Cityam newspaper 2013-07-18

-

Upload

transnational-corporation-of-nigeria-plc -

Category

Documents

-

view

24 -

download

0

description

Transcript of Cityam newspaper 2013-07-18

-

taxpayers is predicted to push the public sectors debt to an eye-watering140 per cent of GDP by 2060.

With a higher level of migration, theOBR expects that the national debtwill stay much lower, below 80 percent in the same period.

Gas prices mayfall by quarterthanks to shaleGAS PRICES in the UK could fall byas much as a quarter if the countrysuccessfully exploits its shale gasreserves, according to agovernment-commissioned reportreleased yesterday.

The most optimistic scenarioplotted by consultants predicts thatthe gas price will drop by more than25 per cent by 2030, potentiallysaving families hundreds of poundsa year in energy costs.

Even if Britain fails to get drillingon a large scale, the reportsauthors forecast that the gas pricewill still fall 10 per cent by 2020.This is because the worldwide shalegas boom will boost global gassupplies.

The report, commissioned by theDepartment of Energy and ClimateChange, yesterday appeared on thegovernments website with littlefanfare. It contradicts recent claimsfrom energy secretary Ed Daveythat shale will have little effect onUK energy bills and the countryshould instead invest in renewableenergy.

Shale gas has alreadyrevolutionised the US energymarket and last month it wasannounced that substantial reserveshave been identified underLancashire and Yorkshire.

But it remains controversial asthe gas is recovered through aprocess known as fracking thatinvolves blasting high pressurewater through rock. Exploratorydrilling was held responsible forsmall earthquakes in the Blackpoolarea in 2011.

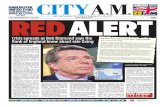

Despite the Conservatives trying to cut net immigration, the report says more workers would help George Osborne balance the books

BY JAMES WATERSON

FTSE 1006,571.93 +15.58 DOW15,470.52 +18.67 NASDAQ 3,610.00 +11.50 /$1.521 +0.007 /1.160 +0.009 /$ t1.311 -0.005

TIMEBOMB TICKSFOR AGEING UK

Certified Distribution from 27/05/2013 to 30/06/2013 is 128,152

BY MICHAEL BIRD

ENERGY BILL: Page 7

ALLISTER HEATH: Page 2

DEBATE: The Forum, Page 19

BUSINESS WITH PERSONALITY

www.cityam.com FREE

WHY THE BANKS CONSENSUS WILL PROVE SHORT-LIVEDANDREW SENTANCE

ISSUE 1,926 THURSDAY 18 JULY 2013

THE APP STORETURNS FIVE

Technology, Page 22See Page 3 and The Forum, Page 18

THE SPIRALLING cost of pensions,health and social care for the elderlymean the UK faces tens of billions ofpounds in spending cuts or tax hikesevery year, the governments fiscalwatchdog warned yesterday.

The Office for Budget Responsibility(OBR) said that the changing age ofthe population would put the publicpurse on an unsustainable pathunless the government accepts severebudget changes or an increase inworking migrants.

Spending on the elderly is expectedto soar over the next 50 years,reaching the size of a fifth of Britainsoutput. The OBR predicts healthspending to rise from the equivalentof seven per cent of annual GDP to 8.8 per cent, state pensions from 5.8 to8.4 per cent, and social care from 1.3to 2.4 per cent.

The independent forecaster warnedthat any plans for more spending nowmust take into account the millions ofbaby boomers heading into old age.Policymakers should certainly thinkcarefully about the long-term conse-quences of any policies they introduceor propose in the short term, it said.

In the absence of offsetting taxincreases or spending cuts, the pres-sure we have identified would eventu-ally increase the budget deficitsufficiently to put public sector net

debt on an unsustainable upwardpath, the report also warned.

The daunting figures show the significant fiscal consolidation thatfuture governments will need to con-sider. If the UKs national debt is to beeliminated in the same period, theTreasury would have to commit to anextra 29bn of permanent spending

cuts or tax increases each year. Evenreducing the public sectors debt tothe equivalent of 40 per cent ofannual GDP will require 19bn moreannual cuts, on top of existing plans.

The study also demonstrates theexpected effect of migration on debt.If the population is not increased byimmigration, the lack of working-age

-

THURSDAY 18 JULY 20132 NEWS To contact the newsdesk email [email protected]

[email protected] me on Twitter: @allisterheath

THERE is no better way to getdepressed than to study theOffice for BudgetResponsibilitys long-termforecasts for the British economy. Imsorry to have to write about this onsuch a beautiful summers day, butits a disturbing and cruciallyimportant story.

The biggest danger is that our ageingpopulation will push up spending andthe national debt probably by a greatdeal or possibly (and in my view mostlikely) by a cripplingly large amount.Of course, if the economy were to sud-denly do much better than anybodyexpects or the labour force were torise substantially as a result of a liberalimmigration policy we could stillavoid a fiscal crisis.

But my own hunch is that the onlyway we can realistically cope with thisis to drastically reform the public sec-tor and move towards a European,

EDITORSLETTER

ALLISTER HEATH

Welfare state needs reform to avoid a long-term fiscal crisis

Australian or Singaporean retirementand health system, where people havefar greater responsibility for their ownlives and there is a mixed economy inhealthcare, rather than one dominat-ed by public financing.

The central forecast for the UKs pri-mary budget balance (excludingspending on interest) is projected bythe OBR to move from a surplus of 0.9per cent of GDP in 2017-18 to 2.1 percent of GDP in 2020-21 and then to adeficit of 1.8 per cent of GDP in 2062-63 an overall deterioration of 2.7 per

cent of GDP, and a structural deterio-ration of 4.2 per cent of GDP, 65bn intodays terms. The net debt would risefrom 76 per cent of GDP in 2012-13 to99 per cent by 2062-63.

So much for the central assumption:really, really bad but arguably nottotally nightmarish.

The problem is if some of the worse-case scenarios are considered: forexample, that the population ages farmore than expected, that the govern-ment enforces a zero net migrationrule or that productivity turns out tobe much lower than it has been in thepast. The result would be catastrophic:spending as a share of GDP would riseby between 2.5 per cent and 7.6 percent of GDP more than expectedunder the central scenario, cripplingthe public finances and forcing eithermassive spending cuts or huge taxhikes. The other big variable is healthspending: if productivity in the NHS

per cent of GDP by the early 2020s andto an insignificant 0.03 per cent ofGDP by 2040-41. Shale gas could cometo our rescue when it comes to energyoutput but even it will never beenough to restore the finances of anageing population.

WARHOLS WISDOMEVERY so often, one comes up with aquote from an unexpected source thatis worth sharing. Heres one fromAndy Warhol, spotted by author AvrilMillar. Writing in The Philosophy ofAndy Warhol, the great artist was spoton. Being good in business is themost fascinating kind of art. Makingmoney is art and working is art andgood business is the best art.

Shame so few people see it that wayin our contemporary culture.

goes up by just one per cent a year, thenational debt would rocket to close to211 per cent of GDP by 2062-63. Again,this would be disastrous.

The report also reminds us of theextent of the collapse in North Sea out-put in recent years, an importantcause of our decline which isunrelated to the damage caused by thebubble and bust. Total oil and gas pro-duction has fallen every year since1999, on average by 7.8 per cent perannum, with falls of 19 per cent in2011 and 14 per cent in 2012.

The OBR thinks there will now be apause over the next five years but thelong-term future is grim. Betweentoday and 2040-41, oil and gas outputis expected to fall on average by fiveper cent a year. Revenues were worthroughly 0.85 per cent of GDP in thelate 2000s and were still about 0.5 percent last year.

But they will collapse to around 0.1

Unemployment down butmore time spent joblessTHE NUMBER of people without jobswho are looking for work fell by57,000 between March and May,against the previous three months,the Office for National Statistics (ONS)revealed yesterday.

Yet the number of people who areunemployed for more than a year ortwo is on the rise. In the same space oftime, 15,000 more people have beenunemployed for more than a year, and11,000 for more than two.

The unemployment rate fell to 7.8per cent, in comparison to eight percent for December 2012 to Februarythis year. The total number of peopleunemployed in the UK is 2.52m.

In London unemployment fellnotably compared to the previousthree months, down 16,000 to a totalof 368,000. The jobless rate in the cap-ital stands at 8.6 per cent nonetheless,above the UK average.

A stronger pace of job creationwould be necessary to deliver a signif-icant fall in the UK unemploymentrate, said Barclays Blerina Urici,adding that there is limited scope forthe rate to fall considerably.

The number of people who areclassed as economically inactive, notin work or looking for work, rose by

Higher salaries to offset bonus capFour out of five European banks plan to raiseexecutive base salaries to counter regulation-driven bonus cuts next year, potentiallyundermining the effectiveness of the plannedvariable pay cap in bringing down pay. An EU-wide bonus cap will from 2014 limit variable payto up to twice the level of salary. However, 79 percent of European banks surveyed by Mercer, theconsultancy, said they were planning to raisebase pay for the employees affected. Half thebanks said they would keep overall pay levelsmostly unchanged next year.

