CHAPTERS - Amazon Web Services€¦ · Chapters Financial Limited in Guildford. Touchdown to...

Transcript of CHAPTERS - Amazon Web Services€¦ · Chapters Financial Limited in Guildford. Touchdown to...

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

®F I N A N C I A L

HAPTERSCNEWSLETTER15th Anniversary Edition

AUTUMN 2019

Celebrating 15 years of financial planning across Surrey and the South East

WelcomeIt will not escape the attention of any of our readers that the UK’s political position has heated up a lot over the last few weeks. Prorogation! If we had never heard of it before with reference to Westminster and our politicians, then you have now as the House of Commons sits empty and our law courts question the legality of the current

situation. The media headlines on the topic of the UK political impasse have seemed to update at too fast a rate for our newsletter to be reflective of the changing position as it twists and turns. At the time of writing, there are only around 49 days to resolve the position between the UK and the EU and time will be of the essence. Will there be a General Election in the UK before the year is out? We will probably know by the time this newsletter has been published!

It has not just been all change in the UK. The European elections are now behind us, and many new faces have now taken their seats in the European Parliament. Again, at the time of writing, the tune to the UK from Brussels seems familiar in its stance and as before, our involvement in the future of the EU still remains unclear. However, one point of note is that the European Central Bank has signalled monetary policy easing ahead to stimulate their slowing economy, and this is anticipated soon. For reference, there were some fears that the UK would fall into recession, and this is still possible, noting that Gross Domestic Product (GDP) was flat for the three months to July 2019 (Source: Office of National Statistics/ONS).

What does this all mean? Sadly, there is no definitive answer, although many are aware that Sterling as a currency has fallen over the year and this has invariably made a glass of wine more expensive abroad this summer.

We aim for individual discussions with clients on investment into pensions, ISAs and the like to consider an individual’s needs, objectives and

importantly their attitude to risk, along with their capacity for investment risk. Sometimes, these investment views can be challenged when there is volatility, and much comment in the media which can appear concerning. Unless personal circumstances or needs change, staying with any agreed investment strategy is recommended. The regular updates on our website (www.chaptersfinancial.com) of our house investment view might be helpful in gaining our latest view on the current economic climate and its effects on investment opportunities.

It is of note that we have seen an uplift over the summer from clients and enquirers about drawing pension benefits earlier than had been planned, with the objective of accessing tax free cash to repay mortgages and loans, or to help children onto the property market, as examples. It is good to consider all options for pension planning and if you would like to receive a copy of our Retirement Options Schedule, which looks at the way pension benefits can be drawn, then please let us know or look on our website.

We always recommend that clients consider a regular review with our team in Guildford, and if recent events have raised any additional questions with regards to your own arrangements then please do get in contact.

As you will see later in this newsletter, Chapters Financial celebrates its 15th anniversary of financial advice in Guildford at the start of October 2019. We hope you enjoy a few fond reminders of our journey. A big thank you to all of our supporters and contacts over the last decade and a half. Over the years we have experienced and guided our clients through many volatile times, and five prime ministers thus far, excluding any change that may occur in October. We look forward to the remainder of 2019 and into 2020, being on hand and ready to provide financial advice whatever the outcomes of the next few months.

Keith Churchouse

3Autumn 20192 Autumn 2019

A close acquaintance of mine has been an advocate of buy-to-let investment for over a decade. In general, we have never argued against buy-to-let investment, as it has had some advantages in the past. These advantages must be balanced by the disadvantages of which many are aware. And it is these disadvantages that are growing and pushing some, including my erstwhile advocate of all things property, to think again...very much to my surprise, with the conversation being eagerly prompted by her.

It is interesting to note that her path to returns has been smooth. Tenant default rate has been almost non-existent over the years for her various properties, and I had envisaged that the annual shrinkage of offset allowances would have made her change her view. No, but it is a factor. Capital gains have also been strong since purchase.

The issue now is one of reasonable control, the landlord in this case being scrupulous in ensuring high quality housing for those in her properties. And I understand this is where ‘the rub’ lies. Not all tenants share the same values in being prompt in paying, looking after the home properly, or being reasonable about their agreements. This is the part that is often unreported.

The proposed reforms in the law to offer greater protection to tenants could be the final straw for this landlord, should new legislation come into force, and I am sure she will not be alone. It is widely noted that many tenants have received poor deals, service, and suffered insecurity

knowing that their home could be withdrawn in as little as eight weeks. These proposed reforms would aim to protect them.

