City Limits Magazine, May 1993 Issue

-

Upload

city-limits-new-york -

Category

Documents

-

view

225 -

download

0

Transcript of City Limits Magazine, May 1993 Issue

-

8/3/2019 City Limits Magazine, May 1993 Issue

1/32

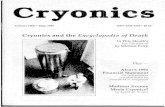

M ay 1993 N ew York 's C ommun ity A ffa irs N ew s Magaz ine $ 2 .

T E N A N T O W N E R S H IP W O R K S D G R A S S R O O T S B A N K IN GA H E A L T H P L A N T H A T D O E S W IN D O W S

D r u g s a n d t h e D r e a mCan housing advocates defeatthe dealers in East New York?

-

8/3/2019 City Limits Magazine, May 1993 Issue

2/32

City Limi tsVolume XVIII Number 5

City Limits is published te n times pe r year.monthly except bi-monthly issues in JunelJul y an d August/September , by the City LimitsCommunity Information Service, Inc., a nonprofit organization devoted to disseminatinginformation conce rning neighborhoodrevitalization .SponsorsAssociation for Neighborhood andHousing Development, Inc.Ne w York Urban CoalitionPratt Institute Cent er for Community an dEnvironmental DevelopmentUrban Homesteading Assistance BoardBoard of Directors"Eddie Bautista, NYLPIICharter Rights

ProjectBeverly Cheuvront, former City LimitsEditorErrol Louis. Central Brooklyn Partnersh ipMary Martinez , Montefiore HospitalRebecca Reich , Turf CompaniesAndrew Reicher, UHABTom Robbins, JournalistJay Small. ANHDWalter Stafford . New York Univers ityDoug Turetsky. former City Limits EditorPete Williams. Center for Law andSocial Justice

Affiliations for identification only.Subscription rates are : for individuals an dcommunity groups , $20/0ne Year , $30/TwoYears; for businesses , foundations , banks ,government agencies an d libraries , $35/0neYear,$50/TwoYears.Lowincome ,un employed,$10/0ne Year .City Limits welcomes comments and articlecontributions . Please include a stamped , selfaddressed envelope for return manuscripts .Material in City Limits does not necessarilyreflect the opinion of the sponsoring organizations. Send correspondence to : City Limits,40 Prince St., New York, NY 10012.Postmaster:Send address changes to City Limits,40 PrinceSt. , NYC 10012.

Second class postage paidNew York , NY 10001City Limits (ISSN 0199-0330)(212) 925-9820FAX (212) 966-3407Editor: Andrew WhiteSenior Editor: Jill KirschenbaumAssociate Editor: Steve MitraContributing Editor: Peter MarcuseProduction: Chip CliffeAdvertising Representative: Faith WigginsOffiee Assistant: Seymour GreenProofreader: Sandy SoeolarPhotographers: F.M.Kearney, Suzanne TobiasCopyright 1993. All Rights Reserved . Noportion or portions of this journal may bereprinted without the express permission ofthe publishers .City Limits is indexed in the Alternative PressIndex an d the Avery Index to ArchitecturalPeriodicals and is available on microfilm fromUniversity Microfilms International, Ann Arbor,MI48106 .

2jMAY 1993jCITY UMITS

I j., 1.1;1 i!j iThe Reagan-Bush-Dole Era?

The Democrats have a majority in Congress, but for now the countryis still ruled by the same old Republicans, who disguise their lackof concern for clean urban air, shelter for the homeless, an d care forpeople with AIDS beneath criticisms of so-called pork-barrel

spending. Even New York's own Alfonse D' Amato is toeing Senator BobDole's party line by joining the filibuster that is gutting the Clintonadministration's stimulus plan as City Limits goes to press.D'Amato's failure to act independently of the party leadership willlikely cost the city tens of millions of dollars. There is clearly a despera teneed for housing with social services for people with AIDS who arecurrently sleeping on the streets and in welfare offices-but apparentlyD' Amato an d Dole would just as soon ignore that fact. President Clinton'soriginal plan to invest $423 million in supportive housing and sheltersfor the homeless is also on the chopping block, as is a proposed investment in mass transit.Clearly much of the blame lies with the administration. Conservativecommentator Richard Brookhiser describes Clinton as a man interestedin a hundred policies and committed to about three. The President'slackadaisical introduction of the stimulus plan to Congress last monthadds beef to that description.The lesson for urban advocates is this: we can't count on significantfunding increases for programs that deal with our immediate crises. Butperhaps we can hope for innovative, longer term initiatives from theadministration that won't draw the Dole axis back into its filibusterformation. One such initiative begins with the palatably small amount ofmoney Clinton has slated for community development banks in the 1994budget. The plan requires congressional approval; fortunately, creatingloan programs an d sources of credi t for small urban businesses desperatefor capital is not the kind of thing Senate Republicans are likely to opposepublicly.But what members of Congress might try to do, as Associate EditorSteve Mitra explains in his article, "Banking on Change," is to hand theinitiative to the corporate banking world in the form of large subsidies,government guarantees for loans to small businesses and a rollback ofcurrent regulatory requirements. The danger is not that large banks willhave a hand in communitybanking-they should and do have a role-butthat they could easily overwhelm the growing network of communitybased financial institutions by becoming the central player in the federalprogram.The proposed funding for the first year of the banking initiative is ameager $45 million nationwide. But it's a start. Let's hope this is one ofthose policies President Clinton really is committed to.

* * *By the time you 're done reading this issue, you 'll have noticed thebyline of our new Senior Editor, Jill Kirschenbaum. She is familiar inNew York's magazine world as a writer for Newsday Magazine, Ms.,Premier an d a number of other publications, and we're pleased to haveher aboard. D

Cover photograph of Carey Shea and Anthony Carter by Suzanne Tobias.

-

8/3/2019 City Limits Magazine, May 1993 Issue

3/32

FEATURESBanking On ChangeWith President Clinton promising support for commu-nity development banks, a look at what lies ahead: Theplayers in the arena, the rules of the game. 10Drugs and the DreamHousing activists try to rid one of the city's most violentneighborhoods of dealers on the streets. 14

DEPARTMENTSEditorialThe Reagan-Bush-Dole Era? ................................ .... 2BriefsRecycled Opposition ...............................................4Credit Union Collapse ................................ .......... ...4Fort Greene Fallout .............. ....................................4

Tenants' Tentative Victory ...................................... 5ProfileThe Fix-It Plan ......................................................... 6PipelineWatchdog or Washout? ............................................8Vital StatisticsCo-ops or Bust ........................................................22City ViewWhen in Doubt, Reorganize .............. ...................24ReviewsChinatown Portraits ............................................... 26Keep Your Chin Up .............................................. 27Letters ...... ................... .............. .................................28Job Ads/Classifieds .................................................... 31

Fix-It/Page 6

Banking/Page 10

Drugs/Page 14

CITY UMITS/MAY 1993/

-

8/3/2019 City Limits Magazine, May 1993 Issue

4/32

11:1;11"11RECYCLEDOPPOSITION

Almost a year after RedHook residents defeated a cityplan to build a sludge processing plant in thei r community,the battle lines are being drawnagain-this time over a proposed recycling facility on theSouth Brooklyn waterfront.The Department of Sanitationhas proposed building a Materials Recycling Facility (MRF) forsorting, cleaning and packingrecyclable materials on thebanks of the Gowanus Canal,two blocks from the Red HookHouses. The MRF is part of thecity's plan to recycle half of allresidential garbage by 1995 .Eventually six such facilities willbe built in the five boroughs,says Department of SanitationDeputy Commissioner AndrewLynn .But at a recent meeting withofficials, Red Hook residentsreacted with anger to theproposal. At full capacity, theMRF would be visited each dayby 80 trucks delivering recyclable materials, 30 tractortrailer trucks taking processedmaterials away, and 70 passenger cars, according to numbersprovided by the city. Thesanitation department's proposed route for the traffic wouldsend the trucks down streetsadjacent to the Red HookRecreational Area, a busy spotin the neighborhood during thesummer."We have young peoplegoing to the park. The ball fieldsare jammed when the weathergets warm," soys Beatrice Byrd,a teacher at PS 27, which is afew blocks north of the sight."I'm concerned for their safety."But Lynn argues that the MRFwill generate 65 permanent jobsfor the community, as well as asmall waterfront park on thesouth side of the site. He saysthe five-acre Red Hook site is themost suitable one available forthe facility because it is zonedfor industrial use and is easilyaccessible to western andnorthern Brooklyn.''The bottom line is thatpeople in communities don't likesonitation facilities and sonitation trucks and there's no way toget around that," Lynn says.''We've really tried to do this the4jMAY 1993jCITY UMITS

right way. We 've spread thesearound the city. The point is thatsomeone will be affeCted."The city plans to submit theproposal for considerationthrough the Uniform Land UseReview Process (ULURP) thissummer, giving the local community bOard, the BrooklynBorough President and the CityPlanning Commission a forum todecide Whether or not the site isappropriate for the project.Community opposition islikely to be fierce, says AlriceNembhard, chairman of theEconomic Development andWaterfront Use Committee ofCommunity Boord 6 . Red Hookhas 22 waste transfer stations,the most in the city afterGreenpoint, he says. "If the votewere taken today there's nochance that the communityboord would pass it," he adds.''The challenge is to come upwith an alternative site."The recycling facility alsoconRicts with recently-devisedcommunity plans for the waterfront, says Nembhard . Theseplans-which have not yet beenfinalized-call for shoring upthe waterfront for maritime useand public access, he says.Tenants of the Red HookHouses, where 10,000 peoplelive , are also determined in theiropposition to the sanitationproposal. "It's always us," saysDorothy Shields, president of theRed Hook East Tenants Association . ''We don't want it, wedon't need it, and we'll do whatwe have to not to get it."Last year, Red Hook residents defeated a proposal bythe Department of Environmental Protection to build a nineacre sludge processing plant atthe site of the vacant RevereSugar Refinery on Beard Street,also a few blocks from the RedHook Houses.

This time, local residents mayfind themselves on the oppositeside of the fence from environmentalists who have longdemanded new processingcenters for recyclable materials .''We'd like to be able to supportth is facility," says MarshaZeesman, who chairs theBrooklyn Solid Waste AdvisoryBoord (SWAB) . "At the sametime we realize there areimportant community concerns.This is an important test case.

It's a really sensitive thing."So far, one other site for anMRF has been selected- theFresh Kills Landfill in StatenIsland--and Sanitation is stilllooking for sites in the otherboroughs. 0 Steve Mitra

CREDIT UNIONCOLLAPSE

A credit union established toprovide loons to low incometenants in the Northwest Bronxwas closed down r e c e n ~ y byfederal regulators because ofpersistent bookkeeping problems and a high percentage ofdelinquent loons.

''They were severely insolvent," says Anthony LaCreta,deputy commissioner in theregional office of the NationalCredit Union Administration . "Itwould take a millennium to getback out of the hole they werein," he explains, adding that all820 depositors in the NorthwestBronx Coolition Federal CreditUnion got their money backwithin three days of the closing.Brien O'Toole, executivedirector of the Northwest BronxCommunity and Clergy Coolition, which created the creditunion six years ago, admitsthere were problems. Foremostamong them was the lack of apaid staff for the lendinginstitution, he says, explainingthat volunteers had until r e c e n ~ y run the entire operation .But he says the coalitionhired a professional bookkeeping service for the credit unionlast summer, and the institutionwas beginning to becomesolvent again. ''We consider[the closing] a mistake," hesays.The credit union had made57 loans totalling approximate ly$120,000, and had expected toget around $80,000 of it back,according to O 'Toole.The Northwest Bronx Coalition Federal Credit Union wasone of the smallest of about 20similar community-based creditunions in the city, according toCliff Rosenthal, director of theNational Association of Community Credit Unions. He saysthe closing will damage the

reputation of other such creditunions in the city, all of whichare geared towards helpingpeople who can' t borrowmoney from traditional banksbecause of their low incomes,and can't afford to pay highbank fees for small deposits .

''Whenever an institution likethis shuts down, it's tragic ," saysRosenthal. ' 'We're alwaysfighting against tremendousodds ." 0 Steve Mitra

FORT GREENEFALLOUT

The city r e c e n ~ y 6eQanreorganizing its a i l i n 9 ~ o m e l e s s shelter system in an effort toprevent people from sleeping onthe Roors of city we lfare offices,and in the process has angereda group of recovering drugaddicts who live on the eighthRoor of the Auburn familyshelter in Fort Greene.The city wants to move thegroup out of the building, whichhas been turned into an "assessment center" where homelessfamilies are housed for one ortwo weeks while their needs aredetermined and long-termshelter placement is found . Thecity plans to o ~ n other suchcenters in each borough by thissummer.The 20 recovering addictsand their families refused toleave the Roor when the cityemptied the rest of the buildingin January, sending 200 homeless families to other sheltersaround the city. The residents ofthe drug-free Roor were offeredrooms at the Saratoga FamilyInn near Kennedy Airport, butthey successfully stalled themove by arguing that their drugtreatment and counselingprogram at the CumberlandDiagnostic and TreatmentCenter, adjacent to the Auburnshelter, was too far from there.Now there is fear the city willsplit up the group and sendthem into areas where drugsare rampant, says ElizabethCoates, who lives on the Roor ."Mothers in drug programsusually get shifted around andshifted around again, and thenthey stop going," she says,

-

8/3/2019 City Limits Magazine, May 1993 Issue

5/32

at least another two years. Thecurrent rent regulation statute isscheduled to expire on June15th of this year.

years," says Anne Pasmanick othe Community Training andResource Center.The Senate version is sponsored by Republican SenatorRoy GoOdman of Manhattanand cosponsored by 20 othersenators, and is the first billproposing permanent rentstabilization to be introduced inthe conservative upper house ofthe legislature since 1985.Still, the Republican majorityin the Senate has proven to bestrongly pro-landlord in thepast, and Senate approval ofthe second bill appears unlikely

C!yIng Foul: Fort Greene residents protest the city's conversion of theAuburn homeless shelter into an assessment center.

Tenant advocates wereencouraged by the early passoge of the first AssemblY bill, inpart because it was sponsoredby Assembly Speaker SaulWeprin. "The tact that Weprinis the sponsor sends a strongmessage to the Senate that theAssembly is serious about rentstabilization," says DerekDenckla of the MetropolitanCouncil on Housins, a tenantadvocacy group. "[Ex-Speaker]Mel Miller was for the most partunmoved by tenant issues." "The real estate lobby likesthe sunset clause [of the currentlawl because it gives them aregular podium to bring upother issues," comments Good-man aide Kevin Davitt. A

number of proposals to exemptall or part of the New York Cityhousing stock from rent regulation nave been introduced atboth the city and state levelsduring the last two years.

emphasizing the importancethat a stable place to live playsin any recovery program.A transfer is imminent,however, according to BertKnaus, a s ~ k e s m a n for theMayor's Office on Homelessness. Knaus says his office islooking for a new site nearby sothe recovering addicts will beable to continue their programat Cumberland."Ideally we'd like to keepthat link," he adds.But the Hoor's residents arenot convinced. For peaple likeJose Rosa, a recovering alcoholic who is also HIV-positive,and Norvel Martin, captain ofthe eighth Hoor, where she haslived tor 15 months, a move willthreaten more than proximity toservices at Cumberland: it willdestroy the camaraderie amongeighth Hoor residents that hasbecome a crucial part of theirrecovery.Members of CommunityBoard 2 and tenants of theWhitman and Ingersoll housingpro/ects, which border theshe ter, oppose the conversioninto an assessment center, andthey have lobbied city officialsto prevent the closure of thedrug-free Hoor. NigerCampbell, president of the FortGreene Community ActionNetwork and the organizer ofrecent protests criticizing theshelter conversion, believes themove by the city was iII-conceived. She says that whenAuburn was a regular shelter,families living there became apar t of the community and theirchildren were known in the

neighborhood and at the localschools.'When peaple are transient,they have no concern for theproperty," she says. "They arejust passing through." D Susan

Bymes

TENANTS'TENTATIVEVICTORYThe politics of rent regulationhave shifted slightly in Albany,following the State Assembly's

rapid passage of two bills thatwould extend rent regulation for

More exciting still for tenantsis the Assembly's approval ofthe second piece of legislation,which would make rent stabilization in New York City apermanent protection so long asthe apartment rental vacancyrate remains below 5 percent.The bill was co-sponsored byDemocrats Howard lasher ofBrooklyn, chair of the HousingCommittee, and Sheldon Silverof Manhattan. The bill's passoge in the Senate this springwould eliminate the politicalfights over regulation that haveoccurred every two years for thelast decade."Passing this bill would meantenants wouldn't have to go intoa tailspin of fear every two

Though tenant advocates arenot overly optimistic that the billcan become law, they say it stillgives them a better fOotholdagainst anti-regulation lobbyists. The New York State Tenantand Neighborhood Coalitionplans to encourage senators topass the bill during Tenant UnityDay in Albony on May 18th. DB.rbFedd . . .r----------------------------,

GUTSY. Il\TCISIVE.PBOVOCA:I-IVE.

