Climate Change, Resilience, Parametric insurance ·...

Transcript of Climate Change, Resilience, Parametric insurance ·...

Your Swiss Re Team

Climate Change, Resilience, Parametric insuranceIAC conference Cancun, 3rd June 2019

Nadja Riedwyl, Senior Structurer, Swiss Re Reinsurance

Agenda

IAC Cancun, Monday 3rd of June 2019 2

1. Climate Change, Adaptation, Resilience2. Parametric insurance

a. Macro, Poolingb. Mass distributionc. Microinsuranced. Facultative risks

3. Take away messages4. Appendix

IAC Cancun, Monday 3rd of June 2019 3

Climate change, Adaptation, Resilience

1

IPCC Understanding global warming

IAC Cancun, Monday 3rd of June 2019 4

Mitigation & adaptation to limit the risks of climate change

http://report.ipcc.ch/sr15/pdf/sr15_spm_final.pdf

gap

Which risk?

Governments

Who carries the risk?

PoolingInsurance schemes and pools

to increase insurance penetration

MacroRisk transfer solutions

for (sub)sovereigns to cover their direct or indirect costs

MicroSimplified products distributed

via aggregators such as MFIs, NGOs, and corporates

Risk transfer solutions

Businesses, homeowners,

farmers

Public physical assets

Emergency response costs

Foregone revenue

Uninsured private assets

Livelihood assistance

Prot

ectio

n ga

p

Individuals

Climate change adaptation

IAC Cancun, Monday 3rd of June 2019 5

Public & private sector – Combined response

Resilience

IAC Cancun, Monday 3rd of June 2019 6

It’s within our grasp – Let’s start now

Geological riskHydrometherological riskEnergy risk

United StatesNational Flood

Insurance Program

Team specialized in risk transfer for government agencies. Pioneer in Emerging Markets

Global presence with government and multilateral bodies. Tailor made solution for our clients.

Track record world wideInnovative risk transfer solutions

7IAC Cancun, Monday 3rd of June 2019

Close the protection gap

8

Strengthen system resilience

https://www.swissre.com/dam/jcr:c37eb0e4-c0b9-4a9f-9954-3d0bb4339bfd/sigma2_2019_en.pdf

Total economic losses from natural and man-made disasters in 2018 amount to

around $155 billion, of which approximately $79 billion are insured

IAC Cancun, Monday 3rd of June 2019

IAC Cancun, Monday 3rd of June 2019 9

Parametric insurance value proposition

2

Parametric insurance

Swiss Re Parametric NatCat

Simple, predictable, transparent

Trigger

Reporting agent

(ev. calculation agent)

Insured InsurerClaim

Premium

"Simplification is the ultimate sophistication" Leonardo Da Vinci

• Parametric insurance is a type of insurance that settles on a pre-agreed, simple measure (the "parameter" or "index")

• Pay out depends on the occurrence of a triggering event, regardless of the actual loss

• An independent third party (e.g. NHC for hurricane or USGS for earthquake) determines the intensity of the event and hence the impact on the claim

• The insured purchases a maximum pay out cover from the insurer. The premium depends on the chosen limit as well as exposure of the insured

• The pay out on a parametric product is unlikely to be exactly equal to the financial loss of an insured and the difference is known as "basis risk“

10IAC Cancun, Monday 3rd of June 2019

Basis risk in parametric insurance

11

Potential scenarios of divergence between the trigger and the economic losses

• The design of the trigger plays a key role in minimizing this risk

• There needs to be a high level of correlation between the trigger and the economic losses

• The parametric product flow includes the proof of loss by the insured in order to avoid scenarios where the trigger activation does not correlate with a real economic loss

• The activation of the coverage occurs when the intensity of the event exceeds the pre-agreed trigger

• Simple communication and clear explanation of the product is the utmost importance to avoid misunderstandings

