$6,760.00 $24,842.00 $24,842.00 $0.002181-302-0401 Fees{Sidewalk Program}

$51,050.00 $51,300.00 $51,300.00 $0.002181-399-0000 Other - Licenses, Permits and Fees

$0.00 $0.00 $0.00 $0.002181-539-0402 Other - State Receipts{Litter Grant}

$10,022.00 $7,707.12 $7,707.12 $0.002181-892-0000 Other - Miscellaneous Non-Operating

$145,750.00 $0.00 $0.00 $0.002181-931-0000 Transfers - In

$378,505.00 $272,298.85 $272,298.85 $0.00Zoning Fund Total:

Permissive Motor Vehicle License Tax

$298,081.00 $277,859.74 $277,859.74 $0.002231-104-0000 Permissive MVL Tax - Township Levied

$0.00 $15,599.25 $15,599.25 $0.002231-591-0000 Intergovernmental Receipts (Non-State and Non-Federal)

$178,849.00 $192,714.59 $192,714.59 $0.002231-592-0000 Motor Vehicle License Tax - County Levied

$535.00 $1,513.29 $1,481.08 ($32.21)2231-701-0000 Interest

$49,289.00 $45,386.58 $45,386.58 $0.002231-892-0000 Other - Miscellaneous Non-Operating

Comparison of Budgeted and Actual Receipts

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:50:11 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 3 of 7Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount

Estimated Receipts -Amended Certificate

of ResourcesActual

Receipts

VarianceFavorable

(Unfavorable)

$526,754.00 $533,073.45 $533,041.24 ($32.21)Permissive Motor Vehicle License Tax Fund Total:

Law Enforcement Trust

$2,920.00 $1,560.00 $1,560.00 $0.002261-401-0000 Fines

$0.00 $0.00 $0.00 $0.002261-801-0000 Gifts and Donations

$1,257.00 $14,793.62 $14,793.62 $0.002261-806-0000 Proceeds - Sale of Forfeited Property and Seized Contraband

$3,914.00 $6,402.83 $6,402.83 $0.002261-892-0000 Other - Miscellaneous Non-Operating

$0.00 $106,774.58 $106,774.58 $0.002261-892-0505 Other - Miscellaneous Non-Operating{DEA Funds}

$8,091.00 $129,531.03 $129,531.03 $0.00Law Enforcement Trust Fund Total:

Enforcement and Education

$1,474.00 $2,089.00 $2,089.00 $0.002271-401-0000 Fines

$0.00 $0.00 $0.00 $0.002271-801-0000 Gifts and Donations

$0.00 $0.00 $0.00 $0.002271-892-0000 Other - Miscellaneous Non-Operating

$1,474.00 $2,089.00 $2,089.00 $0.00Enforcement and Education Fund Total:

Ambulance And Emergency Medical Services

$1,465,414.00 $1,469,689.62 $1,466,133.15 ($3,556.47)2281-302-0000 Fees

$1,465,414.00 $1,469,689.62 $1,466,133.15 ($3,556.47)Ambulance And Emergency Medical Services Fund Total:

Special Assessment - Lighting Districts

$157,103.00 $153,819.96 $153,819.96 $0.002401-601-0000 Special Assessments

$0.00 $0.00 $0.00 $0.002401-931-0000 Transfers - In

$157,103.00 $153,819.96 $153,819.96 $0.00Special Assessment - Lighting Districts Fund Total:

TIF - Kroger

$0.00 $0.00 $0.00 $0.002901-101-0000 General Property Tax - Real Estate

$0.00 $0.00 $0.00 $0.002901-535-0000 Property Tax Allocation

$0.00 $0.00 $0.00 $0.002901-919-0000 Other - Sale of Bonds

Comparison of Budgeted and Actual Receipts

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:50:11 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 4 of 7Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount

Estimated Receipts -Amended Certificate

of ResourcesActual

Receipts

VarianceFavorable

(Unfavorable)

$0.00 $0.00 $0.00 $0.00TIF - Kroger Fund Total:

RECYCLING INCENTIVE

$20,710.00 $26,726.62 $26,726.62 $0.002902-892-0000 Other - Miscellaneous Non-Operating

$20,710.00 $26,726.62 $26,726.62 $0.00RECYCLING INCENTIVE Fund Total:

TIF - Stone Creek

$1,147,590.00 $1,106,343.24 $1,106,343.24 $0.002907-101-0000 General Property Tax - Real Estate

$0.00 $0.00 $0.00 $0.002907-535-0000 Property Tax Allocation

$0.00 $0.00 $0.00 $0.002907-599-0000 Other - Other Intergovernmental

$1,147,590.00 $1,106,343.24 $1,106,343.24 $0.00TIF - Stone Creek Fund Total:

CDBG COM DEV BLOCK GRANT

$0.00 $0.00 $0.00 $0.002908-591-0000 Intergovernmental Receipts (Non-State and Non-Federal)

$0.00 $0.00 $0.00 $0.002908-591-0102 Intergovernmental Receipts (Non-State and Non{Housing Maint}

$0.00 $0.00 $0.00 $0.00CDBG COM DEV BLOCK GRANT Fund Total:

Best Buy TIF

$235,046.00 $233,613.28 $233,613.28 $0.002910-101-0000 General Property Tax - Real Estate

$0.00 $0.00 $0.00 $0.002910-599-0000 Other - Other Intergovernmental

$0.00 $0.00 $0.00 $0.002910-701-0000 Interest

$235,046.00 $233,613.28 $233,613.28 $0.00Best Buy TIF Fund Total:

Parks & Services

$42,615.00 $47,920.87 $47,920.87 $0.002911-802-0399 Rentals and Leases{PK rental receipts}

$0.00 $133.24 $133.24 $0.002911-892-0303 Other - Miscellaneous Non-Operating{PK Miscellaneous}

$11,503.00 $6,496.63 $6,496.63 $0.002911-892-0333 Other - Miscellaneous Non-Operating{PK misc. receipts}

$88,852.00 $88,419.59 $59,814.71 ($28,604.88)2911-892-0334 Other - Miscellaneous Non-Operating{PK PERMITS}

$239,801.00 $201,857.00 $201,857.00 $0.002911-931-0000 Transfers - In

Comparison of Budgeted and Actual Receipts

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:50:11 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 5 of 7Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount

Estimated Receipts -Amended Certificate

of ResourcesActual

Receipts

VarianceFavorable

(Unfavorable)

$382,771.00 $344,827.33 $316,222.45 ($28,604.88)Parks & Services Fund Total:

Community Center

$0.00 $3,645.00 $3,645.00 $0.002912-802-0298 Rentals and Leases{SC CLASSES & EVENTS}

$110,000.00 $84,626.00 $84,626.00 $0.002912-802-0299 Rentals and Leases{SC rental receipts}

$0.00 $210.43 $210.43 $0.002912-892-0214 Other - Miscellaneous Non-Operating{Miscellaneous}

$29,500.00 $30,471.64 $30,471.64 $0.002912-892-0222 Other - Miscellaneous Non-Operating{SC misc. receipts}

$0.00 $0.00 $0.00 $0.002912-931-0000 Transfers - In

$139,500.00 $118,953.07 $118,953.07 $0.00Community Center Fund Total:

$24,422,817.00 $24,696,601.90 $24,663,841.19 ($32,760.71)Special Revenue Funds Total:

3000 Debt Service

General (bond) (note) Retirement

$0.00 $0.00 $0.00 $0.003101-519-0000 Other - Federal Receipts

$0.00 $0.00 $0.00 $0.003101-591-0000 Intergovernmental Receipts (Non-State and Non-Federal)

$107,887.50 $107,887.50 $107,887.50 $0.003101-931-0000 Transfers - In

$107,887.50 $107,887.50 $107,887.50 $0.00General (bond) (note) Retirement Fund Total:

General (bond) (note) Retirement Parks

$0.00 $0.00 $0.00 $0.003102-701-0000 Interest

$306,671.26 $306,671.26 $306,671.26 $0.003102-931-0000 Transfers - In

$306,671.26 $306,671.26 $306,671.26 $0.00General (bond) (note) Retirement Parks Fund Total:

General (bond) (note) Retirement PW Bldg

$0.00 $0.00 $0.00 $0.003103-701-0000 Interest

$216,567.50 $216,567.50 $216,567.50 $0.003103-931-0000 Transfers - In

$216,567.50 $216,567.50 $216,567.50 $0.00General (bond) (note) Retirement PW Bldg Fund Total:

Bond Principal Payments (streetscape)

Comparison of Budgeted and Actual Receipts

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:50:11 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 6 of 7Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount

Estimated Receipts -Amended Certificate

of ResourcesActual

Receipts

VarianceFavorable

(Unfavorable)Bond Principal Payments (streetscape)

$181,675.00 $181,675.00 $181,675.00 $0.003105-931-0000 Transfers - In

$181,675.00 $181,675.00 $181,675.00 $0.00Bond Principal Payments (streetscape) Fund Total:

Special Assessment Fire Bonds

$0.00 $0.00 $0.00 $0.003301-701-0000 Interest

$242,596.26 $242,596.26 $242,596.26 $0.003301-931-0000 Transfers - In

$242,596.26 $242,596.26 $242,596.26 $0.00Special Assessment Fire Bonds Fund Total:

$1,055,397.52 $1,055,397.52 $1,055,397.52 $0.00Debt Service Funds Total:

$29,932,974.52 $30,397,214.65 $30,360,295.17 ($36,919.48)Report Totals:

Comparison of Budgeted and Actual Receipts

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:50:11 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 7 of 7Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

1000 General

General

$62,732.00 $514.20 $63,194.49 $79.711000-110-111-0000 Salaries - Trustees

$62,760.00 $63,274.20 $62,663.15 $531.34

$29,233.00 $234.80 $30,390.98 $76.821000-110-121-0000 Salary - Township Fiscal Officer

$30,233.00 $30,467.80 $30,144.44 $246.54

$136,000.00 $1,000.00 $149,825.20 $0.301000-110-131-0000 Salary - Administrator

$148,825.50 $149,825.50 $149,825.20 $0.00

$100,000.00 $298.50 $111,299.19 $619.551000-110-141-0000 Salary - Legal Counsel

$111,620.24 $111,918.74 $111,299.19 $0.00

$107,670.00 $0.00 $98,143.49 $2,833.511000-110-211-0000 Ohio Public Employees Retirement System

$100,977.00 $100,977.00 $96,816.53 $1,326.96

$9,187.00 $0.00 $8,142.32 $509.311000-110-213-0000 Medicare

$8,651.63 $8,651.63 $8,142.32 $0.00

$203,302.00 $0.00 $171,058.52 $16,621.481000-110-221-0000 Medical/Hospitalization

$187,680.00 $187,680.00 $170,363.87 $694.65

$13,115.00 $0.00 $8,121.57 $0.001000-110-230-0000 Workers' Compensation

$8,121.57 $8,121.57 $8,121.57 $0.00

$1,600.00 $0.00 $1,555.00 $0.001000-110-240-0000 Unemployment Compensation

$1,555.00 $1,555.00 $1,555.00 $0.00

$13,200.00 $0.00 $17,229.00 $0.001000-110-312-0000 Auditing Services

$17,229.00 $17,229.00 $17,229.00 $0.00

$4,369.00 $0.00 $4,583.00 $0.001000-110-313-0000 Uniform Accounting Network Fees

$4,583.00 $4,583.00 $4,583.00 $0.00

$12,285.00 $0.00 $12,977.32 $0.001000-110-314-0000 Tax Collection Fees

$12,977.32 $12,977.32 $12,977.32 $0.00

$40,699.00 $0.00 $42,340.25 $0.001000-110-315-0000 Election Expenses

$42,340.25 $42,340.25 $42,340.25 $0.00

$2,306.00 $0.00 $483.93 $2.881000-110-322-0000 Garbage and Trash Removal

$486.81 $486.81 $418.82 $65.11

$6,391.00 $0.00 $9,218.76 $84.241000-110-323-0000 Repairs and Maintenance

$9,303.00 $9,303.00 $1,449.53 $7,769.23

$18,725.00 $0.00 $17,700.08 $474.921000-110-330-0000 Travel and Meeting Expense

$18,175.00 $18,175.00 $17,700.08 $0.00

$7,575.00 $0.00 $8,300.37 $698.001000-110-342-0000 Postage

$8,998.37 $8,998.37 $8,300.37 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 1 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$9,090.00 $0.00 $2,666.43 $0.001000-110-344-0000 Printing

$2,666.43 $2,666.43 $2,666.43 $0.00

$2,148.00 $0.00 $3,000.00 $0.001000-110-345-0000 Advertising

$3,000.00 $3,000.00 $1,479.47 $1,520.53

$119,245.00 $395.00 $176,888.95 $725.601000-110-360-0000 Contracted Services

$177,219.55 $177,614.55 $137,282.17 $39,606.78

$10,800.00 $0.00 $3,731.77 $6,797.231000-110-381-0000 Property Insurance Premiums

$10,529.00 $10,529.00 $3,731.77 $0.00

$50,658.00 $0.00 $37,911.96 $5,669.331000-110-382-0000 Liability Insurance Premiums

$43,581.29 $43,581.29 $37,911.96 $0.00

$2,621.00 $0.00 $2,392.58 $439.101000-110-410-0000 Office Supplies

$2,831.68 $2,831.68 $2,392.58 $0.00

$2,690.00 $1,033.55 $193.17 $922.381000-110-420-0000 Operating Supplies

$82.00 $1,115.55 $193.17 $0.00

$3,121.00 $0.00 $150.00 $0.001000-110-490-0000 Other - Supplies and Materials

$150.00 $150.00 $150.00 $0.00

$25,600.00 $306.95 $18,782.72 $6,109.231000-110-519-0000 Other - Dues and Fees

$24,585.00 $24,891.95 $18,782.72 $0.00

$41,206.00 $0.00 $37,563.24 $0.001000-110-519-0017 Other - Dues and Fees{Demolition Expense Fund}

$37,563.24 $37,563.24 $31,388.24 $6,175.00

$11,152.00 $46.00 $18,331.53 $1.221000-110-599-0000 Other - Other Expenses

$18,286.75 $18,332.75 $18,331.53 $0.00

$38,160.00 $0.00 $11,783.12 $5,380.491000-110-599-0009 Other - Other Expenses{Miscellaneous Expenses}

$17,163.61 $17,163.61 $11,783.12 $0.00

$2,343.00 $0.00 $1,849.00 $494.001000-110-599-0016 Other - Other Expenses{Admin Miscellaneous Expenses}

$2,343.00 $2,343.00 $1,849.00 $0.00

$2,340.00 $0.00 $1,822.90 $517.101000-110-599-0103 Other - Other Expenses{Township Memorial Fund}

$2,340.00 $2,340.00 $1,822.90 $0.00

$328,736.00 $2,108.41 $319,220.03 $317.881000-120-190-0000 Other - Salaries

$317,429.50 $319,537.91 $317,434.19 $1,785.84

$19,850.00 $0.00 $15,699.00 $345.001000-120-323-0000 Repairs and Maintenance

$16,044.00 $16,044.00 $13,457.00 $2,242.00

$10,897.00 $0.00 $4,168.81 $54.031000-120-341-0000 Telephone

$4,222.84 $4,222.84 $4,168.81 $0.00

$46,350.00 $0.00 $25,899.76 $355.241000-120-351-0000 Electricity

$26,255.00 $26,255.00 $25,899.76 $0.00

$3,423.00 $0.00 $3,171.62 $388.301000-120-352-0000 Water and Sewage

$3,559.92 $3,559.92 $3,171.62 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 2 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$3,829.00 $0.00 $1,383.47 $311.501000-120-420-0000 Operating Supplies

$1,694.97 $1,694.97 $1,383.47 $0.00

$7,429.00 $0.00 $1,544.72 $18.691000-120-599-0000 Other - Other Expenses

$1,563.41 $1,563.41 $1,544.72 $0.00

$5,500.00 $0.00 $572.00 $0.001000-130-190-0018 Other - Salaries{Nuisance Abatements}

$572.00 $572.00 $572.00 $0.00

$0.00 $0.00 $0.00 $0.001000-190-310-0000 Professional and Technical Services

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-190-330-0000 Travel and Meeting Expense

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-190-341-0000 Telephone

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-190-342-0000 Postage

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-190-349-0000 Other-Communications, Printing & Advertising

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-190-490-0000 Other - Supplies and Materials

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-190-599-0000 Other - Other Expenses

$0.00 $0.00 $0.00 $0.00

$44,296.00 $0.00 $43,379.80 $865.941000-310-360-0000 Contracted Services

$44,245.74 $44,245.74 $43,379.80 $0.00

$2,651,571.00 $115,043.93 $2,617,593.55 $149,021.381000-330-360-0000 Contracted Services

$2,651,571.00 $2,766,614.93 $1,308,190.89 $1,309,402.66

$75,682.00 $0.00 $67,876.62 $0.381000-420-370-0000 Payment to Another Political Subdivision

$67,877.00 $67,877.00 $67,876.62 $0.00

$0.00 $0.00 $0.00 $0.001000-610-190-0000 Other - Salaries

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-710-599-0000 Other - Other Expenses

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-760-710-0000 Land

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-760-720-0000 Buildings

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-760-720-0216 Buildings{Buildings & Additions}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $7,603.82 $4,477.891000-760-730-0000 Improvement of Sites

