Chart book 6.18.12

-

Upload

blueguyzee -

Category

Economy & Finance

-

view

133 -

download

0

Transcript of Chart book 6.18.12

Key Information

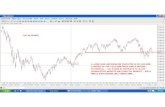

1) all charts utilize weekly price data

2) red line is 40 week moving average

3) red and black dots are key pivot points, which are the best areas of buying (support) and selling (resistance)

4) pink labeled bars are negative divergence bars, which are suggestive of slowing upside momentum

SPY

1) price at high end of range

2) found support at 126.89 which corresponds to LTRO implementation

QQQ

1) price found support at 40 week moving average

2) has yet to test strong support levels at 58.46

GLD

1) likely double bottom

2) a close above 157.18 likely to lead to higher prices especially in the wake of strong fundamentals for gold (LINK)

TLT

1) a break out that no one cares about

2) if this was a stock, traders would be salivating at the “cup and handle” pattern

3) support is noted

UUP

1) a close below 22.36 (support) would not be welcomed for Dollar bulls

2) 22.40 is a target

OIL

1) my favorite chart due to the favorable risk reward

2) price sitting at bottom of range going back to 2009

3) fundamentals are NOT favorable as economies are shrinking around the globe

4) on the other hand, a great hedge to the lunacy of central bankers