• The simpler the trigger, the better understanding by the insured

Insured has an economic loss but the cover is not triggered

The trigger is activated but the insured has no economic loss

IAC Cancun, Monday 3rd of June 2019

Parametric insurance advantagesFast, flexible, accessible

Fast access to cash

Flexibleusage of cash

Accessibleno claims process

Parametric insurance makes sense when traditional insurance is not accessible or affordable

Parametric insurance acts as a complement to traditional insurance, not as a substitute

Parametric insurance offers immediate pay out for emergency cash relief, no claims handling process

Swiss Re Parametric NatCat

12IAC Cancun, Monday 3rd of June 2019

Simplicity drives satisfaction

13

Reducing complexity in insurance drives better performance and consumer loyalty

Source: Simplicity Index (2017) from http://simplicityindex.com/

Global Brand Simplicity Index 2017

+433% vs.

S&P : +135%DAX : +116%DOW : +106%FTSE :+52%

2xgrowth of a stock portfolio comprised of ten publicly traded simplest brands (since 2009)

consumers tend to use twice as much the telephone to receive more information about a product or service in complex industries

FinancialsChannel Switch

?

64% 61%of consumers are more likely to recommend a brand because it provides simpler experiences and communications

of consumers willing to pay more for simpler experiences

Willingness to pay

$Customer

Loyalty

IAC Cancun, Monday 3rd of June 2019 13

IAC Cancun, Monday 3rd of June 2019 14

Macro, PoolingMass distributionMicroinsuranceFacultative risks

2a

CCRIF SPCParametric TC & EQ insurance

Solution features

• CCRIF SPC offers parametric hurricane and earthquake insurance policies to 21 governments (19 Caribbean governments and 2 Central American governments)

• The policies provide immediate liquidity to participating governments when affected by events

• Member governments choose how much coverage they need up to an aggregate limit of USD 100m

• Parametric insurance products make payments based on the intensity of an event (modelled loss triggers, e.g. hurricane wind speed, earthquake intensity), and the amount of loss calculated in a pre-agreed model

• Peace of mind: Protection of funds and operational efficiency

• The facility responded to events and made payments

Involved parties

• Reinsurers: Swiss Re and other overseas reinsurers

• Reinsurance program currently placed by Willis

• Derivative placed by World Bank Treasury

Recent payouts

• 2017: Dominica USD 19.3m (hurricane Maria), Antigua & Barbuda, Anguilla, St. Kitts & Nevis, Turks & Caicos, Haiti and the Bahamas (hurricane Irma) USD 29.6m

• 2016: Nicaragua USD 1.1m (hurricane), USD 500k (earthquake)

• 2010: Haiti USD7.7m (earthquake), Barbados USD 8.5m (hurricane), St. Lucia USD 3.2m (hurricane), St. Vincent & The Grenadines USD 1.1m (hurricane), Anguilla USD 4.2m (hurricane)

15IAC Cancun, Monday 3rd of June 2019 https://www.ccrif.org/

CCRIF SPCExcess of rainfall

Solution features

• In July 2014, CCRIF SPC added a third peril to their program by offering excess rainfall insurance to their members

• Losses are determined based on 2-3 day rainfall totals and the country exposure values

• Utilized Kinetic Analysis Corporation’s (KAC) high resolution data that is a compilation of satellite and ground observations Environmental Resource Management ERM modelling

• Deductible for the CCRIF is USD 7m and Swiss Re provides reinsurance with a limit of USD 35m

Involved parties

• Reinsurer: Swiss Re

• Product designed by: CCRIF, KAC and Swiss Re

• Calculation agent: KAC / Risk Management specialist ERM

Payouts to date

• 2018: Barbados USD 5.8m (Oct 2018), Trinidad & Tobago USD 2.5m (Oct 2018)

• 2017: Trinidad & Tobago USD 7m

• 2016: Haiti, Barbados: XS wind USD 21.5m and Haiti, Barbados, St. Lucia, St. Vincent & the Grenadines: XS rain USD 8m (Oct 2016), Belize: USD 260k (Aug 2016)

