City Limits Magazine | 42nd Street Saga | March 1981 Vol. 6 No. 3

-

Upload

mark-thomas -

Category

Documents

-

view

220 -

download

2

description

Transcript of City Limits Magazine | 42nd Street Saga | March 1981 Vol. 6 No. 3

LI . MARCH 1981 $1.50 VOL.6 NO.3

• Forty-Second Street Saga

• Pension Dollars for Neighborhoods?

• 'Shopsteading' 'Homesteading'

URBAN VIETNAM

by Howard B. Burchman

Vietnam is much on my mind these days. The way things are going a new military adventure seems almost inevitable. The outburst of patriotism following the hostage release presaged more dramatic action than the tying of yellow ribbons. The bountiful billions being pressed on the Pentagon create the momentum for conflict. Urban Vietnam does not speak to military action, however. It speaks to the attitude of arrogance characterized by-one of the more harrowiQg expressions to come out of the war: "We had to destroy the village in order to save it."

The extent to which that attitude has characterized our urban policy is remarkable. What was Urban Renewal other than a "strategic hamlet" approach applied to urban cores. Urban Renewal hated the areas it alleged to be renewing; it loved the money to be made from it. More than the cities, it hated the people living in them. Just so with Vietnam. Cities were destroyed because they were in the way of being saved.

What is behind the popularity of destruction and revamping? First, the opportunity to make big money. Second, simplicity. Destruction allows inconvenient realities to be rooted out rather than acknowledged and responded to. Third, egotism. The process is egotism writ large: the obliteration of another creation for the convenience of asserting one's own personal vision.

Despite the disappearance of Urban Renewal as a program, the underlying attitude and motivation remain. Given the chance, some federal financing, a blurry image transported from somewhere else and it resurfaces. Now it calls itself urban revitalization, the federal mechanism is UDAG, and the blurry images are the South Street Seaport and the Portman Hotel. The similarity between these projects is astonishing. Both represent the wholesale importation of concepts from altogether different urban settings. Both will radically alter neighborhoods already experiencing their own momentum of change. Both greedily demand an unnecessary federal subsidy.

The Portman Hotel is clearly the "Westway" of UDAGs. Has anyone ever wondered how such unnecessarily disruptive schemes manage to get so far? How can a so-called Times Square revitalization destroy three theatres when theatre is the very thing that should be preserved and enhanced in that area? Recent experience should have more than sufficiently demonstrated that theatres cannot just be built. The new ones tend to be

CITY LIMITS/March 1981 2

vast barns, hated by audiences and performers, and loved by producers who fantasize mind boggling grosses in them. The tawdry hotel planned by Portman with its flashing lights is nothing but a cheap conceit seeking to dominate rather than contribute to the area.

And why are boutiques the only means that have been discovered to restore historic areas, or ariy other areas for that matter? Rouse's boutiquery by the Bay joins not only his two other identical ventures but also such places as Convent Garden in London, Les Halles in Paris, and practically every revitalization planned for every city. In place of indigenous quality we get the internationalism of high price consumption. It makes no difference whether the location be New York Bay or Boston Harbor, or the central markets of European cities, we have found a new equality in high price goods.

Probably the most upsetting quality of both Portman and Rouse is their total lack of local identity, their total unresponsiveness to what is New York. There is nothing that roots these developments to the locations chosen for them - indeed, in their own ways they seek to destroy what is already there. In the most stimulating of urban environments we get cookie cutter development; here's our local Rouse Boutique and Portman Hotel. The level of creative enterprise manifested in these projects is the equivalent of that involved in deciding to open a McDonalds on 14th Street. What better argument for the dumping of UDAG than these two projects? 0

Howard Burchman consults on neighborhood-based housing and community development projects.

• l '* l' ~ (

EDITORIAL LIMITS HPD Housing Starts Increase,But Who Benefits And Who Cares?

In what has become an annual bit of fanfare, a City Hall press release dated January 28, 1981,loudly proclaimed yet another banner year for HPD under Mayor Koch's administration. A combined total of 21,776 dwellings units in new construction and rehabilitation were started in calendar year 1980. This record was surpassed only by the rate of new 1981 press releases which had reached 27 by January 28th. All the daily papers picked up the story, as they did last year and the year before. But they failed to ask one basic question - who benefits from these figures? Had they asked, it would have been discovered the city has no answer.

In spite of some sleight of hand in HPD's arithmetic - last year's press release cited only 9,401 rehab , units in 1979, but this number somehow grew to 10,242 units in the interim - the 1980 level of HPD productivity is impressive. Regardless of what one thinks of HPD's politics, the rehabilitation of 16,137 units of housing is no mean feat.

Whether this achievement will stand up under closer scrutiny, however, is another question. Virtually all of the housing rehabilitation initiated by the city in 1980 is being funded in whole or in part by federal Community Development funds. A paramount requirement of the CD program is that apartments rehabbed with CD funds be occupied by low and moderate income families. Ironically, HPD, which has managed to overcome all the logistical problems of producing this housing, has not been able to keep track of who lives there. That is, the City of New York proudly spent $123 million on HPD projects last year, but has no idea who is living in these projects. The city claims that 8A and Participation loans are benefitting low and moderate income people, but in no way can document this benefit. Given the record of the city in slighting low income neighborhoods and projects, we can hardly be expected to take the city's word on this issue.

Although it never made it to the pages of the daily papers, the City Comptroller's own audit of the 8A

3

loan program highlighted this problem an'd characterized HPD claims of benefit as "manifestly illogical:' The Comptroller went on to say that HPD's criteria for documenting benefit "don't even begin to meet HUD requirements:'

It is also worthy of note that those programs which do directly serve low and moderate income people, such as sweat equity, have been slashed and contribute few figures to the Mayor's total.

For some reason, when the Mayor sends out a press release on housing statistics, his figures are broadcast and printed virtually verbatim. Whatever happened to the idea that there is value in a healthy tension between government and the press? This may be the only news vehicle you will read that will tell you not only what the Mayor's press release said, but also, perhaps more importantly, what it didn't say - 0

CITY LIMITS/March 1981

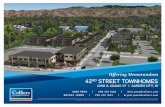

A Forty-Second Street Saga At the corner of Forty-Second Street and Tenth Avenue sit five historic apartment buildings whose tenants have been buffeted by harassment, foreclosures and fires. With a pricetag of $3 million on the structures, many hands are reaching for them. Tenants, however, can be a stubborn lot. by Susan Baldwin

Tenth Avenue and Forty-second Street.

W e're not going to move, and that's it. We have all been through too much, and we can't give

up now. I dare them to try to throw us out," said Larry Flowers, a long-time resident of a turn-of-the century tenement complex in mid-West Manhattan's Clinton neighborhood where speculation is rife and ruthless tactics to empty buildings in "hot" real estate areas are practiced freely.

Flowers is one of some 40 cantankerous, low income tenant families who are barely surviving in their modest homes in the 500-block of West 42nd Street at Tenth Avenue - a corner that daily becomes more attractive to sharp operators bent on turning a high profit in quick sales.

With the spectre of the convention center, the controversial, high-priced Portman Hotel in Times Square, and generally highly inflated land values in Clinton looming over this neighborhood, with its long history of working class ethnics making their way in the city together, the meaning of this battle to save homes becomes even more poignant, and raises serious questions about the city's commitment to save decent affordable housing for residents who have persevered during the bad years when these areas were undesirable.

that their days in their homes are limited if they don't fight back.

"They would have to offer us at least $1 million each if they want to get us out," said Flowers as he and a handful of tenants huddled in the cold on a recent raw day, while a plumber tried to work on the broken pipes leading to a byzantine, over-large, and inefficient boiler that once used to heat an entire tenement block.

"We hear all kinds of figures for what they want for these buildings," said Nancy Kyriacou, the housing organizer from a neighborhood group - Housing Conservation Coordinators - who has been working with the tenants since the early 1970s when they first began to be harassed by unscrupulous landlords and owners - at least four of whom are under indictment and one has been convicted on arson charges.

According to Kyriacou, asking prices for the property range from $2.7 million, as is, with tenants in occupancy, and $3 million, empty. The Madison Avenue broker - LB Kaye Associates, Ltd. - confirmed these figures but refused to identify the owner(.s) and mortgage holder(s).

When one indicted arsonist - Ralph Sperling - served as manager, some tenants came home to their apartments to find the front doors ripped from the hinges, combustible materials heaped up in their rooms, and knives stuck in their mattresses.

"You can live in a place all your life, nobody wants it, and then you find yourself watching as they suddenly drive people out, almost over night," asserted Oliver Gribec, a veteran of the West 42nd Street houses, who has watched properties around him become boarded-up or demolished as the wave of the future - inflated real estate and quick profits - takes its toll on his neighborhood. "I'm not going to say these were gorgeous buildings, but they certainly were habitable - good solid houses - before these real estate crooks came around," he continued, adding, "then we had the typical attack - a lot of fires; someone trying to blow up our boiler; a man freezing to death. And now, two weeks ago, there was a fire in a mattress in an unoccupied apartment (at 502 West 42nd Street), and a former tenant supposedly was offered $5,000 to move by our latest new owner."

Suspicious Fires Plagued by suspicious fires, no heat and water, and,

most recently, broken frozen pipes, for more than two years, the families, which once numbered 170 before the property was taken by the city for non-payment of taxes in May, 1978, and redeemed for $500,000 the following year, have lived under a state of siege not knowing from month-to-month who owned the buildings or held the mortgages. But, what they have known for some time is

5

Built as model, fireproof tenements in 1900 by Ernest Flagg, a popular high society architect who 'Yas

dedicated to improving urban tenement life, the buildings' design featured the elimination of long dark exterior corridors in favor of larger interior spaces and the inclusion of private bathrooms in each apartment - an amenity unheard of in basic low-cost housing of the time.