From the alternative viewpoint, in essence, this would mean that private landlords will no longer be able to evict tenants from their homes at short notice and without good reason. This would effectively create open-ended tenancies, to quote the Government website.

More detail can be found on the Government website here:

h t t p s : / / w w w. g o v. u k / g o v e r n m e n t / n e w s /government-announces-end-to-unfair-evictions

On sale values, the significant rise in first time buyers, a 12 year high, reported in February 2019 in the press may take up any slack in capital values if many more buy-to-lets are released for sale rather than for continued renting.

Alternatives?

I was asked about possible alternatives for the capital being released from the sale of buy-to-let properties, noting that the full capital gains tax allowance would be used in this tax year.

Building an investment-based portfolio is one option, with the aim at the same time of using tax allowances (now & future) such as the tax-free ISA allowance (currently £20,000) and investing with the aim of a balance between income generation and capital growth.

Is the love affair with buy-to-lets over for some?

Breakfast with a fellow business owner recently was enjoyable, and also humbling.

The topic turned promptly at the outset (I think to get the topic over with) to the trials that our politicians had caused SME owners and how the last 6-9 months had been. All ok, but ‘challenging’ was the answer she gave in this instance, and in our experience of speaking to some enquirers of late, this position is not uncommon.

For the time being, gone seem to be the ebullient days of business bravado and significant growth expectations, replaced by concern for the indecision of our politicians to achieve...well, anything really! ‘Steady as we go’ seems, at least for the time being, to be a good place for some. Others who are closer to reaching the retirement window that they had envisaged some five years hence, as an example, have deferred until

later the date they plan to stop work. This is understandable, based on the current business environment for some organisation and sectors of industry, and certainly focuses the mind about what is to be achieved from life.

We always advocate starting any retirement planning early, to consider the options available to a client for using the assets they have accumulated over their working lifetime, pension or otherwise. A look at our Retirement Options page might be worthwhile and this can be found here: https://www.chaptersfinancial.com/private-clients/pension-retirement-planning

And what do we mean by early? I am no pilot, but I can imagine it is like the landing of a jet in London. You start your line up over the Atlantic, know which territories you will pass over on reaching the mainland, know which runway you are touching down on, and (I am sure) have a fair idea based on the conditions how hard the landing might be. The analogy (if correct) works well in lining up your finances and financial planning well in advance to ensure that any retirement ‘landing’ is smooth, rather than bumpy.

However you plan to make your retirement landing, take good financial advice early on in your ‘flight path’ and speak to the team at Chapters Financial Limited in Guildford.

Touchdown to Retirement

To date, dividend yields have remained firm (2.5%-3.5% pa gross as an example / not guaranteed), noting that based on current legislation, the first £2,000 pa gross of dividend income within a taxable investment arrangement is tax free. In this case, my acquaintance has a partner, so we could use both their tax-efficient allowances. The only part she did not like is that natural dividend income can be lumpy (varying across the calendar year), which is different to the rental income she has received in the past. So, a bit of additional personal cash-flow management would be required.

The capital gains tax allowance is £12,000 per individual (tax year 2019/2020), so one aim would be to use this where possible each tax year. One important point that was noted to me is control: no rental agreements refer to getting access to your own capital.

Summary

I think 2019/2020 will be a telling time for the UK buy-to-let market if landlords decide to exit. No one knows what future performance will be for either property or equity/bond type investments, but that might in part be for forthcoming legislation to decide.

4 Autumn 2019 5Autumn 2019

I set up Guildford Fringe Theatre Company back in 2012 with the goal of bringing professional Fringe Theatre to the town but it soon grew into a lot more. Guildford Fringe is now made up of several micro businesses that include the Theatre Company, Guildford Fringe Festival, Guildford Fringe Performing Arts (stage school), Gag House Comedy Clubs, The Godalming Pantomime and Theatrical Marketing. Most of those are self-explanatory but Theatrical Marketing is our staffing and entertainments agency, which is a way to give ‘resting’ actors work. We now supply staff and entertainment all over the UK to various clients for promotional events, business exhibitions and private parties.

Our hearts and homes are in Guildford and we feel privileged to have the opportunity to add to the local community and economy. We are very much looking forward to growing the business over the coming years and always welcome new partners and contributors.

We are, perhaps most well known in Guildford for the Fringe Festival every summer and the Adult Panto every winter. This year’s Adult Panto is Sinders, a re-write of our first ever Panto back in 2013 and its shaping up to be the best yet!