City Limits probes th e misguided public policies and inefficientbureaucracies besetting New York. Bu t we don't think it's good enoughjust to highlight th e muck. CityLimits looks for answers. We uncoverth e stories of activists and local organizers fighting to save theirneighborhoods . That's why CityLimits has wo n seven majorjournalismawards. Isn't it time you subscribed?YES I Start my subscription to City Limits.o $20/one year 00 issues)o $30/two yearsBusiness/Government/Librarieso $35/one year 0 $50/two year

Name ______________________Address ____________________City_____ State _ Zip _

City Limits, 40 Prince Street, New York, NY 10012_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

CITY UMITS/MAY 1993/

-

8/3/2019 City Limits Magazine, May 1993 Issue

6/32

By Lise Funderburg

The Fix-It PlanMembers of a Brooklyn health insurance programfor the elderly improve lives-and save moneythrough community service.Aew months ago, an early mornin g burglar smashed ClaraKurowski's living roomwindow, climbed into the 70-year-old woman's house an d made offwith her VCR. The commotion awokeKurowski, who immediately bolted her bedroomdoor an d screamed outthe window for help. Thepolice arrived shortly,bu t not in time to catchthe thief.As soon as storesopened, Kurowski calledaround her southwestBrooklyn neighborhoodto find a shop that couldreplace the broken glass.But it was Friday, andnone of the local shopkeepers in he r mostlyOrthodox Jewish community had time to makea house call before closing for the Sabbath. That'swhen she rememberedElderplan, her healthinsurer.

part because ofits community serviceprogram called Member-to-Member.Each hour that Elderplan subscribersdonate in volunteer time equals onetime dollar, which can be redeemedfor a discount on their insurance

on issues such as griefan d loneliness.Currently, there are meetings forarthritis sufferers, singles and acaregivers' support group.Mashi Blech, senior manager ofvolunteer services at Elderplan,reports that nearly one third of thehealth plan's 6,000 members us evolunteers' services each year.Time dollar programs are sproutingup allover the country. There arebarter systems for day care services,pregnancy counseling, even delisandwiches. In New York City, 60women have joined together to formWomanSHARE, in which membersearn service credits cooking each other's dinners,fixing appliances, teaching skills an d providingcareer counseling. Anothergroup, SHARE NewYork, offers memberssteep discounts on groceries in exchange for afew hours of communitywork (see City Limits,March 1993).

Since when do insurance companies repairwindows? In the case ofElderplan, since 1987.That's when th e nonprofit, governmentfunded organizationlaunched a volunteerFair Exchange: Elderplan volunteers Norm Abrams and Clif DeBlasio repairClara Kurowski's window in exchange for "time-dollars."

At Elderplan, the ideatook some time to catchon. "For a while this program was a tough sell,"says Blech, explainingthat most of the healthplan's subscribers feltthey gave enough to theinsurance companywhen they paid theirbills. But eventually thevalue became clear, shesays, when they sawpeople like themselves,and not some big corporation, benefiting fromthe time dollar approach.After Kurowski madeprogrambased on the concept of "timedollars," a barter system devisedmorethan a decade ago by Edgar Cahn, afounder of the Legal Services Corporation. Time dollars reward peoplefor performing community servicesthat normally would be oflittle valuein the traditional marketplace.Elderplan's primary mission is tomanage health care for Brooklyn menand women 65 years old and olderwho are on Medicare. I t is an experimental social and health maintenanceorganization, or SHMO, launched bythe federal government eight yearsago in an effort to control health carecosts and promote preventive care.Elderplan has achieved that goal in' /MAY 1993/CITY UMITS

premiums or exchanged for an hour ofanother volunteer's time even monthsor years later.One Hundred VolunteersAt present, about 100 subscribersare Member-to-Member volunteers,putting in an average of three hours ofcommunit y work each week helpingfellow health plan customers. I fsomeone needs an escort to the doctor,a volunteer goes along. Or if a lonelyperson needs company, or someoneneeds errands run, a light bulbreplaced or a window fixed, participants in Member-to-Memberhelp out.In addition, volunteers ru n supportgroups and provide peer counseling

fruitless phone calls tolocal hardware stores an d glass shops,she called Mashi Blech, desperate.Blech called volunteer Clif DeBlasio,66, a retired contractor, builder an dbuilding inspector who is Memberto-Member'shome repair coordinator.He gets eight to 10 repair requestseach week-mostly about leakyfaucets, electrical outl ets that need tobe replaced and the occasionalcarpentry or plastering project. I f heisn't available, he contacts anotherElderplanmember,NormAbrams,72,who used to work on power stationsfor Westinghouse Electric.DeBlasio hasn't spent any of the70-plus credits he's earned in the 14months he's been volunteering. "I'm

-

8/3/2019 City Limits Magazine, May 1993 Issue

7/32

just enjoying myself," he says. "I havecome across people who really needthe assistance," he adds, recalling onewoman who needed her burned-outlight bulbs changed. "You'd think itwas a simple thing, bu t some peoplecan't stand on chairs or a ladder. Shehad Parkinson's disease and couldn'tsit still a minute."Comfort and ReassuranceWhile Kurowski is quite mobile,she doesn' t have DeBlasio's skills. Hefinished replacing her window a fewhours after her call to Blech. "He wassuch a comfort when he came," shesays of DeBlasio. "And when he wasdone, I felt so good that at least1couldsleep in my house." The solution toKurowski's predicament is a perfectexample of how the barter systemworks. The cost of her window repairwas the price of the glass plus threetime dollars from her balance of 41,most of which she earned visiting awoman in Borough Park, the nextneighborhood over. "This woman wasvery crippled up with arthritis," sheexplains. "She didn't like to talkmuch,but she liked company. I must havetold her my whole life story."Providing comfort and reassuranceseems to be Member-to-Member'smost valuable commodity. "Helpinggives me great satisfaction," DeBlasiosays, explaining that many of thepeoplehe assists seem to be strugglingjust to survive. "There have beenpeoplewho are barely getting by, doingwhat they can to pu t food in theirstomachs, much less taking care o f arepair," he says. .When DeBlasio goes into homes,he can't help but apply some of hisinspector's expertise. "I always askthem, 'Do you have a smoke detector?'Usually they do, but the battery's insome drawer." He also points outpotential hazards like loose throwrugs, which ca n slip underfoot.Preventing a senior citizen's fallcan mean the difference betweenstaying home and moving to a nursinghome.lndependentlJvingDeBlasio's dismissal of the creditshe earns is typical of most volunteers,according to Blech. Credits comefourth or fifth on the list ofwhy peopledo this, she says. More important tovolunteers is the knowledge that theyare helping people to live on theirown--sometimes for years longer thanthey might have.

The purchasing power of timedollars tends to be under-utilized,mainly because volunteers are amongthe healthiest of the subscriber groupan d don't need that much help otherthan the occasional home repair.Those who do use the services oftenare not in a position to earn the creditsto "pay" for them. Blech says she usedto describe time dollars as savings fora rainy day, because as they get olderthere may come a time when thevolunteers need help . But volunteerslike DeBlasio don't want to focus onwhen they won'tbe able to take care ofthemselves.Still, Blech adds, the idea of thecredits has tremendous value: peoplewho wouldn't normally take charitywill take help from an Elderplanvolunteer because they know that, atleast in theory, the volunteeris gettingsomething in return.

There 's ano ther payoff, Blech saysthat may be less tangible but has positive impact on people's health-the mission, after all, of Elderplan"Volunteers have a sense ofbeing ablto contribute, to learn new skills, to bin a social environment," she explains"Studies show that people who staactive stay healthy."Dorothy Gochal, 70, has earnemost of her BOO-plus time dollars bco-chairingan arthritis self-help grouwith 68-year-old Gloria Feldstein (46credits). At a recent meeting, BarbarSilverman, 73 , explained what shgets out of attending: "I've realizethat I have to accept my pain and griand bear it," she says. "But mostly enjoy th e young ladies who arrunning the group." 0Lise Funderburg is a freelance writebased in Brooklyn.

D.liv.r.d Vacant An Epic of Urban Transitiona ilm by Nora Jacobson

Vincent Canby of the New York Times calls it .. . .. a fine, rich f:tlm .. . anurban epic." Gene Seymour of Newsday lauds it as .....one of the mosttouching histories we may ever get of what happened in America in thelast decade."

Starts friday May l B t ~ One Week OnlyCinema Village22 East 12th Street, NYC

Call fo r show times: (212) 924-3363

Tenant Advocates!!!!Are you assisting tenants who:live in buildings with serious code violations?

have won HP actions but failed to get court-ordered repairs?have brought the case back for civil penalties?

If the answers are all yes, we may be able to help you get the repairsdone by training you to participate in our Contempt of Court pilot project.For information, call Cindy Roeser at The Citywide Task Force onHousing Court, (212) 982-5512, after 2:00 PM.

CITY UMITS/MAY 1993/

-

8/3/2019 City Limits Magazine, May 1993 Issue

8/32

By James Bradley

Watchdog or Washout?Could the Public Advocate be an investigator for thepeople? Or will the office be just another sinkholefor valuable tax revenue?What's the best way to spend$3.8 million?Ever since the City Charterwas revised in 1989, that'sthe amount of money the city hasspent each year on the office of theCity Council president, a position withlittle influence over the legislativebody for which it's named. As ofJanuary 1, voters will have elected anew politician to the job and, by orderof the council, he or she will have anew title: Public Advocate of the Cityof New York.On its surface, the name changemeans little; the office's few powersremain untouched. But, along withcurrent City Council PresidentAndrew Stein's imminent departurean d the prospect of several goodgovernment reformers running for thepost, the change has sparked a serious

debate about the jobholder'spotentialto be an ombudsman and investigatorkeeping tabs on governmentagencies.There have been many calls for theoffice's elimination, no t least fromMayor Dinkins, who says the moneycould be better spent elsewhere.But there are those who disagree,arguing that the millions of dollarscould be well-spent by an independently elected official with no ties tothe current administration or the CityCouncil leadership."The public advocate can developan office that can monitor differentagencies, improve their services,analyze the budget and work on offering alternative agendas," says PeteWilliams of the Center for Law an dSocial Justice at Medgar Evers College."Ifyou used the office's powers [fully]'like th e ability to monitor public

Now we meet moreinsurance needs than everfor groupslike yours.

8/MAY 1993/CITYUMITS

For nearly 20 years we've insured tenant and communitygroups all over New York City. Now, in our new, largerheadquarlers we can offer more programs and quickerservice than everbefore. Courleously. Efficiently. Andprofessionally.Richards and Fenniman, Inc. has always provicJecJ extremelycompetitive insurance programs based on a careful evaluation of he specialneedsofour customers. And becauseof hevolume of business we handle, we can often couple theseprograms with low-cost financing, if required.We've been a leader from the start. And with our newexpanded services which now include life and benefitsinsurance, we can do even more foryou. For information call:.ngrid Kaminslci, Senior V.P.(2 r2) 267-8080, FAX (2 r2) 267-9345Richards and Fenniman, Inc.123 William Street, New York, NY 10038-3804Your community housing insurance professionals

information an d service complaints,much light could be shed on policyproblems."Wide AccessThe City Council presidency hasundergone dramatic changes sincevoters adopted the revised New YorkCity Charter in 1989. Formerly, thepresident had two votes on the Boardof Estimate, with which it wieldedsubstantial influence over land useand budget considerations. With theSupreme Court-mandateddissolutionof the board, however, the powers ofthe City Council presidentwere largelyeviscerated.The president's few remaining rolesin th e City Council ar e largelyceremonial: to preside at its meetingsand to vote on legislation in the caseof a t ie-an unlikely event in a councildominated by a speaker as powerfulas Peter Vallone.But some other potentially significant powers are written into the jobdescription. According to the charter,the council president "shall serve asthe public advocate," monitoring cityagencies, making proposals to improvethem, reviewing public complaints,conducting investigations an d holding public hearings. To facilitate thepresident's investigations, the charterimbued it with a number of powers,includingwide access to city agencies'internal documents.The discussion of whether or notthe office is as valuable as its budgetappropriation-already likely to becu t back to about $2.7 million by theCity Council next year-comes at atime when the mayor and Vallonehave steadfastly avoided implementing a number of measures required bythe City Charter. These include thecreation of an Independent BudgetOffice, meant to ac tas a "non-partisan"research an d analysis outfit similar tothe Congressional Budget Office inWashington, D.C.; an d the funding ofa Commission of Public Informationand Communication to improve public access to government information.Last month, following a two-yearbattle by citizens' groups, the state'shighest court ruled that the mayormust provide at least $3 million innext year's budget to establish theIndependent Budget Office. The officewould enable citizens and dissidentCity Council members to analyzebudget data without depending oninformat ion carefully packaged by CityHall or the City Council budget office.

-

8/3/2019 City Limits Magazine, May 1993 Issue

9/32

Duplication?Partly as a result of that courtvictory, opinions on the future of thepublic advocate post are not dividedalong standard ideological lines. Notall good government groups are insupport of retaining the post, becausethey charge it could end up duplicating the work of the new budget office,other agencies and nonprofit watchdog organizations. "It's a redundantoffice without any real accountabilityor power," says Penelope Pi-Sunyer,director of the City Project, whichrepresents about 900 civic, labor,religious and advocacy groups. "Whatwe want is an Independent BudgetOffice that will give people information on policy and budget," she explains. "That's what's really needed."Henry Stern of the Citizens Unionalso believes the public advocate isnot worth funding. "It's a ridiculousoffice," he says. "The comptroller' issupposed to be the public advocate."Stern, a former councilman and parkscommissioner, believes the city canuse an ombudsman, but questions thecurrent method of selecting such aperson. "A political election is hardlythe best way to find a seeker of thetruth," he notes. "It's likely he'll endup either a stooge or a rival of the

mayor, neither ofwhich will be in thebest interest of the public."Bureaucratic TendenciesBut Eric Lane, former counsel tothe Charter Commission, argues thatthere was a clear motive for retainingthe job when the charter was revised."There was a belief hat the presenceof an independently elected ombudsma nwouldbe a useful pressure againstthe tendency ofthe bureaucracy to besecretive," he explains. That's alsothe view held by Pete Williams andmany others."A good public advocate could usethe position to develop an agenda formunicipal government, offer adifferent perspective on how it shouldoperate ..and give council membersrefuge for different ideas and agendas.Itcouldbe the thinktankfor munic ipalgovernment," Williams argues.Chris Meyer, City LegislativeDirector for the New York PublicInterest Research Group (NYPIRG),agrees the office has a useful role. "Itcould be a check on the power of theMayor," he says. "If you're havingtrouble with red tape at City Hall, youwon't go to the comptroller. Thecomptroller has specific responsibilities delineated in the charter on how

the city spends money an d othefinancial matters, and the councipresident is different.... The bottomline is, when an issue cuts acrosmany agencies, how do you cuthrough red tape and get a unified cityresponse?"On which specific issues could aPublic Advocate make a readifference? Meyer says the publicadvocate could focus on issues thainvolve a number ofagencies, such aslead poisoning. Williams wants thepublic advocate to take the lead on thecity's public housing problems, particularly on the matter of communitypolicing.Many criticize Andrew Stein'tenure as council president an dbelieve that his performance hacontributed to the current cynicismabout the job. "We're all affected by

our image of Andy Stein," says KenKimerling of the Puerto Rican LegaDefense Fund. "We don't know whathat office could be like if we hadreal gadfly or an outsider [in itl.Manhattan Borough President RuthMessinger, who is also in favor okeeping the office, notes via hespokesperson that "You have to lookat [the public advocatel as a 'can-beoffice rather than what it is now." 0

Applications Sought for fifthLeadership New York ProgramLeadership New York is a competitive fellowship program co-sponsored by the New York City Partnership and Coro. Inthe nine month program, during which part icipants are expected to remain employed full-time in their current profeSSions,participants explore the critical issues confronting New York City.These include housing policy, the city's educational, social service, health care and criminal justice systems, infrastructure,and the city's changing demographics and power structures.Leadership New York welcomes applications, which must be accompanied by two letters of recommendation, from thepublic, private and non-profit sectors. Candidates should have a demonstrated concern about New York City, a record ofprofessional achievement, and the potential to playa significant role in the city's future.

For further information and applications, please telephone the program's sponsors:At Coro: Meryl Greenfield, Director of Leadership New York, (212) 683-8841

At the New York City Partnership: Eve Levy, Director of Leadership Development Programs, (212) 493-7505Application deadline: June 11, 1993

~ N t w l " " ____ --,CITY UMITS/MAY 1993/

-

8/3/2019 City Limits Magazine, May 1993 Issue

10/32

UJZ

ZUJcr~ - - I ! I I ~

A primer on President Clinton's community banking plan:Bow it might work, and who's looking for a piece of the action.