$12,081.71 $12,081.71 $7,603.82 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 3 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$0.00 $0.00 $0.00 $0.001000-760-730-0217 Improvement of Sites{Improvement of Sites}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-760-730-0305 Improvement of Sites{PK Improvement of Sites}

$0.00 $0.00 $0.00 $0.00

$17,061.00 $0.00 $27,574.30 $1,114.631000-760-740-0000 Machinery, Equipment and Furniture

$28,688.93 $28,688.93 $15,374.30 $12,200.00

$0.00 $0.00 $0.00 $0.001000-760-740-0013 Machinery, Equipment and Furniture{New Buildings &Addition}

$0.00 $0.00 $0.00 $0.00

$5,654.00 $0.00 $128.98 $0.001000-760-740-0014 Machinery, Equipment andFurniture{Equipt.Purchases/Replace}

$128.98 $128.98 $128.98 $0.00

$0.00 $0.00 $0.00 $0.001000-760-740-0218 Machinery, Equipment and Furniture{EquipmentReplacement}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-760-740-0306 Machinery, Equipment and Furniture{PK EquipmentReplacement}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-760-750-0000 Motor Vehicles

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-910-910-0000 Transfers - Out

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-910-910-0214 Transfers - Out{Miscellaneous}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-910-910-0333 Transfers - Out{PK misc. receipts}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-910-910-0400 Transfers - Out{Zoning Transfers Out}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-910-910-0500 Transfers - Out{Dues/Fees}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-910-910-0600 Transfers - Out{Police Department Transfers Ou}

$0.00 $0.00 $0.00 $0.00

$812,801.00 $0.00 $812,801.26 $185.111000-910-910-0900 Transfers - Out{DEBT SERVICE}

$812,986.37 $812,986.37 $812,801.26 $0.00

$0.00 $0.00 $0.00 $0.001000-910-910-0901 Transfers - Out{COMMUNITY CENTER}

$0.00 $0.00 $0.00 $0.00

$226,799.00 $0.00 $201,857.00 $0.001000-910-910-0902 Transfers - Out{PARKS}

$201,857.00 $201,857.00 $201,857.00 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 4 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$190,323.00 $0.00 $0.00 $0.001000-910-910-0903 Transfers - Out{ZONING}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-910-910-0904 Transfers - Out{POLICE}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-910-910-0905 Transfers - Out{FIRE}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.001000-910-910-0906 Transfers - Out{ROADS}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $67,518.961000-930-930-0000 Contingencies

$67,518.96 $67,518.96 $0.00 $0.00

$1,169.00 $0.00 $0.00 $0.001000-990-990-0000 Other - Other Financing Uses

$0.00 $0.00 $0.00 $0.00

$5,540,933.00 $120,981.34 $5,222,105.58 $274,031.33General Fund Total: $5,375,155.57 $5,496,136.91 $3,838,538.94 $1,383,566.64

$5,540,933.00 $120,981.34 $5,222,105.58 $274,031.33General Funds Total: $5,375,155.57 $5,496,136.91 $3,838,538.94 $1,383,566.64

2000 Special Revenue

Motor Vehicle License Tax

$40,400.00 $2,527.00 $25,106.24 $4,161.762011-330-323-0000 Repairs and Maintenance

$26,741.00 $29,268.00 $25,106.24 $0.00

$0.00 $0.00 $11,927.00 $0.002011-330-360-0000 Contracted Services

$11,927.00 $11,927.00 $7,100.00 $4,827.00

$8,715.00 $0.00 $6,318.75 $163.252011-330-490-0000 Other - Supplies and Materials

$6,482.00 $6,482.00 $6,318.75 $0.00

$1,010.00 $0.00 $2,319.75 $240.252011-330-599-0000 Other - Other Expenses

$2,560.00 $2,560.00 $2,169.75 $150.00

$50,125.00 $2,527.00 $45,671.74 $4,565.26Motor Vehicle License Tax Fund Total: $47,710.00 $50,237.00 $40,694.74 $4,977.00

Gasoline Tax

$27,537.00 $0.00 $18,670.64 $744.362021-330-323-0000 Repairs and Maintenance

$19,415.00 $19,415.00 $17,799.14 $871.50

$0.00 $0.00 $124,548.20 $2,033.002021-330-360-0000 Contracted Services

$126,581.20 $126,581.20 $124,548.20 $0.00

$300,000.00 $24,336.84 $256,773.32 $69,163.522021-330-420-0000 Operating Supplies

$301,600.00 $325,936.84 $150,055.50 $106,717.82

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 5 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$0.00 $0.00 $0.00 $0.002021-330-490-0000 Other - Supplies and Materials

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $249.00 $0.002021-330-599-0000 Other - Other Expenses

$249.00 $249.00 $249.00 $0.00

$327,537.00 $24,336.84 $400,241.16 $71,940.88Gasoline Tax Fund Total: $447,845.20 $472,182.04 $292,651.84 $107,589.32

Road and Bridge

$1,042,705.00 $7,562.37 $1,004,774.98 $23,275.392031-330-190-0000 Other - Salaries

$1,020,488.00 $1,028,050.37 $998,497.15 $6,277.83

$0.00 $0.00 $806.85 $0.152031-330-221-0000 Medical/Hospitalization

$807.00 $807.00 $31.50 $775.35

$0.00 $0.00 $0.00 $0.002031-330-240-0000 Unemployment Compensation

$0.00 $0.00 $0.00 $0.00

$13,860.00 $0.00 $12,806.74 $1,053.262031-330-314-0000 Tax Collection Fees

$13,860.00 $13,860.00 $12,806.74 $0.00

$5,250.00 $2,725.80 $5,550.89 $3,197.912031-330-322-0000 Garbage and Trash Removal

$6,023.00 $8,748.80 $5,402.94 $147.95

$0.00 $0.00 $0.00 $0.002031-330-323-0000 Repairs and Maintenance

$0.00 $0.00 $0.00 $0.00

$6,180.00 $0.00 $5,592.29 $1,122.712031-330-341-0000 Telephone

$6,715.00 $6,715.00 $5,592.29 $0.00

$21,815.00 $0.00 $12,244.08 $7,364.922031-330-351-0000 Electricity

$19,609.00 $19,609.00 $12,244.08 $0.00

$3,106.00 $0.00 $2,310.77 $53.232031-330-352-0000 Water and Sewage

$2,364.00 $2,364.00 $2,310.77 $0.00

$48,939.00 $742.25 $32,856.64 $716.002031-330-360-0000 Contracted Services

$32,830.39 $33,572.64 $32,743.80 $112.84

$6,999.00 $0.00 $17,517.27 $1.732031-330-381-0000 Property Insurance Premiums

$17,519.00 $17,519.00 $17,517.27 $0.00

$25,642.00 $0.00 $8,410.48 $2,561.522031-330-382-0000 Liability Insurance Premiums

$10,972.00 $10,972.00 $8,410.48 $0.00

$0.00 $0.00 $0.00 $0.002031-330-383-0000 Fidelity Bond Premiums

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002031-330-389-0000 Other - Insurance and Bonding

$0.00 $0.00 $0.00 $0.00

$961.00 $0.00 $1,554.72 $36.282031-330-410-0000 Office Supplies

$1,591.00 $1,591.00 $1,554.72 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 6 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$0.00 $0.00 $2,518.10 $2.902031-330-420-0000 Operating Supplies

$2,521.00 $2,521.00 $2,518.10 $0.00

$0.00 $0.00 $1,016.77 $291.852031-330-599-0000 Other - Other Expenses

$1,308.62 $1,308.62 $1,009.97 $6.80

$1,350.00 $0.00 $13,157.54 $312.452031-760-740-0000 Machinery, Equipment and Furniture

$13,469.99 $13,469.99 $13,157.54 $0.00

$0.00 $0.00 $0.00 $0.002031-760-750-0000 Motor Vehicles

$0.00 $0.00 $0.00 $0.00

$1,176,807.00 $11,030.42 $1,121,118.12 $39,990.30Road and Bridge Fund Total: $1,150,078.00 $1,161,108.42 $1,113,797.35 $7,320.77

Police District

$4,233,246.00 $37,196.08 $4,140,053.59 $128,811.492081-210-190-0000 Other - Salaries

$4,231,669.00 $4,268,865.08 $4,102,308.19 $37,745.40

$756,944.00 $0.00 $708,916.86 $48,003.142081-210-211-0000 Ohio Public Employees Retirement System

$756,920.00 $756,920.00 $708,916.86 $0.00

$61,382.00 $0.00 $56,377.60 $4,981.402081-210-213-0000 Medicare

$61,359.00 $61,359.00 $56,377.60 $0.00

$778,897.00 $0.00 $701,871.69 $25,329.312081-210-221-0000 Medical/Hospitalization

