charitable remainder trusts - Legacy Financial Partners...2 | Charitable Remainder Trusts Parties to...

Transcript of charitable remainder trusts - Legacy Financial Partners...2 | Charitable Remainder Trusts Parties to...

t r a n s a m e r i c a | 2For producer use only. Not for distribution to the public.

charitable remainder trustsProducer Guide

t r a n s a m e r i c a | 1

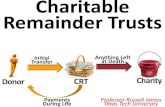

Charitable remainder trusts (CRTs) are irrevocable trusts authorized by the Internal Revenue Code to receive “split-interest” gifts. Properly structured and maintained, CRTs are tax-exempt.

“U.S. charitable giving estimated to be $307.65 billion in 2008.” (Giving USA 2009, The Annual

Report on Philanthropy)

In general, gifts of a partial interest to a

charity do not qualify for an income tax

deduction. However, there are several

exceptions to this rule, and one of them

is the Charitable Remainder Trust. CRTs

are irrevocable trusts authorized by the

Internal Revenue Code to receive

“split-interest” gifts. Properly structured

and maintained CRTs are tax-exempt.

A CRT has a noncharitable income

beneficiary (or beneficiaries), usually

the donor of the trust assets (and/or

his/her spouse or child/children), and

a remainder charitable beneficiary.

An income stream is payable to the

noncharitable beneficiary for his/her/their

lifetime(s), or for a stipulated period not

to exceed 20 years. When the payout

ceases at the death of the income

beneficiary or the end of the trust term,

the trust principal (remainder) is distributed

to the qualified charity (or charities)

designated in the CRT.

2 | Charitable Remainder Trusts

Parties to a Charitable Remainder Trust

The parties to a CRT are:

n The donor(s)—The grantor(s) of the CRT.

n The income beneficiary—Normally, the donor and/or his/her/their child or children.

n The trustee(s)—The donor(s) may be the trustee(s) or serve as co-trustee(s) with the charity or another party. The trustee is responsible for managing and investing the trust assets for both the income beneficiary and the charity.1

n The charity—The not-for-profit entity that will ultimately receive the trust principal (remainder). If more than one charity is named, their respective shares should be expressed as percentages of the remainder interest, instead of as specific dollar amounts. This is because the exact value of the trust principal cannot be deter-mined until the end of the payout period.2

1 If the donor is to be a trustee, it is highly recommended that a third party (unrelated person) be named as “Special Trustee” in the CRT document to handle certain trust assets and transactions in order to avoid violating the “self-dealing” prohibition. For example, if real estate or stock of a closely held corporation transferred to the CRT is to be sold, the Special Trustee should manage the asset until its sale and handle the sales transaction. Similarly, a Special Trustee is needed if trust funds are invested in certain assets, such as an annuity contract. In this regard, the Special Trustee should purchase the annuity contract, be responsible for its administration, handle any distributions from the contract, and so on.

2 Although the CRT is irrevocable, it is possible for the donor to reserve the right to change the charitable beneficiary by making such beneficiary designation(s) revocable rather than irrevocable. However, the remaining trust assets must go to a qualified charity. Alternatively, a class of charitable organizations may be named at the time the CRT is established, with the actual charity to be specified later.

In general, gifts of a partial interest to a charity do not qualify for an income tax deduc-tion. However, a CRT is an exception.

2 | Charitable Remainder Trusts

t r a n s a m e r i c a | 3

Types of Charitable Remainder Trusts

There are basically two types of CRTs. The major difference between the two is in how the calcula-tion of the income payable to the noncharitable beneficiary is performed.

Charitable Remainder Annuity Trust (CRAT)The trust document requires the trustee to pay an amount each payout period—at least annually—to the income beneficiary for his/her lifetime or the term of the trust, which cannot exceed 20 years. This amount can be fixed or a percentage of the fair market value of all assets when they are placed in the trust, but not less than 5% nor more than 50% of their initial value. Any increase or decrease in the value of trust assets does not affect the amount or percentage of the income that must be paid annually. The trustee may deplete the trust principal in making the payout. A CRAT cannot accept subsequent gifts, so new trusts must be established for additional contributions or to change the income payout.