BankingOn ChangeBY S"l"EVE MITBAW hen President Clinton stood before Congressin February and announced his plan to easeaccess to credit in poor neighborhoods, heunleashed more than a decade's worth ofpent-up hopes among community banking advocatesaround the country. Clinton's promise to establish 10 0new community development banks ha d been nothingmore than a potentially disposable campaign pledgenow, it had his official imprimatur ."With a new network of community developmentbanks," Clinton said, "we propose to bring new hope andnew jobs to storefronts and factories from South Boston toSouth Texas to South Central Los Angeles." Within weeks,the administration pledged $4 5 million in the 1994federal budget for the project's first phase.

I t didn't take long for disagreements to develop betweenthe two groups that hope to have a central role in implementing Clinton's community lending plan. On one sideis the corporate banking industry, a powerful player inWashington that is eager to bury its reputation for redliningand denying minorities credit, without exposing itself tofurther regulation. On th e other side are the small,10/MAY 1993/CITY UMITS

community-based credit unions, loan funds and banksexclusively targeted at financing low income entrepreneurs and homeowners.Both groups agree that sticking to Clinton's originalplan to set up 10 0 community banks would be too costlyand time-consuming. Butbeyond that, their agendas clash.Community lenders in poorer communities read in theadministration's plan an opportunity to shore up theirow n institutions, many of which have been struggling fordecades. The corporate bankers see an opening to rewritethe rules by which big banks currently invest in lowincome communities. Their call for new governmentsubsidies, incentives and loan guarantees that will assureprofits even in the most distressed neighborhoods is a redflag to small lending institutions.

"I n the most general terms we all agree in our supportfor [the President's1 initiative," says Cliff Rosenthal,president of he National Federation of Community CreditUnions, which represents about 10 0 community-basedlenders. "But what [the corporate banks] have in mind isentirely different from what we're getting at."Community LendersAt stake is one of the most important building blocks of

-

8/3/2019 City Limits Magazine, May 1993 Issue

11/32

any community: access to credit. If small entrepreneursare unable to borrow money, they can't get a business offthe ground-much less expand and hire new employees.That translates into less jobs, a smaller tax base, fewerservices, empty storefronts-a familiar story for manyurban areas.In response to decades of redlining of their neighborhoods by the mainstreambanking industry, over the yearsactivists have created small commu-nity development financial institutions(CDFIs) that make loans in distressed

making the kind of money that attracts investors odepositors seeking interest ratesor dividends that competwith mainstream banks. Even the widely praised SoutShore Bank of Chicago, the largest of the country's community development banks, took 10 years to becomprofitable after its startup in 1973.Now that community lenders feel they have a potentiaally in the White House, the coalition has pu t together report defining their industry, wherthey see it going, and how the federaneighborhoods, often with interestcharges well below market rate. Mosthave lending pools contributed to bycharitable foundations, religiousgroups, even some large corporatebanks seeking to comply with federallaws requiring them to invest in theirdepositors' communities.

Corporatebanks government can help. The reporincludes a set of spending proposalthey say will make those roadblockeasier to overcome. These include:

These lending pools range from afew thousand dollars for loan funds totens of millions of dollars for the largest community development banks.Currently, the CDFI industry is comprised nationally of four developmentbanks, 100 credit unions and 42 loan

see anopportunity torewrite the rules

Government money to open newCDFls. Traditionally, start-up monefrom charities or corporations has beehard to come by. "Clearly, the biggesneed is for [start-up] capital," sayKathy Tholin of the WoodstocInstitute, an activist and researcorganization in Chicago that specializes in banking issues. "Clinton shoulbe talking about fostering institutions .

of communityinvestment.

funds, as well as a smattering of verysmall "micro-loan" funds, accordingto Mark Pinsky a Philadelphia-area consultant who headsan ad hoc coalition of community-based lenders andactivist organizations.Community Capital Bank in Brooklyn is an example ofhow successful CDFIs can be. The bank is a fairly younginstitution-it opened its doors in January, 1991, a littlemore than four years after Lyndon Comstock, its founder ,started raising money. Today, it has $20 million in assetsand has made$7 million in loans to 30 borrowers, includinga $100,000 construction loan towards the Ben & Jerry's icecream store in Harlem.Like a regular bank, Community Capital offers savingsan d checking accounts and issues automatic tellermachinecards. But its main purpose is to lend money to organizations and individuals who are starting and expandingbusinesses, developing housing or providing social servicesin neglected communities. Among its clients are a Caribbean immigrant starting a soft drink business; the laid-offemployees of Flushing's defunct Taystee Bakery, who arecreating a worker-owned bakery of their own; and anonprofit group starting a nursing home for people withAIDS.Making loans to these kinds of clients is a laborintensive task, so Community Capital has created anorganization called LEAP, which stands for LendingEducation Assistance Program, to provide technical andmanagement assistance to its borrowers; LEAP helps themwith everything from managing their books to raisingstart-up capital. "The range of management skills neededis so broad-it 's marketing, it's product knowledge-it'stoo much for an owner of a small business," Comstockexplains. "We tr y to help with that."Overcoming BoadblockBThe CDFIs frequently run into tremendous roadblockswhen it comes to raising capital. Their mission to invest incommunity-oriented enterprises prevents them from

Government deposits in CDFIsDeposits provide the funds thafinancial institutions lend to theicustomers, and most CDFI directorsay they are constantly short on depositors. "Our pocketare never deep enough to meet the need," says David Ricof Neighborhood Capital Corporation, which provideloans and technical assistance to entrepreneurs in lowincome neighborhoods in Washington, D.C., Chicago, andLos Angeles. Government deposits would also boost thconfidence of others who want to do meaningful, sociallresponsible investing. "State pension funds, for examplewill feel more comfortable [making deposits in CDFIs] ithe federal government makes the same commitment,says Pinsky. Employee-training programs. Traditional MBAprograms rarely produce people interested in communitdevelopment banking, according to Errol Louis of thCentral Brooklyn Partnership, which opened a new crediunion last month. Technical assistance programs to help borrowersMany people in low income communities have neveborrowedmoney from a bankbefore. "The only way a loaprogram is going to work is to give the borrowers the toolfor problem management," says Martin Trimble of thNational Association of Community Development LoaFunds, based in Philadelphia. Currently, technical assistance adds huge sums to the overhead costs of CDFIs anddecreases the chance for profitabili ty, or even solvency.Coalition members are quick to point out that any newfederal money should be directed at institutions andgroups that have already pu t in long years working in lowincome communities, rather than take the form of subsidies for corporate banks that have often ignored sucneighborhoods. "We don't think it should be directetowards traditional banks," says Allen Fishbein of thCenter for Community Changein Washington, D.C. "CDFIknow a lot more about community-based lending," hadds. "We're talking about [serving] the mom-and-popenterprises, the small-time businesses that no one elsserves."

CITY UMITS/MAY 1993/1

-

8/3/2019 City Limits Magazine, May 1993 Issue

12/32

The TraditionalBanksThat kind of talk has lefttraditional commercial andconsumer banks scrambling fora role in the Clinton plan. Theycontend they have been actively involved fostering community development, especially during the last few years,and consequently should bekey players in any new initiative. "I really don't see the reason for banks to be skippedover," says Chris Rieck, spokesma n for the American BankersAssociation (ABA) in Washington,D.C. "We feel that banksare already doing communitydevelopment by law and bychoice."

ible and burdened with government controls. Besides,says Willis, "We are nowwhere the community developmentbanks could be in fiveyears, i f all goes well."Willis suggests that thefederal government expand aguaranteed loan program forsmall businesses that normally wouldn't qualify forcommercial credit because ofinsufficient collateral, for instance. In addition, he saysCongress should create a system oftax credits for community-based economic development, similar to the tax creditcurrently granted to corporations that invest in community groups building low income housing.The current impetus for mostbank lending in low and moderate income communities isrooted in two pieces of federallegislation passed in the1970s-the Community Reinvestment Act of 1977 (CRA)and the Home Mortgage Dis

Cause for Hope: The two-year old Communi ty Capital Bank inBrooklyn is helping to start small businesses in neighborhoodslarger banks have neglected, says founder Lyndon Comstock.

Other bankers go evenfurther by asking for directgovernment subsidies, including federal payments tolenders who make low interest loans. R. Scott Jones , presiclosure Act of 1975 (HMDA). The former requires banks tomake credit available in the communities they serve, andgives federal regulators the opportunity to judge compliance whenever a bank seeks government approval toexpand or to merge with anotherbank. The latter, updatedin 1989, requires most home mortgage lenders to filedetailed records about whom they accept or reject forloans. The government then makes the data public.The mortgage data has proven to be a powerful tool forNew York communitygroups such as ACORN, which wona five-year, $750 million commitment for lending in lowincome communities from the newly merged ChemicalBank and Manufacturers Hanover Trust. Using HMDArecords, ACORN revealed that even when potentialborrowers of different races had equal incomes, Manufacturers Hanover disproportionately rejected blackcustomers. The bank denied it had discriminated by race,but signed an agreement with ACORN in 1991 to vastlyincrease community development funding (seeCityLimits,January 1992). Since then, Chemical Bank has boosted itscommunity development mortgage, loan and grant fundsfrom $750 million to $1 billion.But bankers say they don't want community investmentforced upon them this way. Instead, they'd like an activerole in Clinton's development plan, a relaxation ofbankingregulations, and a new set of loan guarantees, tax credits,or subsidies that would make community investmentmore profitable.