Something new in our portfolio this year is our first family pantomime which we are producing at The Borough Hall in Godalming. Jack and the

Beanstalk will be running from 11-24 December with a fully professional cast and crew. We’ll be employing 15 staff to put this show on and engaging with local youngsters to make up our children’s ensemble. We can’t wait!

The Guildford Fringe Festival goes from strength to strength and in June and July this year, we entertained over 10,000 people. This includes ticketed events, free events and high street performances. The Fringe Festival is all about accessibility and affordability. Ticket prices are kept low and entertainment is kept high!

Next year will be our 8th Festival and we are looking forward to adding even more events and most importantly engaging and thrilling even more people.

Full info on Guildford Fringe can be found at www.GuildfordFringe.com or by contacting Nick on [email protected]

Nick Wyschna

Director of the Guildford Fringe

In the Spotlight

If you would like to be in our spotlight in our next edition please let us know by emailing [email protected]

7Autumn 20196 Autumn 2019

Long Term Care and Inheritance Tax Planning…the conflict?

Guildford in Bloom

Chapters Financial were once again delighted to sponsor this year’s Guildford in Bloom which promotes imaginative ways to make the town and surrounding areas look their best and champions Guildford’s natural environment. This year’s theme was the 50th anniversary of the first moon landing whilst the theme for the school gardening competition was ‘The Colours of Summer’.

Chapters Financial Out and About

End of Help to Buy ISAs

Help to Buy ISAs were launched by the government on 1 December 2015 in an attempt to help first-time buyers save up a deposit for their home. The government adds 25% to your savings, up to a maximum of £3,000 on savings of £12,000.

This scheme will close on 30 November 2019 and will not be available to new savers after this date.

If a Help to Buy ISA is opened before that date, it is possible to keep saving into the account but any bonus must be claimed by 1 December 2030.

If you are looking for an alternative, you could use a Lifetime ISA (Individual Savings Account) to buy your first home or save for later life. You must be 18 or over but under 40 to open a Lifetime ISA and can put in up to £4,000 each year, until you’re 50. The government will add a 25% bonus to your savings, up to

a maximum of £1,000 per year. You can hold cash or stocks and shares in your Lifetime ISA, or have a combination of both. When you turn 50, you will not be able to pay into your Lifetime ISA or earn the 25% bonus. Your account will stay open and your savings will still earn interest or investment returns. There are a number of conditions and penalties that apply to a Lifetime ISA and more can be found here: https://www.gov.uk/lifetime-isa

8 Autumn 2019 9Autumn 2019

Conflicts of interest within financial planning don’t come up very often for an individual; however, one area that does see much concern is the issue of providing for the potential need for long-term care, whilst also looking at ways to reduce the effects of inheritance tax.

On one hand, the need to cater for the costs of long-term care (around £1,250 per week in the South East / £65,000 pa – and that’s out of net income) really does provide a focus on financial planning. On the other hand, the objective of reducing any liability to inheritance tax, charged at 40% above the nil rate band (and now with the residence nil rate band if applicable), possibly by gifting money away in good time, usually seven years to fall outside the estate, does not normally combine well with long-term care cost planning. Gifting assets away to save inheritance tax is common. However, if financial support is then sought from the local authority for care costs, the gifting can be seen as ‘deliberate deprivation of assets’, a specific term, and the gifting can be (and is likely to be) challenged by councils to cover their costs.

For reference on what to consider when paying for care costs, Age UK has produced various fact sheets. Two produced in April 2019 (Factsheet 10 and Factsheet 46) are very helpful in looking at the issues of paying for care, either at home or in a residential care facility. A link to these can be found here:

https://www.ageuk.org.uk/services/information-advice/guides-and-factsheets/

It is important to assess the assets and income available, both now and into the future. Circumstances can and do change, and this may affect allowances available, such as Attendance Allowance. Attendance Allowance is paid at two different levels (Lower and Higher Rate) and how much you get depends on the level of care that you need because of your disability. Attendance Allowance currently offers £58.70 or £87.65 a week to help with personal support and more can be found at the following Government website:

https://www.gov.uk/attendance-allowance/what-youll-get

Chapters Financial is not responsible for the content of external websites.

Taking advice on the issues at hand from an adviser qualified to deal with the points above is important with the aim of achieving all that is possible, particularly with the emotional issues that are long-term care and inheritance tax planning. Both Keith Churchouse and Vicky Fulcher hold suitable qualifications to help with both issues.

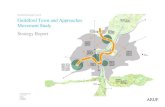

October 2004 January 2005 May 2006Launch of company at

Alexandra HouseKeith becomes a regular contributor on

BBC Surrey & BBC SussexMove to

Hadleigh House

June 2010 2011 2012Company certified as Chartered

Financial PlannersChange of company name Implementation of the Financial

Services Authority (Now FCA) RDR

2010 2007 November 2006

KGC celebrates 25 years in UK retail financial services and has first book launch

Recession of late 2007 and its effects Keith becomes Chartered Financial Planner

May 2014 February 2014 September 2013

Esther becomes a Chartered Manager Vicky Fulcher joins the company First year of BS8577 accreditation

Chapters Financial (originally Churchouse Financial Planning Limited) opened its doors on a wet Monday morning on 04 October 2004. The new business had been around a year in the making, with every spare moment spent planning by its Directors, Keith Churchouse and Esther Dadswell. All aspects of the business had to be correct to ensure that the launch and planned projection forward were successful. As with most aspects of business life, if you don’t get it right at the start, it can be difficult to correct later on.

Business ownership requires conviction in your proposition and after 20+ years within UK retail financial services, Keith Churchouse knew what he wanted to achieve as an alternative to the big, and sometimes faceless, corporates, and the work from home adviser alternative that can have its challenges.

The office opened in Alexandra Terrace in Guildford (now rebuilt as the Harbour Hotel), and the real work of delivering good quality private client and business propositions began, with Esther Dadswell leaving her engineering role in January 2005 to join the office.

A mentor to the business was Roger Churchouse who was a well-known and respected bank manager in and around Guildford in the 1970’s and 1980’s. Keith asked him to be ruthless with the business planning to ensure that the finances remained robust and in order at all times.

The business plan set for the first three years was meticulously monitored and met with all expectations and challenges, with the business moving to a fee based model in May 2006 and moving to its current larger premises in the High Street at the same time.

Clearly the Chapters Financial advice proposition offered by the company filled a need within the locality and across the South-East, and business growth was sustained during these early years,and during the long recession that hit the global economy from 2007, started by the ‘Credit Crunch’. This in itself diversified our proposition as clients sought to manage their funds and objectives in a different way to the previous, more buoyant times.

Team numbers grew to around five and have stayed constant over the years. Although the levels of business have increased significantly over time, so has the capability of technology to help maintain and improve services to our clients. Indeed, of any profession or industry, the evolution of systems and computing power within financial services has been prolific and Esther Dadswell has been at the forefront of guiding the business in using these opportunities (and their security) to maximum effect, including the online proposition SaidSo.co.uk.

Continued education has been a priority for the team over the years, and we were proud to be one of the earliest achievers as a business of Chartered Status from the Chartered Insurance Institute in the summer of 2010.

We were proud to welcome our colleague, Vicky Fulcher, to the company in early 2014 and we were thrilled to join her into the business as an equity director in early 2019. Vicky adds greater strength to our advice capacity and we look forward to working with her into the future.

The last 15 years has been exciting, dynamic, challenging and overall, a fabulous experience. The desire to achieve at the start of the business remains unchanged all these years later and we continue to be proud of our proposition, which remains in high demand.

We would like to take this opportunity to thank our clients and contacts without whom we would not have flourished over the last 15 years. We look forward to the next 15 years with energy and anticipation!

January 2016 June 2018 October 2019Launch of new look Chapters

Financial websiteKeith appointed President of

CISI Southern branch15th Anniversary

10 Autumn 2019 11Autumn 2019

We thought it would be fun to see a pictorial timeline of some of our highlights over the last 15 years. Long may it continue!

And Finally …Celebrating 15 Years

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C C

Summary & ReviewPlease do pass our details on to contacts you may have that may benefit from our

service. We are always pleased to receive referrals.

Please contact the team at Chapters Financial; Keith, Vicky, Esther, Julia or Suzanne on 01483 578800 or by email at [email protected] to discuss your requirements

and to book a meeting or financial planning review.

If you would like to receive this information in e-mail format, please let us know.

This Newsletter provides general information and should not be used as individual advice.

®F I N A N C I A L

HAPTERSCwww.chaptersfinancial.com

Advice on inheritance tax planning is not regulated by the Financial Conduct Authority.

Chapters Financial Limited is Authorised and regulated by the Financial Conduct Authority. Registration Number: 402899

Printed on 100%

Recycled paper

Hadleigh House, 232 High Street, Guildford, GU1 3JF.

Tel: 01483 578800Fax: 01483 578864

email: [email protected]