Charitable Remainder Unitrust (CRUT) Unlike the CRAT, a CRUT may accept multiple con-tributions. There are three forms of CRUTs based on differences in how the payout to the income beneficiary will be determined and the timing of the payments.

n A standard unitrust has the same payout require-ments to the income beneficiary as a CRAT. However, the amount of the payout is based on a specified percentage of the annually determined value of the trust assets. If the value of the assets increases, so does the payout, and vice versa. The trustee may deplete the trust principal in making the payout.

n The net income unitrust requires the trustee to make annual distributions of the earnings of the trust or a percentage of the trust value, which-ever is less, to the income beneficiary. Since the trustee may not deplete the trust principal when making the distribution, any payout can only be made from current trust income as defined in the trust document and applicable state law.

n A NIMCRUT is a net income unitrust with a “make-up” provision. The same payout rules under the net income unitrust apply to a NIMCRUT, with the added provision that if income payments equal to the amount set forth in the trust document are not made in any year, the trustee is required to make up the shortfall in later years if income is then available. In other words, the trustee must pay out larger amounts in years when the trust income is higher to make up for smaller distributions in years when the trust had little or no income.

n A “flip” unitrust allows a net income unitrust to flip or change into a straight or fixed percentage unitrust upon the occurrence of a predetermined triggering event, such as the sale of an unmarket-able asset (e.g., real estate or closely held stock). For example, in its initial phase as a net income unitrust, the flip unitrust will not pay any income if there is no actual trust income earned. However, once the trust asset has been sold and the proceeds reinvested, then the trust changes to a straight CRUT and income is paid based on a fixed percentage of the trust’s annual fair market value.

Producer Guide

4 | Charitable Remainder Trusts

Tax Implications of CRTs

To the Donorn Charitable Income Tax Deduction—Contributions

to the trust qualify for an immediate charitable income tax deduction based on the present value of the charity’s remainder interest. Several factors are considered in determining this value:

1. The term of the trust—lifetime of the income beneficiary or a fixed number of years.

2. The initial value of the asset/property contributed to the trust.

3. The percentage of the income beneficiary’s payout and the frequency of the payments. The payout rate must be at least 5% and can-not exceed 50% of the initial trust value. There is a minimum remainder interest that must ultimately pass to the charity. The remainder interest under CRUTs must be at least 10% of the net fair market value of the property as of the date the property was contributed to the trust. For CRATs, this minimum is 10% of the initial net fair market value of all property placed in the trust. Also, CRATs must pass a “5% probability test.” This test requires that the annuity amount cannot be so large that there is a greater-than-5% probability that the trust corpus will be exhausted before the (last) noncharitable beneficiary dies, the trust termi-nates, and charity receives its remainder.

4. The “Section 7520 rate,” which is 120% of the applicable federal (midterm) rate (AFR), determined monthly. A charitable deduction is permitted for the amount of the remainder interest, subject to certain adjusted gross income (AGI) limitations. This rate is used to calculate the value of the income stream that will be paid to the donor. This amount is sub-tracted from the value of assets transferred to the trust to determine the remainder.

n Capital Gains Tax—Donors may avoid recognition of capital gains since the donated property, if sold, is sold by a tax-exempt CRT. Therefore, an appre-ciated asset, such as stock or real estate, may be “converted” without tax into an income-producing asset, such as a bond portfolio, for the donor.

n Gift Tax Consequences—If an income beneficiary is someone other than the donor or his/her spouse, there may be federal gift taxation. However, if certain requirements are met, the gift can qualify for the annual gift tax exclusion of $13,000 (for 2010, indexed for inflation) per beneficiary.

n Estate Tax Consequences—Gifts to the CRT not only reduce the donor’s taxable estate by the value of the gift, but also by any potential appre-ciation. If a donor is an income beneficiary, the date-of-death value of the trust is includible in his/her estate. However, there is an offsetting charitable estate tax deduction since the trust remainder will be distributed to a charity. If there are income beneficiaries other than the donor and his/her spouse, the value of their income interest may be subject to estate tax.

t r a n s a m e r i c a | 5

To the Income Beneficiaryn “Tiered” Tax System—Income received by a

noncharitable beneficiary is subject to taxation in accordance with the character of the income in the CRT. Distributions from the trust are deemed to be received in the following order:

n Ordinary income

n Capital gains

n Tax-exempt income

n Return of basis

To the extent that a CRT has ordinary income, that income will be distributed first, then capital gains, and so forth, to an income beneficiary.

