Chapter 5: The Expanded Ledger: Revenue, Expense, and Drawings · Revenue, Expense, and Drawings...

Transcript of Chapter 5: The Expanded Ledger: Revenue, Expense, and Drawings · Revenue, Expense, and Drawings...

1

Chapter 5: The Expanded Ledger:Revenue, Expense, and

Drawings

5.1 The Expanded Ledger and Income Statement Pages 132 143

What type of transactions affected capital?

2

The accounting system up to this point is inadequate since it does not provide all the information that the owner wants.

Three new capital accounts:

1. Revenue an increase in equity resulting from the sale of goods or services in the usual course of business.

2. Expense a decrease in equity resulting from the costs of producing revenue.

3. Drawings a decrease in equity resulting from the withdrawal of funds by the owner.

3

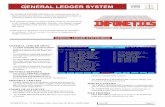

Two Ledgers Compared

Page 134

Two Trial Balances ComparedPage 135

4

Reason for the additional accounts:

provides essential information about the progress of a business.

Income statement a financial report which shows the revenue of a business, subtracts the expenses, and reveals the profit made for a given period of time. It is the formal way of showing in detail whether a business is profitable or not. One capital account does not provide enough information about how the changes in OE occurred.

Preparing an Income StatementPage 136

5

Net Income the difference between total revenue and total expense where the revenues are greater than the expenses.

Net Loss the difference between total revenue and total expenseswhere the revenues are less than the expenses.

People Who Use the Information from the Income StatementOwners and Managers indicates whether or not the business is making a profit.

Bankers helps to determine whether or not a loan should be given to a business.

Investors aids in the decision as to whether or not inject assets into a business.

Income Tax Authorities determines the amount of tax that needs to be remitted to the government.

6

Chart of accounts a list of ledger accounts and their numbers arranged in ledger order.

Page 139

Page 139

7

Equity Summary Page 140

5.2 Equity Transactions and Accounting Principles Pages 144 152

Revenue Transactions:

Transaction for service provided on account:

8

Revenue Recognition Principle revenue must be recorded in the accounts at the time the transaction is completed.

Expense Transactions:

9

Drawings Transactions:

Transaction where owner buys something for personal use and has business paying for it:

Other Transactions affecting drawings:

10

To Summarize

Four equity accounts:1. Capital2. Drawings3. Revenue4. Expense

Account Type Increase Decrease

Asset

Liability

Capital

Drawings

Revenue

Expense

CLR DAE

Increase on CR side Increase on DR side

11

Fiscal Period (financial period or accounting period) period of time over which earnings are measured.

Formally one year.

Other time periods are used by many businesses but an annual income statement still needs to be prepared for income tax purposes.

More accounting principles:

time period concept accounting will take place over specific time periods known as fiscal periods.

matching principle each expense item related to revenue earned must be recorded in the same period as the revenue it helped to generate.

This requires two important steps for accountants:

12

5.3 Equity Relationships and the Balance SheetPages 153 158

Page 153

Impractical to move all equity accounts to the balance sheet. This would be extremely bulky especially for companies with many revenue and expense accounts.

Equity equations have been developed to make the equity section of the balance sheet more concise.

Equity Equations

OR

13

Page 155

*Report Form of Balance Sheet*

Other Possible Situations in the Equity Section: