Cityam 2012-11-20.pdf

Transcript of Cityam 2012-11-20.pdf

-

7/30/2019 Cityam 2012-11-20.pdf

1/35

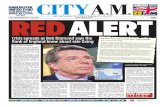

The Mayor of London called for billionaire divorce claims to head to London

BUSINESS WITH PERSONALITY

Meet London Business School

Speak informally with a London Business School representative about our portfolio of top-ranked

Masters programmes and receive advice on the right programme for you.

Wednesday 28 November 2012:Novotel London Tower Bridge, 10 Pepys Street, London EC3N 2NRThursday 29 November 2012:Hilton Canary Wharf, South Quay, Marsh Wall, London E14 9SHPlease join us at any time between 11.00 and 15.00

Find out more and register your interest at: www.london.edu/meetlbs/

Email: [email protected] or call: +44 (0)20 7000 7500

HONGKONG

NEWYORK

DUBAI

Boris slams plans for propertytax as stamp duty hits marketBORIS JOHNSON yesterday slammedLiberal Democrat politicians who arecalling for property tax hikes, whileurging Google and other companiescriticised for tax avoidance to domore to benefit the UK.

It is absurd to be suddenly whack-ing up taxes on cash-poor people whohappen to inhabit expensive housesin London when firms like Google arepaying zero, he told the audience atthe Confederation of BritishIndustrys annual conference.

Neither arrangement strikes me asbeing fair, and so Google and co face avery clear choice: they can eitherchange their tax arrangements, or domuch more work to serve our society.The Mayor of Londons comments

come after devastating statisticsreleased yesterday showed the effectthat higher taxes have already had onLondons property market.Across Greater London, sales of

properties worth between 2m and5m collapsed 53 per cent in the year

leading to the third quarter this year,London Central Portfolio said yester-day. In this years Budget, the govern-ment slapped expensive properties

with a welter of tax hikes and newcharges. Homeowners selling proper-ties for over 2m now face stamp dutyat seven per cent if the transaction isin their own name, rising to 15 percent for firms.

Since 77 per cent of propertiesworth more than 2m are located inthe capital, London has alreadybegun to feel the impact of the taxbarrage.

And plans are in the pipeline toimpose a further yearly charge of upto 140,000 on companies using theseproperties, as well as hitting the busi-nesses with a further capital gains lia-bility.

The Mayor used much of the rest ofhis speech to wax lyrical over the ben-efits of doing business in London,calling on oligarchs to make use ofLondons courts sending the moneytrickling down through the city.

I have no shame in saying to theinjured spouses of the worlds billion-aires: if you want to take him to thecleaners, take him to the cleaners inLondon, he said. Because London

cleaners will be grateful for your busi-ness.

www.cityam.com FREE

your future inthe future... The

stark reality is thatputting something

aside for old age has become anecessity.The dangers of not saving soon

enough are apparent after figuresshow a 35-year-old would have to savetwice as much as a 25-year-old to beable to retire with a 600,000 pensionpot, enough to buy a 30,000 a yearpension.

The government is currentlyattempting to solve the savings chal-lenge by introducing a law making itcompulsory for workers to be enrolled

into a pension.However, at thecurrent auto-enrolment saving

rate of two per cent,a typical worker will

only be saving roughly44 a month hundreds of poundsshort of what they want.

National Association of PensionFunds chief executive Joanne Segarssaid: Young people have a lot on theirplates and face great financial pres-

sures like student debt or saving fortheir first home, but they should stillthink about a pension. An early startcan make a big difference.

BEN SOUTHWOOD

FTSE 100 5,737.66 +132.07 DOW 12,795.96 +207.65 NASDAQ 2,916.07 +62.94 /$ 1.59 unc / M1.24 -0.01 /$ 1.28 +0.01

BY MICHAEL BOW

THE OSTRICH

GENERATION

ISSUE 1,764 TUESDAY 20 NOVEMBER 2012

A NEW WEALTHPUZZLERyan Bourne in The Forum, Page 24See Page 19

MORE: Page 16

ALLISTER HEATH: Page 2

Certified Distribution

01/10/12 til 28/10/12 is 129,297

BRITAINS young savers are wildlyunderestimating how much theyneed to save each month for acomfortable retirement, after anational survey found just one in10 is putting money aside for apension despite having high expec-tations for their final pension pots.Just 12 per cent of Britons between

25-34 years old are saving for retire-ment, even though one third hope toretire on 30,000 a year, some 4,000above the average salary.This is equivalent to a typical 35-

year-old funnelling 750 amonth into a pension pot, or a25-year-old putting away 400 amonth for retirement.The mismatch in expecta-

tions will fuel fears that mil-lions of Britains young people,starved of generous defined benefitpension schemes and saddled withhigh debts and soaring house prices,will retire in poverty.

The survey, conducted by YouGov,found 25-34-year-olds were the thrifti-est generation in the UK, with 18 persaving money from their disposableincome, but for more near-term aimssuch as houses, holidays and carsinstead of retirement.

Tony Stenning, UK head of retail atthe worlds biggest fund managerBlackRock, which commissioned thesurvey, said: You really cant build

MAPPING THE FUTUREHOW LONDON COMPARES TO THE WORLDS OTHER TECH HUBS

31%of25-34 yearoldsexpectto retire on

more than30,000 ayear

13,200Average income

of singlepensioners today

Brits are burying their heads in the sand over retirement plans

32%of Britons are notplanning or savingfor their retirement

600,000isthe total pensionpot required tobeabletoretireat 65on 30,000ayear

L A U R A L E A N / C I T Y A M

-

7/30/2019 Cityam 2012-11-20.pdf

2/35

Follow me on Twitter: @allisterheath

JP MORGAN Chase has namedMarianne Lake as its new chief finan-cial officer (CFO).

Lake, currently CFO of JP MorganChases consumer and communitybanking business, will step into thenew role next year. She will take overfrom Douglas Braunstein, who willbecome the banks vice chairman.

Lakes former positions includeglobal controller of the companysinvestment bank. Prior to that sheworked in London as the seniorfinancial officer for the company inthe UK.

JP Morgan picksLake as new CFO

BY JENNY FORSYTH

BANKS have given in to mad levelsof compensation to victims ofpayment protection insurance (PPI)mis-selling, former HBOS retail riskchair Sir Charles Dunstone claimedyesterday.

Sir Charles said bankssurrendered to the 11bn packageset aside for victims, due to theirunpopularity going on to say thathe didnt think the policies weremis-sold in the way alleged by theFinancial Services Authority, talkingto the Parliamentary Commission onBanking Standards.

Ex-banker callsPPI claims mad

BY BEN SOUTHWOOD

THE GOVERNMENT is expected toget tough on energy companiestoday, with ambitious proposals toreduce bills for consumers.

Energy secretary Ed Davey is tomake a speech this afternoon, inwhich he is expected to outlineplans that he hopes will help con-sumers reduce their growing gasand electricity bills and make it easi-er for households to switchproviders.

Last month, energy regulatorOfgem unveiled proposals to forcesuppliers to tell customers about thecheapest tariff they have on offer.The government is thought tofavour a plan that limits firms toproviding just four various tariffseach for gas and electricity.The regulator also wants suppliers

to simplify the way they express tar-iffs, including clearly presentingdual fuel tariffs separately.

Earlier this month, Davey said thatthe government was studying theregulators plans, and was attractedto many of them. This followed stri-dent criticism of the utilities fromPrime Minister David Cameron, whohinted that the government wouldforce firms to put consumers on thelowest tariff.The Energy Bill is due to be pub-

lished for its second reading in the

SAS staves off bankruptcySAS has staved off the immediate threatof bankruptcy after all eight unionsrepresenting flight personnel at theScandinavian airline signed up to wagecuts of up to 15 per cent. In a marathonnegotiating session that lasted fromSunday morning until yesterdayafternoon, SAS managed to convince oneunion after another to sign up to the deal.

US banks give $26bn mortgage reliefFive of the largest US banks have provided

$26.1bn (16.4bn) in mortgage relief tofinancially struggling homeowners as partof a settlement with regulators agreedearlier this year. Joseph Smith, monitor forthe national mortgage settlement, saidthat about 309,000 borrowers hadreceived some form of relief from AllyFinancial, Bank of America, JPMorganChase, Citigroup or Wells Fargo.

Ecclestone faces new legal caseBernie Ecclestone faces a new legalchallenge over the 2005 sale of FormulaOne after a private equity group filed a$650m lawsuit claiming he conspired withothers to prevent it buying the series.

Commercial hospitals hit by declineThe owner of Britains leading chain ofcommercial hospitals has written 811moff the value of its properties as itstruggles with big debts and a decliningnumber of private patients.

Spain offers home for homeSpain is to offer automatic residency towealthy foreign property buyers in anattempt to lure Chinese and Russians toreduce its huge stockpile of 750,000unsold properties.

MP challenged over family firms taxMargaret Hodges position as chairman ofthe Public Accounts Committee has beencalled into question following revelationsover the tax affairs of Stemcor - the 6.3bn-turnover business controlled by her family.

Greek companies face annihilationGreeces recession-hit businesses faceannihilation, a leading chamber ofcommerce has warned, as a double whammyof falling sales and job cuts meant the statewas in its worst economic shape for 14 years.

Weather investments seeks $5bnWeather Investments, the companycontrolled by Egyptian billionaire NaguibSawiris, is seeking $5bn (3.1bn) in damagesfrom Algeria, claiming its mobile phone unittjere was the victim of harassment anduntoward government interference.

Fiat sweetens offer for CNH GlobalFiat Industrial sweetened its offer to buy outminority shareholders of its US subsidiary,CNH Global, adding a $288m (181m) cashdividend to its original share swap.

FRENCH President FrancoisHollande was hit with yet anotherdowngrade last night, as Moodystook the Eurozones second biggesteconomy down a ratings peg.

In another blow to PresidentHollandes fiscal policy, French

government debt was cut to an Aa1rating, from Aaa, following asimilar decision from Standard &Poors in January. To add salt to the

wound, the ratings agencymaintained its negative outlook,suggesting its assessment could

worsen further.And as well as Hollandes fiscal

issues, Frances long-termproblems, particularly its gradual,sustained loss of competitiveness

were once again blamed, in linewith assessments from the IMF andan independent Frenchcommission. Moodys alsoexpressed worries about thedisproportionately large tradeand banking linkages betweenFrance and peripheral Europe claiming it could he susceptible tofuture Eurozone shocks.

But the ratings agency didexpress some optimism about the

governments commitment tostructural reforms and fiscalconsolidation, and said it hopedthese could mitigate some ofFrances deepest problems.

Hollande hit by

Moodys ratingdowngrade

Energy secretary Ed Davey wants consumers on the lowest energy tariffs

2 NEWS

BY BEN SOUTHWOOD

BY CATHY ADAMS

To contact the newsdesk email [email protected]

ONCE again, Boris Johnson ismaking sense on tax. He isright to be calling for a lowertax economy and to oppose

increasing the tax on homeowners while simultaneously demanding theelimination of the loopholes thatmean that the current system is

riddled with problems, especiallywhen it comes to corporation tax.The reason Boris position makes

more sense than most other politi-cians, including many of those ingovernment, is that the Mayor realisesthat while there is plenty of avoid-ance, and that this needs to be dealtwith, the silent majority of non-avoiders already pay far too much tax.The amount handed over by most pro-fessionals in the City in particular ismonumental.Take the figures for income tax.

High earners many of whom work

EDITORSLETTER

ALLISTER HEATH

It is shocking just how much tax most workers have to pay

TUESDAY 20 NOVEMBER 2012

in London pay a massive amount.The top one per cent those onincomes from employment, self-employment, interest or dividends of156,000 or more a year are expect-ed to pay 24.2pc of all income tax2012-13, even though they will earnonly 10.8 per cent of all income. Thetop 10 per cent on 50,500 or more ayear will pay 55.3pc of all incometax while earning 33.2 per cent of allincome. The top 31,000 individuals those set to earn 500,000 or more in

taxable income are expected to payan astonishingly large 14.8bn inincome tax, substantially more thanthe 13.9bn paid by the bottom 13.6mtaxpayers who earn 20,000 or less (anumber which is in fact even larger asit doesnt include those whose earn-ings are so low that they fall below

the income tax threshold).On average, those earning 500,000or more pay an average of 43-44 percent of their incomes in income tax(they also pay national insurance aswell as indirect taxation). The top2,000 earners pay 2m each on aver-age in income tax alone. This is whythe decline of the City and the drop inthe number of high earners is terriblenews for the Treasury: in 2009-10,16,000 people earned 1m or more; in2010-11 just 6,000; in 2011-12 10,000and in 2012-13 a mere 8,000.The poor and middle classes are also

trously deluded. Stamp duty washiked to 7 per cent (or more in somecases) for homes worth 2m+ thisyear. In London, sales under 2mdipped one per cent in the third quar-ter. But sales of homes worth 2m-5m collapsed 53 per cent comparedto the third quarter of 2012, accord-

ing to Land Registry data analysed byLondon Central Portfolio. This willhave triggered a decline, not anincrease, in tax receipts for that cate-gory of homes, in a stark illustrationof Arthur Laffers famous curve.

Britain is obsessed with tax avoid-ance. This will only be solved throughcomprehensive tax reform. But mostpeople are already appallingly over-taxed. Their vast contribution to theExchequer should not be forgotten.

being hammered, with even mini-mum wage earners paying a scan-dalous share of their wages in tax.Economists usually agree thatemployees, not employers, pick up thebill for national insurance, even thatpart misleadingly known as employ-ers NI (wages would be commensu-

rately higher in their absence). Thecombined tax on labour is extremelyhigh. Income tax and NI mean work-ers pay a shocking 40.25 per cent taxon earnings between 8,105 and42,475; 49 per cent on 42,476-100,000; 66.1 per cent between100,000-116,210; and 57.82 per centon 150,000 or above. Of course, thereis much more to tax than direct tax:Vat and duties hit everybody but thepoor disproportionately so.The increasingly popular idea that

taxing property would be an easy wayof raising even more money is disas-

next few weeks, and it is also under-stood to include plans to reform theelectricity market to enable invest-ment in low-carbon generation capac-ity in the UK.

Over the past few weeks, five of thebig six energy companies includ-ing SSE, British Gas, EDF, ScottishPower and npower have hiked pricesfor bills, blaming the increases on therise in wholesale gas prices.

In a case of bad timing for the sector,this was followed by a FinancialServices Authority (FSA) investigationinto claims that the UK wholesale gas

market is being manipulated, follow-ing a whistleblowers allegations.The government last week pledged

to use the full force of the law onthose abusing the wholesale market.

Consumer groups have given a cau-tious welcome to plans for clearerenergy tariffs, but questions remainover how the government would forcefirms to choose and then change cus-tomers onto the most cost-effectivetariffs. Shadow energy ministerCaroline Flint last month accused thePrime Minister of making it up as hegoes along.

The new jobs website for London professionalsCITYAMCAREERS.com

WHAT THE OTHER PAPERS SAY THIS MORNING

Government to lay outnew plans for energy bills

-

7/30/2019 Cityam 2012-11-20.pdf

3/35

Ocados management, including CEO and co-founder Tim Steiner, own eight per cent

BOTTOM LINE: Page 8

TUESDAY 20 NOVEMBER 20123NEWS

cityam.com

Extremely limited availability. Price is in GBP per person based on two adults sharing at Thulhagiri Island Resort on a half board room basis, and includesreturn flights from LGW to Mal for selected travel between 01/05/13 and 17/07/13. Price is based on midweek travel (Monday to Thursday), weekendsupplements may apply. Prices include all pre-payable taxes and charges, correct as at 31/10/12, but may vary. Book by midnight 22/11/12. Somepayment methods attract a handling fee. Holidays are ATOL protected (number ATOL5985). For full terms and conditions visit ba.com

British Airways flies directfrom the UK to moreIndian Ocean islandsthan any other airline.To Fly. To Serve.

MONDAYMORNINGMEETINGEscape to the Maldives.Its a long way fromthe everyday.London Gatwick toMal. Flights + 7 nights

hotel from 989pp.

Book by 22 Novemberat ba.com

OCADOS shareholders ploughedmore money into the online grocerychain yesterday to support a 36mplacing that will keep the firm finan-cially stable for at least 18 months.

Existing shareholders includingJorn Rausing of the Tetra Pak dynastyand Ocados management team tookup around 19 per cent of the sharesplaced, in line with their currentholdings, advisers said.The fundraising was part of a deal

with lenders that will see Ocadosdebt facility extended, giving the loss-making firm breathing space to opena second warehouse in Warwickshire.

Ocado said Barclays, HSBC andLloyds have agreed to extend its100m capital expenditure facility foran extra 18 months to July 2015.

It said the placing was much aplanned strategy and denied that ithad been in danger of breachingcovenants tests due in December.

Shares in the retailer, which havenearly halved in the past six months

Ocado investorsprop up 36mcapital raising

BY KASMIRA JEFFORD over fears it could breach its bankingcovenants, soared more than 23 percent yesterday.

But analysts remained doubtful overits long-term prospects. Shore Capitalanalyst Clive Black said the use of acash-box placing shows the con-straints that Ocado is facing.

Black described the 11 per cent salesgrowth Ocado posted for the 14 weeksto 11 November as unspectacularcompared to its bricks and mortarrivals, with the group still failing togenerate sufficient cash.

NUMIS Securities and Goldman Sachs actedas joint bookrunners on Ocados share plac-ing. The teams were led by Alex Ham, co-head of corporate broking at Numis and PhilRaper, head of UK equity capital marketsand chairman of corporate broking atGoldman Sachs.Ham, 29, has worked at Numis since 2005,and has worked with Ocado before, helpingto secure the 10 per cent cornerstone

investor needed in the online grocers IPO

fundraising in 2010.Ham also ran Numis involvement in theflotation of Hugh Osmonds cash shellHorizon on the Alternative InvestmentMarket in February 2010, and in 2011 actedfor Horizon on its 527m acquisition oftemporary power provider APR Energy,which was then reversed into the cash shell.He also advised Betfair on its flotation in2010 and New-York based Investcorp on itsbid for Opsec, the maker of anti-counter-feiting technologies last year.Ham, who was named rising star of theyear at the 2011 City A.M. Awards, is also asenior adviser on corporate broking andequity capital markets to online fashionretailer Asos, global software firm MicroFocus and student accommodation group

Unite.

ADVISERS

ALEX HAMNUMIS SECURITIES

Ocado Group PLC

19 Nov13 Nov 14 Nov 15 Nov 16 Nov

60

65

70

75

p

75.0019 Nov

QWhat is a cash box placing ?

AA cash box placing allows acompany to issue new shares bybypassing pre-emptionrequirements meaning withoutshareholder approval providedthey are issued for a non-cash

consideration, such as the shares ofanother company.

QHow does the structure work?

AThe listed company incorporatesa new subsidiary to act as the so-called cash box. It will inject cashinto the unlisted shell companyand then buy that shell, paying

with shares priced at whateverlevel it deems suitable.

QWhat are the advantages of using thisstructure?AThe structure allows companiesto raise more money than theymight otherwise be allowed in a

quick transaction and withoutseeking shareholder approval,which can be expensive and time-consuming.

QHow has the structure been used byOcado?AOcado is using the vehicle toraise 10 per cent of its sharecapital, breaking the usual five per

cent threshold allowedunder pre-emption rules.It has incorporated a vehicle calledWeir Developments Limited, whichcan then lend fund by way ofredemption of the redeemablepreference shares.

QWhich other companies have used thestructure?AProperty developer GreatPortland Estates recently raised140.6m from a cash box placing tohelp fund further acquisitions inthe West End. Drax also raised190m using the mechanism lastmonth. BAE Systems, Logica andMisys have all used cash boxstructures in the past.

QAandCash boxes explained

-

7/30/2019 Cityam 2012-11-20.pdf

4/35

THE GLOBAL financial regulatorformed by the G20 has revealed itsbid to take tighter control of theshadow banking sector.

The Financial Stability Board (FSB)

said that it would seek to regulatethe industry and thereby reducesystemic risk that could lead toanother financial crisis.

The objective is to ensure thatshadow banking is subject toappropriate oversight and regulationto address bank-like risks to f inancialstability emerging outside theregular banking system, said theFSB.

G20 takes aim atshadow banking

BY JULIAN HARRIS

XSTRATA shareholders are expectedto vote through the 56bn mega-merger with Glencore this afternoon,following months of negotiationsbetween the two commodity giants.

Todays shareholder meetings, thefirst of which is scheduled for 1pm inSwitzerland, come nine months aftercommodities trader Glencore firstapproached miner Xstrata.The two meetings will include four

resolutions, thanks to a complicatedarrangement allowing shareholdersto approve the deal but not the 140mremuneration package for Xstrata

staff.It could cast doubt on Sir John

Bonds future as chairman of theenlarged group, after he backed theretention bonuses.

Stakeholders are widely expected togreen-light the deal sweetened inSeptember to 3.05 new shares for eachXstrata share but vote against themanagement incentive arrange-ments.After Glencore, Xstratas largest

shareholder Qatar said last week it

Shareholdersset to approve

Glenstrata dealBY CATHY ADAMS would vote in favour of the tie-up, but

abstain from voting on the manage-ment incentives. A source close to thedeal said that given the way the sover-eign wealth fund will vote, othershareholders may vote tactically toensure that the merger is approved.

Even if the merger is approved thisafternoon, the deal still has to beapproved by European regulatorsbefore the deadline on Thursday.

Glencore has offered up antitrustconcessions thought to be zinc armNyrstar in the hope of securing a nodfrom the EU.

Xstrata plc

19 Nov13 Nov 14 Nov 15 Nov 16 Nov

950

945

955

960

965

p

956.8019 Nov

BRITAINS banks should be forcedto fully separate their retail armsfrom investment banking

operations if they try tocircumvent new rules designed toprotect the taxpayer, a topregulator warned.

Andrew Bailey, head of bankingsupervision at the FinancialServices Authority (FSA), said

banks should face the threat ofbeing broken up if they failproperly to comply with proposalsto ring-fence retail deposits fromriskier activities.

He warned there is a risk that

FSAs Bailey says banks shouldbe forced to ring-fence retail

BY CITY A.M. REPORTER banks would try to tunnel underany ring-fence set for them.

This is an industry which istremendously innovative atthinking of ways to dress things up

to look slightly differently, Baileytold the Parliament Commissionon Banking Standards.

MPs are debating what should beallowed inside the ring-fence and

Adair Turner, the FSAs chairman,said there was a case for retail

banks to be allowed to sell simplederivative products to smallcompanies.

We can see some argumentswhy a relaxation might belegitimate, he said.

THE FORUM: Page 2 5

TUESDAY 20 NOVEMBER 20124 NEWS

cityam.com

The FSAs Andrew Bailey says investment and retail banking arms should be separate

LONMIN shareholders voted throughits $817m (513m) rights issue

yesterday, as they questioned theboard on issues of governance.

The rights issue, announced lastmonth, is designed to cut debt andshore up the balance sheet followingthe six-week strike at South Africanmine Marikana over the summer.

Lonmin had warned it would beleft in a highly vulnerable positionif the cash call was not votedthrough.

More than 90 per cent of investorsbacked the firms plans.

Lonmin gets goahead for issue

BY CATHY ADAMS

-

7/30/2019 Cityam 2012-11-20.pdf

5/35

Comet yesterday announced 735 further redundancies, in a bid to save cash as thetroubled company tries to find a buyer for the best parts of the business. Some 603employees working for its home delivery network were made redundant, along with 132from the firms head office but no staff in stores have so far lost their job.

COMET ANNOUNCES MORE JOB CUTS

A LAWSUIT by AIGs former chiefexecutive Hank Greenberg allegingthe Federal Reserve Bank of New

York broke the law during the

2008 government bailout of thefailing insurance company wasyesterday dismissed.

Starr International, once a largeshareholder in AIG, argued the USacted unconstitutionally when ittook 80 per cent of AIGs equity.

But the US District court ruledthe New York Fed did not havecontrol or f iduciary responsibility

just because AIG felt it had nochoice in taking the bailout.

Judge throwsout AIG lawsuit

BY CITY A.M. REPORTER

TUESDAY 20 NOVEMBER 20125NEWS

cityam.com

THE BRITISH public would like to seethe government invest in or facilitatemore house building to boost the flag-ging economy, according to a poll outyesterday.

However, a survey suggests thatthere is less support for building newairports and runways or for beefingup the countrys rail infrastructure.

Four in ten people believe that gov-ernment support for building morehomes is the best way for the state toboost the economy through infra-structure projects, according to a pollof 1,442 people by Ipsos Mori.Two in ten see improve-

ments to roads as the bestoption, while 14 per centthink work on existing rail

infrastructure would be themost effective way tokickstart growth inthis manner.

In contrast, fiveper cent choseexpanding air

Brits want morehousing but nothigh speed rail

BY MARION DAKERS capacity as their preferred project,while four per cent want a new highspeed rail line the most.The High Speed 2 Action Alliance,

which lobbies against HS2 and com-missioned the research, said the pollshowed public opinion lags behind thecoalitions ambitious plans.The lack of enthusiasm for aviation

expansion has not deterred air chiefsfrom banging the drum for morecapacity, however.

Ryanair boss Michael OLeary toldthe transport select committee yester-day that the UK needs at least three[new runways]: one at Heathrow, oneat Gatwick, one at Stansted, as fast aspossible. However, he mocked theidea of a new hub in the ThamesEstuary as insane, stupid, hare-brained, stopping himself of going

much further as in parliamentarylanguage it would beunprintable.

Terra Firma to spend3.2bn on real estateDEALMAKER Guy Hands buyoutgroup Terra Firma has agreed to

buy Annington Homes fromNomura in a deal worth 3.2bn.Hands, best known for the

high profile loss of music groupEMI to Citigroup after theprivate equity investor defaultedon its loans, was behindNomuras purchase ofAnnington in 1996 when heworked at the Japanese bank.

He has managed theinvestment on behalf of Nomura

BY JENNY FORSYTH for the last 15 years, 10 of thosewhile at Terra Firma.

(Annington) is a pure play UKresidential property company with

a blue chip tenant on a lease ofover 180 years and with the abilityto benefit from the strength of theproperty market, Hands,chairman and chief investmentofficer of Terra Firma, said in astatement.

Annington Homes became one ofthe largest private owners of UKresidential property when itbought the Married Quarters Estatefrom the Ministry of Defence.

Transport secretaryPatrick McLoughlin isbeing kept busy

The publics view on infrastructureInfrastructure Project % who think this is best option

Build more homes 40%

Improve existing road infrastructure 20%

Improve existing rail infrastructure 14%

Improve and extend high speed broadband 8%

Increase airport capacity 5%

Build a new high speed rail line 4%

None of these 5%

Dont know 3%

-

7/30/2019 Cityam 2012-11-20.pdf

6/35

-

7/30/2019 Cityam 2012-11-20.pdf

7/35

-

7/30/2019 Cityam 2012-11-20.pdf

8/35

HSBC yesterday revealed it was intalks to sell its 16 per cent stake inChinas second largest insurer PingAn in a move that would bolster thebanks capital balance sheet.

The firm said in a joint statementto the London and Hong Kong stockmarket it was in discussions withbuyers over a sale.

It followed media reports in theHong Kong Economic Journal thatthe stake was being pursued by CPGroup, a conglomerate owned byThailands richest man DhaninChearavanont.A HSBC spokesman told City A.M.

the bank could not reveal if advisershad been appointed to work on adeal but said valuation was criticalto any sale. He added there was nourgent need to sell the firm.

HSBC took a stake in Ping An in2002 and boosted its holding to 19.9per cent in 2005, investing roughly$1.7bn in the firm, before beingdiluted down to a 15.6 per cent.

Ping An is Chinas second biggestinsurer behind Pacific InsuranceCompany of China Group. Its sharesplummeted close to a two-month lowyesterday, closing down 1.9 per centat HK$58.50, after falling as low as

$57.50.

HSBC in talks to

sell $9bn Chinainsurance stake

BY MICHAEL BOWIan Gordon, a banking analyst at

Investec, said a sale would be positiveas there was a lack of strategic fitbetween Ping An and HSBC. He saidthe current stake may be sold for asmuch as $9.3bn.

He added the likely balance sheetgain on a sale, pegged at $2bn to$3bn, could be given back to share-holders or used to increase its 19.9per cent stake in another Chinesebusiness, Bank of Communications.

A sale would be in line with HSBCsgroup strategy review announced inMay 2011, which sought to achieve$3.5bn of savings by 2014 to stream-line the bank.

HSBCs current core tier 1 capitalratio of 9.6 per cent would be bol-stered by a sale as it seeks to hit its tar-get of 10.5 per cent. Shares closed up2.83 per cent yesterday.

BOTTOMLINE

MARC SIDWELL

HSBC Holdings plc

19 Nov13 Nov 14 Nov 15 Nov 16 Nov

600

595

605

610

615

p

618.3019 Nov

DUTCH banking and insurancegroup ING has won more timefrom regulators to shed assets andrepay government aid, avoiding afire sale but keeping it under statesupervision for longer and delayingdividend payments.

The EUs competition watchdogagreed yesterday that ING, whichreceived 10bn (8bn) of state aid inthe 2008 financial crisis, would

have until 2015 to repay theremaining 3bn, plus a premium of

ING wins more time from the EUto sell assets and repay state aid

BY CITY A.M. REPORTER50 per cent.

It also gave the bank until 2018to sell or list its insurance andinvestment management arms,though parts of these assets must

be sold earlier. The regulatororiginally ruled ING should divestthe businesses and repay statefunds by the end of 2013.

ING said it will face restrictions,such as limiting its ability to makeacquisitions, until 2015 or untilover 50 per cent of its insurance

and investment managementoperations are divested.

TUESDAY 20 NOVEMBER 20128 NEWS

cityam.com

8 aspiring traders tackle the markets under

the mentorship of 2 City Index experts

to win a grand prize of 100,000

Think You Can Do Better? Open an account today

Ashraf Laidi

City Index Chief Global Strategist

James Chen

City Index Chief Technical Strategist

cityindex.co.uk/trading-academy

Spread bets, CFDs & FX are leveraged products & can result in

losses exceeding your initial deposit

#TradingAcademy

Ocado delivers on its debts but profits arent in the bagB

EFORE anyone gets too excitedabout Ocados share pricerising by more than a fifthyesterday, the troubled online

grocer is still trading at less thanhalf its original float price of 180p,which was itself at the bottom ofthe hoped-for range back in 2010.

Yesterdays raising of 35.8mstaved off Ocados most immediateproblems, after it had been forcedto deny speculation at the weekendthat it was close to breaching itsdebt covenants. The arrangementsannounced yesterday morningexplained its confidence, with thebanks agreeing to extend itsborrowing facility for another yearand a half.

But the placing of 55.87m newshares was achieved by turning toinvestors who had alreadycommitted themselves to Ocado. Itwas about doubling down, ratherthan being the sign of widerconfidence the firm really needs.

That reflects a general problemfor Ocado. The company hit an all-

time high of 140,000 orders in oneweek this November, but it stillremains to be seen whether it canscale its way to significant profit.

The debt extension should give ittime to open its 400,000 square footdistribution centre in Dordon,Warwickshire in 2013, which can

serve 200,000 more weekly orders.That would make quite a differencein revenue, if the orders come in,but only if the costs to reach newcustomers dont mount up too fast.

Ocado committed itself to aradically different business modelfor online delivery, operating solelyfrom distribution centres to cut outthe cost of public stores. It also tooka slow and steady approach, rather

than trying to build out as fast aspossible in the manner of thenotorious US dot-com flop Webvan.Both of these were supposed to holdcosts down, but while steering awayfrom one set of dangers, Ocado hasveered dangerously close to theopposite verge. Slow and steady

growth to a fixed plan only works ifthe world of grocery stands stillaround you. Today the onlinedelivery space is increasingly hard-fought, and its competitors aregrowing faster. Meanwhile chainslike Tesco are evolving click andcollect models that storeless Ocadocannot compete with. Buying sometime is a start, but Ocado still has alot to deliver.

CHINESE DIETHSBCs talks over selling its 15.6 percent stake in Chinese insurer PingAn fit with a year in which it hasshed 40 assets. It is on a post-crisisdiet, but this move is not a signal ofswearing off Chinese growth.

HSBC is boosting its capital its

stake in the insurer is worth anestimated 5.6bn and focusing itsattention in the middle kingdom.At the start of the year, StuartGulliver said he wanted to eithergrow HSBCs 20 per cent stake inChinas Bank of Communications,or increase HSBCs Chinese branchnetwork. Whichever regulatoryhurdle proves lower will determinewhat HSBC sheds next.

-

7/30/2019 Cityam 2012-11-20.pdf

9/35

-

7/30/2019 Cityam 2012-11-20.pdf

10/35

UK businesses use of syndicatedloans has plunged to the lowest lev-els since 2009, as more and morefirms use corporate bond markets toaccess financing, figures out yester-day show.

Syndicated loan volumes for UKcorporate borrowers, which meas-ures money lent by a group oflenders to one borrower, now standsat $45.3bn (28.5bn) for the currentyear a 59 per cent drop versus thesame period last year and its lowestlevel since 2009.The drought in syndicated loans

has been replaced by the use of cor-porate bonds, with volumes standingat a record $86.9bn for the currentyear, up 67 per cent compared to thesame 2011 period.The figures, published by Dealogic,

shows the refinancing of syndicatedloans comprises a large part of the

Firms shunningsyndicated loanoffer for bonds

BY MICHAEL BOW volumes, some 69 per cent.This is the largest percentage since

1994.Loan Market Association director

Nick Voisey told City A.M.: Given thelack of corporate M&A activity andgeneral level of uncertainty in theglobal economy its not surprising, asone of the main uses of syndicatedloans is the financing of corporateacquisitions.

However, the fundamentalstrengths of the product remain, forexample its flexibility in providingworking capital facilities for corpo-rates.The data reveals that despite the

drop in volumes there were still largedeals on the table, with BG Energyand Tullow Oil signing up to loanfacilities that both surpassed the$3bn mark.

Lloyds Banking Group was the dom-inant bookrunner for corporate loanswith a ten per cent market share.

CITY investors take a dim view ofthe value of megamergers and

blame investment bankers forweakening the IPO market withunrealistic valuations, a new survey

out today claims.A poll of fund managers from200 major City investment housesfound 72 per cent believedmegamergers such as that ofGlencore and Xstrata offer little orno value to shareholders.

Some 70 per cent of the group,with collective assets undermanagement of over $10 trillion(6.3 trillion), also said investment

bankers unrealistic valuations had

Fund managers complain thatmegamergers have little value

BY JENNY FORSYTH played a role in the lacklustre IPOmarket. And according the survey

by Capital Spreads, over a third (36per cent) went further, saying

valuations had been a major causeof the IPO markets poorperformance.

Despite their generally bearishstance, three quarters thoughtDirect Lines IPO would prove to bea success, while a fifth believed it

would be a major success.Angus Campbell of Capital

Spreads, said: London simplyhasnt been seeing the sort ofactivity it once did in the ninetiesand early noughties whencorporate takeovers and mergers

were a regular occurrence.

Lloyds Banking Group has taken a90 per cent loss on 1.47bn oftroubled Irish real estate loansafter selling them to US firmApollo Global Management.

The sale for 149m will not havea material impact because thevalue of the loans had been largelywritten down previously, Lloydssaid yesterday.

The end of a property marketbubble in Ireland saw commercialreal estates prices fall by twothirds. Lloyds has provided forlosses of 66.8 per cent on its Irishwholesale loans book, its first halfresults showed.

Lloyds offloadsIrish loan book

BY CITY A.M. REPORTER

TUESDAY 20 NOVEMBER 201210 NEWS

cityam.com

VOLUME OF INVESTMENT GRADE SYNDICATED LOANS PLUMMETS

INVESTMENT GRADE

SYNDICATED LOANS

on last yearlowest since 2009

$45.3bn

59%

REFINANCING

$31bn

of totalloan volume69%

INVESTMENT GRADECOPORATE DEBT

Record

$86.9bn

4% on last yearon lastyear67%

UK CORPORATE IG FIXED INCOME VOLUME (1 Jan - 16 Nov)

$ bn180 80%

70 %

60 %

50%

40%

30%

20%

10%

0 %

160

140

120

100

80

60

40

20

0

2008 2009 20122010 2011

LOAN DCM DCM AS A % OF TOTAL

Financial services group City ofLondon yesterday said a 169 percent rise in half year revenues hadlifted its profits by a quarter.The firm, which recently raised1.3m through a share placing,lends to small businesses and saidthe pullback of traditional banklending had been a boon for thefirm. Chief executive Eric Ansteesaid the firm now had a platformfor its ongoing development into a

traditional merchant bankmodel.

City of Londonrevenues jump

BY MICHAEL BOW

NB Private Equity, the Dutch privateequity fund listed in London,yesterday said its net asset value hadincreased 3.6 per cent in the lastnine months.The increase was led by realisedgains of $21.8m (17.6m) from salesof private equity holdings in itsportfolio. The firm also revised up itsunaudited NAV figure published forOctober by 0.5 per cent, increasingfrom $11.35 to $11.41.

This represents a 0.2 per cent declinein value versus the previous month.

Gains for NBPrivate Equity

BY CITY A.M. REPORTER

-

7/30/2019 Cityam 2012-11-20.pdf

11/35

BELEAGUERED accountancy firm RSMTenon yesterday warned its mostrecent turnover figures had disap-pointed management expectations,but the firm was still making impres-sive profits.The company, which announced it is

cutting 400 staff to trim costs andturn around the business, said in itsinterim management statement yes-terday that revenues in the first quar-ter were at the lower end ofmanagement expectation.

However, due to cost cutting thefirm said it had managed to improve

profits compared to last year.RSM Tenon, listed on the FTSE 250,

also said the heightened supervisionits financial management divisionreceived from the Financial ServicesAuthority after a 700,000 fine inFebruary, for failings in advice andsales processes. was at an end. Thefirm described its current relationshipwith regulators as business as usual.

The firms first quarter, runningfrom July until the end of September,is traditionally its weakest period, and

RSM Tenon sayswatchdog has

stepped backBY MICHAEL BOW analysts said it was unlikely RSM

turned a profit in the period. RSMTenon announced a restructure of thebusiness in February on the back of acontinued losses of 8.9m for the fullyear ending June 2012.

We continue to make progress inrestoring RSM Tenon to profitability,chief executive Chris Merry said.With new banking facilities in place,we look forward to the future withconfidence.The bank entered into new arrange-

ments with its lenders to extend thematurity facility to December 2014.The firm is aiming for an earningsmargin of 10 to 15 per cent.

RSM Tenon Group PLC

19 Nov13 Nov 14 Nov 15 Nov 16 Nov

7.00

6.75

7.25

p

6.5019 Nov

ACCOUNTANTS in the UK areexpecting their bonus pots to fallthis year according to researchreleased yesterday, after profits perpartner at the big four firms fell byup to five per cent.

Both bonuses and overallremuneration are expected to fall

by around two percent, mirroringthe decline of the past twofinancial years, said accountancyand finance recruiter Marks Sattin.

Most accountants are expecting

BY ELIZABETH FOURNIER to receive bonuses at around 15 percent of their total remunerationfor 2012-13 an average of 9,087per person. Added to the averagesalary of 59,900, totalremuneration is projected to be68,987 a two per cent fall fromlast years figure of 70,300.

Previous years dip in bonuslevels and the mixed fortunes ofthe big four have clearly influencedthe perception of upcoming

bonuses among accountingprofessionals, said Dave Way,managing director at Marks Sattin.

11NEWScityam.com

Business in the capital? Try our newly opened and beautifully designed hotel just a few minutes

from the City or the West End, and packed with state-of-the-art facilities including a Microsoft Surface

table, iPad table and total connectivity. Why not pop in for after-work drinks and see for yourself:

SCAN FOR VOUCHERS

Novotel London Blackfriars,

46 Blackfriars Road, London SE1 8NZ

WELCOME TO NEW EXPERIENCES.WELCOME TO NOVOTEL LONDON BLACKFRIARS.Experience a brand new hotel on Londons business landscape.

Novotel.com | Accorhotels.com

Accountants expect bonuses tofall after mixed financial results

-

7/30/2019 Cityam 2012-11-20.pdf

12/35

FINANCE ministers from Eurozone

states are expected to finally reachan agreement over the next trancheof bailout cash to Greece today,despite recent disagreementsbetween international lenders.

The Eurogroup of finance chiefswill meet in Brussels for its latestattempt to wave through a deal.Yet the payment of an estimated44bn (35bn) in emergency loans toGreece is likely to be conditional onGreek politicians demonstrating thegovernment is fully committed toagreed reforms called prior actions.

Greece yesterday approved laws toenforce budget targets and ensureprivatisation proceeds are used topay off debt, as it seeks to appease itsbailout providers.

The government used decrees toforce through the measures, butfaced protests from governmentworkers, many of whom could lose

their jobs due to the reforms.The Greek coalition government

Tentative dealover Greek aidexpected today

BY JULIAN HARRIS appears to have done enough, howev-er, to convince the Eurogroup to passa political endorsement in princi-

ple over releasing new funds,sources told Reuters.Following any agreement, the pro-

posals along with a plan for howGreek debt could be made sustain-able will be sent to national govern-ments for approval, with Brusselshoping the measures could be passedby the end of the month.

If all conditions are met and agreedby 3 December, the Eurogroup willmeet in Athens and sign off the fundsto be transferred that week.Yet the process still faces stumbling

blocks, according to researchers atDaiwa Capital Markets. WithGermany continuing to resist a sec-ond restructuring of Greeces remain-ing outstanding debt, anyagreement... is likely to result in onlycosmetic changes to the countrysdebt burden, with an inevitable sec-ond restructuring possibly postponed

only until after the German electionsnext year, Daiwa said in a note.

Bullish Cameron confident ofwinning battle over EU budgetBRITAIN believes a deal can be

reached on the European Unionbudget at crunch talks in Brusselsthis week, a spokeswoman forDavid Cameron said yesterday.

The optimistic tone came asCameron insisted that he is a goodEuropean for attempting to drivedown the EUs budget rise.

I think I have the people ofEurope on my side in arguing thatwe should stop picking theirpockets and spending more and

BY CITY A.M. REPORTER more money through the EUbudget, the PM said.

Meanwhile the spokeswoman

gave no reason for the change intone, but said Cameron had inrecent days spoken to leaders inPoland, Sweden, Denmark, France,Germany and the Netherlands, andwould be calling other EU leaders inthe coming days.

All but one of those countries Poland contacted so far are netcontributors to the EU budget, andmore likely to be sympathetic to UKdemands for a real terms freeze in

EU spending. The PM believes wecan work through these details toget the right deal at this weeks

summit, she said.The think tank Open Europe lastnight talked up the UKs position.

The EU could not circumventthe UKs veto, it said. It couldmove to roll over the 2013 spendingceilings adjusted to inflation withup to 55 individual spending itemsdecided by Qualified MajorityVoting. This would be extremelymessy and the UKs veto remainspowerful.

The Eurogroup, led by Jean-Claude Juncker, will try again to reach agreement today

BAD loans at Spains banksstruck a new high in September,it was revealed yesterday, as a

wave of negative data releasespoured more misery on the

troubled euro area.Figures from the Bank of Spainshowed banks bad loansstanding at 10.7 per cent of theiroutstanding portfolios inSeptember the highest level onrecord and up from 10.5 per centa month earlier.

And in nearby Italy anotherlarge Eurozone state underpressure from a debt crisis

Bad loans at Spanish lendershit a record high in September

BY JULIAN HARRISindustrial new orders collapsed

by a seasonally adjusted four percent.

Across the 17-country euroarea as a whole, meanwhile,production in the constructionsector sank by 1.4 per cent in

September compared to theprevious month reflecting therecession that the bloc has falleninto this year.

Compared with a year earlier,production in the building sector

was down 2.6 per cent in theEurozone in September.

Yet markets shrugged off thedata, rising on hopes for a deal toavoid a fiscal cliff in the US.

TUESDAY 20 NOVEMBER 201212 NEWS

cityam.com

-

7/30/2019 Cityam 2012-11-20.pdf

13/35

REVENUE at outsourcing firm Mitiejumped 5.6 per cent over the sixmonths to September, as it hailedrecent contract wins for the boost.Turnover jumped to 1.03bn as the

FTSE 250-listed company was flatteredby several large contract wins, includ-ing a 775m deal with Lloyds BankingGroup, thought to be its largest-evercontract.Total revenue growth is expected to

accelerate in the second half of theyear, Mitie said yesterday, largelythanks to new contracts and theacquisition of home care companyEnara in October. New contracts forthe firm, which runs services frommaintenance and cleaning to baggagescreening, include a 100m five-yearcontract with BSkyB and a contractworth between 70-120m withGolding Homes over 10 years.

Following on from the acquisition ofEnara, the outsourcing firm addedthat the 8bn home care market hadexcellent organic growth opportuni-ties and was a good entry point into

Mitie revenue

boosted by keycontract winsBY CATHY ADAMS the wider healthcare market.

Mities order book stood at 9bn atthe end of September, up 4.7 per centfrom the 8.6bn in March.

Chief executive Ruby McGregor-Smith yesterday welcomed the resultsin a tough economic climate and adifficult macroeconomic climate,adding that there is a strong pipelineof sales opportunities.

We remain positive about the rangeof outsourcing and energy servicesopportunities across our key markets,she said.

Pre-tax profit rose 1.9 per cent to48.8m, excluding exceptional costs.

Peter Whitbread returned as Lamprell chief executive last month

MITIE Group PLC

19 Nov13 Nov 14 Nov 15 Nov 16 Nov

290

280

270

300

p 280.0019 Nov

TUESDAY 20 NOVEMBER 201213NEWS

cityam.com

Oh Dorothy, hold me as

tight as a Capital Spread.

Take a better position

capitalspreads.com Spread Betting | CFDs

Capital Spreads is a trading name of London Capital Group Ltd (LCG), which is authorised and regulated by theFinancial Services Authority and a member of the London Stock Exchange.

Spread betting carries a high level of risk to your capital and can resultin losses that exceed your initial deposit.

The tightness of our spreads is legendary.

UK100 | WALL ST | DAX | NASDAQ | S&P | CAC | GOLD | BRENT CRUDE | COPPER | EUR:USD | GBP:USD | USD:JPY | EUR:GBP | APPLE | RBS | VODAFONE | GOOGLE

RIG maker Lamprell yesterdaywarned that its losses for the fullyear would increase significantly,six weeks after axing three

executives following its fourthprofit warning of the year.The company now anticipates a

total loss of $105m (66m) for theyear as a result of delays toprojects, up from previousprojections of between $12 and$17m.

Middle-East based Lamprell saidthat it was in talks with its banksto seek a waiver to certain bankingcovenants.

Lamprell increases loss forecastfollowing review of business

BY CATHY ADAMS The forecast losses follow areview of the business, whichassessed how the delays to projects

would impact Lamprells financialposition.

The rig maker last month axed

three senior executives, includingchief executive Nigel McCue, afterchairman John Kennedy warnedthat he would consider changingthe management team to shore upits reputation. Last week the FTSE250-listed company appointedFrank Nelson as interim financechief with immediate effect.

Despite the bleak outlook,shares soared in trading yesterdayto close up 17.33 per cent.

These are solid first-half results from Mitie with profits up two per cent.While challenges remain in its main markets the group has increased its orderbook, providing high revenue visibility, and management expect furtherprogress to be made. We maintain our neutral stance.

ANALYST VIEWS

Half-year results came a touch lower than our expectations, reflectingweakness in the property and asset management divisions. The outlook state-ment reads well with management anticipating higher growth in thesecond half reflecting new contract awards and the impact of acquisition.

Mitie has decided to reduce its exposure to large, one-off mechanical

and electrical installation projects over the next two to three years. First half pre-

tax profit was only up two per cent, and while we anticipate a better sec-ond half, we continue to see better value elsewhere in the sector.

WHAT ARE YOURTHOUGHTS ON MITIES

HALF-YEAR RESULTS?Interviews by Cathy AdamsANDY BROWN PANMURE GORDON

CAROLINE DE LA SOUJEOLE SEYMOUR PIERCE

CHRISTOPHER BAMBERRY PEEL HUNT

-

7/30/2019 Cityam 2012-11-20.pdf

14/35

90

-

7/30/2019 Cityam 2012-11-20.pdf

15/35

DIY SAVINGS

OPPORTUNITY SAVINGS

All poor countries have acommercial banking sector.However, poor people areoten excluded or 2 reasons

Opportunity ismaking financialservices accessibleor poor people

RESULT: DEAD END

RESULT:LIFE SAVINGS ARE

OFTEN LOST OR STOLEN,

MAKING AN ESCAPE

FROM POVERTY EVEN

LESS LIKELY.

RESULT:OUR CLIENTS SAVINGS ARE SECURELY SAVED AND EASILYACCESSIBLE. OUR CLIENTS BUSINESSES, FAMILIES ANDCOMMUNITIES BENEFIT AS A RESULT.

Rejected by the banks, you do it yoursel

COMMERCIAL BANKS

SOCIALMainstream banks ocus on servingwealthy people not poor people.The types o financial products theyofer and the literacy/documentary

requirements they impose put themout o the reach o most poor people

GEOGRAPHIC ACCESSIncreasingly, where you live nolonger matters. We are taking

banking to the people using anetwork o branches, banks onwheels, and mobile phone banking.

SOCIAL ACCESSOur financial productsare designed with poorpeople in mind.Innovations like ATMswith fingerprint

recognition make it easyor illiterate clients tomanage their money.

GEOGRAPHICThe banks (concentrated in the cities)are ar rom where most poor peoplelive (in rural areas)

HOLE IN THEGROUND SAVINGSStore your savings in theground and hope no oneor nothing destroys them

UNDER THEMATTRESS SAVINGSStore your savings under yourmattress and hope no onefinds them

CATTLE SAVINGSTurn your cash savings intocattle and hope that they dontall ill or get stolen

OUR AIM IS TO OPEN

NEW SAVINGS ACCOUNTS

In Ghana, Uganda, Rwanda

Malawi and Mozambique(The 5 countries we aresupporting with appeal unds)

With an average balance o

in each newsavings account

Over 15m that would

otherwise be at risk o thet,decay or disease will insteadbe sae and earning interest

45335,000

HOW TO

GIVE

TUESDAY 20 NOVEMBER 201215

cityam.com

OUR Christmas Appeal in support ofOpportunity International has got offto a flying start this year. Since theappeal was launched just last week,

212,568 has already been raised.Such a healthy start to the 2012 campaign

puts us in a good position to match or evensurpass last years appeal total of 1.58m,which was a truly stunning figure.

The launch of the appeal in last WednesdaysCity A.M.was followed by a sumptuous dinnerin the evening at St Pauls Cathedral. Theevent was attended by many City figures,

including Stagecoach Group founder AnnGloag, Big Society Capitals Nick ODonohoe,Citigroups Kristine Braden and former LloydsBanking Group director Truett Tate, who hasjust joined the board of Virgin Group.

Opportunity International helps people setup their own businesses in developing coun-tries by providing loans, savings facilities andfinancial education. In the coming weeks, wewill be providing a guide to how the charityoperates and explaining the difference thecharitys intervention can make to peopleslives.

Every pound donated by City A.M. will bematched pound for pound by UK Aid from theUK Government, which is backing our cam-paign.

Smart savings for the poorEveryone has savings, even the poorest people. So, how do they keep their savings safe?

Proudlysponsoredby

Matching yourdonations with

Text donations may not work from company mobilephones as these often block premium messages.

If donations exceed our programme needs in Africa,they will be deployed elsewhere.

online at: www.cityam.com/appeal

TWEET #cityamappeal

by text: CITY13 and amount(5 or 10 only) to 70070

credit or debit card by phone to:Opportunity International

(01865 725 304)with details of why youve donated. Thesecomments may be printed in future editionsof City A.M.

CITYA.M. CHRISTMAS APPEAL2012

-

7/30/2019 Cityam 2012-11-20.pdf

16/35

missing the point.It is a myth that judicial

review is stopping thegovernment from proceeding

with policies to help boost theeconomy, he said.He pointed out that the

number of judicial reviewcases had actually gonedown since 2006, if casesonly related to asylumand immigration wereexcluded.

But British PolicyFoundation welcomedthe governments

THE GOVERNMENT must avoid anexit vote in any EU referendum, theUKs most prominent business lobbysaid yesterday, in order to preservetrade links with its old friends onthe continent.

Whilst we look for new partners,we must not forget old friends, saidSir Roger Carr, president of theConfederation of British Industry, inhis speech to the industry groupsannual conference yesterday morn-ing.

Europe, however challenged,remains home for half our exportsitis the bedrock of our internationaltrade. It should be viewed as thelaunch-pad from which our globaltrade can expand not the landmassfrom which we retreat.

His pro-EU line was firmly embracedby Ed Miliband, leader of the opposi-tion, who said that leaving the supra-national body would leave the UKwithout a seat at the negotiatingtable. I will not let Britain sleepwalktoward exit from the EuropeanUnion, he promised.

But the Labour leader said that he

CBIs Carr says

Britain shouldstay within EU

BY BEN SOUTHWOOD understood sceptics issues with thebloc, and slammed it for its attemptsto increase its budget despite difficultausterity across member countries.As well as keeping the UK firmly part

of the EU, Sir Roger also called on thegovernment to pursue a vigorousindustry policy, to radically reformschools to give students a more robustand well-rounded education, and tocontinue travelling around the worldto extol the virtues of UK Plc.This came in a speech where Sir

Roger made a forceful case for the roleof business in society. We must stopsaying all energy companies rip youoff when they dont all bankers aredespicable, when they are not or bigbusiness is bad business, when it isnt,he said.

Carr said that business has to salvageits stature by demonstrating it isfocused not just on how much moneywe make but how we make money.

But he slated businesses and figuresthat had dragged its reputationthrough the mud, giving commenta-tors a free hand to tar all with thesame brush and to poison the mindsof many as to the value of business insociety.

Sir Roger Carr said isolated wrongdoers should not tar the reputations of all UK businesses L A U R A L E A N / C I T Y A M

TUESDAY 20 NOVEMBER 201216 NEWS

cityam.com

Lawyers and business at oddsover Camerons appeals plansLAWYERS said David Cameronsplans to cut down on judicial

reviews, announced in a speechyesterday, were a red herringwhen it came to promotingeconomic growth, but businessgroups responded warmly to theproposals.

The Prime Minister hadpromised to cut back judicialreviews, saying many werecompletely pointless butAdam Chapman at KingsleyNapley said Cameron was

BY BEN SOUTHWOODproposals to cut back on theprocess, saying it could boost the

economy. Planning casesmake up a very small number

of total judicial review cases,but by speeding up the processit would deliver

significant benefits interms of enablingeconomic activity totake place morequickly, said chiefexecutive Liz Peace.

FAST GROWTH in developingcountries represents anopportunity as well as a challenge,claimed Dr. Vince Cable yesterday.

Global growth is undeniablygood news, he told theConfederation of BritishIndustrys annual conference. Weshould welcome the fact that vastswathes of humanity...are nowclawing their way out of poverty they will expand the markets into

which we sell.

We dont live in a zero sumworld.

Cable says trade with emergingmarkets is not a zero sum game

BY BEN SOUTHWOOD But Cable went on to warn thatthese growing economies alsopresented commercialcompetition for the UK andpointed out that other richeconomies were also relying on theBrazilian, Russian, Indian andChinese markets.

This came in a speech which thebusiness secretary used to focuson schemes the government werepromoting to boost science,technology and engineering.

He hailed the governmentsdecision to maintain funding for

these technical subjects even as itslashed funding for humanities.

David Cameron plans tolimit the number of appeals

-

7/30/2019 Cityam 2012-11-20.pdf

17/35

BACK to Banqueting House inWhitehall again this year for the11th Walpole Awards for Excellence.Anthony Head was master of cere-

monies for the luxury bodys annualgathering. The actor, of Gold Blendcoffee advertisements andBuffy the Vampire Slayerfame, was perhaps a lesson brand choice of hostthan last years compre -Downtons dashing HughBonneville.

Nevertheless guests suchas Coutts boss MichaelMorley, Burberry cre-ative directorEmma Hill andhotel tycoonSir Rocco Fortesipped cham-pagne, swiftly

accepted their awards and then it wasoff to members club Annabels for thereal after party.

Excelling in their categories andtaking home Walpole trophies wereMulberry for British Luxury Brand,

Ferrari for International LuxuryBrand, Burberry for Online BritishLuxury Brand, Jaguar for BritishLuxury Brand Overseas and jew-eller Theo Fennell for LuxuryCraftmanship. After acceptinghis award Fennell revealed: I

was absolutely thrilled as this isthe first award Ive won

since I was 13 when Iwon a prize for throw-

ing a cricket ball andeven then I had cheat-ed to get it."

LAURALEAN/CITYAM

Left to right: Michael Morley, chief executive of Coutts; Emma Hill, creative director ofMulberry; and Sir Rocco Forte, chairman and cheif executive of Rocco Forte Hotels

Theo Fennell, founderof the jewellery brand

17cityam.comTUESDAY 20 NOVEMBER 2012

cityam.com/the-capitalistTHECAPITALIST EDITED BY CALLY SQUIRESGot A Story? Email

BARELY a function goes bywithout Mayor Boris Johnson

popping up in some form oranother to dispatch a crowd-pleas-ing speech in faux bumbling fash-

ion and yesterdaysConfederation of BritishIndustrys (CBI) annual conference

was no exception.However the Mayors popularity

appears to be rightly placed. Therearent many people who could filla ballroom the size of theGrosvenors in a post (long) lunchslot.Johnson was talking up British

enterprise: We need to abandonthe rhetoric of austerity. Butcouldnt resist a self-deprecatingplug of his Olympic success: Theonly piece of transport to malfunc-

tion was a zip-wire.Security measures at the hotelentrance were particularly strin-gent The Capitalist can not recallany airports in which such a thor-ough frisking was deployed. Notonce, but twice! General cautious-ness or all thanks to Johnsonsnewfound celebrity status?

Mayor of London Boris Johnson

Beazley 2013calendar boystrikes a poseAs a Team GB Olympic fencer,Husayn Rosowsky is no doubtused to having his photo taken

by the press. However TheCapitalistlearns that theOlympic sportsman has foundhimself cast as the new star ofan unlikely publication. Beazley,British Fencings sponsor andspecialist Lloyds insurer, wasshooting in the City last weekfor its 2013 company calendar.

And who better to snap by theGherkin, casually perusing acopy ofCity A.M, than sportingman Rosowsky?

Olympic GB fencer Husayn Rosowsky

Lots of luxuryin Whitehall forWalpole bash

-

7/30/2019 Cityam 2012-11-20.pdf

18/35

-

7/30/2019 Cityam 2012-11-20.pdf

19/35

TUESDAY 20 NOVEMBER 201219NEWS

cityam.com

Our revolutionary Follicular

Unit Extraction (FUE) hair

transplant is minimally invasive,

with no scalpels, stitches or

scarring, just maximum results.

Many men recapture their

confidence and never look

back. We are the leading UK

specialists in FUE, with a highly

experienced medical team

achieving natural looking,

permanent results.

Clinics nationwide

0800 599 9925

theprivateclinic.co.uk

Because itsyour body

of Harley Street

The mosttechnicallyadvanced hairloss treatment

a man can get

Before After

Shahid, ourpatient, aftertreatment

LONDON is the seventh-best city inthe world for entrepreneurs to set upin, but is still some way off its coun-terparts in the US, research out todayclaims.A report from Telefonica Digital, in

tandem with US researchers at theStartup Genome, says that whileLondons startup scene is the largestand most prosperous in Europe, itstill pales in comparison to areassuch as Silicon Valley and Tel Aviv.

springing up in London is a pet proj-ect of the government, which isworking on easing listing rules forhigh-growth companies.

London mayor Boris Johnson saidthe report cements Londons posi-tion as the high tech start-up capitalof Europe.

London is worlds seventh-beststartup city but no Silicon Valley

BY JAMES TITCOMB The inaugural Startup EcosystemReport, which surveyed more than50,000 entrepreneurs across theworld, identifies the factors that con-tributed to Silicon Valleys success,and assesses those factors in dozens ofcities. The research gave Silicon Valleyan overall score of 0.95, which wasbased on factors such as diversity,funding and talent. This compared toLondons 0.57.

It found that while London hasmany similarities to Silicon Valley interms of the types of business models

they operate on, there is a significantfunding gap for companies trying toget off the ground, and that Londonsentrepreneurs are more risk-aversethan their US counterparts.The report also showed a burgeon-

ing startup ecosystem in developingcities such as Bangalore and Santiago.Ashley Stockwell, who runs the

London branch of Telefonica Digitalsstartup accelerator Wayra, told CityA.M. that Londons major problemwas the low level of investment atthe venture capital level.

Theres a bit of a chicken and eggsituation with how to improve that,but there is more and more successaround, he said, pointing to the likesof Wonga and Moshi Monsters creatorMind Candy, both of which are hotcandidates for flotations next year.The report said that Londons entre-

preneurs are on average better edu-cated and slightly older than those inCalifornia, and that they work anaverage of 9.78 hours a day almostas much as in Silicon Valley.The cluster of technology startups

Moscows entrepreneurs are the youngest in theworld with an average age of 27.9, while Londonsentrepreneurs are the oldest in Europe with an average of 35.98

London is the highestranked city in Europe,and comes seventh

in the world

Tel Avivis the only city

outside of the topsix not in the US

Singapore has thelongest hours,

with the averageentrepreneur working

11 hours a daySilicon Valley has left its imprint on allglobal startup ecosystems. Berlin (4%)and Sao Paulo (7%) have the leastfounders that lived in Silicon Valley,Singapore (33%) and Waterloo (35%)have the most entrepreneurs thatwere previously based in Silicon Valley

STARTUP COMPASS: WORLD'S TOP 20 CITIES FOR ENTREPRENEURS

Silicon Valley

Sao Paulo

Seattle

Boston

Sydney

Toronto

London

Paris

Melbourne

Waterloo

Los AngelesChicago

Vancouver

New York City

Tel Aviv

Singapore

Bangalore

Santiago

MoscowBerlin

TOP CITIES RANKED

Rank City Score

Silicon Valley 0.95

Tel Aviv 0.63

Los Angeles 0.61

Seattle 0.60

New York 0.59

Boston 0.58

London 0.57

Toronto 0.57

Vancouver 0.49

Chicago 0.48

1

2

3

4

5

6

7

8

9

10

Paris 0.48

Sydney 0.47

Sao Paulo 0.41

Moscow 0.38

Berlin 0.36

Waterloo 0.35

Singapore 0.33

Melbourne 0.31

Bangalore 0.29

Santiago 0.27

11

12

13

14

15

16

17

18

19

20

INTEL said yesterday thatchief executive Paul Otellini

will retire in May after 40years at the company, as thechipmaker copes with weakPC demand and an industryshift to mobile computing.

Intel said it would considerboth internal and externalcandidates for the positionand that the leadershiptransition will last sixmonths. Otellini is leaving

ahead of Intels mandatoryretiring age for its chief

Intel boss Otellini takes hisleave after 40-year stretch

BY HARRY BANKSexecutives. The firm, whoseprocessors are dominant inpersonal computers, has beenslow to expand into the fast-

growing mobile industry,where Apples iPads andiPhones and other popularmobile devices use competingtechnology from Cambridge-

based ARM Holdings.Ive been privileged to

lead one of the worldsgreatest companies, Otellinisaid.

Its time to move on and

transfer Intels helm to a newgeneration of leadership. Paul Otellini was made chief exec in 2005

IN BRIEFTexan bid for Balfour Beattyn Balfour Beatty yesterday said ithad been selected as the best valuebidder for a $798m (502m) for theDallas Horseshoe Project in Texas.The design-build joint ventureinvolves the upgrade andreplacement of several bridges inDallas, to shorten the constructionschedule and lower the cost.

Profit jumps at Diploman Technical products supplierDiploma reported full-year profit of17 per cent, boosted by its seals

business. Adjusted pre-tax profit overthe year to September came in at52.6m, up from 44.9m the yearbefore, while revenue increased to260.2m, up 13 per cent year on year.

Tube engineers to striken Engineers are set to down tools onFriday in the latest dispute overpensions, pay and benefits for Tubeworkers. Staff working for Tube Lineson the Northern, Jubilee andPiccadilly lines will walk out for 24hours from 6am on Friday, afterprevious industrial action failed to

prompt an agreement.

Citigroup settles Lehman claimn Citigroup has agreed to pay $360mto the brokerage estate of LehmanBrothers to resolve a dispute over $1bnin collateral that the investment bankwas forced to post in the days leadingup to its bankruptcy in 2008.

Hampson in administrationn Aero-engineer Hampson Industriesyesterday fell into administration.Hampson, which struggled with debtsand failed to find a buyer earlier thisyear, has appointed FTI Consulting asits administrators.

-

7/30/2019 Cityam 2012-11-20.pdf

20/35

THE CITYS fears over the prospect ofbeing hit by another crash have sub-sided, according to a Bank of Englandreport published yesterday.

UK banks, insurers and investmentfunds have bounced back to confi-dence levels last seen in the first halfof 2011, the survey said.

Only one in five respondents consid-er the probability of a high-impactevent occurring in the short term tobe high or very high down 16 per-centage points since the first half ofthis year.

Meanwhile over a third (34 per cent)of interviewed financial workers con-sider the chances of such a prospect tobe low.

Yet people remain wary of a so-called high-impact event hitting mar-kets in the medium term, with 41 percent saying there is still a high or veryhigh probability of such a scenario.And government debt levels are the

greatest concern. Sovereign risk isnow cited by a greater proportion ofrespondents than previously recorded

BY JULIAN HARRIS for any risk, the report said.Sovereign risk was mentioned by 94

per cent of respondents when askedwhich factors could have the greatestimpact on the UK financial system ifthey were to materialise.

Concern focused mainly on Europe(mentioned in 79 per cent of theresponses that indicated a particulararea of sovereign risk), while the USand the UK were cited in nine per centand 12 per cent of those responsesrespectively, the report said.

Of the 79 per cent of respondentsciting Europe, six out of ten highlight-ed concerns over a break up or col-lapse of the euro area.

Following sovereign risk and thethreat of an economic downturn, risksfrom government taxes and regula-tions jumped to an unwelcome thirdplace in the list of risks to the UKsfinancial system.And regulation and taxes also came

third in a list of the risks most chal-lenging to manage as a firm, beingcited by 24 per cent of respondents although this was down eight percent-age points from the previous survey.

Sir Mervyn Kings Bank of England conducts the risk perceptions survey twice a year

TUESDAY 20 NOVEMBER 201220 NEWS

cityam.com

Positive housing market figuresgive boost to US recovery hopesAMERICAS ailing housing marketcould be on the mend, according to

two positive surveys released acrossthe pond yesterday.US homebuilder sentiment rose

for a seventh consecutive month inNovember and hit its highest levelin over six years, according to onewidely-regarded survey.

The National Association ofHome Builders housing marketindex, conducted with Wells Fargo,rose to a score of 46 up from 41the previous month.

BY CITY A.M. REPORTER The index was at its highest levelsince May 2006.

And home resales unexpectedlyrose in October, a separate survey

revealed a sign that slowimprovements in the US labourmarket are helping the housingsector recovery gain traction.

The National Association ofRealtors (NAR) said yesterday thatexisting home sales climbed 2.1 percent last month to a seasonallyadjusted annual rate of 4.79m units.

NAR economist Lawrence Yunsaid superstorm Sandy, whichslammed into the east coast of the

US on 29 October, had only a slightimpact on home resales. The onlyregion where the pace of salesslipped was the north east.

But Yun said the storm couldtemporarily hold back the pace ofsales in November and December.

Our view is that housing is in arecovery phase, but one that willbe restrained by the availability ofcredit, the pace of improvement inlabor market conditions, and theoverhang from distressed andforeclosed properties, commentedMichael Gapen, an economist atBarclays Research.

THE OFFICE for National Statistics(ONS) has said it will not rule

before January on whether theUKs finances will be affected by achange to the handling of intereston the Bank of Englands 375bnof gilt holdings.

The change could affect whetherchancellor George Osborne meetspolitically sensitive deficitreduction targets. But an initialassessment of this in a half-yearly

budget update due on 5 Decemberwill be made by the governments

budget watchdog, without a finalruling from the statistics office.

BY CITY A.M. REPORTER Osborne recently announcedthat the Bank would return to theTreasury some 35bn of interestpaid on these gilts, bought as partof the Banks quantitative easingprogramme, and that futureinterest payments would also go tothe Treasury to pay down debt.

Some critics said the move willmake it easier for Osborne to meetdeficit reduction targets that he isin danger of missing. Yet it isunclear how the payments will beaccounted for in official statistics,and whether they will affect themeasures of public sector net

borrowing and public sector netdebt targeted by the government.

Financial fearsover another

crash subside

Statistics office to run rule overOsbornes QE plan in early 2013

-

7/30/2019 Cityam 2012-11-20.pdf

21/35

FORMER business minister andStandard Chartered chief LordMervyn Davies landed a new role aschairman of ChimeCommunications yesterday.

Lord Davies, who served asGordon Browns minister of state fortrade, investment and smallbusiness from January 2009 untilBrown left Downing Street in 2010,takes the role after Lord Bell steppeddown to run the Bell Pottingerbusiness Chime disposed of in May.

His appointment came as the PRand sports marketing group said itsgrowth had continued in the secondhalf of the year so far, and that itwas looking to make morepurchases following Octobers 7mdeal for pH Associates, apharmaceutical data provider.

There are a range of acquisitionopportunities we continue toreview, the company said, addingthat trading was up on the sameperiod last year, and in line withexpectations.

London-listed Chime owns manycompanies dotted around the world,and has outlined its plans to expandit fast-growing markets such asBrazil and China.

Lord Davies said yesterday: Thereare many internationalopportunities and we intend toseize them. Chime is a very