Four traders sue Deutsche BankFour former Deutsche Bank traders have suedGermanys largest lender for wrongful dismissal,after being fired in an internal investigation intothe manipulation of benchmark interbanklending rates. The traders are suing at a Germanlabour court in Frankfurt, where they used towork at the banks money market desk.

UK and Ireland plan visa-free areaLondon and Dublin plan to create a mini-Schengen area to enable business travellers andtourists from fast-growing Asian economies totravel on common visas between the two islands.

JC Flowers to buy Northern Rock loansAmerican private equity company JC Flowers isset to buy 450m of Northern Rock loans fromthe government in what will be one of thebiggest deals of its type. Negotations are in thefinal stages and an announcement is likely withinthe next few days.

Monsanto drops GM in EuropeBiotechnology company Monsanto is to abandonattempts to launch new genetically modifiedproducts in Europe after years of frustration withbureaucrats in Brussels.

Many behind on business rate pay One in seven business premises has been hit witha court summons over the past year after theoccupier fell behind with business rate payments,equivalent to more than 250,000 businesspremises in England.

BT attacked over rural broadband Telecoms executives attacked the government formoving the goalposts on a subsidy scheme toprovide superfast broadband to rural homes andbusinesses so that BT was effectively awarded1.2bn in public money without competition.

EU seeks power over radio spectrum The European Unions executive body wantsgreater power to reject government plans toauction off valuable radio spectrum, according tonew proposals for EU legislation, a step likely tobe seen in some member countries as excessiveintrusion into their national affairs.

Passengers sue over Asiana crashTwo passengers aboard the Asiana Airliens flightthat crashed while touching down in SanFrancisco have sued the airline.

CHINA needs to take decisivemeasures to ensure its economycontinues to grow amid growingdomestic problems, theInternational Monetary Fund (IMF)said yesterday.

IMF officials said in a report thatthe worlds second biggesteconomy has grown too reliant ondebt and investment driven byexports.

A package of reforms is neededto contain the growing risks whiletransitioning the economy to amore consumer-based, inclusive,and environmentally-friendlygrowth path, it explained.

By contrast, British chancellorGeorge Osborne was yesterdayboosted when the IMFs directors who represent nationalgovernments ignored their ownofficials and backed his austerityagenda, saying it is required topreserve credibility.

But IMF officials repeated theirconcerns that the UK is still faraway from a strong andsustainable recovery.

They said government spendingcuts have hurt growth andrecommended bringing forwardplanned spending oninfrastructure.

JOBS MARKET STRENGTHENING SLOWLY

STILL STRUGGLING TO BRING UNEMPLOYMENT DOWN

8.5

8.0

7.5

7.0

6.5

6.0

5.5

5.0

MAY 2012 - MAY 20132008 2009 2010 2011 2012 2013

Rate of unemployment

Source: ONS

UNEMPLOYMENT

57,00011,000

more people unemployed for

over 2 years

AVERAGE EARNINGS

1%6.0

5.5

5.0

12 - MAY 201320

BUT INFLATION

at 2.4%

IMF warns Chinaas Osborne getsbacking on cuts

BY JAMES WATERSON

BY MICHAEL BIRD

87,000 in the same period up to May.The rate of employment stood at 71.4per cent, up by only 0.1 per cent fromearlier in the year, but down on 12months earlier.

Youth employment also fell betweenMarch and May, to 3.63m. The numberof people aged 16-24 in work dipped by31,000. But the number ofunemployed young people also fell,down to 959,000, a fall of 20,000. This

figure includes full time students whoare looking for work.

Yesterday, the Organisation forEconomic Co-operation andDevelopments employment outlooklauded the UK and other countries,which passed labour market reformsin the 1990s, suggesting that suchaction had allowed them to more suc-cessfully limit unemployment sincethe financial crisis.

WHAT THE OTHER PAPERS SAY THIS MORNING

Find your next step at CITYAMCAREERS.com

US MONEY printing could continueapace into next year after Fedchairman Ben Bernanke last nighthinted that he might wait longerthan previously expected beforeslowing down the pace of itsquantitative easing programme.

Markets rose gently on thespeech, as The Fed boss tried tocalm traders.

A highly accommodativemonetary policy will remainappropriate for the foreseeablefuture, he said.

Money printingset to continue

BY TIM WALLACE

BANKING giant Santander yesterdaysaid it would scrap packaged deals onpaid-for current accounts, in a movethat will affect hundreds ofthousands of customers.

Packaged accounts offer add-onssuch as phone insurance for a feethat can hit 20 a month. Santanderwill scrap all such accounts from 19October, citing a desire to simplify itsservice. Regulators have also recentlytaken an interest in the products.

Santander cutspaid accounts

BY JAMES WATERSON

-

THURSDAY 18 JULY 20133NEWScityam.com

The Banks rate-setters unanimously voted against more QE during Carneys first meeting

THE BANK of Englands rate-settingmonetary policy committee (MPC)voted unanimously to reject more QEearlier this month, according to min-utes released yesterday.

Interest rates were also unchangedduring the July meeting, which wasMark Carneys first as the new gover-nor. Nine MPC members voted for noincrease in the Banks quantitative eas-ing programme, while none votedagainst, breaking the regular stale-mate which occurred during the lastmonths of Sir Mervyn Kings time atthe Bank.

Sterling strengthened on theannouncement, rising to over $1.52immediately afterwards, up by 0.66per cent. Despite the move, the MPCsuggested that rising short-term inter-est rates were not reflecting the con-tinued weakness of the economy. UKdevelopments, while broadly positive,had not been enough to warrant suchan upward move in the near-termpath of bank rate, the minutes said.

David Tinsley of BNP Paribas suggest-

Carney unitesBank againstmore stimulus

BY MICHAEL BIRD ed that there were still likely to be different opinions among the MPC members. The majority, probably sixmembers, do not currently see morestimulus required. He added: For theothers on the committee some addi-tional stimulus over and above thiswould be required, with the mix to bedecided.

For the previous five months, Kinghad voted for 25bn more asset pur-chases, along with two other mem-bers, with six others voting against.

The MPC will report in August onwhether to adopt forward guidanceand new thresholds.

Sterling bounces after MPC minutes

23:01 01:01 03:01 05:01 07:01 09:01

1.5221.5201.5181.5161.5141.5121.510

Sterling in US dollars

17 Jul

THE SERIOUS Fraud Office (SFO)yesterday admitted that its costshave risen even as the number ofsuccessful prosecutions continuesto fall.

The troubled watchdogs annualreport shows it brought 12 casesinvolving 20 defendants to trialduring 2012-13, with a convictionrate of 70 per cent.

This is down on the 19 cases theSFO brought to trial the previousyear, when it also achieved a higherconviction rate. The total sumsrecovered from people involved in

Serious Fraud Office sees costsrise and conviction rates drop

BY JAMES WATERSON fraudulent activity also fell from50.2m to just 11.4m.

The report was published the dayafter MPs attacked ex-SFO directorRichard Alderman for agreeingexcessive pay deals with topexecutives. His replacement asdirector, David Green, yesterdaysaid radical changes have beenmade since he took over in April.

Paul Lomas, a partner withFreshfields, last night warned thatpoor conviction rates could temptthe SFO to rely on its forthcomingability to impose substantial fineson firms rather than prosecutefraud cases in court.

GlaxoSmithKline finance execprevented from leaving China PHARMACEUTICALS companyGlaxoSmithKlines head offinance for China has beenprevented from leaving thecountry, it emerged yesterday.

Steve Nechelput has been undertravel restrictions since the end ofJune, although he has not beendetained or arrested, said a GSKspokesperson.

Chinese authorities haveaccused the FTSE 100 company ofbeing the ringleader in a 3bn(320m) bribery scandal and

BY SUZIE NEUWIRTH detained four senior executivesearlier this week, one of whomappeared on state televisionappearing to confess.

We are in contact withGlaxoSmithKline both in the UKand China and we are in theprocess of seeking moreinformation from the Chineseauthorities, a British foreignoffice spokesman told City A.M.

We are in contact with a Britishnational who has not beenarrested or detained there, headded. Steve Nechelput, GSK finance head in China

-

THURSDAY 18 JULY 20134 NEWS cityam.com

Chief executive Brian Moynihan has led the plan to turn the troubled lender around

BNY Mellon shares leap as assetmanagement book grows againPROFITS increased 78.8 per cent atBNY Mellon, the bank said yesterday,as it gained from improved marketconditions in the second quarter.

The custodian bank saw feerevenues rise 13 per cent on the yearto $3.2bn (2.1bn) on improvedmarket performance, and netinterest revenues edge up 3.1 percent to $757m.

That pushed profits up to $833m,

BY TIM WALLACE up from $466m in the secondquarter of 2012.

BNY Mellon recorded $21bn in netlong-term inflows in the quarter,while assets under managementincreased 10 per cent on the sameperiod of 2012 to $1.43 trillion.

Foreign exchange and othertrading activity brought in revenuesof $207m, up 15 per cent on the year.

And the bank made a profit of$109m on an equity investment.

Headcount edged up 1,500 to

49,800 over the year, while thebanks Basel III core tier one capitalratio increased from 8.7 per cent to9.3 per cent and return on commonequity improved from 5.5 per cent to9.7 per cent.

Our solid revenue growth is areflection of better marketconditions, as well as our success incollaborating across the company todeliver solutions our clients need,said chief Gerald Hassell.

Its shares rose 1.9 per cent.

BANK of America Merrill Lynch (BAML)reported a 70 per cent jump in profitsfor the second quarter yesterday as therecovery pushed volumes up.

And the figure was further bolsteredby the lender keeping a tight rein oncosts, most notably by cutting 18,300staff over the last year, a 6.6 per cent fallin its workforce.

Profits came in at $4bn (2.6bn), upfrom $2.5bn in the same period of 2012and up from $1.48bn in the firstquarter of 2012.

Total revenues climbed 3.4 per cent to$22.9bn, while provisions for bad loansfell 31.7 per cent to $1.2bn and non-interest expenses fell $1bn to $16bn.

Consumer and business bankingprofits increased 15 per cent to $1.4bn,but entirely on falling costs revenuesdipped on the year, down 0.8 per cent.

But that was far outstripped by a 16per cent fall in bad loan provisions anda 5.4 per cent fall in other costs.

Investment management profit grewstrongly, rising 38.2 per cent to $758mthanks to improved revenues onmarket buoyancy.

BAML earningssoar on toughjob cutting plan

BY TIM WALLACE And investment banking fees shot up36 per cent to $1.6bn, largely onimproving debt and equity underwrit-ing volumes.

BAMLs Basel III core tier one capitalratio increased from 7.95 per cent ayear ago to 9.6 per cent at the end ofthe second quarter.

And its return on equity increasedfrom 3.94 per cent in the first half of2012 to 6.84 per cent so far this year.

We must keep improving, but withthe consumer recovering and business-es strong, we have lots of opportunityahead, said chief executive BrianMoynihan.

BAML shares rose 2.8 per cent.

Bank of America Corp

17 Jul11 Jul 12 Jul 15Jul 16 Jul

14.25

14.50

14.00

13.75

13.50

$ 14.3117 Jul

FRENCH banks including SocieteGenerale, BNP Paribas and CreditAgricole were hit by credit ratingdowngrades yesterday in the wakeof the countrys rating cut.

Fitch said it had lowered thestatus of the banks from A+ to A,following its decision to lowerFrances credit score from AAA toA+ last week.

The downgrade of the Frenchstate means that Fitch considersits ability to support French bankshas decreased slightly, it saidyesterday.

The agency also reduced the

Fitch cuts French banks ratingsafter downgrading the country

BY MARION DAKERS rating of several French regionsand the state postal service LaPoste to reflect the nations newstatus.

This week Fitch also lowered therating of Europes rescue fund, theEuropean Financial StabilityFacility, to AA+.

France, Europes second-biggesteconomy, lost its prized AAArating from Standard & Poors andMoodys last year. Fitch said itsdowngrade was prompted by ahigher state debt level, which itnow expects to peak at 96 per centof GDP next year, and theuncertain growth outlook for theEurozone currency bloc.

-

THURSDAY 18 JULY 20136 NEWS cityam.com

HEATHROW yesterday insisted thatbuilding a third runway at the airportis the best way to add extra flights inthe south east of England.

Europes busiest airport by passengernumbers set out three options for anew runway, which would require thedemolition of up to 2,700 homes.

The airport, which is currently operat-ing at 99 per cent capacity, also said theplans would lead to between 10 and 20per cent fewer people affected by noise,though this would be partly achievedby airlines using quieter planes.

Heathrow also conceded that a newrunway would mean the noise getsworse for some nearby residents.

The options, costing between 14bnand 18bn, would be cheaper thanbuilding a new hub as set out this weekby the Mayor of London, Heathrow saidahead of its formal submission to thegovernments aviation commission.

Heathrow claims the runway woulddeliver 100bn of economic benefits.

It also argues that expansion will cre-

Heathrow setsout its stall for a third runway

BY MARION DAKERS ate 70,000 jobs, compared to thebiggest mass redundancy in UKhistory if the airport were to close.

While Heathrow expects most of theproject to be privately funded, it hasflagged up between 4bn and 6bn ofspending on roads and noise reductionthat it thinks qualify for state money.

Any investment happens becauseinvestors will make a fair return,Heathrow CEO Colin Matthews toldreporters yesterday.

The airport set out possible sites for afourth runway but gave no forecasts forcosts or passenger numbers, arguingthat a third runway alone will provideenough capacity until at least 2040.

The London Chamber of Commercebacked a new runway at Heathrow asthe most realistic option.

But Wandsworth Council leader RaviGovindia derided Heathrows pledgeson noise as a complete sham.

Boris Johnson said yesterday: Therewill be more pigs flying than aircraft ifwe are to believe the claim that threerunways at Heathrow will make lessnoise than two.

n Heathrows first option would see arunway built to the north west of theairport, over the Old Slade sewage worksand three villages, meaning 950 homeswill be demolished. n This option would cost 17bn and bedelivered by 2026, based on a governmentdecision by 2015 and five years in theplanning process. n Option two: build a runway to the southwest, over reservoirs and 850 homes. n This is a more complex plan, costing18bn and not due until 2029.n Heathrow prefers these two options,considering them gentler on local residentswhen it comes to noise and propertylosses. They would lift annual flights from

480k to 740k a year, and require part ofthe M25 to be put in a tunnel.n Option three is quicker and cheaper, butmore disruptive. This would see a runwayto the north of the airport, demolishing2,700 homes. This choice would take until2025 and cost 14bn.n This runway would be slightly shorter,meaning bigger planes like the A380would be unable to take off, restrictingtraffic to 700k flights a year.n Any of these options would increaseHeathrows capacity from 80m passengersa year to between 123m and 130m. n By comparison, the Isle of Grain estuaryproposal would cost upwards of 50bn,finish in 2029 and take 130m passengers.

THE AIRPORTS PROPOSALS AT A GLANCEHeathrow, which currently has two runways, wants government backing for a third

BT KICKED off its debut season as asports broadcaster with an early coupyesterday, netting joint rights totelevise the FA Cup until 2018.

The worlds most famous domesticknock-out competition will be shownon both BT Sport and the BBC,starting from the 2014-15 season.

BT had already secured rights forthe coming seasons FA Cup throughits purchase of ESPNs UK business.ITV will also broadcast the 2013-14FA Cup, but its involvement will nowexpire next summer.

The deal for 2014-15 until 2018, thefinancial details of which wereundisclosed, is another boost for BT.The company is launching its sportchannel next month havingacquired a share of Premier Leaguebroadcasting rights alongside Sky.

They have millions of customersand are shaping up to be aheavyweight player inthe broadcastingworld so the FA Cupis a fantastic assetfor their growingportfolio of sports,FA chairman GregDyke said yesterday,about BT.

BT Sport netsrights to shareFA Cup to 2018

BY JULIAN HARRIS

Alex Oxlade-Chamberlainis a BT Sport ambassador

-

THURSDAY 18 JULY 20137NEWScityam.com

RINGFENCED banks will not be allowedto lend to other banks in future, theTreasury announced yesterday, as partof a drive to stop institutions becomingentangled.

The consultation on bank reformssets out which activities will be allowedwithin the ringfenced bank the partof the lender including basic retail serv-ices, which regulators want to keepafloat even if the rest of the bank fails.

Core banks will include retaildeposits and small firms deposits, butbigger companies with over 6.5mannual turnover or more than 50staff and high net worth individualscan choose where to keep their money.

Treasury clampsdown on bankto bank lending

BY TIM WALLACE These core banks will not allowed tobe exposed to any non-ringfencedbanks, ending the flow of fundingfrom retail depositors to other parts ofthe financial system. They can also notlend to insurers, investment firms andsecuritisation businesses.

Ringfenced entities will also be limit-ed in the type of derivatives they canoffer, with only swap, future and for-ward contracts allowed, and only forcurrency, interest and commodityhedging purposes.

And the total risk arising from thosederivatives will not be allowed toexceed 20 per cent of the banks totalcredit risk capital requirement.

The consultation will remain openuntil October.

HARD-LIVING Britons will be ableto keep buying cheap booze andsmoking branded cigarettes afterthe government dropped plans torein in such indulgences.

Proposals to introduce a 45pminimum price for each unit ofalcohol which would introduce a4 base price for a bottle of wine were pushed forward at the end of

Minimum price for alcohol andplain cigarette packs dropped

The PM no longer faces the prospect of paying over 2 for a can of Tennents Super

BY JAMES WATERSON last year. But David Cameron said hewould instead ban retailers fromselling alcohol for less than thecombined cost of the VAT and duty.

Separately, the government alsosaid it had decided not to introduceplain packaging for cigarettepackets in an attempt to dissuadechildren becoming smokers. Bothannouncements reflect DowningStreets decision to drop policiesthat could up the cost of living.

