CITY OFBELTON BELTON, SOUTH CAROLINA...

Transcript of CITY OFBELTON BELTON, SOUTH CAROLINA...

CITY OF BELTONBELTON, SOUTH CAROLINA

ANNUAL FINANCIAL STATEMENTSAND

INDEPENDENT AUDITOR'S REPORT

FOR THE FISCAL YEAR ENDEDJUNE 30, 2012

Argo and Associates, LLPAnderson, South Carolina

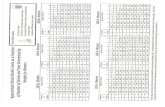

CITY OF BELTON, SOUTH CAROLINATABLE OF CONTENTS

JUNE 30, 2012

Exhibit!Schedule Page

Independent Auditor's Report 1-2

Management's Discussion and Analysis 3-9

Basic Financial Statements:Government-wide Financial Statements:Statement of Net Assets A 10Statement of Activities B 11

Fund Financial Statements:Balance Sheet - Governmental Funds C 12Statement of Revenues, Expenditures, and Changesin Fund Balances - Governmental Funds D 13

Reconciliation of the Statement of Revenues, Expenditures, andChanges in Fund Balances of Governmental Funds to theStatement of Activities E 14

Statement of Net Assets - Proprietary Funds F 15Statement of Revenues, Expenses, and Changes in Fund Net Assets-Proprietary Funds G 16Statement of Cash Flows - Proprietary Funds H 17Statement of Fiduciary Net Assets - Fiduciary Fund I 18

Notes to the Financial Statements 19-31

Required Supplemental Information:Budgetary Comparison Schedule - General Fund 1 32Budgetary Comparison Schedule - Hospitality Fund 2 33Notes to Required Supplemental Information 34

Supplemental Information:Combining Balance Sheet - Nonmajor Governmental Funds -Special Revenue Funds 3 35

Combining Schedule of Revenues, Expenditures, andChanges in Fund Balances - Nonmajor Governmental Funds-Special Revenue Funds 4 36

Schedule of Municipal Court Fines, Assessments, and Surcharges 5 37

Report on Internal Control Over Financial Reporting and onCompliance and Other Matters Based on an Audit ofFinancial Statements Performed in Accordance withGovernment Auditing Standards 38-39

303 E. CALHOUN STREETPOST OFFICE BOX 1406

ANDERSON, SC 29622-1406

~Argo :~~ociates,"Certified Public Accountants

TELEPHONE (864)226-7202FAX (864) 226-4631

EMAIL:admin@argos;pa.comwww.argocpa.com

INDEPENDENT AUDITOR'S REPORT

To the City Council and MayorCity of Belton, State South Carolina

We have audited the accompanying financial statements of the governmental activities, the business-typeactivities, each major fund, and the aggregate remaining fund information of City of Belton, South Carolina, as ofand for the year ended June 30,2012, which collectively comprise the City's basic financial statements as listed inthe table of contents. These financial statements are the responsibility of City of Belton, South Carolina'smanagement. Our responsibility is to express opinions on these financial statements based on our audit.

We conducted our audit in accordance with auditing standards generally accepted in the United States of Americaand the standards applicable to financial audits contained in Government Auditing Standards, issued by theComptroller General of the United States. Those standards require that we plan and perform the audit to obtainreasonable assurance about whether the financial statements are free of material misstatement. An audit includesexamining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An auditalso includes assessing the accounting principles used and the significant estimates made by management, as wellas evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basisfor our opinions.

In our opinion, the financial statements referred to above present fairly, in all material respects, the respectivefinancial position of the governmental activities, the business-type activities, each major fund, and the aggregateremaining fund information of the City of Belton, South Carolina, as of June 30, 2012, and the respective changesin financial position, and, where applicable, cash flows thereof for the year then ended in conformity withaccounting principles generally accepted in the United Statesof America.

In accordance with Government Auditing Standards, we have also issued our report dated March 19,2013, on ourconsideration of the City of Belton, South Carolina's internal control over financial reporting and on our tests ofits compliance with certain provisions of laws, regulations, contracts, and grant agreements and other matters. Thepurpose of that report is to describe the scope of our testing of internal control over financial reporting andcompliance and the results of that testing, and not to provide an opinion on internal control over financialreporting or on compliance. That report is an integral part of an audit performed in accordance with GovernmentAuditing Standards and should be considered in assessing the results of our audit.

Accounting principles generally accepted in the United States of America require that the management'sdiscussion and analysis and budgetary comparison information on pages 3 through 9 and 33 through 34 bepresented to supplement the basic financial statements. Such information, although not a part of the basicfinancial statements, is required by the Governmental Accounting Standards Board, who considers it to be anessential part of financial reporting for placing the basic financial statements in an appropriate operational,economic, or historical context. We have applied certain limited procedures to the required supplementaryinformation in accordance with auditing standards generally accepted in the United States of America, whichconsisted of inquiries of management about the methods of preparing the information and comparing theinformation for consistency with management's responses to our inquiries, the basic financial statements, andother knowledge we obtained during our audit of the basic financial statements. We do not express an opinion orprovide any assurance on the information because the limited procedures do not provide us with sufficientevidence to express an opinion or provide any assurance.

Our audit was conducted for the purpose of forming opinions on the financial statements that collectivelycomprise the City of Belton, South Carolina's fmancial statements as a whole. The combining nonmajor fundfmancial statements, and the schedule of municipal court fmes, assessments, and surcharges are presented forpurposes of additional analysis and are not a required part of the financial statements. The combining nonmajorfund fmancial statements and the schedule of municipal court fines, assessments, and surcharges are theresponsibility of management and were derived from and relate directly to the underlying accounting and otherrecords used to prepare the financial statements. The information has been subjected to the auditing proceduresapplied in the audit of the financial statements and certain additional procedures, including comparing andreconciling such information directly to the underlying accounting and other records used to prepare the financialstatements or to the financial statements themselves, and other additional procedures in accordance with auditingstandards generally accepted in the United States of America. In our opinion, the information is fairly stated in allmaterial respects in relation to the fmancial statements as a whole.

Anderson, South CarolinaMarch 19, 2013

2

------------- - ----

CITY OF BELTON, SOUTH CAROLINAMANAGEMENT'S DISCUSSION AND ANALYSIS

JUNE 30, 2012

As management of the City of Belton, South Carolina (the City), we offer readers of the City's fmancial statements thisnarrative overview and analyses of the fmancial activities of the City for the fiscal year ended June 30, 2012.

FINANCIAL HIGHLIGHTSManagement believes the City's fmancial condition is strong. The following are key financial highlights:

• The total government-wide net assets at the close of the most recent fiscal year were $8,802,108 of which$1,923,315 was unrestricted.

• The government-wide net assets decreased by $129,596 or 1.45%.• Total long-term debt decreased by $7,598 or 3.02%.• The total assets of the governmental funds exceeded its liabilities at the close of the 2012 fiscal year by

$1,172,015.• Total fund balances of the governmental funds decreased by $215,562 or 15.54%.• The total governmental funds revenues were $2,594,073, which was less than total governmental funds

expenditures of$2,868,859 by $274,786.• Other financing sources for governmental funds totaled $59,224 for the recent fiscal year.• The net change in the proprietary funds included an increase of $19,964 for the water fund and a decrease of

$100,605 for the wastewater fund.

OVERVIEW OF THE ANNUAL FINANCIAL REPORTManagement's Discussion and Analysis (MD&A) serves as an introduction to the basic fmancial statements andsupplementary information. The City's basic financial statements are comprised of three components: I) govemmentwide financial statements, 2) fund fmancial statements, and 3) notes to the financial statements. This report also containsother supplementary information in addition to the basic financial statements.

Government-Wide Financial StatementsThe government-wide financial statements are designed to provide a broad overview of the City's finances in amanner similar to private businesses. The statements provide both short-term and long-term information about theCity's financial position. All assets and liabilities of the City are included in the statement of net assets.

The statement of net assets presents information on all of the City's assets and liabilities, with the difference betweenthe two being reported as net assets. Over time, increases and decreases in net assets may serve as a useful indicatorof whether the financial position of the City is improving or deteriorating.

The statement of activities presents information showing how the City's net assets changed over the most recentfiscal year. All changes to net assets are reported at the time that the underlying event giving rise to the changeoccurs, regardless of the timing on the related cash flows. This statement also focuses on both the gross and net costsof the various functions of the City, based only on direct functional revenues and expenses. This is designed to showthe extent to which the various functions depend on general revenues for support.

The activities of the City are presented in two columns on these statements - governmental activities and businesstype activities. A total column for the City is also provided. The governmental activities include the City's basicservices including general government, police, fire, public works, community development, and culture andrecreation. Taxes, licenses, permits and charges for services generally support these activities. The business-typeactivities include private sector type activities such as the City's own water and wastewater systems. These activitiesare primarily supported by user charges and fees.

3

Fund Financial StatementsThese statements provide more detailed information about the City's most significant funds - not the City as a whole.A fund is a grouping of related accounts that is used to maintain control over resources that have been segregated forspecific activities or objectives. The City uses fund accounting to ensure and demonstrate compliance with financerelated legal requirements as well as for managerial control to demonstrate fiduciary responsibility over the assets ofthe City. Traditional fund financial statements are presented for governmental funds and proprietary funds.

Governmental funds - Governmental funds are used to account for essentially the same functions reported asgovernmental activities in the government-wide financial statements. However, unlike the government-wide financialstatements, governmental fund financial statements focus on near-term inflows and outflows of spendable resourcesas well as on balances of spendable resources available at the end of the fiscal year. Such information is useful inevaluating the City's near-term financing requirements. Since governmental fund financial statements focus on nearterm spendable resources, while the governmental activities on the government-wide financial statements have alonger-term focus, a reconciliation of the differences between the two is provided with the fund financial statements.

Proprietary funds - Proprietary funds are used to report the same functions presented as business-type activities inthe government-wide financial statements. The proprietary fund financial statements are prepared on the same longterm focus as the government-wide financial statements. The proprietary funds provide the same information as thegovernment-wide financial statements, only with more detail.

Fiduciary funds - Fiduciary funds are used to account for resources held for the benefit of others outside the Citygovernment. Fiduciary funds are reported separately because the money is not available to support the City'sprograms.

Notes to the financial statements - The notes to the financial statements provide information that is essential to thefull understanding of the data provided in the government-wide and fund financial statements and should be read inconjunction with the financial statements.