$727,201.00 $727,201.00 $699,592.85 $2,278.84

$87,628.00 $0.00 $53,867.96 $33,728.042081-210-230-0000 Workers' Compensation

$87,596.00 $87,596.00 $53,867.96 $0.00

$12,500.00 $0.00 $0.00 $12,500.002081-210-240-0000 Unemployment Compensation

$12,500.00 $12,500.00 $0.00 $0.00

$100,389.00 $0.00 $87,174.46 $7,422.542081-210-314-0000 Tax Collection Fees

$94,597.00 $94,597.00 $87,174.46 $0.00

$26,523.00 $410.00 $22,455.29 $4,477.712081-210-318-0000 Training Services

$26,523.00 $26,933.00 $22,455.29 $0.00

$750.00 $0.00 $351.94 $148.062081-210-322-0000 Garbage and Trash Removal

$500.00 $500.00 $304.60 $47.34

$70,000.00 $100.00 $61,834.67 $1,265.332081-210-323-0202 Repairs and Maintenance{Vehicle Repairs/Maint}

$63,000.00 $63,100.00 $61,834.67 $0.00

$3,348.00 $264.00 $5,321.44 $3,626.562081-210-323-0203 Repairs and Maintenance{Building Maintenance}

$8,684.00 $8,948.00 $5,321.44 $0.00

$17,500.00 $600.00 $13,252.56 $4,081.442081-210-323-1003 Repairs and Maintenance{Communication Repairs}

$16,734.00 $17,334.00 $13,252.56 $0.00

$11,249.00 $0.00 $6,479.70 $1,520.302081-210-341-0000 Telephone

$8,000.00 $8,000.00 $6,479.70 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 7 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$5,000.00 $0.00 $4,018.12 $1,381.882081-210-342-0000 Postage

$5,400.00 $5,400.00 $4,018.12 $0.00

$2,678.00 $0.00 $3,078.00 $0.002081-210-344-0000 Printing

$3,078.00 $3,078.00 $3,078.00 $0.00

$30,740.00 $0.00 $27,039.29 $2,567.712081-210-351-0000 Electricity

$29,607.00 $29,607.00 $27,039.29 $0.00

$2,050.00 $0.00 $1,917.92 $111.082081-210-352-0000 Water and Sewage

$2,029.00 $2,029.00 $1,917.92 $0.00

$1,852.00 $0.00 $1,411.40 $440.602081-210-360-0000 Contracted Services

$1,852.00 $1,852.00 $1,411.40 $0.00

$13,125.00 $0.00 $8,224.56 $1,680.442081-210-360-0507 Contracted Services{Contracted Serv. - Equipment}

$9,905.00 $9,905.00 $8,224.56 $0.00

$15,750.00 $0.00 $24,158.81 $1,191.192081-210-360-0508 Contracted Services{Contract Serv. - Personnel}

$25,350.00 $25,350.00 $22,443.81 $1,715.00

$0.00 $0.00 $0.00 $0.002081-210-370-0000 Payment to Another Political Subdivision

$0.00 $0.00 $0.00 $0.00

$619,000.00 $78.00 $530,346.90 $38,281.102081-210-370-0509 Payment to Another Political Subdivision{Contract Serv. -C}

$568,550.00 $568,628.00 $529,579.70 $767.20

$0.00 $0.00 $0.00 $0.002081-210-370-0510 Payment to Another Political Subdivision{Contract Serv. -S}

$0.00 $0.00 $0.00 $0.00

$1,101.00 $0.00 $16,376.63 $0.372081-210-381-0000 Property Insurance Premiums

$16,377.00 $16,377.00 $16,376.63 $0.00

$41,406.00 $0.00 $41,657.04 $9,052.962081-210-382-0000 Liability Insurance Premiums

$50,710.00 $50,710.00 $41,657.04 $0.00

$0.00 $0.00 $0.00 $0.002081-210-389-0000 Other - Insurance and Bonding

$0.00 $0.00 $0.00 $0.00

$2,575.00 $0.00 $2,844.28 $0.722081-210-410-0000 Office Supplies

$2,845.00 $2,845.00 $2,844.28 $0.00

$120,000.00 $18,321.28 $100,203.23 $21,118.052081-210-420-0000 Operating Supplies

$103,000.00 $121,321.28 $84,473.39 $15,729.84

$2,000.00 $0.00 $1,956.54 $1,043.462081-210-490-0000 Other - Supplies and Materials

$3,000.00 $3,000.00 $1,956.54 $0.00

$7,000.00 $0.00 $5,702.22 $297.782081-210-599-0000 Other - Other Expenses

$6,000.00 $6,000.00 $4,864.22 $838.00

$7,000.00 $0.00 $3,544.91 $3,455.092081-210-599-0500 Other - Other Expenses{Dues/Fees}

$7,000.00 $7,000.00 $3,544.91 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 8 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$100,000.00 $0.00 $125,310.53 $389.472081-210-599-0501 Other - Other Expenses{Impound Lot}

$125,700.00 $125,700.00 $125,310.53 $0.00

$0.00 $0.00 $0.00 $0.002081-210-599-0502 Other - Other Expenses{Mall/Walmart}

$0.00 $0.00 $0.00 $0.00

$7,725.00 $0.00 $5,193.68 $2,306.322081-210-599-0503 Other - Other Expenses{Special Programs}

$7,500.00 $7,500.00 $5,193.68 $0.00

$0.00 $0.00 $0.00 $0.002081-210-599-0504 Other - Other Expenses{NWLSD}

$0.00 $0.00 $0.00 $0.00

$1,500.00 $0.00 $0.00 $1,000.002081-210-599-0518 Other - Other Expenses{Honor Guard}

$1,000.00 $1,000.00 $0.00 $0.00

$50,682.00 $0.00 $250.00 $1,400.002081-760-720-0000 Buildings

$1,650.00 $1,650.00 $250.00 $0.00

$17,500.00 $0.00 $553.24 $650.002081-760-740-0000 Machinery, Equipment and Furniture

$1,203.24 $1,203.24 $553.24 $0.00

$10,300.00 $0.00 $2,978.60 $21.402081-760-740-0511 Machinery, Equipment and Furniture{Capital - DataProcessin}

$3,000.00 $3,000.00 $2,978.60 $0.00

$7,725.00 $0.00 $1,484.53 $3,040.472081-760-740-0512 Machinery, Equipment and Furniture{Capital -Furnishings/Eq}

$4,525.00 $4,525.00 $1,484.53 $0.00

$48,400.00 $0.00 $46,197.48 $402.522081-760-740-0513 Machinery, Equipment and Furniture{Capital - Tactical}

$46,600.00 $46,600.00 $46,197.48 $0.00

$7,468.00 $0.00 $0.00 $0.002081-760-740-0514 Machinery, Equipment and Furniture{Capital - Radar}

$0.00 $0.00 $0.00 $0.00

$8,300.00 $167.95 $4,540.94 $927.012081-760-740-0515 Machinery, Equipment and Furniture{Capital - Motor Veh.Acc}

$5,300.00 $5,467.95 $4,540.94 $0.00

$10,300.00 $4,365.00 $5,732.02 $2,132.982081-760-740-0516 Machinery, Equipment and Furniture{Capital - Firearms}

$3,500.00 $7,865.00 $5,732.02 $0.00

$46,010.00 $0.00 $67,107.19 $2,202.812081-760-740-0517 Machinery, Equipment and Furniture{Capital - Uniforms}

$69,310.00 $69,310.00 $56,920.29 $10,186.90

$132,408.00 $0.00 $178,595.00 $4,263.002081-760-750-0000 Motor Vehicles

$182,858.00 $182,858.00 $178,595.00 $0.00

$7,479,951.00 $61,502.31 $7,068,380.82 $375,253.73Police District Fund Total: $7,382,132.24 $7,443,634.55 $6,999,072.30 $69,308.52

Fire District

$3,909,816.00 $34,325.69 $4,367,422.17 $184,286.252111-220-190-0000 Other - Salaries

$4,517,382.73 $4,551,708.42 $4,314,152.61 $53,269.56

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 9 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$2,416,686.00 $575.87 $1,960,382.54 $226,832.082111-220-190-1000 Other - Salaries{Part-time}

$2,186,638.75 $2,187,214.62 $1,959,790.89 $591.65

$37,231.00 $0.00 $54,363.92 $3,987.722111-220-211-0000 Ohio Public Employees Retirement System

$58,351.64 $58,351.64 $54,363.92 $0.00

$135,966.00 $0.00 $113,980.75 $375.252111-220-212-0000 Social Security

$114,356.00 $114,356.00 $113,980.75 $0.00

$108,105.00 $0.00 $94,213.79 $3,442.562111-220-213-0000 Medicare

$97,656.35 $97,656.35 $94,213.79 $0.00

$1,149,222.00 $0.00 $1,223,496.67 $104,311.332111-220-215-0000 Ohio Police and Fire Pension Fund

