Cityam 2012-11-30.pdf

Transcript of Cityam 2012-11-30.pdf

-

7/30/2019 Cityam 2012-11-30.pdf

1/39

BUSINESS WITH PERSONALITY

Buy a10Starbucks Card eGiftfor only5at livingsocial.co.uk/starbucksOffer valid for a limited time. Further terms and conditions exist on the eGift. Visit livingsocial.co.uk for full details.

Buy a10StarbucksCard eGiftfor only5see offer below

FTSE 100 L5,870.30 +67.02 DOW L13,021.82 +36.71 NASDAQL3,012.03 +20.25 /$ 1.60 unc / 1.24 unc /$ 1.30 unc Certified Distribution01/10/12 til 28/10/12 is 129,297

LAST CHANCE TO TELL US WHAT YOU THINK

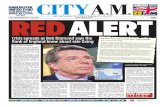

THE BATTLE lines for a parliamen-tary row over press freedom weredrawn yesterday, after DavidCameron rejected the central rec-ommendation of the Levesoninquiry and said he had seriousconcerns about introducing legisla-tion to support press regulation.The combative stance was wel-

comed by the newspaper industrybut means Cameron will now bepitted in a vicious battle againstboth the Labour party and his LibDem coalition colleagues, both ofwhom signalled their support for

Lord Justice Levesons proposals ofstatutory backing for a new, inde-

pendent press regulator.The issue of principle is that for

the first time we would have crossedthe rubicon of writing elements ofpress regulation into the law of theland, Cameron told the Commons.

Im not convinced at thisstage that statute isrequired, he added, warn-ing that legislation couldbe used by politicians toimpose rules and obliga-tions on the press.The inquiry was

ordered last sum-mer followingrevelations about

phone hacking at the News of theWorld. The judges near-2,000 pagereport was released yesterday after-noon with a recommendation for anew, independent regulatory bodythat can resolve complaints aboutthe behaviour of the press at its core.

But the judge also said that it isessential for legislation tounderpin the new organisation.It is this demand for the firststatutory regulation of the

press since 1695 thathas angered manyConservatives andbeen met by over-whelming opposi-

tion from theindustry.

In a break with convention whichdealt a further blow to the coalition,Deputy Prime Minister Nick Cleggmade a separate statement to theCommons where he set out his dif-ferences to Cameron as well as hissupport for legislation.

A free press does not mean a pressthat is free to bully innocent peopleor free to abuse grieving families,Clegg said. Changing the law is theonly way to guarantee a system ofself-regulation.

Labour leader Ed Miliband saidthere can be no more last chancesaloons for the press. But Mayor ofLondon Boris Johnson said the

Prime Minister was absolutelyright to oppose statutory rules.

Leveson wants the new watchdogto be overseen by the broadcast regu-lator Ofcom and have the power tofine newspapers up to one per centof their turnover or 1m. He wantsto ban off-the-record briefings fromthe police and politicians to themedia. A Downing Street source toldCity A.M. the government was draw-ing up draft legislation based onLeveson with the explicit aim ofproving that it will not work.

Full coverage andcomment inside

See pages 2, 4, 5, 22 and 23

READER SURVEY: HELP US MAKE YOUR FAVOURITE PAPER EVEN BETTER WWW.CITYAMSURVEY.COM See Page 9 for full details

BATTLE BEGINSwww.cityam.comISSUE 1,772 FRIDAY 30 NOVEMBER 2012 FREE

n Political parties bitterly divided over Lord Justice Levesons call for statutory regulation of the press

Lord Justice Leveson

BY JAMES WATERSON

LAURALEAN/CITYAM

-

7/30/2019 Cityam 2012-11-30.pdf

2/39

-

7/30/2019 Cityam 2012-11-30.pdf

3/39

KAZAKHSTAN telecoms firm Kcellpriced its London listing yesterday,joining the flood of Russian and cen-tral Asian firms looking to raise fundsin London.The leading mobile phone operator

hopes to raise between $525m and$650m in the initial public offering(IPO). That would value the firm at$2.1bn (1.3bn) to $2.6bn, as the50m shares on offer represent 25per cent of total share capital.The instruments on sale in

London are global depositoryreceipts (GDRs), as is common in

such IPOs.The price range per GDR has

been set at $10.50 to $13.00.Kcells listing is being

undertaken as part of adeal with Kazakhstansgovernment whichwants the nationalchampion to raisefunds. But it is notthought the firm wantsto use the cash to invest rather it plans to paydown debts with thefunds.The government is

not thought to be forc-ing the deal through rap-idly, as it is aware of global

Kcell prices IPOas London bags

another listingBY TIM WALLACE

market conditions.But Kcell itself is understood to be

keen to list before the year is out incase the US fiscal cliff is not avertedand causes market chaos.

London plays host to part of the list-ing because Kazakhstans markets arerelatively immature and may struggleto support an IPO of this size.

Support for the deal was enormous-ly strong at the London roadshow, a

banker working on the IPO toldCity A.M. We did two days worthof business in the first fivehours, with particular interestfrom emerging markets funds.However the banker conceded

demand had been slightly tem-pered by the MegaFon IPO,

which suffered from lowdemand and onlypriced at the bottomend of the scale.

After another dayin London, road-shows will now beheld in Europe andNew York, with thebook due to close on11 December andtrading due to startthe next day.

Swiss giants UBS and Credit Suisse are lead-ing the international drive on Kcells initialpublic offering (IPO), which includes road-shows in London, Europe and New York.The pair are joined by Kazakhstans VisorCapital, partly because Kcell is a nationalchampion, and partly because the listing is

joint London and Kazakhstan, so Visor isleading the domestic offer.Those joint global co-ordinators are being

joined by Renaissance Capital, which steps

in as joint bookrunner, and Halyk Finance,which is a co-manager on the global offer.Credit Suisse in particular has recent experi-ence with joint London listings from thesame region i t was a joint global coordi-nator and joint global bookrunner on theSberbank IPO earlier this Autumn.But all of the banks avoided the MegaFondeal, which was hit when Goldman Sachswithdrew, and only managed to come in atthe bottom end of the price range.

UBSGLOBAL COORDINATOR

CREDIT SUISSEGLOBAL COORDINATOR

VISOR CAPITALDOMESTIC BOOKRUNNER

Three big auditors are slappedwith lawsuits over past work

AUDIT firms Deloitte and KPMGare among the firms named in aUS lawsuit brought by a

disgruntled investor in Hewlett-Packard, though both firmsdistanced themselves from thetroubled deal yesterday.

The case, filed in California,claims the auditors missednumerous red flags aboutAutonomy, which HP bought lastyear. The tech firm has since beenforced to write down $8.8bn(5.5bn) of its purchase.

The lawsuit, brought by investor

BY MARION DAKERSPhilip Ricciardi, names a raft ofpeople linked to the deal includingAutonomy founder Mike Lynch,Margaret Whitman, former HP chiefLeo Apotheker and Barclays.

HP chief executive Meg Whitmanhas said her firm relied on the auditsby Deloitte and KPMG when sizingup the purchase.

But KPMG said it was not engagedin any audit work or oversight ofDeloittes audit, adding that theclaims are based on incorrectunderstandings about the firms rolein this matter and are withoutmerit. Deloitte repeated itsstatement that it was not asked by

HP to provide any due diligence onthe deal.

In a separate case, Ernst & Young isbeing sued by the former Anglo IrishBank for its role before the bank was

nationalised in 2009.Anglo, now known as the IrishBank Resolution Corp (IBRC), hasbeen under investigation for fraudfor the past four years and threeformer executives face charges nextyear. The bank gave no furtherinformation on the litigation.

E&Y said it was aware of thelawsuit but had not yet formallybeen served and had only scantdetails of the case.

Kcell chief executiveVeysel Aral

SHARES in Megafon, the Russianmobile telecoms group controlled

by Arsenal stakeholder AlisherUsmanov, rose above the $20 issueprice yesterday on news that thestock would be fast tracked intothe main Russian stock marketindex, the MSCI.

Normally the MSCI requiresthree months of trading historyfor a company that has justfloated, but there is a fast trackapproach to large IPOs that is

based on valuation. Yesterday theMSCI confirmed that Megafon

would qualify for early inclusion,which means it will likely receive

Megafon rises above $20 as it isfast-tracked into Russias MSCIBY DAVID HELLIER

passive investment from manyRussian funds.

The MSCI currently has 26constituent companies of whichthree are in the telecoms sector.

The London and Moscowflotation of Megafon was one ofthe largest IPOs of the year. Itsprogress through to its first dayof trading on Wednesday has

been dogged by questions overthe groups corporate governancefollowing a decision by GoldmanSachs before the Octoberroadshow to pull out of the

banking syndicate advising on thedeal.