Other information - Governments have an option of including the budgetary comparison statements for the GeneralFund and major special revenue funds as either part of the fund financial statements within the basic financialstatements or as required supplementary information after the notes to the financial statements. The City has chosento present these budgetary statements as part of the required supplementary information.

GOVERNMENT-WIDE FINANCIAL ANALYSISThe following tables and analysis discuss the financial position and changes to the financial position for the City as awhole as of and for the years ended June 30, 2012, and June 30, 2011.

Net AssetsAs noted earlier, net assets may serve over time as a useful indicator of a government's financial position for theCity. The combined total assets of the City's governmental activities and business-type activities exceeded liabilitiesby $8,802,108 at the close of the most recent fiscal year.

By far, the largest portion of the City's total net assets (72.6%) reflects its investment in capital assets (e.g. land,buildings, machinery and equipment, and vehicles), less any related debt used to acquire those assets that are stilloutstanding. The City uses these capital assets to provide services to citizens; consequently, these assets are notavailable for future spending. Although the City's investment in capital assets is reported net of related debt, itshould be noted that the resources needed to repay this debt must be provided from other sources, since the capitalassets themselves cannot be used to liquidate these liabilities.

4

'S::l!l!A!pg ::ldAl-ss::lu!snq JOJ 6!;P'OO£'I$ pug S::l!l!A!pg I~U::lUJUJ::lAO~JOJ 9!;S'ZZ9$ I~Ol Sl::lssg l::lUP::lP!llS::lJU[1'SJOl!P::lJ:) pug SU::lz!l!:) oi SUO!lg~!IqO ~U!o~uo sAD ::llp l::l::lW oi posn ::lq ..(gW '!;I£'£Z6'I$ 'SjaSSDteu petouissuunJO ::l:)ugIgq ~U!u~W::lJ ::lq.L 'S::l!l!A!pg ::ldAl-ss::lu!soq JOJ 9££'9Z$ pug S::l!l!A!pg I~U::lUJUJ::lAO~JOJ OPS'I9P$ I~Ol siossa l::lUP::lP!llS::l1:I 'posn aq ..(gW ..(::lqlMOq UOSUO!P!llS::lJ oi p::l[qns::lJg 19lp S::l:)JnOS::lJsiuesordar siossa l::lUsA!:) oqrjo 9L I'SSP$

'9!;P'£96'!;$ ::lJgS::l!l!A!pg ::ldAl-ss::lU!soq::llp ::lI!qM 'Z!;9'8£8'Z$ ::lJg S::l!l!A!pg IglU::lUJUJ::lAO~sA!:) ::llp JO siossa l::lN 'IP9'08$ posearoap S::l!l!A!pg OOAl-SS::lU!soq::lql ::lI!qM '!;!;6'8P$ P::lsg::lJ:)::lPS::l!l!A!pg I~U::lUJUJ::lAO~=u 'ZIOZ Jg::l..( Ig:)s9 U! 96!;'6ZI$ posaaroop Sl::lSsg iou ::lq.L

tQnEfi'B~ BQi'J:;QB'B~ ~fiQ'ttQ'2~ 2~fE2fi'~~ ~Q2'~Bn~ J:;~2'BEB'J:;~ siossn iou IBlO.LI ~I 'I £O'Z ~1£'£Z6'1 9£~'tl £'1 6~t'00£'1 ~19'9IL 9~S'ZZ9 P:lPPlS:llU(ltSL'SZ9 9LI'SSt 6~Z'9Z 9££'9Z ~Z~'Z09 OtS'19t P:lP!llS:l"M69L'ILZ'9 LI9'06£'9 ZQ£'£OL't 199'9£9't L9t'S9~'1 9~6'£~L'1 iqop JO iou

'siassa (Bl!dB;:'U!P:llS:lAUI:Sl:lSSBl:lN

L£t~U ttl 't~~ 60£'tO~ ZQ£'St£ SZ6'OZZ ZtS'~OZ S:l!l!I!qB!I(BlO.L

6%'I~Z IL6'£tZ l~t'ILI Z~9'9~1 SII 'OS 61£'LS S:l!l!I!qB!I iuauno-uojqS99'£Lt £LI'OI£ S~S'Z££ 0~9'161 OIS'Otl £Z~'SI I S:l!l!I!qB!llu:lllnJ

It6'9~9'6 Z~Z'9~£'6 90t'St~'9 S~L'I 1£'9 ~£~'soI'£ t6t'ttO'£ Sl:lSSB(BlO.L

191'0~t'9 6Z~'Zt~'9 £IO'OLS't £L~'SSL't Stl 'OS~'I 9~6'£~L'1 siesss IBl!dBJ

OSL'90Z'£$ £U'£IS'Z$ £6£'SL9'1$ ~SI'£Z~'I$ LS£'SZ~'I$ Sg'06Z'I$ siossa 1:ll[lOpug l[!mJ

I 10Z '0£ ounj ZIOZ '0£ ounj I IOZ '0£ ounj ZIOZ '0£ :lunf I IOZ '0£ ounj ZIOZ '0£ ounjSIBlO.L S:l!l!A!PB:ldht-ss:lu!sns S:l!l!A!PBIBlU:lWUl:lAOD

sJ3SSV J3NJo JU3W3J8JS p3SU3PUO;)

:Al!:) ::lquo siossa l::lUPUg 'S::l!l!I!qg!I 'Sl::lSsg IglOl ::lql suodor siossa iou JO iuouroreis P::lSU::lpuo:) ~U!MOnOJ ::lq.L

9

'.rn~AlU~JJn:)~ql 2JUJlTlPsiassa iou S~!l!A!P~ I~U~WW~A02JU!osaaroop ~ql OllU~W~P A~){~ql oq oi p~J~P!SUO:)~M sairurpuodxa U!~~~J:)U! SItU '.rn~Aroud wO.IJ (%t9'£) ~1O'96$p~~~J:)U! samnpuodxo S~!l!A!l:)RlU~WW~A02JI~o~ '~~6'8t$ Aq Sl~S~ l~U sA!:::> ~ql possaroop S~!l!A!PRI~U~WW~AOD

S3p!APJB IBJU3IUUJ3AOD

'pury oiaredos ~ U!pouodar ~M W~lSASJ~l~M~l~M ~ql '2:102:'0£ otmj 2JtI!pU~.rn~AIR:)SglU~JJnJ ~ql UI

POL'I £6'8 $ 801'Z08'8 $ L60'PPO'9 $ 9W£96'~ $ L09'L88'Z $ Z~9'8£8'Z $ O£ ounj - siosse l:lN

8£6'LL8'8 POL'I£6'8 P~L'690'9 L60'PPO'9 P81'808'Z L09'L88'Z I Alnf - siassn l:lN

(OZI'6~) (Z6L'g) OZI'6~ Z6L'g SJ:lJSUllJ.l

99L'£~ (96~'6ZI) £9P'££ (6P8'ZZ) £O£'OZ (LPL'901) SJ:lJSUllJl :lJoJ:lq siossa iouU! (:lSll:lJJ:la) :lSll:lJJUI

£6P'9ZI'P 19£'gz:'P Z9£'68P'1 ~1z:'OZ~'1 I £1'L£9'Z 9PI'££L'Z sasuadxo IUlO.l

6£Z'Og 6£z:'OL~ J:llllM:llSl!M.

Z9£'68P'1 9L6'6P6 Z9£'68P'1 9L6'6P6 J:llllM.

Z£O'£ ~~ Z£O'£ )~ lq:lp Ull:lH3UOI uo lS:lJ:llUI

9Z0'0~Z ~86'68Z 9ZO'OH ~86'68Z UO!lllJ:lJJ:lJ pUll :lJfllln:)

8L~'~8~ OOZ'~P~ 8L~'~8~ OOz:'H~ S)jJOM J!lqnd

U8'09P £H'OO~ U8'09P £~L'OO~ :lJ!cI

969'Z88 0£Z'668 969'Z88 0£Z'668 :lJ!IodLZ6'HP £Z6'L6P LZ6'P~P £Z6'L6t lU:lWW:lAOg IllJ:lU:lO

:S:lSU:ldX3

6~Z'081'P ~9L'£ZI'P ~Z8'ZZn 99£'L6P'1 P£P'L~9'Z 66£'9Z9'Z sanuaxar IlllO.l

L~O'9Z £~9'0~ PL I'£Z £88'Z £~9'0~ :lWOJU! sno:lUllII:lJS!W

OOO'Z£ OOO'Z£ PUllI JO uOllnq!Jluo:)

9Z£ 9Z£ siassn JO (jnsodsrp):llllS uo (sso!) ureo

P9~'P P06'£ ~09'1 061'1 6~6'Z PIL'Z sgU!Wll:llU:lWlSMUI

8Z0'01 8£0'9 8Z0'01 8£0'9 S:lXllUO n:l!I U! lU:lWAlld

UO'£ZZ 08L'£OZ ZLO'£ZZ 08L'£OZ IlllU:lWW:lAOgJ:llUI

~O~'£U P90'OIL ~O~'£U P90'01L S:lSU:lJ!I ssoursngZ6~'8£Z 9~P'6PZ (6)'8£Z 9~P'6PZ scxm J:lljlO

~66'Z06 Z)P'8£8 )66'Z06 ZH'8£8 saxm AlJ:ldoJd.sanuaxar IllJ:lU:lO

8)8'16Z 06£'Z61 6)8'9£1 IW£L 666'HI 6P6'81 I SUO!lnqJ!lUOJptra SlUllJg Illl!dll:)

6Pz:') 919' I I 6Pz:') 919'1 I SUO!lnqplUOJpua SlUllJg gUllllJ:ldO

6££'P)L'1 $ 980')Z8'1 $ L8I'19£'1 $ )£L'ZZP'I $ Z) 1'£6£ $ I)£'ZOP $ S:lJ!AJ:lS JOJ s:lgmlj:).sanuoxar UJl!JgOJd

:S:lnU:lMlI

110Z '0£ aunj ZIOZ '0£ aunj I 10Z '0£ sunj ZIOZ '0£ ounj I 10Z '0£ aunj ZIOZ '0£ ounjSIUlO.l S:l!l!A!Pll :ldAl-ss:lu!sng S:l!l!AllJll IlllU:lWUJ:lAOO

'1102: pug 2:102:'0£ eunj papua .rn~AIR:)sg ~qpoJ Al!:::>~qlJo s~su~dx~ pug s~nU~A~J~ql SMOqS~N~ 2JtI!MolloJ~tUSJ3SSYJ3N UJ 3~u8q:J

Governmental Activities - Revenues by source

$1,000,000

Business-type activitiesNet assets of business-type activities decreased in the current year by $80,641 (1.33%). Total business-type activitiesexpenditures increased $30,853 (2.07%) from prior year. This increase in expenditures was the key element of thedecrease in net assets of the business-type activities for the current year,

$900,000

$900,000

$700,000

$900,000

$900,000

$400,000

$300,000

$200,000

$100,000

$0Chugel for lervice. Operating grants and Capital grants and Othertaxel Business Licenses Intergovenvnental

FINANCIAL ANALYSIS OF THE CITY'S FUNDSAs previously mentioned, the City uses fund accounting to ensure and demonstrate compliance with finance-related legalrequirements. The following is a brief discussion of the financial highlights from the fund financial statements,

Property1lI_contributions contributions

Governmental funds - The focus of the City's governmental funds is to provide information on near-term inflows,outflows, and balances of spendable resources. Such information is useful in assessing the City's financing requirements,Unreserved fund balance may serve as a useful measure of a government's net resources available for spending at the endof the fiscal year.