ACTIVIST shareholder Nelson Peltzsaid yesterday he wants PepsiCo tobuy Mondelez International foraround $35 a share in a deal thatwould be worth $62.46bn and createa snack food powerhouse sellingeverything from chocolate to chips.

Peltz said in a 59-pagepresentation that PepsiCo was at astrategic crossroads and the statusquo was unsustainable. Peltz hasplayed a role in some of the foodindustrys biggest deals.

Speaking at a conference that wasbroadcast on CNBC, Peltz saidPepsiCo doesnt love the deal. Healso said he plans to meet withMondelez chief executive IreneRosenfeld in the coming weeks.

PepsiCo has said it sees no needfor large-scale mergers. It hasalready said that it was weighingstructural options for its NorthAmerican beverage business butdoes not plan to discuss it untilearly next year.

Pepsi urged tobecome snackfood behemoth

BY CITY A.M. REPORTER

NEW LAWS designed to clampdown on the lobbying industrywill impose tough restrictions onthe political activities of Labour-supporting trade unions,according to a draft publishedyesterday.

The coalition bill promises alobbying register of contactbetween lobbyists and politiciansand was drawn up afternewspapers last month exposedpoliticians who were willing toaccept money for influence.

But the bill also contains manymeasures that appear to beespecially designed to frustrateunions, such a reduction in theamount third party campaigningorganisations can spend duringelections to 390,000.

Labour could be hit hard by the

move as it receives substantialsupport from third party unioncampaigns, which will also nowbe included in party spendinglimits. The union Unison alonespent more than 670,000 in thismanner during the 2010 generalelection.

Unions will also be legallyrequired to keep accurate recordsof their membership and avoidinflating their support.

Professional lobbying firmsalso highlighted loopholes in theproposed legislation, such as thefact they will only have to publisha list of their clients if they meetwith ministers or top-levelWhitehall mandarins.

Lobbyists who do not work foran external consultancy will beexcluded from the rules, whilefinancial PRs will be largelyexempt from the rules.

Lobbying crackdown willhit trade unions hardest

BY JAMES WATERSON

SAME-SEX couples will be allowed tomarry in England and Wales, aftergovernment legislation became lawyesterday afternoon.

The bill received Royal Assent fromthe Queen following months ofvicious debate and survived last-ditchattempts by backbench MPs and peersto derail its progress. David Cameronsaid we can be proud of as acountry after it was passed.

The first ceremonies are expectedto take place next summer as civilservants need to ensure proceduresare compatible with the new rules.

The news comes just 45 years afterthe Queen signed the Sexual OffencesAct 1967, which decriminalisedhomosexual acts between men overthe age of 21.

Gay marriagebecomes law

BY JAMES WATERSON

THE DEPARTMENT of Energy andClimate Change yesterdaypublished its draft electricitymarket reform (EMR) deliveryplan, which is looking to raise110bn to invest in newelectricity infrastructure by 2020.

The draft document which isunder consultation until 25September gives further detailson the Contracts for Differencesupport mechanism and strikeprices for renewables, both ofwhich aim to encourageinvestment in low carbon energyby diminishing price volatility.

Secretary of State Ed Davey saidthat the plan would provideinvestors with further certaintyof governments intent and

BY SUZIE NEUWIRTH support up to 250,000 jobs acrossthe energy sector.

The new strike prices willmean that renewables cancontribute more than 30 per centof our power mix by 2020,putting us on track to seeingsignificant decarbonisation of thepower sector by 2030 and meetingour wider climate targets, headded.

The industry has been callingfor certainty over the finer detailsof EMR and so any additionalclarity is to be welcomed, aspokesperson from big six energyfirm SSE told City A.M.

We will take time to digest theplans published today, but thereis still a long way to go before wecan tell whether the newmechanisms will be investable.

Government releases draftelectricity market reforms

Ed Milibands party relies on union funding

-

THURSDAY 18 JULY 20138 NEWS cityam.com

Watchdogs tighten up on LiborINTERNATIONAL regulators haveordered watchdogs around the worldto clean up financial benchmarks ina co-ordinated effort to stop anyrepeat of last years Libor scandal.

The International Organisation ofSecurities Commissions (IOSCO)wants increased monitoring of datasubmission and compilation as wellas improved complaints systems.

The regulators also want indices tobe updated regularly when thestructure of markets changes, for

BY TIM WALLACE instance when the rates measuredare no longer the main rates in use.

IOSCOs recommendations arenot legally binding, but dohave influence as the group iscomprised of leading figuresin the regulatory landscape.

US regulators had calledfor an end to any index notbased on market transactions some Libor rates wereessentially made ofguesswork afterliquidity dried upin the crisis.

But IOSCO held back, as it maymean scrapping useful benchmarks.

These principles set out clear androbust standards that will improvetheir construction and oversight ofbenchmarks, and form animportant step in restoring theircredibility, said Martin Wheatley,

head of the UKs Financial ConductAuthority (FCA). We look forward to

working with internationalpartners to drive upstandards.

INTEL last night slashed its year-endfinancial forecast as the personalcomputer business loses marketshare to tablets and smartphones.

The worlds top chipmaker saidsecond quarter profits were down 29 per cent year-on-year to $2bn(1.3bn), below Wall Streetexpectations.

It also reduced its year-end targetfor personal computer chip sales,

Intel suffers as consumers fleethe desktop computer market

BY JAMES WATERSON although the decline in the sale ofsuch components was not as steep assome recent market surveys hadprojected.

The company also posted second-quarter revenue of $12.8bn (8.4bn)and said revenue in the currentquarter would be $13.5bn, give ortake $500m.

Recently appointed CEO BrianKrzanich said the firm will leave nocomputing opportunity untappedas it looks to improve its position.

E-COMMERCE giant eBay reportedsolid second-quarter results yesterdaybut chief executive John Donahoewarned of economic headwinds inthe second half of the year fromEurope and Korea.

Those comments, and weaker-than-expected third-quarter forecasts, sentshares down six per cent in after-hourstrading.

Its not a quarter in which theyabsolutely crushed it, said Ron Josey,an analyst at JMP Securities. They aredoing well, but people were hoping formore.

Second-quarter net income was$822m (540m), or 63 cents a share,versus $730m, or 56 cents a share, inthe same period a year earlier.Revenue rose 14 per cent to $3.88bn.EBay was expected to earn 63 cents ashare on revenue of $3.89bn,according to Thomson Reuters.

Macroeconomic headwinds inEurope and Korea will continue to be achallenge in the second half of theyear, Donahoe said. But our core

eBay markets asolid report butsees headwinds

BY HARRY BANKS businesses are strong.EBay lagged rival Amazon.com for

several years, but chief executive JohnDonahoe has led a turnaround thatfocuses on mobile shoppers, interna-tional expansion and tie-ups withlocal physical stores. eBay is spendingheavily on these initiatives, and hopesthey will fuel revenue and profitgrowth in coming years.

EBays third-quarter forecasts wereweaker than expected, while the com-pany stuck to its full-year guidance.

EBay shares fell six per cent to $53.94in after-hours trading yesterday. Theyhad closed up nearly one per cent.

IBM, the world's largest technologyservices company, raised its full-year outlook as it cut costs andreported second-quarter earningsthat beat estimates.

International Business Machinessaid excluding a $1bn (657m)restructuring charge related to jobcuts, non-GAAP (generally acceptedaccounting principles) earnings pershare forecasts were being raisedto at least $16.90 from $16.70. Full-year GAAP diluted earnings pershare are at least $15.08, IBM said.

The New York-based company

IBM raises its full-year outlookon cost-cutting and strong data

IBM chair and chief executive Virginia Rometty raised the firms full-year outlook

BY CITY A.M. REPORTER said its quarterly non-GAAPincome rose three per cent,excluding a $1bn restructuringcharge, to $4.3bn, or $3.91 a share,compared with $3.51 a year agoand analyst estimates of $3.77 ashare.

On a GAAP basis, earnings pershare were $2.91, down 13 per cent;net income was $3.2bn, down 17 per cent.

Revenue dropped three per centto $24.9bn, below average analystexpectations of $25.4bn.

Shares closed 0.36 per cent up at$194.55 but were up nearly threeper cent in after-hours trade.

CREDIT card company AmericanExpress reported a five per centincrease in quarterly profit as itcharged higher fees and earned morecommissions on its cards.

American Express, which gets thebulk of its US billed business fromaffluent corporate customers, saidcardmember spending increasedeight per cent in the quarter,adjusted for foreign currencytranslations.

Earlier in the day shares fell morethan five per cent following theEuropean Commissions plans tolimit fees banks can charge toprocess card payments.

The companys net profit rose to$1.41bn (962.5m), or $1.27 pershare, for the quarter ended 30 June,from $1.34bn, or $1.15 per share, ayear earlier.

Total revenue, net of interestexpense, rose four per cent to$8.24bn, boosted by a five per centincrease in net card fees. Analysts onaverage had expected the companyto earn $1.22 per share on revenue of$8.28bn, said Thomson Reuters.

American Express, a Dow 30constituent, said consolidatedexpenses rose slightly to $5.66bnfrom $5.62bn.

Shares closed at $76.80 on the NewYork Stock Exchange but fell one percent after the bell.

Amex sees itsearnings riseon higher fees

BY CITY A.M. REPORTER

Handelsbanken profits rise as itplans 12 more branches in the UKBRITISH operations of Nordic lenderHandelsbanken expanded rapidlyagain in the first half of the year,the group reported yesterday.

Operating profits in the UKincreased five per cent on the yearto 276m Swedish krona (27.6m).

Household lending jumped 28 per cent to 3.1bn krona, whilecorporate lending rose 19 per centon the previous year to 8.3bn krona.Deposits increased by 14 per cent to3bn krona.

The bank opened nine new UKbranches in the second quarter,taking its total footprint in thecountry to 147 outlets.

And it has recruited managers to

BY TIM WALLACE open another 12 in the near future.Headcount in the UK shot up to

1,201, up 31 per cent on the 917employed a year ago.

Meanwhile the group overallrecorded profits of 7.2bn krona, anincrease of nine per cent on theyear.

That takes return on equity to 14.2per cent, down a touch on the 14.3per cent a year earlier, while its coretier on capital ratio under Basel IIIrules came in at 17.8 per cent.

Handelsbanken added it will beaffected by the Swedish authoritiesdecision to introduce a tougher newcapital requirement equivalent to a15 per cent risk weight floor forSwedish mortgage loan portfolios.

In the banks assessment, this

entails a capital requirement inPillar 2 of approximately 7bnkrona, the bank said in a statement.

The groups capital marketsoperations also recorded steadygrowth.

The unit, which includesinvestment banking and assetmanagement operations, as well astrading in financial instrumentsand structured products, saw profitsrise four per cent to 3.1 krona.

Commission income increased 10per cent to 2.4bn krona, withmutual funds and custody profitsup 16 per cent to 1.2bn krona.

However insurance profits fell,dipping eight per cent on the year.

The banks shares dipped 1.97 percent on the day.

Martin Wheatley has led thecharge on benchmark reform

eBay Inc

17 Jul11 Jul 12 Jul 15Jul 16 Jul

57.0

57.5

56.5

56.0

55.5

$57.3817 Jul

MATTELS quarterly results offeredfurther proof of the fading appeal ofthe iconic Barbie doll, as newerbrands including the teen monstersof the companys own Monster Highline gained market share.

Mattel shares fell 6.8 per cent afterthe worlds biggest toymakerreported a much weaker-than-expected second-quarter profit.Shares of smaller rival Hasbro fellthree per cent.

Sales of Barbie fell 12 per cent inthe second quarter, their fourthstraight quarterly decline. Sales of itsOther Girls line, which includesMonster High, rose 23 per cent.

The companys second-quarter netincome fell to $73.3m, or 21 centsper share, from $96.2m, or 28 centsper share, a year earlier.

Barbie fallingflat for Mattel

BY CITY A.M. REPORTER

BRIT Insurance, the sponsor of theEngland and Wales cricket team,has sold its stake in an onlinebusiness insurer in a managementbuyout, it emerged yesterday.

The Lloyds of London insurersold a 37 per cent holding inSimply Business in a deal thatvalues the online broker at morethan 50m, according to the DailyTelegraph.

Brit has undergone a radicalrestructuring in recent yearsunder chief executive MarkCloutier, who was brought in atthe end of 2011 and has focused allof the companys efforts on itsLloyds business.

In the process he has sold orclosed most of Brits consumer-facing UK businesses.

Brit Insurancesells subsidiary

BY JAMES WATERSON

-

THURSDAY 18 JULY 20139NEWScityam.com

Severn Trent boss Tony Wray

Severn Trent books 19m charge on failed bidFTSE 100-listed water companySevern Trent said yesterday that ithas incurred 19m in advisory andlegal costs after rejecting lastmonths takeover bid, in a firstquarter trading update that was inline with expectations.

The British utility firm rebuffed a5.2bn offer from investorconsortium LongRiver Partners,claiming it was not fair value.

In yesterdays update, Severn

BY SUZIE NEUWIRTH Trent said that its water division willbenefit from a two per cent increasein tariffs, despite a year-on-yeardecline in consumption.

Growth in the services unit isexpected to be weighted towards thesecond half due to the timing ofwater purification delivery orders.

Bad debt is forecast to remain ataround 2.2 per cent of turnover forthe full year, although the firm willcontinue to monitor developmentssuch as unemployment levels andchanges to the UK benefits system

closely. However, regulatory issues loom

for the company, according toanalysts. We expect marketattention to increasingly focus onthe [2014] regulatory price review asopposed to current companytrading, commented Tina Cook,analyst at Charles Stanley.

All resolutions were passed at thecompanys annual meetingyesterday.

Severn Trent shares closed 0.3 percent higher at 1,752p.

Severn Trent PLC

17 Jul11 Jul 12 Jul 15Jul 16 Jul

1,740

17,60

1,720

P1,752.00

17 Jul

Expensive butfar from 19mdown the drain

SHAREHOLDERS in Severn Trentmay be mourning the sky-highprices of May and early June,but it is too soon to claim theCity didnt earn its fees in helpingthe water firm resist the advances ofthe LongRiver consortium.

It was revealed yesterday that inbatting away the takeover bid SevernTrent paid 19m in advisory fees.The firms involved included Citi andRothschild. That amounts to 8.83per cent of the utilitys group profitbefore tax for 2012-13, no small sum.

The immediate upward journey ofthe shares on news of the bid in Maywas unmistakable: they jumpedmore than 16 per cent overnight,closing at 1,825p on 13 May andopening at 2,125p on 14 May. Thatfell away in June, when the bid wasfinally rejected. Shares closed at2,070p on 7 June, before fallingsteadily for the next fortnight,bottoming out on 21 June with aclose at 1,614p, a fall of 22 per cent.

Since then, the share price hasrecovered somewhat, but remainsbelow pre-bid levels.

That explains the long faces fromshort-term investors who failed toget out while the going was good.Yet the bid was rejected for notrepresenting fair value. As such, foranyone investing in the companyover a longer time horizon this stillhas time to prove 19m well-spent.Given how often the City is tarredwith the short-termist brush, itseems a little unfair to beat itsadvisers up when they play the longgame as well.

BOTTOMLINE

MARC SIDWELL

RBC CAPITAL Markets, thecorporate and investment bankingarm of Royal Bank of Canada, hasappointed Darrell Uden as head ofEuropean equity capital markets(ECM) and corporate broking.

Uden, who was most recently co-

RBC Capital Markets picks Udenas new head of ECM and broking

BY CITY A.M. REPORTER head of ECM for Europe, MiddleEast and Africa at UBS, will reportto Josh Critchley and Patrick Meier,co-heads of European investmentbanking.

Darrell will play a pivotal role indriving forward our strategy togrow our ECM coverage in theregion," Critchley said.

MAGIC circle law firm Allen &Overy has come out on top in aglobal round-up of legal advisers tothe debt and equity capitalmarkets, winning roles on morethan 450 deals in the first half of2013.

According to the latest ThomsonReuters survey, combined debt andequity capital markets activity

Allen & Overy tops capital markets adviser table BY ELIZABETH FOURNIER totalled $3.4 trillion in the six

months to June, up 5.9 per cent onthe total for the whole of 2012.

Allen & Overy acted as adviser tothe manager on 350 deals and tothe issuer on 106 deals narrowlybeating fellow UK firms Linklatersand Clifford Chance in eachrespective category.

Global equity activity in the firstsix months was $388.5bn 36.5 percent higher than last year.

ALMOST 30 per cent of FirstGroupshareholders voting in yesterdaysannual meeting refused to back thetransport groups pay plans for its topstaff.

And 22.7 per cent of shareholdersvoted against the reappointment ofMartin Gilbert, who is steppingdown as chairman once areplacement is found.

Gilbert announced his departurein May alongside news of the firms615m discounted rights issue to cutits debts and defend its credit rating.

Chief executive Tim OTooleturned down a bonus of 70 per centof his 1.02m basic pay for the yearin the wake of the fundraising.

The firm said in an updateyesterday that its recovery plan wason track, though OToole addedthere remains significant work todo.

The task of returning the groupto the position of strength that ourcustomers, employees, andshareholders expect will requirehard work and persistent delivery forsome time to come, and we arepleased by the support of ourshareholders in the recent rightsissue, he said in a statement.

The firm axed its dividend andlaunched the recovery plan after theabrupt cancellation of its contract torun the West Coast Main Line railroute last October.

Investors holding just 64.16 percent of the firms shares used theirvotes yesterday.

FirstGroups sharesclosed at 92.85p, oraround half thelevel seen beforethe rights issueannouncement.

Protest vote atFirstGroup overexecutive pay

BY MARION DAKERS

Martin Gilbertis FirstGroupsoutgoingchairman

- MADE FOR LIVING- ZONE 2 ADDRESS- ON THE EDGE OF THE CITY- HOXTON AND DALSTON ON YOUR DOORSTEP2 BEDROOM APARTMENTS AVAILABLE

0844 406 9289WWW.THECITYMILLS.CO.UK

SALES SUITE OPEN THURS-MON. VIEWINGS BY APPOINTMENT ONLY.REGISTER YOUR INTEREST NOW AND BOOK A VIEWING TODAY

The City Mills, 215 Haggerston Rd, London E8 4HU

NEW RELEASES SELLING FAST - BOOK A VIEWING TODAYComputer Generated Image is indicative only.

TOP LEGAL ADVISERSLegal Adviser 2013 Rank 2012 Rank Allen & OveryClifford ChanceSimpson Thacher& BartlettSkaddenSidley Austin LLP

1 42 13 17

4 85 11

-

THURSDAY 18 JULY 201311NEWScityam.com

LAUR

A LE

AN/C

ITY

A.M

.

!"#$"

!"# $%"&'( &)*+%,%-./0%12&3%#33 !

"4.56.!781%9:$3;;$

3$

7%"

33%#

-

THURSDAY 18 JULY 201312 NEWS cityam.com

BP asks US judge for temporaryhalt to Gulf of Mexico paymentsFTSE 100-listed oil giant BP has askeda US judge to temporarily haltpayments to people and businesseswho say they lost money after theGulf of Mexico oil disaster.

BP said in a New Orleans courtfiling that a brief pause isnecessary until an investigation intoalleged misconduct over thesettlement claims is complete.

There is a material risk that

BY HARRY BANKS payments going out the door havebeen and continue to be tainted bypossibly fraudulent or corruptactivity, said BP spokesman GeoffMorrell. No company would agreeto bear the risk of improperpayments in these circumstances.

Former FBI director Louis Freehwas appointed on 2 July to conductan independent investigation intoallegations of improprieties withinthe settlement programme. BPsshares closed 0.28 per cent up.

FTSE 100-listed BHP Billiton yesterdaysaid that production at two of itsmines had beaten guidance this yearand expansion of its iron ore divisionis running ahead of schedule.

Yet despite petroleum outputincreasing by six per cent to 235.8mbarrels of oil, it fell short of BHPs240m guidance.

Total iron ore production increasedby seven per cent to 170m tonnes inthe 2013 financial year, while copperincreased by 10 per cent to 1.2mtonnes, the miner said.

Production from BHP Billitons ironore expansion project the JimblebarMine Expansion has now beenbrought forward to the December2013 quarter.

All up, more positive than negativeand on first pass we see little downsiderisk to our full year forecasts, said bro-ker Investec in a note. [The company]has not provided any market commen-

BHP Billitonsiron ore outputbeats forecasts

BY SUZIE NEUWIRTH tary while the limited productionguidance for full-year 2014 appears tofall in line with our expectations.Shares closed two per cent higher.

Rio Tinto yesterday announcedrecord iron production in the firsthalf, the mining giants defying a drop-off in demand from China and a dwin-dling iron ore price. Analysts havesuggested that the firms are miningmore for less in order to maximiseeconomies of scale and squeeze outsmaller competitors.

IN BRIEFStrauss-Kahn joins Russian bankn Dominique Strauss-Kahn, the former head ofthe International Monetary Fund, has joined thesupervisory board of a bank owned by Russianstate oil major Rosneft. He will take a seat onthe supervisory board of Russian RegionalDevelopment Bank, according to a regulatoryfiling by the bank.

Sunshine boosts restaurant salesn Restaurants and pubs saw an increase insales in June this year thanks to the warmweather, which encouraged people to spendtheir money. Total sales, including the impact ofnew openings, rose by 4.8 per cent, while like-for-like sales were up by 1.9 per cent, according

to the Coffer Peach business tracker. TheLondon market showed the highest increase,with like-for-like sales up 5.1 per cent in June,while the rest of the country was relatively flat.

Davenport Lyons to move officesn Davenport Lyons has decided to move tonew offices in the West End despite an exodusof law firms moving out of the district in searchof cheaper rents and bigger office space. Thecompany has taken 31,500 square feet of spaceover three floors at 6 Agar Street in CoventGarden and will move in September after 23years in Old Burlington Street, Mayfair. The65m Agar Street office block is owned by Legal& General and was finished last year.

LATIN American miner Hochschildtopped the FTSE 250 indexyesterday, after reducing the boardand slashing directors' salaries.

Shares in the company, whichproduces silver and gold frommines in Peru and Argentina,jumped as much as 10 per cent inmorning trade as investors reactedwell to the cost cuts in the face ofplunging gold and silver prices.

The group said that two non-executive directors out of a10-strong board former JPMorgan executive Fred Vinton andone-time deputy governor of the

Hochschild tops FTSE 250 as payand board cuts please investors

Former Bank of England official Rupert Pennant-Rea will not be replaced on the board

BY CITY A.M. REPORTER Bank of England Rupert Pennant-Rea would be standing down atthe end of the month and wouldnot be replaced.

It said the salary of its chairman,Eduardo Hochschild, and non-executive directors would be cut by30 per cent, while chief executiveIgnacio Bustamante would take a10 per cent cut.

The measures were announcedalongside a dip in quarterlyproduction, though it said outputwas in line with expectations and itremained on track to hit its 2013target.

Hochschilds shares closed 7.4per cent higher at 146.20p.

FTSE 100-listed miner Fresnilloyesterday reported a 6.3 per centincrease in quarterly silverproduction but lowered its full-yearguidance for gold output.

The year-on-year increase in silveroutput was a result of increasedvolumes at two of the firms minesand silver will meet guidance thisyear, the company said.

However, gold output fell 6.8 percent year-on-year and productionguidance was lowered from 465,000ounces from 490,000 ounces, due tothe halt in mining the Dipolos openpit after a district court ruled infavour of a community groupclaiming rights to the mining area.

Fresnillo bounced back from aweak start to 2013, deliveringimproved silver grades, andcontinuing to ramp-up [its silvermine] Saucito, said broker DeutscheBank in a note. The shine was takenoff the results, in our view, by theseemingly permanent closure of theDipolos open pit gold mine.

Our growth pipeline remainsrobust and on track withdevelopment projects andencouraging exploration results,said chief executive Octavio Alvidrez.

Fresnillos goldloses its lustreas silver shines

BY SUZIE NEUWIRTH

BP PLC

17 Jul11 Jul 12 Jul 15Jul 16 Jul

468

472

464

P466.50

17 Jul

Bhp Billiton PLC

17 Jul11 Jul 12 Jul 15Jul 16 Jul

1,800

1,850

1,900

1,750

P1,868.00

17 Jul

-

THURSDAY 18 JULY 201313cityam.com

cityam.com/the-capitalistTHECAPITALIST EDITED BY CALLY SQUIRESGot A Story? Email [email protected]

NOTHING like a bit of hypocrisy fromWhitehall, just as Parliament wrapsup for the summer.

Scribes over in the Cabinet Officelaunched a new magazine onTuesday the glossy Civil ServiceQuarterly. But the timing of thelaunch, which employs a team of sixon editorial and design, couldnot be worse.

Secretary of State forCommunities and LocalGovernment EricPickles led a high pro-file campaign againstcouncils running whathe has nicknamed townhall pravdas earlier thisyear: These glossymagazines have been

Pickles goesquiet on launchof Cabinet rag

designed for the sole purpose oftelling people how great the councilis.

Sadly the mag seems to be full of justthe kind of PR propaganda that Pickleshas been campaigning against. Theopening gambit promises toshowcase excellence and half of theTwitter hashtags (#CSQuarterly) refer-encing the new title are from theCabinet Office itself.

So what did Pickles think about thelaunch? We wont be commentingon this a representative told TheCapitalist yesterday. So much foropenness and transparency then.

THE CITYS historic Guildhallplayed host to one of the capitalsmore eccentric traditionsyesterday.

Every year since 1655 a liverycompany the WorshipfulCompany of Carmen havegathered in the old Yard wieldingred hot branding irons. Not for any

Railway carriages join the Cityrelics facing the branding iron

Alderman Fiona Woolf and London Transport commissioner Sir Peter Hendy

sinister reasons, but to put theirstamp on various horse-drawncarriages and steam-drivenvehicles. A more modern mode oftransport old Metropolitanrailway carriage number 353 thisyear also met its marker. But withspace in mind, it took pride ofplace at Mansion House station.

Former England cricket captain MikeGatting has been getting around the City

charity sporting circuit lately. Not only did hecomplete annual Standard Chartered Great Cityrace last week and blindfolded too he thenhopped straight on his bike for five days ofcycling from Chester-le-Street to Lords cricketground as part of the Investec Ashes Challenge.Gatting made it back to Lords yesterday, afterpedalling the 340 miles around all the Ashes Testmatch venues, to raise money for youth cricketcharity The Lords Taverners. There were hillsthat Id probably struggle to drive a car up,Gatting said at the finish line. Still, it is not allwork and no play: the cricketer told The Capitalisthe will be relaxing at his old Lords stompingground today watching the start of the secondAshes Test hopefully with his feet up.

LAUR

A LE

AN/C

ITY

A.M

.