DAVID HELLIER: Page 11LL

DAVID HELLIER:Page 11LL

FRIDAY 30 NOVEMBER 20123NEWScityam.com

Villeret CollectionQuantime Annuel GMT

Annual calendarDouble time zonePatented under-lug correctors

Ref. 6670-3642-55B

www.blancpain.com

BLANCPAIN BOUTIQUES ABU DHABI BEIJING CANNES DUBAI EKATERINBURG GENEVA HONG KONG

MACAU MADRID MANAMA MOSCOW MUNICH NEW YORK PARIS SEOUL SHANGHAI

SINGAPORE TAIPEI TOKYO ZURICH

ADVISERS KCELLS IPO

-

7/30/2019 Cityam 2012-11-30.pdf

4/39

WITH David Cameron making it

clear that newspapers will haveto overhaul the systems thatcurrently regulate the press ifthey want to ward off legislation,the industry is now scramblingto put forward a new system.

All the major newspapergroups, including those outsideof current body the PressComplaints Commission (PCC),have backed proposals putforward by current PCC chairLord Hunt, which were criticised

by Lord Justice Leveson yesterday.The plan proposes a system of

self-regulation with teeth,which would establ ish arevamped industry body with thepower to impose substantialfines on newspapers, and givemembers of the public aplatform to seek compensation.

Under the terms of the plan,

publishers would signcommercial contracts with a newregulatory body.

The body would then have thepower to investigate, enforce andsanction newspapers for

breaking the terms of thecontract.

Douglas McCabe, a mediaanalyst at Enders Analysis, toldCity A.M.: I dont doubt thereare already people working on anew plan.

Newspaperssearching fornew way ahead

BY JAMES TITCOMB BUSINESS leaders and industry bod-ies warned against government inter-ference in the press yesterday, and

urged the newspaper industry totake the initiative in creating a newregulatory framework.

Shares in paper owners News Corp,Daily Mail & General Trust, andJohnston Press also rose followingLord Justice Levesons report despiteworries over state regulation, sig-nalling a slight subsiding in City ten-sion over his proposal.Advertising trade body the ISBA

[Incorporated Society of BritishAdvertisers] said the press needed toseize the baton to ward off stateregulation. Advertisers are greatbelievers in self regulation, we knowit works, the organisations directorof public affairs, Ian Twinn said.

News International, publisher ofThe Sun and The Times, said it willstudy the reports recommendationsbefore commenting in full. But thegroup insisted that there was no

need for legislation.Chief executive Tom Mockridge

said: We are keen to play our fullpart in creating a new body thatcommands the confidence of thepublic. We believe that this can beachieved without statutory regula-tion and welcome the PrimeMinisters rejection of that proposal.

Financial communications firmCubbitt Consulting said politiciansshould not burn the house to roastthe pig. We have a world class

BY JAMES TITCOMB AND

JAMES WATERSON

media in the UK and that can onlysuffer from statutory regulation,argued founder Simon Brocklebank-Fowler.

Niri Shan and Mark Dennis of lawfirm Taylor Wessing warned that

handing oversight of the newspaperindustry to broadcast quango Ofcomcould be problematic.

Ofcom is a statutory regulator; ithas an active role in content regula-tion for the communications indus-try. The media is unlikely to want astatutory regulator from a different,heavily-regulated area overseeing itsown self-regulatory body, they said.

Meanwhile the Institute forEconomic Affairs think tank warnedthat Levesons suggestion to end pri-vate, off-the-record briefings with thepress in the name of transparencycould backfire: The public interestwill not be served by ending privatebriefings. Such a restriction wouldalmost certainly have prevented ahuge number of stories and scandalscoming to public attention.

Mayor of London Boris Johnson sup-ported this stance, saying briefings

will remain an important part ofpublic life.The Metropolitan Police, who have

been criticised for their handling ofthe investigation into allegations ofphone hacking, said the report vindi-cated their officers: Although therewere incidents that left a perceptionof cosiness between particular seniorofficers and some journalists, LordJustice Leveson found that that didnot influence or taint decision-making.

FRIDAY 30 NOVEMBER 20124 NEWS: THE LEVESON REPORT cityam.com

*For Business Users only. Advance payment applies. Official government fuel consumption figures in mpg (litres per 100km) for the C-Class Coup range: urban: 15.5(18.2) - 44.8(6.3), extraurban: 33.6(8.4) - 65.7(4.3), combined: 23.5(12.0) - 55.4(5.1). CO2 emissions: 280-133 g/km. Model featured is a C 180 Coupe BlueEFFICIENCY AMG Sport at 32,085.00 on-the-road with optional panoramic glass sunroof at 1,350.00 and optionalmetallic paint at 645.00 (OTR price Inc. VAT, delivery, 12 months Road Fund Licence, number plates, first registr ation fee and fuel). *All payments subject to VAT: Finance based on a C 180 Coupe BlueEFFICIENCY AMG Sport with metallic paint on a 36 month Contract Hire agr eement with an

advance payment of 1,794.00. 10,000 miles per annum. Excess mileage charges may apply. Rental includes Road Fund Licence for the contract duration. Guarantees and indemnities may be required. Orders/credit approvals on selected C-Class Coup models between 1 October and

31 December 2012, registered by 31 March 2013. Subject to availability, offers cannot be used in conjunction with any other offer. Some combinations of features/options may not be available. Credit provided subject to status by Mercedes-Benz Financial Services UK Limited, MK15 8BA. Prices

correct at time of going to press.

ADaimlerBrand

The C-Class Coup AMG Sport.From just 299*a month.AMG body styling and 18"AMG alloy wheels, bi -xenon headlamps,

Attention Assist and when youve finished driving, theres Parktronic with

Advanced Parking Guidance. 299* can sometimes go an awfully long way.

For more details, visit mercedes-benz.co.uk/offers

Critics hit out at LevesonLeveson saidthe PressComplaintsCommission

had failed

-

7/30/2019 Cityam 2012-11-30.pdf

5/39

FRIDAY 30 NOVEMBER 20125NEWS: THE LEVESON REPORTcityam.com

plans for pressREPORTS CLAIMS AT A GLANCE

LORD JUSTICE LEVESON'S VISION OF THE REGULATORY FUTURE

n The press serves the country

very well for the vast majority ofthe time.

n The existing watchdog, the PressComplaints Commission (PCC) hasfailed and a new body is required.

n The PCC should be replaced byan independent self-regulatorybody whose chairman and boardmembers must be appointed in atransparent way, without anyinfluence from industry orgovernment.

n Broadcast regulator Ofcom mustact as a backstop regulator ifnewspapers refuse to join therevamped PCC.

n Legislation is essential tounderpin the new body, though

this would not give any rights toparliament to control whatnewspapers publish.

n The legislation would ensurethat the organisation remainedindependent and also enshrinefreedom of the press on the statutebook.

n Newspapers that refuse to takepart in the new self-regulatorybody could face punishment frombroadcast regulator Ofcom.

n There should be a new code ofconduct for journalists.

n Newspapers found guilty ofmajor breaches of the code ofconduct could be fined up to one

per cent of their turnover up to

1m.

n A hotline should be establishedfor journalists who want to revealthat they are being forced to act inunethical ways.

n There should be a new route formembers of the public to seekarbitration without going throughthe courts if they feel they havebeen treated unfairly.

n The new regulator wouldinvestigate complaints and enforceswift justice if required.

n Over the last 30 years politicalparties have developed too close arelationship with the press in a waywhich has not been in the publicinterest.

nMore meetings betweenpoliticians and the press should bedisclosed.

n There should be changes to theway that the police and politiciansgive off-the-record briefings to thepress.

n Decisions on media ownershipshould be made more transparent.

n Journalists have at timeswreaked havoc with the lives ofinnocent people while chasingstories.

n It is now up to politicians todecide who guards theguardians.

MEMBERSHIPOpen to all publishers on fair, reasonable and non-discriminatory terms.Funding is agreed between the board and members on atransparent, medium term basis, approved by Ofcom and isadequate to deliver functions.

INDEPENDENT BOARDMade up of a majority of peopleindependent of the press.Appointed in accordance withstatutory criteria by a processapproved in advance by Ofcom

ARBITRATION SERVICEFair, quick andinexpensive, with anagreement to use thearbitration service is acondition ofmembership. Non-members may facedisadvantageous costsawards and aggravatedor exemplary damages

in court

COMPLAINTS HANDLING

Decisions on individualcomplaints may betaken by sub-committee, but withappeal to the board.All breaches of thecode to be recordedand any remedies toinclude publication ofcorrections and

apologies.

STANDARD CODEAdopted by the Board, following consultationand advised by editors. Covering:*Conduct*Respect for privacy*Accuracy

STANDARDS ENFORCEMENT

Independentinvestigations of seriousand systematic problems will cover internalgovernance standards andserious and systematiccode breaches, withsanctions to includeappropriate andproportionate financial

sanctions

NEWSPAPERS HURT ME BUTREGULATION WOULD BE WRONG:

PETER LILLEYIN THE FORUM

See page 22

-

7/30/2019 Cityam 2012-11-30.pdf

6/39

-

7/30/2019 Cityam 2012-11-30.pdf

7/39

-

7/30/2019 Cityam 2012-11-30.pdf

8/39

THE CHIEF executive of Kingfishersaid uncertainty over the Frenchgovernments future tax policies hadhit consumer confidence in itslargest market, as it posted a six per

cent drop in third quarter profit.The group, which runs B&Q andScrewfix in the UK as well asCastorama and Brico Depot inFrance, reported profits of 257m inthe 13 weeks to 27 October.

Like-for-like sales fell 2.8 per centin France and were down 3.8 percent in the UK and Ireland. Totalsales fell 3.9 per cent to 2.71bn.

Cheshire described the outlook for2013 as opaque and said it wastough to predict when conditions inthe UK and Europe would improve.

He said the backdrop in Francewas very uncertain, due to the lackof clarity on the budget proposalsfrom President Francois Hollande.

Its a temporary period ofuncertainty rather than a majordislocation in the economy but itcould be a six month uncertaintywhile people try and work out what

their tax positions going to be, hesaid.

Kingfisher hitby French woes

BY KASMIRA JEFFORD

THE BOSS of Dixons Retail said heexpected to grab a bigger slice of themarket following rival Cometsdemise, as it returned to profit in theUK for the first time in five years.

Sebastian James said Currys and PCWorld had not seen much disrup-tion from the fire sale of Cometsstock, as shoppers fail to find theitems they want in the sale.

Last week I sat outside the Cometstore in Oxford and customers wouldgo in and then go across to us after-wards, he said

In the long-term, he said the group,

which has hired 1,000 Comet staff ona part-time basis, would benefit from

BY KASMIRA JEFFORD consolidation in the sector and up its19.8 per cent share. Comets exit couldadd 30m to Dixons operating profitnext year, Panmure Gordon analystPhilip Dorgan estimated.

Dixons reported that like-for-likesales rose three per cent in the 24weeks to 13 October, led by a strongfirst quarter when shoppers boughttablets and smart TVs before a sum-mer of sporting events.That helped Dixons post a first-half

profit of 5.6m in the UK, havingmade a loss of 6m a year ago.

But problems at its French businessPixmania dragged it to a total pre-taxloss of 80m after it was forced to take

a 45m writedown on the value of theunit.

THERE are two kinds of peoplein this world: winners andlosers. And if the contrast

between rivals Dixons andComets recent luck is anything togo by, the same looks to be true ofcompanies.

Luckily for Dixons, it looks likeComets demise has put the firmsstar firmly in the ascendant. Itsshares are up more than 50 per centover the past three months, andanalysts are estimating thatadditional market share could topup the firms operating profit in2013 to the tune of 30m.

Add better-than-expectedinterims, like the ones chiefexecutive Sebastian James wheeledout yesterday, and youve got aninvestment case in no need of anextended warranty.

The UK performance looksparticularly impressive against a lesscompetitive backdrop, withunderlying sales up three per cent

and a return to profit after five longyears. But as with so many firms thatpushed to establish a Europeanpresent, weakened consumerspending in Greece and Italy isstifling growth, dragging down salesin the Scandinavian market, whereDixons has been building itspresence since the acquisition oflocal brand Elkjop 13 years ago.

Of course in the run up toChristmas the retailer will have afiresale at Comet to compete with,but as almost the last man standingin the high-street white goodsmarket it seems to have won the

hearts of the British consumer and islikely to end 2012 on a high thoughfurther share gains are unlikely after

such a strong recent performance.

HOLLANDES GRAND DESIGNS HIT DIYMeanwhile fellow retail-parkfavourite Kingfisher is havingproblems a little closer to home.

Despite a hefty high-streetpresence in the UK, France isactually the B&Q owners biggestmarket, and half its profits comefrom the firms Castorama and BricoDepots on the other side of thechannel.

Francois Hollandes governmenthas hardly been selling itself as thechampion of business since itscompetitiveness pact just two weeksago, when the President proposed a20bn (16bn) of tax credits to thecorporate sector. This week has seenhis industry minister, the ever-tactfulArnaud Montebourg, launch an

attack on steel giant Lakshmi Mittalover his firm ArcelorMittals plans toshut down blast furnaces in the

countrys socialist-dominated steelbelt.Now Kingfisher is complaining

that Hollandes lack of clarity ongovernment spending in particularhis tax plans has thrown Francesconstruction market into disarray,sending like-for-like sales at its trade-focused Brico Depots down 4.9 percent. Chief executive Ian Cheshireyesterday called the outlook inFrance very uncertain. Withanalysts suggesting a worst-casescenario would see profits in thecountry downgraded by 30 per centnext year and a 130m tax , its hardto see a case for the shares whichhave been bumping alongunspectacularly for most of thisyear making a significant break foroutperformance anytime soon.

Elizabeth Fournier is news editor of CityA.M. @ej_fournier

BRITISH mobile banking technocompany Monitise confirmedyesterday it was in discussions winstitutional and strategic investo raise up to 100m.

The company said the procewould be used to fund new mobanking and commerceopportunities for financialinstitutions and paymentcompanies.

Our business is seeing enordemand for Mobile Money servsaid chief executive Alastair Lu

City A.M. columnist MarkKleinman broke the story yestein this newspaper, and namedCanaccord Genuity as the likel

adviser.

Monitise intalks to raise

up to 100mBY CITY A.M. REPORTER

FRIDAY 30 NOVEMBER 2012 cityam.com8 NEWS

Dixons says itwill gain from

Comet collapseKingfisher confirmed deteriorating French and Polish demand, with B&Qs

UK sales also subdued. On a more positive note, a resumption in gross mar-gin shows how self-help is an important driver to offset macro challe nges.

ANALYST VIEWS

The results were broadly in line with expectations...We continue to be con-cerned that the decline in 2013 earnings is not just down to the one-offs ofthe summer wet weather and the decline in the euro but is also structural.

We remain buyers on the view that the long term outlook for earnings

remains good. At some stage, there might be some help from the UK econ-omy and, in the meantime, self-help opportunities should support profits.

WHAT ARE KINGFISHERSGROWTH PROSPECTS?

Interviews by Kasmira Jefford

JAMES GRZINIC JEFFERIES

FREDDIE GEORGE SEYMOUR PIERCE

PHILIP DORGAN PANMURE GORDON

KingfisherCEO IanCheshire saidthe outlookfor next yearis opaque

BOTTOMLINE

ELIZABETH FOURNIER

Dixons steals Comets place in the spotlight

-

7/30/2019 Cityam 2012-11-30.pdf

9/39

THE NEW European bankingsupervisory body, to be set upunder the roof of the EuropeanCentral Bank, will not be ready tooperate fully before 2014, an ECBexecutive board member said

yesterday.Making the ECB the supervisor

for lenders chiefly in the 17countries that use the euro

would be the first of threepillars in a banking unionand one EU leaders hadcommitted to complete bythis year, at least on a legal

basis.Joerg Asmussen,

one of the ECB'skey negotiatorsfor a closerintegration of

the Eurozone,said he was

Asmussen warns that bankingbody wont kick off until 2014

BY HARRY BANKSconfident that a meeting offinance ministers on Tuesdaycould deliver basic politicalagreement on the matter.

"After that there will beconsiderable work on details andimplementation and realistically Iexpect that the European bankingsupervision will not be able tooperate fully before the beginningof 2014, Asmussen said in aspeech to be given at the annual

reception of the Association ofGerman pfandbrief banks.

Alongside the supervisorybody, a resolution andrestructuring mechanism to

shore up or wind downtroubled banks should set up

as soon as possible,Asmussen said.

RETAIL SALES continued to declinein the Eurozone in November,according to data out yesterday,making the month the 13th ofshrinking volumes.

Markits retail purchasingmanagers index rose slightly to45.8, from 45.3 in October, but stillindicated steady contraction, sinceit remained below the crucial nochange level of 50.

This came as Italian 10-year bondyields dived to a two-year low of4.485 per cent before rising back to4.6 per cent after a bond auction.Spanish 10-year yields also fell,hitting their lowest point sinceMarch at 5.21 per cent, althoughthey also rose during the day,eventually reaching 5.38 per cent.

And sentiment data from the

European Commission (EC) alsocame in more cheery. The ECs

Eurozone retail sector suffersanother sharp drop in sales

BY BEN SOUTHWOODmeasure of consumer confidencerose 1.4 to 85.7, after eight monthsof continuous falls. The Eurozonestwo biggest economies, France andSpain, enjoyed the biggestimprovements, the EC said.

And German labour market datafrom Destatis added to this moreoptimistic outlook on theEurozones economic climate.Employment in Germany was up 1.4per cent or 285,000 on the year,official statistical body Destatissaid, hitting 41.9m. However,unemployment also increased36,000 over the year to hit 2.24m.