$1,327,808.00 $1,327,808.00 $1,223,496.67 $0.00

$1,057,281.00 $0.00 $1,073,622.92 $0.292111-220-221-0000 Medical/Hospitalization

$1,073,623.21 $1,073,623.21 $1,069,502.23 $4,120.69

$154,295.00 $0.00 $100,903.33 $0.002111-220-230-0000 Workers' Compensation

$100,903.33 $100,903.33 $100,903.33 $0.00

$1,000.00 $0.00 $0.00 $1,000.002111-220-240-0000 Unemployment Compensation

$1,000.00 $1,000.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002111-220-312-0000 Auditing Services

$0.00 $0.00 $0.00 $0.00

$150,390.00 $0.00 $139,450.78 $10,939.222111-220-314-0000 Tax Collection Fees

$150,390.00 $150,390.00 $139,450.78 $0.00

$41,252.00 $5,111.53 $51,025.77 $3,152.062111-220-318-0000 Training Services

$49,066.30 $54,177.83 $45,815.77 $5,210.00

$103.00 $0.00 $98.76 $69.242111-220-318-1001 Training Services{Publications}

$168.00 $168.00 $98.76 $0.00

$35,200.00 $0.00 $20,566.00 $11,803.002111-220-318-1002 Training Services{Tuition Reimbursement}

$32,369.00 $32,369.00 $20,566.00 $0.00

$2,106.00 $0.00 $1,305.43 $194.572111-220-318-1024 Training Services{Citizen Academy}

$1,500.00 $1,500.00 $1,305.43 $0.00

$1,669.00 $0.00 $2,724.70 $130.002111-220-318-1025 Training Services{CPR Instructions}

$2,854.70 $2,854.70 $2,724.70 $0.00

$64,000.00 $0.00 $99,506.51 $12,474.492111-220-319-0000 Other - Professional and Technical Services

$111,981.00 $111,981.00 $93,977.51 $5,529.00

$6,888.00 $0.00 $4,106.48 $901.012111-220-322-0000 Garbage and Trash Removal

$5,007.49 $5,007.49 $3,810.73 $295.75

$77,250.00 $1,000.00 $74,370.50 $6,879.502111-220-323-0000 Repairs and Maintenance

$80,250.00 $81,250.00 $73,164.70 $1,205.80

$10,300.00 $905.28 $5,814.03 $3,391.252111-220-323-1003 Repairs and Maintenance{Communication Repairs}

$8,300.00 $9,205.28 $5,814.03 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 10 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$20,600.00 $50.00 $5,529.92 $9,520.082111-220-323-1004 Repairs and Maintenance{Equipment Repairs}

$15,000.00 $15,050.00 $5,529.92 $0.00

$128,339.00 $0.00 $41,766.13 $4,085.872111-220-323-1005 Repairs and Maintenance{Vehicle Repairs}

$45,852.00 $45,852.00 $41,766.13 $0.00

$0.00 $0.00 $0.00 $0.002111-220-323-1006 Repairs and Maintenance{Office Equipment Repairs}

$0.00 $0.00 $0.00 $0.00

$833.00 $0.00 $0.00 $833.002111-220-323-1020 Repairs and Maintenance{Grounds}

$833.00 $833.00 $0.00 $0.00

$5,000.00 $0.00 $965.00 $3,035.002111-220-323-1021 Repairs and Maintenance{TOWING}

$4,000.00 $4,000.00 $965.00 $0.00

$0.00 $0.00 $0.00 $0.002111-220-330-0000 Travel and Meeting Expense

$0.00 $0.00 $0.00 $0.00

$92,540.00 $0.00 $84,447.40 $1,922.602111-220-341-0000 Telephone

$86,370.00 $86,370.00 $84,447.40 $0.00

$93,450.00 $0.00 $81,366.88 $7,082.122111-220-351-0000 Electricity

$88,449.00 $88,449.00 $81,366.88 $0.00

$19,809.00 $0.00 $19,853.73 $0.002111-220-352-0000 Water and Sewage

$19,853.73 $19,853.73 $19,853.73 $0.00

$22,526.00 $126.75 $15,957.71 $102.002111-220-360-0000 Contracted Services

$15,932.96 $16,059.71 $9,625.73 $6,331.98

$8,053.00 $0.00 $4,849.80 $196.202111-220-360-1028 Contracted Services{Computers - Fire}

$5,046.00 $5,046.00 $4,849.80 $0.00

$170,000.00 $152.50 $140,294.92 $24,857.582111-220-370-0000 Payment to Another Political Subdivision

$165,000.00 $165,152.50 $140,294.92 $0.00

$19,210.00 $0.00 $33,713.54 $7,943.462111-220-381-0000 Property Insurance Premiums

$41,657.00 $41,657.00 $33,713.54 $0.00

$89,131.00 $0.00 $30,072.02 $56,238.982111-220-382-0000 Liability Insurance Premiums

$86,311.00 $86,311.00 $30,072.02 $0.00

$0.00 $0.00 $0.00 $0.002111-220-389-0000 Other - Insurance and Bonding

$0.00 $0.00 $0.00 $0.00

$8,034.00 $0.00 $3,576.52 $1,403.482111-220-410-0000 Office Supplies

$4,980.00 $4,980.00 $3,415.52 $161.00

$21,804.00 $0.00 $17,820.03 $3,348.972111-220-420-0000 Operating Supplies

$21,169.00 $21,169.00 $17,820.03 $0.00

$110,824.00 $13,451.25 $83,121.84 $30,153.412111-220-420-1007 Operating Supplies{Fuel}

$99,824.00 $113,275.25 $77,443.87 $5,677.97

$72,100.00 $0.00 $106,078.63 $28,921.372111-220-420-1008 Operating Supplies{Vehicle Parts/Supplies}

$135,000.00 $135,000.00 $106,078.63 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 11 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$318.00 $0.00 $0.00 $318.002111-220-420-1026 Operating Supplies{Supplies other (convenience)}

$318.00 $318.00 $0.00 $0.00

$15,000.00 $0.00 $7,876.84 $7,123.162111-220-430-0000 Small Tools and Minor Equipment

$15,000.00 $15,000.00 $7,876.84 $0.00

$144,544.00 $591.51 $143,363.75 $1,771.762111-220-490-0000 Other - Supplies and Materials

$144,544.00 $145,135.51 $141,762.68 $1,601.07

$2,730.00 $625.00 $4,949.47 $675.532111-220-490-1009 Other - Supplies and Materials{SCBA Parts/Repairs}

$5,000.00 $5,625.00 $4,949.47 $0.00

$0.00 $0.00 $0.00 $0.002111-220-490-1010 Other - Supplies and Materials{Commissary}

$0.00 $0.00 $0.00 $0.00

$2,122.00 $0.00 $1,431.00 $691.002111-220-519-0000 Other - Dues and Fees

$2,122.00 $2,122.00 $1,431.00 $0.00

$2,171.00 $0.00 $2,059.57 $1,611.432111-220-519-1011 Other - Dues and Fees{Public Education}

$3,671.00 $3,671.00 $2,059.57 $0.00

$0.00 $0.00 $0.00 $0.002111-220-519-1012 Other - Dues and Fees{Investigations}

$0.00 $0.00 $0.00 $0.00

$1,500.00 $0.00 $1,340.00 $160.002111-220-519-1013 Other - Dues and Fees{Inspections}

$1,500.00 $1,500.00 $1,340.00 $0.00

$35,336.00 $760.00 $8,837.33 $17,922.672111-220-599-0000 Other - Other Expenses

$26,000.00 $26,760.00 $8,837.33 $0.00

$3,090.00 $0.00 $425.51 $2,074.492111-220-599-1014 Other - Other Expenses{Package Shipping}

$2,500.00 $2,500.00 $425.51 $0.00

$0.00 $0.00 $0.00 $0.002111-760-720-0000 Buildings

$0.00 $0.00 $0.00 $0.00

$30,000.00 $0.00 $17,830.43 $21,169.572111-760-730-0000 Improvement of Sites

$39,000.00 $39,000.00 $17,830.43 $0.00

$42,230.00 $2,276.06 $44,856.35 $5,649.712111-760-740-0000 Machinery, Equipment and Furniture

$48,230.00 $50,506.06 $37,639.11 $7,217.24

$50,000.00 $0.00 $39,203.60 $5,796.402111-760-740-1015 Machinery, Equipment and Furniture{Fire Equipment}

$45,000.00 $45,000.00 $38,982.75 $220.85

$27,810.00 $203.03 $25,586.31 $2,426.722111-760-740-1016 Machinery, Equipment and Furniture{EMS Equipment}

$27,810.00 $28,013.03 $24,817.10 $769.21

$5,356.00 $0.00 $2,893.19 $2,462.812111-760-740-1017 Machinery, Equipment and Furniture{Building Equipment}

$5,356.00 $5,356.00 $2,893.19 $0.00

$3,811.00 $0.00 $1,026.05 $2,473.952111-760-740-1018 Machinery, Equipment and Furniture{Shop Equipment}

$3,500.00 $3,500.00 $852.45 $173.60

$4,000.00 $0.00 $868.60 $631.402111-760-740-1019 Machinery, Equipment and Furniture{Office Equipt.Repairs}

$1,500.00 $1,500.00 $868.60 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 12 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

2111-760-740-1019 Machinery, Equipment and Furniture{Office Equipt.Repairs}

$12,500.00 $0.00 $11,891.64 $398.322111-760-740-1022 Machinery, Equipment and Furniture{OFFICEEQUIPMENT}

$12,289.96 $12,289.96 $11,891.64 $0.00

$204,520.00 $0.00 $121,112.03 $279.782111-760-740-1023 Machinery, Equipment and Furniture{COMMUNICATIONEQUIPMENT}

$121,391.81 $121,391.81 $121,112.03 $0.00

$570.00 $0.00 $0.00 $570.002111-760-740-1027 Machinery, Equipment and Furniture{Fitness - Fire}

$570.00 $570.00 $0.00 $0.00

$61,115.00 $152.50 $68,973.18 $2,504.102111-760-740-1029 Machinery, Equipment and Furniture{Uniforms - Fire}

$71,324.78 $71,477.28 $66,465.69 $2,507.49

$969,140.00 $491,323.50 $1,441,211.50 $112.002111-760-750-0000 Motor Vehicles

$950,000.00 $1,441,323.50 $287,541.27 $1,153,670.23

$242,596.00 $0.00 $242,596.26 $0.002111-910-910-0000 Transfers - Out

$242,596.26 $242,596.26 $242,596.26 $0.00

$0.00 $0.00 $0.00 $0.002111-990-990-0000 Other - Other Financing Uses

$0.00 $0.00 $0.00 $0.00

$12,101,472.00 $551,630.47 $12,245,101.73 $830,636.74Fire District Fund Total: $12,524,108.00 $13,075,738.47 $10,996,548.64 $1,248,553.09

Zoning

$0.00 $0.00 $0.00 $0.002181-130-141-0000 Salary - Legal Counsel

$0.00 $0.00 $0.00 $0.00

$1,450.00 $0.00 $1,231.50 $218.502181-130-150-0000 Compensation of Board and Commission Members

$1,450.00 $1,450.00 $1,231.50 $0.00

$197,445.00 $1,389.32 $183,555.44 $12,426.442181-130-190-0000 Other - Salaries

$194,592.56 $195,981.88 $182,127.57 $1,427.87

$27,402.00 $0.00 $30,038.67 $2,589.042181-130-211-0000 Ohio Public Employees Retirement System

$32,627.71 $32,627.71 $30,038.67 $0.00

$2,838.00 $0.00 $2,964.01 $15.992181-130-213-0000 Medicare

$2,980.00 $2,980.00 $2,964.01 $0.00

$55,075.00 $0.00 $42,285.39 $0.512181-130-221-0000 Medical/Hospitalization

$42,285.90 $42,285.90 $42,136.22 $149.17

$4,052.00 $0.00 $2,328.73 $0.002181-130-230-0000 Workers' Compensation

$2,328.73 $2,328.73 $2,328.73 $0.00

$0.00 $0.00 $0.00 $0.002181-130-240-0000 Unemployment Compensation

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002181-130-317-0000 Planning Consultants

$0.00 $0.00 $0.00 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 13 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$0.00 $0.00 $0.00 $0.002181-130-318-0000 Training Services

$0.00 $0.00 $0.00 $0.00

$558.00 $0.00 $131.96 $61.002181-130-322-0000 Garbage and Trash Removal

$192.96 $192.96 $114.21 $17.75

$7,084.00 $0.00 $3,558.85 $2,004.352181-130-330-0000 Travel and Meeting Expense

$5,563.20 $5,563.20 $3,558.85 $0.00

$4,979.00 $0.00 $2,995.60 $58.242181-130-341-0000 Telephone

$3,053.84 $3,053.84 $2,995.60 $0.00

$6,565.00 $0.00 $2,400.00 $2,481.002181-130-342-0000 Postage

$4,881.00 $4,881.00 $2,400.00 $0.00

$3,030.00 $0.00 $2,800.00 $0.002181-130-345-0000 Advertising

$2,800.00 $2,800.00 $2,214.01 $585.99

$8,755.00 $0.00 $6,708.10 $291.902181-130-351-0000 Electricity

$7,000.00 $7,000.00 $6,708.10 $0.00

$593.00 $0.00 $554.59 $25.412181-130-352-0000 Water and Sewage

$580.00 $580.00 $554.59 $0.00

$0.00 $0.00 $0.00 $0.002181-130-359-0000 Other - Utilities

$0.00 $0.00 $0.00 $0.00

$11,634.00 $395.52 $10,558.27 $1,471.252181-130-360-0000 Contracted Services

$11,634.00 $12,029.52 $10,558.27 $0.00

$3,030.00 $0.00 $1,694.19 $1,335.812181-130-410-0000 Office Supplies

$3,030.00 $3,030.00 $1,694.19 $0.00

$3,030.00 $1,814.11 $23.72 $2,221.392181-130-420-0000 Operating Supplies

$431.00 $2,245.11 $23.72 $0.00

$1,919.00 $0.00 $0.00 $1,819.002181-130-490-0000 Other - Supplies and Materials

$1,819.00 $1,819.00 $0.00 $0.00

$1,918.00 $46.00 $1,951.07 $112.932181-130-599-0000 Other - Other Expenses

$2,018.00 $2,064.00 $1,678.34 $272.73

$160,913.00 $7,075.00 $7,075.00 $0.002181-130-599-0401 Other - Other Expenses{Sidewalk Program}

$0.00 $7,075.00 $0.00 $7,075.00

$0.00 $0.00 $0.00 $0.002181-130-599-0402 Other - Other Expenses{Litter Grant}

$0.00 $0.00 $0.00 $0.00

$4,400.00 $0.00 $2,514.57 $184.532181-760-740-0000 Machinery, Equipment and Furniture

$2,699.10 $2,699.10 $2,514.57 $0.00

$506,670.00 $10,719.95 $305,369.66 $27,317.29Zoning Fund Total: $321,967.00 $332,686.95 $295,841.15 $9,528.51

Permissive Motor Vehicle License Tax

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 14 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$144,749.00 $0.00 $139,224.50 $2,545.502231-330-211-0000 Ohio Public Employees Retirement System

$141,770.00 $141,770.00 $139,224.50 $0.00

$14,992.00 $0.00 $13,545.32 $1,137.682231-330-213-0000 Medicare

$14,683.00 $14,683.00 $13,545.32 $0.00

$270,563.00 $0.00 $231,659.32 $38,903.682231-330-221-0000 Medical/Hospitalization

$270,563.00 $270,563.00 $231,647.42 $11.90

$21,402.00 $0.00 $9,888.24 $9,673.762231-330-230-0000 Workers' Compensation

$19,562.00 $19,562.00 $9,888.24 $0.00

$0.00 $5,019.36 $3,873.99 $1,145.372231-330-323-0000 Repairs and Maintenance

$0.00 $5,019.36 $3,873.99 $0.00

$37,909.47 $16,960.51 $22,290.80 $17,485.712231-330-360-0000 Contracted Services

$22,816.00 $39,776.51 $18,366.80 $3,924.00

$0.00 $0.00 $0.00 $0.002231-330-420-0000 Operating Supplies

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002231-330-490-0000 Other - Supplies and Materials

$0.00 $0.00 $0.00 $0.00

$1,075.53 $0.00 $512.95 $562.582231-760-740-0000 Machinery, Equipment and Furniture

$1,075.53 $1,075.53 $512.95 $0.00

$490,691.00 $21,979.87 $420,995.12 $71,454.28Permissive Motor Vehicle License Tax Fund Total: $470,469.53 $492,449.40 $417,059.22 $3,935.90

Law Enforcement Trust

$5,000.00 $0.00 $3,552.90 $59.102261-210-599-0000 Other - Other Expenses

$3,612.00 $3,612.00 $3,105.74 $447.16

$20,000.00 $0.00 $19,246.64 $753.362261-210-599-0505 Other - Other Expenses{DEA Funds}

$20,000.00 $20,000.00 $18,917.52 $329.12

$37,596.00 $1,663.94 $77,634.00 $1,713.942261-760-740-0000 Machinery, Equipment and Furniture

$77,684.00 $79,347.94 $77,633.58 $0.42

$0.00 $0.00 $0.00 $0.002261-760-750-0000 Motor Vehicles

$0.00 $0.00 $0.00 $0.00

$62,596.00 $1,663.94 $100,433.54 $2,526.40Law Enforcement Trust Fund Total: $101,296.00 $102,959.94 $99,656.84 $776.70