Conservative MPEric Pickles

L-R: Investecs James Bedingfield, cricketlegend Mike Gatting and Leon Taylor

-

1. Transport for London hereby gives notice that, after consulting the Commissioner of Police for the City of London, the Commissioner of Police of the Metropolis, the Councils of the London Boroughs of Hackney, Hammersmith and Fulham, Wandsworth, Hounslow, Richmond upon Thames, Merton, Tower Hamlets, Lambeth, Southwark, Camden, Redbridge, Waltham Forest and Newham, the Royal Boroughs of Kensington and Chelsea, Kingston upon Thames and Greenwich, the City of Westminster and the Common Council of the City of London, it has made the above named Traffic Order under section 16(A) of the Road Traffic Regulation Act 1984 for the purpose specified in paragraph 2. The effect of the Order is summarised in paragraph 3.

2. The purpose of the Order is to enable the event known as The Prudential Ride London to take place.

3. The effect of the Order is to prohibit: (1) persons or vehicles entering, exiting and proceeding in the

carriageway of any street or length of street specified in Schedule 1 and 2 to this Notice between the time specified in relation to each street or length of street (or earlier if required by a police constable in uniform) and a time when normal traffic operation can be resumed;

(2) stopping or waiting by vehicles (including waiting for the purpose of delivering or collecting goods or loading or unloading a vehicle) in each street and length of street specified in Schedule 1 and Schedule 2 to this Notice.

4. The provisions made in any Order in respect of one-way working which applies to any of the roads listed in Schedule 3 to this Notice, are hereby suspended or reversed as listed during the times specified.

5. During the times specified, the provisions made in any Order in respect of bus lanes are suspended and stopping and waiting will only be permitted by vehicles used in connection with this event on the lengths of streets listed in Schedule 4 to this Notice.

6. The provisions made in any Order in respect of a prohibition of cycling applying to any roads listed in Schedule 1 to this Notice, are herebysuspended for the duration of this Order.

7. Between 0001 and 2359 hours on Saturday 3rd August 2013, this Order will allow the right turn from Moorgate southbound into London Wall westbound.

8. Between 0001 and 2359 hours on Sunday 4th August 2013, the Order will also suspend: (1) all stopping and waiting on West Ham Lane (between its junctions

with Victoria Street and Manor Road), Manor Road southbound carriageway (between its junctions with Memorial Avenue and Stephenson Street) and Silvertown Way (between its junctions with Hallsville Road and Brunel Street) in the London Borough of Newham;

(2) the parking and loading bays on Farringdon Street northbound (between its junctions with Charterhouse Street and Holborn Viaduct) in the City of London except TfL authorised National Express, Megabus and local buses only;

(3) the no right turn prohibition from Tower Bridge Road northbound into Tooley Street eastbound in the London Borough of Southwark;

(4) all stopping and waiting on Park Lane northbound (between the Crossrail lorry holding area and Grosvenor Gate) in the City of Westminster except TfL authorised National Express, Megabus and local buses only;

(5) the bus lanes on York Road in the London Borough of Lambeth and on Waterloo Bridge in the London Borough of Lambeth and the City of Westminster;

(6) all stopping and waiting on Charles II Street south side in the City of Westminster between its junctions with Haymarket and Regent Street;

(7) all stopping and waiting on Waterloo Bridge and Lancaster Place northbound in the London Borough of Lambeth and the City of Westminster;

(8) all stopping and waiting on Concert Hall Approach in the London Borough of Lambeth except buses;

(9) bus stop B on Townmead Road in the London Borough of Hammersmith and Fulham to allow no stopping except buses;

(10) the no entry restriction on Chiswick Mall at its junction with Chiswick Lane south;

(11) the bus lanes on Brook Street in the Royal Borough of Kingston upon Thames;

(12) the no entry restriction from Wheatfield Way into Lady Booth Road in the Royal Borough of Kingston upon Thames;

(13) the no u-turn prohibition on Wheatfield Way northbound carriageway at the end of the central reservation prior to Fairfield North in the Royal Borough of Kingston upon Thames;

(14) the left turn only prescribed route on Acre Road at its junction with Richmond Road in the Royal Borough of Kingston upon Thames;

(15) all stopping and waiting on Ashdown Road (with the exception of the Disabled Bay on the north side) in the Royal Borough of Kingston upon Thames except Taxis on the south side;

(16) all stopping and waiting on The Bittoms (between its junctions with East Lane and Kingston Hall Road), Fairfield West northbound (between its junctions with Fairfield South and Fairfield Road), Fairfield South and Hawks Road in the Royal Borough of Kingston upon Thames;

(17) the no entry restrictions at the junction of Delamere Road and Ethelbert Road and from Pentney Road into Albert Grove in the London Borough of Merton;

(18) the no right turn prohibition from Courthope Road into Church Road in the London Borough of Merton.

9. The following will also be permitted between 0001 and 2359 hours on Sunday 4th August in the London Borough of Wandsworth:(1) access through the fire gate on Felsham Road outside Deer Lodge;(2) access through the fire gate on Charlwood Road at its junction with

Clarendon Drive;(3) access through the fire gate on Langside Avenue at its junction with

Roehampton Lane;(4) access through the removable bollards on Lacy Road.

10. The prohibitions will apply only during such times and to such extent as shall from time to time be indicated by traffic signs and will not apply in respect of:(1) any vehicle being used for the purposes of that event or for fire

brigade, ambulance or police purposes;(2) anything done with the permission or at the direction of a police constable in uniform or a person authorised by Transport for London or any London Borough affected by this Order.

11. Additional streets and lengths of streets may also be closed at the direction of a police constable in uniform, to facilitate alternative routes.

12. Alternative routes will be signposted. Dated this 18th day of July 2013Roger PyeTraffic Directorate, Transport for LondonPalestra, 197 Blackfriars Road, London, SE1 8NJ

SCHEDULE 1 (see Article 3)Roads affected by the race and forming part of the race route

From 0001 hours until 2359 hours on Saturday 3rd August 2013In the Royal ParksBirdcage Walk, Spur Road, The MallIn the City of WestminsterCharing Cross, Whitehall (between its junctions with Charing Cross and HorseGuards Avenue), Horse Guards Avenue, Great George Street, Parliament Square(northern arm), Bridge Street, Victoria Embankment (as much as lies within the Cityof Westminster)In the City of LondonVictoria Embankment (as much as lies within the City of London), BlackfriarsUnderpass, Upper Thames Street, Lower Thames Street, Byward Street, Tower Hill,Puddle Dock, Queen Victoria Street, Friday Street, Cannon Street (between itsjunctions with New Change and Queen Street), New Change, Cheapside (betweenits junction with New Change and King Street), King Street, Gresham Street(between its junctions with King Street and Lothbury), Lothbury (between itsjunctions with Gresham Street and Princes Street), Princes Street, Mansion HouseStreet, Garlick Hill (between its junctions with Queen Victoria Street and Great StThomas Apostle), Great St Thomas Apostle, Queen StreetFrom 1930 hours on Saturday 3rd August 2013 until 2359 hours on Sunday 4thAugust 2013 In the London Borough of HackneyWaterden RoadFrom 2000 hours on Saturday 3rd August 2013 until 2359 hours on Sunday 4thAugust 2013In the London Borough of Richmond Upon ThamesChiswick Bridge (as much as lies within the London Borough of Richmond UponThames), Clifford Avenue, Lower Richmond Road (between its junctions withClifford Avenue and Clifford Avenue), Upper Richmond Road West (between itsjunctions with Clifford Avenue and Sheen Lane), Sheen Lane (between its junctionswith Upper Richmond Road West and Sawyers Hill), Sawyers Hill (between itsjunctions with Sheen Lane and Queens Road), Queens Road (as much as lieswithin the London Borough of Richmond Upon Thames between its junctions withSawyers Hill and the boundary of the Royal Borough of Kingston Upon Thames),Kingston Bridge (as much as lies within the London Borough of Richmond UponThames), Hampton Court Road (between its junctions with Kingston Bridge andHampton Court Bridge) Hampton Court Bridge (as much as lies within the LondonBorough of Richmond Upon Thames)From 0001 hours until 2359 hours on Sunday 4th August 2013 London Borough of HackneyEastway (between its junctions with Waterden Road and East Cross Route), EastCross Route (as much as lies within the London Borough of Hackney)London Borough of Tower HamletsEast Cross Route (as much as lies within the London Borough of Tower Hamlets),Blackwall Tunnel Northern Approach, Brunswick Road, St Leonards Road, EastIndia Dock Road (between its junctions with St Leonards Road and LeamouthRoad), Leamouth Road, Leamouth Roundabout, Aspen Way (between its junctionswith Leamouth Road roundabout off slip and Limehouse Link), Limehouse Link,The Highway, East Smithfield, Tower HillIn the City of LondonByward Street, Lower Thames Street, Upper Thames Street, Blackfriars Underpass,Victoria Embankment (as much as lies within the City of London)In the City of WestminsterVictoria Embankment (between the boundary of the City of London and itsjunction with Northumberland Avenue), Charing Cross, Cockspur Street, Pall Mall,St Jamess Street, Piccadilly (between its junctions with St Jamess Street and HydePark Corner), Hyde Park Corner, Duke of Wellington Place, Knightsbridge (as muchas lies within the City of Westminster), Whitehall, Parliament Street, ParliamentSquare (eastern arm), St Margaret Street, Old Palace Yard, Abingdon Street,Millbank, Grosvenor Road, Knightsbridge (as much as lies within the City ofWestminster between its junctions with Hyde Park Corner and Brompton Road),Brompton Road (as much as lies within the City of Westminster)In the Royal ParksConstitution Hill, The MallIn the Royal Borough of Kensington and ChelseaChelsea Embankment, Knightsbridge (as much as lies within the Royal Borough ofKensington and Chelsea between its junctions with Lowndes Street and BromptonRoad), Brompton Road (as much as lies within the Royal Borough of Kensington andChelsea between its junctions with Knightsbridge and Cromwell Gardens), ThurloePlace (between its junctions with Brompton Road and Cromwell Gardens),Cromwell Gardens, Cromwell Road, West Cromwell Road (as much as lies withinthe Royal Borough of Kensington and Chelsea), Cheyne Walk, Cremorne Road,Ashburnham Road (between its junctions with Cremorne Road and Kings Road),Kings Road (as much as lies within the Royal Borough of Kensington and Chelseabetween its junctions with Ashburnham Road and News Kings Road)In the London Borough of Hammersmith and FulhamWest Cromwell Road (as much as lies within the London Borough of Hammersmithand Fulham), Talgarth Road, Hammersmith Flyover, Great West Road (as much aslies within the London Borough of Hammersmith and Fulham), Kings Road (as muchas lies within the London Borough of Hammersmith and Fulham), New Kings Road,Putney Bridge Approach, Putney Bridge (as much as lies within the London Boroughof Hammersmith and Fulham)In the London Borough of HounslowGreat West Road (as much as lies within the London Borough of Hounslow), GreatChertsey Road, Burlington Lane, Alexandra Avenue, Chiswick Bridge (as much aslies within the London Borough of Hounslow)In the Royal Borough of Kingston Upon Thames Queens Road (as much as lies within the Royal Borough of Kingston UponThames), Kingston Hill (between its junctions with Queens Road and London