But analysts were unimpressedwith the improvements. Theeconomic outlook for the Eurozoneremains pretty awful, saidJonathan Loynes at CapitalEconomics. And Citigroup analystspredicted the Eurozone would

remain in recession going into2013.

www.cityamsurvey.com

THURSDAY 29 NOVEMBER 2012

Terms and conditions: 7 nights accommodation is provided for two adults at Sandals Grande Antigua Resort & Spa, Antigua. Accommodation is on a Luxury Included (all-inclusive) basis in a deluxe room with king size bed. Resort transfers are included, but domestic transfers, including any flights to London, are not included. Flights are included in the prize,and these will be return economy seats for two persons, flying from London Gatwick to Antigua with Virgin Atlantic. There is no cash alternative to the prize and spending money is not included. Holiday insurance is not included and must be purchased before travel. The prize is subject to availability, cannot be taken during peak seasons (Easter, July, August,December and New Year) and cannot be confirmed until 90 days prior to departure. Once dates are confirmed there wil l be an administration fee for any changes made to the reservation. This fee varies in accordance with the airl ines. The prize is strictly non-transferable, non -refundable, and is subject to Sandals Resorts normal terms and conditions. The prize

must be taken before 30 November 2013. Sandals resorts are for couples and accommodations include a king size bed. Sandals Resorts reserves the right to relocate prize winners from the stated resort to an alternative Sandals resort if rooms become unavailable for the travel dates requested. By entering this competition you consent to your details being sharedwith our parent company located outside the European Economic Area. The competition is not open to employees and their immediate families of promoter Unique Vacations (UK) Ltd and their associated agencies. Prize winners must be over 18. One entry per household. ABTA J3152.

THIS weekend will be your last chance tocontribute to City A.M.s annualreadership survey, with the onlinequestionnaire only available untilmidnight on Sunday. Thank you toeveryone whos already taken part, and ifyou havent yet contributed please take afew moments to help us out. As a qualitynewspaper provided free of charge, it isimportant for us to understand who ourreaders are and what you think of us, andthis survey is one of the main vehicles wehave to achieve this.

Many of our growing band of readershave already been keen to help by fillingin our very simple and straightforwardsurvey at www.cityamsurvey.com but asgood capitalists here at City A.M. we alsobelieve in incentives. And in todayssomewhat depressed climate, we realisethat the chance to win a brilliant holidayin the sun is just what the doctor ordered.So everybody who fills in the survey willbe entered into a draw for an all-inclusivetrip for two to one of Sandals Luxury

Included

resorts in beautiful Antigua, apackage which includes return flights (seeterms and conditions below; heartfeltthanks to the company for making thisamazing prize possible). To add furtherspice to the survey, we will also beentering survey participants into a dailydraw to win a bottle of Louis Roedererchampagne. We recently reached ourhighest ever audited circulation and havevery ambitious plans for the future. Weare by no means finished improving thequality of the paper, and we are very keento hear any thoughts or suggestions youmay have. Thanks for reading City A.M.,thank you for your loyalty and we lookforward to receiving your feedback atwww.cityamsurvey.com

Sandals Grande Antigua Resort & Spa is the first Sandals resort to

open outside Jamaica, offering two holidays in one.

Choose from the original charming Caribbean Grove set in lush

gardens with romantic grove suites, just like a small village, or

the all-suite Mediterranean Village with state-of-the-art suites

and waterside dining.

Savour gourmet dishes in 11 speciality restaurants, including

Barefoot by the Sea, or chill in one of the seven bars.

Unwind in the exclusive Red Lane Spa, on the white sandy beach

or in some of the most luxurious suites in the Caribbean. This is a

resort made for romance and with a long relaxing beach, its per-

fect for sunset walks. So it comes as no surprise Sandals Grande

Antigua has won the Worlds Most Romantic Resort at the World

Travel Awards for 14 years in a row now. Its ideal for guests who

want to combine a Caribbean holiday with all the state-of-the-art

amenities of the best hotels in the world. Its two villages mean

that you have two holidays in one.

All rooms feature air-conditioning, king-size bed, ceiling fan,

amenity kit, hairdryer, telephone, private bath and shower, safe,

clock radio, cable TV, coffee/tea maker, iron and ironing board.CITYA.M.

EDITORSLETTER

ALLISTER HEATH 7 nights for two, LuxuryIncluded at Sandals Grande

Antigua Resort & Spa

WIN

Go to www.cityamsurvey.com for the chance of a dream holiday

HELP US MAKE YOUR FAVOURITE PAPER EVEN BETTER LASTCHANCE

MIDNIGHTSUNDAY

THE INTERNATIONAL MonetaryFund will not disburse Greecesnext bailout tranche until thecountry completes a voluntary buy

back of its debt, it said yesterday.Eurogroup finance ministers

and the IMF agreed earlier thisweek to conduct the buy back aspart of measures to make Greecesdebt sustainable and releaseurgent loans that help the near-

bankrupt economy stay afloat.IMF chief Christine Lagarde will

wave through the recent review ofGreeces progress oncecommitments such as the buy

back have been satisfied, an IMFspokesperson said.

Approval of the review is neededfor the next tranche to be paid.

IMF wants buyback of Greek

debt settledBY CITY A.M. REPORTER

Joerg Asmussen said thatdetails had to be resolved

-

7/30/2019 Cityam 2012-11-30.pdf

10/39

TO the Marriott in Grosvenor Squarefor the 14th annual Growing BusinessAwards this week.

The ceremony was held to celebrateBritains brightest business minds,and in the spirit of 2012 was hosted bya British Olympian, Steve Cram.The night quickly went down the

toilet, so to speak, with BetterBathrooms founder Colin Stephensbeing named Entrepreneur of the

Year, and Chris Li, founder of Luxuryfor Less and Bathempire.com, winningthe Young Entrepreneur of the Yearcategory.A surprise winner was the Large

Firm of the Year, awarded to loan com-pany Wonga.com. Judges admittedthat they knew the decision would becontroversial but put their wongawhere their mouth is, describing thefirms success as incontrovertible.

10 cityam.com

cityam.com/the-capitalistTHECAPITALISTCatering giant SSP once part ofCompass but now owned by

private equity group EQT - proudlydescribes itself online as the foodtravel expert. Pity then that the firm isunable to correctly spell the name of

the capitals most famous railwaystation. A receipt from the Pasty Shopat Waterloo, sent to The Capitalistbyan amused commuter, describes thebusy hub as Warterloo.The Capitalistenquired with SSP as to whether thiswas a silly Halloween hangover but wastold it was all a simple IT glitch:Customers at SSPs Waterloo stationPasty Shop can now enjoyimmaculately spelled till receipts alongwith great tasting homemade pasties.You heard it here first, readers.

The City headed to Mayfair onWednesday evening for a mid-

week party at Mahiki, hosted by financialadvisers Welbeck. Faces from MorganStanley, Goldman Sachs, Icap and CliffordChance turned out to support thefundraiser for the youth charity SnowCamp, which takes inner city children to

the slopes. The Capitalist hears thatformer All Black player Mark Robinson,who is leading the Welbeck team in thecharitys race around Morzine in January,was also leading the fun and games at theclub. Dressed in a novelty all-in-one skioutfit the ex-Wasps player confirmed hewould be putting his money on NewZealand this weekend. The Capitalist betsthis was before all but two of the poorsquad came down with a rather nastybout of the Norovirus.

FRIDAY 30 NOVEMBER 2012

EDITED BY CALLY SQUIRES

Got A Story? Email

SOME of the Citys best-respectedwomen flocked to One Maryleboneon Wednesday, to enjoy a slap-uplunch and give themselves a welldeserved pat on the back.

The excuse for such a decadentafternoon was Reds fourth annual

Women of the Year awards.Representing the business ladies

at the ceremony were shortlistersLynn Rattigan, deputy chiefoperating officer at Ernst & Youngand Donna Langley, co-chairman of

Ladies who power lunch arecelebrated at One Marylebone

Universal Pictures, with well-deserved awards going to CarenDownie, buying director at onlineretailer ASOS and Livia Firth,creative director of eco-age.com.

Other big names on the judgingpanel which determined the

winners included West HamFootball Club vice-chair and

Apprentice star Karren Brady,shadow home secretary YvetteCooper and Shine Group chairmanElisabeth Murdoch.

Chairman of Shine Group Elisabeth Murdoch (L) and impressionist Ronni Ancona (R)

Left to right:Lloyds PrivateBank director

Mark Miles,Better

Bathroomsfounder ColinStephens and

Olympian SteveCram

Toilet humour

wins the day atbusiness bash

-

7/30/2019 Cityam 2012-11-30.pdf

11/39

IN BRIEFAston Martin close to capital injectionn British sports car maker Aston Martinsaid it is in advanced talks with potentialinvestors over an injection of capital intothe business. Indian tractor maker Mahindra

and Mahindra last week topped an offerfrom Italian private equity fundInvestindustrial that had been agreed withAstons owner, Kuwaiti investment house

Investment Dar, sources said. We are intalks for a capital increase, the company isnot for sale a nd our existing shareholders,Investment Dar, are very much committedto Aston Martin, said an Aston Martinspokeswoman. The spokeswoman

confirmed that Aston Martins third-quarterpresentation to bondholders, publishedlate on Wednesday, described the talks asbeing at an advanced stage.

FRIDAY 30 NOVEMBER 201211NEWScityam.com

EXPLORE UNFORGETTABLE KANGAROO ISLAND AT AUSTRALIA.COM

Explore spe ctacu la r South Austra l ia.On Kangaroo Island, you get to see wildlife as

nature intended in the wild. Just a short hop

from Adelaide, its one of many spectacular

unspoilt places to explore in South Australia.

Emirates flights to Adelaide f rom 835.*

Adelaide & Kangaroo Island holidays from 1,199.

Call now to book your holiday on 0844 800 8655

or visit flightcentre.co.uk/south-australia

discover a zoo

without fences

*835 fare is valid from London Gatwi ck and on sale until 30th November 2012 for outbound travel between 16th April 15th May 2013.Special fares from Heathrow, Birmingham, Manchester, Newcastle and Glasgow ar e also available. Package prices are per personbased on two people sharing. Subject to availability and terms and conditions apply.

INSIDETRACK

DAVID HELLIER

In the end, the decision byGoldman Sachs to extricate itselffrom a leading position on thesyndicate of banks advising

Russias leading mobile telecomsgroup Megafon on its 7bn Londonand Moscow flotation didnt turn outto be fatal. And although Goldmandidnt advise on the London flotation

of Kazakhstan-based telecoms groupKcell, fears that its exit could dampeninvestors appetite for all Russianfirms also proved unfounded.

Goldmans shock move, which cameahead of the Megafons October globalroadshow, certainly frayed a fewnerves and caused the UKs listingauthority to take a closer look thannormal at the company, leading to adelay in the flotationprocedure.

But Megafons listing went ahead onWednesday in what was a triumph forthose advisers, led by Morgan Stanley,who stayed with the deal, as well asthe London market.

So flimsy is sentiment in the IPOmarkets, though, that the soft start totrading in Megafons shares onWednesday, even though they werepriced at the bottom of the range,caused some to suspect that the flota-

tion of Kcell, the Kazakhstan-basedtelecoms group, might not go aheadas planned.

However, Kcell, advised by UBS andCredit Suisse, announced its pricingyesterday, with those working on thedeal stressing the groups differencefrom Megafon; fewer corporate gover-nance issues and much higher divi-

dends to name but two virtues.Kcell is the leading mobile tele-phone operator in Kazakhstan with12.7m subscribers or 47 per cent ofthe total market in the central Asiancountry.

Most analysts have been fairly san-guine about the effect of GoldmanSachs decision to absent itself fromthe Megafon deal. If Goldman hadremained in the syndicate therewould have been more investment

from some different institutions, saidLuis Saenz, head of equity trading atBCS Financial Group.

But equally many investors wereonly too happy to pick up shares at alower entry point.The devastating thing for Megafon

was that Goldman Sachs decisioncame just days ahead of the groups

roadshow, becoming the talking pointof early presentations.Investment banks these days put

their reputations at risk at their peril,so it will be fascinating to see how thisone turns out.Will Morgan Stanley prove to have

made the right move in standing by itsclient?

Or will Goldman look prescient ifand when a problem in governancesurfaces? Only time will tell.

SECOND GUESSING THE BANKSSTJ Advisors, a boutique bankingadvisory group that pitches itself asbeing a balance to the banking syndi-cates on IPOs, isnt the most popularname amongst investment bankers atthe larger banks.The complaint is that STJ second

guesses the work done by the bank

syndicates and complicates thingswith its time-consuming investor map-ping processes.

But almost two years after a group ofbanks discussed how to effectivelyblackball STJ, the evidence is that thegroup is thriving. Recently it was hiredby the Spanish bank, Banco Popular,to advise on its rights issue andhelped produce a good result. Here tostay, I think.

Kcell and Megafon shrug aside Goldman Sachs effect

-

7/30/2019 Cityam 2012-11-30.pdf

12/39

12 NEWS

HEDGE fund manager Julian Barnett isshutting down his Ridley Park Paragonlong/short equity fund, after two years in atorrid market, a source said yesterday.

Barnett, who could not be contacted forcomment, set up the $350m (218m) fund inMay 2010 after leaving his role as s tar fundmanager at Aim-listed Polar Capital.

But he appears to have been unable torepeat the success of his Polar CapitalParagon fund, which returned more than 20per cent in 2008, and has taken the decisionto close the fund to focus on long-onlyinvesting.

Ridley Park Paragon reportedly lost 27 percent last year, though it had been up by morethan six per cent in 2012.

The fund said in a statement to the marketlast week that it planned to cancel i ts listingon the Irish Stock Exchange.

The volatile aftermath of the Eurozonesovereign debt crisis has thrown many hedgefunds off course in recent years. Earlier thismonth OMG Capital closed its doors andreturned cash to investors.

Barnetts Ridley ParkParagon fund closes

BY MARION DAKERS

MOTOR insurer Direct Line yesterday said it wasexploring plans to slash a further 236 jobs in a

bid to reach its 100m cost cutting targetannounced in September.

The firm, which recently revealed pricing for

its public float, said the job losses would comeacross its commercial, risk and compliance andchief customer office divisions.

Direct Line, which was spun out of Royal Bankof Scotland, has started consultation with

workers under threat of redundancy. It followsthe announcement of cuts to senior managementin September and October.

The company is trying to save 100m by theend of 2014. It has yet to finalise where 30m ofthese savings will come from.

Some 20m will come from slashing itsmarketing budget, with the other 50m comingfrom 891 call centre job losses and 70 seniormanagement redundancies.

Chief executive of Direct Line Paul Geddes said:These proposals are another important step onour journey to deliver on our cost saving target.They are essential to ensure we are as efficientand competitive as possible.

Direct Line to cut 236more jobs to save cash

BY MICHAEL BOW

REGULATORS yesterday approved the planned

takeover of the London Metal Exchange (LME) byHong Kong Exchanges and Clearing (HKEx).This means the deal to buy one of the Citys

oldest and certainly its most unusual tradingvenues could complete as early as 6 December,bringing to an end 135 years of member-ownership.

LME is one of the few venues in the world thatstill practises open outcry trading and visitors toits Leadenhall Street offices can still see tradersenter the ring and use arcane hand signals to buyand sell copper, aluminium, lead, nickel, tin andzinc.

In July members of the exchange voted toaccept a 1.4bn offer from HKEx for the market.As part of the deal, open outcry trading on theworlds biggest marketplace for industrial metalsis guaranteed to continue until at least 2015.

But attempts to preserve it beyond that datetook a blow last week when Barclays announcedthat it would only take part in electronic andtelephone trading for cost reasons. LME hasgrown in importance as the world market for

metals has exploded in recent years and inSeptember recorded record-high trading volumes.

Takeover approvedfor Metal Exchange

BY JAMES WATERSON

-

7/30/2019 Cityam 2012-11-30.pdf

13/39

IN BRIEFAstraZeneca wins China approvaln AstraZeneca has won approval for itsnew heart drug Brilinta in China, anincreasingly important market for thepharmaceuticals group. Chinas statefood and drug administration hasissued a drug import licence for theproduct, meaning it will now beavailable for treating patients withacute coronary syndrome in thecountry, the company said yesterday.Shares in the firm rose 1.58 per cent,outperforming the general market.

Aviva eyes 120 job lossesn Insurer Aviva said yesterday it wouldshed about 120 jobs as it merges itsdedicated property claims service intoits existing claims centres. The staffaffected are based in Sheffield, whereAvivas Asprea property claimsmanagement service is headquartered,the insurer said in an emailed statementyesterday. Aviva is cutting costs andselling under-performing businesses aspart of a turnaround strategy launchedin July.

Shell expects Chesapeake boostnRoyal Dutch Shell expects years and

years of production from oil and naturalgas acreage it recently bought fromChesapeake Energy and plans to addmore drilling rigs, the head of Shell'sAmericas operations said yesterday.Shell paid $1.94bn last September for618,000 acres in the Permian Basin, avast source of oil and natural gas in thewestern part of Texas. The firm wasattracted to the land as it is alreadyproducing, meaning production hasbeen proved viable, its chief exec said.

RIO Tinto said yesterday that it aimsto axe $7bn (4.4bn) in costs over thenext two years and sell more assets tocushion itself against weaker com-modity prices, while at the sametime beefing up output in its lucra-tive iron ore business.The firm is the only global iron ore

producer that has not slowed ironore expansion plans, forging aheadwith $21bn in mine, port andrail work to boost its Australiancapacity.

For me the theme for this year,next year and probably the extendedperiod beyond that in this volatile

environment will be everything hav-ing to do about cost control, Riochief executive Tom Albanese said.The company said it is aiming to

cut more than $5bn of operating andsupport costs by the end of 2014, andwould cut spending on explorationand evaluation projects by $1bn overthe rest of 2012 and 2013.

Much of the cost cuts would comein its coal and aluminium assets,Albanese said, adding that supportcosts in Australia had become the

Rio Tinto planscost cuts and

assets sell-offBY HARRY BANKS most expensive in the world, com-pared with five years ago when theywere among the cheapest.

It also plans to cut spending on sus-taining operations by more than$1bn in 2013.

Rio remained cautiously optimisticabout a pick-up in growth in China,following recent stronger-than-expected economic data.