• 2014: Barbados USD 1.2m (Nov 2014), St Kitts and Nevis USD1m (Nov 2014), Anguilla USD 493k (Oct 2014) and USD 559k (Nov 2014)

16IAC Cancun, Monday 3rd of June 2019 https://www.ccrif.org/

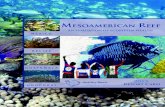

Parametric insurance Coral reefs Mexico

https://www.businessinsurance.com/article/20180309/NEWS06/912319746/Parametric-insurance-policy-launched-for-coral-reefs-Mesoamerican-Reef-Swiss-Re

• Conservation in coastal areas in Mexico has culminated in a new parametric insurance policy designed to cover hurricane-related damage to coral reefs

• The Nature Conservancy and the State Government of Quintana Roo worked with reinsurer Swiss Re Ltd. to explore the possibility of insuring a natural asset like the Mesoamerican Reef and determined that a parametric insurance policy was the most suitable option

• The parametric insurance policy was chosen as the solution for its ability to quickly provide the necessary proceeds for restoration activity

− Insurable interest: Coral reefs

− Trigger: Cat 4-5 hurricane in determined geographical scope

− Payout: Money to quickly restore the reef (within 7 days), depending on hurricane intensity

17IAC Cancun, Monday 3rd of June 2019

IAC Cancun, Monday 3rd of June 2019 18

Macro, PoolingMass distributionMicroinsuranceFacultative risks

2b

Swiss Re Parametric Insurance Platform

19

Digital products require a dynamic, easy to integrate ‘turn-key’ solution

IAC Cancun, Monday 3rd of June 2019

Example: Parametric insurance products

20

EQ shake vouchers & Tropical cyclone “Loss of income”

Earthquake

Tropical cyclone

“Shake vouchers” provide quick cash after an earthquake for insureds to cover incidental losses and expenses. The policy complements property damage insurance with small monetary amounts based on the shake intensity of individual locations worldwide

“Loss of income” covers combine business interruption and supplemental loss covers. For example, in the aftermath of a hurricane, beachfront hotels may experience losses due to cancellations even if they are not directly affected by the event. The policy pays out a lump sum to be spent at the insureds’ discretion if a hurricane occurs within a predefined geographic area surrounding the insured property (e.g. within a 100 km radius of the hotel)

Innovative retail solutions that allow for simple, fast-purchasing and optimised pay out processes

IAC Cancun, Monday 3rd of June 2019 20

21

Premium • Depends on the chosen limit and the geographic area of the insured object

Trigger• Storm intensity within a predefined geographic area surrounding the insured property (e.g. 100 km radius)

• Different possible trigger measures (e.g. Saffir-Simpson scale)

• A proof of loss might be required by the regulator

Reporting agent• Independent, reliable and easily accessible event reports

• e.g. National Hurricane Centre (US) publishes six-hourly information on the location, maximum winds, central pressure, and size of tropical cyclones

Limit • Consumer can choose between several different pay out limits

Pay out• Pay out depends on the distance to the hurricane track and on the hurricane category

• Can be defined as a stepped % function of the face value

Example: TC Parametric insurance productLoss of income” covers for high risk areas

IAC Cancun, Monday 3rd of June 2019 21

22

0 AM, Mar 20

6 AM, Mar 20

12 PM, Mar 20

18 PM, Mar 20

0 AM, Mar 21

6 AM, Mar 21

12 PM, Mar 21

18 PM, Mar 21

Policy bought

Case opened

Case observed

Claim calculated

Under observation

Dear Insured, your Tropical Cyclone policy has been put under observation.

According to the coverage details, you are eligible for a claim of $ XYZ. To confirm, reply YES.

Claim of $ XYZ towards your policy id has been credited to your account.

YES

40 Km

60 Km

100 Km

Case closed

Example: EQ Parametric insurance product

23

• Depends on the chosen limit and the geographic area of the insured object

• Intensity of the EQ at the location of the insured

• Different possible measures (e.g. Mercalli intensity scale)

• A proof of loss might be required by the regulator

• Independent, reliable and easily accessible event reports e.g. U.S. Geological Survey (USGS) publishes near real-time ShakeMaps after an earthquake, reporting the event intensity on a high-resolution grid

• Consumer can choose between several different face values

• How much of the limit is paid out depends on the event intensity

• Can be defined as a stepped % function of the face value

Premium

Trigger

Reporting agent

Limit

Pay out

Quick cash after an earthquake to pay for incidental losses and expenses

IAC Cancun, Monday 3rd of June 2019 23

Central American insurer

Focused on product innovation and simplification with a view to closing NatCat protection gap

End-to-end parametric pricing platform that includes insurance quote, event tracking and policy administration

Innovation through flexible product design, distributed via traditional and non-traditional channels

Streamlined processes allow fast review and acceptance of parametric products into the reinsurance facility

High-growth, dynamic market requiring fast turn-around times

Operational inefficiencies pushing insurer to find improved distribution methods combined with the definition of a trigger index

Developing market needed an easy consumer journey and fast claims pay out in case of severe NatCat event

First-of-its-kind solution required regulatory sign off

The result

Our supportThe challengeThe client

How we helped a Latin American client close the NatCat protection gap, improve consumer journey at lowest internal costs with a lean and fast process

A client story: Digitalization of consumer journey and offer a parametric NatCat product

Swiss Re Parametric NatCat

End-to-end parametric pricing platform offered to clients in +10 countries

Comprehensive solution including IT, product design, innovative distribution and reinsurance capacity

Go live in under 3 months, saving development costs now and future running costs

New

IAC Cancun, Monday 3rd of June 2019

25

Live test with selected users

Split of tasks between carrier, distributor and SR

Shaping Cooperation PilotIT

integrationGo-to-market

IT, Distribution, pricing engine, regulatory check

Deep Dive: Product design: Consumer journey, type of service model

Commercialize, on-going development and support

Time to market: 3-12 month (depends on covered risk)

NDANon Disclosure

Agreement

MOUMemorandum of Understanding

ContractMarket product &

revenue model

Roll-outProject scope and duration tailored to clients’ needs

IAC Cancun, Monday 3rd of June 2019

IAC Cancun, Monday 3rd of June 2019 26

Macro, PoolingMass distributionMicroinsuranceFacultative risks

2c

Parametric insurance BI Guatemala

http://www.swissre.com/global_partnerships/first_MiCRO_natcat_business_interruption_cover_launched_in_guatemala.html

https://www.microrisk.org/countries-regions/central-america/

• Esfuerzo Seguro is the first index protection offering business interruption cover to rural populations in Guatemala, for losses caused by severe drought, excess rain and earthquake, launched Nov 2016

• More specifically, the product is targeted to support financially vulnerable individuals engaged in small farming or entrepreneurial activities

• Esfuerzo Seguro is distributed by insurer Aseguradora Rural, bundled with loans provided by bank Banrural

• The product was designed to meet the affordability standards indicated by clients, and will offer quick, transparent and hassle-free payments in case of risk events

• The cover is complemented with a Disaster Risk Reduction component where the delivery of a 72-hour Emergency Kit with specific training on disaster risk preparedness is at the core

27IAC Cancun, Monday 3rd of June 2019

Micro insurance

IAC Cancun, Monday 3rd of June 2019 28

Solution operation

Event occurs

Remote monitoring

Calcluation platform detects and defines

Insurer identifies clients

and pays

Clients are informed via

SMS

Earthquake shake map

IAC Cancun, Monday 3rd of June 2019 29

Example

USGS ShakeMap, M 7.8, Apr 16, 2016

25%

75%50%

100%

Inde

x

Locations

• The calculation platform "reads" the ShakeMap, identifies the impacted locations and assigns them the compensation level based on pre-agreed terms

• All customers in the same location receive the same compensation percentage

Earthquake Shake map

Overview of Microinsurance

Source: MI Landscape Study 2017 Final Report 30

Coverage Latin America & the Caribbean

IAC Cancun, Monday 3rd of June 2019

Overview of Microinsurance

IAC Cancun, Monday 3rd of June 2019 31

Regulatory frameworks LatAm & Caribbean

Puerto Rico: House Bill 1729 Micro insurance on the horizon for Puerto Rico

Source: MI Landscape Study 2017 Final Report

IAC Cancun, Monday 3rd of June 2019 32

Macro, PoolingMass distributionMicroinsuranceFacultative risks

2d

Parametric insurance Recreational resort in Latin America

33

• The parametric insurance policy is chosen as the solution for its ability to quickly provide the necessary proceeds for restoration activities

• After the occurrence of a hurricane, the resorts or parks may suffer damages not covered by traditional policies, for example damages to golf courses or the beach. In addition, loss of benefits due to cancellations or loss of demand may occur, even when substantial physical harm has not been suffered

• This parametric product is focused on compensating for these coverage deficiencies that traditional policies can not efficiently provide

IAC Cancun, Monday 3rd of June 2019

IAC Cancun, Monday 3rd of June 2019 34

Take away messages

3

We’re smarter together

Take away messages

35

Relevance of parametric insurance

1 Parametric and conventional indemnity insurance costs cannot be compared like for like, as they do not cover the same thing

3 Parametric and indemnity insurance are a smart mix, complementing each other

5 Parametric insurance solutions exist in a wide range of sizes and guises (mass distribution, macro, micro, facultative/single risks)

2 Parametric or index based insurance solutions are simple, transparent with fast pay-out

4 The parametric insurance contract requires an "insurable interest" and a "proof of loss"

6 Nat Cat events are common triggers for parametric insurance solutions, however there are plenty of other triggers and applications

http://www.swissre.com/reinsurance/insurers/sigma_52016__Strategic_reinsurance_and_insurance_the_increasing_trend_of_customised_solutions.html#

https://corporatesolutions.swissre.com/insights/knowledge/10_myths_about_parametric_insurance.html

36

Parametric insurance

Traditional insurance

• Premium is paid in return for a promise to cover the actual loss incurred of an incident or named peril

• Payment is made only after an actual loss assessment and investigation, with the goal to put the insured back in the position they were prior to the event

• indemnifying actual loss incurred

• Covers the probability of a predefined event happening

• It is an agreement to make a payment upon the occurrence of a triggering event and subsequent loss notification, and as such is detached of an underlying physical asset or piece of infrastructure

• Always consists of:− A triggering event− A pay-out mechanism

From a broader risk management perspective the mix of parametric insurance with traditional (indemnity) insurance has distinct benefits:

Parametric insurance• Fast access to liquidity following a disaster

• Absence of expensive and lengthy loss adjustment processes

• Money for all types of losses (also the "excluded" ones under the indemnity policies)

Traditional (indemnity insurance)• Avoidance of basis risk

The two risk transfer solutions are complementary, and not substituting each other

It’s a smart mix

Take away messagesIntegrated Risk Management

IAC Cancun, Monday 3rd of June 2019

IAC Cancun, Monday 3rd of June 2019 38

©2019 Swiss Re. All rights reserved. You are not permitted to create any modifications or derivative works of this presentation or to use it for commercial or other public purposes without the prior written permission of Swiss Re.

The information and opinions contained in the presentation are provided as at the date of the presentation and are subject to change without notice. Although the information used was taken from reliable sources, Swiss Re does not accept any responsibility for the accuracy or comprehensiveness of the details given. All liability for the accuracy and completeness thereof or for any damage or loss resulting from the use of the information contained in this presentation is expressly excluded. Under no circumstances shall Swiss Re or its Group companies be liable for any financial or consequential loss relating to this presentation.

Legal notice

IAC Cancun, Monday 3rd of June 2019 39