Road), London Road, Queen Elizabeth Road (between its junctions with LondonRoad and Cromwell Road), Cromwell Road, Richmond Road (between its junctionswith Cromwell Road and Sopwith Way), Sopwith Way, Kingsgate Road (between itsjunctions with Sopwith Way and Wood Street), Wood Street (between its junctionswith Kingsgate Road and Horse Fair), Horse Fair, Kingston Bridge (as much as lieswithin the Royal Borough of Kingston Upon Thames), Portsmouth Road (as much aslies within the Royal Borough of Kingston Upon Thames), High Street, Eden Street,Clarence Street (between its junctions with Eden Street and Wheatfield Way),Wheatfield Way (between its junctions with Clarence Street and Fairfield North),Fairfield North, Coombe Road, Coombe Lane West, Coombe Lane FlyoverIn the London Borough of MertonCoombe Lane (between its junctions with Coombe Lane Flyover and LambtonRoad), Lambton Road (between its junctions with Coombe Lane and Worple Road),Worple Road, Wimbledon Hill Road, High Street, Parkside, Wimbledon Park Side (asmuch as lies within the London Borough of Merton)In the London Borough of WandsworthPutney Bridge (as much as lies within the London Borough of Wandsworth),Wimbledon Park Side (as much as lies within the London Borough of Wandsworth),Tibbets Corner, Tibbets Ride, Putney Hill, Putney High Street

SCHEDULE 2 (see Article 3)Roads affected by the race and not forming part of the race route

From 0001 hours until 2359 hours on Saturday 3rd August 2013In the Royal ParksConstitution Hill, Horse Guards RoadIn the City of WestminsterMarlborough Road, Link Road, Buckingham Palace Road eastbound (between itsjunctions with Lower Grosvenor Place and Buckingham Gate), Buckingham Gateeastbound (between its junctions with Buckingham Palace Road and Birdcage Walk),Buckingham Gate northbound (between its junctions with Victoria Street andBirdcage Walk), Victoria Street eastbound (between its junctions with BuckinghamGate and Broad Sanctuary), Broad Sanctuary eastbound, Broadway northbound,Storeys Gate northbound, Parliament Street northbound, Whitehall northbound(between its junctions with Parliament Street and Horse Guards Avenue),Westminster Bridge westbound (as much as lies within the City of Westminster),Trafalgar Square, Northumberland Avenue eastbound (local access maintained),Charing Cross Road southbound, St Martins Place southbound, Great ScotlandYard westbound (between its junctions with Scotland Place and Whitehall),Whitehall Place westbound (between its junctions with Scotland Place andWhitehall), Whitehall Court (local access maintained), Savoy Place eastbound(between its junctions with Savoy Hill and Victoria Embankment), Savoy Streetsouthbound, Slip Road between Aldwych eastern arm and Strand westbound,Arundel Street southboundIn the City of LondonTemple Avenue southbound, Westbound slip road from Blackfriars Bridgenorthbound leading to Victoria Embankment, Westbound slip road from NewBridge Street leading to Victoria Embankment, Ludgate Hill eastbound, St PaulsChurchyard eastbound, Cannon Street westbound (between its junctions with NewChange and St Pauls Churchyard and between its junctions with King WilliamStreet and Queen Victoria Street), Cheapside (between its junctions with NewChange and St Martin Le Grand), Gresham Street eastbound (between its junctionswith St Martin Le Grand and King Street)(local access maintained), Foster Lane,Gutter Street southbound, Wood Street southbound (between its junctions withGresham Street and Cheapside), Basinghall Street (between its junctions withBasinghall Avenue and Gresham Street), Moorgate southbound (between itsjunctions with South Place and Lothbury)(local access maintained), Lothburywestbound (between its junctions with Throgmorton Street and Princes Street),Threadneedle Street westbound (between its junctions with Bishopsgate andPrinces Street), Old Broad Street southbound (between its junctions withWormwood Street and Threadneedle Street), Cornhill westbound, LeadenhallStreet westbound, Lombard Street westbound, King William Street northbound(between its junctions with Cannon Street and Bank junction), Lombard Streetnorthbound (between its junctions with King William Street and Bank junction),Arthur Street westbound, Monument Street eastbound, Fish Street Hillsouthbound (between its junctions with Monument Street and Lower ThamesStreet), Southwark Bridge northbound (as much as lies within the City of London)Trinity Square southbound (as much as lies within the City of London), Great TowerStreet eastboundIn the London Borough of LambethWestminster Bridge (as much as lies within the London Borough of Lambeth),Westminster Bridge Road westbound (between its junctions with Lambeth PalaceRoad and Westminster Bridge)In the London Borough of SouthwarkSouthwark Bridge Road northbound (between its junctions with Southwark Streetand Southwark Bridge)(local access maintained), Southwark Bridge northbound (asmuch as lies within the London Borough of Southwark)In the London Borough of Tower HamletsTrinity Square southbound (as much as lies within the London Borough of TowerHamlets)From 2000 hours on Saturday 3rd August 2013 until 2359 hours on Sunday 4thAugust 2013In the London Borough of Richmond upon ThamesThames Street eastbound, Hampton Court Road (between its junctions withHampton Court Way and Thames Street)(local access maintained), High Streetsouthbound (between its junctions with Park Road and Hampton Court Road),Church Grove southbound (local access maintained), Mortlake Road southbound,Upper Richmond Road West eastbound (between its junctions with Manor Roadand Clifford Avenue), Sheen Road eastbound (between its junctions with ManorRoad and Upper Richmond Road), Upper Richmond Road West westbound (asmuch as lies within the London Borough of Richmond upon Thames between itsjunctions with Upper Richmond Road and Sheen Lane), Upper Richmond Roadwestbound (as much as lies within the London Borough of Richmond upon Thamesbetween its junctions with Roehampton Lane and Upper Richmond RoadWest)(local access maintained), Larches Avenue, Colston Road, Sheen GateGardens, Penrhyn Crescent, Palmerston Road, Christchurch Road, Wayside, YorkAvenue (North), Vicarage Road, Stonehill Road, York Avenue (South), Clare LawnAvenue, Fife Road, Muirdown Avenue, Shrewsbury Avenue, Sheen Lane (betweenits junctions with Upper Richmond Road and Mortlake High Street), High Street(Hampton Wick)(between its junctions with Kingston Bridge roundabout andVicarage Road), Park Road (between its junctions with High Street and St JohnsRoad), Shalstone Road, Somerton Avenue, Kingsway, St Leonards Road, LangdaleClose, Graemesdyke Avenue, Deanhill Road, Coval Road, Carlton Road, ConnaughtRoad, Leinster Avenue, Elm Road, Columbia SquareFrom 0001 hours until 2359 hours on Sunday 4th August 2013 London Borough of Redbridge

Transport for London Public Notice ROAD TRAFFIC REGULATION ACT 1984 THE PRUDENTIAL RIDE LO

-