More than a couple of months ago,Im cautiously optimistic about thefact that were beginning to see greenshoots in China, Albanese said.The company has generated $12bn

from selling more than 20 assetssince 2008 and expects to add to thatnext year.

Rio Tinto PLC

29 Nov23 Nov 26 Nov 27 Nov 28 Nov

2,950

2,900

3,000

3,050

3,100 p 3,090.0029 Nov

BHP BILLITON said yesterday it islooking inside and outside thecompany as well as using external

advisers to help with successionplans for its chief executive,following reports the worlds

biggest miner was preparing forchanges at the top.

Chairman Jac Nasser told BHPsAustralian annual general meetingthat planning for a successor tochief executive Marius Kloppershad started the day he wasappointed and was ongoing.Kloppers oversaw phenomenal

growth during the final boom years

BHP assures it is looking insideand out for chief exec successor

BY CITY A.M. REPORTER of the last decade and won plauditsfrom investors for reining in costsand maintaining shareholderpayouts.

But BHP now faces a sharp drop

in profits as it battles a tougherenvironment after a slowdown intop customer China has knockedcommodity prices. An early exit

would spare Kloppers the task ofoverseeing a prolonged period ofsliding profits. BHPs profit is notexpected to get back to the high of2011 for at least another five years.

In 2012-13, BHPs bottom line istipped to tumble by some $4bn(2.5bn) to just under $15bn due tolower mineral prices.

FRIDAY 30 NOVEMBER 201213NEWScityam.com

Marius Kloppers has been popular with shareholders for maintaining payouts

-

7/30/2019 Cityam 2012-11-30.pdf

14/39

IN BRIEFBarnes & Noble Nook losses grownBarnes & Noble said yesterday thatthe quarterly loss in its Nook divisionincreased as the bookseller increasedspending on its e-readers and tablets tokeep pace with larger rivalsAmazon.com and Apple. Overall revenuein the quarter slipped 0.4 per cent to$1.88bn, while retail sales, still itsbiggest segment by far, fell 2.9 per centto $996m, hurt by flat same-store sales.

Mobile growth boosts Paypointn Electronics payments operatorPaypoint said it sees a substantialopportunity for growth via mobilepayments as the company reported a16 per cent rise in profits to 18.3m.The company saw its biggest growthin its half-year in PayByPhone whichallows people to pay for parking viatheir phones. This led to a six per centrise in turnover to 101.7m.

AA bondholders call for shake-upnA group of some of bankruptAmerican Airlines most significantbondholders said it will not support astandalone restructuring unless a newboard is brought in, a move that may

increase hurdles for chief executive TomHorton. The 12-member bondholdergroup includes JP Morgan, PentwaterCapital Management and York Capital.

SHAFTESBURYs fortress of West Endproperties helped the landlord post aglowing set of full year results yester-day, in what it called an exceptional-ly busy year for London.The FTSE 250 companys net asset

value rose by 7.6 per cent to 498p ashare in the year to 30 September,driven by a boost in the value of theportfolio by 8.9 per cent to 1.82bn.

Shaftesburys 1.8bn portfoliostretches across Carnaby, CoventGarden, Chinatown, Soho andCharlotte Street. Some 72 per cent islet to retailers and restaurants.The group said vacancy levels con-

tinued to be at low levels of around3.2 per cent and that it is enjoyingunusually high levels of interestfrom retailers and other businessesparticularly since the summer.

Popular WestEnd lifts profits

at ShaftesburyBY KASMIRA JEFFORD

Chairman John Manser said theOlympics caused some short-termdisruption in visitor numbers butadded that it had no discernibleeffect on the business.

Shaftesburys estimated rentalvalue (ERV) rose six per cent whilepre-tax profits increased 6.8 per centto 31.2m. A total of 44m was spenton acquisitions in the period.

Shaftesbury PLC

29 Nov23 Nov 26 Nov 27 Nov 28 Nov

545.0

542.5

540.0

547.5

550.0

552.5

555.0

557.5 p 550.0029 Nov

PUB chain Marstons said it had gotoff to a good start to its newfinancial year, but reported anannual loss yesterday owing to animpairment charge on its taverns.

The owner of more than 2,000pubs, including the Pitcher and

Piano chain, said trading inOctober and November hadimproved on last year. This wasalmost entirely down to food sales,

which have been up 3.4 per cent

Pub chain Marstons sees hopein food sales but swings to loss

BY JAMES TITCOMB since September.However, Marstons which also

brews ales such as Pedigree saw apre-tax loss of 135.5m in the 12months ending 29 September, afteran 80m profit in the year before.This was due to a 223m writedownon the value of Marstons property.

Revenues improved by 5.5 per

cent to 720m, which chiefexecutive Ralph Findlay said was aresilient performance during the

wet summer which has affectedmost of the UKs pub chains.

Chief executive Ralph Findlay wrote off 223m but hailed a resilient performance

FRIDAY 30 NOVEMBER 201214 NEWS cityam.com

The newjobs websitefor Londonprofessionals

CITYAMCAREERS

.com

BRITISH Land yesterday said it hasacquired the 2.3-acre Canal CorridorNorth site in Lancaster city centrethat includes the former Mitchellsof Lancaster brewery.

The property giant is also in talkswith Lancaster City Council to buyits adjoining land to build a retail-led scheme across the 10 acre site.

Lancaster has seen very littleretail investment over the last twodecades and we look forward tocreating a retail and leisuredestination to serve local peopleand attract significant numbers ofvisitors into the city, said RichardWise, head of retail developmentfor British Land.

Wise believes the initialinvestment could lead to a future

development end value of over75m for the company.

British Landbuys new site

BY ALEX CROELL

Waste management businessweighs on Pennons first-halfUTILITIES company Pennon Groupyesterday reported a drop inprofits at its recession-hit wastemanagement unit, as warnedearlier this month, and said it didnot see a recovery in prices forrecycled materials in the nearfuture.

Pre-tax profit at wastemanagement business Viridor fellover 30 per cent in the six monthsto the end of September to 28m,in line with a profit warning issuedby the company two weeks ago.

A weak global economy hasseverely depressed average pricesfor waste paper and recovered

BY CITY A.M. REPORTER metals used in recycling, andViridor remained cautious aboutthe prospect of recyclate pricesrecovering.

The fall in recyclate prices hasa fairly brutal impact onturnover, Colin Drummond,chief executive of Viridor, said.

Weve been able very quicklyto recover 50 per cent of the fall inrecyclate prices through acombination of cost reduction,facilities rationalisation,headcount reduction, change inthe terms of our supply withcustomers.

The performance at Viridor wasoffset by a 10 per cent rise in pre-tax profit at Pennons South West

Water business to 84m.Shares in Pennon climbed over

four per cent to 625p yesterday,recovering some of their losses afterthey dropped as much as 10 per centfollowing the profit warning.

Pennon Group PLC

29 Nov23 Nov 26 Nov 27 Nov 28 Nov

605

600

610

615

620

625

630 p 625.0029 Nov

-

7/30/2019 Cityam 2012-11-30.pdf

15/39

-

7/30/2019 Cityam 2012-11-30.pdf

16/39

HOGG Robinson shares fell five per

cent yesterday after the corporatetravel services group posted fallingrevenues and earnings.

The FTSE Small Cap-listed firmsaid turnover fell 10 per cent to168.9m for the six months to theend of September, while underlyingpre-tax profits declined seven percent to 17.3m.

The group blamed currencymovements for some of the drop, aswell as the gloomy economicbackdrop.

Corporates are understandablycautious in their approach to travelbut our proven ability to help ourclients achieve best value from theirtravel budgets is reflected in ourongoing strong client retentionrate, said chief executive DavidRadcliffe.

The firm said its clients werechoosing cheaper travel options

through its service, though this wasmitigated by new mandates from theFinnish government, Pirelli andBayer.

Net debt jumped 46 per cent to100.5m, in a period that saw HoggRobinson make two acquisitions.

Thrifty businessjet-setters dentHogg Robinson

BY MARION DAKERS

RYANAIR will today introduce two sur-charges on its online flight bookings,blaming an Office of Fair Trading rul-ing for the hike in fees.The low-cost airline, which has been

on the receiving end of several OFTcomplaints over surprise booking fees,said it is adding the levies after thewatchdogs crackdown on air ticketsover the summer.

Ryanair said the two per cent creditcard processing fee will be in additionto its 6 per flight fee for all bookingsthrough its website, which will nowbe included in the headline price.

Both charges come into effect today,

four months after a number of otherfirms altered their online booking sys-tems to comply with the OFTs recom-mendations on transparent pricing.The OFT yesterday objected to

Ryanairs reasoning, issuing a state-ment to stress that is has not made

Ryanair blameswatchdog for a

hike in chargesBY MARION DAKERS any airline introduce new paymentcharges, increase their credit cardcharges, or scrap any discounts theywish to offer.

The Irish airline hit back, slammingthe OFTs planned changes over thesummer as anti-consumer.

As the OFT has removed our abilityto help passengers avoid fees throughexclusive partnerships perhaps theymay wish to pay these fees on the con-sumers behalf, said a spokesman.

Wood Group seen as attractiveafter 126m family stake saleANALYSTS picked energy servicesfirm Wood Group as a buyingopportunity yesterday after itsshares fell following a family stakesale.

The Wood family trust andmembers of the Wood family soldjust over 16m shares representingtheir entire 4.4 per cent stake inthe firm through Credit Suisseand JP Morgan Cazenove.

The sale of the stake at 775p pershare raised around 126m in total,and saw the shares drop 4.3 percent yesterday to 780p, making it

BY KATIE HOPEthe biggest faller on the FTSE 100.

However, Sir Ian Wood, whoretired as chairman last month,said he had no current plans to sellany of his 2.4 per cent stake.

And analysts said the share pricedrop made the stock attractive.

Oriel Securities highlighted itsstrong international position inoffshore facilities and said thismeant Wood Group was in a goodposition to take advantage ofincreased industry spending.

This is a good opportunity to buyinto a high quality company, itadded.

Meanwhile, Liberum advised

investors not to read anything intothe share sale, noting the familyhistorically had shown little interestin the firm.

John Wood Group PLC

29 Nov23 Nov 26 Nov 27 Nov 28 Nov

780

790

800

810

820 p780.0029 Nov

Ryanair Holdings PLC

29 Nov23 Nov 26 Nov 27 Nov 28 Nov

4.65

4.70

4.75

4.80

4.85 4.7829 Nov

MONARCH said yesterday that itsturnaround plan is progressingfaster than expected as the airlineand holiday group posted risingturnover and passenger numbers.

The firm did not release an

earnings figure for the year toOctober, but finance directorRobert Palmer said the losses weresubstantially reduced on the45m operating loss a year ago.

Turnover was up 9.2 per cent to827.7m, on traffic up 1.6 per cent

Monarchs recovery on courseas turnover and traffic increase

BY MARION DAKERS to 6.4m. Cost savings were asexpected at 31.6m.

We are very much on track onthe turnaround and we are aheadof where we thought we would bein terms of airline growth. Its allencouraging, executive chairmanIain Rawlinson told City A.M.

We are quite cautious for theyear ahead in terms of yields, butwe have some in-built growth inthe airline both in terms of winterski routes and continued expansionfrom our new bases over thesummer.

FRIDAY 30 NOVEMBER 201216 NEWS cityam.com

Monarch, which flies from six UK airports, said it is looking to buy new planes

GOLD Fields, the worlds fourth-largest bullion producer, isspinning off its two oldest South

African mines in the latest sign ofthe countrys once mighty goldindustry succumbing to decliningoutput and soaring costs.

In a move that nearly severs itsties with South Africa, Gold Fields70-year-old KDC mines near

Johannesburg and its Beatrixoperations near the central city ofBloemfontein will be renamedSibanye Gold and floated on the

Johannesburg stock exchange inFebruary.

The deal leaves Gold Fields withjust one mine in South Africa, the

Gold Fields spin-off plans showdecline of South African mining

BY CITY A.M. REPORTER highly mechanised South Deepoperation on which it has pinnedthe bulk of its hopes for growth.The rest of its mines are in Ghana,Peru and Australia.

Gold production in South Africahas halved in the last seven years,knocking Africas biggest economyoff its perch as the worlds top

bullion producer, a position itheld throughout most of the 20thcentury.

It is not only Gold Fields. Ourdecline is no different from thedecline you see at AngloGold andHarmonys South Africanoperations, Gold Fields chiefexecutive Nick Holland said.

We are all struggling with thesame challenges.

-

7/30/2019 Cityam 2012-11-30.pdf

17/39

in storemobilecarphonewarehouse.com

Important: due to the fast moving nature of this market, all offers, prices and availability are subject to change. All information is accurate at the time of going to print. Our price applies to new subscriptions and upgrades on pay monthly connections with O2, subject to credit check and a minimum term of 24 months. Avoid tech misery with Geek Squads insurance cover that

comes with 24/7 expert technical advice from only .99 per month. Upfront price of iPhone 5 6GB on O2 36 per month unlimited calls/unlimited texts/GB data. 24 month tariff was 94.99 between th October and 5th November, then 64.99 between 6th November and 20th November. TM and 200 Apple Inc. All rights reserved.

A TARIFF AS AMAZINGAS

5

FINALLYiPhone 5 16GB

ONLY 25 UPFRONT

36PERMONTH1

Available to new andupgrading customers

UNLIMITEDMINUTES,UNLIMITEDTEXTS,1GBDATA

-

7/30/2019 Cityam 2012-11-30.pdf

18/39

SHARES in technology firm Invensyscontinued to climb yesterday, asinvestors reacted to news it hadoffloaded its rail division toGermanys Siemens for 1.7bn.After rising more than 20 per cent

in late trading on Wednesday after-noon, when the deal wasannounced, shares in Invensysgained another nine per cent yester-day, closing at 305.8p and valuingthe firm at almost 2.3bn. Analystsat RBC said the sale increased thelikelihood that Invensys couldbecome a bid target once the deal iscompleted in the middle of 2013,having admitted to early interest ear-lier this year.

The disposal of rail leaves Invensysmore focused on automation andeliminates the UK defined benefitpension net deficit, thereby remov-ing two major obstacles for potentialacquirers, said RBCs Andrew Carter.

Meanwhile Siemens promisedinvestors that the deal would con-tribute to boosting its profits in a

Invensys ascent

continues afterSiemens dealBY ELIZABETH FOURNIER tough economy. The engineering con-

glomerate, Germanys most valuablecompany, aims to save 6bn (4.9bn)and focus on its core areas of expert-ise to close a gap with rivals such asABB and General Electric.

The deals will lift the operatingprofit margin of SiemensInfrastructure & Cities (I&C) divisionby more than one percentage point infiscal 2014 from 7.5 per cent last year,I&C chief executive Roland Buschsaid.

We are investing in our profitabili-ty. We see a margin improvement ...as validation, Busch said.

New chief executive Peter Bertram said the results were disappointing

Phoenix IT Group PLC

29 Nov23 Nov 26 Nov 27 Nov 28 Nov

160

162

164

166

168 p 167.0029 Nov

Invensys PLC

29 Nov23 Nov 26 Nov 27 Nov 28 Nov

220

240

260

280

300

320 p 305.0029 Nov

FRIDAY 30 NOVEMBER 201218 NEWS cityam.com

Phoenix IT swings to loss aftermanipulated books discoveredACCOUNTING irregularities haveforced business software firm

Phoenix IT into a 68mwritedown, the company saidyesterday.

The impairment, which led tothe downfall of chief executiveDavid Courtley and the sacking ofPhoenix ITs auditors Deloitte inOctober, dragged the companyinto a pre-tax loss of 63.3m inthe six months to October.

The company said that aninternal review conducted by PwC

BY JAMES TITCOMB found that the profits of[subsidiary] Servo Limited have beenmanipulated and overstated for anumber of years starting in the

financial year ending 31 March2009.Even with this charge taken out,

the companys performance wasworse than last years. Phoenix ITsaw revenues of 124m, five percent down on last year.

The company blamed this ondisruption on the transition to thenew structure, and reinvestment incertain areas that had dropped tounacceptable levels. Executive

chairman Peter Bertram, whoreplaces Courtley, admitted theresults were disappointing.

CABLE maker Belden said yesterdayit will sell its Thermax and Raydexcable businesses to diversifiedmanufacturer Carlisle Cos forabout $265m (165.4m), includingdebt, as it looks to exit theaerospace and defence markets.

Belden, which also makes cablesand networking products for the

broadcast and consumerelectronics industries, has beenunable to remain competitiveoffering cables as a stand-aloneproduct to the aerospace anddefence markets, companyspokesman Matt Tractenberg said.

Carlisle said it expects the

acquisition to close by 31 Decemberand add to earnings in 2013.

Belden selling

unit to CarlisleBY CITY A.M. REPORTER

CISCO Systems said yesterday itwill buy privately held networktraffic-management softwaremaker Cariden Technologies forabout $141m (88m) in cash.

Cariden will be integrated intoCiscos service providernetworking group unit, Cisco said.

California-based Caridensupplies network planning, designand traffic management solutionsfor telecommunications serviceproviders. This is Ciscos thirdacquisition in November. Earlierthis month Cisco said it will buyprivately held cloud networkingcompany Meraki for $1.2bn in

cash as part of its cloud andnetworking strategy.

Cisco snaps upsoftware firm

BY CITY A.M. REPORTER

-

7/30/2019 Cityam 2012-11-30.pdf

19/39

IN BRIEFRoyal Bank of Canada profit risesn Royal Bank of Canadas quarterlyprofit rose 22 per cent on a sharpjump in fixed-income trading revenueand steady loan growth, suggestingthe long-awaited slowdown inCanadian consumer lending has yet tomaterialise. The bank, Canadaslargest, earned C$1.9bn (1.2bn), orC$1.25 a share, in the fourth quarterended 31 October. That compared witha year-earlier profit of C$1.6bn, orC$1.02 a share. Capital marketsincome more than tripled to C$410m.