Enforcement and Education

$1,500.00 $0.00 $1,480.83 $19.172271-210-599-0000 Other - Other Expenses

$1,500.00 $1,500.00 $1,480.83 $0.00

$1,500.00 $0.00 $1,480.83 $19.17Enforcement and Education Fund Total: $1,500.00 $1,500.00 $1,480.83 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 15 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

Ambulance And Emergency Medical Services

$1,129,043.00 $13,517.16 $1,138,847.49 $17,133.672281-220-190-0000 Other - Salaries

$1,142,464.00 $1,155,981.16 $1,138,829.04 $18.45

$95,252.00 $0.00 $128,386.56 $165.442281-220-360-0000 Contracted Services

$128,552.00 $128,552.00 $128,386.56 $0.00

$16,070.00 $0.00 $17,433.49 $336.512281-220-590-0000 Other Expenses

$17,770.00 $17,770.00 $10,478.47 $6,955.02

$53,000.00 $0.00 $53,000.00 $0.002281-760-750-0000 Motor Vehicles

$53,000.00 $53,000.00 $53,000.00 $0.00

$52,778.00 $21,009.00 $91,009.00 $0.002281-760-790-0000 Other - Capital Outlay

$70,000.00 $91,009.00 $21,009.00 $70,000.00

$1,346,143.00 $34,526.16 $1,428,676.54 $17,635.62Ambulance And Emergency Medical Services Fund Total: $1,411,786.00 $1,446,312.16 $1,351,703.07 $76,973.47

Special Assessment - Lighting Districts

$148,203.00 $0.00 $140,794.21 $7,408.792401-310-360-0000 Contracted Services

$148,203.00 $148,203.00 $140,794.21 $0.00

$5,590.00 $0.00 $4,681.48 $908.522401-760-314-0000 Tax Collection Fees

$5,590.00 $5,590.00 $4,681.48 $0.00

$153,793.00 $0.00 $145,475.69 $8,317.31Special Assessment - Lighting Districts Fund Total: $153,793.00 $153,793.00 $145,475.69 $0.00

TIF - Kroger

$0.00 $0.00 $0.00 $0.002901-110-314-0000 Tax Collection Fees

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002901-760-599-0000 Other - Other Expenses

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002901-760-710-0000 Land

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002901-810-810-0000 Principal Payments - Bonds

$0.00 $0.00 $0.00 $0.00

$169,425.00 $0.00 $169,425.00 $0.002901-830-830-0000 Interest Payments

$169,425.00 $169,425.00 $169,425.00 $0.00

$169,425.00 $0.00 $169,425.00 $0.00TIF - Kroger Fund Total: $169,425.00 $169,425.00 $169,425.00 $0.00

RECYCLING INCENTIVE

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 16 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$4,668.00 $0.00 $2,197.41 $2,470.592902-110-190-0000 Other - Salaries

$4,668.00 $4,668.00 $2,197.41 $0.00

$17,575.00 $0.00 $17,523.83 $51.172902-110-599-0000 Other - Other Expenses

$17,575.00 $17,575.00 $17,299.83 $224.00

$0.00 $0.00 $0.00 $0.002902-290-211-0000 Ohio Public Employees Retirement System

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002902-290-213-0000 Medicare

$0.00 $0.00 $0.00 $0.00

$22,243.00 $0.00 $19,721.24 $2,521.76RECYCLING INCENTIVE Fund Total: $22,243.00 $22,243.00 $19,497.24 $224.00

TIF - Stone Creek

$30,227.00 $0.00 $12,345.75 $17,695.462907-110-314-0000 Tax Collection Fees

$30,041.21 $30,041.21 $12,345.75 $0.00

$0.00 $0.00 $0.00 $0.002907-110-599-0000 Other - Other Expenses

$0.00 $0.00 $0.00 $0.00

$250,000.00 $0.00 $11,300.00 $238,700.002907-760-360-0000 Contracted Services

$250,000.00 $250,000.00 $7,436.00 $3,864.00

$0.00 $0.00 $0.00 $0.002907-760-599-0000 Other - Other Expenses

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002907-760-710-0000 Land

$0.00 $0.00 $0.00 $0.00

$559,469.00 $0.00 $559,654.36 $0.012907-810-810-0000 Principal Payments - Bonds

$559,654.37 $559,654.37 $559,654.36 $0.00

$20,199.00 $0.00 $20,199.42 $0.002907-830-830-0000 Interest Payments

$20,199.42 $20,199.42 $20,199.42 $0.00

$0.00 $0.00 $0.00 $0.002907-910-910-0000 Transfers - Out

$0.00 $0.00 $0.00 $0.00

$859,895.00 $0.00 $603,499.53 $256,395.47TIF - Stone Creek Fund Total: $859,895.00 $859,895.00 $599,635.53 $3,864.00

CDBG COM DEV BLOCK GRANT

$0.00 $0.00 $0.00 $0.002908-590-599-0000 Other - Other Expenses

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002908-590-599-0102 Other - Other Expenses{Housing Maint Code Assistance}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.00CDBG COM DEV BLOCK GRANT Fund Total: $0.00 $0.00 $0.00 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 17 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

Best Buy TIF

$2,376.12 $0.00 $2,561.81 $0.002910-110-314-0000 Tax Collection Fees

$2,561.81 $2,561.81 $2,561.81 $0.00

$0.00 $0.00 $0.00 $0.002910-110-599-0000 Other - Other Expenses

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002910-760-360-0000 Contracted Services

$0.00 $0.00 $0.00 $0.00

$85,531.32 $0.00 $85,345.63 $0.002910-810-810-0000 Principal Payments - Bonds

$85,345.63 $85,345.63 $85,345.63 $0.00

$3,088.08 $0.00 $3,088.08 $0.002910-830-830-0000 Interest Payments

$3,088.08 $3,088.08 $3,088.08 $0.00

$90,995.52 $0.00 $90,995.52 $0.00Best Buy TIF Fund Total: $90,995.52 $90,995.52 $90,995.52 $0.00

Parks & Services

$107,360.00 $249.43 $119,763.18 $27,446.502911-610-190-0000 Other - Salaries

$146,960.25 $147,209.68 $119,290.17 $473.01

$40,000.00 $0.00 $22,899.75 $0.002911-610-190-0334 Other - Salaries{PK PERMITS}

$22,899.75 $22,899.75 $22,899.75 $0.00

$20,630.00 $0.00 $19,197.35 $4,582.652911-610-211-0000 Ohio Public Employees Retirement System

$23,780.00 $23,780.00 $19,197.35 $0.00

$2,137.00 $0.00 $1,932.28 $530.722911-610-213-0000 Medicare

$2,463.00 $2,463.00 $1,932.28 $0.00

$0.00 $0.00 $0.00 $0.002911-610-221-0000 Medical/Hospitalization

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002911-610-222-0000 Life Insurance

$0.00 $0.00 $0.00 $0.00

$3,050.00 $0.00 $4,766.73 $0.002911-610-230-0000 Workers' Compensation

$4,766.73 $4,766.73 $4,766.73 $0.00

$9,225.00 $0.00 $3,000.00 $3,000.002911-610-240-0000 Unemployment Compensation

$6,000.00 $6,000.00 $2,541.00 $459.00

$23,286.00 $0.00 $7,976.81 $3.192911-610-322-0000 Garbage and Trash Removal

$7,980.00 $7,980.00 $7,590.27 $386.54

$16,880.00 $0.00 $20,424.95 $2,005.052911-610-323-0000 Repairs and Maintenance

$22,430.00 $22,430.00 $20,424.95 $0.00

$7,051.00 $0.00 $6,452.57 $1,448.432911-610-323-0300 Repairs and Maintenance{PK Vehicle Repairs/Maint.}

$7,901.00 $7,901.00 $6,452.57 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 18 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$45,144.00 $12,000.00 $38,302.05 $2,497.952911-610-329-0000 Other - Property Services

$28,800.00 $40,800.00 $37,402.05 $900.00

$9,734.00 $0.00 $3,237.68 $1,450.322911-610-341-0000 Telephone

$4,688.00 $4,688.00 $3,237.68 $0.00

$500.00 $0.00 $50.00 $450.002911-610-342-0000 Postage

$500.00 $500.00 $50.00 $0.00

$0.00 $0.00 $0.00 $0.002911-610-349-0000 Other-Communications, Printing & Advertising

$0.00 $0.00 $0.00 $0.00

$32,523.00 $0.00 $19,432.43 $5,152.572911-610-351-0000 Electricity

$24,585.00 $24,585.00 $19,432.43 $0.00

$25,857.00 $0.00 $21,494.15 $3,948.852911-610-352-0000 Water and Sewage

$25,443.00 $25,443.00 $21,494.15 $0.00

$0.00 $0.00 $0.00 $0.002911-610-359-0000 Other - Utilities

$0.00 $0.00 $0.00 $0.00

$63,647.00 $0.00 $45,565.80 $4,532.202911-610-360-0000 Contracted Services

$50,098.00 $50,098.00 $40,815.80 $4,750.00

$6,045.00 $0.00 $4,450.25 $1,518.752911-610-381-0000 Property Insurance Premiums

$5,969.00 $5,969.00 $4,450.25 $0.00

$3,046.00 $0.00 $362.25 $1,999.752911-610-382-0000 Liability Insurance Premiums

$2,362.00 $2,362.00 $362.25 $0.00

$631.00 $0.00 $449.53 $0.472911-610-410-0000 Office Supplies

$450.00 $450.00 $449.53 $0.00

$11,903.00 $1,361.35 $10,622.81 $1,804.542911-610-420-0000 Operating Supplies

$11,066.00 $12,427.35 $10,622.81 $0.00

$22,581.00 $10,190.91 $20,416.04 $11,017.872911-610-420-0301 Operating Supplies{PK Gasoline/Oil}

$21,243.00 $31,433.91 $12,439.84 $7,976.20

$0.00 $0.00 $0.00 $0.002911-610-430-0000 Small Tools and Minor Equipment

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002911-610-490-0000 Other - Supplies and Materials

$0.00 $0.00 $0.00 $0.00

$2,810.00 $609.33 $2,890.10 $1,039.232911-610-490-0302 Other - Supplies and Materials{PK Uniforms}

$3,320.00 $3,929.33 $2,528.53 $361.57

$633.00 $0.00 $565.00 $62.002911-610-519-0000 Other - Dues and Fees

$627.00 $627.00 $565.00 $0.00

$1,093.00 $0.00 $2,236.50 $354.502911-610-599-0303 Other - Other Expenses{PK Miscellaneous}

$2,591.00 $2,591.00 $2,236.50 $0.00

$1,714.00 $0.00 $2,893.84 $120.162911-610-599-0304 Other - Other Expenses{PK Rental Refunds}

$3,014.00 $3,014.00 $2,893.84 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 19 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$0.00 $0.00 $0.00 $0.002911-610-599-0333 Other - Other Expenses{PK misc. receipts}

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002911-760-720-0000 Buildings

$0.00 $0.00 $0.00 $0.00

$0.00 $0.00 $0.00 $0.002911-760-730-0305 Improvement of Sites{PK Improvement of Sites}

$0.00 $0.00 $0.00 $0.00

$23,800.00 $0.00 $10,145.36 $3,254.642911-760-740-0306 Machinery, Equipment and Furniture{PK EquipmentReplacement}

$13,400.00 $13,400.00 $316.36 $9,829.00

$481,280.00 $24,411.02 $389,527.41 $78,220.34Parks & Services Fund Total: $443,336.73 $467,747.75 $364,392.09 $25,135.32

Community Center

$19,870.00 $232.47 $35,107.59 $0.002912-610-190-0000 Other - Salaries

$34,875.12 $35,107.59 $34,808.18 $299.41

$3,560.00 $0.00 $5,396.14 $0.002912-610-211-0000 Ohio Public Employees Retirement System

$5,396.14 $5,396.14 $5,396.14 $0.00

$369.00 $0.00 $573.38 $81.622912-610-213-0000 Medicare

$655.00 $655.00 $573.38 $0.00

$0.00 $0.00 $19.80 $0.202912-610-221-0000 Medical/Hospitalization

$20.00 $20.00 $19.80 $0.00

$526.00 $0.00 $1,194.16 $0.002912-610-230-0000 Workers' Compensation

$1,194.16 $1,194.16 $1,194.16 $0.00

$56.66 $0.00 $56.66 $0.002912-610-240-0000 Unemployment Compensation

$56.66 $56.66 $56.66 $0.00

$1,030.00 $0.00 $548.57 $14.002912-610-322-0000 Garbage and Trash Removal

$562.57 $562.57 $503.57 $45.00

$2,582.34 $0.00 $1,408.02 $291.982912-610-323-0201 Repairs and Maintenance{Equipment Repairs/Maint}

$1,700.00 $1,700.00 $1,408.02 $0.00

$3,020.00 $0.00 $862.20 $0.002912-610-323-0202 Repairs and Maintenance{Vehicle Repairs/Maint}

$862.20 $862.20 $862.20 $0.00

$4,584.00 $0.00 $4,297.11 $1,133.892912-610-329-0203 Other - Property Services{Building Maintenance}

$5,431.00 $5,431.00 $4,297.11 $0.00

$4,540.00 $0.00 $4,218.07 $1.932912-610-341-0000 Telephone

$4,220.00 $4,220.00 $4,218.07 $0.00

$101.00 $0.00 $50.00 $0.002912-610-342-0000 Postage

$50.00 $50.00 $50.00 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 20 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$0.00 $0.00 $0.00 $0.002912-610-349-0000 Other-Communications, Printing & Advertising

$0.00 $0.00 $0.00 $0.00

$11,578.00 $0.00 $9,387.03 $402.972912-610-351-0000 Electricity

$9,790.00 $9,790.00 $9,387.03 $0.00

$4,026.00 $0.00 $3,843.00 $57.002912-610-352-0000 Water and Sewage

$3,900.00 $3,900.00 $3,843.00 $0.00

$25,935.00 $0.00 $19,517.74 $4,482.262912-610-359-0204 Other - Utilities{Utilities}

$24,000.00 $24,000.00 $19,517.74 $0.00

$40,440.00 $44.20 $47,926.45 $11.242912-610-360-0205 Contracted Services{Service Contracts}

$47,893.49 $47,937.69 $47,101.99 $824.46

$116.00 $0.00 $0.00 $95.462912-610-360-0206 Contracted Services{Contracted Social Services}

$95.46 $95.46 $0.00 $0.00

$4,088.00 $0.00 $700.56 $3,243.712912-610-381-0000 Property Insurance Premiums

$3,944.27 $3,944.27 $700.56 $0.00

$4,284.00 $0.00 $362.23 $2,137.772912-610-382-0000 Liability Insurance Premiums

$2,500.00 $2,500.00 $362.23 $0.00

$0.00 $0.00 $385.39 $0.002912-610-410-0207 Office Supplies{Office Supplies}

$385.39 $385.39 $385.39 $0.00

$2,081.12 $0.00 $2,309.70 $160.302912-610-420-0208 Operating Supplies{Operating Supplies}

$2,470.00 $2,470.00 $2,309.70 $0.00

$3,030.00 $674.91 $2,199.92 $639.602912-610-420-0209 Operating Supplies{Gasoline/Oil}

$2,164.61 $2,839.52 $1,739.04 $460.88

$0.00 $0.00 $56.78 $0.002912-610-430-0210 Small Tools and Minor Equipment{Office Equipment-CC}

$56.78 $56.78 $56.78 $0.00

$0.00 $0.00 $0.00 $0.002912-610-490-0211 Other - Supplies and Materials{Program Supplies}

$0.00 $0.00 $0.00 $0.00

$253.00 $0.00 $0.00 $0.002912-610-490-0212 Other - Supplies and Materials{Uniforms}

$0.00 $0.00 $0.00 $0.00

$723.00 $0.00 $720.00 $3.002912-610-519-0213 Other - Dues and Fees{Dues & Training}

$723.00 $723.00 $521.56 $198.44

$908.00 $0.00 $1,150.00 $50.002912-610-519-0215 Other - Dues and Fees{Rental Refunds}

$1,200.00 $1,200.00 $1,150.00 $0.00

$369.00 $0.00 $395.85 $34.152912-610-599-0000 Other - Other Expenses

$430.00 $430.00 $395.85 $0.00

$2,876.00 $0.00 $923.72 $76.282912-610-599-0214 Other - Other Expenses{Miscellaneous}

$1,000.00 $1,000.00 $923.72 $0.00

$0.00 $0.00 $1,100.00 $0.002912-610-599-0215 Other - Other Expenses{Rental Refunds}

$1,100.00 $1,100.00 $1,100.00 $0.00

Comparison of Disbursements and EncumbrancesWith Expenditure Authority

COLERAIN TOWNSHIP, HAMILTON COUNTY 2/3/2017 11:51:12 AM

UAN v2017.1

All Budgeted Funds for Fiscal 2016 Year-to-Date

Page 21 of 23Statement excludes amounts for advances.These financial statements have not been subjected to an audit or review or compilation engagement, and no assurance is provided on them.

Fund Types / Funds

OriginalBudgetAmount Total

VarianceFavorable

(Unfavorable)

AppropriationsFor Year Ended

December 31, 2016 Total

Disbursementsfor Year Ended

December 31, 2016

Reserve forEncumbrances

as ofDecember 31, 2016

Reserve ForEncumbrances as

of PrecedingDecember 31, 2015

$0.00 $0.00 $0.00 $0.002912-610-599-0222 Other - Other Expenses{SC misc. receipts}

$0.00 $0.00 $0.00 $0.00