Chemicals and Resins Outlook - The Right Place...IHS Markit Customer Care [email protected]...

Transcript of Chemicals and Resins Outlook - The Right Place...IHS Markit Customer Care [email protected]...

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

Chemicals and Resins OutlookResins: Key Market Drivers and the Outlook for 2020

September 25th, 2019

Ted Semesnyei, Senior Economist +1 781 301 9121 [email protected]

Tony Budd, Account Manager+1 248 728 8409 [email protected]

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

Enabling smarter purchasing decisions and supply chain cost savings

The IHS Markit Pricing & Purchasing

Service enables supply chain cost

savings by providing timely, accurate

cost and price analysis.

Armed with a better understanding of

suppliers’ cost structures and market

dynamics, organizations can effectively

negotiate prices, strategically time buys,

and boost the bottom line.

Comprehensive Data and Analysis

to Cover All Your Spend Categories

Wages and benefits Ferrous metals

Industrial machinery and equipment

Petroleum products

Building materials Paper and packaging

Electricity and gas Steel

Transportation and logistics Chemicals and plastics

Electronic components Services

Nonferrous metals Indirect Costs

Clients realize savings of up to 10% of overall spend

2

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

Key chemical and resin drivers

• Pricing outlook has been lowered because of several factors

> Concerns about slowing demand are negatively impacting market sentiment

> Oversupply conditions continue to persist, which are keeping pricing pressures muted

> Soft feedstock cost pressures

> Buying conditions are clearly improved compared to 2018 and

earlier in 2019

3

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

Global growth slows, but no recession

4

GDP (in local currency,

percent change) 2018 2019 2020 2021

World 3.2 2.7 2.6 2.6

Brazil 1.1 0.9 1.3 1.5

Canada 1.9 1.4 1.3 1.6

China 6.6 6.2 5.7 5.6

Eurozone 1.9 1.1 0.8 1.0

India 6.8 6.1 6.4 6.9

Japan 0.8 1.0 0.3 0.6

Mexico 2.0 0.3 1.1 1.4

Russia 2.2 1.3 1.7 1.8

United States 2.9 2.3 2.1 1.9

United Kingdom 1.4 1.0 0.5 0.9

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

Manufacturing: the point of weakness in the global economy

5

Industrial Production (percent

change) 2018 2019 2020 2021

World 3.1 1.3 2.0 2.3

Brazil 0.9 -0.9 1.3 1.4

Canada 3.0 1.5 1.7 1.9

China 6.3 5.7 5.2 5.1

Eurozone 0.9 -0.5 0.4 1.2

India 5.2 3.6 4.3 4.8

Japan 1.0 -0.9 0.6 0.8

Mexico 0.1 -1.2 0.6 0.7

Russia 2.9 2.3 2.0 2.1

United States 4.0 1.0 1.1 1.4

United Kingdom 0.8 -0.2 0.4 1.2

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

Shrinking backlogs and faster delivery times describe a buyers’ market

6

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

Global chemical production is dependent on feedstock source and varies by region

7

0%

20%

40%

60%

80%

100%

China Europe N. America

Coal to Olefins Methanol to Olefins Gas Oil

Naphtha Butane Propane

EthaneSource: IHS Markit

Regional ethylene production: 2020

0%

20%

40%

60%

80%

100%

China Europe N. America

Coal to Olefins Methanol to Olefins Gas Oil

Naphtha Butane Propane

EthaneSource: IHS Markit

Regional ethylene production: 2016

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

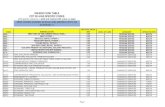

Summary of chemical and resin pricing factors

• Energy

> N. America t natural gas

– Ethylene and ethylene derivatives are mainly via natural gas. Thus, a resin such as

polyethylene is heavily impacted by gas feedstocks

– Cost of production for the aromatics chain (coming from benzene) is more strongly

associated with crude oil, including in N. America. Thus, a resin such as polystyrene

will be more influenced by oil.

> Europe/Asia crude oil

• In addition to feedstock costs, there are several other factors that can impact final market prices for chemicals and resins. These include, but are not limited to:

8

Demand growth

Trade flowsInventory and

supply growthProduction capacity

Alternative valuesProduction routes

and technologies

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

Ethylene: Market has turned the corner, with prices now trending higher

• US contract prices pushed higher

by 0.75 cents per pound (cpp) in July, and is forecasted to have risen

by 2 cpp in Aug

• Additional price increases are

projected for the fall

• Despite a continuing slide in

feedstock costs, short-term supply

disruptions have helped push market sentiment more bullish

• Still, new plant operations continue

to come online. Thus, the price push is expected to ease soon, with the market shifting to a more neutral position by early next year

9

22.0

24.0

26.0

28.0

30.0

32.0

34.0

36.0

38.0

2015 2016 2017 2018 2019 2020

North America

Ethylene contract price, cents per pound

Source: IHS Markit © 2019 IHS Markit

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

Big surge in new ethylene/PE capacity, notably in the USNew ethylene supply has come on quicker, with major price implications

1010

0

50

100

150

200

250

Millio

n M

etr

ic T

on

s

Africa Middle East Asia Americas Europe

© 2019 IHS Markit

Ethylene Capacity by Geography

0

10

20

30

40

50

60

70

80

Millio

n M

etr

ic T

on

s

Africa Europe Middle East Asia Americas

© 2019 IHS Markit

Polyethylene (HDPE) Capacity by Geography

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

11

Drivers of ethylene demand:N. American profile

Total domestic demand: 33.3 Million Metric Tons

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.12

Polyethylene: US prices fell by 3 cents per pound in both July and August, as buyers have gain leveraged

800

1,000

1,200

1,400

1,600

1,800

2,000

2,200

2015 2016 2017 2018 2019 2020

North America, Domestic Market Contract (converted)

West Europe, Domestic Contract Market (converted)

Northeast Asia, Spot Average

Polyethylene, Blow Molding, dollars per metric ton

Source: IHS Markit © 2019 IHS Markit

US

do

llars

per

metr

ic t

on

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

13

Polyethylene: Global supply and demand summary

0

5

10

15

20

25

2013 2014 2015 2016 2017 2018 2019 2020 2021

Western Europe Northeast Asia North America

Polyethylene (HDPE) total demand

Source: IHS Markit © 2019 IHS Markit

Millio

n m

etr

icto

ns

0

5

10

15

2013 2014 2015 2016 2017 2018 2019 2020 2021

Western Europe Northeast Asia North America

Polyethylene (HDPE) total production

Source: IHS Markit © 2019 IHS Markit

Millio

n m

etr

ic t

on

s

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.14

Polypropylene: Outlook is for prices to decline slightly, with risk to the forecast on the downside

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2,200

2015 2016 2017 2018 2019 2020

North America, Domestic Market Contract (converted)

West Europe, Domestic Contract Market (converted)

Northeast Asia, Spot Average

Polypropylene, Homopolymer, dollars per metric ton

Source: IHS Markit © 2019 IHS Markit

US

do

llars

per

metr

ic t

on

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

15

Polypropylene: Global supply and demand summary

Western Europe18%

Northeast Asia66%

North America16%

Polypropylene total demand in 2019

Source: IHS Markit © 2019 IHS Markit

5

10

15

20

25

30

35

40

2014 2015 2016 2017 2018 2019 2020 2021

Western Europe Northeast Asia North America

Polypropylene total production

Source: IHS Markit © 2019 IHS Markit

Millio

n m

etr

ic t

on

s

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

Bottom line: North American PC

prices will continue to ease into 2020,

while Asian prices look to have

reached bottom and will begin pushing

up shortly

Following a prolonged period of sliding

prices, Asian producers are beginning

to manage production and supply

levels in an attempt to firm pricing

pressures

North America general purpose

polycarbonate market price has fallen

by more than 20 cents per pound so

far in 2019 because of increasing

supply and slowing demand

16

Demand in North America is growing at a

slower pace than last year, but still has the

best growth of the major global markets

0

1

2

3

4

5

6

7

8

9

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Millio

n M

etr

ic T

on

s

Middle East Americas Europe Asia© 2019 IHS Markit

Global Polycarbonate Capacity Growth

2019Q2 2019Q3 2019Q4 2020Q1

PC,cts/lb (US) 168.7 ▼ 158.0 ▼ 147.7 ▼ 140.0 ▼

PC euro/mt 2,217 ▼ 2,147 ▼ 2,093 ▼ 2,117 ▲

PC, $/mt (Asia) 1,933 ▼ 1,933 ► 2,000 ▲ 1,953 ▼

Polycarbonate: Buy now in Asia; wait in North America

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

17

Nylon: Prices finally pushing down for nylon66, as feedstock issues begin to clear up

100.0

120.0

140.0

160.0

180.0

200.0

220.0

2016 2017 2018 2019 2020

North America

Nylon 66 (Engineering Thermoplastic), cents per pound

Source: IHS Markit © 2019 IHS Markit

112.0

116.0

120.0

124.0

128.0

132.0

136.0

140.0

144.0

2016 2017 2018 2019 2020

North America

Nylon 6 (Engineering Thermoplastic), cents per pound

Source: IHS Markit © 2019 IHS Markit

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

Bottom Line: Demand is soft and

supplies are more than adequate. Still, feedstock costs will begin to

rise, which will balance pressures by early next year. Thus, look to

lock in and purchase this fall in Q4

Stronger than expected production in the first half of 2019 and

ensuing accumulation of finished

goods has weighed on ABS prices in Asia

The downside pricing risk is strong

over the next couple of months,

especially in Asia

18

The North American market has seen lower

costs, softer demand, and lower prices of

imported ABS

2019Q2 2019Q3 2019Q4 2020Q1

ABS,cts/lb (US) 86.7 ► 81.7 ▼ 79.3 ▼ 81.3 ▲

ABS, $/mt (Asia) 1,511 ► 1,412 ▼ 1,358 ▼ 1,405 ▲

ABS: Fourth quarter of this year is shaping up to be the ideal time to buy

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

19

800

1,200

1,600

2,000

2,400

2,800

3,200

2016 2017 2018 2019 2020

North America, contract-market price (converted)West Europe, contract-market price (converted)Asia, spot price

Styrene Butadiene Rubber, dollars per metric ton

Source: IHS Markit © 2019 IHS Markit

US

do

llars

per

metr

ic t

on

100.0

120.0

140.0

160.0

180.0

200.0

220.0

240.0

260.0

280.0

2016 2017 2018 2019 2020

Singapore, Spot Price, Natural Rubber

Natural rubber outlook, cents per kilogram

Source: IHS Markit © 2019 IHS Markit

Rubber: Natural and synthetic prices trending down and contained for the foreseeable future

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

Chemical and resins summary

• Bottom Line:

> Prices are declining for most resin markets, with leverage on the side of buyers

> Look to time purchasing and to lock in rates in late 2019/early 2020 when prices will generally be at their near-term low point

• Risk Factors:

> The overall risk to the forecast is on the downside

> Still upside risks are present: crude oil pricing/weather disruptions

20

Confidential. © 2019 IHS MarkitTM. All Rights Reserved.

Negotiating Tips for 2020

21

• Lock in at late 2019 pricesPolyethylene

• Buy as neededPolypropylene

• Ask for ongoing price dropsNylon

• Ask for ongoing price dropsPolycarbonate

• Capture price drops of 2019ABS

• Buy as neededRubber

IHS Markit Customer Care

Americas: +1 800 IHS CARE (+1 800 447 2273)

Europe, Middle East, and Africa: +44 (0) 1344 328 300

Asia and the Pacific Rim: +604 291 3600

DisclaimerThe information contained in this presentation is confidential. Any unauthorized use, disclosure, reproduction, or dissemination, in full or in part, in any media or by any means, without the prior written permission of IHS Markit Ltd. or any of its affiliates ("IHS Markit") is strictly prohibited. IHS Markit owns all IHS Markit logos and trade names contained in this presentation that are subject to license. Opinions, statements, estimates, and projections in this presentation (including other media) are solely those of the individual author(s) at the time of writing and do not necessarily reflect the opinions of IHS Markit. Neither IHS Markit nor the author(s) has any obligation to update this presentation in the event that any content, opinion, statement, estimate, or projection (collectively, "information") changes or subsequently becomes inaccurate. IHS Markit makes no warranty, expressed or implied, as to the accuracy, completeness, or timeliness of any information in this presentation, and shall not in any way be liable to any recipient for any inaccuracies or omissions. Without limiting the foregoing, IHS Markit shall have no liability whatsoever to any recipient, whether in contract, in tort (including negligence), under warranty, under statute or otherwise, in respect of any loss or damage suffered by any recipient as a result of or in connection with any information provided, or any course of action determined, by it or any third party, whether or not based on any information provided. The inclusion of a link to an external website by IHS Markit should not be understood to be an endorsement of that website or the site's owners (or their products/services). IHS Markit is not responsible for either the content or output of external websites. Copyright © 2017, IHS MarkitTM. All rights reserved and all intellectual property rights are retained by IHS Markit.

22