Hostess Brands attracts interestn Hostess Brands, the bankruptmaker of Twinkies snack cakes,received court permission to winddown its 82-year-old businessyesterday but revealed furiousinterest in its iconic brands frompotential buyers. Around 110 potentialbidders have contacted the companyabout bidding for at least part of itsbusiness, and 70 had enough interestto sign confidentiality agreements,Hostess banker told the hearing inWhite Plains, New York.

Hangar8 snaps up JetClub

n Aim-listed private jet operatorHangar8 has spent 3.7m plus500,000 new shares to take overInternational JetClub, a high-endaircraft management firm. Theacquisition boosts Hangar8s fleetfrom 36 to 46. The firm alsoannounced a 4.2m share placing tofund the acquisition, to be run bySeymour Pierce. Oxford-basedHangar8 this week defied a gloomyaviation sector with soaring earnings.

HEDGE funds increased their betsagainst big name European technolo-gy stocks last month, after datashowed a surge in the short selling ofshares in the sector.

Data out this week shows 6.7 percent of European technology shares including big name brands likeNokia and Logitech are currentlyout on loan to short sellers such ashedge funds, an increase of three percent over the month.

Under short selling strategies,hedge funds make money if thefirms do badly and their shares fall.

Leading the pack of companies hed-

gies think will do badly is German

Hedgies bet onfresh downturn

in tech sharesBY MICHAEL BOW

tech manufacturer Aixtron, whichhas 23.4 per cent of its shares out onloan, almost three quarters of thetotal amount allowed.

It would be hard to borrow any-more, Markit director Alex Brog,who conducted the research, said.

Mobile phone maker Nokia has alsoseen an 8.1 per cent rise in the num-ber of shorts against it, rising to 18.8per cent of its stocks out on loan, asinvestors bet against the success of itsforthcoming Lumia 920 phone.

Swiss company Logitech, whichmakes keyboards and computeraccessories, is also being heavilyshorted after it posted a profit warn-ing last month, sending its shares to a

nine year low.

FRIDAY 30 NOVEMBER 201219NEWScityam.com

TAKE A COLD SNAP OF THE BROADGATE ICE CAB TO WIN A FREE SKATE

Broadgate Ice, the only ice rink in the Square Mile and Londons only turn-up and skate venue, has commissioned aspecially designed London Ice Cab to celebrate this years skating season. Budding skaters can snap the cab onlocation around London and tweet the picture using #BroadgateIce to be in with the chance of winning a two-for-one skate voucher including skate hire.

Broadgate Ices 2012/13 season was launched yesterday by London 2012 gold medal Olympic boxer Luke Campbelland 100 Mayor of London Olympic Volunteers joined Luke to celebrate Broadgates commitment to oer a freeskate to all Olympic Volunteers. Luke said: Theres so much going on at the rink over the next few months, and itwas good fun helping them kick it all o.

The Ice season runs until 24th February and will round o a year of sporting and royal focus. Visitors will be able toshare a piece of the celebratory action by choosing their own ice-tunes skating soundtrack and having photos oftheir group posted to their Facebook pages during selected skate sessions.

Along with oering sedate skates, Broadgate Ice oers a more challenging activity in the form of Broomball. Animport from Canada and currently growing in popularity in the UK, Broomball resembles ice hockey, with teams ofsix players kitted out in trainers, knee and elbow pads and a crash helmet as they slip and slide across the icescoring goals using a broom.

The Ice Cab will be on the road until 28th December, so spottersneed to get their skates on.

WHERE:Broadgate Ice Rink, Broadgate Circle, London EC2M 2RH

2 minutes from Liverpool Street Station

The voucher includes free access to the ice within designated time slots plus free skatehire for one person when accompanied bya second paying skater.

visit www.broadgate.co.uk/tandc/broadgateice for full details, terms and conditions.

ADVERTORIAL

JEWELLER Tiffany & Co yesterday lowered its full-year sales and profit outlook for the thirdstraight quarter and posted lower-than-expected revenue and earnings after a drop in same-store sales in its Asia market. Like-for-like sales at Asian stores fell four per cent, excludingcurrency effects, as global sales rose 3.8 per cent to $852.7m in the year to 31 October.

ASIAN SPARKLE FADES FOR TIFFANY & CO

TOP 5 MOST SHORTED TECH STOCKS IN EUROPE

Rank Company Name Country Stock out on loan

Aixtron Germany 23.4 per cent

Nokia Finland 18.8 per cent

Logitech Switzerland 18.8 per cent

Alcatel-Lucent France 15.6 per cent

Neopost France 13.3 per cent

12345

-

7/30/2019 Cityam 2012-11-30.pdf

20/39

NET migration into the UK fell to itslowest total for almost eight years inthe year to March 2012, data outyesterday revealed.

In the year to March, 536,000people came from abroad to live inthe UK, according to estimates fromthe Office for National Statistics,down 42,000 on the year before, andthe lowest figure since the year toJune 2004. Combined with a bumpin emigration, which hit 353,000 inthe year to March compared to336,000 a year earlier, net migrationcollapsed from 242,000 to 183,000,closing in on the governments goalof below 100,000.

The fall appears to have continuedinto recent months excludingvisitor and transit visas, 85,940 fewervisas were issued in the year toSeptember than in the previous 12months. A large contributor to thefigures was student visa issuance,which collapsed 26 per cent in just ayear, while work-related visas fell byjust four per cent.

The government hailed the data asevidence its policies were succeedingin reducing immigration, but theInstitute of Directors warned thatcutting off the flow of global talentcould harm the UKs growthprospects.

Net migrationto UK sinks to

eight-year lowBY BEN SOUTHWOOD

RETAIL sales growth accelerated inNovember, industry data out yester-day indicated, marking the thirdmonth of expansion after Augustssmall decline.The net balance of retailers who

reported a rise in sales year-on-yearrose to plus 33 per cent in Novemberfrom plus 30 per cent in October, theConfederation of British Industry(CBI) said.And businesses thought this sales

growth could continue a net bal-ance of plus 25 per cent told the CBIthey thought their volumes could goup in December, slightly down fromthe plus 27 per cent who had predict-ed growth in November.

This months survey is reason tobe cheerful as we head into the fes-tive period, said Anna Leach at theCBI. Retailers at the board will beheartened by these encouragingresults, she added, highlighting theincrease in employment as particu-larly positive.

Retailers enjoy

a third monthof sales growth

BY BEN SOUTHWOODHoward Archer at IHS Global

Insight agreed the news was encour-aging, and cited the recent slowdownin inflation as a major factor.

But he said the recent bump in con-sumer price inflation, bringing itback up to 2.7 per cent, after it hadfallen down to 2.2 per cent, meantthere was a risk that purchasingpower will be squeezed beforeChristmas.

But retailers did not appear to sharehis worries, with a net balance ofseven per cent expecting their overallbusiness situation to improve.

Interest rates inch down in thirdmonth of Funding for LendingINTEREST rates on new securedloans edged down in October, thethird month since the Fundingfor Lending Scheme (FLS) began,data revealed yesterday, but rateson unsecured loans rose.

The average interest rate onnew secured loans edged downfrom 3.77 per cent to 3.74 per centlast month, the Bank of Englandsaid. And in the same month,lenders extended 11.6bn in loanssecured on houses, up from the11.3bn gross lending in

September.But the average interest rate on

BY BEN SOUTHWOODunsecured loans hit 7.13 per centin October, up from 6.72 per centin September. In line with this,total consumer credit fell from157bn in September to 156bn inOctober, dragging down totallending to individuals, despite therise in secured lending.

But Chris Williamson at Markitsaid that the mild improvementsdo not mean FLS has succeeded.Although the increase inmortgage approvals from 50,000to 53,000 is encouraging, thenumber continues to run atalmost half of the average seen in

the 15 years leading up to thefinancial crisis, he said.

The data therefore suggest thatthe much-vaunted FLS has so fardone little to provide the housingmarket with a much neededboost, he added.

Housing market treads water inNovember as weakness persistsHOUSE PRICES were completely flatin November, data out yesterday

revealed, highlighting the weaknessin the market.According to Nationwides latest

monthly survey average prices wereunchanged this month at justunder 164,000.

However, in spite of staying flatin the month, the annual changein price worsened from minus 0.9per cent in the year to October tominus 1.2 per cent in the year toNovember.

For each of the last nine months,prices have been lower than they

BY BEN SOUTHWOOD were in the same month a yearearlier.

Despite the downward trend,Robert Gardner, Nationwides chief

economist, said the underlyingposition of the housing market wasstable. Annual price growth hasremained in a narrow bandbetween plus 1.5 per cent andminus 1.5 per cent on all but twooccasions over the past two years,he said.

And data out today suggestedthat extra supply could keepdownward pressure on prices. TheGlenigan index for housing startswas up three per cent in the threemonths to November, compared to a

year ago, the firm said.Private housing construction

continues to go from strength tostrength in the latter part of this