"If you want to make people more positive aboutcommunity development, the economics have to work,"says Mark Willis, director of the Chase CommunityDevelopment Corporation, part ofChase ManhattanBank.Willis explains that banks are simply looking for safeinvestments for depositors' money.The bankers dislike Clinton's idea of creating a newnetwork of institutions specifically designated for community development because it could prove to be inflex-12/MAY 1993/CITY UMITS

dent and chief executive of Goodhue County NationalBank in Red Wing, Minnesota, an d a board member of theABA, says that since small, inner-city borrowers needbelow-market-rate-interest loans, the government shouldpay banks for the difference. "The borrower would becharged a lower interest rate, but the financial institutionwould get the full market rate," he says. "There needs tobe some sort of subsidy."PaperChaaeOf great importance to the ABA-as laid out in lengthytestimony to Congress-is the scaling back of federalregulations that limit the amount of money they can lend,whether or not their customers have good credit backgrounds. These regulations, put in place in the wake of hesavings and loan scandal in the late 1980s, require banksto hold a higher percentage of their deposits off the loanmarket than in the past, reducing the risks of speculativeinvestment, at least in theory. Regulators also institutedoverly strict rules regarding the appraisal of collateral,limiting the potential loans banks can make, bankers say.Meanwhile, the ABA is continuing its long-foughtbattle to scale back CRA and HMDA regulations. It arguesthat banks want to do more community lending-what'sholding them back is the extensive paper chase requiredby the government to document their lending activities inlow income communities."The industry is really suffering," says Jones. "Ourrecommendations would be to put less emphasis on documentation. Just think of the lending that could occur i ftwenty-five percent of the paperwork were eliminated."Activists point out that despite such complaints, banksare no t required currently to reveal the full extent of theirlending data. They do not, for instance, have to disclosewhereor how they make loans to small businesses. Furtherscaling back of paperwork shouldn't be allowed, theyinsist, pointing out that it is precisely these regulations

-

8/3/2019 City Limits Magazine, May 1993 Issue

13/32

that have helped community groups successfully challenge redlining of low income neighborhoods and leverage more than $6 billion in housing and communitydevelopment loans since 1978.Also, Congress may have its own ideas on where wants community development lending to go. Two sucideas are already being floated in Washington: RepublicaSenator Alfonse D' Amato of New York, a member of thSenate Banking Committee, wants to allow banks to buout of CRA requirements by investing in CDFIs. An"I t is categorically incorrect to say that paperwork is aproblem that's keeping [banks] from doing communitydevelopment," says John Taylor, ex-ecutive director of the National Com- Democratic Representative JohLaFalce, also of New Yark and head othe House Small Business Committeeunity Reinvestment Coalition."That's simply not the case ... CRAhasminimal paperwork, and the paperwork has a purpose: it provides a mosaic of what the bank is doing or notdoing in a community. It's not thatpeople are trying to make them jumpthrough hoops."

P r e ~ f o r B e v U d o D Following his speech to Congressin February, Clinton proposed annual

Activists arebracing fora letdown.wants to set up a secondary market focommunity development loans, iwhich a government-sponsored corporation like Fannie Mae or Freddie Mawould be established to buy high-risloans from banks. These and otheproposals may conflict with administration efforts.

increases in the initial $45 million investment in community development banks, to a total of $354 million overfive years. Though this is far more than the Bush administration ever proposed for such a scheme, i t is considerably less than the $1 billion Clinton promised during thecampaign.

But even without congressional interference, many activists lack confidence that the Clinton administratiohas the will to see its proposals get through Congresintact. "Given the way this administra tion operates, whastarts as a grand proposal quickly becomes a demonstration project," says Rich Ferlauto, who directs the community economic development program for the Center foPolicy Alternatives, a progressive Washington think-tankCommunity activists say they are bracing for a letdownwhen the administration releases more concrete plans.One fear is that any proposal on banking could be met withstrong pressure for revision from Congress: bankers areamong the top contributors to federal campaigns, with thebanking industry contributing more than $9 million to1990 congressional campaign coffers.

Still, many activists' hopes are pinned on Clinton, ionly because his proposals have succeeded in introducinthe phrase "community development" into the mainstream. Six months ago, observes Comstock, not manpeople knew what CDFIs were."For the past 12 years we had no one to talk to," he says"At least Clinton's heart is in the right place." 0

NEW Y 0 R KExpo Tech 93An all-day expo on computertechnology withworkshops and exhibitsfor small organizations andf i rms-DATEThursday, May 27TIME8:30 am to 4:30 pmPLACENew School for Social Research65 Fifth Avenue (at 14th Street)ADMISSION$15-pre-registered$20-at the door

FOR FURTHER INFORMATION.TELEPHONE 212-791-3660

Thirteen workshops will be offered throughout theday, including these workshops of interest to notfor-profit organizations:10:45 am - 12:15 pmIssues In Computerizing Non-profitsAddresses special needs and concerns of not-for-profit agencies. Fundraising, fund accounting, mail list management,membership systems.2:30 pm - 4:00 pmUsing Public Access Databases for Grantwritlng andNeeds Assessment.There is a wealth of information out there at little or nocost. Learn how to access it.2:30 pm - 4:00 pmLooking Good on Paper: Desktop PublishingIn-house print and presentation production with desktoppublishing systems and graphic software.Other topics: Hardware Buying Tips; Focuson Windows;Low Cost Direct Mail Techniques; Avoiding Disasters.

CITY UMITS/MAY 1993/1

-

8/3/2019 City Limits Magazine, May 1993 Issue

14/32

AND mE

Community groups rebuilding East New York are caught in a war of willswith dealers on the streets. So far, the dealers are winning.BY JILL KIRSCHENBAUMI n the springtime, Brooklyn's Alabama Avenue betweenRiverdale an d Newport is like a block straightout of Mister Rogers' Neighborhood. Budding treesline the street of meticulously maintained houses;residents sweep their stoops and tend their yards; avest pocket garden begins to bloom; children run about."You couldn't find a nicer block in all of New YorkCity," says Carey Shea, director of a nonprofit housingdevelopment group that has renovated an d managed 29buildings in the area since 1991.One would be hard-pressed to disagree, if it wasn't for the fact that this

"You come into a neighborhood ," says Shea, "and yousee all of these vacant buildings and shady characters andyou say to yourself, 'I'm going to rehab these buildings,move in nice people, an d they're going to be the dominantforce; and all these other people are going to slide off tosome other sleazy area because they'll feel so out of placehere.' In other places, you rehab the buildings and thedealers leave."But the dealers, she reports, aren't leaving, an d fear ofthe violence their presence breeds is making it difficul t forhousing groups here to fill up their spotless, rehabilitatedbuildings. It's also made it next toimpossible to organize local residentsto fight back. Day by day, the groups'stretch ofAlabama Avenue lies smackin the middle of one of the most violent sections of notorious East NewYork.The district's reputation for dangeris well-earned. Since 1985, East NewYork's crime rates have consistentlyranked among the city's highest.Ninety murders, or one ofevery 20 inthe city, were recorded within theboundaries of East New York's 75th

Fear has made itnext to impossibleto organize local

residents.

dreams of renewal are being challenged, and they know their chancesfor survival are directly linked withwhether or not they can figure outhowto push the dealers offthestreets.

An tmosphere of unmistakable menace hangs over pockets of he40-block domain of the UYC like avenal dark cloud. Drug sales are carriedPrecinct in 1992.It's not as if Shea wasn't aware ofthis when she and the East New York Urban Youth Corps(UYC) ,which formerly ran after-school and summer youthprograms in the neighborhood, decided to get into thenonprofit housing business. But while revitalization efforts in other parts of the city have had an impact on streetcrime, particularly on the drug trade, that's not been thecase in this corner of East New York, where UYC an d ahandful of other groups are scrambling for new ways todea,l ~ i t h problems far more intransigent than they everantIcipated.14/MAY 1993jCITY UMITS

ou t in plain sight by clusters of jittery dealers affectingstances ofnonchalance; at 9:30on a Thursdaymorning thedealers and their customers are virtually the only peoplein sight. Shea refers to the quadrant as "west of Pennsylvania" because it is separated from the rest of East NewYork by Pennsylvania Avenue. Deputy Inspector JosephDunn, commanding officer of the 75th Precinct, identifiesit as the Western Sector. Most cops just call it the deadzone.Gunfire is a common. occurrence here. Anthony E.

-

8/3/2019 City Limits Magazine, May 1993 Issue

15/32

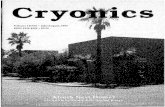

Desolation Row: AnthonyE. Carter of the East New York Urban Youth Corps and a friend from the neighborhood in the Western Sector.

Carter, a DYC tenant and the assistant superintendent offour of the organization's buildings on Williams Avenue,says he has witnessed three murders and 15 shootings inthe eight months he has worked for Shea. One neighborhood resident who considers herself lucky to live east ofPennsylvania and who asked that her name no t be usedsays some streets-Alabama,Georgia, Newport, Sheffieldshould be avoided at all costs after dark. "At night it's sopacked over there with people and there's so much drugsan d so many shootings-it's like a western."Still, even in East New York's wild Western Sector,Shea had reason to believe that solid housing stock andmotivated, concerned tenants would make th e difference.Comparable development projects in neighborhoods likeHarlem, the South Bronx, even other sections of East NewYork, are testament to that. For instance, one Harlemgroup, Neighborhood Gold, has dramatically reduceddrug traffic in and around six buildings with a simplestrategy: organize tenants to create a climate less hospitableto drug dealers, an d the dealers will go. Broken mailboxes,windows and intercoms and dimly lit hallways send outthe message that a building is vulnerable, and its tenantsare easy targets, says the organization's director, RayLaszczych.Similar strategies in the Western Sector have had alimited impact, though there have been some gains. OneofUYC's apartment houses at the corner of Williams andNewport avenues has seen a marked improvement sincethe organization took it over, renovated it, and moved inlow income and formerly homeless families eager for achance to start a new life. The building, 584 WilliamsAvenue, was one of the worst drug locations in the

neighborhood, says Shea."There'd been a big crowd there for years," she notesreferring to the swarms of buyers and sellers that oncdominated the building. "[Dealers] had actually cu t a holin the building and had set up a sort of fortress in thvestibule when i t was vacant."Today, there are no dealers taking up residence in thimmaculate, nine-unit apartment house, its well-lit halways painted a bright white with soft teal trim. But steadtenants and a well-maintained building have no t stemmethe illegal commerce on the sidewalk out front. In manways the dealers are still holding the building hostagestashing their drugs under the exterior window sills anbeneath cars parked by the curb, hassling tenants as thecome and go.Carter stays inside his apartment at 584 Williams aftedark, protected by Snoopy, hi s stalwart pi t bull. As thsuperintendent, he maintains an uneasy peace with thdealers who congregate outside ; on more than one occasiohe has been physically threatened and falsely accused otipping off the police to their activities. "I go to stay witfriends in Manhattan on the weekends, just to get a chancto relax," he says.Other tenants have been unable to adapt to the pressureIn April, after months of harassment and threats from thdealers, a young couple that ha d rented an apartment ithe building took their newborn and three-year-old chilan d moved out on less than a moment's notice."They just walked in and dropped off the key," sayShea sadly. "Didn't even ask about the security deposiThey were gone." They are not a unique case-it 's hard foUYC to find tenants willing to stay. At any given time ther

CITY UMRS/MAY 1993/1

-

8/3/2019 City Limits Magazine, May 1993 Issue

16/32

may be as many as 30 UYC vacancies, and these areaffordable apartments; rents range from only $215 for astudio to $590 for three bedrooms, depending on incomeand whether or not a tenant is receiving public assistance.Ralph Anderson, who has lived for three months in aUYC building with his fiance and four-year-old daughter,says he's fed up as well. He moved there from BedfordStuyvesant because he wanted to save money for a newhouse, and UYC's low rents couldn't be beat. His is thekind of moderate income family that the housing groupshoped would help stabilize the area. But now, Andersonis making plans to move as soon as he can. Home-buyingplans will have to wait. Any intelligent person, he says,would do the same."How can they even ask us to pay rent in this situation?"he asks. "The drug business here is a stand-on-line, driveup-all-day kind of thing. I've never seen anything like i t -only in the movies. But this is for real."ACORN, another nonprofit group staking a claim to 12buildings in the Western Sector, has had even more severeproblems. Last summer, a man hired to guard an ACORNconstruction site on a particularly drug-riddled section ofSheffield Avenue, two blocks over from Shea's basementoffice on Alabama, was shot and killed. And last month,a block down from a UYC apartment house on Williams,there was a shootout outside one of the nine buildingswest of Pennsylvania managed by the OceanhillBrownsville Tenants Association (OHBTA). The violencewas apparently in retaliation for an ambush that hadoccurred in a vacant lotnearby just hours before-part of a turf warbetween two rival drugoperations, Carter explains. In all, four peoplewere shot, two of themfatally.

the low level dealers, but they don't target the suppliersand they don't often trap the buyers who drive into theneighborhood from allover the region to purchase cocaine,crack, heroin and marijuana. And the police sweepscertainly don't address the allure o f big money, status andopportunity that motivates the dealers in the first place.Dave Nelson, lead organizer of East Brooklyn Congregations, a group of churches and one synagogue that hasbuilt approximately 1,050 single-family homes in EastNew York since the early 1980s, says the TNT methodclearly isn't the answer. "The history of the area west ofPennsylvania has been one o f a lot of TNT activity, but fewclosings of drug sites," Nelson states. "There are lots ofstatistics, lots of arrest activity, but no closings. And onlythe closings of drug locations are of any value to thecommunity." In fact, there have been three TNT operationssince 1989, and though arrest statistics have slightlydeclined, the street-drug activity has continued unabated."They busted everybody," Shea adds. "But everyoneknows that you can drive to the corner of Williams andNewport and buy drugs. It's been that way for years. Soeven though the dealers were gone, thebuyers kept coming.And now there's a whole new group selling out there."Currently there are at least halfa dozen drug "hot spots"in the Western Sector, which accounts for only a tiny pieceof the precinct. The corner of Williams and Newport is atthe top of the list, according to the police.Assistant District Attorney Pat Gatling, chief of theMajor Narcotics Investigations Bureau in the BrooklynDistrict Attorney'soffice, agrees in partwithNelson's and Shea'scomplaints about theshortcomings of conventional enforcementefforts.

"Large scale arrestscan slow down theactivity," she says. "Wecan do buy and busts tillwe're blue in the face.We can lock up all thesellers and all the buyers. But there will beothers to replace them."T ere have beenmany attempts by police to clean up the drugtraffic on the blocks ofthe Western Sector. Mostrecently, the policedepartment's TacticalNarcotics Team (TNT)spent the last threemonthsof1992 carryingout repeated undercoverobservation, surveillance and buy-and-bust

en The key, says Gatlingand other law enforcement officials, is to infiltrate andbust the houses;:5 where drugs are stashed,1il the packaging locations,

Mister Roprs' Nelchboltlood: "You couldn't find a nicer block in all of New York and the distributors.City," says Carey Shea ofUYC. Identifying and infil-operations, and made a total o f 401 felony arrests. For awhile, the streets were quiet, confirming the expectationsof Shea and other community leaders who had encouraged TNT to target the area. "That was my Plan A. I reallythought that if we brought in TNT, we'd get rid of theseguys," she recalls. "I was so wrong." In no time at all, thedealers were back.The problem, says critics of the TNT method, is that itssolutions are only temporary and are not coordinated overthe long term with other police activity, like regular footpatrols through the community. The street sweeps harass11/MAY 1993/CITY UMITS

trating drug distributionrings is a slow process, however. Currently there areseveral such investigations underway in East New York,Gatling says, including one of the "A-Team," a gangbasedin the Cypress Hills housing project and believed to belong-time suppliers of drugs to the neighborhood. Butsuch news is cold comfort for housing groups whosetenants don't have the luxury of waiting for down-theroad solutions.Meanwhile the war of attrition continues. In 1991, theprecinct was second only to Washington Heights in thenumber of homicides that occurred there, and it topped

-

8/3/2019 City Limits Magazine, May 1993 Issue

17/32

the list for assaults. Ofthe 12,268 felony crimllscommitted there in1992, more than on ethird of the 3,942 casesending in arrests weredrug-related.

Darlene D., anACORN member whoasked that her full namenot be used, acknowledges that even those inthe community willingto participate in blockwatches or patrols mustgrapple with a potentially crippling contradiction."People have to trustthe police. They saidthey would teach people

en how to do neighborhoodpatrols, and I'd do it,"::; Darlene says. "But thenyou have a situation likethe store at the corner of

T e inadequaciesof TNT notwithstanding, housing advocatesare dissatisfied with thedaily coverage they'vereceived from the police.Following the death oftheir security guard lastJuly, ACORN held ralliesat the 75th Precinct andat One Police Plaza _ _ _ ~ e n Hendrix and New Lots.Taldng a $bind: Darlene D. and other ACORN members convinced the 75th They've been sellingPrecinct to increase the number of oot patrols in the neighborhood. drugs out of there for"We'vebeen pressuring the police to provide more patrols" notes organizerLonn Heymann, "and we've been holding monthly meetings with them for four months." The meetings have notbeen in vain. In January, Deputy Inspector Dunn designated eight new Police Academy recruits to do foot patrolsin the Western Sector.Still, even that's not enough. Knowing that the policecan't give the neighborhood round-the-clock protection,many local residents have learned to live with the dealers."What develops is a culture of coexistence," saysHeymann. "The only way people can live their lives is toestablish some sort of relationship so they can coexist withthe dealers living on their doorstep, so they can go to work

every day with minimal threat."But such fatalistic pragmatism means more traditionalmethods for countering drug dealers, such as organizingresiden ts to take a stand by working intenant patrols alongside local police,

years. Why hasn't itbeenshut down? The police have to be on the take ... There's alot of suspicion here about the police."Just as the police represent a suburban presence in EastNew York-many, like Dowd, live on Long Island beyondthe city's borders-so do the drive-up drug buyers, another sticking point for residents here.According to Sergeant Larry Nikunen, a supervisor inthe 75th Precinct's Street Narcotics Enforcement Unit, atleast 50 percent of the buyers west of Pennsylvania drivein from other neighborhoods-Canarsie, Howard Beach,Bensonhurst-as well as Nassau, Suffolk and Westchestercounties. Some even come from as far as Connecticut andNew Jersey.Housing groups have pressed police to try focusingtheir efforts on the buyers rather than the sellers. Butthey've met resistance from a law enforcement and political culture that they say appears tofavor people who don't live in theneighborhood.ave gone by the wayside."We have to be careful," says Martin Dunn, UYC's director of housingdevelopment. "The tenants are scared,and if they get threatened, they moveout. So we try to take the lead on that.We'relessofatarget."And,addsDunn,his organization doesn't have muchfaith in programs that call for tenants

"When wetake their cars

they're devastated"

A method that has been used sporadically in other parts of the ci tymost notably Washington Heightshas been the confiscation of buyers 'cars after they've bought their highfor the day. Shea would like to seethis become regular policy in Eastto function as adjuncts to the policeforce."The police always say [reporting information] is anonymous," notes Dunn. "But the cops come and tell thedealers that a tenant called and made a complaint. So thenthe tenants get harassed. We want a different strategy thatdoesn't threaten the tenants."There is also a more compelling basis for many EastNew Yorkers' fears about the police. Last year, OfficerMichael Dowd and several of his colleagues from the 75thPrecinct were arrested on felony charges of conspiracy tosell and distribute cocaine in Suffolk County. The arreststhrew the department into turmoil, and severely compromised the precinct's integrity in the already jaundicedeyes of many community residents.

New York."Pop the cars," she says. "Ifenoughof he buyers who drive into the neighborhood have to walk out, the word will get around thatthis is not a safe place to do business."Deputy Inspector Dunn confirms that this has beentried a few times recent ly; nine vehicles were confiscatedin the first three months of 1993. Two of the drivers eventried to bribe the police to let them go, Dunn reports,further compounding their legal problems. And SergeantNikunen, whose unit was responsible for the car seizures,is enthusiastic about the idea. A mere misdemeanor countof possession, he says, is not nearly as effective."They just receive a desk appearance ticket with a courtdate, and they're out in two hours. But when we take theircars they're devastated. And we've taken some very nice

CITY UMITS/MAY 1993/17

-

8/3/2019 City Limits Magazine, May 1993 Issue

18/32

cars-Lincolns, Blazers, Jeeps."But Robert H. Silbering, the city's special narcoticsprosecutor, conside rs seizure programs problematic."What if the person driving the car is not the owner?What if a parent has loaned it to a son? Is it fair to the ownerto have the car seized? They may not even know the kidwas using it. Should the bank holding the car loan be out$20,000?"The housing groups are cognizant of the tricky watersthey must navigate in order to defeat the street dealers andprotect their tenants ' safety without sacrificing civilliberties in the bargain. Residents, however, are fed upwith legal philosophyan d the rationalizationsof officials like Silbering."Ifyou don't have theright to live peacefully,without the fear of beingshot, you don 't have anyrights ," states JuanitaFisher, a resident of theFiorentino Plaza housing project in the Western Sector.

displacing long-time residents who can't afford to bu y thehouses, which cost about $61,500 when last built in 1992.And in fact, an estimated 249 families were displaced forthe project built east of Pennsylvania, according to the cityDepartment of Housing Preservation an d Development.On the other hand, the clean streets an d row ufon row ofsmall prefab-style houses offer a sort of critica mass thatUYC, ACORN an d OHBT A can only dream of becausetheir buildings are so scattered.East Brooklyn Congregations is slated to break groundon its development in the Western Sector early next year.The group fought long and hard with the Dinkins administration to get acommitment for enoughland to build 750 to 800homes. Originally, thegovernment was onlywilling to give them scattered plots of land, butthe organization rejectedthe offer. The final goahead is contingent on

City Council approval,according to Nelson.Achieving criticalT mass-whether it takesthe form of ne w housingunits or the consolidatedhough East New effort of hundreds of 10-York housing groups calresidents-isimpera-share many common tive, says Nelson. "It'sconcerns, to date they . en foolish to do scattershoth h d l 'ttl Hope 011 the War. East Brooklyn CongregatIOns plans to bulldoze empty lots and d 1 t t f. avbe ad' I e sUChess abandoned buildings to make way for hundreds of single family homes in the peve o p m e ~ wbes 0In an Ing toget er , Western Sector. ennsylvanIa, ecausepooling resources and of the nature of the drugforming a coalition that can galvanize large groups of business there. We build houses around congregationstenants and neighborhood residents and coordinate with roots deep an d wide in the community."activities more efficiently with the police department. A large part of the problem housing groups face is theAnd that, say some community organizers an d others vast number of empty lots and abandoned buildings in thefamiliar with the problem, is the only way the war on area, giving East New York one of the lowest populationdrugs in East New York ca n be waged with any success. densities in Brooklyn. On this point, Abdur RahmanTo make matters worse, local politicians have yet to Farrahkan, director of OHBTA, agrees with Nelson'stake a leadership position in the fight against drug dealers. assessment. "East New York is so spread out, it's difficultCity Council member Virginia Wooten is helping to de- to concentrate the resources that enable you to get thevelop youth programs in her district, bu t she admits she is dealers out and keep them out," he says.not currently involved in initiating any kind of policy thatwould directly address the problem of drug markets westof Pennsylvania. Nor is the district manager of Community Board 5, Walter Campbell. Instead, he believes theanswer is in a wholesale redevelopment of the neighborhood, such as that planned by East Brooklyn Congregations for a stretch of land that straddles New Lots Avenueright in the heart of the Western Sector.Call it safety in numbers. The strength of East BrooklynCongregations' Nehemiah housing projects, supporterssay, is that they can create stable communities in impoverished, high-crime neighborhoods precisely because theybuild hundreds of single-family homes in relative1 small,centralized locations. In addition to tearing down dozensof vacant or derelict buildings and bulldozing empty lotsin the process, Nehemiah developments (named for thebiblical prophet who rebuilt Jerusalem) introduce into anarea a stable, unified force ofhomeowners that is organizedand trained by EBC about how to address crime problems.Critics have long charged that EBC achieves its ends by18jMAY 1993/CITY UMITS

N !far from Williams Avenue. a brigade oftenantshas things to worry about other than critical mass. TheFiorentino Plaza housing project's tenants association isbusy with preparations for a play called "East New YorkRevisited." It's about a time when three angels-BrotherMartin, Brother Malcolm and Sister Harriet-come backto the neighborhood to see what the devil has wrought,an d it's the brainchild of]uanita Fisher, a retired hospitalworker and a member of the association's drug elimination program.One ought not underestimate Juanita Fisher. After all,she's the one who convinced two local teenagers known tobe hard core drug dealers to take parts in the play. Not onlyare they now the star attractions (though they have onlyminor roles), but they are also involved with the technicalaspects of the production-sound, lights, sets.

-

8/3/2019 City Limits Magazine, May 1993 Issue

19/32