Governmental Activities - Expenses

The City's total governmental funds reported a combined ending fund balance of $1,172,015. Of this amount $67,544 isnonspendable, $461,840 is restricted, and $323,483 is assigned, The unassigned fund balance of $319,148 is available fornew spending,

$900,000

$800,000

$700,000

$600,000

$500,000

$400,000

$300,000

$200,000

$100,000

$0General Government Police Fire PublicWorki Culture and Recreation Interest on Longe Tenn

Deb!

7

The General Fund is the chief operating fund of the City and accounts for the major functions of the governmentincluding general government, public safety, public works, community development, culture, recreation and tourism.The fund balance decreased $180,499 (19.97%) during the current fiscal year.

Proprietary funds - The City's Proprietary Funds statements provide the same type of information as the governmentwide financial statements, except in more detail. In fiscal year 2012, net assets decreased $80,641 (1.33%).

BUDGETARY HIGHLIGHTSThe City's annual budget is the legally adopted expenditure control document of the City. A budgetary comparisonstatement is included for the General Fund. This statement compares the original adopted budget, the final budget and theactual revenues and expenditures prepared on a budgetary basis. Amendments to the adopted budget may occurthroughout the year in a legally permissible manner.

Budgetary comparison highlights for the current year for the General Fund are as follows:

Revenues and Other Financial ResourcesExpendituresExcess (Deficiency) of Revenues Over (Under) Expenditures

Budget-Final$ 2,643,800

2,646,800($ 3,000)

Actual Variance$ 2,457,625

2,638,124($ 186,175)

8,676($ 180,499) ($ 177,499)

Actual General Fund revenues and other revenue sources were less than budgeted revenues and other financing sourcesby $186,175. Intergovernmental, property tax, franchise fees, and licenses and permits revenues accounted for themajority of the decrease of revenues under budgeted amounts. General fund expenditures were less than budgetedamounts by $8,676. Administration and community development expenditures accounted for the majority of the decreaseof expenditures under the budgeted amounts.

CAPITAL ASSET AND DEBT ADMINISTRATIONCapital assets - The City's investment in capital assets for its government-wide activities as of June 30,2012, amountsto $6,542,529 (net of accumulated depreciation.) This investment in capital assets includes land, improvements otherthan buildings, buildings and systems, and machinery and equipment. This year's major capital asset additions includedcosts incurred for the construction of an elevator at City Hall and purchases of police vehicles.

Governmental activities Business-type activities

LandConstruction inprogress

Buildings andsystem

Improvementsother thanbuildings

Machinery andequipment

VehiclesTotal

June 30, June 30,2012 2011

$ 288,080 $ 256,080

10,110 215,604

June 30, June 30,2012 2011

$ 57,418 $ 57,418

96,613

334,490 358,594 4,490,016 4,444,681

578,412 360,524

175,789377,185

204,175390,665

140,6233,603

148,0194,291

$ 1,753,956 $ 1,580,148 $ 4,788,573 $ 4,870,013

TotalJune 30,2012

June 30,2011

$ 345,498

96,913

$ 313,498

225,714

4,824,506 4,803,275

578,412 360,524

316,412380,788

352,194394,956

$ 6,542,529 $ 6,450,161

Additional information on the City's capital assets can be found in the Notes to Financial Statements in Note 4.

8

Debt administration - At year-end the City had $151,912 in notes payable to banks for its government-wide activities.This is a decrease of$26,480 (14.84%) from the previous year amount of$178,392.

Outstanding DebtGovernmental activities Business-type activities TotalJune 30, June 30, June 30, June 30, June 30, June 30,2012 2011 2012 2011 2012 2011

Notes payable $ $ 11,681 $ 151,912 $ 166,711 $ 151,912 $ 178,392Compensatedabsences 87,319 68,437 4,740 4,740 92,059 73,177

Totals $ 87,319 $ 80,118 $ 156,652 $ 171,4551 $ 243,971 $ 251,569

Additional information on the City's long-term debt can be found in the Notes to Financial Statements in Note 5.

Economic Factors, Next Year's Budget and Rates

General safety and welfare of the community is top priority. Our fire department remains consistent with no staffchanges. We have hired a new police chief upon the retirement of our previous chief. We also have had two policeofficers retire over this year and have replaced them. We have acquired four new police cars this year with themajority of the monies coming from grants. Our police chief is using every available source to equip the officerswith necessary equipment with minimal cost to the City. Our fire chief is continuing to make sure all firefighters areequipped with the essential equipment and are sufficiently trained. Our fire chief is continuing to diligently work onour ISO rating.

The parks and recreation facilities continue to improve as ongoing repairs and upgrades take place. Playerparticipation continues to grow each year.

The Combined Utilities Department has completed the Energy Grant Upgrade System by implementing a system toallow meters to be read internally. As money is available, the department will continue to replace the old meters withnew ones that will be compatible with this new system. The department is working to improve our water and sewerlines and upgrading our Ducworth Facility and lagoons to meet DHEC standards. The City is working with USDAfor grant funding for this project.

The City of Belton does not anticipate financial impact from changes with funding from the State and Countygovernments; nor income from franchise fees and taxes. Belton will continue to operate with a conservative budget.

Contacting the City's financial managementThis financial report is designed to provide a general overview of the City's finances for all those with an interest in theCity's finances. Questions concerning any of the information provided in this report or requests for additional financialinformation should be addressed to Laurie Kennedy, City Treasurer, City of Belton, PO Box 828, Belton, South Carolina29627.

9

Exhibit ACITY OF BELTON, SOUTH CAROLINA

STATEMENT OF NET ASSETSJUNE 30, 2012

Primary Government

Governmental Business-Activities !IRe Total

ASSETSCash and cash equivalents $ 1,058,100 $ 1,092,009 $ 2,150,109Receivables (net of allowance for uncollectibles) 158,333 221,626 379,959Interest receivable 413 466 879Intergovernmental receivables 19,440 19,440Internal balances (36,355) 36,355Inventories 4,652 17,891 22,543Prepaids 62,892 10,025 72,917Restricted assets:Cash and cash equivalents:Escheat deposits 9,749 9,749Municipal Court deposits 13,314 13,314Customer deposits 118,477 118,477Note payable covenant deposit 26,336 26,336

Capital assets not being depreciated:Land 288,080 57,418 345,498Construction in progress 96,913 96,913

Capital assets net of accumulated depreciation:Buildings and systems 334,490 4,490,016 4,824,506Improvements other than buildings 578,412 578,412Machinery and equipment 175,789 140,623 316,412Vehicles 377,185 3,603 380,788Total assets 3,044,494 6,311,758 9,356,252

LIABILITIESAccounts payable and other current liabilities 108,516 72,990 181,506Unearned revenue 1,875 1,875Liabilities payable from restricted assets 8,132 118,660 126,792Noncurrent liabilities:Due within one year 19,352 19,989 39,341Due in more than one year 67,967 136,663 204,630Total liabilities 205,842 348,302 554,144

NET ASSETSInvested in capital assets, net of related debt 1,753,956 4,636,661 6,390,617Restricted for:Victims' assistance 38,374 38,374Drug enforcement 13,056 13,056Firemen's fund 5,398 5,398Municipal Court 13,314 13,314Hospitality 391,698 391,698Debt service 26,336 26,336

Unrestricted 622,856 1,300,459 1,923,315Total net assets $ 228382652 $ 529632456 $ 828021108

The notes to the financial statements are an integral part of this statement.

10

Exhibit BCITY OF BELTON. SOUTH CAROLINA

STATEMENT OF ACTIVITIESFOR THE YEAR ENDED JUNE 30, 2012

Net (Expense) Revenue andProgram Revenues Changes in Net Assets

Operating CapitalCharges for Grants and Grants and Governmental Business-type

Function I Programs Ex~enses Services Contributions Contributions Activities Activities TotalPrimary GovernmentGovernmental Activities:General government $ 497,923 $ 688 $ $ $ (497,235) $ $ (497,235)Police 899,230 155,815 17,830 (725,585) (725,585)Fire 500,753 5,074 25,989 (469,690) (469,690)Public works 545,200 239,482 19,080 (286,638) (286,638)Culture and recreation 289,985 6,366 6,542 56,050 (221,027) (221,027)Interest on long-term debt 55 (55) (55)Total governmental activities 2,733,146 402,351 11,616 118,949 (2,200,230) (2,200,230)

Business-type Activities:Water 949,976 945,024 73,441 68,489 68,489Wastewater 570,239 477,711 (92,528) (92,528)Total business-type activities 1,520,215 1,422,735 73,441 (24,039) (24,039)

Total Primary Government $ 412533361 $ 138251086 $ 113616 $ 1921390 {2z200z230} {24z039} {2z224z269}

General Revenues:Taxes 1,087,908 1,087,908Business licenses 710,064 710,064Intergovernmental 203,780 203,780Interest earnings 2,714 1,190 3,904Payments in lieu of taxes 6,038 6,038Gain (loss) on sale of capital assets 326 326Contribution of land 32,000 32,000Miscellaneous 50,653 50,653