CRTs and Asset “Replacement”

The tax benefits derived from a CRT are based on the premise that ultimately a charitable gift is being made at death with a charitable income tax deduction when the CRT is established. Also, an asset that would normally go to a donor’s loved ones would be gifted to a charitable organization instead, reducing the loved ones’ inheritance, and possibly the donor’s estate tax, by the value of the gifted asset. Consequently, the ability to “replace” the asset for the benefit of the donor’s loved ones can become an important planning consideration when dealing with charitable giving.

Under certain circumstances, life insurance on the donor may be the ideal “replacement” asset for a number of reasons:

n The life insurance premiums may be paid with cash flow from the CRT in excess of that needed by the income beneficiary.

n An “increasing death benefit” option may be elected for the policy. This would generally provide the beneficiary with an increasing amount of death benefit proceeds over a

period of time that could match the appreciation of the gifted asset had it remained within the estate of the donor.

n A third party—such as an “Asset Replacement Trust”—can own the policy so that the proceeds are excluded from the estate of the insured CRT donor.

n Proceeds from the life insurance policy are generally received by the beneficiary income tax–free.

Action Steps

Following are the suggested action steps for implementing and maintaining a CRT. For purpos-es of this Guide, it is assumed that the donor will replace the asset transferred to the CRT with life insurance for the benefit of the heirs. For estate planning purposes, the life insurance should be owned and payable to an Irrevocable Life Insurance Trust (ILIT) created by the donor.

To achieve the desired results from the planning technique of combining a CRT with an ILIT, the donor should consult with professional advisors. Ongoing services and/or guidance from knowl-edgeable professionals who can provide the needed expertise in the management and operation of these trusts may also be required.

Producer Guide

A third party—such as an “Asset Replacement Trust”—can own the policy so that the proceeds are excluded from the estate of the insured CRT donor.

6 | Charitable Remainder Trusts

Initially, the donor, professional advisor, trustee, and/or legal counsel:

1. Select the asset/property to be transferred to the trust.

2. Determine the type of CRT to be established based on factors such as desired income, payout frequency, duration, age, number of income beneficiaries, and so on.

3. Obtain an analysis of the proposed CRT arrangement, including projections of the income stream to the noncharitable beneficiary and the charitable income tax deduction based on the present value of the charitable remainder interest, and verify that the proposed arrangement complies with the government rules and regulations for CRTs.

4. Draft the CRT document (legal counsel) and sign it (donor and trustee).

5. Submit Internal Revenue Service Form SS-4 to obtain a federal tax ID number for the CRT, establish the trust bank account, and so on.

6. Transfer asset/property to the CRT.

7. Sell the transferred asset/property and reinvest the sales proceeds in an investment appropriate for the CRT that also considers the timing of income needs in making payouts to the beneficiary. For example, a variable annuity may be appropriate in a NIMCRUT should the trustee desire to delay payments to the income beneficiary.

Ongoing, the trustee and/or professional advisors, such as the appraiser, CPA, and others:

1. Distribute payouts to the income beneficiary in accordance with CRT provisions.

2. Manage and invest the trust asset.

3. Maintain detailed records of all trust transac-tions. Certain complex trust administration and recordkeeping, as well as various accounting functions, may require the services and/or assistance of other profes-sionals. For example, an independent appraiser may be needed to perform the annual valuation of the trust.

4. Calculate the annual payout, depending upon the type of CRT. In some cases, a recalculation may be required more frequently. Generally, CRUTs that receive additional contributions may need multiple valuations and pay-out calculations.

At termination, the trustee:

1. Distributes the remainder interest to the charity in accordance with the terms of the trust upon the CRT’s termination.

Charitable Remainder Trust (CRT) Action Steps

t r a n s a m e r i c a | 7

Producer Guide

Initially:

1. Legal counsel drafts the ILIT with the donor(s) of the CRT as the grantor(s) for the benefit of the beneficiary(s). The trust contains appropriate provisions, such as the authority for the trustee to purchase insur-ance on the life of the grantor and Crummey withdrawal rights for trust beneficiaries. The grantor and trustee sign the trust. The grantor must not serve as trustee.

2. The trustee submits Internal Revenue Service Form SS-4 to obtain a federal tax ID number for the ILIT, and establishes a non-interest-bearing checking account in the name of the ILIT.

3. After the checking account is established, the grantor gifts a nominal amount to the trust, such as a check for $100 payable, for example, to “The Client Family Irrevocable Trust, John Q. Trustee, Trustee.”

4. The trustee deposits the gift in the trust checking account and notifies the trust beneficiary of his/her/their withdrawal rights.

5. The trustee applies for the insurance policy on the life of the grantor. The ILIT is named owner and beneficiary. The tax ID number of the trust must be included on the application.

6. The life insurance application and other required forms are completed. The full name of the trust—including the date the trust was established—is inserted over the signature line for “Owner other than the Insured.” The trustee signs the application, with the title “Trustee” following the signature. The grantor signs only as the insured.

7. The trustee submits the life insurance appli-cation with the “Verification of Irrevocable Trust Agreement” form (TON 205).

Ongoing:

1. The grantor gifts sufficient cash to the trust to cover the premiums due. The grantor may use income from the CRT to make gifts to the ILIT.

2. The trustee deposits the gifts of cash in the trust’s checking account and notifies the Crummey beneficiaries in writing of their limited right to withdraw the cash. The trustee must include in the notice the “withdrawal period” during which the power can be exercised, as stipulated in the trust. The trustee keeps records of the Crummey notices—and any responses—in the trust files.

3. After the withdrawal period expires, the trustee pays the premium due from the trust checking account.

4. Even if there is no trust income, the trust is required to file an informational tax return, IRS Form 1041, annually.

“Funding” the ILIT:

1. Upon the death of the insured grantor—or the last to die of the joint insured grantors—the trustee files a claim with the insurance company and the death benefit proceeds are paid to the trustee. The proceeds may be invested, and the income and/or principal may be distributed by the trustee to the trust beneficiary in accordance with the terms of the ILIT.

Irrevocable Life Insurance Trust (ILIT) Action Steps

8 | Charitable Remainder Trusts

For more information about this and other advanced marketing strategies, be sure to visit our Web site at www.tatransact.com, or call Advanced Marketing toll-free at (866) 545-9058.

In 2008, the majority of charitable donations came from individual donors - $229.28 billion, or 75%. (Giving USA 2009, The Annual

Report on Philanthropy)

This Guide provides an overview of Charitable Remainder Trusts (CRTs) and the action steps necessary to properly implement and maintain them. For discussion purposes, it assumes that the CRTs are established during the lifetime(s) of the donor(s)—as opposed to testamentary CRTs created by a will.

Please note that all legal documents mentioned in this Guide, such as Charitable Remainder Trusts and Asset Replacement Trusts, must be drafted by the client’s legal counsel with special attention to pertinent sections of the Internal Revenue Code, Treasury Regulations, and applicable state law. In addition, licensed professionals who are knowl-edgeable in the area of charitable trusts must provide any needed professional services, such as accounting or tax advice.

t r a n s a m e r i c a | 1For producer use only. Not for distribution to the public.

This material was not intended or written to be used, and cannotbe used, to avoid penalties imposed under the Internal RevenueCode. This material was written to support the promotion ormarketing of the products, services, and/or concepts addressedin this material. Anyone to whom this material is promoted,marketed, or recommended should consult with and rely solelyon their own independent advisors regarding their particularsituation and the concepts presented here.

Transamerica Insurance & Investment Group (“Transamerica”), and their representatives do not give tax or legal advice. This material and concepts presented here are provided for informational purposes only and should not be construed as tax or legal advice. Although care is taken in preparing this material and presenting it accurately, Transamerica disclaims any express or implied warranty as to the accuracy of any material contained herein and any liability with respect to it. This information is current as of February 2010.

Life insurance products are issued by Transamerica LifeInsurance Company, Cedar Rapids, IA 52499, or TransamericaFinancial Life Insurance Company, Harrison, NY 10528. Allproducts may not be available in all jurisdictions.

Transamerica Financial Life Insurance Company is authorizedto conduct business in New York. Transamerica Life InsuranceCompany is authorized to conduct business in all other states.

OLA 806 0210