CHAPTER 1 The Individual Income Tax Return

description

Transcript of CHAPTER 1 The Individual Income Tax Return

Income Tax Fundamentals 2009 edition Gerald E. Whittenburg

Martha Altus-BullerStudent’s Copy

2009 Cengage Learning

Raise revenue

Tool for social and economic policies

• Social policy encourages desirable activities and discourages undesirable activities

Can’t deduct penalties

Can deduct charitable contributions

Credits for higher education expenses

• Economic policy as manifested by fiscal policy

Encourage investment in capital assets

• Both economic and social

Exclude gain on sale of personal residence up to $250,000 ($500,000 if married)

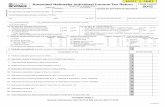

Individuals• Taxable income includes wages, salary, self-

employment earnings, rent, interest and dividends• An individual may file the simplest tax form that he/she

qualifies for 1040EZ 1040A 1040

• If error made on one of the three above forms, can amend with a 1040X.

This model follows Form 1040

Gross Income

less: Deductions for Adjusted Gross Income [AGI]

AGI

less: Greater of Itemized or Standard Deduction

less: Exemptions

Taxable Income

times: Tax Rate

Gross Tax Liability

less: Tax Credits and Prepayments

Tax Due or Refund

2008 standard deductionSingle $ 5,450

Married Filing Joint [MFJ] $10,900Qualifying Widow(er) $10,900 also known as Surviving Spouse

Head of Household [HOH] $ 8,000

Married Filing Separate [MFS] $ 5,450

*Taxpayers 65 or older and/or blind get an additional amount$1050 if MFJ, MFS or SS$1350 if HOH or Single

2008 exemption $3500 – personal & dependency

2009 Cengage Learning

Single

• Unmarried or legally separated as of 12/31

• And not qualified as married filing separately, head of household or qualifying widow[er]

Married Filing Jointly [MFJ]

• If married on 12/31 – even if didn’t live together entire year

• Same-sex couples may not file jointly

• If spouse dies during year you can file MFJ in current year

Married Filing Separately [MFS]

• Each file separate returns

• Must compute taxes the same way - both itemize or both use standard

• If living in community property state, must follow state law to determine community and separate income

Head of Household [HOH]

• Tables have lower rates than single or MFS

• Taxpayer can file as HOH if: Unmarried or abandoned* as of 12/31 Paid > 50% of cost of keeping up home that was

principal residence of dependent

There is one exception to principal residence requirement: if dependent is taxpayer’s parent, he/she doesn’t have to live with taxpayer

*See p. 1-10 for requirement for abandoned spouse

Surviving Spouse [SS]• Also known as qualifying widow or widower

• Available in year of spouse’s death and for

two subsequent years Must pay over half the cost of maintaining a

household where a dependent child, stepchild, adopted child or foster child lives

Personal exemptions may be taken for self/spouse

Additional exemptions may be taken for individuals who are either • Qualifying child

or

• Qualifying relative For 2008 each exemption = $3500 Exemption phased out to $2333 when AGI

exceeds thresholds found on p. 1-12

A capital asset is any property [personal or investment] held by a taxpayer, with certain exceptions as listed in the tax law

• Examples: stocks, bonds, land, cars and other items held for investment

• Gains/losses on these assets are subject to special rates

Holding period of asset determines treatment • Long term is held >12 months (taxed at capital rates)

• Short term is held <= 12 months (taxed at ordinary rates)