The Flagg family held the mortgage until the early 1970s when a number of landlords with dubious reputations - Walter Scott, Jacob Fine, Henry Hof, Jr., and his wife, Henriette, and Milton Herman, to name a few - owned them at some point, skimped on services, and reveled in selling them back and forth to each" other apparently to avoid paying extensive property liens and avail themselves of paper losses for tax purposes.

Following a year-long, drawn-out court case and the redemption of the property on a technical proceeding, which could best be described as "murky," in November, 1979, the buildings at 500-506 West 42nd Street and 567 Tenth Avenue were reclaimed for convicted arsonist Joseph Bald, head of 500 West 42nd Street Corporation, by his attorney, Kevin Sullivan, a former city housing official. They were then quickly turned over to the Tenth Avenue Development Corporation, whose chief, Henry Roth, owns numerous buildings in the city

CITY LIMITS/March 1981

and operates as a shadowy figure in the New York City real estate empire. Sullivan insists that Bald was not his client, although such a relationship is listed in city records.

Deny Knowledge Asked about the properties, Roth and his associates

deny any knowledge of them and abruptly hang up the telephone when questioned by outsiders. And, according to neighborhood organizers and the buildings' latest court-appointed receiver, Seymour Yanowitz, who serves as manager, the "Roth group" as it is known is pushing hard for the buildings to be vacant by spring.

"Anything that could happen to these tenants already has," said Kyriacou, adding, "some of the malicious attacks on people here should have ended in jail sentences, but they didn't." When one indicted arsonist- Ralph Sperling - for instance, was listed as the property owner and served as manager last year, Kyriacou reported, some tenants came home to their apartments to find the front doors ripped from the hinges, combustible materials heaped up in their rooms, and knives stuck in their mattresses. The city has charged Sperling with harassment and fined him $5,000, but it could not be determined whether or not he has paid the fine. Also, according to Kyriacou, during this stormy period last spring, a local daily newspaper called her organization to report that it had received a tip alluding to the imminent "torching" of the buildings. The tenants spent a long holiday weekend on 24-hour guard to save their homes.

During the Christmas and New Year holiday season, the tenants narrowly escaped hasty departures

from their homes when the fire department attempted to vacate them because the pipes were frozen. They are now paying for major repairs to the boiler and frozen pipes and sprinkler system with $19,000 from their bank account which accrued during past rent strikes and from August to December, 1980, when the first receiver, appointed by the court - Leonard Drucker of Belson Associates - made no repairs to the buildings.

A recent computer check of the city's records listed Ken Passafiume, a Brooklyn landlord also under indictment for arson, as the owner of record of the 500 West 42nd Street buildings, noting that there were 60 uncorrected violations on the structures and unpaid back taxes and water and sewer charges totaling $54,613.87.

City Held Title During the period prior to the redemption when the

city held title to the buildings, the West 42nd Street Development Corporation, a nonprofit local development corporation that is sponsoring work on Theatre Row Phase II in the old West Side Airlines Terminal across the street, sought to negotiate a long term lease with the

CITY LIMITS/March 1981 6

city to rehabilitate this parcel as a combination low income (Section 8) and fair market rental facility . The onsite tenant families , according to the plan, were to be relocated in a nearby motel while the rehabilitative work was being done and then moved back into the apartments as subsidized Section 8 tenants, if they met the income requirements.

The redemption precluded this scheme, but the private developer who was approached by the local development corporation two years ago to render plans for the site, Lewis Futterman, says he is still interested in the property if the price is right. "There's really no profit in it for me, but because I am committed to this (income) mixture in housing, I might like to give it a try," Futterman added, noting that he is already doing "open market" housing on the old Armory site between 10th and 11th Avenues down the block. Futterman also emphasized that he has already spent $30,000 on plans for the site and has met several times with the local comJ

munity board.

Thomas Mulcare in his nonjunctioning bathroom at 502 West 42nd Street. .

In the meantime, the families continue their salvage work on the properties and are presently talking about consolidating into the five-story, corner walk-up building at 506 West 42nd Street and Tenth Avenue. To make this move, the tenants are consulting with the city to make sure that their rent-controlled status will be honored in these replacement apartments.

"We will feel we have accomplished something in this long difficult battle if we can get title to this one building:' Kyriacou concluded. "That will leave the other properties open for development, and who knows what the future will bring? But, we must keep fighting these dishonest forces that continue to plague us in Clinton. Nothing they do surprises us, and they seem to have nothing to fear. After all, who can bring charges against them, and what would these charges be anyway? This is business as usual. And, if there is a law hidden somewhere that forbids this sort of unethical behavior, they believe they're above it."

If the tenants are successful in their fight to relocate into the one building, real estate interests might have to reconsider their plans as this arrangement would remove one of the most valuable parcels from this rather extensive land package.

Meanwhile, the broker continues to get nu~erous inquiries into what she terms a "discreet" advertisement of the sale of the property, and tenants wonder if they are wasting their money to try to keep warm for the next few months. 0

Ernest Flagg's 1900floor plan for the buildings.

Correction: Funds for 7-As In the February issue of City Limits, in the arti

cle "Evicting the Landlord", the description of the special seed money allowance and revolving fund for the city's 7-A program was unclear. Since September, 1978, the city has received Community Development funds for seed grants of up to $10,000 for 7-A buildings in need of basic repairs that cannot be covered by the tenants' rent roll. In order to speed up payment of contractors who make building repairs, the Fund for the City of New York and the New York Community Trust in July, 1980, set up a revolving fund of $50,000

I /

! / 'c /3:~~. I ~

I i i I i

/

7

which is used to make these payments within five to ten days after the work is completed and passes inspection. In turn, HPD draws on its CD allocation to replenish the revolving fund within a four to six-week period.

To date, the revolving fund has provided $131,133 to 7-A administrators to pay contractors. HPD's 7-A unit received $254,000 in CD seed money this year and has already spent about $154,000 of this amount. According to Albion Liburd, head of the 7-A monitoring unit, his department hopes to receive somewhere between $750,000 and $1 million for the program this year.

CITY L1MITS/March 1981

Can Union Pension Dollars Help

by Daniel McCarthy

The trustees of New York City's public employee pension funds, who hold $12 billion in assets, are currently pondering several plans that could provide $100 million or more in financing for housing rehabilitation and small business development in the five boroughs. No moves have yet been made, but the discussions so far have pointed up the opportunities - and the obstacles - that confront pension fund managers in attempting , to meet larger social objectives and still safeguard their funds.

Today, the five major retirement systems administered by the City of New York jointly comprise the third largest pension system in the nation. These funds have traditionally been conservatively invested in long-term corporate bonds and in the stock of major national corporations. Since 1975 the funds have, under political pressure, played a major role in averting city bankruptcy through their purchase of city securities.

But, as the threat of municipal bankruptcy has re-

CITY LIMITS/March 1981

ceded, and as the value of the City's pension assets has increased, there has been a growing interest on the part of local unions, city officials and public interest groups in exploring the feasibility of harnessing some of this vast wealth to revitalize local neighborhoods.

The proposais now under consideration would provide capital at market rates of interest for home mortgages and loans for small business expansion. All of the proposals would employ certain insurance mechanisms, either public or private, to reduce the exposure of the pension funds to the risk of loan defaults. In certain cases, federal subsidies would be used to write down interest costs to borrowers.

The recent flurry of activity in New York is a reflection of the growing national interest in pension funds. With $600 billion in assets nationwide, the country's pension funds have simply grown too big to ignore. In a single generation, pension funds have become the largest single source of investment capital in the U.S. eco-

8

Rebuild NY's Neighborhoods? nomy. Pension funds currently own more than 25% of all common stock traded on the New York and American Stock Exchanges and hold 400/0 of all corporate bonds.

Even the investment managers who control these funds have been slow to fully recognize the economic power that has been thrust upon them. At the center of the current debate is a larger issue, one which promises to be the center of American politics in the 1980s: How much public control should be exercised over the allocation of capital resources in the U.S. economy?

Who Would Benefit? The New York City pension issue has brought toge

ther local neighborhood groups, Wall Street brokers, pension trustees and union officials in a wide-ranging discussion on the finer points of large capital investment. But underlying these discussions are larger issues: Who would benefit from local pension investments? Who should administer such a lending program? And what risk-return criteria should local investments be measured against?

Several recent developments have served to bring the pension issue to public attention. Last October, City Comptroller Harrison Goldin issued a report which recommended that the City's pension trustees approve a plan to purchase up to $250 million in Government National Mortgage Association (GNMA) securities as a means of stimulating the city's housing market. These so-called "Ginnie Mae" mortgage-backed securities would be assembled from FHA-and VA-insured mortgages on one-to-four family homes in the five boroughs. These mortgages would be originated by local banks, which would then package and sell them to the city's pension funds in the form of securities. The securities would pay a market rate of return and carry the guarantee of the federal government. The Comptroller claimed that his plan - which is typical of proposals offered in other states - would increase mortgage activity and stimulate new construction in the five boroughs.

Last December, City Council Member Ruth Messinger, in conjunction with the Municipal Research Institute, released a major 6O-page report on the investment policies of the City's pension funds. The report recommended that the City's five major pension systems allocate one per cent of their assets, up to $100 million, to a Neighborhood Reinvestment Fund that would finance local housing rehabilitation and small business development.

Under Messinger's plan, loan packages would be assembled by two local development agencies, the Community Preservation Corporation and the Economic

9

Capital Corporation, which now work directly with the city's banking community in the areas of housing and economic development. Once insured, these loans would be purchased by the municipal pension funds for their own portfolios. All of the proposed investments would be government insured and all would pay a competitive rate of return.

A directly targeted investment program, suggested Messinger, would provide "far greater and more measurable" benefits than any mortgage-backed securities program, such as that proposed by the Comptroller. Messinger argued that the market for "Ginnie Mae" securities is so active nationwide that pension fund purchases would serve primarily to displace private investors who are already eager to buy whatever mortgages local banks are prepared to sell. The issue of "investor displacement" is one of the major concerns of advocates of alternative pension fund investments.

Messinger proposed that the city's pension trustees work through the Community Preservation Corporation to provide financing for the moderate rehabilitation of occupied single family and multi-family dwellings. The objective would be to upgrade buildings -with tenants in place - before they enter the cycle of deterioration that almost inevitably leads to abandonment. "With one-fifth of the City's housing stock now in substantial tax arrears, the public sector must act decisively to preserve the housing we now have," Messinger said.

The emphasis would be on providing mortgage capital to the areas the private sector has so far neglected. Under that proposal, both rental buildings and tenant cooperatives would be eligible for assistance. Since FHA insurance is generally not available for moderate rehabilitation of occupied dwellings (except where federal Section 8 subsidies are also available) Messinger proposed a combination of SONYMA (State of New York Mortgage Agency) and REMIC (NYC Rehabilitation Mortgage Insurance Corporation) insurance. The 10 per cent of each loan that would not be covered by insurance would be financed by a $10 million federal grant of CD or UDAG funds. City employees, whose funds are at stake, would directly benefit because a special effort would be made to target neighborhoods that both require rehabilitation and have a high proportion of city employees in residence.

Daniel McCarthy is the Executive Director of the Municipal Research Institute (MRI), a new public policy consulting firm based in New York City. He has just completed a major study of the city's pension funds in conjunction with City Council Member Ruth Messinger. (Democrat, Manhattan).

CITY LIMITS/March 1981

In order to hold down the degree of federal subsidies required, the plan offers· three cost-sharing measure~ that would ensure that property owners, the banking community and city government all contribute to the task of neighborhood revitalization. First, landlords would be required to reinvest at least 75 per cent of the tax shelter benefits generated by their rehabilitation projects. Second, banks which hold mortgages on distressed properties would be urged to write-down at least 50 per cent of the outstanding indebtedness on loans subject to refinancing by the pension funds. Third, the city should grant tax forgiveness of past arrearages on a building scheduled for rehabilitation in order to remove a cost burden that could otherwise make the project uneconomic.

There has been no formal response by the trustees to either the Comptroller's or Council Member Messinger's proposals. A special Investment Policy Subcommittee has been established with City Council President Carol Bellamy acting as chairperson. (The New York City Employees Retirement System (NYCERS) board is the largest of the five funds and is composed of the Mayor, the Council President, the Comptroller, the five Borough Presidents and three union representatives.) Also, since these reports were released, Governor Carey has called upon the state Legislature to create a Special Commission on New York State Pension Fund Investments, to explore "targeted" investmen.t proposals that contribute to the state's economic revitalization.

Unions Ambivalent The union trustees on the NYCERS board have ap

proached the issue of "targeted" local investments with a certain measure of ambivalence. The city's unions have traditionally been more concerned with the level of benefits their members receive than with the type of investment portfolio that the systems maintain. Since pension benefits are fixed by law, the investment performance of the city's pension system has no direct bearing on what retirees receive. At the same time, some union officials are reluctant to make any investment that would increase their exposure to New York City related securities or mortgages, since their pension systems have already made a significant social commitment to the city through purchases of city securities.

Still, local union officials such as Lillian Roberts of District Council 37 have been eager to discuss any investment plan that would directly benefit their mem'bers. Union officials have been particularly interested in a homeownership program that would provide mortgage financing to its members at below market rates.

The notion of discounting interest rates raises a fundamental issue: should pension fund trustees relax their stringent investment criteria and accept a rate of return that is less than that which is available on competing investments, if it can be demonstrated that the lower

CITY LIMITS/March 1981 10

return results in significant social benefits to a commun" . ity or to the members of a pension system? ,-.

The concept of choosing investments based upon their "social rate of return" is considerably controversial. The City Comptroller, as chief investment officer •. would be virtually certain to reject out of hand any targeted investment program that failed to meet conventional investment criteria.

Implementation The chief advantage of the Comptroller's program is

that it would be easy to administer. Since the "Ginnie Mae" market already exists, it would. require only that the present framework be adapted to meet local r:equirements . (There is some question, however, as to whether the Comptroller will actually be able to convince local banks to cooperate with his plan. Since they already have access to the "Ginnie Mae" market, these banks have no major incentive to go to the trouble of assembling special pools of mortgages to satisfy the NYCERS system). Council Member Messinger's plan may provide greater benefits, but implementation is more complicated. In addition to the NYCERS trustees, the boards of the CPC, REMIC and SONYMA must also be convinced. So far, the city's housing officials have not stepped in to provide the leadership required to·bring all parties together.

The city Comptroller's office has expressed some general reservations about the concept of a direct mortgage lending program, such as that proposed by Messinger. Fixed-rate mortgage loans do not provide the liquidity that other investments offer. Messinger's proposal attempts to compensate for this disadvantage by providing that each mortgage include a shared appreciation clause that would enable the pension fund to share in any profits at the time an owner sells his property. The Comptroller has also questioned the security offered by SONYMA and REMIC insurance, since both are tied at least indirectly to the credit of the State and City of New York. In actuality, the security offered by these two insurance mechanisms does not rest upon the credit of the City or the State, but rather upon a self-supporting cash reserve fund, which has been established on an acturial basis to meet projected defaults.

Basic questions have been raised by some neighborhood activists who think none of the proposals to date go far enough in providing housing investment monies for those low and moderate income residents who need it most. They suggest that even with federal financing, the interest rates demanded by the pension funds may be unaffordable by many homeowners. Some also question the wisdom of appointing the Community Preservation Corporation as lending agent for the pension fund. The CPC has not been willing to invest in the city's most distressed areas, and its rehabilitation work often benefits middle class residents who do not warrant special attention, according to its critics. Messinger acknowledges

these criticisms but suggests that only a bank-sponsored entity like CPC has the stature and standards acceptable to the pension fund managers.

Finally, several securities brokers and mortgage bankers have proposed an alternative to both the Goldin and Messinger plans. They have urged that the pension funds invest in conventional mortgage-backed securities, which are similar to "Ginnie Mae" securities in concept, but which involve conventional mortgages that carry private mortgage insurance rather than federal guarantees. Some local banks find these preferable because they avoid the paperwork and delays involved in federal insurance programs. The plan would provide mortgages on only one-to-four family homes and. while they may be excellent investments in themselves, their purchase by the pension funds would have only a marginal impact on local mortgage originations. These conventional mortgage-backed securities would provide some relief for the severe disintermediation problems some banks now face. But, again, they could be marketed without using the pension funds. There also is no precedent for targeting them to housing in blighted neighborhoods. The investment community, whi~h

assembles them, is far more comfortable with single family mortgages in the secure middle class communities of the outer boroughs.

It seems likely that the city's pension fund trustees will approve some form of targeted local investment in the coming year. Since there is no consensus on what constitutes the optimal approach, we are likely to see a period of experimentation with various strategies. The most promising development so far is that the pension trustees have proven to be remarkably receptive to new and unconventional ideas for housing development. This is unusual for New York City, where housing policy is usually made in an atmosphere that emits much heat, but sheds little light. D

'The Housing Show'

"The Housing Show," a work in progress theatrical event about trying to find an apartment in New York City, will run through March 22 at the Theatre for the New City, 162 Second Avenue.

Subject matter for the play includes newspaper and magazine-documented information on arson, urban planning, housing court, rent control, and the future of New York as well as photographic and sculptur~ materials.

Director of the presentation is Neile Weissman. Admission is $3.00. For more information, call 254-1109. D

11 CITY LIMITS/March 1981

Co-op Bank LilDps Into New York by Michael Powell

The National Consumer Cooperative Bank, plagued by threatened f'ederal budget cuts and concern over its economic orientation, has hired a regional director, a staff and is closing several loans within the greater metropolitan area. While 15 loans totaling $10 million are still awaiting final approval, Philip st. Georges, previously the Commissioner of Alternative Management at the city housing department, and now the Consumer Co-op Bank's Mid-Atlantic director, predicts that "at least initially, housing will command about 60 per cent of our available funds." Low income groups are expected to obtain approximately half of the available housing loans.

Two housing groups, The Housing Development Corp. at 300 West 17th Street and The Grand Liberte' Co-op at 96 Grand Street, have received final loan approval. Housing Development will receive $172,440 and Grand Liberte $118,716 for energy conservation and new windows. In general, the bank's loan activity is expected to be evenly distributed throughout the MidAtlantic. Five staff members were recently hired and the bank is presently looking to place its regional office in Brooklyn, as part of its self-avowed effort to "reach out to the comrilUnity."

As a number of New York-based community groups await final loan approvals, the issues of community and low income participation in the bank's decision-making process are not yet resolved. The regional Advisory Council, originally intended as an integral part of the bank's struCture, is still only in the early planning stages. When asked about the Council, St. Georges commented that "this [the Advisory Council] should be a long-term objective." St. Georges expressed confidence that the bank's regional conferences and his "extensive contacts in housing and other fields", will temporarily compensate for the lack of an advisory board. Many community groups, however, contest St. Georges's sanguine assessment. As one community activist said, "Informal contacts are fine, but, the board is a way of formalizing these relationships."

Low income groups' access to loans and the decisionmaking process is a critical aspect of the community input issue. As the Co-op Bank Monitor puts it, "The Bank has a legislative mandate to assist low income coops." This mandate is encompassed by the Title II Office of Self-Help Development and Technical Assistance. Under this program, low income groups can obtain special assistance in starting up and maintaining co-ops.although St. Georges says that "many low income projects can work at 11 and 12 per cent interest rates," the Title II program can specifically grant reduced-income loans to low income groups. Interest

CITY LIMITS/March 1981 12

rates of 7-10 per cent are foreseen as falling within the Self-Help area. During the last year, however, attempts to water down the Title II mandate caused the Monitor to state that, " ·t'he Bank has so far failed to aggressively address the needs of low income groups." st. Georges replies that "extensive efforts to reach low income groups are being made" in the Mid-Atlantic region. He cautions, however, that "middle income co-ops of all kinds are an important part of our program. Many structures built under the 312 loan program and the Mitchell-Lama's need minor rehabs and touch-ups -This will be a significant part of our housing effort."

Perhaps more ominously, St. Georges warned that "unless the low income people can become better organized and more creative, the moderate income co-ops might well dominate the national board and the stockholders meetings." Co-op members will eventually con: trol eleven out of twelve seats on the national board. This change will occur as the bank gradually repays its startup loan from the Federal Reserve. While the relationship between the board, staff and regional office is not yet clearly demarcated, the National Board is expected to play an increasingly active role as the Bank expands.

The Bank's expansion, however, is not merely a matter of time. The Reagan a9ministration has proposed cutting all future funding and appropriations fOT the Bank. The funding figure originally projected by the Carter administration was $300 million over five years. $137 million was appropriated for 1981, with $80 million already committed . Reagan's administration is asking that the remaining $57 million appropriated for the third and fourth quarters of this year be rescinded as well. This last cut would, St. Georges admitted, "effectively scotch our present concept of the bank." He insists, however, that the "prospects are fairly good for holding onto the $137 million allocated for 1981." Although the Bank originally passed the House of Representatives by only one vote, Bank officials are confident that they have gained manY valuable allies in the interim and, that $137 million will provide sufficient start-up capital.

With the appropriations and banking committees in both houses of Congress still waiting to vote on funding for the Bank, however, nothing is being taken for granted. Bank officials are discussing contingency plans, such as floating a bond issue or going to secondary mortgagees for funding. These plans, however, are speculative. As the National Consumer Co-op Bank limps into operation, with Reagan's budget cutters taking sword swipes at its legs, St. Georges admitted that, "people are starting to think about a very different bank than the one we originally envisioned." 0

DEPARTMENT OF HOUSING PRESERVATION AND DEVELOPMENT HOUSING DEVELOPMENT

I-----l CORPORATION (HOC) I COMMISSIONER I I Hoger Simon 480-1212 I

Anthony Glledman ------________________ J

I 566-2324 I .I REHABILITATION MORTGAGE I

'-____ INBURANCECORP.-(REMIC)·

I Neal Hardy 42:"~351 I

I I I ADMINISTRATION ENERGY CONSERVATION OPERATIONS SPECIAL PROJECTS POLICY AND GOVERNMENT

RELATIONS DEPUTY COMMISSIONER ASST. COMM. DEPUTY COMMISSIONER ASST. COMM. DEPUTY COMMISSIONER Judy Seidenfeld 2356 Mary Brennan 6456 Robert Davis 6841 Janet Langsam 6465 Ronald Marino 5035,6909

I FISCAL

AFFAIRS J I I I ~~~M". ,.,GT. SERVICES INSPECTOR GENERAL EQUAL PROGRAM &

Nachbar 6502 INFO SYSTEMS GENERAL COUNSEL OPPORTUNITY MGT. ANALYSIS DIRECTOR! Steve Shapiro ~T. COMM. EXEC. DIRECTOR

Andrew Cooper 2356 5454 2310 . Laila long 2486 Bruce Gould 6125

I I 1 OFFICE OF '/If OFFICE OF RENT STABILIZATION ASSOC. OFFICE OF ~ RENT AND

PROPERTY MANAGEMENT DEVELOPMENT RENT GUIDELINES BOARD -- HOUSING MAINTENANCE DEPUTY COMMISSIONER William Eimicke 5610,4983

I RELOCATION OPERATIONS

ASST. COM"" Wilfredo Vargas

248-6411

Urban Renewal and Property Management

Public Improvement Relocation

Emergency Housing Activities

·75 ............

ALTERNATIVE MANAGEMENT

ASST COMM. Joan Wallstein

05820584

Community Mgt. 1585

Sales 3930

Interim lease Program

...... 0fIIae-1ODG ......... t

PROPERTY MANAGEMENT

ASST. COMM.

1820,1821

Upper Man. and Bx. 4890 lower Man., 5 .1. and

Ons. 4843

DEPUTY COMMISSIONER CONCILIATION & APPEALS BD.

DEPUTY COMMISSIONER (Independent Bodl •• ) Charles Reiss 6557

~EHABILITATIO~ COMMUNITY HOUSING DEVELOPMENT SUPERVISION

ASST. COMM. ASST.COMM. ASST. COMM. Manuel Mirabal Ruth lerner

6902 5146 6478

Participation loans 7582 Community Service Management Supervision 6512

SH IP, Sec. 312 loans 1626 Neighborhood Preservat ion

J-51 Tax Exemptlonl Abatement 0620

421 Tax Exemption 8050

Moderate Rehab. 6555

Area Office 7992 Rental Subsidies and

Project Planning: Bx-7480

Bklyn-5844 Man - 7477

Ons. & 5.1.-4960

land Acquisition and Appraisals 1131

Site Improvement 8550

Jec. 8 Contracts 7941

Mltchell·lama Refinancing 6510

Tech. Services Bureau

CITY LIMITS/March 1981

EVALUATION COMPLIANCE

ASSl. COMM. Joseph Shuldiner

5800

Art icle 8A loans 7766

Voluntary Agmts. 2612

Housing litigation Bureau 7375

ERP Recoupment 0940

Management Alternatives 1029

7A Monitoring 6434

Owners Counseling Unit 3918

Daniel Joy 1037

1 CODE

ENFORCEMENT ASST. COMM.

Frank DeIl'Aira 6974

Housing Code and Other Inspections 0019

Central Complaints

960·4800

Emergency Services 678·2037

RENT CONTROL

Robert Muniz 5076 (110 Church.l

Maximum Base Rent

Trad it ional Renl Adjustments

Evictions

Hardship and Rent Structuring

Protest

litigation

Enforcement

Senior Citizen Rent Increase Exemption

Recontrol and late Enrollment

Research and Survey

District Offices: Bx - 585-2600

Bklyn - 643-7570 lower Man. & 5.1.- 566·7970

Upper Man.-678·2201 Ons.-526-2040

(CITY TOOLS) by Michael Powell TAKING YOUR

Winter has fallen across the city, and your apartment feels like a suburb of Nome, Alaska. Water from your kitchen sink would be leaking allover the floor if it weren't frozen and the falling plaster keeps you awake at night. Your landlord? He's in Florida until April, maybe May. What do you do?

Tenants throughout New York City, with problems both more and less severe than the one described above, are increasingly resorting to legal remedies for otherwise intractable housing problems. While Housing Court is not necessarily the best, or only, remedy for housing problems, it can be used very effectively by individual tenants and tenant associations.

Tenant Petition or Dispossess - Which Route? When considering legal remedies, tenants are faced

with two possibilities: taking the landlord to court with a tenant petition or withholding rent and awaiting a dispossess. While there are differing philosophies regarding the effectiveness of both actions, this article will address the tenant petition. Tenants, however, should be aware that both have drawbacks and that the two actions can be used together.

Tenant Petition (aka - H.P. Action) A tenant petition can best be described as the tenant

on the offensive. The tenant petition involves pulling the landlord into Housing Court to explain, or "Show Cause", why certain repairs are not being attended to. As with any tenant action, the petition is much more effective if brought by a tenant association, rather than one or two isolated tenants.

Tenant Petition forms can be picked up at Housing Court. The cost of an action for the entire tenant association is $20 - hence, another incentive for organizing; the more tenants involved, the cheaper the action will be. A form should be filled out by each member of the association. Tenants should write their names and the tItle of the tenant association on the top of the form, which reads "petitioner". (For example: John Smith/ 305 Martense St. Tenants Association). This method allows twenty or thirty tenants to file one action with the same docket number. In some cases, several buildings belonging to the same landlord have banded together and filed joint actions, using such names as "The Striving Three". Once again, the tenants should be careful that everyone receives the same docket number. Joint actions are often initially resisted by housing court clerks, but the tenants should persist; tenant power, as always, lies in numbers.

Each form should be carefully filled out. The landlord's name, address and management company should

CITY LIMITS/March 1981

be written in where the form reads, "RESPONDENT". Tenant signatures must be notarized and complaints carefully enumerated. Complaint sheets are used by writing, "See attached sheet", on the petition form. Finally, three copies must be made of each form; one each for the court, HPD Litigation, and the landlord. Service of the forms, after a judge signs them, should be made via certified mail, return receipt requested. These receipts must be brought back to the court the same day, along with a notarized Affidavit of Service.

The Tenants' Day In Court When your court date arrives, efforts should be

made to marshal every tenant to court. Technically, a judge can rule that the tenants have defaulted if they do not appear in court. Evidence, such as high electric and gas bills (and a normal bill for comparison), repair receipts, calendars marked for lack of heat, medical bills and any other information should be compiled and brought into court. City housing department (HPD) lawyers, usually very effective ones, are available to help the tenants. Tenants should, however, try to obtain the services of an outside attorney. Legal Services and Legal Aid lawyers will generally handle petitions for income-eligible tenants, though this varies from office to office. Other private public interest lawyers will represent tenants for reasonable and negotiable fees. The drawbacks with HPD lawyers are two-fold: one, they are technically allowed only to "advise" tenants in

. court, and, two, they are not allowed to do follow-up work, such as representing tenants with dispossesses and traveling out to buildings to meet with the tenants.

In addition to the personal evidence mentioned above, tenants should obtain the inspection printout for their building. All violations certified by Code Enforcement are registered on its computer. Thus, even if your tenant association is not able to obtain an inspection before going to court, HPD should have access to previous inspection records. If your tenant association is working with HPD litigation, this bureau can provide the printout in court.

Violation records are important; however, the tenants need not ask for an adjournment to wait for a courtordered inspection to certify their own problems. Tenants are allowed to testify about violations within their apartment. This testimony is written up as A, B, or C violations, depending upon the severity of the problems. Tenants should be warned, however, that judges do not like this method... Judges claim testimony is too timeconsuming and too imprecise. The tenants' answer should be that adjournments are time7 consuming for everyone and that they have a right to be heard in court.

14