Chapter 9 Debt Instruments Quantitative Issues. Pricing a Bond where P 0 = price of bond today T =...

-

Upload

matilda-obrien -

Category

Documents

-

view

215 -

download

2

Transcript of Chapter 9 Debt Instruments Quantitative Issues. Pricing a Bond where P 0 = price of bond today T =...

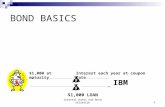

Chapter 9

Debt Instruments

Quantitative Issues

Pricing a Bond

where P0 = price of bond today

T = maturity of the bond

Y = appropriate discount rate

PAR = par or face value of the bond

T

T

1tt0

Y1

PAR

Y1

coupon P

Bond Prices with Semiannual Payments

• Divide coupon payment by two • Multiply maturity of bond by two.• Divide discount rate by two

T2

2T

1tt0

2

Y 1

PAR

2

Y 1

2

coupon

P

Bond Yields & Rates

• Coupon rate (nominal yield)• Current yield (coupon / price)• Yield to maturity (YTM = IRR)• Realized compound yield to maturity (RCYTM)• Yield to First (earliest) Call• Realized return

ABC Example

• Coupon: $40 per year

• Par Value: $1,000

• Maturity: 6 years

• Callable: in 3 years @ $1040

• Price: $950

Coupon Rate

• Stated dollar return of fixed-income investment

• Equals annual interest payments divided by par value

Current Yield

• Bond’s coupon rate divided by current market price

OR

• Stock’s indicated dividend rate divided by per-share price

Yield to Maturity• Measure of bond yield that takes into account capital gain

or loss, as well as coupon payments

• Discount rate that would make present value of bond’s cash flows (payments plus face value at maturity) equal purchase price of bond

where C = the coupon payment

T

1tTt0

Y 1

PAR

Y 1

C P

Yield Relationships

Yield to Call

where Tc = time to earliest call

Yc = yield to first call

• Almost identical to YTM, except– Call price replaces par value

– Time to call replaces term to maturity

cT

1tT

ct

c

0Y 1

price call

Y 1

coupon P

3c

3c

2cc Y 1

1040

Y 1

40

Y 1

40

Y 1

40 950

Realized Rate (Yield)

where TH = holding period

YH = realized rate of return

• Ex post rate of return or yield from investment (internal rate of return)

Bond Price Volatility

• Bond prices and interest rates inversely related• Maturity effect: longer a bond’s term to maturity, greater

percentage change in price for given change in interest rates• Coupon effect: lower a bond’s coupon rate, greater

percentage change in price for given change in interest rates• Yield-to-maturity effect: For given change in interest rates,

bonds with lower YTMs have greater percentage price changes than bonds with higher YTMs – all other things equal

Which Bond’s Price Is Most Volatile?

• Bond X: 25 years to maturity, 10% coupon rate, and a 6% YTM

• Bond Y: 10 years to maturity, 2% coupon rate, and a 6% YTM

• Bond Z: 17.5 years to maturity, 6% coupon rate, and a 4% YTM

Answer

• Based on maturity effect, it would be X

• Based on coupon effect, it would be Y

• Based on yield-to-maturity effect, it would be Z

Duration

• Weighted average amount of time until present value of bond’s purchase price repaid to the investor

• Based on time-weighted present value of bond’s principal and interest payments divided by the bond’s price

• Used as measure of bond’s sensitivity to interest rate changes

Formula for Duration

Where P0 = price of the bond today

Y = yield to maturity

Ct = cash flow in period t (coupon, principal or both)

T = term to maturity

0

T

1tt

t

P

Y 1

Ct x

D

Equation 9-6

• Insert Equation

• WhereY = yield to maturity

C = coupon rate

T = term to maturity

T

1 Y T C Y1 YD

Y C 1 Y 1 Y

Uses of Duration

• Price volatility index– Larger duration statistic, more volatile price of

bond

• Immunization– Interest rate risk minimized on bond portfolio

by maintaining portfolio with duration equal to investor’s planning horizon

Major Characteristics of Duration

• Duration of zero-coupon bond equal to term to maturity

• Duration of coupon bond always less than term to maturity

• Inverse relationship between coupon rate and duration

(continued)

Major Characteristics of Duration (continued)

• Inverse relationship between yield to maturity and duration

• Direct relationship between maturity and duration

Modified Duration

• Adjusted measure of duration used to estimate a bond’s interest rate sensitivity

D* = D (1 + YTM)

% Chg in price of bond = –D x % Chg in YTM

% Chg in price of bond = – D* x [Chg in YTM]

Convexity

Portfolio Duration

• Market value weighted average of durations of individual securities in the portfolio

Components of InterestRate Risk

• Price Risk

• Reinvestment Rate Risk

Price Risk

• Risk of existing bond’s price changing in response to unknown future interest rate changes– If rates increase, bond’s price decreases– If rates decrease, bond’s price increases

Reinvestment Rate Risk

• Risk associated with reinvesting coupon payments at unknown future interest rates– If rates increase, coupons are reinvested at

higher rates than previously expected– If rates decrease, coupons are reinvested at

lower rates than previously expected

Immunizing a Portfolio

• If a single time horizon goal, purchasing zero-coupon bond whose maturity corresponds with planning horizon

• If multiple goals, purchasing series of zero-coupon bonds whose maturities correspond with multiple planning horizons

(continued)

Immunizing a Portfolio (continued)

• Assembling and managing bond portfolio whose duration is kept equal to planning horizon

Note: this strategy involves regular adjustment of portfolio because duration of portfolio will change at SLOWER rate than will time itself

Bond Swaps

• Technique for managing bond portfolio by selling some bonds and buying others

• Possible benefits achieved:– tax treatment

– yields

– maturity structure– trading profits

Types of Swaps

• Substitution swap– Tax swap

• Intermarket spread swap

• Pure-yield pick-up swap

• Rate anticipation swap

Strategies for Managing a Bond Portfolio

• Bullet Portfolio

– Entire portfolio is placed in one maturity

• Bond ladders– Equally distributed dollar allocations over time

• Barbells– Majority of dollar allocations in shortest-term

and longest-term holdings

Yield Curve or Term Structure

• Vertical axis: yield to maturity

• Horizontal axis: term to maturity

• Bonds of like quality

• Always based on Treasuries

Shapes of Yield Curve

• Rising: Most common (used to be only one observed)

• Falling: Next most common

• Humped

• Flat: Rare

Types of Yield Curves

Theories of the Yield Curve

• Unbiased expectations– Long-term rates reflect market’s expectation of

current and future short-term rates.

• Preferred habitat– Significantly more attractive rates can induce

investors and borrowers out of their preferred maturity structures

(continued)

Theories of Yield Curve(continued)

• Market Segmentation:– Yields reflect supply and demand for each

maturity class.

• Liquidity Preference:– Borrowers are risk averse and demand premium

for buying long-term securities– Yield curves tend to be upward sloping.

(continued)

Theories of the Yield Curve (continued)

• Preferred habitat– Significantly more attractive rates can induce

investors and borrowers out of their preferred maturity structures

• Unbiased expectations– Long-term rates reflect market’s expectation of

current and future short-term rates.

Factors Affecting Bond Yields

• General credit conditions: Credit conditions affect all yields to one degree or another.

• Default risk: Riskier issues require higher promised yields.

• Term structure: Yields vary with maturity• Duration: Weighted average amount of time until

present value of purchase price is recouped.• Coupon effect: Low-coupon issues offer yields

that are partially taxed as capital gains.(continued)

• Seasonings: Newly issued bonds may sell at slight discount to otherwise-equivalent established issues.

• Marketability: Actively traded issues tend to be worth more than similar issues less actively traded.

• Call protection: Protection from early call tends to enhance bond’s value.

• Sinking fund provisions: Sinking funds reduce probability of default, thereby tending to enhance bond’s value.

• Me-first rules: Bonds protected from diluting effect of additional borrowings are generally worth more than otherwise-equivalent unprotected issues.

Factors Affecting Bond Yields (continued)