Transfers 57792 {57z792}Total General Revenues, Special Items, and Transfers 2z151z275 {56z602} 220942673Change in Net Assets (48,955) (80,641) (129,596)

Net Assets - Beginning 228872607 6z044z097 82931z704Net Assets - Ending $ 2z8382652 $ 529632456 $ 8z8022108

The notes to the financial statements are an integral part of this statement.11

Z~9!8£8!Z $ S~!l!A!l:ltlIlllU~WW~Ao~JO siosse l~N

(61 £'L8) ·spullJ ~ql U!pouodar lOU~Jll~JoJ~J~qlpUllpouod iuauno~ql U!~IqllAlldpUllonp lOU~Jl! '~IqllAlldspuoq ~U!pnpU! 'S~!l!I!qll!IUJJ~l-~UO'l

9~6'£~L'1 -spunj ~ql U!pauodar lOU~Jl! '~JOPJ~ql'pua S~::lJnOS~JIllPUlluy lOU~Jl!S~!l!A!PllIlllu~ww~AO~U!p~sn Sl~SSl!Il!l!dll;)

:~snll::l~qlU~J~JJ!P~Jl!Sl~SSl!l~UJO lu~w~ll!lS~ql U!S~!l!A!PllIl!lU~WW~AO~JOJpoirodar siunourv

8Z8i9~ $ £81!Z6£ $ vL£!988 $ S33UBIBqpun; pUBs3HmQB!lIBlO.L

~1O'ZL1'I 8Z8'9~ 869'16£ 68v'£ZL S~::lUllIllqpUllJ IlllO.L

817161£ 8171'61£ P~U~!SSllUfl£8V'£Z£ £8V'£Z£ P~U~!SSV0178'1917 8Z8'9~ 869'16£ 171£'£1 P~PPlS~"Mvv~'L9 vv~'L9 ~Iqllpu~dsuON

:S33UBIBqPUD.!!

OL£'£91 ~8v ~88'Z91 s3HmQB!lIBlO.L

Z£1'8 Z£1'8 siesss P~P!JlS~l WOlJ~IqllAlldS~!l!I!qlln~L8'I ~L8'I ~nU~A~JP~UJl!~Ufl668'91 668'91 s~!l!I!qll!IporuocvLv8'vv Lv8'vv spunj roqio oi ~naLI9'I6 $ $ ~8v $ Z£I'16 $ ~IqllAlldsiunooov

S3!l!nqBnS3:JNYIV9 aNIH aNY SID.LI'1U1VI'1

~8£'~££'I $ 8Z8'9~ $ £8I'Z6£ $ vL£'988 $ Sl3SSBIBlO.L

£90'£Z £90'£Z peiouisai - qSl!;)Z68'Z9 Z68'Z9 SW~l!p!lld~ldZ~9'V Z~9'V S~!lOlU~AuIZ6V'8 Z6V'8 spunj l~qlo WOlJ=o01717'61 01717'61 SlU~WWMO~l~qlo WOlJ~na£117 OLI £VZ ~IqllA!~::l~JlS~l~lUI6vtL~ OO~'Z~ 6vL'v ~IqllA!~::l~lslUlllD~~v'OZ ~~v'OZ ~::lUllM.0IIllJO iou '~IqllA!~::l~lS~Xll.L6Z9'08 ~I I'ZI vI~'89 ~IqllA!~::l~lsiunooov

:s~IqllAP::l~"M00I'8~0'1 $ 8Z8'9~ $ 86£'a£ $ vL8'£L9 $ slU~IllA!nb~qSll::lpUllqSl!;)

S.L3SSV

spun.!! SpUD.!! PUD.!! PUD.!!IBlU3WUJ3AO~ IBlU3WUJ3AO~ 4!1Bl!dSOH IBJ3U3~

IBlO.L J3qlQ

'llOl '0£ 3NI1fSaNI1.!!'lV.LN3WNH3AO~

.L33HS 3;)NV'lV9VNI'101lV3 H.LI10S 'NO.L'l39.!!O A.LD

3 l!Q!qx3

---------------------------------- ----------

£1

~IO'UI'I $ 8Z8'9~ $ 869'16£ $ 68P'£U $ ~u!pua - aJUll1llQpun.!!

LL~'L8£'I 9I9'6~ £L6'£Zp 886'£06 ~uluul~~q - ~:)ull[llqpund

(Z9~'~IZ) (88L'Z) (~a'z£) (66P'081) saJulllllQ punj U!a~ullqJ JaN

PZz'6~ (Z09'~1) 9Z8'PL (sosn) saamos ~upulluy Jaqlo 111:)0.1

L9~ L9~ sl;')sSll[lllldlloJO ~[llS(Z09'~1) (Z09'H) mo Sl~JSUllJl~u!lllJ;')dO6~z'PL 6~z'pL ul Sl~JSUllJl~u!lllJ;')dO

(S3SG) S3::nmOS ~NI::>NVNI.{ 1I3H.1O

(98L'pa) (88L'Z) (£L9'9I) (~Zn~Z) sarmjpuadxa (rapun) JaAOsanUaAaJJO (AJUapyap) ssaJx3

6~8'898'Z PL8'91 I98'£1Z pZI'8£9'Z samnpuadxe 111:)0.1

IL~'LO£ Z6p'ZI I 6LO'~61 All[lno[lllldll:)~~ 6£ 91 lS~J~lUIZ89'II 6£z'9 £pp'~ [lldlOUlJd

:~OlAJ;,)sN~aLg LL~ iuourdojcxop Allunwwo:)~L6'8~Z L90'16 806'L91 ursunoi pua 'uouaaroer '~ml[n:)ILz'9£~ tzz'srs S:>[JOMo!lqnd90P'Z8z'1 pL8'91 Zg'~9z'1 Al;')JllSo!lqndZZ£'ILp PZO'P 86z'L9P UOllllJlSlUlWPV

S3lIG.1ION3dX3

£LO'p6~'Z 980'PI 881'L61 66L'Z8£'Z sanuaaar IBlO.1

8LP'g 8LP'P~ sno;')UtlIl~os!Y1!PIL'Z 96 PP6 PL9'1 S~UlUlll;,)iuaunsaxu]£Iz'~~1 916'8 L6z'9PI S~JDll~JlOJpun s~uld£IL'ZPZ £IL'ZPZ S~OlAJ~SlOJ S~~ltlq:)9<:9'8£Z PLO'~ Z~~'££Z IlllU;,)WW;,)AO~l~luI89z'0~P 89z'0~P snuuod pua s~su~on61£'96 OO~'Z~ 618'£P SlUtllD96L'6~Z 96L'gZ s~~J~SlqOUllld8£0'9 8£0'9 S~XllUOn~!1UlSlU;')WAlldPPL'£PI PPL'£PI S~~dXtll Al!lll:)!dsOHZIL'~OI ZIL'~OI xuj omvZ~P'8£8 $ $ $ Z~P'8£8 $ Xtll All~dOld

:S~XtllS3GN3A3lI

spun.!! spun.!! pun.!l pun.!!11IlUaWUJaAO~ IBlUaWUJaAO~ Al!(lIl!dsOH 11IJaua~

IBlO.1 JaqlO

zrez 'Of 3NGr 030N311V3A '1V::>SI.!I3H.1 1I0.!lSONG.!I'1V.1N3WNlI3AO~

S3::>NV'1V8 ONG.!INI S3~NVH::> ONV'S3lIG.1ION3dX3 'S3GN3A3lI.!IO .1N3W3.1V.1S

VNI'IOllV::> H.1GOS 'N0.1'138.!10 AU::>o HQ!qx3

CITY OF BELTON, SOUTH CAROLINARECONCILIATION OF THE STATEMENT OF REVENUES, EXPENDITURES,

AND CHANGES IN FUND BALANCES OF GOVERNMENTAL FUNDSTO THE STATEMENT OF ACTIVITIES

FOR THE FISCAL YEAR ENDED JUNE 30, 2012

Amounts reported for governmental activities in the statement of activities are different

Net change in fund balances - total governmental funds

Governmental funds report capital outlays as expenditures. However, in thestatement of activities the cost of those assets is allocated over their estimateduseful lives and reported as depreciation expense. This is the amount by whichcapital outlay of$307,571 exceeded depreciation expense of$164,657in the current period.

The net effect of various miscellaneous transaction involving capital assets(i.e., sales and donations) is to increase net assets.

The issuance oflong-term debt (e.g., bonds, leases) provides current financialresources to governmental funds, while the repayment of the principal of long-termdebt consumes the current financial resources of governmental funds. Neithertransactions, however, have any effect on net assets. This is the amount of prinicpalpayments of long-term debt in the current period.

Some expenses reported in the statement of activities do not require the useof current resources, and, therefore, are not reported as expenditures ingovernmental funds.Compensated absences

Change in net assets of governmental activities

The notes to the financial statements are an integral part of this statement.

14

Exhibit E

$ (215,562)

142,914

30,894

11,681

(18,882)

$ (48.955)

51

9SP!£96!S $ ILS!LSL!£ $ S8S!SLI!Z $ siossa iou Jlno.L

6SP'00£'I ~9~'£1£ P6S'9S6 papplSa1Ufl9££'9Z 9££'9Z a:>!Alasiqop 10J papplSalI199'9£9'P OL9'LPP'£ 166'SSI'1 iqap pallllal JO lau 'SlaSSl!llll!dll:>U! palsaAuI

S.L3SSV .L3N

S~z'£9£ 69£'LL 1 9S8'~SI saHmqll!lllllO.L

£99'9£1 £99'9£1 alqllAlld saloN:saml!qll!llualln:>uoN

099'811 099'SII alqllAlld snsodop 1aUlOlSn;).siossa peiojnsar UlO.galqllAlld saml!qll!llualln;)

Z£6'LOI 90L'OP 9Zz'L9 saml!qll!llualln:> 11ll0.L

6Pz'~1 6Pz'~1 iuauno - ::IlqllAllds::lloNLS£'£ Ol~ LLS'Z S::I!l!l!qll!lparuoovOPL'P OPL'P soouasqn poiasuaduro.j

£~6'PI 9S0'~ L9S'6 spunJ roqio oi ::InG£09'69 19S'61 ZPL'6P ::IlqllAlldsiunooov

:S::I!lmqll!llu::Illn;)S3I.LI'IUlVI'I

IlL'9Z£'9 OP6'P96'£ ILL'19£'Z Sl::lSSl!IlllO.L

£g'88L'P ZSS'66~'£ 166'S81'1 (uoparoaidop p::lllllnUln:>:>llJO ieu) siossa Illlldll:>IlllO.L

(ZOS'OS£'~) (P£z'16~'£) (S9~'6SL'I) uoumoardap poramumooe sS::I10£9'P6Z IlL 616'£6Z s::IJ:>!q::lA9IL'ZZL ££0'861 £S9'PZ~ iuourdmbo pua Al::lU!q:>llWS69'L66'8 ~~z'0£6'9 £PP'L90'Z SUl::llSASpus sj3u!Pl!na£16'96 L18'19 960'~£ SS::I1j301dU!uOH:>nllSUO;)SIP'g SIP'L~ pUll1

.siossa llll!dll;)

8£1'8£~'1 8~£'~9£ 08L'ZLI'l siossa iuauno IlllO.L

9££'9Z 9££'9Z nsodop lUllU::IAO:>::IlqllAlld::IloNLLP'SII LLP'SII snsodop rouroisn j

:l::lqlo pua 'S}u::IIllA!nb::lqsso 'qsao P::lP!llS::IlI~ZO'OI 90P'9 619'£ suron P!lld::l1d168'L 1 168'L 1 S::IPOlu::IAuI80£'1~ ~L£'I ££6'6P spunj l::lqlo UlOl] ::InG99P 99P ::IlqllAP:>::I1lS::I1::llUI9Z9'IZZ L 1£'1 60£'OZZ (::I:>UllMollllJO iou) S::IlqllAP:>::I1siunooov600'Z60'1 $ PZ6'6Z£ $ ~80'Z9L s SlU::IlllA!nb::lqsno pus qSl!;)

:siesss lU::Illn;)S.L3SSV

spnnj J3J'BM.3JS'BA\. J3J'BA\.3s!JdJ3JU3

I'BJO.LUOZ: '0£ 3Nflf

SONfl.!l AlIV.L3Il1dOlidS.L3SSV .L3N.!IO .LN3W3.LV.LS

VNI'IOllV3 H.LflOS 'NO.L'I38.!10 A.LI:>.!Il!Q!qx3

Exhibit GCITY OF BELTON, SOUTH CAROLINA

STATEMENT OF REVENUES, EXPENSES,AND CHANGES IN FUND NET ASSETS

PROPRIETARY FUNDSFOR THE FISCAL YEAR ENDED JUNE 30, 2012

TotalEnterprise

Water Wastewater FundsOPERATING REVENUESCharges for services $ 945,024 $ 477,711 $ 1,422,735

OPERATING EXPENSESCost of sales and services 836,928 383,625 1,220,553Administration 62,920 8,738 71,658Depreciation 50,128 173,077 223,205

Total operating expenses 949,976 565,440 1,515,416

Operating loss (4,952) (87,729) (92,681)

NONOPERATING REVENUES (EXPENSES)Investment earnings 634 556 1,190Interest expense (4,799) (4,799)

Total nonoperating revenues (expenses) 634 (4,243) (3,609)

Income (loss) before contributions and transfers (4,318) (91,972) (96,290)

Capital contributions - Grants 73,441 73,441Capital contributions 864 864Transfers in 439 20,503 20,942Transfers out (49,598) (30,000) (79,598)

Change in net assets 19,964 (100,605) (80,641)

Total net assets - beginning 2,155,921 3,888,176 6,044,097

Total net assets - ending $ 2;175;885 $ 317871571 $ 5;963;456

The notes to the financial statements are an integral part of this statement.

16

ExhibitHCITY OF BELTON, SOUTH CAROLINA

STATEMENT OF CASH FLOWSPROPRIETARY FUNDS

FOR THE FISCAL YEAR ENDED JUNE 30, 2012

TotalEnterprise

Water Wastewater FundsCASH FLOWS FROM OPERATING ACTIVITIESCash received from customers $ 951,957 $ 477,217 $ 1,429,174Cash paid to suppliers (708,232) (210,335) (918,567)Cash paid to employees (215z847} (l68z063} (383,910}Net cash provided (used) by operating activities 27878 98819 126,697

CASH FLOWS FROM NONCAPIT AL FINANCING ACTIVITIESIncrease (Decrease) in due from other funds (20,770) 3,711 (17,059)Transfers to other funds (49,598) (30,000) (79,598)Transfers from other funds 439 20,503 20,942Net cash provided (used) by noncapital financing activities (69,929} (5,786} (75,715}

CASH FLOWS FROM CAPITAL AND RELATED FINANCING ACTIVITIESPrincipal payments - revenue bonds and notes (14,799) (14,799)Interest paid (4,799) (4,799)Proceeds from capital contributions - grants 163,684 163,684Purchase of fixed assets (209,615} (63,645} (273,260}Net cash provided (used) by capital and related financingactivities (45,931} (83,243} (l29,174}

CASH FLOWS FROM INVESTING ACTIVITIESInterest income 633 556 1 189

NET INCREASE (DECREASE) IN CASH ANDCASH EQUIVALENTS (87,349) 10,346 (77,003)

CASH AND CASH EQUIVALENTS - BEGINNING(Including restricted assets of $137,316) 967911 345914 1,313,825

CASH AND CASH EQUIVALENTS - ENDING(Including restricted assets of $144,813) $ 8801562 $ 3561260 $ 11236!822

Reconciliation of operating income to net cashprovided (used) by operating activities:

Operating (loss) $ (4,952) $ (87,729) $ (92,681)Adjustments to reconcile operating loss to net cashprovided (used) by operating activities:Depreciation expense 50,128 173,077 223,205(Increase) decrease in accounts receivable (487) (494) (981)(Increase) decrease in prepaid items 12,409 (6,406) 6,003Increase (decrease) in accounts payable (35,817) 19,861 (15,956)Increase (decrease) in accrued liabilities (823) 510 (313)Increase (decrease) in customer deposits 7420 7420Total adjustments 32,830 186,548 219,378

Net cash provided by operating activities $ 271878 $ 981819 $ 1261697

The notes to the financial statements are an integral part of this statement.

17

ASSETSCash and cash equivalents

Total assets

LIABILITIESZion Street payabJes

Total liabilities

CITY OF BELTON, SOUTHCAROLINASTATEMENTOF FIDUCIARYNET ASSETS

FIDUCIARY FUNDJUNE 30, 2012

The notes to the financial statements are an integral part of this statement.

18

Exhibit I

Zion Street SeniorCitizens Agency

Fund

$ 1 512

$ 1 512

$ 1 512

$ 1 512

CITY OF BELTON, SOUTH CAROLINANOTES TO BASIC FINANCIAL STATEMENTS

JUNE 30,2012

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The financial statements of the City of Beiton, South Carolina (the City) have been prepared in accordance withgenerally accepted accounting principles in the United States of America (GAAP) applicable to state and localgovernments. The Governmental Accounting Standards Board (GASB) is the accepted standard-setting body forestablishing governmental accounting and financial reporting principles. The more significant of the City'saccounting policies are described below.

A. Reporting Entity

The City of Belton, South Carolina was incorporated in 1855. It is governed by a mayor and six council members whoserve staggered four year terms. The City operates under the council/mayor form of government by South Carolina law.The City provides the following services: public safety (police and fire), street maintenance, sanitation, culture-recreation,public improvements, planning and zoning, and general administrative services. The City also owns and operates a utilitysystem which provides water and wastewater services. The fmancial statements of the City include all of the aboveoperations. No other organizations are included in the financial statements and the City is not included in any othergovernmental "reporting entity" as defined by GASB, since Council members are elected by the public and have decisionmaking authority, the authority to levy taxes, the power to designate management, the ability to significantly influenceoperations, and primary accountability for fiscal matters.

B. Government-wide and fund financial statements

The government-wide financial statements (i.e., the statement of net assets and the statement of activities) reportinformation on all of the non-fiduciary activities of the City. For the most part, the effect of interfund activity hasbeen removed from these statements. Governmental activities, which are normally supported by taxes andintergovernmental revenues or from specific revenue sources such as grants, are reported separately from businesstype activities, which rely to a significant extent on fees and charges for support.

The statement of activities demonstrates the degree to which the direct expenses of a given function or identifiableactivity are offset by program revenues. Direct expenses are those that are clearly identifiable with a specificfunction. Program revenues include 1) charges to customers or applicants who purchase, use, or directly benefit fromgoods, services, or privileges provided by a given function or segment and 2) grants and contributions that arerestricted to meeting the operational or capital requirements of a particular function or segment. Taxes and otheritems not properly included among program revenues are reported instead as general revenues.

Separate financial statements are provided for governmental funds, proprietary funds, and fiduciary funds, eventhough the fiduciary funds are excluded from the government-wide financial statements. Major individualgovernmental funds and major enterprise funds are reported as separate columns in the fund financial statements.

C. Measurement focus, basis of accounting, and financial statement presentation

The government-wide financial statements are reported using the economic resources measurement focus and theaccrual basis of accounting, as are the proprietary fund and fiduciary fund financial statements. Revenues arerecorded when earned and expenses are recorded when a liability is incurred, regardless of the timing of related cashflows. Property taxes are recognized as revenues in the year for which they are levied. Grants and similar items arerecognized as revenue as soon as all eligibility requirements imposed by the provider have been met.

19

--------------------------------------------------------------------- - -- -

CITY OF BELTON, SOUTH CAROLINANOTES TO BASIC FINANCIAL STATEMENTS

JUNE 30, 2012

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Governmental fund financial statements are reported using the current financial resources measurement focus and themodified accrual basis of accounting. Revenues are recognized as soon as they are both measurable and available.Revenues are considered to be available when they are collectible within the current period or soon enough thereafterto pay liabilities of the current period. For this purpose, the City considers revenues to be available if they arecollected within 60 days of the end of the current fiscal period. Expenditures generally are recorded when a liabilityis incurred, as under accrual accounting. However, debt service expenditures, as well as expenditures related tocompensated absences and claims and judgments, are recorded only when payment is due.

Property taxes, state shared revenue, and charges for services associated with the current fiscal period are allconsidered to be susceptible to accrual and, therefore, have been recognized as revenues of the current fiscal period.Only the portion of special assessments receivable due within the current fiscal period is considered to be susceptibleto accrual as revenue of the current period. All other revenue items are considered to be measurable and availableonly when cash is received by the City.

Because governmental fund statements are presented using a measurement focus and basis of accounting differentfrom that used in the government-wide statements' governmental column, a reconciliation is presented that brieflyexplains the adjustments necessary to reconcile ending net assets and the change in net assets.

Major Governmental Funds - The major governmental funds reported by the City are as follows:

General Fund. The General Fund is the government's primary operating fund. It accounts for all financialresources of the general government, except those required to be accounted for in another fund.

Hospitality Fund. The Hospitality Fund is used to account for the proceeds of hospitality fees to be segregated forthe expenditures of tourism related costs.

Water Fund. This enterprise fund accounts for the activities of the City-owned water system.

Major Proprietary Funds - The City reports the following major proprietary funds:

Wastewater Fund. This enterprise fund accounts for the activities of the City-owned wastewater system.

In prior years, activities of the water and wastewater operations were reported in one fund. In the fiscal year endingJune 30, 2012, the operations of the wastewater fund are separately reported. The prior year-end balance sheet wasseparated between the water and wastewater systems.

Additionally, the City reports the following fund type:

Fiduciary Fund. The fiduciary fund accounts for the assets held by the government in a trustee capacity or as anagent for individuals, private organizations, other governmental units, and/or funds. The Zion Street SeniorCitizensJund accounts for assets that the government holds for others in an agency capacity.

Private-sector standards of accounting and financial reporting issued through November 30, 1989, generally arefollowed in both government-wide and proprietary fund financial statements to the extent that those standards do notconflict with or contradict guidance of the Governmental Accounting Standards Board. Governments also have theoption of following subsequent private-sector guidance for their business-type activities and enterprise funds, subjectto this same limitation. The government has elected not to follow subsequent private-sector guidance.

20

CITY OF BELTON, SOUTH CAROLINANOTES TO BASIC FINANCIAL STATEMENTS

JUNE 30,2012

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

As a general rule the effect of interfund activity has been eliminated from the government-wide financial statements.Exceptions to this general rule are charges between the government's general fund, special revenue funds, andproprietary funds. Elimination of these charges would distort the direct costs and program revenues reported for thevarious functions concerned.

Amounts reported as program revenues include I) charges to customers or applicants for goods, services, orprivileges provided, 2) operating grants and contributions, and 3) capital grants and contributions, including specialassessments. Internally dedicated resources are reported as general revenues rather than as program revenues.Likewise, general revenues include all taxes.

Proprietary funds distinguish operating revenues and expenses from non-operating items. Operating revenues andexpenses generally result from providing services and producing and delivering goods in connection with aproprietary funds' principal ongoing operations. The principal operating revenues of the water and wastewaterenterprise funds are charges to customers for sales and services. The water fund also recognizes as operating revenuethe portion of tap fees intended to recover the cost of connecting new customers to the system. Operating expensesfor the water and wastewater funds includes the cost of sales and services, administrative expenses, and depreciationon capital assets. All revenues and expenses not meeting this definition are reported as non-operating revenues andexpenses.

D. Assets, liabilities, and net assets or equity

1. Cash and InvestmentsCash and cash equivalents include currency on hand, demand deposits with financial institutions, and short-terminvestments with a maturity date within three months of the date purchased. Investments are recorded at fair value.The calculation of realized gains and losses is independent of calculation of changes in fair value of investments.

State statutes authorize the government to invest in obligations of the U.S. Treasury, obligations of the State of SouthCarolina, repurchase agreements, certificates of deposit and the South Carolina Local Government Investment Pool.Investments for the government are reported at fair value. The reported value of the South Carolina LocalGovernment Investment Pool is the same as the fair value of the pool shares.

2. Interfund Receivables and PayablesActivity between funds that are representative oflending/borrowing arrangements outstanding at the end of the fiscalyear are referred to as either "due to/from other funds" (i.e., the current portion of interfund loans) or "advancesto/from other funds" (i.e., the non-current portion of interfund loans). All other outstanding balances between fundsare reported as "due to/from other funds." Any residual balances outstanding between the governmental activitiesand business-type activities are reported in the government-wide financial statements as "internal balances."

Advances between funds, as reported in the fund financial statements, are offset by a fund balance reserve account inapplicable governmental funds to indicate that they are not available for appropriation and are not expendableavailable financial resources.

3. Accounts ReceivableAccounts receivable represent amounts owed the City for property taxes, water and sewer fees, and franchise feesand are reflected net of an allowance for uncollectibles.

21

CITY OF BELTON, SOUTH CAROLINANOTES TO BASIC FINANCIAL STATEMENTS

JUNE 30,2012

NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

4. InventoriesSignificant inventories are valued at cost using the first-inlfirst-out (FIFO) method and are offset equally by a fundbalance reserve account which indicates that they do not constitute expendable available financial resources andtherefore are not available for appropriation. The costs of governmental fund-type inventories are recorded asexpenditures when consumed rather than when purchased.

5. Prepaid ItemsPayments to vendors for services that will benefit periods beyond the end of the fiscal year are recorded as prepaiditems in both government-wide and fund financial statements.

6. Restricted AssetsCertain resources are classified as restricted assets on the balance sheet because their use is limited by applicablelaws, grant agreements, or bond covenants.

7. Capital AssetsCapital assets, which include property, plant, and equipment, are reported in the governmental or business-typeactivities columns in the government-wide financial statements. Capital assets are defined by the government asassets with an initial, individual cost of more than $500 and an estimated useful life in excess of two years. Theassets are recorded at historical cost or estimated historical cost if purchased or constructed. Donated capital assetsare recorded at estimated fair market value at the date of donation.

The costs of normal maintenance and repairs that do not add to the value of the asset or materially extend asset livesare not capitalized. Major outlays for capital asset and improvements are capitalized as projects are constructed.

Assets Years5-5020-303-205-15

Property, plant, and equipment of the primary government are depreciated using the straight line method over thefollowing estimated useful lives:

Buildings and SystemsImprovements Other Than BuildingsMachinery and EquipmentVehicles

8. Compensated AbsencesIt is the government's policy to permit employees to accumulate earned but unused vacation and sick pay benefits.There is no liability for unpaid accumulated sick leave since the government does not have a policy to pay anyamounts when employees separate from service with the government. All vacation pay is accrued when incurred inthe government-wide and proprietary fund financial statements. A liability for these amounts is reported ingovernmental funds only if they have matured, for example, as a result of employee resignations and retirements.

9. Long-term ObligationsIn the government-wide financial statements, and proprietary fund types in the fund financial statements, long-termdebt and other long-term obligations are reported as liabilities in the applicable governmental activities, businesstype activities, or proprietary fund type statement of net assets.

22

CITY OF BELTON, SOUTH CAROLINANOTES TO BASIC FINANCIAL STATEMENTS

JUNE 30, 2012

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

10. Fund EquityIn the fund financial statements, governmental funds report aggregate amounts for five classifications of fundbalances based on the constraints imposed on the use of these resources. The nonspendable fund balanceclassification includes amounts that cannot be spent because they are either (a) not in spendable form - prepaid itemsor inventories; or (b) legally or contractually required to be maintained intact.

The spendable portion of the fund balance comprises the remaining four classifications: restricted, committed,assigned, and unassigned.

Restrictedfund balance. This classification reflects the constraints imposed on resources either (a) externally bycreditors, grantors, contributors, or laws or regulations of other governments; or (b) imposed by law throughconstitutional provisions or enabling legislation.

Committedfund balance. These amounts can only be used for specific purposes pursuant to constraints imposedby formal resolutions or ordinances of the City Council - the government's highest level of decision makingauthority. Those committed amounts cannot be used for any other purpose unless the City Council removes thespecified use by taking the same type of action imposing the commitment. This classification also includescontractual obligations to the extent that existing resources in the fund have been specifically committed for usein satisfying those contractual requirements.

Assignedfund balance. This classification reflects the amounts constrained by the City's "intent" to be used forspecific purposes, but are neither restricted nor committed. The City Council and Mayor have the authority toassign amounts to be used for specific purposes. Assigned fund balances include all remaining amounts (exceptnegative balances) that are reported in governmental funds, other than the General Fund, that are not classified asnonspendable and are neither restricted or committed.

Unassigned fund balance. This fund balance is the residual classification for the General Fund. It is also used toreport negative fund balances in other governmental funds.

When both restricted and unrestricted resources are available for use, it is the City's policy to use externallyrestricted resources first, then unrestricted resources - committed, assigned, and unassigned - in order as needed.

11. Net AssetsIn the government-wide financial statements, net assets are classified in the following categories:

Invested in Capital Assets, Net of Related Debt. This amount consists of capital assets net of accumulateddepreciation and reduced by outstanding debt attributed to the acquisition, construction, or improvement of theassets.

Restricted Net Assets. This amount is restricted by external creditors, grantors, contributors, laws or regulationsof other governments, enabling legislation, or constitutional provisions.

Unrestricted Net Assets. This amount is all the net assets that do not meet the definition of "invested in capitalassets, net of related debt" or "restricted net assets."

23

CITY OF BELTON, SOUTH CAROLINANOTES TO BASIC FINANCIAL STATEMENTS

JUNE 30, 2012

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

12. Property TaxesAnderson County bills and collects real and vehicle property taxes for the City. Property taxes are levied on October1, and are payable without penalty through January 15. Unpaid taxes attach as an enforceable lien on property as ofthe following March 17.

13. EstimatesThe preparation of the financial statements in conformity with generally accepted accounting principles requires theuse of management's estimates. Accordingly, actual results could differ from these estimates.

NOTE 2 - DEPOSITS ANDINVESTMENTS

The State of South Carolina General Statutes permits the City to invest in certain types of financial instruments.Cash is maintained in demand deposits or savings accounts, certificates of deposits, repurchase agreements, or U.S.Government securities. There were no deposit or investment transactions during the year that were in violation ofeither the state statutes or the policy of the City.

As of June 30, 2012, bank balances of the City's deposits were $2,329,873.

Interest rate risk. The City manages its exposure to declines in fair values by limiting its investments to certificatesof deposit which can be sold and withdrawn on demand.

Custodial credit risk - deposits. In the case of deposits, this is the risk that in the event of a bank failure, the City'sdeposits may not be returned to it. The City does not have a deposit policy for custodial credit risk. As of June 30,2012, all of the City's bank balances were insured and collateralized.

Custodial credit risk - investments. For an investment, this is the risk that, in the event of the failure of thecounterparty, the City will not be able to recover the value of its investments or collateral securities that are in thepossession of an outside party.

NOTE 3 - RECEIVABLES

Receivables as of June 30, 2012, including the applicable allowance for uncollectible accounts, are as follows:

Governmental Business-typeActivities Activities Total

Receivables:Accounts $ 68,514 $ 312,429 $ 380,943Property taxes 63,455 63,455Hospitality taxes 12,115 12,115Grants 57,249 57,249Interest 413 466 879Gross receivables 201,746 312,895 514,641Less: Allowance for uncollectibles {43,OOO2 {90,8032 {133,8032Net receivables $ 158,746 $ 222,092 $ 380,838

24

- -- -- -- -----------------------------------------------------------------

CITY OF BELTON, SOUTH CAROLINANOTES TO BASIC FINANCIAL STATEMENTS

JUNE 30, 2012

NOTE 4 - CHANGES IN CAPITAL ASSETS

Capital assets activity for the governmental activities for the fiscal year ended June 30,2012, was as follows:

Balance BalanceJune 30, June 30,

Governmental activities: 2011 Increases Decreases 2012Capital assets, not being depreciated:Land $ 256,080 $ 32,000 $ $ 288,080Construction in progress 10,110 209,985 {220,095}

Total capital assets, not being depreciated 266,190 241,985 {220,095} 288,080

Capital assets, being depreciated:Buildings and improvements 982,254 982,254Improvements other than buildings 673,843 246,769 920,612Machinery and equipment 698,484 15,430 (37,857) 676,057Vehicles 1,324,588 55,484 {49,565} 1,330,507

Total capital assets, being depreciated 3,679,169 317,683 {87,422) 3,909,430

Accumulated depreciation for:Buildings and improvements (623,660) (24,104) (647,764)Improvements other than buildings (313,319) (28,881) (342,200)Machinery and equipment (494,309) (42,708) 36,749 (500,268)Vehicles {933,923} {68,964} 49,565 {953,322}

Total accumulated depreciation (2,365,211) (164,657} 86,314 (2,443,554)

Total capital assets, being depreciated, net 1,313,958 153,026 (1,108} 1,465,876

Governmental activities capital assets, net $ 1,580,148 $ 395,011 $ (221,203) $ 1,753,956

Depreciation expense was charged to functions/programs of the primary government as follows:

Governmental activities:General governmentPoliceFirePublic worksCulture and recreation

Total depreciation expense - governmental activities

$ 23,48923,33180,5767,512

29,749$ 164,657

Current year increase in governmental activities includes purchases of police vehicles and costs incurred toward theconstruction of an elevator at City Hall.

During the fiscal year ended June 30, 2012, four acres of property were donated to the City at a value of $32,000.The donated asset was reported in the government-wide statement of net assets.

25

CITY OF BELTON, SOUTH CAROLINANOTES TO BASIC FINANCIAL STATEMENTS

JUNE 30,2012

NOTE 4 - CHANGES IN CAPITAL ASSETS (continued)

Assets were transferred from the governmental activities to be used in the business-type activities during the fiscalyear ended June 30, 2012. The net amount reported as transfers in the government-wide statement of activities for thetransfer of capital assets was $864.

Capital assets activity for business-type activities for the fiscal year ended June 30, 2012, was as follows:

Balance BalanceJune 30, June 30,

Business-type activities: 2011 Increases Decreases 2012Capital assets, not being depreciated:Land $ 57,418 $ $ $ 57,418Construction in progress 215,604 61,817 {l80,508} 96,913

Total capital assets, not being depreciated 273,022 61,817 (180,508} 154,331

Capital assets, being depreciated:Buildings and systems 8,743,407 254,291 8,997,698Machinery and equipment 689,400 33,316 722,716Vehicles 294,630 294,630

Total capital assets, being depreciated 9,727,437 287,607 10,015,044

Accumulated depreciation for:Buildings and systems (4,298,726) (208,956) (4,507,682)Machinery and equipment (541,381) (40,712) (582,093)Vehicles {290,340} {6872 {291,027}

Total accumulated depreciation {5,130,447) {250,355} {5,380,802}

Total capital assets, being depreciated, net 4,596,990 37,252 4,634,242

Business-type activities capital assets, net $ 4,870,012 $ 99,069 $ (180,508) $ 4,788,573

Depreciation expense for the water and wastewater enterprise funds was $50,128 and $173,077, respectively for theyear ended June 30, 2012.

Current year increases in business-type activities includes completion of construction for a water meter monitoringsystem and additional cost for projects under construction and not completed as of June 30, 2012.

26

CITY OF BELTON, SOUTH CAROLINANOTES TO BASIC FINANCIAL STATEMENTS

JUNE 30, 2012

NOTE 5 - CHANGES IN LONG-TERM DEBT

The following is a summary of changes in long-term debt of the City for the fiscal year ended June 30, 2012:

Balance Balance AmountsJune 30, June 30, due in one

Governmental activities: 2011 Additions Reductions 2012 ~earNotes payable:Note $ 6,239 $ $ (6,239) $ $Note 5,442 (5,442)Compensated absences 68,437 18,882 87,319 19,352Totals $ 80,118 $ 18,882 $ (11,681) $ 87,319 $ 19,352

Balance Balance AmountsJune 30, June 30, due in one

Business-type activities: 2011 Additions Reductions 2012 ~earNotes payable:Note $ 166,711 $ $ (14,799) $ 151,912 $ 15,249Compensated absences 4,740 4,740 4,740Totals $ 171,451 $ $ ~14,799l $ 156,652 $ 19,989

Long-term debt at June 30, 2012, was comprised of the following:

Business-type Activities:

May, 2021Collateralized By:

Balance atJune 30,2012

Note PayableTo:

InterestRate:

SCIRF 3.00%

MonthlyPayment:$1,633

Maturity Date:Water Revenues $ 151,912

The annual requirements to amortize notes payable debt outstanding as of June 30, 2012, are as follows:

Year EndingJune 30

Governmental activities Business-type activities

20132014201520162017

2018-2022Totals

Principal Interest Principal Interest$ $ $ 15,249

15,71316,19116,68417,19170,884

$ 4,3493,6063,4072,9152,4074,242

$ $ $ 151,912 $ 20,926

27

-- ----

CITY OF BELTON, SOUTH CAROLINANOTES TO BASIC FINANCIAL STATEMENTS

JUNE 30, 2012

NOTE 6 - INTERFUND RECEIVABLES, PAY ABLES, AND TRANSFERS

The composition of interfund balances as of June 30, 2012, is as follows:

Receivable fund Pa~able fund AmountGeneral Water $ 9,867

Water General 44,847Water Wastewater 5,086

Wastewater General 1,375Total $ 61,175

The outstanding balances between funds result mainly from the time lag between the dates that (1) interfund goodsand services are provided or reimbursable expenditures occur, (2) transactions are recorded in the accounting system,and (3) payments between funds are made.

The interfund balance of $5,086 due to the Water fund from the Wastewater fund was eliminated and therefore notreported in the government-wide statement of net assets.

The composition of interfund transfers for the year ended June 30, 2012, is as follows:

Interfund transfers:Transferred In:

General Water WastewaterTransferred out: Fund Fund Fund TotalHospitality fund $ 14,258 $ 439 $ 905 $ 15,602Water fund 30,000 19,598 49,598Wastewater fund 30,000 30,000Total $ 74,258 $ 439 $ 20,503 $ 95,200

Transfers are used to move unrestricted general fund revenues to finance various programs that the City must accountfor in other funds in accordance with budgetary authorizations, including amounts provided as subsidies or matchingfunds for various grant programs. Amounts were transferred from the Water and Sewer Enterprise Fund to theGeneral Fund for administrative costs.

Amounts transferred from the Water fund to the Wastewater fund were for costs of repairs shared by these Enterprisefunds. Total transfers in the amount of $19,598 were eliminated and therefore not reported in the government-widestatement of activities.

28

CITY OF BELTON, SOUTH CAROLINANOTES TO BASIC FINANCIAL STATEMENTS

JUNE 30, 2012

NOTE 7 - RESTRICTED ASSETS

The balances of the restricted asset accounts in the governmental and enterprise fund as of June 30, 2012, are asfollows:

Escheat depositsMunicipal Court depositsCustomer meter depositsNote payable covenant depositTotal restricted assets

Governmental Business-typeactivities activities

$ 9,749 $13,314

118,47726,336

$ 23,063 $ 144,813

NOTE 8 - FUND BALANCES

The following is a summary of the Governmental fund balances of the City as of June 30, 2012:

Major Special OtherGeneral Revenue Fund - GovernmentalFund HosQitali!i:Fund Funds Totals

Nonspendable:Inventory $ 4,652 $ $ $ 4,652Prepaids 62,892 62,892

67,544 67,544

Restricted for:Municipal court 13,314 13,314Hospitality 391,698 391,698Victims compensation 38,374 38,374Drug enforcement 13,056 13,056Firemen's activities 5,398 5,398

13,314 391,698 56,828 461,840

Assigned to:Parks and Recreation 941 941City Hall capital improvements 119,361 119,361Longevity 59,225 59,225Insurance premiums 143,956 143,956

323,483 323,483

Unassigned: 319,148 319,148

Total Fund Balance $ 723,489 $ 391,698 $ 56,828 $ 1,172,015

29

CITY OF BELTON, SOUTH CAROLINANOTES TO BASIC FINANCIAL STATEMENTS

JUNE 30, 2012

NOTE 9 - RISK MANAGEMENT

The City is exposed to various risks of loss related to torts; theft of, damage to, and destruction of assets; errors andomissions; injuries to employees; and natural disasters. The City has joined together with other municipalities in thestate to form the South Carolina Municipal Insurance and Risk Financing Fund (SCMIRF), and the South CarolinaLocal Government Assurance Group (SCLGAG), which are public entity risk pools currently operating as commonrisk management and insurance programs. The City pays an annual premium to SCMIRF for its general insurancecoverage and a monthly premium to SCLGAG for its employee health, life, and dental insurance coverage.

The SCMIRF is self-sustaining through member premiums and wiJI reinsure through commercial companies forclaims in excess of $1,000,000 for each insured event. The SCLGAG is also self-sustaining through memberpremiums and wiJI reinsure through commercial companies for claims in excess of $100,000 for each insured event.For claims in excess of $40,000 but less than $100,000, the "stop loss" insurance is pooled with other members.

The City also has joined together with other municipalities in the state to form the South Carolina MunicipalInsurance Trust (SCMIT), a public entity risk pool operating as a common risk management and insurance programfor worker's compensation. The City pays an annual premium to SCMIT.

There were no significant reductions in insurance coverage from coverage in the prior year. Settlements have notexceeded insurance coverage for each of the past three years.

NOTE 10 - EMPLOYEE RETIREMENT BENEFITS

The City contributes to the South Carolina Retirement System (SCRS) and the South Carolina Police OfficersRetirement System (PORS). These plans are cost-sharing, multiple-employer pension plans administered by theRetirement Division of the State Budget and Control Board. The SCRS and the PORS offer retirement and disabilitybenefits, cost of living adjustments on an ad-hoc basis, life insurance benefits and survivor benefits. The Plan'sprovisions are established under Title 9 of the South Carolina Code of Laws. A Comprehensive Annual FinancialReport containing financial statements and required supplementary information for the South Carolina RetirementSystem and Police Officers Retirement System is issued and publicly available by writing the South CarolinaRetirement System, Post Office Box 11960, Columbia, South Carolina 29211-1960.

The SCRS plan members are required to contribute 6.5% of their annual covered salary and the City is required tocontribute at an actuarially determined rate. The current rate is 9.385% of annual covered payroll. The contributionrequirements of plan members and the City are established by Title 9 of the SC Code of Laws. The City'scontributions to the SCRS for the fiscal years ending June 30, 2012, 2011, and 2010, were $63,728, $61,465, and$68,907, respectively, equal to the required contributions for each year.

The PORS plan members are required to contribute 6.5% of their annual covered salary and the City is required tocontribute at an actuarially determined rate. The current rate is 11.363% of annual covered payroll. The contributionrequirements of plan members and the City are established by Title 9 of the SC Code of Laws. The City'scontributions to the PORS for the fiscal years ending June 30, 2012, 2011, and 2010, were $81,865, $77,636, and$74,249, respectively, equal to the required contributions for each year.

The City has a tax sheltered annuity program qualified under Section 403(b) of the Internal Revenue Code coveringall eligible employees. If an employee elects to do so, they can contribute a minimum of 2% of eligible wages. Sincethe City contributes to the South Carolina Retirement System, no matching contributions are made to this program bythe City.

30

----- - -

CITY OF BELTON, SOUTH CAROLINANOTES TO BASIC FINANCIAL STATEMENTS

JUNE 30,2012

NOTE 11 - LEASE AGREEMENT

The City signed an agreement with Anderson County School District Two on February 6, 2007, to provide lighting fora school district football field in the amount of $44,750 and to pay for electricity to operate these lights in exchangefor the use of this field by the Recreation department football teams for a period of twenty years, ending on February15,2027.

NOTE 12 - COMMITMENTS

The City has a commitment for the upgrading of three Wastewater Treatment Plants within the City to becomecompliant with NPDES permitting. Estimated project budget is $6,908,000. Funding from Rural Development hasbeen obligated in the form of a loan for $4,687,000 and $2,221,000 in grant funds. Construction is expected to startwithin the next fiscal year ending June 30, 2013. As of the date of the financial statements, the letter of conditionswith Rural Development has been signed and approval of the final engineering contract is pending review.

NOTE 13 - SUBSEOUENT EVENTS

The City has applied for funding in the form of a loan from Rural Development for a water system upgrade projectestimated to cost $4 million. Should funding be approved for the project, the City would start construction within thenext fiscal year ending June 30, 2013. As of the date of the financial statements, the application had not beenapproved.

31

Z£

(66thuJ $ 68thU $ 886!006 $ 886!006 $ ~U!PU3 - 3JUII18q pUO~

886'£06 886'£06 886'£06 ~U!UU!~3q - 3:)Ulllllq punj

(6617'LL I) (6617'081) (000'£) (000'£) 30Ulllllq pUllJ U! 3~Ullq:) l3N

(17LI'O£) 9Z8'17L 000'~01 000'~01 (S3S0) S3J.IDOS~upulluyJ3qlo 18lO.1

L9~ L9~ Sl3SS1111ll!dlloJO 3111S(I17L'O£) 6~z'17L 000'~01 000'~01 U! SJ3JSUllJl~U!lIlJ3dO

(S3SIl) S3::nmOS ~NI:)NVNU 1I3H.1O

(~Z£'L171) (~Z£'~~Z) (000'80T) (000'80T) S,Unl!PU3dx3 (aapun)S3RU3A3JJO (AJU3PY3O)

9L9'8 17ZI'8£9'Z 008'9179'Z 008'9179'Z S3JOJ!PU3dx3 IlIlO.1

(6LO'69) 6LO'~61 000'9Z1 000'9Z1 AllllnO Illl!dll:)

c 91 61 61 lS3J3luI(£L) £1717'~ OL£'~ OL£'~ Illdpu!Jd

:3:)!AJ3S lq30£Z17'66 LL~ 000'001 000'001 lU3WdoPA3P Al!unwwo:)816'L 806'L91 9Z8'~Ll 9Z8'~Ll UO!lIl3J03J pua 3Jntln:)(9817'£~) lLZ'9£~ ~8L'Z817 ~8L'Z817 s:lJJOM.o!lqnd(Z98'17£) Z£~'~9z'l OL9'0£z'1 OL9'0£z'1 Al3JllS :)!IqndZ£8'8~ 86z'L917 0£1'9Z~ 0£1'9Z~ UO!lIlJlS!U!Wpy

S3lIfUION3dX3

(100'9~1) 66L'Z8£'Z 008'8£~'Z 008'8£~'Z S30U3A3J Il1Jo.1

8L17'£~ 8L17'17~ 000'1 000'1 sno3Ull1l30S!W

17L9 17L9'1 000'1 000'1 S~U!W1l3lU3WlS3AUI

(£OL'£) L6z'917l 000'0~1 000'0~1 S3Jnl!3JJOJ pUll S3U!d

(L86'17l) £IL'Z17Z OOL'gZ OOL'gZ S3:)!AJ3SJOJ S3~J1lq:)

(817L'~L) Z~~'££Z 00£'60£ 00£'60£ Illlu3WW3AO~J3lUI

(Z£~'6~) 89z'0~17 008'60~ 008'60~ snuuod pun S3SU3:)!'l

618'£17 618'£17 SlUllJO

(17Oz'OZ) 96L'6~Z 000'08Z 000'08Z S33J 3S!qoUllJd

8£0'1 8£0'9 OOO'~ OOO'~ S3XlllJO n3!1 U! lU3WAlld

ZIL'~ ZIL'~OI 000'001 000'001 Xll.Loinv

(817~'98) $ Z~17'8£8 $ 000'~Z6 $ 000'~Z6 $ Xll.LA}J3doJd:S3Xll.L

S3IlN3A3lI

l3~pOO: 18U!~ SlUOOWV 18U!~ 18U!~!JOqlJM 3JU8!J8A 18npV

siunourv P3l33pOo:

ztez 'Of 3NIlf 030N3 lIV3A 'lV:)SU 3H.1 1I0~ONIl~'lVll3N3~

3'lIl03H:)S NOSIlIVdWO:) AlIV.13~OIlO:VNI'lOllV:) H.1IlOS 'N0.1'l3O: ~O AU:)

££

~l9'1 II $ 869'16£ $ £LO'08l $ £LO'08l $ ~U!PU3 - 3JUBIBq pun.!!

£L6'£lp £L6'£lp £L6'£lp ~U!UU!~()q- ():lUBIBqpund

~l9'1 11 (~Ltl£) (006'£171) (006'£171) ():lUBIBqpUIlJ U! ()~uBq:ll()N

(l09'~I) (l09'~1) (sasn) S3J.IDOS~UPUBUY J3qJO IBJO.L

(l09'~I) (l09'~1) mo Sl()JStmll ~UllBl()dO(S3SIl) S3:)lIIlOS ~NI:)NVNI.!!1I3H.LO

zzz'zzt (£L9'91) (006'£171) (006'£171) S3JnJ!pu3dx3 (rapun) J3AOS3nU3A3JJO (AJU3PY3p) SS3JX3

6g'09 198'£Il OOp'pLl OOp'pLl S3JnJ!pU3dx3 IBJo.L

(l6p'Lp) l6p'1I 1 000'~9 000'~9 ABpno IBl!dB:)(6£) 6£ lS()l()lUI19~'6£ 6£t9 008'~p 008'~p IBdpulld

;():l!Al()SJq()G~I £'L 1 ~8p'8£ 008'~~ 008'~~ wS!lno~81L'6p zss'zs OO£'lOI OO£'lOI uouaaroar pUB()lDlIn:)9Lp'I PZO'P OO~'~ OO~'~ UO!lBllS!U!WPV

S3lIIl.LIaN3dX3

889'99 88I'L61 OO~'O£l OO~'O£l S3nU3A3J IBJo.L

171717 17176 OO~ OO~ S~U!WB()lU()WlSMUIOO~'l~ OO~'l~ SltmlDppL'£1 $ ppL'£pI $ 000'0£1 $ OOO'O£I $ Al!Itn!dsOH

;S()XB~S3IlN3A3lI

J3~pnH snmourv IBuB IBU!~!JOIBU!.!!qJ!M IBnpv3JOB!JBA

srunourv p3J33pnH

ZIOZ '0£ 3NIlf <I3<IN311V3A 'lV:)SM 3H.L 1I0.!!<INIl.!! A.LI'lV.LldSOH

3'lIl<I3H:)S NOSrnV dWO:) AliV .L3~<IIlHVNI'lOllV:) H.LIlOS 'NO.L'l3H.!!O AU:)

CITY OF BELTON, SOUTH CAROLINANOTES TO REQUIRED SUPPLEMENTAL INFORMATION

JUNE 30, 2012

NOTE 1 - BUDGETS

The City prepares an annual budget on the General Fund, Special Revenue Funds, the Water Fund, and WastewaterFund. The City follows these procedures in establishing the budgetary data reflected in the financial statements: